Bank digital transformation, bank competitiveness and systemic risk

- School of Business Administration, Liaoning Technical University, Huludao, Liaoning, China

The aim of this paper is to analyze the impact of the digital transformation of banks on their systemic risks. We find that the digital transformation of commercial banks can significantly inhibit the systemic risk of banks, and this conclusion is still valid after considering the endogeneity of the model. The bank’s digital transformation reduces its systemic risk by increasing its own competitiveness. Further analysis shows that the reduction of banks’ marginal costs due to digital transformation is a key factor in promoting banks’ competitiveness as the mechanism by which digital transformation reduces banks’ systemic risk. The role of bank digital transformation in reducing systemic risk is heterogeneous, which is more obvious in large commercial banks, commercial banks that have not established financial technology subsidiaries, and systemically important banks.

1 Introduction

Information technology has become the primary engine for social and economic development as a result of the third scientific and technological revolution. Nowadays, the world has entered the era of the digital economy. Along with the disruptive impact of digital technology on all industries, how to combine with digital information technology, how to stand firm in the new round of technological revolution, how to realize their own sustainable development, and other issues have become the focus of research in all industries of society. The financial industry is no exception [1], and digital finance and fintech are precisely the products of the deep integration of traditional finance and technological innovation [2].

As an essential foundation and significant component of the financial industry, commercial banks have become the earliest industry in the financial industry to face the opportunities and challenges brought by digital technologies [3]. On the one hand, new technologies such as block chain, the Internet of Things, and intelligent investment can bring innovative value to commercial banks [4]. On the other hand, the rapid development of fintech innovation accelerates market diversion, resulting in lower profits for commercial banks [5]. In order to better develop in the wave of digitization and reduce certain profit losses brought by fintech to banks, commercial banks are actively carrying out digital transformation work. For example, in China’s banking industry, since November 2015, when China’s Industrial Bank set up the CIB Digital Financial Services Co., Ltd., by the end of 2021, 17 banks in China have set up fintech subsidiaries, which include five large state-owned commercial banks, eight joint-stock commercial banks, two city commercial banks, as well as Shenzhen Rural Commercial Bank and Guangxi Rural Credit Union. Meanwhile, nearly one-half of the commercial banks have set up fintech and digital finance business units. On top of that, more than half of China’s listed commercial banks have reached strategic cooperation agreements with headline Internet companies such as Jingdong, Tencent, and Ali.

Digital transformation is the central theme of the global economy [6]. The digital transformation of commercial banks has changed the traditional forms of services and business practices in the banking sector [7], which has led to a better ability to adapt to market competition and customer consumer preferences in the digital era [8], which contributes to the sound operation and sustainable development of banks. The use of fintech can not only bring innovations in payment systems, credit markets, and insurance to commercial banks [9], but also bring improvements in business models to banks by introducing specialized platforms, reaching neglected customer segments, improving customer selection, reducing banks’ operating costs, and optimizing banks’ business processes [10]. All of these help keep banks running smoothly and lessen the possibility of bank risks. Of course, digital transformation does have problems, such as increased inter-institutional correlation and homogenization of transformation, which exacerbate banks’ risks. The operational risks of banks can easily trigger bank failures, and the resulting systemic financial risks can even lead to the outbreak of a financial crisis. This will have extremely strong negative impacts on the sustainable development of the banking industry and even the whole society and economy. Since the financial crisis in 2008, systemic risk has been the focus of academic research [11], and the prevention and resolution of systemic financial risk are even more fundamental to the smooth development of a country’s economy. Yet traditional banks are again major players in systemic financial risk [12]. Thus, the intriguing question: Does the digital transformation of commercial banks contribute to the reduction of the banks’ systemic risk and, as a result, ensure the stable operation and long-term growth of the banking industry? In order to further analyze the impact of banks’ digital transformation on systemic risk, this study will address the following questions: First, how does systemic risk in banks change as a result of digital transformation? Second, what are the mechanisms underlying the impact if the digital transformation of banks has an effect on systemic risk for banks? Third, does this effect vary for banks with various qualities?

The Chinese market is the primary focus of this study for the following reasons: First of all, China is a leader in the development of international fintech [3]. Meanwhile, due to the enormous market in China, the rapid development of emerging technologies such as big data, block chain, and artificial intelligence has pushed China’s fintech level to continuously enhance and have a significant impact on China’s financial industry [13]. Second, the Chinese government has permanently attached great importance to the stability of the financial market. It has never been lax in preventing systemic financial risks [14]. Third, the structure of China’s financial system has its characteristics, and the dominant role of banks in indirect financing makes them occupy a significant position in the financial market. This bank-oriented financial market makes the vast majority of risks in China’s financial system concentrated in the banking system [15]. Therefore, choosing China as the research object to investigate the effects of digital transformation on commercial banking systemic risk is very important and representative.

We combined relevant data from 2013 to 2021 to conduct an empirical study. We create a system of indicators for bank digital transformation in three dimensions: cognitive, organizational, and product. We empirically investigated the effect of banks’ digital transformation on systemic risk and its mechanism of action on the basis of measuring banks’ digital transformation. It is discovered that the digital transformation of commercial banks successfully lowers systemic risk, and this finding holds true after considering the endogeneity of the model and replacing variables. Consider that competitiveness is the basis for banks’ long-term survival and sustainable development. And it has always been important to investigate whether banks’ level of competition affects their systemic risk and, in turn, the stability of the entire financial market. Therefore, regarding the study of the mechanism of action, we mainly focus on banks’ competitiveness levels. The mechanism analysis shows that digital transformation → increase in bank competitiveness (Lerner index) → decrease in systemic risk is the mechanism of action of bank digital transformation to reduce systemic risk. Further decomposition of the Lerner index into bank pricing and marginal cost reveals that the decline in marginal cost due to bank digital transformation is the main reason for attenuating systemic risk. In addition, the impact of commercial banks’ digital transformation on systemic risk has heterogeneity regarding bank size, transformation mode, etc., and its effect is more substantial for large commercial banks, commercial banks that have not set up fintech subsidiaries in the process of transformation, and systemically important banks.

The remainder of the text is structured as follows: In order to determine the connection between bank digitalization and financial risk, we first review the pertinent literature. Then, based on existing studies, we conduct a theoretical analysis to explore the mechanism by which banks’ digital transformation affects systemic risk and put forward corresponding hypotheses. Subsequently, the research design was carried out, and we collected relevant data from 31 listed commercial banks in China, detailing the variable measurement, model setup, and data sources of this paper. On this basis, an empirical analysis was conducted, including benchmark regression, a mechanism test, heterogeneity analysis, and robustness check. Finally, our research conclusions and insights are presented.

2 Literature review

After reviewing the previous research, academics have concentrated on the micro and macro levels when examining the reasons behind systemic risk in banks. At the micro level, bank size [16, 17], linkages among banks and other financial institutions [18–20], the size of shadow banking [21], and the financial condition of banks and other financial institutions [22, 23] and other factors all have an impact on banking systemic risk. Systemic risk is also influenced at the macro level by variables like monetary policy [24], economic policy uncertainty [25], [26], and the pro-cyclicality of the economy [27]. However, with the advent of the digital economy, data has become a new factor of production, leading to changes in the factors that constitute bank risk.

Digital transformation is a new concept that has emerged as the world enters the era of the digital economy, and a unified understanding of it has not yet been formed in the academic community. Since the Financial Stability Board of the United States put forward the concept of “digital transformation of commercial banks is the use of new technologies in the banking industry to form innovations in products and services, etc.” in 2016, more scholars have referred to the process of introducing digital technologies in the industry as the process of digital transformation [28]. From past research, scholars usually analyze the research related to bank digitalization from the perspective of banks’ use of digital technologies such as fintech. Regarding the issue of the relationship between digitization and bank risk, most of the existing studies focus on the impact of digital technology on banks’ individual risk, especially bank risk-taking. There is a relative lack of analysis on the impact of bank digitization on their systemic risk.

Some scholars believe that using fintech by banks can effectively reduce banks’ risk-taking. Utilizing digital technologies, such as fintech, can help banks be better at determining the creditworthiness of their clients [13], cut down on their percentage of non-performing loans [29], [30], and increase their competitiveness [31] to lower banks’ level of risk-taking and improve the stability of the banking sector. Li, He [32] found that bank fintech innovation can effectively reduce bank risk-taking from four perspectives: bank operating income, capital adequacy ratio, operating performance, and risk control ability. Some scholars also believe that the use of fintech can exacerbate the level of risk-taking by banks. Wang, Liu [33] found that fintech overall exacerbated the risk-taking behaviors of banks after analyzing the relevant data in China from 2011 to 2018. And Chen, Yang [3] concluded that with the continuous development of fintech, financial risk shows a changing trend of increasing and then decreasing.

