Nexus between government debt, economic policy uncertainty, government spending, and governmental effectiveness in BRIC nations: Evidence for linear and nonlinear assessments

- 1National Economics, School of Economics, Central University of Finance and Economics, Beijing, China

- 2School of Business and Economics, United International University, Dhaka, China

Quality institutions augment economic sustainability by ensuring domestic resource optimization with equitable development principles. Therefore, ensuring this equitable development and quality institutions is required. This study assessed the effects of government debt, uncertainty of economic policies, and government spending on institutional quality, as measured by governmental effectiveness in BRIC (Brazil, Russia, India, and China) nations from1990–2020. This study applied several econometrical techniques for empirical nexus assessment, including Augmented ARDL, nonlinear Autoregressive Distributed Lagged (ARDL), and Fourier Toda-Yamamoto causality tests. This study documented long-run cointegration in both symmetry and asymmetric assessments. In the long run, both government debt and uncertain economic policies were significantly negatively associated with institutional quality, while government spending and institutional quality were positively associated. Furthermore, the results of asymmetric ARDL revealed both long- and short-run asymmetric relationships between institutional quality and government debt, EPU, and government spending. The directional causality test documented bidirectional causality between debt and institutional quality in all nations, whereas mixed causalities were detected for uncertain economic policy, institutional quality, and government spending. Regarding policy, the results of this study suggested that economic stability was indispensable for efficient institutional quality in BRIC nations.

1 Introduction

Institutions play a vital role in economic sustainability and equitable development. Existing literature on economic development has shown that strong government institutions promote growth. Moreover, successful administrations eventually nurture and reward private-sector innovations and initiatives. Effective governments may make public expenditure choices that promote and drive economic growth. Reinhart and Rogoff (2011) stressed the vital need for good governance for development. The economic literature has increasingly converged over the past two decades on the need to build an effective institutional and legal framework to encourage development and support economic transitions and social changes. However, the recognition of the need for institutional reforms to ensure the sustainability of economic reforms and their long-awaited development is relatively recent, having originated from the fertile debate that arose in the aftermath of the emergence of weaknesses and criticalities embedded in the strategies and actions of international organisms and financial systems. These weaknesses and criticalities have become even more apparent in the aftermath of the recent financial crisis. Economists often relate development to resource availability and aggregated degree of efficiency. In essence, modern growth theory is a reaction to this assumption. In contrast to this vision, a new, not necessarily incompatible, point of view has emerged in recent decades. This viewpoint supports the relevance of normative frameworks and institutions in facilitating development. The institutional framework influences development by establishing incentives and penalties, influencing social behavior, and articulating collective action. Several empirical studies in recent years have supported this link between institutional quality and development and, albeit less clearly, the link between institutional quality and growth (Aron, 2000). The importance of institutional quality has been extensively investigated in literature based on assessments of time series (Qamruzzaman, 2022) and panel data, and have conclusively documented a positive nexus between institutional quality and development (Valeriani and Peluso, 2011; Qamruzzaman, 2021; Yang et al., 2021).

The present study considered government debt, economic policy uncertainty, government spending, financial development, and foreign direct investment to assess institutional quality. The economic availability of quality institutions supports sustainable development with the optimal use of economic resources; therefore, certain macro agents are critical for institutional progress. The recent debate over the government stimulus package has highlighted the lack of a consensus regarding the effects of government spending. While most approaches agree that increases in government spending lead to increased output and hours, they differ in their predictions concerning other key variables. Studies have suggested that government expenditure may have a cost-benefit trade-off (Dinh Thanh and Canh, 2019). Moreover, government spending effects on economic growth are expected to reverse (Hajamini and Falahi, 2018). Increases in the expenditure of small governments may have a beneficial crowding-in impact on economic growth and institutional development (Bahal et al., 2018). However, excessive government expenditure may deleteriously affect economic growth and government effectiveness (Kandil, 2017). Thus, an asymmetric association is assumed to exist between government spending and institutional quality. Literature on the nexus between financial development and institutional quality has examined the impact of institutional quality on financial development (Khan et al., 2020a; Khan et al., 2020b; Hunjra et al., 2020). Empirical studies have documented the deterministic role of an effective institutional presence in the economy in accelerating financial development by offering financial intermediation and efficiency. However, evidence is sparse regarding the role of financial development in ensuring better institutional quality in the economy.

The objective of this study was to investigate the effects of government debt, economic policy uncertainty, and government spending on institutional quality in BRICS between 1995 and 2020. The contributions of this study to the existing literature are as follows. First, the study examined the impact of government debt, economic policy uncertainty, and government spending on institutional quality in BRIC nations. To our knowledge, this is the first empirical investigation to evaluate the role of these factors on institutional quality. While previous studies have investigated these factors according to diverse economic phenomena, their potential impacts on institutional quality have not yet been reported. Second, to test our hypothesis, we performed both symmetric and asymmetric analyses using a linear and nonlinear framework, to reveal new and conclusive evidence in the assessment of empirical relationships. Third, this study considered governmental effectiveness as a proxy for institutional quality in examining the asymmetric impact of government debt, uncertain economic policy, and government spending. This empirical output may support the formulation of effective policy guidelines to improve government effectiveness by managing and mitigating government debt dependency, EPU, and government spending.

To conduct an in-depth analysis, this study considered the impact of government debt, economic policy uncertainty, and government spending on institutional quality among the BRIC (Brazil, Russia, India, and Chain) nations from 1995 to 2020. This study applied augmented ARDL, nonlinear linear ARDL, and Fourier TY causality tests. The results demonstrated that government debt dependency adversely affected institutional quality, especially in the long term. Furthermore, we observed both long- and short-run asymmetry between government debt and institutional quality. The linear ARDL estimation suggested a negative and statistically significant link between economic policy uncertainty and institutional quality, whereas government spending was a catalyst for institutional development.

The structure of this report is as follows: Section 2 describes the results of the literature review, while Section 3 describes the theoretical development and justification of the study. Section 4 includes the variable definitions and econometrical methodologies. Section 5 shows the empirical estimations and interpretations. Finally, Section 6 discusses the findings from Section 4 and provides our conclusions and policy suggestions.

2 Literature review

2.1 Effects of government debt

When a government cannot commit to future policy decisions, it must make a trade-off that considers debt (Kormendi, 1983; Elmendorf and Mankiw, 1999). While there is an incentive to raise debt and postpone taxes to remedy current injustices, inflation reduces the actual worth of nominal debt, providing an incentive to pay it off quickly. The combination of these two diametrically opposing impulses determines the long-term debt (Elmendorf and Gregory Mankiw, 1999; Martin, 2009). Optimally, governments should finance their expenditures to minimize losses from distortionary taxation. Some authors have emphasized that such losses might be substantially reduced through state-contingent capital levies on government debt: in bad times, the government defaults outright and/or engineers a debt devaluation through a price level increase (Kormendi, 1983; Alesina and Tabellini, 1990). However, real-world policy debates are not typically cast in such terms. Following the financial crisis of 2007/08, public debt surged in rich and developing countries. Governments acquired substantial debt; however, fiscal deficits are not sustainable (Afonso, 2005; Murshed et al., 2022). Rising debt ratios have generated concerns in economic institutions about fiscal sustainability and its influence on the global economy. While governments’ economic strategies have received attention, the relationship between governance quality and government debt has received less attention. Additionally, little research has been conducted on public debt and governance quality.

Studies have assessed the effect of corruption on public debt based on using either the World Governance Index (WGI) or the Corruption Perceptions Index (CPI) as explanatory variables (Cooray et al., 2017). Tarek and Ahmed (2017) analyze how governance quality influenced public debt in Middle Eastern and North African nations. Presbitero (2012) reported that the quality of institutions in low- and middle-income nations substantially affected debt accumulation. Similarly, Woo and Kumar (2015) established a link between fiscal policy, government institutions’ quality, and political and social stability.

A growing number of studies have assessed the critical role of government debt on economic growth (Baidoo et al., 2021; Yusuf and Mohd, 2021; Khan et al., 2022; Yang et al., 2022), fiscal policy, urban pollution (Qi et al., 2022), interest rates (Smith et al., 2022), and foreign direct investment (Zainuddin et al., 2021). Government debt may promote aggregate demand, resulting in near-term positive growth. However, governmental debt also inhibits private investment and, as a result, worsens economic performance in the long term (Elmendorf and Gregory Mankiw, 1999). Increased government debt may discourage investment by increasing long-term interest rates (Kumar and Baldacci, 2010). However, this is not the only way that high financial debt might affect long-run growth. While a deficit is required to fund public investments, worsening the fiscal balance in the face of massive public debt holdings is adverse to growth (Aizenman et al., 2007). In general, growing public debt stock is expected to result in future distortionary taxes or higher inflation to pay down the debt, thus reducing future potential growth. Consequently, growing public debt limits governments’ capacity to pursue countercyclical fiscal measures, resulting in higher volatility and slower growth. A government debt crisis might harm growth by causing banking or currency crises (Burnside et al., 2001; Hemming et al., 2003).

Waqas, et al. (2021) investigated the nexus between public debt and institutional quality in Pakistan from 1996–2018 based on OLS and quantile regression. They reported a negating linkage between government effectiveness and public debt, suggesting that inadequate national institutional quality poses a significant market risk, as it suggests the presence of a negative economic environment that contributes to increasing public debt.

2.1.1 Effects of uncertainty in economic policies

First, studies have investigated the impact of uncertain economic policy based on firm-level data (Kang et al., 2014; Wang et al., 2014; Li and Qiu, 2021; Yu et al., 2021; Feng et al., 2022; Lou et al., 2022). The EPU has various implications on capital investment and expenditure across various countries. Capital investment and corporate borrowing frequently fall sharply during policy uncertainty and financial crises (Kahle and Stulz, 2013). Uncertainty may negatively affect bank loans, leading to lower capital expenditures (Hu and Gong, 2019). EPU, overall, is detrimental to global capital investment. The banking industry further impedes foreign direct investment due to high policy risk and unpredictability. The EPU index was used by Gulen and Ion (Gulen and Ion, 2016) to analyze the influence of uncertainty on business choices. They reported an asymmetric connection between the EPU index and corporate capital investment. In that study, capital investment in the United States decreased 32% between 2007 and 2009 due to the global financial crisis. Businesses that rely significantly on government contracts or are particularly vulnerable to irreversible investments are more significantly affected. When economic policy and market swings are unclear, a country’s economy will have difficulty attracting consumers, company expenditures, and capital investments.

