A study of production outsourcing strategies of dual oligopoly manufacturers based on quality investments

- Guangzhou Railway Polytechnic, Guangzhou, Guangdong, China

Introduction: Self-production and outsourcing are two important production strategies for manufacturers, and the production capacity and investment capacity of manufacturers and suppliers play a decisive role in the quality of products. This study aims to analyze the manufacturer’s best production strategy and the drivers of outsourcing in the context of quality.

Methods: This study constructs production outsourcing game models for duopoly manufacturers, examines the trade-offs between self-production and outsourcing when suppliers have the ability to invest in quality, explores the requirements and implications of outsourcing and compares the differences between “one-to-one” and “one-to-many” outsourcing structures.

Results: First, outsourcing can reduce the level of product quality and that a necessary condition for manufacturers’ outsourcing is a strong advantage in the supplier’s production costs. Second, duopoly manufacturers may face a prisoner’s dilemma as a result of outsourcing. Finally, compared to two independent suppliers, outsourcing to a common supplier can increase the level of product quality by exploiting the centralization effect and increase the firm’s profits when the market’s competition intensity is low.

Conclusion: First, the production strategy balance of duopoly manufacturers is closely related to the outsourcing structure, production efficiency and investment efficiency. Second, duopoly manufacturers choose outsourcing may fall into the prisoner’s dilemma, and outsourcing has the risk of quality reduction.

1 Introduction

The globalization of supply chains and the division of labor refinement have made production outsourcing more and more popular among manufactures. Self-production and outsourcing have become important production strategies for manufactures [1]. As consumers pay more attention to product quality, products with advanced processes tend to win consumers’ favor. For this reason, manufactures are not only investing in internal production processes, but also actively investing in supplier capabilities [2], and even proactively seeking external suppliers with independent investment capabilities. This quality investment is essentially investing in innovating the production process to improve the quality of the product and increase the market share.

A leading example is Intel and AMD in the semiconductor industry, where the quality of the CPU products depends heavily on the performance of the chips. This requires a large injection of technology, and long technology refresh cycles can lead to market and consumer loss. According to a ChinaIRN.com study, Intel insisted on the route of integrated chip makers, building factories to produce chips on their own, thus occupying a dominant position in the field of chip manufacturing in the United States for nearly 50 years. AMD, on the other hand, outsourced its chip production to TSMC, a specialized foundry, and relied on TSMC’s advanced technological innovations to gradually rise to a strong competitor in the semiconductor industry. H However, due to technical errors, Intel has lagged behind TSMC in recent years by a whole generation of technology updates, and product quality has been questioned. Forced by competition and technological pressure, Intel announced that it will launch its leading CPU products manufactured by TSMC in 20231.

The growing number of outsourcing cases in integrated electronics shows that the pursuit of higher levels of product quality has become an important driver for manufacturers to choose outsourcing. However, outsourcing makes manufactures’ performance in competitive markets more dependent on supplier performance [3], and the impact of outsourcing structure and outsourced suppliers cannot be ignored. On the one hand, different manufacturers may choose the same supplier for outsourcing, which can raise concerns about product differentiation among manufacturers. For example, in response to Intel’s outsourcing decision, CEO Gelsinger stated that outsourcing to TSMC would make it more difficult to differentiate its chips from AMD’s, because they would be manufactured on the same process, potentially permanently preventing Intel from overtaking AMD. On the other hand, while stronger supplier quality investment capabilities can significantly increase the market demand for a product, higher product quality levels may prompt suppliers to increase the price they charge manufacturers for outsourcing. As a result, manufacturers have to face cost and quality tradeoffs given quality investments and production processes. For example, in 2018, Samsung, in order to compete with TSMC for chip orders from potential customers, not only made every effort to develop process technologies that could rival TSMC’s, but even took the initiative to lower its foundry prices by 20%. However, the actual performance of Samsung is unsatisfactory due to customers’ concerns about product process quality and qualification rate. According to SamMobile, until 2023, Samsung has made significant breakthroughs in volume production and yields of 3 nm chips, but competition with TSMC remains challenging.

Based on this fact, we will restrict our attention to the following issues. Can a manufacturer gain a competitive advantage through outsourcing when the supplier has the ability to invest on its own? For different outsourcing structures, under what market conditions do manufacturers outsourcing? How does production strategy affect the level of investment and profitability of manufacturers? How do duopoly manufacturers interact their strategies? To address these questions, this paper considers two outsourcing structures to construct dynamic game models of duopoly manufacturers, compares and analyzes the equilibrium results under different combinations of self-production and outsourcing. We also verify the robustness of the conclusions with the arithmetic example analyses.

The theoretical contributions of this paper are:

(1) First, this paper can expand and enrich operations management research by extending outsourcing motivations from cost to investment. The quantitative approach fills the gap in explaining investment-based outsourcing.

(2) Second, this paper examines suppliers’ production and investment capabilities to increase supply chain value. This is to compensate for the lower supplier dynamism in traditional production strategies.

(3) Finally, by examining different structures of outsourcing, this paper extends the framework for the study of supply chain competition and provides new insights into whether competition encourages or discourages investment.

The research in this paper contributes to the understanding of the important role of quality investment elements in outsourcing activities, with a view to informing the decision-making of manufacturing firms’ production strategies.

This paper contributes to understanding the role of quality investment in outsourcing, with a view to informing production strategy decisions for manufacturers and suppliers.

2 Literature review

Our work belongs to the research field of production outsourcing. Earlier literatures explored the motivations, impacts, and decision-making frameworks of outsourcing from a strategic perspective, utilizing resource dependence theory, core competitiveness theory, and transaction cost theory [4–6].

From the perspective of operation management, firstly the impacts of outsourcing on supply chain members have been discussed. Gilbert et al. [7] argued that outsourcing mitigates downstream manufacturers’ overinvestment in reducing production costs, thus mitigating mutually destructive cost competition. Kenyon et al. [8] found that production outsourcing has a negative impact on operational performance and that outsourcing significantly reduces the effectiveness of operational equipment and on-time delivery, and even negatively affects customer loyalty. Heydari et al. [9] argued that the use of flexible quantity contracts and outsourcing strategies under stochastic demand can share the risk of overstocking and overproduction, and that partial outsourcing can increase the profitability of the supply chain. Lee et al. [10] found that outsourced supplier development not only directly improves outsourcing performance but also indirectly improves outsourcing performance by facilitating contract and relationship governance.

