How can social responsibility enhance the green value of financial enterprises? Empirical research based on the qualitative comparative analysis method

- 1School of Business, Qingdao University, Qingdao, China

- 2School of Economics, Nankai University, Tianjin, China

Given the high revenues of financial enterprises, they should carry out their social responsibilities to contribute to sustainable social and economic development. The purpose of this study is to provide a more efficient strategy for China’s listed financial enterprises to improve their green value under the condition of realizing the optimal allocation of their resources in the future. To this end, the present study adopts the fuzzy set qualitative comparative analysis method on 26 domestic listed banks to examine the impact of social responsibility undertaking on the improvement of the green values of enterprises. The findings show that the promotion of green values of listed financial enterprises in China does not simply depend on a one-dimension social responsibility investment but requires a combination of multiple dimensions. Accordingly, policy recommendations are provided to help ensure the long-term development of financial enterprises while achieving sustainable economic development.

1 Introduction

China’s economy has developed rapidly with the continuous advancement of industrialization. However, the extensive development mode of enterprises in the initial stage has put tremendous ecological pressure on economic development (Wang S. H. et al., 2022). The emergence of energy shortages, ecological environment deterioration, greenhouse effect, and other problems has severely constrained China’s economy and society (Wang et al., 2020; Sun et al., 2021). To effectively solve the ecological contradiction between economic development and environmental protection, improving the green value of enterprises has become an important guarantee for the high-quality development of enterprises (Wang S. H. et al., 2022). “Green value,” also known as “environmental value,” refers to the concept of seeking efficient coexistence and promoting the diversification of the environment and ecology. The green value of enterprises refers to those enterprises that take the coordination of business activities and environmental protection as the starting point to finally realize the common interests of enterprises, consumers, and the ecological environment. Specifically, enterprises apply the concept of green value to daily production and operation activities, formulate and implement their own environmental protection strategies while achieving profits, and consciously practice environmental protection behaviors. Thus, to realize the “green” development of the economy, improving the “green value” of enterprises and enhancing corporate social responsibility (CSR) have become strong supports for high-quality economic development.

To realize the sustainable development of the economy while taking profit maximization as the business goal, enterprises must also consider the adaptability of society and the environment as an important part of their business activities and infiltrate it into the development strategy and corporate culture (Amoako et al., 2021). Therefore, on the one hand, the social evaluation of enterprises is reflected in the level of economic benefits; on the other hand, it is also necessary to comprehensively investigate the green value of enterprises from the perspective of social responsibility (Wang and Chen, 2022). As an important part of economic society, enterprises undertake the obligation and responsibility of promoting green development. In this case, there is a close relationship between corporate green value and social responsibility (Mehmood and Hanaysha, 2022).

First, adhering to the concept of green development and improving the green value of enterprises are important embodiments of the realization of CSR (Kraus et al., 2020). CSR, especially green social responsibility, enables enterprises to undertake activities such as improving the environment and developing new energy, integrating the concept of green development into production and business activities, and gradually improving the green value of enterprises while trying to reduce the loss of all kinds of resources and strengthen the resource recycling (Li, 2022). Second, social green development is the inevitable choice for mankind to solve the increasingly serious problems of ecological environment deterioration, resource shortage, and global warming, among others (Sun et al., 2021). As the main body of social green development, enterprises actively performing social responsibilities is the basis of social green development (Xiong and Luo, 2022). The end of green development is to promote the harmonious development of society, which requires attention to both economic as well as social and ecological benefits to organically combine CSR with a harmonious society (Amoako et al., 2021). By taking the fulfillment of social responsibilities as the foundation and green development as the path, enterprises can finally promote the realization of a harmonious society (Wang et al., 2018).

It is an inevitable requirement for enterprises to fulfill their social responsibilities based on the concept of green development to achieve sustainable economic and social development. With the continuous development of China’s market economy, the financial industry has thrived in China, of which risk management is critical as it holds huge amounts of funds. Owing to high incomes, financial enterprises have a more prominent contradiction between self-development and social responsibility, especially green social responsibility. More and more domestic enterprises have publicly disclosed their social responsibility data and begun exploring and practicing relevant social responsibility theories constantly. While pursuing profit maximization, enterprises should interact with all parties related to their own interests for existence and development and, in the meantime, reduce energy consumption, protect the ecological environment, and realize the coordinated distribution of resources among various stakeholders in response to the requirements of a green economy. However, in reality, multiple stakeholders often require enterprises to distinguish between hierarchical differences and perform responsibilities to different stakeholders to varying degrees, leading to the ignorance of environmental benefits (Chatjuthamard et al., 2016). There is a certain degree of complementarity and intersection between various stakeholders related to the development of enterprises, which jointly affects the social responsibility investment in enterprises and the level of green value of enterprises. Financial enterprises have certain particularity and play an essential role in national economic development and people’s living standards. Hence, to better realize the green value of enterprises, financial enterprises need to allocate internal and external resources reasonably, and the development of enterprises should achieve the benefits of coordination of society, economy, and ecology. This includes fulfilling different levels of social responsibility to different stakeholders (Petersen and Vredenburg, 2009), achieving higher investment efficiency while considering the development of the green economy, and obtaining their own optimal investment strategies. However, until now, there has rarely been a multiple-dimension comprehensive analysis of financial enterprises in the existing literature.

Currently, there are few studies on the social responsibility of financial enterprises, and the division of social responsibility is relatively general. Several scholars divide the dimensions and contents of CSR based on the stakeholder theory (Lartey et al., 2021) and reach a general agreement that enterprises should also perform certain social responsibilities to stakeholders while realizing their own value (Buallay et al., 2020). Concurrently, many researchers at home and abroad pointed out in the literature that the core stakeholders of enterprises are shareholders, employees, and customers, and the secondary stakeholders are communities and the environment (Wang, 2010).

