The Impact of Transmission and Distribution Price Reform on Economic Growth in Liberalized Electricity Markets: An Inter-Provincial Panel Data Analysis

- 1School of Economics, Peking University, Beijing, China

- 2School of Insurance and Economics, University of International Business and Economics, Beijing, China

- 3China National Grid Energy Research Institute, Beijing, China

- 4School of Economics and Management, Tsinghua University, Beijing, China

This paper investigates and quantifies the extent of the Transmission and Distribution Price Reform (TDPR) on economic growth. Provincial-level data from 2010 to 2019 was used to estimate the impacts of the TDPR on economic growth using a progressive difference in differences method (DID). Findings showed that the reform had a positive impact on regional GDP and regional GDP per capita. Furthermore, to explore its mechanism of influence, the impacts of the TDPR on electricity prices, including the average sale prices and sale prices for industrial users, were analyzed, and the evidence suggests that the TDPR has significantly reduced the sale price. Additionally, the regression result suggests that the TDPR mainly affects electricity prices to reduce the energy cost of enterprises, and then promotes the innovation of industrial enterprises above designated size (IEADS) and fixed asset investment, which act on total factor productivity and promote regional economic growth. The regression results showed good robustness under various robustness tests.

Introduction

In March 2015, the “Opinions of the Central Committee of the Communist Party of China and the State Council on Further Strengthening the Reform on the Electric Power System” was issued, signifying the start of a new era of electrical power system reform in China. The focus of this reform is to promote the marketization process and straighten the price formation mechanism of electricity. Among numerous considerations, the TDPR is a very important part of this reform, with the main goal of promoting the reform of the electricity market. The main contents include the fundamental goal of promoting the development of the electricity market, adopting a pricing method that allows cost plus reasonable benefits, formulating the simplest transmission and distribution (T&D) price that meets the needs of the electricity market, and combining the guidance of national policy with the pilot formulations at the provincial level. Since the launch of a pilot project for the reform of transmission and distribution prices at the end of 2014, Shenzhen, China, has launched three batches of pilot projects for the TDPR in a total of 19 provinces or regions.

After the state approved the transmission and distribution prices in Shenzhen and West Inner Mongolia power grids, the state included the Anhui, Hubei, Ningxia, Yunnan, and Guizhou power grids into the scope of the pilot reform in 2015. In 2016, the National Development and Reform Commission (NDRC) clearly stated in the “Notice on Matters Concerning the Expansion of the Pilot Scope of TDPR” that it is necessary to continue to promote the pilot TDPR in other 12 provinces (cities or districts) including Beijing. Within the context of the relatively delayed reform of the electricity and market, the reform of transmission and distribution prices has advanced steadily, which has led to the achievement of some results. Presently, the state has approved the transmission and distribution prices for 32 provincial-level power grids, five regional power grids, and 31 inter-provincial and cross-regional special power transmission projects. During the first round of power transmission and distribution cost supervision and review, a total of about 128.4 billion yuan was reduced in related expenses, with an average reduction rate of 15.1%, which has yielded reform dividends to the market players. In 2019, China’s electricity market-oriented transaction electricity volume was approximately 2.3 trillion kWh, accounting for nearly 32% of the total electricity consumption in the whole society, with a significant increment in the degree of marketization. Generally, China’s TDPR is still at the pilot stage; however, the public and the government are now formulating the relevant conclusions in this regard.

The impact of energy sector reforms on generation efficiency differs among countries due to the varying levels of economic development and regional characteristics (Nela and Vedran, 2015). Different electric industry reform policies/measures have different impacts on geographically and economically diverse countries (Nagayama, 2010). When a country’s electricity market-oriented reforms are not appropriate for its level of development and regional characteristics, it could hamper economic growth (Nela and Vedran, 2015). Therefore, it is pertinent to carefully analyze the main economic benefits of the current TDPR. Moreover, it is propitious to make some inherent ambiguities clear, and to summarize the experiences gleaned from the pilot projects to enhance the TDPR.

Many studies have been conducted on the effectiveness of power sector reform in a certain country or region. Inglesi-Lotz and Ajmi (2021) used South Africa’s economic and social data from 1985 to 2018 to study how electricity supply and electricity prices can attract foreign direct investment. They found that electricity supply has a positive effect on the introduction of FDI and excessive electricity prices will hinder FDI. Aldubyan and Anwar (2021) analyzed the impacts of electricity price reform on the economy and environment in Saudi Arabia. Hartley et al. (2019) used a database from Texas to examine the impacts of electricity reform on retail prices. Their findings supported the hypothesis that market-oriented reforms can promote electricity prices to better reflect marginal costs. Akiko and Jeffrey-S (2018) used a set of panel data to explore the effectiveness of OECD countries’ electricity market reforms and posited that electricity market reforms are linked with lower household electricity prices. Furthermore, Nela and Vedran (2015) explored the impact of energy sector reforms on the efficiency of electricity generation in the EU-12 and selected Southeast European countries. Meher and Sahu (2013) studied the impacts of Odisha India power sector reform on electricity price. Nagayama (2010) examines the impacts of power sector reform measures on investments and transmission/distribution loss in 4 regions from 1985 to 2006 based on original panel data. He asserted that reform policy support should result in increased generation per capita and the reduction in the loss of T&D. Silva et al. (2007) studied the impact of Montenegro’s electricity price reform and found that the increment in electricity price not only exacerbates poverty but also has a negative impact on the environment. Hosoe (2006) analyzed the impacts of Japan’s electricity industry on production consumption, welfare, and the environment using a computable general equilibrium model (CGE).

