The impact of ESG performance on firms’ technological innovation: evidence from China

- 1School of Economics and Finance, Xi’an International Studies University, Xi’an, China

- 2School of Economics and Business Administration, Central China Normal University, Wuhan, China

- 3Business College, Jiangxi Institute of Fashion Technology, Nanchang, Jiangxi, China

Technological innovation is crucial for creating sustainable corporate value and shaping competitive advantage in the market. ESG, as an indicator of corporate value practices, plays a significant role in enterprise technological innovation. However, there is little empirical evidence to support this claim. This study analyzes the relationship between ESG performance and technological innovation in Chinese A-share listed enterprises from 2011 to 2021. The statistical data shows that strong ESG performance has a significant positive impact on corporate technological innovation. ESG performance can promote corporate technological innovation through external mechanisms, such as enhancing corporate network location and increasing institutional shareholding. Additionally, internal mechanisms, such as reducing labor costs and easing financing constraints, can also promote corporate technological innovation. The impact of ESG performance on corporations exhibits heterogeneity, with ESG performance promoting innovation more strongly among labor-intensive firms, non-state-owned firms, highly competitive industries, and mature firms. Based on the study results, it is recommended that enterprises actively practice ESG development concepts, optimize their equity structure, strengthen information communication with stakeholders, and alleviate problems such as information asymmetry to improve their technological innovation. The government should focus on enterprise characteristics, improve ESG development policies, and promote enterprise innovation through ESG performance.

1 Introduction

ESG is a crucial framework for evaluating and directing corporate sustainability. The concept was first introduced in the Who Cares Wins repor1 by the United Nations Global Compact in 2004. The three letters E, S, and G represent Environment, Social, and Governance, respectively, and encompass information on the company’s impact on the environment, responsibility to society, and corporate governance. The acronym ESG stands for Environment, Social, and Governance. It encompasses information on the company’s impact on the environment, its responsibility to society, and its corporate governance. ESG is an emerging method of evaluating the non-financial aspects of enterprises. Given global challenges such as slow economic recovery, frequent extreme weather, wealth inequality, and labour issues, the ESG concept has become the international community’s general consensus. This concept promotes multiple values and emphasises the coordinated development of the economy, environment, and society. An increasing number of large and medium-sized enterprises are taking ESG factors into account when making strategic decisions, and many are now publishing ESG reports (Tsang et al., 2023). In China, the ESG concept has opened doors for rapid development opportunities. According to the Analysis Report on Business Performance of Chinese Listed Companies in 20222, over 1,700 listed firms have compiled and published ESG-related reports for 2022, accounting for 34% of the total, which is an increase of over 300 from 2021. The ESG concept is well suited to China’s major initiatives, including promoting high-quality development, achieving carbon peaking and carbon neutrality targets, and promoting common prosperity. Hence, it complies with the development needs of the new era.

ESG, as an indicator of corporate value practices, significantly impacts corporate operations. Empirical evidence supports the important role played by ESG in enhancing corporate performance, managing financial risks, and achieving corporate value (Friede et al., 2015; Fatemi et al., 2018; Broadstock et al., 2021). Moreover, technological innovations are the driving force behind sustainable creation of corporate performance and critical to shaping competitive advantage in the market (Li et al., 2019; Li et al., 2021). Hence, what is the impact of ESG on the progress of technological innovation within corporations? The existing body of literature on ESG and corporate technological innovation primarily focuses on examining the influence of specific dimensions of ESG performance on corporate technological innovation. Initially, scholars have analyzed the influence of corporate environmental responsibility on corporate technological innovation. Corporate environmental responsibility (ER) can impact a company’s value by influencing technological innovation (Li Z. et al., 2020). Environmental regulation holds a noteworthy position in shaping the realm of green innovation by exerting influence and mediating the impact of environmental regulations on the progress and acceptance of green technological innovations. It serves as a crucial determinant that strengthens the impact and efficacy of these regulations in propelling the advancement of sustainable technologies. (Chang, 2011; Wang et al., 2021). Corporate environmental responsibility positively affects innovation legitimacy and enables companies to undertake innovative activities that align with environmental requirements (Xu et al., 2022). Secondly, previous research has shown that social responsibility plays a crucial role in enhancing companies’ technological innovation (Martinez-Conesa et al., 2017). Significant disparities exist in the impacts of corporate adoption of social responsibility strategies on technological innovation. Proactive social responsibility strategies serve to promote corporate technological innovation, whereas passive social responsibility hampers it (Bocquet et al., 2013). Paruzel et al. (2023) explain how social responsibility affects corporate technological innovation through financing constraints, information asymmetry, and employee innovation within the firm. Thirdly, some scholars have posited that ineffective corporate governance impedes innovative activity (Belloc, 2012), whereas enhanced corporate governance encourages firms to adopt technological innovations (Tylecote and Ramirez, 2006; Jia et al., 2019). The influence of corporate governance on innovation promotion differs depending on the specific stage in which the company is operating (Chiang et al., 2013). Additionally, a limited number of studies examine the effect of ESG performance as a whole on the technological innovation of firms. Several studies have examined the impact of ESG on firms’ green innovation and have reached a consensus that ESG ratings exhibit a notable positive effect on both the quantity and quality of firms’ green innovation (Tan and Zhu, 2022). Other studies have centered on the correlation between ESG and firms’ technological innovation, highlighting that ESG disclosure supports technological innovation and evaluating the internal factors of ESG ratings that impact technological innovation in firms (Chen et al., 2023; Li et al., 2023).

The extant literature has primarily focused on examining the impact of ESG on corporate technological innovation through the lenses of environmental sustainability, social responsibility, and corporate governance. This body of work has established a robust foundation for further inquiry into the intricate relationships between ESG and technological innovation. Considering China’s low-carbon development strategy and sustainable development, it is worth investigating if ESG genuinely encourages technological innovation in corporations. If there is an effect, what is the mechanism of ESG in promoting corporate technological innovation? Does this effect differ based on firm characteristics? Answering the aforementioned questions is crucial in improving the innovation capabilities of enterprises, encouraging innovation-driven development, and ultimately achieving sustainable economic and social development.

Drawing upon the aforementioned discourse, this study investigates the association between ESG performance and corporate technological innovation in Chinese A-share listed companies spanning from 2011 to 2021. Additionally, it examines the influence of ESG performance on corporate technological innovation from external and internal viewpoints. The findings of the study indicate that proficient ESG performance plays a crucial role in fostering substantial advancements in technological innovation. The ESG performance of enterprises can enhance technological innovation through both external and internal mechanisms. External mechanisms include enhancing the location of corporate networks and increasing the proportion of institutional shareholdings. Internal mechanisms include improving labor costs and easing financing constraints. Furthermore, there exists heterogeneity in the influence of corporate ESG performance. Exceptional ESG performance exerts a more pronounced impact on promoting corporate technological innovation within labor-intensive firms, non-state-owned firms, industries characterized by high competition, and enterprises in the mature growth stage. The potential marginal benefits of this study are to: (1) Unlike previous studies that have examined the impact of ESG on corporate technological innovation from a single perspective, this paper presents a comprehensive examination of the impact of overall ESG performance on corporate technological innovation. It extends the literature on the economic consequences of ESG and the factors influencing corporate technological innovation. Furthermore, this paper offers theoretical insights on how ESG can better encourage corporate technological innovation. (2) Existing research on the mechanisms of ESG’s influence on corporate technological innovation has primarily focused on internal factors such as corporate debt, financing, and managers’ environmental awareness. In contrast, this paper broadens the scope of the mechanisms by considering both internal and external factors of enterprises. It explores the financing mechanism and labor costs from an internal perspective of the enterprise. Additionally, it examines the roles of the enterprise’s network location and the proportion of institutional shareholding from an external perspective. This approach provides a novel perspective for studying the mechanisms and processes of ESG’s impact on enterprise technological innovation. (3) This paper comprehensively accounts for the impact of enterprise characteristics heterogeneity, such as labor intensity, ownership structure, market competition level, and stage of enterprise development, on both ESG and enterprise technological innovation. This approach aims to enhance the understanding of ESG’s innovation effect, to promote the development of ESG practices, and to provide empirical support for more targeted study conclusions.

The study is structured in the following manner: the study’s design is clarified in Section 3 once the theoretical analysis and research hypotheses have been presented in Section 2. Section 4 provides a summary of the empirical findings and analysis, whereas Section 5 explores the investigation of heterogeneity. Finally, policy ideas are presented in Section 6 to conclude the study.

2 Theoretical analysis and research hypothesis

2.1 ESG performance and corporate technological innovation

According to resource dependence theory, firms must obtain the necessary resources from the environment to sustain their production and operations. The more resources a firm has, the more it can reduce uncertainty in its production and operations, improve its ability to cope with risk, and thus invest more resources in its technological innovation activities (Pfeffer and Salancik, 2003). Thus, sustainable access to key resources is central to the survival and growth of firms. Since resources do not flow completely freely between different sectors, it is necessary for firms to acquire resources through interaction with other members of society, thus creating resource dependence. According to stakeholder theory, stakeholders will participate in the development of the firm, help the firm to share business risks, help the firm with financing and provide financial support for the firm’s technological innovation activities. The innovation performance of enterprises is influenced by stakeholders, and stakeholders with stronger innovation capabilities can improve the innovation performance of enterprises (Li and Zajac, 2018). Favourable ESG performance enhances the transparency of enterprise information, diminishes information asymmetry between the enterprise and stakeholders, facilitates stakeholder involvement in enterprise innovation decisions, and the stakeholders’ keen focus on innovation significantly propels the enterprise’s technological advancement (Flammer and Kacperczyk, 2016).

