Financial Development, Institutional Quality, and the Influence of Various Environmental Factors on Carbon Dioxide Emissions: Exploring the Nexus in China

- 1Department of Business Administration, Iqra University, Karachi, Pakistan

- 2School of Economics, Shandong Technology and Business University, Yantai, China

- 3Department of Economics, Faculty of Management and Social Sciences, Lasbela University of Agriculture Water and Marine Sciences, Uthal, Pakistan

- 4Institute of Mountain Hazard and Environment, Chinese Academy of Sciences, Chengdu, China

Carbon dioxide (CO2) emissions have been the key source of extreme environmental degradation and have an adverse impact on climate and human activities. Although a large number of studies have explored the determinants of CO2 emissions, the role of institutional quality has not been fully studied. Our study contributes to the existing literature by examining the influence of financial development, institutional quality, foreign direct investment, trade openness, urbanization, and renewable energy consumption on CO2 emissions over the period 1996–2020 by utilizing the dynamic autoregressive distributed lag simulations. The empirical findings of the study indicate that the indicators of governance, trade, financial development, and renewable energy consumption adversely affect CO2 emissions, while urbanization and foreign direct investment contribute to environmental degradation. The empirical results of this study indicate that in order to mitigate environmental degradation and to achieve environmental sustainability, the government should establish consistency between environmental and economic policies. Moreover, in order to achieve low carbon emissions and sustainable development, countries need viable financial institutions that focus on green growth by promoting clean production process strategies to ensure the reduction of CO2 emissions.

1 Introduction

Global warming is a serious and challenging environmental issue of the contemporary period. Scientists unanimously believe that carbon emissions from the burning of fossil fuels and greenhouse gas emissions are warming the atmosphere around the globe (Intergovernmental Panel on Climate Change (IPCC), 2007). In the past few decades, greenhouse gas emissions, mainly, carbon dioxide emissions, have led to global warming, which leads to changes in global climate (Seetanah et al., 2018; Farooq et al., 2019; Ghazouani et al., 2020; Shahzad et al., 2020; Fatima et al., 2021a; Rafique et al., 2021; Shahzad et al., 2021c). Environmental degradation has become one of the world’s major issues that may adversely affect the health of human beings (Zhang et al., 2018; Mardani et al., 2019; Adedoyin et al., 2020; Shahzad et al., 2021b; Murshed et al., 2021) and sustainable economic performance of countries (Amin et al., 2020b; Ding et al., 2020; Amin and Dogan, 2021; Yousaf et al., 2021; Sharma et al., 2021); this is the reason the issue of environmental degradation has attracted enormous attention from researchers and policymakers in the recent era (Destek and Sarkodie, 2019). It is widely recognized that environmental degradation arises from greenhouse gas (GHG) emissions (Amin et al., 2020a), which contribute to global warming (Atasoy, 2017).

China has experienced rapid economic development in recent decades, and this rapid development has contributed to environmental degradation in the country (Jalil and Feridun, 2011). According to the Carbon Brief calculations, China’s CO2 emission reached 10 billion tons in 2018, whereas the total carbon emissions of the United States and the European Union countries were 5.4 billion tons and 3.5 billion tons, respectively, in the same year. Recently, China became the world’s largest CO emitter and energy-consuming country (Al-Arkawaz, 2018). Its energy consumption per unit of GDP is twice the world average, and per capita CO2 emissions have increased by 40% in the world. The growth rate of carbon (CO2) emissions in China has risen more than 11% per annum (Auffhammer and Carson, 2008). Hence, this rapid increase in CO2 in the last couple of years might result in degradation of the Chinese economy (Ang, 2009; Jalil and Mahmud, 2009). In order to understand the key determinants of China’s carbon emissions precisely, a lot of research scholars investigated the nexus among energy consumption, economic growth, population, energy, as well as the industrial structure and carbon emissions (Auffhammer and Carson, 2008; Lin and Jiang, 2009; Zhang et al., 2011; Dietzenbacher et al., 2012; Du et al., 2012; Zhou et al., 2013; Wang et al., 2014). However, the nexus between financial development and energy consumption is hardly explored, particularly in the case of China (Xiong and Qi, 2018) despite the Chinese economy having gone through a high rate of economic growth at the regional and international levels and rapid financial development in the recent two and a half decades (Jalil and Ma, 2008; Jalil et al., 2010).

Two empirical research studies, Jalil and Feridun (2011) and Zhang (2011), explored the impact of financial development on carbon emissions, particularly in the case of China (Xiong and Qi, 2018). Jalil and Feridun (2011) investigated the long-run impact of financial development on carbon emissions and concluded that financial development reduces carbon emissions in the long run. The study by Zhang (2011) investigated the nexus between financial development and carbon emissions; the study concluded that financial development is the key driver of carbon emission in the case of China. Another recent study by Xiong and Qi (2018) explored the nexus between financial development and carbon emissions in China at the provincial level; they concluded that the effect of technology and structure on financial development surpasses decreases carbon emissions per capita. An empirical study by Tamazian and Rao (2010) confirmed the importance of both financial development and institutional quality for carbon emission performance, but this study claims that financial liberalization might harm environmental quality if the institutional framework is not strong enough. Another study by Claessens and Feijen (2007) confirmed that financial development can significantly reduce environmental problems through improved governance. Also, a study by Frankel and Romer (1999) confirmed that financial liberalization may drive FDI inflows, which, in turn, can hasten quick growth and, thus, harm environmental quality and increase carbon emissions. Also, renewable energy is the most efficient way to protect environmental quality (Bhattacharya et al., 2016; Sharif et al., 2019; Bashir et al., 2020; Bashir et al., 2021; Doğan et al., 2021; Fatima et al., 2021b; Shahzad et al., 2021a; Wang et al., 2021).

The practical significance of financial development in terms of economic growth and its long-term effects on environmental degradation is quite interesting to explore due to several reasons (Jalil and Feridun, 2011). Although the empirical studies, such as Zhang (2011) and Jalil and Feridun (2011), are quite interesting and provide valuable insight into understanding the nexus between financial development and carbon emissions at the macroeconomic level, particularly in the case of China, these studies also suffer from significant shortcomings in the form of missing notable variables such as institutional quality, FDI inflows, and interactive proxy variables (TRADE*FD). Another recent study by Xiong and Qi (2018) also provides useful insight into comprehending the linkage between financial development and carbon emissions by incorporating interesting key notable variables such as urbanization, research and development ratio, and energy consumption by applying STIRPAT panel data methodology, but this study also suffers from a major limitation that it narrowly focused only at the Chinese provincial level or industrial level.1 There are few empirical panel data studies that analyzed the impact of financial development on carbon emissions. However, it is widely recognized that any potential inference drawn from these cross-country studies provides only a general understanding of the linkage between the variables, and thus, these studies are unable to offer much guidance on policy implications for each country (Stern et al., 1996; Lindmark, 2002; Ang, 2008). Hence, the aim of this research was to investigate particularly the impact of financial development on carbon emissions in the case of China.