Although there are individual scholars’ studies involving the impact of digital technology on banks’ systemic risk, they only analyze it from the perspectives of risk-taking, inter-bank correlation, and banks’ leverage. Wang, Liu [34] found that the increase in risk-taking propensity and inter-bank correlation brought about by the improvement in the level of bank fintech pushes up the likelihood of the occurrence of systemic risk. Dong, Wu [35] found that from the perspective of capital, after using leverage ratio as a decomposition index of capital adequacy ratio, the use of fintech can effectively increase the level of leverage ratio of banks, thus inhibiting the transfer of risk and reducing the systemic risk of banks. However, there is a gap in research on the competitiveness perspective of banks themselves.

While digital transformation can increase the level of competitiveness of banks. However, scholars have also not come to a consensus on the topic of how competitiveness among banks affects systemic risk. The level of competitiveness of banks themselves is weakened by competition in the banking industry [36]. Some scholars believe that bank competitiveness helps to reduce systemic risk and that banks are characterized by “competitiveness-stability”, i.e., “competition-fragility”. According to Beck, Demirgüç-Kunt [37], a bank’s financial position is more likely to be stable and less likely to result in systemic risk the higher the market concentration, or how competitive the bank is. From the perspective of risk-taking, scholars analyzed the relationship between competition and risk in Indonesian banks [38] and Vietnamese banks [39], and found that banks tend to take on more risk when they face increased competition, which is not conducive to the stability of the financial system. From the perspective of bank commonality, in-creased interbank competition prompts banks to prefer portfolio diversification and increase interbank holdings of common loans [40], and banks’ common behavior is enhanced, which exacerbates the accumulation of systemic risk [41]. According to Xu, Eva [42] China’s banking sector has high barriers to entry, and competition among banks may increase banks’ future demand for counterparty banking products, which aggravates the accumulation of systemic risk. Some scholars have also argued that monopolistic behavior due to increased bank competitiveness can exacerbate the systemic risk of banks, which are characterized by “competitiveness-vulnerability”, i.e., “competition-stability”. For European countries, the negative impact of bank competition on systemic risk becomes more pronounced when there is foreign investment in banks [43]. In terms of the Chinese banking system, there is also a reduction of systemic risk due to banking competition [44], [45].

It is not difficult to find from the existing research that the research on the impact of the bank’s digitalization on its risk focuses more on the bank’s individual risk, and there is a relative lack of research on the impact of systemic risk. The analysis of the corresponding role of the mechanism is also not perfect. Although it has been concluded that the development of fintech by banks can improve their own competitiveness, the online operation mode also helps banks to expand the scope of their own services and attract more customers to form a competitive strategy and gain a competitive advantage [46]. However, there is still a gap in the research on whether banks’ competitiveness will be a factor affecting the overall systemic risk of banks in the digitalization process. Since there are different views on the impact of bank competitiveness on systemic risk, we believe that it is of research interest to consider competitiveness as a mechanism of bank digital transformation on systemic risk. At the same time, considering that banks’ digital transformation is more about the reconstruction of self-worth, there is still a particular difference from fintech, which uses cutting-edge technology to innovate products and services. Therefore, unlike the existing studies analyzing the systemic risk of fintech on banks, the article focuses more on banks’ digital transformation. It conducts empirical research on the aforementioned question based on the fixed effects and mediation effects models from the perspective of banks’ own competitiveness. The answer to this question is of great value in understanding the systemic risk formation mechanism in the context of digital transformation, improving the path of banks’ digital transformation, and maintaining financial stability.

3 Theoretical analysis and research hypothesis

3.1 Digital transformation and systemic risks of commercial banks

Information asymmetry is an important cause of bank systemic risk [47]. The information asymmetry that existed between banks and their clients prior to banks going digital had the following effects on banks: Initially, before loans were granted, applicants would frequently conceal their negative information. At this time, banks affected by information asymmetry not only find it challenging to discover the applicant’s financial problems in a timely manner but also find it difficult to accurately identify high-quality customers, which reduces the quality of the bank’s credit. Second, the bank found it challenging to monitor the lender’s cash flow after the loans were issued because of the information asymmetry issue. This raises the likelihood of the bank having non-performing loans, lowers the quality of the bank’s credit, and aggravates the bank’s insolvency risk. Depositors will become suspicious of associated banks when one exhibits bankruptcy-like behavior, which will generate serious group run problems and increase the possibility of systemic risk. However, banks’ digital transformation can effectively solve the adverse selection and moral hazard problems caused by information asymmetry, thus effectively reducing banking systemic risk. Applying digital technologies such as big data and block chain has broadened the scope of information collection by banks. The standardized and visualized information processing mode has improved the utilization rate of information and can effectively alleviate the problem of information asymmetry in the traditional management model of banks [48], [49], thereby reducing the systemic risk of banks. Specifically, the use of digital technology can help banks form an accurate portrait of customer behavior. Before lending, multi-dimensional information identification and intelligence risk identification improve the accuracy of banks’ credit evaluation of borrowers, help banks better identify high-quality customers, and enhance the forward-looking nature of risk supervision, thereby improving credit quality and reducing the probability of default risk. After the loan, the supervision mode of dynamically tracking the flow of funds will help the bank detect suspicious behaviors of loan customers in a timely manner and quickly take remedial measures to enhance the timeliness of risk tracking and the accuracy of risk treatment, effectively reducing the possibility of bank risks and reducing its contribution to systemic risk.

The long-tail theory shows that traditional banks frequently give priority to the needs of the top 20% of large customers while neglecting or even ignoring the needs of the remaining 80% of long-tail customers. Digital transformation enhances the ability of bank information collection, organizing, and processing comprehensively through bulk data processing, which not only realizes the accurate identification of potential high-quality long-tail customers and improves the profitability of the bank but also enhances the risk prevention ability of the bank itself [50]. Improvements in profitability and risk control levels help to reduce banks’ risk-taking behavior and bankruptcy risk due to profit-seeking motives [51]. In turn, this lessens the degree of spillovers from individual bank risk and the level of bank systemic risk contribution. Based on the above analysis, the following research hypotheses are proposed in this paper:

H1. Under the condition that other conditions remain unchanged, the digital transformation of commercial banks will reduce their systemic risk.

3.2 Bank digital transformation, bank competitiveness, and systemic risk

Bank digital transformation reshapes its own competitiveness and affects the franchise value of banks. The theory of bank franchises holds that enhancing one’s own competitiveness is the only way to increase the intrinsic value of bank franchises [52], and the self-discipline effect of franchise values has an obvious restraint effect on bank risk behaviors. Due to the existence of franchise value, bank bankruptcy will be more expensive because it will result in double losses from the loss of the franchise license and loss of the additional income it would have received. Banks are compelled to adopt more cautious business strategies as a result of the high cost of bankruptcy, which also deters them from pursuing high-risk investments and lowers the likelihood of systemic risks.

The reasons why digital transformation improves the competitiveness of banks are as follows: First, there is a lot of information. Digital transformation has broadened the channels for commercial banks to obtain information and enhanced the ability of banks to collect information [53]. The comprehensive and dynamic grasp of borrower information increases the bank’s own competitiveness. Second, there are many customers. On the one hand, digital transformation has brought offline business online, broadened the bank’s business coverage, extended customer acquisition channels, and expanded the bank’s total customer base. On the other hand, intelligent services brought by digital technology optimize customer experience, improve service quality, further enhance customer stickiness, and enhance the market power of banks. Third, there are too many products. The application of digital technology has accelerated the update speed of banking products and services, and promoted the diversification of banking business and the refinement and granulation of services [29], enhanced the diversity and difference of products, and enhanced the competitiveness of banks themselves in the industry. Fourth, high efficiency and low cost. Online payment has changed the traditional business model of banks, which not only increases the convenience of operation for customers but also increases the efficiency of the bank’s services, reduces the cost of business, and increases the level of competitiveness of the bank itself.

With the continuous enhancement of the bank’s own competitiveness level, the performance level is further increased, which effectively promotes the bank’s capital growth. Capital accumulation can effectively alleviate the contagion effect of individual risks and further reduce the possibility of bank systemic risks [15]. First of all, the more competitive banks have greater market power, they have higher cost plus or lower marginal costs, and can obtain high returns through higher loan interest rates or lower marginal costs, effectively promoting the bank’s capital. Growth, improving its own capital buffer capacity, effectively enhancing the bank’s own ability to resist risks, and reducing the possibility of systemic risks. Secondly, banks with stronger competitiveness can form more stable long-term lending relationships with customers, which helps to alleviate the information asymmetry between the two, effectively reduces the probability of default risk, and thus weakens the contribution of banks to systemic risks. Based on the above analysis, this paper proposes the following research hypotheses:

H2. The digital transformation of commercial banks will reduce their contribution to systemic risk by enhancing the competitiveness of banks.

