Effect of China’s Land Resource Allocation Method on Enterprise Technological Innovation: Promoting or Inhibiting

- 1School of Business, Ningbo University, Ningbo, China

- 2Marine Economic Research Center, Dong Hai Strategic Research Institute, Ningbo University, Ningbo, China

Whether the land resource allocation method with Chinese characteristics can continue to play a positive role must be explored in the context of high-quality development. This study is based on the panel data of A-share listed non-financial insurance enterprises from 2006 to 2018. The proportion of industrial land area in urban construction land area to characterize land resource allocation methods and analyzes the effect of China’s land resource allocation methods on enterprise technological innovation. Results show that 1) the land resource allocation methods of the large-scale transfer of industrial land and the restricted transfer of commercial and residential land inhibit enterprises from technological innovation. 2) The inhibition is heterogeneous given the nature of the enterprise and the degrees of technology intensity and regional differences. The effect is greater on state-owned enterprises and those in high-tech industries and eastern cities. 3) The increase in corporate R&D expenditure and government subsidies weakens the negative effect of China’s land resource allocation method to a certain extent. This study maintains that the reform of land resource allocation methods should be promoted following local conditions, the role of the market should be fully utilized, and the subjective initiative of local governments should also be mobilized to promote the overall transformation of the economy and society to innovation-driven development effectively.

Introduction

China’s economy is in a critical transition period from high-speed growth to high-quality development. As the first driving force leading the high-quality development of the economy and society, innovation plays a crucial role in promoting the transformation of development models, improving social benefits, and resolving unbalanced development. The 14th Five-Year Plan points out “the core position of innovation in the overall situation of the country’s modernization drive.” highlighting China’s emphasis on scientific and technological innovation. How to promote innovation is now an urgent issue to address. As the main body of a market, an enterprise plays a vital role in implementing an innovation-driven development strategy. Enterprise technological innovation is a key force for improving production efficiency, optimizing the economic structure, and building an innovative society.

Local governments often need to use a large amount of fiscal expenditure, including investment in infrastructure, subsidies for enterprises, and tax reductions, to stimulate the innovation vitality of enterprises and accelerate the transformation of new and old kinetic energy (Maureen and Wallace, 1992; Parimal and Keith, 1994; Nola and Stephen, 2010). The promotion mechanism of the GDP championship (Zhou, 2007) further drives local governments to increase financial investment. As a key production factor and carrier of production activities, land attracts high-quality enterprises to settle in and helps alleviate fiscal constraints. Land is important for government macro-control. Its action mechanism is mainly reflected in the following two aspects (Li and James, 2015; Liu, 2017). One is to reduce business costs and expand investment promotion by providing cheap industrial land. Another is to use the land rent difference between agricultural land, commercial land, and industrial land to obtain a large amount of differential funds. The “land for development” model can be traced back to the tax-sharing reform in 1994, when the central government recovered most of the fiscal revenue power delegated during the initial reform period (Chen and Gao, 2012), resulting in a substantial decline in local fiscal revenue. On the contrary, the local government’s responsibility was constantly increasing.

In the real dilemma of increasingly mismatched financial rights, powers, and responsibilities, the land financial system with Chinese characteristics has become a good strategy for local governments to solve this contradiction. The “Land Administration Law of the People’s Republic of China” clearly stipulates that only local governments have the right to expropriate, develop, and sell agricultural land to supply urban construction land. With the monopoly of local governments on land supply, the land resource allocation methods of large-scale transfer of industrial land and restricted transfer of commercial and residential land emerged. In the past decades of development, the land resource allocation method with Chinese characteristics has supported China’s rapid industrialization and urbanization, and played a pivotal role in the last round of rapid economic growth in China. However, with the development of the economy and society, the “race to the bottom” of land transfer prices among local governments and the “zero-sum game” of GDP among local governments have become prominent (Li and Zhou, 2004), and problems in the allocation of land resources in China have gradually emerged. The misallocation of land resources between industrial land and commercial and residential land provides an important policy tool for local governments to implement fiscal spending that emphasizes productive investment and ignores innovative investment, resulting in insufficient investment in innovation. Furthermore, this misallocation negatively impacted the regional industrial structure, institutional environment and the cost of living in the city. Moreover, it severely affected the innovation enthusiasm of enterprises, residents and even the whole society, and restricted the economic and social progress toward high-quality development, and the “land for development” model has been questioned. As China’s economic transformation and upgrading meet with a new round of global technological revolution, exploring the effect of land resource allocation with Chinese characteristics on innovation is important and analyzing whether it can effectively promote the implementation of innovation-driven development strategies.

Literature Review

Most academic studies on the allocation of land resources focus on its relationship with economic growth (Liu, 2018; Xu et al., 2018), urbanization (Zhao, 2014), industrial efficiency (Xi and Mei, 2019), and official promotion incentives (Tian et al., 2019), as well as a series of complex economic and social problems that it brings, including hindering the transformation, upgrading of industrial structure (Li and Luo, 2017), increasing environmental pollution (Zhang and Xu, 2017; Yu et al., 2020), reducing the level of public service supply (Zuo and Yin, 2013), restraining the increase of total factor productivity (Zhang and Yu, 2019), raising housing prices, and causing brain drain (Song and Wu, 2020). Although these studies do not directly focus on the field of innovation, they can inspire for exploring the relationship between land resource allocation and innovation.

With the improvement of the status and role of innovation, some scholars have noticed the impact of land resource allocation on innovation, and used urban or provincial panel data to analyze it. Xie (Xie, 2020) used prefecture-level city panel data to test the effect of China’s land resource allocation methods and found that the resource mismatch between industrial land and commercial and residential land significantly reduces a city’s innovation ability. Lu (Lu et al., 2018) and An (An and Yuan, 2019), based on the perspective of land finance, pointed out that the expenditure structure and entrepreneurial spirit are distorted owing to the excessive dependence of local governments on land finance. Enterprises invest funds in the real estate industry rather than in technology R&D, inhibiting regional technological innovation. Feng (Feng and Sun, 2021) and Tao (Tao et al., 2021) focused on the problem of high housing prices caused by land mismatch. They believed that rising housing prices squeeze out corporate R&D expenditures, hinder the advancement of the industrial structure, and have a restraining effect on urban innovation. Although most studies emphasize the negative impact of China’s low-price industrial land allocation and high-priced commercial land supply on innovation, some scholars reveal the positive side. Shao (Shao et al., 2016) found that in the early stages of development, the allocation of land resources with Chinese characteristics promoted the agglomeration and growth of industrial enterprises, which stimulated the demand for innovation to a certain extent. Xie (Xie and Hu, 2020) pointed out that China’s land resource allocation method allows the government to obtain a large amount of land income, prompting local governments to increase scientific research and education expenditures to promote innovative activities.

In sum, previous studies analyze the effect mechanism of land resource allocation on innovation, laying the foundation for our research. However, current studies are mostly based on panel data at the city or industry level and rarely focus on the enterprise level to analyze the effect of land resource allocation on technological innovation. The allocation of land resources directly impacts enterprises’ enthusiasm for technological innovation, and giving full play to the main role of enterprises in innovation is an important prerequisite for improving the level of innovation in a region or even a country. Therefore, analyzing the relationship between land resource allocation and enterprise innovation is necessary. It enriches and expands the relevant research on the impact of China’s land resource allocation on economic development and helps to explore the influencing factors of enterprise innovation. The main contributions of this study are as follows: 1) We brought the research object to the enterprise level. We quantitatively evaluated the effect of China’s land resource allocation method on enterprise technological innovation. We analyzed whether it can continue to support the implementation of the innovation-driven development strategy in the current context, which broadens the research horizon of analyzing the innovation level of Chinese enterprises and provides a theoretical basis and empirical evidence for promoting the reform of land resource allocation. 2) On the basis of the benchmark analysis, we considered the differences in enterprise ownership, industry technical level and urban regional distribution, analyzed the impact mechanism of China’s land resource allocation method comprehensively through heterogeneity analysis, which provides a reference for relevant departments to promote reform according to time and place. 3) Based on the perspective of enterprise R&D investment and government subsidies, we analyzed the impact mechanism of China’s land resource allocation method on enterprise technological innovation to point out the direction for steadily promoting the reform of land resource allocation and improving the level of enterprise innovation.

