- 1First Street Foundation, Brooklyn, NY, United States

- 2Department of Geographical and Sustainability Sciences, University of Iowa, Iowa City, IA, United States

- 3Department of Public Administration and National Center for Integrated Coastal Research, University of Central Florida, Orlando, FL, United States

Disaster recovery spending for major flood events in the United States is at an all-time high. Yet research examining equity in disaster assistance increasingly shows that recovery funding underserves vulnerable populations. Based on a review of academic and grey literature, this article synthesizes empirical knowledge of population disparities in access to flood disaster assistance and outcomes during disaster recovery. The results identify renters, low-income households, and racial and ethnic minorities as populations that most face barriers accessing federal assistance and experience adverse recovery outcomes. The analysis explores the drivers of these inequities and concludes with a focus on the performance of disaster programs in addressing unmet needs, recognition of intersectional social vulnerabilities in recovery analysis, and gaps in data availability and transparency.

Introduction

The US government distributes billions of dollars in recovery assistance each year to communities impacted by flood disasters. With recent increases in the frequency and severity of coastal storms and inland flooding (Jay et al., 2018) these costs are rising rapidly. In 2017 alone, following Hurricanes Harvey, Irma, and Maria, US federal disaster spending reached record highs, with total appropriations surpassing $130 billion dollars (Lingle et al., 2018). The growing footprint of flood disasters is particularly concerning for socially vulnerable populations, who disproportionally bear adverse impacts (National Academies of Sciences, 2019; US Water Alliance, 2020; Tate et al., 2021). However, research examining the social equity of disaster assistance indicates that recovery spending underserves populations who need it most (Muñoz and Tate, 2016; Emrich et al., 2020; Drakes et al., 2021; GAO, 2021). As a countermeasure, new federal government directives call for broad policy change toward equitable distribution of resources for underserved communities (Executive Order 13986, 2021). Empirical findings of how flood recovery and disaster assistance vary across affected populations are salient to support this direction. Unfortunately, such findings largely remain siloed, spanning research articles in multiple academic disciplines, and reports by government agencies, non-governmental organizations, and think tanks. Synthesizing this understanding is critical to support policy remedies.

Media narratives of disaster recovery increasingly portray a broken system fraught with inequities. Headlines like “How Federal Disaster Money Favors the Rich” (Hersher and Benincasa, 2020) and “How Disaster Aid Favors White People” (Flavelle, 2021) reflect growing attention to unequal benefits of disaster recovery spending, particularly for socially vulnerable populations. Recent academic research has found US disaster spending may reinforce inequities (Elliott et al., 2020; Emrich et al., 2020) or even widen existing inequality (Howell and Elliott, 2019; Ratcliffe et al., 2019). The premises underlying these conclusions are two-fold. First, certain populations face greater barriers in accessing recovery assistance, driven by eligibility restrictions, procedural inequality, and application complexity (American Flood Coalition, 2020). Second, post-disaster assistance is less likely to address the needs of socially vulnerable populations, resulting in slower and incomplete recoveries (SAMHSA, 2017; Mickelson et al., 2019). Both assertions are supported by empirical data, case studies, and anecdotal reports. Less clear are their generalizability across flood disasters and the extent to which federal recovery programs contribute to negative outcomes for vulnerable populations.

This study examines the state of knowledge regarding access to flood disaster assistance and recovery outcomes for socially vulnerable populations. We use the term “assistance” to refer to federal government funds granted or loaned to individuals and families for disaster recovery and rebuilding. We focus on two interrelated questions: Who faces the greatest barriers accessing recovery assistance and who experiences adverse outcomes during recovery? Via comprehensive review of academic articles and grey literature, we synthesize empirical knowledge at the nexus of US flood disaster impacts, federal recovery programs, and socially vulnerable populations.