In recent years, the Chinese government has accelerated the reformation of the electricity market. Song and Cui (2016) believed that the key to successful reform is the establishment of a market-oriented electricity pricing system that accurately reflects the relationship between the market supply and the demand, resource scarcity, the environment, and cost. In addition, numerous studies in China have focused on the effectiveness of China’s electricity price reform. Liu et al. (2019) and Wang et al. (2021) analyzed the effects of China’s TDPR on the investment behavior and the rational return of power grid enterprises. Zheng et al. (2021) investigated the impacts of electricity reform of China on retail price, technical efficiency, and electricity supply interruptions by adopting a fixed effect model. Pollitt (2021), Xie and Pollitt (2020) measured and assessed the impacts of electricity market reform within the context of the Chinese economy and found that power sector reform has a significant effect on industrial electricity prices in Guangdong and Zhejiang. Wang and Li (2019) pointed out that the new round of electricity market reforms has had a positive impact on the generation of renewable energy. Liu et al. (2020) found that electricity marketization can promote accommodation of renewable energy in Guangdong Province. Chen and He (2013) analyzed the impacts of China’s electricity market reform on efficiency of electricity production, employment, and household welfare by using a CGE model, and consequently enhance market-oriented electricity reform. Zhao et al. (2012) analyzed the effects of China’s previous power market reforms on electricity price and investment incentives using panel regression models and discovered the electricity price reforms in 1996 and 2003 have different effects on power generation corporations.

At the national policy level, the content of the TDPR is the price, and the target is the market. The impact of TDPR on electricity prices is pertinent to analyzing the impact of TDPR on economic growth. The re-approval of the transmission and distribution price will help to form an electricity price level that depends on market regulation. In addition, the market-oriented electricity prices can give full play to the resource allocation function of electricity prices, allow electricity prices to reflect the true power production costs, and promote industrial restructuring and transformation of economic development methods. Many studies have discussed the impact of electricity prices on the economy. Lin and Chen (2019) investigated the impacts of electricity prices on innovation of the renewable energy technologies based on FMOLS, DOLS, and PMG models at the provincial level from 2006 to 2016. They found that in the long run, the price of electricity can improve the efficiency of renewable energy innovation. Alexander et al. (2018) assessed the relationships between electricity prices and regulatory quality and corruption in the context of the European electricity market. Zhao and Hu (2020) showed that market-based electricity prices have a significant positive impact on energy efficiency and show heterogeneity in different regions. Meher and Sahu (2013) discussed the impact of the Odisha’s electricity price policy on financial systems, and they found that electricity prices can flexibly guide the investment, production, and consumption behavior of market entities. Many existing studies focused on the relationships between electricity price and economic growth using the Engle-Granger methodology to estimate a Vector-Error Correction Model. According to Payne (2010), the relationships between energy price and economic growth were summarized into four theoretical hypotheses. Ciarreta and Zarraga (2008), Yoo (2005), Appiah (2018) found that their conclusions have concurred in the growth hypothesis. Additionally, Dagoumas et al. (2020) revisited the relationship between economic growth and energy price and found that their results concur with the conservation hypothesis. Homoplastically, Narayan and Smyth (2009), Shahbaz and Lean (2012), Raza et al. (2015), Arawomo and Osigwe (2016)found that their conclusions were consistent with the feedback hypothesis. However, Bah and Azam (2017) and Bretschger (2009) believed that the relationship between economic growth and energy prices presents the characteristics of the neutrality hypothesis.

However, at present, few scholars are concerned about the economic impact of TDPR on a country. Particularly, only a few studies have evaluated the economic impact of the 2015 reform. In addition, the existing papers mainly focused on the impacts of power sector reforms or electricity price reform on the price of electricity, and a small part of the literature analyzed the impact of the reform on some social and economic variables, such as innovation and energy efficiency. Granted, numerous papers have assessed the relationship between electricity prices and economic growth; however, the majority adopted the causality testing methods, which are relatively lacking in the impact mechanism. Hence, this paper attempts to fill this existing gap in the field. Definitely, it is very difficult to evaluate the effects of the policy reform due to a policy mixed with many measures, especially, China’s TDPR aimed at marketization, which involves multiple changes. This simultaneity of the reforms enhances the difficulty level of specifically assessing the impact of the “reform” (Pollitt, 2021). Therefore, we adopted the DID method to evaluate the effect of the TDPR on regional GDP and regional GDP per capita. We also evaluate the impacts of TDPR on the average sale prices and industrial sale prices. To investigate the potential impact mechanisms, we estimate the impact of TDPR on the effective patent application counts and investments in fixed assets of industries above the designated size.

Our results showed that the TDPR has promoted regional economic growth by about 4% and has resulted in the reduction of the average sales price. Furthermore, the reform has significantly promoted technical innovations measured by the number of effective patent applications and has increased investment in the fixed assets of industrial enterprises above the designated size. Additionally, we found that the policy effects are heterogeneous across the various Chinese regions.

The innovativeness of this paper is depicted in the following: (1) Only a few studies have examined the relationship between electricity price reform and economic growth, and the relevant literature is mostly focused on the causality test of energy prices or energy consumption and economic growth, without providing the exact mechanism of impact. By analyzing the impact of the TDPR on the prices of electricity, this paper posited and tested two possible mechanisms of impact. (2) The literature on the effect of the new round of power market in China is rather limited, and the majority are focused on the potential reform effect or possible reforms rather than on the measurement of the actual reform impact. Given the gradual implementation of the current TDPR in batches, this paper regards the implementation of the TDPR as a quasi-natural experiment, using China’s provincial panel data from 2010 to 2019, and employing a progressive DID method to systematically evaluate the magnitude of the driving effect of the TDPR on regional economic growth. (3) These findings provide pertinent insight for the Chinese policy maker to further promote the reform of the electricity market and strengthen the reform on the transmission and distribution of electricity prices. Additionally, it has reference significance for other developing countries facing similar situations.

The rest of this paper is organized as follows: Data and Research Methodology describes the data and research methodology, and the baseline empirical results are presented in Empirical Result and Discussion. Robustness Checks and Heterogeneity Analysis analyzes the heterogeneity of the TDPR in different regions and the robustness test. Possible Mechanisms is an empirical demonstration of the ways in which the research objects of this paper play a role. The relevant conclusions and some actionable policy insights are put forward in Concluding Remarks and Policy Implications.