4 Research design

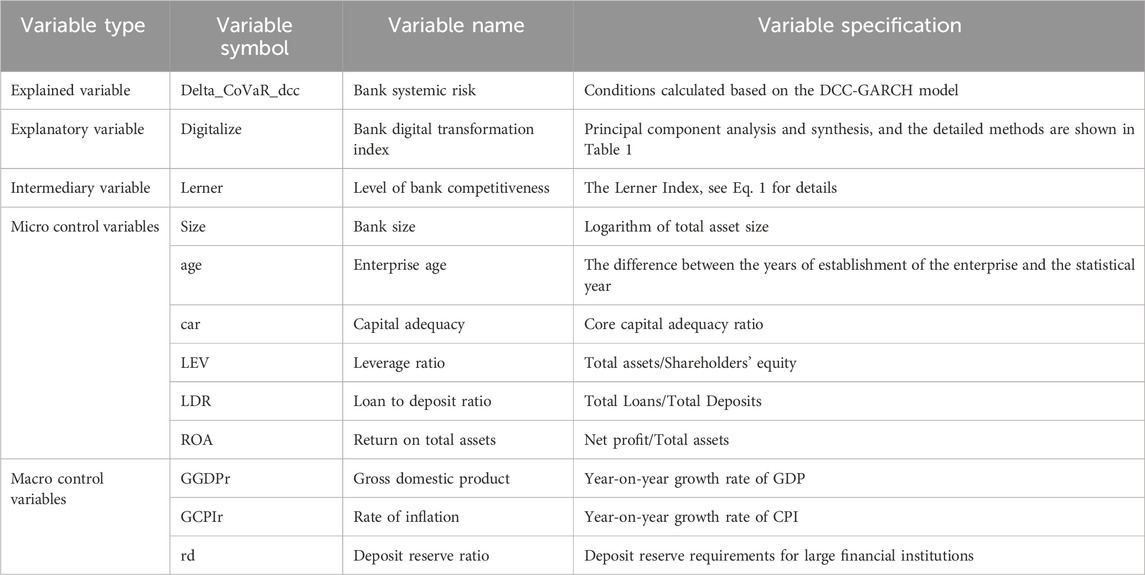

4.1 Definition and measurement of variables

4.1.1 Bank systemic risk

Consistent with most of the existing literatures, this paper is based on the ΔCoVaR theory proposed by Adrian and Brunnermeier [54] and adopts DCC-GARCH modified ΔCoVaR to measure systemic risk. Additionally, as proxy variables for systemic risk of banks in the robustness test, the marginal expected loss (MES) proposed by Acharya, Pedersen [55] and the SRISK proposed by Brownlees and Engle [56] are used. The specific measurements are presented in the Supplementary Appendix.

4.1.2 Digital transformation of commercial banks

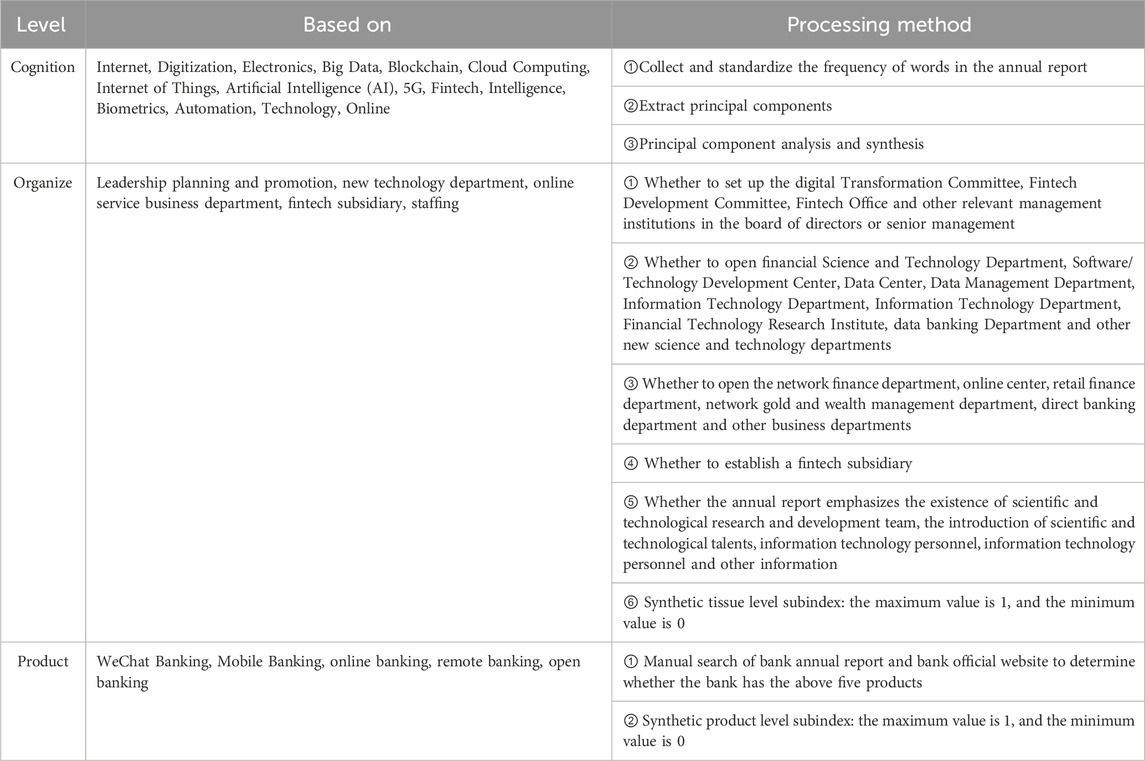

This paper draws on the construction ideas of the Internet transformation index of the Internet Finance Research Center of Peking University and the digital transformation index measured by Zhang, Guo [57], and based on the characteristics of the digital transformation of the bank, the features of the annual reports of listed companies are crawled with the help of the Python crawler function, and the corresponding word frequency statistics and principal component analysis are carried out. Specifically, the digital transformation index of commercial banks is constructed from the three dimensions of cognition, organization, and product. 1) Cognitive level, taking into account the ongoing advancement of Chinese digital technology and the characteristics of the banking sector’s digital transformation. Based on the research of Zhang, Guo [57], this paper adds seven words such as “technology”, “online”, “artificial intelligence (AI)”, “5G”, “financial technology”, “biometrics” and “automation”, and counts the frequency of relevant words appearing in the bank’s annual report constitutes the sub-indicator D-cognition of the cognitive level of the bank’s digital transformation through principal component analysis. 2) At the organizational level, with reference to the classification of the digital transformation of commercial banks from the organizational perspective, information is sorted out from five perspectives: planning and promotion at the leadership level, setting up new science and technology departments, setting up online services and other business departments, setting up financial technology subsidiaries, and scientific and technological personnel. And finally, the sub-indicator D-organization at the organizational level of the digital transformation of commercial banks is synthesized. 3) At the product level, this paper manually searched for information on whether the bank has launched WeChat banking, mobile banking, online banking, remote banking, and open banking through channels such as commercial bank official websites and commercial bank annual reports, and finally obtained the sub-indicator D-product at the product level.

After the sub-indices are formed, the comprehensive index Digitalize of digital transformation is synthesized by principal component analysis, and it is used as a proxy variable for the digital transformation of banks. The specific construction methods of relevant indicators are shown in Table 1. At the same time, drawing on the measure of Xie and Wang [58], this paper uses the total bank digitalization index (D_T) as a proxy variable for the digital transformation of commercial banks in the robustness test.

4.1.3 Mediating variables

In order to explore the mediating effect of banks’ own competitiveness in the process of digital transformation’s impact on systemic risk, this paper draws on the research method of Angelini and Cetorelli [59] and measures the level of competitiveness of commercial banks by Lerner index. Calculated as shown in (Eq. 1):

Among them, Pit is the price of bank output, which is measured by the ratio of total income to total assets. MCit is the bank’s marginal cost, which is calculated by transcending the logarithmic cost function. The Lerner index indicates the ability of a company to obtain excess profits. The larger the Lerner index, the stronger the ability of commercial banks to obtain excess profits, and the higher the level of bank competitiveness.

4.1.4 Control variables

According to the studies that are currently available, banks’ systemic risk is influenced by micro characteristics like their own assets and liabilities. Accordingly, the following six micro-level control variables are added to the empirical model with reference to Wang, Liu [34], Shi, Sun [60], Denis, Sami [61], and Tian and Wang [62]: i) the size of the bank is represented by the natural logarithm of its total asset size; ii) since the core capital adequacy ratio is able to effectively dampen the systemic risk of banks [62], the core capital adequacy ratio (CAR) is therefore included in the model; iii) the ratio of total assets to shareholders’ equity (LEV) is introduced into the model in the paper, taking into account that higher leverage is more likely to trigger systemic risk [12]; iv) the bank’s deposit and loan ratios are expressed through the ratio of total loans to total deposits, which measures the bank’s own liquidity; v) the ratio of the bank’s net profit to total assets is used to express the bank’s return on total assets (ROA), which reflects the bank’s profitability level; and (vi)the difference between the firm’s year of incorporation and the statistical year (age) is included in the model in view of the fact that the firm’s age may also have a certain impact on the systemic risk. Additionally, the following three macro-level control variables are introduced with reference to the studies conducted by Wang, Liu [34] and Lim, Costa [63]: i) A nation’s GDP growth rate is a good indicator of its economic health; the stronger the macroeconomic environment, the more it contributes to lowering bank systemic risk. As a result, the regression model in this paper includes the GDP growth rate (GGDPr) at the national level; ii) deposit reserves are included because, as a national macro-prudential tool, they can effectively reduce systemic risk [63]; and iii) excessive price level growth in a country may result in domestic pass-through inflation, which can then cause systemic risk. As a result, the model incorporates the national CPI growth rate as a macro-level control variable. The specific variables and definitions are shown in Table 2.

