Bank digitalization and corporate green innovation: empowering or negative?

- College of Business Administration, Liaoning Technical University, Huludao, China

In the context of bank digitalization construction, this paper explores the impact and mechanism of bank digital transformation on corporate green innovation based on the data of listed enterprises from 2010 to 2021. It is found that bank digital transformation enhances the overall and strategic nature of corporate green innovation but has no significant impact on corporate substantive green innovation. The mechanism analysis shows that bank digital transformation can promote corporate green innovation by inhibiting corporate financialization and alleviating corporate financing constraints. Government environmental regulation and media attention have a positive moderating effect on the relationship between banks’ digital transformation, and enterprises’ green innovation, i.e., an increase in the level of government environmental regulation and an increase in media attention will strengthen the promotion effect of banks’ digital transformation on enterprises’ green innovation. Heterogeneity analysis shows that the promotion effect of banks’ digital transformation on corporate green innovation is more significant for state-owned enterprises, heavily polluted enterprises, large-scale enterprises, and enterprises in the eastern region. Therefore, the digital transformation of banks can “empower” the green innovation of enterprises, help the green development of enterprises, and lead the high-quality development of the economy. At the same time, the study’s results also show that the green development of enterprises should not be “superficial” but “substantial.”

1 Introduction

This paper explores the relationship between bank digitalization and corporate green innovation. China has neglected the environment while upgrading its economy in the past (Zhao et al., 2023). Now that the problems of resource scarcity and climate change are becoming more pressing, implementing green production methods has become a consensus. As the first driver of high-quality green development, innovation can improve energy efficiency and achieve cleaner production (Takalo and Tooranloo, 2021). Green innovation has undoubtedly become a powerful tool for solving environmental problems (Ulucak and Baloch, 2023). However, green innovation is a long-cycle activity with uncertain returns (Cao et al., 2021; Lin and Ma, 2022), and the traditional banking sector, which is the primary source of financing for Chinese firms, has been reluctant to take risks, resulting in a stagnant green innovation process. The arrival of digital technology has led to an all-round change in the banking sector, which has taken up the responsibility of promoting corporate green development (Yang et al., 2021; Cao et al., 2022). Therefore, exploring the impact of banking digitalization on corporate green innovation is significant for achieving sustainable and high-quality economic development.

Since the Industrial Revolution, economic growth has led to severe environmental problems (Xiong and Xu, 2021; Lin and Ma, 2022). China’s past crude economic development model has sacrificed the ecological environment for economic growth, leading to increasingly severe problems of resource depletion and environmental pollution. As the world’s second-largest economy, China is the world’s largest emitter of carbon dioxide (CO2), accounting for more than a quarter of global emissions and playing a pivotal role in global environmental governance (Gregg et al., 2008; Zheng et al., 2023). As environmental control becomes increasingly urgent, China is pursuing a green transformation alongside economic growth to ensure sustainable economic and ecological development (Zhao et al., 2022). The 20th National People’s Congress report pointed out that “promoting the greening and decarbonization of economic and social development is a key link to achieving high-quality development. ”Therefore, enterprises are an essential focus point for high-quality development and should be embedded in social development’s greening and decarbonization process. Enterprises are a necessary engine of economic growth, a crucial main body for pollution prevention and ecological civilization construction (Shrivastava, 1995; Liu et al., 2022; Ding et al., 2023). Innovation is the first driving force to lead development, and green innovation, with the core pursuit of realizing green growth, is an inevitable response to strict environmental regulations and the realization of sustainable development in production and consumption. Green innovation can enhance the competitiveness of enterprises while reducing the consumption of natural resources (Tu and Wu, 2021).

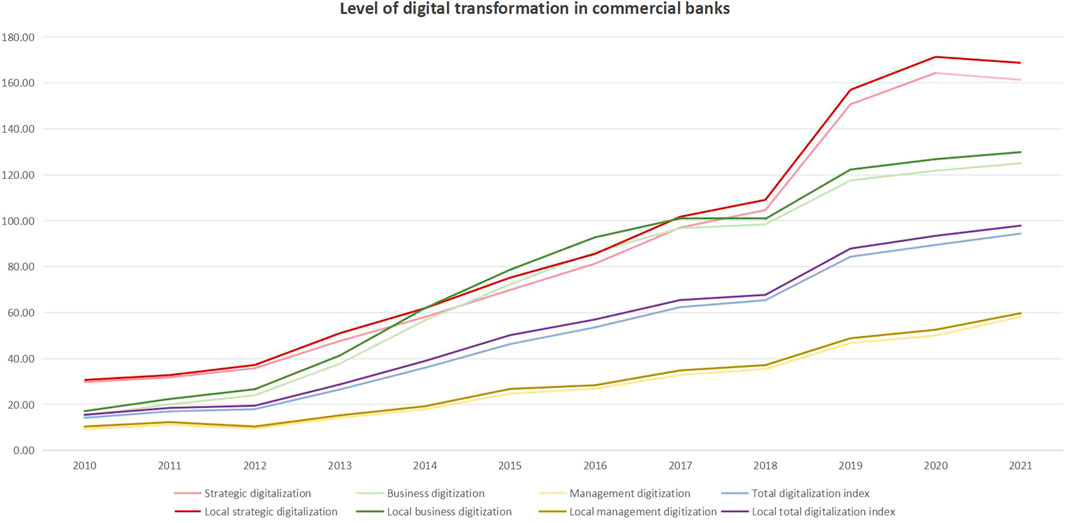

Finance, as the bloodline of the real economy, is undergoing a systemic digital transformation, taking on the heavy responsibility of greening enterprises and promoting high-quality economic development (Yang et al., 2021; Cao et al., 2022). Ma and Zhu’s (2022) study shows that the digital economy promotes the change of production and governance methods, effectively driving high-quality green development. The digital economy has also demonstrated its strong resilience and potential in the face of China’s severe environmental problems at this stage (Hao et al., 2023). The development of digital technology has changed how financial service providers perform their duties, and competition in the financial services industry has intensified in the digital environment, making it imperative for financial institutions to undergo digital transformation to adapt to the overall environment (Gomber et al., 2018). In this regard, the Outline of the 14th Five-Year Plan for the National Economic and Social Development of the People’s Republic of China and the Vision 2035 emphasizes that fintech should be developed prudently and the digital transformation of financial institutions should be accelerated. Long cycles and large investments in corporate green innovation require significant and stable financing (Cao et al., 2021; Lin and Ma, 2022). Traditional finance is less inclusive and has high service thresholds, making it difficult to provide long-term and stable financial support for enterprises, negatively affecting their green innovation investments (Ghisetti et al., 2017). Digitalization of financial institutions breaks time and space constraints and improves the efficiency of financial services, which can fill the funding gap of corporate green transformation (Feng et al., 2022; Lee et al., 2022). Chinese finance is characterized by significant bank dominance (Allen et al., 2005; Cao et al., 2022). Gomber et al. (2018) and Wang et al. (2021) find that banks do reduce operating costs, streamline business processes, and improve service efficiency through digital technology to achieve a win-win situation for both banks and enterprises. As shown in Figure 1, the level of digital transformation of Chinese commercial banks has been increasing from 2010 to 2021, with the total digitization index rising from the initial 14.2 to 50.64. Moreover, the digitization level of local banks, excluding foreign banks, is higher than overall commercial banks. Specifically, according to the mean value of each data and then finding the percentage difference between the digital transformation of local and overall commercial banks, we know that the digitalization of local banks’ strategy is 4.48% higher than that of overall commercial banks, the digitalization of local banks’ business is 5.71% higher than that of overall commercial banks, the digitalization of local banks’ management is 5.59% higher than that of overall commercial banks, and the total digitalization index of local banks is 5.45% higher than that of overall commercial banks. However, the development of digital technology has brought both opportunities and challenges to banks. Murinde et al. (2022) and Buchak et al. (2018) found that financial disintermediation is getting worse in the digital context, traditional banking business is severely impacted, competition among banks is intensifying, and fintech companies are encroaching on banking business. Banks face disruptive changes, and various types of banks show differentiation in the digitalization process; for example, diversified banks become less stable with digital transformation (Khattak et al., 2023), and there is uncertainty in the effect of banks’ digital transformation. Whether bank digital transformation can promote corporate green innovation and realize a low-carbon economy still needs further exploration.

Many previous studies have explored the influencing factors of corporate green innovation. For example, Xia et al. (2022) explored the influencing factors of corporate green innovation from the perspective of government subsidies, Li and Du (2021), Lin et al. (2014), and Galbreath (2019) carried out a series of investigations from the perspectives of environmental regulation, corporate political capital, and corporate governance, but there are not many studies that investigate whether and how banks’ digital transformation can promote corporate green innovation has not been studied much. Although some scholars have noted that the development of digital finance is expected to achieve green economic growth (Hao et al., 2023), they are more likely to explore the impact of digital finance on the level of corporate green innovation (Feng et al., 2022; Liu et al., 2022). None of them have sunk the study of the impact of digital finance on corporate green innovation to the level of bank digitization. They are more likely to bank digitization, which is covered in digital finance (Lin and Ma, 2022). However, digital finance emphasizes the innovation of products and services, and bank digital transformation emphasizes the innovation of business models, which are fundamentally different. Therefore, this paper explores the impact of banks’ digital transformation on corporate green innovation. Bank digital transformation is the main body of the digital transformation of financial institutions, but it is also the main channel for enterprises to obtain external financing. Whether bank digital transformation can positively affect corporate green innovation is crucial to how China can achieve synergistic development of digital greening. This paper attempts to address the above gap through the following questions:

i) How will banks’ digital transformation affect corporate green innovation in the context of digitization?

ii) What is the exact mechanism by which banks’ digital transformation affects corporate green innovation?

iii) Is there any heterogeneity in the impact of banks’ digital transformation on corporate green innovation in the context of differences in China’s corporate development and regional economic development?