Second, outsourcing forms and supplier selection have been investigated. Chen et al. [11] studied production strategies with demand uncertainty, quantity uncertainty and outsourcing information asymmetry for the supplier selection problem in outsourcing. Xiao and Qi [12] discussed the effect of product quality level on production outsourcing strategy and show that symmetric outsourcing tends to increase product line variability and that asymmetric outsourcing outperforms symmetric outsourcing when non-quality costs are low. Chen et al. [13] constructed the outsourcing relationship between an original equipment manufacturer and a contract manufacturer when they compete in the same product market, identifying boundary conditions under which both parties can benefit from outsourcing. Niu et al. [14] investigated the dual horizontal outsourcing strategy of “production + sourcing” and its impact on the cost of investment in innovation from the perspective of the learning capability of manufacturers.

Quality investment has been a hot topic in operations management since the 1990s. Quality investment in the supply chain depends on both the manufacturer’s or supplier’s own development capability and the degree of cooperation among the members of the supply chain [15–17]. Karaer and Erhun [18] investigated how the decision of potential firms to enter a monopoly market is influenced by quality factors. Xie et al. [19] extended intra-chain competition to chain-chain competition to study the mechanism of quality improvement strategies in market segments. Xia et al. [20] analyzed the quality investment and pricing decisions of start-ups under financial constraints. In addition, there are a number of works dealing with cost sharing, investment incentives and supply chain coordination between manufacturers and suppliers in cooperative quality investment. Chen et al. [21] examined the importance of cooperative quality investment strategies, obtained analytical equilibrium by establishing a three-stage dynamic game framework, and proposed an investment share sharing agreement applicable to outsourced supply chains. Nagurney and Li [22] proposed a supply chain network quality management problem applicable to outsourced distribution with the objective of weighted minimization of production cost and reputation loss. Yang et al. [23] study the raw material quality control problem in production outsourcing, and design a procurement outsourcing contract to incentivize suppliers to select higher quality raw materials. Xiao et al. [24] studied the strategic outsourcing decisions of two competing manufacturers faced with improving the quality of key components, and the results show that asymmetric outsourcing is not a good solution to the problem. Xiao et al [24] study the strategic outsourcing decisions of two competing manufacturers faced with improving the quality of critical components, and the results show that the manufacturer that adopts an outsourcing strategy in asymmetric outsourcing can achieve a higher level of quality investment. Karaer et al. [25] investigated how manufacturers can use full control strategies and cost sharing mechanisms to develop the sustainable quality capabilities of their suppliers.

The literature has the following findings. Firstly, there are two different types of investment in outsourcing: process investment, which aims at reducing costs and gaining a price advantage, and quality investment, which aims at improving quality and gaining a non-price advantage. There are more studies on the former and fewer on the latter. Studies related to quality investment consider a single supply chain structure, ignoring the ability of suppliers to invest on their own, which is also inconsistent with the increasingly important role of suppliers in outsourcing. There is also the fact that the supply chain structure considered in quality investment is relatively homogenous, ignoring the ability of suppliers to invest on their own, which is also inconsistent with the increasingly important role of suppliers in outsourcing. Secondly, in reality, supply chain competition has long risen from inventory and price to higher levels such as quality and service, and it is more relevant to consider non-price competitive factors such as quality. Therefore, distinguishing from price competition, this study considers quality competition and aims to explore the non-price drivers in outsourcing using mathematical models.

3 The model

Consider two competing supply chains

Both outsourcing structures are reflected in practice [26–28]. As shown in the study by Feng et al. [29], in the computer industry, for example, Flextronics, as one of the largest contract manufacturers, also produces for Dell, Pratt & Whitney, etc., while another important contract manufacturer, Asahi Electric, produces for IBM and NEC. However, when Flextronics acquired Asahi Electric in 2007, manufacturers that used to compete with each other (e.g., HP and IBM) started to work with the same company.

3.1 Demand function

A linear inverse demand function is used to portray the quantity and quality competition of duopoly manufacturers [30, 31]:

3.2 Cost structure

Manufacturers and suppliers have certain technologies and resources to invest in product quality and promote market demand. In response to the law of diminishing marginal efficiency of investment, according to the literature [31, 32], the cost of quality investment

Referring to the literature [29] for a convenient analysis, we make

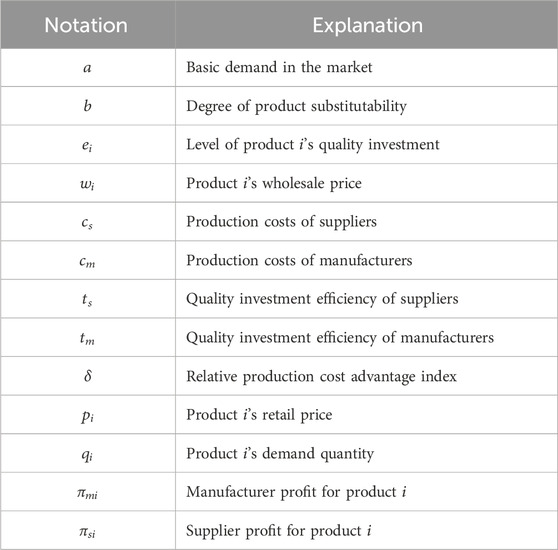

Table 1 provides a summary of all the notations used in this paper.