Our empirical research study contributes to the existing research literature in different contexts. First, we extend the prior works of Zhang (2011) and Jalil and Feridun (2011) but with significant differences. Limited to our knowledge, this is the first empirical study that examined the impact of financial development on carbon emissions by conceptualizing key notable variables such as institutional quality, FDI inflows, and renewable energy, which are significantly ignored in the prior works of Zhang (2011) and Jalil and Feridun (2011). Second, we formulate a comprehensive index of institutional quality to capture the effects of all important individual governance indicators extensively into one aggregate component by aggregating six key individual governance indicators into one aggregate institutional index. Next, we analyze the impact of each institutional indicator on carbon emissions separately to diagnose more precisely the role of each governance indicator on environmental upgradation. In addition, we develop interactive proxy terms from prior research literature and thus add interactive term proxies (TRADE*FD) in our model. Also, our analysis is more robust as we utilize an updated dataset for the rapidly growing economy of China from 1996 to 2020 annually and also apply the most robust dynamic autoregressive distributed lag simulation methodology to control the endogeneity, multicollinearity, and autocorrelation issues for the time series dataset of our empirical research study.

The aim of the present study was to investigate, for the first time in the existing literature, the nexus among financial development, institutional quality, various other environmental factors, and CO2 emissions for China over the period 1996–2020. In contrast to the previous studies that used conventional econometric approaches, this study fills the gap in the existing literature by employing up-to-date time series econometric approach dynamic ARDL simulations and provides reliable and robust results.

This study is organized as follows: Section 2 presents the literature review. Section 3 discusses data, model, and methodology, while results and discussions are reported in Section 4. The last section concludes the whole study with policy implications.

2 Literature Review

A vast body of existing literature identified a strong relationship between financial development and CO2 emissions. For instance, Frankel and Romer (1999) argued that financial development attracts foreign direct investment (FDI) and hence leads to accelerated economic growth and CO2 emissions. According to Tamazian et al. (2009), financial development increases environmental degradation. However, other researchers suggested that an established financial system not only helps improve the efficiency of the financial sector but also contributes to the economic development of a country (Sadorsky, 2010; Zhang, 2011; Shoaib et al., 2020). Ma and Fu (2020) and Dasgupta et al. (2001) argued that due to the development of the financial markets and expansion of production, the enterprises may reduce financing costs and increase financing channels to make investment in new projects, and this may stimulate energy consumption and carbon emissions. Khan et al. (2021) found that financial development, energy intensity, renewable energy production, research and development, natural resource depletion, and temperature contribute to environmental pollution degradation in Canada. Sadorsky (2010) identified that financial intermediation encourages people to take loans to buy heavy vehicles that ultimately accelerate CO2 emissions. However, some researchers support that financial development can alleviate environmental degradation. For instance, Tamazian et al. (2009) emphasized that financial development helps companies reduce CO2 emissions by adopting technological innovation, while Claessens and Feijen (2007) suggested that enterprises with advanced governance tend to be more willing to consider low-carbon development; therefore, financial development can promote corporate performance, and thereby reduce energy consumption and carbon emissions.

Recent literature has focused more on investigating the impact of financial development on environmental development in recent times (Boutabba, 2014). A study by Yuxiang and Chen (2011) investigated the impact of financial development on environmental pollution for the Chinese economy using provincial level data and concluded that financial development reduces the level of environmental pollution. The result estimations of their empirical study suggest that financial development improves environment conditions through the spread of technology, increase in capital, and enforcement of new environmental rules and regulations. Jalil and Feridun (2011) explored the effects of financial development, trade openness, and energy consumption on environmental degradation in the case of China from 1953 to 2006 annually by applying ARDL methods. The empirical results show a negative sign for the coefficient of financial development, suggesting that financial development did not contribute to environmental pollution in China. Quite the reverse, the results show that financial development reduced environmental pollution. Accordingly, energy consumption, trade openness, and income are the key determinants of carbon emissions (CO2) in the long run. Moreover, the result estimates confirm the presence of an environmental Kuznets curve for China.

In addition, Zhang (2011) investigated the impact of financial development on carbon emissions in the long run. The empirical results showed that financial development is an important stimulator of carbon emissions that must be considered when carbon emission demand is highly anticipated. Second, the impact of financial intermediation on carbon emissions offsets that of other financial development indicators, but the impact of its efficiency seems to be weaker even though it might affect carbon emission statistically. Furthermore, although the Chinese stock market widely affects carbon emission, its efficiency influence is on a limited scale and quite weaker. Lastly, China’s FDI has little impact on the size of carbon emission because of its smaller size relative to income. A study by Ozturk and Acaravci (2013) explored the nexus among financial development, energy consumption, economic growth, and carbon emissions for Turkey from 1960 to 2007 annually. The empirical estimations showed that there exists a relationship among financial development, income, carbon emissions, openness ratio, and energy consumption in the long run. Nevertheless, financial development had insignificant long-run effects on carbon emissions in the case of Turkey. Equally, developing countries can access new technology that might be environmentally friendly through the higher level of financial development in their country (Birdsall and Wheeler, 1993; Frankel and Rose, 2002). On the other hand, Jensen (1996) noted that financial development may lead to increased industrial activities, which, in turn, may lead to industrial pollution.

A study by Talukdar and Meisner (2001) explored the effects of financial sector development on carbon emissions for a panel of 44 developing countries from 1987 to 1995 annually. The empirical results showed that international capital flows and financial institutions positively influence environmental degradation. Claessens and Feijen (2007) studied the impact of governance on CO2 emission, and they confirmed that firms can reduce carbon emissions with the help of technology-advanced governance. They concluded that financial development might enhance the productivity of the firms due to the promotion of innovative technology emits less energy, which ultimately decreases the rate of carbon emissions. Tamazian et al. (2009) explored the nexus among financial development, economic development, and environmental problems for BRIC economics from 1992 to 2004. The empirical results showed that a higher level of financial development improves environmental degradation. A study by Tamazian and Rao (2010) explored the impact of financial and institutional development on environmental pollution for 24 emerging countries from 1990 to 2004 annually and concluded that financial openness might be detrimental to environmental quality if it is not strongly interconnected with sound institutional quality.

Previous studies identified that urbanization (Balsalobre-Lorente et al., 2021; Qader et al., 2021), institutional quality (Usman and Jahanger, 2021), renewable/nonrenewable/total energy consumption (Usman et al., 2020; Hussain and Rehman, 2021; Usman and Makhdum, 2021; Regmi and Rehman, 2021; Rehman et al., 2021a; Rehman et al., 2021b), and trade (Rehman et al., 2021c; Rehman et al., 2021d; Usman et al., 2021) are more influencing factors that affect CO2 emissions.

3 Model, Data, and Econometric Methodology

3.1 Model and Data

This study investigates the role of institutional quality, financial development, FDI, trade openness, and renewable energy consumption in carbon emissions for China from 1996 to 2020. Inspired by Pata (2018) and Ehigiamusoe and Lean (2019), this study proposes the following model of Eq. 1:

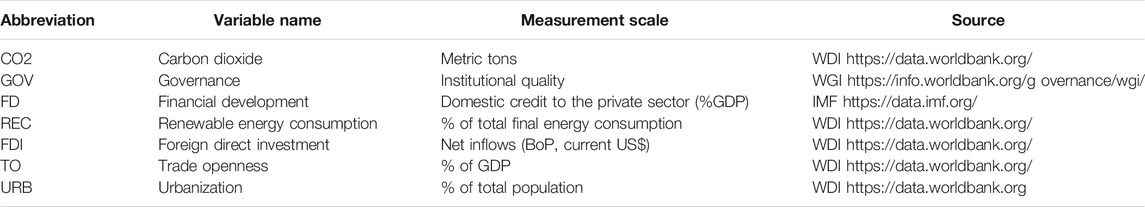

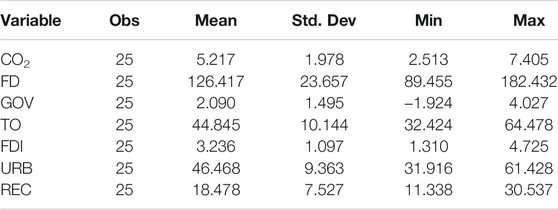

where CO2 emission is an environmental indicator; GOV is the governance index, FD is financial development, REC is renewable energy consumption, FDI is foreign direct investment, URB is urbanization, and TO is trade openness. The description of all indicators is reported in Table 1. We scrutinize the descriptive statistical results presented in Table 1 showing the mean, maximum, minimum, and standard deviations of the variables. The results of descriptive statistics show the positive trends of all the variables. These variations seem sufficient for further empirical estimation.