Research Hypothesis

Owing to the excessive dependence of local governments on the land resource allocation method with Chinese characteristics based on China’s tax-sharing system and land system, the “land for development” model was gradually formed. To increase fiscal revenue and regional economic development, local governments intervened in the quantity and price of land supplied for different purposes. On the one hand, large-scale transfer of industrial land at low prices attracts manufacturing capital to settle in, provides jobs, and promotes the development of the service industry. On the other hand, restricting the supply of commercial and residential land to raise prices can make up for the loss of low-priced industrial land and capitalize on urban infrastructure to promote industrial development and attract population inflows (Fan et al., 2015; Li and Kung, 2015). The implementation of the “bidding, auction, and listing” system in 2002 further accelerated the conversion of land to capital. Large-scale land financing laid the foundation for the rapid development of industrialization and urbanization by crossing the threshold of capital accumulation. The “land for development” model played a certain positive role in the early stage of economic development. Local governments used land elements to promote regional infrastructure construction, attract talents, ease corporate financing constraints, and boost technological innovation and development (Xie and Hu, 2020). However, the excessive distortion of the allocation of land resources also inhibits corporate innovation in many ways. First, the rise in housing prices causes the real estate market to prosper, making the real estate industry’s rate of return much higher than other industries. As a result, enterprises pursue profits across industries, squeezing out innovation funds and causing the manufacturing industry to shift from real to virtual (Lv, 2010; Li and Wu, 2014). The rise in housing prices also affects the introduction of innovative talents, the leasing of workplaces, and the acquisition of productive services, increasing the cost of enterprise innovation. Second, the government builds development zones to attract enterprises to settle in and invest with land concessions and subsidies. The problem is that the lack of supervision and the incomplete legal system can easily induce enterprises to misappropriate innovation funds for rent-seeking activities, which then leads to the introduction of projects that lack innovation and competitiveness and have quality problems (Yang et al., 2014). This not only causes a large amount of waste of land resources (Du and Peiser, 2014) but also hinders the construction of a good innovation environment, which is not conducive to the industry’s rise to the middle and high end of the value chain (Lai, 2019). Ultimately, it will cause greater constraints on enterprises to carry out independent innovation activities. Third, owing to the local government’s fiscal expenditure bias of “emphasizing production and neglecting innovation”, land transfer income is often not used to improve public services, cultivate human capital, and support R&D innovation but is mainly used to invest in infrastructure construction in cities and industrial parks (Chen and Kung, 2016; He et al., 2016), which is not conducive to enterprises carrying out innovative activities with high risks, strong positive externalities, and long return periods. With the above analysis as a basis, Hypothesis 1 is proposed.

Hypothesis 1. The land resource allocation methods of large-scale transfer of industrial land and restricted transfer of commercial and residential land inhibit enterprises from technological innovation.

For state-owned enterprises and non-state-owned enterprises with different characteristics, the effect of China’s land resource allocation method on their technological innovation may vary. State-owned enterprises are an important tool for the government to regulate the economy. Local governments tend to emphasize state-owned enterprises to achieve economic development goals and get the top spot in the GDP championship. Policies such as scientific research subsidies and land concessions may give priority to these enterprises. State-owned enterprises thus have a stronger dependence on government land finances than non-state-owned enterprises. The enthusiasm for technological innovation of state-owned enterprises may decrease as the cost of maintaining competitive advantage decreases. They tend to engage in non-productive rent-seeking activities and improve their performance by obtaining cheap land and high subsidies, which distort the incentive effect of the government’s innovation subsidy policy while weakening the impact of property rights protection (Claessens and Laeven, 2003). Non-state-owned enterprises enjoy less policy support and face fiercer market competition. They should pay much attention to substantive R&D to improve production levels and avoid being eliminated by the market (Ruo, 2017). From the above analysis, Hypothesis 2 is proposed.

Hypothesis 2. China’s land resource allocation method has a stronger inhibitory effect on the technological innovation of state-owned enterprises than on non-state-owned enterprises.

The development of innovation activities in high-tech industries has higher requirements for industrial foundation, capital investment, and innovative talents than in traditional industries. Relevant enterprises can prioritize obtaining low-cost industrial land and enjoy tax incentives, government subsidies, and other incentive policies. However, the strict technical standards, rapid technological iteration, and cruel market competition of the high-tech industry are taken into account. Government support relying on the allocation of land resources mainly provides short-term assistance in terms of funds. It has a relatively limited promotion of technological innovation for related enterprises, and is insufficient to support their long-term development. The large-scale supply of industrial land at low prices instead leads to the excessive entry of inefficient enterprises. On the one hand, it squeezes the innovation resources of high-tech enterprises. On the other hand, it hinders the construction of a good innovative ecological environment and the upgrading of high-level industrial foundations. Furthermore, the increased housing prices owing to the restricted transfer of commercial and residential land affect the inflow of innovative and entrepreneurial talents, induce companies to invest funds in the real estate sector, squeeze out R&D investment, and further cause market distortions (Miao and Wang, 2012). Therefore, China’s land resource allocation method may affect the innovation enthusiasm of enterprises in high-tech industries. Hypothesis 3 is proposed on the basis of the above analysis.

Hypothesis 3. China’s land resource allocation method has a stronger inhibitory effect on the technological innovation of enterprises in high-tech industries than in low-tech industries.

According to the above analysis, when the level of economic development is low, the positive role of the China’s land resource allocation method is more prominent, which can provide support for enterprises to carry out innovative activities. However, with the development of economy and society, the positive effect gradually weakens or even disappears, whereas the negative effect gradually becomes prominent. Specifically, the latter includes crowding out innovative talents and R&D funds, hindering the development of service industry, and so on. These negative outcomes greatly influence the improvement of enterprises’ independent innovation ability. Evidently, given the different development levels of regions, the effect of the China’s land resource allocation method on enterprise technological innovation varies considerably. In areas with low development level, a positive effect may still occur, but the negative effect is more prominent in areas with high development level. Considering China’s vast territory, eastern cities and central and western cities are often at different stages of development. Some eastern cities focus on the overall transformation of leading industries to innovation driven, whereas some central and western cities are still consolidating their industrial foundation and accumulating innovation funds. Therefore, we infer that the China’s allocation of land resources has a greater negative effect on the technological innovation of enterprises in eastern cities. In view of this, Hypothesis 4 is proposed.

Hypothesis 4. The China’s land resource allocation method has stronger inhibitory effect on the technological innovation of enterprises in eastern cities than that of enterprises in the central and western cities.

Methodology and Data

Data Sources

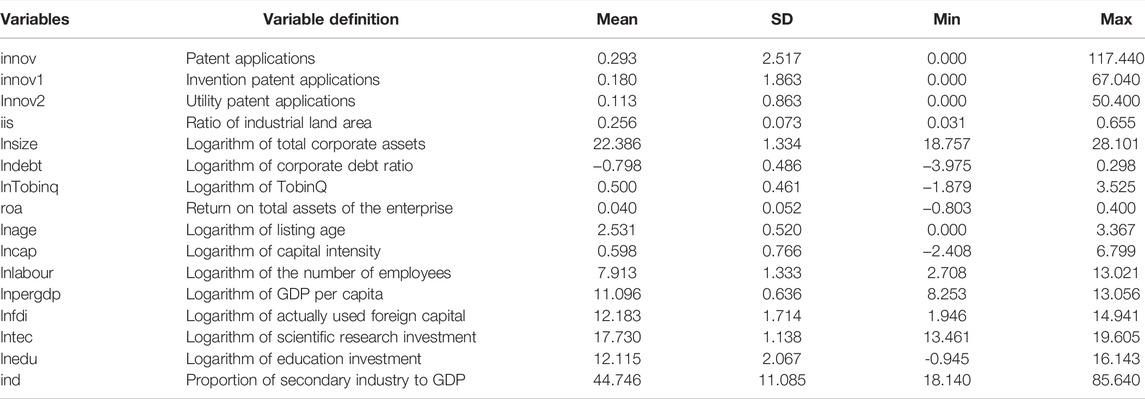

We took the data of China’s A-share listed non-financial insurance companies from 2006 to 2018 as sample. The patent data of listed enterprises are from the State Intellectual Property Office of the People’s Republic of China. The data of industrial land area and urban construction land area of prefecture level cities are from China Urban Construction Statistical Yearbook. The data of assets, liabilities, number of employees, and other control variables of enterprises come from Guotai An database. The data of foreign capital utilization and industrial structure of prefecture-level cities are from the statistical yearbook of Chinese cities over the years. The China Urban Construction Statistical Yearbook only provides data from 2006 to 2018, so in view of the availability of data, we selected the data from 2006 to 2018 for empirical analysis. Summary statistics for the data are shown in Table 1.

