The Spatial Correlation Between Green High-Quality Development and Technology Finance

- 1Business School, Suqian University, Suqian, China

- 2Pan-Asia Business School, Yunnan Normal University, Kunming, China

- 3School of Business, China University of Political Science and Law, Beijing, China

Based on an analysis of the function of technology finance for green high-quality development, this paper selects 35 basic indicators from the five dimensions of innovation, coordination, greenness, openness, and sharing to construct an Green High-quality Development Index. Moreover, 14 basic indicators are selected from the three dimensions of technology finance resources level, technology finance input level, and technology finance output level to construct a technology finance development evaluation system. Then, using the entropy method, panel data from the period 2000–2020 from China’s 30 provinces was employed to assess the Economic Quality Development Index and the Technology Finance Development Index. The results show that provinces and cities with a good economic development level have a relatively high level of strong economic and technology finance development, including Beijing, Shanghai, and Jiangsu. Moreover, the results reveal a certain gap between different provinces. Multiple regression, static panel regression, dynamic panel regression, the static space Dubin model, the dynamic space Dubin model, and the semi-parametric space lag model were used to test the effect of technology finance on China’s green high-quality development. This study found that technology finance has significantly enhanced green high-quality development of China’s as a whole through a non-linear promotion effect. To better promote green high-quality development, the following measures are recommended: 1) improving the level of technological and financial development, 2) increasing the scale of government expenditures, 3) strengthening infrastructure construction, 4) accelerating the construction of new urbanization, and 5) improving the level of human capital.

1 Introduction

The report of the 19th National Congress of the Communist Party of China pointed out that “socialism with Chinese characteristics has entered a new era, and China’s economy has shifted from a stage of high-speed growth to a stage of high-quality development.” China adheres to the new development concept - promoting green transformation in economic development and achieving greater development in green transformation. In the first year of the “14th Five-Year Plan”, green is becoming a bright background for high-quality development. General Secretary Xi Jinping pointed out that green and high-quality development is the organic integration of green development and high-quality development, and the organic integration of new development concepts and high-quality development in terms of scientific connotations, paths and mechanisms. Green development is an inevitable requirement for building a high-quality modern economic system and a fundamental solution to the pollution problem. Green high-quality development emphasizes new development concepts, especially green development to lead economic development, that is, green innovation, coordination, openness and shared development. Green and high-quality development needs to be understood from all aspects of the new development concept. The new development concept is an organic whole, and the five development concepts of green, innovation, coordination, sharing and openness are synergistic relationships that promote and strengthen each other. Green high-quality development includes not only green development, but also the contents of the other four development concepts. Promoting and realizing green and high-quality development is to solve the contradiction between the people’s growing demand for a better life and the unbalanced and insufficient development. The future direction of China’s economic development must give priority to quality and efficiency, and focus on changes in quality, efficiency and dynamics. Therefore, it is of great significance to establish a Green High-quality Development Index evaluation system to measure the level of green development in various regions and the gap between regions.

With the aim of expanding previous studies, this paper explores a new application of the entropy method to measure and promote the development of science and technology finance. To achieve this goal, the present paper constructs a Green high-quality development Index based on five dimensions and uses the entropy method for calculation and analysis, setting a foundation for the subsequent quantitative analysis of the impact of various factors on green high-quality development. Moreover, the level of technology finance development is difficult to measure directly. Therefore, this paper constructs a Technology Finance Development Index based on three dimensions and employs the entropy method to conduct an analysis. The paper offers new insights into the study of technology finance development.

The multiple regression, fixed effects, random effects, system GMM, and spatial Dubin models all show that there is a positive correlation between technology finance and green high-quality development. Thus, developing technology finance plays a key role in promoting green high-quality development. More specifically, the semi-parametric estimation model shows that the green high-quality development of various provinces in China does not have a purely linear relationship with science and technology finance. With the continuous improvement of science and technology finance, the marginal contribution to the China’s green high-quality development is gradually decreasing. At a time when the level of technology finance is low, every increase in this level—even by one unit—will significantly improve the rate of green high-quality development.

2 Literature Review

Bei, (2018), He (2018), Ren and Li, (2018), and Meng and Xing, (2018) have analyzed the meaning of high-quality economic development. It is generally believed that high-quality development is no longer about purely pursuing economic aggregates and economic growth, but that it should focus on the balanced development of an economy, society, and the environment to achieve more efficient, fairer, and more sustainable development. Lu et al. (2019) define high-quality economic development based on four aspects: economic growth, innovative development, ecological civilization, and people’s livelihood development. Liu and Guo, (2020) has established an indicator system for evaluating high-quality economic development based on the five development concepts of innovation, coordination, greenness, openness, and sharing. Zhou et al. (2019), Gong & Zhang (2021), Yang and Zhang (2021) select indicators from multiple dimensions including economic development, structural coordination, innovation drive, open upgrade, ecological civilization, and achievement sharing to employ the High-quality Economic Development Index.

Both the sustainable development theory and the green growth theory originated from the Western academic circles. Jenkins (2002), released EU’s sustainable development strategy begins with the 2001 policy document “Sustainable Europe makes the world a better place: EU strategy for sustainable development”. Sustainability in the EU was revised in 2006 as various external factors changed. The Organization for Economic Co-operation and Development (OECD, 2011) released the Green Growth Indicator System in 2011, proposing a framework including 5 items including economic opportunity, policy response, ecological productivity, green asset base and environmental quality, and 14 topics including green policy response, renewable energy and other 25 indicators. In 2012, on the basis of the Organization for Economic Cooperation and Development (COECD), the Netherlands constructed a green growth indicator system with 34 indicators, mainly including environmental efficiency, natural resource base, living environment quality, policy response and economic opportunity. Guo et al. (2015) constructed an index system of county green development level including three first-level indicators including government policy support, and conducted an empirical study on the green development level of Ningxia County. Based on the actual situation of Yunnan Province, Ma Xing (2018) constructed a green economy development evaluation index system including four first-level direct indicators of resources, environment, society and economic benefits, and 22 second-level indicators such as urban sewage treatment rate. Dou, (2020) constructed a green and high-quality development evaluation index system, and analyzed the green and high-quality development levels of China’s provinces and municipalities from 2012 to 2017.

Berger (2003), Tadesse (2006), Ang (2010), Neff (2003), Zetzsche et al. (2017), Kang (2018), Raghupathi & Raghupathi (2019) have found that with technological advancements, banks can create new business types and improve service levels, resulting in better integration of the entire banking industry. Market-led financial institutions are more conducive to contributing to technological progress.

Some scholars proposed a broader definition of technology finance as a systematic and innovative arrangement of financial tools, systems, policies, and services to promote technological innovation as well as the transformation and development of high-tech industries and entities—e.g., governments, enterprises, markets, and social intermediaries—to provide financial resources for scientific and technological innovation activities. These entities and their behavioral activities in the process of scientific and technological innovation constitute a system. In other words, they make up an important part of the national scientific and technological innovation and financial system. Fang (2010), Xie (2014), Liu, (2017), Kou, (2018) have conducted research on the significance of technology finance, pointing out that technology finance is the product of the integration of technology and financial innovation. Wang, (2015) and Yang et al. (2020) have employed various methods—such as the Malquist index model and projection pursuit model—to construct an evaluation index system to measure technological and financial development.

A few scholars have specialized in the impact of technology finance on high-quality economic development. Han et al. (2018) have analyzed science and technology from a theoretical perspective, focusing on the relationship between finance and high-quality economic development. More specifically, Wang and Gu, (2021) constructed a high-quality development evaluation system based on the five dimensions of innovation, coordination, greenness, openness, and sharing. They then used inter-provincial panel data from China to empirically test the effect of technology finance on China’s high-quality economic development as well as its influential factors.