3.2 Econometric Methodology

Jordan and Philips (2018) developed a new dynamic stimulated ARDL, namely, dynamic ARDL simulations, approach to overcome the complications in short- and long-run examinations of the autoregressive distributed lag (ARDL) approach, which was developed by Pesaran et al. (2001). The dynamic ARDL simulation approach estimates and predicts the probability change in the regress and one regressor while keeping the other regressors unchanged. On the other hand, the Pesaran et al. (2001) ARDL approach only examines the long-run and short-run linkages between variables. Although the implementation of the ARDL approach is very convenient, its dynamic form accepts the first difference and multiple lags of both the regressor and regress (Jordan and Philips, 2018). To estimate the dynamic ARDL simulations, all the variables in the econometric model must be stationary at the first difference I(I), and there should be cointegration among all indicators (Jordan and Philips, 2018; Sarkodie et al., 2019). This method uses the multivariate normal distribution to simulate the vector of parameters 5,000 times. The equational form of the dynamic ARDL simulation approach is presented in Eq. 2.

In Eq. 2, y demonstrates the variation in the dependent variable,

4 Results and Discussion

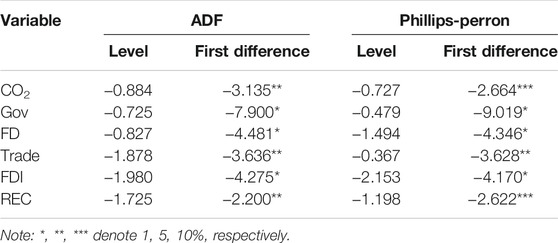

4.1 Unit Root Test

Before applying the dynamic ARDL simulation approach, the first step is to check the stationarity of all variables; that is, the dependent variable should be stationary at first difference I (1), while all independent variables must be stationary at level or at first difference, that is, I (0) or I (1). This study applies augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) unit root tests to check the stationarity of all variables. The results of the unit root tests in Table 3 demonstrate that all variables are stationary at first difference I (1).

4.2 Dynamic Autoregressive Distributed Lag Simulations

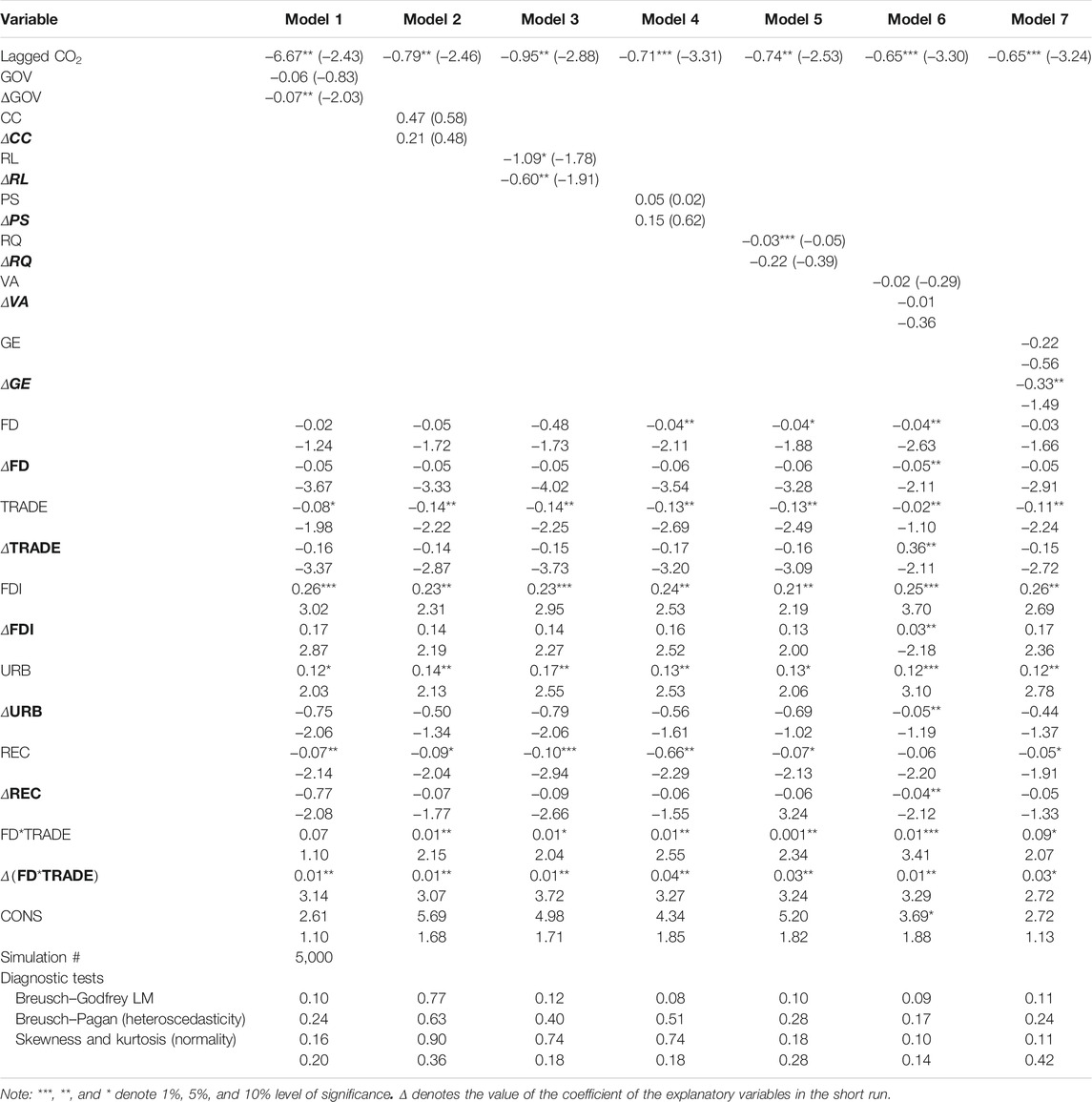

This study utilized dynamic ARDL simulations proposed by Jordan and Philips (2018), and this econometric approach overcomes the complexities in the existing ARDL approach. The results of the dynamic ARDL simulations are reported in Table 4. The proxies of the governance index, that is, RL and RQ, posit a negative relationship with CO2 emissions. The positive sign of governance indicators denotes that an increase in rule of law and regulatory quality leads to an increase in CO2 emissions in China. Our findings are consistent with Abid (2016).

The coefficient of trade has a negative and significant relationship with CO2 emissions, which implies that trade helps mitigate environmental pollution. A potential reason is that China’s higher economic growth rate and increasing income have reduced the trade barriers, which ultimately improves environmental quality. In addition, China has modified its manufacturing structure. Due to the higher demand for traded goods, China produces low-polluting goods which help reduce CO2 emissions significantly. Our results are in line with Jayantha Kumaran et al. (2012), Shahbaz et al. (2013), Hao and Liu (2015), Yazdi and Beygi (2018), Chen et al. (2019), and Fatima et al. (2021a).