Variable Description

Explanatory Variable

According to the effect analysis, large-scale low-cost transfer of industrial land and limited high price supply of commercial and residential land are the main characteristics of China’s land resource allocation method. The allocation of land resources plays an important role in the economic growth and urbanization, but it also leads to the distortion of the supply of industrial land and commercial and residential land, especially the excessive expansion of the former. Therefore, this study intends to start from the perspective of industrial land expansion, refer to existing studies (Mao and Lu, 2020; Xie and Hu, 2020), take the degree of industrial land expansion (including industrial land area and storage land area) as an explanatory variable, and use the ratio of industrial land area to urban construction land area (iis) to characterize the land resource allocation method so as to explore its effect on enterprise technological innovation.

Dependent Variable

Since patent data is open and objective, the possibility of being manipulated is relatively low (Griliches et al., 1986; Claessens and Laeven, 2003; Aghion et al., 2005), and patent information is updated in a timely manner, which can more accurately reflect the changing trend of enterprise innovation (Miao and Wang, 2012). Therefore, the number of patent applications (innov) of listed enterprises is taken as the explained variable to reflect the technological innovation of enterprises, including invention patents (innov1) and utility model patents (innov2). Considering that the innovation content of design patent is low, it is not included in the number of patent applications of listed companies in this study. On the one hand, the cycle of patent technology application is long, and the effect on enterprise performance may have begun in this process. Therefore, the index of patent application quantity is more reliable and timely than the index of patent authorization quantity. On the other hand, the number of patent applications directly reflects enterprises’ investment and achievements in technological innovation, and the patent application data can be classified according to their different nature to reflect the value connotation of innovation activities, which can more clearly and accurately show enterprises’ attention to technological innovation than the R&D investment data (Li and Zheng, 2016).

Control Variable

We selected other factors that may affect enterprise technological innovation at the enterprise and city level as control variables.

1) Enterprise maturity (lnage). As the current market competition becomes increasingly fierce, the longer a company goes public, the more mature its prospect planning, goal setting, and development focus become. The company also becomes highly sensitive to policy changes and develops a strong sense of innovation. We measured this indicator by the logarithm of the number of years that the company has been listed (To avoid the influence of the number of listing years being 0, we increased the number of listing years by 1 and took the logarithm).

2) Enterprise size (lnsize). The scale of an enterprise is closely related to its technological innovation (Li and Wu, 2014). To ensure the implementation of their development prospects and plans, large-scale enterprises generally maintain a stable R&D investment to promote their technological progress and ensure their dominant position in scientific research. We used the logarithm of total capital at the end of the year to measure this indicator.

3) Corporate debt (lndebt). The debt situation of enterprises reflects the evaluation of the market on the credit ability of enterprises (Colombo et al., 2013). Moderate debt management can fill in the funding gap of a company in its technological innovation. We used the logarithm of the ratio of a company’s total liabilities to its total assets at the end of the period to measure this indicator.

4) TobinQ (lntobinq). A larger Tobin’s q value corresponds to more social wealth created by an enterprise and a stronger sense of innovation. We dealt with this indicator by using a logarithm.

5) The related variables of corporate performance. Given that corporate performance and capital structure affect corporate innovation in green technology, we took corporate return on total assets (roa), capital intensity (lncap), and number of employees (lnlabor) as control variables. We measured return on total assets by the proportion of a company’s net profit in its total assets, capital intensity by the logarithm of the ratio of a company’s total assets to its operating income, and number of employees by the logarithm of the number of employees in a year.

6) City-level variables. Given that the degree of openness of cities, their industrial structure, economic status, education investment, and scientific research investment affect the performance of enterprises in technological innovation (Xie and Hu, 2020), we controlled the use of foreign capital (lnfdi), industrial structure (ind), GDP per capita (lnpergdp), education investment (lnedu), and scientific research investment (lntec). We measured use of foreign capital by the logarithm of the actual use of foreign capital, industrial structure by the proportion of the secondary industry, per capita GDP by the logarithm of regional per capita GDP, educational investment by the logarithm of the regional education expenditure, and scientific research investment by the logarithm of regional science and technology expenditure.

Model Settings

According to the above research analysis and hypotheses, to explore the effect of China’s land resource method on enterprise technological innovation, we constructed the following model:

where innovit is the number of patent applications of a listed company in year t, and iisrt is the degree of industrial land expansion of a prefecture level city in year t. In addition, control represents the control variable. μi, γt, and λr control the fixed effects of enterprises, time, and city, respectively. ξit is a random interference item. i, t, and r represent an enterprise, time, and city, respectively. In this model, the empirical analysis examines whether the coefficient of iisrt is positively significant. If α1 is significantly less than 0, then China’s land resource allocation method inhibits enterprises from technological innovation. If α1 is significantly greater than 0, then China’s land resource allocation method can play a positive role in promoting enterprise innovation.

Empirical Results

Benchmark Estimation Results

According to the benchmark model, the specific results are shown in Table 2. Columns (1), (3), and (5) examine the relationship between the allocation of land resources and enterprise technological innovation without the introduction of control variables. The coefficient of the core explanatory variable is significantly negative at the level of 1%, which indicates that with the gradual expansion of the proportion of industrial land area in urban construction land area, the enthusiasm of enterprises for technological innovation is gradually declining, and the number of patent applications is significantly reduced. We explained the above results as follows. First, in the context of the over-prosperity of the real estate market, many real enterprises, in pursuit of short-term high profits, have invested limited resources in the real estate business, crowding out investment in innovative R&D projects that require a large amount of capital support, resulting in reduced innovation capabilities. Second, the extensive mode of land transfer by the agreement at a low price leads to the concentration of a large number of low-efficiency enterprises with backward production equipment and low technological innovation, which strengthens the rigidity of the regional low-end industrial structure, squeezes the development space of high-tech industries, and hinders enterprises from carrying out innovation activities and climbing up the value chain. Third, local governments intend to leverage greater land demand, promote regional economic growth and increase fiscal revenue. Thus, they tend to use land transfer income for productive expenditures such as investment in infrastructure construction in cities and industrial parks, rather than for public services and human capital expenditures that are conducive to long-term economic development, such as education and social security, resulting in insufficient support from local governments for corporate innovation activities. Furthermore, expanding the proportion of industrial land area has a strong inhibitory effect on enterprises’ utility model patent applications. On the one hand, this effect may be because the R&D of invention patents is difficult, and the number of applications is often less than that of utility model patents. On the other hand, such an effect may be that the expansion of industrial land reduces the enthusiasm of enterprises for strategic innovation (Li and Zheng, 2016). The results preliminarily verify the negative effect of China’s land resource allocation method on innovation. The control variables at enterprise and city levels are introduced in Columns (2), (4), and (6) to avoid the estimation error caused by missing important influencing factors. The results show that the coefficient of iis remains negative at 1% and the fitting degree is improved. Hypothesis 1 is verified. The land resource allocation methods of large-scale transfer of industrial land and restricted transfer of commercial and residential land inhibit enterprises from technological innovation, which is not conducive to enterprises breaking through development bottlenecks, improving market competitiveness, and climbing up the value chain. The “land for development” model is gradually exhausted and has difficulty supporting the high-quality and sustainable development of China’s economy. The effectiveness of land-based development has diminished, operational risks have increased, and unsustainability has emerged.

