- 1School of Economics and Management, Lanzhou University of Technology, Lanzhou, China

- 2Al Rayyan International University College in partnership with University of Derby UK- Doha, Qatar, University of Derby, Derby, United Kingdom

- 3Business School, Shandong Jianzhu University, Jinan, China

- 4School of Media and Communication, Shanghai Jiao Tong University, Shanghai, China & Antai College of Economics and Management, Shanghai Jiao Tong University, Shanghai, China

- 5Newcastle Business School, Northumbria University, Newcastle upon Tyne, United Kingdom

Employees' behavior and corporate social responsibility (CSR) can affect firms’ profitability and increase the corporate economic burden. This current research endeavors to explore how business firms navigate employees' technology-driven behavior and CSR sustainable practices for tax avoidance to affect firms’ performance. This study examines how CSR sustainable practices moderate the relationship between employees' behavior and tax avoidance to achieve sustainable business performance. The study incorporated the Maximum Likelihood Estimator (MLE) for the purpose of data analysis using the structural equation modeling (SEM) technique that is suitable for this sample size. The study’s target population is employees of small and medium enterprises located in Pakistan. The study has drawn a sample of employees and applied a convenience sampling technique. The findings show that tax avoidance, employee behavior, and corporate social responsibility positively affect business firms’ performance. The results further indicate that sustainable CSR practices significantly moderate tax avoidance’s effect on business firms’ performance. However, there is no condition to identify the relationship between employee behavior and firm performance. In theory, this research contributes to the corporate strategy literature by answering how corporate social responsibility sustainable practices mediate the relationship between tax avoidance, employees' behavior, and sustainable business performance. It shows that socially responsible organizations will engage less in tax avoidance behaviors. The results exhibit that the study provides a systematic, holistic framework to attain sustainable firms’ performance. The findings' generalizability offers future direction with helpful insights for business managers and policymakers.

Introduction

Corporate tax is a significant contributor to the economic growth in technology-enabled circular economy practices. It is considered a vital feature of corporate social responsibility; however, some business firms keep their tax payments to retain extra profit margins (Khuong et al., 2020). Business firms indulge in tax avoidance to enhance shareholders’ wealth, a substantially workable corporate strategy for the sustainable production of goods (Armstrong, Blouin, Jagolinzer & Larcker, 2015). Tax avoidance has a significant impact on corporate firm performance and society as a whole. Thus, it is essential to explore the effects in-depth and see how a technology-enabled circular economy documents sustainable practices of CSR to attain healthier business performance. Conventionally, tax avoidance is an organizational tactic that transfers government wealth to organizations, contributing to the overall firm performance through financial stability (Khuong et al., 2020). Henceforth, subjective evidence indicates that tax avoidance has an unavoidable effect on sustainable firm performance, particularly from the perspective of wealth. In contrast, tax avoidance has certain costs associated. These costs include damage to reputation, cost of implementation, and legal action if authorities identify these practices (Hardeck and Hertl, 2014). Organizations should therefore decide whether to indulge in tax avoidance based on the associated costs and benefits.

Scholars see business firms’ performance as a broader perspective, covering the overall achievement of organizations that is often reflected in organizational, environmental, and social activities. At a narrower level, corporate performance results from the functions and operations performed by an organization through adequate human resources, relationships with stakeholders, and sustainable practices of corporate social responsibility (CSR) activities. Organizational performance is primarily studied from a financial perspective. However, other determinants can affect non-financial performance, such as e-marketing strategy, word of mouth (WoM), goal achievement, customer retention, reduced employee turnover (Spillan and Parnell, 2006). Consequently, it is essential to stretch the boundaries of sustainable business performance through sustainable practices of organizations' social performance, tax strategy, and social responsibility.

Employees are a crucial strength in an organization, and their behavior is critical in shaping the work environment across the organization. Organizations that experience employees' positive emotions at work, such firms show sustainable and enhanced business performance (Goswami et al., 2016; Burić and Macuka, 2018). Organizations need to ensure that employees have a good relationship with leadership at the operational level. It helps the organization achieve positive and beneficial staff behavior for attaining sustainable financial performance. Xi, Zhao, and Xu (2017) argue that a well-structured organization makes the work environment more comfortable and helps gain enhanced business performance (Xi et al., 2016). High-performing organizations have shown that employee behavior is an essential determinant of their success, and sustainable and balanced HR policies maintain a positive attitude of the employees.

Organizations are under increasing pressure to manage and assess their social responsibilities properly. Consequently, organizations are more inclined to devote resources and time to the sustainable practice of CSR to ensure mutual expectations and the interests of stakeholders. The main stakeholders of sustainable practices of CSR are government agencies, civil society, and customers who facilitate business relationship management. An intense display of sustainable practices of CSR activities has a significant impact on overall organizational performance and corporate image. However, disagreements remain about taking up such socially responsible actions. It is due to the high cost of implementing CSR sustainable practices, which contradicts the organization’s primary goal of maximizing profits (Ikram Sroufe, Mohsin, Solangi, Shah and Shahzad, 2020).

Past literature has not shown greater level of research exploring the relationship between tax avoidance and firm performance in developing countries (Khuong et al., 2020). Various research fields of the studies have chosen their tax avoidance methods, such as finance, economics, and accounting (Hanlon and Heitzman, 2010). There is a lack of discrete and multidisciplinary frameworks addressing tax avoidance’s impact on sustainable business performance from an HR perspective. Past research studies have examined the relationship between sustainable corporate social responsibility practices, organizational growth, and tax avoidance on financial performance (Mao and Wu, 2019). Some studies have emphasized exploring the influence of tax avoidance and sustainable practices of CSR on firm performance (Hasseldine and Morris, 2013). Past literature has not shown any comprehensive studies examining the impact of tax avoidance and employee behavior on sustainable firm performance. In addition, there is room for assessing CSR sustainable practices to enrich quantitative research by examining the moderating role of CSR. Accordingly, this research study expands on the sparse literature on organizational behavior by examining the inclusive impact of corporate social responsibility on sustainable corporate performance, taking into account tax avoidance and employee behavior in organizations. This novel research framework contributes to the growing literature on sustainable firm performance in the Pakistani context. An organization’s employee behavior and sustainable corporate social responsibility practices are vital for controlling environmental challenges to safeguard firms’ social responsibility for a green environment.

Literature Review

Tax Avoidance and Firm Performance

Scholars have debated the core issue of tax avoidance, which determines the legal use of the public tax system for a firm’s or one’s benefit to reduce the payable tax amount through means within the law (Maydew et al., 2008). A tax shelter is one tax avoidance form, while a tax haven is a jurisdiction that promotes tax cuts. Therefore, tax avoidance refers to a condition of tax noncompliance or violation, as it describes a range of practices that are detrimental to the national tax system (Tang et al., 2022). A past study describes that tax avoidance is the practice of reducing business firms’ tax liabilities (Chen, Hu, Wang and TAng, 2014). Constant growth in a firm’s capital, the scale of corporate tax avoidance, and its impact on firm-level and overall economic developments produce a robust case for studying the relationship between corporate social responsibility, employee behavior, corporate tax avoidance, and firm performance. A recent study conducted by Dyreng et al. (2017) shows that corporate tax avoidance has risen significantly over the 3 decades (Dyreng et al., 2017). The annual cost of tax avoidance in the U.S. is around $200 billion. Nearly 73% of Fortune 500 companies have different types of subsidiaries in the countries that are tax havens states (Chen et al., 2022). Academic researchers have examined many firm-level features to understand cross-sectional discrepancies in corporate tax avoidance (Hasan et al., 2021).

It is a continuum of corporate tax strategies. It shows legal practices that differs from tax avoidance practice. However, managers also believe in having exploited complex and ambiguous tax avoidance strategies that negatively influence cash flow in some organizations. Similarly, agency theory presents this situation as the cash flow generated by tax avoidance may indicate the occurrence of consumption on behalf of the organization (Donaldson & Davis, 2016). It will lead to reduced cash inflows.in the future, thereby reducing company performance. In addition to reputational damage, tax avoidance can lead to decreased cash flow and increased cost of organizational capital (Mao & Wu, 2019). Nonetheless, whether tax avoidance positively or negatively affects firm performance remains an empirical question, as there are mixed findings in the literature (Khuong et al., 2020). Free cash flow results from tax avoidance, both in the short and long term, and as a result, it affects business performance. These emerging dominant effects are related to certain factors, including the operating sustainable business environment, institutional settings, and the social status of the organization. Therefore, it will be interesting to understand the effect of tax avoidance on firm performance from a human resources perspective. Based on the literature review, the study puts forward the following hypothesized assumptions:

H1: There is a significant relationship between tax avoidance and firm performance.

Employee Behavior and Firm Performance

Artificial Intelligence systems and technology-enabled employees are productive for organizations. Trained employees perceive and respond to complicated and dynamic industry turbulent environments (Kaplan and Haenlein, 2019). Over the past 2 decades, technological innovations have rapidly transformed business firms to expand the scope of their inventions. It was historically a human task. Business Organizational recruit high-tech employees for technological innovations that help achieve business success, organizational competitive advantage, and long-term survival. Hence, it requires the implementation of new ideas generated by high-tech employees (Lin et al., 2020). Afsar, Badir, and Khan (2015) suggest that motivating firms’ employees keep them innovative, and high-tech employees' are creative, and their productive behavior is helpful. Employees' innovative work behavior is one of the perfect ways to encourage business innovation. When introducing technological innovations into the workplace, it is critical to study the factors that influence employee innovative work behavior that brings mental peace, affectiveness, and analytical energy to their role (Belanche et al., 2019). However, some studies have indicated that employee perceptions about technological innovations and AI systems vary. Ultimately, companies strive to adapt their strategic decision-making processes to reflect changes in AI systems and technological advancement successfully (Dwivedi et al., 2019).