Second is the nexus between EPU and financial assistance pricing (Brogaard and Detzel, 2015)). For example, Ashraf and Shen (2019) investigated the nexus between long pricing and EPU in 17 countries between 1998 and 2012. The results showed that EPU positively affected the pricing of loan products. The interest rate for credit facilities increased due to uncertainties regarding government economic policies. Furthermore, Bloom (2014) reported that uncertainty often results in sluggish hiring and investment since businesses are typically fearful of making critical or expensive choices under unclear regulatory environments. Policy uncertainty may significantly increase risk premiums in different financial markets, raise borrowing costs, limit productivity, and delay employment growth, resulting in poor economic prospects (Brunnermeier, 2009; Gilchrist et al., 2017). Furthermore, Caggiano et al. (2017) reported that uncertainty more greatly influenced unemployment than previously believed and that EPU added to unemployment volatility, especially during recessions. The authors proposed that uncertainty shocks, rather than monetary policy shocks, accounted for a greater proportion of the unemployment increase during recessions.

Third, existing literature has suggested the impact of EPU on macro fundamentals, including economic growth, financial innovation, energy consumption, institutional quality, and stock market volatility (Ko and Lee, 2015; Liu and Zhang, 2015). Phan et al. (2020) investigated the role of EPU on financial stability in 23 countries. The study documented the adverse effects of EPU on financial stability, suggesting that financial instability is a key output of economic uncertainty. Caggiano et al. (2017) evaluated the state of unemployment due to EPU, reporting that established business cycle disruption due to uncertainties adversely affects job creation; alternatively, uncertainty regarding economic policy led to increased unemployment. Krol (2014) assessed the effect of EPU on exchange rate volatility in the US economy. They reported that price appreciation and depreciation relied heavily on the stability of the economic policy, especially in the long run. Qamruzzaman (2022) investigated the role of uncertainty in economic policy on institutional quality in India and Pakistan by applying linear and nonlinear frameworks to quarterly data. They reported that EPU adversely affected the institutional quality and observed an asymmetric relationship between EPU and IQ in both countries. These empirical findings suggested the need for stable macro fundamentals to ensure institutional quality.

2.1.2 Effects of government spending

Policymakers are split on whether expanding government helps or hinders economic growth. Supporters of the government claim that extending government programs increases the supply of important “public goods” such as education and infrastructure (Chowdhury, 1991; Goldsmith, 2008; Murshed et al., 2021). Furthermore, increased government expenditure may stimulate economic development by increasing the quantity of money in people’s wallets. The proponents of limited government take the opposite position, arguing that the government is too large and that growing expenditure slows economic progress by diverting resources away from the productive sector and transferring them to the government, where they are wasted (Jeong et al., 2020).

Furthermore, supporters of limited government warn that larger public sectors stymie attempts to adopt pro-growth policies like fundamental tax reform and personal retirement accounts as opponents may exploit budget deficits to argue against pro-growth proposals. The impact of government expenditure on growth has been extensively researched, with occasionally contradictory results (Hsieh and Lai, 1994; Lin, 1994; Plümper and Martin, 2003; Popescu and Diaconu, 2021). This applies to overall government spending, capital vs. consumer expenditures, and different government expenditure components. The effects of government spending often differ between industrialized and developing nations. Keefer and Knack (2007) reported that the quantity of government expenditure was inversely related to its productivity as a function of government quality. Governments with fewer resources may be unwilling to invest in public infrastructure, even if the investment is profitable. Ineffective and unscrupulous governments might squander large amounts of money that are not essential. Thus, public investment may be an insufficient predictor of productivity.

The trend of government spending has been guided by several key macro agents, including political institutions (Gabrini, 2010; Butkiewicz and Yanikkaya, 2011; Dizaji et al., 2016), tax management (Anderson et al., 1986; Patnaik and Yaji, 2018), government debt and others. Dizaji et al. (2016) postulated that democratic institutional aspects have negative attitudes regarding military spending by the government and positive effects regarding educational spending with the development of democratic institutions. The study further argued that an authoritarian government is more likely than a democratic one to increase military spending to safeguard its entrenched interests. A more democratic government, on the other hand, is more likely to devote resources to public goods like education, which boosts the pay premium for intelligent people in the private sector and raises their prospects of progression. Other studies have reported the opposite findings; that is, neutral effects. For example, Gabrini (2010) investigated the role of institutions on government spending in a larger sample of smaller US cities. reporting that the institutional framework neither induced government spending nor guided the restraint of unproductive investments.

2.2 Limitations of the existing literature

The existing literature focuses on the nexus between institutional quality and macro fundaments. While many researchers have investigated the key determinants for institutional quality, little attention has been paid to assessing the role of government debt, uncertainty regarding economic policy, and government spending in institutional quality in the economy. Existing literature has advocated the critical role of institutional quality in government reliance on debt for economic growth because a higher degree of debt propensity might jeopardize the overall economic sustainability. Thus, the government’s attitudes toward debt acquisition could affect the institutional development of the economy.

Second, the impact of EPU has been extensively investigated by considering both macro and micro fundamentals. Recent literature has advocated policy formulation without acknowledging that the EPU might produce a biased and unrealistic approach to managing economic phenomena. Furthermore, institutional quality has been placed in an apex position for achieving economic sustainably; therefore, the determinants of IQ demand persistent and continual investigations to explore the role of IQ with an effective term. However, the terms of EPU’s impact on institutional quality have not yet been extensively investigated; thus, the existing research gap can be managed with fresh evidence and policy suggestions.

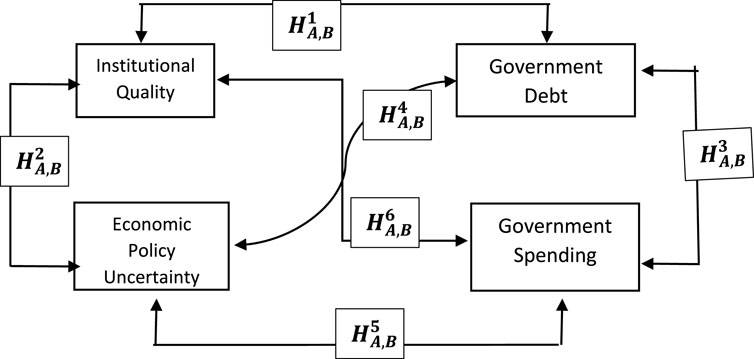

2.2.1 Conceptual and hypotheses model for hypothesis testing

With a focus on institutional quality, the existing literature has suggested two lines of findings. First, some studies have investigated the role of institutional quality on macro agents such as economic growth, trade openness, remittances, financial development, inequality, energy consumption, and others. Second, other studies have identified several determinants of institutional quality. The present study aimed to gauge the impact of government debt, uncertainty regarding economic policy, and government spending on institutional quality in BRIC. Based on these aims, we propose the following conceptual model (Figure 1) for understanding and hypothesis development.

The following hypothesis was tested to evaluate the directional causalities.

3 Study variable definitions and methodology

3.1 Model specification

This study assessed the period’s role of government debt, EPU, government spending, financial development, and FDI on institutional quality BRIC nations. According to the existing literature, we reported the generalized relationships as follows:

-All variables were then transformed into natural logarithms to decrease the non-normality of the research units (Andriamahery and Qamruzzaman, 2022; Xia et al., 2022). Equation 1 was then reproduced with an econometric form for empirical estimation.

Where IQ stands for institutional quality, DEBT for government debt, EPU for economic policy uncertainty, GS for government spending, FDI for foreign direct investment, and FD for financial development. The long-run coefficients are indicated by the value of