3.3 Game order

The sequence of the game considers two aspects: (a) Quality investment involves pre-preparation of technology, R&D, production lines, etc. Therefore, manufacturers must determine production outsourcing strategies in advance. (b) Quality investment determines the market positioning of a product, which is long-term and stable relative to pricing. Therefore, quality investment decisions come after outsourcing and before pricing. In addition, manufacturers can determine the competitor’s production strategy by observing whether investing in a new production line, so they play a complete information dynamic game. The game sequence is as follows: firstly, the manufacturers determine the production strategy: self-production or outsourcing; secondly, the manufacturers and/or the suppliers announce the level of quality investment

4 Analysis with two independent suppliers

In this section, we investigate the production strategies of duopoly manufacturers in a “one-to-one” structure, where each manufacturer has an independent supplier and chooses either self-production or outsourcing. Depending on manufacturers’ choices, the market is characterized by four sub-game scenarios: (Self-production, Self-production), (Self-production, Outsourcing), (Outsourcing, Self-production), and (Outsourcing, Outsourcing), denoted by N and O for self-production and outsourcing, respectively.

4.1 Equilibrium solution

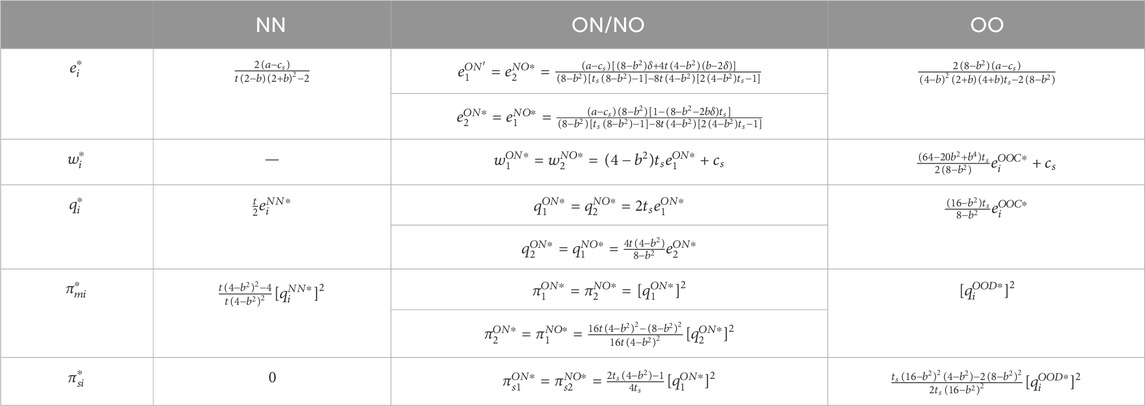

4.1.1 The NN scenario

In this scenario, both manufacturers choose the self-production strategy, i.e., the manufacturer autonomously decides to invest in product quality and pays for it. The manufacturers’ profit functions are:

In the last stage of the game, the manufacturers decide their quantity decisions. According to the first-order conditional joint equations

For the manufacturers’ quality investment decisions, Eq. 2 is brought into Eq. 1 with the joint equations

4.1.2 The NO/ON scenario

In these two scenarios, one manufacturer produces in-house and the other outsources. Without loss of generality, we take the NO scenario as an example, where manufacturer

In the last stage of the game, the manufacturers decide their quantity decisions. According to the first-order conditional joint equations

Next, we consider the supplier’s wholesale price decision. By bringing Eqs 6, 7 into Eq. 5, we have the first-order condition

For the quality investment decisions, Eqs 6–8 are sequentially substituted back into Eqs 3–5. Then according to

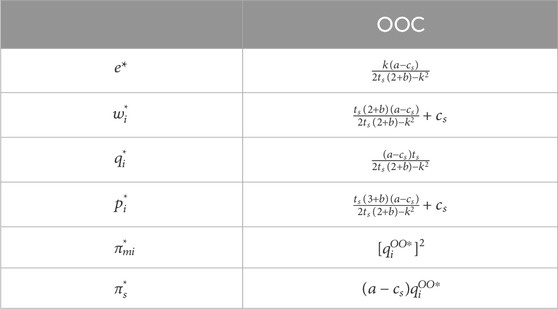

4.1.3 The OO scenario

In this scenario, both manufacturers outsource, and the corresponding suppliers are responsible not only for manufacturing but also for quality investments. The profit functions of the manufacturers and suppliers are respectively:

In the last stage of the game, the manufacturers decide their quantity decisions. According to the first-order conditional joint equations

Next, we bring Eq. 11 into Eq. 10, and obtain the first-order conditions

For the quality investment decisions, Eqs 11, 12 are substituted back into Eq. 10. Then according to

Lemma 1. As

Lemma 1 shows that a decrease in the supplier’s production cost increases the production advantage of outsourcing, while a decrease in the efficiency of the manufacturer’s quality investment increases the investment advantage of outsourcing. Faced with either a production advantage or a quality advantage, the supplier will increase quality investment and reduce wholesale price, and the outsourced manufacturer will therefore increase quantity to realize higher profit. However, as a result of competition, the self-produced manufacturer will invest less in quality and produce less, leading to lower profit.

4.2 Comparative analysis of equilibrium

In this section, we compare the equilibrium results of the four sub-game models described above and analyze the impacts of different production strategies on quality investment and profit, as well as the choice of the duopoly manufacturers between the two production strategies.

