Effects of Heterogeneity of Financialization on Firm Innovation: Evidence in Context of Energy Transition in Lens of Research and Development

- 1School of finance, Shandong Technology and Business University, Yantai, China

- 2School of economics, Shandong Technology and Business University, Yantai, China

- 3Department of Sustainable Finance and Capital Market, Institute of Economic and Finance, University of Szczecin, Szczecin, Poland

- 4Department of Projects Management and Security Policy, Faculty of Management, Rzeszow University of Technology, Rzeszow, Poland

Innovation is essential to promote energy transition, reduce CO2 emissions and break resources and environmental constraints. Financialization has become an important part of firm asset portfolio. Different forms of financialization have great differences in liquidity, profitability, risk and purpose. This paper focus on the effect of heterogeneity of financialization on firm innovation to provide evidence for energy transition from the perspective of R&D with annual data of non-financial listed firms in Shanghai and Shenzhen A shares from 2009 to 2018. The Pooled Ordinary Least Square, fixed effect regression, Heckman two-stage model and instrumental variable regression are implied. The study also examines the impact of agency conflict on the relationship between the heterogeneity of financialization and firm innovation. The results show that: first, there is heterogeneity in financialization, with different motives and influences on firm innovation. Second, transaction-oriented financialization can significantly improve firm innovation, while there is a negative correlation between investment-oriented financialization and firm innovation. Finally, the existence of two types of agency conflict not only weakens the role of transaction-oriented financialization in promoting firm innovation, but also intensifies the ‘crowding-out’ effect of investment-oriented financialization. Firms should allocate financialization types rationally under effective supervision and incentives to achieve innovation and energy transition goals.

1 Introduction

Energy is crucial to basic human needs and economic development, among which fossil fuel including natural gas, oil, and coal is the most important (Zhao et al., 2022). While, the use of these types of energy harm the environment and the ozone layer by increasing carbon dioxide (CO2) emissions (Awosusi et al., 2022), which is believed to be the main cause of global climate change (Ahmadi et al., 2022). This issue has prompted policy makers in developed and developing countries to find green energy sources that can meet their energy needs and reduce CO2 emissions (Pata and Samour, 2022; Samour and Pata, 2022). Innovation is essential to promote energy transition, and break resources and environmental constraints (Habesoglu et al., 2022) Since the reform and opening up of the economy, China has made great achievements, but also faced with huge energy consumption and serious environmental pollution. As one of the world’s largest carbon emitters, it faces enormous pressure to cut emissions. Innovation is the realistic need to promote energy transition, reduce CO2 emissions and break resources and environmental constraints in China.

After the international financial crisis in 2008, China entered a ‘new normal’ in economic development. The costs of land and labor rose sharply and the original traditional expansion model which relied on increasing leverage and expanding capacity was already showing signs of fatigue and became unsustainable (Me and Chen, 2016). Meanwhile, both the financial market and the real estate industry are flourishing with the emerging of continuous innovation in financial business, the increasingly active role of financial market, the gradual introduction of derivatives and various leverage mechanisms as well as the uptrend of the share of the financial industry in GDP. The rapid rise in housing price also gave birth to the real estate industry more than a decade of golden development period. As a result, the profits of the financial market and the real estate industry are far beyond the average level of that of real economy which are recognized as the two ‘windfall’ industries. Therefore, more and more real firms are keen on financial assets investment, resulting in an obvious phenomenon of financialization. Funds of real firms circulate among financial markets, gradually forming an economic financialization pattern with financial investment as the dominant mode of firm profits (Zhang and Zhang, 2016). These phenomena seem to confirm the view of Luo and Zhu (2014) that resource scarcity will lead to the ‘crowding-out’ effect of financialization on other investment funds.

However, statistics1 show that the innovation of China’s real firms does not seem to be crowded out by financialization. From 2010 to 2019, the proportion of China’s R&D expenditure in GDP has grown from 1.71% to 2.19% which shows a steady growth. The R&D expenditure alone reached 2,173.7 billion CNY in 2019 which has increased 2.7 times compared with 796.3 billion CNY in 2010. It is worth noting that the proportion of R&D expenditure from the government has been declining in total R&D expenditure from 24% in 2010 to 20% in 2019. And the increase in China’s R&D expenditure mainly comes from real firms themselves instead of the government which seems to verify the view of another group of scholars that the profit from financialization of real firms can alleviate financing constraints in the process of reinvestment, reduce firm financing cost and provide financial support for firm innovation (Liu, 2017).

At present, the research conclusions on the relationship between financialization and innovation are controversial. Some believe that financialization promotes firm innovation. It can bring investment revenue, enhance financing ability, provide stable cash flow for firm innovation activities (Almeida et al., 2004), and alleviate the pressure of stock price fluctuation and performance appraisal faced by the management, who has more opportunities to focus on firm innovation (Kim et al., 1998). The other believe that financialization inhibits firm innovation. In order to obtain equity investment returns, firms give priority to financial investment with limited funds (Palley, 2008), making their profits more dependent on financialization and reducing their emphasis on R&D projects with long cycles and high risks (Orhangazi, 2008). One possible reason for this controversy is that they study the impact of financialization on firm innovation as a whole, ignoring the purpose and complex motives of financialization with different attributes. If the forms and motives are not distinguished, it is impossible to reach a unified conclusion.

This paper distinguishes the different purposes, motives and forms of financialization, and divides it into two categories. Transactional financial assets for balancing main business risks or providing reserves for main business, and short-term financing and trust are defined as transaction-oriented financialization, and long-term equity investment, real estate investment and other financial assets allocated for speculation or industrial transformation are defined as investment-oriented financialization. The two types of financialization meet different needs of firms, so they have different impacts on firm innovation. Therefore, it is necessary to identify the heterogeneity of financialization before studying its impact on firm innovation.

Firm innovation activities are usually initiated by management and major shareholders so that their attitude towards the innovation determines the motivation and forms of firms’ choice of financialization as well as the impact of financialization on its innovation. In view of this based on the heterogeneity of financialization, this paper selects Shanghai and Shenzhen A-share non-financial films from 2009 to 2018 as samples to study the impact of two types of financialization on firm innovation by identifying the forms and motivations of financialization. The moderating effect of agency conflicts on the relationship between the different types of financialization and firm innovation is also empirically tested which is helpful to reveal the influence of financialization on firm innovation in a more comprehensive and in-depth way and can provide a decision-making basis for relevant decision makers.

The contributions of our study are as follows: Firstly, we confirm that there are differences in risk, liquidity and profitability of different forms of financialization. Based on the attribute of different risk, we deeply analyze their different motivations and purposes, and divide financialization into transaction-oriented and investment-oriented, providing a new perspective for financialization research. Secondly, based on the identification of the two types of financialization, the paper studies their influences on firm innovation respectively and overcomes the defect that existing literature ignores the influence of financialization with different motives and purposes on firm innovation, which bridges the gap between the existing academic research on the economic consequences of financialization. Lastly, under different governance environments, different forms of financialization may have different influences on firm innovation. There have been few studies to explore the moderating effect of internal governance differences on relationship between financialization and its innovation. The paper considers the impact of two types of agency conflicts on the relationship between the two types of financialization and firm innovation and strives to make the research conclusion be in accord with the actual situation of the firm.

The study employs the Pooled Ordinary Least Square (Xu and Zhu, 2017) as the basic regression strategy with the data of non-financial listed firms in Shanghai and Shenzhen A shares from 2009 to 2018 to discuss the relationship between the heterogeneity of financialization and firm innovation. In the robustness tests, in order to solve the problem of missing variables that do not change with time, the fixed effect model is used to control individual heterogeneity. In addition, we adopt the Heckman two-stage model and the explaining variables with one period lag regression to solve the endogeneity problem and ensure the stability of the regression results. The rest of the study is organized as follows. Section 2 discusses the literature review. Section 3 presents the model and the data. Section 4 reports the results. Section 5 is the robustness testing. In section 6, we discuss and conclude the study.

2 Literature Review and Hypothesis

2.1 The Impact of Financialization on Firm Innovation

At present, the research conclusions on the relationship between financialization and innovation are controversial. Some believe that financialization promotes firm innovation. It can bring investment revenue, enhance financing ability, provide stable cash flow for firm innovation activities (Almeida et al., 2004). The other believe that financialization inhibits firm innovation. In order to obtain equity investment returns, firms give priority to financial investment with limited funds (Palley, 2008), making their profits more dependent on financialization and reducing their emphasis on R&D projects with long cycles and high risks (Orhangazi, 2008). One possible reason for this controversy is that the they study the impact of financialization on firm innovation as a whole, ignoring the purposes and complex motives of financialization with different attributes.

