The effectiveness of dual regulation and synergistic governance of market-incentivized carbon reduction policies and public environmental supervision: a study based on the sustainable development performance of listed companies in China

- 1School of Economics and Finance, Xi'an Jiaotong University, Xi'an, China

- 2School of Economics and Management, Nanjing Tech University, Nanjing, China

Introduction: In the current background of global economic slowdown, the traditional reliance on one regulatory instrument or the unilateral consideration of the effectiveness of one regulatory policy in policy formulation is no longer sufficient to cope with the increasingly complex contradictions between environmental protection and economic development. In the construction of a modernized environmental governance system, it has become an inevitable choice to achieve synergy between various environmental regulations. In China, the citizens' environmental supervision campaign that gradually emerged in 2006 and the local carbon trading pilots that started in 2013, as typical representatives of informal and formal environmental regulation respectively, provide vivid and realistic materials for our study.

Methods: Using econometric models and microdata from listed Chinese firms from 2009 to 2020, we analyze the profound logic and internal mechanism by which this synergistic governance effect of environmental regulation affects the economic society and the development pattern of firms.

Results and discussion: The study found that: (1) the synergistic effect of the carbon trading policy and citizens' environmental supervision can significantly promote the transition of enterprises to a sustainable development model, especially paying attention to the role of citizens' environmental supervision in this process. (2) The regional development level, cost transfer capability, and political connection can make the synergy of the two environmental regulations vary across firms. (3) The synergistic effect of environmental regulation promotes the behavior of enterprises in line with the requirements of sustainable development by influencing enterprises' R&D and innovation investment, resource allocation efficiency, and sustainable development awareness. (4) A favorable regional rule of law environment and moderate media attention can effectively increase the intensity of citizens' environmental supervision, and at the same time strengthen the effectiveness of synergistic governance of environmental regulation in the transformation and development of enterprises.

1 Introduction

Since the Industrial Revolution in the late 18th century, the adverse consequences of man-made environmental damage and climate change resulting from excessive economic development frenzy are becoming more and more intractable. Economic growth at the expense of crude resource consumption has led to the gradual depletion of ecological resources, rising greenhouse gas concentrations and increasingly severe environmental problems, and the traditional development model has become hard to sustain, with the resultant climate change and environmental problems that mankind has been unable to ignore and avoid (Ide et al., 2020).

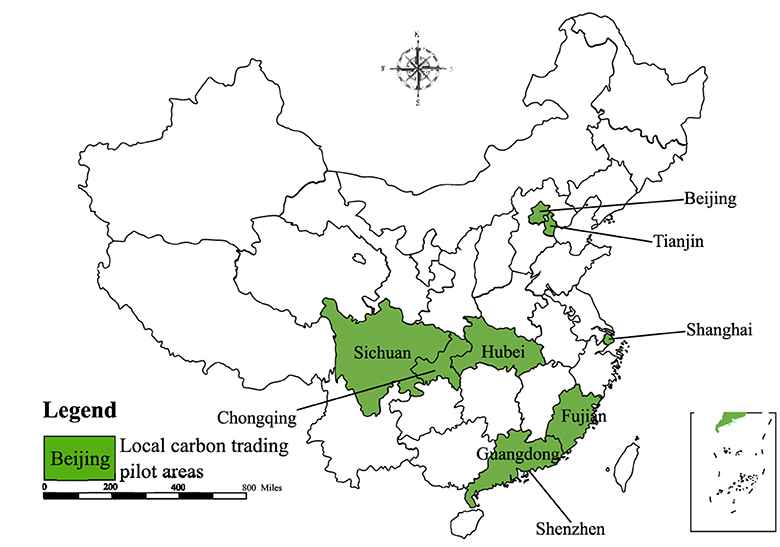

As the world's second largest economy and the largest developing country, China has experienced a miracle of economic growth that has caught worldwide attention. However, behind this rapid development, the extensive economic growth model has also seriously overdrawn the ecological load, making the environmental problems in reality highly pressing and arduous. To alleviate environmental problems and demonstrate the determination to combat global climate change, China has pledged to achieve peak carbon emissions by 2030 and carbon neutrality by 2060 (Yao et al., 2023). Therefore, during the 14th Five-Year Plan period, the Chinese government has clearly stated the development goals of carbon reduction, pollution reduction, greening and growth in a coordinated manner, and introduced a series of environmental regulations and carbon control policies, including the Carbon Emissions Trading System (ETS). ETS is recognized as an effective market-incentivized environmental regulation policy for combating climate change and controlling greenhouse gas emissions (Li and Lu, 2015; Calel and Dechezleprêtre, 2016). As a typical representative of market incentivized environmental regulatory policies, ETS has been implemented in China for a decade. Since 2011, China has conducted the first carbon trading pilots in seven regions, including Beijing, Shanghai, and Guangdong, and officially launched the market in 2013. After that, Fujian and Sichuan provinces were also added to the scope of carbon trading pilots, forming a “7 + 2” local pilot pattern (Figure 1); at the national level, China officially started the construction of the national carbon market in 2017, and took the power industry as a breakthrough in 2021 for the official operation of trading. A unified carbon market system is gradually taking shape.

In addition to ETS, citizens' environmental supervision plays an equally important role as a form of informal environmental regulation in a society-wide environmental governance system. In view of the partial failure of formal environmental regulation in ecological governance and protection practices in the early period, the movement of social participation in environmental protection, which began with the disclosure of environmental information in 2006, has emerged and flourished as a pioneering mechanism and a useful supplement to formal environmental regulation, becoming an indispensable part of China's environmental governance system, and laying the foundation for the construction of a pluralistic, efficient, balanced, and complementary system of environmental regulation. Citizen participation in environmental monitoring is aimed at introducing social forces into environmental governance, with third-party organizations or members of the public other than the government and enterprises taking the lead in monitoring environmental issues and disclosing information on environmental issues, raising public awareness of environmental protection, forming an advantage in public opinion, and then drawing the attention of enterprises and local governments to environmental issues.

The synergistic effect of the carbon trading policy and public supervision needs to be realized at the level of microenterprises, through their efforts in sustainable development and their actual performance in environmental governance and environmental responsibility. Environmental, Social and Governance (ESG), as an important criterion for measuring the level of green and sustainable development of enterprises, has become the focus of widespread academic attention since the 30·60 carbon target was put forward (Yu et al., 2023), and at the same time, it also provides a measurement standard for us to study the efforts of enterprises in sustainable development and their performance in environmental governance and the assumption of environmental responsibility. Enterprise ESG performance specifically refers to the value concept of comprehensively considering environmental, social, and governance factors in the process of management and investment decision-making, which not only reflects the concept of integrating the enterprise with the national strategy and macroeconomic development, but also is an important symbol of the enterprise's sustainable development capability (Wang, 2023). Given the significance of studying enterprises' sustainability and environmental governance performance in the era of carbon emission reduction, scholars have explored the constraining and incentivizing effects of environmental regulations on enterprises' ESG performance. Some scholars have noted that the carbon trading policy can significantly enhance enterprises' carbon emission reduction and effectively reduce energy consumption and emission (Gu G. et al., 2022; Liu and Li, 2022; Zhang W. et al., 2022), which allows enterprises to obtain higher scores on environmental protection, a sub-index of ESG (Li and Li, 2022). In terms of social value scoring, the carbon trading policy can draw the attention of enterprises to environmental protection and increase their understanding of the construction of an environmentally friendly society (Niyommaneerat et al., 2023); transformation or investments made by enterprises into green and low-carbon industries can significantly boost employment in energy-intensive and low-carbon industries, enabling enterprises to create more social benefits (Jia, 2023). In addition, efficient participation in the carbon market relies on well-organized internal governance (Yu et al., 2022); facing the pressure of the carbon trading policy, many enterprises have improved their disclosure systems to reduce the impact of information asymmetry on their enterprise image in the market (Ma et al., 2022); at the same time, they have actively improved their market performance under the carbon emissions trading system in order to obtain more carbon allowances and reduce the cost of corporate finance and attract more institutional investors (Ni et al., 2022). All of the above will ultimately improve the effectiveness of the internal governance and the score of the social value dimension of the enterprise.

Combining the above literature, we can clearly conclude that the carbon trading policy plays a significant role in promoting enterprises' ESG performance. As for the impact of public environmental monitoring on ESG performance, theoretically, on the one hand, when the public discovers environmental problems, they can urge the government to carry out more stringent supervision through letters, petitions, phone calls, etc., so as to motivate enterprises to disclose their environmental information and reduce environmental violations (Shen and Feng, 2012); on the other hand, the public's opinion and product preferences can motivate enterprises to change their concepts of production and management, and to change their attitudes toward ESG practices (Wang and Zhao, 2018; Wu et al., 2019; Gu Y. et al., 2022).

In the above analysis, it can be seen that both carbon trading policies and public environmental monitoring can incentivize firms to make more positive ESG performance. However, little literature has focused on the reciprocal relationship and synergistic governance effects of market-incentivized carbon reduction policies and public environmental monitoring, especially for corporate sustainability. The synergistic governance mentioned in this paper refers to a multi-subject (government and public), multi-channel (policy constraints and citizen monitoring), multi-faceted (around the three themes of corporate environmental protection, green responsibility, and internal governance based on the sustainable development goals) co-participation in the environmental governance mechanism. Policy synergy is conducive to the joint participation of multiple subjects in governance, thus increasing the motivation of participants (Turnpenny et al., 2009). Based on the formal written regulations issued by the government, previous scholars have also conducted preliminary discussions on the topic of regulatory synergy and environmental governance. For example, Lu et al. (2023) explored the synergistic inhibition effect of environmental information disclosure policy and low-carbon city construction policy on urban carbon emissions; Zhang B. et al. (2022) examined the impact of systematic codified legislation in the field of environmental governance on the green productivity of enterprises through the command environmental legislation issued by the city government; similarly, Zhang B. et al. (2023) utilized the local environmental legal texts and analyzed the impact of the existing set of pollution restrictive regulations in local governments on firms' environmental performance. In addition, non-environmental macro policies, such as monetary policies, which can also have an impact on a country's carbon emissions (Wu et al., 2023), creating synergistic constraints in the same direction as environmental policies. In these literature, the scholars' attention to the synergistic effect of environmental regulation can already be seen, as they are no longer only focusing on a single environmental protection regulation; however, in order to study the impact of environmental regulation on the business choices and transformation and development of enterprises, in addition to focusing on the restrictive regulations that the government is currently pushing for, it is also necessary to pay full attention to the effect of public participation, and the examination of sustainable development should also use more comprehensive indicators to include a broader concept of reality, which is not only the meaning of “multi-subject,” “multi-channel,” and “multi-faceted” mentioned above, and also the focus of this paper. The carbon trading policy and citizen supervision cooperate with each other to form an environmental regulation system in time, space, and function, which jointly contribute to the enhancement of corporate environmental performance and ESG performance. Based on this, there are several questions that this paper will try to address in the following: first, in the background of China's high-quality development, is there an obvious synergistic governance effect between the carbon trading policy and the public environmental supervision on the ESG performance of enterprises? If so, what is the mechanism between them? Further, will this effect be heterogeneous depending on the characteristics of the enterprises themselves and the external environment? Currently, there is still a lot of space for in-depth research on the micro synergistic governance effect of the carbon trading policy and public environmental monitoring at the enterprise level, especially in the current era of carbon emission reduction, thus the research on this topic has important theoretical value and practical significance. In view of this, on the basis of analyzing the economic logic of the carbon trading policy and public environmental monitoring synergistically affecting enterprise's ESG practice, this paper empirically examines the synergistic governance effect, the mechanism of action, and the potential heterogeneous effect of the carbon trading policy and public environmental monitoring on enterprise's ESG performance based on the data of China's A-share non-financial listed companies from 2009 to 2020.