As described above, theoretical and empirical research on the high-quality development of technology finance and the economy is becoming more abundant. This research has not only laid a solid theoretical foundation for the development of science and technology finance but also provided important insights into its relationship with high-quality development. However, within the context of China’s economy entering a stage of high-quality development, research has remained relatively insufficient regarding the effects of the high-quality development of technology finance. In particular, there has been a lack of empirical system testing, which is not conducive to the application of technology finance to high-quality economic development. Therefore, this paper considers both theoretical and empirical perspectives and systematically discusses the issues related to the high-quality development of technology finance and the economy.

3 Mechanism Analysis of Technology Finance to Promote Green High-Quality Development

3.1 Theoretical Analysis of Technology Finance to Promote Green High-Quality Development

1) Technology finance promotes economic innovation and development. Technology finance can boost the innovation and development of the economy. Technological finance synergizes the two elements of technological innovation and modern finance. Technological innovation through modern financial services, thereby promoting the development of the real economy. The financing function of technological finance is conducive to increasing corporate innovation financing. The risk management function of technological finance can help prevent and resolve many risks faced in the innovation process. The incentive and supervision function of technological finance can effectively avoid adverse selection and moral hazard problems, improve the probability of enterprise innovation success, and reduce innovation risks. The information identification function of technological finance helps capital flow from inferior projects to high-quality projects and improves innovation efficient.

2) Technology finance promotes coordinated economic development. The development of science and technology finance can further promote the progress of agricultural technology and agricultural modernization, increase farmers’ income, support urbanization, increase rural fixed asset investment, and improve the urban-rural dual structure. At the same time, technology finance development can further enhance the growth of high-tech industries to better optimize the industrial structure. In addition, the development of science and technology finance can better guide investors to invest in upgrading industries. Finally, technological progress can create new types of consumption types, stimulating consumption and regulating the proportion of investment and consumption.

3) Technology finance promotes the economy’s green development. The capital allocation function of science and technology finance can help to better allocate financial resources to enterprises with high technological content and green production, prompting the continuous transformation of “three highs” enterprises and promoting the green transformation of traditional enterprises and the development of new green industries. Technology and finance development can help enterprises to improve production processes, achieve higher levels of energy conservation and emission reduction, engage in green production, and promote the realization of green economic development. Green development plays an important role in energy consumption, energy conservation and sustainable economic development. Such as Sun et al., 2019, Sun et al. (2021).

4) Technology finance promotes economic openness and development. The openness is essential to the economics, Alam and Murad, (2020), Bui and Bui, 2020, Kong et al. (2021) believe that openness is good for economic development. Technology finance development can also promote technological innovation. In turn, technologically innovative countries will use their technological advantages to increase the scale of exports, and technological innovation will bring about transnational technology transfer. The availability of advanced technology is an important factor for companies to invest abroad. Countries with stronger technological advancements are more likely to attract foreign investment. Moreover, technological advantages will produce excess profits, thereby expanding foreign investment.

5) Technology finance promote sharing economic development. Many scholars have studied the sharing economy. They think that sharing economy contributes to economic development. Such as Hamari et al., 2016, Zhang et al. (2018), Roy, (2021). Technology and finance can enable the realization of shared economic development, welfare sharing, and financial sharing. Technology and finance development can produce new economic growth and a broader employment space, providing a material guarantee for the promotion of welfare sharing. At the same time, technology finance supports the continuous innovation of financial products, which can further reduce transaction costs, diversify risks, and improve financial institutions’ profitability. A number of financial institutions have already carried out product innovations to help enterprises realize financial sharing.

3.2 Variables

3.2.1 Explanatory Variables

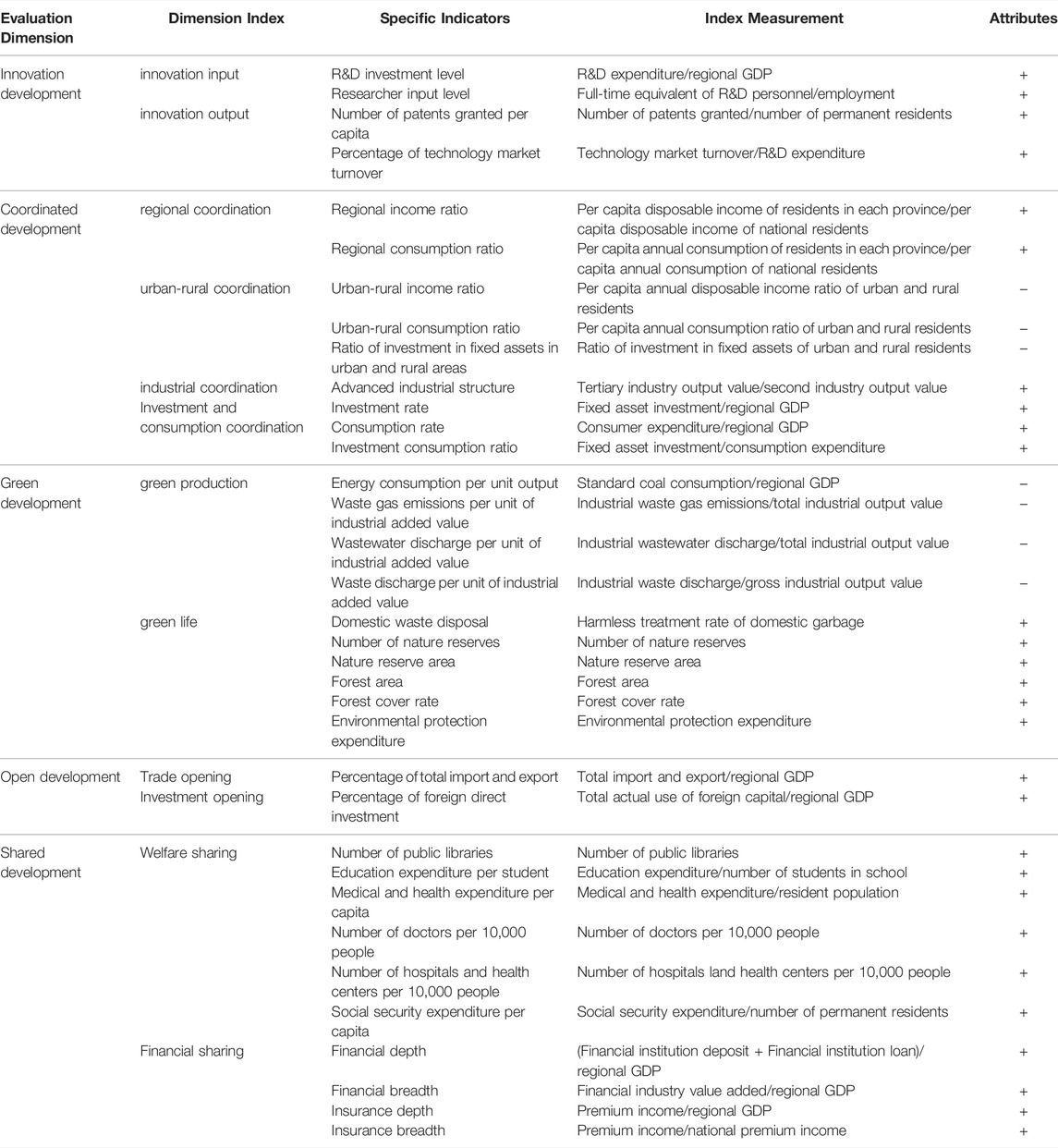

This paper adopts the Green High-quality Development Index as its explanatory variable, featuring five dimensions: innovation development (innovation input, innovation output), coordinated development (regional coordination, urban-rural coordination, industrial coordination, investment and consumption coordination), green development (green production, green life), open development (open trade, open investment), and shared development (welfare sharing, financial sharing). For this study, 35 basic indicators were selected to measure the Green High-quality Development Index (see Table 1 for details). Innovative development is the driving force for achieving green high-quality development. Meanwhile, a coordinated economic structure is not only a necessary condition for green high-quality development but also the inevitable result of such development. Green development is also an important part of green high-quality development, and open development is required for sustained economic growth. Shared development is another result of green high-quality development. Constructing an indicator system based on the above five perspectives can therefore enable us to comprehensively examine all dimensions of green high-quality development and make a reasonable evaluation of the level of such development.