An organization’s employees are a key component that plays an vital role in organizational business performance (Schneider, Yost, Kropp, Kind and Lam, 2018). Employee behavior determines how staff performing responsibilities in an organization respond to specific relevant and distinct situations (Bhattacharya, Gibson and Harold, 2005). Nevertheless, leadership functions and a firm’s employee behavior are crucial for sustainable financial performance. Employee behavior is essential for helping and motivating each other and promoting a positive attitude. The growing literature on firm performance discusses the role of top management behavior in an indirect but positive relationship to financial performance in well-structured business organizations (Xi, et al., 2017). In addition, past research identifies that high-performance work system that value employees even at the operational level tend to impact business performance by shaping employee behavior. Technology-enabled trained employees are helpful for better firm performance (Schmidt, Pohler and Willness, 2018). Lin, Zhao, and Li (2014) argue that there is a need for further investigations to explore the mechanisms and conditions that identify the relationship between employees' technology-driven behavior and sustainable firm performance. Consequently, it is worth and valuable steps to examine the behavior of employees at the operational level. Study examines how behaviors influences the organizational system to attain sustainable financial performance (Lin et al., 2014). With the support of the literature on technology-enabled trained employees, this study formulated the hypotheses on the relationship between employee behavior and sustainable firm performance, as given below.

H2: There is a significant relationship between technology-enabled trained employee behavior and sustainable firm performance.

Sustainable Practices of Corporate Social Responsibility and Firm Performance

Sustainable practices of CSR activities encourage organization contribution to environmental protection, which is a crucial driver of sustainable economic development (He et al., 2021; Yu et al., 2022). The social responsibility of the business firms is a driver factor of environmental-driven innovation (Abbas et al., 2019a; Abbas et al., 2020; Azizi et al., 2021). Fussler and James (1996) introduced ecological innovation (Fussler and James 1996). CSR practices motivate organizations to launch green innovations that significantly lower the negative effect on the environment in the production process of business firms worldwide (Abbas et al., 2019b; Hussain et al., 2019). Corporate social responsibility (CSR) emphasizes firms safeguard the environment while pursuing financial profits (Abbas et al., 2019c; Hao and He 2022). The sustainable practices of CSR implementation require enterprises to consider stakeholders' interests, including consumers, society, and the environment, while performing their production operations (Golinska-Dawson and Spychała 2018; Awan et al., 2019; Yang et al., 2019; Ikram et al., 2021). In recent times, business firms have faced increasing internal and external coercion to enhance non-financial performance and different dimensions, such as environmental protection challenges, social welfare, employee interest, and acceptable employment practices (Awan et al., 2020; Bhutto et al., 2021; Cheng et al., 2021; Rashid Khan et al., 2021). Scholars have debated sustainability issues converged by various stakeholders, policymakers, and investors (Begum et al., 2021a; Begum et al., 2021b; Ikram et al., 2021; Awan and Sroufe 2022). Sustainability performance is a vital component of achieving more comprehensive sustainability and climate protection objectives. Research studies have examined the impact of CSR performance on firms’ short-term firm performance and shareholders' welfare (Lins et al., 2017; Krueger et al., 2021; Ioannou and Serafeim, 2012; Chen et al., 2018). At the same time, the actual sustainable practices of CSR activities on social welfare, employee behavior, and long-term business performance remain unexplored.

The growing literature lacks systematic evidence estimating the sustainable practices of CSR organizations to produce innovations for solving environmental problems. Business firms engaged in sustainable practices of CSR activities effectively manage relationships with their stakeholders, responsible for creating, developing, and maintaining relationships with productive resources (Baumgartner, 2014; Shen and Benson, 2016; Trivellas et al., 2019). From a stakeholder’s perspective, CSR practices tend to enhance their connection to the company’s operations (Babiak and Kihl, 2018). According to Yang, Paulo and Ahsan (2019), companies gain financial stability through profitability when customers and other stakeholders admire their social responsibility activities. It shows that adequate investment in sustainable CSR practices is critical for clients (Yang et al., 2019). CSR practices help improve employee morale which leads to influencing overall business performance. Besides, business performance determines not only the effectiveness of its employees but also the functioning and results of its operations, leadership, and CSR activities (Ikram et al., 2020; Saha et al., 2020). Therefore, organizations that effectively conduct CSR activities and link strategic resource allocation and stakeholder preferences tend to achieve higher business performance (Jang, Ko, Chung and Woo, 2019). Accordingly, based on the above debate, the study formulates assumptions about CSR and corporate business performance, as follows.

H3: There is a significant association between sustainable practices of CSR activities and firm performance.

Moderating Role of CSR on Sustainable Firm Performance

Over the past decades, various studies have extensively examined the concept of sustainable practices related to CSR activities, covering various aspects. These investigations include as CSR components, firms’ CSR performance, CSR regulations and their impact on consumers, corporate governance, and even tax avoidance (Aras and Crowther, 2008; Baumgartner, 2014; Blanco-Gonzalez et al., 2020; del-Castillo-Feito et al., 2022; Hardeck and Hertl, 2014; Martínez et al., 2020; Tsourvakas and Yfantidou, 2018). Mao and Wu (2019) debate that organizations can maintain their competitive advantage by investing in sustainable practices of CSR activities (Mao & Wu, 2019). Different organizational factors, primarily strategic risk management and corporate culture, significantly impact how corporate social responsibility practices affect corporate tax avoidance and firm performance. Empirical surveys on sustainable practices of CSR from different perspectives show that responsible CSR activities indicated a negative impact on corporate tax avoidance. However, such evidence comes from developed countries (Ikram et al., 2020). Past studies explored sustainable practices of CSR on firms’ performance and further examined the relationship by adhering to different scenarios (Zulfiqar, Rabeea, József, Jolita and Domicián 2019; Ahmed, Zehou, Raza, Qureshi, Yousufi, 2020).

Therefore, this research is necessary to seek empirical evidence from developing countries, such as Pakistan, taking tax avoidance and corporate business performance into account. Past studies investigated CSR’s moderating role in tax avoidance and business performance. However, this study measured the opposite relationship. In contrast to previous studies, which only examined the direct effect of CSR on other variables, this study examined whether moderating effects also occurred. This research proposes that tax avoidance directly affects firms’ financial performance, and corporate social responsibility moderates the relation between tax avoidance, employee behavior, and sustainable business performance. This research study addresses this newly identified literature gap. The recent literature indicates a potential gap in measuring the relationship between tax avoidance, employee behavior, and firm performance through the moderating role of sustainable practices of CSR to attain sustainable firm performance. Thus, keeping in view the above discussion, this study proposes the following hypotheses:

H4: Sustainable practices of CSR moderate the relationship between tax avoidance and sustainable business firm performance.

H5: Sustainable practice of CSR moderates the relationship between employee behavior and firm’s sustainable performance.

Research Framework

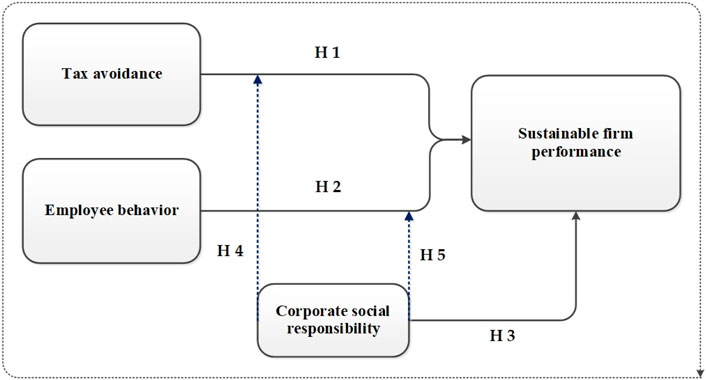

The current research study has extensively reviewed the fresh literature and examined the relationship between tax avoidance, employee behavior, and sustainable firm performance. This research survey examines how sustainable practices of corporate social responsibility moderates the relationship between tax avoidance, employee behavior, and sustainable firm performance. This research model contains four chosen variables to describe the proposed framework. This study determined tax avoidance and employee behavior as independent variables (IVs) and sustainable firm performance as a dependent variable (DV). Concurrently, sustainable practices of CSR are the moderating variable. This research framework aims to address the potential literature gaps. This study model appraises the influence of employee behavior, tax avoidance, and sustainable firm performance through the moderating role of CSR practices. The below framework shows a pictorial description indicating the theoretical grounds built in this study. Figure 1 below exemplifies a proposed framework.

FIGURE 1. The proposed study framework indicates selected variables: Tax avoidance, employee behavior, sustainable practices of CSR activities.

Theoretical Framework

Materials and Methods

This section describes materials and methods to explain the entire process of methods applied to draw the desired results.

Research Design

This study employed a quantitative research design to measure the formulated hypotheses, as shown in the proposed model, which aligns with past literature (Ge et al., 2022; Liu et al., 2022; Mubeen et al., 2022; Zhang et al., 2022). This statistical technique follows a deductive research approach to the investigation of the model as broader concepts that are incorporated into the hypotheses (Li et al., 2021; Paulson et al., 2021; Aqeel et al., 2022; Farzadfar et al., 2022; Yu et al., 2022). This research design helps in reducing the statistical biases in the study (Nakagawa and Cuthill, 2007). This present study employed the Maximum Likelihood Estimator (MLE) for data analysis using the structural equation modeling (SEM) approach suitable to this sample size (Abbas et al., 2019a; Aman et al., 2022; Liu et al., 2022). The MLE techniques simultaneously assess all parameter estimates (Chumney, 2012). Besides, the constructs with 33 questions (356 > 24*10 = 240) are considered adequate and above the threshold level of 10–15 responses per item as per guidelines of (Hair et al., 2015; Kline. 2015). Similarly, Barclay et al. (1995) recommend that the sample size of the study under investigation should be at least ten times higher than the highest number of items taken in the research model’s constructs. The target population of the study is employees of small and medium enterprises (SMEs) located in Pakistan. The sampling technique used for sample selection is convenience sampling that aligns with the literature (Wang et al., 2021; Zhou et al., 2021; Fu and Abbas 2022; Mamirkulova et al., 2022; Rahmat et al., 2022; Yao et al., 2022). The convenience sampling helps save time and helps making data availability (Etikan et al., 2015). This survey has drawn a sample of respondents to measure the influence of tax avoidance, employee behavior, and sustainable practices of CSR activities on sustainable business performance (Mubeen et al., 2020; Hussain et al., 2021; Khazaie et al., 2021; Mubeen et al., 2021). under the category of a developing country like Pakistan (Ikram et al., 2020). The study distributed 507 questionnaires and received 356 valid forms with a response rate of 70.21%. The selected sample size of 356 respondents is adequate as described in the literature (Wolf et al., 2013). This research survey has (Geng et al. 2022, Halbusi et al. 2022, Li et al. 2022) adapted questionnaires from the literature to measure the concept of the proposed study model (Shoib et al., 2021; Zeidabadi et al., 2022).