3.2 Estimation strategy

3.2.1 Unit root test

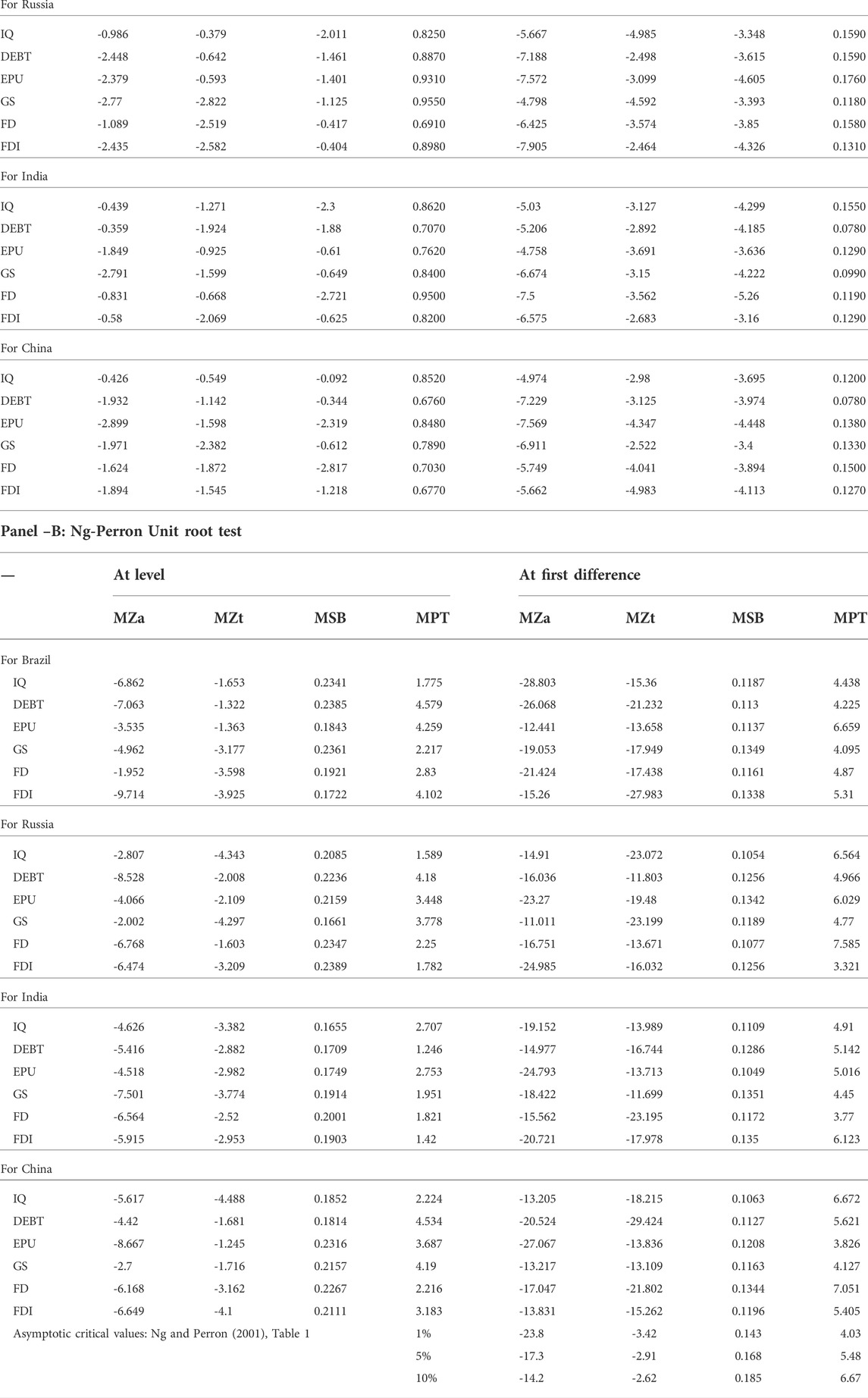

An appropriate econometric techniques section is guided by the selection of research variables and their inherent properties; thus, the stationary test has become one pre-assessment technique applied in the literature. We considered several unit root tests following the ADF test described by Dickey and Fuller (1979), the P-P test proposed by Phillips and Perron (1988), the GF-DLS test following Elliott et al. (1996), and the KPSS test introduced by Kwiatkowski et al. (1992). We also performed the unit root test described by Ng and Perron (2001). The results of the unit root tests are shown in Table 3.

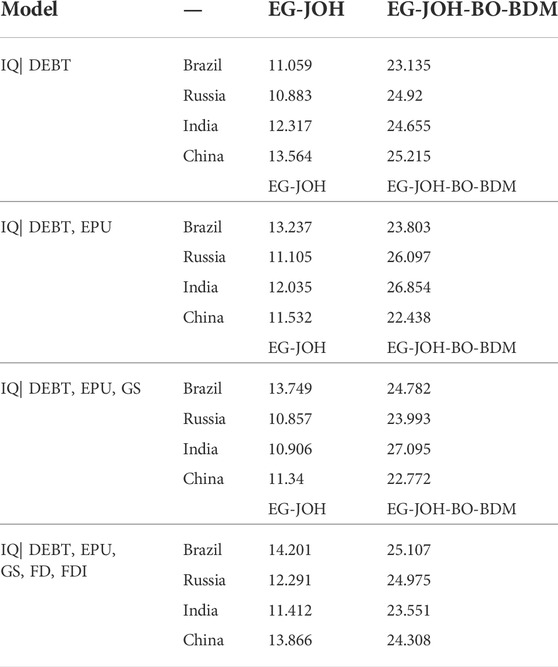

3.2.2 Bayer-Hacked combined cointegration test

This study implemented the cointegration test according to the framework proposed by Bayer and Hanck (2013), commonly known as the combined cointegration test. The proposed cointegration test comprises four conventional tests proposed by Banerjee et al. (1998), Peter Boswijk (1994), Johansen (1991), and Engle and Granger (1987) with the null hypothesis of a no-cointegration test. The following Fishers’ equation is considered in deriving the test statistics for detecting long-run associations.

where PBDM, PBO, PJOH, and PEG represent the significance levels defined by Banerjee et al. (1998), Boswijk (1995), Johansen (1991), and Engle and Granger (1987), respectively.

3.3 Autoregressive distributed lagged

Long-run associations in empirical literature have been implemented using several conventional cointegration tests such as those described by Engle and Granger (1987), Johansen (1998), and Johansen and Juselius (1990); the proposed cointegration test requires the unique order of integration of the research variables, suggesting that the mixed order of integration of I (0) or I (1) are not applicable. To address the limitations of conventional cointegration tests, Pesaran et al., (2001) have described a cointegration test with a mixed order of variable integration commonly known as the autoregressive distributed lagged (ARDL). The ARDL approach has been extensively used in empirical studies investigating long-run associations (Qamruzzaman and Jianguo, 2018; Qamruzzaman and Karim, 2020a; Qamruzzaman and Karim, 2020b; Qamruzzaman et al., 2020). ARDL estimation provides certain benefits over traditional cointegration tests, including (1) efficient estimation regardless of the study’s sample size (Ghatak and Siddiki, 2001; Rehman et al., 2021; Li and Qamruzzaman, 2022; Qamruzzaman, 2022; Xia et al., 2022), (2) mixed-order variable integration and model stability and efficiency by the selection of appropriate lagged specifications (Pesaran et al., 2001; Faruqui et al., 2015; Ferdousi and Qamruzzaman, 2017; Ahmad et al., 2022), and (3) unbiased estimation for both long-run and short-run elasticity (Banerjee et al., 1993). For hypothesis, please see Table 2.

Following Pesaran et al., (2001), this study considered a generalized ADRL model to detect both long-run and short-run coefficients according to the following equation

where ∆ indicates differences in variables, while is the error term (white noise), and (t-1) is for the lagged period, is the long-run coefficient. Based on linear ARDL 11, the long-run coefficient range from

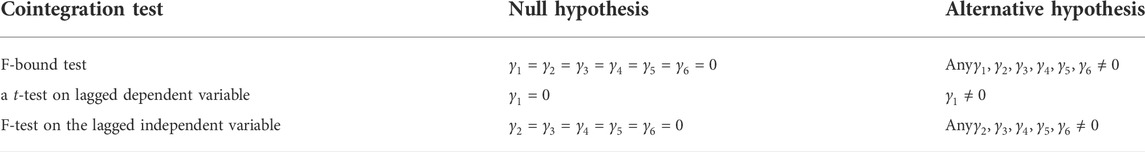

According to Pesaran et al., (2001) and Pesaran et al., (1999), the bound testing approach in the ARDL are F-statistics established to determine the combined significance of the coefficients on the level. For the lagged dependent variables, the second test is a t-test. Under the null hypothesis, the statistics show a nonstandard distribution because no level connection exists regardless of whether the regressors are I (0) or I. (1). However, reporting the F-test statistic for the overall test and the t-test statistic for a delayed dependent variable is inadequate for the ARDL test. To avoid the degenerate case, McNown et al., (2018) suggested a second t-test or F-test on the lagged independent variables in addition to the ARDL test used by Pesaran et al., (2001). All three criteria were required to differentiate between cointegration and degenerate instances.

Pesaran et al., (2001) and Sam et al., (2019) presented two sets of asymptotic critical values, one for I (1) regressors and another for I (0) regressors. If the F-test statistic’s value was less than the lower bound critical value or the t-test statistic’s absolute value was less than the absolute lower bound critical value, the null hypothesis of “no long-run connection” could not be rejected. This indicated that there was no long-run connection between the variables. By contrast, if the F-test statistic’s value exceeded the upper limit critical value or the t-test statistic’s absolute value exceeded the upper bound critical value, the null hypothesis may be rejected (Meng et al., 2021; Miao and Qamruzzaman, 2021; Zhang et al., 2021). This indicated the presence of long-run connections between the variables. Finally, if the test statistic’s value was neither less than nor higher than the two critical values, indicating that the value lay between the two critical values, the conclusion regarding the long-run associations between the variables was ambiguous (Qamruzzaman and Ferdaous, 2014; Qamruzzaman, 2015; Qamruzzaman and Ferdaous, 2015; Qamruzzaman and Jianguo, 2017).

This study implemented the following equation with error correction terms to capture the short-run dynamics.

We used a variety of diagnostic tests. First, we used the Harvey test to assess the heteroscedasticity of the residuals of the enhanced ARDL model. Second, we used the Breusch-Godfrey Serial Correlation LM test to determine whether the residuals were serially correlated. Third, we utilized the Ramsey RESET test as a model specification test. Fourth, we used the Jarque-Bera normality test to determine the normality of the model residuals. Finally, we checked for model stability using the cumulative sum (CUSUM) and CUSUM of square tests.

3.4 Nonlinear ARDL

This study considered a nonlinear framework as described by Shin et al., (2014) for empirical assessment to identify the asymmetric impact of economic policy uncertainty and financial inclusion on remittances. To gauge the asymmetric effects of DEBT, EPU, and GS on IQ, we implemented the following generalized equation:

where

The equation was then transformed for asymmetric long-run and short-run coefficient assessments as follows:

A standard Wald test with a null symmetry hypothesis was implemented to detect long- and short-run asymmetries (Adebayo et al., 2022a). Only insignificant test statistics confirmed the asymmetric association in the long and short run. Furthermore, the asymmetric long-run cointegration was assessed by F-bound, Joint Primality, and tBDM tests, in which higher test statistic values relative to the critical values confirmed asymmetric cointegration in the empirical model.