This paper empirically analyzes the impact and mechanism of banks’ digital transformation on corporate green innovation using data from 2010 to 2021. The possible marginal contributions of this study are as follows:

i) Existing literature has focused on the impact of digital finance on corporate greening (Feng et al., 2022; Liu et al., 2022), emphasizing the impact of new service models on corporate greening. As the dominant player in China’s financial industry, banks differ from digital finance in digital transformation. Digitalization of banks emphasizes business model innovation. In light of the speeding up and deepening of digital transformation in China’s banking industry, this paper explores the impact of banks’ digital transformation on corporate green innovation from theoretical and empirical perspectives. It provides empirical evidence of the positive effect of banks’ digital transformation on corporate green innovation through benchmarking analysis, which expands the consequences of banks’ digital transformation and provides valid evidence of positive externalities brought by banks’ digital transformation.

ii) Existing literature mainly focuses on the impact of financing constraints, a mediating variable, on corporate green development (Li et al., 2022; Lin and Ma, 2022). This paper broadens the new perspective and explores the mechanism of bank digital transformation on corporate green innovation by focusing on two mechanisms: financing constraints and corporate financialization.

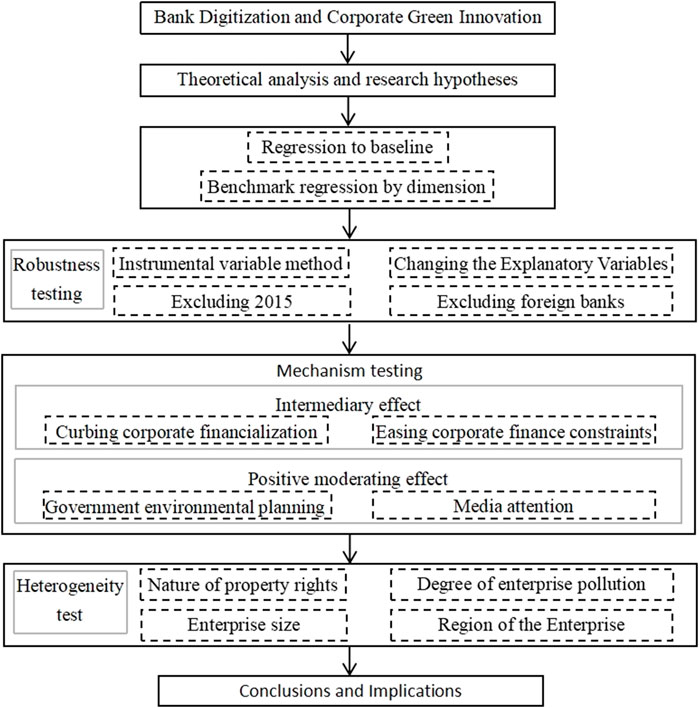

The rest of the study is structured as follows: Section 2 provides a theoretical analysis and presents the theoretical hypotheses; Section 3 details the data sources, variables, and methodology; Section 4 gives the empirical results; Section 5 gives the conclusions and implications. The flow chart of the study is shown in Figure 2.

2 Theoretical analysis and research hypothesis

Green innovation is characterized by strong externalities, long cycles, and high capital demand (Cao et al., 2021), and enterprises’ inputs are unable to meet the funding gap of green innovation, so external financing has become an important channel for enterprises to obtain funds for green innovation activities. However, traditional financial institutions have poor inclusivity and tend to focus on projects with low risk and short maturities. Bank digitization relying on digital technology has the characteristics of high efficiency and convenience, providing critical support for enterprises’ green innovation activities. Bank digitalization is the mutual integration of digital technology and traditional banks (Rodrigues et al., 2022; Xie and Wang, 2023). Digital technology has been deeply rooted in green attributes from its birth to crack the environmental dilemma facing human development and realize its sustainable development. The green qualities of digital technology and the essence and mission of financial services for the high-quality development of the real economy embedded corporate green innovation in the financial digital development (Ozturk and Ullah, 2022). It has been shown that digital finance promotes enterprise green innovation and reduces environmental pollution by optimizing credit allocation and regulation (Li et al., 2022; Lin and Ma, 2022). Chinese finance is characterized by significant bank dominance. The digital transformation of banks will further break down the information barriers between banks and enterprises, provide a new business model, and significantly improve the quantity, quality, depth, breadth, and speed of information of banks and enterprises, further reducing the pricing bias, supervision bias, and risk control bias of bank credit, and constrain the abuse of power by bank management so that the screening and supervision of green projects will become more scientific and precise, and thus be able to empower enterprise green innovation (Gomber et al., 2018; Lin and Ma, 2022). innovation (Gomber et al., 2018; Diener and Špaček, 2021; Wang et al., 2021; Lee et al., 2022).

Based on the above analysis, this paper proposes the following hypotheses:

H1. Banks’ digital transformation empowers corporate green innovation.

Because of insufficient support from financial resources, real enterprises often adopt financialization methods to pursue profit maximization, risk avoidance, and misappropriation of enterprise innovation and R&D investment (Yan et al., 2023). In the face of the downturn of the real economy, governments have launched loose monetary policy, which makes a large number of funds flow into the capital market and real estate market. The profitability of financial investment continues to rise, and non-financial enterprises, out of pursuing the principle of maximizing profits, tend to become increasingly financialized. The financialization of physical enterprises has led to a continuous flow of funds to the financial sector, resulting in a lack of physical assets and difficulty in obtaining credit support. At the same time, enterprise green innovation is a kind of investment with a longer cycle, delayed return, and greater capital demand, which managers will regard as having more significant uncertainty, thus cutting down green innovation investment and hindering enterprises from carrying out green innovation. Banks use digital technology to automate business processes, optimize cumbersome processes, and improve credit allocation efficiency (Lin and Ma, 2022). At the same time, by accurately capturing the “digital footprints” of enterprises, banks know the actual operating conditions of enterprises, effectively alleviate the problem of information asymmetry between banks and enterprises before lending, improve the banks’ ability to evaluate the creditworthiness of enterprises, reduce the reliance on collateral, expand the proportion of credit issuance, and weaken the financialization phenomenon caused by enterprises’ risk avoidance (Gao and Ren, 2023; Wang and Hu, 2023; Yan et al., 2023), thus expanding the R&D investment of enterprises and promoting green innovation.

Based on the above analysis, this paper proposes the following hypothesis:

H2. Banks’ digital transformation expands credit scale, inhibits enterprises’ financialization behaviors out of risk aversion, increases enterprises’ green innovation funds, and thus promotes enterprises’ green innovation.

The Guiding Opinions on Digital Transformation of the Banking and Insurance Industry issued by the China Banking and Insurance Regulatory Commission (CBIRC) in 2022 specifies that bank digitalization is an inevitable necessity based on a new stage of development and that its origin lies in serving the real economy and carrying out ecological construction. Banks’ digital transformation alleviates the problem of high cost and low efficiency of traditional banks and makes it possible for banks to benefit enterprises. 1) According to data showing that China’s population officially entered negative growth in 2022, it is predicted that China’s negative population growth will show a trend of long duration, rapid development, large-scale downsizing, and difficulty to rebound, and labor costs are rising. The digital transformation of banks promotes the shift of banking services to online, and the previous highly repetitive work is replaced by machines, reducing the labor cost of banks (Rodrigues et al., 2022; Xie and Wang, 2023). 2) Banks also use technologies such as big data and artificial intelligence for regulatory purposes, enhancing their information screening capabilities, tracking the use of corporate funds in real-time, reducing bank regulatory costs (Guo et al., 2023), and reducing the requirements for corporate credit collateral, driving down bank costs and improving operational efficiency. Compared with the traditional banking system’s high-risk premiums and high operating costs, bank digitization breaks down the financing barriers of enterprise green innovation projects, effectively solves the financing problems of enterprise green innovation projects, and promotes the transformation of economic structure to green and low-carbonization.

Based on the above analysis, this paper puts forward the following hypotheses:

H3. Bank digitalization transformation promotes bank concessions to enterprises, effectively eases enterprise financing constraints, and then promotes enterprise green innovation.