Although the research conclusions on purposes and motives of financialization vary, three kinds are summarized in essence. The first is the ‘substitution’ motive for speculation. In order to obtain equity investment earnings, real firms will make their profits more rely on the earnings of financial assets and reduce their emphasis on R&D projects with long cycle and high risk (Orhangazai, 2008). Financialization reduces the stability of the financial system and destroys the self-regulation ability of economic operation (Bhaduri, 2011). Managers’ behaviors become short-term (Krippner, 2011), which is not conducive to the realization of long-term goals of firms (Ortiz et al., 2014). The second is the ‘reservoir’ motivation for prevention and storage. Imperfect capital markets often have credit discrimination. Financial assets have flexible liquidity, and can bring investment income to firms, enhance their financing capacity and alleviate external financing difficulties (Almeida et al., 2004), which is conducive to the long-term and stable development of firms and realizes the mutual growth of industrial and financial capital. Financialization provides continuous funds for firm innovation (Yang et al., 2019) and plays a crucial role in dealing with cash flow risks and easing external financing constraints (Liu, 2017). The last is the motivation to use the financial market to spread risk. Under the background of declining real investment profit, firms will allocate an asset investment portfolio according to short-term investment return demand (Crotty, 2003). The high returns of financial assets just meet the needs. By hedging transactions, firms can save taxes, reduce the cost of financial distress, and help disperse the risk of firm’s investment portfolio (Bessem, 1991).

It can be seen from the above study, there are differences in risk, liquidity and earning of different forms of financialization. For the purpose of balancing the risks of the main business or providing reserve resources for the leading industry, real firms may allocate financial assets with low risks and high liquidity in the process of financialization (Liu, 2017). Such type of financialization may have a positive impact on current business and innovation activities instead of doing harm to them. For the purpose of speculation or industrial transformation, real firms are more likely to allocate equity and long-term financial assets in the process of financialization (Liu, 2017). Such type of financialization may have a negative impact on the current operation. Therefore, we divide financialization into transaction-oriented and investment-oriented financialization. Transaction-oriented financialization usually refer to short-term financial assets with low returns and risks, but with strong liquidity which can be converted into reserve assets for real investment while investment-oriented financialization refer to financial assets for profit, long-term investment or speculation purposes. The paper expects that because the two types of financialization have different earnings and risk attributes and represent different motives and purposes, they will have different impacts on firm innovation.

2.2 Transaction-Oriented Financialization and Firm Innovation

As a high-risk investment, firm innovation gets its funds mainly from two parts: firstly, the internal cash flow generated by production and operation activities (Yang and Zeng 2014) and secondly, financing through the external financial market (Rajan and Zingales, 1998; Brown et al., 2012). However, firms are still in the environment of ‘financial repression’ under the current financial system in China (Liu, 2017) and resource allocation system is not mature. The financial sector is very strict with firms in risk assessment and often prefers mortgage of physical assets. Also, it is cautious about the financing needs of firm innovation activities. At the same time, the information asymmetry in the capital market makes it more difficult for firms to obtain external funds which make the external financing costs much higher in China. As a result, the financing constraints on R&D investment of firms are higher than that of general investment projects (Ren, 2011). Firms have the motivation of smoothing innovation (Opler et al., 1997; Brown and Petersen, 2011) and internal financing becomes one of the main sources of R&D funds (Hall et al., 2005). Compared with fixed and intangible assets with long term and poor liquidity, transaction-oriented financialization such as purchase of securities assets for sale and short-term wealth investment assets and trust assets, are the better substitutes for cash assets because they are usually more liquid, easier to monetize, low in conversion cost, fast in turnover of capital, frequent in transaction, lower in holding cost, higher in economic value and can be used to get short-term earnings and cope with firm financial fluctuations of strong fluidity (Liu, 2017).

Firms purchasing transaction-oriented financial assets with its temporarily idle funds can not only preserve or increase the value of capital but also increase capital supply and reduce the moderating cost of temporary shortage of R&D funds when the capital level is low which balances the risk of failure in the knowledge transformation process of scientific and technological innovation (Yang et al., 2019). Also, it can reduce firms’ dependence on external financing, expand financing channels of firms and alleviate the financing constraints (Yang et al., 2017). Moreover, financial assets with strong liquidity are more conducive for firms to deal with future uncertainty than fixed and intangible assets. They are an important way for firms to reasonably allocate assets and prevent risks (Tornell, 1990). Although, financialization may exacerbate the problem of investment shortsightedness because management and major shareholders may continue to invest funds gained from financial sector into financial assets under the two kinds of agency conflicts, so as to quickly make profits and crowded out R&D funds, yet, the earnings of transaction-oriented financialization usually are not high and the more likely reason for firms is to maintain the capital flow in operating activities and also brings a certain degree of financialization earnings (Hu et al., 2017) which plays a significant role in coping with cash flow risks and alleviating external financing constraints (Almeida et al., 2004; Liu, 2017). In view of this, this paper believes that as a powerful substitute for cash assets, transaction-oriented financialization with strong reserve characteristics will not ‘crowd out’ innovation, but can serve as a buffer for firm finance, helping to lower financial distress and external financing costs, improve the efficiency of asset allocation and promote firm innovation activities. Accordingly, the following hypothesis is proposed:

Hypothesis 1. Transaction-oriented financialization can significantly promote firm innovation.

2.3 Investment-Oriented Financialization and Firm Innovation

Investment-oriented financialization are regarded as financial assets with low liquidity and their conversion cost are relatively high because they are with the characteristics of consuming a large amount of funds in transaction, holding for a long time and performing inactively in transaction, and also, they are difficult to recover their costs in a short term. Cardella et al. (2015) shows that holding long-term securities helps firms to obtain higher returns. At the same time, driven by the policy of housing commercialization, the profitability of China’s real estate industry far exceeds that of real investment, and the rising housing price promotes firm capital to enter the real estate market.

Orhangazi (2008) believes that the main reason why financialization has a negative impact on real investment is that the increase of profit opportunities in financial investment leads managers to be more willing to hold financial assets rather than real investment. Firms invest their limited funds in investment-oriented financial assets with low liquidity and higher returns, which can trigger capital to flee from the real economy (Gu and Shen, 2012), exacerbating the difficulties of firm cash flow. Hu et al. (2017) point out that, when financial assets become the main source of firm profits, the focus of firm asset allocation will shift and more capital will be used for financial investment in order to ensure the short-term profit maximization, and ignore the sustainable development of the main business (Seo et al., 2012). By studying the real estate investment of non-financial firms in China, Luo and Zhang (2015) find that the higher returns in the real estate market, the less incentive non-financial firms have to develop new products. Attracted by the high rate of return on investment, firms give priority to investment-oriented financialization rather than innovation with long cycle, high risk and unstable returns. There is an ‘either/or’ relationship between investment-oriented financialization and firm innovation. Based on the above analysis, Hypothesis 2 is proposed in the paper:

Hypothesis 2. Investment-oriented financialization crowds out firm innovation.

2.4 The Impact of Agency Conflicts on the Relationship Between Financialization and Firm Innovation

The innovation activities of firms are usually led by managers, while the operation and development strategies are mainly determined by major shareholders. Therefore, as an important financial and investment decision, the goal of managers and shareholders on financialization determines the motivation and forms of financialization and the impact of financialization on firm innovation.

The separation of ownership and management can cause serious agency conflicts between owners and managers in modern firms (Jensen and Meckling, 1976). Owners focus on maximizing shareholders value and the long-term earnings while managers pursue the maximization of their own interests and pay more attention to the short-term earning (Chen and Zhang, 2020). Maximization of shareholders’ value-oriented profit and managers’ self-interest-oriented free cash flow jointly form the basic mechanism of financialization (Crotty, 2003; Dallery, 2009).

Financialization may become a tool for managers to obtain self-interests while bringing sustainable R&D funds to firms (Crotty, 2003). The cost and earnings of innovation activities do not match with time, and the high cost of innovation may have a negative impact on the current performance of firms and managers also will face the double pressure of R&D failure and market failure (Cornaggia et al., 2015; Li et al., 2016). Compared with innovation activities with high risks and uncertain earnings, financialization helps management reduce private costs and gain the control over self-interest. Even if an investment fails, it also can be attributed to external systemic risks. So managers are more inclined to use the financial market to obtain investment returns (Stockhammer, 2004), and innovation activities become a worst-hit part of agency conflicts in firms with separation of ownership and control.