The possible marginal contributions of this paper compared to existing studies are as follows:

First, based on enterprise ESG performance, this paper explores the synergistic effectiveness of the carbon trading policy and public environmental monitoring on corporate environmental pollution behavior and sustainable development responsibility. The reason why we need to study the synergistic effectiveness of various environmental regulations is that, in the context of the current economic slowdown, relying on only one type of regulatory means or unilaterally considering the effectiveness of only one type of regulatory policies is no longer sufficient to cope with the increasingly complex contradictions between environmental protection and economic development, and it is necessary to integrate various environmental regulations into a modernized environmental governance system to enhance the overall achievements of environmental regulation through complementarity and synergy between the various environmental regulations. Based on this, this paper carries out an in-depth study on the effectiveness and functioning mechanism of synergistic governance of environmental regulation, which makes up for the inadequacy of previous literature that is limited to only one type of environmental regulation.

Second, this paper enriches the research on enterprise ESG practices. Existing literature mostly focuses on the impact of enterprise ESG practices on enterprise value, return on assets, operating performance, and financing constraints (Fatemi et al., 2018; Giese et al., 2019), and most of them are explored from the perspective of formal regulation such as government policy (Wang and Wang, 2022; Wang Y. et al., 2022). By incorporating public environmental monitoring, the main form of informal regulation, into the research framework, this paper explores the synergistic effects of these two different natures of environmental regulation and makes a useful addition to the research in this field.

Thirdly, this paper explores the possible mechanisms and paths of synergistic governance on enterprise environmental pollution between the carbon trading policy and public environmental monitoring from three perspectives: R&D innovation, resource allocation efficiency and sustainable development consciousness. In particular, in the paper, we further study the role of citizen supervision, especially the complementary and regulating role of citizen supervision for the carbon trading policy, and the conclusions obtained not only fill the gaps of previous studies, but also provide useful references and lessons for the economic society to realize the policy goal of low-carbon development.

2 Theoretical analysis and hypotheses

The carbon trading policy relies on policy-based regulation to artificially promote and build a carbon trading market, and uses market-based means to constrain the polluting behaviors of enterprises, so that the environmental costs are retained within the enterprise, thus forcing the enterprise to save energy and reduce emissions, improve the efficiency of energy use in production technology, transform to a cleaner energy production method and even carry out green innovation projects (Zhang et al., 2023b). However, the principle of market-based governance requires that policymakers are often not able to directly intervene in the trading activities of enterprises in the carbon market (Wang and Liao, 2022), coupled with the imperfections of the regulation system at the early stage of the establishment of the carbon market, which leads to the competent authorities are often in an information disadvantage, especially at the stage when the carbon trading policy is still being piloted in some individual regions and industries, and the intensity, scope, and time of the implementation of the policy, as well as the local cultural, economic, and judicial environments, all of which have a significant effect on the effectiveness of the implementation of the carbon trading policy (Li and Li, 2021). Unlike formal environmental regulation, environmental supervision from the public is not a mandatory directive, but a kind of environmental protection agreement reached by the government, enterprises, environmental protection organizations, industry associations and stakeholders through communication, negotiation, cooperation, etc. (Zhang et al., 2023a). The main purpose of this means of regulation is to coalesce public environmental consciousness into an effective external pressure on the enterprise pollution control behavior to comprehensively regulate and incentivize and influence its operational decision-making, so as to improve the ecological environment and enhance the efficiency of resource use (Zhao and Ni, 2022). Formal carbon trading policy and informal citizen supervision can compensate for the deficiencies that exist in each other. The sustained and stable implementation of the carbon trading policy reflects the government's willingness and determination to promote energy conservation and emission reduction by enterprises and to realize the transformation of the development mode (Wu et al., 2020), which provides an important basis and guarantee for citizens' supervision, empowers emission-control enterprises to cater to the endogenous motivation of citizens' supervision, and raises the cost of speculative and rent-seeking behaviors of enterprises (Zhao et al., 2021). At the same time, citizens' environmental monitoring is also an important supplement to the carbon trading policy, and its effective implementation can improve the transparency of environmental information, alleviate the negative impacts caused by occasional market failures in the carbon market as well as the information disadvantage of the policy makers, expand the coverage of the policy, raise the awareness of environmental protection of the residents, and reduce the cost of regulation (Hu and Yang, 2021); especially in the background of China's decentralization of environmental regulation policies and officials' GDP appraisal tournaments, informal environmental regulation can force enterprises to adopt sustainable development strategies by avoiding the drawbacks of government-enterprise collusion (Zhou and Wang, 2023).

Accordingly, this paper proposes research hypothesis 1 (H1): synergistic governance of the carbon trading policy and citizens' environmental supervision can promote enterprises to improve their own ESG performance.

The synergistic improvement path of the carbon trading policy and public's supervision on enterprises' ESG performance is reflected in many aspects. Firstly, it is reflected in the impact on enterprises' investment in R&D and innovation. The synergistic effect of the carbon trading policy and public supervision significantly improves the survival pressure of polluting enterprises, which prompts them to seek for cleaner energy, cleaner production methods, and cleaner products through R&D and innovation in order to adapt to the environmental regulations on the enterprises' ESG performance (Jiang et al., 2021). Secondly, the carbon trading policy and public environmental monitoring, as environmental regulations from the outside, bring a certain amount of cost pressure to enterprises, which will reconsider the allocation of production factors based on long-term economic interests, reducing inputs in polluting and inefficient production sectors and increasing inputs in clean and efficient production sectors (Ren et al., 2019), which leads to an increase in the ESG scores of enterprises. Finally, Hofstede argues that external societal trends and values can profoundly influence the values of companies, decision makers, and employees alike (Hofstede, 1998). The continuous implementation and improvement of the carbon trading policy shows the government's determination to promote sustainable economic and social development, and the rise of the environmental monitoring movement and the public's continuous enthusiasm for environmental pollution shows the public's recognition of the concept of sustainable development. Under the joint action of the government and the public, the trend and value orientation of green transformation and sustainable development has been formed in the whole society, which makes the higher consciousness of sustainable development gradually coalesce in the enterprise culture, forcing the enterprises to change their business concepts, pay attention to their own social and environmental impacts at all times, and choose long-term sustainable production and operation modes, and adapt to the local values in order to promote the integration of the enterprises and local development. The improvement of enterprise sustainable development consciousness helps it fully optimize the allocation efficiency of resources between ESG practices and production and operation goals, and positively promotes the transformation of value in ESG practices. Under the guidance of sustainable development consciousness, enterprise ESG practice realizes the unity of decision-making and practice, and ultimately achieves the goal of simultaneous enhancement of the enterprise's economic, social and environmental benefits (Li et al., 2020).

Accordingly, this paper proposes research hypothesis 2 (H2): the synergistic governance effect of the carbon trading policy and public environmental monitoring can enhance the ESG performance of enterprises by influencing their R&D and innovation investment, resource allocation efficiency, and sustainable development awareness.

3 Research design

3.1 Empirical model construction

The theoretical analysis shows that both formal market-incentivized government carbon reduction regulation and informal public scrutiny can drive firms to make better sustainability performance and green transition outcomes. In order to test whether these two different sources of environmental regulatory forces achieve the expected complementary synergies, this paper sets up an econometric model with reference to the study of Liu et al. (2016), Li and Bai (2020), and Lu (2021):

In Equation (1), i and t denote firms and years, respectively, and the explained variable ESGit is the ESG rating of ith firm in tth year. On the right side of the equal sign, DIDit denotes the implementation of the carbon trading policy. If the listed enterprise is included in the local carbon trading pilot1 and in the year after the implementation of the pilot, DID is 1, otherwise it is 0. PESit denotes public environmental supervision. Controlsit is a series of control variables that may affect enterprises' ESG performance, νi denotes firm fixed effects and μt denotes time fixed effects. ε is a robust standard error that corrects for heteroscedastic effects.

If α1 in Equation (1) is significantly greater than 0, it indicates that there is a synergistic and complementary effect between carbon trading policy and citizens' environmental monitoring, and that environmental supervision from citizens can effectively compensate for the bias existing in the implementation of carbon trading policy and strengthen the governance effectiveness of carbon trading policy in promoting enterprises' transformation to sustainable development. In addition, the test of synergies still needs to test the actual existence of governance effects in two aspects of carbon trading and citizen environmental supervision respectively, in order to mitigate the bias in the estimation of the parameter α1 caused by the high correlation between the variables due to the addition of the interaction term and the complexity of the model design. To strengthen the significance and reliability of the regression results in Equation (1), this paper adds auxiliary models as shown in Equations (2, 3) to the baseline regression.

If α1 > 0 in Equation (1) holds together with β1 > 0 in Equations (2, 3), it indicates that the simultaneous implementation of carbon trading policies and citizen environmental supervision can have a synergistic governance effect on firms' ESG performance as well as sustainable development, and the research hypothesis H1 holds.

3.2 Data sources and variable definitions

3.2.1 Sample selection and data processing

As mentioned in Section 1, China has launched carbon market trading in nine regions since 2013, and a unified national carbon market for the power generation sector has been officially launched in 2021. Given the impact of the COVID-19 epidemic on China and the still short experimental window resulting from incomplete data updates for 2021 and beyond, this paper sets the nine regions that have already implemented carbon trading before 2020 as carbon trading implementation regions. We use Shanghai and Shenzhen A-share listed companies from 2009 to 2020 as the initial sample. The financial data of listed companies are disclosed by their annual reports. Based on the list of firms in the announcements published by local carbon trading pilots, we categorize the sample firms into carbon trading pilot group and non-pilot group. To ensure the quality of the dataset, this paper filters the initial samples according to the following principles: (1) excluding financial and insurance listed companies, whose financial data structure and regulatory system are very different from those of other industries: (2) excluding samples of companies that were ST in the current year, which are labeled for treatment due to continuous financial losses; (3) excluding samples of companies with missing financial data. After the above treatment, a dataset with 14,328 firm-year observations is obtained. Considering the bias that data extremes produce on coefficient estimates, we replaced singular values outside these two percentiles with data at the 1st and 99th percentiles.