According to reputation theory, corporate reputation is an intangible asset accumulated in the process of production and operation of enterprises, and is a key resource for enterprises to obtain and maintain their own advantages. Good corporate reputation can help enterprises obtain resources and reduce business risks, and enterprises can invest more resources in innovation and technology development (Mai et al., 2021). Enterprises adhering to the ESG development concept and actively fulfilling social responsibility can win good corporate reputation for enterprises. According to the signaling theory, good ESG performance helps enterprises to establish a good corporate image and release positive signals to the society, which can obtain more social resources and ultimately promote innovation (Lee et al., 2022). Drawing upon the aforementioned analysis, this study formulates the subsequent hypothesis:

H1: Good ESG performance enhances firms’ technological innovation.

2.2 External mechanisms of ESG performance affecting corporate technol-ogical innovation

2.2.1 Network location of firms

Due to the complexity and uncertainty of innovation activities, firms are unable to obtain all the information and knowledge needed for innovation from internal sources alone and are forced to realize innovation through wider external cooperation (Escribano et al., 2009). As a result, a network of firms’ technological innovation cooperation is formed through the continuous exchange of information and resources between firms, with each firm in the network in a different position and with different resources under its control. Being at the center of the network helps firms to access the information and resources they need for their innovation activities, which in turn helps them to innovate.

The main variables that measure the location of a firm’s network are centrality and structural holes. Analyzing business networks entails looking at and identifying networks made up of companies connected via alliances, partnerships, and cooperative efforts. In this study, the term of centrality refers to valuing a company’s significance in the larger network and its ability to exert control over essential resources required for the network’s operation. (Wasserman and Faust, 1994). The higher the centrality, the more the firm is at the core of the network, the more resources and information the firm has access to, and the stronger the firm’s ability to learn, absorb and transform new information and knowledge, which is conducive to promoting technological innovation (Tsai, 2001). Secondly, firms with higher centrality possess a greater number of information channels and sources, enabling them to effectively mitigate information asymmetry between the firm and stakeholders through the comparison of diverse information. This conducive scenario further enhances the prospects of technological innovation within the firm. Finally, enterprises with high centrality can establish links with more enterprises, which is more helpful for enterprises to select appropriate partners and promote innovation through mutual learning and cooperation (Larcker et al., 2013). Structural holes refer to voids in the network framework that arise between nodes possessing information and resources, yet lacking direct connections or interrupted relationships. These gaps serve as a vital determinant of a firm’s network positioning. Firms located in structural holes are more conducive to technological innovation because they play a central role in information exchange and have the advantage of access to and control over information (Burt, 1997). First, firms occupying structural holes have non-redundant and heterogeneous linkages and access to differentiated information domains that can be filtered and integrated for innovation (Kwon et al., 2020). Additionally, firms occupying structural holes have a greater propensity to discern the qualifications of potential trading partners and collaborators, as well as swiftly grasp opportunities or threats. This ability aids in circumventing innovation failures and augmenting the likelihood of innovation success (Uzzi, 1997). Finally, maintaining ties with many firms is costly, and firms that eliminate redundant ties can devote their limited managerial effort to the most valuable ties, which is beneficial for the efficiency of collaborative innovation (Gnyawali and Madhavan, 2001; Soda et al., 2004).

Favorable ESG performance has the potential to enhance a company’s network position. On one hand, it can boost the company’s reputation, which, to some extent, signifies its standing and influence within the network. The higher the status and influence, the more important the company’s position in the network. Alternatively, favorable ESG performance communicates to the market and stakeholders the company’s dedication to the principles of sustainable development. This highlights the company’s focus on environmental conservation, social accountability, and corporate governance, resulting in heightened societal recognition. The higher the social recognition, the more the company is at the core of the network, and the more power the company has to control resources in the network (Wang et al., 2014). Powell et al. (2005) and others found that core companies with obvious advantages control the corporate network, and their network control power is brought about by their network position. Therefore, good ESG performance can help improve the firm’s position, influence and control over resources, i.e., increase the firm’s network position.

2.2.2 Institutional shareholding

Institutional investors, with their expertise and information advantages, have gradually become a major investor in the capital market. Compared with individual investors, institutional investors have more initiative to participate in corporate governance and are more able to influence firms’ technological innovation decisions and actions and reduce short-sighted behavior (Jiang and Yuan, 2018). Institutional investors are able to gather more information about the firm and increase the transparency of corporate information, thereby alleviating corporate financing constraints to some extent (Cornett et al., 2007). Simultaneously, institutional investors, in their capacity as shareholders, can furnish ample financial support for firms’ decisions and endeavors related to technological innovation.

Good ESG performance helps increase institutional shareholdings. Companies with good ESG performance tend to be larger, faster growing and more profitable companies, which are more preferred by institutional investors (Lin et al., 2014); optimal ESG performance augments the transparency of corporate disclosures and diminishes information asymmetry with the market, making them more appealing to institutional investors (Leuz et al., 2009; Bushee et al., 2014; McCahery et al., 2016); ESG performance can have a significant impact on company performance, which is also reflected in the stock market, making it easier to attract institutional investors to hold company shares.

Drawing upon the analysis presented above, the subsequent hypothesis is formulated:

H2a: Favorable ESG performance has the potential to enhance firms’ technological innovation by augmenting their network positioning.

H2b: Favorable ESG performance can stimulate firms’ technological innovation by augmenting institutional shareholding.

2.3 Internal mechanisms of ESG performance affecting firms’ technological innovation

2.3.1 Financial constraints

Due to the high investment, risk, and long return cycle associated with innovation activities, companies facing high financing constraints may experience greater financial pressure and reduce their innovation inputs, ultimately inhibiting their technological innovation. Good ESG performance can alleviate financing constraints and promote technological innovation. In the first instance, as a form of non-financial information that is disseminated to external entities, ESG has the potential to mitigate information disparities between firms and markets. This can subsequently contribute to a decrease in external financing costs and assuage financing constraints experienced by firms, ultimately exerting a favorable impact on technological innovation (Dhaliwal et al., 2012; Zhang and Lucey, 2022). Secondly, good ESG performance can demonstrate corporate social responsibility, enhance corporate reputation, and build a positive corporate image. This can help to secure financial support from stakeholders, alleviate financing constraints, and promote technological innovation within the enterprise. Consequently, strong ESG performance assists companies in alleviating their financing constraints and securing external financial backing, thereby exerting a positive influence on corporate technological innovation (Zeng, 2018).

2.3.2 Labor costs

Favorable ESG performance is likely to lead to an escalation in the labor costs incurred by a company. First, in the social responsibility aspect of ESG, human resource management and development and employee health and safety are important manifestations of corporate social responsibility. Second, in the corporate governance aspect of ESG, wages, dividends and benefits are important components of corporate governance performance. For companies, good ESG performance must be achieved by continuously improving employee benefits and promoting human resource development, which will inevitably lead to rising labor costs. Rising labor costs, in turn, generate factor substitution effects, human capital enhancement effects, and innovation compensation effects that encourage firms to innovate technologically (Acemoglu, 2010; Antonelli and Quatraro, 2014). First, when labor costs rise, firms will choose to use capital and technology instead of labor, generating a factor substitution effect that promotes firms’ technological innovation. Second, rising labour costs lead to higher employee compensation. This in turn has a dual effect: it attracts more innovative employees to the firm and encourages the firm to improve talent training, thereby increasing the innovation efficiency of employees. (Hutchens, 1989). Finally, rising labor costs cause firms to increase production costs and reduce profits, which to some extent stimulates firms’ demand for new technologies and compensates for lower profits caused by rising labor costs through technological innovation (Li J. et al., 2020). Therefore, good ESG performance leads to higher labor costs and thus promotes technological innovation in firms.

Drawing upon the analysis presented above, the subsequent hypothesis is formulated:

H3a: Good ESG performance can promote firms’ technological innovation by alleviating financing constraints.

H3b: Good ESG performance leads to an increase in labor costs and thus promotes corporate technological innovation.

The specific mechanism of action is shown in Figure 1.

3 Research design

3.1 Model building

To examine the aforementioned research hypotheses, this study constructs a model to assess the influence of firms’ ESG performance on their technological innovation:

where

3.2 Variable setting

3.2.1 Technological innovation of enterprises (innovation)

In line with the methodology adopted by Hsu et al. (2014), this study employs the count of patents granted to firms as a proxy for measuring the technological innovation output and evaluation of the level of innovation exhibited by enterprises. Because the number of patents granted is highly right-skewed, and if the number of patents granted is 0, it will cause missing values, so this study adopts the number of patents granted plus 1, and then takes the logarithm as the measure of enterprise technological innovation.

3.2.2 Enterprise ESG performance (Esg)

At present, scholars primarily rely on third-party rating agencies to assess the ESG performance of corporations. However, this study utilizes the Bloomberg ESG score as the primary explanatory variable to assess ESG performance in corporations. The Bloomberg ESG score comprises three crucial dimensions, namely, environmental, social, and corporate governance indicators, making it a comprehensive measure. A higher score denotes better fulfillment of relevant responsibilities by the company. This indicator provides a comprehensive and objective reflection of a company’s fulfillment of its environmental, social and corporate governance responsibilities.

3.2.3 Enterprise network location (Centrality, SH)

Enterprise network location is measured by degree centrality and structural holes (SH), the measure of centrality is degree centrality (Centrality), this study draws on the research of Freeman (1978), Burt (1992), degree centrality and structural holes of the calculation formula is as follows:

where

where

3.2.4 Institutional shareholding ratio (INST)

Following Fang and Na (2020) and Li and Lu (2015), this study uses institutional investors’ holdings in listed firms to denote institutional shareholding.

3.2.5 Financing constraints (Fc)

Following Hadlock and Pierce (2010), this study constructs and measures the SA index using firm age (Age) and firm size (Size). Financing variables with endogenous characteristics are excluded to avoid endogenous interference and to better measure the degree of financing constraints of firms. Based on the study of Longsheng and Hui (2022), this study uses the logarithm of the absolute value of the SA index (Fc) to measure firms’ financing constraints. The formula for calculating the SA index is as follows Hadlock and Pierce (2010):

3.2.6 Labor costs (Wage)

Labor cost refers to the expenses paid by enterprises (or all other types of units and institutions) for employing social labor, and its statistical accounting scope is theoretically larger than wages. As the definition and statistical scope of other forms of labor cost are not clear, this study makes reference to the investigation conducted by Xia and Dong (2014) and employs the average remuneration of employees as a metric to gauge labor costs.