Data and Research Methodology

Data Description

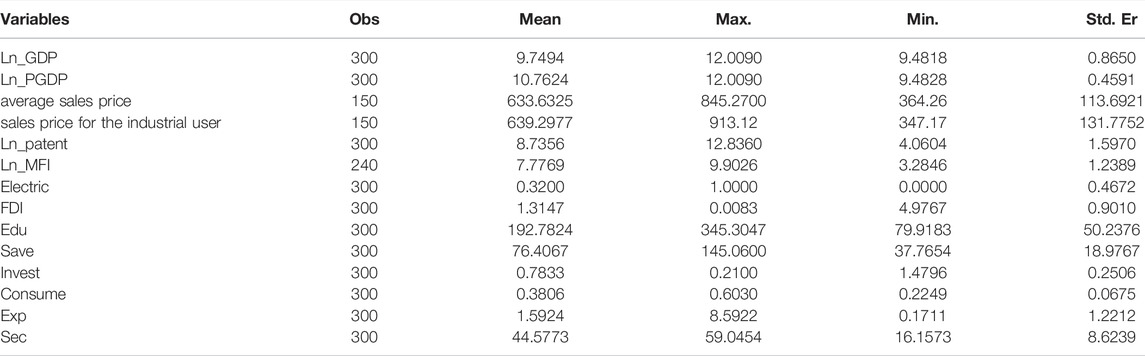

The 2011–2020 China Statistical Yearbook is the main source of data for this paper. The average sale prices and the sale price for industrial users from 2014 to 2018 are from the China State Grid Corporation. The economic performance variable is measured by GDP. Ln_GDP is the annual natural log of the GDP. Ln_PGDP is the annual natural log of GDP per capita. Investment in fixed assets of IEADS is measured by the natural log of the fixed asset investment in the manufacturing sector (Ln_MFI). Innovation is measured by the natural log of the number of effective patent applications of IEADS (Ln_patent). Although not all inventions are patented, there are few major inventions that have not been patented (Johnstone et al., 2010), which also shows that the number of patents can better reflect the performance of technological innovation (Lin and Chen, 2019). The other control variables data in this study was also from China Statistical Yearbook. Table 1 displays the summary statistics for the selected variables. FDI is the annual net flows of foreign direct investment, which is measured as the percentage of FDI in the GDP in a given province. Edu is the number of students in regular colleges and universities divided by the total population of the region. Save is total savings for urban and rural residents divided by the GDP. Invest is regional fixed asset investment divided by GDP. Consume is total sales of whole society goods divided by GDP. Exp is the ratio of total exports to total imports. Sec is the output value of the secondary industry divided by GDP. The key policy variable electric is represented using a dummy variable, denoted as whether to carry out TDPR for a given province. Given the time lag of the policy, electricity price reform will generally have an effect in the subsequent year after the reform. If province i implemented the TDPR in year t-1, then in province i in year t and subsequent years, electric = 1, otherwise = 0. Table 1 presents descriptive statistics for this baseline sample. Variable definitions are in the Supplementary Appendix A.

Specification of the Econometric Model

The following equation is estimated by using a two-way fixed-effect model:

where i and t denote the province and year, respectively. We define

Electric indicates whether to carry out TDPR for province i on year t, which is the dummy variable. The coefficient of interest is β, which is an estimate of the contemporaneous relation between regional economic development and TDPR. The vector

This paper considers the TDPR to be a quasi-natural experiment. It is implemented in batches; Anhui, Hubei, Hainan, Guizhou, Yunnan provinces were approved to pioneer the TDPR in 2015, and by the end of 2016, all provinces except the Tibet Autonomous Region have completed the TDPR. Consequently, the TDPR in various regions varies in time and region. There are many factors affecting the economic growth of the region, and other policies introduced at the same time will also affect regional economic growth, leading to an incorrect identification strategy. Next, we use a DID design to evaluate the effectiveness of TDPR.

Empirical Result and Discussion

We begin our analysis by examining the TDPR impact on regional economic development.

The Baseline Regression Result

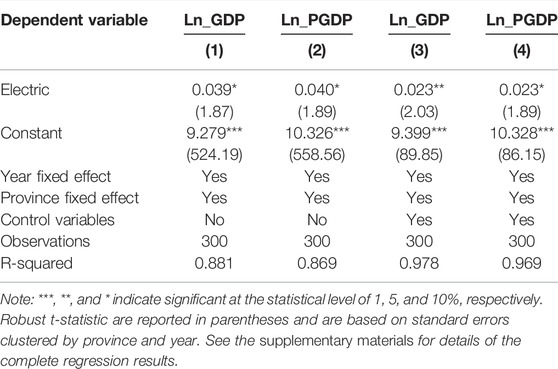

Table 2 presents the result testing the effect of TDPR on regional economic development using Eq. 1. Columns 1 and Columns 2 are the regression results with the absence of the control variables, and Columns 3–4 contain the regression model with the inclusion of the control variables. The results showed that the coefficient on electricity is significantly positive throughout, suggesting that the reform of the electricity system with electricity price reform as its core can significantly promote regional economic growth. The effect is also economically significant. Furthermore, the coefficient of consumption, investment, and net export are significantly positive, with the consumption coefficient being the largest, indicating that the current consumption is still the most significant factor in the regional economic development. Although the level of secondary industry development also significantly promotes regional economy, the coefficient is only 0.009; hence, paramount attention should be given to the optimization of China’s industrial structure based on its significant impact on the level of economic development.

