Environmental financing: does digital economy matter?

- 1Institute of Economics of the Ural Branch of the Russian Academy of Sciences, Ekaterinburg, Russia

- 2Institute of Economics and Management, Ural Federal University Named After the First President of Russia B. N. Yeltsin, Ekaterinburg, Russia

Sustainable development and ecological restoration are a common goal pursued by countries around the world to mitigate the collision between economic growth and the environment. Digital economy has been rather instrumental in settling this type of conflict. The study is intended to identify the relationship between digital financing and environmental financing by assessing the specificities of their temporal and industry-specific dynamics, as well as to determine the side effects that the digital economy has in terms of current environmental investments and costs. The special attention is paid to the effect of the digital economy on both total environmental financing and its components, namely, environmental investment and current environmental protection costs. The authors come up with two indicators to evaluate the impact of the digital economy, these are digital financing (direct impact) and digital capital (indirect impact). To calculate these indicators, the authors’ own method is developed. The impact of the digital economy on environmental financing was tested using the least squares method with clustering of annual standard deviation and individual fixed effects. The research data were retrieved from the Federal State Statistics Service (Rosstat) of the Russian Federation for 2012–2022. Our findings show that digital financing exerts a significant positive effect on environmental financing, which indicates that two dynamic processes in the economy—digital transformation and introduction of advanced environmental digital technologies—are synchronized. The authors prove that digital investments stimulate a comparable increase in environmental investment due to the effects created by digital technologies penetrating into environmental protection technologies. We demonstrate that the level of digitalization of the population, companies and the state assessed through the digital capital index has a positive effect on environmental financing. The results of the study are of use in the sphere of public policy.

1 Introduction

Accelerated economic growth entails significant environmental problems associated with increasing pollution and depletion of resources. In the 21st century, anthropogenic pressure has turned into the main threat to human health, survival and development across the world. Sustainable development and ecological restoration have become, therefore, a common goal that all nations are striving for to mitigate the conflict between economic growth and the environment (Lu et al., 2017; Liang and Yang, 2019). Solving environmental problems and preventing new ones require companies and the states to invest significant amounts of financial resources. One of the most pressing issues of environmental protection, therefore, is the search for funding. The financial mechanism of nature management characterizes the state environmental policy, which means both direct financing of environmental protection measures at the expense of the state budget, and a set of tools to stimulate private investors.

However, sustainable development is not the only trend of the 21st century. Total digitalization has underlain the economic transition from one technological paradigm to another through the massive use of digital and information and communication technologies for boosting efficiency and competitiveness. To some extent, the digital economy has resolved the conflict between economic development and environmental pollution (Limna et al., 2022; Meng and Zhao, 2022).

The extensive use of digital technologies encourages the transformation and modernization of many traditional sectors of the economy, which eases the burden on the environment and resources, and reduces energy intensity. At the same time, digital technologies utilized in the environmental protection sphere allow providing more accurate assessments of the environmental impact and more reliable forecasts. The development of digital technologies opens up a plethora of opportunities for tackling environmental problems: from creating services for efficient waste management, searching for EV charging stations, monitoring systems and collecting climate change observation data to systems capable of preventing environmental risks and predicting environmental disasters.

A considerable number of scholarly publications scrutinize the role of digital technologies in reducing global emissions. Researchers analyze industry-specific features and the ownership structure and introduce them into their models, focus on spatial aspects of digital technologies’ influence, conduct research using data from various countries, regions, and cities. In this context, environmental indicators such as air and water pollution, waste generation and energy consumption are used as dependent variables. In general, the impact of the digital economy on environmental financing has been understudied.

In our research, we want to focus specifically on the issues of financing environmental and digital transitions. If digitalization and sustainable development as synchronous processes are always considered together (through specific technologies that affect each other), then no one has studied the synchronization of financing of these processes. And we see in this a number of problems that have been overlooked by researchers. For example, environmental financing, as well as digital financing, represent government and corporate expenses. But the decision to finance these processes relates to different areas—for example, in companies these are different budgets located within different areas of strategy, and in the government, these are completely different departments with their own budgets and strategies. Since financing decisions are made by different responsible groups, it is quite difficult to talk about full synchronization of digital transformation and sustainable development. In addition, we intuitively believe that the propensity for digital financing is higher than the propensity for environmental financing, since digital transformation directly affects productivity and income. Therefore, if we can prove the connection between these financial flows, it will open up new opportunities for the implementation of stimulating mechanisms of public policy. This is our research motivation.

The foregoing explains the purpose of the study, which is to identify the relationship between digital financing and environmental financing by assessing the specificities of their temporal and industry-specific dynamics, as well as to determine the side effects that the digital economy has in terms of current environmental investments and costs.

In the study, we address the following research questions:

1. Does digital financing affect environmental financing? Can we affirm that the dynamic transformation of the economy is synchronized?

2. If it is, does digital investment stimulate a comparable increase in environmental investment due to the effects created by digital technologies penetrating into environmental protection technologies?

3. Is the impact of the digital economy on environmental financing dependent on the overall level of digital transformation of companies, population and the state?

We see the only limitation of the study related to the lack of separate statistical accounting. State statistical services do not single out the costs of implementing digital environmental technologies as part of environmental financing in a separate line, nor do they allocate costs for digital technologies aimed at environmental protection as part of digital financing. We will propose a solution to this problem in the Section 4.

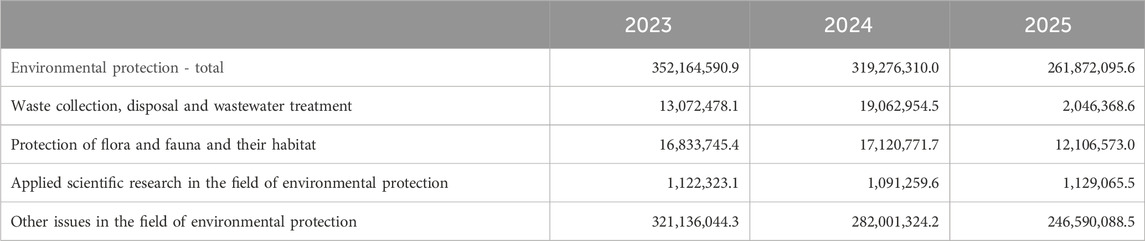

To answer these questions, we use evidence from the Russian Federation. Similar to other nations, the country pays great attention to sustainable development, while the unfavorable state of the environment there is among the main constraints upon long-term development. According to the Environmental Security Strategy of the Russian Federation until 2025 (approved on 19 April 2017), over 70% of the population live in poor environmental conditions and are exposed to a substantial negative impact of manufacturing, transport and other industries. In recent years, green issues, such as environmental protection and the rational use of natural resources, have been high on the agenda in the country. The Russian government actively finances environmental protection activities and creates conditions for public-private partnerships to develop in this area by transferring part of the financial burden to partner companies and private investors. This is especially true for the costs incurred in collection and disposal of waste and wastewater treatment (Table 1).

TABLE 1. Russian government expenditure on environmental protection from the federal budget in 2023 and for the 2024–2025 planning period, thousands of rubles.

Source: Federal law of 5 December 2022 No. 466-FZ “On the federal budget for 2023 and the 2024–2025 planning period”. Available at https://www.consultant.ru/document/cons_doc_LAW_433298/(accessed on 30 May 2023).

In Russia, the primary document guiding the digitalization of the environment is the Strategic Direction for Digital Transformation of Ecology and Nature Management, which was approved on 8 December 2021. This document outlines several technologies that will be implemented to enhance environmental management. Artificial intelligence will be employed to analyze monitoring data, predict hazardous weather conditions and forest fire risks, automate real-time decision-making, and identify flora and fauna in complex environments. Remote sensing of the Earth and the use of unmanned aerial vehicles will be utilized for surveying, planning efficient resource utilization, protecting natural resources and the environment, and monitoring climate change. The Internet of Things (IoT) will play a crucial role in the development of the Federal Service for Hydrometeorology and Environmental Monitoring (Roshydromet) observation network program, improving the efficiency of data collection and transmission from stationary and mobile observation points. Big data and analytical data processing will be used to accumulate, store, analyze, and process data within federal state information systems and digital platforms. Additionally, the concept of a digital twin will be employed to update and create a comprehensive database of natural objects, including ecosystems such as subsoil, bodies of water, forests, and wildlife habitats. This will enable better understanding and management of these natural resources. Overall, these technological advancements aim to enhance environmental monitoring, resource management, and conservation efforts in Russia.

Another solution to environmental problems is the development of geographic information systems (GISs) that are designed to collect, analyze, store and graphically interpret spatial and temporal data, as well as attributive information about the objects presented in the GIS. Owing to these systems, it is possible to rationally manage resources and, by applying new means and methods of data processing, to optimize and control their use both at the regional and federal levels.