4.2 Model setting

This paper builds the following regression model to further test the influence of banks’ digital transformation on banks’ systemic risk based on measuring the indicators of banks’ digital transformation and systemic risk:

Among them, i and t are the bank and the year respectively; Delta_CoVaR_dcci,t is the systemic risk of bank i in year t; Digitalizei,t is the degree of digital transformation of bank i in year t. Controli,t is the control variable at the micro and macro levels; μi is the banks fixed effects;

4.3 Samples and data sources

As of 2021, there are 41 A-share listed commercial banks in China. In terms of data selection, due to the short data interval, this paper excludes four banks that were listed in 2021, Ruifeng Bank, Qilu Bank, Shanghai Rural Commercial Bank and Bank of Chongqing. At the same time, since the digital transformation indicators are constructed through text analysis, the availability of the original disclosure data is critical, so six companies with missing information, including Changshu Rural Commercial Bank, Bank of Beijing, China Everbright Bank, Xiamen Bank, Jiangsu Zijin Rural Commercial Bank and Jiangsu Suzhou Rural Commercial Bank, were excluded bank. Finally, 31 A-share listed banks were retained, including 6 state-owned commercial banks, 8 joint-stock commercial banks, 12 city commercial banks, and 5 rural commercial banks. The text data that digital transformation relies on is obtained through manual searches such as bank annual reports, web page information, and bank official websites. Stock return data comes from Choice Financial Terminal (https://choice.eastmoney.com/). Other variables mainly come from Wind database (https://www.wind.com.cn/) and CSMAR database (https://global.csmar.com/). Considering that 2013 is the first year of digital finance in China, this paper selects 2013–2021 as the sample period.

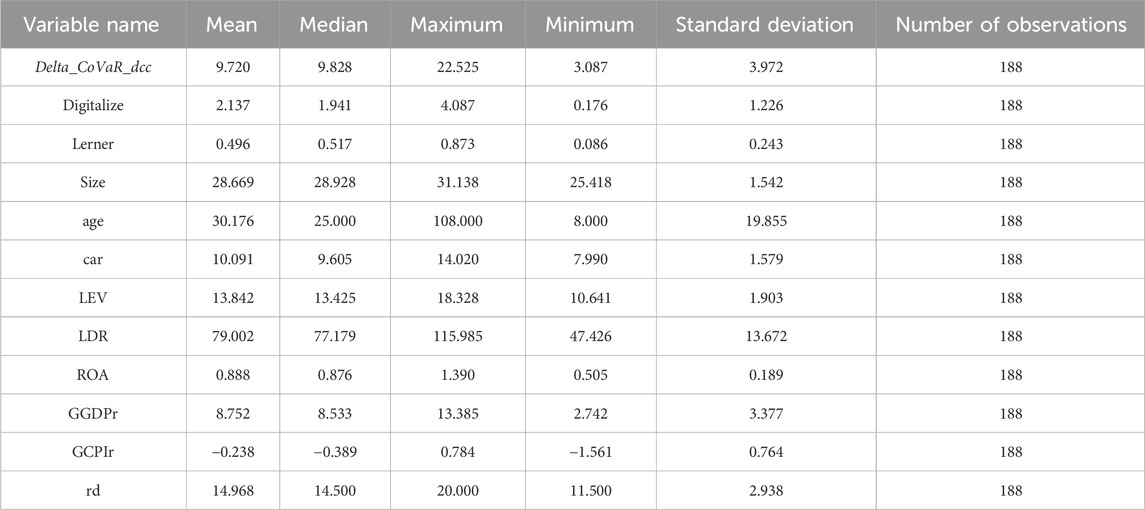

This paper performed a 1% winsorize on the continuous variables to lessen the impact of outliers on the empirical analysis, and in the end, it was able to produce the descriptive statistics of the unbalanced panel data in Table 3. Among them, the mean, maximum, and minimum values of banking systemic risk are, respectively, 9.720, 22.525, and 3.087. This demonstrates that there were differences in the systemic risk among various banks and a certain polarization trend in the banks’ systemic risk levels during the observation period. The bank digital transformation index has average, maximum, and minimum values of 2.137, 4.087, and 0.176, respectively, reflecting the varying degrees of digital transformation experienced by various commercial banks. The Lerner index, which measures the level of bank competitiveness, has a maximum value of 0.873 and a minimum value of just 0.086, showing that there are clear differences in the level of competitiveness among banks.

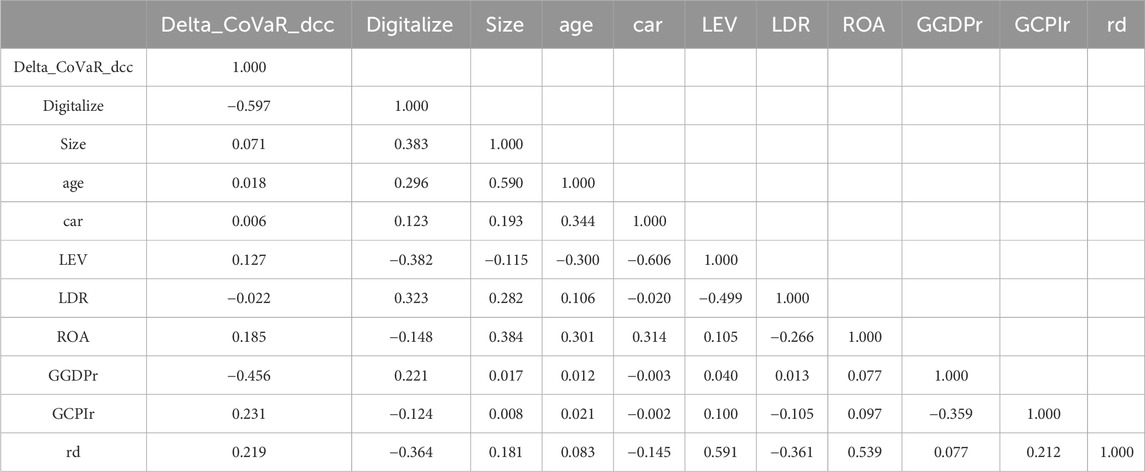

To observe the correlation between the variables more intuitively, in Table 4, we analyze the correlation of the variables involved in this paper. The correlation coefficient between systemic risk and banks’ digital transformation is −0.597, as shown by the correlation coefficient matrix in Table 4. This negative correlation is consistent with Hypothesis H1, which serves as the foundation for the empirical research that follows in this paper.

5 Empirical tests

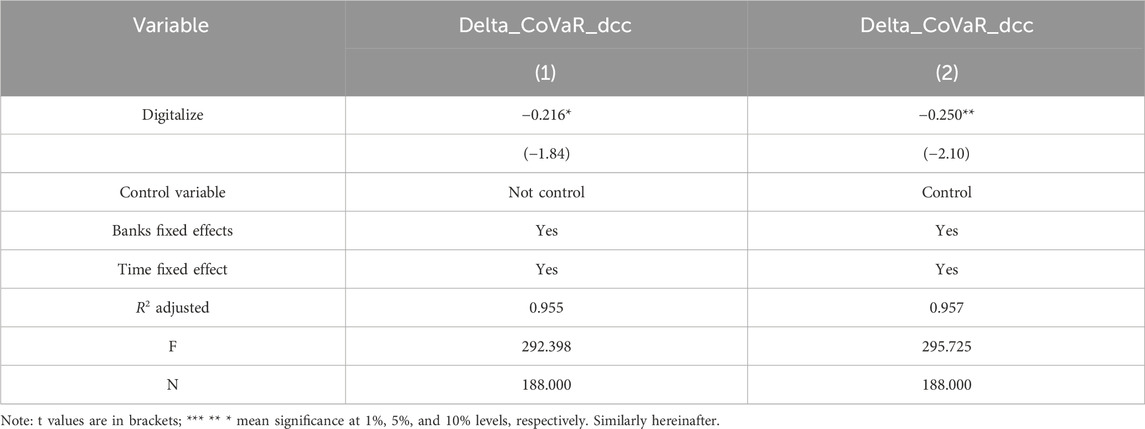

5.1 Digitalization of commercial banks and banking systemic risk

The baseline regression results for the impact of commercial banks’ digital transformation on banking systemic risk are shown in Table 5, where columns (1) and (2) show the results without and with control variables, respectively. The empirical findings demonstrate that the regression coefficient’s sign direction is consistent both before and after the introduction of a number of control variables. It demonstrates the robustness of this model. Specifically, the regression coefficient of bank digital trans-formation is significantly negative at the 5% level after all control variables are included in column (2), showing that the likelihood of bank systemic risk gradually decreases with increasing bank digital transformation. For every unit of bank digital transformation, its contribution to systemic risk decreases by 25%. This confirms the anticipated conclusion drawn from the earlier theoretical analysis that the digital transformation of commercial banks can lower the systemic risk of banks. The specific cause may be that during the digital transformation process, the use of digital technologies like big data and cloud computing, on the one hand, lowers the cost of information acquisition for banks, effectively resolving the issue of information asymmetry between banks and enterprises, and, on the other hand, enhances the ability to prevent and control risk before lending. On the other hand, the bank’s service system has been expanded to include high-quality long-tail groups, which has increased its profitability and decreased the likelihood of systemic risks. This result is consistent with the previous theoretical analysis and verifies that hypothesis H1 of this paper is established.