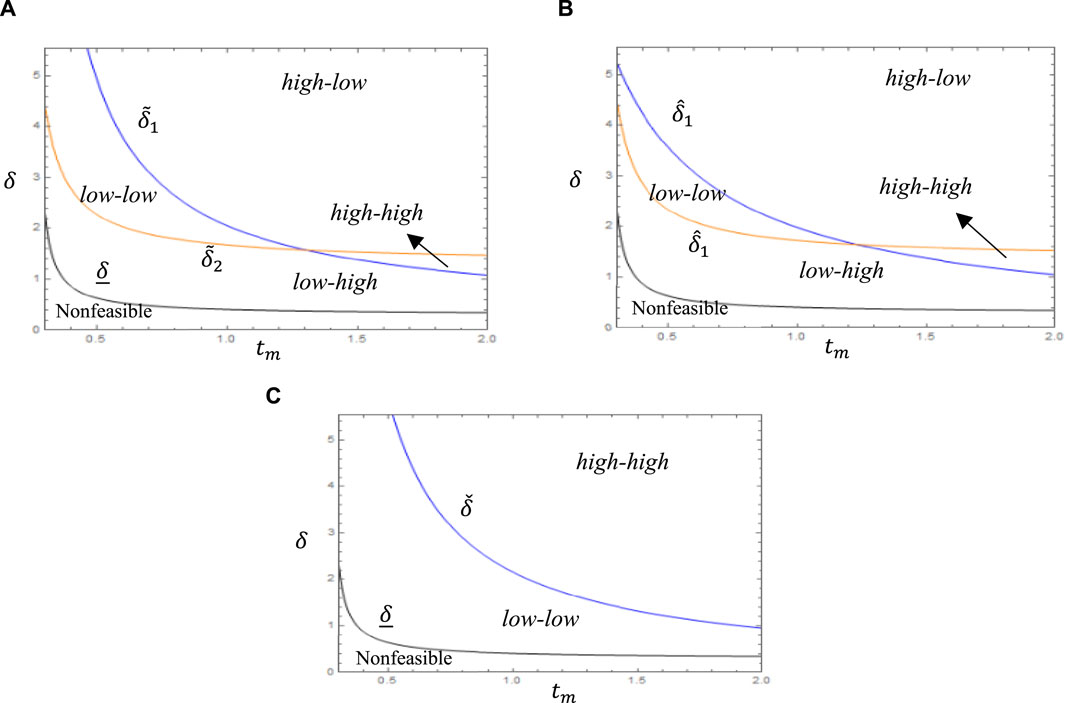

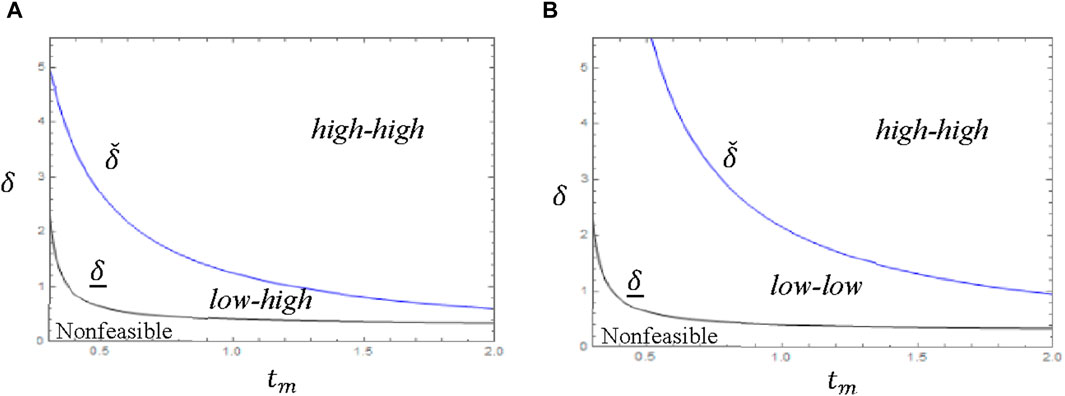

In order to analyze the effect of outsourcing on quality investment, we hold one manufacturer’s production strategy constant and compare the quality investment of another manufacturer’s self-production and outsourcing. The results are summarized in Theorem 1 and Figure 2.

Figure 2. Impact of outsourcing on quality investment (

Theorem 1. A comparison of the quality investment for the four scenarios is as follows:

Case 1. There exist two thresholds

(i)

(ii)

Case 2. There exist two thresholds

(i)

(ii)

Case 3. There exist a threshold

Theorem 1 shows that outsourcing does not necessarily increase quality investment. Outsourcing has two effects on quality. On the one hand, the supplier with lower production cost or more efficient investment has an incentive to invest in higher quality; on the other hand, outsourcing makes the manufacturer more dependent on their supplier, and a decentralized channel structure reduces the manufacturer’s control over quality. Thus, outsourcing can improve quality only if the positive effects of low cost or high efficiency are higher than the negative effects of system decentralization. Specifically, given that one manufacturer self-produces, it holds the advantage of system centralization. If the other manufacturer’s quality investment is more efficient, then outsourcing results in a higher loss of quality due to system decentralization. Combined with market competition, outsourcing reduces the manufacturer’s quality. Conversely, given that one manufacturer outsources, then the other manufacturer’s outsourcing exposes both parties to the same system decentralization. So even if the manufacturer’s quality investment is more efficient, outsourcing will increase the manufacturer’s quality as long as the supplier’s relative cost is low. In addition, outsourcing may reduce the rival’s quality investment if the supplier’s relative cost is low, as market competition increases the pressure on rival to invest.