Measures of Research Instruments

The questionnaire of tax avoidance contains a four-item scale. This study has measured these items based on the past research study (Fuadah et al., 2022). The present research framework employed the received datasets and evaluated the value of Cronbach alpha. Accordingly, the analysis produced a decent result (α = 0.872) (Asad et al., 2017; Taber, 2017). The result shows good reliability. Past research by Ağan et al. (2016) introduced the scale of corporate social responsibility. This research study has measured the influence of CSR on firm performance with seven items adapted from the literature (Ağan et al., 2016). This study utilized the received valid data and measured the Cronbach alphas value, indicating a satisfactory result (α = 0.701), indicating adequate reliability. Investigators have adapted five-item scale from a past study conducted by Cherian et al. (2021) to evaluate employee behavior’s impact on sustainable firm performance (Cherian et al., 2021). This research paper the Maximum Likelihood Estimator (MLE) for data analysis using the structural equation modeling (SEM) approach on the available datasets to assess the value of Cronbach alpha. Consequently, the analysis revealed a satisfactory outcome (α = 0.873). The study finding indicates an adequate reliability. Similarly, the study has adapted eight items from the study of Spillan and Parnell (2006) to evaluate the sustainable performance of business firms (Spillan and Parnell, 2006). Finally, this research study employed the MLE method and analyzed the received data to evaluate the outcome of Cronbach alpha. The analysis produced a decent result (α = 0.865). The result shows good reliability.

Designing a Questionnaire

This study adapted the chosen scales and distributed questionnaire items of the selected variables to the recruited participants by using a self-structured survey for the targeted population to collect the desired data. The study employed a convenience sampling approach (Franke and Sarstedt, 2019; RodrÍguez-Casallas et al., 2020; Su et al., 2021). The researchers informed, educated, and trained the participants about the purpose of the research survey and guaranteed them that all the information would be strictly confidential and study would use it for research purposes. The self-administered scales also recorded participants’ (SMEs employees) general profile data, including employees' gender, education, age, profession, and inhabited locations. The investigators invited participants from various regions. The study used designed questionnaires using a five-point Likert scale, with responses ranging from “strongly agree = 5” to “strongly disagree = 1”. The investigators approached targeted participants and recruited them to participate in the survey with their consent with their agreed appointments. The study distributed 422 forms to potential respondents and collected data using self-administered selected questionnaires. The researchers introduced themselves to the participants and explained study protocols to fill out the forms appropriately. Investigators explained to participants that the questions on the scales are equally important. It helps eliminate social expectation bias in research (Larson, 2019). Respondents returned a total of 356 filled forms to the researcher. After screening, the study excluded 33 incomplete forms and used 356 duly filled forms for data analysis. The research unit analysis refers to the respondents (employees) from small and medium enterprises operating business operations in Pakistan.

Data Analysis and Results

Investigators and academics of management, business and social sciences typically use various research tool, like SPSS, STAT, and the smart-PLS-SEM for theory development required in investigative research (Fursova 2016). This present model applied the Maximum Likelihood Estimator (MLE) for the purpose of data analysis through the structural equation modeling (SEM) technique. The central applications of this method helps draw study result to test the proposed hypotheses (Hall et al., 2008). The SEM methods simplify and assist the analysis of linear relationships between latent constructs and explicit model variables. This research employed the MLE approach for screening and analyzing the datasets because this technique facilitates the empirical evaluation of the formulated framework. See Table 1 below.

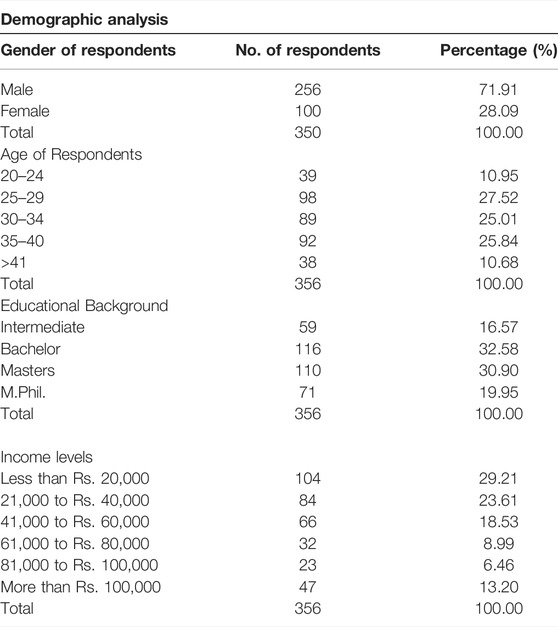

Table 1 shows the demographic analysis of the study participants. Analysis indicates that male participants (256) are the major proportion of the sample (71.91%), and female employees are 100 (28.09%). The mainstream participants hold bachelor’s (116/356 = 32.58%), and master’s degree holders (110/356 = 30.90%) respectively. The majority of the recruited employees are between the age bracket of 25–29 (27.52%), 30–34 (25.01%), and 35–40 (25.84%). However, 48 respondents (10.68%) were over 41 years old, and 39 employees were between 20 and 24 years old, showing the lowest participation. Regarding the income levels, 104 employees (29.21%) salary was below Rs. 20,000 and 47 workers (13.20%) salary was over Rs. 100,000, respectively.

Statistically Analysis

This study employed the SPSS software version-25 and AMOS version-24 to evaluate the proposed model. The study used a two-step modeling technique based on the measurement model’s estimation and the structural model’s assessment to draw the results (Barclay et al., 1995). Internal consistency, convergent validity, and discriminant validity are components of the measurement model (Hair et al., 2014; Hair et al., 2020; Mehta et al., 2020). We evaluated the structural model by examining the relationship between exogenous and endogenous dependent variables (Hair et al., 2017).

Measurement Analysis

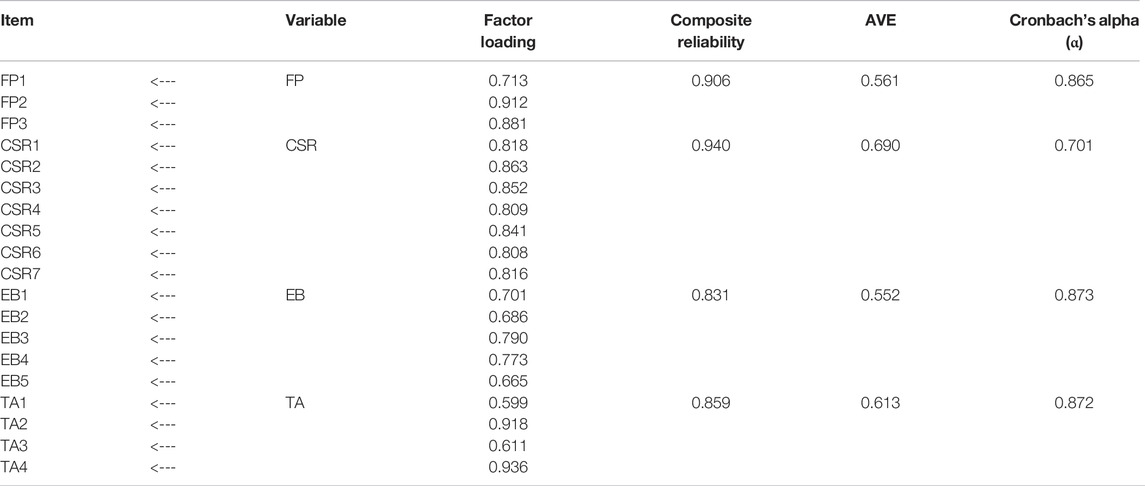

The measurement model helps evaluate the relationship between items and construct (Sarstedt et al., 2017). The study used the maximum likelihood approach to analyze CFA. In the next step, the study established the validity of all analyzed constructs and determined Cronbach’s alpha for each metric to demonstrate internal reliability (Jordan and Spiess, 2019; Lebni et al., 2020). Investigators use Cronbach’s Alpha as a tool to evaluate instrument dependability (Hair et al., 2020). In the first step, the Cronbach’s Alpha for each construct should range from 0.701 to 0.873, higher than the required threshold level of .070 (Hair et al., 2016). Secondly, the Convergent validity consists of three components: composite reliability (CR), average variance extract (AVE), and factor loading. The values for standardized factor loading vary from 0.611 to 0.936, which is higher than the suggested cut-off level of 0.50, according to Hair’s recommendation (Hair et al., 2014). The composite reliability value varies from 0.831 to 0.940, and the AVE value ranges from 0.552 to 0.690. These cut-off values satisfy the threshold level, supporting the convergent validity described by Hair in the literature (Hair et al., 2020; Mehta et al., 2020). See Table 2 that shows the analysis.