The error correction term of the above equation was as follows

3.5 Asymmetric Fourier causality test

Researchers often apply the Granger (1969) causality test to examine the causal relationships between macroeconomic variables. However, this test ignores structural discontinuities in the series; moreover, other causality tests, including those proposed by Toda and Yamamoto (1995), Enders and Jones, (2016), and Adebayo et al. (2022b) also could not account for structural breaks, leading to misspecification issues in the VAR model. Thus, deviations toward the erroneous rejection of the genuine null hypothesis occur. The Fourier TY causality tests were developed by Nazlioglu et al., (2016) to compensate for this omission with the extension of the trigonometric term. Therefore, the VAR model can be reproduced as follows:

where

where k refers to the frequency, t denotes the time trend, T indicates the number of observations, and %_ and %_ represent the frequency amplitude and displacement. The null hypothesis for Fourier–TY test assumed no causality between variables:

4 Empirical model estimation and interpretation

4.1 Unit root test

In the existing literature, selecting an appropriate econometrical model relies on the properties of the variables; thus, before implementing the target model, we performed stationary tests of the variables used in the ADF, GF-DLS, PP, and KPSS tests. The results of these stationary tests are shown in Table 3. Regarding the test statistics, all variables were stationary in mixed order; that is, stationary either at a level I (0) and/or after the first difference I (1); neither variable was exposed to stationary after the second difference I (2), which is desirable in implementing the Autoregressive Distributed lagged model. The results of the unit root tests ( Panel–B) performed as described by Ng and Perron, (2001) revealed that all test statistics (i.e., MZa, MZt, MSB, and MPT) were statistically significant at a 1% level of significance after the first difference. Thus, the verdict of stationary properties was valid for all country estimations.

4.2 Cointegration test

Next, we implemented a cointegration test widely known as the combined cointegration test, as proposed by Bayer and Hanck (2013). Table 4 shows the results of these tests, in which all test statistics are statistically significant at a 1% level of significance. The results also showed the long-run associations between institutional quality, government debt, government spending, financial development, and foreign direct investment in the BRIC nations. We then assessed the magnitudes of government spending, economic policy uncertainty, government spending, financial development, and FDI on institutional quality.

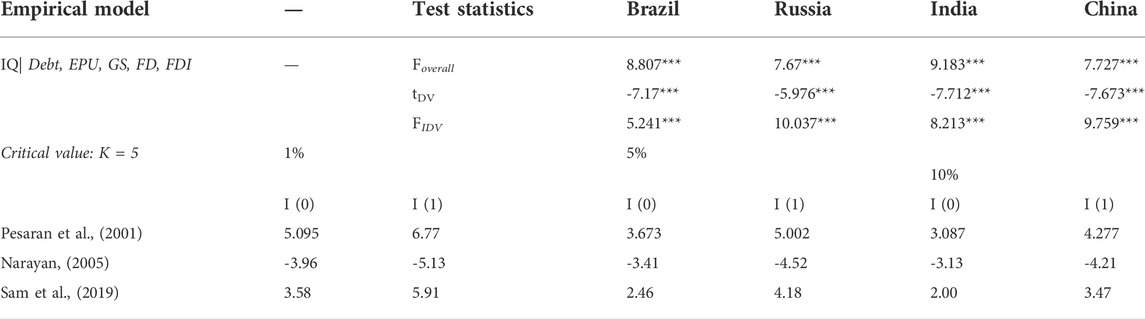

4.3 Auto-regressive distributed lagged test

This section addresses the empirical model estimation with Augmented ARDL, as described by Sam et al., (2019). The results of long-run cointegration according to Pesaran et al. (2001), Narayan (2005), and Sam et al. (2019) are shown in Table 5. All test statistics (Foverall, tDV, and FIDV) used to assess the long-run association between institutional quality, government debt, economic policy uncertainty, government spending, financial development and FDI in BRIC nations were statistically significant at a 1% level, suggesting a long-run association between the target variables.

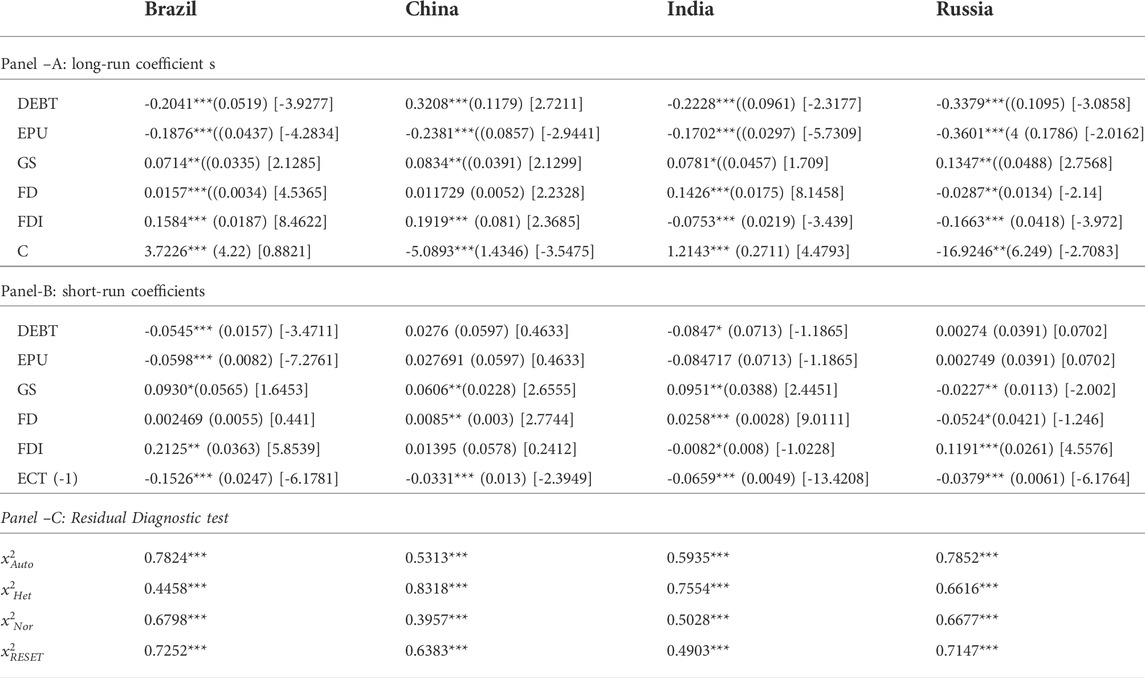

The long-run and short-run coefficients are displayed in Table 6, where panels–A and –B show the long- and short-run coefficients, respectively, and panel–C shows the residual diagnostic test results.

Regarding the nexus between government debt and institutional quality, in the long run, this study showed a significant negative association, suggesting that government reliance on debt adversely influenced institutional development. The existing literature supports our study findings see, for instance, Waqas et al., (2021) and Brady and Magazzino, (2018); more precisely, a 10% growth in government debt capacity reduced the institutional quality by 2.04% in Brazil, 3.20% in China, 2.22% in India, and 3.37% in Russia. The short-run analysis showed significant negative coefficients of government debt in Brazil (-0.054546) and India (-0.084717) and positive coefficients in Russia (0.027691) and China (0.00274). Considering the elasticity of government debt, even in the short run, the mixed effects can be observed in the development of institutional quality in the BRIC nations, whereas in the long run, the detrimental effects prevailed in all economies. Therefore, these results suggested that a propensity for external debt should be discouraged and that governments should be very particular in receiving foreign debt for economic progress as several studies have documented a negative connection between government debt and economic growth (Checherita-Westphal and Rother, 2012; Pegkas, 2018; Yusuf and Mohd, 2021; Cao et al., 2022).

We observed significant negative associations between economic policy uncertainty and institutional quality in Brazil (coefficient: −0.1876), China (−0.2380), India (−0.17020), and Russia (−0.3601). These findings suggested that economic stability is necessary for institutional development. In the short-run, the results showed that EPU adversely influenced institutional quality in Brazil (coefficient: −0.05981) and India (−0.084717) but had a positive influence in China (0.027691) and Russia (0.002749). Based on these empirical findings, we postulated that economic stability; that is, fiscal and monetary policy consistencies, allows increased governmental effectiveness. Macro instability indicates an aggregate economic imbalance resulting in the ineffectiveness of institutional activities in the economy. Furthermore, institutional development is also guided by economic sustainability, which is adversely affected by economic policy uncertainties (Zakari and Khan, 2021). Therefore, managed and stable economic policies tend to positively increase overall economic aspects, including institutional development (Arvin et al., 2021).

In the long run, the nexus between government spending and institutional quality showed significant positive linkages in Brazil (coefficient: 0.071495), China (0.083418), India (0.078169), and Russia (0.13477). In the short run, the empirical output showed a similar line of association, although the coefficient elasticities were more obvious in the long run compared to the short run. These findings suggested that government spending should be in the channel of higher productivity to ensure an established efficient and effective institutional framework.

4.4 Asymmetric ARDL assessment

The asymmetric nexus between government debt, EPU, government spending, and institutional quality were investigated according to the nonlinear framework proposed by Shin, Yu, and Greenwood-Nimmo (Shin et al., 2014). The asymmetric magnitudes of DEBT, EPU, and GS were observed in both the long- and short-run by executing the empirical equation. The results of the asymmetric estimation are displayed in Table 7, which includes the asymmetric cointegration test results in Panel–A, the asymmetric long-run coefficients in Panel–B, the short-run coefficients in Panel–C, and the residual and symmetry test results in Panel–D. The asymmetric cointegration test results in Panel–A indicated that all test statistics from the standard Wald tests were statistically significant at a 1% level of significance, which was valid for all four country assessments. These findings suggest the asymmetric long-run cointegration between DEBT, EPU, GS, and institutional quality. We then assessed the asymmetric coefficients in both the long- and short-run.

Asymmetric shocks showing positive (negative) variation in DEBT on institutional quality demonstrated significant negative relationships in Russia (coefficient: −0.156285 (−0.190056)), China (−0.125943 (−0.095413)), India (−0.278158 (−0.14584)), and Russia (−0.077128 (−0.093618)). These findings suggested that a higher degree of debt reliance by the government negatively affected institutional development. However, economic growth with domestic capital investment and less government tendency to accept foreign created favored institutional development. In the short-run, the results showed mixed interconnections, with a negative linkage in Brazil (coefficient: −0.051972 (−0.041637)) and positive associations between debt and institutional quality in China (0.064217 (0.07551), India (0.074993 (0.088865)), and Russia (0.015347 (0.067766)).