Digital technologies are also used to automate decision-making and managerial processes in the field of environmental and natural resources management. In this framework, it is planned to create a unified federal state information system for environmental monitoring that will contain data on the state of natural objects and environmental pollution. In addition, new data analysis methods will be pioneered to more accurately and quickly assess the environmental situation and forecast possible ecological problems. The government plans to implement full digital transformation of the environmental sector. Thus, the Strategic Direction for Digital Transformation of Ecology and Nature Management is an important step towards environmental security and sustainable development in Russia.

The present study consists of the following parts. Section 2 provides a literature review to find out the conceptual and logical relationship between the indicators under analysis. In Section 3, we elaborate on research design and theoretical hypothesis. The details about the models, variables and data resources are given in Section 4. Section 5 contains the modelling outcomes and economic rationale for them. Section 6 summarizes the research results.

2 Literature review

2.1 Digital economy and sustainable development

Digital economy is an economic concept that views digital knowledge as a key factor of production and looks at modern information and communication networks as the main carrier of digital knowledge (Purnomo et al., 2022). The digital economy plays a crucial role in mitigating market imperfections, improving economic efficiency and optimizing the industrial structure. The existing definitions of the concept of digital economy are summarized by a number of researchers (Williams, 2021; Zhang et al., 2021). The core characteristics of the digital economy are systematized in (Borremans et al., 2018; Ding et al., 2021). The digital economy consists of three main components: digital infrastructure, digital technologies in economic sectors, and e-commerce. Digital infrastructure ensures the connectivity of economic agents; digital technologies and solutions transform virtually all aspects of production and consumption; and e-commerce includes the exchange of economic resources using platforms and reduces transaction costs (Akberdina and Barybina, 2022). It is worth noting that the development level of the digital economy directly correlates with the level of the material sphere. The digital economy is a superstructure over the material sector of the economy and allows increasing the efficiency of any interaction. Hence, if digital technologies are introduced in the context of the insufficient development of material production, the cumulative economic effect of digitalization will not be of decisive importance.

The digital economy in a country covers information technology, software, mobile communications, and data transmission. There is quite a lot of studies on various aspects of the digital economy in Russia (Akberdina, 2018; Basaev, 2019; Ziyadullaev et al., 2019; Belokurova et al., 2020; Gureev et al., 2020; Vlasov, 2020; Rudyk et al., 2022). The researchers note that the digital economy in Russia is developing at a high pace, transforming industries and markets and penetrating into education and intellectual activity. At that, the digital inequality of the regions and the low share of their own digital technologies serve as development constraints.

Sustainable development, green economy, circular economy and ESG-concept are the components of a worldview advocating that a just economy should be built in accordance with both social and environmental dimensions, since the economy and the environment have a tremendous mutual influence on each other (Söderholm, 2020; D’amato & Korhonen, 2021). These concepts share a common thesis that a low-carbon, resource-efficient and socially inclusive economy should improve human wellbeing and social justice, while significantly reducing environmental threats and resource scarcity (Bouchoucha, 2021; Xie et al., 2023). The bibliometric analysis indicates that there is an upward trend in the number of research in the field of green economy, circular economy and sustainable development; however, there are country-specific differences in terminology (Ali et al., 2021). At that, all researchers tend to believe that the efficient use of resource, the circular economy, innovation, social integration, ecosystem protection, etc., contribute to the coordinated development of the economy, society and the environment and the achievement of sustainable development (Ozkan et al., 2023).

Sustainability and the green economy in Russia are also deeply investigated (Bobylev and Solovyeva, 2017; Zhironkin et al., 2017; Popkova et al., 2018; Karieva et al., 2020; Tulupov et al., 2020; Lavrikova et al., 2021; Kuznetsova et al., 2022; Tagaeva et al., 2022). The researchers highlight that Russia is rich in natural resources, which has historically formed an evolution model based on commodity exports. To shift to a new paradigm of economic development, the concept of sustainability with a balanced set of economic, social and environmental components should be included in the strategic documents underlying the country’s long-term development.

Researchers typically sharing similar views within each subject area, however, express serious disagreements on the impact the digital economy has on sustainable development (Adeshola et al., 2023). On the one hand, extensive studies have shown that the digital economy and the green economy develop in sync and positively influence each other (Wu et al., 2018; Kostoska and Kocarev, 2019; Vinuesa et al., 2020). Some works analyze the overall impact of the digital economy on the total productivity of green factors of production. Researchers emphasize that information technology can increase labor productivity and promote economic growth, which are in a positive correlation with the total productivity of green factors of production (Niebel, 2018; Nguyen et al., 2020; Wang et al., 2021; Wang et al., 2022c). A number of publications put the emphasis on the relationship between digitalization and energy consumption and conclude that digital technologies cause a decrease in energy intensity (Mughal et al., 2022; Sun, 2022). For example, it was found that with a 1% increase in the digital economy index, the number of developments in the new energy domain increases by an average of 0.2% (Wang et al., 2022a). Additionally, the digital economy not only creates conditions for clean energy to develop in countries with high carbon emissions (Wang et al., 2022b), but also helps to optimize the energy structure, increase energy efficiency (Li et al., 2021; Nikitaeva and Dolgova, 2022; Pierli et al., 2022; Xue et al., 2022; Akberdina et al., 2023) and reduce energy consumption.

On the other hand, a fairly large part of works is devoted to the inverse relationship between the digital economy and environmental pollution. For instance, researchers demonstrate that there are certain contradictions between smart digital cities and sustainable development goals (Martin et al., 2018), note that digitalization is not yet proved to be essential for reducing energy consumption and greenhouse gas emissions (Jin et al., 2018), and assume that digital equipment causes a lot of damage to the environment during production, maintenance and disposal (Kuntsman and Rattle, 2019). The main argument for the inverse relationship between the digital economy and reducing the burden on the environment is the fact that the use of digital technologies (big data, in particular) increases energy consumption (Van Heddeghem et al., 2014; Zhou et al., 2018). The researchers claim that the share of digital infrastructure in the national energy consumption can reach up to 10%–15%.

2.2 Environmental financing

Sufficient funding is a vital prerequisite for a significant improvement in the state of the environment. Strictly speaking, sustainable development should be carried out amid the simultaneous progress in financial instruments. To handle this problem, various financing models are implemented (Cui et al., 2021; Sinha et al., 2021). Environmental protection funding was initially the state’s responsibility; however, in recent years, this function has been transferred to public-private partnerships leaving the state in charge of financing the relevant infrastructure (Ho and Park, 2019). In addition to PPP, the state actively encourages private investors to invest in environmental protection by providing tax incentives, grants and subsidies. Traditionally, there are two types of private investors—institutional and individual (Zhou et al., 2020; Akomea-Frimpong et al., 2022). Institutional investors are commercial banks, insurance companies, pension and public funds. Private capital is provided by interested companies. Recently, the market for green loans (Su et al., 2022) and green bonds (Tolliver et al., 2020) has been formed in the institutional segment. The evolution of the digital economy has led to the emergence of a new type of investor, i.e., crowdfunding platforms to finance environmental expenditures (Böckel et al., 2021).

In various studies, the term “environmental finance” is used as a synonym for such concepts as ”green finance” (Muganyi et al., 2021; Meo and Zhao, 2022), ”ecological finance” (Kihombo et al., 2021; Lee et al., 2022), ”sustainable finance” (Develay and Giamporcaro, 2023) or ”clean technology finance” (Madaleno et al., 2022). Originally, the term referred to the environmental economics paradigm and environmental investment. However, with the development of direct and derivative financing instruments, the growing impact of environmental problems and the tightening of environmental regulations (Cao et al., 2021; Feng et al., 2022) the scope of the term’s application has gradually expanded. Hence, the concept of environmental finance will be evolving adding new research aspects over time.

Publications on environmental financing in the Russian Federation cover the full range of issues identified above, focusing on the development of a green financial market and green risks (Ziyadin et al., 2019; Tulupov et al., 2020; Tyuleneva & Moldazhanov, 2020; Altunina and Alieva, 2021).

2.3 Digital capital

The existing literature on the digital economy primarily deals with measuring its level and effects. Currently, there is no single measurement method for selecting and evaluating indicators of the digital economy. Researchers mainly evaluate the digital economy and related indicators in terms of their specific tasks. The details of these methods are beyond the scope of the given study, but it is sufficient to refer to review articles (Bukht and Heeks, 2017). We are going to consider one of the indicators of the digital economy, namely, digital capital. This phenomenon is less popular among researchers if compared to the digital economy, and there are significant differences in studies with respect to the approaches used.