3.2.2 Definition of variables

① Enterprise ESG performance (ESG). In this paper, the Sino-Securities Index (SNSI) ESG Rating2 is selected as a measure of enterprises' ESG performance, which has been recognized and widely used by the industry and academia (Wu et al., 2021). SNSI ESG Rating is divided into nine grades, from low to high, C, CC, CCC, B, BB, BBB, A, AA, AAA, and this paper assigns these nine ratings in order from 1 to 9, and the closer the rating is to nine indicates that the better the ESG performance of the enterprise. Meanwhile, considering the time lag in the rating of corporate ESG performance due to the data feedback and influence effect, the ESG rating of the enterprise at the beginning of the following year is used as the rating result of the current year.

② Public environmental supervision (PES). Citizens' participation in environmental supervision stems from their recognition of the concept of environmental protection and the cultivation of environmental awareness, so citizens' participation in environmental supervision can be measured by environmental awareness. Kathuria (2007) measures the intensity of citizens' environmental monitoring by the media exposure of pollution incidents. Goldar and Banerjee (2004) use turnout in parliamentary elections and the growth rate of educational attainment as proxy variables for citizen monitoring. However, since governmental management system, education level, laws, media coverage, employment situation, and place of residence are all important factors affecting the level of public environmental awareness (Zhao et al., 2009), they are not only complex but also difficult to express quantitatively. Therefore, using a single indicator to measure the intensity of citizens' environmental monitoring is too one-sided and inaccurate. In this paper, referring to Pargal and Wheeler (1996), four indicators, namely, income level,3 education level,4 population density5 and age structure,6 are selected and the entropy weighting method is used to calculate the corresponding indices, which are used to measure the intensity of citizens' environmental monitoring in each region. The original values of the above data are obtained from the China Statistical Yearbook, China Labor Statistics Yearbook and the database of the National Bureau of Statistics.

③ Control variables. Referring to Giannetti et al. (2015) and Shive and Forster (2020), this paper controls the following variables in model (1): firm size (SIZE), asset-liability ratio (DAR), age at listing (AGE), financial leverage (LEV), management expenses (MEA), nature of ownership (SOE), ratio of shareholding of the first largest shareholder (SRF), ratio of shareholding of the top 10 shareholders (SRT), institutional investor ownership ratio (IO), sole director share (PSD), analyst focus (ANF), financing constraints (FIC), and firm value (FIV). The raw values of the above data are taken from the annual reports of listed companies and the complete dataset is available from the CSMAR and Wind databases.

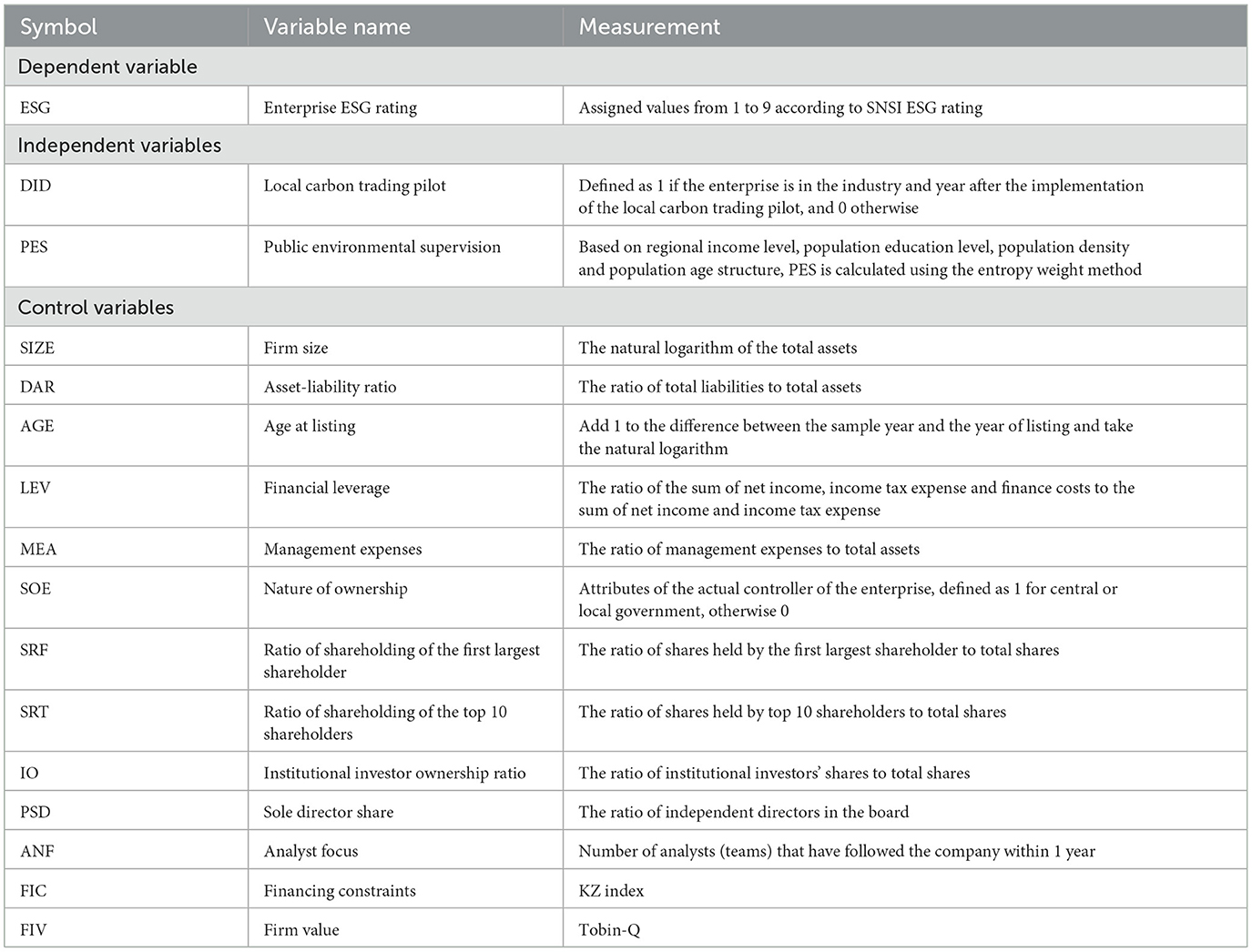

The detailed definitions of the above variables are shown in Table 1.

4 Results and analysis

4.1 Descriptive statistics for variables

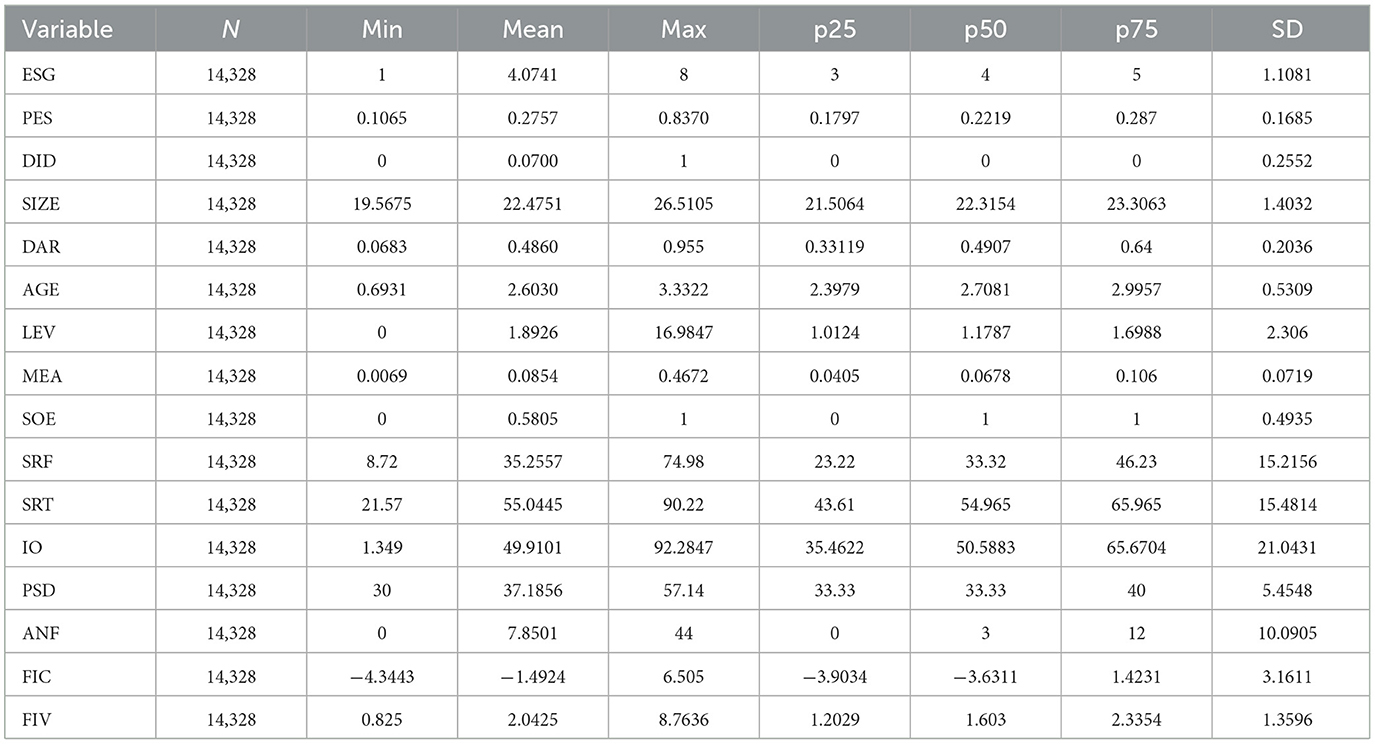

Table 2 reports the descriptive statistics of the variables in this paper. Among them, the mean of ESG is 4.074 with a median of 4, indicating that the ESG performance of most firms is at a low to medium level and there is still much room for improvement; the standard deviation is relatively large at 1.1081, indicating that there is a large number of individual differences in the ESG ratings of the sample firms. The mean of DID is 0.07, indicating that about 7% of the firms in the sample are included in the pilot scope of the carbon trading policy. The mean of SOE is 0.5804, indicating that about 58% of the enterprises in the sample are controlled by the central or local governments. In addition, the mean and median of the variables SIZE, DAR, SRF, SRT, IO, and FIV are relatively close to each other, indicating that these variables conform to normal distribution as a whole. Overall, the distribution of each control variable is within reasonable limits.