Regarding the asymmetric effects of EPU on institutional quality, this study observed a significant negative linkage between positive (negative) shocks on institutional quality in BRIC nations. More precisely, a 10% positive (negative) variation resulted in decreases (increases) of the institutional quality by 1.92% (1.318%) in Brazil, 0.652% (0.701%) in China, 1.378% (1.529%) in India, and 0.705% (0.921%) in Russia. Furthermore, the asymmetric shocks of EPU showed exposed mixed effects on institutional quality in the short run. Positive (negative) shocks of EPU demonstrated a negative (positive) linkage with institutional quality in Brazil. In China, asymmetric shocks showed a positive (positive) connection with institutional quality. In India, asymmetric shocks showed a negative (negative) association. Finally, in Russia, asymmetric shocks showed a negative (negative) association with institutional quality. Based on the coefficient magnitudes, EPU significantly impacted institutional quality in the long run compared to the short run. These findings suggested that economic policy uncertainty created discomfort among the Marco agents in the economy, adversely affecting institutional development. Thus, stability in monetary and fiscal policies are required for institutional improvement in the economy.

Asymmetric assessment of government spending on institutional quality revealed significant positive associations, suggesting that government spending induces institutional development in the economy. More specifically, 10% positive (negative) variations resulted in increased (decreased) institutional growth by 1.66% (0.648%) in Brazil, 0.743% (0.801%) in China, 1.675% (0.975%) in India, and 1.23% (1.201%) in Russia. The results of the present study revealed diverse associations between positive (negative) government spending shocks and institutional quality in the short run. In particular, a 10% innovation in government led to a 0.452% decline in institutional development, while a reduction in government spending decreased the growth by 0.144% in Brazil. In China, a 10% innovation in government led to a 0.292% decrease in institutional development, while a reduction in government spending decreased the growth by 0.642%. In India, a 10% variation in government spending resulted in a 0.963% (0.749%) increase (decrease) in institutional quality. In Russia, a 10% increase in government spending decreased the institutional quality by 1.81%, while a reduction in spending increased institutional development by 0.957%.

The results of symmetry tests with a null hypothesis of symmetrical association in both the long- and short-run using the standard Wald test are shown in Panel–D. The test statistics of long-run (Wlr) and short-run (Wsr), the null hypothesis were rejected, suggesting the asymmetric effects running from government debt, economic policy uncertainty, and government spending to institutional quality in BRIC nations in the long- and short-run. The residual diagnostic test results suggested that the estimation models were free from serial correlation, had no issues with heteroskedasticity, and were internally robust for efficient estimation. Furthermore, the residual terms were normally distributed.

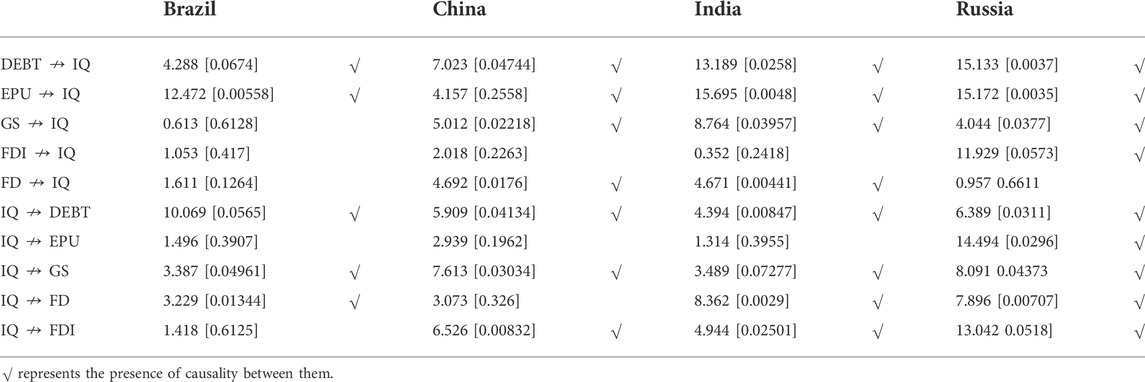

The results of the investigation of the possible directional causality tests by implementing the Fourier TY causality test are displayed in Table 8. The results revealed bidirectional causality between government debt and institutional quality [DEBT←→IQ] in all four BRIC nations. Thus, an economic inclination to external debt influences governmental effectiveness and vice-verse, implying that a strong institutional framework can play a decisive role in government external debt acquisition and ensuring domestic resources optimization for sustainable economic growth. Moreover, bidirectional causality was observed between economic policy uncertainty and institutional quality [EPU←→EPU] in Russia, while unidirectional causality (EPU → IQ) was observed in Brazil, India, and China. Regarding causality between government spending and institutional quality, we observed bidirectional causality [GS←→IQ] in India, China, and Russia and unidirectional causality in Brazil.

5 Discussion

External debt or government debt reliance on macro fundamentals has been investigated extensively, particularly on economic growth (Checherita-Westphal and Rother, 2012; Pegkas, 2018; Yusuf and Mohd, 2021). Moreover, the role of institutional quality on economic growth has attracted research interest (Hassan et al., 2019; Nair et al., 2021; Ahmed et al., 2022). Considering the existing evidence, especially the critical role of government debt and institutional quality on economic growth, it is assumed that the possible linkages can be observed in either direction. Empirical estimation of the relationship of government debt on institutional quality showed a negative linkage in BRIC nations, suggesting that a high degree of government external debt acquisition compromises the institutional development of the economy. More precisely, 1% additional government debt degraded the institutional quality by 0.204% in Brazil, 0.320% in China, 0.222% in India, and 0.337% in Russia. Optimistically, government debt has become a common occurrence globally. The 2008–2009 financial crisis resulted in a massive increase in global government debt. During economic downturns, the budget deficit increases, forcing governments to borrow money from domestic and international markets, as demonstrated in both developing and developed nations. Significant growth in government debt may also have a detrimental effect on a country’s economy. Reinhart et al., (2012) postulated that in the long term, high debt accumulations might result in decreased economic activity, either by discouraging private capital investment or by demanding a rise in distortionary taxes and a reduction in government expenditure to maintain repayment status.

Uncertainty regarding economic policy has been a frequent subject of discussion in recent years. These arguments are primarily concerned with determining the impact of this uncertainty on economic actors in both real and financial sectors. Uncertainty regarding future changes in the government’s fiscal, monetary, and regulatory policies is referred to as “policy ambiguity” in economic policy uncertainty (EPU) (Baker et al., 2016). An EPU may occur if there are unanticipated changes in current government policy (Ashraf and Shen, 2019; Ng et al., 2020). According to empirical output, economic policy can play a detrimental role in governmental effectiveness, implying a negative association between these factors in BRIC nations, which has been supported by evidence in existing literature (Qamruzzaman, 2022). More precisely, a 1% increase in EPU in BRIC nations can result in a reduction in the institutional quality by a coefficient of -0.1876% in Brazil, -0.2380% in China, -0.1702% in India, and -0.3601% in Russia. Ozili, (2021) reported that increased EPU led to pain for financial institutions since the cumulative repercussions of nonperforming loans increase with increasing EPU degree. EPU negatively impacts families and individuals that rely on the services and products provided by financial institutions. Because of families’ reluctance to save and invest, financial institutions face challenges in the long term as a higher level of EPU disincentives individuals and families, especially those involved in unbanked pollution, which often includes the formal financial sector.

Continual institutional development persistently seeks government support to effectively integrate institutional frameworks in the economic process. The existing literature has demonstrated that government spending on current expenditures (sometimes called government consumption expenditures) may negatively impact economic development in some countries. While government spending negatively affects development in countries with inefficient governments, it has no effect in countries with well-functioning governments. Second, capital expenditures boost economic development in developing countries, even those with weak governments. Thus, the growth effect of government expenditure in developing countries is strongly influenced by government performance. Like other investment forms, public spending may produce declining returns with time. For instance, consider road construction, which can provide significant economic advantages to a developing country. A new road in a developed country may have a very low marginal product as roads are normally constructed to relieve current traffic congestion or prepare for future traffic congestion rather than expand the system. This “constant returns to scale” investment is unlikely to have a noticeable aggregate empirical growth impact since it preserves the current public-private capital ratio. Furthermore, construction expenses might be “pork barrel” or spending for roads that go nowhere. Good government institutions are more likely to reduce such “pork barrel” spending compared to bad government organizations. Weak governments may benefit from such spending. Thus, depending on government efficacy, public investment such as road construction may have very different effects.

6 Conclusion and policy recommendation

Government effectiveness has emerged in the literature as a catalytic factor associated with sustainable economic progress regardless of the state of economic structure and performance. Good governance exhibits an effective and efficient institution in the economy characterized by efficient reallocation of domestic resources and productivity optimization. Therefore, the development of quality institutions has attracted research attention and studies have assessed the impact of institutional quality on the economy and the key factors critically important for institutional quality. The present study aimed to assess the effects of government debt, uncertainty regarding economic policy, and government spending on institutional quality, as measured by governmental effectiveness, in BRIC nations from 1995–2020. This study applied Augmented ARDL, Nonlinear ARDL, and Fourier TY causality tests. The key study findings are as follows:

First, the results of the Bayer-Hacked Combined Cointegration tests showed long-run associations between government debt, EPU, government spending, and institutional quality. Furthermore, the cointegration test with AARDL showed similar results. The results of the nonlinear ARDL showed an asymmetric long-run association in the empirical model.

Second, the augmented ADRL model estimation showed a negative and statistically significant association between government debt and institutional quality in both the long and short run. These findings suggested that excessive government debt acquisition for economic progress could jeopardize institutional development. The coefficient of EPU was significantly negatively correlated with institutional quality in BRIC nations, indicating macro and micro fundamental appropriate behaviors crucial for institutional effectiveness. Thus, fiscal and monetary policy formulations must align with economic agents to ensure economic stability for institutional growth. Government spending was beneficial to institutional development, indicating that government spending ensured infrastructural and equitable economic development, which efficiently leads to institutional performance.