Robustness Test

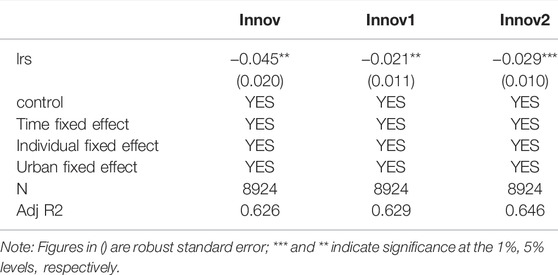

Heterogeneity Test Based on Corporate Ownership

Many studies (Zhang et al., 2013; Yu et al., 2015) assume that industrial land is mainly sold by agreement and take “agreement transfer land area” as a proxy variable for local governments’ transfer of industrial land area. Considering that the “invigoration” of the stock of construction land is often carried out in the form of agreement transfer, it is an important indicator to measure the allocation of land resources. To exclude other unobservable factors that interfere with the conclusions of the regression model, we referred to the practice of Mao (Mao and Lu, 2020), Li (Li et al., 2016), and other scholars and tested the robustness of the newly increased agreement transfer area to the total newly added land transfer area (lrs) as a substitute variable. The results are shown in Table 3. The coefficient of the core explanatory variable lrs is negative and significant, indicating that as the proportion of the newly increased agreement transfer area in the total newly added land transfer area increases, the number of patent applications decreases significantly, which verifies the robustness of the benchmark regression results.

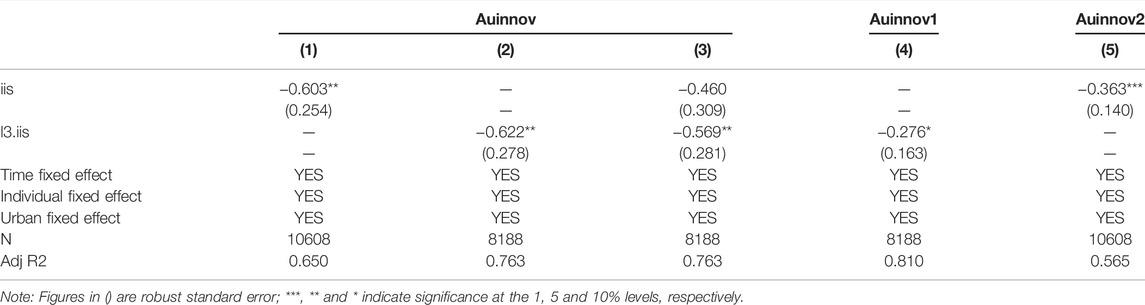

Replacing Dependent Variables

In the benchmark regression, we selected the index of patent applications as explanatory variables. However, to obtain policy support and preference, companies have the motivation to apply for substandard patents or false patents. The number of patent grants reflects the number of patents obtained by the company and can more clearly and accurately reflect a company’s technological innovation capabilities. Therefore, we selected the number of enterprise patent authorizations (auinnov), including the number of invention patent authorizations (auinnov1) and utility model patent authorizations (auinnov2), to conduct a robustness test. As the examination and approval of invention patents often take roughly three years, whereas utility model patents take less than six months, the explanatory variable (iis) in Columns 1) and 5) takes the current year value. The explanatory variable in Columns 2) and 4) is treated with three-stage lag. The explanatory variable in Column 3) is controlled with the current year and three-stage lag at the same time. The regression results are shown in Table 4. The coefficients of iis are significantly negative, indicating that the China’s land resource allocation method is not conducive to the technological innovation of enterprises. The conclusion of benchmark regression is robust.

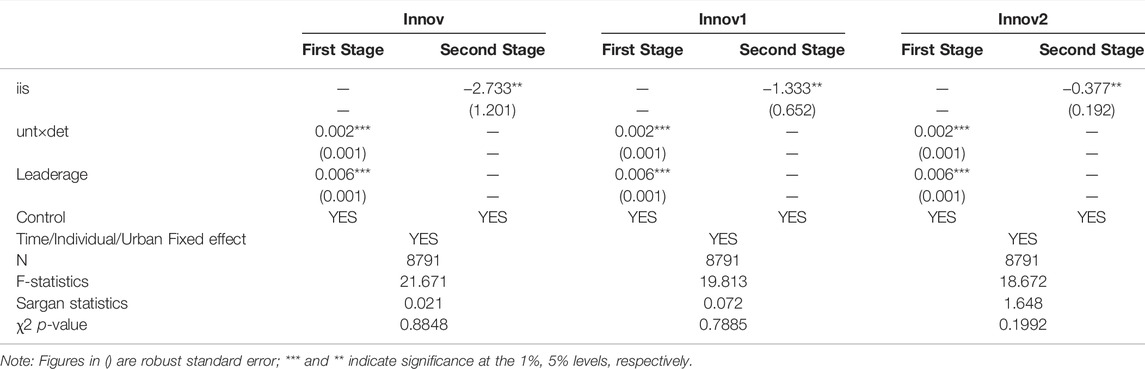

Endogenous Test

The above empirical analysis verifies Hypothesis 1, but there may be endogenous problems in the effect of land resource allocation on enterprise technological innovation, mainly including the following two aspects. First, there may be missing variables, which not only affect enterprise innovation but also are highly related to the proportion of industrial land area in urban construction land area. Second, there may be a reverse causal relationship between the allocation of land resources and enterprise technological innovation. Listed enterprises are an important driving force of regional economic development. When planning land supply, local governments may consider the level of enterprise innovation and modify the planning according to the situation of enterprise innovation during development. To overcome the endogenous problem, we referred to the practice of Xie (Xie, 2020), Xie (Xie and Hu, 2020), Mao (Mao and Lu, 2020), and other scholars and introduced two instrumental variables. First, the proportion of undeveloped land area in the initial year and the difference between the economic growth target of the province where the city is located and the national economic growth target (unt×det).Second, the age of the municipal party committee secretary (leaderage).

The first instrumental variable is composed of two variables: the proportion of undeveloped land in the initial year (unt) and the difference between the economic growth target of the province where the city is located and the national economic growth target (det). Existing research (Saiz, 2010; Chen and Kung, 2016; Aladangady, 2017) points out that the type of land transfer is affected by the slope of the urban terrain. The industrial land transferred is generally land with a slope less than 15 degrees, and the government’s supply of land is limited by the initial undeveloped land area (Xie and Hu, 2020). Therefore, we took the ratio of undeveloped land area in the initial year (unt) as a variable of the interaction term (unt×des). We used ArcGIS software to calculate the land area with an urban slope below 15 degrees, set the urban built-up area in 2001 as the land area developed in the initial year, and then use "(Land area with urban slope below 15 degrees −2001 city built-up area)/Land area with urban slope below 15 degrees” to get this variable. Taking into account the role of economic growth targets in promoting land transfer (Hu and Lv, 2019), city-level targets are often affected by corporate innovation. Therefore, we used the difference (des) between the province where the city is located and the national economic growth target as another variable of the interaction term (unt×des). The variable data comes from the government work reports of various provinces and cities over the years.

Many studies exploring the influence of officials’ behavior on the allocation of land resources (Zhang et al., 2013; Yang and Peng, 2015; Tian et al., 2019) point out that the age of the secretary of the municipal party committee affects the transfer of industrial land by the local government. Officials younger than 57 years old have more opportunities for promotion (Yang and Zheng, 2013), and they have a stronger motivation to quickly drive GDP growth through the extensive development model of large-scale transfer of industrial land. In addition, the appointment and dismissal of the secretary of the municipal party committee is a decision of higher-level government departments. As far as the innovation level of enterprises is concerned, the age of the secretary of the municipal party committee is an exogenous variable. Therefore, we took the age of the secretary of the municipal party committee as the second instrumental variable and set it as a dummy variable. When the age of the secretary of the municipal party committee is less than 57 years old, it is assigned a value of 1, 0, otherwise. Relevant information is crawled through Python.