3.2.7 Control variables

Size: The nature of R&D necessitates substantial, long-term investments. Large enterprises, with their inherent scale advantages, tend to enjoy more stable cash flows and possess greater access to financing options. Consequently, they are better equipped to allocate resources towards innovative projects. For the purpose of this study, we adopt the natural logarithm of total assets as a metric to capture the essence of size.

Age: Mature enterprises often accumulate rich experiences in innovation, leading to reduced costs and a more proactive approach towards R&D. Conversely, some argue that as companies age, they may become complacent about past successes and lose sight of the importance of ongoing innovation. Therefore, controlling for the age of the enterprise is crucial. For our analysis, we consider the number of years since the company’s establishment as a metric of age.

Growth: Growth represents a company’s potential for future expansion and its ability to identify and capitalize on investment opportunities. From a value perspective, growth signifies a company’s capacity to generate outsized returns and its potential worth as a going concern. In this study, we employ sales revenue growth rate as a proxy for growth.

Financial Leverage (Lve): The equipment, personnel, and results of R&D activities possess unique characteristics that render their conversion costs substantial. Given the substantial nature of R&D investments and the associated risks, creditors often impose stringent conditions on the funding they provide to protect their interests. Consequently, lower financial leverage is more favorable for technological innovation investment. High levels of debt can have a negative impact on innovation investment decisions. For this study, we use total liabilities/total assets as a proxy for financial leverage.

Cash Flow (CF): Sustaining R&D activities requires significant cash flow investments. Firms without sufficient cash flow may struggle to maintain their R&D efforts. Therefore, adequate net cash flow is a crucial factor for firms to engage in R&D activities. We measure cash flow using the natural logarithm of net cash flow from operating activities.

Fixed Asset Share (Fasset): A higher fixed asset ratio indicates less liquid assets and potentially lower investments in innovation. This, in turn, may limit funds available for innovative R&D activities. To capture this aspect, we use net fixed assets/total assets as a metric for the fixed asset share.

Shareholding Concentration (Top1): A higher shareholding concentration ratio signifies that the primary shareholder holds a disproportionately large stake in the enterprise. This concentration of power not only enhances their voice in management and operational decisions but also grants them a greater say in strategic choices. In their pursuit of maximizing their own interests, these shareholders may be inclined to avoid high-risk, high-reward endeavors like innovation and research and development due to their long investment cycles and inherent uncertainties. Such a mindset often leads to more conservative investment strategies. This study employs the proportion of shares held by the largest shareholder as a metric to assess shareholding concentration.

Return on Total Assets (Roa): Return on Assets (ROA) serves as a proxy for the profitability of an enterprise. A higher ROA indicates that the enterprise is generating sufficient profits, thereby providing low-cost internal financing for innovative activities. This, in turn, not only supports the company’s internal financing needs but also sends positive signals to external financiers, making it easier for the enterprise to secure external financing for its innovative pursuits. In this study, we use net profit/total assets as a measure of Return on Total Assets.

3.3 Sample selection and data source

In order to ensure the availability and consistency of the research data, this study takes the Shanghai and Shenzhen A-share listed companies in 2011–2021 as the research object, and processes the samples as follows: (1) exclude the companies belonging to ST, *ST and PT during the sample period; (2) exclude the financial companies; (3) exclude the samples with missing data; and finally obtain 5,091 company annual observation data.

This study draws upon data from two primary sources: firm innovation data sourced from the CNRDS database and ESG data obtained from the Bloomberg database3. The network location of firms is obtained based on board members who are also directors of different firms, forming a chain director network of firms. To obtain the location data for the chain director network, this study downloaded information on board members of the sample firms from the CSMAR database from 2011 to 2021. Concurrent positions of directors between different firms were identified based on information such as directors’ names, gender, and age. If any two firms had at least one common director in year t, then a chain director relationship was established. After identifying the director relationships between firms in the chain, the next step is to calculate the network centrality and structural holes for each firm. These calculations are performed utilizing the Python programming language, which provides a robust and versatile platform for performing such analyses. Institutional Shareholding Ratio (INST), financing constraint (Fc), labor cost (Wage), firm industry size (Size), firm age (Age), firm growth (Growth), financial leverage (Lve), firm cash flow (CF), fixed asset share (Fasset), equity concentration (Top1) and return on total assets (Roa). The financial data utilized in this research are sourced from the CSMAR database. In order to mitigate the impact of extreme outliers, all continuous variables in this study have undergone Winsorization at the upper and lower 1% thresholds.

3.4 Analysis of descriptive statistics

Table 1 displays the descriptive statistics of the variables, with the mean value of firms’ technological innovation level (Innovation) estimated as 1.990. The level of technological innovation among the analyzed enterprises is measured on a numerical scale, with the highest recorded value being 9.588. This indicates the greatest degree of technological innovation achieved. Conversely, the minimum recorded value is 0, indicating a lack or absence of technological innovation in certain companies. Additionally, the standard deviation is estimated at 1.979, signifying that there exists substantial variability in the level of innovation across different firms. The maximum value of ESG performance (Esg) is 68.917, the minimum value is 6.198, and the standard deviation is 9.713, which indicates that there are different ESG performances in different enterprises.

4 Empirical results and analysis

4.1 Benchmark regression analysis

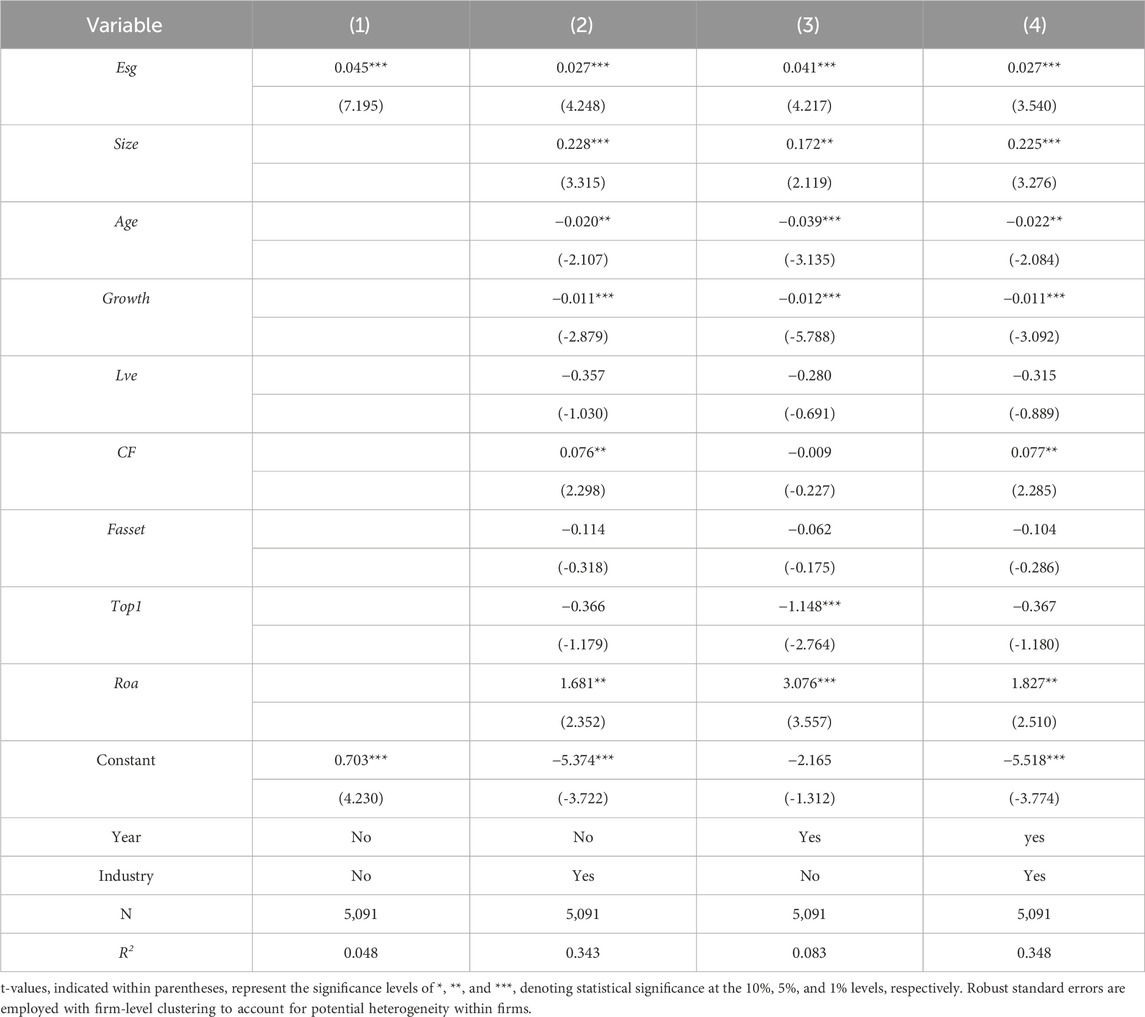

Table 2 presents the outcomes of the benchmark regression analysis conducted in this study. In column (1), the regression analysis reveals a statistically significant positive coefficient of ESG performance (Esg) on firm technological innovation (Innovation), indicating that firms with a competitive edge in ESG factors exhibit higher levels of technological innovation, even without the inclusion of control variables and time-industry fixed effects. As shown in columns (2)–(3), the regression coefficient of the variable Esg is still significantly positive at the 1% level when only industry fixed effects or time fixed effects are added after adding control variables. Based on the results outlined in column (4) of the analysis, it is apparent that the regression coefficient indicating the correlation between ESG performance and corporate technological innovation (Innovation) is estimated to be 0.027, which is still significant at the 1% level when controlling for both industry and time fixed effects. These results suggest that good ESG performance has a significant positive impact on firms’ technological innovation. This is consistent with the conclusion of Li et al. (2023). Hence, hypothesis H1 is accepted.