Third, asymmetric estimation showed long-run and short-run asymmetrical relationships between government debt, EPU, government spending, and institutional quality in BRIC. Regarding the asymmetric effects of government debt and EPU on institutional quality, we observed a negative and statistically significant link, suggesting that increased (decreased) government debt and EPU results in institutional quality deterioration (improvement). Regarding the coefficient magnitudes, the positive effects of government debt and EPU were more intense than those of negative innovation. We demonstrated a positive and statistically significant association between government spending and institutional quality, suggesting that government expenditure boosts economic activities, eventually augmenting institutional development.

Fourth, our study findings revealed bidirectional causality between government debt and institutional quality [DEBT←→IQ] in all four BRIC nations. Bidirectional causality was also observed between economic policy uncertainty and institutional quality [EPU←→EPU] in Russia, while unidirectional causality from EPU → IQ was observed in Brazil, India, and China. We also observed bidirectional causality between government spending and institutional quality [GS←→IQ] in India, China, and Russia, and unidirectional causality in Brazil.

Based on these findings, we developed the following policy recommendations for further institutional development in BRIC nations.

1) The accumulation of government debt has beneficial and distinctive impacts on the economy; however, a heavy reliance on external debt leads to increased economic vulnerability at the cost of institutional destruction. Therefore, we suggest the establishment of an optimal debt proposition by ensuring the optimal reallocation of domestic resources by acquiring external debt for economic progress.

2) Uncertainty in economic events cause both economic and financial turmoil; therefore, the economy must formulate and implement fiscal and monetary policies appropriately aligned with key macro agents to manage economic and cyclical variations.

3) Government spending productively boosts economic activities and channelizes resource circulation in the economy. The money flows in the economy such that government spending allows for a higher degree of economic activities, eventually encouraging better institutions to ensure institutional development.

As is inherent in empirical studies, this study has several limitations. First, global economic and financial integration has played a critical role in macroeconomic development; therefore, it is assumed that globalization may also affect institutional quality. Future studies are needed that consider globalization in the proposed model. Second, the issue of structural break has gained momentum, especially in time series data assessment; thus, future studies should include these issues in further empirical development.

Data availability statement

This study analyzed publicly available datasets. These data can be found here: world development indicator.

Author contributions

RM: introduction: methodology; discussion: first manuscript draft and final preparation. MQ: literature survey; methodology; model estimation; final preparation.

Funding

This study received the financial support from the Institute for Advanced Research (IAR), United International Universiti (UIU) (Grant Ref. No. IAR/2022/Pub/021).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adebayo, T. S., Abdul Kareem, H. K. K., Bilal, Kirikkaleli, D., Shah, M. I., and Abbas, S. (2022). CO2 behavior amidst the COVID-19 pandemic in the United Kingdom: The role of renewable and non-renewable energy development. Renew. Energy 189, 492–501. doi:10.1016/j.renene.2022.02.111

Adebayo, T. S., Oladipupo, S. D., Kirikkaleli, D., and Adeshola, I. (2022). Asymmetric nexus between technological innovation and environmental degradation in Sweden: An aggregated and disaggregated analysis. Environ. Sci. Pollut. Res. 29, 36547–36564. doi:10.1007/s11356-021-17982-6

Afonso, A. (2005). Fiscal sustainability: The unpleasant European case. Finanz./Public Finance Anal. 61, 19–44. doi:10.1628/0015221053722532

Ahmad, M., Jabeen, G., Shah, S. A. A., Rehman, A., Ahmad, F., and Işik, C. (2022). Assessing long- and short-run dynamic interplay among balance of trade, aggregate economic output, real exchange rate, and CO2 emissions in Pakistan. Environ. Dev. Sustain. 24, 7283–7323. doi:10.1007/s10668-021-01747-9

Ahmed, F., Kousar, S., Pervaiz, A., and Shabbir, A. (2022). Do institutional quality and financial development affect sustainable economic growth? Evidence from South asian countries. Borsa Istanb. Rev. 22, 189–196. doi:10.1016/j.bir.2021.03.005

Aizenman, J., Kletzer, K., and Pinto, B. (2007). Economic growth with constraints on tax revenues and public debt: Implications for fiscal policy and cross-country differences. Santa Cruz, CA: Department of Economics, UCSC.

Alesina, A., and Tabellini, G. A. (1990). A positive theory of fiscal deficits and government debt. Rev. Econ. Stud. 57, 403–414. doi:10.2307/2298021

Ali, M., Nazir, M. I., Hashmi, S. H., and Ullah, W. (2022). Financial inclusion, institutional quality and financial development: Empirical evidence from oic countries. Singap. Econ. Rev. 67, 161–188. doi:10.1142/s0217590820420084

Anderson, W., Wallace, M. S., and Warner, J. T. (1986). Government spending and taxation what causes what? South. Econ. J. 52, 630–639. doi:10.2307/1059262

Andriamahery, A., and Qamruzzaman, M. (2022). A symmetry and asymmetry investigation of the nexus between environmental sustainability, renewable energy, energy innovation, and trade: Evidence from environmental kuznets curve hypothesis in selected MENA countries. Front. Energy Res. 9. doi:10.3389/fenrg.2021.778202

Arvin, M. B., Pradhan, R. P., and Nair, M. S. (2021). Are there links between institutional quality, government expenditure, tax revenue and economic growth? Evidence from low-income and lower middle-income countries. Econ. Analysis Policy 70, 468–489. doi:10.1016/j.eap.2021.03.011

Ashraf, B. N., and Shen, Y. (2019). Economic policy uncertainty and banks’ loan pricing. J. Financial Stab. 44, 100695. doi:10.1016/j.jfs.2019.100695

Bahal, G., Raissi, M., and Tulin, V. (2018). Crowding-out or crowding-in? Public and private investment in India. World Dev. 109, 323–333. doi:10.1016/j.worlddev.2018.05.004

Baidoo, S. T., Duodu, E., Kwarteng, E., Boatemaa, G., Opoku, L., Antwi, A., et al. (2021). Does government debt promote economic growth? New empirical evidence from Ghana. Int. J. Public Sect. Perform. Manag. 7, 192–216. doi:10.1504/ijpspm.2021.114040

Banerjee, A., Dolado, J. J., Galbraith, J. W., and Hendry, D. (1993). Co-integration, error correction, and the econometric analysis of non-stationary data. Econ. J. 106, 439. doi:10.1093/0198288107.001.0001

Banerjee, A., Dolado, J., and Mestre, R. (1998). Error-correction mechanism tests for cointegration in a single-equation framework. J. Time Ser. Anal. 19, 267–283. doi:10.1111/1467-9892.00091

Bayer, C., and Hanck, C. (2013). Combining non-cointegration tests. J. Time Ser. Anal. 34, 83–95. doi:10.1111/j.1467-9892.2012.00814.x

Bloom, N. (2014). Fluctuations in uncertainty. J. Econ. Perspect. 28, 153–176. doi:10.1257/jep.28.2.153

Brady, G. L., and Magazzino, C. (2018). Government debt in EMU countries. J. Econ. Asymmetries 18, e00096. doi:10.1016/j.jeca.2018.e00096

Brogaard, J., and Detzel, A. (2015). The asset-pricing implications of government economic policy uncertainty. Manag. Sci. 61, 3–18. doi:10.1287/mnsc.2014.2044

Brunnermeier, M. K. (2009). Deciphering the liquidity and credit crunch 2007–2008. J. Econ. Perspect. 23, 77–100. doi:10.1257/jep.23.1.77

Burnside, C., Eichenbaum, M., and Rebelo, S. (2001). Hedging and financial fragility in fixed exchange rate regimes. Eur. Econ. Rev. 45, 1151–1193. doi:10.1016/S0014-2921(01)00090-3

Butkiewicz, J. L., and Yanikkaya, H. (2011). Institutions and the impact of government spending on growth. J. Appl. Econ. 14, 319–341. doi:10.1016/S1514-0326(11)60017-2

Caggiano, G., Castelnuovo, E., and Figueres, J. M. (2017). Economic policy uncertainty and unemployment in the United States: A nonlinear approach. Econ. Lett. 151, 31–34. doi:10.1016/j.econlet.2016.12.002

Cao, H., Khan, M. K., Rehman, A., Dagar, V., Oryani, B., and Tanveer, A. (2022). Impact of globalization, institutional quality, economic growth, electricity and renewable energy consumption on Carbon Dioxide Emission in OECD countries. Environ. Sci. Pollut. Res. 29, 24191–24202. doi:10.1007/s11356-021-17076-3

Checherita-Westphal, C., and Rother, P. (2012). The impact of high government debt on economic growth and its channels: An empirical investigation for the euro area. Eur. Econ. Rev. 56, 1392–1405. doi:10.1016/j.euroecorev.2012.06.007

Chowdhury, A. R. (1991). A causal analysis of defense spending and economic growth. J. Confl. Resolut. 35, 80–97. doi:10.1177/0022002791035001005

Cooray, A., Dzhumashev, R., and Schneider, F. (2017). How does corruption affect public debt? An empirical analysis. World Dev. 90, 115–127. doi:10.1016/j.worlddev.2016.08.020

Dickey, D. A., and Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 74, 427–431. doi:10.1080/01621459.1979.10482531

Dinh Thanh, S., and Canh, N. P. (2019). Dynamics between government spending and economic growth in China: An analysis of productivity growth. J. Chin. Econ. Bus. Stud. 17, 189–212. doi:10.1080/14765284.2019.1567069

Dizaji, S. F., Farzanegan, M. R., and Naghavi, A. (2016). Political institutions and government spending behavior: Theory and evidence from Iran. Int. Tax. Public Financ. 23, 522–549. doi:10.1007/s10797-015-9378-8

Elliott, G., Rothenberg, T. J., and Stock, J. (1996). Efficient tests for an autoregressive unit root. Econometrica 64, 813–836. doi:10.2307/2171846

Elmendorf, D. W., and Gregory Mankiw, N. (1999). “Chapter 25 government debt,” in Handbook of macroeconomics (Amsterdam, Netherlands: Elsevier), 1, 1615–1669.