5.2 Digital transformation of commercial banks, bank competitiveness, and bank systemic risk

From the results of the above benchmark regression, it can be seen that the digital transformation of banks has a negative inhibitory effect on their systemic risk. So, what is the mechanism for the impact of digital transformation on the systemic risk of commercial banks? Is bank competitiveness an important factor in commercial banks’ digital transformation to reduce their systemic risks? In order to better explore related issues, this paper uses the mediating effect model for analysis. The specific model is shown in Eqs 3–5 below:

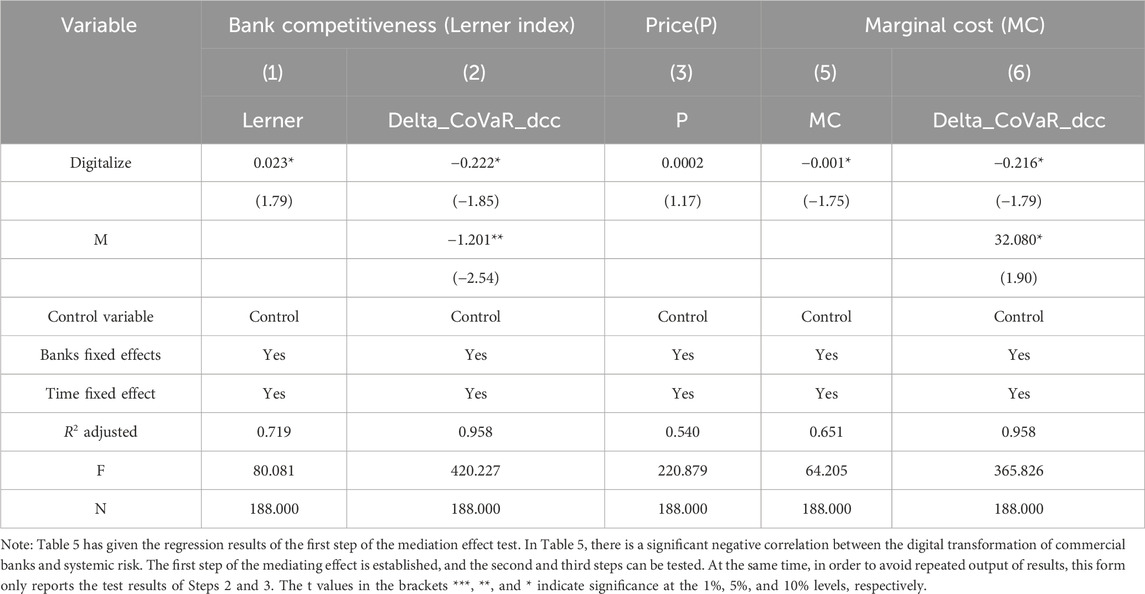

The intermediary variable among them is Mi,t, and the other variables are the same as in formula (2). Table 6 displays the results of the regression.

From the results in Table 6, we can see that in column (1), the impact of the digital transformation of commercial banks on the Lerner index is positive at the 10% significance level because the Lerner index reflects the level of competitiveness of commercial banks. Therefore, it can be concluded that the digital transformation of commercial banks has significantly improved the competitiveness of banks themselves at a level of 10%. It can be seen in column (2) that the regression coefficient of the digital transformation of commercial banks is negative at the 10% significance level, and the regression coefficient of the Lerner index is negative at the 5% significance level. All the above steps are in line with the test conditions of the mediation effect model, indicating that the bank’s own competitiveness level plays an intermediary role in the impact of the digital transformation of commercial banks on systemic risk and that the bank’s digital transformation reduces bank systemic risk by affecting competitiveness. The mediation effect is 0.028. This shows that the bank’s digital transformation can reduce systemic risk by improving its own competitiveness. This is consistent with the previous theoretical analysis and verifies the hypothesis H2 of this paper.

Considering that the Lerner index, which measures the level of bank competitiveness, is composed of two parts: price and marginal cost, Therefore, after decomposing the Lerner index into price (P) and marginal cost (MC), it is further analyzed to determine which index is the key to promoting the level of bank competitiveness to become the mechanism of commercial bank digital transformation to reduce bank systemic risk. The empirical results are shown in columns (3) through (5) of Table 6.

Since the price (P) in this article is measured by the ratio of total income to total assets, its essence is the turnover rate of total assets. For banks, although digital transformation can prompt them to expand their business scope and improve service efficiency. However, from the perspective of China’s monetary policy, since 2013, China has entered a cycle of interest rate cuts, and the narrowing of interest rate spreads has weakened the profitability of banks, which has reduced the asset turnover rate of banks to a certain extent. At this time, banks are more likely to ensure stable operations by reducing costs, thereby mitigating systemic bank risks. To sum up, the mechanism for digital transformation to increase bank competitiveness by increasing price P to reduce bank systemic risk is not significant.

Regarding marginal cost (MC), the reduction effect of bank digital transformation on its marginal cost is mainly reflected in the following aspects: First of all, from the perspective of banks providing services, on the one hand, although the basic investment involved in digital transformation is relatively large, however, with the use of digital technology, the online business model has led to a continuous reduction in service labor costs and store operating costs. On the other hand, digital technology brings a large number of high-quality long-tail customers into the bank’s service scope, increasing the total number of customers. At the same time, the exclusive customized service model brought by big data technology has greatly increased the quality and efficiency of banking services, further enhancing customer stickiness. It can be seen that with the continuous deepening of digital transformation, banks have not only achieved a reduction in service costs but also expanded the overall number of high-quality customers. This has led to a gradual decline in the marginal cost of servicing each customer for banks. Secondly, from the perspective of information collection and processing, on the one hand, after the transformation, the application of digital technology can help banks collect more extensive customer-related information and provide them with diversified and targeted information after accurately analyzing customer behavior. Diversified products and services help to expand the bank’s advantages of economies of scope, which are consistent with the reduction of marginal costs emphasized in the theory of economies of scope. On the other hand, the batch processing of data and the continuous improvement of information systems have also made the marginal cost of bank information processing lower and lower. Thirdly, from the perspective of risk management, with the optimization of the bank’s overall business chain in the digital transformation process, the bank’s internal risk management system is becoming more and more perfect. The information tracking of borrowers before and after lending has achieved full coverage of business risk management. Moreover, the decentralization of the block chain increases the accuracy of information and reduces the marginal cost of bank risk management. On the one hand, the capital accumulation brought about by reducing marginal costs helps to increase the bank’s risk prevention and control capabilities. On the other hand, it increases the liquidity level of banks, reduces the bank’s dependence on interbank lending, reduces the degree of financial correlation between banks, and thus reduces the possibility of systemic risks.

From the empirical analysis results in Table 6, we can see that the regression coefficient in column (3) does not meet the condition of a mediating effect. When marginal cost is used as an intermediary variable, the coefficient of the core explanatory variable in column (4) is significantly negative at the 10% level, indicating that the digital transformation of banks helps reduce the marginal costs of banks. In column (5), the coefficient of bank digital transformation is negative at a significance level of 10%, while the coefficient of marginal cost is positive at a significance level of 10%. It shows that marginal cost plays an intermediary role in the impact of a commercial bank’s digital transformation on systemic risk and further shows that the reduction of the marginal cost of banks brought about by digital transformation is the key factor that promotes the competitiveness of banks to become the mechanism of digital transformation to reduce the systemic risk of banks. It is consistent with the above theoretical analysis.