3.2.2 Explanatory Variables

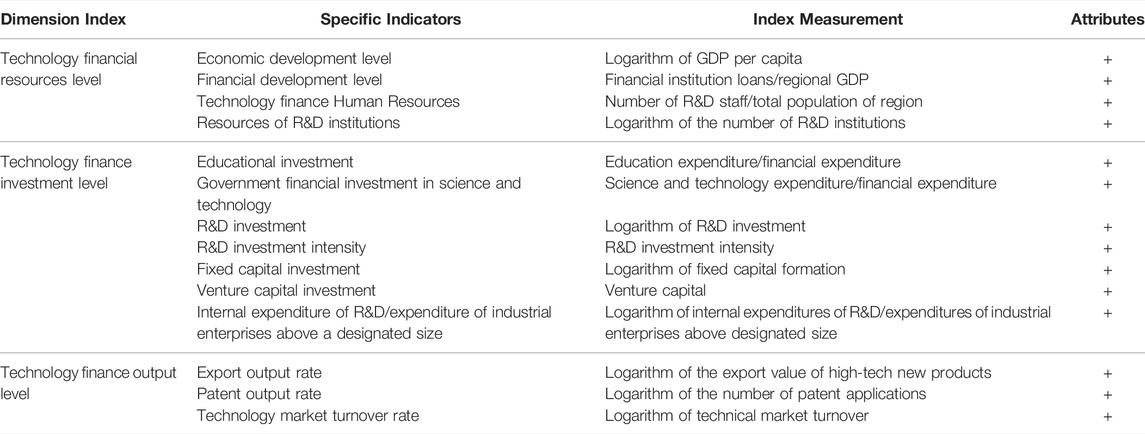

Based on the prior research, the indicators from the dimensions of the level of technology financial resources, the level of technology finance input, and the level of technology finance output are selected to construct the Technology Finance Evaluation Index. Table 2.

3.2.3 Control Variables

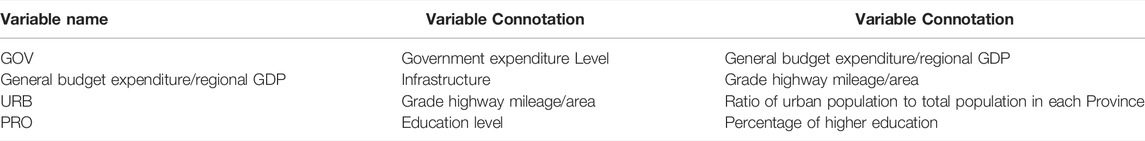

This study’s selection of control variables mainly draws on the research of Pan and Luo, (2020) and Zhou and He, (2020). The following control variables were chosen: government intervention (general budget expenditure/regional GDP), infrastructure (grade road/area), urbanization rate, number of years of education, and proportion of higher education (Table 3 for details). The data was derived from the China Statistical Yearbook.

Government expenditure level (GOV) is related to finance as the foundation and key pillar of national governance; thus, it has played a primary role in promoting economic growth, providing public services, regulating income distribution, and protecting the ecological environment. The higher the level of government expenditure, the more conducive conditions for green high-quality development. In other words, the level of government expenditure is directly proportional to the level of green high-quality development.

Infrastructure is the cornerstone of economic and social development, fulfilling a strategic and important role. Thus, infrastructure construction (INF) can better stimulate the endogenous and new kinetic energy of economic development. INF will not only help alleviate the adverse effects of the new pneumonia epidemic and effectively respond to downward pressures on the economy, but it will also help enterprises to respond to challenges as they transform and upgrade themselves. Therefore, INF can effectively help China’s economy achieve high-quality development. Infrastructure construction is also directly proportional to the level of green high-quality development.

For urbanization level (URB), promoting the high-quality development of China’s new-type urbanization is an important way to accomplish the goal of rural revitalization. The report of the 19th National Congress of the Communist Party of China pointed out that China’s economy has shifted from a stage of rapid growth to a stage of high-quality development. Urbanization is the only way to achieve green high-quality development, and urbanization level is also directly proportional to the level of green high-quality development.

The enhancement of green high-quality development is inseparable from the improvement of people’s overall quality of life, and education level is an important factor affecting that overall quality of life. Thus, the higher the level of education (PRO), the stronger people’s innovation consciousness and ability, resulting in more conducive conditions for green high-quality development. Education level is also directly proportional to the level of green high-quality development.

3.3 Entropy Method

This paper adopts the entropy method to calculate the Green high-quality development Index and Technology Finance Development Index. The entropy method is widely used, such as Zhang & Wang, (2019), Jiang et al. (2020).

In the above formula,

Calculate the proportion of the

In the above formula,

Calculate the entropy value of the

In the above formula, ensure that

Calculate the entropy redundancy of the

Then, calculate the weight of the

Finally, calculate the comprehensive evaluation score:

In the above formula,

3.4 Model Setting

3.4.1 The Impact of Technology Finance on Green High-Quality Development Based on Panel Regression

After employing the multiple regression model to analyze the green high-quality development of technology finance, this study adopted the panel regression model to analyze the relationship between technology finance and green high-quality development.

First, this paper establishes a static panel regression model; then, considering that green high-quality development is a dynamic process with endogenous problems, a system GMM model for research was further established. The specific model is presented below.

Static panel regression model:

Dynamic panel regression model:

3.4.2 The Impact of Technology Finance on Green High-Quality Development Based on Spatial Panel Regression

After identifying a significant spatial correlation between the China’s green high-quality development and the Technology Finance Development Index, the spatial effect between high-quality development and the development of technology finance cannot be ignored. Therefore, it is necessary to further employ the space measurement method to derive in-depth results. The form of the static space model is detailed below.

Here,

Typically, spatial measurement models are divided into the following three types: spatial error model (SEM), spatial auto-regressive model (SAR), and spatial Dubin model (SDM).

The SEM model only contains the spatial autocorrelation of the error term, which is expressed in the formula:

The SAR model usually contains the spatial autocorrelation term of the explained variable, which is expressed in the formula:

Beyond the limitations of the SAR model, the SDM model adds an explanatory variable spatial autocorrelation term, which is expressed in the formula:

This paper selected a specific model through the LM test, Hausman test, Wald test, and joint significance test.

As mentioned above, when studying China’s green high-quality development, the endogenous problem cannot be ignored. Thus, this paper further adopted the dynamic spatial regression model to conduct research.

The form of the dynamic space model is as follows:

In the above analysis, we only considered the linear relationship between financial technology and China’s green high-quality development. It is necessary to examine the nonlinear relationship between technology finance and green high-quality development. This paper employed the semi-parametric space lag model to study the non-linear relationship between technology finance and green high-quality development.