4.2 Robustness test

4.2.1 Transformation of the regression model

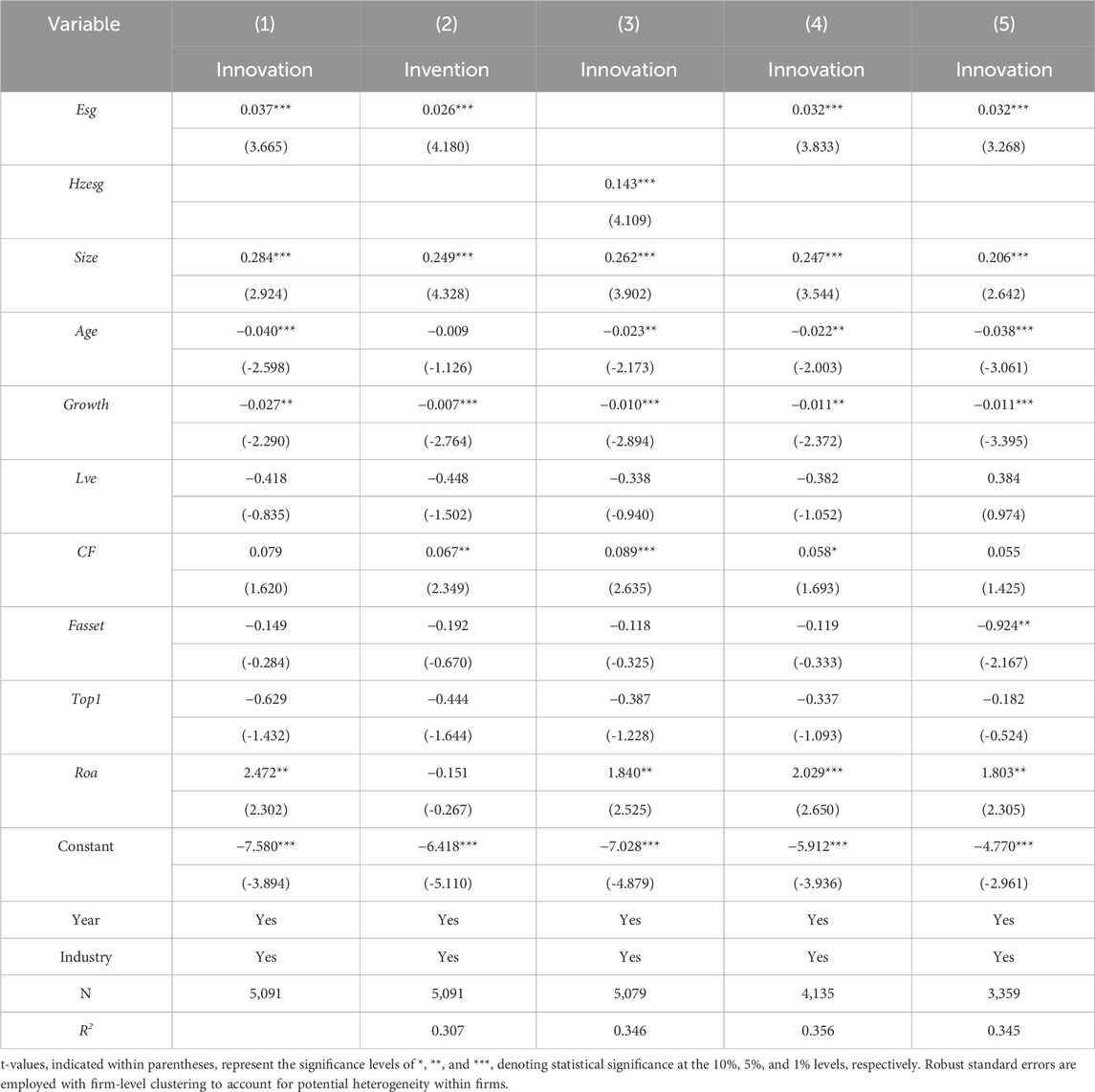

In the benchmark regression, this study adopts the panel fixed effects model for regression. The chosen explanatory variable in this study is the number of patents granted. Due to the nature of patenting processes, it is possible to observe a significant number of zero values. To address this issue, we employ the Tobit model as an appropriate statistical framework. This study adopts the Tobit model to test whether the regression results of the above fixed effects model are robust. The results from analyzing column (1) of Table 3 show that a positive correlation between sound ESG performance and firms’ technological innovation still exists and is statistically significant. This indicates that the key findings and conclusions derived from this study are durable and dependable, offering convincing proof to affirm that effective ESG performance can propel technological innovation within companies.

4.2.2 Transformation of the explanatory variables

By utilizing the total count of patents granted by firms to measure technological innovation, this study aims to capture the breadth and diversity of technological advancements achieved by different firms in the regression. Patents can be categorized into three types: invention patents, utility model patents, and design patents. Among these, invention patents serve as a measure of the innovation quality of enterprises, providing a more comprehensive reflection of their substantive technological innovation. Consequently, this study utilizes the count of invention patents granted by enterprises, rather than the overall count of patents, as the explanatory variable to assess the resilience of the aforementioned regression findings. Building on the studies by Tan et al. (2014) and Tong et al. (2014), this study utilizes a natural logarithmic transformation of the total number of patents awarded to companies, with the addition of 1. The findings presented in column (2) of Table 3 demonstrate that positive ESG performance continues to play a vital role in driving firms’ technological innovation, which reinforces the robustness of the central conclusions drawn in this study.

4.2.3 Transformation of explanatory variables

In this study, the Huazheng ESG rating (Hzesg) for the sample companies is employed as an alternative core explanatory variable in robustness testing, replacing the Bloomberg ESG rating. Here, Huazheng ratings are assigned values: 9 levels from C to AAA are assigned values from 1 to 9. The results of the regression analysis, as reported in column (3) of Table 3, demonstrate that the positive relationship between good ESG performance and companies’ technological innovation remains statistically significant. These findings provide convincing evidence in support of the primary conclusions of the study, hence attesting to the robustness and dependability of the study’s principal outcomes.

4.2.4 Change in sample interval

Due to the severe impact of the new crown epidemic in 2020 and 2021, the production and business environment of firms may have changed dramatically, and ignoring this factor may affect the robustness of the regression results. In this study, based on the study of Cao et al. (2023), we exclude the impact of the epidemic factor, limit the sample interval to 2011–2019, and re-run the regression, and the results are shown in column (4) of Table 3, which shows that the role of good ESG performance in promoting technological innovation of enterprises is still significant, suggesting that the core conclusions of this study are robust.

4.2.5 Excluding the four first-tier cities

Since the economic development level of the four first-tier cities (Beijing, Shanghai, Guangzhou, and Shenzhen) is significantly different from that of other cities, and the economic development level of the region where firms are located significantly influences their business environment, this study adopts the study by Yu et al. (2018) and re-runs the regression after removing the sample of enterprises in the four first-tier cities, and the results are shown in column (5) of Table 3. The results show that the role of good ESG performance in promoting technological innovation of enterprises remains significant, indicating that the core findings of this study are robust.