Robustness Checks and Heterogeneity Analysis

Placebo Test

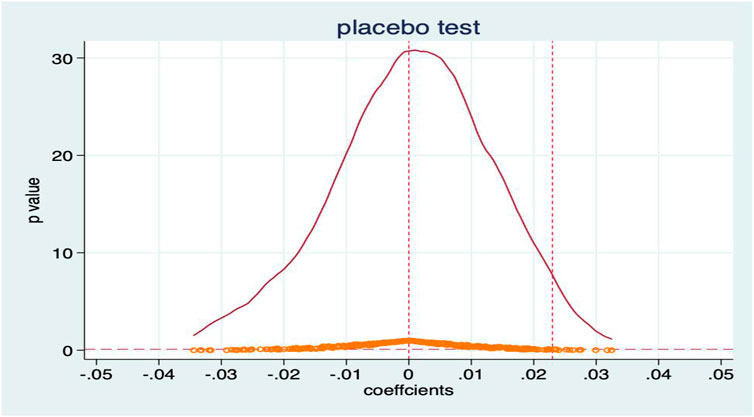

To test whether other random factors influence our conclusions, we tested the conclusions of this paper using a placebo test based on the results from previous studies (Ferrara et al., 2012; Li et al., 2016). The test idea is to randomize the implementation of the TDPR time. If province i implemented the TDPR in year t, then we randomly select 1 year from the sample period as the implementation time in province i. Similarly, the above process was replicated 500 times, and the results of the placebo test were reported in Figure 1.

FIGURE 1. Placebo Test. The abscissa axis represents the estimated coefficient, and the ordinate axis represents the p-value. The red dashed line is the position of the actual estimated coefficient. The orange dots represent the distribution of the randomly estimated coefficients.

Figure 1 reports the probability density distribution of the estimated coefficients. It can be found that the estimated values of the dependent variable coefficients after randomization are concentrated around 0, and the baseline estimation result is 0.023. Therefore, the implementation time of random reforms will lead to a significant decline in the effect of reforms on regional economic development, which proves that there are no other random factors affecting the basic conclusion. In other words, this shows that the random transmission and distribution price reform time does not have “reform dividend,” and the reverse introduction of the transmission and distribution price reform does have a significant role in promoting regional economic development. To sum up, the positive and significant effect of the implementation of the transmission and distribution price reform on regional economic development has not been disturbed by the missing variables.

Is the Implementation of the TDPR Affected by the Economic Development of the Region?

To test the premise of the applicability of the difference in differences method (DID), this model is adapted from Beck et al. (2010) and Cao (2020), and the risk regression model is given as:

In Eq. 2,

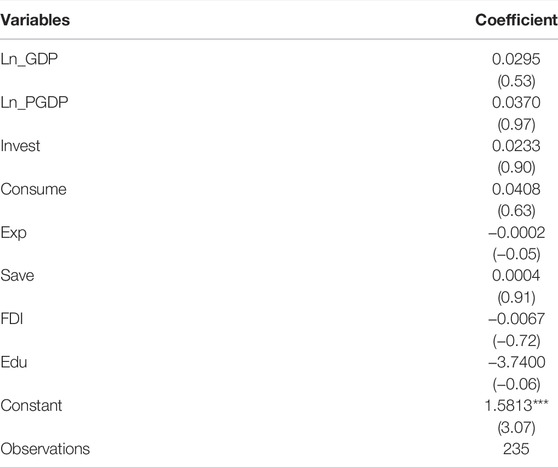

TABLE 3. The risk regression model results. Z-statistics are reported in parentheses beneath the coefficients.

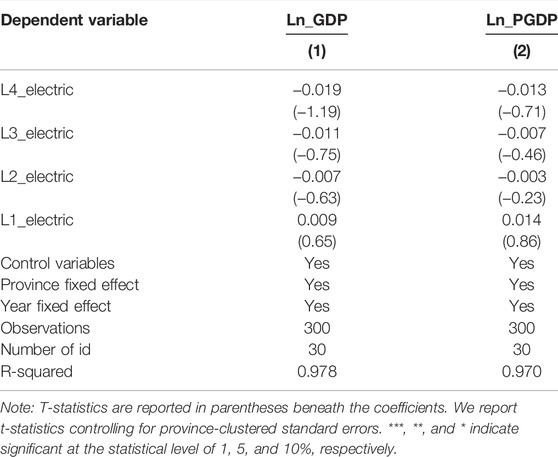

Counterfactual Check

To further test the robustness of the results, a counterfactual test which is commonly used in prior literature (Chen, 2012; Fan and Tian, 2013; Liu and Zhao, 2015) was performed by changing the policy implementation time. Counterfactual testing aims to exclude other policies or random factors that have affected the economic development of the regions before the implementation of the TDPR, so the differences in the regions may not necessarily be due to the research objects under investigation, and then the conclusions drawn may not be reliable. Therefore, we projected the implementation time of the TDPR by 1–4 years respectively (because this paper assumes that the TDPR policy takes effect later than the implementation time if the previous year is actually the year when the power reform is implemented). We define variable L1_electric to indicate that the reform was implemented 1 year in advance, and so on. If the coefficient of the core explanatory variables is significantly positive, it means that before the implementation of the TDPR, other factors have affected the regional economic growth. The specific regression results are reported in Table 4.

Table 4 shows that if the implementation time of the TDPR is pushed forward by 1–4 years, the coefficients of the variables are not significant. This shows that the reason for the difference in regional economic development is not due to other factors, but due to the implementation of the TDPR.