The first approach addresses digital capital from the perspective of an individual and in close connection with social and cultural capital (Resnick, 2004; Seale, 2012). These studies lie in the field of sociology and explore the extent to which people are involved in the use of digital technologies. Digital capital is interpreted as an individual’s digital technology ecosystem that determines how a user interacts with digital technologies. This characterizes the conditions for effective interaction between an individual and digital technologies, which he/she needs for their wellbeing in a digital society. The ability to purchase digital gadgets and software is a subset of an individual’s economic capital, and the material exchange takes place in areas where ICTs are used. Digital capital manifests itself in cultural capital in the form of digital skills, knowledge and competencies (Park and Park, 2017; Vartanova and Gladkova, 2020).

The second approach examines digital capital in the context of companies’ intangible assets (Crouzet and Eberly, 2019; Ayyagari et al., 2020; McGrattan, 2020; Tambe et al., 2020; Wu et al., 2020). Firms invest in both manufacturing and digital equipment to enhance their production capacity. ICT equipment (servers, routers, online shopping platforms and basic Internet software) acts as a tangible part of digital capital. In order to benefit from new technologies, digital-focused companies not only require investments in digital technologies but also in intangible assets. These intangible assets include staff training, new decision-making structures, and new business models to generate profits from digital activities (Eisfeldt and Papanikolaou, 2013; Bughin and Manyika, 2018). These investments often result in higher overall costs compared to the costs of digital technologies alone. These intangible assets make up the intangible part of digital capital. Similar to other forms of capital, digital capital can depreciate over time and needs to be replenished through additional investments. However, unlike tangible assets, the value of the intangible part of digital capital is closely tied to a specific company and is influenced by external economic conditions. As a result, the value of intangible assets tends to fluctuate more strongly than the value of tangible ICT assets, which are more easily exchangeable and have active secondary markets. As digital capital becomes an increasingly crucial component of a company’s overall capital reserves, differences in digital capital among firms can explain variations in the performance of new digital-focused companies compared to older firms. These differences in digital capital can be attributed to the accumulated reserves and variations in the marginal costs of investing in digital capital. In summary, the presence and management of digital capital play a significant role in determining the success and performance of digital-focused firms in comparison to traditional firms (Tambe et al., 2020).

The third approach to investigating digital capital lies in the field of the regional economy and characterizes the extent to which digital capital of a country or region is formed. The existing studies in this domain are not numerous. A number of publications on the assessment of the country’s digital capital as a combination of digital technologies and digital competencies explore its relationship with socio-economic and demographic characteristics such as income, age, education level, and place of residence, etc. (Ragnedda, 2018; Ragnedda et al., 2020). The techUK trade association holds a regular study of the Local Digital Capital Index (LDC Index) in the UK regions (LDCI, 2021; LDCI, , 2022). This index incorporates eight components, these are digital skills, digital technologies, data ecosystems, digital infrastructure, finance and investment, research and innovation, trade support, and cooperation. The LDC Index evaluates the impact that digital technologies can exert on the region, demonstrates its strengths and sets the direction for further development. The Index can be applied when formulating public policy to address a range of issues faced by the region and the entire country. The LDC Index also provides data to regional innovation ecosystems, including industry, government, universities and the public.

2.4 Research gap

Despite the fact that the mutual impact of digitalization and sustainable development is being studied in depth, the issues of the relationship of financial flows underlying these processes have not been investigated. Our research should fill this gap, initiate such research, and substantiate the directions for clarifying public policy.

3 Research design and theoretical hypothesis

Environmental financing consists of two components—environmental investment and current environmental protection costs. Environmental investment is investment in equipment, technologies and new facilities in a particular period to insure environmental protection. Current environmental protection costs cover annual costs incurred in many areas of environmental protection, such as expenditures on the current control of the production and consumption wastes circulation, on the maintenance of the fixed capital for environmental purposes, and R&D expenditures as far as they relate to nature protection.

We will assess the impact of the digital economy on environmental financing using two indicators, these are digital financing and digital capital. Digital financing includes digital investment, current digital costs, and digital competence costs. To calculate digital capital, we adopt the aforementioned approach, but offer our own index methodology described in Section 3 ‘Methods and Data’.

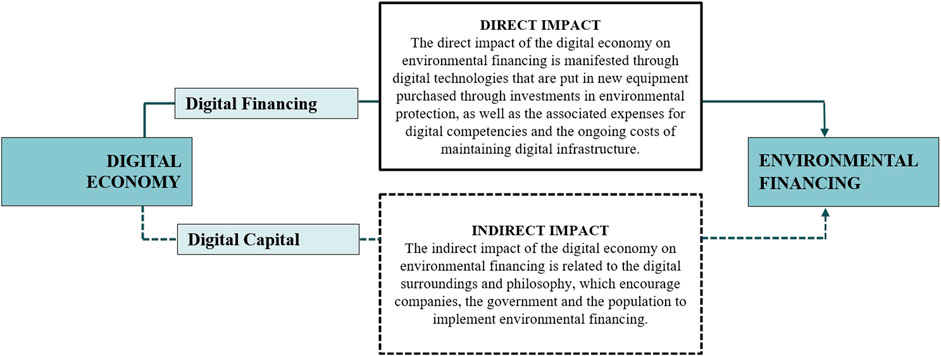

We believe that the mechanism for linking the digital economy and environmental financing can be represented as follows (Figure 1):

1. The effect of the digital economy on environmental financing is assessed through digital financing. Digital economy is manifested through digital technologies that are put in new equipment purchased through investments in environmental protection, as well as the associated expenses for digital competencies and the ongoing costs of maintaining digital infrastructure.

H1. The higher the share of digital financing in a company, region or country, the more likely it is that environmental financing will cover expenses on new digital environmental protection technologies, and the larger the total amount of environmental financing.

Since any investments depend on companies’ financial situation, profitability and risk, their dynamics will be unidirectional if investments are aimed at technological changes. Investments and current operating expenses are of a different nature, and their dynamics is determined by different factors. This thesis allows us to come up with another two hypotheses.

H2. A positive relationship of digital financing is stronger with environmental investment and weaker with current environmental protection costs.

H3. There is a strong positive relationship between digital investment and environmental investment, and the positive relationship of current digital costs and digital competence costs with environmental investment is weaker.

2. The indirect effect of the digital economy on environmental financing is associated with the formation of the necessary digital environment and worldview that stimulate companies, the state and the population to engage in environmental financing. To assess the strength of the relationship, the ‘digital capital’ indicator is used.

H4. Digital capital has a positive effect on environmental financing due to the cumulative synergistic effect of digitalization of the population, companies and the state.

H5. Effect of digital capital on environmental investment is more positive whereas its effect on current environmental protection costs is less positive.

4 Methods and data

4.1 Model’s construction

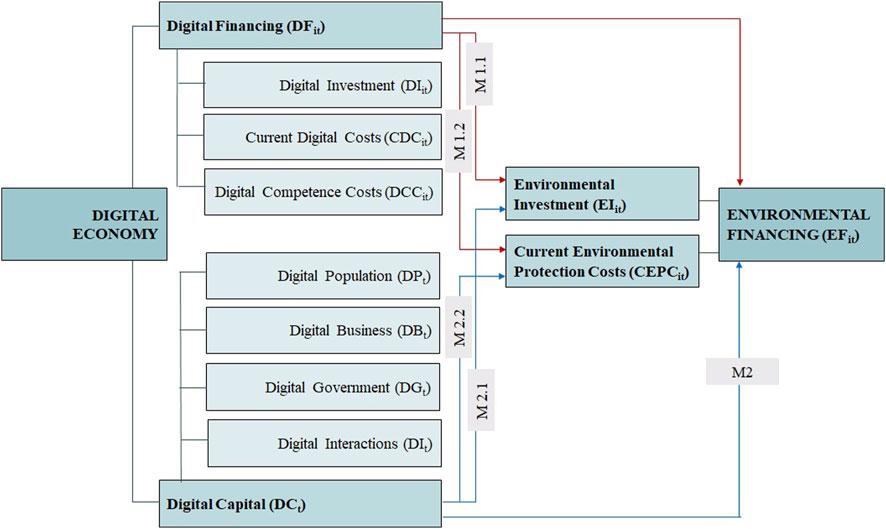

According to the above theoretical analysis and study design, to test the impact of the digital economy on environmental financing, we will use the least squares method (LSM) with clustering of annual standard deviation and individual fixed effects. Figure 2 presents the set of the tested models.