4.3 Endogeneity treatment

4.3.1 Omitted variables

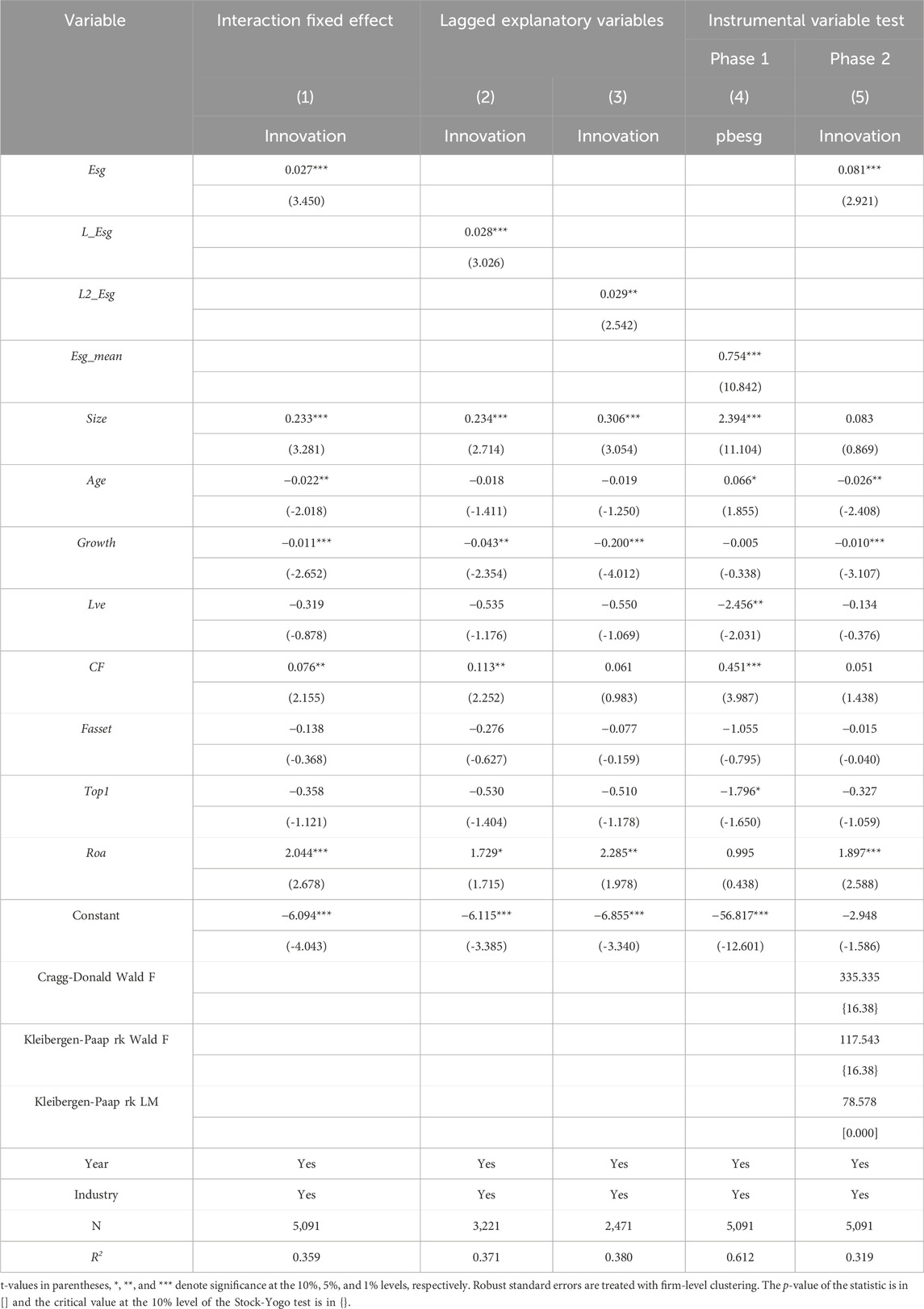

To reduce the likelihood of omitted variables or unobservable effects in the model, this study implements the methods outlined in Tang et al. (2020), including controlling for “time-industry” joint fixed effects at a higher order, controlling for time-varying industry-level unobservable variables, and re-estimating the regressions. The regression results, as shown in column (1) of Table 4, provide further evidence supporting the enduring importance of favorable ESG performance in fostering technological innovation within firms. These findings reinforce the strength and validity of the fundamental conclusions drawn in this study.

4.3.2 Two-way causality

The regression outcomes from the benchmark analysis indicate a positive relationship between a company’s ESG performance and its level of technological innovation. Specifically, as a company’s ESG performance improves, there is a corresponding increase in its level of technological innovation. However, it is also possible that the issue of endogeneity resulting from bidirectional causality emerges due to the fact that firms exhibiting high levels of innovation tend to be more proactive in enhancing their ESG performance. In order to mitigate the two-way causality problem, this study draws on the study of Longsheng and Hui (2022) and selects the one-period lagged term (L_Esg) and the two-period lagged term (L2_Esg) of the explanatory variable (Esg) as the explanatory variables, and re-runs the regression. The regression results, as shown in columns (2)–(3) of Table 4, show that the coefficients of L_Esg and L2_Esg are still significantly positive, indicating that the key findings of the study remain robust.

4.3.3 Instrumental variables

This study employs the mean (Esg_mean) of the ESG performance of other listed companies within the province of the focal enterprise as an instrumental variable. The use of 2SLS for instrumental variable regression allows us to account for potential endogeneity issues in our analysis. Notably, the instrumental variable is chosen based on the premise that other listed companies in the same provincial location as our sample enterprises share a similar institutional environment. This correlation between instrumental variables and the institutional environment within the same province ensures that the chosen instrumental variable is exogenous to the technological innovation of our sample firms. Crucially, the ESG performance of these other firms within the same province is assumed to have no direct impact on the technological innovation of our sample firms, further reinforcing the exogenous nature of our instrumental variable. To address this relationship, the instrumental variable approach is employed to address potential endogeneity issues and establish a causal relationship between a firm’s ESG performance and its financial performance in this study. The two-stage least squares (2SLS) approach is employed to conduct instrumental variable regression. Table 4, column (4) presents the results of the first stage regression, the coefficient of the instrumental variable (Esg_mean) is significantly positive at 1% level, indicating that the selected instrumental variable is highly positively correlated with ESG performance. Column (5) presents the results of the second stage regression based on Cragg-Donald Wald F = 335.335, {S-Y10% critical value: 16.38}; Kleibergen-Paap rk LM = 78.578, p-value less than 0.001 and Kleibergen-Paap rk Wald F = 117.543, {The results of statistics such as S-Y10% critical value: 16.38} indicate that the weak instrumental variables test is passed and there is no over-identification. In the second stage, the coefficient of ESG performance is significantly positive at the 1% level, suggesting that despite addressing endogeneity concerns, positive ESG performance remains a driving factor of firms’ technological innovation. Furthermore, the key findings of the study remain robust.

4.4 Mechanism test

4.4.1 External mechanism test

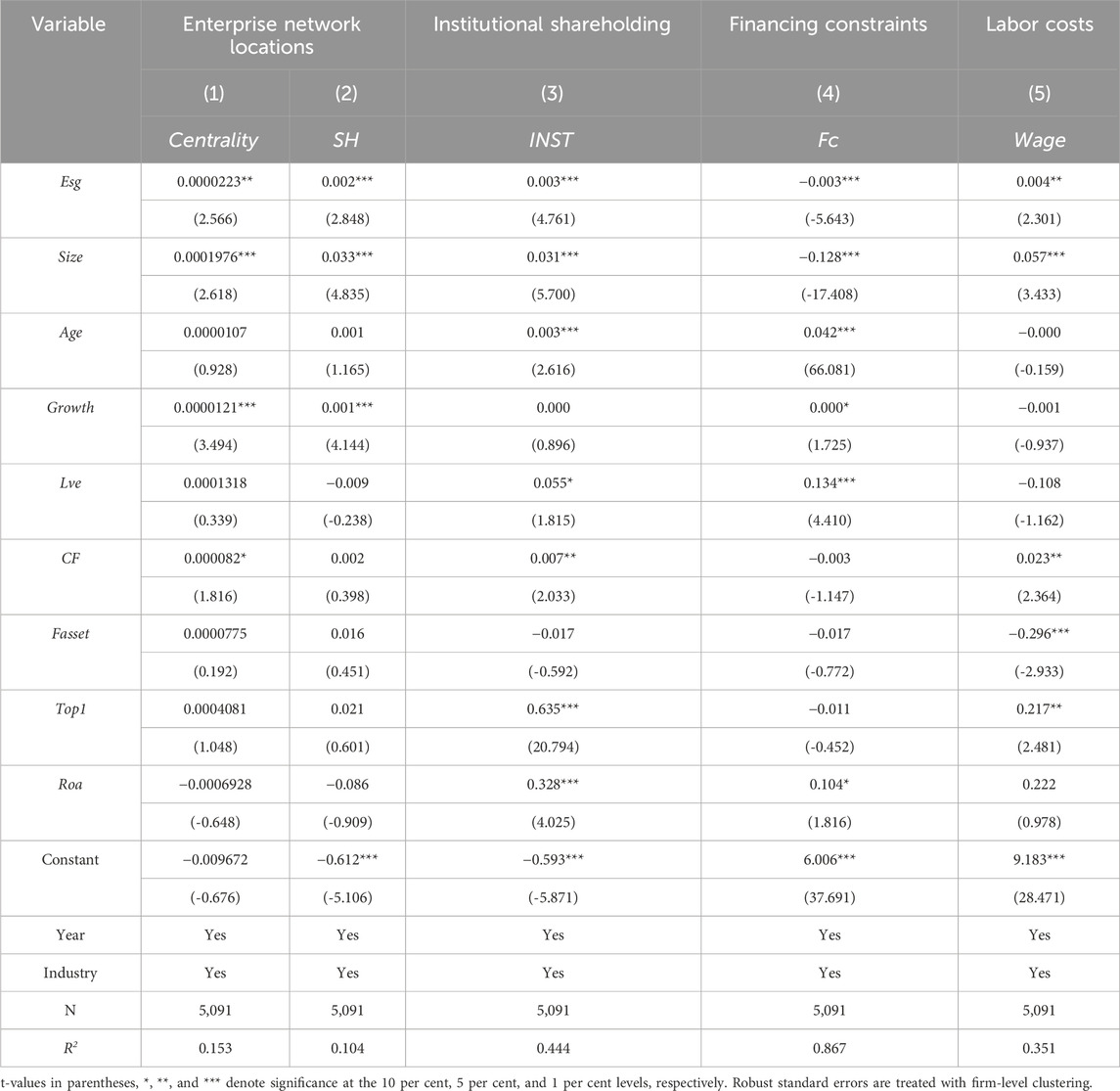

There are a large number of studies confirming the positive impact of corporate network location on firm technological innovation (Ahuja, 2000; Woods et al., 2019). To test whether corporate network location is one of the mechanisms through which ESG promotes corporate technological innovation, this study takes corporate network location (Centrality, SH) as an explanatory variable and conducts regression analyses on ESG performance (Esg) and corporate network location, and the outcomes are presented in columns (1)–(2) of Table 5, where the regression coefficients for the relationship between ESG advantage (Esg) and Centrality, as well as SH, are observed to be significantly positive at a significance level of 1%. This suggests a substantial enhancement in corporate technological innovation resulting from the ESG advantage. Similarly, the coefficients for the firm’s network position are also significantly positive, implying that ESG advantage enhances the firm’s central position and control in the network, thus promoting technological innovation. Hence, hypothesis H2a is accepted.

A large number of studies have confirmed the positive impact of institutional shareholding on firms’ technological innovation (Manso, 2011; Aghion et al., 2013). To verify that institutional shareholding is one of the mechanisms through which ESG promotes firms’ technological innovation, this study takes institutional shareholding (INST) as an explanatory variable and conducts regression analyses on ESG performance (Esg) and institutional shareholding, and the results are shown in column (3) of Table 5. The coefficient of Esg is significantly positive, suggesting that ESG performance can effectively increase firms’ institutional shareholding and thus promote firms’ technological innovation. This is consistent with the findings of Bai et al. (2022). Hence, hypothesis H2b is accepted.