4.2 Baseline regression results

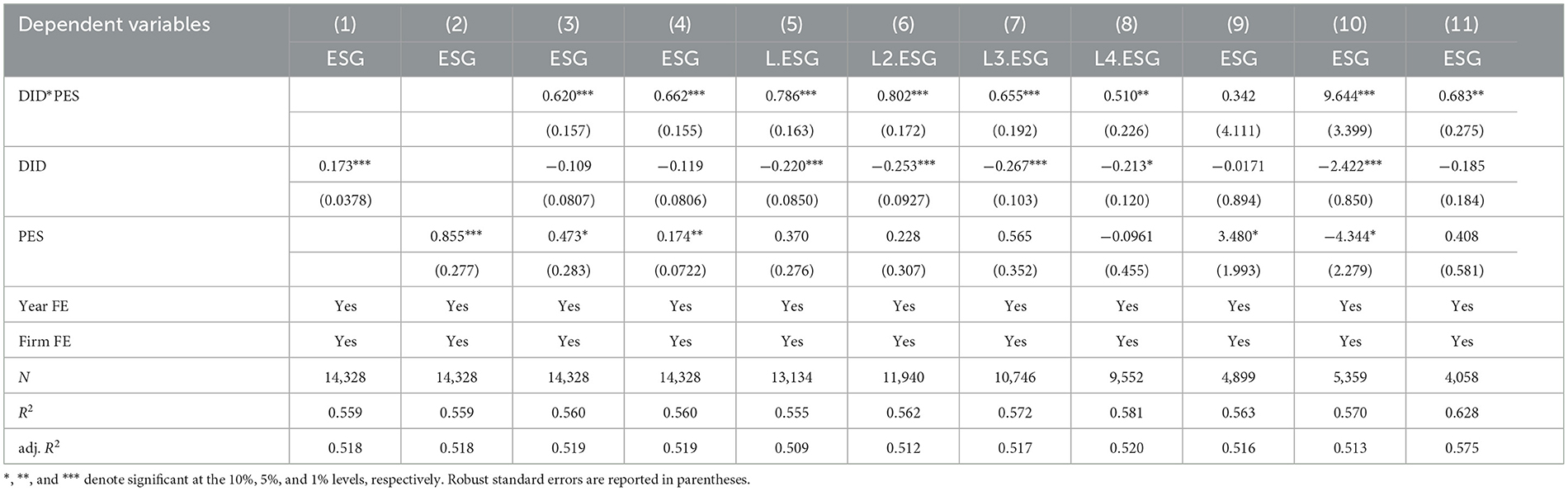

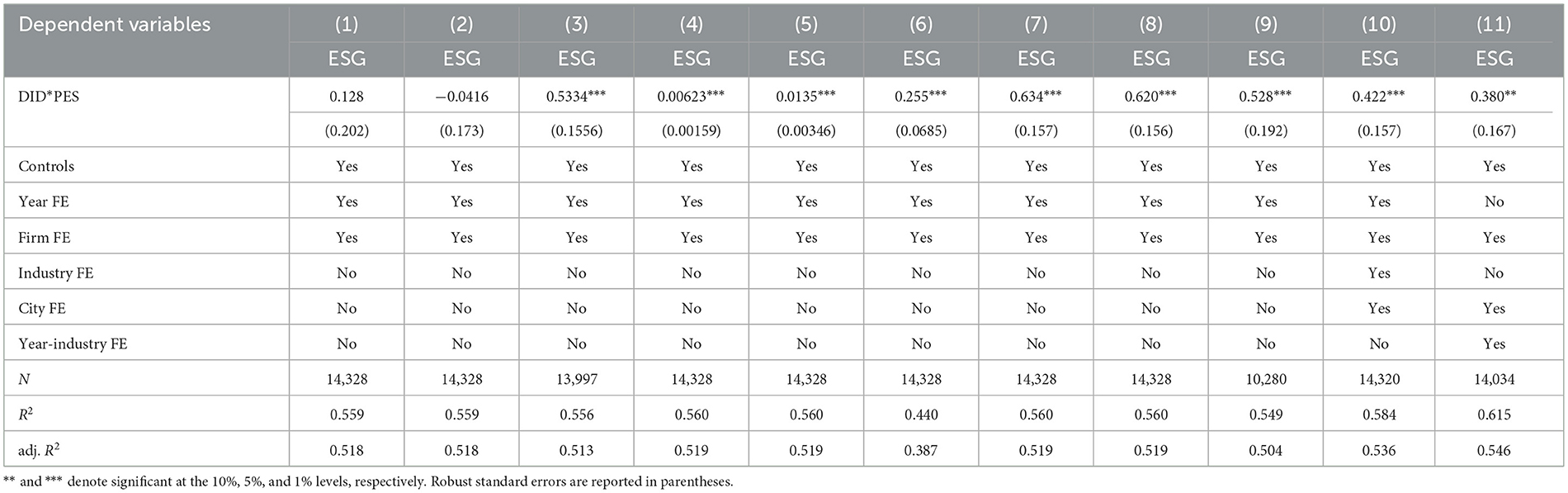

Table 3 reports the results of the model regressions. In columns (1) and (2), from the perspective of the implementation effectiveness of individual environmental regulatory measures, both carbon trading policies and citizens' environmental monitoring are able to contribute significantly and positively to firms' ESG performance; on the other hand, the significant one-sided effects also indicate that when one of the two environmental regulation instruments does not exist or is difficult to be effective, the other one can effectively fill in the gap. The third column examines the synergistic effect of these two regulatory instruments, and it can be found that DID*PES is 0.62, and it is significantly positive at the 1% significance level, indicating that there is a synergistic effect between the carbon trading policy and the citizens' environmental monitoring, and hypothesis H1 is confirmed. Column (4) is the regression result of PES assigned to 0 or 1 according to the annual median and substituted into Equation (1), and it can be seen that there is no change in the sign or significance of the coefficient of DID*PES compared to column (3), again leading to the same conclusions as above. Considering the complexity of the mechanism of environmental regulation and the comprehensive nature of the ESG evaluation system, the synergistic effect of the two regulatory instruments cannot be directly and quickly reflected in the ESG performance of enterprises. In order to test this lag effect, this paper respectively regresses the lag terms of ESG from one to four lags. From the results in columns (5) to (8) of Table 3, it can be seen that as the lag period prolongs, the coefficient of DID*PES gradually increases with the same significance and sign, reaching its maximum at lag 2 and then decreasing, indicating that there is a lag effect in the synergistic effect and the strength of the lag period first increases and then decreases. As described in the results in columns (1) and (2), either a single carbon trading system or an environmental monitoring regulation can have an implementation effect that promotes firms' ESG enhancement, but in terms of the synergistic effect of the two, do differences in the intensity of one of the regulations, such as citizen monitoring, have an impact on this synergistic effect? We obtain more detailed findings by dividing the sample equally into low, medium, and high level groups according to the annual PES data, and the results are shown in columns (9), (10), and (11) of Table 3, in that order. In the last three columns of Table 3, when the environmental awareness of the citizens in a region is not strong and the environmental supervision is not strong enough, the environmental supervision and the carbon trading system do not produce the expected synergistic and complementary effects; on the contrary, the synergistic governance effect of the two environmental regulatory instruments is more fully realized only in the regions with medium or even higher environmental supervision. Such results suggest that the synergistic and complementary relationship between citizen supervision and government policy is not unconditional, but rather there is a certain threshold that produces synergistic effects only when citizens' awareness and supervision intensity reach a certain level. In addition, in regions with medium environmental monitoring intensity, the utility potential of synergistic governance is greater than that of the high-level group, as the modernized environmental regulatory system is being constructed in these regions, and there is still a lot of room for improvement in the civic awareness of environmental supervision and the ESG performance of enterprises.

4.3 Robustness tests results

To further verify the reliability of the empirical results, this paper also conducts the following robustness tests:

(1) Parallel trend test

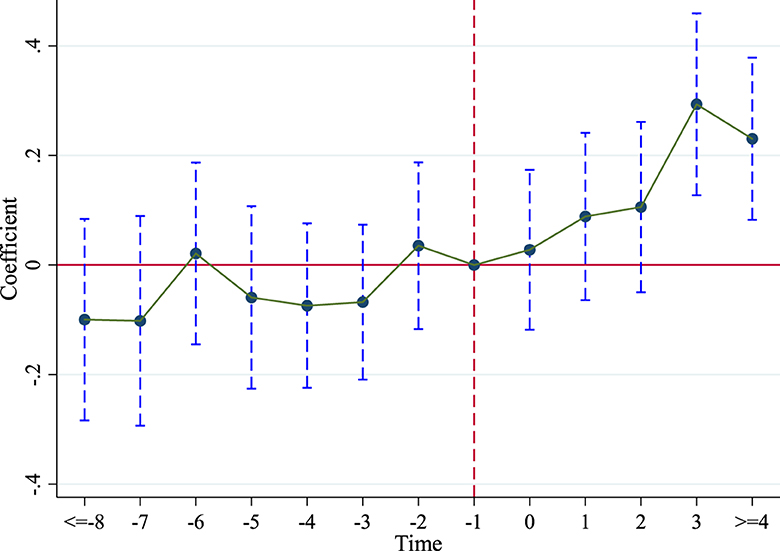

The selection bias that exists in the selection process of carbon trading pilot cities can affect the accuracy of the results. By verifying the assumption of parallel trends, the model estimation bias caused by selection bias can be effectively mitigated and the reliability of the estimation results can be enhanced. To this end, this paper adopts an event-study framework to examine whether the ESG performance of pilot firms and non-pilot firms have similar time trends before policy implementation.

In this paper, taking the period before the implementation of the carbon trading policy as the base period, the results of the parallel trend test at the 5% significance level are shown in Figure 2. As can be seen from the figure, the zero-valued horizontal axis crosses the confidence interval of the coefficient estimates of the periods before the implementation of the carbon trading pilot policy, indicating that there is no significant difference between the pilot and non-pilot enterprises before the implementation of the policy, and the research samples passed the parallel trend test.

(2) Advancing the implementation year of the formal carbon trading policy

In order to test that the synergistic effect found empirically above does exist, rather than other factors leading to changes in corporate ESG performance as in the empirical results, this paper adopts the following method to carry out the test: the selection of sample firms in the test remains unchanged, but the implementation of the carbon trading system is advanced forward by 2 and 3 years, respectively. If the conclusion of this paper is mainly caused by the synergistic effect of the carbon trading policy and citizen supervision, the conclusion obtained by the above test method will not be consistent with or similar to the previous conclusion. The regression results are shown in columns (1) and (2) of Table 4, where it can be found that the coefficients of DID*PES are not significant and inconsistent with the benchmark regression results, suggesting that the results of the benchmark regression are not caused by other interfering factors by chance.

(3) Excluding estimation interference from selection bias

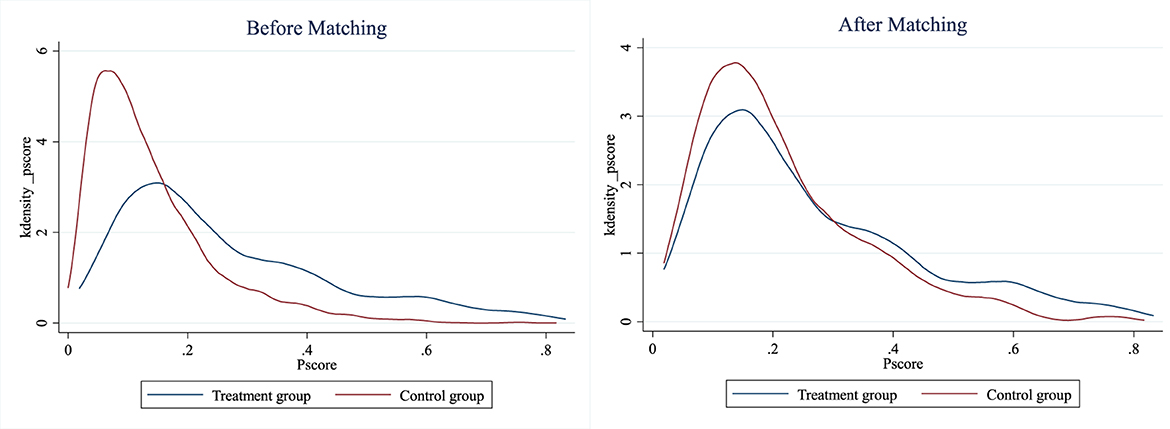

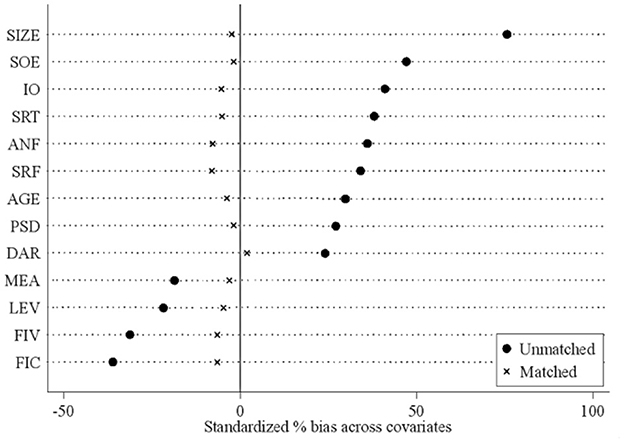

The use of listed companies as research samples in this paper will, to some extent, lead to selection bias and thus affect the accuracy of the estimation of Equation (1), because listed companies are generally well-performing enterprises in the industry; and for listed companies, they also have a stronger motivation and strength to accomplish the goal of improving the sustainable development capability than other enterprises. To this end, we estimated propensity scores by logit modeling to artificially match treatment and control groups with smaller differences in characteristics to overcome estimation distortions due to bias in sample selection. We used 1:1 nearest neighbor matching (NNM) with the caliper range of 0.05 and obtained a t-statistic of 2.29 for the average treatment effect (ATT) after matching, indicating that the treatment effect remained significant after balanced matching of the samples. It should be noted that the plausibility of the propensity score matching method is based on the common support assumption and the balance condition. To ensure the credibility and stability of the estimation results, this paper verifies the matching quality through the common interval assumption and the matching balance test, respectively. First, Figure 3 presents the distribution of propensity scores before and after matching. Before matching (left figure), the probability distributions of propensity scores of the samples in the treatment and control groups differ greatly; while after matching (right figure), the kernel density distributions between the two groups of samples are more consistent and the common support region is larger, thus fulfilling the requirements of the common interval hypothesis. Figure 4 shows the results of the balance test, the standardized deviations of most variables are significantly reduced after matching, indicating that the matching process balances the distribution of observable variables between the treatment and control groups. In summary, the above test shows that the matching method used in this paper is reasonable and ensures the reliability of the results.

After verifying the validity of the propensity score matching method in this paper, we resubstitute the matched samples into Equation (1) for regression and obtain the results as shown in column (3) of Table 4. It can be seen that the coefficient of DID*PES is significantly positive, indicating that the conclusion above still holds after excluding selection bias.

(4) Replacing indicators of environmental supervision intensity

Considering that there are many alternative indicators that can be used to measure citizens' environmental supervision intensity, in order to test the robustness of the results of the baseline regression, this paper refers to the study of Shen and Jin (2020), and selects the geometric average of the number of environmental letters and visits and environmental proposals submitted by National People's Congress deputies with the population density of the region to represent the citizens' environmental supervision intensity of the region, respectively. The data are from the Ministry of Ecology and Environment, China Statistical Yearbook, China Environmental Yearbook and China Environmental Statistics Bulletin.

The results obtained by replacing the original indicators with the above data are shown in columns (4) and (5) of Table 4. It can be noticed that the coefficient sign and significance of the interaction terms do not change compared to the baseline regression.

(5) Changing the ESG assignment methodology

In some literature, instead of using a nine-point assignment system from 1 to 9 to assign values to firms' ESG ratings, a three-point system is used, i.e., when firms' ratings are AAA, AA, and A, they are all assigned 3 points, BB, BB, and B are 2 points, and CCC, CC, and C are 1 point. In order to test the robustness of the findings, this paper re-assigns ESG using the above scheme and conducts the regression analysis again, and the results are shown in column (6) of Table 4. It can be seen that the coefficient sign and significance of the re-obtained interaction terms remain consistent with those in the baseline regression.

(6) Excluding other policy interference

In order to avoid that other policies during the sample period would affect firms' ESG performance and cause bias in the baseline estimation results, this study identifies two policies that may affect firms' ESG ratings during the sample period by collecting and combing through documents: the Announcement on the Implementation of Special Emission Limits for Air Pollutants enacted in 2013, and the Central Environmental Protection Inspection System that started in 2016. To exclude the interference of these two policies on the research results, dummy variables for these policies are added to the benchmark regression. The variable AIPO indicates whether the city where the enterprise is located is within the scope of air pollutant emission limits, and takes 1 if it is, and 0 if it is not. The Central Environmental Protection Inspectorate, which started in 2016, has achieved full coverage of heavy pollutants in all provinces since its implementation, and consolidated its long-term effect through the mechanism of irregular “looking back.” Based on this, this paper sets the variable CEPI, if the enterprises in the sample belong to the heavy pollution industry7 after 2016, then CEPI is assigned the value of 1, otherwise it is 0. After adding the dummy variables of these policies in the baseline regression, the regression results are shown in columns (7) and (8) of Table 4, and the synergistic effect remains significant.

(7) Excluding non-manufacturing industry enterprises in the experimental group

Existing studies examining the impact of the carbon market pilots have concluded that this policy mainly affects eight major energy-consuming industries (petrochemicals, chemicals, building materials, iron and steel, non-ferrous metals, paper-making, electricity and aviation) (Liu and Zhang, 2017). According to the officially disclosed list of pilot enterprises, the emission control subjects of the Beijing and Shanghai pilots include some enterprises in the production service industry and living service industry, while the pilot enterprises in other pilot regions basically belong to the industrial industry. Compared with industrial enterprises, there are relatively few green transition measures in the service industry, which may affect the estimation results. Therefore, this paper excludes the non-industrial enterprises in the experimental group and then re-estimates Equation (1). According to the regression results in column (9) of Table 4, after excluding non-industrial enterprises in the experimental group, the regression result of DID*PES is still significantly positive, indicating that the above conclusion is robust.

(8) Adding firm, year, industry, city joint fixed effects and interaction fixed effects terms

In order to reduce the impact of endogeneity due to omitted variables on the model estimation results, this paper continues to add industry fixed effects, city fixed effects, and industry and year interaction fixed effects to the model for regression estimation on the basis of Equation (1), and the results are shown in columns (10) and (11) of Table 4. The results reconfirm the robustness of the above results.

Through the above series of robustness tests, we find that the econometric analysis and qualitative description can corroborate each other, and the empirical results can support the logic of the theoretical analysis. At least from the perspective of listed companies, carbon trading policy and citizens' environmental supervision can indeed generate synergistic effects, and this synergistic effect can significantly promote the ESG performance of companies.

4.4 Heterogeneity analysis

In order to examine whether the synergistic effects of the carbon trading policy and citizen supervision are heterogeneous under different scenarios, the firms in the sample are categorized according to three dimensions: regional development level,8 cost transfer ability,9 and political connections.10 Considering that differences in the three indicators mentioned above of firms have an impact on the effectiveness of the implementation of individual environmental regulation policies, such as carbon trading policies (Zhang et al., 2020; Su et al., 2022; Tao et al., 2023), will the synergistic effect of the two environmental regulations also be affected by the differences in the nature of enterprises in the above three aspects after adding citizens' environmental supervision? This question will be answered in this section.

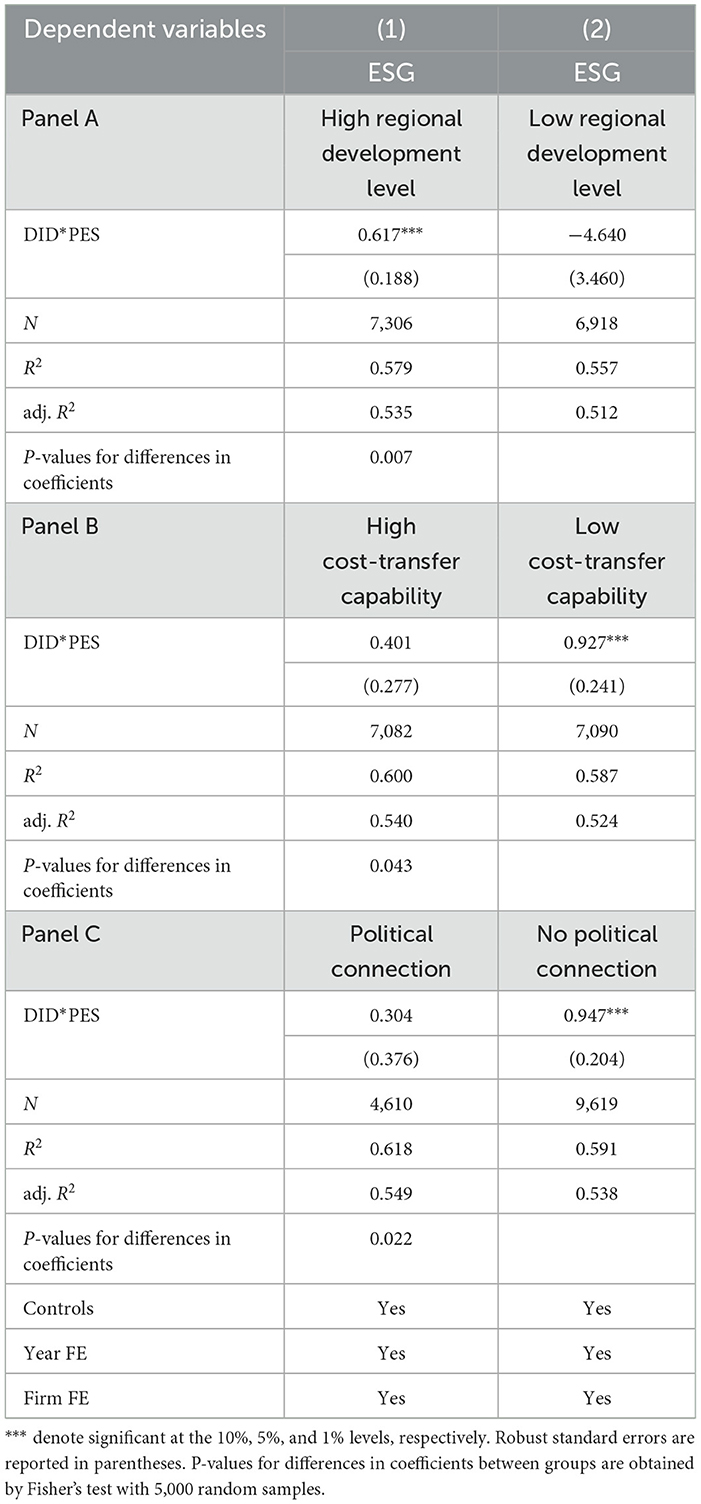

The results of the heterogeneity test are shown in Table 5. According to the results in Panel A of Table 5, it can be found that the differences in the geographical location, economic development level and resource endowment of the regions make the synergistic governance of environmental regulation significantly show different effectiveness in enterprises of different regions. The more economically developed regions, after a phase of rapid development, are now gradually shifting to a phase of high-quality development characterized by energy efficiency and sustainability, and the pressure on the performance of economic growth has been alleviated. In the contradiction between environmental protection and economic development, the increased priority of environmental protection has led to a big difference between these regions and other regions still focusing on economic growth in terms of governmental governance goals, enforcement of environmental regulatory policies, environmental information disclosure, public environmental awareness and participation in environmental supervision, leading to a good collaboration and complementarity between the carbon trading policy and citizen supervision in these regions, and jointly promoting the transformation of enterprises to a sustainable development model. Based on the results in Panel B of Table 5, it can be found that differences in firms' ability to pass on costs make the synergistic governance of environmental regulation significantly show different results. The reason why differences in cost-shifting ability can affect the synergistic effectiveness of the two types of environmental regulation is that a strong cost-shifting ability allows firms to pass on some or all of the costs of environmental compliance to downstream firms or consumers in the marketplace, reducing the incentive constraints on emission reductions created by environmental regulation, and thus affecting the pressures and incentives of firms to improve their productivity and change their development patterns. Based on the results in Panel C in Table 5, it can be found that the differences in the political connection of firms make the synergistic governance of environmental regulation significantly show different effectiveness. The main reason for this result is that, through the establishment of government-enterprise relations, enterprises can obtain political resources, which, to a certain extent, will make enterprises intentionally avoid social responsibility, distort environmental performance (De Villiers et al., 2011), and provide a refuge for non-compliant companies to avoid penalties, thus making enterprises ignore the pressure that their own production causes to the social environment. In contrast, firms that are less closely related to government may be subject to stricter behavioral oversight, resulting in the synergistic governance effects of environmental regulation being more fully realized in these firms.

4.5 Mechanism analysis

Through the theoretical analysis in Section 2, it can be found that the synergistic governance effect of carbon trading policy and public environmental supervision enhances the ESG performance of firms by influencing their R&D and innovation investment, resource allocation efficiency, and sustainability awareness. In order to test whether this view is valid at the micro enterprise level in reality, referring to Sun and Zhong (2020), Wang R. et al. (2022), and Li et al. (2023), this paper uses firms' R&D investment intensity11 (RDI), total factor productivity12 (TFP), and executives' awareness of sustainable development13 (EAS) to measure firms' R&D and innovation investment, resource allocation efficiency, and sustainable development awareness, respectively. The mechanism test model is set up as follows:

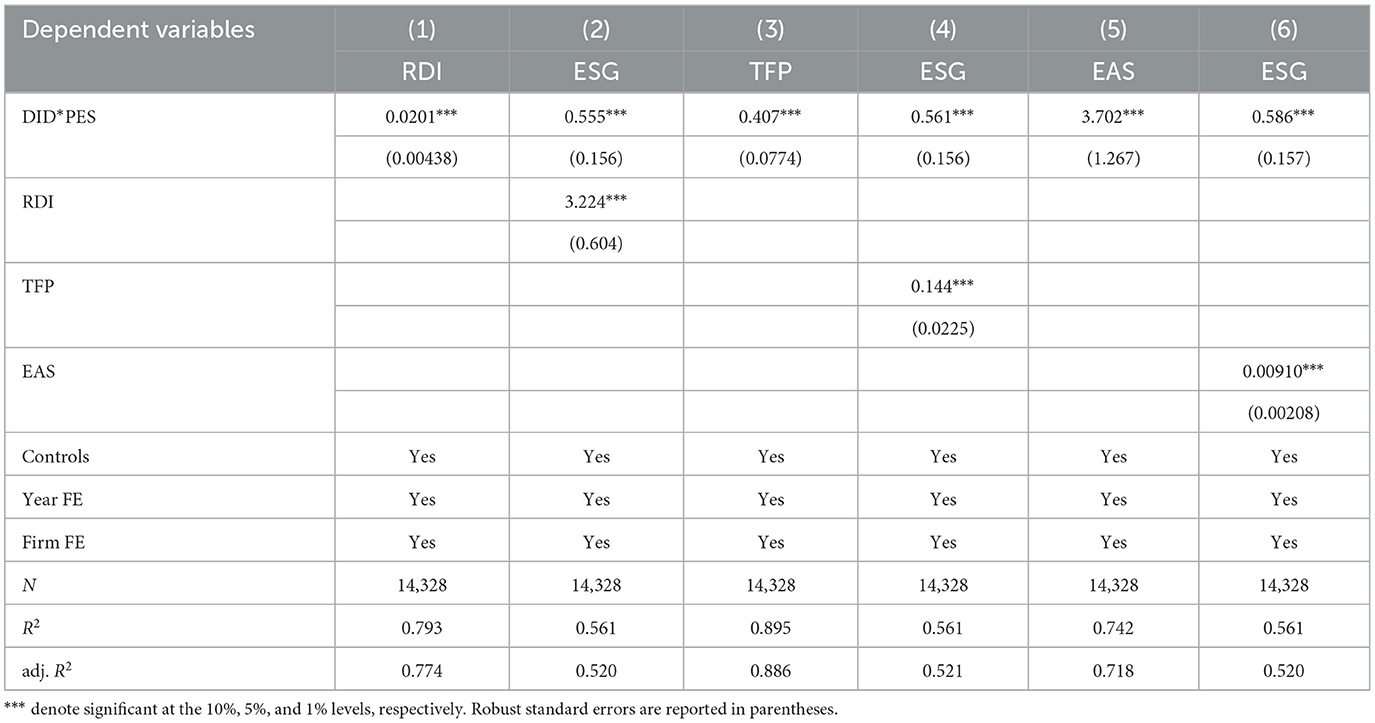

In Equations (4, 5), Mediatorit represents the mediator variables, i.e., RDI, TFP, and EAS; the other variables are consistent with those in Equation (1). The regression results of the model are shown in Table 6. From the results in columns (1) and (3), we can find that the coefficients of DID*PES are all significantly positive, which indicates that under the joint effect of the two environmental regulations, the affected enterprises, forced by the external compliance pressure, begin to increase the attention to the green development mode, increase the investment in the transformation of R&D, and actively regulate the internal resource allocation to adapt to the new social environment, while the concept of sustainable development is also gradually popular among the management. Columns (2) and (3) show the regression results of model (3), from which it can be found that the estimated coefficients of DID*PES become smaller compared with the baseline regression results after introducing the mechanism variables RDI, TFP, and ESP respectively, but they are still significantly positive at 1% level, and the mechanism variables RDI, TFP, and ESP pass the test of significance, which indicates that the path of the impact through the mediating variables does exist. The research hypothesis H2 in Section 2 is confirmed.

5 The impact of informal environmental regulation on the synergy effect

Above, we have focused on the synergistic governance effects of the carbon trading policy and citizen supervision. However, the implementation effects of unilateral formal or informal environmental regulations can also have obvious influence on the synergy of the two. Considering that most of the previous literature has focused on the carbon trading policy, and little attention has been paid to the role of citizen supervision, especially its complementary and moderating effect on the carbon trading policy, so this paper shifts the focus to citizen supervision and analyzes it further in the following section.