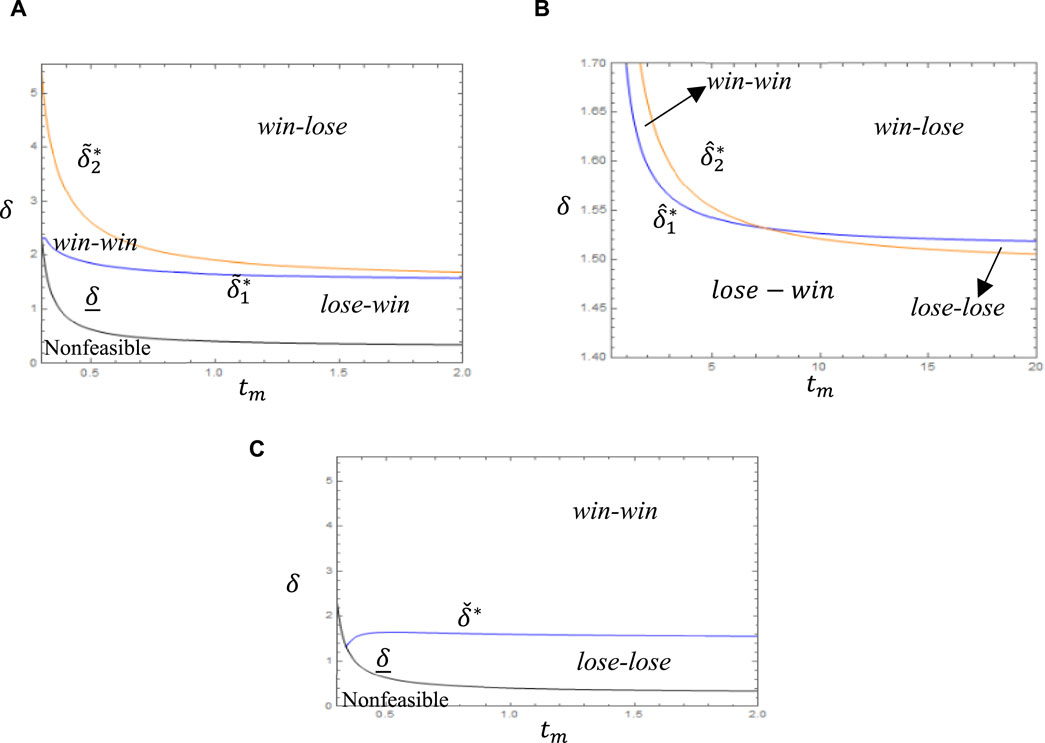

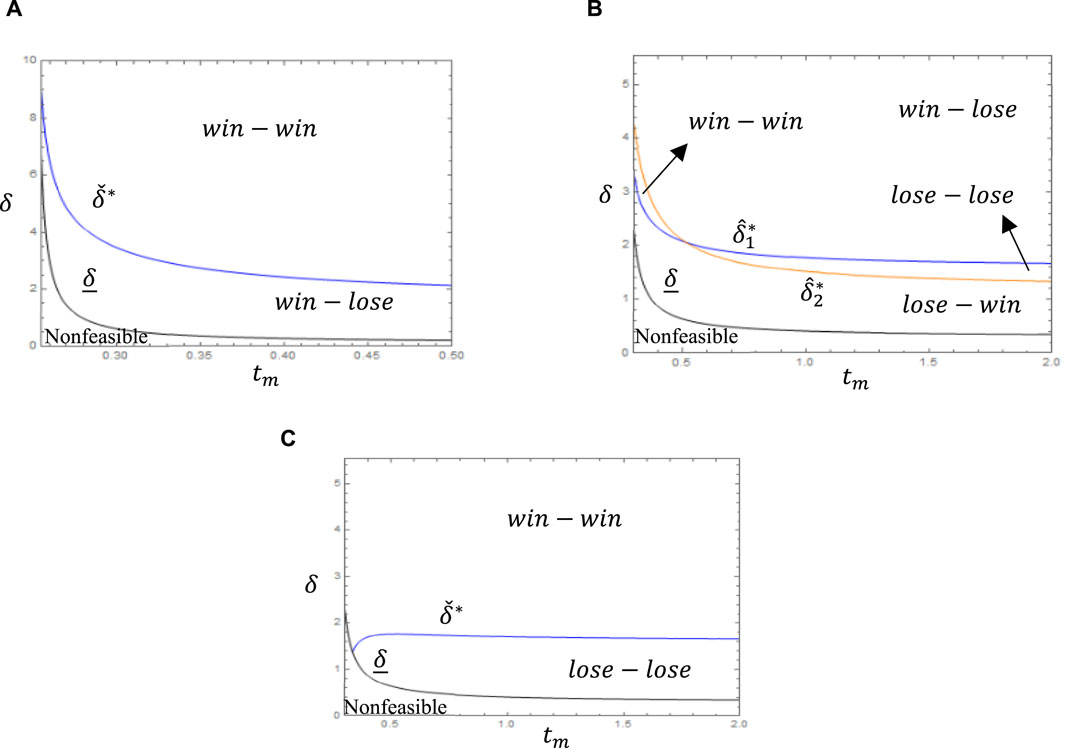

Next, We compare manufacturers’ profits provided that only one party changes its production strategy, showing as Theorem 2 and Figure 3.

Figure 3. Impact of outsourcing on manufacturer profit (

Theorem 2. A comparison of the profits for the four scenarios is as follows:

Case 1. There exist two thresholds

(i)

(ii)

Case 2. There exist two thresholds

(i)

(ii)

Case 3. There exist a threshold

Among them,

Theorem 2 shows that a necessary condition for a manufacturer to outsource is that the supplier has an absolute cost advantage. When

The results of Lemma 1 suggest that the supplier’s lower production cost and higher investment efficiency have a boosting effect on the outsourced manufacturer and a dampening effect on the self-produced manufacturer, so whether outsourcing can achieve a win-win situation for the duopoly manufacturers depends not only on relative production cost and investment efficiency, but is also closely related to the rival’s production strategy. Given that one manufacturer self-produces, outsourcing is win-win only if the supplier’s relative cost of production is moderate, regardless of investment efficiency. Given that one manufacturer outsources, outsourcing is win-win only if the manufacturer’s quality investment is efficient and the supplier’s relative cost of production is moderate (

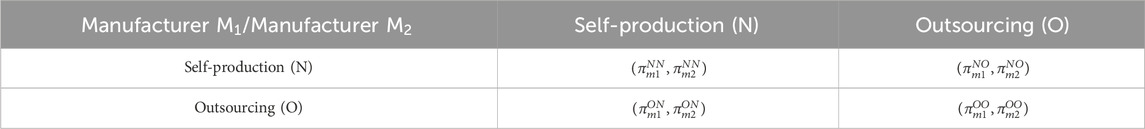

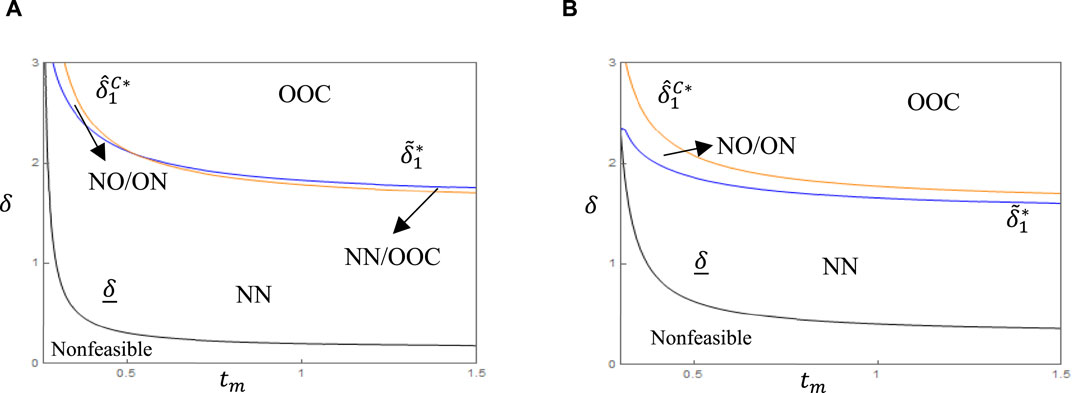

Finally, we analyze the optimal production strategy of the duopoly manufacturers and solve the equilibrium in the first stage of the game based on the payment matrix (see Table 3).