Government environmental regulation is a formal system constraining firms’ environmental pollution behavior, forcing firms to increase green investment and undergo green transformation (Feng et al., 2022). Firms subject to more lenient environmental regulations do not take the initiative to go green due to concerns about production costs (Hasan and Du, 2023), while strict government environmental regulations increase firms’ costs, reduce firms’ revenues, and incentivize firms to innovate green. Government environmental regulation incorporates corporate environmental governance into the economic and social rating system for high-quality development, utilizing the government’s “hand” to support sustainable development (Yu et al., 2023). In the era of the digital economy, the increase in the intensity of government environmental regulation can help enterprises improve the efficiency of factor allocation and effectively utilize the funds provided by the digital transformation of banks for enterprises. At the same time, the greater the intensity of government environmental regulation, the more significant the impact of corporate green behavior on bank credit decision-making, effectively promoting bank digitalization of corporate green change, thus promoting corporate green innovation.

Based on the above analysis, this paper puts forward the following hypotheses:

H4. The increase in the intensity of government environmental regulation will strengthen the promotion effect of bank digital transformation on enterprise green innovation.

Media attention is an informal system that complements government environmental regulation. Media attention is the primary external supervisor and information intermediary. On the one hand, the media, through tracking enterprises and reports, increases corporate information’s transparency and the difficulty and cost of corporate environmental violations. On the other hand, with the continuous improvement of public awareness of environmental protection, media reports have become an essential channel for the public to understand the information of corporate environmental governance, condemn corporate pollution behavior, increase the possibility of government regulatory intervention, the relevant adverse reports affect corporate value and reputation, further increasing public and bank supervision of environmental governance issues and monitoring corporate management’s adoption of green strategies (Becchetti and Manfredonia, 2022). Therefore, the higher the media attention, the more significant the contribution of bank digitization to corporate green innovation should be.

Based on the above analysis, this paper proposes the following hypothesis:

H5. Increased media attention reinforces the role of bank digitalization in promoting corporate green innovation.

3 Research design

3.1 Sample data source and processing

In this paper, Chinese-listed companies are selected as the research sample. Given that the timeframe of the commercial bank digital transformation data from the Digital Finance Research Center of Peking University used in this paper is 2010–2021. Therefore, this paper selects listed enterprises from 2010 to 2021 as the research object.

The sample data are processed as follows: 1) ST, ST*, and PT enterprises are excluded; 2) financial and real estate enterprises are excluded; 3) enterprises with less than 5 years of operation are excluded; 4) samples with missing data are excluded. Finally, 21,532 valid sample observations were obtained. The financial data in this paper comes from the CSMAR database, and the green patent data and the number of media reports come from the CNRDS database.

3.2 Definition of variables

3.2.1 Explained variables

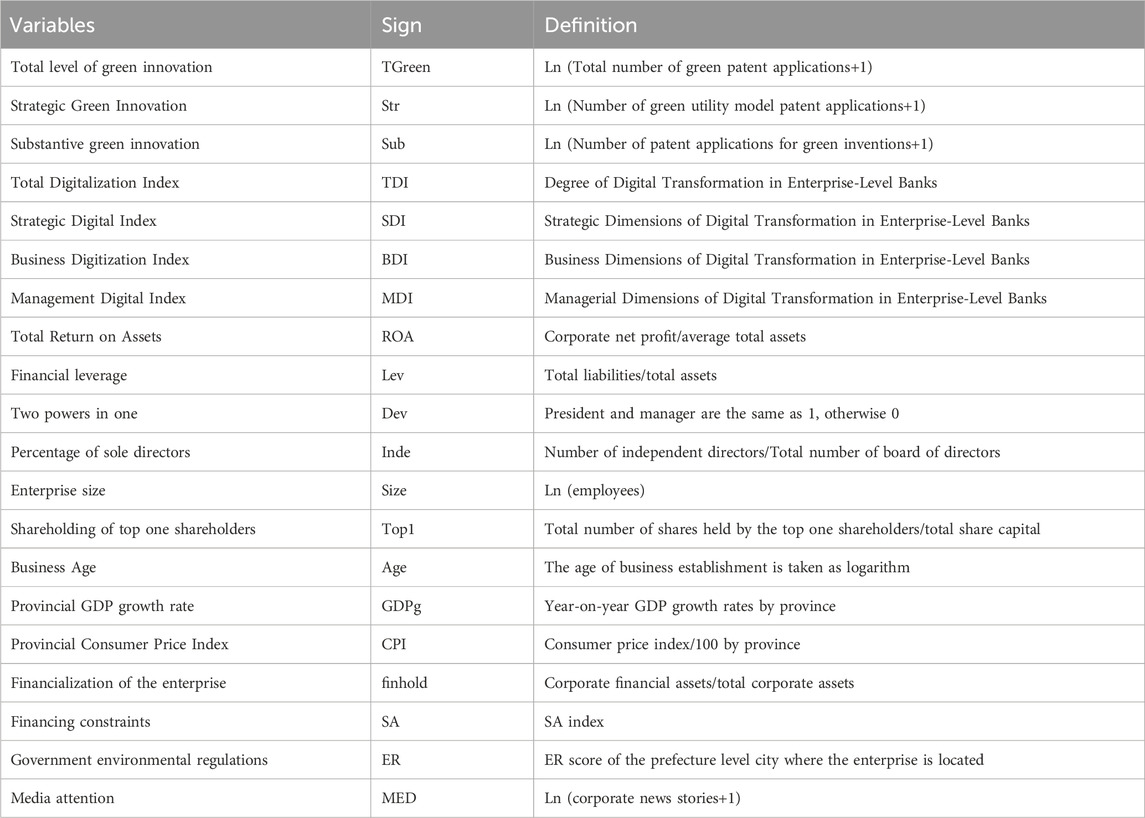

Corporate Green Innovation (TGreen). This paper uses the number of corporate green patent applications to measure the level of corporate green innovation. Referring to existing studies, it is found that the number of corporate green patent applications is a standard indicator for measuring corporate green innovation (Cao et al., 2021; Li et al., 2022; Liu et al., 2022). Based on this, this paper refers to the study of Rao et al. (2022), which takes the total number of corporate green patent applications as a measure of the total level of corporate green innovation and takes the number of corporate green utility model patent applications as a measure of the level of strategic green innovation (Str), and the number of corporate green invention patent applications as a measure of the level of substantive green innovation (Sub) of the enterprise.

3.2.2 Explanatory variables

The degree of bank digital transformation at the enterprise level (TDI). First, this paper takes Peking University’s digital transformation index of Chinese commercial banks as a measure of the digital transformation of commercial banks. It subdivides banks’ digital transformation into three sub-dimensions: strategic digitalization, business digitalization, and management digitalization. Second, based on the data of commercial banks’ lending to enterprises, the level of digital transformation of commercial banks’ lending to enterprises is calculated to obtain the degree of bank digital transformation (TDI), the degree of strategic digital transformation (SDI), the degree of business digital transformation (BDI), and the degree of management digital transformation (MDI) at the enterprise level.

3.2.3 Intermediary variables

Firm financialization level (finhold). This paper refers to the studies of Yan et al. (2023) and Gao and Ren (2023) to measure corporate financialization by the ratio of corporate financial assets to total assets where corporate financial assets include trading financial assets, loans and advances granted, derivative financial assets, held-to-maturity investments, available-for-sale financial assets, and investment properties.

Corporate Financing Constraints (SA). Currently, there are the SA index, WW index, and KZ index for measuring corporate financing constraints, of which the SA index is more exogenous. Hence, the research in this paper takes the SA index as a measure of corporate financing constraints.SA index is calculated as follows:

where Asset is the natural logarithm of the firm’s total assets, and Age is the firm’s year of establishment. The SA index is negative, and the larger its absolute value, the more severe the financing constraints faced by the enterprise.

3.2.4 Regulatory variables

Government environmental regulation intensity (ER). In this paper, referring to the studies of Li et al. (2023) and Chen and Chen (2018), 27 environmental words were selected by considering the three aspects of environmental protection goals, objects, and measures. Secondly, we downloaded the work reports of each prefectural and municipal government, read the work reports of the prefectural and municipal governments by using Python software, and divided the words into words in the text of the work reports of each prefectural and municipal government, and tallied. Finally, the ratio of the frequency of environmental words to the frequency of the full text of the government work report is used to measure the intensity of environmental regulation in each prefecture-level city. The larger the value, the greater the intensity of government environmental regulation. The intensity of government environmental regulation for each enterprise is matched according to the city to which the enterprise belongs.

Media Attention (MED). With the arrival of the digital era, traditional paper media are affected by new media, the survival space is constantly compressed, and more and more traditional paper media choose to suspend publication due to the deterioration of economic benefits. In comparison, online media has the advantages of stronger timeliness, longer retention time, more openness, and lower cost. Considering this, the influence of online media is more significant than traditional paper media in the context of the digital economy. Therefore, this study measures the media attention received by enterprises based on the online news coverage of listed companies in CNRDS.

3.2.5 Control variables

To avoid the possibility of biased econometric tests due to omitted variables, this paper refers to the studies of Lin and Ma (2022) and Liu et al. (2022). It selects the following control variables: at the micro level, we choose the return on total assets (ROA), financial leverage (Lev), unification of the two powers (Dev), the percentage of sole director (Inde), the size of the firm (Size), the percentage of the first shareholding (Top1), and firm Age (Age). In addition, to minimize the endogeneity problem, this paper further controls for the following macro-level variables: provincial GDP growth rate (GDPg) and provincial consumer price index (CPI).