According to Myers and Rajan (1998), assets with high liquidity are easy to be converted into self-interest at a lower cost. When there is an agency conflict between managers and owners, managers tend to hold cash reserves to keep their positions (Kalcheva and Lins, 2007), and achieve a good performance through rapid cash consumption. Transaction-oriented financialization, close to cash, have become the object of profligacy and appropriation by managers. When there are disposable funds, managers are more likely to invest them into investment-oriented financial assets with higher returns and low uncertainty instead of investing in innovation activities with strong risks, long cycle of returns and lower uncertain in order to protect their self-interests (Laeven and Levine, 2007). Financialization crowds out firm innovation because of the agency conflict between owners and managers.

The second type of agency conflict between major and minor shareholders is also very common in the governance of listed firms in China. Under the pyramid structure of firms, major shareholders are keen to put funds into financial and real estate markets to get short-term earnings (Wen and Ren, 2015). Also, they use the financial market as a channel to transfer the interests between firms, and hollow out the interests of minor shareholders by transferring profits through related transactions and control (Ye and Zeng, 2011). For high-risk innovation projects, major shareholders need to bear the risks of control right and cash flow right, but can only get benefits from cash flow right, which means that earnings and costs of major shareholders in high-risk innovation projects do not match. For self-interest, major shareholders are more inclined to obtain short-term earnings through capital operation strategies such as financial investment and refuse to invest in programs beneficial to the long-term development with high risks. The opportunistic behaviors of major shareholders have negative effects on firm innovation (Zhou and Song, 2016). In addition, high-risk innovation activities have high uncertainty of earnings. Once R&D projects fail, the stock price will fall, resulting in a serious shrinkage of major shareholders’ assets and reducing their willingness to take the risk of innovation (Bragoli et al., 2016). Under the influence of profit-seeking motivation and the agency conflict, major shareholders tend to invest in financial assets to obtain high earnings via capital market. Two types of agent conflicts drive managers and major shareholders to invest in financial assets that bring self-interest to them. Therefore, Hypothesis 3 is proposed:

Hypothesis 3. The two types of agency conflict not only weaken the promoting effect of transaction-oriented financialization on firm innovation, but also intensify the “crowding-out” effect of investment-oriented financialization on firm innovation.

3 Methodology

3.1 Data Collection

This paper selects 2,232 listed firms in 18 industries in China’s Shanghai and Shenzhen A shares from 2009 to 2018 as the original samples and forms an unbalanced panel data containing 12,086 effective observations. The data herein are mainly from CSMAR database1 and Wind database2. The data of financialization are manually sorted according to firms’ financial statements. Missing data are supplemented by manual collection of firm annual reports.

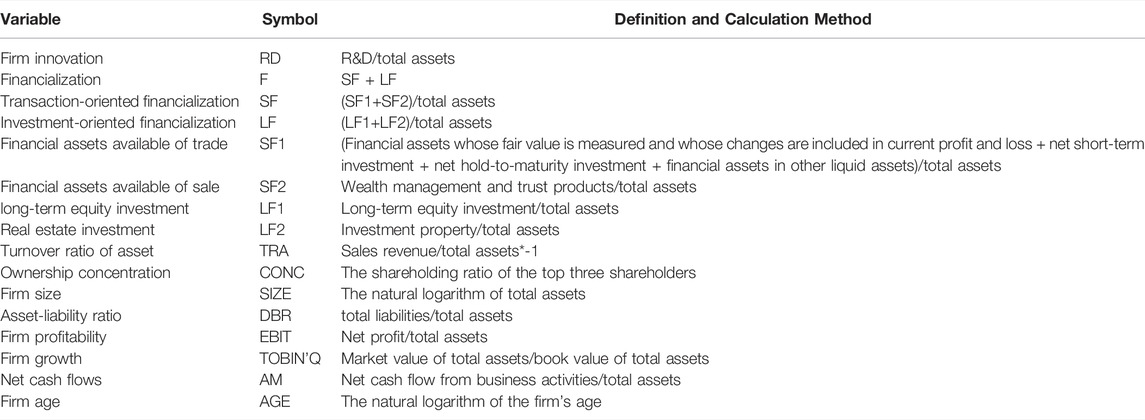

3.2 Definition of Variables

3.2.1 Explained Variable: Firm Innovation

In academic field, the behavior of firm innovation is usually measured from two dimensions: innovation input and innovation output (Li and Zheng, 2016; Chen et al., 2019). There are two ways to measure firm innovation input: one is to take intangible assets as the proxy variable, the other is the R&D expenditure. At present, the vast majority of listed firms in China have disclosed their R&D expenditure data, which are easy to obtain with high reliability. This paper intends to use the R&D expenditure to measure firm innovation. In order to maintain the stability of research results, patent data, as the indicator of innovation output, is used to conduct the robustness testing at the same time.

3.2.2 Explaining Variable: Financialization

Hu et al. (2017) believe that financial assets include cash assets and non-cash assets. Earnings of cash is a basic financial asset which is also an operational one with the characteristics of the lowest risk and the best liquidity. But the essence of cash is to ensure the liquidity of capital in case of emergency and the only possible motivation for holding it is ‘precautionary reserves’, which doesn’t conform to our definition of financial assets. Therefore, financial assets defined in this paper only include non-cash financial assets. At the same time, based on the definitions of financial assets by Demir (2009), Du et al. (2017), Liu (2017) and Wang et al. (2017), the paper divides non-cash financial assets into transaction-oriented and investment-oriented financial assets. Transaction-oriented financial assets include two categories: financial assets available for trade and available for sale, which are less affected by capital market fluctuations and have strong liquidity and low capital conversion costs. While investment-oriented financial assets include another two categories: long-term equity investment and investment property. The main reason why real estate investment is included in the analysis of firm financial assets is because the rapid developed China’s real estate industry in recent years, has given birth to the abnormal pattern of driving GDP growth by the real estate industry in many regions. The average profit level of real estate firms is higher than that of other real firms, which causes real firms to invest a large amount of capital in real estate in order to obtain high returns. Real estate has the function of financial investment.

3.2.3 Adjustment Variable: Agency Conflict

Referring to Li (2007), the asset turnover ratio is used to reflect the cost caused by the inefficient use of assets by managers. The higher the turnover ratio of all assets is, the lower the cost of the first type of agency conflict in firms will be. In order to facilitate the subsequent empirical analysis, we multiply the asset turnover rate by −1, and the closer its value is to 0, the more serious the first type of agency conflict is. Chen and Zhang (2020) adopt equity concentration to reflect the second type of agency conflict. The higher the concentration of equity is, the more serious the agency conflict between major and minor shareholders is, and the higher the agency cost is.

3.2.4 Control Variables

Firm innovation is also affected by other factors. Based on references of Hu et al. (2017) and Liu (2017), variables related to firm characteristics and governance are selected as control variables:

3.2.4.1 Firm Size

Larger firms with larger scales, relatively abundant operating cash flow, less financing constraints, more external financing opportunities and lower financing costs, in order to maintain competitive positions, are more likely to invest in risky projects.

3.2.4.2 Asset-Liability Ratio

The higher the asset-liability ratio of a firm is, the higher the debt financing cost will be. In addition, firms with high asset-liability ratios are more likely to be constrained by creditors, who will restrict firms from investing funds in risky investments with the consideration of their own interests.

3.2.4.3 Firm Profitability

Firms with high profitability have more abundant funds, which will have a greater impact on their future innovation activities.

3.2.4.4 Firm Growth

The higher the growth, the greater the market demand for the firm’s products, thus promoting the innovation activities of the firm (Liu, 2017).

3.2.4.5 Net Cash Flow

The more abundant the cash flow, the stronger the ability to resist risks, and the more likely the firm is to invest in projects with higher risks.

3.2.4.6 Firm Age

It is generally believed that the longer a firm has been established, the higher its risk resistance is and the more willing it is to challenge high-risk projects. However, some studies believe that mature firms lack competitive power, pursue steady returns and hold a cautious attitude towards projects with uncertain returns.

3.2.4.7 Dummy Variables

In addition, in order to control the influence of the heterogeneity of industry and macroeconomic environment, this paper sets up an industry dummy variable (Industry) and a year dummy variable (Year). Further information and calculation methods of variables are provided in Table 1.