Due to the symmetry of the model, we can obtain the optimal production strategy of the duopoly manufacturers by comparing the positives and negatives of

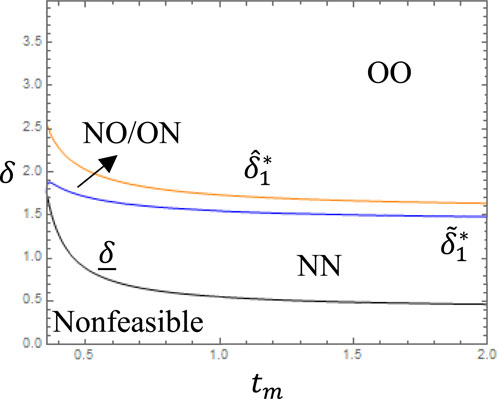

Theorem 3. The optimal production strategy of duopoly manufacturers with two independent suppliers is: (i) if

Theorem 3 shows that the relative production cost of manufacturers and suppliers dominate the equilibrium of production strategy. The lower cost advantage makes manufacturers prefer self-production, and as the cost advantage increases, the attractiveness of outsourcing to manufacturers increases and one of them will favor outsourcing. The reason is that, for manufacturers, if the supplier’s production cost is low, both manufactures can enjoy the benefits of investment cost transfer and production cost saving through outsourcing. However, if the supplier’s production cost is not low enough, both manufacturers outsource to make the product homogenization competition more intense, and the effect of outsourcing benefits are weakened, so the differentiated production strategy is more favorable to them.

Theorem 2 and Theorem 3 together show that outsourcing can be an equilibrium strategy for duopoly manufacturers under certain conditions. Outsourcing increases suppliers’ profits, which can either increase or decrease manufacturers’ profits. In short, only if outsourcing can increase the profits of the duopoly manufacturers at the same time, they will realize a win-win situation, otherwise outsourcing puts the duopoly manufacturers in a prisoner’s dilemma.

5 Analysis with a common supplier

In this section, we study production strategy in a “one-to-many” structure, where the duopoly manufacturers choose to self-produce or outsource to a common supplier. There are four sub-game scenarios based on the manufacturer’s choice: (Self-production, Self-production), (Self-production, Outsourcing), (Outsourcing, Self-production), and (Outsourcing, Outsourcing). Among them, the first three sub-game scenarios are the same as those in Section 4. To avoid confusion, we refer to (Self-production, Outsourcing) and (Outsourcing, Self-production) collectively as asymmetric outsourcing, outsourcing to two independent suppliers (OO scenario) as decentralized outsourcing, and outsourcing to a common supplier (OOC scenario) as centralized outsourcing.

5.1 Equilibrium solution

In this section, both manufacturers outsource to the same supplier. The supplier makes a one-time quality investment to provide equal quality to the duopoly manufacturers. Denoting this scenario by superscript OOC, the profit functions of the manufacturers and supplier are, respectively:

In the last stage of the game, the manufacturers decide their quantity decisions. According to the first-order conditional joint equations

Next, we bring Eq. 15 into Eq. 14, and obtain the first-order condition

For the quality investment decisions, Eqs 15, 16 are substituted back into Eq. 14. Then according to

Lemma 2. (i)

Lemma 2 compares the quality and profitability of two manufacturers when they both outsource to independent suppliers and common supplier. Obviously, regardless of the production cost and the efficiency of quality investments, a common supplier uses centralized outsourcing to avoid duplication of investment and competition for quality, to increase the product quality with consolidation advantages, and to achieve a higher profit. However, the manufacturers may be suffer from higher product quality. This is because if products are more substitutable and more competitive, the prices increase for high-quality products may result in lower demand and thus lower profits for the duopoly manufacturers.

5.2 Comparative analysis of equilibrium

Next we analyze the impact of centralized outsourcing on product quality and profit, and compare the choices of the duopoly manufacturers between self-production, decentralized outsourcing and centralized outsourcing.

To analyze the effect of centralized outsourcing on the quality investment, we keep one manufacturer’s production strategy unchanged and compare the quality investment under self-production and centralized outsourcing of another manufacturer, obtaining Theorem 4 and Figure 5.

Figure 5. Influence of centralized outsourcing on quality investment (

Theorem 4. A comparison of the quality investment for the four scenarios is as follows:

Case 1. There exist a threshold

(i)

(ii)

Case 2. There exist a threshold

Theorem 4 shows that if one manufacturer outsources, then another manufacturer’s choice of centralized outsourcing over self-production raises the competitor’s quality investment. This is because centralized outsourcing gives the supplier more investment capital and avoids investment competition, and the consolidation effect and scale advantage of quality investment promotes the outsourced product’s quality. Similarly, the quality of the self-produced manufacturer can only improve from outsourcing if the supplier’s relative production cost is below a certain threshold to compensate for the loss of investment due to double marginalization.

Next, We compare manufacturers’ profits provided that only one party changes its production strategy, showing as Theorem 5 and Figure 6.

Figure 6. Impact of outsourcing on manufacturer profit. (A) Profit comparison of OOC and NO (

Theorem 5. A comparison of the profits for the four scenarios is as follows:

Case 1. There exist two thresholds

(i)

(ii)

Case 2. There exist a threshold

Where,

Theorem 5 shows that the self-produced manufacturer chooses centralized outsourcing only if the

Finally, the optimal production strategy of the duopoly manufacturers is considered, and the equilibrium in the first stage of the game is solved based on the payment matrix (see Table 5), summarized in Theorem 6 and Figure 7.