Enders, W., and Jones, P. (2016). Grain prices, oil prices, and multiple smooth breaks in a VAR. Stud. Nonlinear Dyn. Econ. 20, 399–419. doi:10.1515/snde-2014-0101

Engle, R. F., and Granger, C. W. (1987). Co-Integration and error correction: Representation, estimation, and testing. Econometrica 55, 251–276. doi:10.2307/1913236

Faruqui, G. A., Ara, L. A., and Acma, Q. (2015). TTIP and TPP: Impact on Bangladesh and India economy. Pac. Bus. Rev. Int. 8, 59–67.

Feng, X., Lo, Y. L., and Chan, K. C. (2022). Impact of economic policy uncertainty on cash holdings: Firm-level evidence from an emerging market. Asia-Pacific J. Account. Econ. 29, 363–385. doi:10.1080/16081625.2019.1694954

Ferdousi, F., and Qamruzzaman, M. (2017). Export, import, economic growth, and carbon emissions in Bangladesh: A granger causality test under VAR (restricted) environment. Manag. Cities Regions 79.

Gabrini, C. J. (2010). Do institutions matter?:the influence of institutions of direct democracy on local government spending. State Local Gov. Rev. 42, 210–225. doi:10.1177/0160323x10381600

Ghatak, S., and Siddiki, J. U. (2001). The use of the ARDL approach in estimating virtual exchange rates in India. J. Appl. Statistics 28, 573–583. doi:10.1080/02664760120047906

Gilchrist, S., Schoenle, R., Sim, J., and Zakrajšek, E. (2017). Inflation dynamics during the financial crisis. Am. Econ. Rev. 107, 785–823. doi:10.1257/aer.20150248

Goldsmith, A. H. (2008). Rethinking the relation between government spending and economic growth: A composition approach to fiscal policy instruction for principles students. J. Econ. Educ. 39, 153–173. doi:10.3200/JECE.39.2.153-173

Gómez-Puig, M., and Sosvilla-Rivero, S. (2015). The causal relationship between debt and growth in EMU countries. J. Policy Model. 37, 974–989. doi:10.1016/j.jpolmod.2015.09.004

Gulen, H., and Ion, M. (2016). Policy uncertainty and corporate investment. Rev. Financial Stud. 29, 523–564.

Hajamini, M., and Falahi, M. A. (2018). Economic growth and government size in developed European countries: A panel threshold approach. Econ. Analysis Policy 58, 1–13. doi:10.1016/j.eap.2017.12.002

Hassan, A. S., Meyer, D. F., and Kot, S. (2019). Effect of institutional quality and wealth from oil revenue on economic growth in oil-exporting developing countries. Sustainability 11, 3635. doi:10.3390/su11133635

Hemming, R., Schimmelpfennig, A., and Kell, M. (2003). Fiscal vulnerability and financial crises in emerging market economies. Washington, DC: International Monetary Fund.

Hsieh, E., and Lai, K. S. (1994). Government spending and economic growth: The G-7 experience. Appl. Econ. 26, 535–542. doi:10.1080/00036849400000022

Hu, S., and Gong, D. (2019). Economic policy uncertainty, prudential regulation and bank lending. Finance Res. Lett. 29, 373–378. doi:10.1016/j.frl.2018.09.004

Hunjra, A. I., Tayachi, T., Chani, M. I., Verhoeven, P., and Mehmood, A. (2020). The moderating effect of institutional quality on the financial development and environmental quality nexus. Sustainability 12, 3805. doi:10.3390/su12093805

Jacobs, J., Ogawa, K., Sterken, E., and Tokutsu, I. (2020). Public debt, economic growth and the real interest rate: A panel VAR approach to eu and oecd countries. Appl. Econ. 52, 1377–1394. doi:10.1080/00036846.2019.1673301

Jeong, S.-h., Lee, Y., and Kang, S. H. (2020). Government spending and sustainable economic growth: Based on first-and second-level COFOG data. Public Money & Manag. 40, 140–148. doi:10.1080/09540962.2019.1651035

Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59, 1551–1580. doi:10.2307/2938278

Johansen, S. (1998). Statistical analysis of co integration vectors. J. Econ. Dyn. Control 10, 231–254. doi:10.1016/0165-1889(88)90041-3

Johansen, S., and Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration – with applications to the demand for money. Oxf. Bull. Econ. Statistics 51, 169–210. doi:10.1111/j.1468-0084.1990.mp52002003.x

Kahle, K. M., and Stulz, R. M. (2013). Access to capital, investment, and the financial crisis. J. Financial Econ. 110, 280–299. doi:10.1016/j.jfineco.2013.02.014

Kandil, M. (2017). Crowding out or crowding in? Correlations of spending components within and across countries. Res. Int. Bus. Finance 42, 1254–1273. doi:10.1016/j.ribaf.2017.07.063

Kang, W., Lee, K., and Ratti, R. A. (2014). Economic policy uncertainty and firm-level investment. J. Macroecon. 39, 42–53. doi:10.1016/j.jmacro.2013.10.006

Keefer, P., and Knack, S. (2007). Boondoggles, rent-seeking, and political checks and balances: Public investment under unaccountable governments. Rev. Econ. Stat. 89, 566–572. doi:10.1162/rest.89.3.566

Khan, H., Khan, S., and Zuojun, F. (2020). Institutional quality and financial development: Evidence from developing and emerging economies. Glob. Bus. Rev. 2020, 097215091989236. doi:10.1177/0972150919892366

Khan, M. A., Kong, D., Xiang, J., and Zhang, J. (2020). Impact of institutional quality on financial development: Cross-country evidence based on emerging and growth-leading economies. Emerg. Mark. Finance Trade 56, 3829–3845. doi:10.1080/1540496x.2019.1588725

Khan, S., Murshed, M., Ozturk, I., and Khudoykulov, K. (2022). The roles of energy efficiency improvement, renewable electricity production, and financial inclusion in stimulating environmental sustainability in the Next Eleven countries. Renew. Energy 193, 1164–1176. doi:10.1016/j.renene.2022.05.065

Ko, J.-H., and Lee, C.-M. (2015). International economic policy uncertainty and stock prices: Wavelet approach. Econ. Lett. 134, 118–122. doi:10.1016/j.econlet.2015.07.012

Kormendi, R. C. (1983). Government debt, government spending, and private sector behavior. Am. Econ. Rev. 73, 994–1010.

Krol, R. (2014). Economic policy uncertainty and exchange rate volatility. Int. Finance 17, 241–256. doi:10.1111/infi.12049

Kumar, M. M. S., and Baldacci, M. E. (2010). Fiscal deficits, public debt, and sovereign bond yields. Washington, DC: International Monetary Fund.

Kwiatkowski, D., Phillips, P., Schmidt, P., and Shin, Y. (1992). Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J. Econ. 54, 159–178. doi:10.1016/0304-4076(92)90104-y

Li, J., and Qamruzzaman, M. (2022). Dose tourism induce Sustainable Human capital development in BRICS through the channel of capital formation and financial development: Evidence from Augmented ARDL with structural Break and Fourier TY causality. Front. Psychol. 2022, 1260.

Li, X.-M., and Qiu, M. (2021). The joint effects of economic policy uncertainty and firm characteristics on capital structure: Evidence from US firms. J. Int. Money Finance 110, 102279. doi:10.1016/j.jimonfin.2020.102279

Lin, S. A. Y. (1994). Government spending and economic growth. Appl. Econ. 26, 83–94. doi:10.1080/00036849400000064

Liu, L., and Zhang, T. (2015). Economic policy uncertainty and stock market volatility. Finance Res. Lett. 15, 99–105. doi:10.1016/j.frl.2015.08.009

Lou, Z., Chen, S., Yin, W., Zhang, C., and Yu, X. (2022). Economic policy uncertainty and firm innovation: Evidence from a risk-taking perspective. Int. Rev. Econ. Finance 77, 78–96. doi:10.1016/j.iref.2021.09.014

Martin, F. M. (2009). A positive theory of government debt. Rev. Econ. Dyn. 12, 608–631. doi:10.1016/j.red.2009.02.003

McNown, R., Sam, C. Y., and Goh, S. K. (2018). Bootstrapping the autoregressive distributed lag test for cointegration. Appl. Econ. 50, 1509–1521. doi:10.1080/00036846.2017.1366643

Meng, L., Qamruzzaman, M., and Adow, A. H. E. (2021). Technological adaption and open innovation in SMEs: An strategic assessment for women-owned SMEs sustainability in Bangladesh. Sustainability 13, 2942. doi:10.3390/su13052942

Miao, M., and Qamruzzaman, M. (2021). Dose remittances matter for openness and financial stability: Evidence from least developed economies. Front. Psychol. 12, 696600. doi:10.3389/fpsyg.2021.696600

Murshed, M., Ali, S. R., and Banerjee, S. (2021). Consumption of liquefied petroleum gas and the EKC hypothesis in South asia: Evidence from cross-sectionally dependent heterogeneous panel data with structural breaks. Energy Ecol. Environ. 6, 353–377. doi:10.1007/s40974-020-00185-z

Murshed, M., Khan, S., and Rahman, A. K. M. A. (2022). Roadmap for achieving energy sustainability in Sub-Saharan Africa: The mediating role of energy use efficiency. Energy Rep. 8, 4535–4552. doi:10.1016/j.egyr.2022.03.138

Nair, M., Arvin, M. B., Pradhan, R. P., and Bahmani, S. (2021). Is higher economic growth possible through better institutional quality and a lower carbon footprint? Evidence from developing countries. Renew. Energy 167, 132–145. doi:10.1016/j.renene.2020.11.056

Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 37, 1979–1990. doi:10.1080/00036840500278103

Nazlioglu, S., Gormus, N. A., and Soytas, U. (2016). Oil prices and real estate investment trusts (REITs): Gradual-shift causality and volatility transmission analysis. Energy Econ. 60, 168–175. doi:10.1016/j.eneco.2016.09.009

Ng, S., and Perron, P. (2001). Lag length selection and the construction of unit root tests with good size and power. Econometrica 69, 1519–1554. doi:10.1111/1468-0262.00256

Ozili, P. K. (2021). Does economic policy uncertainty reduce financial inclusion? Int. J. Bank. Finance. Forthcoming.