5.1 Regional legal environment

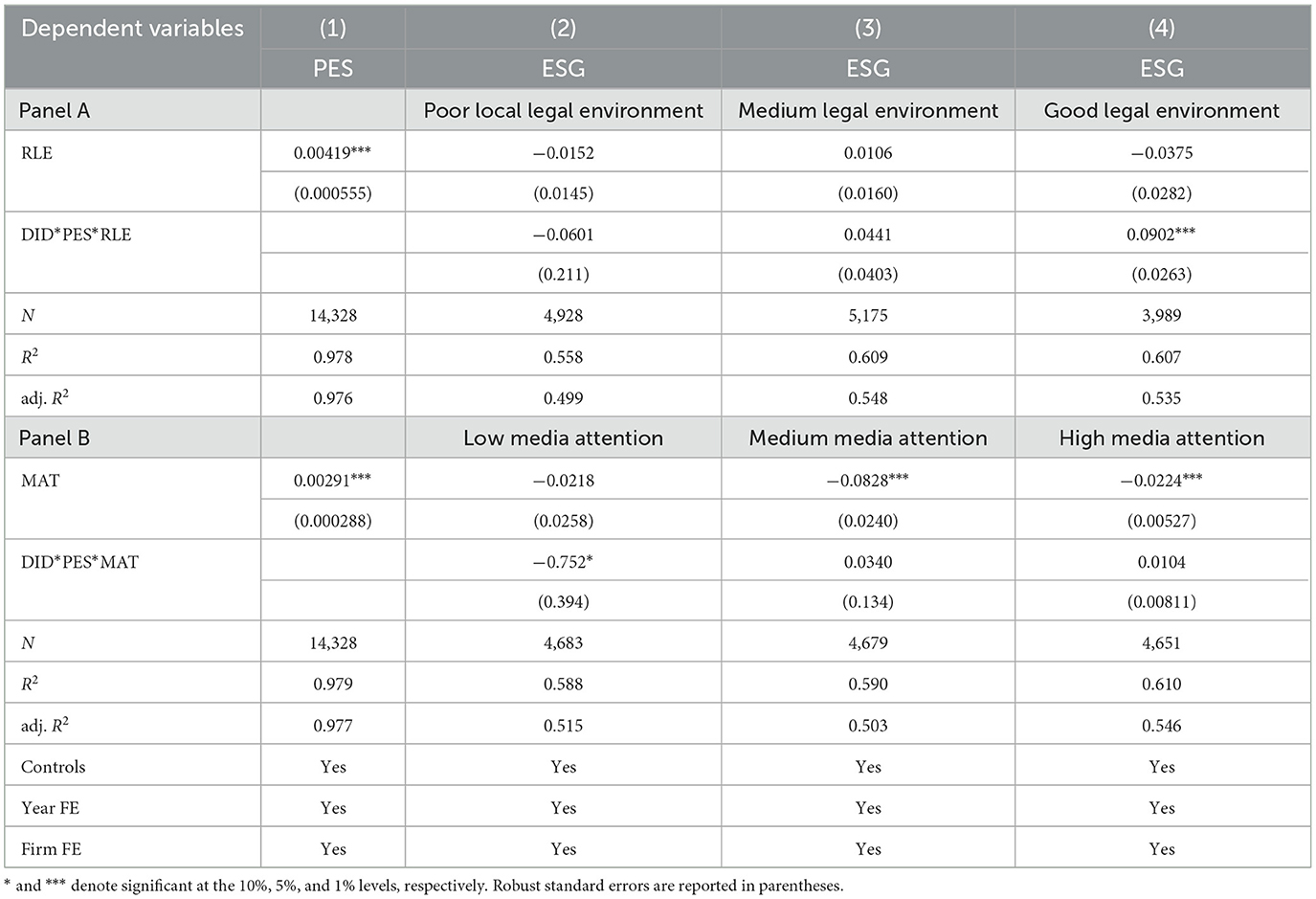

The effective organization and implementation of citizens' supervision activities depend on a good legal environment. The legal environment is the basic system for maintaining and safeguarding the productive forces and relations of production, and a good legal environment can effectively monitor the exercise of government power, reduce illegal and redundant approval processes, and improve the efficiency of public environmental supervision (Zhao et al., 2022). In contrast, in regions with a low degree of rule of law, government processes are lengthy, public appeals and petitions are not responded to positively by the government, and companies may adopt symbolic and passive implementation of government policies, resulting in “implementation bias” of policies, thus weakening the effect of public scrutiny on the enhancement of companies' ESG performance. Based on this, this paper expects that in areas with a good legal environment, the synergistic governance of environmental regulations will have a more significant impact on the ESG performance of enterprises, as the public's environmental supervision power is better guaranteed. In order to verify this assumption, this paper refers to the practice of Wan (2013), adopts the score of market intermediary organization maturity and legal system environment in the marketization index14 to measure the regional legal environment (RLE). We divide enterprises into good legal environment group, medium legal environment group and poor legal environment group according to the annual scores of the province where the enterprise is located, and add the interaction term of RLE and environmental regulation in the model, to analyze the influence of regional legal environment on the effectiveness of the synergistic governance of environmental regulation. The regression results are shown in Panel A of Table 7. It can be found that a favorable regional rule of law environment not only effectively guarantees citizens' supervisory power and strengthens their role in environmental supervision, but also promotes the synergistic governance effect of environmental regulation. The results in columns (2), (3), and (4) of Panel A show that the synergistic governance effects of environmental regulation are more clearly and fully reflected as the rule of law environment continues to improve and citizens' power to monitor is safeguarded. A good regional legal environment can strengthen the effect of the synergy between the two to promote the transformation of enterprises to a sustainable development model; on the contrary, when the regional legal environment is weak, the synergistic effect cannot be effectively exerted, and it is difficult for market-incentivized carbon reduction policies and public scrutiny to form a comprehensive regulatory synergy to promote firm transformation.

5.2 Media attention

Public understanding and monitoring of environmental incidents and polluting behaviors can be largely influenced by media coverage. The media, as an important intermediary of the information transmission function, is an important channel for the public to know the real production and operation behaviors of the company in a timely manner, and its huge public opinion guiding and mobilizing ability plays an important role in the process of public understanding and judging of enterprises (Fang and Peress, 2009). The media's reporting attitude and number of reports on enterprises directly affect the public's attention level and evaluation attitude toward enterprises (Gatewood and Carroll, 1991). At the same time, the existence of the news media has well alleviated the problem of information asymmetry between the various stakeholders of the enterprise, and has become an important channel for enterprise stakeholders to obtain information about the enterprise (Dyck et al., 2008; Bednar et al., 2013). Therefore, this paper argues that media coverage plays an important role in effectively exerting the role of public environmental supervision and the synergistic effect of various environmental regulation methods. Based on the above analysis, we adopt the number of media reports15 in the CNRDS database to quantify the degree of media attention (MAT) for enterprises. According to the annual media attention of enterprises, enterprises are divided into high media attention group, medium media attention group and low media attention group and the interaction term between MAT and environmental regulation is added to the model to analyze the effect of media attention on the effectiveness of synergistic governance between the two. The regression results are shown in Panel B of Table 7. Based on the regression results, it can be seen that media reports help citizens to be informed of potential or ongoing environmental violations by enterprises in a timely manner, ensure the public's right to know, and assist the public in better fulfilling their duty to monitor the environment. From the results in columns (2), (3), and (4) of Panel B, the coefficient is significantly negative for enterprises with low media attention, indicating that low-intensity media exposure will weaken the synergistic effect of environmental regulations. Among firms with medium and higher levels of media attention, although the coefficient on DID*PES*MAT is not significant, the sign is positive, consistent with the analysis above. Considering the negative impact that excessive media exposure may have on firms and the fact that various firms may have different attitudes toward different types of news under different circumstances, the reinforcing effect of media coverage on policy synergies may vary considerably across firms, resulting in the coefficients of DID*PES*MAT failing to pass the significance requirement is also possible.

6 Conclusions, implications and limitations

6.1 Conclusions

The complementary role and synergistic governance of carbon trading policy and citizens' environmental supervision play an important role in promoting the transformation of corporate development model and sustainable economic and social development. This paper utilizes the micro data of China's A-share non-financial listings from 2009 to 2020 to test the facilitating effect of the synergistic governance of the two environmental regulation methods on the ESG performance of enterprises and its influencing mechanism from both theoretical and empirical perspectives. The paper concludes with the following four main points: first, the synergy between carbon trading policies and citizen environmental monitoring can significantly contribute to better ESG performance by firms, with particular attention to the role of citizen environmental monitoring, which contributes significantly to the synergistic effects of environmental regulation. Second, the results of the heterogeneity analysis show that the regional development level where the firm is located, the firm's ability to pass on costs, and the firm's political connection all make the synergies of environmental regulation vary across firms. Specifically, the synergistic effects of the carbon trading policy and citizens' environmental monitoring can be more fully demonstrated in firms that are located in economically developed regions, have limited cost transfer capabilities, and have low political connection attributes. The mechanism analysis reveals that the synergistic effect of the two environmental regulation approaches drives the behavior of enterprises to improve their ESG scores by influencing their R&D and innovation investment, resource allocation efficiency, and sustainable development awareness. Finally, this paper further investigates the role of citizen supervision, especially the complementary and moderating role of citizen supervision for the carbon trading policy, and we find that a favorable regional rule of law environment and moderate media attention can effectively increase the intensity of citizen environmental supervision, and at the same time strengthen the effectiveness of synergistic governance of environmental regulation in the transformation and development of enterprises.

6.2 Implications

Our study provides new implications for policymakers. First, local administrators should strategically focus on the complementary and synergistic effects of citizen supervision on policy-based environmental regulation. Based on the findings above, a formal environmental regulatory policy can achieve better results when it is implemented in areas where public participation in governance is more adequate. Therefore, policymakers should give full play to public participation in environmental governance, and safeguard and broaden the channels for public feedback and suggestions to improve governance efficiency. Second, local governments need to have a clear understanding of the social governance goals while developing the economy, avoid the excessive tendency of resource allocation toward short-term low-quality economic development, control the strength of environmental regulation policy implementation, improve the level of environmental information disclosure, create a good political and business environment, eliminate collusion between government and enterprises, and effectively stimulate public environmental awareness and participation in environmental supervision to provide a favorable social environment for environmental regulation and citizen supervision to play a role. Third, given the impact of the local rule of law environment and media news on the effectiveness of public scrutiny, local governments need to actively create a favorable rule of law environment on the one hand; on the other hand, they also need to provide proper guidance on media reporting, which not only alleviates the friction of information faced by the market and creates a kind of strong supervision of corporate pollution and corruption, but also echoes the public's environmental concerns and promotes the practice of ESG by corporations.

6.3 Limitations

First, this paper examines the synergistic effects of carbon trading policies and citizen environmental monitoring based on data from listed firms in China. However, listed firms are only a portion of all firms. Although we use propensity scores to artificially match the sample to mitigate the effects of selection bias, using the actual sample of all firms to obtain the results may be more helpful in revealing the impact of such synergies on the sustainable development of firms, which is a direction that can be complemented by future research.

Second, the carbon trading policy has attracted widespread attention in the academic community as a governance policy that is currently being promoted by the Chinese government in order to achieve the goal of reducing carbon emissions. However, the synergies between other similar government-enacted environmental policies and informal regulation are also worthy of attention. Therefore, future research can further integrate more environmental governance policies and citizen monitoring into an analytical framework to form the concept of an environmental governance system, and compare the differences in connotations, synergistic mechanisms, and paths to realization of such a system in different historical periods and different national contexts, which is very necessary at the moment when the impact of national development strategies and geopolitical implications on the ecological environment is becoming increasingly obvious (Cao et al., 2024).

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JC: Conceptualization, Investigation, Methodology, Software, Writing – original draft, Writing – review & editing. WY: Conceptualization, Formal analysis, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Listed companies are included in the scope of carbon trading pilot including three cases: (1) listed enterprises' parent enterprises are carbon trading pilot enterprises; (2) listed enterprises' subsidiaries are carbon trading pilot enterprises; (3) listed enterprises themselves are carbon trading pilot enterprises.

2. ^SNSI ESG Rating data is available on the official website (https://www.chindices.com/esg-ratings.html).

3. ^In general, the higher the income level, the stronger the public demand for a high-quality living environment. Higher-income areas have a higher level of concern about the impacts of environmental pollution than poorer areas. Pargal and Wheeler's study showed that higher-income neighborhoods in the U.S. have significantly lower pollution emissions, possibly because income level affects the public's preference for environmental quality and its ability to pressure polluters; the higher the level of income, the greater the power of lobbying to the government or to polluters. In this paper, we use the average wage of urban on-the-job workers to measure the income level of each province.

4. ^The higher the level of education, the greater the awareness of environmental protection and the higher the level of public concern for environmental quality. If the education level of the population in a region is generally low, the public's awareness and ability to resist the polluting behavior of manufacturers are weak, and the polluting manufacturers will tend to move to regions with lower education levels because it is easier to hire labor. In this paper, the proportion of employed people with junior college education or above in each province is chosen as a measure to portray the greater influence of higher education in citizens' participation in environmental monitoring.

5. ^Higher population density means that more people are affected by the negative externalities of environmental pollution and more people are involved in environmental monitoring.

6. ^Provinces with a high proportion of young population are more concerned about pollution and have a higher level of participation in environmental NGOs. In this paper, the proportion of population under 15 years old is selected as the age structure variable.