Financial development (FD) has a significant and negative impact on CO2 emissions. The negative coefficient FD implies that financial developments cause R&D investments, thereby promoting the expansion of high-tech and environmentally friendly energy investment, in turn hindering carbon emissions. Furthermore, financial sector development contributes to reducing CO2 emissions by guiding the banking sector to provide loans to companies for establishing environmentally friendly investment projects. Our findings are consistent with Shahbaz et al. (2013), Hafeez et al. (2019a), Hafeez et al. (2019b), Shoaib et al. (2020), and Szymczyk et al. (2021).

With respect to the coefficient of renewable energy consumption (REC), it is found that an increase in the share of renewable energy consumption adversely affects CO2 emissions in China. In China, with increasing concerns about the health and environmental costs of CO2 emissions, consumption of renewable energy must become an effective alternative to fossil fuels (such as oil, coal, and natural gas). Moreover, the increasing energy demand and huge consumption of nonrenewable energy sources exert an adverse impact on the environment. Our findings are in line with Bilgili et al. (2016), Danish et al. (2017), Ito (2017), Sarkodie and Adams, (2018), Bekun et al. (2019), Wang et al. (2020), and Anwar et al. (2021).

The coefficient value of foreign direct investment (FDI) demonstrates a positive and significant relationship with CO2 emissions. FDI inflows increase the host country’s CO2 emissions by establishing more industrial units. In addition, foreign investors are attracted to invest in countries with lower environmental regulations in terms of CO2 emissions; this factor ultimately leads to more CO2 emissions. Our findings are similar to those of Paramati et al. (2016), Shahbaz et al. (2018), Chishti et al. (2021), Farooq (2021), and Mehmood (2021). Urbanization has a positive and significant relationship with CO2 emissions, which reveals that urbanization is a highly significant factor of environmental degradation in China. On the one hand, urbanization promotes household energy consumption, which ultimately contributes to increase in CO2 emissions; on the other hand, the process of urbanization in China is accompanied by an increase in consumption of goods and services such as housing and automobiles, leading to more indirect household CO2 emissions. Moreover, the reason for rapid urbanization in China is that nowadays people prefer to live and work in urban areas, and they are moving rapidly to urban areas. Our estimated coefficient is parallel to that of Hossain (2011), Al-Mulali et al. (2013), Pata (2018), Mahmood et al. (2020), Gao and Zhang (2021), and Mignamissi and Djeufack (2021).

The coefficient value showed that the interaction term of financial development and trade is not environment friendly. This shows that a higher (lower) level of financial sector development in China will have higher (lower) export (import) share and trade balance in the financial sector. Over the past decades, many studies identified that financial development plays an important role in influencing a country’s economic variables. For instance, King and Levine (1993a), King and Levine (1993b), and Levine (1997) found that a close relationship exists between the level of financial development and microeconomic and macroeconomic growth. Furthermore, the studies of Demirguc-Kunt and Maksimovic (1998), Beck and Levine (2001), and Rajan and Zingales (1998) demonstrated that a well-established financial sector helps countries obtain external financing for investment projects, while Svaleryd and Vlachos (2005) and Beck (2003) found a significant and positive correlation between financial development and international trade and comparative advantage.

The results of the diagnostic tests are presented in Table 4. The diagnostic tests are applied to check the consistency of econometric models. The results of the Breusch–Godfrey LM test demonstrate that no serial correlation was found in the model. The results of the Breusch–Pagan test show the absence of heteroscedasticity in the model. To check the normality of the dataset, we applied skewness and kurtosis tests. The results demonstrate that normal distribution existed under the null hypothesis.

5 Conclusion and Policy Recommendations

In recent years, climate change has become a serious issue that may lead to deterioration of sustainable development throughout the world. Over the past few decades, CO2 emission has significantly and positively contributed to global warming, which has ultimately led to a change in climate across the globe. Thus, it is essential to examine those factors which significantly contribute to enhancing CO2 emissions. This study investigates the impact of financial development, governance, foreign direct investment, urbanization, trade openness, and renewable energy consumption on CO2 emissions in China over the period 1996–2020 annually.

The present study utilized an up-to-date time series econometric approach, namely, dynamic ARDL simulations proposed by Jordan and Philips (2018). The dynamic ARDL simulations overcome limitations in the already existing ARDL approach model. This approach used 5,000 simulations of the vector of parameters by utilizing multivariate normal distribution. The study examined the impact of financial development, institutional quality, and various other environmental factors, for example, renewable energy consumption, foreign direct investment, urbanization, and trade, on CO2 emissions. The empirical findings of our study highlight that the proxies of governance index, that is, rule of law and regulatory quality; trade; financial development; and renewable energy consumption have a negative relationship with CO2 emissions, while foreign direct investment and urbanization have a positive relationship with CO2 emissions.

Based on the empirical findings, this study provides some important policy implications. First, since institutional quality adversely affects CO2 emissions, policymakers must support local institutions to reduce environmental degradation. The lack of environmental protection policies in financial institutions has led to an increase in CO2 emissions. Therefore, it is recommended to strengthen financial institutions and adopt environmentally friendly policies to decrease CO2 emissions. The establishment of stable financial, economic, and environmental institutions contributes to green energy, thus helping mitigate environmental degradation. The findings of the study demonstrate that renewable energy consumption helps decrease CO2 emissions in China, which in turn promotes sustainable development. In order to maintain environmental quality and establish an eco-friendly environment, policymakers must establish consistency between environmental and economic policies. In terms of limitation, as this study applies single-country analysis, further study can be extended by utilizing panel data for developed and developing countries.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This project was funded by the National Social Science Fund of China (Grant No. 21BJY113).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Xiong and Qi (2018) did not focus on the whole economy with a macroeconomic perspective.

References

Abid, M. (2016). Impact of Economic, Financial, and Institutional Factors on CO2 Emissions: Evidence from Sub-saharan Africa Economies. Utilities Policy 41, 85–94. doi:10.1016/j.jup.2016.06.009

Adedoyin, F. F., Gumede, M. L., Bekun, F. V., Etokakpan, M. U., and Balsalobre-Lorente, D. (2020). Modelling Coal Rent, Economic Growth and CO2 Emissions: Does Regulatory Quality Matter in BRICS Economies?. Sci. Total Environ.. doi:10.1016/j.scitotenv.2019.136284

Al-Arkawaz, S. A. Z. (2018). Measuring the Influences and Impacts of Signalized Intersection Delay Reduction on the Fuel Consumption, Operation Cost and Exhaust Emissions. Civ. Eng. J. 3, 552–571. doi:10.28991/cej-0309115

Al-Mulali, U., Fereidouni, H. G., Lee, J. Y. M., and Sab, C. N. B. C. (2013). Exploring the Relationship between Urbanization, Energy Consumption, and CO2 Emission in MENA Countries. Renew. Sustain. Energ. Rev. 23, 107–112. doi:10.1016/j.rser.2013.02.041

Amin, A., Altinoz, B., and Dogan, E. (2020a). Analyzing the Determinants of Carbon Emissions from Transportation in European Countries: the Role of Renewable Energy and Urbanization. Clean. Techn Environ. Pol. 22 (8), 1725–1734. doi:10.1007/s10098-020-01910-2

Amin, A., Dogan, E., and Khan, Z. (2020b). The Impacts of Different Proxies for Financialization on Carbon Emissions in Top-Ten Emitter Countries. Sci. Total Environ. 740, 140127. doi:10.1016/j.scitotenv.2020.140127