Hypothesis H1. is tested using model M1:

where

To test hypothesis H2, models M1.1 and M1.2 are used, respectively:

where

Hypothesis H3. is tested using model M1.1.1:

where

For testing hypothesis H4, model M2 is designed:

where

As indicated above, we offer our own index methodology to evaluate digital capital:

where

Similar approach to integrating sub-indices into a composite index produced a positive outcome in the case of the digital space index (Akberdina et al., 2022).

The first sub-index

The second sub-index

The third sub-index

The fourth sub-index

The indicators of the sub-indices were normalized. The maximum value for each indicator over a period of time was equated to one, and the values for the remaining years were normalized in relation to it.

Finally, hypothesis H5 is tested using models M1.2 and M2.2:

where

4.2 Variables and data sources

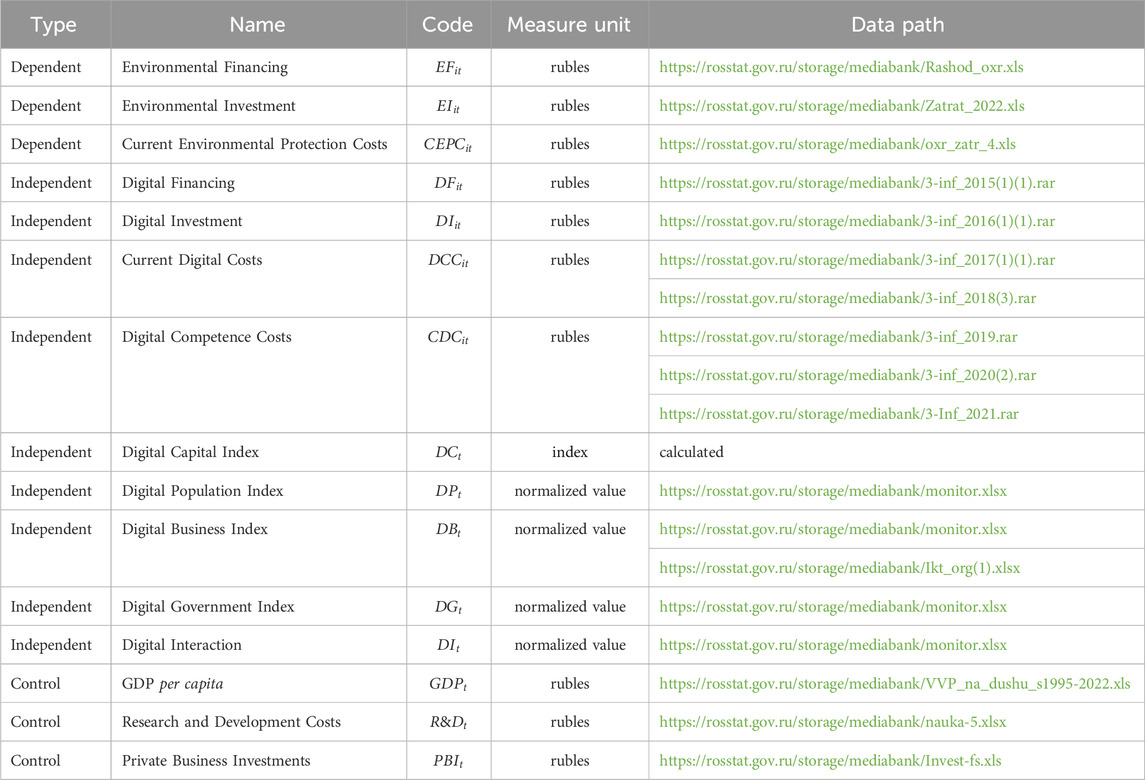

Based on the research purpose and data availability, we have developed dependent variables, main independent variables, control variables, and intermediate variables. Their specific values, calculation methods and data sources are presented in Table 2.

The study used data from the Federal State Statistics Service of the Russian Federation (Rosstat) on environmental protection expenditures for 2012–2022 by industry, including investment and current costs. In the research, the data are given by types of industry-specific economic activity—in aggregate (sections B, C, D, E according to the OKVED-2 classifier [OKVED-2 is the Russian National Classifier of Types of Economic Activity]) and in detail (industry sectors—decimal codes according to the OKVED-2 classifier).

To perform regression modeling of the relationship between environmental financing and digital financing, the data for 2015–2021 were taken, since the statistics on digitalization by type of industry expenses has been collected only since the approval of the state program Digital Economy of the Russian Federation. To carry out the regression assessment of the relationship between environmental financing and digital capital, data for 2012–2022 were used. The indicators for calculating the digital capital index and sub-indices are presented in the Consolidated Monitoring of the Development of the Information Society in the Russian Federation, provided by the Federal State Statistics Service of the Russian Federation.

5 Results and discussion

5.1 Digital financing and environmental financing

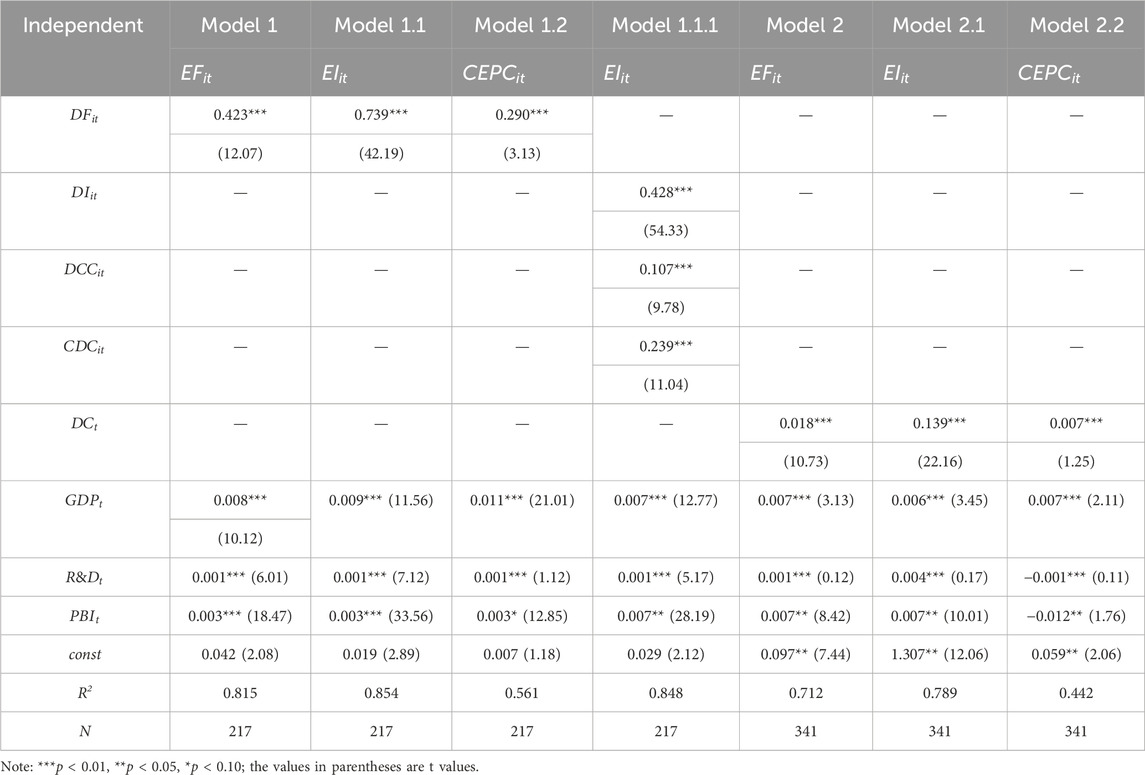

The first group of the research models dealt with the direct relationship between digital financing and environmental financing. Table 3 presents empirical results based on panel data for 31 Russian industries for 7 years (2015–2021). As we can see, the main model M1 (Eq. 1) gives quite good results: the regression coefficient of the impact of digital financing (

We suppose that in this case the effect of digital technologies penetrating into environmental protection technologies is triggered. Digital technologies such as the Internet, the IoT, artificial intelligence, big data, digital twins, etc., are widely used in environmental protection, which changes resource consumption patterns, pollution reduction, and higher energy efficiency. These technologies are instrumental in analyzing big data obtained through environmental monitoring, automating management decision-making in real time, and predictive forecasting of potentially hazardous natural phenomena and objects. Owing to the use of GISs, Earth space sensing data and unmanned observation, it possible to control landfills, identify flora and fauna objects, etc. The effect of the digital economy is also evident when solving any engineering and environmental problem. Software for design and automation of technological preparation of production is of great importance for cleaner production to progress. Increasingly scrupulous attention is paid to the latest achievements in artificial intelligence and neural networks applied to produce optimal technological solutions, i.e., to optimize resource consumption, reduce emissions of harmful substances, and cut down energy consumption.