Considering China’s financial market situation, which remains in volatile development, and to help listed financial enterprises meet the interests of stakeholders and obtain public recognition, this study divides the stakeholder theories of listed financial enterprises into the following. First, the financing of listed financial enterprises mainly comes from shareholders, and the investment in shareholders’ social responsibility will have a general and significant impact on the development of financial enterprises (Chen et al., 2020). Second, the efficient operation of financial enterprises cannot be separated from the support of employees’ professional quality. Therefore, enterprises must strengthen their investments in employee responsibility if they want to achieve their own sustainable development in the long run (Xu et al., 2020). Third, financial enterprises, especially banking deposit financial institutions and securities financial institutions, are growing vigorously, which means enhancing customer viscosity is becoming increasingly crucial for the development of financial enterprises (Arıkan and Güner, 2013). Fourth, for local financial enterprises, undertaking the improvement of people’s livelihood in their communities has been included in the social responsibility evaluation system. Fifth, environmental protection has also attracted increasing social attention in recent years, making corresponding requirements for listed financial enterprises. Environmental investment has become an important basis for measuring the social responsibility of financial enterprises (Pan and Tian, 2016).

At present, the analysis of the impact of financial enterprises’ social responsibility on value performance only focuses on the relationship between individual factors and outcome variables. However, in reality, the development factors of financial enterprises need to be distributed among various dimensions of social responsibility, and the choice of enterprises to assume the responsibility of a particular dimension will often affect their investments in the responsibilities of other dimensions (Wang and Chen, 2011). The impact of financial enterprises’ social responsibility performance on their values is a diverse and complex problem, and few scholars have considered the linkage effect between various stakeholders in the past. To sum up, a single correlation analysis is no longer suitable for the current research on the internal relationship of multi-dimensional social responsibility.

On the one hand, the interaction between the social responsibility fulfillment of listed financial enterprises and their own business performance will be affected by the nature of enterprise property rights. On the other hand, there are differences in the configuration paths listed financial enterprises of different sizes can choose when assuming responsibility. Financial enterprises can selectively perform social responsibilities of different dimensions according to their actual situations, and their own values will change to varying degrees due to the performance of social responsibilities of different dimensions (Barchiesi and Fronzetti Colladon, 2021). Therefore, this study takes the nature of property rights and enterprise size as different situational factors and uses the fuzzy set qualitative comparative analysis (fsQCA) method to study the relationship between social responsibility and self-worth improvement of listed financial enterprises in China. The QCA method combines the advantages of qualitative and quantitative research, which can play a good role in dealing with the complex causality common in social phenomena. This study expands the current research boundary between the social responsibility of financial enterprises and the green value of enterprises, which can help financial enterprises find a better way to fulfill their social responsibilities and improve their green values.

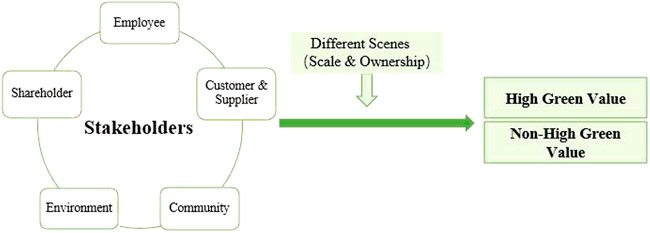

Thus, based on relevant stakeholder theories, this study starts from multiple dimensions of financial enterprises’ social responsibility, and takes the realization of the green value of enterprises as the research background, listed financial enterprises (including banking deposit financial institutions and securities financial institutions) as samples, and different property rights and different enterprise sizes as the situational factors to examine the optimal portfolio of financial enterprises to undertake green social responsibility in different situations by using the fsQCA. In this research, the return on equity of financial enterprises is the outcome variable and stakeholders are the conditional variable. Fundamentally, this study aims to provide a more efficient strategy for China’s listed financial enterprises to improve their green value under the condition of realizing the optimal allocation of their own resources in the future.

The remainder of this study is structured as follows. Section 2 explains the materials and methods utilized in this study. Subsequently, the results of the analysis are presented in Section 3. Finally, Section 4 concludes by providing the study’s theoretical and practical implications as well as policy recommendations.

2 Materials and methods

2.1 Sample selection and data source

For this study’s research sample, 26 listed banks that comprehensively disclose their green financial business information are selected, and the sample financial data come from their annual reports published by the China Stock Market & Accounting Research Database and the Cninfo. The data relating to the nature of enterprise property rights are obtained from Eastmoney.com, and the specific standards and data for the size division of financial enterprises are from the Standards for classifying financial enterprises that are jointly issued by the People’s Bank of China, the China Banking Regulatory Commission, the China Securities Regulatory Commission, the China Insurance Regulatory Commission, and the China National Bureau of Statistics; the date are taken for the year 2015. The social responsibility rating report of financial enterprises comes from the social responsibility reports of listed enterprises published by Hexun.com, a third-party rating agency, which evaluates the total social responsibility score of each listed enterprise and the scores of each dimension every year through five dimensions: shareholder, employee, customer, environment, and community. The main driving mechanism mode is shown in Figure 1 below:

This study selects the social responsibility rating report of financial enterprises for the year 2020 to quantify the social responsibility of enterprises and correspondingly reflect the relevant data of green values of financial enterprises in 2022 to avoid relevant lagging impacts as far as possible. This specific approach is employed to address the lag between the performance of financial enterprises’ social responsibilities and the implementation of green credit-related businesses and projects. Excel and fsQCA3.0 software are used for the technical analysis of data.

2.2 Variable selection and measurement

(1) Explained variable. The explained variable used in this study is the green value (GV) of financial enterprises. According to the China Green Finance Development Report—Research on the Route of Promoting Carbon Peak and Carbon Neutral in China’s Financial Industry (2021), green credit has always played a core role in the green financial system under the system of indirect financing in China. Green credit can guide and promote the upgrading of industrial structure and technological innovation of enterprises from the source by strictly controlling the loans of polluting enterprises and supporting emission reduction credits. Therefore, it can be used as an important indicator to measure the green values of financial enterprises. Meanwhile, considering that the current green finance in China is mainly based on the green credit business of the banking industry, and considering the availability of data, the green credit balance data of relevant listed financial institutions to the loan balance of the current year is selected in this study to reflect the green values of these financial institutions.