All variables are defined as shown in Table 1.

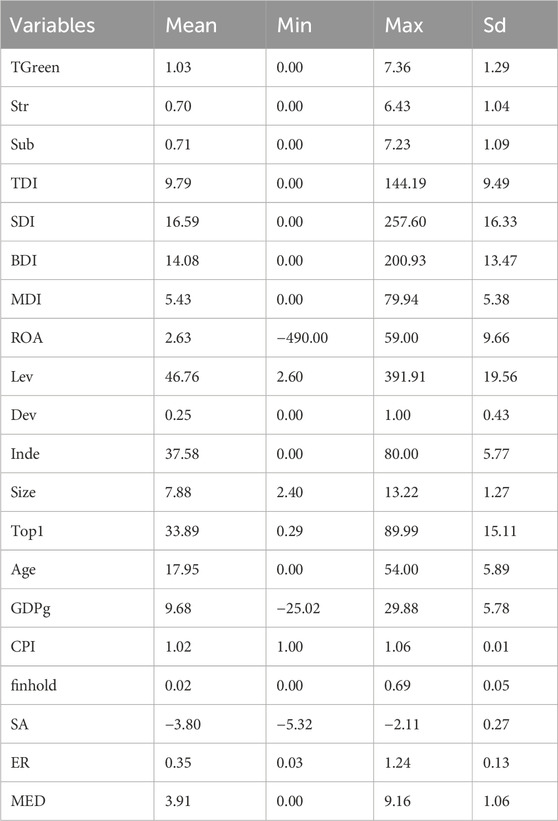

3.3 Analysis of descriptive statistics

Table 2 gives the descriptive statistics results of the main variables. As can be seen from Table 2, the minimum value of the total level of enterprise green innovation is 0, the maximum value is 7.36, and the mean value is 1.03, indicating significant differences in the total level of green innovation among enterprises. The minimum value of the two sub-dimensions of corporate green innovation, strategic green innovation, and substantive green innovation is 0, and the maximum value is 6.43 and 7.23, with a mean value of 0.7 and 0.71, respectively, indicating that there are also significant differences in strategic green innovation and substantive green innovation among different enterprises. The minimum value of the degree of digital transformation of banks at the enterprise level is 0, the maximum value is 144.19, and the mean value is 9.79, indicating that the digital transformation of banks at the enterprise level varies widely.

3.4 Model construction

This paper uses a two-way fixed effects model to test the role of bank digital transformation on corporate green innovation, controlling for individual and year-fixed effects. The baseline model is as follows:

In model, i denotes the enterprise, and t denotes the year. Where Green is the level of corporate green innovation, specifically, it includes the total level of corporate green innovation (TGreen) and its two sub-dimensions. The sub-dimensions include corporate strategic green innovation (Str) and corporate substantive green innovation (Sub).DI denotes the bank digital transformation index, and precisely, the bank digital transformation index consists of the following four dimensions: the SDI denotes the Strategic Digitalization Index, BDI denotes the Business Digitalization Index, MDI denotes the Management Digitalization Index, and TDI denotes Total Digitalization Index.

4 Empirical analysis

4.1 Benchmark regression results

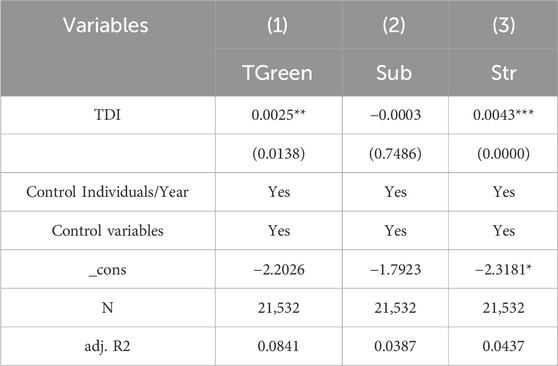

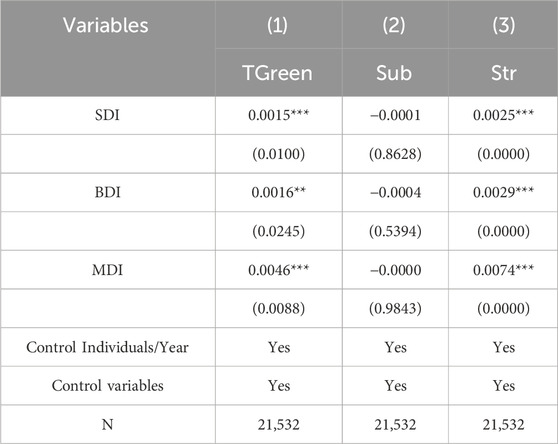

Table 3 shows the results of the benchmark regression on the impact of bank digital transformation on corporate green innovation. The column (1) results in Table 3 show that the total bank digital transformation index is significantly positive at the 5% level with the total level of corporate green innovation, indicating that bank digital transformation improves the overall corporate green innovation. To further explore the impact of bank digitization on corporate green innovation, columns (2) and (3) examine the impact of bank digitization on the sub-dimensions of corporate green innovation. The results show that the total bank digitization index is negatively correlated with corporate substantive green innovation and that the entire bank digitization index is positively correlated with corporate strategic innovation at the 1% level, which indicates that the digital transformation of banks increases the strategic green innovation of enterprises, but does not promote the substantive green innovation of enterprises. It can be seen that although banks’ digital transformation has taken advantage of digital technology to provide better support for enterprises’ green innovation, it only promotes enterprises’ strategic green innovation. Enterprises only carry out strategic green innovation with little technical difficulty and investment capital to obtain government green subsidies, bank credit support and preferences, etc., to satisfy the bank’s screening of green development enterprises (Liu and Dong, 2022). It can be seen that at this stage, the purpose of enterprises to carry out green innovation is more to meet the national green development requirements, and the number of pursuing green innovation to convey to the bank the signal that they are actively carrying out green innovation, to obtain more and more stable credit support (Rao et al., 2022), and did not really enhance the green innovation ability of enterprises.

To further explore the impact of banks’ digital transformation on corporate green innovation, this paper examines the impact of three sub-dimensions of banks’ digital transformation on corporate green innovation situation, and the regression results are shown in Table 4. Table 4 shows that bank digital transformation significantly improves the overall level of corporate green innovation in strategy, business, and management dimensions. At the same time, all the dimensions of bank digital transformation show a negative but insignificant correlation with corporate substantive green innovation and a significant positive correlation with corporate strategic green innovation. It further indicates that strategic digitalization, business digitalization, and management digitalization of banks only improve enterprises’ overall and strategic green innovation but have no significant impact on their substantive green innovation. In the process of driving green development of enterprises through digital technology, banks emphasize the quantity rather than the quality of green innovation, resulting in enterprises only carrying out simple green innovation.

4.2 Robustness tests

4.2.1 Instrumental variable method

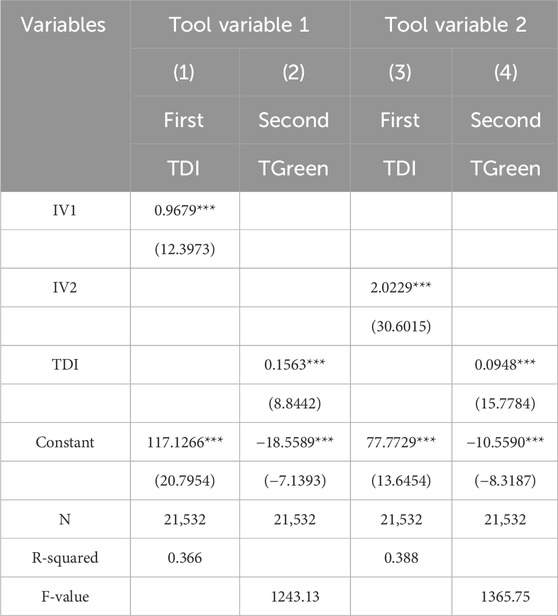

Considering the possible endogeneity problem of the model, this paper adds control variables such as total return on assets and financial leverage into the model. However, there may still be endogeneity problems, such as omitted variables. Firstly, this paper takes the number of cell phone subscribers per year in each province as instrumental variable 1 (IV1) to mitigate the endogeneity problem. There is a close connection between smartphones, the material environment driving digital transformation, and cell phones’ mobility and Internet capabilities, which are essential drivers for banks to undergo digital transformation. At the same time, the number of cell phone users does not directly impact green innovation, so the number of cell phone users meets the requirement of exogeneity of instrumental variables. Secondly, this paper refers to the study of Luo et al. (2022) to alleviate the endogeneity problem by using the number of Internet broadband access ports per year in each province as instrumental variable 2 (IV2). Digital development must be connected to the construction of Internet infrastructure. In regions with a higher level of Internet development, banks have fewer barriers to digital transformation, relatively lower costs, faster transformation processes, and do not directly affect corporate green innovation. Hence, the number of Internet broadband access ports meets the requirements of instrumental variable exogeneity.