Theorem 6. The optimal production strategy of duopoly manufacturers with a common supplier is: (i) if

Theorem 6 and Theorem 3 show that a mixed-strategy Nash equilibrium may occur for two manufacturers when

The above findings provide a new theoretical perspective on outsourcing strategies in the chip industry. As the mass production advantages of specialised chip foundries (e.g., TSMC) are exploited and advanced technological processes are improved, the tendency to outsource to the same foundries will gradually increase, and an oligopolistic competitive pattern will emerge in the foundry sector. With the aim of pursuing quality improvement, manufacturers’ outsourcing also takes into account factors such as suppressing market competition and exploiting the advantages of intensification.

6 Conclusion

Quality investments are increasingly important in outsourcing. We investigate whether duopoly manufacturers will outsource to a supplier that has the ability to invest on its own, and compare the differences in the manufacturers’ production strategies between two outsourcing structures: independent suppliers and common supplier.

The study has the following findings. First, two manufacturers choosing to outsource at the same time may be caught in a prisoner’s dilemma. A necessary condition for outsourcing to be beneficial to the manufacturers is the supplier’s strong production cost advantage, and even if the supplier’s investment in quality is more efficient, outsourcing may reduce the quality of the product due to the risk of systemic decentralization. Secondly, compared to outsourcing to independent suppliers, duopoly manufacturers outsourcing to a common supplier can take advantage of the centralizing effect of outsourcing to improve quality and, when competition in the market is low, to improve profits. In addition, when the competitor outsource, the manufacturer’s choice of a more productive independent supplier reduces the competitor’s quality and its choice of a common supplier increases the competitor’s quality. Finally, the equilibrium of production strategies of duopoly suppliers is closely related to the outsourcing structure, supplier production efficiency and investment efficiency. In the independent supplier structure, the supplier’s productivity dominates the market equilibrium. If the supplier’s productivity is low, then both manufacturer produce itself; if the supplier’s productivity is moderate, then one manufacturer produces itself and the other outsources; if the supplier’s productivity is high, then both manufacturers outsource. In a common supplier structure with moderate supplier production efficiency, lower market competition intensity and higher supplier quality investment efficiency may lead to a mixed strategy Nash equilibrium in which both manufacturers produce themselves or both outsource.

The findings of this research can provide some insights for foundry suppliers and manufacturing companies. When it comes to delivering high quality products to the market, the urgency for manufacturers to improve quality is at odds with their own inadequate level of quality improvement, and partnering with contract manufacturers who have the capacity to invest in quality is a viable solution to such problems. Therefore, how to fully exploit the capacity of suppliers to invest in the quality of their products to improve their competitive advantage is a key concern for manufacturing companies. Firstly, foundry suppliers can increase the attractiveness of production outsourcing to manufacturing companies by improving production efficiency and investment efficiency in two ways, such as improving production processes to reduce production costs or improving production technology to increase investment efficiency. Foundry suppliers should actively improve their own strength, strengthen the centralization effect of outsourcing, and enhance the core advantages of outsourcing. Second, manufacturing enterprises choose to outsource does not necessarily enhance the competitive advantage, both sides choose to outsource instead may be due to product homogenization to intensify market competition, and then fall into the prisoner’s dilemma. When competition in the market is weak, manufacturers should not rule out outsourcing to their competitors. In addition, they should also continue to improve their own capabilities to gain competitive advantage and, if necessary, reduce dependence on foundry suppliers. In conclusion, the choice of suppliers with independent investment capacity of outsourcing production can bring new opportunities to the product quality and profitability of manufacturing enterprises. Manufacturing enterprises should pay close attention to the foundry supplier production investment factors, but also to keep abreast of competitors’ production decisions, pay attention to market competition and outsourcing structure changes, according to the strategic objectives of the enterprise in the choice of production strategy to balance the product quality and profitability.

The research in this paper has some limitations. First, due to the complexity of the parameters and the limitations of the analyses, this paper only considers the game models of two manufacturers and two suppliers with a small sample size. The limited case studies may affect the generality of the conclusions. In the future, other methods of analysis, such as simulations, may be considered to increase the size of the sample and to test the robustness of the results. Second, the model only addresses the issue of selecting production methods for two symmetric manufacturers or suppliers with comparable productivity and investment power. Future considerations may include asymmetric cases with disparities in power to better reflect real-world scenarios. Finally, the research only considers fixed production costs and ignores investment spillover effects. Including these factors may enrich the results. Future research could expand the cost structure and consider additional production and investment influences in the game model.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YW: Writing–original draft. TD: Formal Analysis, Writing–review and editing. HC: Visualization, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research is supported by funding from the New Talent Research Initiation Project of Guangzhou Railway Polytechnic (GTXYR2310).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1https://www.chinairn.com/hyzx/20210112/115853502.shtml

References

1. Charles M, Ochieng SB. Strategic outsourcing and firm performance: a review of literature. Int J Soc Sci Humanities Res (Ijsshr) ISSN 2959-7056 (O) 2959-7048 (P) (2023) 1(1):20–9. doi:10.61108/ijsshr.v1i1.5

2. Mandal P, Jain T. Partial outsourcing from a rival: quality decision under product differentiation and information asymmetry. Eur J Oper Res (2021) 292(3):886–908. doi:10.1016/j.ejor.2020.11.018

3. Schaltegger S, Burritt R, Bai C, et al. Measuring and managing sustainability performance of supply chains. Supply Chain Manag Int J (2014) 19(3):275–91. doi:10.1108/scm-02-2014-0083

4. Schoenherr T. Outsourcing decisions in global supply chains: an exploratory multi-country survey. Int J Prod Res (2010) 48(2):343–78. doi:10.1080/00207540903174908

5. Dekkers R. Impact of strategic decision making for outsourcing on managing manufacturing. Int J Operations Prod Manage (2011) 31(9):935–65. doi:10.1108/01443571111165839