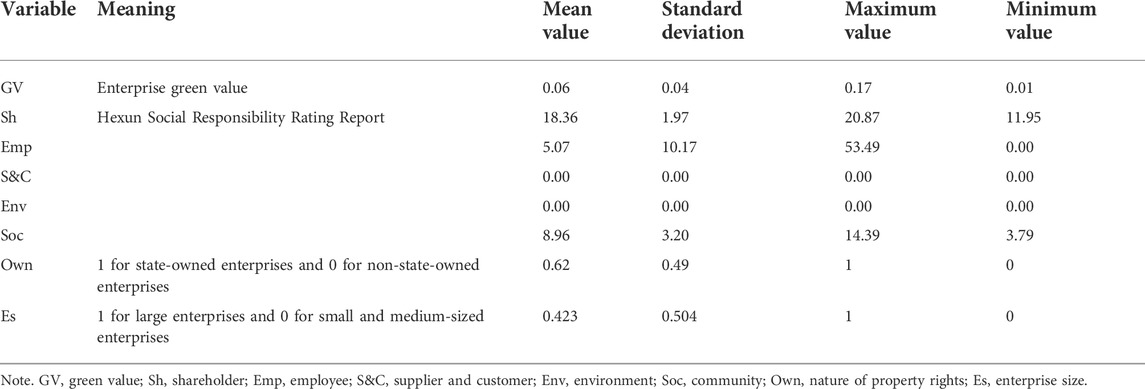

(2) Explanatory variable. The explanatory variable used in this study is the social responsibility of financial enterprises. To measure the performance of social responsibility of listed financial enterprises, this study selects the stakeholders of listed financial enterprises in the social responsibility rating report published by Hexun.com as the antecedent variable, and analyzes from five dimensions, including shareholder, employee, supplier and customer, environment and community, respectively, Sh, Emp, S&C, Env, and Soc. Among them, shareholder, supplier and customer, as well as community are continuous variables, while employee and environment are binary variables, which are represented by numbers 1 when the score of dimensions is greater than 0, and 0 when the score of dimensions is equal to 0.

(3) Control variables. (a) The nature of property rights of financial enterprises. In this study, the ultimate actual controller of domestic listed financial enterprises is taken as the classification standard of the nature of property rights, which divides the research sample into state-owned listed financial enterprises and non-state-owned listed financial enterprises. The nature of property rights is represented by Own, the state-owned enterprises (where the ultimate actual controller is the country or local government) are represented by 1, and the non-state-owned enterprises are represented by 0. (b) Size of financial enterprises. In accordance with the document, Standards for classifying financial enterprises, the research sample is divided into large financial enterprises (with more than RMB 4 trillion total assets in banking deposit) and small and medium-sized financial enterprises (with less than RMB 4 trillion total assets in banking deposit). The enterprise size is expressed as Es. Accordingly, large enterprises are expressed as 1, and small and medium-sized enterprises are expressed as 0.

The definitions and descriptive statistical values of relevant variables are shown in Table 1.

As can be seen from the above table, among all the stakeholders, financial enterprises in China pay more attention to their responsibility for shareholders and community during the sample period, which suggests that the current investment in the social responsibility of stakeholders in various dimensions of these listed financial enterprises still at an adequate level. Furthermore, the standard deviation of the score of the listed financial enterprises in the dimension of employee is larger than that of others. This shows that the investment intensity of different financial enterprises in their employees varies greatly.

2.3 Research method

Traditional quantitative research usually assumes that variables are independent of each other, and research methods are relatively subjective even though the interaction between variables is considered, which often leads to a lack of strength in the interpretation of results. Compared with traditional analysis, qualitative comparative analysis pays more attention to the effects of the joint actions of many possible influencing factors, and the research conclusions drawn in this case are more practical and universal. Thus, to deal with such small sample data of 26 listed banks more effectively, the fsQCA was adopted. fsQCA can conduct a more in-depth analysis of the causes and clarify the channels leading to certain results or phenomena. In addition, it can be used for different combination analyses of multiple causes and can effectively solve the problems of changes and subordination to different degrees. The qualitative comparative analysis integrates qualitative and quantitative research methods and conducts cross-case research from an overall perspective, which can effectively analyze the necessity of the complex causal relationship between different combinations of conditions and results.

3 Results

3.1 Data processing

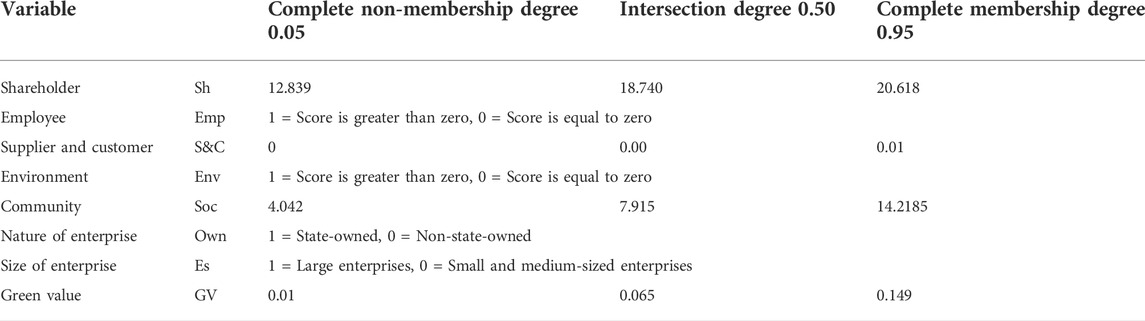

(1) Data calibration. With the help of the fsQCA, the quartile of continuous variables is set, and 0.05, 0.5, and 0.95 are successively used as calibration points to represent complete non-membership, intersection, and complete membership, respectively. The degrees of antecedent conditions belonging to the corresponding set are calculated to the membership degrees within the range of [0,1]. The closer the value to 1, the higher the membership degree of data. The results after calibration are shown in Table 2.