Table 2 shows factor loadings, composite reliability (CR), average variance extracted AVE), and Cronbach’s Alpha values of the study variables. All the items have shown satisfactory values drawn by the analysis results. Table 3 shows model fit indices below.

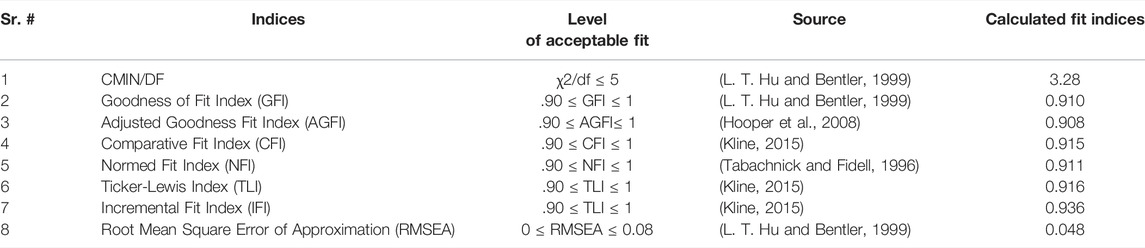

The study performed the analysis of “Goodness of Fit” and evaluated it by calculating numerous indicators, including χ2 value to the degree of freedom ratio (χ2/df), Goodness of Fit Index (GFI), Adjusted Goodness Fit Index (AGFI), Ticker-Lewis Index (TLI), Normed Fit Index (NFI), Comparative Fit Index (CFI), and Root Mean Square Error of Approximation (RMSEA). Table 3 indicates model fit indices (MFI). All values are in an acceptable range and fit the data well, as presented in Table 3 above. The outcome values are satisfactory.

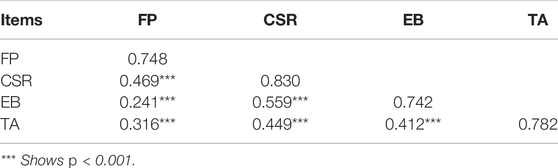

Table 4 shows the results of the Fornell and Larcker (1981) analysis. According to this criterion, Table 4 shows cross-loadings, and the results show that the study outcome established the constructs' discriminant validity. The Fornell and Larcker (1981) criterion commonly helps investigators evaluate the degree of disseminated variance between the selected model’s latent variables. Based on this criterion, Composite Reliability (CR) and Average Variance Extracted (AVE) are helpful in measuring the convergent validity of the study’s measurement model. Table 4 has shown satisfactory results. Besides, Table 2 above demonstrates the discriminant validity of the employed constructs. The square root of AVE for each dimension is greater than the values in the lower-left triangle shown as off-diagonal, establishing discriminant validity (Hair et al., 2014). Hence, the results presented the adequacy of reliability, convergent validity, and discriminant validity. See Table 5 for Structural Analysis.

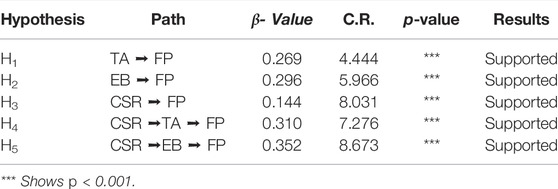

Table 5 displays the study results of the paths analyses to test the formulated hypotheses. Results for the first hypothesis of the study indicate that tax avoidance has a significant positive impact on the firm performance, as indicated in Table 5, TA➝ FP (β = 0.269, p < 0.001). The findings approve H1. Past studies that measured the effect of tax avoidance on business firm performance have reported mixed results.

Results of the second hypothesis proposed in this study indicate that employee behavior has a significant positive impact on sustainable firm performance. The findings as indicated in Table 5 have validated H2. These findings are synchronous with the past studies that also advocate the view that organically structured organizations that show positive employee behaviors improve firm performance. The results show that employee behavior positively influences sustainable firm performance (β = 0.296, p < 0.001). The findings have shown that employee behavior is the most influential predictor of sustainable. Thus, results approved H2, as indicated in Table 5.

The results of the third hypothesis proposed by this study show that corporate social responsibility has a significant positive impact on sustainable corporate business performance, as indicated in Table 3 CSR ➝ FP (β = 0.144, p < 0.001). The findings approved H3. The study findings, considering the impact of sustainable practices of CSR on sustainable firm performance are in line and consistent with previous studies.

The study proposed H4 that sustainable practices of corporate social responsibility moderates the relationship between tax avoidance and sustainable firm performance. The results indicated a moderating impact of sustainable practices of CSR to achieve sustainable firm performance, which reveals that tax avoidance has a positive effects healthier firm performance CSR ➝TA ➝ FP (β = 0.310, p < 0.001). Thus, the results validate H4. This insightful outcome shows that business firms become more involved in socially responsible activities and are less likely to engage in tax avoidance. The results are consistent with research that found that organizations with higher CSR-focused activities tended to reduce their tax avoidance behavior.

Finally, the study proposed the last hypothesis that indicated a moderating influence of sustainable practices of CSR on the relationship between employee behavior and sustainable firm performance. The results have validated H5 as indicated CSR➝EB ➝ FP (β = 0.352, p < 0.001) in Table 5. Employee behavior is a subjective, personal behavior that may affect a sustainable firm, but many are not affected by external factors such as corporate social responsibility. These findings supported the past research conducted in a similar context. See Figure 1 below.

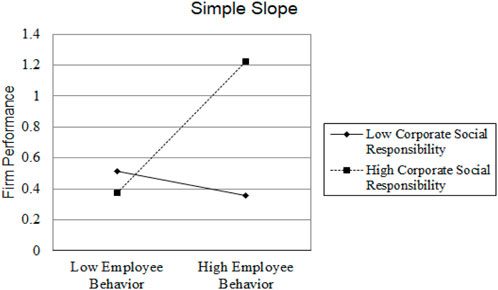

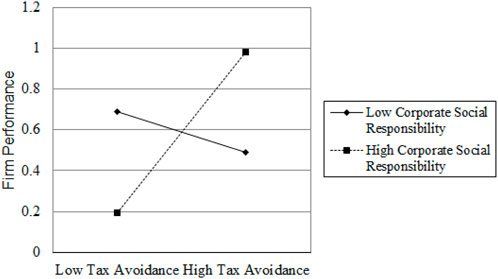

Figure 2 demonstrates the nature of the first interaction. In the first interaction, higher CSR practices show the positive impact of employee behavior on the sustainable performance of the business enterprises. The graph shows that the lower CSR has no contradictory effects. Figure 3 indicates the second interaction. It explains that high tax avoidance leads to investing in high CSR activities. This practice will improve the sustainable firm performance of the enterprises. In addition, a lower level of tax avoidance shows that investing in insufficient CSR activities will decrease sustainable business performance.

Discussion

This research paper aims to address the identified gaps in the context of tax avoidance and corporate employee behavior through the moderating role of sustainable practices of CSR activities. The present research study performs a systematic analysis of sustainable practices of CSR implications, employee behavior, and tax avoidance to evaluate business firms’ reliable, sustainable performance. This research study combines insights from new literature related to corporate governance, finance, and CSR practices to discuss and advance the possible impact of employee behavior and sustainable practices of CSR activities at the firm level on sustainable financial performance. This study primarily emphasizes exploring how CSR practices moderate the relationship between tax avoidance and employee behavior to achieve sustainable business performance.

Table 3 displays the study results regarding the measurement model. Results for the first hypothesis of the study indicate that tax avoidance has a significant positive impact on the firm performance. The findings approve H1. Past studies that measured the effect of tax avoidance on business firm performance have reported mixed results. Some studies have indicated that tax avoidance causes a boost in the firm performance by saving money and retaining profits (Armstrong et al., 2015; Jiang et al., 2022). However, some studies have described that tax avoidance leads to financial and nonfinancial losses to business firms sustainable performance (Chen et al., 2014). The results show that tax avoidance positively affects sustainable firm performance, which is inconsistent with previous studies (Khuong et al., 2020; Hasan et al., 2021). This finding supports agency theory, which states that shareholders do not always want management to avoid taxes because of the associated costs. Still, companies must declare to reduce information asymmetry with stakeholders, especially shareholders (Fuadah et al., 2022). As companies are forced to disclose their tax amounts in their financial statements, shareholders will know the amount of tax avoidance the company has promised. These complex transactions allow management to reallocate resources to its own goals and conceal resources from tax authorities. This finding is consistent with the first hypothesis, which stated that tax avoidance positively and substantially affects business firms’ performance. It shows that the more tax avoidance, the better the company’s performance. Existing research shows that managers who engage in tax avoidance activities generate a positive tax avoidance corporate value relationship (Shams et al., 2022). In contrast, another study shows that corporate tax avoidance implies that tax avoidance is a value-adding activity (Armstrong et al., 2012). The findings are consistent with many previous studies reporting that tax avoidance reduces the cost of equity, implying that the additional advantage of considerable tax savings from tax avoidance improves firm performance (Shams et al., 2022).

Results for the second hypothesis proposed in the study indicate that employee behavior has a significant positive impact on sustainable firm performance. Therefore, the findings have validated H2. These findings are synchronous with the past studies that also advocate the view that organically structured organizations that show healthy employee behaviors are found ahead in the firm performance and outcomes (Lin et al., 2014; Xi et al., 2017). This finding shows that employee behavior has a substantial impact on explaining sustainable business performance. The study finding is consistent with the earlier research studies that identified significant effects on employees' overall perceptions of their company’s sustainable performance (Kim et al., 2016; Wong et al., 2021).

The results of the third hypothesis of this study show that corporate social responsibility has a significant positive impact on sustainable corporate business performance. The findings approved H3. The study findings, considering the impact of sustainable practices of CSR on sustainable firm performance are in line and consistent with previous studies (Jang et al., 2019; Abdelfattah & Aboud, 2020; Saha et al., 2020). Past studies have reported that sustainable practices of CSR implementation have a strong and direct impact on firm performance. However, these findings contradict the findings of a previous study that identified that CSR disclosure of business organizations led to lower overall firm performance and profitability (Mao and Wu, 2019).