3.3 Regression Model

In order to test the influence of the heterogeneity of financialization on firm innovation, this paper uses the research of Brown and Petersen (2011), Yang et al. (2017) and Sheng et al. (2018) as references, and sets the regression equation as:

In Eq. 1, FC represents F, SF and LF respectively. The empirical analysis mainly focuses on the direction of the coefficient

Eq. 2 is a regression model for the impact of the two types of agency conflict between financialization and firm innovation. APM represents TRA and CONC. The regression coefficient

4 Empirical Results

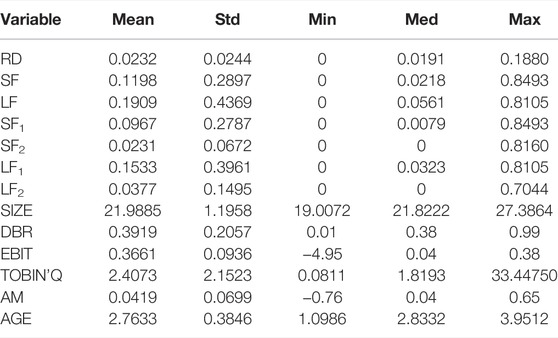

4.1 Descriptive Statistics of Variables

Table 2 is the descriptive statistics for main variables from which it can be seen that the financial assets of sample firms are mainly transaction-oriented and long-term equity investment, and the proportion of investment-oriented financial assets is higher than that of transaction-oriented ones. Therefore, it is necessary to investigate the different influences of the two forms of financialization on firm innovation.

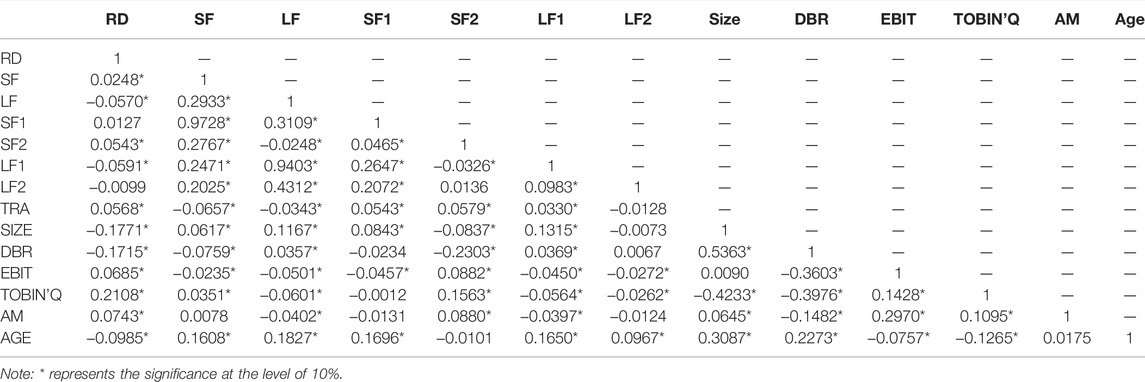

4.2 Correlation Analysis

In order to test whether there is multicollinearity among variables to interfere the non-bias and consistency of regression coefficients, Pearson correlation coefficient test is carried out in this section, and the results are shown in Table 3. According to the results, the correlation coefficients between variables are small, except the correlation coefficients between SF and SF1 and LF and LF1, which are significantly greater than 0.5. However, SF, LF, SF1 and LF1 as different forms of financialization, will not exist in the same model, so the regression results will not be interfered by multicollinearity.

4.3 The Impact of Different Forms of Financialization on Firm Innovation

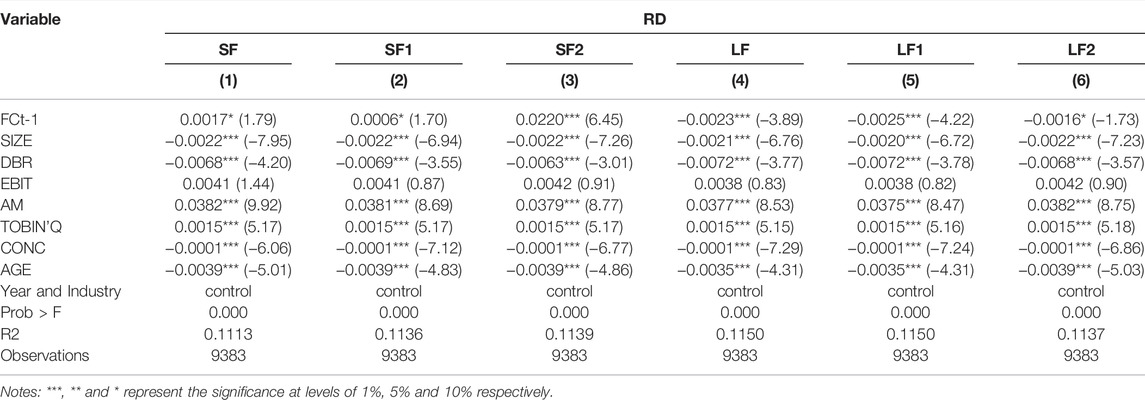

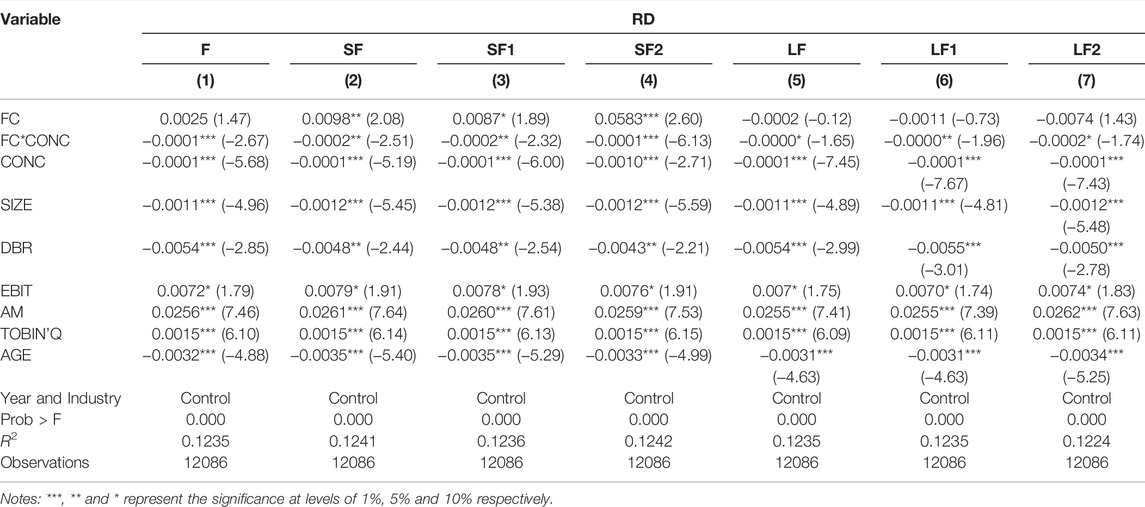

Table 4 shows the multiple regression results of the relationship between different forms of financialization and firm innovation with the R&D expenditure as the explained variable. Column (2)–(4) are the regression results of the impact of transaction-oriented financialization on firm innovation. Column (5)–(7) are the regression results of the impact of investment-oriented financialization and firm innovation. At the same time, the impact of the overall level of financialization on firm innovation is also investigated as comparison in column (1).

TABLE 4. Regression results of the relationship between different forms of financialization and firm innovation.

As can be seen from the regression results in Column (1), the coefficient of the total level of financialization is significantly negative. But different forms of financialization have significantly different influences on firm innovation. All coefficients of Column (2)–(4) are significantly positive, indicating that transaction-oriented financialization has a positive impact on firm innovation. The possible reason is that innovation mainly depends on technology and talent input, and innovation results are mainly intangible assets such as proprietary technology or patent, lacking physical guarantee. Firms are reluctant to disclose detailed R&D information to investors due to intellectual property protection. So there is a serious information asymmetry between external capital supply and innovative firms, resulting in the ‘lemon market’ in innovation financing. In addition, due to the long cycle and uncertain returns of innovation activities, relatively higher risks also lead to higher interest rates or credit rationing for firm R&D loan (Stiglitz and Weiss, 1981). The difference between internal and external financing costs further reduces the opportunities for firms to obtain external financing.

On the one hand, firms can take advantage of the characteristics of transaction-oriented financialization, such as short holding time, frequent transaction rates, ready to be cashed in at any time, fast turnover rate and certain income to store liquidity reserve for innovation activities and assist the main business. On the other hand, firms can obtain reasonable profit and reduce the uncertainty of main business income volatility, avoid the opportunity cost of holding cash and decrease the pressure of uncertain innovation risk, which has complementary effect with firm innovation activities. Hypothesis 1 is proved.