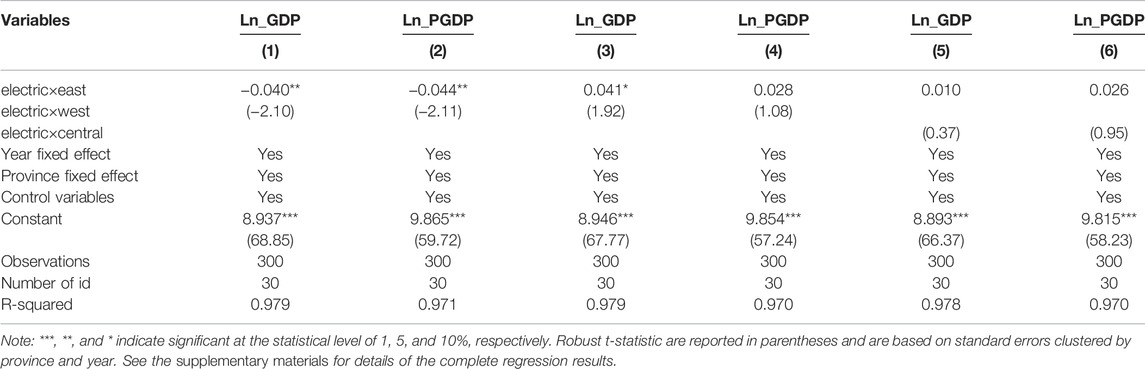

Heterogeneity Analysis

This section aims to distinguish the heterogeneous impact of electricity price changes on regional economic growth and clarify the transmission mechanism of the impact of electricity prices on regional economic development. On the basis of the classification standard of the economic regions of each province (cities, districts) that was first proposed in the National Seventh Five-Year Plan in 1987 and still used today, we divided the samples into the eastern region, the central region, and the western region.1 We constructed the following regression equation:

where location is a dummy variable that the province belongs to the above three categories and is assigned a value of one, otherwise it is assigned a value of zero. Other variables are the same as Eq. 1. The coefficient of interest is

Table 5 displays the results of the heterogeneity effect of TDPR on regional economic development using Eq. 3. Columns 1–2 report the regression result of the Eastern region. Columns 3–6 repeats the analysis in Columns 1–2 after replacing an interaction term between electric and west, central. The results showed given the impact on regional GDP, the coefficient of the interaction term electric×east is negative 0.040 at the 5% significance level. The coefficient of the interaction term electric×west is positive 0.041 at the 10% significance level. Although this is not significant in the per capita GDP, it does not affect the differences between the regions in our analysis. The regression results in Table 5 show that when electricity transactions are implemented across provinces and regions, electricity prices in the eastern region will decrease and increase in the western region. In this way, electricity prices are positively correlated with regional economic growth, and the decline in electricity prices will inhibit economic growth; rising electricity prices will boost the economy. At the level of regional GDP, the effect of the western region will be greater than that of the eastern region. This is similar to the conclusion reached by Shi et al. (2017). In a sense, the TDPR can help reduce the economic development gap between the eastern and western regions.

Possible Mechanisms

This paper is not only satisfied with analyzing the role of TDPR in promoting economic development. In this section, we will analyze the impact path of TDPR and propose and test two possible potential mechanisms.

Impacts of the Reforms on Electricity Sale Prices

Before analyzing the possible mechanism of the impact of TDPR on economic growth, it is critical to assess the impact of TDPR on electricity prices. The price of electricity is a salient factor in the coordinated development of the power sector and the economy. The reform of the power sector first affects electricity prices, and second, the adjustment of electricity prices will have an impact on various industries and sectors, especially high-energy-consuming industries that are more sensitive to electricity prices, such as non-metallic mineral products, metal smelting, rolling processing industries, and the chemicals industry, etc., which would invariably have an impact on the economy.

To test the impact of the TDPR on the average sale prices and the sale prices for the industrial user, we estimate the following regression equation:

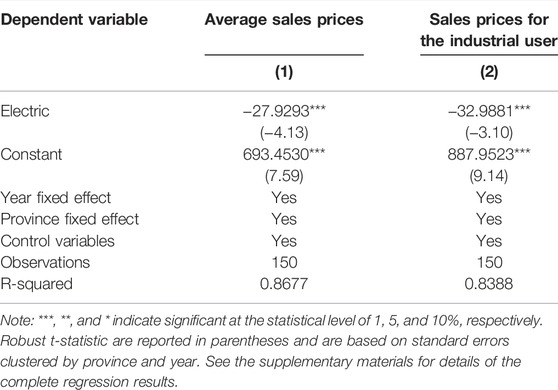

where i and t indicate province and year, respectively. Price includes average sale prices and sale prices for the industrial user. Other variables are defined in the same way as Eq. 1. The estimation results of the regression equation are reported in Table 6.

Columns 1 and 2 report the impact of the TDPR on average sales price and sales price for the industrial user, respectively. According to our regression results, the TDPR has reduced the average sales price by over 27% and the sales prices for the industrial user by over 32%, and both are significant at the 1% level. We already know that the TDPR can significantly reduce the electricity price, especially the price of the industrial users. Next, we discuss the potential impact mechanism by analyzing the relevant variables of industrial enterprises above the designated size.

Impact Through Innovation of IEADS

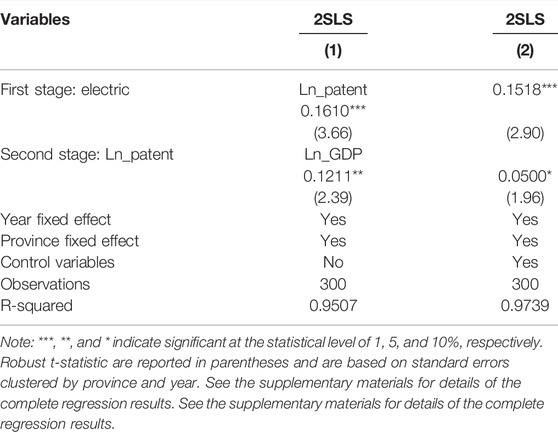

TDPR’s first mechanism for impacting economic growth is to promote industrial innovation above designated size as measured by the natural log of the number of effective patent applications. Technological innovation first promotes technology and technology, and then manifests itself as an increase in total factor productivity (TFP) (Tang et al., 2014). From the perspective of international comparison, the cost advantage of Chinese manufacturing relative to the United States, Japan, South Korea, Taiwan, and other countries and regions is gradually reducing, especially in terms of energy costs, due to the fierce competition from Vietnam, Thailand, Malaysia, and other countries with lower prices. The gradual increment in industrial operating costs increased the losses in some industries, reduced competitiveness, and accelerated external transfers have led to continued downward pressure on the economy. The contribution rate of the total output value of China’s industrial industry remains above 60%. Therefore, there is evidence to believe that TDRS can reduce the electricity cost of industrial enterprises above a designated size through its impact on electricity prices, thereby promoting the innovation of IEADS and driving the rapid development of the Chinese economy. We establish the following two-stage least squares (2SLS) regression equations to test the credibility of this mechanism. Equation 5 and Equation 6 represent respectively the first and second stage regression, and the estimate results are reported in Table 7.