4 Empirical Analysis

4.1 Data Selection and Processing

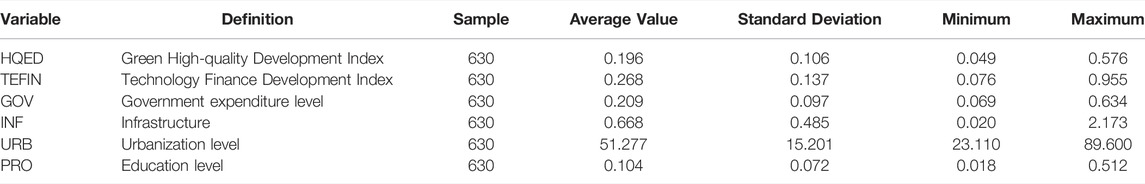

As its object of study, this paper adopted panel data from 30 provinces, autonomous regions, and municipalities in China (excluding Tibet, Hong Kong, Macau, and Taiwan). The data was derived from the “China Statistical Yearbook”, the “EPS Database”, and the “China Science and Technology Statistical Yearbook”. The data for 2020 was obtained through forecasting, and any individual missing data was supplemented via the trend repetition method. Table 4 presents the data’s descriptive statistics.

As Table 4 shows, the standard deviation of each variable is not overly large, indicating that there is a certain gap between variables in each region; however, that gap is not particularly prominent. It can also be seen from the maximum and minimum values of each variable that there is a certain gap between each variable across different years.

4.2 Calculation Results of China’s Green High-Quality Development

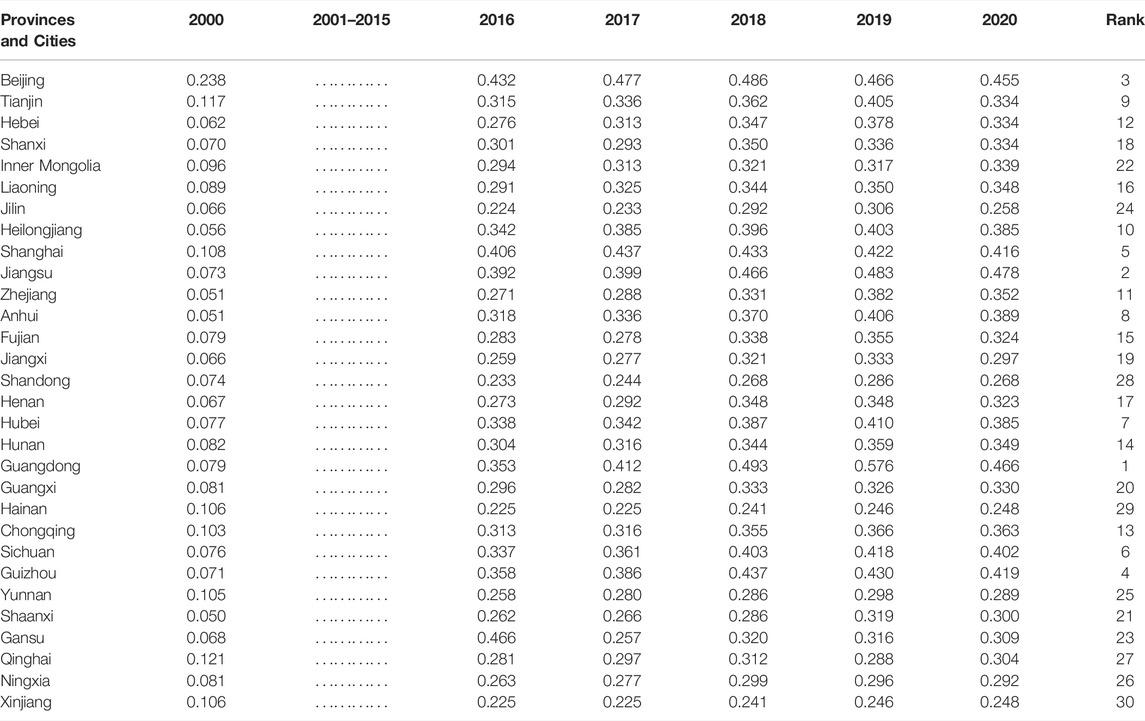

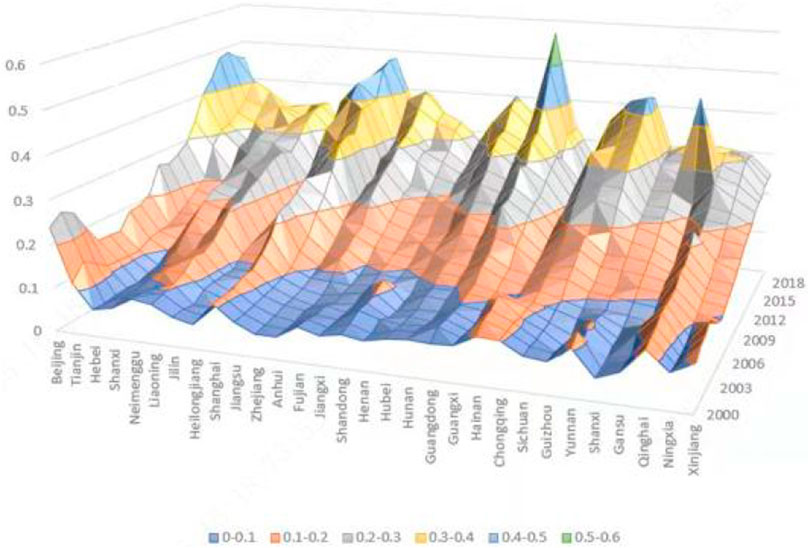

Table 5 and Figure 1 present the Green High-quality Development Indexes of China’s provinces and cities. In 2020, the economic development of various regions was affected to a certain extent by the new pneumonia epidemic. Therefore, when ranking the Green High-quality Development Indexes of various regions, we took 2019 as an example.

A certain gap was identified in the Green High-quality Development Index of various regions in China. Guangdong Province ranked first with an Green High-quality Development Index of 0.5758 in 2019, while Xinjiang ranked 30th with an Green High-quality Development Index of 0.22 in 2019. Clearly, there is a significant gap between Guangdong and Xinjiang. The Green High-quality Development Index of various provinces and cities exhibited a steady upward trend as a whole from 2000 to 2020, which is consistent with the actual conditions of steady green economic growth over the past 20 years.

The calculation results reveal that three places—Guangdong, Jiangsu, and Beijing—rank in the top three in terms of the Green High-quality Development Index. These three places are also major centers of economic development. Xinjiang, Qinghai, Ningxia, and other provinces rank relatively low on the Green High-quality Development Index over the years. The findings indicate that the level of green high-quality development has a positive relationship with regional economic development. In addition, there is a disparity in the economic development of China’s eastern, central, and western regions1. A disparity in the Green High-quality Development Index of these regions is also obvious: Eastern region > Central region > Western region.