The findings show that sustainable practices of corporate social responsibility moderates the relationship between tax avoidance and sustainable firm performance. The results indicated a negative moderating impact of sustainable practices of CSR to achieve sustainable firm performance, which reveals that tax avoidance has a weak effect on sustainable firm performance. Thus, the results validate H4. This insightful outcome shows that business firms become more involved in socially responsible activities and are less likely to engage in tax avoidance. The results are consistent with research that found that organizations with higher CSR-focused activities tended to reduce their tax avoidance behavior (Lanis and Richardson, 2015). However, these findings contradict past research that found CSR to have no moderating role in the relationship between tax avoidance and firm performance (Mao & Wu, 2019).

Another study supports the findings of this study, arguing that CSR increases business value by treating all stakeholders fairly and defending their interests. Companies can reduce risks and costs by building appropriate relationships with stakeholders. There may be a competitive advantage. Therefore, a good relationship with all stakeholders always positively influences firm performance (Harjoto and Jo 2011). Overall, the results of this study confirm Hypothesis 2: CSR is positively related to corporate performance (Rehman et al., 2015). A company that increases stakeholder trust through CSR activities ultimately improves business performance (Adams 2002). The reason for supporting CSR regulations is that businesses demonstrate their obligations to the public by demonstrating their commitment to society and using CSR as a beneficial tool (Adams 2002). Second, shareholders generally view companies engaged in CSR business as optimistic (Freeman and Hasnaoui 2011). Besides, other studies (Adams 2002; Sellers-Rubio et al., 2014; Abbas et al., 2019b) support that environmental improvement activities can improve firm performance. Organizational CSR initiatives increase revenue by resolving conflicts between the various interests of the CEO and shareholders. (Wang and Chen 2017). Managers strive to increase long-term benefits by improving stakeholder relationships, corporate social responsibility practices, and building social trust (Godos-Díez et al., 2010). Furthermore, stakeholder representatives claim that CSR generates reasonable income for shareholders, and CSR initiatives attract more investment and increase corporate profits (Jensen 2002; Sen et al., 2006).

Finally, the study proposed the last hypothesis that indicated a moderating role of CSR practices on the relationship between employee behavior and sustainable firm performance. The results have approved H5. Employee behavior is a subjective, personal behavior that may affect a sustainable firm, but many are not affected by external factors such as corporate social responsibility. These findings are consistent with the past studies conducted in a similar context (Zulfiqar et al., 2019; Ahmed et al., 2020). When business firms involve in specific CSR activities, the enterprises create a higher degree of recognition among their employees' behavior, which upsurges sales because customers’ purchase increases. Similarly, when business enterprises fail to treat their employees reasonably, the consumers' trust decreases to buy the products from these companies. Past literature documents that CSR practices undermine business firms’ corporate reputation as well as brands image (Oikonomou et al., 2012). It also affects business organizations relationships with various stakeholders, which ultimately affects sustainable firm performance (Wei et al., 2020).

Conclusion

Corporate taxation determines an essential milestone for the organization to stand with other socially responsible organizations. However, hoarding tax bucks is also used to preserve additional cash inflows and profit margins. Business organizations implement tax avoidance to increase the wealth of their stakeholders, and literature has reported such practices by the organizations. Business firms incorporate such tax-saving strategies directly or indirectly to improve their financial performance. In such scenarios, employees are involved gaining their personal interests in this phenomenon. Employees are the backbone of organizational structures, and taming and caring for their behavior is critical to having a positive and growing impact on firms’ sustainable business performance. Likewise, another crucial organizational factor affecting sustainable business performance is participating in corporate social responsibility activities.

As the post-pandemic situation worsens, organizations have encountered stress and pressure to assess and demonstrate sustainable, socially responsible behavior. Therefore, organizations are more inclined to invest in human capital and time to achieve sustainable financial performance and profitability. Sustainable corporate social responsibility implication guarantees the common interests and expectations of the organizations and their stakeholders. Accordingly, this research study aimed to investigate further the role of tax avoidance, employee behavior, and sustainable corporate social responsibility practices in achieving sustainable corporate financial performance. The results show that tax avoidance, employee behavior, and corporate social responsibility significantly influence sustainable business performance. It preserves cash inflows, increasing profits, corporate reputation, and image. The study further shows that corporate social responsibility has a negative but significant moderating effect on the relationship between tax avoidance and corporate business performance.

This research contributes to the fresh literature on organizational behavior and corporate strategy to measure employee behavior theoretically and tax avoidance’s influence on corporate financial performance. This study further questions how CSR moderates the relationship between tax avoidance, employee behavior, and corporate performance, suggesting that socially responsible organizations will be less involved in tax avoidance behaviors. In addition, the tax department of an organization is of great importance and benefit in developing a tax strategy that best suits the interests of the organization and the country. This informative research offers insightful findings that help policymakers at the state level. The study results ensure that organizations performing well over the years are audited transparently to collect taxes due.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics Statement

Ethics review and approval/written informed consent was not required as per local legislation and institutional requirements.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This study was partially supported by: The 13th Five Year Plan for Education and Science in Gansu Province (GS[2020]GHB4756) and the Science and Technology Plan of the Department of Science and Technology of Gansu Province (20CX9ZA046, 21CX6ZA067). This study was also partially supported by the Shandong Social Science Planning Fund Program (21CSDJ44).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, J., Aman, J., Nurunnabi, M., and Bano, S. (2019a). The Impact of Social Media on Learning Behavior for Sustainable Education: Evidence of Students from Selected Universities in Pakistan. Sustainability 11 (6), 1683. doi:10.3390/su11061683

Abbas, J., Mahmood, S., Ali, H., Raza, M., Ali, G., Aman, J., et al. (2019b). The Effects of Corporate Social Responsibility Practices and Environmental Factors through a Moderating Role of Social Media Marketing on Sustainable Performance of Firms' Operating in Multan, Pakistan. Sustainability 11 (12), 3434. doi:10.3390/su11123434

Abbas, J., Raza, S., Nurunnabi, M., Minai, M. S., and Bano, S. (2019c). The Impact of Entrepreneurial Business Networks on Firms' Performance through a Mediating Role of Dynamic Capabilities. Sustainability 11 (11), 3006. doi:10.3390/su11113006

Abbas, J., Zhang, Q., Hussain, I., Akram, S., Afaq, A., and Shad, M. A. (2020). Sustainable Innovation in Small Medium Enterprises: The Impact of Knowledge Management on Organizational Innovation through a Mediation Analysis by Using SEM Approach. Sustainability 12 (6), 2407. doi:10.3390/su12062407

Abdelfattah, T., and Aboud, A. (2020). Tax Avoidance, Corporate Governance, and Corporate Social Responsibility: The Case of the Egyptian Capital Market. J. Int. Account. Auditing Tax. 38, 100304. doi:10.1016/j.intaccaudtax.2020.100304

Adams, C. A. (2002). Internal Organisational Factors Influencing Corporate Social and Ethical Reporting. Account. Auditing Account. J. doi:10.1108/09513570210418905

Ağan, Y., Kuzey, C., Acar, M. F., and Açıkgöz, A. (2016). The Relationships between Corporate Social Responsibility, Environmental Supplier Development, and Firm Performance. J. Clean. Prod. 112 (112), 1872–1881. doi:10.1016/J.JCLEPRO.2014.08.090

Ahmed, M., Zehou, S., Raza, S. A., Qureshi, M. A., and Yousufi, S. Q. (2020). Impact of CSR and Environmental Triggers on Employee Green Behavior: The Mediating Effect of Employee Well‐being. Corp. Soc. Responsib. Environ. Manag. 27 (5), 2225–2239. doi:10.1002/CSR.1960

Aman, J., Abbas, J., Shi, G., Ain, N. U., and Gu, L. (2022). Community Wellbeing under China-Pakistan Economic Corridor: Role of Social, Economic, Cultural, and Educational Factors in Improving Residents' Quality of Life. Front. Psychol. 12, 816592. doi:10.3389/fpsyg.2021.816592

Asad, A., Abbas, J., Irfan, M., and Raza, H. M. A. J. J. o. M. S. (2017). The Impact of HPWS in Organizational Performance: A Mediating Role of Servant Leadership. Journal of Managerial Sciences 11.