Amin, A., and Dogan, E. (2021). The Role of Economic Policy Uncertainty in the Energy-Environment Nexus for China: Evidence from the Novel Dynamic Simulations Method. J. Environ. Manage. 292, 112865. doi:10.1016/j.jenvman.2021.112865

Ang, J. B. (2009). CO2 Emissions, Research and Technology Transfer in China. Ecol. Econ. 68 (10), 2658–2665. doi:10.1016/j.ecolecon.2009.05.002

Ang, J. B. (2008). Economic Development, Pollutant Emissions and Energy Consumption in Malaysia. J. Pol. Model. 30, 271–278. doi:10.1016/j.jpolmod.2007.04.010

Anwar, A., Siddique, M., Eyup Dogan, E., and Sharif, A. (2021). The Moderating Role of Renewable and Non-renewable Energy in Environment-Income Nexus for ASEAN Countries: Evidence from Method of Moments Quantile Regression. Renew. Energ. 164, 956–967. doi:10.1016/j.renene.2020.09.128

Auffhammer, M., and Carson, R. T. (2008). Forecasting the Path of China's CO2 Emissions Using Province-Level Information. J. Environ. Econ. Manage. 55 (3), 229–247. doi:10.1016/j.jeem.2007.10.002

Balsalobre-Lorente, D., Ibáñez-Luzón, L., Usman, M., and Shahbaz, M. (2021). The Environmental Kuznets Curve, Based on the Economic Complexity, and the Pollution haven Hypothesis in PIIGS Countries. Renewable Energy.

Bashir, M. A., Sheng, B., Doğan, B., Sarwar, S., and Shahzad, U. (2020). Export Product Diversification and Energy Efficiency: Empirical Evidence from OECD Countries. Struct. Change Econ. Dyn. 55, 232–243. doi:10.1016/j.strueco.2020.09.002

Bashir, M. F., Ma, B., Bashir, M. A., Radulescu, M., and Shahzad, U. (2021). Investigating the Role of Environmental Taxes and Regulations for Renewable Energy Consumption: Evidence from Developed Economies. Econ. Research-Ekonomska Istraživanja, 1–23. doi:10.1080/1331677X.2021.1962383

Beck, T. (2003). Financial Dependence and International Trade. Rev. Int. Econ. 11, 107–131. doi:10.1111/1467-9396.00384

Beck, T., and Levine, R. (2001). Industry Growth and the Allocation of Capital: Does Having a Market or Bank-Based System Matter. J. Financial Econ. 64, 147–180.

Bekun, F. V., Alola, A. A., and Sarkodie, S. A. (2019). Toward a Sustainable Environment: Nexus between CO2 Emissions, Resource Rent, Renewable and Nonrenewable Energy in 16-EU Countries. Sci. Total Environ. 657, 1023–1029. doi:10.1016/j.scitotenv.2018.12.104

Bhattacharya, M., Inekwe, J., and Sadorsky, P. (2020). Consumption-Based and Territory-Based Carbon Emissions Intensity: Determinants and Forecasting Using Club Convergence Across Countries. Energy Econ. 86, 104632. doi:10.1016/j.eneco.2019.104632

Bilgili, F., Koçak, E., and Bulut, Ü. (2016). The Dynamic Impact of Renewable Energy Consumption on CO 2 Emissions: A Revisited Environmental Kuznets Curve Approach. Renew. Sustain. Energ. Rev. 54, 838–845. doi:10.1016/j.rser.2015.10.080

Birdsall, N., and Wheeler, D. (1993). Trade Policy and Industrial Pollution in Latin America: where Are the Pollution Havens. J. Environ. Dev. 2 (1), 137–149. doi:10.1177/107049659300200107

Boutabba, M. A. (2014). The Impact of Financial Development, Income, Energy and Trade on Carbon Emissions: Evidence from the Indian Economy. Econ. Model. 40, 33–41. doi:10.1016/j.econmod.2014.03.005

Chen, Y., Wang, Z., and Zhong, Z. (2019). CO2 Emissions, Economic Growth, Renewable and Non-renewable Energy Production and Foreign Trade in China. Renew. Energ. 131, 208–216. doi:10.1016/j.renene.2018.07.047

Chishti, M. Z., Ahmed, Z., Murshed, M., Namkambe, H. H., and Ulucak, R. (2021). The Asymmetric Associations between Foreign Direct Investment Inflows, Terrorism, CO2 Emissions, and Economic Growth: a Tale of Two Shocks. Environ. Sci. Pollut. Res., 1–19.

Claessens, S., and Feijen, E. (2007). Financial Sector Development and the Millennium Development Goals (No. 89). World Bank Publications.

Danish, R., Ulucak, R., and Khan, S. U. D. (2020). Relationship between Energy Intensity andCO2emissions: Does Economic Policy Matter. Sustain. Dev. 28 (5), 1457–1464. doi:10.1002/sd.2098

Danish, , Zhang, B., Wang, B., and Wang, Z. (2017). Role of Renewable Energy and Non-renewable Energy Consumption on EKC: Evidence from Pakistan. J. Clean. Prod. 156, 855–864. doi:10.1016/j.jclepro.2017.03.203

Dasgupta, S., Laplante, B., and Mamingi, N. (2001). Pollution and Capital Markets in Developing Countries. J. Environ. Econ. Manag. 42, 310–335.

Demirguc¸-Kunt, A., and Maksimovic, V. (1998). Law, Finance and Firm Growth. J. Finance 53, 2107–2137.

Destek, M. A., and Sarkodie, S. A. (2019). Investigation of Environmental Kuznets Curve for Ecological Footprint: the Role of Energy and Financial Development. Sci. Total Environ. 650, 2483–2489. doi:10.1016/j.scitotenv.2018.10.017

Dietzenbacher, E., Pei, J., and Yang, C. (2012). Trade, Production Fragmentation, and China's Carbon Dioxide Emissions. J. Environ. Econ. Manage. 64, 88–101. doi:10.1016/j.jeem.2011.12.003

Ding, Q., Khattak, S. I., and Ahmad, M. (2020). Towards Sustainable Production and Consumption: Assessing the Impact of Energy Productivity and Eco-Innovation on Consumption-Based Carbon Dioxide Emissions (CCO2) in G-7 Nations. Sustain. Prod. Consum. 27, 254–268. doi:10.1016/j.spc.2020.11.004

Doğan, B., Driha, O. M., Balsalobre Lorente, D., and Shahzad, U. (2021). The Mitigating Effects of Economic Complexity and Renewable Energy on Carbon Emissions in Developed Countries. Sustain. Dev. 29 (1), 1–12.

Du, L., Wei, C., and Cai, S. (2012). Economic Development and Carbon Dioxide Emissions in China: Provincial Panel Data Analysis. China Econ. Rev. 23, 371–384. doi:10.1016/j.chieco.2012.02.004

Ehigiamusoe, K. U., and Lean, H. H. (2019). Effects of Energy Consumption, Economic Growth, and Financial Development on Carbon Emissions: Evidence from Heterogeneous Income Groups. Environ. Sci. Pollut. Res. 26 (22), 22611–22624. doi:10.1007/s11356-019-05309-5

Farooq, M. U., Shahzad, U., Sarwar, S., and ZaiJun, L. (2019). The Impact of Carbon Emission and forest Activities on Health Outcomes: Empirical Evidence from China. Environ. Sci. Pollut. Res. 26 (13), 12894–12906. doi:10.1007/s11356-019-04779-x

Farooq, U. (2021). Foreign Direct Investment, Foreign Aid, and CO2 Emissions in Asian Economies: Does Governance Matter. Environ. Sci. Pollut. Res., 1–16.