The difference between the regressions in Columns 1 and 2 is the addition of the control variables. The first stage regression results showed that the TDPR has increased the number of effective patent applications of industrial enterprises above a designated size by over 15%. The regression results in the second stage suggest that a 1% change in the number of effective patent applications of industrial enterprises leads to a 0.05–0.12% change in regional GDP. Generally, the TDPR has significantly promoted the innovation of industrial enterprises and the coefficients of Ln_patent on Ln_GDP are positive and significant at the 5 and 10% significant levels, respectively. With the Ln_patent as an instrument in the 2SLS, we can verify the impacts of the TDPR on economic growth through the promotion of technological innovation of industrial enterprises above the designated size. The analysis of the underlying mechanism showed that reducing industrial electricity prices decreased the energy cost of industrial enterprises, and could motivate the enterprises to carry out technological innovation, improve technical efficiency, and ultimately improve TFP.

Impact Through Increasing Investment in Fixed Assets of IEADS

The second mechanism through which the reform could impact regional economic growth is by increasing investment in the fixed assets of IEADS as measured by manufacturing fixed asset investment. The manufacturing industry is very sensitive to adjustments in the price of electricity. The decline in electricity price levels can significantly reduce the energy costs of industrial manufacturing enterprises, thereby promoting fixed asset investment in the manufacturing industry, increasing total industrial output, and promoting regional economic growth. Sanguk et al. (2016) analyzed the effects of electricity price policy on manufacturing output in South Korea and found that rapid increases in electricity prices may trigger a slowdown in manufacturing output.

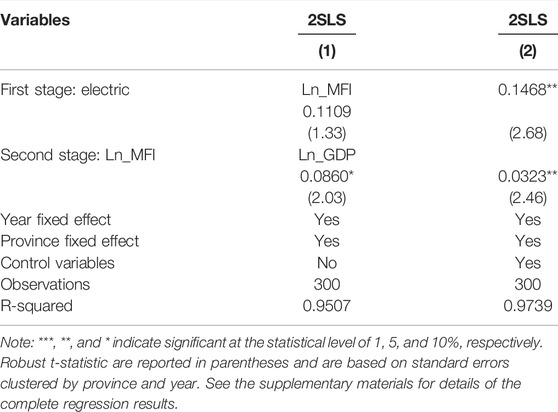

We establish the following two-stage least squares (2SLS) regression equations to test the impact mechanism of the TDPR through increment in the fixed assets of IEADS. Eqs 5, 6 represent respectively the first and second stage regression, and the estimate results are reported in Table 8.

The first stage regression shows that the TDPR has substantially increased the investment in fixed assets of IEADS. The second stage estimation results show that the investment in the fixed assets of IEADS measured by manufacturing fixed asset investment has positively affected the regional economic growth.

Concluding Remarks and Policy Implications

On the basis of the panel data of 30 provinces in China from 2010 to 2019, this study empirically examined the regional economic impact of China’s TDPR in 2015. Not only does the price of electricity have the function of compensating cost, but it also guides the efficient allocation of resources, ensuring the power supply and regulating the social distribution (Ye et al., 2014; Sharif and Raza, 2016). Therefore, the accurate evaluation of the impact of TDPR on regional economic growth is of great significance.

Findings from the study give evidence to infer that the TDPR has significantly promoted regional economic growth. This result is still robust after a variety of robustness tests. Furthermore, the analysis of heterogeneity shows that TDPR have different impacts on China’s eastern and western regions. Also, we showed that the reform first affects electricity prices, especially industrial sales prices. Our regression results showed that the reforms have significantly reduced the average sales electricity prices and the industrial sales electricity prices. By influencing the price of electricity, reducing the energy cost of IEADS, motivating enterprises to carry out technological innovation, increasing enterprise investment in fixed assets, and releasing market vitality, this promotes regional economic growth.

On the basis of the conclusions of this study, the Chinese relevant policy makers should continue to promote the reform of the electricity market and promote the coordinated advancement of the TDPR and the reform of the electricity market. Therefore, the following actionable policy recommendations are suggested: Firstly, the Chinese government should further strengthen the deregulation of electricity and promote the market development of electricity prices; it is recommended that the cross-subsidy of electricity prices should be properly handled so that the commodity properties of electricity are eventually restored. Secondly, it is urgent to continuously complete the cross-provincial and cross-regional trading platform of electricity, and perform the function of the market pricing mechanism, using the adjustment of the electricity price level to guide the rational allocation of regional resources and the industrial structure to optimize, and gradually eliminate the existence of China’s “low electricity price trap” phenomenon. Thirdly, it is necessary to intensify the development of the national power market transaction information system, and establish a visual transaction environment. Lastly, it is indispensable to formulate policies that are compatible with the TDPR, which is a complex system project, and it is necessary to establish an accounting system, examination and approval system, and an evaluation system in line with state-owned enterprises to serve the TDPR.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

All authors contributed to this study. HL, XW, and TC formulated the study design. YX conceived and designed the research methodology. XW designed this research and wrote this paper, HH and YY collected the data.