Aqeel, M., Rehna, T., Shuja, K. H., and Abbas, J. (2022). Comparison of Students' Mental Wellbeing, Anxiety, Depression, and Quality of Life during COVID-19's Full and Partial (Smart) Lockdowns: A Follow-Up Study at a 5-Month Interval. Front. Psychiatry 13, 835585. doi:10.3389/fpsyt.2022.835585

Aras, G., and Crowther, D. (2008). Governance and Sustainability: An Investigation into the Relationship between Corporate Governance and Corporate Sustainability. Manag. Decis. 46 (3), 433–448. doi:10.1108/00251740810863870

Armstrong, C. S., Blouin, J. L., Jagolinzer, A. D., and Larcker, D. F. (2015). Corporate Governance, Incentives, and Tax Avoidance. J. Account. Econ. 60 (1), 1–17. doi:10.1016/J.JACCECO.2015.02.003

Armstrong, C. S., Blouin, J. L., and Larcker, D. F. (2012). The Incentives for Tax Planning. J. Account. Econ. 53 (1-2), 391–411. doi:10.1016/j.jacceco.2011.04.001

Awan, U., Khattak, A., and Kraslawski, A. (2019). “Corporate Social Responsibility (CSR) Priorities in the Small and Medium Enterprises (SMEs) of the Industrial Sector of Sialkot, Pakistan,” in Corporate Social Responsibility in the Manufacturing and Services Sectors. Editors P. Golinska-Dawson, and M. Spychała (Berlin, Heidelberg: Springer Berlin Heidelberg), 267–278. doi:10.1007/978-3-642-33851-9_15

Awan, U., Nauman, S., and Sroufe, R. (2020). Exploring the Effect of Buyer Engagement on Green Product Innovation: Empirical Evidence from Manufacturers. Bus. Strat. Env. 30 (1), 463–477. doi:10.1002/bse.2631

Awan, U., and Sroufe, R. (2022). Sustainability in the Circular Economy: Insights and Dynamics of Designing Circular Business Models. Appl. Sci. 12 (3), 1521. doi:10.3390/app12031521

Azizi, M. R., Atlasi, R., Ziapour, A., Abbas, J., and Naemi, R. (2021). Innovative Human Resource Management Strategies during the COVID-19 Pandemic: A Systematic Narrative Review Approach. Heliyon 7 (6), e07233. doi:10.1016/j.heliyon.2021.e07233

Babiak, K., and Kihl, L. A. (2018). A Case Study of Stakeholder Dialogue in Professional Sport: An Example of CSR Engagement. Bus. Soc. Rev., 123 (1), 119–149. doi:10.1111/basr.12137

Baumgartner, R. J. (2014). Managing Corporate Sustainability and CSR: A Conceptual Framework Combining Values, Strategies and Instruments Contributing to Sustainable Development. Corp. Soc. Responsib. Environ. Mgmt. 21 (5), 258–271. doi:10.1002/CSR.1336

Begum, S., Ashfaq, M., Xia, E., and Awan, U. (2021a). Does Green Transformational Leadership Lead to Green Innovation? the Role of Green Thinking and Creative Process Engagement. Bus. Strat. Env. 31 (1), 580–597. doi:10.1002/bse.2911

Begum, S., Xia, E., Ali, F., Awan, U., and Ashfaq, M. (2021b). Achieving Green Product and Process Innovation through Green Leadership and Creative Engagement in Manufacturing. Jmtm 33 (4), 656–674. doi:10.1108/jmtm-01-2021-0003

Bhattacharya, M., Gibson, D. E., and Doty, D. H. (2005). The Effects of Flexibility in Employee Skills, Employee Behaviors, and Human Resource Practices on Firm Performance. J. Manag. 31 (4), 622–640. doi:10.1177/0149206304272347

Bhutto, T. A., Farooq, R., Talwar, S., Awan, U., and Dhir, A. (2021). Green Inclusive Leadership and Green Creativity in the Tourism and Hospitality Sector: Serial Mediation of Green Psychological Climate and Work Engagement. J. Sustain. Tour. 29 (10), 1716–1737. doi:10.1080/09669582.2020.1867864

Blanco‐Gonzalez, A., Diéz‐Martín, F., Cachón‐Rodríguez, G., and Prado‐Román, C. (2020). Contribution of Social Responsibility to the Work Involvement of Employees. Corp. Soc. Responsib. Environ. Manag. 27 (6), 2588–2598. doi:10.1002/csr.1978

Burić, I., and Macuka, I. (2018). Self-Efficacy, Emotions and Work Engagement Among Teachers: A Two Wave Cross-Lagged Analysis. J. Happiness Stud. 19 (7), 1917–1933. doi:10.1007/s10902-017-9903-9

Chen, H., Liu, S., Wang, J., and Wu, Z. (2022). The Effect of Geographic Proximity on Corporate Tax Avoidance: Evidence from China. J. Corp. Finance 72, 102131. doi:10.1016/j.jcorpfin.2021.102131

Chen, X., Hu, N., Wang, X., and Tang, X. (2014). Tax Avoidance and Firm Value: Evidence from China. Nankai Bus. Rev. Int. 5 (1), 25–42. doi:10.1108/NBRI-10-2013-0037

Cheng, Y., Awan, U., Ahmad, S., and Tan, Z. (2021). How Do Technological Innovation and Fiscal Decentralization Affect the Environment? A Story of the Fourth Industrial Revolution and Sustainable Growth. Technol. Forecast. Soc. Change 162, 120398. doi:10.1016/j.techfore.2020.120398

Cherian, J., Gaikar, V., Paul, R., and Pech, R. (2021). Corporate Culture and its Impact on Employees' Attitude, Performance, Productivity, and Behavior: An Investigative Analysis from Selected Organizations of the United Arab Emirates (UAE). JOItmC 77 (1), 45. doi:10.3390/JOITMC7010045

del-Castillo-Feito, C., Blanco-González, A., and Hernández-Perlines, F. (2022). The Impacts of Socially Responsible Human Resources Management on Organizational Legitimacy. Technol. Forecast. Soc. Change, 174, 121274. doi:10.1016/j.techfore.2021.121274

Donaldson, L., and Davis, J. H. (2016). Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Aust. J. Manag. 16 (1), 49–64. doi:10.1177/031289629101600103

Dyreng, S. D., Hanlon, M., and Maydew, E. L. (2008). Long-Run Corporate Tax Avoidance. Account. Rev. 83 (1), 61–82. doi:10.2308/accr.2008.83.1.61

Dyreng, S. D., Hanlon, M., Maydew, E. L., and Thornock, J. R. (2017). Changes in Corporate Effective Tax Rates over the Past 25 Years. J. Financial Econ. 124 (3), 441–463. doi:10.1016/j.jfineco.2017.04.001

Etikan, I., Musa, S. A., and Alkassim, R. S. (2016). Comparison of Convenience Sampling and Purposive Sampling. Ajtas 5 (1), 1. doi:10.11648/J.AJTAS.20160501.11

Farzadfar, F., Naghavi, M., Sepanlou, S. G., Saeedi Moghaddam, S., Dangel, W. J., Davis Weaver, N., et al. (2022). Health System Performance in Iran: a Systematic Analysis for the Global Burden of Disease Study 2019. Lancet 399 (10335), 1625–1645. doi:10.1016/s0140-6736(21)02751-3

Fornell, C., and Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 18 (1), 39. doi:10.2307/3151312

Franke, G., and Sarstedt, M. (2019). Heuristics versus Statistics in Discriminant Validity Testing: a Comparison of Four Procedures. Intr 29 (3), 430–447. doi:10.1108/IntR-12-2017-0515

Freeman, I., and Hasnaoui, A. (2011). The Meaning of Corporate Social Responsibility: The Vision of Four Nations. J. Bus. Ethics 100 (3), 419–443. doi:10.1007/s10551-010-0688-6

Fu, Q., and Abbas, J. (2022). Reset the Industry Redux through Corporate Social Responsibility: The COVID-19 Tourism Impact on Hospitality Firms through Business Model Innovation. Front. Psychol. 12, 795345. doi:10.3389/fpsyg.2021.795345

Fuadah, L. L., Dewi, K., Mukhtaruddin, M., Kalsum, U., and Arisman, A. (2022). The Relationship between Sustainability Reporting, E-Commerce, Firm Performance and Tax Avoidance with Organizational Culture as Moderating Variable in Small and Medium Enterprises in Palembang. Sustainability 14 (7), 3738. doi:10.3390/su14073738

Fursova, J. (2016). The 'business of Community Development' and the Right to the City: Reflections on the Neoliberalization Processes in Urban Community Development. Community Dev. J. 53 (1), 119–135. doi:10.1093/cdj/bsw027

Fussler, C., and James, P. (1996). Driving Eco-Innovation: A Breakthrough Discipline for Innovation and Sustainability. Pitman Publishing.

Ge, T., Abbas, J., Ullah, R., Abbas, A., Sadiq, I., and Zhang, R. (2022). Women's Entrepreneurial Contribution to Family Income: Innovative Technologies Promote Females' Entrepreneurship amid COVID-19 Crisis. Front. Psychol. 13, 828040. doi:10.3389/fpsyg.2022.828040

Geng, J., Ul Haq, S., Abbas, J., Ye, H., Shahbaz, P., et al. (2022). Survival in Pandemic Times: Managing Energy Efficiency, Food Diversity, and Sustainable Practices of Nutrient Intake amid COVID-19 Crisis. Frontiers in Environmental Science 13, 945774. doi:10.3389/fenvs.2022.945774

Godos-Díez, J.-L., Fernández-Gago, R., and Martínez-Campillo, A. (2010). How Important Are CEOs to CSR Practices? an Analysis of the Mediating Effect of the Perceived Role of Ethics and Social Responsibility. J. Bus. Ethics 98 (4), 531–548. doi:10.1007/s10551-010-0609-8

Golinska-Dawson, P., and Spychała, M. (2018). Corporate Social Responsibility in the Manufacturing and Services Sectors. Springer Berlin Heidelberg.

Goswami, A., Nair, P., Beehr, T., and Grossenbacher, M. (2016). The Relationship of Leaders' Humor and Employees' Work Engagement Mediated by Positive Emotions. Lodj 37 (8), 1083–1099. doi:10.1108/LODJ-01-2015-0001

Hair, J. F., Howard, M. C., and Nitzl, C. (2020). Assessing Measurement Model Quality in PLS-SEM Using Confirmatory Composite Analysis. J. Bus. Res. 109, 101–110. doi:10.1016/j.jbusres.2019.11.069

Hair, J. F., Hult, G. T. M., Ringle, C., and Sarstedt, M. (2016). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). New York: SAGE Publications.

Hair, J. F., Sarstedt, M., Ringle, C. M., and Gudergan, S. P. (2017). Advanced Issues in Partial Least Squares Structural Equation Modeling. Los Angeles: SAGE Publications.