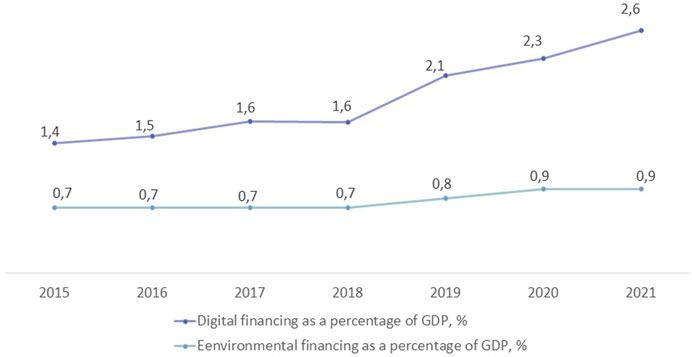

On the other hand, there is a substitution effect: outdated production technologies are replaced by new digital solutions, which ultimately leads to a significant decrease in environmental pollution and resource savings in industry. This, in turn, reduces the need for environmental facilities construction funding and lowers current environmental protection costs. For example, industrial robots replace human labor for automated production, intelligent design improves the efficiency of allocation of production factors and productivity. Digital technologies also contribute to reducing the volumes of raw materials required. With electronic sensors of various sizes, virtually any change in the production system’s operating state can be monitored. This allows not only tracking CO2 emissions, but also controlling the level of emissions related to the company’s entire value chain. The effects of penetration and substitution are manifested in different growth rates of digital financing and environmental financing. As evidenced by the case of Russia, digital financing is increasing annually at a faster pace than environmental financing. This led to the fact that over 7 years the share of digital financing in GDP increased 1.8 times, while the rise in the share of environmental financing in GDP was only 1.3 times (Figure 3). This absolutely does not mean that the digital economy in Russia is prioritized over sustainable development; this is merely a manifestation of the abovementioned effects. Thus, we can conclude that hypothesis H1 has been confirmed.

FIGURE 3. Digital financing and environmental financing as a percentage of GDP in the Russian Federation, %.

Models M1.1 and M1.2 (Eqs 2, 3) were developed to test hypotheses about the impact of digital financing on the elements of environmental financing, namely, environmental investment and current environmental protection costs. Table 3 demonstrates the situation that we had predicted. There is a sustainable positive relationship between digital financing (

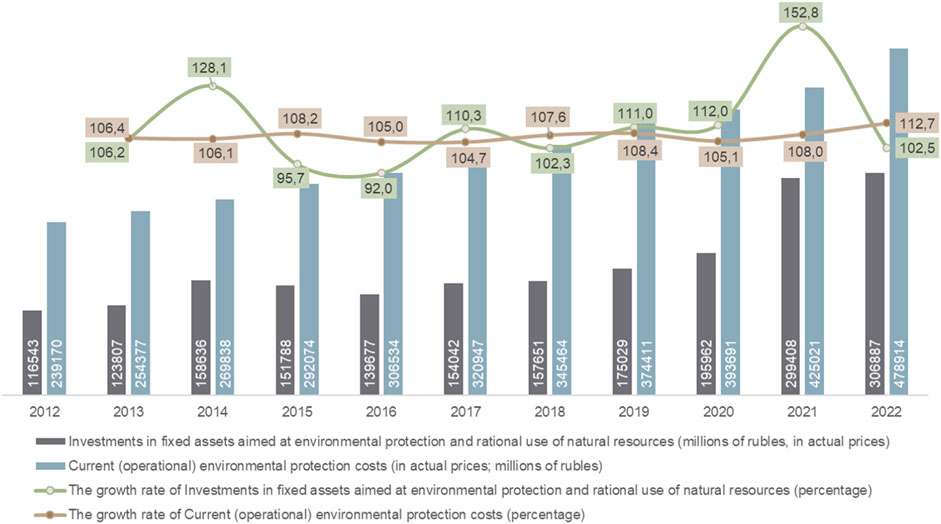

We argue that environmental investment and current environmental protection costs are of a different nature and determined by different factors. This is clearly illustrated in Figure 4.

FIGURE 4. Dynamics of environmental investment and current environmental protection costs in the Russian Federation.

The dynamic graphs of environmental investment and current environmental protection costs are configured in a completely manner. Current environmental protection costs are related to production volumes and resource consumption. Digital technologies have little effect on the costs associated with previous technological solutions. We believe that environmental investment is determined by the willingness of companies to invest and the availability of sufficient funding. Any investment in technology, therefore, will have unidirectional dynamics and a close statistical relationship. These arguments, in our view, support hypothesis H2.

Model M1.1.1 (Eq. 4) is a variation of model M1.1 and supposed to reveal the relationship of environmental investment (

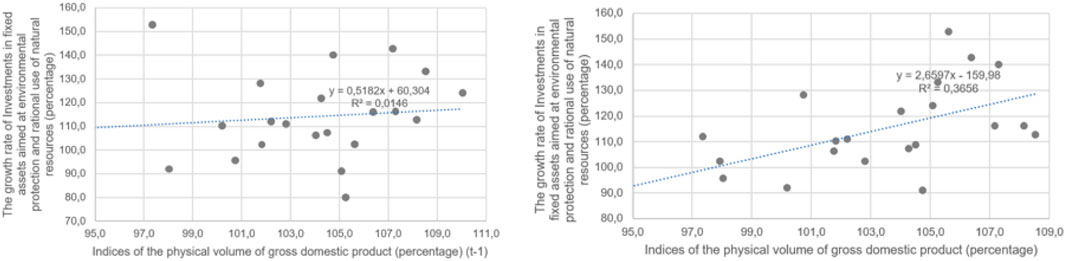

However, we prove that there is a relationship between environmental investment and GDP, but it is rather weak. Moreover, this relationship is significant only in the regression without a time lag, while a 1-year lag notably worsens the regression values (Figure 5).

In 2021, we analyzed the structure of digital financing in Russia. Of the total funds allocated for digital transformation in industry, 72% were directed to internal expenses, such as the purchase of information and communication equipment, software, staff training, etc. The remaining 28% of the budget was allocated to external expenses, such as digital equipment rental, software, technical support, and database access. The internal costs of digital transformation were involved in the acquisition of digital machinery and equipment, and 40.2% of these were associated with the purchase of computers and office equipment. However, the share of digital production equipment purchases remained small. Software accounted for 22% of the total domestic digitalization budget in 2021. Employee training comprised just 3% of all internal digital transformation spending. In industry, there are practically no costs incurred in the formation of digital context. Thus, the internal funds for digital transformation exceed the external ones, and most of them are aimed at purchasing hardware and software. Employee training and creating digital context in industry remain less significant expenses.

5.2 Digital capital and environmental financing

In the second part of our study of the relationship between the digital economy and environmental financing, we applied the digital capital index, for which we had previously proposed a definition and an assessment method. The digital capital index characterizes the environment, where technological segments of traditional industries develop. To assess the impact of the digital capital index (

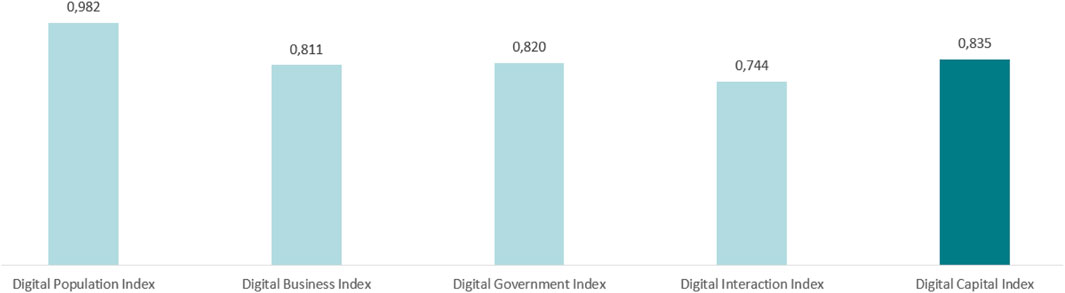

The digital capital index has an indirect impact due to the cumulative synergistic effect of digitalization of the population, companies and the state. As follows from Figure 6, in 2022 the digital capital index in Russia was 0.835 out of the maximum possible value of 1. If the digital population index is close enough to the maximum value, and the digital business index and the digital government index are 18%–19% behind the maximum value, then the digital interaction index remains at a relatively low level of 0.744. With the growing importance of factors affecting the digital interaction index (e.g., the share of companies receiving orders via the Internet, the share of companies using digital platforms, the share of the population using the Internet to order goods and services, etc.), its contribution to the digital capital index will increase, so will the importance of the environmental financing index. These arguments support hypotheses H4 and H5.