From columns (5)–(7), we can find that all coefficients are significantly negative, which means that both long-term equity investment and real estate investment crowd out firm innovation. Investment-oriented financialization significantly inhibits firm innovation activities. Although innovation can improve the use efficiency of production factors, upgrade industrial structure, and bring high returns for firms and has a positive impact on improving the market competitiveness of firms. It is also characterized by high uncertainty, long-term nature and information asymmetry. In the case of relatively difficult external financing and limited available capital, the management prefers more long-term equity investment under the attraction of high ROI (Cardella et al., 2015). Long-term equity investment establishes the link between firms and financial institutions, let firms be easier access to loans, but increase excessive investment risk. In order to enhance the robustness of whole assets allocation, firms will try to reduce the business activities of other risky investment to maintain their whole risk level.

At the same time, under the impetus of the commercialization of housing policy, China’s real estate prices have been continuing to rise quickly for many years, and the profits of the real estate industry are more higher than real investment. The ‘crowding out’ of house prices induces firm capital out of real investment and invest in real estate to achieve arbitrage. The higher the return from real estate, the less inclined firms are to develop new products. Investment-oriented financialization leads firms to deviate from their main business objectives and sacrifice the long-term interests of innovation. There is an ‘either/or’ relationship between investment-oriented financialization and firm innovation. Hypothesis 2 is proved.

4.4 The Influence of Agency Conflict on the Relationship Between Financialization and Innovation

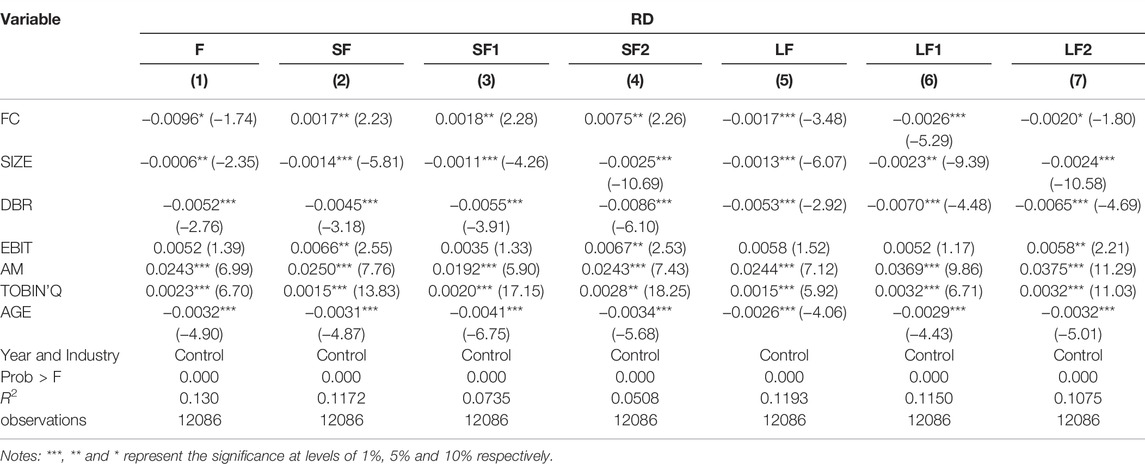

Table 5 shows the regression results of the moderating effect of asset turnover ratio on the relationship between different forms of financialization and firm innovation. From the regression results in column (1), the asset turnover ratio has no significant impact on the relationship between financialization and firm innovation. However, the results of columns (2)–(7) show that the intersection terms of different forms of financialization and asset turnover ratio are significantly negative. The results of column (2)–(4) show that the first type of agency problem significantly reduces the promotion effect of transactional financial assets on firm innovation. The results of columns (5)–(7) show that the first agency conflict significantly intensifies the ‘crowding-out ‘effect of investment-oriented financialization on firm innovation. This means that when the interests of management and owners tend to be consistent, more attention is paid to long-term revenue, and financialization has a positive impact on firm innovation. An effective reward and punishment system can reduce the self-interested behavior of the management and motivate the management to make investment decisions for the long-term interests of the firm (Barton, 2011).

TABLE 5. The regression results of the impact of asset turnover ratio on the relationship between financialization and firm innovation.

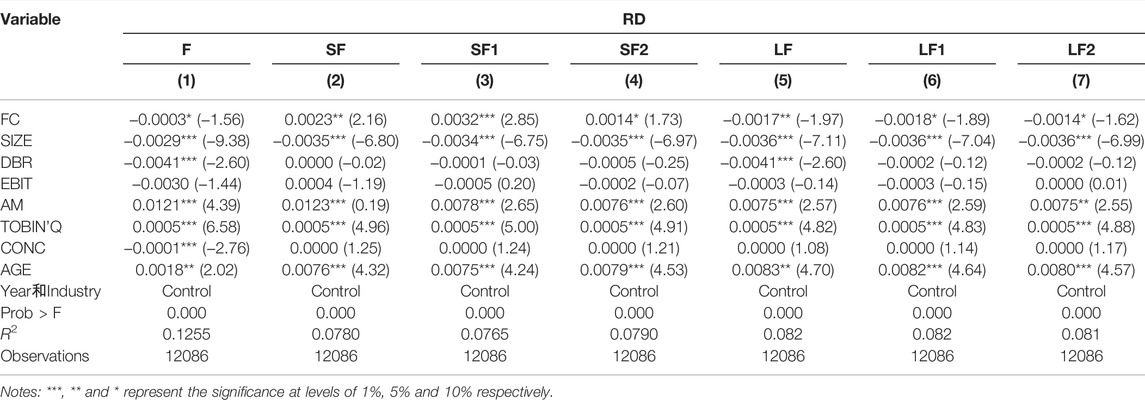

Table 6 shows the regression results of the moderating effect of equity concentration on the relationship between different forms of financialization and firm innovation. The results of columns (2)–(4) show that the interaction terms of transaction-oriented financialization and equity concentration are negatively correlated at the levels of 5%, 5%, and 1% respectively, indicating that equity concentration significantly reduces the promoting effect of transaction-oriented financialization on firm innovation.

TABLE 6. Regression results of the moderating effect of entity concentration on the relationship between financialization and firm innovation.

The results of columns (5)–(7) show that the interaction terms of investment-oriented financialization and equity concentration are negatively correlated at the significance levels of 10%, 5%, and 10% respectively, indicating that equity concentration increases the “crowding-out” effect of investment-oriented financialization on firm innovation。The capital market has become a channel for major shareholders to dig out the interests of minority shareholders. The higher the equity concentration, the more prominent the opportunistic behavior of major shareholders, and the greater the negative impact on firm innovation. With the increase of ownership concentration, related party transactions between firms and major shareholders become more frequent, which leads to the occurrence of interest transmission (Luo and Zhu., 2014) and weakens the innovation motivation of firms. Hypothesis 3 is proved.

5 Robustness Testing and Endogenous Treatment

In order to ensure the stability of the regression results, four methods are used to conduct robustness tests and deal with potential endogenous problems in this part.

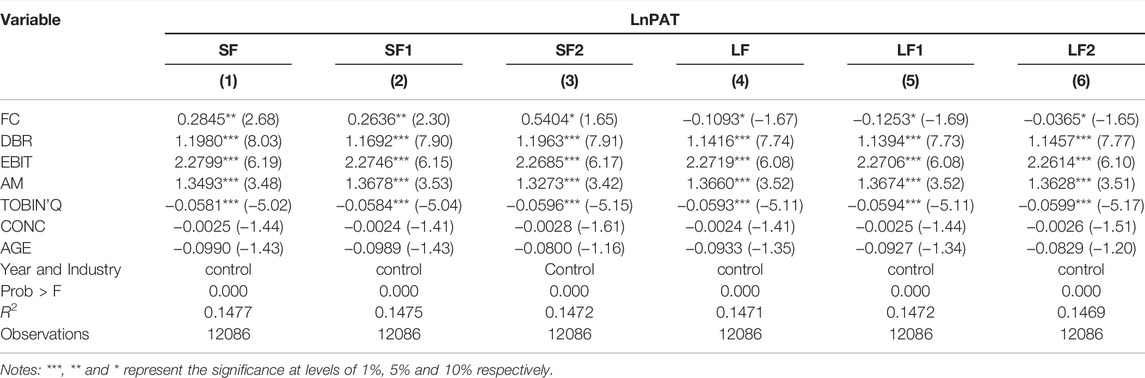

5.1 Replacement of Firm Innovation Indicator

At present, there are two main indicators to measure firm innovation, namely, R&D expenditure and innovation output. In the paper, LnPAT is chosen as a substitute for firm innovation indicator to conduct robustness tests, and the results in Table 7 are consistent with previous regression results.