6. Gunasekaran A, Irani Z, Choy KL, Filippi L, Papadopoulos T. Performance measures and metrics in outsourcing decisions: a review for research and applications. Int J Prod Econ (2015) 161:153–66. doi:10.1016/j.ijpe.2014.12.021

7. Gilbert SM, Xia Y, Yu G. Strategic outsourcing for competing OEMs that face cost reduction opportunities. IIE Trans (2006) 38(11):903–15. doi:10.1080/07408170600854644

8. Kenyon GN, Meixell MJ, Westfall PH. Production outsourcing and operational performance: an empirical study using secondary data. Int J Prod Econ (2016) 171:336–49. doi:10.1016/j.ijpe.2015.09.017

9. Heydari J, Govindan K, Nasab HRE, Taleizadeh AA. Coordination by quantity flexibility contract in a two-echelon supply chain system: effect of outsourcing decisions. Int J Prod Econ (2020) 225:107586. doi:10.1016/j.ijpe.2019.107586

10. Lee G, Shin G, Hwang DW, Kuper P, Kang M. How manufacturers' long-term orientation toward suppliers influences outsourcing performance. Ind Marketing Manage (2018) 74:288–97. doi:10.1016/j.indmarman.2018.07.003

11. Chen X, Wang X, Xia Y. Production coopetition strategies for competing manufacturers that produce partially substitutable products. Prod Operations Manage (2019) 28(6):1446–64. doi:10.1111/poms.12998

12. Xiao T, Qi X. Product line design and outsourcing strategies in dyadic supply chains. IEEE Trans Eng Manage (2017) 64(3):316–26. doi:10.1109/tem.2017.2665702

13. Chen KS, Chung L, Chang TC. Developing a quality-based supplier selection model from the buying company perspective. Qual Tech Quantitative Manage (2021) 18(3):267–84. doi:10.1080/16843703.2020.1787307

14. Niu B, Zeng F, Chen L. “Production + procurement” outsourcing with competitive contract manufacturer's partial learning and supplier's price discrimination. Int Trans Oper Res (2021) 28(4):1917–51. doi:10.1111/itor.12904

15. Hsieh CC, Liu YT. Quality investment and inspection policy in a supplier–manufacturer supply chain. Eur J Oper Res (2010) 202(3):717–29. doi:10.1016/j.ejor.2009.06.013

16. Guan X, Liu B, Chen Y, Wang H. Inducing supply chain transparency through supplier encroachment. Prod Operations Manage (2020) 29(3):725–49. doi:10.1111/poms.13133

17. Chen Y, Karamemis G, Zhang J. A win–win strategy analysis for an original equipment manufacturer and a contract manufacturer in a competitive market. Eur J Oper Res (2021) 293(1):177–89. doi:10.1016/j.ejor.2020.12.016

18. Karaer Ö, Erhun F. Quality and entry deterrence. Eur J Oper Res (2015) 240(1):292–303. doi:10.1016/j.ejor.2014.07.016

19. Xie G, Wang S, Lai KK. Quality improvement in competing supply chains. Int J Prod Econ (2011) 134(1):262–70. doi:10.1016/j.ijpe.2011.07.007

20. Bing X, Jue G, Richard YK. Quality Investment Strategies of start-ups under capital constraints. Syst Eng Theor Pract (2019) 39(06):1373–84. doi:10.12011/1000-6788-2018-1303-12

21. Chen J, Liang L, Yang F. Cooperative quality investment in outsourcing. Int J Prod Econ (2015) 162:174–91. doi:10.1016/j.ijpe.2015.01.019

22. Nagurney A, Li D. A supply chain network game theory model with product differentiation, outsourcing of production and distribution, and quality and price competition. Ann Operations Res (2015) 226(1):479–503. doi:10.1007/s10479-014-1692-5

23. Yang FX, Zhang RQ, Zhu K. Should purchasing activities be outsourced along with production? Eur J Oper Res (2017) 257(2):468–82. doi:10.1016/j.ejor.2016.07.029

24. Xiao T, Xia Y, Zhang GP. Strategic outsourcing decisions for manufacturers competing on product quality. IIE Trans (2014) 46(4):313–29. doi:10.1080/0740817x.2012.761368

25. Karaer Ö, Kraft T, Yalçın P. Supplier development in a multi-tier supply chain. IISE Trans (2020) 52(4):464–77. doi:10.1080/24725854.2019.1659523

26. Heese HS, Kemahlıoğlu-Ziya E, Perdikaki O. Outsourcing under competition and scale economies: when to choose a competitor as a supplier. Decis Sci (2021) 52(5):1209–41. doi:10.1111/deci.12449

27. Pun H. The more the better? Optimal degree of supply-chain cooperation between competitors. J Oper Res Soc (2015) 66(12):2092–101. doi:10.1057/jors.2015.40

28. Li C. Supplier competition and cost reduction with endogenous information asymmetry. Manufacturing Serv Operations Manage (2020) 22(5):996–1010. doi:10.1287/msom.2019.0784

29. Feng Q, Lu LX. The strategic perils of low cost outsourcing. Manage Sci (2012) 58(6):1196–210. doi:10.1287/mnsc.1110.1481

30. Banker RD, Khosla I, Sinha KK. Quality and competition. Manage Sci (1998) 44(9):1179–92. doi:10.1287/mnsc.44.9.1179

Keywords: self-production strategy, outsourcing strategy, duopoly manufacturers, quality investment, outsourcing structure

Citation: Wang Y, Deng T and Cheng H (2024) A study of production outsourcing strategies of dual oligopoly manufacturers based on quality investments. Front. Phys. 12:1334698. doi: 10.3389/fphy.2024.1334698

Received: 07 November 2023; Accepted: 19 March 2024;

Published: 05 April 2024.

Edited by:

Jianbo Wang, Southwest Petroleum University, ChinaReviewed by:

Günther Schuh, RWTH Aachen University, GermanyKa Leung Lok, University of South Wales, United Kingdom

Dun Han, Jiangsu University, China

Copyright © 2024 Wang, Deng and Cheng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yang Wang, wangyang@gtxy.edu.cn

Yang Wang

Yang Wang Tongbo Deng

Tongbo Deng