4.3 Measurement Results of the Technology Finance Development Index

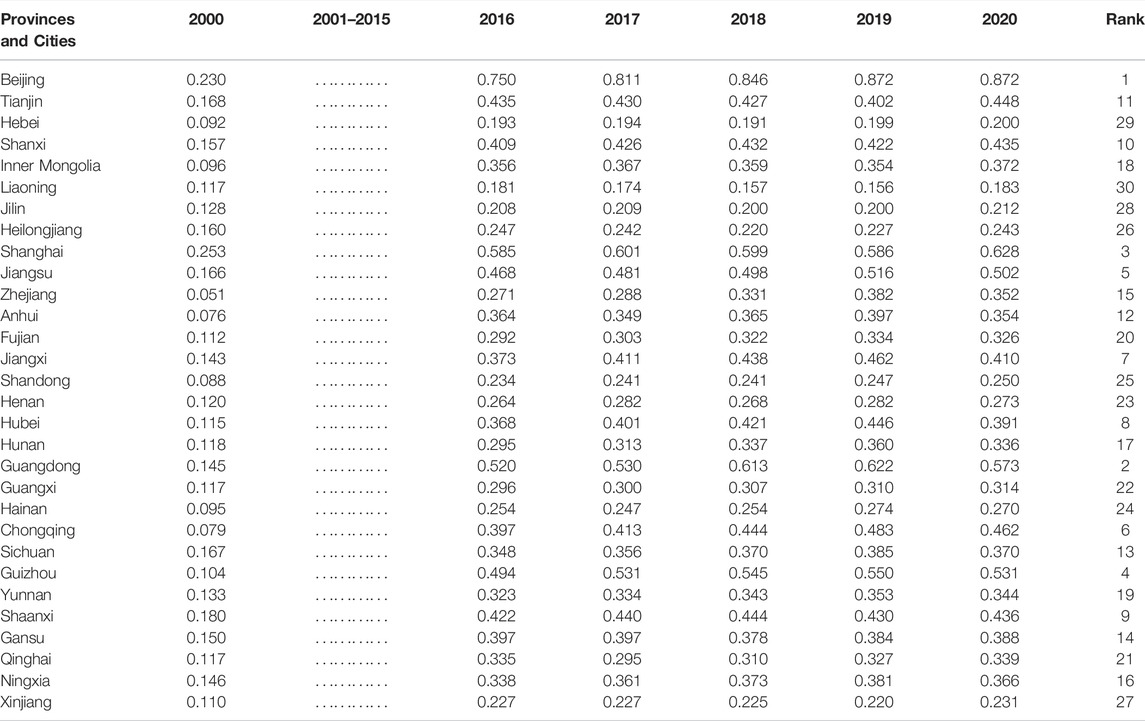

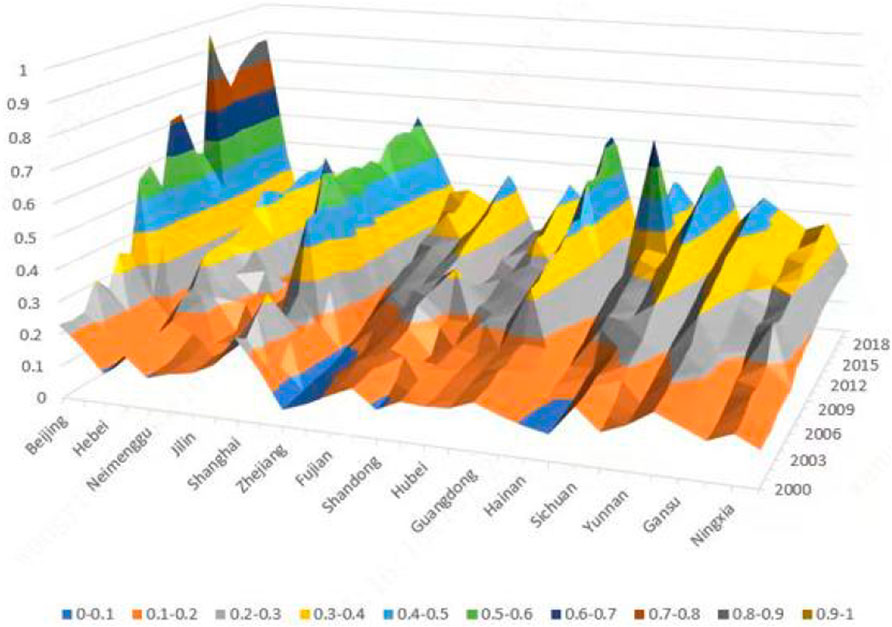

Table 6 and Figure 2 displays the Technology Finance Development Index of various provinces and cities in China from 2000 to 2020. The findings reveal that Beijing, Guangdong, and Shanghai rank in the top three for 2019 and other years. Moreover, these regions’ level of green high-quality development was also found to be in a leading position.

As the capital of China, Beijing has accumulated a wealth of economic and various forms of human resources. Furthermore, many leading financial institutions, industry leaders, and high-tech companies have their headquarters in Beijing. Overall, Beijing is characterized by a strong atmosphere for the development of technology finance. Beijing is home to the most universities in China, and it is a city that employs a wide range of talent across many fields every year. The influx of talent is a major reason behind the acceleration of Beijing’s technology and finance development. In other words, Beijing is China’s economic, cultural, and technological development center. Its comprehensive strengths provide a solid foundation for the development of technological finance.

Meanwhile, Guangdong Province’s GDP in 2020 was 1,107.094 billion yuan. A province with strong economic development, Guangdong is located at the center of the Pearl River Delta. As the youngest city in Guangdong (and across the whole country), Shenzhen has developed significant economic resources. Many technology-based companies have settled there, making Shenzhen an innovative city. When it comes to technology and finance, Guangdong’s development in these areas is driven largely by Shenzhen.

As the third highest-ranking city, Shanghai features strong transportation development. Shanghai is an international financial center with a globally strategic position. China regards Shanghai as a window into the world, and the world often regards Shanghai as a doorway into China. The government’s support for Shanghai’s technology finance development is thus very strong. Additionally, Shanghai’s economic development advantages have attracted a significant talented workforce in the fields of technology and finance. Shanghai is also characterized by good educational resources. Many financial companies and innovative financial leaders have settled in Shanghai. Shanghai’s economic development is open and inclusive, with a strong financing environment, numerous financial institutions, and abundant resources. In sum, Shanghai’s technology and financial development is robust.

Beyond Beijing, Guangdong, and Shanghai, regions such as Guizhou, Jiangsu, and Chongqing also exhibited relatively high levels of technology finance development. Although Guizhou’s overall economic development level is not very high, more attention has been paid to technology finance investment in recent years in this city. Jiangsu is in an important location on the Yangtze River Delta, and it is home to many financial institutions and enterprises. Thus, its economic development level is one of the highest in the country.

As a municipality directly under the central government in southwest China, Chongqing is an important economic center. As a strategic fulcrum for the development of the western region, Chongqing has attracted abundant funding, talent, and enterprises. Consequently, Chongqing’s technology finance has developed rapidly.

The overall level of technology finance development in the three northeastern provinces is relatively low. These three provinces have suffered from a significant loss of talent in recent years. Additionally, given these provinces’ old industrial base, the development of financial institutions has been relatively weak. There has been a lack of investment in funding and resources for technology finance development, resulting in a relatively low overall level of such development in the three northeastern provinces.

The level of technology finance development in the central and western regions is lower than in the eastern regions. The level of economic and financial development in the central and western regions is insufficient to meet the demand for innovation, the technological infrastructure is imperfect, there is a lack of high-end technological talent, the technological market is immature, and the technological and financial ecological environment is still incomplete. All of these factors weaken the high-quality development of technological finance in these regions.

Overall, the level of technology finance development in China’s provinces and cities has exhibited a rising trend from 2000 to 2020. This trend is closely related to China’s various economic policies. Along with its economic development, China continues to encourage innovation, develop the financial market, and provide financial support and resources to technological innovation enterprises. Under the strategy of revitalizing the country through science and education and strengthening the country through abundant talent, the amount and quality of financial support for technological innovation has continuously increased. In sum, China’s technology finance development is in a stage of steady progress.