Patnaik, D., and Yaji, V. (2018). Assessing the effects of tax elasticity on government spending. Int. J. Eng. Manag. Res. (IJEMR) 8, 70–76. doi:10.31033/ijemr.8.5.8

Pegkas, P. (2018). The effect of government debt and other determinants on economic growth: The Greek experience. Economies 6, 10. doi:10.3390/economies6010010

Pesaran, M. H., Shin, Y., and Smith, J. R. (2001). Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. Chichester. Engl. 16, 289–326. doi:10.1002/jae.616

Pesaran, M. H., Shin, Y., and Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 94, 621–634. doi:10.1080/01621459.1999.10474156

Peter Boswijk, H. (1994). Testing for an unstable root in conditional and structural error correction models. J. Econ. 63, 37–60. doi:10.1016/0304-4076(93)01560-9

Phan, D. H. B., Iyke, B. N., Sharma, S. S., and Affandi, Y. (2020). Economic policy uncertainty and the financial stability–Is there a relation? Econ. Model.

Phillips, P. C. B., and Perron, P. (1988). Testing for a unit root in time series regression. Biometrika 75, 335–346. doi:10.1093/biomet/75.2.335

Plümper, T., and Martin, C. W. (2003). Democracy, government spending, and economic growth: A political-economic explanation of the barro-effect. Public Choice 117, 27–50. doi:10.1023/A:1026112530744

Popescu, C. C., and Diaconu, L. (2021). Government spending and economic growth: A cointegration analysis on Romania. Sustainability 13, 6575. doi:10.3390/su13126575

Presbitero, A. F. (2012). Total public debt and growth in developing countries. Eur. J. Dev. Res. 24, 606–626. doi:10.1057/ejdr.2011.62

Puente-Ajovín, M., and Sanso-Navarro, M. (2015). Granger causality between debt and growth: Evidence from OECD countries. Int. Rev. Econ. Finance 35, 66–77. doi:10.1016/j.iref.2014.09.007

Qamruzzaman, M. (2021). Nexus between environmental quality, institutional quality and trade openness through the channel of FDI: An application of common correlated effects estimation (CCEE), NARDL, and asymmetry causality. Environ. Sci. Pollut. Res. 28, 52475–52498. doi:10.1007/s11356-021-14269-8

Qamruzzaman, M. (2015). Determinants of foreign direct investment (FDI): Evidence from Bangladesh. Pac. Bus. Rev. Int. 7, 97–105.

Qamruzzaman, M., and Ferdaous, J. (2014). Building a knowledge-based economy in Bangladesh. Asian Bus. Rev. 4, 41–49. doi:10.18034/abr.v4i3.266

Qamruzzaman, M., and Ferdaous, J. (2015). Building a knowledge-based economy in Bangladesh. Asian Bus. Rev. 4 (3), 41–49. doi:10.18034/abr.v4i3.266

Qamruzzaman, M., and Jianguo, W. (2017). Financial innovation and economic growth in Bangladesh. Financ. Innov. 3, 19–24. doi:10.1186/s40854-017-0070-0

Qamruzzaman, M., Jianguo, W., Jahan, S., and Yingjun, Z. (2020). Financial innovation, human capital development, and economic growth of selected South Asian countries: An application of ARDL approach. Int. J. Fin. Econ. 26, 4032–4053. doi:10.1002/ijfe.2003

Qamruzzaman, M., and Jianguo, W. (2018). SME financing innovation and SME development in Bangladesh: An application of ARDL. J. Small Bus. Entrepreneursh. 31, 521–545. doi:10.1080/08276331.2018.1468975

Qamruzzaman, M., and Karim, S. (2020). Do remittance and financial innovation causes stock price through financial development: An application of nonlinear framework. Fourrages 242 (7), 38–68.

Qamruzzaman, M., and Karim, S. (2020). Nexus between economic volatility, trade openness and FDI: An application of ARDL, NARDL and asymmetric causality. Asian Econ. Financial Rev. 10, 790–807. doi:10.18488/journal.aefr.2020.107.790.807

Qamruzzaman, M. (2022). Nexus between economic policy uncertainty and institutional quality: Evidence from India and Pakistan. Macroecon. Finance Emerg. Mark. Econ. 2022, 1–20. doi:10.1080/17520843.2022.2026035

Qi, Z., Yang, S., Feng, D., and Wang, W. (2022). The impact of local government debt on urban environmental pollution and its mechanism: Evidence from China. Plos one 17, e0263796. doi:10.1371/journal.pone.0263796

Rehman, A., Ma, H., Ahmad, M., Ozturk, I., and Işık, C. (2021). Estimating the connection of information technology, foreign direct investment, trade, renewable energy and economic progress in Pakistan: Evidence from ARDL approach and cointegrating regression analysis. Environ. Sci. Pollut. Res. 28, 50623–50635. doi:10.1007/s11356-021-14303-9

Reinhart, C. M., Reinhart, V. R., and Rogoff, K. S. (2012). Public debt overhangs: Advanced-economy episodes since 1800. J. Econ. Perspect. 26, 69–86. doi:10.1257/jep.26.3.69

Reinhart, C. M., and Rogoff, K. S. (2011). From financial crash to debt crisis. Am. Econ. Rev. 101, 1676–1706. doi:10.1257/aer.101.5.1676

Sam, C. Y., McNown, R., and Goh, S. K. (2019). An augmented autoregressive distributed lag bounds test for cointegration. Econ. Model. 80, 130–141. doi:10.1016/j.econmod.2018.11.001

Shin, Y., Yu, B., and Greenwood-Nimmo, M. (2014). “Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework,” in Festschrift in honor of peter schmidt (Berlin, Germany: Springer), 281–314.

Smith, R. P. (2022). “Government debt, deficits and interest rates 1870–2016,” in Essays in honor of M. Hashem pesaran: Prediction and macro modeling. Advances in econometrics. Editors A. Chudik, C. Hsiao, and A. Timmermann (Bingley, UK: Emerald Publishing Limited), 43A, 323–340.

Tarek, B. A., and Ahmed, Z. (2017). Governance and public debt accumulation: Quantitative analysis in MENA countries. Econ. Analysis Policy 56, 1–13. doi:10.1016/j.eap.2017.06.004

Valeriani, E., and Peluso, S. (2011). The impact of institutional quality on economic growth and development: An empirical study. J. Knowl. Manag. Econ. Inf. Technol. 1, 1–25.

Wang, Y., Chen, C. R., and Huang, Y. S. (2014). Economic policy uncertainty and corporate investment: Evidence from China. Pacific-Basin Finance J. 26, 227–243. doi:10.1016/j.pacfin.2013.12.008

Waqas, M., Rasidah, M.-R., Attia, A.-U., and Chui, Z. O. (2021). Country-level institutional quality and public debt: Empirical evidence from Pakistan. J. Asian Finance, Econ. Bus. 8, 21–32. doi:10.13106/JAFEB.2021.VOL8.NO4.0021

Woo, J., and Kumar, M. S. (2015). Public debt and growth. Economica 82, 705–739. doi:10.1111/ecca.12138

Xia, C., Qamruzzaman, M., and Adow, A. H. (2022). An asymmetric nexus: Remittance-led human capital development in the top 10 remittance-receiving countries: Are FDI and gross capital formation critical for a road to sustainability? Sustainability 14, 3703. doi:10.3390/su14063703

Yang, W., Zhang, Z., Wang, Y., Deng, P., and Guo, L. (2022). Impact of China’s provincial government debt on economic growth and sustainable development. Sustainability 14, 1474. doi:10.3390/su14031474

Yang, Y., Qamruzzaman, M., Rehman, M. Z., and Karim, S. (2021). Do tourism and institutional quality asymmetrically effects on FDI sustainability in BIMSTEC countries: An application of ARDL, CS-ARDL, NARDL, and asymmetric causality test. Sustainability 13, 9989. doi:10.3390/su13179989

Yu, J., Shi, X., Guo, D., and Yang, L. (2021). Economic policy uncertainty (EPU) and firm carbon emissions: Evidence using a China provincial EPU index. Energy Econ. 94, 105071. doi:10.1016/j.eneco.2020.105071

Yusuf, A., and Mohd, S. (2021). The impact of government debt on economic growth in Nigeria. Cogent Econ. Finance 9, 1946249. doi:10.1080/23322039.2021.1946249

Zainuddin, I., Inuzula, L., and Sutoyo, (2021). Impact of government debt and foreign investment on the Indonesian economy: An ARDL model analysis. J. Account. Bus. Finance Res. 12, 32–39. doi:10.20448/2002.122.32.39

Zakari, A., and Khan, I. (2021). Boosting economic growth through energy in africa: The role of Chinese investment and institutional quality. J. Chin. Econ. Bus. Stud. 20, 1–21. doi:10.1080/14765284.2021.1968709

Keywords: governmental effectiveness, government debt, economic policy uncertainty, government spending, augmented ARDL, nonlinear ARDL, Fourier TY causality, BRIC I

Citation: Ma R and Qamruzzaman M (2022) Nexus between government debt, economic policy uncertainty, government spending, and governmental effectiveness in BRIC nations: Evidence for linear and nonlinear assessments. Front. Environ. Sci. 10:952452. doi: 10.3389/fenvs.2022.952452

Received: 25 May 2022; Accepted: 28 June 2022;

Published: 19 August 2022.

Edited by:

Muntasir Murshed, North South University, BangladeshReviewed by:

Samiha Khan, North South University, BangladeshTomiwa Sunday Adebayo, Cyprus International University, Turkey