The specific results are shown in Table 5. In the first stage of regression, the two instrumental variables (unt×des, leaderage) and the explanatory variable (iis) are significantly positively correlated at 1%, and the F statistic is greater than 10, indicating no weak instrumental variable problem. In the regression results of the second stage, the p values of Sargen test are all greater than 0.1, indicating that the null hypothesis is accepted. The instrumental variable is exogenous, and the estimated coefficient of iis remains negative at 5%, indicating the inhibitory effect of China’s land resource allocation method on the technological innovation of enterprises. Once again, Hypothesis 1 is verified.

Heterogeneity Analysis

Heterogeneity Test Based on Corporate Ownership

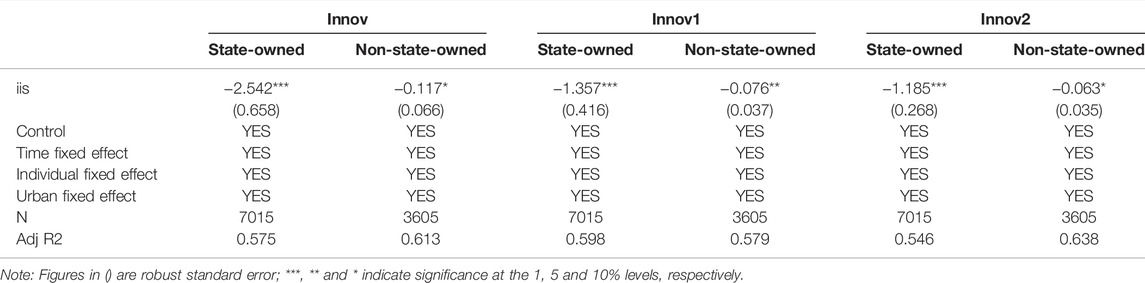

We divided listed companies into state-owned and non-state-owned companies and compared the effect of China’s land resource allocation methods on the technological innovation of enterprises with different property rights. The results are shown in Table 6. In the regression with state-owned enterprises as the sample, the coefficients of iis are all negative at the 1% level. In the regression with non-state-owned enterprises as the sample, the coefficient of the explanatory variable iis is also negative and significant, but the estimated value and significance level are lower than the former. The expansion of industrial land hit the enthusiasm of state-owned enterprises and non-state-owned enterprises for technological innovation. The number of applications for invention patents and utility model patents is significantly reduced, but the inhibitory effect on state-owned enterprises’ innovation is stronger, verifying Hypothesis 2. The findings have two main reasons. First, local governments often use state-owned enterprises to control the economy. Whether it is the transfer of industrial land or the subsidies of land finance, local governments are more inclined to state-owned enterprises. Therefore, compared with non-state-owned enterprises, state-owned enterprises are more affected by China’s land resource allocation method. Second, state-owned enterprises and non-state-owned enterprises have different innovative vigor. State-owned enterprises have undertaken part of the social functions while pursuing profits. Most of their industries are monopolistic and often face less competitive pressures than non-state-owned enterprises. Non-state-owned enterprises generally have greater motivation to carry out technological innovation activities to maintain competitive advantages or increase market share.

Heterogeneity Test Based on the Technical Level of the Industry

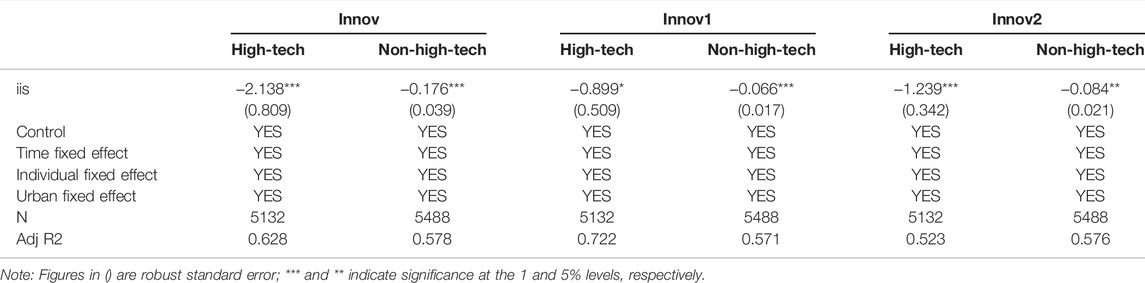

We further explored whether the effect of land resource allocation methods on enterprise technological innovation varies due to the technological level of the enterprise’s industry. Based on the “China Cities and Industry Innovation Report 2017″ ranking of all two-digit industries in China in 2016, we set the top 20 industries in the innovation index as high-tech industries, and the rest are non-high-tech industries. The regression results are shown in Table 7. The estimated coefficients of iis are all negative and significant, indicating that the expansion of industrial land significantly reduces the number of patent applications by related companies, regardless of whether it is a high-tech or non-high-tech industry. However, in the regression with state-owned enterprises as the sample, the estimated value of the explanatory variable iis is significantly larger, indicating that China’s land resource allocation method has a stronger inhibitory effect on the technological innovation of enterprises in high-tech industries. Hypothesis 3 is verified. We think this may be related to the high requirements of high-tech industries for industrial foundation, scientific research investment, and innovative talents. The innovation of high-tech industries requires a supporting high-level industrial system, perfect productive services, a large amount of stable R&D investment, and high-level scientific research personnel. However, the large-scale transfer of industrial land often attracts low-efficiency enterprises to settle in, and it is difficult to form a competitive industrial cluster, which is not conducive to the construction of a high-level industrial base. The restrictive supply of commercial and residential land also leads to soaring housing prices and rising profits in the real estate sector, hindering the inflow of talents and squeezing R&D funds.

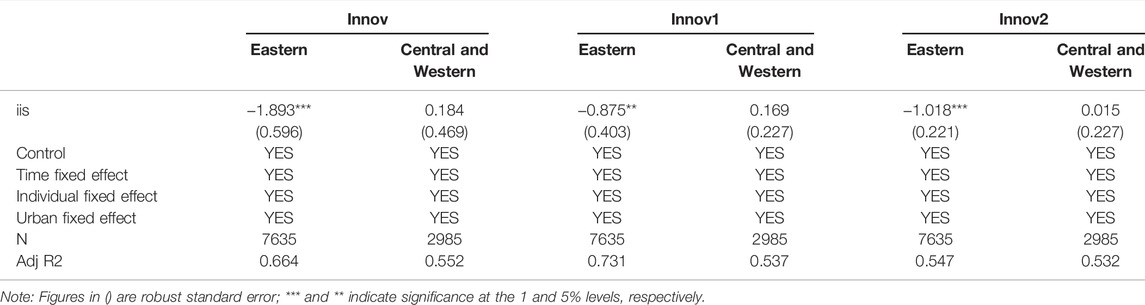

Heterogeneity Test Based on the Urban Areas

The differences in economic conditions, resource endowments, and business environment among China’s regions are big. Although the inherent location and environmental deficiencies in the central and western regions are compensated for through policy guidance and infrastructure advancement, considerable differences between the eastern, central, and western cities remain. This variation affects the innovation activities of enterprises. On the basis of the geographical distribution of enterprises, we divided the sample into eastern cities and central and western cities. We performed regression analysis to explore whether the effect of land resource allocation on enterprise technological innovation varies because of the difference in the location of the cities where the enterprises belong. The results are shown in Table 8.