4.4 The Impact of Technology Finance Development on Green High-Quality Development Based on Multiple Regression and Panel Regression

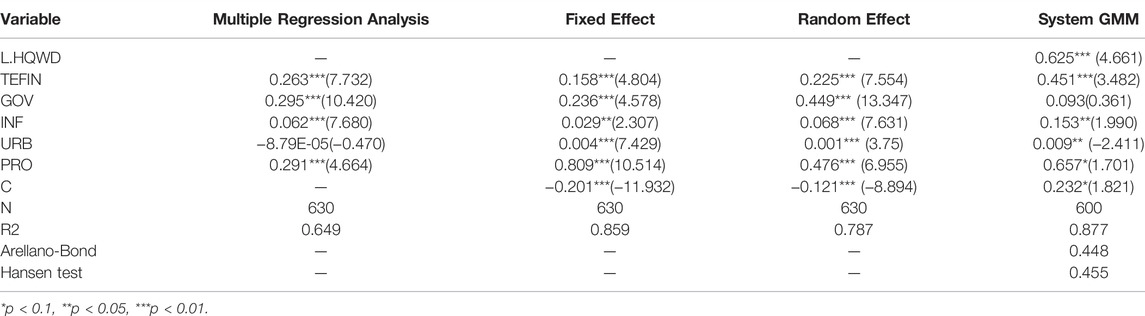

Table 7presents the study’s findings regarding the impact of technology finance development on green high-quality development through multiple regression analysis, static panel regression analysis (fixed effects and random effects), and the system GMM model regression analysis.

The results of multiple regression and static panel regression analyses reveal that technology finance development has an obvious positive impact on green high-quality development. Control variables such as government expenditure level, infrastructure construction, urbanization rate, and education level also have a positive impact on green high-quality development, which is consistent with the theoretical analysis.

Moreover, the system GMM analysis shows that the p values of the Hansen test and Arellano-Bond in the system GMM estimation are both greater than 0.1 after the residual error is tested. The p value represents the lowest probability level of mistakes made by rejecting the null hypothesis; thus, the null hypotheses of “all instrumental variables are valid” and “all disturbance items have no autocorrelation” cannot be rejected. In other words, the model passed the correlation test and its estimated empirical analysis result is effective. The system GMM model analysis reveals that the development of technology and finance not only has a positive impact on the overall index of green high-quality development, but also that the control variables—including infrastructure construction, urbanization rate, and education level—have a positive impact on such development.

4.5 Regression Results of Spatial Measurement of the Impact of Technology Finance Development on Green High-Quality Development

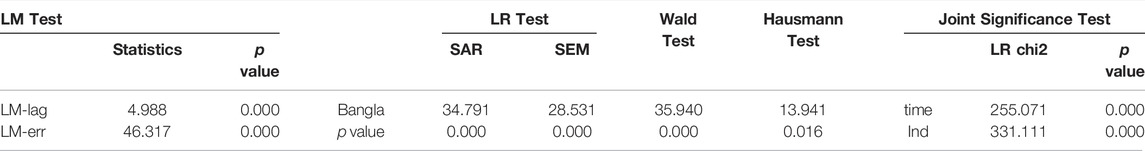

For this study’s theoretical analysis, we tested commonly used spatial measurement models to identify the most appropriate one. First, we employed the LM test to determine whether to use the SEM model or the SAR model. If the test finds both models to be suitable, we must consider the SDM model. Then, we must evaluate the model through the Wald test and likelihood ratio test (LR). After selecting one of these models, a Hausman test must be done to determine whether to use a fixed effects model or a random effects model. For spatial measurement, a joint significance test must also be performed. The joint significance test can help to determine whether to use an individual fixed-effect model or a time-fixed-effect model. The study’s empirical results are shown in Table 8.

From Table 8 we can see that The LM test found that Spatial Doberman model should be used Based on the results of Hausmann’s test, a fixed-effects model was constructed. Finally, a joint significance test was performed. Therefore, we decided to use the double fixed effect model.

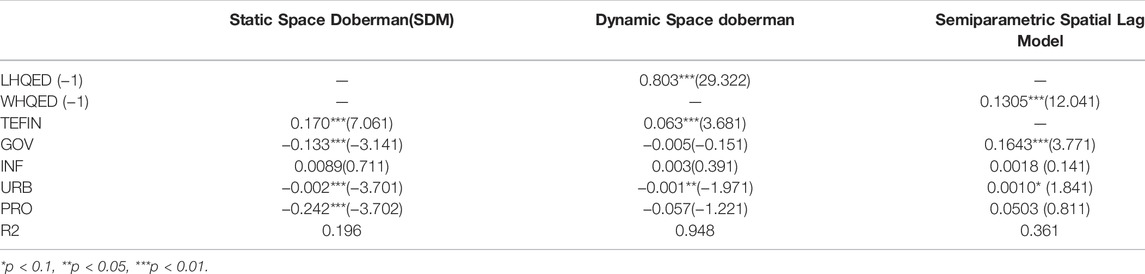

The results of the static space Dubin model and the dynamic space Dubin model as presented in Table 9 reveal that technology finance development can promote the green high-quality development of various provinces and cities in China. More specifically, the regression results of the static space Dubin model show that when China’s technology finance level increases by 1%, China’s Green high-quality development Index will increase by 0.17%. At the same time, the results of the dynamic space Dubin model show that the endogenous problem in China’s green high-quality development cannot be ignored. First-order lagging green high-quality development has a strong positive effect on the current level of green high-quality development, and it is significantly different from 0 at the 1% significance level. Meanwhile, the regression results of the dynamic space Dubin model suggest that technology finance also has a significant positive effect on green high-quality development with a regression coefficient of 0.063, which is significant at a significance level of 1%. However, whether a static or dynamic spatial Doberman model is adopted, only the static relationship of technology finance to China’s green high-quality development is considered. Thus, the nonlinear dynamic relationship between the two must be studied in greater depth using the semi-parametric spatial lag model.

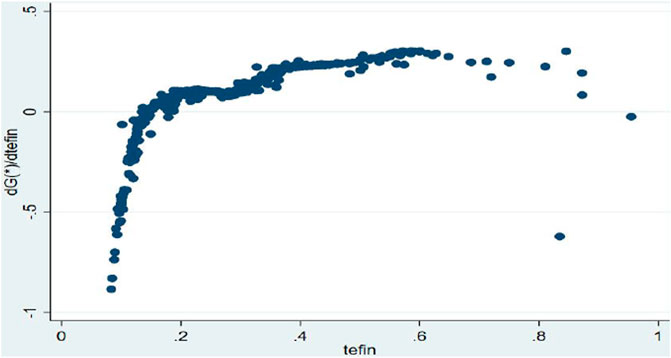

The results of the non-parametric spatial lag model in Table 8 and Figure 3 reveal the absence of a purely linear relationship between the green high-quality development of China’s provinces and technology finance, and that technology finance has a significant non-linear impact on green high-quality development. Figure 3 displays the derivative graph of China’s green high-quality development on technology finance, showing the degree to which China’s green high-quality development has increased due to a 1% increase in technology finance. Figure 3 clearly shows that along with the continuous improvement of technology finance, the marginal contribution to China’s green high-quality development has exhibited a gradual decline. When there is a low level of science and technology finance development, every increase in the level of such development will have a significant effect on green high-quality development. This reflects China’s current reality, as the country is in a critical period of transition from traditional finance to technology finance. Currently, the level of technology finance is still in its infancy. At this stage, improving the level of technology and finance will play a vital role in China’s green high-quality development; therefore, we must identify other important factors that can contribute to this improvement.

5 Conclusions and Policy Recommendations

This study employed the entropy method to measure China’s Green high-quality development Index and Technology Finance Development Index. The results show that there is a gap between the Green high-quality development Index and the Technology Finance Development Index in various regions. Moreover, Technology finance has significantly promoted China’s green high-quality development. Additionally, government expenditure levels, infrastructure construction, urbanization rate, and education level all have a significant positive impact on green high-quality development. Based on its findings, the study proposes the following policy recommendations.