Table 5 shows the test results of two-stage least squares regression on instrumental variables 1 and 2. Columns (1) and (2) are the test results of instrumental variable 1 (IV1). Column (1) is the result of the first stage of the test, which shows that instrumental variable 1 is significantly positive with the total bank digitization index at the 1% level, with a coefficient of 0.9679, which indicates that the number of cell phone subscribers has a significant positive correlation with the bank’s digital transformation. Column (2) shows the results of the second stage of the test. The total index of bank digital transformation and the total level of green innovation of enterprises are significantly positive at the 1% level, indicating that after the introduction of instrumental variable 1, the total index of bank digital transformation and the total index of green innovation of enterprises are still significantly positively correlated with each other. The findings of this paper are robust. Columns (3) and (4) are the test results of instrumental variable 2 (IV2). Column (3) is the test result of the first stage, which shows that the instrumental variable two and the total index of banks’ digital transformation are significantly positive at the 1% level, with a coefficient of 2.0229, indicating that the number of Internet broadband access ports has a significant positive relationship with banks’ digital transformation. Column (4) shows the results of the second stage of the test, which shows that the total index of banks’ digital transformation is significantly positive at the 1% level with the total level of enterprises’ green innovation, indicating that after the introduction of the instrumental variable 2, there is still a significant positive correlation between the digital transformation of banks and the total index of enterprises’ green innovation, which also indicates that the findings of this paper are robust.

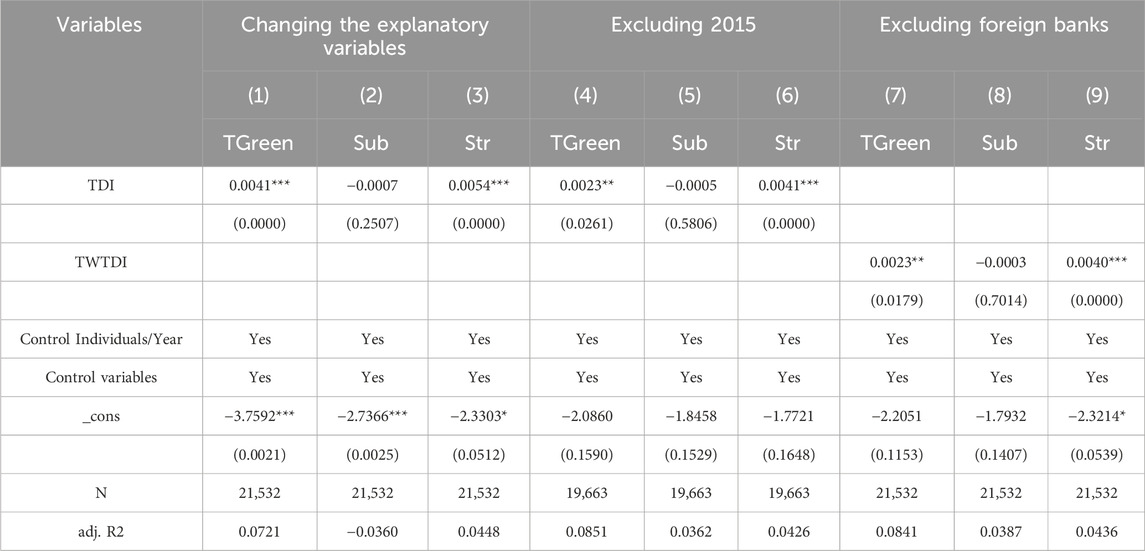

4.2.2 Changing the explanatory variables

This paper uses the number of green patent applications in the benchmark regression part to measure enterprises’ level of green innovation. To improve the reliability of the results of this paper, the number of green patents obtained is used here to replace the explanatory variables and conduct the robustness test. The results are shown in columns (1)–(3) of Table 6. The total index of bank digital transformation shows a significant positive correlation with the total level of enterprise green innovation, there is no significant relationship with substantive green innovation, and there is a significant positive correlation with strategic green innovation, which is consistent with the results of the benchmark regression in Table 3, indicating that the findings of this paper are robust.

4.2.3 Excluding 2015

The stock market crash 2015 significantly impacted the capital market, with the banking industry assets shrinking, systemic risk rising, and enterprises facing the dilemma of capital breaks. Therefore, this paper synthesizes scholars’ research and excludes the sample 2015 for the robustness test. The results are shown in columns (4)–(6) of Table 6. The total index of banks’ digital transformation shows a significant positive relationship with the total level of corporate green innovation, there is no significant relationship with substantive green innovation, and there is a significant positive relationship with strategic green innovation, which is consistent with the results of the benchmark regression in Table 3, indicating that the conclusions of this paper’s research are robust.

4.2.4 Excluding foreign banks

Foreign banks are founded by foreign sole proprietorships, which are closely linked to their headquarters and other regional operations and are highly influenced by their home countries (Mili et al., 2017). Foreign banks’ operation mode and disclosure quality differ from those of Chinese banks. Therefore, this paper excludes the sample of foreign banks and is based on the digital transformation of local Chinese banks. Columns (7)–(9) in Table 6 show the test results after excluding foreign banks, and the results are consistent with the baseline regression results in Table 3, except for slight changes in the coefficients. It shows that the test results of this paper are still robust after excluding foreign banks.

4.3 Tests of intermediation effects

4.3.1 Intermediary effect test based on enterprise financialization

A high degree of enterprise financialization means that enterprises are detached from their primary business and invest a large amount of money in finance and real estate, which encroaches on the funds for enterprise green innovation and hinders enterprise green innovation. Columns (1)–(3) of Table 7 show the regression results of bank digitalization and enterprise financialization on enterprise green innovation. Column (1) shows that bank digital transformation promotes the improvement of the total level of enterprise green innovation, column (2) shows that the higher the degree of bank digital transformation, the more conducive to the “de-virtualization to the real” of the enterprise, and column (3) verifies the mediation effect of enterprise financialization. Banks can reduce enterprise financialization through digital transformation, which promotes the enterprise’s “transferring from emptiness to reality” and thus enhances enterprise green innovation. While verifying the results of Wang and Hu’s (2023) study on banks’ fintech development to reduce the level of corporate financialization, it also provides new ideas on how the financial industry can empower corporate green innovation in the era of digital economy.

4.3.2 Intermediary effect test based on enterprise financing constraints

The enterprise green innovation cycle is long, and capital consumption is significant. If the enterprise faces considerable financing constraints resulting in insufficient funds, it will inhibit its investment in green innovation (Lee et al., 2022; Lin and Ma, 2022). Columns (4)–(6) of Table 7 show the regression results of bank digitalization and corporate financing constraints on corporate green innovation, column (4) shows that bank digital transformation promotes the total level of corporate green innovation, column (5) shows that the higher the degree of bank digital transformation, the smaller the corporate financing constraints, and column (6) verifies the mediating effect of corporate financing constraints. Banks can alleviate the degree of enterprise financing constraints through digital transformation, which promotes enterprise green innovation, providing a direction for banks’ digital transformation to serve the sustainable development of the real economy (Feng et al., 2022).