6 Heterogeneity analysis

6.1 Scale heterogeneity

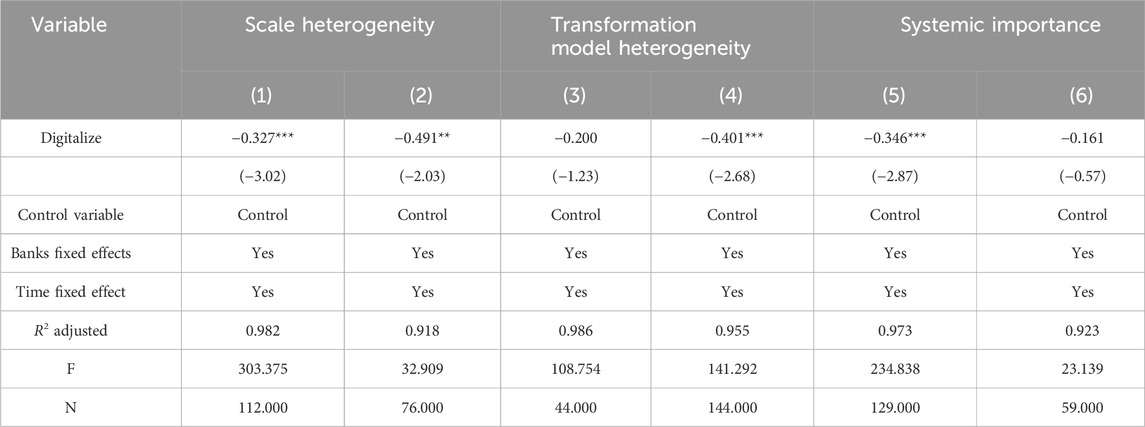

Because China’s commercial banks have their own characteristics in terms of scale and type, in the process of digital transformation, the impact of commercial banks with different characteristics on their systemic risk may also be different. Therefore, referring to existing research methods, this paper classifies state-owned commercial banks and joint-stock commercial banks as large commercial banks and analyzes urban commercial banks and rural commercial banks as small and medium-sized commercial banks. Empirical results are shown in columns (1) and (2) of Table 7.

From the results of columns (1) and (2) in Table 7, it can be seen that the regression coefficient of the digital transformation of large commercial banks is significantly negative at the level of 1%. In comparison, the negative impact of the digital transformation of small and medium commercial banks on systemic risk only holds at the 5% significance level. This shows that compared with small and medium-sized commercial banks, large banks have advantages in terms of capital scale, talent allocation, and risk management. Therefore, it is easier to reduce its systemic risk through digital transformation.

6.2 Heterogeneity of digital transformation models

Through the collection of relevant data, it can be seen that the digital transformation models of the Chinese banking industry at this stage are mainly divided into three types: setting up its own digital service departments, establishing financial technology subsidiaries, and cooperating with Internet or technology companies. And the difference in transformation mode may have different impacts on its systemic risk. Therefore, this paper conducts a heterogeneity test based on the model of bank digital transformation. Considering that all sample banks in the sample period have set up digital or technical electronic services and cooperate with Internet or technology companies to a certain extent. So, the heterogeneity analysis focuses on whether to establish financial technology subsidiaries.

Columns (3) and (4) in Table 7 report the test results of establishing a fintech subsidiary, and not establishing a fintech subsidiary. Among them, the regression result of column (3) is not significant, and the regression result of column (4) is significantly negative at the 1% level. This result suggests that the systemic risk reduction effect of banks’ digital transformation is more pronounced among banks without establishing fintech subsidiaries, under equal conditions of having opened digital or technology-enabled e-services and having partnered with internet or technology firms. The possible reasons are as follows: First, cooperation with Internet or technology companies can effectively make up for the bank’s own technical shortcomings. While making full use of the technological resources of the partner company, it can effectively reduce the innovation cost and innovation risk in the process of the digital transformation of the bank, weakening the bank’s possibility of contagion. Secondly, compared with building a financial technology subsidiary by itself, it is easier to obtain returns in the short term by cooperating with enterprises, which reduces the motivation of banks to pursue high-risk assets in order to make up for the high investment costs of digital transformation, and the probability of systemic risks has also decreased. Therefore, the reduction effect of bank digital transformation on systemic risk is more obvious in banks that have not established financial technology subsidiaries. For banks to set up financial technology subsidiaries on their own. On the one hand, although the establishment of financial technology subsidiaries by banks is a means for them to promote their own digital transformation based on the advantages of the parent Company. In the long run, the establishment of a fintech subsidiary will help improve the bank’s overall digitalization level, enhance the bank’s own core competitiveness, and effectively reduce its systemic risk. However, Chinese financial technology subsidiaries appeared relatively late. Except for a few banks established in 2015 and 2016, most financial technology subsidiaries were established between 2018 and 2020. Due to the short establishment time, it is very likely that there will be problems, such as an insufficient risk management model and a single business operation. In the case of an unsound banking supervision system, it is easier to induce systemic banking risks. On the other hand, these banks that have established financial technology subsidiaries are also carrying out digital transformation through cooperation with Internet or technology companies, and cooperation with Internet or technology companies can effectively reduce the contribution level of banking systemic risk. Therefore, in general, the impact of digital transformation on the systemic risk of banks may not be significant.

6.3 The heterogeneity of systemically important banks and non-systemically important banks

Compared with non-systemically important banks, systemically important banks play a more important role in the generation and infection of banking systemic risks. Therefore, the impact of digital transformation on different systemically important banks may be different. According to the list of Chinese systemically important banks in 2022 issued by the People’s Bank of China and the China Banking and Insurance Regulatory Commission, this paper divides the sample banks into two categories: systemically important and non-systemically important for empirical analysis. The empirical results are shown in Table 7 (5) and (6). Among them, the regression coefficient of digital transformation of systemically important banks is significantly negative at the 1% level; the regression coefficient of non-systemically important banks is negative but not significant. This shows that the reduction effect of digital transformation on bank systemic risk is more obvious in systemically important banks. The possible reasons for this result are as follows: First, systemically important banks have strong financial strength and obvious advantages such as scientific and technological talents and R&D capabilities, making it easier for such banks to form economies of scale in the process of digital transformation. Under the influence of economies of scale, the profitability of banks has gradually increased, their risk management and control capabilities have improved, and their ability to prevent systemic risks has become stronger. Secondly, because systemically important banks occupy an important position in Chinese banking system, they are subject to stricter financial supervision, prompting banks to choose more prudent decisions in the process of digital transformation. In addition, its decision-making execution ability is strong, and the speed of adapting to the market is relatively fast. All of these help to reduce the possibility of systemic risks in banks.

7 Robustness test

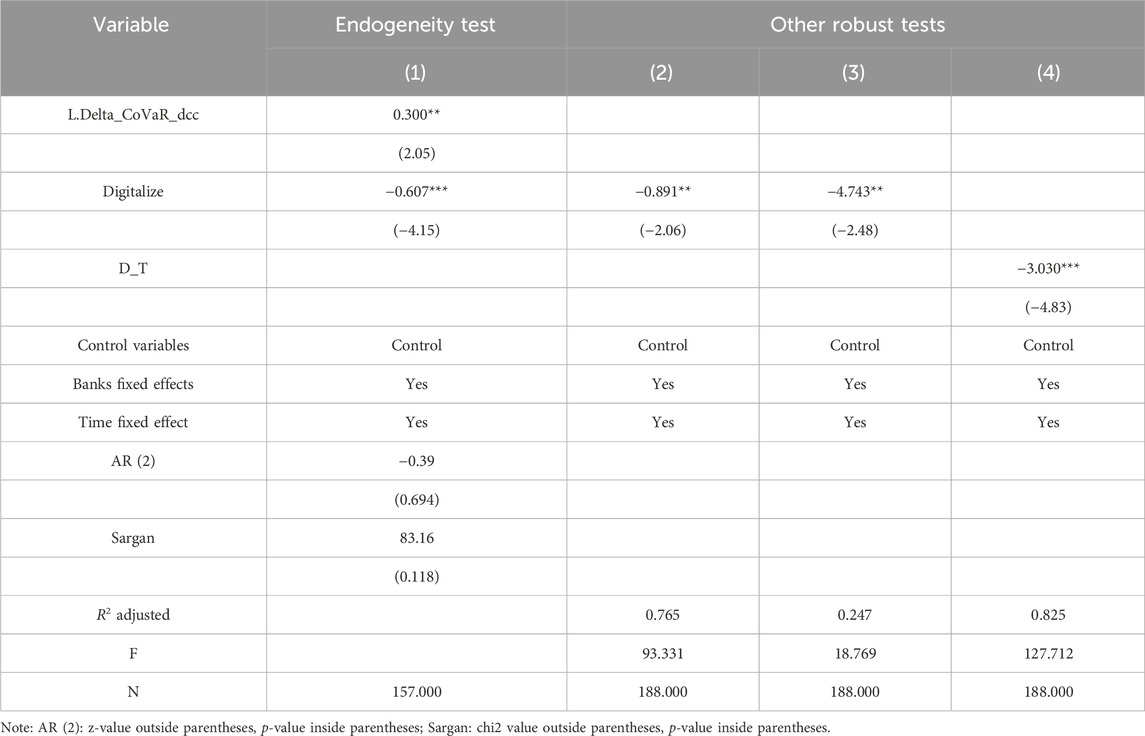

7.1 Endogeneity test

This paper’s analysis suggests that banks’ digital transformation can lower their systemic risk; however, more discussion is required to arrive at this conclusion. This is due to the possibility that the two variables—bank digital transformation and bank systemic risk—have a mutually causal endogeneity relationship. In order to reduce the possible endogeneity problem in the model, this paper replaces the estimation method and uses a dynamic panel model (Generalized Method of Moments) for the test. Table 8’s column (1) illustrates that the p-value for both the Sargan and AR (2) tests is greater than 0.1, indicating the absence of second-order autocorrelation in the residual terms and the instrumental variables are appropriately selected, confirming that the selection of the model is justified. From the regression results, the number of estimated coefficients after the lagged first order of systemic risk of banks is positive at a 5% significance level, indicating that systemic risk has a continuous effect. And the effect of banks’ digital transformation on systemic risk is significantly negative, which is consistent with the results of the previous benchmark regression, which indicates that the results of this paper that banks’ digital transformation can reduce systemic risk are reliable.