Fatima, T., Mentel, G., Doğan, B., Hashim, Z., and Shahzad, U. (2021a). Investigating the Role of export Product Diversification for Renewable, and Non-renewable Energy Consumption in GCC (Gulf Cooperation council) Countries: Does the Kuznets Hypothesis Exist. Environ. Dev. Sustainability, 1–21.

Fatima, T., Shahzad, U., and Cui, L. (2021b). Renewable and Nonrenewable Energy Consumption, Trade and CO2 Emissions in High Emitter Countries: Does the Income Level Matter. J. Environ. Plann. Manage. 64 (7), 1227–1251. doi:10.1080/09640568.2020.1816532

Frankel, J. A., and Romer, D. (1999). Does Trade Cause Growth. Am. Econ. Rev. 89 (3), 379–399. doi:10.1257/aer.89.3.379

Frankel, J., and Rose, A. (2002). An Estimate of the Effect of Common Currencies on Trade and Income. Q. J. Econ. 117 (2), 437–466. doi:10.1162/003355302753650292

Gao, J., and Zhang, L. (2021). Does Biomass Energy Consumption Mitigate CO2 Emissions? the Role of Economic Growth and Urbanization: Evidence from Developing Asia. J. Asia Pac. Economy 26 (1), 96–115. doi:10.1080/13547860.2020.1717902

Ghazouani, A., Xia, W., Ben Jebli, M., and Shahzad, U. (2020). Exploring the Role of Carbon Taxation Policies on CO2 Emissions: Contextual Evidence from Tax Implementation and Non-implementation European Countries. Sustainability 12 (20), 8680. doi:10.3390/su12208680

Hafeez, M., Yuan, C., Khelfaoui, I., Sultan Musaad O, A., Waqas Akbar, M., and Jie, L. (2019a). Evaluating the Energy Consumption Inequalities in the One belt and One Road Region: Implications for the Environment. Energies 12 (7), 1358. doi:10.3390/en12071358

Hafeez, M., Yuan, C., Shahzad, K., Aziz, B., Iqbal, K., and Raza, S. (2019b). An Empirical Evaluation of Financial Development-Carbon Footprint Nexus in One belt and Road Region. Environ. Sci. Pollut. Res. 26 (24), 25026–25036. doi:10.1007/s11356-019-05757-z

Hao, Y., and Liu, Y. (2015). Effects of Foreign Business on Carbon Emission in China: a Provincial 608 Panel Data-Based Analysis. China Environ. Manage. 4, 85–93.

Hussain, I., and Rehman, A. (2021). Exploring the Dynamic Interaction of CO2 Emission on Population Growth, Foreign Investment, and Renewable Energy by Employing ARDL Bounds Testing Approach. Environ. Sci. Pollut. Res., 1–11. doi:10.1007/s11356-021-13502-8

Intergovernmental Panel on Climate Change (IPCC), 2007. Climate Change Synthesis Report 2007. Available at: http://www.ipcc.ch/S.

Ito, K. (2017). CO2 Emissions, Renewable and Non-renewable Energy Consumption, and Economic Growth: Evidence from Panel Data for Developing Countries. Int. Econ. 151, 1–6. doi:10.1016/j.inteco.2017.02.001

Jalil, A., Feridun, M., and Ma, Y. (2010). Finance-growth Nexus in China Revisited: New Evidence from Principal Components and ARDL Bounds Tests. Int. Rev. Econ. Finance 19 (2), 189–195. doi:10.1016/j.iref.2009.10.005

Jalil, A., and Feridun, M. (2011). The Impact of Growth, Energy and Financial Development on the Environment in China: a Cointegration Analysis. Energ. Econ. 33 (2), 284–291. doi:10.1016/j.eneco.2010.10.003

Jalil, A., and Ma, Y. (2008). Financial Development and Economic Growth: Time Series Evidence from Pakistan and China. J. Econ. Cooperation 29 (2), 29–68.

Jalil, A., and Mahmud, S. F. (2009). Environment Kuznets Curve for CO2 Emissions: A Cointegration Analysis for China. Energy policy 37 (12), 5167–5172. doi:10.1016/j.enpol.2009.07.044

Jayanthakumaran, K., Verma, R., and Liu, Y. (2012). CO2 Emissions, Energy Consumption, Trade and Income: A Comparative Analysis of China and India. Energy Policy 42, 450–460. doi:10.1016/j.enpol.2011.12.010

Jensen, V. (1996). The pollution haven hypothesis and the industrial flight hypothesis: Some perspectives on theory and empirics. Working Paper No.5 Centre for Development and the Environment, University of Oslo.

Jordan, S., and Philips, A. Q. (2018). Cointegration Testing and Dynamic Simulations of Autoregressive Distributed Lag Models. Stata J. 18 (4), 902–923. doi:10.1177/1536867x1801800409

Khan, M. K., Babar, S. F., Oryani, B., Dagar, V., Rehman, A., Zakari, A., et al. (2021). Role of Financial Development, Environmental-Related Technologies, Research and Development, Energy Intensity, Natural Resource Depletion, and Temperature in Sustainable Environment in Canada. Environ. Sci. Pollut. Res., 1–17. doi:10.1007/s11356-021-15421-0

Khoshnevis Yazdi, S., and Ghorchi Beygi, E. (2018). The Dynamic Impact of Renewable Energy Consumption and Financial Development on CO2emissions: For Selected African Countries. Energ. Sourc. B: Econ. Plann. Pol. 13 (1), 13–20. doi:10.1080/15567249.2017.1377319

King, R. G., and Levine, R. (1993b). Finance, Entrepreneurship and Growth. J. Monetary Econ. 32, 513–542. doi:10.1016/0304-3932(93)90028-e

King, R., and Levine, R. (1993a). Finance and Growth: Schumpeter Might Be Right. Q. J. Econ. 108, 713–737. doi:10.2307/2118406

Levine, R. (1997). Financial Development and Economic Growth: Views and Agenda. J. Econ. Lit. 35, 688–726.

Lin, B. Q., and Jiang, Z. J. (2009). Kuznets Curve Prediction and Influence Factors of China’s CO2 Emission. Manage World 4, 27–36.

Lindmark, M. (2002). An EKC-Pattern in Historical Perspective: Carbon Dioxide Emissions, Technology, Fuel Prices and Growth in Sweden 1870-1997. Ecol. Econ. 42, 333–347. doi:10.1016/s0921-8009(02)00108-8

Ma, X., and Fu, Q. (2020). The Influence of Financial Development on Energy Consumption: Worldwide Evidence. Int. J. Environ. Res. Public Health 17, 1428. doi:10.3390/ijerph17041428

Mahmood, H., Alkhateeb, T. T. Y., and Furqan, M. (2020). Industrialization, Urbanization and CO2 Emissions in Saudi Arabia: Asymmetry Analysis. Energ. Rep. 6, 1553–1560. doi:10.1016/j.egyr.2020.06.004

Mardani, A., Streimikiene, D., Cavallaro, F., Loganathan, N., and Khoshnoudi, M. (2019). Carbon Dioxide (CO2) Emissions and Economic Growth: A Systematic Review of Two Decades of Research from 1995 to 2017. Sci. Total Environ. 649, 31–49. doi:10.1016/j.scitotenv.2018.08.229

Mehmood, U. (2021). Renewable Energy and Foreign Direct Investment: Does the Governance Matter for CO2 Emissions? Application of CS-ARDL. Environmental Science and Pollution Research, 1–7.