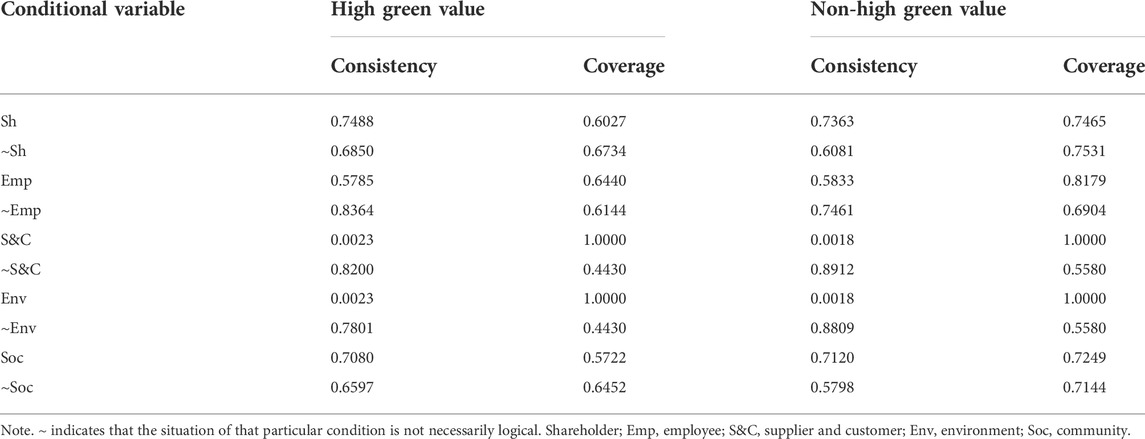

(2) Analysis of variables and configuration necessity. To better enhance the high green value and avoid the related paths of non-high green value, this paper discusses both the cases of high green value and non-high green value. The results of the necessary conditions for the full sample for high green value and non-high green value performance are shown in Table 3.

Based on the statistical analysis of the sample data, the consistency and coverage data of the impact of each antecedent (condition) variable on the result variable are obtained. As shown in Table 3 above, all the test results of the consistency level of each condition variable are less than 0.9, indicating that there is no impact on the non-high green value and high green value of the financial enterprises. This result is consistent with the core ideas of the stakeholder theory. The stakeholder theory posits that to achieve better development, enterprises need to comprehensively balance the needs of various stakeholder groups, rather than focusing on the interests of a certain stakeholder group (Freeman, 2010). Necessity analysis results reveal that no specific dimension of CSR is a determinant of green value of financial enterprises. Therefore, to obtain the green value generated by meeting the needs of different stakeholders, it is necessary to consider the different dimensions of CSR. That is, the exploration result (green value of financial enterprises) will require the combination of multiple conditions (multi-dimensional CSR).

(3) Standard analysis. After perfecting the truth table according to the case frequency threshold, original consistency threshold, and PRI consistency, we obtain three results: parsimonious solution, intermediate solution, and complex solution. When determining the configuration path, we should focus on the intermediate solution and the parsimonious solution, in which the antecedents of both the intermediate solution and parsimonious solution are the core conditions of the result variables. This shows that there is a strong necessary causal relationship between the antecedent variable and the result, and the antecedent conditions that only appear in the intermediate solution exist as edge conditions, which to some extent indicates that the causal relationship between these variables and the result variable is relatively weak. For the interpretation of the configuration path, intermediate solutions are often used to determine the number of configurations that lead to the results and the antecedents contained in these configurations. Then the results of parsimonious solutions are used to determine the core condition variable in the configuration (Fiss, 2011).

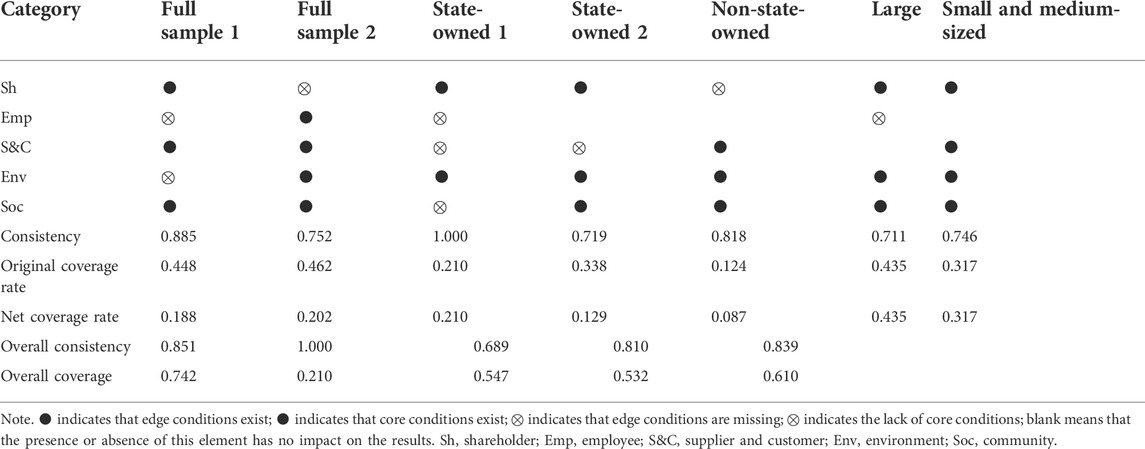

(4) Evaluate the explanatory power of the conditional configuration to the results. Generally, consistency and coverage are introduced to evaluate which of the many configurations are the necessary conditions that lead to the occurrence of result variables so as to measure the effect of each combination when the results come from multiple combinations of reasons (Wang et al., 2018). Consistency thresholds for measuring configuration adequacy can adopt different criteria depending on each certain study case. Ragin and Fiss (2008) have suggested a consistency threshold of 0.75, which includes any factor with consistency greater than or equal to 0.75. The standard of frequency threshold is determined according to the size of the research sample (Schneider and Wagemann, 2012). Therefore, this study finally determines the frequency threshold to be 1, that is, the configuration represented by at least one case is considered to be empirically relevant or important. The configuration analysis results that lead to high green value and non-high green value performance of financial enterprises are shown in Tables 4 and 5 below, respectively.

3.2 High green value cases

3.2.1 Configuration path under full sample

For high green value cases, Table 4 above presents the results of the characteristic analysis of each configuration path, from which it can be seen that the two configuration paths under the full sample cover more than 50% of the sample enterprises, indicating that these two paths are feasible. Under the full sample, there are two following equivalent paths for financial enterprises to undertake social responsibility (the symbol “*” below denotes the logical operator “AND”, while the symbol “∼” denotes that the given condition does not exist or is a low level of the condition): Sh*∼EMP*∼S&C*∼Env*Soc and *∼Sh* EMP*S&C*ENV*Soc. That is, shareholder ∼ non-employee ∼ supplier and customer ∼ non-environment ∼ community; and non-shareholder ∼ employee ∼ supplier and customer ∼ environment ∼ community. The overall consistency is 0.851, and the overall coverage rate is 0.742. It is also displayed that the commitment to social responsibility exists as the core condition under both paths. However, the two paths specifically reflect different internal driving forces for financial enterprises to achieve green value. One is from the inside out, that is, improving green value to fulfill their obligations to internal shareholders, while the other is jointly promoted by internal employees and external stakeholders, such as communities, suppliers and customers.