6 Discussion

Digital transformation is a key factor for Russia in changing the technological structure of the economy and preserving the environment. Considering the importance of the digital economy in ensuring sustainable development, the present research has focused on the role of the digital economy in not only reducing the anthropogenic load on the environment, but in environmental financing, which, among other things, characterizes the technological renewal of this area. Having conducted the study, we answered the posed questions and arrived at the following conclusions.

Firstly, we found that digital financing has a significant positive impact on environmental financing, which indicates that the two dynamic processes in the economy—the digital transformation of the economy and the introduction of the latest digital technologies in the field of environmental protection—are synchronized. Digital technologies can be used to create innovative solutions aimed at reducing emissions of harmful substances and improving the environmental efficiency of production. For example, the use of sensors and the control system can help improve air and water quality, as well as reduce greenhouse gas emissions.

Secondly, we proved that digital investment stimulates a comparable increase in environmental investment due to the effects of digital technologies penetrating into environmental technologies. Investment in digital technologies has the potential to improve environmental monitoring, analyze pollution and resource efficiency data, and work out innovative solutions to lessen adverse environmental impacts.

Thirdly, we demonstrated that the level of digitalization of the population, companies and the state and the strengthening of the digital environment for interactions have a favorable effect on environmental financing. We introduced the digital capital index and traced the logic of its impact on environmental financing. It was found that digital involvement of the population stimulates the dissemination of information and awareness of sustainable development methods and environmentally friendly technologies; it also encourages active participation in crowdfunding platforms in support of environmental initiatives. Digital technologies in public administration can be used to create platforms for monitoring and managing various aspects of environmental protection, such as air, water and soil quality. This makes it possible to quickly detect problems and take action to resolve them, thus, minimizing the negative impact on the environment. Digitalization of production business processes allows the optimal use of material and human resources, granting the industry the opportunities to achieve sustainable development goals.

7 Discussion

The findings of our study are of special interest for public authorities. By creating conditions for a deep digital transformation of the economy, governments generate a significant demand for digital financing, which in turn increase the penetration of digital technologies into the field of ecology and stimulates environmental financing. One of the domains, where these results can be of use, is the development of the renewable energy sector. Digital technologies can make production processes and the use of renewable energy sources significantly more efficient. For example, sensors and the monitoring system allow optimizing the operation of solar and wind power plants, analyzing energy production data and predicting the consumption level. This will enhance the efficiency of using renewable energy sources and mitigate the negative impact on the environment.

Moreover, digital financing can contribute to the introduction of eco-friendly projects and initiatives. By attracting investments via digital platforms, the state can support the development and implementation of new technologies aimed at reducing greenhouse gas emissions, improving air and water quality, and the sustainable use of natural resources. Such projects may include the design of energy efficient technologies, the creation of waste management systems and sustainable agriculture.

Another fundamental aspect of digital financing is to ensure financial inclusion and access to financial services for all segments of the population. Digital platforms can provide small and medium-sized businesses and the population with limited financial resources with access to loans, investments and other financial instruments. This will improve the economic situation in regions and raise the standard of living of the population.

Thus, the results of our study can be widely used in public policy. The progress in digital financing and environmental financing can contribute to the sustainable development of the economy, reduce the damaging effect on the environment and boost the living standards of the population. The state should actively support and accelerate the development of digital technologies and eco-friendly projects to ensure a sustainable future for all.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

VA: Conceptualization, Formal Analysis, Investigation, Methodology, Visualization, Writing–original draft, Writing–review and editing. YL: Conceptualization, Funding acquisition, Methodology, Resources, Writing–review and editing. MV: Data curation, Investigation, Visualization, Writing–review and editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. The research funding from the Ministry of Science and Higher Education of the Russian Federation Ural Federal University Program of Development within the Priority-2030 Program is gratefully acknowledged.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adeshola, I., Usman, O., Agoyi, M., Awosusi, A. A., and Adebayo, T. S. (2023). “Digitalization and the environment: the role of information and communication technology and environmental taxes in European countries,” in Natural resources forum (Oxford, UK: Blackwell Publishing Ltd).

Akberdina, V., and Barybina, A. (2022). “Digital platform for regional industry: prerequisites and functionality,” in Digital transformation in industry: digital twins and new business models (Cham: Springer International Publishing), 109–120. doi:10.1007/978-3-030-94617-3_9

Akberdina, V., Naumov, I., and Krasnykh, S. (2022). “Regional digital space and digitalisation of industry: spatial econometric analysis,” in International scientific conference on Digital Transformation in Industry: Trends, Management, Strategies, Cham (Springer Nature Switzerland), 7–19. doi:10.1007/978-3-031-30351-7_2

Akberdina, V., Strielkowski, W., Linder, N., Kashirin, S., and Shmeleva, L. (2023). Information technology and digital sufficiency for building the sustainable circular economy. Energies 16 (3), 1399. doi:10.3390/en16031399

Akberdina, V. V. (2018). Digitalization of industrial markets: regional characteristics. Manag. 9 (6), 78–87. doi:10.29141/2218-5003-2018-9-6-8

Akomea-Frimpong, I., Adeabah, D., Ofosu, D., and Tenakwah, E. J. (2022). A review of studies on green finance of banks, research gaps and future directions. J. Sustain. Finance Invest. 12 (4), 1241–1264. doi:10.1080/20430795.2020.1870202

Ali, E. B., Anufriev, V. P., and Amfo, B. (2021). Green economy implementation in Ghana as a road map for a sustainable development drive: a review. Sci. Afr. 12, e00756. doi:10.1016/j.sciaf.2021.e00756

Altunina, V. V., and Alieva, I. A. (2021). Current trends in the development of a green finance system: methodology and practice. Balt. Reg. 13 (2), 64–89. doi:10.5922/2079-8555-2021-2-4

Ayyagari, M., Demirgüç-Kunt, A., and Maksimovic, V. (2020). The rise of star firms: intangible capital and competition. Available at https://ssrn.com/abstract=3230154 (accessed on May 30, 2023).

Basaev, Z. V. (2019). The digitalisation of the economy: Russia in the context of global transformation. World New Econ. 12 (4), 32–38. doi:10.26794/2220-6469-2018-12-4-32-38

Belokurova, E. V., Pizikov, S. V., Petrenko, E. S., and Koshebayeva, G. K. (2020). “The institutional model of building the digital economy in modern Russia,” in Digital economy: complexity and variety vs. Rationality (Springer International Publishing), 64–70. 9. doi:10.1007/978-3-030-29586-8_8

Bobylev, S. N., and Solovyeva, S. V. (2017). Sustainable development goals for the future of Russia. Stud. Russ. Econ. Dev. 28, 259–265. doi:10.1134/S1075700717030054

Böckel, A., Hörisch, J., and Tenner, I. (2021). A systematic literature review of crowdfunding and sustainability: highlighting what really matters. Manag. Rev. Q. 71, 433–453. doi:10.1007/s11301-020-00189-3

Borremans, A. D., Zaychenko, I. M., and Iliashenko, O. Y. (2018). “Digital economy. IT strategy of the company development,” in MATEC Web of Conferences (St. Petersburg, Russia: EDP Sciences) 170. 01034. doi:10.1051/matecconf/201817001034

Bouchoucha, N. (2021). The effect of environmental degradation on health status: do institutions matter? J. Knowl. Econ. 12 (4), 1618–1634. doi:10.1007/s13132-020-00680-y

Bughin, J., and Manyika, J. (2018). Measuring the full impact of digital capital. Available at: https://www.mckinsey.com (accessed on May 30, 2023).