5.1 Improving the Level of Technology and Finance Development in Various Regions to Promote Green High-Quality Development

Our empirical analysis revealed that there is a significant positive correlation between the level of technology finance development and green high-quality development. Therefore, it is important to increase technology investment, improve the financing system, and raise the level of technology finance development. Financial investment methods must be innovated and various industry guidance funds must be allowed to play a significant role. Other strategies include optimizing the structure of funding sources for technology finance, accelerating the development of venture capital, and improving the ecological environment and enhancing the efficiency of technology finance. It will be important to continuously improve the level of economic and financial development to establish a solid foundation for technology finance development, as well as expanding the level of information and communication construction, capital flow, industry-university-research cooperation, and technology transfer. Education investment must be strengthened and innovative talent must be nurtured as the total investment in scientific and technological resources is increased. It would be beneficial to build a full-scale technology market trading platform to provide services such as technology property rights transactions, intellectual property evaluation, and equity custody transfer. Additional strategies include adjusting the strategic layout of financial investment in science and technology; enhancing independent innovation capabilities; increasing support for basic, strategic, and original research; improving China’s overall level of scientific discovery, technological invention, and industrial innovation; and establishing a system of continuous innovation to sustain a long-term momentum for enhancing green high-quality development.

5.2 Increasing the Scale of Government Expenditures to Promote Green High-Quality Development

This strategy focuses on implementing a proactive fiscal policy to stimulate economic growth. To achieve green high-quality development, we must appropriately increase the scale of government fiscal expenditures. Of course, this expansion should not be done blindly, and it is particularly important to clearly define the boundary between the government and the market. The government and the market should stand in their respective positions and develop their individual strengths to complement each other’s advantages and avoid competition.

5.3 Increasing Investment in Infrastructure to Promote Green High-Quality Development

The study’s empirical analysis revealed that infrastructure construction has a positive role in promoting green high-quality development. Infrastructure development plays an indispensable role in a country’s economic development. Infrastructure construction is the driving force behind economic development, significantly contributing to the growth of the national economy. Therefore, it is critical to increase infrastructure investment and improve infrastructure conditions and services to enhance the economic development environment, which will better support green high-quality development.

5.4 Speeding up the Progress of New Urbanization to Promote Green High-Quality Development

The construction of a new type of urbanization must rely on the solid foundation of the real economy, and industrial development is key to revitalizing the real economy. Promoting the coordinated progress of industrial development and the construction of new urbanization is conducive to the urbanization of the agricultural population, thereby improving the quality of urbanization and realizing the goal of new urbanization with people at its core. Presently, China’s economy is shifting to a stage of high-quality development; thus, transforming and upgrading the industrial structure is an important task for updating the country’s economic development mode. To this end, strategies might include taking full advantage of the opportunity to transform the industrial structure and attracting social capital to play a role in industrial planning, industrial cultivation, construction, operation, etc.

While ensuring the coordinated development of industries and new urbanization types through institutional mechanisms, it is also important to create new jobs and provide a sustained and stable driving force for new-type urbanization.

5.5 Improving the Level of Human Capital to Promote Green High-Quality Development

Human capital refers to a form of capital that is embodied in people, often defined as the sum of production knowledge, labor and management skills, and individuals’ health status. The relationship between human capital and economic development is complementary and mutually reinforcing. In general, a country’s level of economic development as a whole determines the level of investment in and accumulation of its human capital. Moreover, the status of human capital has a negative effect on all aspects of economic society. Therefore, we must reform training methods to support talented workers; in particular, it is important to improve the “production, study, and research” training approach so that workers can develop through a first-class learning and scientific research environment. The talent selection system must also be upgraded as workers’ innovation and creativity are fostered to the greatest extent. Finally, we must provide a first-class platform and sufficient policy support for workers to engage in entrepreneurship and innovation, fully contributing to economic and technological advancement.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author Contributions

LJ and SW contributed to the writing of this manuscript. HW and ZH contributed to the empirical study of this manuscript. AT contributed to the data collection of this manuscript. YW contributed to the revision of this manuscript.

Funding

This paper was supported by 2020 Suqian Science and Technology Planning Project (Social Development), “Research on Science and Technology Finance Boosting the Development of Science and Technology SMEs in Suqian under the Background of the Epidemic.”(S202005) This paper was supported by the mechanism and path of scientific and technological innovation to promote the integration of urban and rural areas in Anhui under the new development pattern of “dual circulation” (SK2021ZD0086). This paper was supported by the Jiangsu Blue Project.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The reviewers LL and JW declared a shared affiliation with the authors LJ, ZH, AT, and YW to the handling editor at the time of review.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1The western region includes Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, Sichuan, Chongqing, Yunnan, Guizhou, and Tibet. The central region includes Shanxi, Inner Mongolia, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan. The eastern region includes Liaoning, Beijing, Tianjin, Hebei, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, Guangxi, and Hainan.

References

Alam, M. M., and Murad, M. W. (2020). The Impacts of Economic Growth, Trade Openness and Technological Progress on Renewable Energy Use in Organization for Economic Co-operation and Development Countries. Renew. energy 145 (Jan.), 382–390. doi:10.1016/j.renene.2019.06.054

Ang, J. B. (2010). Research, Technological Change and Financial Liberalization in south korea. J. Macroecon. 32 (1), 457–468. doi:10.1016/j.jmacro.2009.06.002

Bei, J. (2018). Study on the “High-Quality Development” Economics. China Industrial Economics. China Ind. Econ. 1 (6), 5–18. doi:10.1108/cpe-10-2018-016

Berger, A. N. (2003). The Economic Effects of Technological Progress: Evidence from the Banking Industry. J. Money, Credit, Bank. 35 (2), 141–176. doi:10.1353/mcb.2003.0009

Bui, T. D., and Bui, H. (2020). Threshold Effect of Economic Openness on Bank Risk-Taking: Evidence from Emerging Markets. Econ. Model. 91 (11), 1–38. doi:10.1016/j.econmod.2019.11.013

Commission of the European Communication (2005). On the Review of the Sustainable Development Strategy-A Platform for Action”.

Dou, R. (2020). Research on the Construction and Measurement of Green High-Quality Development Evaluation Index System [D]. Beijing: Chinese Academy of Social Sciences.

Fang, H. (2010). Thoughts on the Theory, Practice and Policy of S&T Finance. Forum Sci. Technol. China 1 (11), 5–10. doi:10.13580/j.cnki.fstc.2010.11.017

Gong, R., and Zhang, T. (2021). Research on the Connotation and Measurement of Regional High-Quality Development—Empirical Analysis of Nine National Central Cities. J. Tech. Econ. Manag. 1 (01), 105–110.

Guo, Y., Wenbao, M., and Zhao, Y. (2015). Spatial Differentiation and Influencing Factors of Green Development Levels in Ningxia Counties. Econ. Geogr. 35 (03), 45–51. doi:10.15957/j.cnki.jjdl.2015.03.007

Hamari, J., Sjöklint, M., and Ukkonen, A. (2016). The Sharing Economy: Why People Participate in Collaborative Consumption. J. Assn Inf. Sci. Tec. 67 (9), 2047–2059. doi:10.1002/asi.23552

Han, J., Han, H., and Zhou, Q. (2018). A Research on the Economic Growth Effect,operation Mode and Risk Management Path of Science and Technology Financial Innovation. Sci. Manag. Res. 36 (03), 102–105. doi:10.19445/j.cnki.15-1103/g3.2018.03.027

He, L. (2018). In-depth Implementation of the New Development Concept to Promote the High-Quality Development of China's Economy. Macroecon. Manag. 04 (04), 4–5. doi:10.19709/j.cnki.11-3199/f.2018.04.003

Jenkins, V. (2002). Communication from the Commission: A Sustainable Europe for a Better World: A European Union Strategy for 'Sustainable Development'. J. Environ. Law 14 (2), 261–264. doi:10.1093/jel/14.2.261