Hair, J. J., Sarstedt, M., Hopkins, L., and G. Kuppelwieser, V. V. (2014). Partial Least Squares Structural Equation Modeling (PLS-SEM). Eur. Bus. Rev. 26 (2), 106–121. doi:10.1108/ebr-10-2013-0128

Halbusi, A., Al-Sulaiti, K., Abbas, J., and Al-Sulaiti, I. (2022). Assessing factors influencing technology adoption for online purchasing amid COVID-19 in Qatar: Moderating role of word of mouth. Frontiers in Environmental Science 13, 942527. doi:10.3389/fenvs.2022.942527

Hall, P. C. M., Müller, D. K., and Saarinen, P. J. (2008). Nordic Tourism: Issues and Cases. Bristol: Channel View Publications.

Hanlon, M., and Heitzman, S. (2010). A Review of Tax Research. J. Account. Econ. 50 (2–3), 127–178. doi:10.1016/J.JACCECO.2010.09.002

Hao, J., and He, F. (2022). Corporate Social Responsibility (CSR) Performance and Green Innovation: Evidence from China. Finance Res. Lett. 48, 102889. doi:10.1016/j.frl.2022.102889

Hardeck, I., and Hertl, R. (2014). Consumer Reactions to Corporate Tax Strategies: Effects on Corporate Reputation and Purchasing Behavior. J. Bus. Ethics 123 (2), 309–326. doi:10.1007/sl0551-013-1843-7

Harjoto, M. A., and Jo, H. (2011). Corporate Governance and CSR Nexus. J. Bus. Ethics 100 (1), 45–67. doi:10.1007/s10551-011-0772-6

Hasan, M. M., Lobo, G. J., and Qiu, B. (2021). Organizational Capital, Corporate Tax Avoidance, and Firm Value. J. Corp. Finance 70, 102050. doi:10.1016/j.jcorpfin.2021.102050

Hasseldine, J., and Morris, G. (2013). Corporate Social Responsibility and Tax Avoidance: A Comment and Reflection. Account. Forum 37 (1), 1–14. doi:10.1016/J.ACCFOR.2012.05.001

He, K., Chen, W., and Zhang, L. (2021). Senior Management's Academic Experience and Corporate Green Innovation. Technol. Forecast. Soc. Change 166, 120664. doi:10.1016/j.techfore.2021.120664

Hussain, T., Abbas, J., Wei, Z., Ahmad, S., Xuehao, B., and Gaoli, Z. (2021). Impact of Urban Village Disamenity on Neighboring Residential Properties: Empirical Evidence from Nanjing through Hedonic Pricing Model Appraisal. J. Urban Plan. Dev. 147 (1), 04020055. doi:10.1061/(asce)up.1943-5444.0000645

Hussain, T., Abbas, J., Wei, Z., and Nurunnabi, M. (2019). The Effect of Sustainable Urban Planning and Slum Disamenity on the Value of Neighboring Residential Property: Application of the Hedonic Pricing Model in Rent Price Appraisal. Sustainability 11 (4), 1144. doi:10.3390/su11041144

Ikram, M., Sroufe, R., Awan, U., and Abid, N. (2021). Enabling Progress in Developing Economies: A Novel Hybrid Decision-Making Model for Green Technology Planning. Sustainability 14 (1), 258. doi:10.3390/su14010258

Ikram, M., Sroufe, R., Mohsin, M., Solangi, Y. A., Shah, S. Z. A., and Shahzad, F. (2019). Does CSR Influence Firm Performance? A Longitudinal Study of SME Sectors of Pakistan. Jgr 11 (1), 27–53. doi:10.1108/JGR-12-2018-0088

Jang, S. S., Ko, H., Chung, Y., and Woo, C. (2019). CSR, Social Ties and Firm Performance. Cg 19 (6), 1310–1323. doi:10.1108/CG-02-2019-0068

Jensen, M. C. (2002). Value Maximization, Stakeholder Theory, and the Corporate Objective Function. Bus. Ethics Q. 12, 235–256. doi:10.2307/3857812

Jiang, W., Zhang, C., and Si, C. (2022). The Real Effect of Mandatory CSR Disclosure: Evidence of Corporate Tax Avoidance. Technol. Forecast. Soc. Change 179 (2318), 121646. doi:10.1016/j.techfore.2022.121646

Jordan, P., and Spiess, M. (2019). Rethinking the Interpretation of Item Discrimination and Factor Loadings. Educ. Psychol. Meas. 79 (6), 1103–1132. doi:10.1177/0013164419843164

Khazaie, H., Lebni, J. Y., Abbas, J., Mahaki, B., Chaboksavar, F., Kianipour, N., et al. (2021). Internet Addiction Status and Related Factors Among Medical Students: A Cross-Sectional Study in Western Iran. Int. Q. Community Health Educ., 0272684X2110254. 272684X211025438. doi:10.1177/0272684X211025438

Khuong, N. V., Liem, N. T., Thu, P. A., and Khanh, T. H. T. (2020). Does Corporate Tax Avoidance Explain Firm Performance? Evidence from an Emerging Economy. Cogent Bus. Manag. 7 (1), 1780101. doi:10.1080/23311975.2020.1780101

Kim, M., Knutson, B. J., and Choi, L. (2016). The Effects of Employee Voice and Delight on Job Satisfaction and Behaviors: Comparison between Employee Generations. J. Hosp. Mark. Manag. 25 (5), 563–588. doi:10.1080/19368623.2015.1067665

Lanis, R., and Richardson, G. (2015). Is Corporate Social Responsibility Performance Associated with Tax Avoidance? J. Bus. Ethics 127 (2), 439–457. doi:10.1007/S10551-014-2052-8

Larson, R. B. (2019). Controlling Social Desirability Bias. Int. J. Mark. Res. 61 (5), 534–547. doi:10.1177/1470785318805305

Lebni, J. Y., Toghroli, R., Abbas, J., NeJhaddadgar, N., Salahshoor, M. R., and Mansourian, M. (2020). A study of internet addiction and its effects on mental health: A study based on Iranian University Students [Original Article]. J Educ Health Promot 9 (1), 205. doi:10.4103/jehp.jehp_148_20

Li, Z., Wang, D., Abbas, J., Hassan, S., and Mubeen, R. (2021). Tourists' Health Risk Threats amid COVID-19 Era: Role of Technology Innovation, Transformation, and Recovery Implications for Sustainable Tourism. Front. Psychol. 12, 769175. doi:10.3389/fpsyg.2021.769175

Li, X., Abbas, J., Dongling, W., Ul Ain Baig, N., and Zhang, R. (2022). From Cultural Tourism to Social Entrepreneurship: Role of Social Value Creation for Environmental Sustainability. Frontiers in Psychology 13. doi:10.3389/fpsyg.2022.925768

Lin, Y., Zhao, S., and Li, N. (2014). A Study of Network-Building HR Practices for TMT, Strategic Flexibility and Firm Performance: The Moderating Role of Environmental Uncertainty. Nankai Bus. Rev. Int. 5 (1), 95–114. doi:10.1108/NBRI-01-2014-0001

Liu, Q., Qu, X., Wang, D., Abbas, J., and Mubeen, R. (2022). Product Market Competition and Firm Performance: Business Survival through Innovation and Entrepreneurial Orientation amid COVID-19 Financial Crisis. Front. Psychol. 12, 790923. doi:10.3389/fpsyg.2021.790923

Mamirkulova, G., Mi, J., and Abbas, J. (2022). Economic Corridor and Tourism Sustainability amid Unpredictable COVID-19 Challenges: Assessing Community Well-Being in the World Heritage Sites. Front. Psychol. 12, 797568. doi:10.3389/fpsyg.2022.797568

Mao, C.-W., and Wu, W.-C. (2019). Moderated Mediation Effects of Corporate Social Responsibility Performance on Tax Avoidance: Evidence from China. Asia-Pacific J. Account. Econ. 26 (1–2), 90–107. doi:10.1080/16081625.2019.1546157

Martínez, P., Herrero, Á., and García-de los Salmonesdel, M. d. M. M. (2020). Determinants of eWOM on hospitality CSR issues. In Facebook we trust? J. Sustain. Tour. 28 (10), 1479–1497. doi:10.1080/09669582.2020.1742133

Mehta, B., Deleu, T., Raparthy, S. C., Pal, C. J., and Paull, L. (2020). Curriculum in Gradient-Based Meta-Reinforcement Learning. New Yark: J arXiv preprint arXiv:07956.

Mubeen, R., Han, D., Abbas, J., Álvarez-Otero, S., and Sial, M. S. (2021). The Relationship Between CEO Duality and Business Firms' Performance: The Moderating Role of Firm Size and Corporate Social Responsibility. Front. Psychol. 12, 669715. doi:10.3389/fpsyg.2021.669715

Mubeen, R., Han, D., Abbas, J., and Hussain, I. (2020). The Effects of Market Competition, Capital Structure, and CEO Duality on Firm Performance: A Mediation Analysis by Incorporating the GMM Model Technique. Sustainability 12 (8), 3480. doi:10.3390/su12083480

Mubeen, R., Han, D., Abbas, J., Raza, S., and Bodian, W. (2022). Examining the Relationship Between Product Market Competition and Chinese Firms Performance: The Mediating Impact of Capital Structure and Moderating Influence of Firm Size. Front. Psychol. 12. doi:10.3389/fpsyg.2021.709678

Nakagawa, S., and Cuthill, I. C. (2007). Effect size, confidence interval and statistical significance: A practical guide for biologists. Biol. Rev. 82 (4), 591–605. doi:10.1111/J.1469-185X.2007.00027.X

Oikonomou, I., Brooks, C., and Pavelin, S. (2012). The impact of corporate social performance on financial risk and utility: A longitudinal analysis. Financ. Manag. 41 (2), 483–515. doi:10.1111/j.1755-053x.2012.01190.x

Paulson, K. R., Kamath, A. M., Alam, T., Bienhoff, K., Abady, G. G., Abbas, J., et al. (2021). Global, regional, and national progress towards Sustainable Development Goal 3.2 for neonatal and child health: all-cause and cause-specific mortality findings from the Global Burden of Disease Study 2019. Lancet 398 (10303), 870–905. doi:10.1016/s0140-6736(21)01207-1

Rahmat, T. E., Raza, S., Zahid, H., Abbas, J., Mohd Sobri, F. A., and Sidiki, S. N. (2022). Nexus between integrating technology readiness 2.0 index and students' e-library services adoption amid the COVID-19 challenges: Implications based on the theory of planned behavior. J. Educ. Health Promot 11 (1), 50. doi:10.4103/jehp.jehp_508_21

Rashid Khan, H. u., Awan, U., Zaman, K., Nassani, A. A., Haffar, M., and Abro, M. M. Q. (2021). Assessing Hybrid Solar-Wind Potential for Industrial Decarbonization Strategies: Global Shift to Green Development. Energies 14 (22), 7620. doi:10.3390/en14227620

Rehman, A., Baloch, Q., and Sethi, S. (2015). Understanding the relationship between firm’s corporate social responsibility and financial performance: Empirical analysis. Abasyn J. Soc. Sci. 8 (1), 98–107.