Bukht, R., and Heeks, R. (2017). Defining, conceptualising and measuring the digital economy. Dev. Inf. Work. Pap. 68. doi:10.2139/ssrn.3431732

Cao, S., Nie, L., Sun, H., Sun, W., and Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: evidence from China's regional economies. J. Clean. Prod. 327, 129458. doi:10.1016/j.jclepro.2021.129458

Chen, X., Despeisse, M., and Johansson, B. (2020). Environmental sustainability of digitalization in manufacturing: a review. Sustainability 12 (24), 10298. doi:10.3390/su122410298

Crouzet, N., and Eberly, J. C. (2019). Understanding weak capital investment: the role of market concentration and intangibles (No. w25869). Cambridge, United Kingdom: National Bureau of Economic Research. doi:10.3386/w25869

Cui, L., Duan, H., Mo, J., and Song, M. (2021). Ecological compensation in air pollution governance: China's efforts, challenges, and potential solutions. Int. Rev. Financial Analysis 74, 101701. doi:10.1016/j.irfa.2021.101701

D'amato, D., and Korhonen, J. (2021). Integrating the green economy, circular economy and bioeconomy in a strategic sustainability framework. Ecol. Econ. 188, 107143. doi:10.1016/j.ecolecon.2021.107143

Develay, E., and Giamporcaro, S. (2023). “Sustainable finance and the role of corporate governance in preventing economic crimes,” in Sustainable finance and financial crime (Cham: Springer International Publishing), 267–287. doi:10.1007/978-3-031-28752-7_14

Ding, C., Liu, C., Zheng, C., and Li, F. (2021). Digital economy, technological innovation and high-quality economic development: based on spatial effect and mediation effect. Sustainability 14 (1), 216. doi:10.3390/su14010216

Eisfeldt, A. L., and Papanikolaou, D. (2013). Organization capital and the cross-section of expected returns. J. Finance 68 (4), 1365–1406. doi:10.1111/jofi.12034

Feng, S., Zhang, R., and Li, G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Gureev, P. M., Degtyareva, V. V., and Prokhorova, I. S. (2020). “National features of forming a digital economy in Russia,” in Artificial intelligence: anthropogenic nature vs. Social origin (Springer International Publishing), 13–20. doi:10.1007/978-3-030-39319-9_2

Ho, V. H., and Park, S. K. (2019). ESG disclosure in comparative perspective: optimizing private ordering in public reporting. U. Pa. J. Int'l L. 41, 249. Available at https://ssrn.com/abstract=3470991 (accessed on May 30, 2023).

Jin, S. T., Kong, H., Wu, R., and Sui, D. Z. (2018). Ridesourcing, the sharing economy, and the future of cities. Cities 76, 96–104. doi:10.1016/j.cities.2018.01.012

Karieva, E., Akhmetshina, L., and Mottaeva, A. (2020). “Green economy in the world and in Russia: preconditions and prospects,” in E3S Web of Conferences (Les Ulis, France: EDP Sciences) 217. 07008. doi:10.1051/e3sconf/202021707008

Kihombo, S., Ahmed, Z., Chen, S., Adebayo, T. S., and Kirikkaleli, D. (2021). Linking financial development, economic growth, and ecological footprint: what is the role of technological innovation? Environ. Sci. Pollut. Res. 28 (43), 61235–61245. doi:10.1007/s11356-021-14993-1

Kostoska, O., and Kocarev, L. (2019). A novel ICT framework for sustainable development goals. Sustainability 11 (7), 1961. doi:10.3390/su11071961

Kuntsman, A., and Rattle, I. (2019). Towards a paradigmatic shift in sustainability studies: a systematic review of peer reviewed literature and future agenda setting to consider environmental (Un) sustainability of digital communication. Environ. Commun. 13 (5), 567–581. doi:10.1080/17524032.2019.1596144

Kuznetsova, S. N., Kozlova, E. P., Kuznetsov, V. P., and Tsymbalov, S. D. (2022). ““Green” economy as a trend in the socio-economic development of Russia,” in Business 4.0 as a subject of the digital economy (Cham: Springer International Publishing), 671–674. doi:10.1007/978-3-030-90324-4_108

Lavrikova, Y. G., Buchinskaia, O. N., and Wegner-Kozlova, E. O. (2021). Greening of regional economic systems within the framework of sustainable development goals. Econ. Regions 17 (4), 1110–1122. doi:10.17059/ekon.reg.2021-4-5

LDCI (2022). Local digital capital index for 2022. Available at: https://www.creativelancashire.org/files/library/LDCI-Report-2022-Final.pdf (accessed on May 30, 2023).

Lee, C. C., Li, X., Yu, C. H., and Zhao, J. (2022). The contribution of climate finance toward environmental sustainability: new global evidence. Energy Econ. 111, 106072. doi:10.1016/j.eneco.2022.106072

Li, Y., Yang, X., Ran, Q., Wu, H., Irfan, M., and Ahmad, M. (2021). Energy structure, digital economy, and carbon emissions: evidence from China. Environ. Sci. Pollut. Res. 28, 64606–64629. doi:10.1007/s11356-021-15304-4

Liang, W., and Yang, M. (2019). Urbanization, economic growth and environmental pollution: evidence from China. Sustain. Comput. Inf. Syst. 21, 1–9. doi:10.1016/j.suscom.2018.11.007

Limna, P., Kraiwanit, T., and Siripipatthanakul, S. (2022). The growing trend of digital economy: a review article. Int. J. Comput. Sci. Res. 6, 1–11. Available at https://ssrn.com/abstract=4183686 (accessed on May 30, 2023).

Lu, Z. N., Chen, H., Hao, Y., Wang, J., Song, X., and Mok, T. M. (2017). The dynamic relationship between environmental pollution, economic development and public health: evidence from China. J. Clean. Prod. 166, 134–147. doi:10.1016/j.jclepro.2017.08.010

Madaleno, M., Dogan, E., and Taskin, D. (2022). A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 109, 105945. doi:10.1016/j.eneco.2022.105945

Martin, C. J., Evans, J., and Karvonen, A. (2018). Smart and sustainable? Five tensions in the visions and practices of the smart-sustainable city in Europe and North America. Technol. Forecast. Soc. Change 133, 269–278. doi:10.1016/j.techfore.2018.01.005

McGrattan, E. R. (2020). Intangible capital and measured productivity. Rev. Econ. Dyn. 37, S147–S166. doi:10.1016/j.red.2020.06.007

Meng, F., and Zhao, Y. (2022). How does digital economy affect green total factor productivity at the industry level in China: from a perspective of global value chain. Environ. Sci. Pollut. Res. 29 (52), 79497–79515. doi:10.1007/s11356-022-21434-0

Meo, M. S., and Abd Karim, M. Z. (2022). The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanb. Rev. 22 (1), 169–178. doi:10.1016/j.bir.2021.03.002

Muganyi, T., Yan, L., and Sun, H. P. (2021). Green finance, fintech and environmental protection: evidence from China. Environ. Sci. Ecotechnology 7, 100107. doi:10.1016/j.ese.2021.100107

Mughal, N., Arif, A., Jain, V., Chupradit, S., Shabbir, M. S., Ramos-Meza, C. S., et al. (2022). The role of technological innovation in environmental pollution, energy consumption and sustainable economic growth: evidence from South Asian economies. Energy Strategy Rev. 39, 100745. doi:10.1016/j.esr.2021.100745

Nguyen, T. T., Pham, T. A. T., and Tram, H. T. X. (2020). Role of information and communication technologies and innovation in driving carbon emissions and economic growth in selected G-20 countries. J. Environ. Manag. 261, 110162. doi:10.1016/j.jenvman.2020.110162

Niebel, T. (2018). ICT and economic growth–Comparing developing, emerging and developed countries. World Dev. 104, 197–211. doi:10.1016/j.worlddev.2017.11.024

Nikitaeva, A., and Dolgova, O. (2022). “Digital technologies and circular value chains for sustainable development,” in International scientific conference on Digital Transformation in Industry: Trends, Management, Strategies, Cham (Springer Nature Switzerland), 169–179. doi:10.1007/978-3-031-30351-7_14

Ozkan, O., Coban, M. N., Iortile, I. B., and Usman, O. (2023). Reconsidering the environmental Kuznets curve, pollution haven, and pollution halo hypotheses with carbon efficiency in China: a dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 30 (26), 68163–68176. doi:10.1007/s11356-023-26671-5

Park, S., and Park, S. (2017). Understanding digital capital within a user’s digital technology ecosystem. Digit. Cap., 63–82. doi:10.1057/978-1-137-59332-0_4

Pierli, G., Murmura, F., and Bravi, L. (2022). “Digital transformation and sustainability. A systematic literature review,” in International scientific conference on Digital Transformation in Industry: Trends, Management, Strategies, Cham (Springer Nature Switzerland), 83–99. doi:10.1007/978-3-031-30351-7_8

Popkova, E. G., Bogoviz, A. V., and Ragulina, J. V. (2018). “Technological parks, “green economy,” and sustainable development in Russia,” in Exploring the future of Russia’s economy and markets: towards Sustainable Economic Development (Moscow, Russia: Emerald Publishing Limited), 143–159. doi:10.1108/978-1-78769-397-520181008

Purnomo, A., Susanti, T., Rosyidah, E., Firdausi, N., and Idhom, M. (2022). Digital economy research: thirty-five years insights of retrospective review. Procedia Comput. Sci. 197, 68–75. doi:10.1016/j.procs.2021.12.119

Ragnedda, M. (2018). Conceptualizing digital capital. Telematics Inf. 35 (8), 2366–2375. doi:10.1016/j.tele.2018.10.006

Ragnedda, M., Ruiu, M. L., and Addeo, F. (2020). Measuring digital capital: an empirical investigation. New Media & Soc. 22 (5), 793–816. doi:10.1177/1461444819869604

Resnick, P. (2004). “Impersonal sociotechnical capital, ICTs, and collective action among strangers,” in Transforming enterprise: the economic and social implications of information technology. Editors W. H. Dutton, B. Kahin, and R. O’Callaghan (Cambridge, MA: MIT Press).