Jiang, L., Wang, H., Tong, A., Hu, Z., Duan, H., Zhang, X., et al. (2020). The Measurement of Green Finance Development Index and its Poverty Reduction Effect: Dynamic Panel Analysis Based on Improved Entropy Method. Discrete Dyn. Nat. Soc. 12 (12), 1–16. doi:10.1155/2020/8851684

Kang, J. (2018). Mobile Payment in Fintech Environment: Trends, Security Challenges, and Services. Hum. Centric Comput. Inf. Sci. 8 (1), 1–16. doi:10.1186/s13673-018-0155-4

Kong, Q., Peng, D., Ni, Y., Jiang, X., and Wang, Z. (2021). Trade Openness and Economic Growth Quality of China: Empirical Analysis Using ARDL Model. Finance Res. Lett. 38, 101488. doi:10.1016/j.frl.2020.101488

Kou, M. (2018). Analysis of Knowledge Management Influence on Manufacturing Enterprise Performance. Stud. Sci. Sci. 36(12), 2170–2178. doi:10.16192/j.cnki.1003-2053.2018.12.014

Liu, Q. (2017). A Research on the Development Strategies of Science and Technology Finance in the New Normal Background. J. Nanchang Univ. Humanit. Soc. Sci. 48 (03), 79–86. doi:10.13764/j.cnki.ncds.2017.03.012

Liu, R., and Guo, T. (2020). Construction and Application of the High-Quality Development Index-Also on the High-Quality Development of Northeast China’s Economy. J. Northeast. Univ. Sci. 22 (01), 31–39. doi:10.15936/j.cnki.1008-3758.2020.01

Lu, B., Xing, M., and Yang, Q. (2019). Measurement and Spatio-Temporal Differences Analysis of High Quality Development Level of China's Economy. Statistics Decis. 35 (21), 113–117. doi:10.13546/j.cnki.tjyjc.2019.21.026

Meng, X., and Xing, M. (2018). Research on the HuBei High-Quality Development Comprehensive Evaluation under the Based on the Weighted Factor Analysis. J. Appl. Statistics Manag. 38 (04), 675–687. doi:10.13860/j.cnki.sltj.20190226-003

Neff, C. (2003). Corporate Finance, Innovation, and Strategic Competition. Berlin Heidelberg: Springer.

Pan, Y., and Luo, L. (2020). The Impact of Infr astr uctur e Investment on High- quality Economic Development: Mechanism and Heter ogeneity Research. Reform 14 (06), 100–113.

Raghupathi, V., and Raghupathi, W. (2019). Exploring Science-And-Technology-Led Innovation: a Cross-Country Study. J. Innovation Entrepreneursh. 8, 1–45. doi:10.1186/s13731-018-0097-0

Ren, B., and Li, Y. (2018). On the Construction of Chinese High-Quality Development Evaluation System and the Path of its Transformation in the New Era 47. J. Shaanxi Normal Univ. Soc. Sci. Ed. (03), 105–113. doi:10.15983/j.cnki.sxss.2018.0421

Roy, M. (2021). Sharing Economy and Sustainability. Sustain. Dev. Strateg., 167–188. doi:10.1016/b978-0-12-818920-7.00004-9

Statistics Netherlands (2011). Green Growth in the Netherlands. Available at https:ww. cbs. Nl/en-gb.

Sun, H., Edziah, B. K., Kporsu, A. K., Sarkodie, S. A., and Taghizadeh-Hesary, F. (2021). Energy Efficiency: the Role of Technological Innovation and Knowledge Spillover. Technol. Forecast. Soc. Change 167, 120659. doi:10.1016/j.techfore.2021.120659

Sun, H., Edziah, B. K., Sun, C., and Kporsu, A. K. (2019). Institutional Quality, Green Innovation and Energy Efficiency. Energy policy 135, 111002. doi:10.1016/j.enpol.2019.111002

Tadesse, S. (2006). Innovation, Information, and Financial Architecture. J. Financ. Quant. Anal. 41 (4), 753–786. doi:10.1017/s0022109000002635

Wang, J. (2015). Sci-Tech Progress Environment, Hi-Tech Industrialization, Sci-Tech Financial Benefit and Transformation of Economic Growth Mode. Sci. Technol. Manag. Res. 35 (14), 32–37. doi:10.3969/j.issn.1000-7695.2015.14.007

Wang, S., and Gu, S. (2021). Research on the Impact of S&T Finance on the High-Quality Development of Chinese Economy--Theoretical Analysis and Empirical Test. Economist 11 (02), 81–91. doi:10.16158/j.cnki.51-1312/f.2021.02

Xie, Y. (2014). Support of Technology Finance for Enterprise Innovation:taking Zhangjiang Shanghai Demonstration Zone as Example. J. Technol. Econ. 33 (02), 83–88.

Xing, M. (2018). Research on the Evaluation Index System of Green Economic Development in Yunnan Province" [J]. J. Southwest Univ. Nationalities" Humanit. Soc. Sci. Ed. 39 (12), 128–136.

Yang, J., Li, Q., and Xie, J. (2020). Evaluation Index System of Regional Science and Technology Finance Development: Analysis Based on Projection Pursuit Model. Sci. Technol. Manag. Res. 40 (06), 69–74. doi:10.3969/j.issn.1000-7695.2020.6.010

Yang, Y., and Zhang, P. (2021). Logic,Measurement and Governance in China's Green High-Quality Development. Econ. Res. J. (01), 26–42.

Zetzsche, D., Buckley, R., Arner, D., and Barberis, J. (2017). From Fintech to Techfin: the Regulatory Challenges of Data-Driven Finance. SSRN Electron. J. 06, 1–38. doi:10.2139/ssrn.2959925

Zhang, B., and Wang, Y. (2019). The Effect of Green Finance on Energy Sustainable Development: a Case Study in china. Emerg. Mark. Finance Trade 57, 1–20. doi:10.1080/1540496x.2019.1695595

Zhang, T., Gu, H., and Jahromi, M. F. (2018). What Makes the Sharing Economy Successful? an Empirical Examination of Competitive Customer Value Propositions. Comput. Hum. Behav. 95 (JUN), 275–283.

Zhou, J., Wu, C., Huang, H., and Long, Q. (2019). Evaluation of China's Inter-provincial High-Quality De-velopment Level Based on Factor Analysis—On the High-Quality Development Path of Jiangxi. Prices Mon. 14 (05), 82–89. doi:10.14076/j.issn.1006-2025.2019.05.14

Keywords: technology finance, entropy method, nonlinear spatial lag model, nonlinear spatial correlation, green high-quality development

Citation: Jiang L, Wang H, Wang S, Hu Z, Tong A and Wang Y (2022) The Spatial Correlation Between Green High-Quality Development and Technology Finance. Front. Environ. Sci. 10:888547. doi: 10.3389/fenvs.2022.888547

Received: 03 March 2022; Accepted: 19 April 2022;

Published: 20 May 2022.

Edited by:

Huaping Sun, Jiangsu University, ChinaReviewed by:

Guoqiang Wang, Xiamen University, ChinaJingzheng Wang, Suqian College, China

Lili Liang, Suqian College, China

Copyright © 2022 Jiang, Wang, Wang, Hu, Tong and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hui Wang, wanghui_0401@163.com; Shaowen Wang, 364550703@qq.com; Zhifei Hu, huzhifei86@126.com; Aihua Tong, tongaihua12@163.com; Yifeng Wang, wyf870403@163.com

Lili Jiang1

Lili Jiang1  Hui Wang

Hui Wang Yifeng Wang

Yifeng Wang