7.2 Other robustness tests

In order to ensure the robustness of the benchmark model, this paper further analyzes the robustness from the following two perspectives. First, the explanatory variables are replaced. On the basis of the baseline model selecting ΔCoVaR to measure systemic risk, in the robust-type test, marginal expected loss (MES) proposed by Acharya, Pedersen [55], and SRISK proposed by Brownlees and Engle [56] are selected to be used as proxies for systemic risk of banks. The exact formula is presented in the Supplementary Appendix, and the regression results are presented in column (2) and column (3) of Table 8. Second, the core explanatory variables are replaced. In this paper, we draw on the measurement method of Xie and Wang [58] to reconstruct the bank digital transformation index, and the bank digitalization index (D_T) is used as a proxy variable for digital transformation of commercial banks for the robustness test, and the regression results are shown in Table 8, column (4).

The estimates of the digital transformation coefficients for banks in columns (2) through (4) are all negative, as shown in Table 8. The estimates of columns (2) and (3) among them are significant at a significance level of 5%, whereas the estimate of column (4) is significantly negative at a significance level of 1%. This suggests that the digital transformation of banks is effective in reducing banks’ systemic risk. The regression results of the robustness tests are similar to the previous benchmark regression, which again indicates that the estimation results of this paper are more robust and further validate the previous hypotheses.

8 Conclusions and recommendations

8.1 Conclusions

In the digital era, more and more companies are starting to enhance their competitiveness through digital transformation. Does the digital transformation of the banking industry, a major player in systemic financial risk, affect systemic risk? Does the digital transformation of banks make them more competitive, which lowers systemic risk? This study demonstrates that commercial banks’ digital transformation boosts their own competitiveness and lowers systemic risk. Further research finds that the reduction of the marginal cost of banks brought about by digital transformation is the key factor that promotes the competitiveness of banks to become the mechanism of digital transformation to reduce the systemic risk of banks. In addition, the digital transformation of commercial banks has a heterogeneous effect on reducing systemic risk. The digital transformation of large commercial banks, commercial banks that have not established financial technology subsidiaries, and systemically important banks is more helpful in reducing the systemic risk level of banks.

8.2 Recommendations

We can better understand the overall direction of banking digital transformation and the development strategy of risk prevention and control by examining the overall impact, mechanism, and heterogeneity of banking digital transformation on banking systemic risk. The future development strategy for the digital transformation of Chinese commercial banks should be continually enhanced based on further strengthening risk prevention and control. In this regard, this paper puts forward the following policy recommendations:

Enhancing awareness of cooperation and promoting mutual benefit and win-win results: The improvement of the level of competitiveness will help to increase the bank’s own capital accumulation and reduce the possibility of bank systemic risk. Moderate cooperation also has certain advantages for the rational allocation of financial resources. Therefore, the digital transformation of commercial banks should carry out the reciprocal cooperation while improving their own competitiveness, and avoiding the vicious and homogeneous competition in the cooperation, so as to promote the mutual benefit and win-win situation among commercial banks. For small and medium-sized banks, they can alleviate the problem of being disadvantaged due to scale and capital constraints in the process of digital transformation through intra-industry alliance and cooperation, and enhance their competitiveness level by embracing the group to increase their attenuating effect on systemic risks.

Clarifying the path of transformation and adhering to differentiated development: At present, the digital transformation of Chinese banks is still in the exploratory stage. This is a long-term and continuous improvement process. Commercial banks should give full consideration to their own capital scale and research and development level, formulate differentiated transformation strategies in line with their own development, not blindly follow, and effectively respond to the lack of competitiveness in the digital process, so as to form personalized services with their own characteristics.

Enhancing risk awareness and innovating risk management: In the early stages of digital transformation, the disequilibrium between input and output may prompt commercial banks to disregard risks in order to maintain profitability, increase the allocation of risky assets, and affect bank risks. Therefore, commercial banks should strengthen their awareness of risk prevention. In the process of digital transformation, we should always keep in mind the priority of risk prevention and control and adhere to digital innovation behaviors based on risk prevention and control.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://choice.eastmoney.com/, https://www.wind.com.cn/, and https://global.csmar.com/.

Author contributions

KJ: Conceptualization, Formal Analysis, Project administration, Supervision, Writing–review and editing. XL: Data curation, Formal Analysis, Investigation, Methodology, Writing–original draft.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fphy.2023.1297912/full#supplementary-material

References

1. Brandl B, Hornuf L. Where did fintechs come from, and where do they go? The transformation of the financial industry in Germany after digitalization. Front Artif Intelligence (2020) 3:8. doi:10.3389/frai.2020.00008

2. Lee SH, Lee DW. Fintech - conversions of finance industry based on ict. J Korea Convergence Soc (2015) 6:97–102. doi:10.15207/JKCS.2015.6.3.097

3. Chen B, Yang X, Ma Z. Fintech and financial risks of systemically important commercial banks in China: an inverted U-shaped relationship. Sustainability (2022) 14(10):5912 .doi:10.3390/su14105912

4. Chen MA, Qinxi W, Baozhong Y. How valuable is fintech innovation? Rev Financial Stud (2019)(5) 5. doi:10.1093/rfs/hhy130

5. Zeng L. Application of financial technology innovation in commercial banks: a case study of bank of China. Int J New Dev Eng Soc (2021)(3) 5 doi:10.25236/ijndes.2021.050306

6. Furr N, Ozcan P, Eisenhardt KM. What is digital transformation? Core tensions facing established companies on the global stage. Glob Strategy J (2022) 12(4):595–618doi:10.1002/gsj.1442

7. Halemani SSM Importance of banks in cashless transactions under digitalization system. Journal of Trend in Scientific Research and Development(2018), 188–190. doi:10.31142/ijtsrd18702

8. Cuesta C, Ruesta M, Tuesta D, et al. The digital transformation of the banking industry. Oriental Art (2015). doi:10.1109/TMAG.2013.2243424

9. Thakor AV. Fintech and banking: what do we know? J Financial Intermediation (2020) 41:100833. doi:10.1016/j.jfi.2019.100833

10. Virginia M, Oona V, Emil S. The digital transformation and disruption in business models of the banks under the impact of fintech and bigtech. Proc Int Conf Business Excell (2020) 14:294–305. doi:10.2478/picbe-2020-0028

11. Benoit S, Colliard J-E, Hurlin C, Pérignon C. Where the risks lie: a survey on systemic risk*. Rev Finance (2017) 21(1):109–52. doi:10.1093/rof/rfw026

12. Cincinelli P, Pellini E, Urga G. Systemic risk in the Chinese financial system: a panel granger causality analysis. Int Rev Financial Anal (2022) 82. doi:10.1016/J.IRFA.2022.102179

13. Hu D, Zhao S, Yang F. Will fintech development increase commercial banks risk-taking? Evidence from China. Electron Commerce Res (2022). doi:10.1007/s10660-022-09538-8

14. Jiang H, Zhang J. Discovering systemic risks of China's listed banks by covar approach in the digital economy era. Mathematics (2020) 8(2):180. doi:10.3390/math8020180

15. Yang Z, Li D. Research on the systemic financial risk of Chinese banks — application analysis based on the "go to one method. Econ Res J (2018) 53(08):36–51.