Mignamissi, D., and Djeufack, A. (2021). Urbanization and CO2 Emissions Intensity in Africa. J. Environ. Plann. Manage., 1–25. doi:10.1080/09640568.2021.1943329

Murshed, M., Nurmakhanova, M., Elheddad, M., and Ahmed, R. (2021). Value Addition in the Services Sector and its Heterogeneous Impacts on CO2 Emissions: Revisiting the EKC Hypothesis for the OPEC Using Panel Spatial Estimation Techniques. Environ. Sci. Pollut. Res. 27, 38951–38973. doi:10.1007/s11356-020-09593-4

Ozturk, I., and Acaravci, A. (2013). The Long-Run and Causal Analysis of Energy, Growth, Openness and Financial Development on Carbon Emissions in Turkey. Energ. Econ. 36, 262–267. doi:10.1016/j.eneco.2012.08.025

Paramati, S. R., Bhattacharya, M., Ozturk, I., and Bhattacharya, S. (2016). The Effect of Renewable Energy Consumption on Economic Growth: Evidence from Top 38 Countries. Appl Energy 162, 733–741. doi:10.1016/j.apenergy.2015.10.104

Pata, U. K. (2018). Renewable Energy Consumption, Urbanization, Financial Development, Income and CO2 Emissions in Turkey: Testing EKC Hypothesis with Structural Breaks. J. Clean. Prod. 187, 770–779. doi:10.1016/j.jclepro.2018.03.236

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econ. 16 (3), 289–326. doi:10.1002/jae.616

Qader, M. R., Khan, S., Kamal, M., Usman, M., and Haseeb, M. (2021). Forecasting Carbon Emissions Due to Electricity Power Generation in Bahrain. Environ. Sci. Pollut. Res. Int., 1–12. doi:10.1007/s11356-021-16960-2

Rafique, M. Z., Nadeem, A. M., Xia, W., Ikram, M., Shoaib, H. M., and Shahzad, U. (2021). Does Economic Complexity Matter for Environmental Sustainability? Using Ecological Footprint as an Indicator, Environ. Dev. Sustainability, 1–18.

Regmi, K., and Rehman, A. (2021). Do carbon Emissions Impact Nepal’s Population Growth, Energy Utilization, and Economic Progress? Evidence from Long-And Short-Run Analyses. Environ. Sci. Pollut. Res., 1–11.

Rehman, A., Ma, H., Ahmad, M., Ozturk, I., and Işık, C. (2021c). An Asymmetrical Analysis to Explore the Dynamic Impacts of CO2 Emission to Renewable Energy, Expenditures, Foreign Direct Investment, and Trade in Pakistan. Environ. Sci. Pollut. Res., 1–13. doi:10.1007/s11356-021-14537-7

Rehman, A., Ma, H., and Ozturk, I. (2021a). Do industrialization, Energy Importations, and Economic Progress Influence Carbon Emission in Pakistan. Environ. Sci. Pollut. Res., 1–13. doi:10.1007/s11356-021-13916-4

Rehman, A., Ma, H., Radulescu, M., Sinisi, C. I., and Yousaf, Z. (2021b). Energy Crisis in Pakistan and Economic Progress: Decoupling the Impact of Coal Energy Consumption in Power and Brick Kilns. Mathematics 9 (17), 2083. doi:10.3390/math9172083

Rehman, A., Radulescu, M., Ma, H., Dagar, V., Hussain, I., and Khan, M. K. (2021d). The Impact of Globalization, Energy Use, and Trade on Ecological Footprint in Pakistan: Does Environmental Sustainability Exist. Energies 14 (17),5234. doi:10.3390/en14175234

Sadorsky, P. (2010). The Impact of Financial Development on Energy Consumption in Emerging Economies. Energy Policy 38, 2528–2535. doi:10.1016/j.enpol.2009.12.048

Sarkodie, S. A., and Adams, S. (2018). Renewable Energy, Nuclear Energy, and Environmental Pollution: Accounting for Political Institutional Quality in South Africa. Sci. Total Environ. 643, 1590–1601. doi:10.1016/j.scitotenv.2018.06.320

Sarkodie, S. A., Strezov, V., Weldekidan, H., Asamoah, E. F., Owusu, P. A., and Doyi, I. N. Y. (2019). Environmental Sustainability Assessment Using Dynamic Autoregressive-Distributed Lag Simulations-Nexus between Greenhouse Gas Emissions, Biomass Energy, Food and Economic Growth. Sci. Total Environ. 668, 318–332. doi:10.1016/j.scitotenv.2019.02.432

Seetanah, B., Sannassee, R. V., Fauzel, S., Soobaruth, Y., Giudici, G., and Nguyen, A. P. H. (2018). Impact of Economic and Financial Development on Environmental Degradation: Evidence from Small Island Developing States (SIDS). Emerg. Mark. Financ. Trade. doi:10.1080/1540496X.2018.1519696

Sencer Atasoy, B. (2017). Testing the Environmental Kuznets Curve Hypothesis across the U.S.: Evidence from Panel Mean Group Estimators. Renew. Sustain. Energ. Rev. 77, 731–747. doi:10.1016/j.rser.2017.04.050

Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., and Leitão, N. C. (2013). Economic Growth, Energy Consumption, Financial Development, International Trade and CO2 Emissions in Indonesia. Renew. Sustain. Energ. Rev. 25, 109–121. doi:10.1016/j.rser.2013.04.009

Shahbaz, M., Nasir, M. A., and Roubaud, D. (2018). Environmental Degradation in France: the Effects of FDI, Financial Development, and Energy Innovations. Energ. Econ. 74, 843–857. doi:10.1016/j.eneco.2018.07.020

Shahzad, U., Doğan, B., Sinha, A., and Fareed, Z. (2021a). Does Export Product Diversification Help to Reduce Energy Demand: Exploring the Contextual Evidences from the Newly Industrialized Countries. Energy 214, 118881. doi:10.1016/j.energy.2020.118881

Shahzad, U., Ferraz, D., Doğan, B., and Aparecida do Nascimento Rebelatto, D. (2020). Export Product Diversification and CO2 Emissions: Contextual Evidences from Developing and Developed Economies. J. Clean. Prod. 276, 124146. doi:10.1016/j.jclepro.2020.124146

Shahzad, U., Lv, Y., Doğan, B., and Xia, W. (2021c). Unveiling the Heterogeneous Impacts of export Product Diversification on Renewable Energy Consumption: New Evidence from G-7 and E-7 Countries. Renew. Energ. 164, 1457–1470. doi:10.1016/j.renene.2020.10.143

Shahzad, U., Schneider, N., and Ben Jebli, M. (2021b). How Coal and Geothermal Energies Interact with Industrial Development and Carbon Emissions? an Autoregressive Distributed Lags Approach to the Philippines. Resour. Pol. 74, 102342. doi:10.1016/j.resourpol.2021.102342

Sharif, A., Raza, S. A., Ozturk, I., and Afshan, S. (2019). The Dynamic Relationship of Renewable and Nonrenewable Energy Consumption with Carbon Emission: A Global Study with the Application of Heterogeneous Panel Estimations. Renew Energy 133, 685–691. doi:10.1016/j.renene.2018.10.052

Sharif Hossain, M. (2011). Panel Estimation for CO2 Emissions, Energy Consumption, Economic Growth, Trade Openness and Urbanization of Newly Industrialized Countries. Energy Policy 39 (11), 6991–6999. doi:10.1016/j.enpol.2011.07.042