(1) Path 1: The type of shareholder ∼ non-employee ∼ supplier and customer ∼ non-environment ∼ community. Under the full sample condition, the green value of financial enterprises is mainly affected by the two dimensions of shareholder, and supplier and customer, even if other conditions may not be complete, such as failing to perform social responsibilities to communities and the environment. The shareholder is the main source of financing for listed financial enterprises, and the investment in shareholders’ social responsibility will generate a general and significant impact on the development of financial enterprises. Implementing shareholders’ social responsibility can effectively enhance shareholders’ investment confidence, and help enterprises obtain stable sources of funds. In this case, a virtuous circle has been realized for better developing green credit and related green financial businesses. However, it should be noted that green credit generally has a long cycle with certain risks and lower returns than those of other commercial credits. Thus, it may be difficult to mobilize employees’ enthusiasm if publicity and training are not done well while expanding the green credit business. In this case, enterprises should ensure the fulfillment of their social responsibilities to employees while improving their own green values. The typical case under this driving mechanism is the Postal Savings Bank of China, of which the scores of dimensions of shareholder, supplier and customer, and community are all relatively high, while those of employee and environment are lower.

(2) Path 2: The type of non-shareholder ∼ employee ∼ supplier and customer ∼ environment ∼ community. Under this path, the green value of financial enterprises is mainly driven by the dimensions of employee, supplier and customer, environment, and community. As an important part of the enterprise, employees’ performances of their community responsibilities can effectively mobilize their enthusiasm and enhance their senses of ownership. With the current emphasis on environmental issues, people are also increasingly concerned about the commitment of listed enterprises to the environment and society, which has become the main indicator to measure the green value of enterprises. The typical cases under this driving mechanism are China CITIC Bank and Bank of China, of which the scores of dimensions of shareholder, employee, and environment are all relatively high under the high level of Rate of Return on Equity in the social responsibility rating report. The scores of dimensions of employee, supplier and customer, environment, and community of Bank of Chongqing and Huaxia Bank are also relatively high, while the score of the shareholder dimension is low. According to the results of the full sample, it can be seen that listed financial enterprises should pay full attention to the performance of shareholders’ and employees’ responsibilities in the practice of social responsibility and appropriately strengthen the investment in social responsibility, which is more conducive to the improvement of green values of financial enterprises.

3.2.2 Configuration paths under different property rights

According to the ultimate actual controllers of listed financial enterprises in China, enterprises are divided into state-owned and non-state-owned types. In the case of heterogeneous property rights, after analyzing the sample data, the following three equivalent situations are concluded for financial enterprises with high green value performance to bear social responsibility.

(1) For state-owned listed financial enterprises, there are two paths: one is a) Sh*Env*∼emp*∼Soc*∼S&C, that is, shareholder ∼ environment with an overall consistency of 1.0 and overall coverage rate of 0.210; the other is b) Sh*Env*Soc*∼S&C, that is, shareholder ∼environment ∼ community with an overall consistency of 1.0 and overall coverage rate of 0.210. Thus, for the two paths, the overall consistency is 0.719, and the total coverage rate is 0.338.

(a) Shareholder ∼ environment type. Under different property rights, the self-worth of listed financial enterprises in China is mainly driven by the factors of shareholder and environment, even if other conditions may not be complete, such as failing to perform social responsibilities to communities, suppliers, and customers.

(b) Shareholder ∼environment ∼ community type. As the main source of financing for listed financial enterprises, shareholders’ investment in social responsibility will generate general and significant impacts on the development of financial enterprises and, most significantly, on the financing decision-making and financing amount of financial enterprises.

(2) For non-state-owned listed financial enterprises, there is one development strategy: ∼Sh*Env*Soc*S&C, that is, non-shareholder ∼ employee ∼ environment ∼ community ∼ supplier and customer. The overall consistency is 0.689, and the overall coverage rate is 0.547. It can be seen from the table that the configuration path under the nature of non-state-owned property rights covers more than half of the sample enterprises, indicating that this path is of certain feasibility. Among them, undertaking the social responsibility in the dimensions of supplier and customer and environment exists as an edge condition, while the dimension of community exists as a core condition.

Although the overall coverage of this configuration under the state-owned scenario is lower than that under the non-state-owned scenario, it still effectively shows that the state-owned financial enterprises themselves have more investment options to a certain extent. Meanwhile, compared with financial enterprises in the full sample and non-state-owned scenarios, state-owned financial enterprises place greater emphasis on strengthening the social responsibility of the shareholder dimension. This research result provides more reference paths for listed financial enterprises to improve their green values.

3.2.3 Configuration path under different enterprise sizes

The sizes of banking deposit financial institutions and securities financial institutions are divided based on the total assets in the policy documents issued by the People’s Bank of China. By analyzing the classified samples, it can be concluded that there are the following three equivalent paths for financial enterprises to undertake social responsibility. It can be seen from the table that the two configuration paths under different sizes cover more than 50% of the sample enterprises, indicating that these three paths are highly feasible.

(1) For large listed financial enterprises, there is one investment strategy: Sh*Env*Soc*∼Emp, that is, the type of shareholder ∼ environment, of which the overall consistency is 0.711, and overall coverage rate is 0.532. Undertaking environment and community responsibilities exist as the edge condition, and whether shareholders’ interests are realized has no impact on results. The employee responsibility is missing as the edge condition. Thus, it can be seen that large listed financial enterprises must first ensure the investments in shareholder, environment and community responsibilities if they want to improve their green values, and there is a lack of investment in employee’s and customer’s responsibilities. The possible reason is that enterprises’ social responsibility investments in these two dimensions may not get timely feedback on the improvement of their green values. In other words, a great lag or interruption leads to the reduction of the initiative of financial enterprises to bear social responsibility.

(2) For small and medium-sized listed financial enterprises, there is one investment path: Sh*Env*Soc*S&C, that is, shareholder ∼ environment ∼ community ∼ supplier and customer.

• The self-worth of small and medium-sized listed financial enterprises is mainly driven by the factors of shareholder, community, supplier and customer, and environment, even if other conditions may not be complete, such as failing to fulfill their social responsibilities to employees. The fulfillment of social responsibilities to shareholders can effectively enhance shareholders’ investment confidence and provide continuous and effective financial support for enterprises. Meanwhile, with the continuous improvement of public awareness of environmental protection and the increasing attention to environmental issues, the performance of social responsibility in the environment dimension has also become the main indicator to measure the social value of enterprises.