RodrÍguez-Casallas, J. D., Luo, W., and Geng, L. (2020). Measuring environmental concern through international surveys: A study of cross-cultural equivalence with item response theory and confirmatory factor analysis. Journal of Environmental Psychology 71, 101494. doi:10.1016/j.jenvp.2020.101494

Saha, R., ShashiCerchione, R., Cerchione, R., Singh, R., and Dahiya, R. (2020). Effect of ethical leadership and corporate social responsibility on firm performance: A systematic review. Corp. Soc. Responsib. Env. 27 (2), 409–429. doi:10.1002/CSR.1824

Sarstedt, M., Ringle, C. M., and Hair, J. F. (2017). “Partial Least Squares Structural Equation Modeling,” in Handbook of Market Research. Editors C. Homburg, M. Klarmann, and A. Vomberg (Cham: Springer International Publishing), 1–40. doi:10.1007/978-3-319-05542-8_15-1

Schmidt, J. A., Pohler, D., and Willness, C. R. (2018). Strategic HR system differentiation between jobs: The effects on firm performance and employee outcomes. Hum. Resour. Manage 57 (1), 65–81. doi:10.1002/hrm.21836

Schneider, B., Yost, A. B., Kropp, A., Kind, C., and Lam, H. (2018). Workforce engagement: What it is, what drives it, and why it matters for organizational performance. J. Organ Behav. 39 (4), 462–480. doi:10.1002/JOB.2244

Sellers-Rubio, R., Ruiz-Moreno, F. L., Nicolau-Gonzálbez, J. B., and Casado-Díaz, A. (2014). The Differentiated Effects of CSR Actions in the Service Industry. J. Serv. Mark. 28 (7), 558–565. doi:10.1108/jsm-07-2013-0205

Sen, S., Bhattacharya, C. B., and Korschun, D. (2006). The role of corporate social responsibility in strengthening multiple stakeholder relationships: A field experiment. J. Acad. Mark. Sci. 34 (2), 158–166. doi:10.1177/0092070305284978

Shams, S., Bose, S., and Gunasekarage, A. (2022). Does corporate tax avoidance promote managerial empire building? J. Contemp. Account. Econ. 18 (1), 100293. doi:10.1016/j.jcae.2021.100293

Shen, J., and Benson, J. (2016). When CSR Is a Social Norm: How Socially Responsible Human Resource Management Affects Employee Work Behavior. J. Manag. 42 (6), 1723–1746. doi:10.1177/0149206314522300

Shoib, S., Gaitan Buitrago, J. E. T., Shuja, K. H., Aqeel, M., de Filippis, R., Abbas, J., et al. (2021). Suicidal behavior sociocultural factors in developing countries during COVID-19 L'Encéphale 47 doi:10.1016/j.encep.2021.06.011

Spillan, J., and Parnell, J. (2006). Marketing Resources and Firm Performance Among SMEs. Eur. Manag. J. 24 (2–3), 236–245. doi:10.1016/j.emj.2006.03.013

Su, Z., McDonnell, D., Cheshmehzangi, A., Abbas, J., Li, X., and Cai, Y. (2021). The promise and perils of Unit 731 data to advance COVID-19 research. BMJ Glob Health 6 (5), e004772. doi:10.1136/bmjgh-2020-004772

Taber, K. S. (2018). The Use of Cronbach's Alpha When Developing and Reporting Research Instruments in Science Education. Res. Sci. Educ. 48 (6), 1273–1296. doi:10.1007/S11165-016-9602-2/TABLES/1

Taber, K. S. (2017). The Use of Cronbach's Alpha When Developing and Reporting Research Instruments in Science Education. Research in Science Education 48 (6), 1273–1296. doi:10.1007/s11165-016-9602-2

Tang, T., Xu, L., Yan, X., and Yang, H. (2022). Simultaneous debt-equity holdings and corporate tax avoidance. J. Corp. Finance 72, 102154. doi:10.1016/j.jcorpfin.2021.102154

Trivellas, P., Rafailidis, A., Polychroniou, P., and Dekoulou, P. (2019). Corporate social responsibility (CSR) and its internal consequences on job performance: The influence of corporate ethical values. Ijqss 11 (2), 265–282. doi:10.1108/IJQSS-12-2017-0117

Tsourvakas, G., and Yfantidou, I. (2018). Corporate social responsibility influences employee engagement. Srj 14 (1), 123–137. doi:10.1108/SRJ-09-2016-0153

Wang, C., Wang, D., Abbas, J., Duan, K., and Mubeen, R. (2021). Global Financial Crisis, Smart Lockdown Strategies, and the COVID-19 Spillover Impacts: A Global Perspective Implications From Southeast Asia. Front. Psychiatry 12 (1099), 643783. doi:10.3389/fpsyt.2021.643783

Wang, M., and Chen, Y. (2017). Does voluntary corporate social performance attract institutional investment? Evidence from China. Corp. Gov. Int. Rev. 25 (5), 338–357. doi:10.1111/corg.12205

Wei, A.-P., Peng, C.-L., Huang, H.-C., and Yeh, S.-P. (2020). Effects of corporate social responsibility on firm performance: does customer satisfaction matter? Sustainability 12 (18), 7545. doi:10.3390/su12187545

Wolf, E. J., Harrington, K. M., Clark, S. L., and Miller, M. W. (2013). Sample Size Requirements for Structural Equation Models: An Evaluation of Power, Bias, and Solution Propriety. Educ. Psychol. Meas. 73 (6), 913–934. doi:10.1177/0013164413495237

Wong, A. K. F., Kim, S., and Hwang, Y. (2021)). Effects of Perceived Corporate Social Responsibility (CSR) Performance on Hotel Employees' Behavior. Int. J. Hosp. Tour. Adm. 28, 1–29. doi:10.1080/15256480.2021.1935390

Xi, M., Zhao, S., and Xu, Q. (2016). The influence of CEO relationship-focused behaviors on firm performance: A chain-mediating role of employee relations climate and employees' attitudes. Asia Pac J. Manag. 34 (1), 173–192. doi:10.1007/s10490-016-9487-7

Xi, M., Zhao, S., and Xu, Q. (2017). The influence of CEO relationship-focused behaviors on firm performance: A chain-mediating role of employee relations climate and employees' attitudes: A chain-mediating role of employee relations climate and employees’ attitudes. Asia Pac J. Manag. 34 (1), 173–192. doi:10.1007/S10490-016-9487-7

Yang, M., Bento, P., and Akbar, A. (2019). Does CSR Influence Firm Performance Indicators? Evidence from Chinese Pharmaceutical Enterprises. Sustainability 11 (20), 5656. doi:10.3390/su11205656

Yao, J., Ziapour, A., Abbas, J., Toraji, R., and NeJhaddadgar, N. (2022). Assessing puberty-related health needs among 10-15-year-old boys: A cross-sectional study approach. Arch. Pédiatrie 29 (2), 307–311. doi:10.1016/j.arcped.2021.11.018

Yu, S., Abbas, J., Draghici, A., Negulescu, O. H., and Ain, N. U. (2022). Social Media Application as a New Paradigm for Business Communication: The Role of COVID-19 Knowledge, Social Distancing, and Preventive Attitudes. Front. Psychol. 13. doi:10.3389/fpsyg.2022.903082

Zeidabadi, S., Abbas, J., Mangolian Shahrbabaki, P., and Dehghan, M. (2022). The Effect of Foot Reflexology on the Quality of Sexual Life in Hemodialysis Patients: A Randomized Controlled Clinical Trial. Sexuality and Disability 41 (1), 1–2. doi:10.1007/s11195-022-09747-x

Zhang, X., Husnain, M., Yang, H., Ullah, S., Abbas, J., and Zhang, R. (2022). Corporate Business Strategy and Tax Avoidance Culture: Moderating Role of Gender Diversity in an Emerging Economy. Front. Psychol. 13. doi:10.3389/fpsyg.2022.827553

Zhou, Y., Draghici, A., Abbas, J., Mubeen, R., Boatca, M. E., and Salam, M. A. (2021). Social Media Efficacy in Crisis Management: Effectiveness of Non-pharmaceutical Interventions to Manage COVID-19 Challenges. Front. Psychiatry 12, 626134. doi:10.3389/fpsyt.2021.626134

Keywords: corporate social responsibility, tax avoidance, firm performance, profitability corporate social responsibility, employee behavior

Citation: Li Y, Al-Sulaiti K, Dongling W, Abbas J and Al-Sulaiti I (2022) Tax Avoidance Culture and Employees' Behavior Affect Sustainable Business Performance: The Moderating Role of Corporate Social Responsibility. Front. Environ. Sci. 10:964410. doi: 10.3389/fenvs.2022.964410

Received: 08 June 2022; Accepted: 21 June 2022;

Published: 22 July 2022.

Edited by:

Usama Awan, Lappeenranta University of Technology, FinlandReviewed by: