Risky mindset: prior exposure to risk increases utilitarian choices in sacrificial moral scenarios

- 1Department of Psychological Sciences, FLAME University, Pune, India

- 2Centre for Cognitive and Brain Sciences, Indian Institute of Technology Gandhinagar, Gandhinagar, India

Evidence of cross-domain spillover into the moral domain has been limited to altruistic and consumption behaviors. Building on the literature on spillover effects and domain-general decision processes, we predicted that choice behavior in the economic domain would affect subsequent choices in sacrificial moral dilemmas. We tested this prediction using hypothetical risky gambles and vignettes for moral dilemmas. We found that prior exposure to risky gambles increased utilitarian responses toward sacrificial moral dilemmas. Mediation analysis suggests that this is due to the spillover of a cost–benefit mindset. This mindset increases the probability of making utilitarian-type choices when faced with moral dilemmas but does not affect moral judgment. These results suggest that moral decisions are susceptible to cross-domain spillover effects. Moral values might get easily traded off in transactional scenarios in which cost–benefit analysis is a dominant decision strategy.

Introduction

We make many decisions every day. These can come under various domains like economic, social, and moral. Making consequential decisions in different domains can lead to spillover effects (Dolan and Galizzi, 2015) across decision problems. Spillover occurs when different situation-specific actions (choosing between gambles and choosing between moral actions) arise from the same underlying general process (e.g., assessing action and outcome values). Thus, applying a situation-specific procedure in a prior task increases the accessibility of the general process. This, in turn, increases the probability of the first procedure being preferentially recruited in the subsequent task (Xu and Schwarz, 2018). Consider a situation in which a manager has to decide to fund a project based on various costs involved and the potential benefits. At another moment, he might have to decide to fire a subordinate.

Furthermore, he could be faced with the moral decision to lie about his boss misappropriating project funds to buy personal items. Will the decision process used by the manager in the prior economic scenario (the allocation of funds to projects) result in a mindset that increases the accessibility of cost–benefit procedures in the subsequent scenario (when firing a subordinate or reporting misappropriation by the boss)? If so, this would increase utilitarian-type choices in the moral scenario. Similarly, consider a larger market scenario in which traders are making transactions based on costs and benefits. Will this increase their likelihood of using cost–benefit analysis toward moral situations, such as organ donation, carbon emissions, or the depletion of resources inside and outside of the market? The present study aims to test the hypothesis that prior choices in economic scenarios will affect choices made in moral scenarios.

Decisions in moral scenarios are not immune to spillovers. Broeders et al. (2011) showed that a utilitarian choice vs. a deontological choice is based on which moral rule is most readily accessible at the time of the decision-making process. Indulging in ostensibly benign and unrelated behaviors can have a profound influence on subsequent decisions and actions in moral scenarios. Mere exposure to green products increases charitable behavior, but the purchase of green products has the opposite effect of decreasing charitable behavior (Mazar and Zhong, 2010). Endorsing a liberal political candidate can lead to race-based charitable donations (Effron et al., 2009). Even imagining teaching homeless children can reduce charitable donations and increase frivolous purchases (Strahilevitz and Myers, 1998; Khan and Dhar, 2006). Knowledge of kinship influences moral judgment (Uhlmann et al., 2012). Spillovers might also occur over long periods during which values change due to exposure to other societies in marketplaces through trade. In a purely Rawlsian society, individuals trading with purely egalitarian society individuals might have to come to a middle ground. The rules of this middle ground (often marketplaces where trade takes place) ultimately spill over and change the morality of both societies (Enke, 2023). One mechanism through which this might occur is by engaging in proportional (portion of people saved vs. lost) thinking activated by markets that call for trading in terms of costs and benefits (Zaleskiewicz et al., 2020). Such spillovers happen when a prior behavior activates underlying traits, factors, and motives shared with other (subsequent) behaviors (Dolan and Galizzi, 2015). Thus, it is expected that moral dilemmas will be susceptible to similar spillover effects.

Moral psychology literature suggests that people are sensitive to how harm arises when faced with sacrificial moral dilemmas. Sacrificial moral dilemmas involve sacrificing something or someone (kill or harm one person) to gain a more significant overall benefit (saving many people or items). The classic trolley problem and its “push” and “switch” variants illustrate this distinction well. A runaway trolley is hurtling down the tracks and will kill several people if not stopped. This can be resolved by either pushing one person to death in front of the trolley (push variant) or switching the trolley track (switch variant) to a different one where one person will die. Here, utilitarianism proposes that the morally correct action is to sacrifice one person since it maximizes the overall benefit with minimum harm.

By comparison, deontology proposes that killing is wrong irrespective of the outcome. When faced with the “push” variant, most people refrain from the act of pushing a person. However, most people are willing to “switch” the trolley's track in the “switch” variant.

Thus, push-type scenarios are called “personal” because of the physical contact and the means to ending the nature of the harm, while switch-type scenarios are called “impersonal” due to the side-effect nature of the harm (Greene, 2009; Cushman et al., 2012). Traditionally, decisions toward personal and impersonal moral dilemmas have been explained by the dual-process theory (Greene et al., 2001). Personal dilemmas produce a significant conflict between automatic and deliberate processes. A utilitarian choice in a personal dilemma takes more time (slow) because it is effortful and more complex to override the default automatic aversive response (Paxton et al., 2013) to engage the deliberate cost–benefit process.

In contrast, utilitarian choice toward an impersonal dilemma takes less time because it produces a weak default aversive response. In this case, the automatic process can be easily overridden by the intervening deliberate process. This leads to quick engagement of the cost–benefit assessment process and, subsequently, a quick utilitarian choice.

However, recent evidence (Baron and Gürçay, 2017; Białek and De Neys, 2017) challenges the default interventionist account and the automatic/deliberate distinction between processes. It has been suggested that more domain-general (Shenhav and Greene, 2010) processes involved in the risky economic domain are employed in social and moral domains. Even the observed response time differences are not due to the amount of effort but due to the consideration of several things like interests, rules, outcomes, and so on (Kahane, 2012). Domain-general processes help people compute an “expected moral value” of action in a moral scenario similar to an “expected value” of action in an economic scenario. This computation of action value need not be a sophisticated process and can constitute a simple comparison of potential actions or outcomes (Baron and Gürçay, 2017). Even the dual-process theory has now changed to a tri-process theory whereby moral decisions are produced by a final process in which information from the emotional/intuitive system and deliberate system are integrated and, with all things considered, a decision is made (Cohen and Ahn, 2016). Risky decisions and utilitarian decisions also share underlying mechanisms, factors, and motives. Both involve assessing costs and benefits to maximize benefits (Fiske and Rai, 2014). Both are enhanced and attenuated by the same underlying processes and contextual factors (Lucas and Galinsky, 2015). This literature leads to the first hypothesis, where it is expected that spillover from prior risky decision tasks will lead to the activation of the domain-general process that will be easily accessible in the subsequent moral dilemma task. This will result in an increase in the likelihood of making utilitarian choices.

H1: Prior exposure to risky gambles will increase utilitarian choices in sacrificial moral dilemmas.

People often make choices or take actions that are in contrast with their judgments of right/wrong. Consider the earlier example of the manager who uncovers that their boss is misappropriating funds. It is not necessary that the manager blow the whistle even if they believe the boss's action to be immoral. Prior risky gambling tasks might influence moral choices, but they might not influence moral judgment. While risky and utilitarian choices involve the same mechanism for value construction, studies show that judgments rely on a different mechanism of object evaluation (Tassy et al., 2011). Additionally, choices are made by taking a first-person view (Monin et al., 2007), while judgments require an allocentric view (Frith and De Vignemont, 2005). Choices and judgments in moral scenarios can differ, with choices being more utilitarian compared to judgments (Kurzban et al., 2012; Tassy et al., 2013). Even psychopathy affects moral choice and judgment differently, whereby it increases utilitarian choices to moral dilemmas but not the judgments (Tassy et al., 2013). Thus, people tend to make choices that contradict their judgments of right and wrong, but importantly, the moral choices tend to be more utilitarian as compared to the judgments. Given that moral judgments will not be affected by the risky gambling task and be less utilitarian, it is likely that moral judgments will be different under risk and control conditions.

H2: Participants in the risky gambling condition will judge their choices to be more immoral compared to the controls.

Organizational and market decisions involve using cost–benefit analysis to reach optimal outcomes (Wang et al., 2014). Cost–benefit analysis involves assessing the costs (negative outcomes) and benefits (positive outcomes) weighted by the probabilities associated with the outcomes (Fleischhut et al., 2017). The probability may be known under risk or subjectively estimated under uncertainty. When faced with hypothetical gambling scenarios, people use cost–benefit analysis, but the exact strategy to assess the costs and benefits may vary (Wood et al., 2005; Cabeza et al., 2020). People use different decision strategies when faced with moral decisions (Hirschberger et al., 2015). Assessing the positive and negative outcomes (costs and benefits) weighted by the probability of the outcome is a utilitarian decision strategy. Applying rules to determine the choice is a deontological strategy (Fleischhut et al., 2017). Behavioral mindset refers to a cognitive or motor procedure that gets activated while performing one task and spills over into a different task. A behavioral mindset should activate and increase the accessibility and likelihood of a general procedure (Xu and Schwarz, 2018). First, assessing costs and benefits under organizational, market, hypothetical risky gambles, and moral scenarios are instances of the same general procedure of assessment of action and outcome values. Second, cost–benefit analysis in a hypothetical risky gambling task will increase the accessibility of the general procedure. Finally, this will result in the likelihood of the use of cost–benefit analysis in the subsequent moral scenarios. Given this susceptibility to spillover and domain-general decision processes in the literature, we predict that prior exposure to risky gambles in the economic domain that involve cost–benefit analysis will preferentially cue cost–benefit information in moral scenarios, making it more likely to be used as decision strategy.

H3a: The probability of using cost–benefit analysis as a decision strategy will be higher in the risk group compared to the control group.

H3b: The cost–benefit analysis mindset will mediate the relationship between risky gambling and moral choice.

Experiment 1

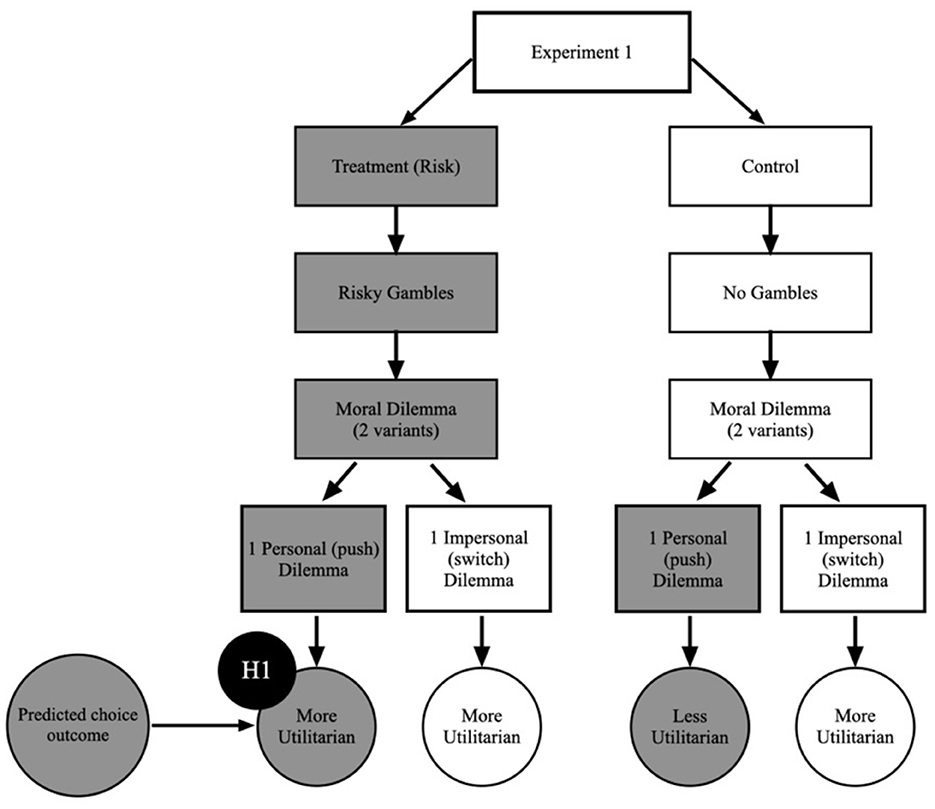

Research on sacrificial moral dilemmas has been mainly focused on Western and some Asian populations (Ahlenius and Tännsjö, 2012; Cao et al., 2017). To understand wider and more diverse samples' perspectives toward moral scenarios, new research (Bago et al., 2022) suggests that moral choices in South Asian samples differ from Western samples. Our goal here was to study a baseline choice pattern of our sample when faced with sacrificial moral dilemmas and test H1 (Figure 1).

Figure 1. Showing a flowchart for the treatment arms. Dark gray portions are the important treatments and comparisons. H1: Prior exposure to risky gambles will increase utilitarian choices in sacrificial moral (personal) dilemma as compared to control (personal moral dilemma) condition.

Participants were randomly assigned to risk (personal), risk (impersonal), control (personal), and control (impersonal) groups. Personal dilemmas are push-type variants of the trolley dilemma in which harm occurs through personal contact between the agent and the victim. However, impersonal dilemmas are switch-type variants of the trolley dilemma in which harm occurs through side effects (collateral damage without personal contact). Participants in the risk group completed a hypothetical risky gambling task followed by a moral dilemma vignette.

Methods

Participants

In total, 160 university students participated and were assigned randomly to 1 of 4 groups with 40 participants in each group: (1) risk (impersonal): 36 men and four women, mean age = 20.38, SD = 1.975; (2) risk (personal): 36 men and four women, mean age = 20.63, SD = 1.749; (3) control (impersonal): 32 men and eight women, mean age = 20.55, SD = 1.907; and (4) control (personal): 32 men and eight women, mean age = 20.75, SD = 2.216. Participants were recruited in 2017–2018 through an email sent to all students informing them about the study and asking them to register for participation if interested. All participants gave written informed consent and were provided economic compensation of INR50 for their participation.

Material

In the hypothetical risky gambling task, 40 gambles were constructed with 20 high-risk (expected value = 50, mean SD = 214.44) and 20 low-risk (expected value = 2.5, mean SD = 62.10) gambles. A high-risk gamble constituted a large win amount as well as a large loss amount. A low-risk gamble constituted a small win amount as well as a small loss amount. The win/loss probability of all gambles was 50/50. The risky gambles in this study constituted mixed gambles in both the gain and loss domains. Mixed gambles cover choices under uncertainty accounting for both risk aversion (tendency to avoid risk) in the gain domain with an S-shaped value function and loss aversion (losses loom larger than gains) in the loss domain with an inverse S-shaped probability weighting function (Wu and Markle, 2008). Mixed gambles also simulate real-life choices better as compared to single-domain gambles and have been found to elicit more risk-neutral behavior (Ert and Erev, 2013).

Moral dilemma (vignette):

Personal (push type)

A runaway trolley is speeding down the tracks toward 10 workmen who will be killed if the trolley continues on its present course. You are standing next to the tracks, but you are too far away to warn them. Next to you there is a very large stranger. If you push the large stranger onto the tracks, the trolley will slide off the tracks and won't continue its course toward the workmen. This will kill the stranger, but you will save the 10 workmen.

Impersonal (switch type)

A runaway trolley is speeding……………… Next to you there is a lever. If you pull the lever the trolley will be diverted onto a different track where 1 person is working. This will kill the stranger, but you will save the ten workmen.

Two sacrificial moral dilemmas were presented for the four group conditions: (1) risk (personal), (2) risk (impersonal), (3) control (personal), and (4) control (impersonal).

Procedure

Participants in the risk group were first presented with a hypothetical risky gambling task for 20 trials. Participants chose between two gambles in each trial, one high-risk gamble and one low-risk gamble. Each gamble consisted of a winning and a loss amount. The winning amount was presented with a positive (+) sign and the losing amount with a negative (–) sign. Participants were informed that the win/loss probability would always be 50% for each gamble. These two gambles appeared on the left and right side of a computer screen. To choose the gamble on the left side of the screen, participants had to press “Z” on the keyboard. To choose the gamble on the right side of the screen, participants had to press “M” on the keyboard. Each choice was followed by feedback informing the participants whether they won or lost in that particular trial. After completing the gambling task, participants faced a sacrificial moral dilemma in the form of a vignette presented on the screen. The moral vignette was followed by a question: Do you take the suggested action or not? to which participants had to respond yes or no by pressing key “1” for yes and “2” for no.

Participants in the control group were presented with a moral dilemma in the form of a vignette on a computer screen. The vignette was followed by a question: Do you take the suggested action or not? to which they had to respond yes or no by pressing key “1” for Yes and “2” for No.

Results

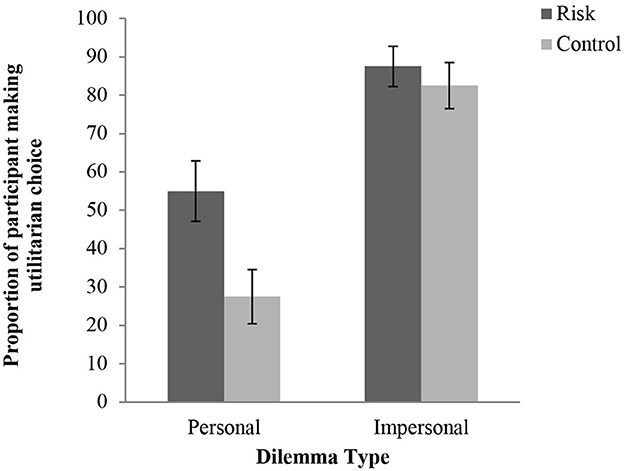

A utilitarian choice means that participants chose to sacrifice one person in order to save many and was coded with a “1.” A deontological choice means that participants chose not to sacrifice one person even if it was to save many and was coded with a “0.” A chi-square analysis was done to compare the difference in the proportion of participants making a utilitarian choice. This comparison was between the risk and control groups for personal and impersonal dilemmas. A significant difference between risk and control groups was found for the personal dilemma. Of participants in the risk group, 55% made a utilitarian choice compared to 27.5% of participants in the control group, X2(1, 80) = 6.241, p = 0.012; w = 0.3 (medium effect).

For the impersonal dilemma, a non-significant difference between the risk and control group was found; X2(1, 80) = 0.392, p = 0.531. Here, 87.5% of the participants in the risk group made a utilitarian choice compared to 82.5% of participants in the control group (Figure 2).

Figure 2. Percentage of participants who chose to sacrifice one person to save more people (utilitarian choice) in two types of a moral dilemma: (1) impersonal and (2) personal. Error bars indicate standard errors of the proportions.

Discussion

The control group data suggest that for sacrificial moral scenarios, the choices of the Indian population are in line with the findings in the literature. When faced with a personal dilemma, most control participants made a deontological choice, and when faced with an impersonal dilemma, most made a utilitarian choice. In line with our hypothesis, participants in the risk group were more inclined to make a utilitarian choice than controls for a personal moral dilemma. This suggests that prior decisions in risky economic tasks lead to an increase in utilitarian-type choices in a subsequent moral dilemma.1

Experiment 2

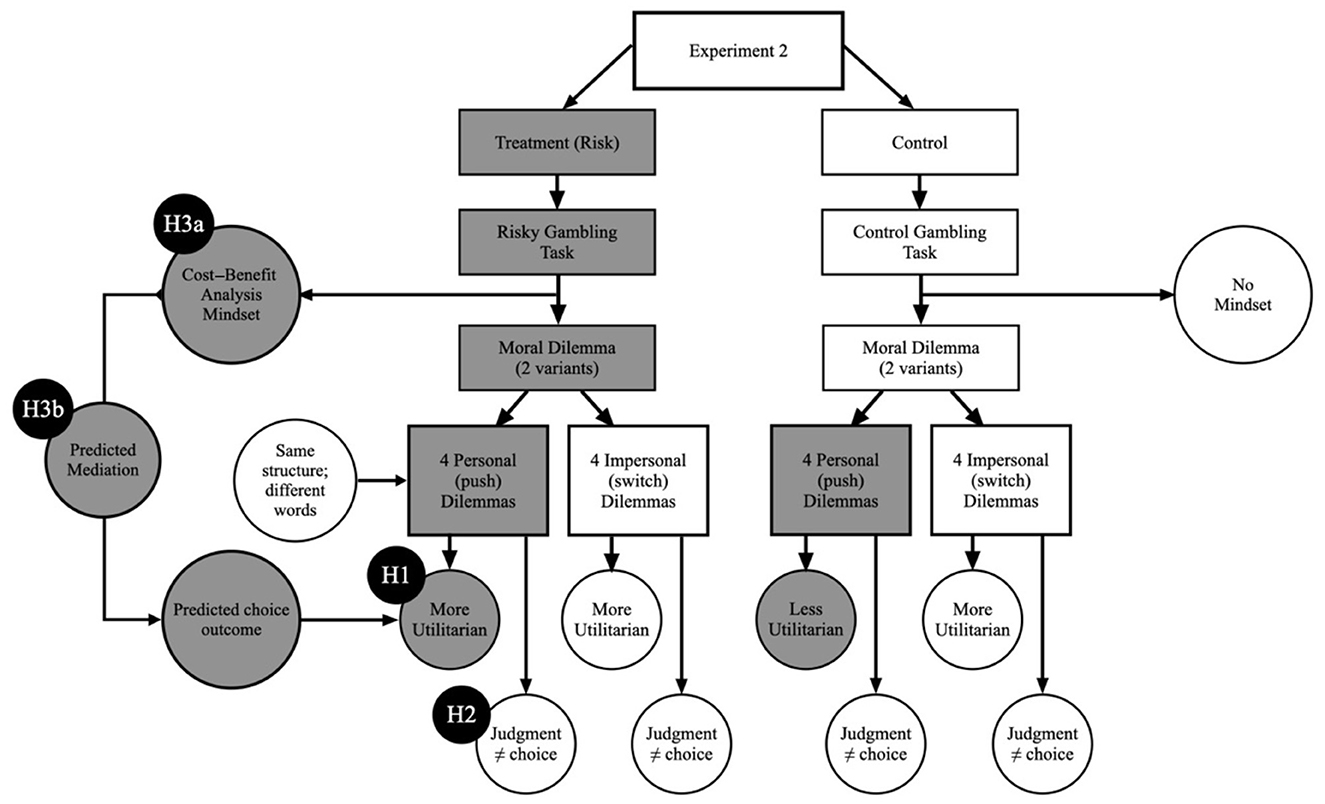

In Experiment 1, we showed that decisions in risky economic gambles increase the probability of making a utilitarian choice in moral scenarios. The aim here was to replicate the H1 findings and test H2, H3a, and H3b (Figure 3).

Figure 3. A flow chart for the treatment arms [rectangles represent the independent variable (IV); circles represent dependent variable (DV)]. Dark gray portions are the important treatments and comparisons for H1, H2, H3a, and H3b. Risky gambling task should lead to cost–benefit analysis mindset which acts as a mediator increasing the likelihood of utilitarian choices in the personal moral dilemma as compared to control condition (personal dilemma).

Each participant's general risk attitude and perceived locus of control were also measured. This was done to explore whether participants' locus of control and risk attitude influenced their choices when faced with moral dilemmas. People differ in the perceived locus of control over the actions and resultant outcomes. People with internal locus control perceive more control over circumstances (Rothbaum et al., 1982), are more independent in their decisions (Neaves, 1989), believe their actions are causally related to the outcomes or rewards (Rotter, 1966), are more extreme in their moral attitudes (Arhiri and Holman, 2011), and take more risk in their decisions as compared to those with an external locus of control (Higbee, 1972; Horswill and McKenna, 1999). Thus, we measured each participant's locus of control by asking them to fill out a Rotter's Locus of Control Scale. Additionally, people generally differ in their risk preferences (high-risk taker, neutral, or low-risk taker). Thus, participants' risk preference might also affect their decisions in moral scenarios. Risk group and control group participants were given risky gambling tasks to measure risk preference using a repeated-choice measure (Jessup et al., 2008; Lejarraga and Gonzalez, 2011).

Methods

Participants

In total, 160 university students participated in this experiment. Participants were randomly assigned to one of four groups, with 40 participants in each group: risk (personal) group (33 men and seven women, mean age = 20.90, SD = 2.78), control (personal) group (30 men and 10 women, mean age = 21.05, SD = 3.11), risk (impersonal) group (33 men and seven women, mean age = 21.88, SD = 2.87), and control (impersonal) group (28 men and 12 women, mean age = 21.43, SD = 2.43). Participants were recruited in 2017–2018 through an email sent to all students informing them about the study and asking them to register for participation if interested. All participants provided written informed consent and were given economic compensation of INR50 for participation.

Materials

In all, 80 gambles were constructed, with 40 high-risk (expected value = 3, SD = 262.09) and 40 low-risk (expected value = 3 and mean variance = 114.73) gambles. The gain/loss probability of the gambles was 50/50. This new set of gambles was constructed with equal expected values, and the number of gambles was increased to compensate for the time reduction caused by the removal of feedback (whether they won or lost in each trial). Four personal (the same in structure and different in words) dilemmas and four impersonal (switch-type versions of personal dilemmas) were adapted from Gold et al. (2013).

Procedure

The procedure was the same as the previous experiment except that feedback (win/loss) was not provided; the hypothetical risky gambling task (without incentive) was followed by a moral dilemma task presented through a vignette on a computer. This procedure was repeated for all four moral dilemmas. Each vignette was followed by four questions:

Moral dilemma (vignette):

Personal (Push type)

Ten Indians are having a nude sauna in a spa in Finland……………..nude saunas are the norm in Finland. Unknown to them the spa keeps hidden surveillance cameras in the sauna…………………………Pushing the man in front of the camera will save the ten men, but will result in extreme emotional distress for the other man (see the Supplementary material for the complete description and the full list of all dilemmas).

1. Do you push the man so that the live feed to the internet is not of the other 10 people? (Yes/No). Participants had to respond by pressing key “1” for Yes and “2” for No.

2. Is it morally acceptable for you to take this decision? (Yes/No). Participants had to respond by pressing key “1” for Yes and “2” for No.

3. How morally acceptable is it for you to take this decision? 7-point rating scale (1 = completely unacceptable – 7 = completely acceptable).

4. Please indicate why you decided to take this action. Five options were provided, and participants had to select one. These options were adapted from Fleischhut et al. (2017).

1. The benefits outweigh the negative consequences of the action (Benefit reason).

2. The action is morally wrong but should be permissible in this case since it leads to a more significant benefit or prevents large harm (Trade-off reason).

3. The negative consequences of the action outweigh the benefits of the action (Cost reason).

4. The action is morally wrong and should not be permissible even if it leads to a large benefit or prevents large harm in this case (Deontic reason).

5. Other reasons.

The control task was the same as the experimental task except that the participants did not use cost–benefit analysis since they followed a rule for choosing gambles. In every trial, participants were presented with two gambles. Each gamble consisted of a winning and a losing amount. The winning amount was presented with a plus (+) sign and the losing amount with a minus (–) sign. Of four amounts, any amount could be presented with a sign that was green in color. The control group was asked to select the gamble that had a green (±) sign next to it. If the green sign appeared in the gamble on the left side of the screen, they had to select the left gamble by pressing “Z.” If the green sign appeared in the gamble on the right side of the screen, participants had to select the right gamble by pressing “M.” After completion of the control task, a moral dilemma was presented on the screen. This procedure was repeated for all four moral dilemmas, and the same questions posed to the risk group were presented.

After completion of the experiment, all participants filled out a Rotter's Locus of Control Scale and completed a repeated-choice task (Ert and Yechiam, 2010; Yechiam and Ert, 2011). This was done to see whether there were differences in risk attitude and locus of control between risk and control groups.

A randomly selected subset (40 participants) of the total participants (160 participants) was given a funnel debrief questionnaire that tested (1) awareness of the purpose of the priming procedure and (2) whether this awareness influenced their choices in moral dilemmas.

Results

Out of the 40 participants, the majority were not aware of the priming procedure and its purpose. On the funnel debrief questionnaire, five of the 40 participants showed a general suspicion of the procedure, and three participants stated that since we were testing the gambling and moral scenarios together, they must be somehow related. Only two participants provided a correct guess of how they were related.

Choice

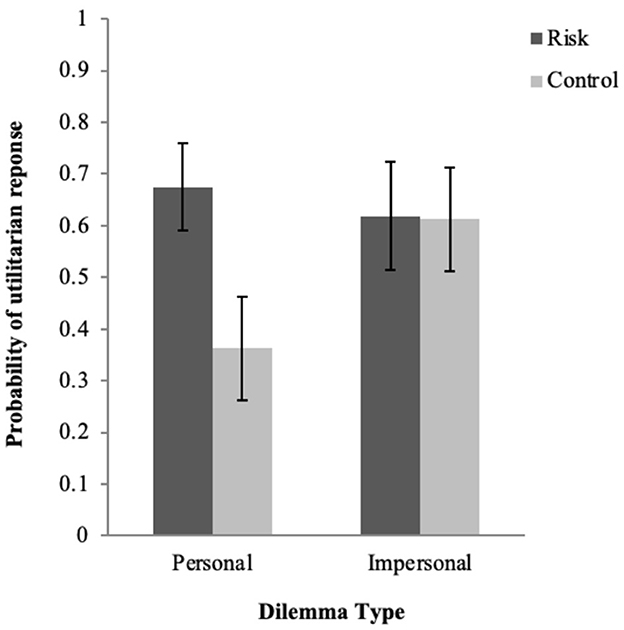

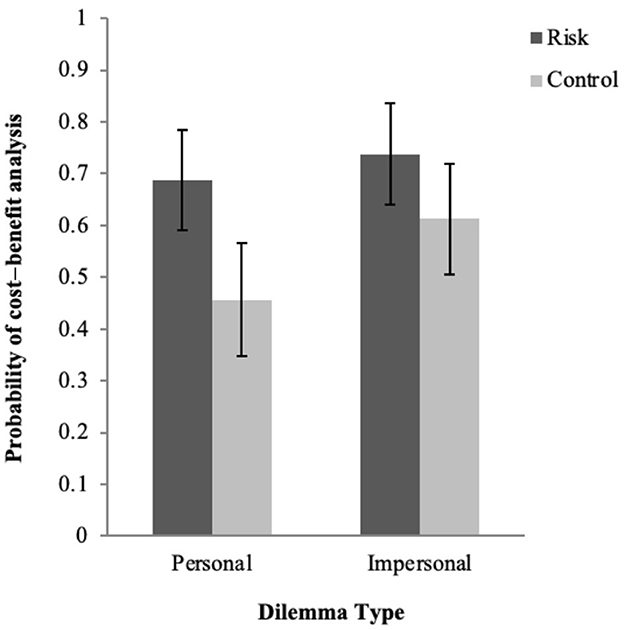

Data coding was the same as in Experiment 1. A 2 (Groups: Risk and Control) × 2 (Dilemma Type: Personal and Impersonal) between-subjects design analysis of variance (ANOVA) was conducted. The main effect of the group on the probability of making a utilitarian choice in the moral dilemma was significant, F(1,156) = 10.14, p = 0.002, = 0.06. The main effect of the dilemma type (personal/impersonal) was also significant, F(1,156) = 3.75, p = 0.005, = 0.02. However, the interaction between group and dilemma type was also significant, F(1,156) = 9.38, p = 0.003, = 0.06 (Figure 4). This suggests that the difference in the probability of making a utilitarian choice between risk and control groups changed as a function of the dilemma type.

Figure 4. Probability of making a utilitarian choice toward personal and impersonal moral scenarios by risk and control groups. Error bars indicate 95% confidence intervals of the means.

Post-hoc analysis was done to further understand the interaction effects. An independent samples t-test was conducted to test the difference between all four groups: (1) risk (personal), (2) risk (impersonal), (3) control (personal), and (4) control (impersonal).

Participants in the risk (personal) group were more likely to make a utilitarian choice (mean = 0.68, SD = 0.27) as compared to the control (personal) group (mean = 0.36, SD = 0.33), t(78) = 4.66, p < 0.0001, 95% CI [0.18, 0.45]. Participants in the risk (personal) group were as likely to make a utilitarian choice (mean = 0.68, SD = 0.27) as those of the risk (impersonal) group (mean = 0.62, SD = 0.34), t(78) = 0.82, p = 0.42, 95% CI [−0.08, 0.19]. Participants in the risk (personal) group were as likely to make a utilitarian choice (mean = 0.68, SD = 0.27) as those of the control (impersonal) group (mean = 0.61, SD = 0.33), t(78) = 0.93, p = 0.35, 95% CI [−0.07, 0.20]. Participants in the risk (impersonal) group were as likely to make a utilitarian choice (Mean = 0.62, SD = 0.34) as those in the control (impersonal) group (mean = 0.61, SD = 0.33), t(78) = 0.08, p = 0.93, 95% CI [−0.14, 0.15]. Participants in the control (personal) group were less likely to make a utilitarian choice (mean = 0.36, SD = 0.33) as compared to the control (impersonal) group (mean = 0.61, SD = 0.33), t(78) = 3.44, p = 0.001, 95% CI [−0.39, −0.11]. Participants in the control (personal) group were less likely to make a utilitarian choice (mean = 0.36, SD = 0.33) compared to the risk (impersonal) group (mean = 0.62, SD = 0.34), t(78) = 3.45, p = 0.001, 95% CI [−0.40, −0.11] (Figure 4).

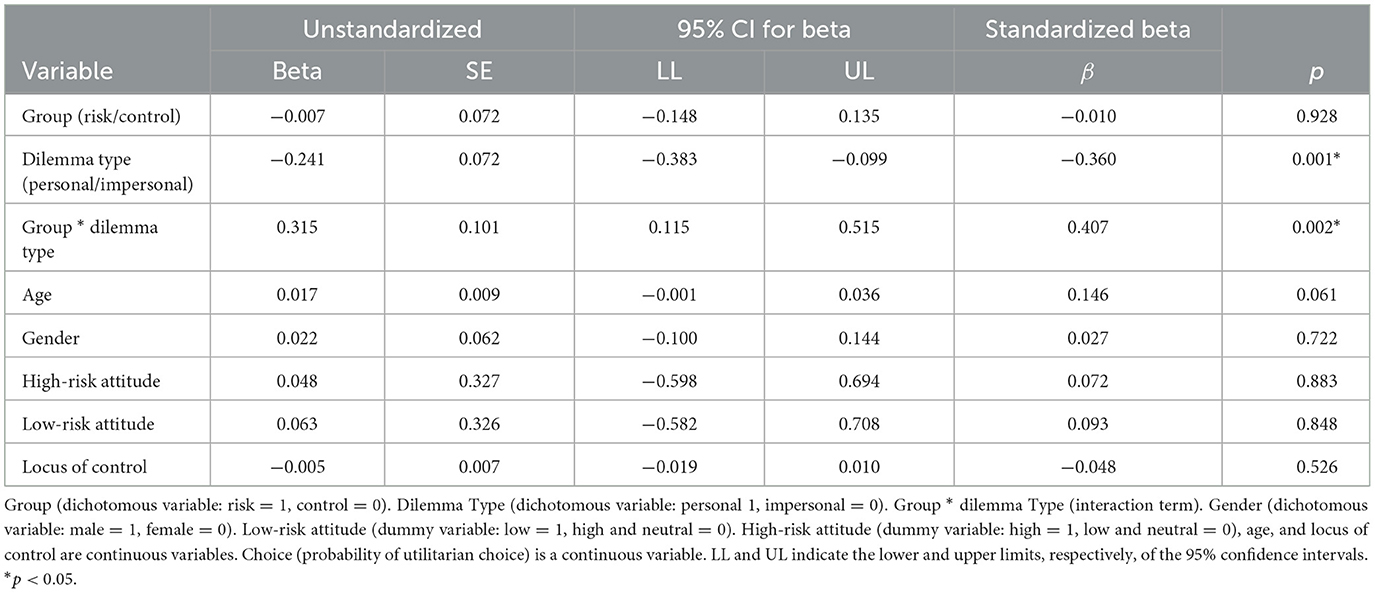

To test the effect of personality variables on the choice of the participants, the following analyses were conducted: A Kruskal–Wallis H test over the four groups with three risk attitude levels (low = 1, neutral = 2, high = 3) showed that there was no difference, = 1.45, p = 0.69. A between-subjects one-way ANOVA showed that the four groups did not differ on the locus of control scores, F(3,156) = 0.74, p = 0.53. Additionally, a multiple linear regression analysis in using SPSS was conducted using the “Enter” (simultaneous entry of all predictor variables) method. The dependent variable (probability of utilitarian choice) was regressed on the predictor variables: group (risk/control), dilemma type (personal/impersonal), group*dilemma type (interaction term), age, gender, risk attitude, and locus of control. The results showed that the regression model was a good fit, F(8,151) = 3.43, p = 0.001. Hence, the predictor variables did have a significant impact on the dependent variable. The interaction between group and dilemma type was significant (B = 0.315, p = 0.002). However, there was no effect of risk attitude, locus of control, gender, and age. The unstandardized beta coefficients of these predictors are non-significant at p < 0.05 (Table 1). The results show that the probability of making a utilitarian choice was really low, with a unit change in age, a change in gender (from male to female), a change in risk attitude (from high- to low-risk attitude), and a change in locus of control of the participants.

Table 1. Multiple linear regression analysis with choice as the dependent variable and simultaneously (together at the same time) entered (using “Enter” method in SPSS) predictor variables.

Cost–benefit analysis

Participants were provided five options (reasons/rationale for their choice), and they could choose one option. Out of five reasons, three reasons (benefit, trade-off, and cost) represented utilitarian (cost–benefit) reasoning, one (deontic) represented deontological reasoning, and one was open-ended for any other reasons that the participant might cite for making a choice. Each participant made choices for a total of four moral dilemmas.

A “cost–benefit” reason was coded as “1,” and “deontological” and “other reason” were coded as “0.” Following this, response “1” was counted for each participant, and this was divided by the total number of dilemmas, which was 4. This yielded the probability of using a cost–benefit analysis for each participant. Then, the mean probability of cost–benefit analysis was calculated across all participants.

To test the H3a, a 2 (Groups: Risk and Control) × 2 (Dilemma Type: Personal and Impersonal) between-subjects design ANOVA was conducted. The main effect of the group on the probability of cost–benefit analysis was significant, F(1,156) = 11.52, p = 0.001, = 0.07. The main effect of the dilemma type was marginally significant, F(1,156) = 3.86, p = 0.051, = 0.024. The interaction between group and dilemma type was not significant, F(1,156) = 1.02, p = 0.31 (Figure 5). Furthermore, the probability of utilitarian reasoning (cost–benefit analysis) was compared between the risk and control groups by using an independent-samples t-test. As predicted, the probability of using cost–benefit analysis was significantly higher in the risk group (mean = 0.71, SD = 0.31) when compared to the control group (mean = 0.53, SD = 0.36), t(158) = 3.36, p = 0.001, 95% CI [0.07, 0.28].

Figure 5. Probability of using cost–benefit analysis as a decision strategy in risk and control groups for personal and impersonal dilemmas. Error bars indicate 95% confidence intervals of the means.

Mediation analysis

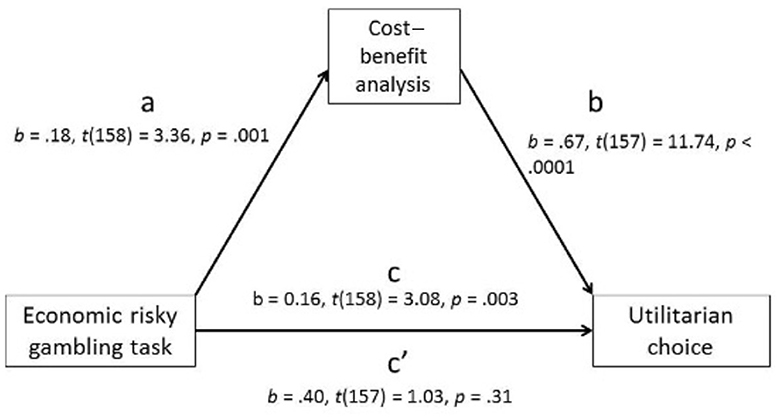

To test the H3b, a mediation analysis was conducted. This was done with a bootstrap method using 5,000 bootstrapped samples and 95% confidence intervals. The results indicated that the risky gambling task significantly predicted the probability of making a utilitarian choice (path c), b = 0.16, t(158) = 3.08, p = 0.003, 95% CI [0.06, 0.26]. The risky gambling task significantly predicted the probability of using a cost–benefit analysis mindset (path a), b = 0.18, t(158) = 3.36, p = 0.001, 95% CI [0.07, 0.28]. Cost–benefit analysis mindset significantly predicted a utilitarian choice (path b), b = 0.67, t(157) = 11.74, p < 0.0001, 95% CI [0.56, 0.78]. The risky gambling task failed to predict utilitarian choice when controlling for a cost–benefit mindset (path c′), b = 0.40, t(157) = 1.03, p = 0.31, 95% CI [−0.04, 0.12]. The indirect effect of the risky gambling task on utilitarian choice was significant and positive (a × b); b = 0.12, bootstrapped 95% CI [0.05, 0.20]. This suggests that cost–benefit analysis as a decision process mediated the relationship between the risky gambling task and utilitarian-type choice in moral dilemmas (Figure 6).

Figure 6. Path diagram showing mediation analysis. Cost–benefit analysis significantly mediated the relationship between prior risky economic gambles and utilitarian choices in subsequent moral dilemmas.

Judgment and ratings

For the forced-choice judgment task, each participant made a judgment for a total of four moral dilemmas. A “morally acceptable” judgment was coded as “1,” and a “morally unacceptable” judgment was coded as “0.” Following this, response “1” was counted for each participant, and this was divided by the total number of dilemmas, which was 4. This yielded the probability of making a morally acceptable judgment for each participant. Then, the mean probability of morally acceptable judgment was calculated across all participants.

To test H2, a 2 (Groups: Risk and Control) × 2 (Dilemma Type: Personal and Impersonal) between-subjects design ANOVA was conducted over the probability of morally acceptable judgment and mean ratings. For judgment, a main effect of the group was non-significant, F(1,156) = 1.99, p = 0.16. The main effect of dilemma type was non-significant, F(1,156) = 0.26, p = 0.61. An interaction between group and dilemma type was also non-significant, F(1,156) = 0.16, p = 0.69. For the rating task, the mean moral acceptability rating of the choice was calculated. To test the differences between risk and control groups, a 2 (Groups: Risk and Control) × 2 (Dilemma Type: Personal and Impersonal) between-subjects design ANOVA was conducted over mean moral acceptability ratings. A main effect of the group was non-significant, F(1,156) = 0.24, p = 0.63. A main effect of dilemma type was non-significant, F(1,156) = 0.04, p = 0.84. An interaction between group and dilemma type was also non-significant, F(1,156) = 2.87, p = 0.09. These results suggest that the risk and control groups did not differ in the judgment of their actions, thereby disproving H2.

Discussion

In this experiment, we found that prior exposure to choices in the economic domain led to an increase in the probability of making a utilitarian choice in “personal” moral dilemmas. This is due to increased cost–benefit analysis as an easily accessible decision process from the previous gambling task. The following findings support this claim. First, the probability of using cost–benefit analysis was higher in the risk group than in the control group. Second, the mediation analysis showed that the relationship between risky gambling tasks and utilitarian choices in moral dilemma tasks was mediated by cost–benefit analysis. Our results suggest that prior exposure to a risky gambling task led to activation of the domain-general process, which was easily accessible in the subsequent moral dilemma task due to a mindset created in the previous gambling task. This, in turn, preferentially supported the use of the cost–benefit analysis (Weber et al., 2005; Shenhav and Greene, 2010; Krosch et al., 2012; Leavitt et al., 2016) and increased the probability of utilitarian choices.

Unlike the observed differences between choices, judgments did not differ across groups. It could be possible that participants rationalized their actions (Haidt, 2001) and gave judgments consistent with their choices to reduce cognitive dissonance (Brehm, 1956; Stone and Cooper, 2001). Because we did not directly measure the judgment of utilitarian action, it is not clear from this study whether the risky gambling task had any influence on the judgment of utilitarian choices.

Exploratory analysis

We analyzed the response times in each experiment and found that they were inconsistent and varied across experiments and groups. The data and results are openly available at Open Science Framework (https://doi.org/10.17605/OSF.IO/6TA4K).

General discussion

We do not make one-off decisions that are isolated from other decisions. We also make a variety of decisions every day while embodying different roles. In this study, we found that the prior decision processes in an economic scenario spill over into moral scenarios. The general effect was observed in Experiment 1 and was replicated in Experiment 2 even when controlling for confounds. The spillover increased utilitarian choices in the moral scenario. Prior economic decisions promote a utilitarian mindset rather than a rule-based mindset, thereby allowing the assessment of costs and benefits rather than a moral rule (Cornelissen et al., 2013). The cost–benefit analysis process took precedence in the risky economic gambling group, which facilitated utilitarian reasoning, cueing (cost, lives lost vs. benefit, and lives saved) information.

The choice data in this study can have another possible but complementary explanation coming from the reinforcement learning and decision-making literature. According to Cushman (2013), a model-free system assigns value directly to “actions” based on action–reward history. The act of pushing someone carries a negative consequence of harm. This harmful consequence gets assigned over time to the action “push.” Consequently, this prevents “pushing” into “personal” moral dilemmas. In this way, people learn a “rule” such as “pushing is wrong” because it will lead to “harm,” preventing them from harming someone even if it benefits others.

By comparison, a model-based system assigns value to the “outcomes” and subsumes actions (such as pushing) as necessary steps in a plan to reach a goal or “outcome.” Thus, pushing someone becomes a necessary step to achieve a goal such as “saving” others. It is possible that the observed increased probability of utilitarian responding mediated by cost–benefit analysis could be due to the activation of the model-based outcome-value (benefit maximization) process resulting in utilitarian responses to “personal” scenarios. It is also possible that the model-free negative action value “action-harm” was changed to a positive “action-reward” value due to a previous economic task. However, there could also have been an interaction between model-free positive action value (cost–benefit analysis) and model-based outcome value (benefit maximization). Future studies could examine the decision mechanism and the exact nature of this interaction.

Response times were inconsistent and varied across experiments. This is in contrast with the dual-process accounts (Greene et al., 2001, 2008) and supports newer theories that suggest simultaneous activation of both systems (Gilovich et al., 2002; Baron and Gürçay, 2017; Białek and De Neys, 2017). Both processes (emotional and utility) are in competition or start simultaneously, and depending on the situation or which information is cued, either of the two processes can take precedence for judgment and decision-making (Baron and Gürçay, 2017).

The current findings can be seen in a larger frame of market interactions as well. Markets provide information cues for making decisions that harm others. Falk and Szech (2013) showed that people become more utilitarian (likely to harm a third party for money) in a market compared to when individually making decisions in isolation. They suggest that markets provide social cues (how others are deciding), diminishing the responsibility of harm since it is shared among all individuals and creates frames. In a similar line, our findings suggest that the market might create cost–benefit mindsets that lead to an easier trade-off of moral values such as harm to climate, water, food, animals, and other people for the self-gain. Markets also lower the inhibition to consider costs and benefits of trading of sacred values such as selling the organs, selling the body (prostitution), or selling the environment (carbon tax; Elias et al., 2015). Does this mean that markets promote immoral behavior? The answer is 2-fold. Having a more calculative mindset while making decisions can lead to more selfish and unethical choices (Zhong, 2011; Wang et al., 2014). However, the spillover of cost–benefit mindset due to the market might lead to the development of universal moral values (Agneman and Chevrot-Bianco, 2023; Enke, 2023) that are favorable, flexible, and accommodating of multiple moral perspectives. The spillover also can lead to an increase in social trust (Berggren and Bjørnskov, 2023) between different states and societies because the utilitarian approach looks to solve a moral problem by applying the principle of the greater good that benefits most people rather than pitting one religion against another, one culture against another, one gender against another, and one rigid sacred moral value against another.

Limitations

One limitation of the current study is that gender differences were not investigated due to the sample population being disproportionate. Evidence of gender differences has been observed at the neuronal and process levels. Studies suggest that men are concerned with or sensitive to “rule-based” or “justice” violations in moral scenarios and show greater activation in the posterior cingulate cortex and inferior parietal cortex (Robertson et al., 2007; Harenski et al., 2008). Women, by comparison, exhibit an increased sensitivity to “situation-based” or “care” violations in moral scenarios and thus show greater activation of posterior and anterior cingulate and anterior insular regions (Robertson et al., 2007). Traditionally, the evidence for gender difference has been mixed (Jaffee and Hyde, 2000; Harenski et al., 2008). However, more recent studies have found that these neural differences also produce behavioral differences, whereby women are less utilitarian in moral scenarios compared to men who are willing to inflict harm for the larger benefit (Harenski et al., 2008; Fumagalli et al., 2010a,b). Whether gender differences would result in women being more resistant to influences of the cost–benefit mindset can be a fruitful direction of research for future studies.

Another limitation of the study is the sample, which was composed solely of university students. This restricts the generalizability of the findings, especially given the fact that we were interested in the choice pattern of an Indian population. While the sample had a diverse group of individual Indian students, the small size falls short of being representative of the diversity of the Indian population. First, language has direct effects on moral choice because foreign language reduces access to normative knowledge (Geipel et al., 2015), and India has large number of languages. Our sample does not account for the variance due to language and is something that future studies can explore. Second, our sample does not account for the role of religion. Literature suggests that religion makes people more deontic in their moral choices (Shariff, 2015). Religion also affects markets (Fischer, 2016). It influences what can be traded, how to trade, and when and where can trade occur (Mittelstaedt, 2002). India has polytheistic, monotheistic, and atheistic religions and tribal cultures, and all these have different perspectives on morality and right/wrong behavior.

Conclusion

In conclusion, the present findings have important implications for understanding cross-domain spillover effects and the nature of processes involved in moral decision-making. Certain contexts (markets) and previous decisions (trading) have the capacity to change the rules and processes of moral decisions. Consequently, a moral rule normally expected to be applied in a moral dilemma is no longer preferred, thereby changing the resultant moral choice. Thus, markets might universally increase the use of cost–benefit analysis for choices related to the environment, prostitution, climate, water quality, and carbon emissions.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

The studies involving humans were approved by Institutional Ethics Committee—IIT Gandhinagar. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

AS: Conceptualization, Investigation, Methodology, Visualization, Writing—original draft, Writing—review & editing. JM: Project administration, Supervision, Writing—original draft, Writing—review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frbhe.2024.1332416/full#supplementary-material

Footnotes

1. ^We conducted another experiment in which we tested whether the decisions in Experiment 1 were affected by feedback in the hypothetical gambling task. Win/loss information about one's choice affects subsequent choices (Vermeer and Sanfey, 2015). Winning makes people risk-averse, and losing makes people risk-seeking (Dong et al., 2015). In contrast, people might also start feeling lucky after winning; referred to as the hot-hand fallacy (Gilovich et al., 1985). Thus, a change in the decision attitude of the participants could make participants either kill one to save more lives or refrain from making that choice. We replicated the findings of Experiment 1 and there was no effect of feedback.

References

Agneman, G., and Chevrot-Bianco, E. (2023). Market participation and moral decision-making: experimental evidence from Greenland. Econ. J. 133, 537–581. doi: 10.1093/ej/ueac069

Ahlenius, H., and Tännsjö, T. (2012). Chinese and Westerners respond differently to the trolley dilemmas. J. Cogn. Cult. 12, 195–201. doi: 10.1163/15685373-12342073

Arhiri, L., and Holman, A. (2011). Locus of control and the dynamics of moral fluctuation and rationalization. Sci. Ann. Alexandru Ioan Cuza Univ. Iasi-Psychol. 1, 69–91.

Bago, B., Kovacs, M., Protzko, J., Nagy, T., Kekecs, Z., Palfi, B., et al. (2022). Situational factors shape moral judgements in the trolley dilemma in Eastern, Southern and Western countries in a culturally diverse sample. Nat. Hum. Behav. 6, 880–895. doi: 10.1038/s41562-022-01319-5

Baron, J., and Gürçay, B. (2017). A meta-analysis of response-time tests of the sequential two-systems model of moral judgment. Mem. Cogn. 45, 566–575 doi: 10.3758/s13421-016-0686-8

Berggren, N., and Bjørnskov, C. (2023). Does globalization suppress social trust? J. Econ. Behav. Org. 214, 443–458. doi: 10.1016/j.jebo.2023.08.018

Białek, M., and De Neys, W. (2017). Dual processes and moral conflict: evidence for deontological reasoners' intuitive utilitarian sensitivity. Judg. Decision Mak. 12:148. doi: 10.1017/S1930297500005696

Brehm, J. W. (1956). Postdecision changes in the desirability of alternatives. J. Abnorm. Soc. Psychol. 52:384. doi: 10.1037/h0041006

Broeders, R., Van den Bos, K., Müller, P. A., and Ham, J. (2011). Should I save or should I not kill? How people solve moral dilemmas depends on which rule is most accessible. J. Exp. Soc. Psychol. 47, 923–934. doi: 10.1016/j.jesp.2011.03.018

Cabeza, L., Giustiniani, J., Chabin, T., Ramadan, B., Joucla, C., Nicolier, M., et al. (2020). Modelling decision-making under uncertainty: a direct comparison study between human and mouse gambling data. Eur. Neuropsychopharmacol. 31, 58–68. doi: 10.1016/j.euroneuro.2019.11.005

Cao, F., Zhang, J., Song, L., Wang, S., Miao, D., and Peng, J. (2017). Framing effect in the trolley problem and footbridge dilemma: number of saved lives matters. Psychol. Rep. 120, 88–101. doi: 10.1177/0033294116685866

Cohen, D. J., and Ahn, M. (2016). A subjective utilitarian theory of moral judgment. J. Exp. Psychol. 145:1359. doi: 10.1037/xge0000210

Cornelissen, G., Bashshur, M. R., Rode, J., and Le Menestrel, M. (2013). Rules or consequences? The role of ethical mind-sets in moral dynamics. Psychol. Sci. 24, 482–488. doi: 10.1177/0956797612457376

Cushman, F. (2013). Action, outcome, and value: a dual-system framework for morality. Personal. Soc. Psychol. Rev. 17, 273–292. doi: 10.1177/1088868313495594

Cushman, F., Gray, K., Gaffey, A., and Mendes, W. B. (2012). Simulating murder: the aversion to harmful action. Emotion 12:a0025071. doi: 10.1037/a0025071

Dolan, P., and Galizzi, M. M. (2015). Like ripples on a pond: behavioral spillovers and their implications for research and policy. J. Econ. Psychol. 47, 1–16. doi: 10.1016/j.joep.2014.12.003

Dong, G., Zhang, Y., Xu, J., Lin, X., and Du, X. (2015). How the risky features of previous selection affect subsequent decision-making: evidence from behavioral and fMRI measures. Front. Neurosci. 9:364. doi: 10.3389/fnins.2015.00364

Effron, D. A., Cameron, J. S., and Monin, B. (2009). Endorsing Obama licenses favoring whites. J. Exp. Soc. Psychol. 45, 590–593. doi: 10.1016/j.jesp.2009.02.001

Elias, J. J., Lacetera, N., and Macis, M. (2015). Markets and morals: an experimental survey study. PLoS ONE 10:e0127069. doi: 10.1371/journal.pone.0127069

Enke, B. (2023). Market exposure and human morality. Nat. Hum. Behav. 7, 134–141. doi: 10.1038/s41562-022-01480-x

Ert, E., and Erev, I. (2013). On the descriptive value of loss aversion in decisions under risk: six clarifications. Judg. Decision Mak. 8, 214–235. doi: 10.1017/S1930297500005945

Ert, E., and Yechiam, E. (2010). Consistent constructs in individuals' risk taking in decisions from experience. Acta Psychol. 134, 225–232. doi: 10.1016/j.actpsy.2010.02.003

Falk, A., and Szech, N. (2013). Morals and markets. Science 340, 707–711. doi: 10.1126/science.1231566

Fischer, J. (2016). Markets, religion, regulation: Kosher, halal and Hindu vegetarianism in global perspective. Geoforum 69, 67–70. doi: 10.1016/j.geoforum.2015.12.011

Fiske, A. P., and Rai, T. S. (2014). Virtuous Violence: Hurting and Killing to Create, Sustain, End, and Honor Social Relationships. Cambridge: Cambridge University Press.

Fleischhut, N., Meder, B., and Gigerenzer, G. (2017). Moral hindsight. Exp. Psychol. 64:110. doi: 10.1027/1618-3169/a000353

Frith, U., and De Vignemont, F. (2005). Egocentrism, allocentrism, and Asperger syndrome. Conscious. Cogn. 14, 719–738. doi: 10.1016/j.concog.2005.04.006

Fumagalli, M., Ferrucci, R., Mameli, F., Marceglia, S., Mrakic-Sposta, S., Zago, S., et al. (2010a). Gender-related differences in moral judgments. Cogn. Process. 11, 219–226. doi: 10.1007/s10339-009-0335-2

Fumagalli, M., Vergari, M., Pasqualetti, P., Marceglia, S., Mameli, F., Ferrucci, R., et al. (2010b). Brain switches utilitarian behavior: does gender make the difference? PLoS ONE 5:e8865. doi: 10.1371/journal.pone.0008865

Geipel, J., Hadjichristidis, C., and Surian, L. (2015). The foreign language effect on moral judgment: the role of emotions and norms. PLoS ONE 10:e0131529. doi: 10.1371/journal.pone.0131529

Gilovich, T., Griffin, D., and Kahneman, D. (2002). Heuristics and Biases: The Psychology of Intuitive Judgment. Cambridge: Cambridge University Press.

Gilovich, T., Vallone, R., and Tversky, A. (1985). The hot hand in basketball: on the misperception of random sequences. Cogn. Psychol. 17, 295–314. doi: 10.1016/0010-0285(85)90010-6

Gold, N., Pulford, B. D., and Colman, A. M. (2013). Your money or your life: comparing judgements in trolley problems involving economic and emotional harms, injury and death. Econ. Philos. 29, 213–233. doi: 10.1017/S0266267113000205

Greene, J. D. (2009). Dual-process morality and the personal/impersonal distinction: a reply to McGuire, Langdon, Coltheart, and Mackenzie. J. Exp. Soc. Psychol. 45, 581–584. doi: 10.1016/j.jesp.2009.01.003

Greene, J. D., Morelli, S. A., Lowenberg, K., Nystrom, L. E., and Cohen, J. D. (2008). Cognitive load selectively interferes with utilitarian moral judgment. Cognition 107, 1144–1154. doi: 10.1016/j.cognition.2007.11.004

Greene, J. D., Sommerville, R. B., Nystrom, L. E., Darley, J. M., and Cohen, J. D. (2001). An fMRI investigation of emotional engagement in moral judgment. Science 293, 2105–2108. doi: 10.1126/science.1062872

Haidt, J. (2001). The emotional dog and its rational tail: a social intuitionist approach to moral judgment. Psychol. Rev. 108:814. doi: 10.1037/0033-295X.108.4.814

Harenski, C. L., Antonenko, O., Shane, M. S., and Kiehl, K. A. (2008). Gender differences in neural mechanisms underlying moral sensitivity. Soc. Cogn. Affect. Neurosci. 3, 313–321. doi: 10.1093/scan/nsn026