Funding

This research was funded by National Natural Science Foundation of China (Grant No. 72073007) and the Science and Technology Project of the State Grid Corporation of China, “Research on the Theory, Model and Key Technology of the Relationship between Electricity Price and Economic Society and Industrial Development in the New Situation” (Grant No. 1400-202057411A0000).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2021.755319/full#supplementary-material

Footnotes

1The eastern region includes 12 provinces and municipalities in Liaoning, Beijing, Hebei, Tianjin, Shandong, Jiangsu, Shanghai, Fujian, Zhejiang, Guangdong, Guangxi, and Hainan; the central region includes Inner Mongolia, Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, and Hubei 9 provinces and municipalities in Hunan and Hunan; the western region includes 9 provinces and municipalities in Sichuan, Guizhou, Yunnan, Shanxi, Gansu, Qinghai, Ningxia, Xinjiang, and Chongqing; due to the lack of data in the Tibet Autonomous Region, the data selected in this paper do not include the Tibet Autonomous Region.

References

Akiko, I., and Jeffrey-S, C. (2018). The Impact of Renewable Energy on Household Electricity Prices in Liberalized Electricity Markets: A Cross-National Panel Data Analysis[J]. Utilities Policy 54, 96–106.

Aldubyan, M., and Anwar, G. (2021). Energy price Reform in Saudi Arabia: Modeling the Economic and Environmental Impacts and Understanding the Demand Response[J]. Energy Policy, 148111941.

Alexander, K., Samantha, B., and Wim, M. (2018). The Impact of Regulatory Quality and Corruption on Residential Electricity Prices in the Context of Electricity Market Reforms. Energy Policy 123, 514–524.

Appiah, M. O. (2018). Investigating the Multivariate Granger Causality between Energy Consumption, Economic Growth and CO2 Emissions in Ghana. Energy Policy 112, 198–208. doi:10.1016/j.enpol.2017.10.017

Arawomo, D. F., and Osigwe, A. C. (2016). Nexus of Fuel Consumption, Car Features and Car Prices: Evidence from Major Institutions in Ibadan. Renew. Sustain. Energy Rev. 59, 1220–1228. doi:10.1016/j.rser.2016.01.036

Bah, M. M., and Azam, M. (2017). Investigating the Relationship between Electricity Consumption and Economic Growth: Evidence from South Africa. Renew. Sust. Energ. Rev. 80, 531–537. doi:10.1016/j.rser.2017.05.251

Beck, T., Levine, R., and Levkov, A. (2010). Big Bad Banks? the Winners and Losers from Bank Deregulation in the United States. J. Finance 65 (5), 1637–1667. doi:10.1111/j.1540-6261.2010.01589.x

Bretschger, L. (2009). “Energy Prices, Growth and the Channels in Between:Theory and Evidence. OxCarre Working Paper 034,” in Oxford Center for the Analysis of Resource Rich Economies (University of Oxford).

Cao, Q. F. (2020). The Driving Effect of National-Level New Districts on Regional Economic Growth. China Ind. Economy (7), 43–60.

Chen, G. (2012). Judges' Remote Communication and Judicial Efficiency: Empirical Evidence from the Dean of the High Court. Economics (Quarterly) (4).

Chen, S., and He, L. (2013). Deregulation or Governmental Intervention? A Counterfactual Perspective on China's Electricity Market Reform[J]. China & World Economy (4), 20.

Ciarreta, A., and Zarraga, A. (2008). “Economic Growth and Electricity Consumption in 12 European Countries: A Causality Analysis Using Panel Data (Working Paper),” in Department of Applied Economics III (Econometrics and Statistics) (University of the Basque Country).

Dagoumas, A-S., Polemis, M-L., and Symeoni-Eleni, S. (2020). Revisiting the Impact of Energy Prices on Economic Growth: Lessons Learned from the European Union[J]. Economic Analysis and Policy 66, 85–95.

Fan, Z. Y., and Tian, B. B. (2013). Tax Competition, Tax Law Enforcement and Corporate Tax Avoidance. Econ. Res. (4).

Ferrara, E. L., Chong, A., and Duryea, S. (2012). Soap Operas and Fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 4 (4), 1–31. doi:10.1257/app.4.4.1

Hartley, P-R., Medlock, K-B., and Olivera, J. (2019). Electricity Reform and Sales Pricing in Texas[J]. Energ. Econ. 80, 1–11.

Hosoe, N. (2006). The Deregulation of Japan's Electricity Industry. Jpn. World Economy 18 (2), 230–246. doi:10.1016/j.japwor.2004.07.002

Iimura, A., and Cross Jeffrey, S. (2018). The Impact of Renewable Energy on Household Electricity Prices in Liberalized Electricity Markets: A Cross-National Panel Data analysis[J]. Utilities Policy, 5496–6106.

Inglesi-Lotz, R., and Ajmi, A. N. (2021). The Impact of Electricity Prices and Supply on Attracting FDI to South Africa. Environ. Sci. Pollut. Res. 28 (22), 28444–28455. doi:10.1007/s11356-021-12777-1

Johnstone, N., Haščič, I., and Popp, D. (2010). Renewable Energy Policies and Technological Innovation: Evidence Based on Patent Counts. Environ. Resource Econ. 45 (1), 133–155. doi:10.1007/s10640-009-9309-1

Li, P., Lu, Y., and Wang, J. (2016). Does Flattening Government Improve Economic Performance? Evidence from China. J. Dev. Econ. 123 (6), 18–37. doi:10.1016/j.jdeveco.2016.07.002

Lin, B., and Chen, Y. (2019). Does Electricity Price Matter for Innovation in Renewable Energy Technologies in China?. Energy Econ. 78, 259–266.

Liu, D., Xu, E., and Qin, G. (2019). Research on Reasonable Grid Investment Scale Measurement under the Reform of Transmission and Distribution Electricity Price[J]. Energy Procedia 156, 412–416.

Liu, R. M., and Zhao, R. J. (2015). Does the National High-Tech Zone Promote Regional Economic Development? Based on the Verification of the Double Difference Method. Manag. World (8), 30–38.