4.4.2 Internal mechanisms

A large number of studies have been conducted to confirm the negative impact of financing constraints on firms’ R&D (Brown et al., 2009; Mancusi and Vezzulli, 2010). To examine the role of financing constraints as a mediating factor in the relationship between ESG performance and firms’ technological innovation, this study employs financing constraints as an independent variable and performs regression analyses on both ESG performance (Esg) and financing constraints (Fc). The findings, presented in column (4) of Table 5, provide evidence supporting the presence of such a mechanism. The estimated coefficient of Esg is significantly negative, indicating that ESG advantage obviously alleviates the problem of firms’ financing constraints and further promotes their technological innovation development. This is consistent with the findings of He et al. (2023). Hence, hypothesis H3a is accepted.

The research validates the positive influence of labor costs on firms’ technological innovation (Acemoglu, 2010; Wei et al., 2020). To verify that financing constraints is one of the mechanisms through which ESG promotes firms’ technological innovation, this study takes labor cost (Wage) as an explanatory variable and conducts a regression analysis between ESG performance (Esg) and labor cost, and the outcomes are presented in column (5) of Table 5, where a statistically significant positive regression coefficient for the relationship between labor cost and Esg on Wage is observed at a significance level of 5%. This implies that firms’ labor costs play a significant role as a mechanism through which ESG performance influences an important aspect of firms’ technological innovation. Hence, hypothesis H3b is accepted.

5 Heterogeneity analysis

5.1 Labor intensity

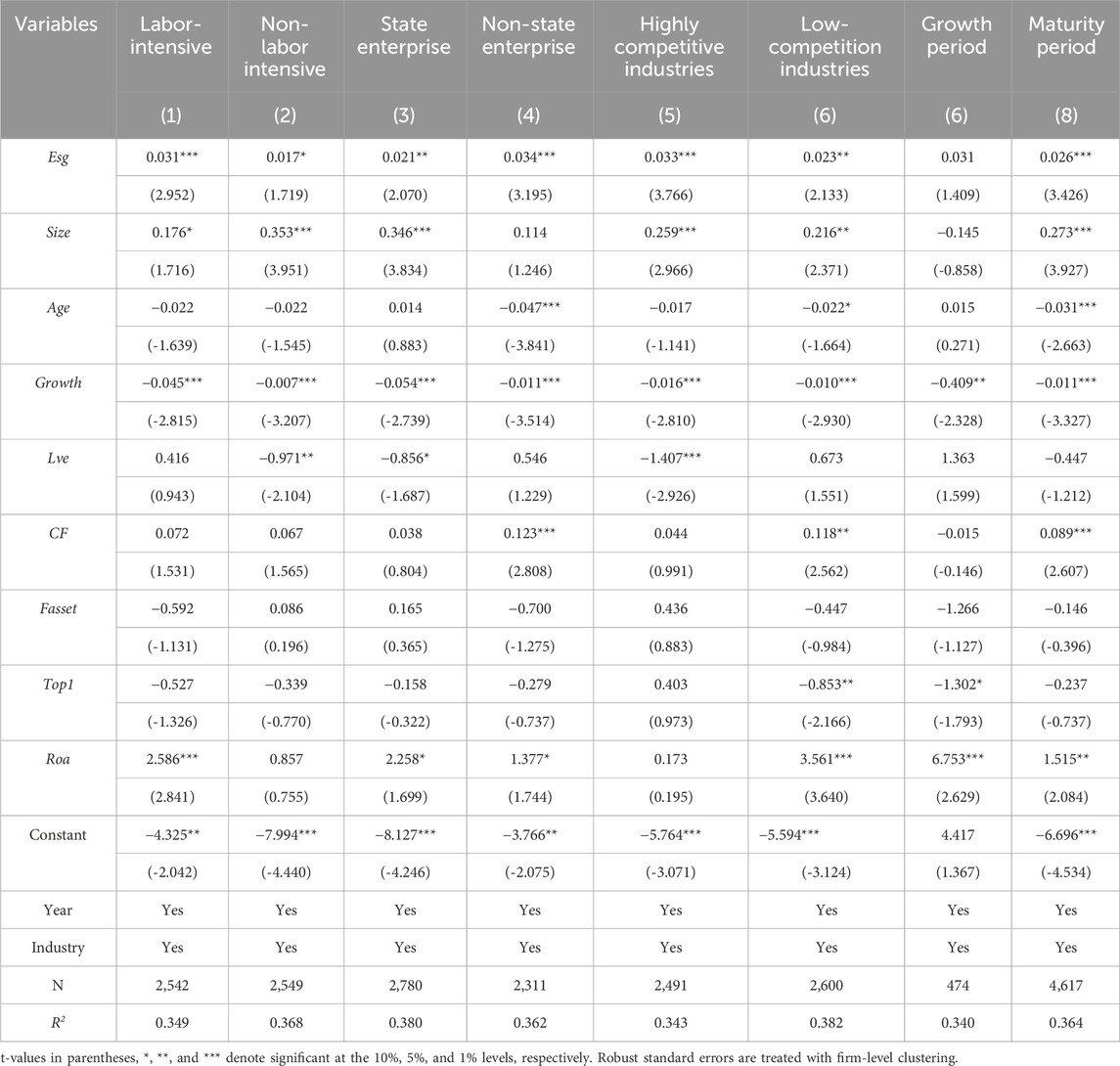

Labor intensity can affect the relationship between ESG performance and firms’ technological innovation. From one perspective, labor-intensive companies typically allocate a higher proportion of their production costs to labor expenses. As labor costs rise, firms will gradually choose capital and technology to replace labor, creating a factor substitution effect that promotes firms’ technological innovation. Second, labour-intensive enterprises typically possess more human capital. Improving this capital can attract innovative workers to join the enterprise and encourage the enterprise to strengthen talent training, thereby improving the innovation efficiency of employees. Therefore, this study argues that the role of ESG performance in promoting enterprise technological innovation is more significant in labor-intensive enterprises. To test the above inference, this study draws on the studies of Huang et al. (2023) and Zhao and Li (2016), and compares the amount of capital per capita of enterprises with their median, divides labor-intensive enterprises and non-labor-intensive enterprises, and conducts a subsample regression. In this case, the formula for capital per employee is (firm size)/total assets/number of employees. The regression results are shown in columns (1) and (2) of Table 6, where the regression coefficients of ESG performance on firms’ technological innovation are more significant in labor-intensive firms, suggesting that good ESG performance stimulates technological innovation more effectively in labor-intensive firms.

5.2 Type of ownership

The connection between ESG performance and firms’ technological innovation might exhibit variations based on the ownership structure of the firm. In comparison to state-owned enterprises (SOEs), non-state-owned enterprises (non-SOEs) potentially encounter more pronounced financial constraints and have a greater urgency for research and development (R&D) funding. ESG may help non-SOEs to reduce the pressure on funds used for R&D, give them incentives to increase R&D investment, and enhance the firm’s innovation capability. In addition, compared to SOEs, non-SOEs may be at the edge of the corporate network, and good ESG performance can improve the corporate network position of non-SOEs, which is conducive to non-SOEs’ technological innovation. Based on the analysis and theory presented in this study, it is posited that ESG performance has a greater impact on enhancing technological innovation in non-state-owned enterprises. To validate the aforementioned assertion, this study distinguishes the sample enterprises into two categories: state-owned enterprises (SOEs) and non-state-owned enterprises (non-SOEs). Group regression is then performed, and the outcomes are presented in columns (3) and (4) of Table 6. The results reveal that the regression coefficients of ESG on enterprise technological innovation are larger in the sample of non-SOEs, indicating that favorable ESG performance holds greater efficacy in fostering the innovative progression of non-SOEs.

5.3 Degree of industry competition

The potential influence of ESG performance on companies’ technological innovation could be contingent upon the degree of competition within their respective industries. In competitive industries, firms must continuously improve their competitive advantages. Good ESG performance can help build a corporate image, enhance corporate reputation, and improve firms’ technological innovation. This is crucial for enhancing firms’ competitiveness. Accordingly, this study hypothesizes that the more competitive the industry, the stronger the role of ESG performance in promoting technological innovation. To examine the aforementioned hypothesizes, this study relies on the research conducted by Peng et al. (2018) as the foundation for measuring the level of industry competition through calculating the Herfindahl index. By utilizing the median value of the Herfindahl index as the benchmark for categorization, the industries in which the sample companies operate are divided into high-competition and low-competition sectors. Building upon the diligent analysis and theoretical structure presented in this study, a proposed hypothesis suggests that ESG performance significantly influences the enhancement of technological innovation in privately owned businesses (non-SOEs). The proposition remains objective, concise, and employs clear language to ensure ease of comprehension for readers. Through the analysis conducted in this study, it becomes evident that the regression coefficients associated with ESG performance exhibit comparatively larger magnitudes within industries characterized by high levels of competitiveness. This observation indicates a positive relationship between the intensity of market competition and the influential role played by ESG performance in fostering technological innovation within firms. The larger regression coefficients signify that as the degree of competition escalates within an industry, the significance of ESG performance as a catalyst for promoting firms’ technological innovation becomes more pronounced.

5.4 The development stage of the company

The impact of ESG performance on a company’s technological innovation may also be related to the development stage of the company. Companies in the growth stage typically carry higher investment risks. External investors tend to be more cautious due to this risk. Additionally, the financial pressure of technological innovation is greater during this stage. The importance of ESG investment is often overlooked, and there is a lack of enthusiasm for ESG information disclosure. When a company reaches the maturity period, it constantly improves its organizational structure, gains management experience, and achieves stable profits and cash flow. This enables it to meet the needs of capital and talent for technological innovation. At this time, companies pay more attention to ESG investment and information disclosure, and good ESG performance is more effective in promoting technological innovation in mature companies. To confirm the above conclusion, this study refers to Yu et al.'s (2018) research. The analyzed enterprises were divided into two groups based on their developmental stage, namely, growth and mature, depending on whether the age of the enterprise is over 10 years. Group regression was then conducted. The outcomes of this analysis can be observed in columns (7) and (8) of Table 6, in the mature enterprises, ESG performance can be more effective in improving the level of technological innovation of enterprises.