7. ^The division between heavily polluting industries and non-heavily polluting industries is mainly based on the Guidelines for Disclosure of Environmental Information of Listed Companies issued by the Ministry of Ecology and Environment of China in 2010 and the new industry categorization standards formulated by the Securities and Futures Commission (SFC) in 2012. Specifically, heavily polluting industries include 16 categories of industries, including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, chemicals, petrochemicals, building materials, papermaking, brewing, pharmaceuticals, fermentation, textiles, tanning and mining.

8. ^Referring to Zhang et al. (2020), this paper categorizes firms in China's eastern coastal region into the high regional development level group, while others are categorized into the low regional development level group.

9. ^Referring to Su et al. (2022), this paper utilizes the Lerner index to measure the cost transfer capability of firms. Firms are categorized into the strong cost transfer capability group if their cost transfer capability is above the annual median; otherwise, they are categorized into the weak cost transfer capability group.

10. ^Referring to Tao et al. (2023), this paper categorizes firms into the close government-enterprise connection group and the less close connection group based on whether any one of the firm's chairman and general manager is or has been a government official.

11. ^The specific calculation of RDI is: . Data on corporate R&D expenditures comes from company annual reports.

12. ^TFP is calculated by the Olley-Pakes method (OP).

13. ^Based on the three dimensions of green competitive advantage cognition, corporate social responsibility cognition, and external environmental pressure perception, we select 19 keywords about environmental protection and sustainable development and measure EAS by the frequency of the keywords appearing in the annual reports of listed companies from 2009 to 2020.

14. ^Marketization Index is provided by the China Marketization Index Database (https://cmi.ssap.com.cn/).

15. ^The number of media reports is obtained by quantitatively counting the frequency of the company's appearances in newspaper news and online news throughout the year.

References

Bednar, M. K., Boivie, S., and Prince, N. R. (2013). Burr under the saddle: how media coverage influences strategic change. Organ Sci. 24, 910–925. doi: 10.1287/orsc.1120.0770

Calel, R., and Dechezleprêtre, A. (2016). Environmental policy and directed technological change: evidence from the European carbon market. Rev. Econ. Stat. 98, 173–191. doi: 10.1162/REST_a_00470

Cao, Q., Feng, Z.-Y., Yang, R.-Z., and Yang, C.-Y. (2024). Conflict and natural resource condition: an examination based on national power heterogeneity. Resour. Policy 89:104549. doi: 10.1016/j.resourpol.2023.104549

De Villiers, C., Naiker, V., and Van Staden, C.-J. (2011). The effect of board characteristics on firm environmental performance. J. Manage. 37, 1636–1663. doi: 10.1177/0149206311411506

Dyck, A., Volchkova, N., and Zingales, L. (2008). The corporate governance role of the media: evidence from Russia. J. Financ. 63, 1093–1135. doi: 10.1111/j.1540-6261.2008.01353.x

Fang, L., and Peress, J. (2009). Media coverage and the cross-section of stock returns. J. Financ. 64, 2023–2052. doi: 10.1111/j.1540-6261.2009.01493.x

Fatemi, A., Glaum, M., and Kaiser, S. (2018). ESG performance and firm value: the moderating role of disclosure. Glob. Financ. J. 38, 45–64. doi: 10.1016/j.gfj.2017.03.001

Gatewood, R. D., and Carroll, A. B. (1991). Assessment of ethical performance of organization members: a conceptual framework. Acad. Manage. Rev. 16:667. doi: 10.2307/258976

Giannetti, M., Liao, G., and Yu, X. (2015). The brain gain of corporate boards: evidence from China. J. Financ. 70, 1629–1682. doi: 10.1111/jofi.12198

Giese, G., Lee, L.-E., Melas, D., Nagy, Z., and Nishikawa, L. (2019). Foundations of ESG investing: how ESG affects equity valuation, risk, and performance. J. Portf. Manage. 45, 69–83. doi: 10.3905/jpm.2019.45.5.069

Goldar, B., and Banerjee, N. (2004). Impact of informal regulation of pollution on water quality in rivers in India. J. Environ. Manage. 73, 117–130. doi: 10.1016/j.jenvman.2004.06.008

Gu, G., Zheng, H., Tong, L., and Dai, Y. (2022). Does carbon financial market as an environmental regulation policy tool promote regional energy conservation and emission reduction? Empirical evidence from China. Energy Policy 163:112826. doi: 10.1016/j.enpol.2022.112826

Gu, Y., Ho, K.-C., Xia, S., and Yan, C. (2022). Do public environmental concerns promote new energy enterprises' development? Evidence from a quasi-natural experiment. Energy Econ. 109:105967. doi: 10.1016/j.eneco.2022.105967

Hofstede, G. (1998). Attitudes, values and organizational culture: disentangling the concepts. Organ. Stud. 19, 477–493. doi: 10.1177/017084069801900305

Hu, Y., and Yang, C. (2021). Can dual environmental regulation facilitate industrial RandD efforts? Sci. Technol. Ind. 12, 186–192. Available online at: http://qikan.cqvip.com/Qikan/Article/Detail?id=7106318677 (in Chinese).

Ide, T., Fröhlich, C., and Donges, J. F. (2020). The economic, political, and social implications of environmental crises. Bull. Amer. Meteorol. Soc. 101, E364–E367. doi: 10.1175/BAMS-D-19-0257.1

Jia, Z. (2023). What kind of enterprises and residents bear more responsibilities in carbon trading? A step-by-step analysis based on the CGE model. Environ. Impact Assess. Rev. 98:106950. doi: 10.1016/j.eiar.2022.106950

Jiang, Z., Wang, Z., and Lan, X. (2021). How environmental regulations affect corporate innovation? The coupling mechanism of mandatory rules and voluntary management. Technol. Soc. 65:101575. doi: 10.1016/j.techsoc.2021.101575

Kathuria, V. (2007). Informal regulation of pollution in a developing country: evidence from India. Ecol. Econ. 63, 403–417. doi: 10.1016/j.ecolecon.2006.11.013

Li, J., and Li, S. (2022). Environmental protection tax, corporate ESG performance, and green technological innovation. Front. Environ. Sci. 10:982132. doi: 10.3389/fenvs.2022.982132

Li, S., and Li, T. (2021). Improvement and reform direction of complex environmental policy instrument system: a theoretical analytical framework. J. Sun Yat-sen Univ. 2, 155–165. doi: 10.13471/j.cnki.jsysusse.2021.02.017 (in Chinese).

Li, W., and Lu, C. (2015). The research on setting a unified interval of carbon price benchmark in the national carbon trading market of China. Appl. Energy 155, 728–739. doi: 10.1016/j.apenergy.2015.06.018

Li, Y., Xia, Y., and Zhao, Z. (2023). The impact of executives' green perceptions on firm performance in heavy pollution industries: a moderated mediation effect model. Sci. Technol. Prog. Policy 40, 113–123. Available online at: https://xueshu.baidu.com/usercenter/paper/show?paperid=1k210jw0676f0pb0nh520te00h039245&site=xueshu_se (in Chinese).

Li, Z., and Bai, X. (2020). How does industrial policy promote green total factor productivity improvement in manufacturing industry? — a perspective based on the synergy of incentive and restrictive policies. Ind. Econ. Res. 6, 28–42. doi: 10.13269/j.cnki.ier.2020.06.003 (in Chinese).

Li, Z., Ruan, D., and Zhang, T. (2020). Value creation mechanism of corporate social responsibility: a study based on internal control perspective. Acct. Res. 11, 112–124. Available online at: http://qikan.cqvip.com/Qikan/Article/Detail?id=7104314782 (in Chinese).

Liu, G., Lee, C., and He, L. (2016). The synergistic effects between insurance and credit markets on economic growth: evidence from China. Global Econ. Rev. 45, 1–18. doi: 10.1080/1226508X.2015.1075897

Liu, M., and Li, Y. (2022). Environmental regulation and green innovation: evidence from China's carbon emissions trading policy. Financ. Res. Lett. 48:103051. doi: 10.1016/j.frl.2022.103051

Liu, Y., and Zhang, X. (2017). Carbon emission trading system and corporate RandD innovation — an empirical study based on triple difference modeling. Econ. Sci. 3, 102–114. doi: 10.19523/j.jjkx.2017.03.008 (in Chinese).

Lu, J., Wang, T., and Liu, X. (2023). Can environmental governance policy synergy reduce carbon emissions? Econ. Anal. Policy 80, 570–585. doi: 10.1016/j.eap.2023.09.003

Lu, M. (2021). The impact of formal and informal environmental regulation on the environmental performance and economic performance of Chinese manufacturing industry. Statistics Manage. 9, 10–17. doi: 10.16722/j.issn.1674-537x.2021.09.004 (in Chinese).

Ma, G., Liang, M., and Sun, W. (2022). Effect analysis of carbon information on enterprise value based on big data. Math. Probl. Eng. 2022, 1–11. doi: 10.1155/2022/4406064

Ni, X., Jin, Q., and Huang, K. (2022). Environmental regulation and the cost of debt: evidence from the carbon emission trading system pilot in China. Financ. Res. Lett. 49:103134. doi: 10.1016/j.frl.2022.103134

Niyommaneerat, W., Suwanteep, K., and Chavalparit, O. (2023). Sustainability indicators to achieve a circular economy: a case study of renewable energy and plastic waste recycling corporate social responsibility (CSR) projects in Thailand. J. Clean Prod. 391:136203. doi: 10.1016/j.jclepro.2023.136203

Pargal, S., and Wheeler, D. (1996). Informal regulation of industrial pollution in developing countries: evidence from Indonesia. J. Polit. Econ. 104, 1314–1327. doi: 10.1086/262061

Ren, S., Zheng, J., Liu, D., and Chen, X. (2019). Does the emission right trading mechanism improve firms' total factor productivity — evidence from listed companies in China. China Ind. Econ. 5, 5–23. doi: 10.19581/j.cnki.ciejournal.2019.05.001 (in Chinese).

Shen, H., and Feng, J. (2012). Public opinion supervision, government regulation and corporate environmental information disclosure. Acct. Res. 2, 72–78. Available online at: https://www.docin.com/p-940668687.html (in Chinese).

Shen, H., and Jin, D. (2020). Can informal environmental regulation promote RandD in industrial firms — an analysis based on threshold modeling. Sci. Technol. Prog. Policy 37, 106–114. Available online at: http://qikan.cqvip.com/Qikan/Article/Detail?id=7100893563&from=Qikan_Search_Index (in Chinese).

Shive, S. A., and Forster, M. M. (2020). Corporate governance and pollution externalities of public and private firms. Rev. Financ. Stud. 33, 1296–1330. doi: 10.1093/rfs/hhz079

Su, T., Meng, L., and Zhang, J. (2022). China's carbon market pilot and green transformation of enterprises: role effect and mechanism analysis. RandD Manage. 34, 81–96. doi: 10.13581/j.cnki.rdm.20211882 (in Chinese).

Sun, H., and Zhong, X. (2020). Impact of financial RandD resource allocation efficiency based on VR technology and machine learning in complex systems on total factor productivity. Complexity 2020, 1–15. doi: 10.1155/2020/6679846