5.2 Explaining Variables With One Period Lag

Considering the influence of financialization on R&D expenditure may have somewhat lagging, therefore, learning from the practice of Huang et al. (2018), the one-period-lag treatment to core variables can alleviate the impact of reverse causality and solve the endogenous problem between financialization and R&D expenditure. The results in Table 8 show that, the overall level of financialization with one period lag is still significantly negative correlated with R&D expenditure at the significance level of 5%. The regression coefficients of the other variables in each column also pass the significance test with no change in directions, which means that after the elimination of endogenous problems, there is no significant change in the effect of the heterogeneity of financialization on R&D expenditure.

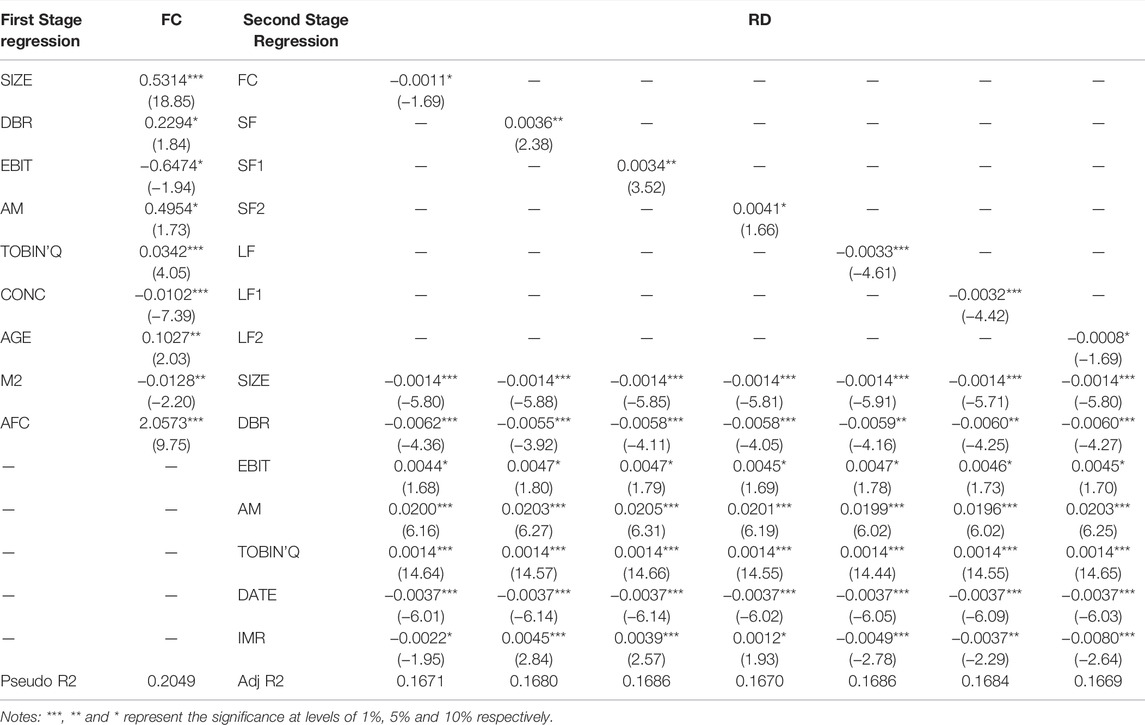

5.3 Heckman Two-Stage Regression Model

Due to the uncertainty of innovation results, firms may seek a balance between innovation and financialization in order to avoid risks and pursue short-term gains. The financialization strategy of a firm can affect innovation, and innovation-strategy may inversely affect its financialization decision. Meanwhile, the financialization strategy of other firms in the same industry will also have an impact on the financialization strategy of the firm. Therefore, there may be endogeneity problems among variables, such as omitted variables, bidirectional causality and self-selection. In order to avoid bias in the conclusion, this paper introduces macro policy M2 as the instrumental variable by referring to Yang et al. (2019). Meanwhile, the average financialization of other firms (AFC) in the same industry is used as the instrumental variable too. The Heckman two-stage model is used to solve the endogeneity problem and sample selection bias caused by omitted variables. The results are shown in Table 9, which are consistent with the main regression.

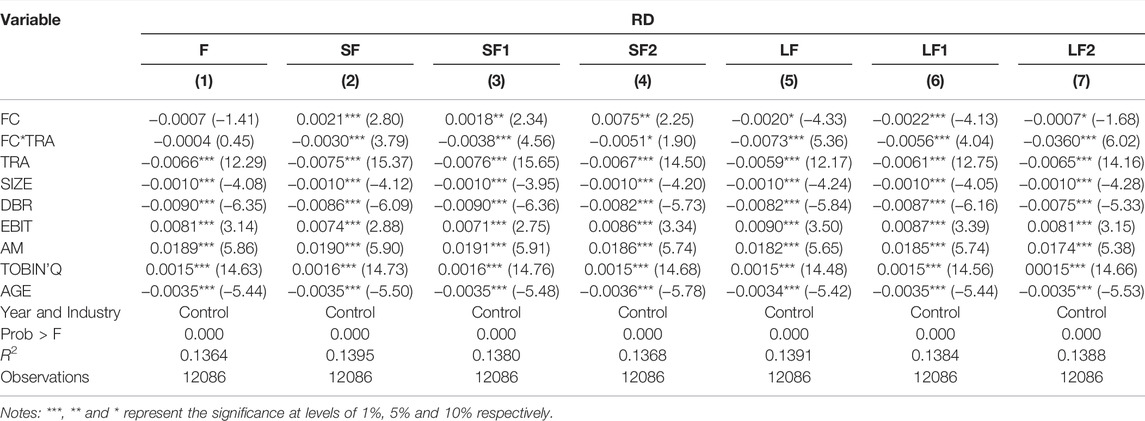

5.4 Panel Fixed Effect Regression

In order to solve the problem of missing variables that do not change with time, the fixed effect model is used to perform regressions again. The results of panel fixed effect estimation are listed in Table 10. As can be seen from the results, the coefficients of the main variables all pass the significance tests, which are consistent with the previous the OLS regression results. Therefore, compared with the OLS regression results, only the significance of some control variables’ coefficients changed, while the direction and significance of explaining variables’ coefficients remain unchanged.

TABLE 10. Regression results of the relationship between financialization and R&D expenditure of firms.

6 Conclusion and Recommendations

6.1 Conclusion

Innovation is critical to promote energy transition and address global climate change. Firms are the main body of innovation, and more and more firms are keen on financial investment, resulting in the obvious phenomenon of financialization in China. The academic conclusions on the impact of financialization on firm innovation is controversial. The reason may be that there are different forms and motivations of financialization, which affect the conclusions. Based on the heterogeneity of financialization, this paper empirically examines the relationship between different forms of financialization and firm innovation. From the empirical results, it can be seen that the greater the level of financialization, the less conducive it is for firm innovation. But different forms of financialization have significantly different influences on firm innovation. This means that the evaluation of financialization cannot be generalized, it needs to be analyzed separately according to the heterogeneity of financialization.

The results also show that transaction-oriented financialization can significantly improve firm innovation while there is a negative correlation between investment-oriented financialization and firm innovation. Firms can take advantage of the characteristics of transaction-oriented financialization, such as short holding time, frequent transaction rates, ready to be cashed in at any time, fast turnover rate and certain income to store liquidity reserve for innovation activities, which enable firms to undertake high-risk innovation activities at an acceptable level of risk. Investment-oriented financialization leads firms to deviate from their main business objectives and sacrifice the long-term interests of innovation. There is an ‘either/or’ relationship between investment-oriented financialization and firm innovation. Long-term equity investment increases excessive investment risk. In order to enhance the robustness of whole assets allocation, firms will try to reduce the business activities of other risky investment to maintain their whole risk level. Under the certain resources, investment-oriented financialization reduces the tolerance of firms to innovation investment risk and crowds out innovation. However, this does not mean that firms should be strictly prevented from financialization nor does it mean that any proportion of transaction-oriented financialization can promote firm innovation. However, to achieve the dynamic balance between financialization and firm innovation needs further research.