6 Conclusions and recommendations

6.1 Research conclusion

This study examines the impact of corporate ESG performance on corporate technological innovation and its mechanism of action by using panel data consisting of a total of 5,089 research samples of A-share listed companies in Shanghai and Shenzhen from 2011 to 2021. The research findings show that: (1) The capability of a company to innovate technologically is directly correlated with its ESG performance, i.e., the better the ESG performance, the more robust the company’s capability. (2) ESG performance promotes corporate technological innovation through external mechanisms, such as improving corporate network location and increasing institutional ownership, on the one hand, and internal mechanisms, such as improving labor costs and easing financing constraints, on the other hand. (3) The effect of ESG performance on corporate technological innovation varies, with ESG performance favoring technological innovation more in labor-intensive businesses, privately held businesses, industries with intense competition, and businesses in the mature stage.

6.2 Policy recommendations

Drawing upon the research conclusions outlined above, this study proposes the following policy recommendations:

Firstly, this paper supports the positive role of ESG performance in technological innovation. For Chinese companies in the early stages of ESG development, it is important to recognize the significance of ESG performance. This can be achieved by taking various measures, such as actively practicing environmental protection, assuming social responsibilities, and improving corporate governance. These actions will enhance ESG performance, strengthen information communication with stakeholders, and alleviate information asymmetry issues, ultimately improving the level of technological innovation.

Secondly, companies should aim to establish a wide network of inter-company cooperation and innovation, striving to become core enterprises within the network. They should improve their information screening capabilities, avoid redundant connections, and actively establish cooperative relationships with different types of organizations. Additionally, they should optimize their ownership structure to reduce agency costs and avoid short-sighted behavior. It is also important to disclose ESG information in a timely manner to attract external financing, expand financing channels, and reduce financing costs. Finally, companies should introduce external high-end talent and cultivate internal innovative talent to stimulate employee creativity.

Thirdly, this study also confirms that labor-intensive enterprises and private enterprises are more conducive to the positive role of ESG performance in promoting technological innovation. When formulating ESG development policies, the government should establish a scientific ESG rating standard, increase the proportion of ESG information disclosure, and also classify companies. Considering the characteristics of companies comprehensively, encourage labor-intensive enterprises and private enterprises to enhance their ESG performance, amplify the promoting effect of ESG performance, and unleash the innovation vitality of enterprises.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

XZ: Conceptualization, Funding acquisition, Project administration, Supervision, Writing–review and editing. WL: Data curation, Methodology, Software, Writing–original draft, Writing–review and editing. TJ: Formal Analysis, Visualization, Writing–review and editing. HX: Formal analysis, Visualization, Writing-review and editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by 2023 Xi’an International Studies University (XISU) School-level Research Programs; General Project of Social Science Foundation of Shaanxi Province (2020D006); General Project of Soft Science Research Program of Science and Technology Department of Shaanxi Province (2024ZC-YBXM-192); General Program of Humanities and Social Sciences Research, Ministry of Education References (22YJC790008).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Who Cares Wins report issued by the United Nations Global Compact Organization: https://www.unepfi.org/fileadmin/events/2004/stocks/who_cares_wins_global_compact_2004.pdf

2Analysis of Business Performance of Listed Companies in China for 2022: https://www.capco.org.cn/sjfb/dytj/202305/20230505/j_2023050516083000016832742309451910.html

3The Bloomberg database: ESG Bloomberg Professional Services: https://www.bloomberg.com/professional/solution/bloomberg-terminal/

References

Acemoglu, D. (2010). When does labor scarcity encourage innovation? J. Political Econ. 118 (6), 1037–1078. doi:10.1086/658160

Aghion, P., Van Reenen, J., and Zingales, L. (2013). Innovation and institutional ownership. Am. Econ. Rev. 103 (1), 277–304. doi:10.1257/aer.103.1.277

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: a longitudinal study. Adm. Sci. Q. 45 (3), 425–455. doi:10.2307/2667105

Antonelli, C., and Quatraro, F. (2014). The effects of biased technological changes on total factor productivity: a rejoinder and new empirical evidence. J. Technol. Transf. 39, 281–299. doi:10.1007/s10961-013-9328-5

Bai, X., Han, J., Ma, Y., and Zhang, W. (2022). ESG performance, institutional investors’ preference and financing constraints: empirical evidence from China. Borsa Istanb. Rev. 22, S157–S168. doi:10.1016/j.bir.2022.11.013

Belloc, F. (2012). Corporate governance and innovation: a survey. J. Econ. Surv. 26 (5), 835–864. doi:10.1111/j.1467-6419.2011.00681.x

Bocquet, R., Le Bas, C., Mothe, C., and Poussing, N. (2013). Are firms with different CSR profiles equally innovative? Empirical analysis with survey data. Eur. Manag. J. 31 (6), 642–654. doi:10.1016/j.emj.2012.07.001

Broadstock, D. C., Chan, K., Cheng, L. T., and Wang, X. (2021). The role of ESG performance during times of financial crisis: evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Brown, J. R., Fazzari, S. M., and Petersen, B. C. (2009). Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J. Finance 64 (1), 151–185. doi:10.1111/j.1540-6261.2008.01431.x

Burt, R. S. (1992). Structural holes: the social structure of competition. Cambridge, United Kingdom: Harvard University Press. Available at: http://crl.du.ac.in/ical09/papers/index_files/ical-51_250_732_3_RV.pdf

Burt, R. S. (1997). The contingent value of social capital. Adm. Sci. Q. 42, 339–365. doi:10.2307/2393923

Bushee, B. J., Carter, M. E., and Gerakos, J. (2014). Institutional investor preferences for corporate governance mechanisms. J. Manag. Account. Res. 26 (2), 123–149. doi:10.2308/jmar-50550

Cao, Y., Peng, K., and Guo, T. (2023). The impact of VAT rate adjustment on enterprise innovation. China Soft Sci. 2, 214–224. doi:10.3969/j.issn.1002-9753.2023.02.020

Chang, C. H. (2011). The influence of corporate environmental ethics on competitive advantage: the mediation role of green innovation. J. Bus. ethics 104, 361–370. doi:10.1007/s10551-011-0914-x

Chen, L., Khurram, M. U., Gao, Y., Abedin, M. Z., and Lucey, B. (2023). ESG disclosure and technological innovation capabilities of the Chinese listed companies. Res. Int. Bus. Finance 65, 101974. doi:10.1016/j.ribaf.2023.101974

Chiang, S., Lee, P., and Anandarajan, A. (2013). Corporate governance and innovative success: an examination of the moderating influence of a firm’s life cycle stage. Innovation 15 (4), 500–514. doi:10.5172/impp.2013.15.4.500

Cornett, M. M., Marcus, A. J., Saunders, A., and Tehranian, H. (2007). The impact of institutional ownership on corporate operating performance. J. Bank. finance 31 (6), 1771–1794. doi:10.1016/j.jbankfin.2006.08.006

Dhaliwal, D. S., Radhakrishnan, S., Tsang, A., and Yang, Y. G. (2012). Nonfinancial disclosure and analyst forecast accuracy: international evidence on corporate social responsibility disclosure. Account. Rev. 87 (3), 723–759. doi:10.2308/accr-10218

Escribano, A., Fosfuri, A., and Tribó, J. A. (2009). Managing external knowledge flows: the moderating role of absorptive capacity. Res. policy 38 (1), 96–105. doi:10.1016/j.respol.2008.10.022

Fang, X., and Na, J. (2020). Stock market reaction to green innovation: evidence from GEM firms. J. Econ. Res. 55 (10), 106–123. doi:10.3390/ijerph18073412

Fatemi, A., Glaum, M., and Kaiser, S. (2018). ESG performance and firm value: the moderating role of disclosure. Glob. finance J. 38, 45–64. doi:10.1016/j.gfj.2017.03.001

Flammer, C., and Kacperczyk, A. (2016). The impact of stakeholder orientation on innovation: evidence from a natural experiment. Manag. Sci. 62 (7), 1982–2001. doi:10.1287/mnsc.2015.2229

Freeman, L. C. (1978). Centrality in social networks conceptual clarification. Soc. Netw. 1, 215–239. doi:10.1016/0378-8733(78)90021-7

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J. Sustain. finance Invest. 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Gnyawali, D. R., and Madhavan, R. (2001). Cooperative networks and competitive dynamics: a structural embeddedness perspective. Acad. Manag. Rev. 26 (3), 431–445. doi:10.5465/amr.2001.4845820

Hadlock, C. J., and Pierce, J. R. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. financial Stud. 23 (5), 1909–1940. doi:10.1093/rfs/hhq009

He, G., Liu, Y., and Chen, F. (2023). Research on the impact of environment, society, and governance (ESG) on firm risk: an explanation from a financing constraints perspective. Finance Res. Lett. 58, 104038. doi:10.1016/j.frl.2023.104038

Hsu, P. H., Tian, X., and Xu, Y. (2014). Financial development and innovation: cross-country evidence. J. financial Econ. 112 (1), 116–135. doi:10.1016/j.jfineco.2013.12.002

Huang, B., Li, H., Liu, J., and Lei, J. (2023). Digital technology innovation and high-quality development of Chinese enterprises: evidence from enterprise digital patents. Econ. Res. J. 3, 97–115.