• For small and medium-sized listed financial enterprises, they should not only first fulfill their responsibilities to shareholders, suppliers and customers, and communities, but also appropriately strengthen the investments in the environment to better realize the improvement of their own values.

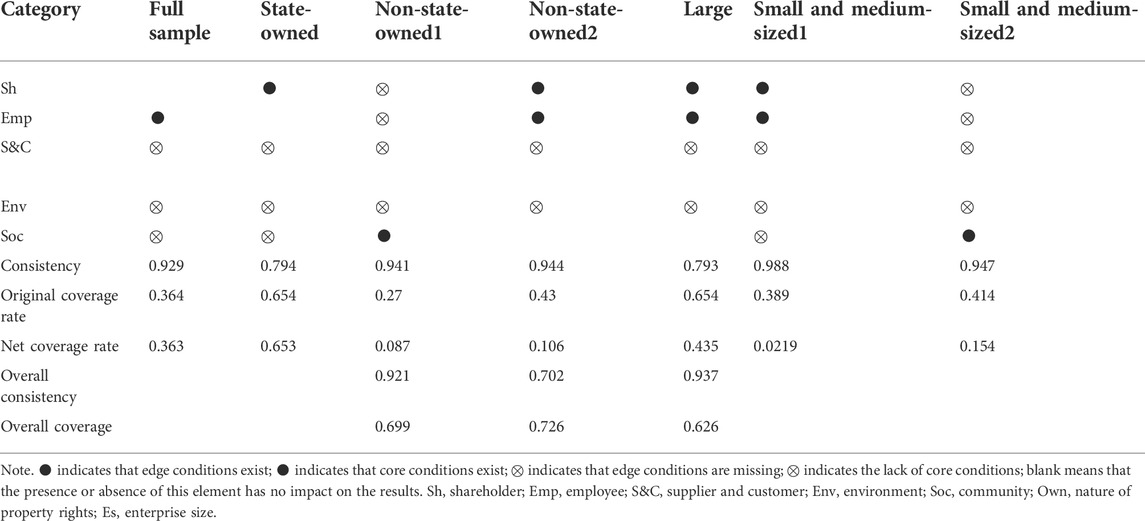

3.3 Non-high green value performance cases

Table 5 shows the characteristic analysis of each configuration path for non-high green value cases. We find that all configuration paths in the different categories cover over 50% of the sample enterprises, which suggests that all the paths are feasible. There is only one path for the full sample, state-owned sample, and large-scale sample, respectively. While both non-state-owned and small and medium-sized enterprises have two equivalent paths.

3.3.1 Configuration path under full sample

The configuration path under full sample of non-high green value cases is employee* ∼ supplier and customer *∼ environment ∼ *community, with a consistency of 0.928, original coverage of 0.364, and unique coverage of 0.364. This shows that about 36.4% of the financial enterprise cases can be explained by this path. In this path, financial enterprises only focus on the responsibility of employees, which leads to a non-green value performance adhering to the stakeholder theory; that is, CSR is a comprehensive concept and enterprises should not only meet the needs of a certain stakeholder group. Members of this configuration include the Shanghai Pudong Development Bank, Bank of Beijing, Bank of Shanghai, and Bank of Ningbo. Among them, the typical case is of the Bank of Ningbo that was established on 10 April 1997, and became the first city commercial bank in China to be listed on the Shenzhen Stock Exchange on 19 July 2007. Not only does it not have high green value, but it also fails to fulfill its social responsibility for different stakeholders. According to China Quality News, Bank of Ningbo Co., Ltd. has repeatedly violated laws and regulations.1 The administrative penalty information released by the Ningbo Banking and Insurance Regulatory Bureau shows that Bank of Ningbo Co., Ltd. is not competent due to inadequate salary management, non-standard related-party transaction management, inadequate implementation of green credit policies, imprudent credit management, lax control over the use of funds, and classification of loan risks. Furthermore, their inaccuracy, lax control of bill business, and errors in off-site statistical data resulted in fines of 2.7 million yuan and 3.05 million yuan by the Ningbo Banking and Insurance Regulatory Bureau in 2022 and 2021, respectively.

3.3.2 Configuration path under different property rights

There is only one configuration path for the sub-sample of state-owned financial enterprises, that is, shareholder *∼ non-supplier and customer* ∼ non-environment* ∼ non-community. The consistency, original coverage, and unique coverage of this path are 0.794, 0.654, and 0.654, respectively. Similar to the path of the full sample above, the samples of this path are also internally driven by a single element in their performance of CSR. The only difference is that the internal driving force of the full sample approach comes from employees, while the state-owned enterprise sample comes from shareholders. The main members of this group contain the Bank of Guiyang, Bank of Chengdu, Zijin Bank, Bank of Shanghai, Shanghai Pudong Development Bank, and Bank of Communications. Shareholders, as the main source of financing for listed financial enterprises, are often at the heart of CSR; however, only pursuing the maximization of shareholders’ interests may reduce the green value of enterprises, who may subsequently be punished for violations of laws and regulations. For example, the Bank of Shanghai was established in December 1995 and listed on the Shanghai Stock Exchange on 16 November 2016. As of the end of the third quarter of 2021, the bank’s total assets were 2.65 trillion yuan, capital adequacy ratio was 12.37%, and non-performing loan ratio was 1.19%. The main violation of laws and regulations involved in the fine of the Bank of Shanghai is the violation of the bank’s inter-bank investment business that occurred 7 years ago. The ticket information shows that from March to July 2015, Shanghai Bank’s interbank investment business illegally accepted guarantees from third-party financial institutions.