US Disaster Recovery Programs

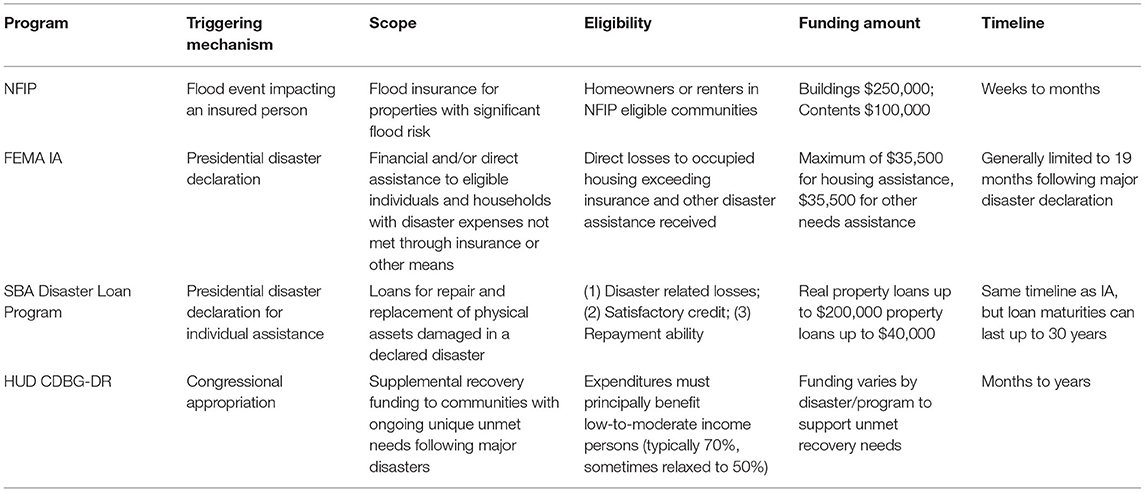

Four federal programs dominate the disaster recovery landscape for individual households: The National Flood Insurance Program (NFIP), the Individual Assistance (IA) Program of the Federal Emergency Management Agency (FEMA), the Small Business Administration (SBA) Disaster Loan Program, and the Community Development Block Grant Disaster Recovery (CDBG-DR) Program of the Department of Housing and Urban Development (HUD). Basic details for each program are included in Table 1. While each program is unique in its scope, eligibility, funding ceiling, and implementation timeline, these programs form what has been referred to as the “Disaster Recovery Safety Net” (Emrich et al., 2020). Contrary to common perception, federal recovery assistance to households is limited in both size and scope (Kousky and Shabman, 2012), and a significant amount is allocated in delayed supplementary appropriations that support longer-term recovery of affected populations (Kousky and Shabman, 2017). The totality of recovery resources an area receives can take years to administer, with regulation and compliance measures complicating rapid spending (Cheatham et al., 2015). Gaining an understanding of how these programs are accessed and the resulting outcomes of this assistance on socially vulnerable populations, can support better guidance on how to build equitable recoveries in the future.

Table 1. Federal programs providing direct support to households and individuals (Cecire and Jaroscak, 2019; Lindsay and Webster, 2019; Webster, 2019; Jaroscak, 2021).

Methodology

Literature sources examining flood recovery and socially vulnerable populations are diverse. Academic disaster research spans many disciplines, including economics, sociology, emergency management, geography, planning, and engineering. Meanwhile, grey literature includes reports from an array of non-profits, think-tanks, consultancies, and government agencies. Identifying academic and grey literature sources required a snowball method for collecting potentially relevant documents from Google Search and Scholar. An outline of the process is shown in Figure 1.

We modified the keywords “flood recovery” or “hurricane recovery” by “report,” “program,” “progress,” and “outcomes,” and coupled with keywords “social vulnerability,” “social equity,” or “vulnerable populations” to align the scope of returned documents with flood recovery. We supplemented these general searches with targeted searches for documents related to significant US flood and hurricane disasters (defined as an event with at least 1,500 NFIP payouts) and the four major recovery programs described in the previous section. From this list of potential sources, we reviewed the titles and abstracts/summaries to filter out documents lacking either a strong connection to flood disasters or a focus on recovery outcomes or federal aid access.

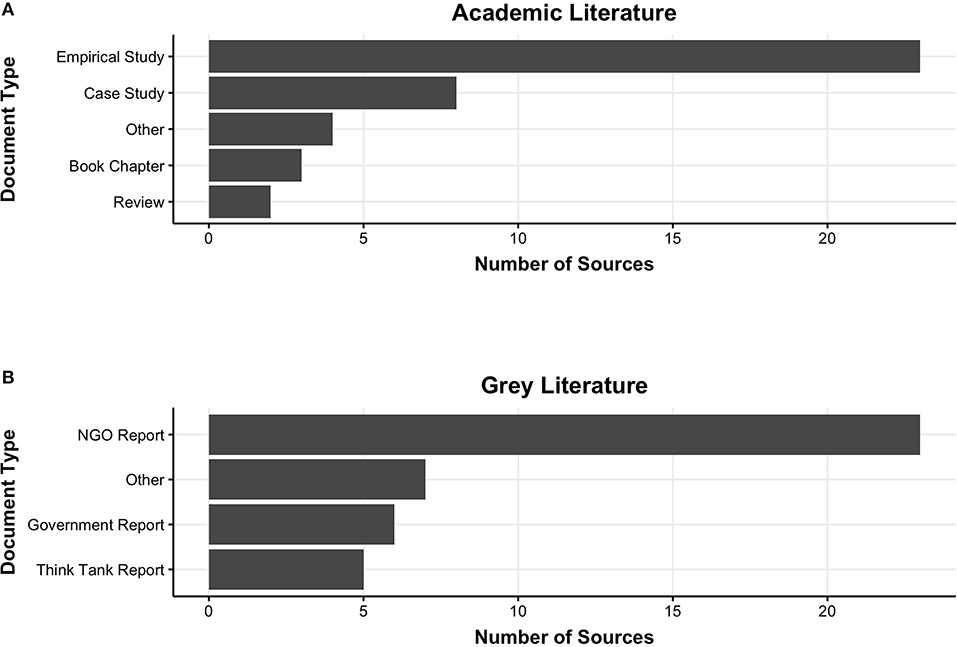

We then reviewed full documents meeting these initial criteria for evidence pertaining to our research questions on assistance access and adverse recovery outcomes. Additional relevant citations from each document were included as they were discovered. The distribution of sources by document type is shown in Figure 2. We reviewed roughly equal numbers of academic (Figure 2A) and grey literature (Figure 2B) sources. Empirical studies were the most frequent type of academic research, followed by descriptive case studies. For grey literature, we found non-governmental organization reports most often, followed by governmental and think-tank documents.

Results

Three demographic drivers of social vulnerability emerged most consistently during the review: housing tenure, socioeconomic status, and race and ethnicity. This section presents the findings for each driver, centering on assistance access barriers, and adverse recovery outcomes. As a rule, we report findings as they are described in their original sources. However, given the diversity of document types in this review, we encourage interested readers to refer to the original sources for more detailed context on specific findings. Additionally, we emphasize that the recovery programs discussed herein span several decades of time and involve different sets of policies and implementation strategies. We made every effort to distill results in a manner accurately reflecting the diversity of individual events and updates to program regulations and guidance, but acknowledge that some findings may not be reflective of current federal recovery program policies and implementation guidance.