4.4 Moderating effects tests

4.4.1 Moderating effect test based on environmental regulation

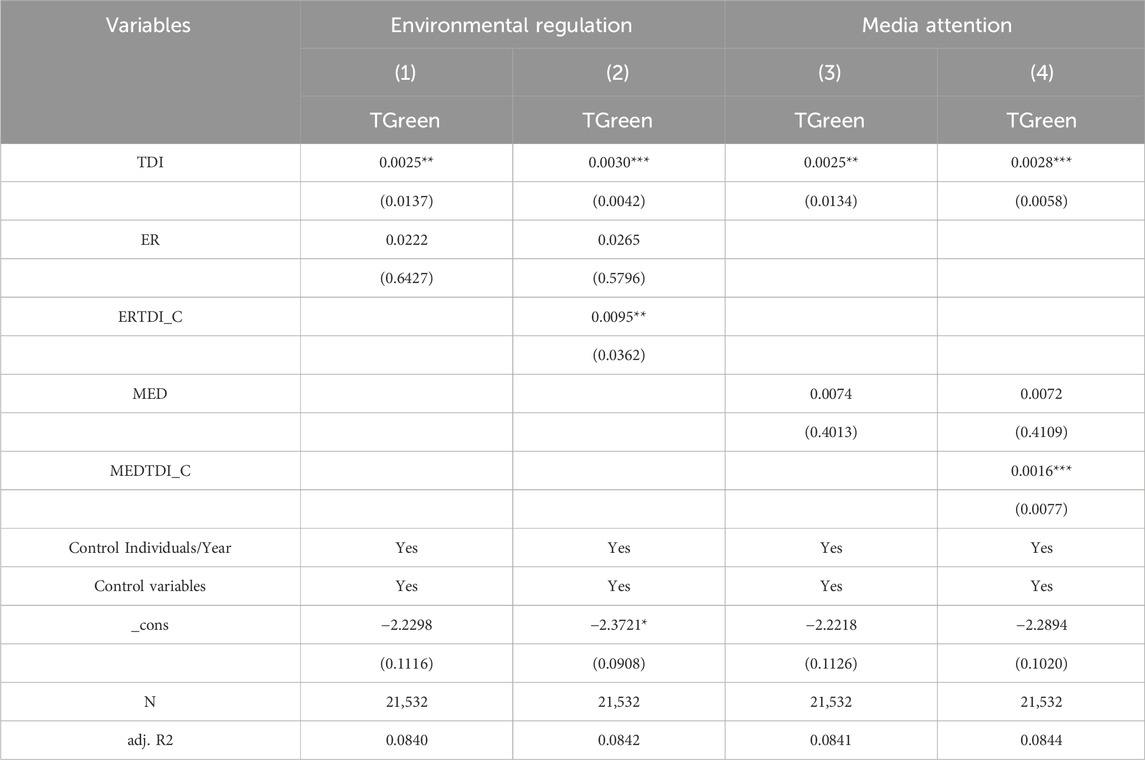

Government environmental regulation is an important policy tool to stimulate enterprises to innovate green. When the intensity of government environmental regulation in a region is high, it will increase enterprises’ environmental and economic costs and force them to carry out green innovation. To examine the moderating effect of environmental regulation on the relationship between bank digitization and enterprises’ green innovation, this paper introduces the intensity of government environmental regulation (ER) suffered by enterprises and its interaction term with the total index of bank digitization to construct a moderating effect test model and to ensure the robustness of the results, the explanatory variable (TDI) and the moderating variable, government environmental regulation (ER) are decentered, and then the interaction term is constructed.

The results of columns (1) and (2) in Table 8 show that the interaction term (ERTDI-C) between environmental regulations and the overall index of bank digital transformation is significantly positive at the 5% level with the overall level of enterprise green innovation, indicating that government environmental regulations have a positive moderating effect on the relationship between bank digitalization and enterprise green innovation. The reason is that government environmental regulation is an essential institutional means for the government to protect the environment and constrain enterprises’ pollutant emissions and other behaviors detrimental to environmental protection (Hasan and Du, 2023; Yu et al., 2023). Government environmental regulations regulate and supervise enterprises to make rational use of bank loans, penalize enterprises that pollute more and are unwilling to change their original production methods, increase the costs of the relevant enterprises, and motivate enterprises to improve their awareness of environmental governance and carry out green innovation.

4.4.2 Moderating effect test based on media attention

The aggravation of environmental and sustainable development issues makes the media pay more attention to corporate environmental issues. Given that the media has the role of supervision and information intermediary, it has an essential impact on corporate green innovation. To examine the moderating effect of media attention on the relationship between bank digitization and corporate green innovation, this paper introduces the moderating effect test model consisting of the media attention received by enterprises (MED) and its interaction term with the total index of bank digitization, and to ensure the robustness of the results, the explanatory variable (TDI) and the moderating variable, media attention (MED), are decentered, and then the interaction term is constructed.

The results of columns (3) and (4) in Table 8 show that the interaction term (MEDTDI_C) between media attention and the overall index of bank digital transformation is significantly positive at the 1% level with the overall level of enterprise green innovation, indicating that media attention has a positive moderating effect on the relationship between bank digitalization and enterprise green innovation. The reason is that media attention is an essential complement to government regulation. Media reports can improve the transparency of corporate information, increase public attention to corporate green behavior, increase the possibility of government regulatory intervention, and make it more difficult and costly for corporations to carry out polluting production activities, thus regulating corporate environmental behavior (Li et al., 2023). Enterprises engage in green innovation activities to protect their reputation and obtain bank credit support.

4.5 Heterogeneity test

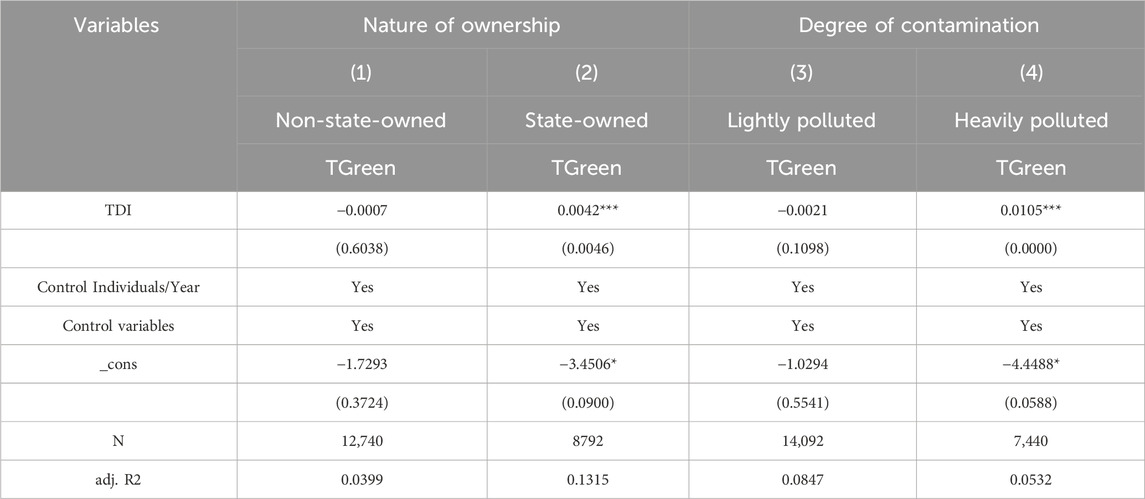

4.5.1 Heterogeneity test based on the nature of property rights

Traditional finance is more inclined to allocate funds to state-owned enterprises, resulting in the problem of attribute mismatch and slowing down the financial system’s process to support enterprises’ high-quality development. Whether the digital transformation of banks can correct the mismatch problem in traditional finance and improve the ability of finance to support the green development of enterprises still needs to be further explored. Therefore, this paper divides enterprises into two groups, state-owned and non-state-owned, according to their property rights. The regression results in columns (1) and (2) of Table 9 show a negative correlation between banks’ digital transformation index and the total level of green innovation in non-state-owned enterprises. At the same time, both are significantly positive at the 1% level in state-owned enterprises. This indicates that banks’ digital transformation in state-owned enterprises has a more green-driven effect than in non-state-owned enterprises. Due to their political relevance, state-owned enterprises are more likely to obtain bank credit support and bear more social responsibility. They are more willing to carry out green innovation. In contrast, non-state-owned enterprises tend to invest in short-term investments to alleviate their difficulties because of higher production costs due to resource mismatch, which encroach on the capital investment in green innovation (Rao et al., 2022).

4.5.2 Heterogeneity test based on the degree of corporate pollution

There are differences in the relationship between enterprises with different pollution levels and the financial industry, and the enthusiasm for green innovation activities also varies. Therefore, this article divides enterprises into two categories based on their types of pollution: light-polluting enterprises and heavy-polluting enterprises. For the selection of heavily polluting enterprises, the original Ministry of Environmental Protection and the Ministry of Ecology and Environment issued the “Guidelines for Environmental Information Disclosure of Listed Companies” (draft for soliciting opinions) in 2010, which classified 16 industries such as thermal power, steel, and cement as heavily polluting industries. Then, combined with the China Securities Regulatory Commission’s “Guidelines for Industry Classification of Listed Companies” (2012), 20 industries were preliminarily selected, including non-metallic mining and selection, alcohol, beverages, and refined tea manufacturing. Finally, select industry enterprises with industry codes B06, B07, B08, B09, B10, C15, C17, C18, C19, C22, C25, C26, C27, C28, C29, C30, C31, C32, C33, and D44 as heavy polluting enterprises. The regression results of columns (3) and (4) in Table 9 show a negative correlation between banks’ total digital transformation index and the overall level of green innovation in light-polluting enterprises. In contrast, the two are positively correlated at the 1% level in heavy-polluting enterprises. Banks’ digital transformation has a more promoting effect on the green innovation activities of heavily polluting enterprises, indicating that heavily polluting enterprises can better enjoy the “dividends” brought by the digital transformation of banks. The reason is that under the digital development of banks, the financial barriers faced by heavily polluting enterprises have been broken, and they can obtain loans from banks. Faced with the shortage of funds caused by traditional finance, heavily polluting enterprises are more urgent and quick to carry out green innovation to exchange loans from banks and enjoy the “benefits” brought by the digital transformation of banks.