Hutchens, R. M. (1989). Seniority, wages and productivity: a turbulent decade. J. Econ. Perspect. 3 (4), 49–64. doi:10.1257/jep.3.4.49

Jia, N., Huang, K. G., and Man Zhang, C. (2019). Public governance, corporate governance, and firm innovation: an examination of state-owned enterprises. Acad. Manag. J. 62 (1), 220–247. doi:10.5465/amj.2016.0543

Jiang, X., and Yuan, Q. (2018). Institutional investors' corporate site visits and corporate innovation. J. Corp. Finance 48, 148–168. doi:10.1016/j.jcorpfin.2017.09.019

Kwon, S. W., Rondi, E., Levin, D. Z., De Massis, A., and Brass, D. J. (2020). Network brokerage: an integrative review and future research agenda. J. Manag. 46 (6), 1092–1120. doi:10.1177/0149206320914694

Larcker, D. F., So, E. C., and Wang, C. C. (2013). Boardroom centrality and firm performance. J. Account. Econ. 55 (2-3), 225–250. doi:10.1016/j.jacceco.2013.01.006

Lee, M. T., Raschke, R. L., and Krishen, A. S. (2022). Signaling green! Firm ESG signals in an interconnected environment that promote brand valuation. J. Bus. Res. 138, 1–11. doi:10.1016/j.jbusres.2021.08.061

Leuz, C., Lins, K. V., and Warnock, F. E. (2009). Do foreigners invest less in poorly governed firms? Rev. Financial Stud. 22 (8), 3245–3285. doi:10.1093/rfs/hhn089

Li, C., Ba, S., Ma, K., Xu, Y., Huang, W., and Huang, N. (2023). ESG rating events, financial investment behavior and corporate innovation. Econ. Analysis Policy 77, 372–387. doi:10.1016/j.eap.2022.11.013

Li, F., Xu, X., Li, Z., Du, P., and Ye, J. (2021). Can low-carbon technological innovation truly improve enterprise performance? The case of Chinese manufacturing companies. J. Clean. Prod. 293, 125949. doi:10.1016/j.jclepro.2021.125949

Li, G., Wang, X., Su, S., and Su, Y. (2019). How green technological innovation ability influences enterprise competitiveness. Technol. Soc. 59, 101136. doi:10.1016/j.techsoc.2019.04.012

Li, J., Shan, Y., Tian, G., and Hao, X. (2020b). Labor cost, government intervention, and corporate innovation: evidence from China. J. Corp. Finance 64, 101668. doi:10.1016/j.jcorpfin.2020.101668

Li, J., and Zajac, E. J. (2018). On the duality of political and economic stakeholder influence on firm innovation performance: theory and evidence from Chinese firms. Strategic Manag. J. 39 (1), 193–216. doi:10.1002/smj.2697

Li, W. J., and Lu, X. Y. (2015). Do institutional investors care firm environmental performance? Evidence from the most polluting Chinese listed firms. J. Financial Res. 12, 97–112. Available at: http://www.jryj.org.cn/EN/Y2015/V426/I12/97.

Li, Z., Liao, G., and Albitar, K. (2020a). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 29 (3), 1045–1055. doi:10.1002/bse.2416

Lin, F., Wu, C. M., Fang, T. Y., and Wun, J. C. (2014). The relations among accounting conservatism, institutional investors and earnings manipulation. Econ. Model. 37, 164–174. doi:10.1016/j.econmod.2013.10.020

Longsheng, X., and Hui, Z. (2022). The influence mechanism and data test of enterprise ESG performance on earnings sustainability. Manag. Rev. 34 (9), 313. doi:10.14120/j.cnki.cn11-5057/f.20221024.001

Mai, N. K., Nguyen, A. K. T., and Nguyen, T. T. (2021). Implementation of corporate social responsibility strategy to enhance firm reputation and competitive advantage. J. Compet. 13 (4), 96–114. doi:10.7441/joc.2021.04.06

Mancusi, M. L., and Vezzulli, A. (2010). “R&D, innovation and liquidity constraints,” in CONCORD 2010 conference (Sevilla), 3–4.

Manso, G. (2011). Motivating innovation. J. finance 66 (5), 1823–1860. doi:10.1111/j.1540-6261.2011.01688.x

Martinez-Conesa, I., Soto-Acosta, P., and Palacios-Manzano, M. (2017). Corporate social responsibility and its effect on innovation and firm performance: an empirical research in SMEs. J. Clean. Prod. 142, 2374–2383. doi:10.1016/j.jclepro.2016.11.038

McCahery, J. A., Sautner, Z., and Starks, L. T. (2016). Behind the scenes: the corporate governance preferences of institutional investors. J. Finance 71 (6), 2905–2932. doi:10.1111/jofi.12393

Paruzel, A., Schmidt, L., and Maier, G. W. (2023). Corporate social responsibility and employee innovative behaviors: a meta-analysis. J. Clean. Prod. 393, 136189. doi:10.1016/j.jclepro.2023.136189

Peng, Y., Han, X., and Li, J. (2018). Economic policy uncertainty and corporate financialization. China Ind. Econ. 1, 137–155. doi:10.19581/j.cnki.ciejournal.20180115.010

Pfeffer, J., and Salancik, G. R. (2003). The external control of organizations: a resource dependence perspective. Stanford University Press.

Powell, W. W., White, D. R., Koput, K. W., and Owen-Smith, J. (2005). Network dynamics and field evolution: the growth of interorganizational collaboration in the life sciences. Am. J. Sociol. 110 (4), 1132–1205. doi:10.1086/421508

Soda, G., Usai, A., and Zaheer, A. (2004). Network memory: the influence of past and current networks on performance. Acad. Manag. J. 47 (6), 893–906. doi:10.2307/20159629

Tan, Y., Tian, X., Zhang, C., and Zhao, H. (2014). Privatization and innovation: evidence from a quasi-natural experience in China. Unpubl. Work. Pap. doi:10.2139/ssrn.2433824

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: the mediating role of financial constraints and managers. Environ. Aware. Technol. Soc. 68, 101906. doi:10.1016/j.techsoc.2022.101906

Tang, S., Wu, X., and Zhu, J. (2020). Digital finance and enterprise technology innovation: structural feature, mechanism identification and effect difference under financial supervision. Manag. World 36 (5), 52–66. doi:10.19744/j.cnki.11-1235/f.2020.0069

Tong, T. W., He, W., He, Z. L., and Lu, J. (2014). Patent regime shift and firm innovation: evidence from the second amendment to China’s patent law. Acad. Manag. Proc. 2014 (1), 14174. doi:10.5465/ambpp.2014.14174abstract

Tsai, W. (2001). Knowledge transfer in intraorganizational networks: effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 44 (5), 996–1004. doi:10.5465/3069443

Tsang, A., Frost, T., and Cao, H. (2023). Environmental, social, and governance (ESG) disclosure: a literature review. Br. Account. Rev. 55 (1), 101149. doi:10.1016/j.bar.2022.101149

Tylecote, A., and Ramirez, P. (2006). Corporate governance and innovation: the UK compared with the US and ‘insider’economies. Res. Policy 35 (1), 160–180. doi:10.1016/j.respol.2005.09.004

Uzzi, B. (1997). Social structure and competition in interfirm networks: the paradox of embeddedness. Adm. Sci. Q. 42, 35–67. doi:10.2307/2393808

Wang, C., Rodan, S., Fruin, M., and Xu, X. (2014). Knowledge networks, collaboration networks, and exploratory innovation. Acad. Manag. J. 57 (2), 484–514. doi:10.5465/amj.2011.0917

Wang, Y., Yang, Y., Fu, C., Fan, Z., and Zhou, X. (2021). Environmental regulation, environmental responsibility, and green technology innovation: empirical research from China. Plos one 16 (9), e0257670. doi:10.1371/journal.pone.0257670

Wei, Y., Nan, H., and Wei, G. (2020). The impact of employee welfare on innovation performance: evidence from China's manufacturing corporations. Int. J. Prod. Econ. 228, 107753. doi:10.1016/j.ijpe.2020.107753

Woods, J., Galbraith, B., and Hewitt-Dundas, N. (2019). Network centrality and open innovation: a social network analysis of an SME manufacturing cluster. IEEE Trans. Eng. Manag. 69 (2), 351–364. doi:10.1109/tem.2019.2934765

Xia, N., and Dong, Y. (2014). Executive compensation, employee compensation and corporate growth—based on listed SMEs in China empirical data. Account. Res. 9, 89–95. doi:10.3969/j.issn.1003-2886.2014.09.012

Xu, P., Xu, X., and Bai, G. (2022). Corporate environmental responsibility, CEO’s tenure and innovation legitimacy: evidence from Chinese listed companies. Technol. Soc. 70, 102056. doi:10.1016/j.techsoc.2022.102056

Yu, Y., Zhao, Q., and Ju, X. (2018). Inventor executives and corporate innovation. China Ind. Econ. 3, 136–154. doi:10.19581/j.cnki.ciejournal.2018.03.008

Zeng, T. (2018). Relationship between corporate social responsibility and tax avoidance: international evidence. Soc. Responsib. J. 15 (2), 244–257. doi:10.1108/SRJ-03-2018-0056

Zhang, D., and Lucey, B. M. (2022). Sustainable behaviors and firm performance: the role of financial constraints’ alleviation. Econ. Anal. Policy. 74, 220–233.

Keywords: ESG, firm network location, labor costs, firm technological innovation, institutional shareholding, financing constraints

Citation: Zhang X, Li W, Ji T and Xie H (2024) The impact of ESG performance on firms’ technological innovation: evidence from China. Front. Environ. Sci. 12:1342420. doi: 10.3389/fenvs.2024.1342420

Received: 21 November 2023; Accepted: 30 January 2024;

Published: 19 February 2024.

Edited by:

Wei Zhang, China University of Geosciences Wuhan, ChinaReviewed by:

Shikuan Zhao, Chongqing University, ChinaFengtao Guang, China University of Geosciences Wuhan, China

Michail Tsangas, CDA College, Cyprus

Copyright © 2024 Zhang, Li, Ji and Xie. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenjun Li, liwenjun4144@outlook.com

Xiaoyun Zhang

Xiaoyun Zhang Wenjun Li

Wenjun Li Tonghui Ji2

Tonghui Ji2