Liu, W., Zhang, X., and Wu, Y. (2020). Economic Analysis of Renewable Energy in the Electricity Marketization Framework: A Case Study in Guangdong, China[J]. Front. Energ. Res. 8. doi:10.3389/fenrg.2020.00098

Meher, S., and Sahu, A. (2013). Power Sector Reform and Pricing of Electricity: The Odisha Experience. J. Asian Afr. Stud. 48 (4), 447–468. doi:10.1177/0021909613493604

Nagayama, H. (2010). Impacts on Investments, and Transmission/distribution Loss through Power Sector Reforms. Energy Policy 38 (7), 3453–3467. doi:10.1016/j.enpol.2010.02.019

Narayan, P. K., and Smyth, R. (2009). Multivariate granger-causality between Electricity Consumption, Exports, and GDP: Evidence from a Panel of Middle Eastern Countries. Energy Policy 35 (9), 229–236. doi:10.1016/j.enpol.2008.08.020

Nela, V. L., and Vedran, P. (2015). Growth Potential of Energy Sector Reforms:New Evidence on EU and Southeast European Countries By Exploring Impact on Electricity Generation. Zb. rad. Ekon. fak. 33 (2), 275–297.

Payne, J. E. (2010). A Survey of the Electricity Consumption-Growth Literature. Appl. Energ. 87, 723–731. doi:10.1016/j.apenergy.2009.06.034

Pollitt, M-G. (2021). Measuring the Impact of Electricity Market Reform in a Chinese Context[J]. Energy and Climate Change, 2100044.

Raza, S. A., Shahbaz, M., and Nguyen, D. K. (2015). Energy Conservation Policies, Growth and Trade Performance: Evidence of Feedback Hypothesis in Pakistan. Energy Policy 80, 1–10. doi:10.1016/j.enpol.2015.01

Sanguk, K., Seong, H., Roland, K. R., and Kim, H. J. (2016). Effects of Electricity-price Policy on Electricity Demand and Manufacturing Output. Energy 102, 324–334. doi:10.1016/j.energy.2016.02.027

Shahbaz, M., and Lean, H. H. (2012). The Dynamics of Electricity Consumption and Economic Growth: A Revisit Study of Their Causality in Pakistan. Energy 39 (1), 146–153. doi:10.1016/j.energy.2012.01.048

Sharif, A., and Raza, S. A. (2016). Dynamic Relationship between Urbanization, Energy Consumption and Environmental Degradation in Pakistan: Evidence from Structure Break Testing. J. Manag. Sci. 3 (1), 1–21. doi:10.20547/jms.2014.1603101

Shi, R. Y., Nie, R. K., and Nie, C. G. (2017). Comparative Analysis of the Impact of Electricity price Fluctuations on Regional Economy. J. China Univ. Mining Tech. (3), 78–82.

Silva, P., Klytchnikova, I., and Radevic, D. (2009). Poverty and Environmental Impacts of Electricity price Reforms in Montenegro. Utilities Policy 17 (1), 102–113. doi:10.1016/j.jup.2008.02.008

Song, M. L., and Cui, L. B. (2016). Economic Evaluation of Chinese Electricity Price Marketization Based on Dynamic Computational General Equilibrium Model. Comput. Ind. Eng. 101, 614–628. doi:10.1016/j.cie.2016.05.035

Tang, W. B., Fu, Y. H., and Wang, Z. X. (2014). Technological Innovation, Technology Introduction and the Transformation of Economic Growth Mode[J]. Econ. Res. 49 (07), 31–43.

Wang, P., and Li, M. (2019). Scenario Analysis in the Electric Power Industry under the Implementation of the Electricity Market Reform and a Carbon Policy in China. Energies 12 (11), 2152. doi:10.3390/en12112152

Wang, Y. L., Zhou, M. H., and Liu, L. (2021). Chinese Grid Investment Based on Transmission and Distribution Tariff Policy: An Optimal Coordination Between Capacity and Demand. Energy 101, 119589. doi:10.1016/j.energy.2020.119589

Xie, B. C,X. J., and Pollitt, M. G. (2020). What Effect Has the 2015 Power Market Reform Had on Power Prices in China Evidence from Guangdong and Zhejiang. (Working paper).Energy Policy Research Group. University of Cambridge.

Ye, Z., Yuan, W. Z., Li, K., and Li, X. Q. (2014). The Formation Mechanism of the Low Electricity price Trap: An Empirical Study Based on China's Inter-provincial Panel Data. China Soft Sci. (10), 25–36.

Yoo, S.-H. (2005). Electricity Consumption and Economic Growth: Evidence from Korea. Energy Policy 33, 1627–1632. doi:10.1016/j.enpol.2004.02.002

Zhao, X-g., and Hu, S-r. (2020). Does Market-Based Electricity price Affect China's Energy efficiency?[J]. Energy Economics 91, 104909.

Zhao, X., Lyon, T. P., and Song, C. (2012). Lurching Towards Markets for Power: China’s Electricity Policy1985–2007. Appl. Energy 94, 148–155. doi:10.1016/j.apenergy.2012.01.035

Keywords: Transmission and distribution electricity price reform, Economic growth, Difference in differences, Innovation, Fixed asset investment

Citation: Li H, Wang X, Xie Y, Chen T, Han H and Yang Y (2022) The Impact of Transmission and Distribution Price Reform on Economic Growth in Liberalized Electricity Markets: An Inter-Provincial Panel Data Analysis. Front. Environ. Sci. 9:755319. doi: 10.3389/fenvs.2021.755319

Received: 08 August 2021; Accepted: 31 December 2021;

Published: 24 March 2022.

Edited by:

Qiang Ji, Institutes of Science and Development (CAS), ChinaCopyright © 2022 Li, Wang, Xie, Chen, Han and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuantao Xie, xieyuantao@uibe.edu.cn; Ting Chen, c123789h@163.com

Hong Li1

Hong Li1  Xiaogang Wang

Xiaogang Wang Yuantao Xie

Yuantao Xie Haoming Han

Haoming Han