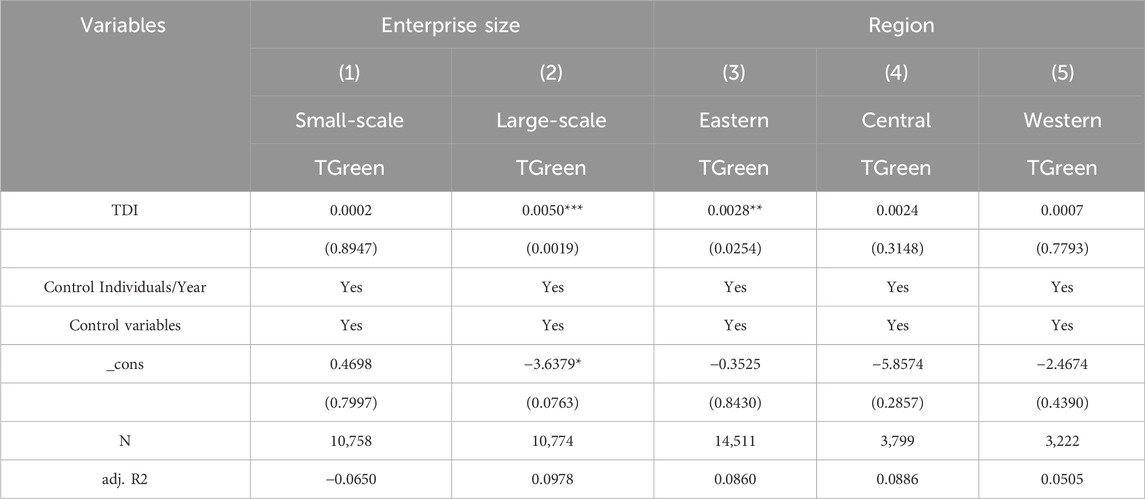

4.5.3 Heterogeneity test based on firm size

Financing ability and innovation ability differ by enterprise size. Therefore, this paper categorizes firms into two columns, small and large-scale, according to the median number of employees. The regression results in columns (1) and (2) of Table 10 show that although both sets of results are positive, only in large-scale enterprises does digital transformation show a significant positive relationship with green innovation. This is because large-scale enterprises are well-funded and stable, making them more likely to obtain bank loans and more capable of green innovation than small-scale enterprises.

4.5.4 Heterogeneity test based on the region of enterprises

Under the promotion of a series of policy initiatives in China, the overall economic development of China has been dramatically improved, but there are still problems of insufficiency and incoherence. The central and western regions are limited by regional production factor mismatch, low efficiency of digital technology absorption, and other factors compared to the eastern regions, resulting in a low level of development of the digital economy in the region and the gathering of financial resources to economically developed regions, which makes the development of enterprises in less-developed regions limited. In this regard, whether banks’ digital transformation can alleviate the regional mismatch of financial resources needs to be further studied. Therefore, this paper divides enterprises into eastern, central, and western parts according to the region to which they belong. The regression results in columns (3)–(5) of Table 10 show that bank digitalization has a more obvious promotion effect on green innovation of enterprises in the eastern region compared with enterprises in the central and western regions. This indicates that the current digital transformation of banks needs to be accelerated, has not yet played its “universality, ” and has not been able to effectively compensate for the regional mismatch of financial resources in the central and western regions. The reason is that the eastern region has accumulated rich resources in the early stage of economic development, and its economic development is higher than that of other regions, so the digital transformation of banks is faster than that of the central and western regions. Enterprises in the eastern region are also more likely to obtain credit support from banks for green innovation.

5 Conclusion and implications

5.1 Conclusion

Based on the annual data of Chinese listed enterprises from 2010 to 2021, this paper empirically analyzes whether banks’ digital transformation affects corporate green innovation and its possible internal mechanisms, and the study concludes as follows: (1) Overall, banks’ digital transformation empowers corporate green innovation. This conclusion still holds after considering the model’s endogeneity problem. It is also found that the driving effect of the total bank digital transformation index on corporate strategic green innovation is more prominent. (2) The digitalization of bank strategy, business, and management only promotes overall and strategic green innovation of the enterprise and has yet to impact substantive green innovation significantly. (3) Bank digital transformation promotes corporate green innovation by inhibiting corporate financialization and alleviating corporate financing constraints. (4)The strengthening of government environmental supervision and the increasing media attention have strengthened the promoting effect of banks’ digital transformation on enterprises’ green innovation. (5) The total index of banks’ digital transformation is heterogeneous in promoting corporate green innovation. The driving effect of bank digital transformation on green innovation is more significant for state-owned enterprises, heavily polluted enterprises, large-scale enterprises, and enterprises in the eastern region. The above results indicate that banks’ digital transformation has generally empowered enterprises with green innovation and promoted overall and strategic green innovation but has yet to promote substantive green innovation of enterprises. The digitalization of banks has expanded the scale of bank credit, reduced the financialization behavior of enterprises for risk avoidance, and effectively alleviated their financing difficulties, providing funds for green innovation. Moreover, the continuous strengthening of government environmental regulations and the increasing media attention have also made digital banking more focused on enterprises’ green innovation behavior. However, the focus on green development in the digital transformation process of banks only forces enterprises to engage in strategic green innovation to obtain credit support from banks, which to some extent encroaches on the funds and research and development time for substantial green innovation of enterprises. Banks’ lack of understanding of the essence of enterprise green innovation has been exposed. In the digital transformation process, banks should increase their requirements and review substantive green innovation by enterprises to truly support the high-quality development of the real economy.

5.2 Implications

Based on the above findings, this paper draws the following insights:

(1) Banks should take the initiative to embrace digitalization and accelerate digital transformation and upgrading. Banks’ digital transformation can alleviate the phenomenon of financialization of enterprises, promote enterprises to use their funds for green innovation, and help enterprises develop in a high-quality manner.

(2) The government should improve the construction of digital technology-related infrastructure, especially in central and western regions, to create favorable conditions for banks’ digital transformation. Weak digital infrastructure construction will hinder the process of banks’ digital transformation, so the government should increase the construction of digital infrastructure, such as broadband networks, and implement subsidies to introduce talent to strengthen the robustness of digital infrastructure.

(3) Banks should develop differentiated credit to support green innovation in enterprises. Different types of enterprises have different asset sizes research and development capabilities, and therefore face varying degrees of difficulty in green innovation. Banks developing differentiated credit can help low-capacity enterprises achieve green development.

(4) Relevant government departments and banking institutions should increase the review system for enterprises’ green patents, effectively improving the quality of green innovation in enterprises. To comply with the national green development strategy and obtain support from the government and banks, Chinese enterprises are more focused on strategic green innovation rather than substantive and true green innovation. In this regard, relevant departments and banking institutions should increase the review system for enterprises’ green patents and implement green innovation to promote high-quality development in the new era.

The research in this paper has some limitations. First, the research in this paper only focuses on China, and future research should include a global sample to guarantee the applicability of the results. Second, bank digitization is an all-around and systematic change, and with the development of digital technology, the bank digital transformation index needs to be refined. Third, the level of green development of enterprises should be comprehensively measured. This paper measures the level of green development of enterprises with the green patent situation of enterprises, which makes it difficult to react to the green development of enterprises completely. Further research can construct the index system of enterprise green development level and explore the impact of bank digital transformation on the overall level of enterprise green development. Finally, unexplored avenues exist between bank digitalization and enterprise green innovation. There are rich pathways for the impact of bank digitization on corporate green innovation, and the role of enterprise risk in the relationship between bank digitization and corporate green innovation can be further explored in the future.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

KJ: Conceptualization, Funding acquisition, Project administration, Resources, Supervision, Validation, Writing–review and editing. YZ: Data curation, Formal Analysis, Investigation, Methodology, Software, Validation, Writing–original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by the 2023 Liaoning Provincial Science Public Welfare Research Fund (Soft Science Research Program) Project (Class B) (2023JH4/10600041) and the Key Research Topics For Decision-making Consultation And New Think Tanks In Liaoning Province in 2023 (23-A008).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2024.1336087/full#supplementary-material

References

Allen, F., Qian, J., and Qian, M. (2005). Law, finance, and economic growth in China. J. financial Econ. 77 (1), 57–116. doi:10.1016/j.jfineco.2004.06.010

Becchetti, L., and Manfredonia, S. (2022). Media, reputational risk, and bank loan contracting. J. Financial Stab. 60, 100990. doi:10.1016/j.jfs.2022.100990

Buchak, G., Matvos, G., Piskorski, T., and Seru, A. (2018). Fintech, regulatory arbitrage, and the rise of shadow banks. J. financial Econ. 130 (3), 453–483. doi:10.1016/j.jfineco.2018.03.011

Cao, J., Law, S. H., Samad, A. R. B. A., Binti W Mohamad, W. N., Wang, J., and Yang, X. (2022). Effect of financial development and technological innovation on green growth—analysis based on spatial Durbin model. J. Clean. Prod. 365, 132865. doi:10.1016/j.jclepro.2022.132865

Cao, S., Nie, L., Sun, H., Sun, W., and Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

Chen, S., and Chen, D. (2018). Smog pollution, government governance and high-quality economic development. Econ. Res. 53, 20–34.