However, non-high green value of non-state-owned financial enterprises might be driven by the following two paths: ∼shareholders ∼employee ∼supplier and customer ∼ environment * community; shareholders*employee ∼supplier and customer ∼environment. They show two different types of internal driving force, external driving (community) and internal driving (shareholders and employees). In the first path of this case, the fulfillment of CSR to shareholders, employees, suppliers, and the environment is missing, and only the fulfillment of responsibilities to the community exists as an auxiliary condition. The consistency of this path is 0.941, original coverage is 0.27, and unique coverage is 0.087. It shows that about 27% of the cases of non-state-owned financial enterprises can be explained by this path, but about 8.7% of the cases of non-high green value of financial enterprises can only be explained by this path. A typical case of path 1 is the China Minsheng Bank. Furthermore, approximately 43% of the cases of non-state-owned financial enterprises can be explained by the second path, however, about 10.6% of the cases of high green value of financial enterprises can only be explained by this path. Two typical cases of path 2 are the Changsha Bank and Bank of Suzhou. From these two paths, we can speculate that only considering the performance of internal or external social responsibilities cannot effectively enhance the green value of financial enterprises.

3.3.3 Configuration path under different enterprise sizes

For large-scale financial enterprises, there is only one configuration path (shareholder *employee*∼ non-supplier and customer* ∼ non-environment), which is consistent with path 2 of non-state-owned financial enterprises above. The consistency, original coverage, and unique coverage of this path are 0.793, 0.654, and 0.435, respectively. The samples of this path are also internally driven by the shareholders and employees dimensions in their performance of CSR. The main members of this group contain the Bank of Communications and China Construction Bank.

Moreover, there are two paths for small and medium-sized financial enterprises: ∼ shareholders* employees *∼supplier and customer*∼non- environment*∼community; and ∼employee*∼ supplier and customer*∼environment*community. Path 1 is similar to the case of large-scale financial enterprises (i.e., internally driven by shareholders and employees), while the other path might be auxiliary driven by only the fulfillment of community social responsibility. The consistency of path 1 of small and medium-sized financial enterprises is 0.988, original coverage is 0.389, and unique coverage is 0.022, indicating that approximately 38.9% of the cases of small and medium-sized financial enterprises can be explained by this path. However, approximately 2.2% of the cases of non-high green value of financial enterprises can be explained by this path. Typical cases of path 1 include Beijing Bank, Bank of Shanghai, and Bank of Ningbo. Furthermore, only the fulfillment of responsibilities to the community exists as an auxiliary condition in path 2 of this case.

From the investigation of non-high green value cases, we can find that only being accountable to internal or external stakeholders is not conducive to enterprises improving their own green value; therefore, financial enterprises should strive to balance the requirements of various stakeholder groups.

3.4 Robustness test

A key step in fsQCA research is checking the robustness of analysis results. There are many ways to test the robustness of QCA, among which the commonly used one is to reasonably adjust the settings of the relevant parameter. The specific adjustment includes changing the calibration basis, minimum case frequency, and consistency threshold, then analyzing the adjusted sample data again, and evaluating the reliability of the research results by comparing the changes before and after the configuration. After the robustness test, the adjusted values of various parameters do not cause substantial changes in the number, components, consistency, and coverage of the configuration. Therefore, our analysis results can be considered reliable (Schneider and Wagemann, 2012).

To ensure the robustness of the research results, this study conducted a robustness test by adjusting the consistency threshold and selecting a robustness test method for the remaining other unchanged conditions. Furthermore, improving the PRI value from the threshold value greater than 0.7 to the threshold value greater than 0.75 for both high green value and non-high green value cases assists to avoid the “simultaneous subset relations” as far as possible. The new configurations obtained from the robustness test are consistent with the configuration paths obtained from the above analysis, indicating that our analysis results are robust and reliable.

4 Discussion

This study explored the impact of social responsibility undertaking on the improvement of green values of enterprises by adopting the fsQCA method on 26 domestic listed banks. It found that the promotion of green values of listed financial enterprises in China does not simply depend on a one-dimension social responsibility investment, but also requires the combination of multiple dimensions. Under different scenario characteristics, listed financial enterprises in China have different configuration paths to improve their values. Specifically, the theoretical and practical implications of the study are as follows. First, among the paths of social responsibility investment of financial enterprises, the investment in shareholder responsibility exists as the core condition. Under the scenario division of property rights, fulfilling the shareholders’ social responsibility has always been the core condition. Under the scenario division of enterprise size, the path of small and medium-sized financial enterprises also requires the shareholders’ social responsibility investment to be the core condition. Second, in the context of the full sample condition, compared with state-owned listed financial enterprises, non-state-owned listed financial enterprises begin to pay more attention to the implementation of social responsibility through the dimensions of supplier and customer. Third, compared with large listed financial enterprises, small and medium-sized listed financial enterprises often bear more comprehensive social responsibilities. On the basis of this research, future research can employ more diversified methods to quantify the green value of enterprises. Furthermore, the research method of fsQCA can be extended to other different industries and various samples.

Based on these research conclusions, the policy recommendations of this study are as follows. First and foremost, domestic listed financial enterprises should focus on the fulfillment of shareholders’ responsibility, maintain the relationship between enterprises and shareholders sufficiently, and enhance shareholders’ investment confidence so that they can better provide sufficient and lasting development funds for listed enterprises to develop better and improve their green value and performance. Second, listed financial enterprises should attach importance to the input of employees’ social responsibility, strengthen the professional training of employees, and increase salaries and innovative rewards to mobilize the enthusiasm of employees to improve their green consciousness. In particular, the professional level and quality of employees in listed financial enterprises can provide strong support for the efficient development of financial enterprises. Third, in future production and operation, the management of listed financial enterprises should enhance environmental protection when implementing corporate development strategies and actively respond to government policies in daily operation to obtain more policy support and improve their own business strategy. Fourth, for some domestic listed financial enterprises, of which customers are usually local communities, strengthening the performance of their own green social responsibility in the community dimension can replace the green social responsibility in the shareholder dimension to a certain extent and help achieve green development performance of enterprises. Finally, large listed financial enterprises should strengthen their social responsibility to all stakeholders. When facing less competitive pressure in the industry, large listed financial enterprises may be more inclined to improve their own development strategies and centralize investment; however, in the future, they also need to strengthen the performance of their responsibilities to their stakeholders in all dimensions so as to ensure their long-term development while achieving sustainable economic development.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZZ: Conceptualization, methodology, data processing, and writing (original draft); QW: Visualization, investigation, supervision, and writing (review and editing); BL: Data collection, formal analysis and language edit.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1https://www.cqn.com.cn/cj/content/2022-04/24/content_8811717.htm