At the same time, the two types of agency conflict have moderating effects on the relationship between the two forms of financialization and firm innovation. The impact of the first type of agency conflict on the relationship between financialization and firm innovation shows that when the interests of management and owners tend to be consistent, more attention is paid to long-term revenue, and financialization has a positive impact on firm innovation. An effective reward and punishment system can reduce the self-interested behavior of the management and motivate the management to make investment decisions for the long-term interests of the firm (Barton, 2011). Compared with traditional compensation incentive plans, incentive plans focusing on long-term performance are more conducive to firms’ implementation of innovation activities. The influence of the second type of agency conflict on the relationship between financialization and firm innovation shows that in firms with relatively concentrated ownership structure, the major shareholders play a leading role in the firm’s operation and development strategy, affect the firm’s financialization goals and financial assets selection, and have different impacts on the firm’s innovation activities. The capital market has become a channel for major shareholders to dig out the interests of minority shareholders. The higher the equity concentration, the more prominent the opportunistic behavior of major shareholders, and the greater the negative impact on firm innovation. With the increase of ownership concentration, related party transactions between firms and major shareholders become more frequent, which leads to the occurrence of interest transmission (Luo and Zhu., 2014) and weakens the innovation motivation of firms. Controlling the shareholding ratio of major shareholders within a certain range, alleviating the agency conflict between major shareholders and minority shareholders through equity checks and balances, reducing tunnel behavior, and facilitating firms to grasp investment opportunities.

6.2 Recommendations

In the context of relatively sluggish real economy, appropriate financialization can broaden profit channels for firms, diversify investment risks, and help firms transform and upgrade. But financialization can also take firms away from their main business. In order to avoid the ‘predatory effect’ of financialization on firm innovation and play the role of providing funds for firm innovation, this paper puts forward the following suggestions based on the research conclusions:

First, real firms should give full play to the promoting role of financialization in business activities and realize the organic combination of financialization and innovation according to their own competitive advantages and industry characteristics and comprehensively consider the long-term development strategy, benefits and risks of firms.

Second, firms should modify the incentive mechanism of managers to reduce their short-sighted behaviors. Reducing the proportion of market value performance to managers’ incentives, increasing the relationship between innovation performance and management’s incentives, stimulating the subjective innovation initiative of managers, which is conducive to the management to make strategic decisions in line with the long-term development of firms.

Last, firms should optimize ownership structure and reduce short-term arbitrage activities of major shareholders. Firms need to improve the board of directors’ examination and supervision of financialization, and give play to the supervisory role of independent directors.

Based on the identification of financialization forms and motivations, this paper conducts theoretical analysis and empirical tests on the relationship between the heterogeneity of financialization and firm innovation. However, the following two problems remain need to be further discussed: One is the measurement methods of firm innovation. The ultimate goal of innovation is to bring benefits to firms. In addition to consider input and output, innovation benefits should also be included in the evaluation system. We will try to establish a more perfect firm innovation evaluation system in subsequent studies. The other is that this paper reveals the relationship between the heterogeneity of financialization and firm innovation, but which does not mean that firms should be strictly prevented from investment-oriented financialization. How to achieve the dynamic balance between financialization and firm innovation needs a further analysis.

China Stock Market and Accounting Research Database (CSMAR) as a research-based database, referring to the standards of CRSP, COMPUSTAT and other authoritative databases, services for universities and financial institutions for research and quantitative investment analysis.

1WIND is the financial and economic data provided by WIND Information, a financial, information and software service enterprise in mainland China.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding authors.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This study was supported by the National Natural Science Found of China (Grant No. 71904107) and the Doctoral Research Startup Fund of Shandong Technology and Business University (Grant No. 306408). We received funds for open access publication fees from those two grants.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmadi, M., Soofiabadi, M., Nikpour, M., Naderi, H., Abdullah, L., and Arandian, B. (2022). Developing a Deep Neural Network with Fuzzy Wavelets and Integrating an Inline PSO to Predict Energy Consumption Patterns in Urban Buildings. Mathematics 10 (10), 1270. doi:10.3390/math10081270

Almeida, H., Campello, M., and Weisbach, M. S. (2004). The Cash Flow Sensitivity of Cash. J. Finance 59 (4), 1777–1804. doi:10.1111/j.1540-6261.2004.00679.x

Awosusi, A. A., Xulu, N. G., Ahmadi, M., Rjoub, H., Altuntas, M., Uhunamure, S. E., et al. (2022). The Sustainable Environment in Uruguay: the Roles of Financial Development, Natural Resources, and Trade Globalization. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.875577

Barton, A. D. (2011). Public Sector Accountability and Commercial-in-Confidence Outsourcing Contracts. Account. Audit. Accoun. 19 (2), 256–271.

Bessem, B. H. (1991). Forward Contracts and Firm Value: Investment Incentive and Contracting Effects. J. Financ. Quant. Anal. 26 (4), 519–532.

Bhaduri, A. (2011). A Contribution to the Theory of Financial Fragility and Crisis. Camb. J. Econ. 35 (6), 995–1014. doi:10.1093/cje/ber011

Bragoli, D., Cortelezzi, F., and Marseguerra, G. (2016). R&D, Capital Structure and Ownership Concentration: Evidence from Italian Microdata. Industry Innovation 23 (3), 1–20. doi:10.1080/13662716.2016.1145573

Brown, J. R., Martinsson, G., and Petersen, B. C. (2012). Do financing Constraints Matter for R&D? Eur. Econ. Rev. 56 (8), 1512–1529. doi:10.1016/j.euroecorev.2012.07.007

Brown, J. R., and Petersen, B. C. (2011). Cash Holding and R&D Smoothing. J. Firm Finance 17 (4), 694–709. doi:10.1016/j.jcorpfin.2010.01.003

Cardella, L., Hao, J., and Kalcheva, I. (2015). Make and Take Fees in the U.S. Equity Market. University of Arizona, Working Paper.

Chen, T.-c., Guo, D.-Q., Chen, H.-M., and Wei, T.-t. (2019). Effects of R&D Intensity on Firm Performance in Taiwan's Semiconductor Industry. Econ. Research-Ekonomska Istraživanja 32 (1), 2377–2392. doi:10.1080/1331677X.2019.1642776

Chen, X. M., and Zhang, K. X. (2020). Allocation of Financial Assets and Innovative Investment: Reservoir Effect or Crowding-Out Effect. Mod. Finance Economics-Journal Tianjin Univ. Finance Econ. 40 (6), 80–98. doi:10.19559/j.cnki.12-1387.2020.06.006

Cornaggia, J., Mao, Y., and Tian, X. (2015). Does Banking Competition Affect Innovation? J. Financial Econ. 115 (1), 189–209. doi:10.1016/j.jfineco.2014.09.001

Crotty, J. (2003). The Neoliberal Paradox: The Impact of Destructive Product Market Competition and Impatient Finance on Nonfinancial Corporations in the Neoliberal Era. Rev. Radic. Political Econ. 35 (3), 271–279. doi:10.1177/0486613403255533

Dallery, T. (2009). Post-keynesian Theories of the Firm under Financialization. Rev. Radic. Political Econ. 41 (4), 492–515. doi:10.1177/0486613409341371

Demir, F. (2009). Financial Liberalization, Private Investment and Portfolio Choice: Financialization of Real Sectors in Emerging Markets. J. Dev. Econ. 88 (2), 314–324. doi:10.1016/j.jdeveco.2008.04.002

Du, Y., Zhang, H., and Chen, J. Y. (2017). The Impact of Financialization on Future Development of Real Enterprises’ Core Business: Promotion or Inhibition. China Ind. Econ. (12), 113–131. doi:10.19581/j.cnki.ciejournal.20171214.007

Gu, Y. Y., and Shen, K. R. (2012). The Effect of Local Governments’ Behavior on firmR&D Investment—Empirical Analysis Based on China’s Provincial Panel Data. China Ind. Econ. (10), 77–88. doi:10.19581/j.cnki.ciejournal.2012.10.007

Habesoglu, O., Samour, A., Tursoy, T., Ahmadi, M., Abdullah, L., and Othman, M. (2022). A Study of Environmental Degradation in Turkey and its Relationship to Oil Prices and Financial Strategies: Novel Findings in Context of Energy Transition. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.876809

Hall, B. H., Jaffe, A., and Trajtenberg, M. (2005). Market Value and Patent Citations. Rand J. Econ. 36 (1), 16–38. doi:10.1007/s11127-005-3550-0

Hu, Y. M., Wang, X. T., and Zhang, J. (2017). The Motivation for Financial Asset Allocation: Reservoir or Substitution? Evidence from Chinese Listed Companies. Econ. Res. J. 52 (1), 181–194.