In the regression using eastern cities as a sample, the coefficients of iis are all negative and significant, indicating that the expansion of industrial land in eastern cities reduces the number of patent applications by enterprises. However, in the regression using the central and western cities as the sample, the coefficient of iis is not significant, indicating that the China’s land resource allocation method has a stronger inhibitory effect on the technological innovation of enterprises in eastern cities. Hypothesis 4 is verified. This finding may be because, in the early stages of development, the land resource allocation method with Chinese characteristics played an active role in building the industrial foundation and accumulating innovation funds and promoted the technological innovation of enterprises. However, with the development of the economy and society, the adverse effects gradually become prominent. Especially in eastern cities with a high level of economic development, the emergence of environmental pollution, high housing prices, and low-end lock-in of the industrial structure restrict the introduction of high-tech talents, the development of productive services, and the investment of R&D funds. These then inhibit corporate innovation and hinder the real economy represented by the manufacturing industry from moving toward high-end and specialization. However, in the central and western cities, the “land for development” model relying on China’s land resource allocation method can still play a positive role owing to the relatively low overall economic development, weak industrial foundation, and insufficient independent innovation ability of enterprises. Therefore, the restraining effect of China’s land resource allocation method on the technological innovation of enterprises is prominently manifested in the eastern cities than in central and western cities. As China’s economy moves towards high-quality development, the continued use of the land resource allocation method will restrict the formation of innovative leading industries in eastern cities. It will hinder the implementation of China’s innovation-driven transformation strategy, and is not conducive to the country’s high-quality development. However, it will force eastern cities to compete with central and western cities for mid-to-low-end industrial resources, making the effective alleviation of the “empty cities” phenomenon in the central and western regions impossible.

Mechanism Analysis

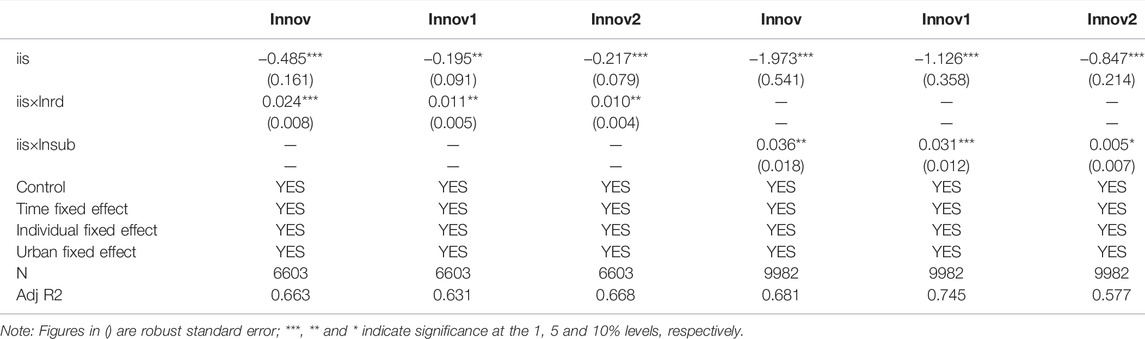

The above empirical results show that the land resource allocation methods of large-scale transfer of industrial land and restricted transfer of commercial and residential land inhibit enterprises from technological innovation, which are prominently manifested in state-owned enterprises and those in high-tech industries and eastern cities. On this basis, we further explored its effect mechanism and provided suggestions for the follow-up reform of land resource allocation. Government subsidies and enterprise R&D investment are important factors to promote enterprise technological innovation. They are closely related to the allocation of land resources. Therefore, we added the interaction terms of corporate R&D expenditure (lnrd) and the degree of land expansion (iis) and the interaction terms of government subsidies (lnsub) and the degree of land expansion (iis) into Model 1) to test the effect of enterprise R&D expenditures and government subsidies on the relationship between China’s land resource allocation methods and enterprise technological innovation. The model is constructed as follows:

In Eqs 2, 3, lnrd is the logarithm of R&D expenditure of enterprises, lnsub is the logarithm of government subsidies obtained by enterprises, and the relevant data are from Guotai An database. In this model, we focused on whether the coefficient of the interaction item is positively significant. When it is significantly greater than 0, enterprise R&D expenditure and government subsidies can reduce the inhibitory effect of the China’s land resource allocation on enterprise technological innovation to a certain extent.

The test results are shown in Table 9. When the coefficient of iis is negative and significant, the coefficients of the interaction terms iis×lnrd and iis×lnsub are positively significant. The increase in enterprise R&D expenditure and government subsidies can effectively reduce the inhibitory effect of China’s land resource allocation methods on enterprise technological innovation. Preferential policies can increase scientific research subsidies for enterprises and encourage enterprises to increase R&D expenditures to reduce the negative effects of China’s land resource allocation method and facilitate the gradual advancement of reforms.

Discussion

The land resource allocation methods of large-scale transfer of industrial land and restricted transfer of commercial and residential land are important driving forces for China’s rapid industrialization and urbanization. However, as China’s economy moves toward a stage of high-quality development, many problems are gradually exposed. Whether China’s land resource allocation method can continue to stimulate the innovation vitality of enterprises and promote the implementation of innovation-driven development strategies has become the focus of current research. On the basis of the panel data of A-share listed companies from 2006 to 2018, we used the proportion of industrial land area to urban construction land area to characterize land resource allocation methods. We also explored the effect of land resource allocation methods with Chinese characteristics on enterprise technological innovation. Our study contributes to the literature in three important aspects. First, from a micro perspective at the enterprise level, we quantitatively evaluated the effect of China’s land resource allocation methods on enterprise technological innovation. We found that with the expansion of industrial land area, the enthusiasm of enterprises for technological innovation gradually declines, and the number of patent applications decreases significantly, indicating that using China’s land resource allocation method to support the implementation of the innovation-driven development strategy faces challenges. Second, on the basis of benchmark analysis, we distinguished enterprise ownership, industry technology level, and urban regional distribution to test the heterogeneous impact of China’s land resource allocation on enterprise technological innovation. The results show that China’s land resource allocation method has a greater negative effect on the technological innovation of enterprises that are state-owned and those in high-tech industries and eastern cities, pointing out the direction for local governments to formulate differentiated reform plans. Third, from the perspective of enterprise R&D investment and government subsidies, we found that the increase in enterprise R&D expenditure and government subsidies weakens the negative impact of China’s land resource allocation on enterprise technological innovation, which provides empirical support for steadily promoting the reform of land resource allocation and improving the level of enterprise innovation.

Based on the analysis of the advantages and disadvantages of China’s land resource allocation methods (Zuo and Yin, 2013; Zhao, 2014; Li and Luo, 2017; Zhang and Xu, 2017; Liu, 2018; Xu et al., 2018; Tian et al., 2019; Xi and Mei, 2019; Zhang and Yu, 2019; Song and Wu, 2020; Yu et al., 2020), this study broke through the original macro research paradigm (Lu et al., 2018; An and Yuan, 2019; Xie, 2020), and revealed the reasons for the depletion of the “land for development” model from the perspective of enterprise innovation. The economic implications of the findings include the following three aspects. The first is to point out that improving land use efficiency is a key link in achieving high-quality development of China’s economy, emphasizing the focus of China’s economic reform in the new development stage. The second is to clarify the reform direction of land resource allocation, promote the effective allocation and efficient use of resources among industries, effectively enhance the independent innovation capability of enterprises, and help enterprises climb to the mid-to-high end of the global value chain. The third is to speed up the reform of optimizing the space allocation of land resources, curb the trend of bubbles in the real estate market, avoid low-level industrial agglomeration, and create a good environment for enterprise innovation.

Conclusion

The allocation of land resources based on the tax sharing system and land system with Chinese characteristics has provided an important support for China’s last round of rapid industrialization and urbanization. However, many problems have also been exposed in this process. With China’s economic development stepping into the new normal, exploring whether China’s land resource allocation method can promote the implementation of innovation-driven development strategy is of great significance for China’s economy. Basing on the panel data of A-share listed non-financial insurance companies from 2006 to 2018, we used the proportion of industrial land area to urban construction land area to characterize land resource allocation methods and explored the effect of land resource allocation methods with Chinese characteristics on enterprise technological innovation.