Diener, F., and Špaček, M. (2021). Digital transformation in banking: a managerial perspective on barriers to change. Sustainability 13 (4), 2032. doi:10.3390/su13042032

Ding, Q., Huang, J., and Chen, J. (2023). Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Econ. 117, 106476. doi:10.1016/j.eneco.2022.106476

Feng, S., Zhang, R., and Li, G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Galbreath, J. (2019). Drivers of green innovations: the impact of export intensity, women leaders, and absorptive capacity. J. Bus. Ethics 158, 47–61. doi:10.1007/s10551-017-3715-z

Gao, X., and Ren, Y. (2023). The impact of digital finance on SMEs financialization: evidence from thirty million Chinese enterprise registrations. Heliyon 9 (8), e18664. doi:10.1016/j.heliyon.2023.e18664

Ghisetti, C., Mancinelli, S., Mazzanti, M., and Zoli, M. (2017). Financial barriers and environmental innovations: evidence from EU manufacturing firms. Clim. Policy 17 (1), S131–S147. doi:10.1080/14693062.2016.1242057

Gomber, P., Kauffman, R. J., Parker, C., and Weber, B. W. (2018). On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 35 (1), 220–265. doi:10.1080/07421222.2018.1440766

Gregg, J. S., Andres, R. J., and Marland, G. (2008). China: emissions pattern of the world leader in CO2 emissions from fossil fuel consumption and cement production. Geophys. Res. Lett. 35 (8). doi:10.1029/2007gl032887

Guo, J., Fang, H., Liu, X., Wang, C., and Wang, Y. (2023). FinTech and financing constraints of enterprises: evidence from China. J. Int. Financial Mark. Institutions Money 82, 101713. doi:10.1016/j.intfin.2022.101713

Hao, X., Li, Y., Ren, S., Wu, H., and Hao, Y. (2023). The role of digitalization on green economic growth: does industrial structure optimization and green innovation matter? J. Environ. Manag. 325, 116504. doi:10.1016/j.jenvman.2022.116504

Hasan, M. M., and Du, F. (2023). Nexus between green financial development, green technological innovation and environmental regulation in China. Renew. Energy 204, 218–228. doi:10.1016/j.renene.2022.12.095

Khattak, M. A., Ali, M., Azmi, W., and Rizvi, S. A. R. (2023). Digital transformation, diversification and stability: what do we know about banks? . Econ. Analysis Policy 78, 122–132. doi:10.1016/j.eap.2023.03.004

Lee, C. C., Wang, F., and Lou, R. (2022). Digital financial inclusion and carbon neutrality: evidence from non-linear analysis. Resour. Policy 79, 102974. doi:10.1016/j.resourpol.2022.102974

Li, J., and Du, Y. X. (2021). Spatial effect of environmental regulation on green innovation efficiency: evidence from prefectural-level cities in China. J. Clean. Prod. 286, 125032. doi:10.1016/j.jclepro.2020.125032

Li, X., Shao, X., Chang, T., and Albu, L. L. (2022). Does digital finance promote the green innovation of China’s listed companies? . Energy Econ. 114, 106254. doi:10.1016/j.eneco.2022.106254

Li, Z., Huang, Z., and Su, Y. (2023). New media environment, environmental regulation and corporate green technology innovation: evidence from China. Energy Econ. 119, 106545. doi:10.1016/j.eneco.2023.106545

Lin, B., and Ma, R. (2022). How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 320, 115833. doi:10.1016/j.jenvman.2022.115833

Lin, H., Zeng, S. X., Ma, H. Y., Qi, G., and Tam, V. W. (2014). Can political capital drive corporate green innovation? Lessons from China. J. Clean. Prod. 64, 63–72. doi:10.1016/j.jclepro.2013.07.046

Liu, Q., and Dong, B. (2022). How does China’s green credit policy affect the green innovation of heavily polluting enterprises? The perspective of substantive and strategic innovations. Environ. Sci. Pollut. Res. 29 (51), 77113–77130. doi:10.1007/s11356-022-21199-6

Liu, Z., Deng, Z., He, G., Wang, H., Zhang, X., Lin, J., et al. (2022). Challenges and opportunities for carbon neutrality in China. Nat. Rev. Earth Environ. 3 (2), 141–155. doi:10.1038/s43017-021-00244-x

Luo, K., Liu, Y., Chen, P. F., and Zeng, M. (2022). Assessing the impact of digital economy on green development efficiency in the Yangtze River Economic Belt. Energy Econ. 112, 106127. doi:10.1016/j.eneco.2022.106127

Ma, D., and Zhu, Q. (2022). Innovation in emerging economies: research on the digital economy driving high-quality green development. J. Bus. Res. 145, 801–813. doi:10.1016/j.jbusres.2022.03.041

Mili, M., Sahut, J. M., Trimeche, H., and Teulon, F. (2017). Determinants of the capital adequacy ratio of foreign banks’ subsidiaries: the role of interbank market and regulation. Res. Int. Bus. finance 42, 442–453. doi:10.1016/j.ribaf.2016.02.002

Murinde, V., Rizopoulos, E., and Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: opportunities and risks. Int. Rev. Financial Analysis 81, 102103. doi:10.1016/j.irfa.2022.102103

Ozturk, I., and Ullah, S. (2022). Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? Empir. analysis. Resour. Conservation Recycl. 185, 106489. doi:10.1016/j.resconrec.2022.106489

Rao, S., Pan, Y., He, J., and Shangguan, X. (2022). Digital finance and corporate green innovation: quantity or quality? Environ. Sci. Pollut. Res. 29 (37), 56772–56791. doi:10.1007/s11356-022-19785-9

Rodrigues, A. R. D., Ferreira, F. A. F., Teixeira, F. J., and Zopounidis, C. (2022). Artificial intelligence, digital transformation and cybersecurity in the banking sector: a multi-stakeholder cognition-driven framework. Res. Int. Bus. Finance 60, 101616. doi:10.1016/j.ribaf.2022.101616

Shrivastava, P. (1995). The role of corporations in achieving ecological sustainability. Acad. Manag. Rev. 20 (4), 936–960. doi:10.2307/258961

Takalo, S. K., Tooranloo, H. S., and Shahabaldini parizi, Z. (2021). Green innovation: a systematic literature review. J. Clean. Prod. 279, 122474. doi:10.1016/j.jclepro.2020.122474

Tu, Y., and Wu, W. (2021). How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustain. Prod. Consum. 26, 504–516. doi:10.1016/j.spc.2020.12.031

Ulucak, R., and Baloch, M. A. (2023). An empirical approach to the nexus between natural resources and environmental pollution: do economic policy and environmental-related technologies make any difference? Resour. Policy 81, 103361. doi:10.1016/j.resourpol.2023.103361

Wang, Q., and Hu, C. (2023). Fintech, financial regulation and corporate financialization: evidence from China. Finance Res. Lett. 58, 104378. doi:10.1016/j.frl.2023.104378

Wang, Y., Xiuping, S., and Zhang, Q. (2021). Can fintech improve the efficiency of commercial banks? an analysis based on big data. Res. Int. Bus. finance 55, 101338. doi:10.1016/j.ribaf.2020.101338

Xia, L., Gao, S., Wei, J., and Ding, Q. (2022). Government subsidy and corporate green innovation-Does board governance play a role? Energy Policy 161, 112720. doi:10.1016/j.enpol.2021.112720

Xie, X., and Wang, S. (2023). Digital transformation of commercial banks in China: measurement, progress and impact. China Econ. Q. Int. 3 (1), 35–45. doi:10.1016/j.ceqi.2023.03.002

Xiong, J., and Xu, D. (2021). Relationship between energy consumption, economic growth and environmental pollution in China. Environ. Res. 194, 110718. doi:10.1016/j.envres.2021.110718

Yan, X., Wang, X., and Liu, S. (2023). A U-shaped relationship between real financialization and financial risk: evidence from a single threshold model. Finance Res. Lett. 56, 104017. doi:10.1016/j.frl.2023.104017

Yang, Y., Su, X., and Yao, S. (2021). Nexus between green finance, fintech, and high-quality economic development: empirical evidence from China. Resour. Policy 74, 102445. doi:10.1016/j.resourpol.2021.102445

Yu, H., Wang, J., Hou, J., Yu, B., and Pan, Y. (2023). The effect of economic growth pressure on green technology innovation: do environmental regulation, government support, and financial development matter? J. Environ. Manag. 330, 117172. doi:10.1016/j.jenvman.2022.117172

Zhao, B., Wang, K. L., and Xu, R. Y. (2023). Fiscal decentralization, industrial structure upgrading, and carbon emissions: evidence from China. Environ. Sci. Pollut. Res. 30 (13), 39210–39222. doi:10.1007/s11356-022-24971-w

Zhao, X., Ma, X., Chen, B., Shang, Y., and Song, M. (2022). Challenges toward carbon neutrality in China: strategies and countermeasures. Resour. Conservation Recycl. 176, 105959. doi:10.1016/j.resconrec.2021.105959

Keywords: bank digitalization, green innovation, corporate financialization, financing constraints, government environmental regulation, media attention

Citation: Jia K and Zhang Y (2024) Bank digitalization and corporate green innovation: empowering or negative?. Front. Energy Res. 12:1336087. doi: 10.3389/fenrg.2024.1336087

Received: 10 November 2023; Accepted: 06 February 2024;

Published: 28 March 2024.

Edited by:

Michael Carbajales-Dale, Clemson University, United StatesReviewed by:

Adriana Grigorescu, National School of Political Studies and Public Administration, RomaniaSarat Chandra Mohapatra, University of Lisbon, Portugal

Copyright © 2024 Jia and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kaiwei Jia, 1980jkw@163.com

Kaiwei Jia

Kaiwei Jia Yu Zhang

Yu Zhang