16. Varotto S, Zhao L. Systemic risk and Bank size. J Int Money Finance (2018). doi:10.1016/j.jimonfin.2017.12.002

17. Laeven L, Ratnovski L, Tong H. Bank size, capital, and systemic risk: some international evidence. J Banking Finance (2016) 69:S25–34. doi:10.1016/j.jbankfin.2015.06.022

18. Sun L. Financial networks and systemic risk in China's banking system. Finance Res Lett (2020) 34. doi:10.1016/j.frl.2019.07.009

19. Mistrulli PE. Assessing financial contagion in the interbank market: maximum entropy versus observed interbank lending patterns. J Banking Finance (2011) 35(5):1114–27. doi:10.1016/j.jbankfin.2010.09.018

20. Liao M, Sun T, Zhang J. China's financial interlinkages and implications for inter-agency coordination. IMF Working Pap (2016) 16(181):1. doi:10.5089/9781475530490.001

21. Bellavite Pellegrini C, Cincinelli P, Meoli M, Urga G. The contribution of (shadow) banks and real estate to systemic risk in China. J Financial Stab (2022) 60:101018. doi:10.1016/j.jfs.2022.101018

22. Cincinelli P, Pellini E, Urga G. Leverage and systemic risk pro-cyclicality in the Chinese financial system. Int Rev Financial Anal (2021) 78. doi:10.1016/J.IRFA.2021.101895

23. Beltratti A, Stulz RM. The credit crisis around the globe: why did some banks perform better? Journal of Financial Economics (2012). 105 (1), 1–17. doi:10.1016/j.jfineco.2011.12.005

24. Gang J, Qian Z. China's monetary policy and systemic risk. Emerging Markets Finance & Trade (2015) 51(4):701–13. doi:10.1080/1540496x.2015.1039895

25. Yi F, Yanru W, Qi W, Yang Z. Policy uncertainty and Bank systemic risk: a perspective of risk decomposition. J Int Financial Markets, Institutions Money (2023) 88. doi:10.1016/J.INTFIN.2023.101827

26. Xite Y, Qin Z, Haiyue L, Zihan L, Qiufan T, Yongzeng L, et al. Economic policy uncertainty, macroeconomic shocks, and systemic risk: evidence from China. North Am J Econ Finance (2024) 69. doi:10.1016/J.NAJEF.2023.102032

27. Bakoush M, Gerding EH, Wolfe S. Margin requirements and systemic liquidity risk. J Int Financial Markets, Institutions Money (2018) 58:78–95. doi:10.1016/j.intfin.2018.09.007

28. Riedl R, Benlian A, Hess T, Stelzer D, Sikora H. On the relationship between information management and digitalization. Business Inf Syst Eng (2017) 59(6):475–82. doi:10.1007/s12599-017-0498-9

29. Cheng M, Qu Y. Does Bank fintech reduce credit risk? Evidence from China. Pacific-Basin Finance J (2020) 63. doi:10.1016/j.pacfin.2020.101398

30. Yin F, Jiao X, Zhou J, Yin X, Ibeke E, Iwendi MG, et al. Fintech application on banking stability using big data of an emerging economy. J Cloud Comput (2022) 11(1):43. doi:10.1186/s13677-022-00320-7

31. Li X, Yang P. Financial technology, market power, and banking risk. Mod Econ Sci (2021) 43(01):45–57.

32. Li C, He S, Tian Y, Sun S, Ning L. Does the bank’s fintech innovation reduce its risk-taking? Evidence from China’s banking industry. J Innovation Knowledge (2022) 7(3):100219. doi:10.1016/j.jik.2022.100219

33. Wang R, Liu J, Luo H. Fintech development and Bank risk taking in China. Eur J Finance (2021) 27(4-5):397–418. doi:10.1080/1351847x.2020.1805782

34. Wang D, Liu Y, Xu Y, Liu L. Fintech, macroprudential supervision and systemic risk in China’s banks. China Finance Econ Rev (2022) 11(4). doi:10.1515/CFER-2022-0025

35. Dong X, Wu Z, Chen Q. The impact of fintech development on the risk prevention and control of commercial banks —— is based on the demonstration of 176 commercial banks in China analyse. Jiangsu Soc Sci (2023)(01) 84–94. doi:10.13858/j.cnki.cn32-1312/c.20230207.016

36. Cihak M, Wolfe S, Schaeck K. Are more competitive banking systems more stable. J Money, Credit Banking (2009) 06:41–4. doi:10.5089/9781451864038.001

37. Beck T, Demirgüç-Kunt A, Levine R. Bank concentration, competition, and crises: first results. J Banking Finance (2006) 30(5):1581–603. doi:10.1016/j.jbankfin.2005.05.010

38. Wibowo IGBE, Wibowo B. The effect of competition levels and banking concentration on systemic risks: Indonesia’s case. Indonesian Capital Market Rev (2019) 9(2). doi:10.21002/icmr.v9i2.7138

39. Nguyen TH, Tran HG. Competition, risk and profitability in banking system — evidence from vietnam. Singapore Econ Rev (2020) 65(06):1491–505. doi:10.1142/s0217590820500137

40. Hirata W, Ojima M. Competition and Bank systemic risk: new evidence from Japan's regional banking. Pacific-Basin Finance J (2020)(C) 60. doi:10.1016/j.pacfin.2020.101283

41. Silva-Buston C. Systemic risk and competition revisited. J Banking Finance (2019) 101. doi:10.1016/j.jbankfin.2019.02.007

42. Xu F, Eva L, Yajun X. Wealth management products, banking competition, and stability: evidence from China. J Econ Dyn Control (2022) 137. doi:10.1016/J.JEDC.2022.104346

43. Faia E, Laffitte S, Ottaviano GIP. Foreign expansion, competition and Bank risk. J Int Econ (2019) 118. doi:10.1016/j.jinteco.2019.01.013

44. Morelli D, Vioto D. Assessing the contribution of China’s financial sectors to systemic risk. J Financial Stab (2020) 50. doi:10.1016/j.jfs.2020.100777

45. Wei SC, Meng Q, Abbas RSK, Muhammad U. Bank competition in China: a blessing or a curse for financial system? Econ Research-Ekonomska Istraživanja (2021) 34(1):1244–64. doi:10.1080/1331677x.2020.1820361

46. Kolodiziev O, Krupka M, Shulga N, Kulchytskyy M, Lozynska O. The level of digital transformation affecting the competitiveness of banks. Banks Bank Syst (2021) 16(1):81–91. doi:10.21511/bbs.16(1).2021.08

47. Summer M. Banking regulation and systemic risk. Open Economies Rev (2003) 14(1):43–70. doi:10.1023/a:1021299202181

48. Yongfang A, Guanglin S, Tao K. Digital finance and stock price crash risk. Int Rev Econ Finance (2023) 88. doi:10.1016/J.IREF.2023.07.003

49. Tobias B, Valentin B, Ana G, Manju P. On the rise of fintechs: credit scoring using digital footprints. Rev Financial Stud (2020) 33(7):2845–97. doi:10.1093/rfs/hhz099

50. Guo Y, Liang C. Blockchain application and outlook in the banking industry. Financial Innovation (2016) 2(1):24. doi:10.1186/s40854-016-0034-9

51. Liu Z. Research on the influence of internet finance on the risk taking of commercial banks. Finance Trade Econ (2016)(04) 71–85+115. doi:10.19795/j.cnki.cn11-1166/f.2016.04.007

52. Xu G, Shi Q. An empirical study on the self-regulation effect of the franchise value of listed banks in China. China Soft Sci (2009)(01) 20–7+40.

53. Zhu C. Big data as a governance mechanism. Rev Financial Stud (2019) 32(5):2021–61. doi:10.1093/rfs/hhy081

55. Acharya VV, Pedersen LH, Philippon T, Richardson M. Measuring systemic risk. Rev Financial Stud (2017) 30(1):2–47. doi:10.1093/rfs/hhw088

56. Brownlees C, Engle RF. Srisk: a conditional capital shortfall measure of systemic risk. Rev Financial Stud (2017) 30(1):48–79. doi:10.1093/rfs/hhw060

57. Zhang Q, Guo L, Ou Y. Has the digital transformation improved the banks' ability to serve the real economy? —— based on the economy of China's listed commercial banks verified by the document. Wuhan Finance Monthly (2022)(04) 29–39.

58. Xie X, Wang S. Digital transformation of China Commercial Bank: measurement, process and impact. Q J Econ (2022) 22(06):1937–56. doi:10.13821/j.cnki.ceq.2022.06.06

59. Angelini P, Cetorelli N. The effects of regulatory reform on competition in the banking industry. J Money, Credit Banking (2003) 35(5):663–84. doi:10.1353/mcb.2003.0033

60. Shi Q, Sun X, Jiang Y. Concentrated commonalities and systemic risk in China's banking system: a contagion network approach. Int Rev Financial Anal (2022) 83. doi:10.1016/J.IRFA.2022.102253

61. Denis D, Sami V, Sara Y. Bank liquidity creation and systemic risk. J Banking Finance (2021) 123. doi:10.1016/J.JBANKFIN.2020.106031

62. Tian J, Wang QB. Capital constraints, bank risk spillovers and macrofinancial risk. Finance Trade Econ (2015)(08) 74–90. doi:10.19795/j.cnki.cn11-1166/f.2015.08.008

Keywords: digital transformation, commercial banks, systemic risk, bank competitiveness, China

Citation: Jia K and Liu X (2024) Bank digital transformation, bank competitiveness and systemic risk. Front. Phys. 11:1297912. doi: 10.3389/fphy.2023.1297912

Received: 20 September 2023; Accepted: 22 December 2023;

Published: 11 January 2024.

Edited by:

Matthieu Garcin, Pôle Universitaire Léonard de Vinci, FranceCopyright © 2024 Jia and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kaiwei Jia, 1980jkw@163.com

Kaiwei Jia

Kaiwei Jia Xinbei Liu

Xinbei Liu