We reached the following conclusions First, the land resource allocation methods of large-scale transfer of industrial land and restricted transfer of commercial and residential land inhibit enterprises from technological innovation. The distortion of the structure and price of land transfer by the local government makes the allocation of land resources inefficient, resulting in the increase of housing prices, the crowding out of R&D funds, and the deterioration of the innovation environment. While increasing the innovation risk of enterprises, it reduces the expected benefits of innovation, hinders enterprises from climbing to the high end of the industrial value chain, and restricts the improvement of the overall independent innovation capability of society. It shows that the “land for development” model has difficulty promoting the sustainable development of China’s economy, and urgent reform is needed to support the needs of China’s innovation-driven transformation and development. Second, the restraint effect is heterogeneous owing to the nature of the enterprise and the degrees of technology intensity and regional differences. The effect is greater on state-owned enterprises and enterprises in high-tech industries and eastern cities. Among them, state-owned enterprises are the “ballast stone” of the national economy, high-tech industries are important carriers for enhancing the status of the global value chain, and eastern cities are the pioneers of China’s market-oriented reforms. Thus, under the background of the raging COVID-19 pandemic and the intensification of the game between major powers, in order to stabilize the macro economy and consolidate the cornerstone of high-quality development, local governments need to optimize the land supply structure gradually according to the characteristics of regional economic development. Third, the increase in enterprise R&D expenditure and government subsidies weakens the negative effect of China’s land resource allocation methods on enterprise technological innovation. Thus, tax relief, financial subsidies, and other policy tools can be used to strengthen the support for scientific research of enterprises and guide them to increase R&D expenditure to enhance the independent innovation ability of enterprises and help the steady adjustment of land resource allocation.

To encourage the reform of land resource allocation and promote the overall transformation of the economy and society to innovation-driven development effectively, we proposed the following countermeasures:

1) In advancing the reform of land resource allocation, each region’s industrial characteristics and development goals should be fully considered to formulate differentiated optimization adjustment plans in combination with innovation-driven development strategies. The central government can encourage some developed cities in the east to take the lead in carrying out pilot projects and include innovation-related indicators in the assessment system to promote effectively the reform of land resource allocation methods that meet the needs of innovative development. For cities with relatively backward economic development levels, local governments should fully weigh the differential impact of the current allocation of land resources on different innovation elements according to the local development stage, and optimize the use of industrial, commercial, and residential land according to actual needs.

2) Local governments should actively promote market-oriented reforms in the allocation of land resources, give play to the role of the market in resource allocation and enterprise selection, and stimulate the enthusiasm of enterprises to carry out innovative activities. Local governments should abandon the concept of the one-sided pursuit of economic growth and reduce administrative intervention in land resources. On the one hand, industrial land should be strictly transferred through “bidding, auction, and listing.” The supervision of the agreement transfer of land should also be strengthened. Doing so can reduce the dependence of enterprises on government support, avoid the entry of low-efficiency enterprises and create a good environment for innovation. On the other hand, a fair competition mechanism should be introduced on the basis of the transaction reserve price. The price of industrial land and commercial and residential land should be kept within a reasonable range to promote the introduction of innovative talents and the development of productive services. This not only meets the R&D and innovation needs of enterprises and stimulates their innovation vitality, but also prevents enterprises from crowding out R&D funds and conducting cross-industry arbitrage.

3) The local government should fully utilize the existing industrial land and improve the screening mechanism to ensure that the introduced enterprises have a high level of technology. Updating, revitalizing, and re-developing the idle and inefficient industrial stock land are necessary to create conditions for high-tech enterprises to form an industrial cluster effect. Furthermore, local governments should actively explore innovations in the fiscal and taxation system, such as introducing real estate taxes to improve the local taxation system, reducing dependence on “land finance,” and enhancing the government’s fiscal capacity. The introduction of preferential policies can increase scientific research subsidies to enterprises and encourage enterprises to increase R&D expenditures, thereby promoting enterprises to carry out technological innovation. Furthermore, given the pursuit of explicit political achievements, local governments may ignore the actual needs of corporate innovation and promote the excessive expansion of industrial land. The central government can consider incorporating innovation-related indicators into the evaluation system for official promotion, while weakening the importance of explicit indicators such as GDP, thereby reducing the unreasonable allocation of land resources.

We preliminarily analyzed the inhibitory effect of China’s land resource allocation methods on enterprise technological innovation. Following limitations need to be further tracked and analyzed. First, this study only focused on the technological innovation of listed companies, ignoring a large number of non-listed companies. Second, the analysis of enterprise technological innovation only considers the innovation output such as the number of patent applications, and does not pay enough attention to the input of innovation elements and the economic transformation of achievements. Third, the government’s regulation of land resources affects the technological innovation of local enterprises and may affect the innovation enthusiasm of enterprises in adjacent areas because of competition between local governments. However, this study only discusses the direct effects of land resource allocation, and does not include spillover effects into the research scope. Therefore, further study can be done from the following aspects. 1) The follow-up study can focus on the price of land purchased by various companies based on the land transfer information published by China Land Market Network, match it with the database of Chinese industrial enterprises, and explore comprehensively and in-depth the effect and mechanism of China’s land resource allocation. 2) Future study can explore the internal mechanism of technological innovation, and reveal the impact mechanism of China’s land resource allocation on the efficiency of technological innovation of enterprises from the perspective of innovation value chain. 3) Our follow-up study can analyse the impact of land resource allocation on the innovation of enterprises in surrounding cities from a spatial perspective, and comprehensively evaluate whether the “land for development” model is sustainable.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

QH put forward the idea and revised the paper; JM analyzed the data and wrote the paper; XW contributed to the conceptual framework of the methodology. All authors have read and approved the final manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (No. 71874092).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

Thanks to all the teachers and students in the research group that gave us so many suggestions in the process of our writing.

References

Aghion, P., Bloom, N., Blundell, R., Griffith, R., and Howitt, P. (2005). Competition and Innovation: An Inverted-U Relationship*. Q. J. Econ. 120, 701–728. doi:10.1162/0033553053970214

Aladangady, A. (2017). Housing Wealth and Consumption: Evidence from Geographically Linked Microdata. Am. Econ. Rev. 107, 3415–3446. doi:10.1257/aer.20150491

An, Y., and Yuan, Y. (2019). Land Finance, Distortion Effect and Regional Innovation Efficiency. Chin. Land Sci. 33, 36–42+52. doi:10.11994/zgtdkx.20190717.162958

Chen, S., and Gao, L. (2012). The Relationship between the Central and Local Governments: the Measurement of Fiscal Decentralization and the Reassessment of its Mechanism. Manage. World. 28, 43–59. doi:10.19744/j.cnki.11-1235/f.2012.06.005

Chen, T., and Kung, J. K.-S. (2016). Do land Revenue Windfalls Create a Political Resource Curse? Evidence from China. J. Dev. Econ. 123, 86–106. doi:10.1016/j.jdeveco.2016.08.005

Claessens, S., and Laeven, L. (2003). Financial Development, Property Rights, and Growth. J. Finance 58, 2401–2436. doi:10.1046/j.1540-6261.2003.00610.x

Colombo, M. G., Croce, A., and Guerini, M. (2013). The Effect of Public Subsidies on Firms' Investment-Cash Flow Sensitivity: Transient or Persistent? Res. Policy 42, 1605–1623. doi:10.1016/j.respol.2013.07.003

Du, J., and Peiser, R. B. (2014). Land Supply, Pricing and Local Governments' Land Hoarding in China. Regional Sci. Urban Econ. 48, 180–189. doi:10.1016/j.regsciurbeco.2014.07.002

Fan, J., Mo, J., and Zhang, J. (2015). Residential Mode and Urbanization in China: An Empirical Study Based on the Perspective of Land Supply. Soc. Sci. Chin. 36, 44–63+205.

Feng, C., and Sun, H. (2021). The Influence Mechanism of Housing Price Level on Enterprise R&D Expenditure. Theory Pract. Financ. Econ. 42, 57–66. doi:10.16339/j.cnkihdxbcjb.2021.02.008

Griliches, Z., Pakes, A., and Hall, B. (1986). The Value of Patents as Indicators of Inventive Activity. NBER Work. Pap.