References

Amoako, G. K., Doe, J. K., and Dzogbenuku, R. K. (2021). Perceived firm ethicality and brand loyalty: the mediating role of corporate social responsibility and perceived green marketing. Soc. Bus. Rev. 16, 398–419. doi:10.1108/SBR-05-2020-0076

Arıkan, E., and Güner, S. (2013). The impact of corporate social responsibility, service quality and customer-company identification on customers. Procedia Soc. Behav. Sci. 99, 304–313. doi:10.1016/j.sbspro.2013.10.498

Barchiesi, M. A., and Fronzetti Colladon, A. F. (2021). Corporate core values and social responsibility: what really matters to whom. Technol. Forecast. Soc. Change 170, 120907. doi:10.1016/j.techfore.2021.120907

Buallay, A., Kukreja, G., Aldhaen, E., Al Mubarak, M., and Hamdan, A. M. (2020). Corporate social responsibility disclosure and firms' performance in mediterranean countries: a stakeholders' perspective. EuroMed J. Bus. 15, 361–375. doi:10.1108/EMJB-05-2019-0066

Chatjuthamard, P., Jiraporn, P., Tong, S., and Singh, M. (2016). Managerial talent and corporate social responsibility (CSR): how do talented managers view corporate social responsibility? Int. Rev. Finance 16, 265–276. doi:10.1111/irfi.12067

Chen, T., Dong, H., and Lin, C. (2020). Institutional shareholders and corporate social responsibility. J. Financ. Econ. 135, 483–504. doi:10.1016/j.jfineco.2019.06.007

Fiss, P. C. (2011). Building better causal theories: a fuzzy set approach to typologies in organization research. Acad. Manage. J. 54, 393–420. doi:10.5465/amj.2011.60263120

Freeman, R. E. (2010). Strategic management: a stakeholder approach. Cambridge: Cambridge University Press, 1–2. doi:10.1017/CBO9781139192675.003

Kraus, S., Rehman, S. U., and García, F. J. S. (2020). Corporate social responsibility and environmental performance: the mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Change 160, 120262. doi:10.1016/j.techfore.2020.120262

Lartey, P. Y., Shi, J., Jaladi, S. R., and Afriyie, S. O. (2021). Corporate social responsibility factors, environment and corporate sustainability: specific overview of India and China. Front. Manage. Bus. 3, 126–148. doi:10.25082/FMB.2022.01.001

Li, Y. (2022). Corporate social responsibility of Chinese manufacturing companies’ effect on green business strategy, innovation and performance. Tech. Soc. Sci. J. 31, 522–552. doi:10.47577/tssj.v31i1.6382

Mehmood, K. K., and Hanaysha, J. R. (2022). Impact of corporate social responsibility, green intellectual capital, and green innovation on competitive advantage: building contingency model. Int. J. Hum. Cap. Inf. Technol. Prof. 13, 1–14. doi:10.4018/IJHCITP.293232

Pan, C., and Tian, H. (2016). Stakeholder pressure, corporate environmental ethics and proactive environmental strategy. J. Manag. Sci. 29, 38–48.

Petersen, H. L., and Vredenburg, H. (2009). Morals or economics? Institutional investor preferences for corporate social responsibility. J. Bus. Ethics 90, 1–14. doi:10.1007/s10551-009-0030-3

Ragin, C. C., and Fiss, P. C. (2008). Net effects analysis versus configurational analysis: an empirical demonstration. Redesigning Soc. Inq. Fuzzy Sets Beyond 240, 190–212. doi:10.1007/0-387-28829-5

Schneider, C. Q., and Wagemann, C. (2012). Set-theoretic methods for the social sciences: a guide to qualitative comparative analysis. Cambridge: Cambridge University Press.

Sun, Y., Li, Y., Yu, T., Zhang, X., Liu, L., and Zhang, P. (2021). Resource extraction, environmental pollution and economic development: evidence from prefecture-level cities in China. Resour. Policy 74, 102330. doi:10.1016/j.resourpol.2021.102330

Wang, H. (2010). Factor analysis of corporate environmental responsibility from the stakeholder theory perspective. Environ. Dev. Sustain. 12, 481–490. doi:10.1007/s10668-009-9206-3

Wang, S. H., and Chen, H. X. (2022). Could Chinese enterprises real benefit from embedding in global value chains? Environ. Dev. Sustain., 1–30. doi:10.1007/s10668-022-02348-w

Wang, S. H., Chen, M., and Song, M. L. (2018). Energy constraints, green technological progress, and business profit ratios: evidence from big data of Chinese enterprises. Int. J. Prod. Res. 56, 2963–2974. doi:10.1080/00207543.2018.1454613

Wang, S. H., Wang, X. Q., and Lu, B. B. (2022). Is resource abundance a curse for green economic growth? Evidence from developing countries. Resour. Policy 75, 102533. doi:10.1016/j.resourpol.2021.102533

Wang, S. H., Wang, X. Q., and Tang, Y. (2020). Drivers of carbon emission transfer in China-An analysis of international trade from 2004 to 2011. Sci. Total Environ. 709, 135924. doi:10.1016/j.scitotenv.2019.135924

Wang, X. W., and Chen, H. (2011). Research on the relationship between corporate social responsibility and corporate value based on stakeholders. J. Manag. Sci. 24, 29–37. (in Chinese). doi:10.3969/j.issn.1672-0334.2011.06.004

Xiong, Y., and Luo, Y. (2022). Will green development increase the cost of debt financing for heavily polluting companies? Mod. Econ. 13, 545–565. doi:10.4236/me.2022.134029

Keywords: fuzzy set qualitative comparative analysis, green value, green development, social responsibility, financial enterprises

Citation: Zhang Z, Wang Q and Lu B (2022) How can social responsibility enhance the green value of financial enterprises? Empirical research based on the qualitative comparative analysis method. Front. Environ. Sci. 10:1005768. doi: 10.3389/fenvs.2022.1005768

Received: 28 July 2022; Accepted: 09 August 2022;

Published: 31 August 2022.

Edited by:

Shuhong Wang, Shandong University of Finance and Economics, ChinaReviewed by:

Hanxue Chen, Ocean University of China, ChinaYuanxiang Zhou, Anhui University of Finance and Economics, China

Copyright © 2022 Zhang, Wang and Lu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Binbin Lu, nklubinbin@163.com

Zhe Zhang

Zhe Zhang Qingjin Wang1

Qingjin Wang1  Binbin Lu

Binbin Lu