Higbee, K. L. (1972). Perceived control and military riskiness. Percept. Motor Skills 34, 95–100. doi: 10.2466/pms.1972.34.1.95

Hirschberger, G., Pyszczynski, T., and Ein-Dor, T. (2015). Why does existential threat promote intergroup violence? Examining the role of retributive justice and cost-benefit utility motivations. Front. Psychol. 6:1761. doi: 10.3389/fpsyg.2015.01761

Horswill, M. S., and McKenna, F. P. (1999). The effect of perceived control on risk taking. J. Appl. Soc. Psychol. 29, 377–391. doi: 10.1111/j.1559-1816.1999.tb01392.x

Jaffee, S., and Hyde, J. S. (2000). Gender differences in moral orientation: a meta-analysis. Psychol. Bullet. 126:703. doi: 10.1037/0033-2909.126.5.703

Jessup, R. K., Bishara, A. J., and Busemeyer, J. R. (2008). Feedback produces divergence from prospect theory in descriptive choice. Psychol. Sci. 19, 1015–1022. doi: 10.1111/j.1467-9280.2008.02193.x

Kahane, G. (2012). On the wrong track: process and content in moral psychology. Mind Lang. 27, 519–545. doi: 10.1111/mila.12001

Khan, U., and Dhar, R. (2006). Licensing effect in consumer choice. J. Market. Res. 43, 259–266. doi: 10.1509/jmkr.43.2.259

Krosch, A. R., Figner, B., and Weber, E. U. (2012). Choice processes and their post-decisional consequences in morally conflicting decisions. Judg. Decision Mak. 7, 224–234. doi: 10.1017/S1930297500002217

Kurzban, R., DeScioli, P., and Fein, D. (2012). Hamilton vs. Kant: pitting adaptations for altruism against adaptations for moral judgment. Evol. Hum. Behav. 33, 323–333. doi: 10.1016/j.evolhumbehav.2011.11.002

Leavitt, K., Zhu, L., and Aquino, K. (2016). Good without knowing it: subtle contextual cues can activate moral identity and reshape moral intuition. J. Bus. Ethics 137, 785–800. doi: 10.1007/s10551-015-2746-6

Lejarraga, T., and Gonzalez, C. (2011). Effects of feedback and complexity on repeated decisions from description. Org. Behav. Hum. Decision Process. 116, 286–295. doi: 10.1016/j.obhdp.2011.05.001

Lucas, B. J., and Galinsky, A. D. (2015). Is utilitarianism risky? How the same antecedents and mechanism produce both utilitarian and risky choices. Perspect. Psychol. Sci. 10, 541–548. doi: 10.1177/1745691615583130

Mazar, N., and Zhong, C. B. (2010). Do green products make us better people? Psychol. Sci. 21, 494–498. doi: 10.1177/0956797610363538

Mittelstaedt, J. D. (2002). A framework for understanding the relationships between religions and markets. J. Macromarket. 22, 6–18. doi: 10.1177/027467022001002

Monin, B., Pizarro, D. A., and Beer, J. S. (2007). Deciding versus reacting: conceptions of moral judgment and the reason-affect debate. Rev. Gen. Psychol. 11, 99–111. doi: 10.1037/1089-2680.11.2.99

Neaves, J. J. (1989). The relationship of locus of control to decision making in nursing students. J. Nurs. Educ. 28, 12–17. doi: 10.3928/0148-4834-19890101-05

Paxton, J. M., Bruni, T., and Greene, J. D. (2013). Are 'counter-intuitive'deontological judgments really counter-intuitive? An empirical reply to. Soc. Cogn. Affect. Neurosci. 9, 1368–1371. doi: 10.1093/scan/nst102

Robertson, D., Snarey, J., Ousley, O., Harenski, K., Bowman, F. D., Gilkey, R., et al. (2007). The neural processing of moral sensitivity to issues of justice and care. Neuropsychologia 45, 755–766. doi: 10.1016/j.neuropsychologia.2006.08.014

Rothbaum, F., Weisz, J. R., and Snyder, S. S. (1982). Changing the world and changing the self: a two-process model of perceived control. J. Personal. Soc. Psychol. 42:5. doi: 10.1037/0022-3514.42.1.5

Rotter, J. B. (1966). Generalized expectancies for internal versus external control of reinforcement. Psychol. Monogr. 80:1. doi: 10.1037/h0092976

Shariff, A. F. (2015). Does religion increase moral behavior? Curr. Opin. Psychol. 6, 108–113. doi: 10.1016/j.copsyc.2015.07.009

Shenhav, A., and Greene, J. D. (2010). Moral judgments recruit domain-general valuation mechanisms to integrate representations of probability and magnitude. Neuron 67, 667–677. doi: 10.1016/j.neuron.2010.07.020

Stone, J., and Cooper, J. (2001). A self-standards model of cognitive dissonance. J. Exp. Soc. Psychol. 37, 228–243. doi: 10.1006/jesp.2000.1446

Strahilevitz, M., and Myers, J. G. (1998). Donations to charity as purchase incentives: how well they work may depend on what you are trying to sell. J. Consum. Res. 24, 434–446. doi: 10.1086/209519

Tassy, S., Oullier, O., Duclos, Y., Coulon, O., Mancini, J., Deruelle, C., et al. (2011). Disrupting the right prefrontal cortex alters moral judgementjudgment. Soc. Cogn. Affect. Neurosci. 7, 282–288. doi: 10.1093/scan/nsr008

Tassy, S., Oullier, O., Mancini, J., and Wicker, B. (2013). Discrepancies between judgment and choice of action in moral dilemmas. Front. Psychol. 4:250. doi: 10.3389/fpsyg.2013.00250

Uhlmann, E. L., Zhu, L. L., Pizarro, D. A., and Bloom, P. (2012). Blood is thicker: moral spillover effects based on kinship. Cognition 124, 239–243. doi: 10.1016/j.cognition.2012.04.010

Vermeer, A. B. L., and Sanfey, A. G. (2015). The effect of positive and negative feedback on risk-taking across different contexts. PLoS ONE 10:e0139010. doi: 10.1371/journal.pone.0139010

Wang, L., Zhong, C. B., and Murnighan, J. K. (2014). The social and ethical consequences of a calculative mindset. Org. Behav. Hum. Decision Process. 125, 39–49. doi: 10.1016/j.obhdp.2014.05.004

Weber, E. U., Ames, D. R., and Blais, A. R. (2005). “How do I choose thee? Let me count the ways”: a textual analysis of similarities and differences in modes of decision makingdecision-making modes in China and the United States. Manag. Org. Rev. 1, 87–118. doi: 10.1111/j.1740-8784.2004.00005.x

Wood, S., Busemeyer, J., Koling, A., Cox, C. R., and Davis, H. (2005). Older adults as adaptive decision makers: evidence from the Iowa Gambling Task. Psychol. Aging 20:220. doi: 10.1037/0882-7974.20.2.220

Wu, G., and Markle, A. B. (2008). An empirical test of gain-loss separability in prospect theory. Manag. Sci. 54, 1322–1335. doi: 10.1287/mnsc.1070.0846

Xu, A. J., and Schwarz, N. (2018). How one thing leads to another: spillover effects of behavioral mind-setsmindsets. Curr. Direct. Psychol. Sci. 27, 51–55. doi: 10.1177/0963721417724238

Yechiam, E., and Ert, E. (2011). Risk attitude in decision making: in search of trait-like constructs. Top. Cogn. Sci. 3, 166–186. doi: 10.1111/j.1756-8765.2010.01126.x

Zaleskiewicz, T., Gasiorowska, A., Kuzminska, A. O., Korotusz, P., and Tomczak, P. (2020). Market mindset impacts moral decisions: the exposure to market relationships makes moral choices more utilitarian by means of proportional thinking. Eur. J. Soc. Psychol. 50, 1500–1522. doi: 10.1002/ejsp.2701

Keywords: moral choice, spillover, behavioral mindset, cost–benefit analysis, utilitarian, deontological

Citation: Sahai A and Manjaly JA (2024) Risky mindset: prior exposure to risk increases utilitarian choices in sacrificial moral scenarios. Front. Behav. Econ. 3:1332416. doi: 10.3389/frbhe.2024.1332416

Received: 02 November 2023; Accepted: 19 March 2024;

Published: 16 April 2024.

Edited by:

Ximeng Fang, University of Oxford, United KingdomCopyright © 2024 Sahai and Manjaly. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Abhishek Sahai, abhishek.sahai@flame.edu.in

Abhishek Sahai

Abhishek Sahai Jaison A. Manjaly

Jaison A. Manjaly