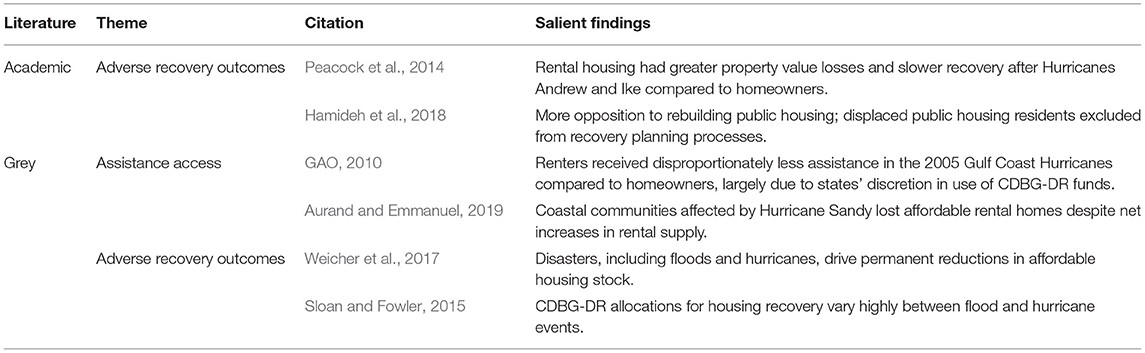

Housing Tenure

Housing tenure is the set of legal and financial arrangements under which people inhabit a home, with the most common forms being ownership and renting. Housing tenure is a major determinant of federal assistance availability and amount, as many US recovery programs prioritize specific tenure types before specific occupant characteristics. Yet housing tenure is understudied in the social vulnerability literature compared to other socio-demographic characteristics (Lee and Van Zandt, 2019). Because assistance resources are conditional on the types of housing that people occupy, we first summarize findings across tenure types to reflect the broader role that housing plays in flood recovery. Key findings for housing tenure are reported in Table 2.

Assistance Access Barriers

Renters Are Underprioritized Compared to Homeowners

Homeowners generally have more options for short-term disaster assistance relative to renters because they can request funding for housing damages in addition to personal property damages (Mickelson et al., 2019). Although direct assistance amounts under IA are typically modest, with average payments in the range of US $1,000–$4,000 (McCarthy, 2010; VMAP, 2021), short-term financial resources may help mitigate longer-term displacement among homeowners (Fussell and Harris, 2014). By contrast, landlords are ineligible to apply for IA to fund rental unit repairs or replacement, and neither FEMA nor SBA allow tenants to apply for funding to repair their residences. Community Development Block Grant Disaster Recovery funded programs allow tenants to seek repairs on behalf of property owners in some instances, but there is no obligation to remain in damaged housing (HUD, 2017). Impacted renters are eligible to apply for rental assistance for up to 18 months post disaster, but may face rental market shortages and price increases (Liu, 2006; Ross, 2013; Mickelson et al., 2019).

Rental property owners received less assistance relative to homeowners in previous flood disasters. Following Hurricanes Katrina, Rita, and Wilma, only 18% of damaged rental units received funding compared to 62% of damaged homeowner units (GAO, 2010). Similar discrepancies were reported in New Jersey and New York after Hurricane Sandy, with rental assistance programs receiving disproportionately low support levels and repair rates relative to damages (Fair Share Housing Center, 2014; MRNY, 2014). There are also concerns over geographic disparities in the distribution of rental unit funding, with instances where areas with fewer damaged units have received disproportionately high percentages of funding (Fair Share Housing Center, 2014). Restrictions around CDBG-DR funded rehabilitation in flood zones may have contribute to these geographic disparities in funding levels. New Jersey has some of the highest rates of affordable housing exposed to flood risks, both in absolute terms and relative to affordable housing stock at large (Buchanan et al., 2020).

Community Development Block Grant Disaster Recovery funded rental assistance programs have been criticized for underestimating program demand, or providing insufficient participation incentives (Steps Coalition, 2008; GAO, 2010; MRNY, 2014; NJVOAD, 2016; Aurand and Emmanuel, 2019; Mickelson et al., 2019). Although the design of CDBG-DR recovery programs varies, significant underestimation of rental assistance needs is not an isolated issue. For example, Make the Road New York estimated that the CBDG-DR Action Plan for New York City underestimated housing voucher funding for low-income renters by several orders of magnitude (MRNY, 2014). In Louisiana and Mississippi, demand for the Road Home Small Landlord Program following Katrina was two to eight times greater than funding or staffing would support, leading to application processing times upwards of 400 days (GAO, 2010). The Sandy CDBG-DR funded Landlord Rental Repair Program targeted toward small, affordable rental properties was funded at lower levels than programs for large-scale developers or homeowners (Aurand and Emmanuel, 2019). The Sandy Fund for Restoration of Multifamily Housing, targeted larger-scale developers and completed only one housing project with 51 units in 2 years of operation (Aurand and Emmanuel, 2019).

Recovery program administrators in Louisiana and Mississippi justified lower priority for rental programs on several bases, including proportionally fewer renters in coastal counties, beliefs that homeowners lost real property, perceptions of alternative sources of resources for renters, and concerns over triggering environmental reviews associated with rental construction (GAO, 2010). Louisiana officials indicated they did not want to “duplicate FEMA's efforts in assisting displaced renters,” despite delays that extended beyond the 18-month period of FEMA assistance (GAO, 2010). Sandy program administrators similarly justified prioritizing homeowners, noting extensive regulatory compliance in rental unit reconstruction and beliefs that landlords are business owners and therefore of lower priority (Aurand and Emmanuel, 2019). The New Jersey Volunteer Organizations Active in Disaster Network noted that in Sandy, non-profit funding was used to support rental assistance during these programmatic delays (NJVOAD, 2016).

Adverse Recovery Outcomes

Flooding disrupts rental housing markets and can permanently displace renters. In the short-term, flood disasters disrupt rental housing markets, resulting in sharp rent increases. After Hurricane Katrina, HUD's fair market rent increased upwards of 40% over a 4-year period in New Orleans compared to 15% nationwide (GAO, 2010). National-scale research indicates that disasters permanently increase housing rents in affected areas, with effects appearing 1-year post-disaster and not reversing (Dillon-Merrill et al., 2018); effects on housing prices are more ambiguous. These price effects are attributed to long-term increases in rental demand and hold true for in-migrating households (Dillon-Merrill et al., 2018; Sheldon and Zhan, 2019). Rental price increases coupled with reductions in affordable housing contribute to post-disaster displacement, particularly for residents relying on housing vouchers (Vinogradsky, 2009; Hamideh and Rongerude, 2018). Longer-term outcomes are less studied, but some research finds that displaced renters are less likely to return to their original places of residence (Levine et al., 2007; Hori and Schafer, 2010; Fussell and Harris, 2014).

Rental housing is often slower to rebuild and recover pre-storm values. Analysis of property tax appraisals provides empirical measures of both disaster damages in the short term, and recoveries as structures are repaired or replaced. After Hurricanes Andrew and Ike, rental housing units saw larger property value losses and slower recovery of pre-storm assessed values over a 4-year period, with smaller differences in wealthier neighborhoods (Zhang and Peacock, 2009; Peacock et al., 2014; Hamideh et al., 2018). Multifamily and duplex units also lagged owner-occupied housing, with assessed values sometimes experiencing steady declines due to abandonment or demolition several years into the recovery process. Research on Hurricane Sandy shows similar trends, with damaged rental properties in many jurisdictions failing to recover their pre-storm values within a 3-year period (Aurand and Emmanuel, 2019). Some areas experienced rapid rebounds or even increases in property values, which the authors attributed to redevelopment or replacement affordable units with market-rate units. A study on Hurricane Charley noted no clear differences in recovery speed between occupancy types, which the authors attribute to a more study area consisting primarily of older, wealthier, and Caucasian households with income generated outside of the state (Rathfon et al., 2013).

Affordable and public housing face compounding challenges. Flooding poses a risk of permanent losses to housing stock, both privately owned and public housing units (Ortiz et al., 2019). Longitudinal research shows disasters drive permanent reductions in affordable housing stock, with lower quality units more likely to be demolished rather than rebuilt (Weicher et al., 2017). Most permanent affordable housing losses are rental units, whereas owner-occupied units (mostly mobile homes) are more likely to be relocated (Weicher et al., 2017). Research consistently finds net losses to affordable housing stock following major flood events (Bernstein et al., 2006; Reece, 2011; Fussell, 2015; Rumbach and Makarewicz, 2016; Hamideh et al., 2018; Aurand and Emmanuel, 2019; Ortiz et al., 2019). Public housing has faced stronger opposition to rebuilding than other housing tenure types (Hamideh and Rongerude, 2018), with anti-rebuilding sentiment toward public housing rooted in long-standing issues with racial and class-based stigmas (Hirsch and Levert, 2009), and perceived blight along with high vacancy rates. There are notable examples of public housing units becoming embroiled in drawn-out debates and legal proceedings regarding reconstruction. In Galveston, Texas following Hurricane Ike, only 142 of 569 demolished low-income public housing units were rebuilt despite court mandates for replacement (Vinogradsky, 2009; Reece, 2011; Hamideh and Rongerude, 2018). Similarly, four major public housing complexes were demolished in the wake of Hurricane Katrina, including units without storm damage, without clear plans for accommodating affected residents (Liu, 2006; Graham, 2012).

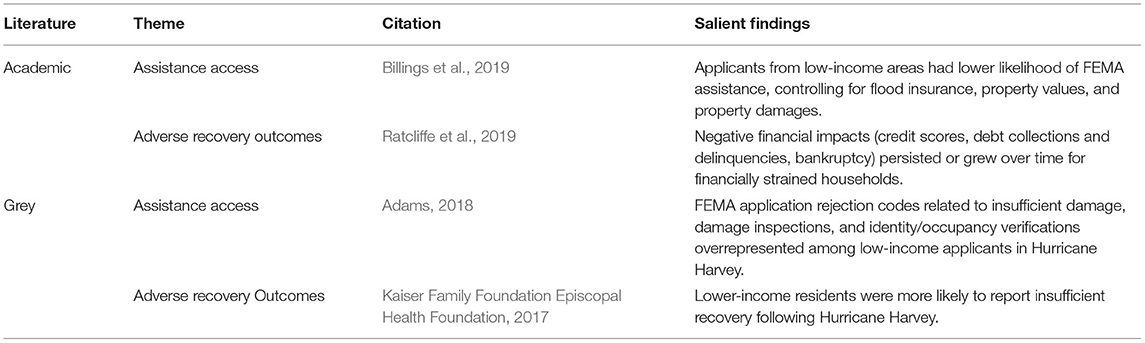

Income, Wealth, and Financial Conditions

Household financial condition emerged as an important determinant of social vulnerability during flood recovery. While poorer households may sustain less absolute property damage in floods, their impact levels relative to pre-event financial conditions can be larger than wealthier households (SAMHSA, 2017; Billings et al., 2019). With less personal capital for recovery, households in poor financial condition are also more dependent on external assistance for recovery support (SAMHSA, 2017). Income was the most reported indicator of financial conditions, potentially due to income reporting requirements for FEMA and SBA assistance applications and the low-moderate income (LMI) benefit requirements under CDBG-DR. However, individual sources considered other metrics of financial condition, including wealth, unemployment, poverty, financial stress, and asset ownership. We summarize results for these metrics in Table 3.

Assistance Access Barriers

Low-income populations are disincentivized from submitting assistance applications and face barriers in properly completing assistance applications (Sloan and Fowler, 2015; Kaiser Family Foundation Episcopal Health Foundation, 2017; Mickelson et al., 2019; American Flood Coalition, 2020). Data on assistance application rates are limited, but one survey found 43% of low-income households needed more help than was initially provided when applying for disaster assistance, compared to 34% of total affected households (Kaiser Family Foundation Episcopal Health Foundation, 2017). Non-profit reports find the most common reasons for non-application are application length and complexity, lack of necessary paperwork, and feeling like the process was too much of a hassle (Sloan and Fowler, 2015; Kaiser Family Foundation Episcopal Health Foundation, 2017). Low-income populations who lack alternative modes of transportation or communication may also struggle to keep up to date with the demands of application processes (MRNY, 2014; Sloan and Fowler, 2015). As in illustrative example, the Texas Appleseed Foundation notes that “The Texas Katrina and Rita Round Two Homeowner Assistance Program was originally 52 pages long, required the applicant to read at college level, and contained 14 affidavits that needed to be witnessed and notarized,” (Sloan and Fowler, 2015). Although this specific application was eventually edited, the example underscores the fact that applications can be complicated or subject to frequent rule changes.

There is growing evidence that low-income populations experience disproportionately high rejection rates, independent of damage levels (Mickelson et al., 2019). Following most disasters, FEMA receives far more applications than are approved (~25% approval rate since 2010; VMAP, 2021) and provides only basic details on ineligibility (FEMA, 2020a,b). Using data from Hurricane Harvey, Billings et al. (2019) found applicants from lower-income areas had less likelihood of FEMA assistance per registrant, after controlling for flood insurance, property values, and property damages. These effects were even larger for renters. Analysis of FEMA rejection codes following Hurricane Harvey reported insufficient damage, lack of damage substantiation, and lack of contact for inspections as reasons for over 75% of rejected applications (Adams, 2018). Other rejection codes that were disproportionately represented among low-income applicants included failed identity verifications, duplicate applications, and failure to prove occupancy at the time of disaster (Adams, 2018; American Flood Coalition, 2020). Advocates for low-income describe that “insufficient damage” denials are often based on what FEMA calls “deferred maintenance,” a category intended to capture pre-storm maintenance issues that are unaffected by storm-damage. Non-profits also report that low-income populations are more likely to have damages ascribed to deferred maintenance, with some reported instances of entire neighborhoods being rejected for this reason (Sloan and Fowler, 2015; Mickelson et al., 2019). Transportation and communication barriers are other commonly reported drivers of high rejection rates among low-income populations, along with a lack of required documentation (Sloan and Fowler, 2015).

Lower-income areas often receive less federal assistance relative to damage levels. Aggregate analyses of federal recovery assistance find allocations are generally commensurate with economic loss, which is usually positively correlated with income levels (Emrich et al., 2020; Drakes et al., 2021). In other words, recovery assistance tends to be allocated to places with higher valued homes and personal property. There is some uncertainty when factoring in income eligibility at individual household levels, but it is clear that economic loss is an important determinant of the magnitude of recovery assistance. Some research also indicates low-income areas may receive less assistance relative to damage levels (e.g., Kamel, 2012; Hoopes Halpin, 2013; Billings et al., 2019). Billings et al. (2019) found that successful assistance applicants in lower-income areas received fewer total assistance dollars after Harvey, controlling for property values and damage. Results from Katrina are similar, showing that areas with high concentrations of low-income households had some the lowest assistance to damage ratios (Kamel, 2012).

Low-income populations are less likely to qualify as “most impacted” for CDBG-DR unmet needs determinations. To meet the statutory requirement of “most impacted,” HUD has previously required that CDBG-DR funding be allocated toward properties with FEMA inspected damages of at least at $8,000, personal property damage of at least $3,500, or flooding over one foot (HUD, 2020). Rental properties (generally not inspected by FEMA for real property damage) require at least $2,000 dollars in personal property damage or flooding over one foot on the first-floor level to be deemed most impacted. Similar restrictions were imposed by the Texas General Land Office following Hurricane Harvey (Rosales, 2018). In effect, this damage assessment system favors wealthier residents who can more easily accumulate larger amounts of property damage (American Flood Coalition, 2020). Low-income populations are not strictly ineligible, but in practice are more likely to be renters and less likely to meet the standards for most impacted unmet need. Using estimates of loss proportional to structure values or adjusting the thresholds for lower-income populations have been proposed as alternative solutions for defining unmet need (Rosales, 2018).

Adverse Recovery Outcomes

Floods have persistent negative impacts on financial health for financially strained households. Several studies have examined impacts of flood disasters on financial outcomes, including income (Deryugina et al., 2018), consumer credit (Gallagher and Hartley, 2017; Billings et al., 2019), mortgage debt (Edmiston, 2017; Gallagher and Hartley, 2017), administrative wages (Vigdor, 2007, 2008; Groen et al., 2020), and bankruptcy (Billings et al., 2019). This body of literature finds average flood-related financial impacts are generally modest and short lived, with negative impacts often surpassed by later gains (Gallagher and Hartley, 2017; Deryugina et al., 2018; Groen et al., 2020). However, such average net effects may not reflect outcomes for low-income populations, with several studies describing larger impacts for certain populations. Vigdor (2008) and Groen et al. (2020) noted that individuals who relocated, lost, or changed jobs, whose residence or workplace experienced damage, or those who worked in tourism sectors experienced no net change or net decreases in earnings. Deryugina et al. (2018) found an uptick in savings account withdrawals post disaster exposure, emphasizing the importance of pre-existing savings for weathering the impacts of floods. Chappell et al. (2007) similarly found that those with greater financial, economic, and social capital were less likely to experience severe long-term economic hardship post Katrina. Edmiston (2017) found large hurricane related reductions in credit scores were almost double for financially vulnerable households. Finally, both Billings et al. (2019) and Ratcliffe et al. (2019) showed that negative financial impacts (credit scores, debt collections and delinquencies, bankruptcy) persisted or grew over time for households under existing financial strain.