Rudyk, N. V., Niyazbekova, S. U., Yessymkhanova, Z. K., and Toigambayev, S. K. (2022). “Development and regulation of the digital economy in the context of competitiveness,” in Сooperation and sustainable development (Springer International Publishing), 167–174. doi:10.1007/978-3-030-77000-6_20

Seale, J. (2012). When digital capital is not enough: reconsidering the digital lives of disabled university students. Learn. Media Technol. 38 (3), 256–269. doi:10.1080/17439884.2012.670644

Sinha, A., Mishra, S., Sharif, A., and Yarovaya, L. (2021). Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J. Environ. Manag. 292, 112751. doi:10.1016/j.jenvman.2021.112751

Söderholm, P. (2020). The green economy transition: the challenges of technological change for sustainability. Sustain. Earth 3 (1), 6. doi:10.1186/s42055-020-00029-y

Su, C. W., Umar, M., and Gao, R. (2022). Save the environment, get financing! How China is protecting the environment with green credit policies? J. Environ. Manag. 323, 116178. doi:10.1016/j.jenvman.2022.116178

Sun, H. (2022). What are the roles of green technology innovation and ICT employment in lowering carbon intensity in China? A city-level analysis of the spatial effects. Resour. Conservation Recycl. 186, 106550. doi:10.1016/j.resconrec.2022.106550

Tagaeva, T. J. O., Gilmundinov, V. M., Kazantseva, L. K., and Sinigaeva, D. D. (2022). «Green» economy and «green» investments in Russia IOP conference series: Earth and environmental science. IOP Publ. 962 (No. 1), 012035. doi:10.1088/1755-1315/962/1/012035

Tambe, P., Hitt, L., Rock, D., and Brynjolfsson, E. (2020). Digital capital and superstar firms (No. w28285). Cambridge, United Kingdom: National Bureau of Economic Research. doi:10.3386/w28285

Tolliver, C., Keeley, A. R., and Managi, S. (2020). Policy targets behind green bonds for renewable energy: do climate commitments matter? Technol. Forecast. Soc. Change 157, 120051. doi:10.1016/j.techfore.2020.120051

Tulupov, A. S., Mudretsov, A. F., and Prokopiev, M. G. (2020). Sustainable green development of Russia. Complex Syst. Innovation Sustain. Digital Age 1, 135–140. doi:10.1007/978-3-030-44703-8_15

Tyuleneva, T., and Moldazhanov, M. (2020). “The use of environmental taxation instruments in order to ensure sustainable development of mining region,” in E3S Web of Conferences (Les Ulis, France: EDP Sciences) 174. 04061. doi:10.1051/e3sconf/202017404061

Van Heddeghem, W., Lambert, S., Lannoo, B., Colle, D., Pickavet, M., and Demeester, P. (2014). Trends in worldwide ICT electricity consumption from 2007 to 2012. Comput. Commun. 50, 64–76. doi:10.1016/j.comcom.2014.02.008

Vartanova, E. L., and Gladkova, A. A. (2020). Digital capital within the context of the intangible capitals concept. Mediascope 1. Available at http://www.mediascope.ru/2614 (accessed on May 30, 2023).

Vinuesa, R., Azizpour, H., Leite, I., Balaam, M., Dignum, V., Domisch, S., et al. (2020). The role of artificial intelligence in achieving the Sustainable Development Goals. Nat. Commun. 11 (1). doi:10.1038/s41467-019-14108-y

Vlasov, M. (2020). “Digitalization of intellectual activity: Russian case,” in Proceedings of the 16th European Conference on Management Leadership and Governance, ECMLG 2020, 266–274. doi:10.34190/ELG.20.020

Wang, H., Cui, H., and Zhao, Q. (2021). Effect of green technology innovation on green total factor productivity in China: evidence from spatial durbin model analysis. J. Clean. Prod. 288, 125624. doi:10.1016/j.jclepro.2020.125624

Wang, J., Wang, B., Dong, K., and Dong, X. (2022a). How does the digital economy improve high-quality energy development? The case of China. Technol. Forecast. Soc. Change 184, 121960. doi:10.1016/j.techfore.2022.121960

Wang, J., Wang, K., Dong, K., and Shahbaz, M. (2022b). How does the digital economy accelerate global energy justice? Mechanism discussion and empirical test. Energy Econ. 114, 106315. doi:10.1016/j.eneco.2022.106315

Wang, J., Wang, W., Ran, Q., Irfan, M., Ren, S., Yang, X., et al. (2022c). Analysis of the mechanism of the impact of internet development on green economic growth: evidence from 269 prefecture cities in China. Environ. Sci. Pollut. Res. 1, 9990–10004. doi:10.1007/s11356-021-16381-1

Williams, L. D. (2021). Concepts of digital economy and industry 4.0 in intelligent and information systems. Int. J. Intelligent Netw. 2, 122–129. doi:10.1016/j.ijin.2021.09.002

Wu, J., Guo, S., Huang, H., Liu, W., and Xiang, Y. (2018). Information and communications technologies for sustainable development goals: state-of-the-art, needs and perspectives. IEEE Commun. Surv. Tutorials 20 (3), 2389–2406. doi:10.1109/COMST.2018.2812301

Wu, L., Hitt, L., and Lou, B. (2020). Data analytics, innovation, and firm productivity. Manag. Sci. 66 (5), 2017–2039. doi:10.1287/mnsc.2018.3281

Xie, S., Li, T., and Cao, K. (2023). Analysis of the impact of carbon emission control on urban economic indicators based on the concept of green economy under sustainable development. Sustainability 15 (13), 10145. doi:10.3390/su151310145

Xue, Y., Tang, C., Wu, H., Liu, J., and Hao, Y. (2022). The emerging driving force of energy consumption in China: does digital economy development matter? Energy Policy 165, 112997. doi:10.1016/j.enpol.2022.112997

Zhang, W., Zhao, S., Wan, X., and Yao, Y. (2021). Study on the effect of digital economy on high-quality economic development in China. PloS One 16 (9), e0257365. doi:10.1371/journal.pone.0257365

Zhironkin, S., Gasanov, M., Barysheva, G., Gasanov, E., Zhironkina, O., and Kayachev, G. (2017). “Sustainable development vs. post-industrial transformation: possibilities for Russia,” in E3S Web of Conferences (Les Ulis, France: EDP Sciences) 21. 04002. doi:10.1051/e3sconf/20172104002

Zhou, X., Tang, X., and Zhang, R. (2020). Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ. Sci. Pollut. Res. 27, 19915–19932. doi:10.1007/s11356-020-08383-2

Zhou, X., Zhou, D., and Wang, Q. (2018). How does information and communication technology affect China's energy intensity? A three-tier structural decomposition analysis. Energy 151, 748–759. doi:10.1016/j.energy.2018.03.115

Ziyadin, S., Streltsova, E., Borodin, A., Kiseleva, N., Yakovenko, I., and Baimukhanbetova, E. (2019). Assessment of investment attractiveness of projects on the basis of environmental factors. Sustainability 11 (9), 2544. doi:10.3390/su11092544

Ziyadullaev, N. S., Zoidov, K. K., and Usmanov, D. I. (2019). “Analysis and forecasting of the likely development of the digital economy in modern Russia,” in The cyber economy: opportunities and challenges for artificial intelligence in the digital workplace, 203–214. doi:10.1007/978-3-030-31566-5_22

Keywords: sustainable development, digital economy, environmental financing, ecological restoration, digital capital

Citation: Akberdina V, Lavrikova Y and Vlasov M (2024) Environmental financing: does digital economy matter?. Front. Environ. Sci. 11:1268286. doi: 10.3389/fenvs.2023.1268286

Received: 27 July 2023; Accepted: 13 December 2023;

Published: 16 February 2024.

Edited by:

Paul Terhemba Iorember, Nile University of Nigeria, NigeriaReviewed by:

Bruce Iortile Iormom, University of Mkar, NigeriaOjonugwa Usman, Istanbul Commerce University, Türkiye

Copyright © 2024 Akberdina, Lavrikova and Vlasov. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Victoria Akberdina, akberdina.vv@uiec.ru

Victoria Akberdina

Victoria Akberdina Yulia Lavrikova1,2

Yulia Lavrikova1,2  Maxim Vlasov

Maxim Vlasov