Huang, X. H., Wu, Q. S., and Wang, Y. (2018). Financial Asset Allocation and Financial Risks of Enterprises: “Precautions” or “Bartering”. J. Finance Econ. 44 (12), 100–112. doi:10.16538/j.cnki.jfe.2018.12.008

Jensen, M. C., and Meckling, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency Cost, and Ownership Structure. J. Financial Econ. 3 (4), 305–360. doi:10.1016/0304-405x(76)90026-x

Kalcheva, L., and Lins, K. V. (2007). International Evidence on Cash Holdings and Expected Managerial Agency Problems. Rev. Financial Stud. Soc. Financial Stud. 20 (4), 1087–1112. doi:10.1093/rfs/hhm023

Kim, C., Mauer, D. C., and Sherman, A. E. (1998). The Determinants of Corporate Liquidity: Theory and Evidence. J. Financ. Quant. Anal. 33 (3), 335–359.

Laeven, L., and Levine, R. (2007). Is There a Diversification Discount in Financial Conglomerates? J. Financial Econ. 85 (2), 331–367. doi:10.1016/j.jfineco.2005.06.001

Li, C. R., Liu, Y. Y., and Lin, C. J. (2016). Top Management Team Diversity, Ambidextrous Innovation, and the Mediating Effect of Top Team Decision-Making Processes. Industry Innovation 23 (2), 260–275. doi:10.1080/13662716.2016.1144503

Li, W. J., and Zheng, M. N. (20162016). Is it Substantive Innovation or Strategic Innovation? impact of Macroeconomic Policies on Micro-enterprises’ Innovation. Econ. Res. J. (4), 60–73.

Liu, G. C. (2017). Financial Asset Allocations and the Firms’ R&D Activity in China: Crowding-Out or Crowding in? Stat. Res. (7), 49–61. doi:10.19343/j.cnki.11-1302/c.2017.07.005

Luo, Y. U., and Zhu, F. (2014). Financialization of the Economy and Income Inequality in China. Econ. Political Stud. 2 (2), 46–66. doi:10.1080/20954816.2014.11673844

Luo, Z., and Zhang, C. C. (2015). Credit Expansion, Real Estate Investment and the Efficiency of Resource Allocation in Industry. J. Financial Res. 07, 60–75.

Me, L. H., and Chen, Z. H. (2016). The Convergence Analysis of Regional Growth Differences in China: the Perspective of the Quality of Economic Growth. J. Serv. Sci. Manag. 9 (6), 453–476. doi:10.4236/jssm.2016.96049

Myers, S., and Rajan, R. (1998). The Paradox of Liquidity. Q. J. Econ. 113 (3), 733–771. doi:10.1162/003355398555739

Opler, T., Pinkowitz, L., Stulz, R., and Williamson, R. (1997). The Determinants and Implications of Firmcash Holdings. NBER Work. Pap. 52 (1), 3–46. doi:10.1016/S0304-405X(99)00003-3

Orhangazai, Q. (2008). Financialization and Capital Accumulation in the Non-financial Corporate Sector: A Theoretical and Empirical Investigation on the US Economy: 1973-2003. Camb. J. Econ. 32 (6), 863–886.

Ortiz, J. P. D., and Pablo, J. (2014). Financialization: The Aids of Economic System. Ens. de Econ. 23 (44), 55–73.

Palley, T. I. (2008). Financialization: What it is and Why it Matters. The Levy Economics Institute, IMK Working Paper.

Pata, U. K., and Samour, A. (2022). Do renewable and Nuclear Energy Enhance Environmental Quality in France? A New EKC Approach with the Load Capacity Factor. Prog. Nucl. Energy 149, 104249. doi:10.1016/j.pnucene.2022.104249

Rajan, R. G., and Zingales, I. (1998). Financial Dependence and Growth. Am. Econ. Rev. 88(3): 559–586. doi:10.2753/PET1061-1991410353

Ren, H. Y. (2011). Moderating Effects of Firm Governance on the Relation between R&D Input and Firm Performance. J. Manag. Sci. 24 (5), 37–47.

Samour, A., and Pata, U. K. (2022). The Impact of the US Interest Rate and Oil Prices on Renewable Energy in Turkey: a Bootstrap ARDL Approach. Environ. Sci. Pollut. Res. doi:10.1007/s11356-022-19481-8

Seo, H. J., Kim, H. S., and Kim, T. C. (2012). Financialization and the Slowdown in Korean Firm’s R&D Investment. Asian Econ. Pap. 11 (3), 35–49. doi:10.1162/asep_a_00160

Sheng, M. Q., Wang, S., and Shang, Y. P. (2018). Financial Assets Allocation and Entity Enterprises’ Total Factor Productivity: “Integration of Industrial-Finance Capital” or “Removing Reality to Virtual”. Finance Trade Res. 10, 87–97. doi:10.19337/j.cnki.34-1093/f.2018.10.008

Stiglitz, J. E., and Weiss, A. (1981). Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 71 (3), 393–410.

Stockhammer, E. (2004). Financialization and the Slowdown of Accumulation. CJE 28 (5), 719–741. doi:10.1093/cje/beh032

Tornell, A. (1990). Real vs. Financial Investment Can Tobin Taxes Eliminate the Irreversibility Distortion. J. Dev. Econ. 32 (2), 419–444. doi:10.1016/0304-3878(90)90045-d

Wang, H. J., Cao, Y. Q., Yang, Q., and Yang, Z. (2017). Does the Financialization of Non-financial Enterprises Promote or Inhibit Firm Innovation. Nankai Bus. Rev. (1), 155–166.

Wen, C. H., and Ren, G. L. (2015). Research on Separating Development of Virtual and Substantial Economy-Evidence from China’s Listed Firms from 2006-2013. China Ind. Econ. (12), 115–129. doi:10.19581/j.cnki.ciejournal.2015.12.009

Xu, G., and Zhu, W. D. (2017). Firm financialization, Market Competition and R&D Investment—Evidence From Chinese Non-Finance Listed Companies. Stud. Sci. 35 (5), 709–728.

Yang, X. Q., and Zeng, Y. (2014). Has Cash Holding Been Able to Smoothed Corporate R&D—An Empirical Research Based on Perspective of Financing Constraints and Financial Development. Sci. Res. Manag. 35 (7), 107–115.

Yang, Z., Liu, F., and Wang, H. J. (2017). Are Firm Financial Assets Allocated for Capital Reserve or Speculative Purpose? Manag. Rev. (2), 13–25. doi:10.14120/j.cnki.cn11-5057/f.2017.02.002

Yang, S. L., Niu, D. Y., Liu, T. L., and Wang, Z. H. (2019). Financialization of Entity Firms, Analyst Coverage and Internal Innovation Driving Force. J. Manag. Sci. (2), 3–18.

Ye, K. T., and Zeng, X. Y. (2011). Economic Consequences of Internal Capital Market: the Role of Business Strategt. Account. Res. (6), 63–69.

Zhang, C. S., and Zhang, B. T. (2016). The Falling Real Investment Puzzle: a View from Financialization. Econ. Res. J. (12), 32–46.

Zhao, X., Ramzan, M., Sengupta, T., Deep Sharma, G., Shahzad, U., and Cui, L. (2022). Impacts of Bilateral Trade on Energy Affordability and Accessibility across Europe: Does Economic Globalization Reduce Energy Poverty? Energy Build. 262, 112023. doi:10.1016/j.enbuild.2022.112023

Keywords: financialization, firm innovation, research and development, energy transition, heterogeneity, agency conflict, China

Citation: Yu W, Zhan Q, Ameer W, Li L, Tarczyński W and Mentel U (2022) Effects of Heterogeneity of Financialization on Firm Innovation: Evidence in Context of Energy Transition in Lens of Research and Development. Front. Energy Res. 10:930974. doi: 10.3389/fenrg.2022.930974

Received: 28 April 2022; Accepted: 24 May 2022;

Published: 14 June 2022.

Edited by:

Magdalena Radulescu, University of Pitesti, RomaniaReviewed by:

Ahmed Samour, Near East University, CyprusMohsen Ahmadi, Urmia University of Technology, Iran

Copyright © 2022 Yu, Zhan, Ameer, Li, Tarczyński and Mentel. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qilin Zhan, 201613571@sdtbu.edu.cn; Waqar Ameer, waqar.ameer@yahoo.com

Wenjing Yu1

Wenjing Yu1  Qilin Zhan

Qilin Zhan Waqar Ameer

Waqar Ameer Lianwei Li

Lianwei Li Urszula Mentel

Urszula Mentel