Low-income households have fewer relocation options and are impacted by post-disaster housing shortages. Among surveys with flood affected households, housing is the most cited post-disaster need after financial stability, with lower-income residents more often reporting they are not receiving needed recovery help (Kaiser Family Foundation Episcopal Health Foundation, 2017). Housing is a critical component of restoring basic economic activity post-disaster (Chappell et al., 2007). Low-moderate income populations, predominately renters, inherit many of the barriers discussed in the previous section. Principally, reductions in affordable housing units and delays in funding for rental reconstruction leave low-income households with fewer relocation options than other groups who can readily access resources to repair their own units (Bernstein et al., 2006; Elliott et al., 2009; Fussell, 2015). Low-moderate income populations also are more likely to have complex and persistent housing needs that require additional support beyond what federal assistance and non-profit funding provide (NJVOAD, 2016). Two frequently cited secondary effects of housing interruptions are displacement and homelessness (e.g., Mickelson et al., 2019), but neither outcome is well-tracked, and we found no data that could speak to their general prevalence.

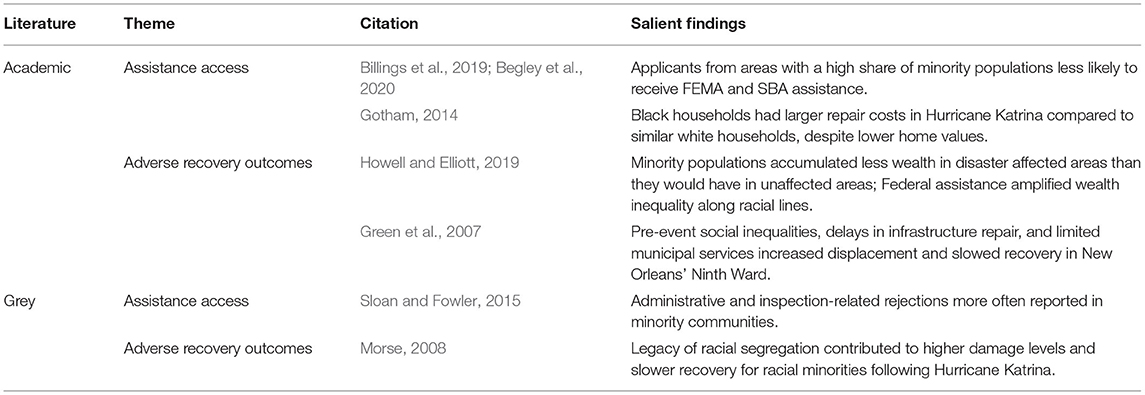

Racial and Ethnic Minority Populations

Racial and ethnic minority populations also experience higher vulnerability in flood recovery. Individual studies varied in their representation of racial and ethnic groups. Many focused on Black and/or Hispanic populations, two demographics strongly affected by past flood disasters. Other research presented results for more generalized measures including persons/communities of color, percentage non-Hispanic white, or racial categories in U.S. Census data. For consistency, we use the term “minority populations” to summarize this broad set of demographics and refer to more specific population groups whenever possible. Key findings for minority populations are shown in Table 4.

Assistance Access Barriers

Federal assistance may be harder to access for minority households. Analyses of FEMA application data from Hurricanes Harvey and Katrina report that areas with a high percentage of minority populations generally receive less assistance (Kamel, 2012; Billings et al., 2019). In a case study on the 2008 Iowa Floods, Muñoz and Tate (2016) reported lower relative recovery ratios, a metric assessing the amount of assistance received relative to property values, for Hispanic populations. In an analysis of SBA disaster loan data, applicants from areas with high percentages of minority populations also had lower likelihood of approval (Begley et al., 2020). The authors suggest that risk-insensitive loan policies are the primary driver of these discrepancies. Unlike most commercial loans, SBA loan interest rates are fixed and do not have credit risk-adjusted pricing, resulting in denials for households with poor credit scores. There are some exceptions to this trend, such as successful applicants with rental tenure in high minority areas receiving slightly more total FEMA assistance in the Harvey data (in the form of rental assistance) (Billings et al., 2019).

There are several potential explanations for racial or ethnic disparities in access to assistance. Underlying socio-demographic characteristics (e.g., lower incomes and higher probabilities of renting) are a potential contributor, as are higher application rates among minority populations regardless of damage levels (Kaiser Family Foundation Episcopal Health Foundation, 2017). However, some studies reported additional effects for minority share percentage after controlling for these factors (e.g., Billings et al., 2019). Subjectivity or bias in damage inspections may arise because damage assessment and data collection protocols are not standardized and inspections vary in quality and consistency (Hodde, 2012; Massarra, 2012; Kaiser Family Foundation Episcopal Health Foundation, 2017). Analysis by the Fair Share Housing Center found that 79% of appealed rejections for the Hurricane Sandy CDBG-DR funded Rehabilitation, Reconstruction, Elevation, and Mitigation program were later overturned, many of whom were minority homeowners (Fair Share Housing Center, 2014). However, because the race of applicants is not collected by FEMA or SBA, it is difficult to empirically assess why approval rates differ.