Sharma, G. D., Shah, M. I., Shahzad, U., Jain, M., and Chopra, R. (2021). Exploring the Nexus between Agriculture and Greenhouse Gas Emissions in BIMSTEC Region: The Role of Renewable Energy and Human Capital as Moderators. J. Environ. Manage. 297, 113316. doi:10.1016/j.jenvman.2021.113316

Shoaib, H. M., Rafique, M. Z., Nadeem, A. M., and Huang, S. (2020). Impact of Financial Development on CO2 Emissions: A Comparative Analysis of Developing Countries (D8) and Developed Countries (G8). Environ. Sci. Pollut. Res. 27 (11), 12461–12475. doi:10.1007/s11356-019-06680-z

Stern, D. I., Common, M. S., and Barbier, E. B. (1996). Economic Growth and Environmental Degradation: the Environmental Kuznets Curve and Sustainable Development. World Dev. 24 (7), 1151–1160. doi:10.1016/0305-750x(96)00032-0

Svaleryd, H., and Vlachos, J. (2005). Financial Markets, the Pattern of Industrial Specialization and Comparative Advantage: Evidence from OECD Countries. Eur. Econ. Rev. 49, 113–144. doi:10.1016/s0014-2921(03)00030-8

Szymczyk, K., Şahin, D., Bağcı, H., and Kaygın, C. Y. (2021). The Effect of Energy Usage, Economic Growth, and Financial Development on CO2 Emission Management: an Analysis of OECD Countries with a High Environmental Performance index. Energies 14 (15), 4671. doi:10.3390/en14154671

Talukdar, D., and Meisner, C. M. (2001). Does the Private Sector Help or Hurt the Environment? Evidence from Carbon Dioxide Pollution in Developing Countries. World Dev. 29 (5), 827–840. doi:10.1016/s0305-750x(01)00008-0

Tamazian, A., and Bhaskara Rao, B. (2010). Do economic, Financial and Institutional Developments Matter for Environmental Degradation? Evidence from Transitional Economies. Energ. Econ. 32 (1), 137–145. doi:10.1016/j.eneco.2009.04.004

Tamazian, A., Chousa, J. P., and Vadlamannati, K. C. (2009). Does Higher Economic and Financial Development lead to Environmental Degradation: Evidence from BRIC Countries. Energy policy 37 (1), 246–253. doi:10.1016/j.enpol.2008.08.025

Teng, J.-Z., Khan, M. K., Khan, M. I., Chishti, M. Z., and Khan, M. O. (2021). Effect of Foreign Direct Investment on CO2 Emission with the Role of Globalization, Institutional Quality with Pooled Mean Group Panel ARDL. Environ. Sci. Pollut. Res. 28 (5), 5271–5282. doi:10.1007/s11356-020-10823-y

Usman, M., and Jahanger, A. (2021). Heterogeneous Effects of Remittances and Institutional Quality in Reducing Environmental Deficit in the Presence of EKC Hypothesis: A Global Study with the Application of Panel Quantile Regression. Environ. Sci. Pollut. Res., 1–19. doi:10.1007/s11356-021-13216-x

Usman, M., Kousar, R., Yaseen, M. R., and Makhdum, M. S. A. (2020). An Empirical Nexus between Economic Growth, Energy Utilization, Trade Policy, and Ecological Footprint: a Continent-wise Comparison in Upper-Middle-Income Countries. Environ. Sci. Pollut. Res. 27 (31), 38995–39018. doi:10.1007/s11356-020-09772-3

Usman, M., Makhdum, M. S. A., and Kousar, R. (2021). Does Financial Inclusion, Renewable and Non-renewable Energy Utilization Accelerate Ecological Footprints and Economic Growth? Fresh Evidence from 15 Highest Emitting Countries. Sustain. Cities Soc. 65, 102590. doi:10.1016/j.scs.2020.102590

Usman, M., and Makhdum, M. S. A. (2021). What Abates Ecological Footprint in BRICS-T Region? Exploring the Influence of Renewable Energy, Non-renewable Energy, Agriculture, forest Area and Financial Development. Renew. Energ. 179, 12–28. doi:10.1016/j.renene.2021.07.014

Wang, R., Mirza, N., Vasbieva, D. G., Abbas, Q., and Xiong, D. (2020). The Nexus of Carbon Emissions, Financial Development, Renewable Energy Consumption, and Technological Innovation: what Should Be the Priorities in Light of COP 21 Agreements. J. Environ. Manage. 271, 111027. doi:10.1016/j.jenvman.2020.111027

Wang, S., Fang, C., Guan, X., Pang, B., and Ma, H. (2014). Urbanisation, Energy Consumption, and Carbon Dioxide Emissions in China: A Panel Data Analysis of China's Provinces. Appl. Energ. 136, 738–749. doi:10.1016/j.apenergy.2014.09.059

Wang, Z., Ben Jebli, M., Madaleno, M., Doğan, B., and Shahzad, U. (2021). Does export Product Quality and Renewable Energy Induce Carbon Dioxide Emissions: Evidence from Leading Complex and Renewable Energy Economies. Renew. Energ. 171, 360–370. doi:10.1016/j.renene.2021.02.066

Xiong, L., and Qi, S. (2018). Financial Development and Carbon Emissions in Chinese Provinces: a Spatial Panel Data Analysis. Singapore Econ. Rev. 63 (02), 447–464. doi:10.1142/s0217590817400203

Yousaf, H., Amin, A., Baloch, A., and Akbar, M. (2021). Investigating Household Sector's Non-renewables, Biomass Energy Consumption and Carbon Emissions for Pakistan. Environ. Sci. Pollut. Res. Int. 28, 40824–40834. doi:10.1007/s11356-021-12990-y

Yuxiang, K., and Chen, Z. (2011). Resource Abundance and Financial Development: Evidence from China. Resour. Pol. 36 (1), 72–79. doi:10.1016/j.resourpol.2010.05.002

Zhang, B., Wang, Z., and Wang, B. (2018). Energy Production, Economic Growth and CO2 Emission: Evidence from Pakistan. Nat. Hazards 90 (1), 27–50.

Zhang, Y.-J. (2011). The Impact of Financial Development on Carbon Emissions: An Empirical Analysis in China. Energy Policy 39, 2197–2203. doi:10.1016/j.enpol.2011.02.026

Zhang, Y., Zhang, J., Yang, Z., and Li, S. (2011). Regional Differences in the Factors that Influence China's Energy-Related Carbon Emissions, and Potential Mitigation Strategies. Energy Policy 39 (12), 7712–7718. doi:10.1016/j.enpol.2011.09.015

Keywords: financial development, CO2 emissions, institutional quality, renewable energy, sustainability development

Citation: Amin A, Ameer W, Yousaf H and Akbar M (2022) Financial Development, Institutional Quality, and the Influence of Various Environmental Factors on Carbon Dioxide Emissions: Exploring the Nexus in China. Front. Environ. Sci. 9:838714. doi: 10.3389/fenvs.2021.838714

Received: 18 December 2021; Accepted: 28 December 2021;

Published: 11 February 2022.

Edited by:

Magdalena Radulescu, University of Pitesti, RomaniaReviewed by:

Abdul Rehman, Henan Agricultural University, ChinaMuhammad Usman, Wuhan University, China

Copyright © 2022 Amin, Ameer, Yousaf and Akbar. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Waqar Ameer, waqar.ameer@yahoo.com

Azka Amin

Azka Amin Waqar Ameer

Waqar Ameer Hazrat Yousaf

Hazrat Yousaf Muhammad Akbar

Muhammad Akbar