He, C., Zhou, Y., and Huang, Z. (2016). Fiscal Decentralization, Political Centralization, and Land Urbanization in China. Urban Geogr. 37, 436–457. doi:10.1080/02723638.2015.1063242

Hu, S., and Lv, B. (2019). Economic Growth Target and Land Transfer. Public. Fin. Res. 40, 46–59. doi:10.19477/j.cnki.11-1077/f.2019.07.003

Lai, M. (2019). Does the Mismatch of Land Factors Hinder the Optimization and Upgrading of China's Industrial Structure? Empirical Evidence Based on 230 Prefecture-Level Cities in China. Ind. Econ. Res. 18, 39–49. doi:10.13269/j.cnki.ier.2019.02.004

Li, H., and James, K. (2015). Fiscal Incentives and Policy Choices of Local Governments: Evidence from China. J. Dev. Econ. 116, 89–104. doi:10.1016/j.jdeveco.2015.04.003

Li, H., and Zhou, L. (2004). Political Turnover and Economic Performance: the Incentive Role of Personnel Control in China. J. Public Econ. 89, 1743–1762. doi:10.1016/j.jpubeco.2004.06.009

Li, L., Huang, P., and Ma, G. (2016). The Mismatch of Land Resources and the Productivity Difference of Chinese Industrial Enterprises. Manage. World. 32, 86–96. doi:10.19744/j.cnki.11-1235/f.2016.08.008

Li, L., and Wu, X. (2014). Housing Price and Entrepreneurship in China. J. Comp. Econ. 42, 436–449. doi:10.1016/j.jce.2013.09.001

Li, W., and Zheng, M. (2016). Is it Substantive Innovation or Strategic Innovation?Impact of Macroeconomic Policies on Micro-enterprises' Innovation. Econ. Res. J. 51, 60–73.

Li, Y., and Luo, H. (2017). Does Land Resource Misallocation Hinder the Upgrading of Industrial Structure? Empirical Evidence from Chinese 35 Large and Medium-sized Cities. J. Financ. Econ. 43, 110–121. doi:10.16538/j.cnki.jfe.2017.09.009

Liu, K. (2018). How the Land System with Chinese Characteristics Affects China's Economic Growth: An Analysis Based on a Multi-sector Dynamic General Equilibrium Framework. Chin. Ind. Econ. 35, 80–98. doi:10.1108/CPE-05-2020-0009

Lu, Y., Zhang, K., and Ouyang, J. (2018). Does Land Finance Hinder Regional Technological Innovation? An Empirical Test Based on Panel Data of 267 Prefecture-level Cities. Financ. Res. 61, 101–119.

Lv, J. (2010). The Measurement of the Bubble Level of the Urban Housing Market in my country. Econ. Res. J. 45, 28–41.

Mao, W., and Lu, J. (2020). How Does Land Misallocation Affect the Quality of Urban Innovation and Entrepreneurship in China? Empirical Evidence from the City Level of Prefecture-level Cities. Ind. Econ. Res. 19, 17–29. doi:10.13269/j.cnki.ier.2020.03.002

Nola, H., and Stephen, R. (2010). Output Additionality of Public Support for Innovation: Evidence for Irish Manufacturing Plants. Eur. Plan. Stud. 18, 107–122. doi:10.1080/09654310903343559

Parimal, P., and Keith, P. (1994). National Innovation Systems: Why They Are Important, And How They Might Be Measured And Compared. Econ. Innov. New Technol. 3, 77–95. doi:10.1080/10438599400000004

Ruo, W. (2017). House Price, Ownership Type and Firm Innovation. Open J. Soc. Sci. 5, 339–351. doi:10.4236/jss.2017.57021

Saiz, A. (2010). The Geographic Determinants of Housing Supply*. Q. J. Econ. 125, 1253–1296. doi:10.1162/qjec.2010.125.3.1253

Shao, C., Su, D., and Deng, H. (2016). Housing Prices, Land Finance and City Agglomeration Characteristics: the Road of China's City Development. Manage. World. 32, 19–31. doi:10.19744/j.cnki.11-1235/f.2016.02.005

Song, H., and Wu, M. (2020). Do Excessive Housing Prices Lead to an Outflow of Talent? Financ. Res. 63, 77–95.

Tao, A., Wang, T., and Wu, W. (2021). The Impact of Rising Housing Prices on Urban Innovation: Reevaluation Based on the Perspective of Industrial Structure Optimization. East Chin. Econ. manage. 35, 64–73. doi:10.19629/j.cnki.34-1014/f.200807015

Tian, W., Yu, J., and Gong, L. (2019). Promotion Incentives and Industrial Land Leasing Prices: A Regression Discontinuity Design. Econ. Res. J. 54, 89–105.

Xi, Q., and Mei, L. (2019). Industrial Land Price, Selection Effect and Industrial Efficiency. Econ. Res. J. 54, 102–118.

Xie, C., and Hu, H. (2020). China's Land Resource Allocation and Urban Innovation: Mechanism Discussion and Empirical Evidence. Chin. Ind. Econ. 37, 83–101. doi:10.19581/j.cnki.ciejournal.2020.12.004

Xie, D. (2020). Land Resource Misallocation and City Innovation Capacity: Based on Chinese City-level Panel Data Analysis. Chin. J. Econ. 7, 86–112. doi:10.16513/j.cnki.cje.2020.02.004

Xu, S., Chen, J., and Zhao, G. (2018). How Does the Land Leasing Marketization Affect the Economic Growth. Chin. Ind. Econ. 35, 44–61. doi:10.19581/j.cnki.ciejournal.2018.03.003

Yang, Q., and Peng, Y. (2015). Promotional Competition and Industrial Land Sale: An Analysis Based on Panel Data of Chinese Cities from 2007 to 2011. Econ. Theor. Bus. Manag. 35, 5–17.

Yang, Q., and Zheng, N. (2013). Is the Competition for Promotion of Local Leaders a Benchmark, a Championship or a Qualifier? World Econ. 36, 130–156.

Yang, Q., Zhuo, P., and Yang, J. (2014). Industrial Land Transfer and the Bottom-line Competition of Investment Quality: An Empirical Study Based on the Panel Data of Prefecture-level Cities in China from 2007 to 2011. Manage. World. 30, 24–34. doi:10.19744/j.cnki.11-1235/f.2014.11.004

Yu, J., Xiao, J., and Gong, L. (2015). Political Cycle and Land Transfer Behavior of Local Government. Econ. Res. J. 50, 88–102+144.

Yu, X., Shen, M., Shen, W., and Zhang, X. (2020). Effects of Land Urbanization on Smog Pollution in China: Estimation of Spatial Autoregressive Panel Data Models. Land 9, 337. doi:10.3390/land9090337

Zhang, L., Gao, Y., and Xu, X. (2013). Land Transfer Under the Collusion of Government and Enterprise. Manage. World. 29, 43–51+62. doi:10.19744/j.cnki.11-1235/f.2013.12.005

Zhang, S., and Yu, Y. (2019). Land Transfer, Resource Misallocation and Total Factor Productivity. J. Financ. Econ. 45, 73–85. doi:10.16538/j.cnki.jfe.2019.02.006

Zhang, W., and Xu, H. (2017). Effects of Land Urbanization and Land Finance on Carbon Emissions: A Panel Data Analysis for Chinese Provinces. Land Use Policy 63, 493–500. doi:10.1016/j.landusepol.2017.02.006

Zhao, Y. (2014). Land Finance in China: History, Logic and Choice. Urban Stud. 21, 1–13. doi:10.3969/j.issn.1006-3862.2014.01.001

Zhou, L. (2007). Governing China's Local Officials: An Analysis of Promotion Tournament Model. Econ. Res. J. 42, 36–50.

Keywords: land resource allocation method, enterprise technological innovation, industrial land expansion, enterprise R&D investment, government intervention

Citation: Ma J, Hu Q and Wei X (2022) Effect of China’s Land Resource Allocation Method on Enterprise Technological Innovation: Promoting or Inhibiting. Front. Environ. Sci. 10:766246. doi: 10.3389/fenvs.2022.766246

Received: 28 August 2021; Accepted: 13 June 2022;

Published: 28 June 2022.

Edited by:

Salvador García-Ayllón Veintimilla, Technical University of Cartagena, SpainCopyright © 2022 Ma, Hu and Wei. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qiuguang Hu, huqiuguang@nbu.edu.cn

Jintao Ma

Jintao Ma Qiuguang Hu1,2*

Qiuguang Hu1,2*