Other non-profits report that neighborhoods affected by “deferred maintenance” rejections are predominantly minority (Sloan and Fowler, 2015). Informal property titles, usually resulting from heirs' property or rent-to-own arrangements, are another potential contributor. When property titles are held informally, it is more difficult to document home ownership for disaster assistance applications (Kane et al., 2019). Research estimates that over 20,000 property owners were denied federal assistance in Hurricanes Katrina and Rita due to informal property titles (Way, 2010). In Hurricanes Dolly and Ike, as many as one in five low-income households were estimated to have had informal property titles, with rates as high as 90% in some areas (Way, 2010). Data on the full extent of heirs' property is limited, but there is consensus that it predominantly affects low-income minorities (largely African Americans), Appalachian Whites, and others with lower educational attainment and income than the general population (Pippin et al., 2017).

Longstanding discriminatory housing policies restrict assistance access. Racially discriminatory housing policies have limited pathways to homeownership for minority households and decreased home values in and around minority neighborhoods (e.g., Perry et al., 2018). Several sources describe how these policies continue to negatively affect minority households in flood recovery (Elliott and Pais, 2006; Morse, 2008). A frequently cited example is the Louisiana Road Home program, where grant amounts were based on a calculation that used the lower of two values: the assessed level of property damage or the pre-storm home value. In practice, this resulted in reduced assistance for low-income, historically Black communities where pre-storm home values were significantly lower than equivalently affected white neighborhoods (Bates and Green, 2009; Gotham, 2014). Black applicants subsequently faced larger gaps between housing resources the cost to rebuild compared to white applicants (average of $39,082 compared to $30,863) In certain neighborhoods, differences were even more stark, with gaps in the similarly damaged Lower Ninth Ward (predominately African American) reaching $75,355 while Lakeview (predominately white) averaged $44,405 (Gotham, 2014). The state of Louisiana was ultimately successfully sued by African American homeowners and civil rights organizations (Fletcher, 2011).

Depreciated home values also affect federal flood buyout programs. Buyout programs, a form of managed retreat where flood-damaged properties are purchased as pre-flood values and the land is converted into open space (Siders, 2019), includes a “substantial damage” classification (FEMA assessed repair costs ≥50% of the structure's pre-flood value) as part of the eligibility criteria. This potentially skews buyout acquisition toward areas where property values are lower and substantial damage classifications are easier to obtain (de Vries and Fraser, 2012). National studies find that buyout programs often occur in rich, white, densely populated counties, potentially due to increased administrative capacity, but the actual property being demolished is typically located in minority neighborhoods that are less densely populated, poorer and less educated, and have lower English language proficiency (Mach et al., 2019; Elliott et al., 2020). Understanding the legal obligations relevant to equity in flood buyout programs in more detail is an active area of research (Friedman and Read, 2020).

Recovery support for populations with low English proficiency is limited. People with low English proficiency, predominately racial and ethnic minorities, encounter more barriers during the assistance application process, including a lack of outreach, inadequate translation services, and concerns over drawing attention to immigration status (Kaiser Family Foundation Episcopal Health Foundation, 2017). Federal and State recovery agencies have Language Access Plans that provide guidance on reaching communities with limited English proficiency, but their practical implementation varies (GAO, 2017). To determine language needs of affected areas, FEMA uses US Census estimates of spoken languages. However, the estimates can be outdated when the disaster occurs and contribute to underserving translation needs (GAO, 2017; American Flood Coalition, 2020). For example, voluntary organizations had to fill translation service gaps following the Texas 2015 Memorial Day flood due to a lack of bilingual FEMA staff, while Oklahoma officials noted that churches were used as the primary outreach mechanism in one large Spanish-speaking community (GAO, 2017). After severe flooding in Texas in 2018, congressional and senate members again called upon FEMA for additional Spanish speaking staff (GAO, 2017).

While additional language translation resources and outreach may ultimately become available, delays potentially affect both the ability of households to apply for assistance within allotted time requirements and the receipt of assistance when it is needed. Accessibility barriers for non-English speakers have been noted in CDBG-DR funded programs as well. According to the Fair Share Housing Center, an initial version of the Spanish language version of New Jersey's Hurricane Sandy recovery website had incorrect details on deadlines, office locations, and the possibility of appeals (Fair Share Housing Center, 2014).

Adverse Recovery Outcomes

Negative financial outcomes may be amplified for minority populations. Findings vary on post-flood financial outcomes for minority populations, driven in part by differences in study design that affect how recovery progress is tracked relative to factors like pre-existing financial health. Ratcliffe et al. (2019) found larger reductions in credit scores in minority communities, but no significant differences among other financial outcomes. Deryugina et al. (2018) and Groen et al. (2020) found long-term gains in post-disaster employment and income across all racial and ethnic categories. Billings et al. (2019) found positive associations between bankruptcy and a proxy for financial stress that included minority population share. Meanwhile, Howell and Elliott (2019) examined wealth trajectories of disaster-impacted counties, finding that Blacks, Hispanics, and other races accumulated less wealth in heavily impacted areas than they otherwise would have in unaffected areas, while white households accumulated more wealth in disaster affected areas.

There are inconsistent findings for the speed of recovery for minority communities, but several clear examples of racial inequity in housing recovery. Data from Hurricane Andrew show that areas with higher concentrations of Hispanic and Black populations had greater housing-related economic loss, and housing values recovered slower than white neighborhoods. By contrast, housing values in minority communities recovered quicker following Hurricane Ike than in non-Hispanic white neighborhoods (Zhang and Peacock, 2009; Peacock et al., 2014). Other research focuses on racial inequity in housing recovery. Green et al. (2007) identified racial disparities in adequate insurance coverage, slow grant disbursement timelines, and housing burden as factors limiting resident's ability to initiate reconstruction. Nguyen and Salvesen (2014) described how narrow racial and ethnic identification of Asian populations affected assistance levels for Vietnamese communities who did not associate with the “Asian” racial classification.

More broadly, concerns over disparate negative effects of aging stormwater infrastructure (or broader environmental protection infrastructure) on severe flooding and exclusionary zoning into flood-prone areas are also reflected in the literature (e.g., Green et al., 2007; Morse, 2008; Mickelson et al., 2019). For example, Green et al. (2007) identified restrictions on entering, lack of potable water and electricity over a year post-event, and widespread displacement as factors contributing to lower rates of recovery activity in New Orleans' Upper and Lower Ninth Wards (two Black low to moderate-income residential neighborhoods) compared to other heavily damaged areas.

Discussion

As disaster recovery research and practice shifts emphasis toward equity, our review establishes a baseline set of population characteristics useful for assessing inequity in flood recovery. For federal direct assistance programs in the US, we found that renters, low-income households, minority populations, and intersections across these demographics, faced more barriers in accessing flood recovery assistance and experience more adverse recovery outcomes. Our synthesis of multiple types of literature highlights gaps in current knowledge, opportunities for future research, and important limitations in data availability and transparency. In the following sections, we discuss three themes emerging from our review, focusing on highlighting major concepts rather than providing specific policy recommendations, given the intricacies of federal flood recovery policies.

Federal Flood Recovery Programs Do Not Meet the Needs of Vulnerable Populations

Many documents described how federal assistance does not typically fully mitigate the negative consequences of flooding for renters, low-income, and minority populations. Empirical research shows that flood-related negative financial impacts persist over long time periods for vulnerable populations (e.g., Howell and Elliott, 2019; Ratcliffe et al., 2019), and without flood insurance coverage, recovery funding is typically insufficient for repairing or replacing damaged housing (e.g., Gotham, 2014; Muñoz and Tate, 2016). These findings point toward the reality that direct federal assistance programs are far more limited in scope than they are sometimes portrayed and average financial payouts to disaster survivors are significantly lower than posted maximums (Kousky and Shabman, 2012). In general, direct federal assistance is not intended to fully recompense disaster survivors, and funding uses are often restrictive given budget and statutory constraints—especially for structural improvements or mitigation measures. Alternative funding schemes for flood recovery have been discussed in the academic literature (e.g., Slavíková et al., 2019), but there is no consensus over which types of funding mechanisms best achieve efficient and equitable recovery, especially within existing institutional structures.

There are some mechanisms for directing more assistance toward individual households (e.g., federal buyouts or CDBG-DR funded housing programs), but narrow scopes and extended timelines may reduce their efficacy for vulnerable populations (e.g., Mickelson et al., 2019; Weber and Moore, 2019). Furthermore, inconsistent eligibility requirements among CDBG-DR funded programs, and the lack of permanent authorization of the CDBG-DR program itself, make it difficult to proactively ensure that vulnerable populations do not fall between the cracks of short- and long-term assistance. Emblematic of this is unmet needs determinations of CDBG-DR requiring absolute levels of verified economic loss. Not only are vulnerable populations less likely to meet the thresholds, but our research highlights that many vulnerable populations face barriers in accessing short-term assistance in the first place. This potentially leaves significant numbers of socially vulnerable households unaccounted for in long-term recovery needs assessments that employ records collected for initial assistance applications (Rosales, 2018).

More broadly, the CDBG-DR requirement that 70% of funds benefit LMI populations is also a subject of debate. Proponents of LMI benefit thresholds argue that relaxing the requirement steers funds toward projects that do not principally benefit LMI populations (Gotham, 2014), citing examples like the redirecting of CDBG-DR funds away from low-income housing programs to a commercial port expansion in Mississippi following Hurricane Katrina (Steps Coalition, 2008; Gotham, 2014). Others have argued that specific thresholds make it difficult to design program service areas that meet LMI benefit requirement, potentially disincentivizing recovery programs that may include highly impacted households and communities (McDonnell et al., 2018). In the past, HUD has granted waivers on the basis that programs may conform with requirements in practice even if thresholds are waived (Steps Coalition, 2008). While the core disagreement here is less about how much funding should be allocated toward LMI populations and more about how to best ensure that funding is used for its intended purpose, designing recovery programs to unequivocally address unmet housing and financial needs for vulnerable populations throughout the recovery process is clearly more difficult than often conceived. Encouragingly, federal agencies are increasingly soliciting feedback and researching how to improve equity and stakeholder participation in disaster recovery (e.g., Martin et al., 2019; Executive Order 13986, 2021).

Integrate Intersectional Social Vulnerability Into Flood Recovery Research and Practice

Socially vulnerable groups are typically described and analyzed as single populations. Indeed, we organized results in this review by the unidimensional demographic characteristics of renters, low-income, and minority. However, distinct vulnerable groups also lie at intersections of these characteristics. Recognizing intersectionality in social vulnerability during flood recovery is important for study design and analysis because different social characteristics can interact in ways that compound impediments to recovery. This tracks with growing national and international understanding of the need to integrate intersectionality into examination of social vulnerability to disasters (Fussell and Harris, 2014; Kuran et al., 2020; Tate and Emrich, 2021).

Low-income renters and low-income minorities emerged as uniquely vulnerable demographic groups in flood recovery. These populations should be given more explicit attention throughout the recovery process. Our finding that low-income renters, inclusive of households living in public and affordable housing, are underprioritized in federal assistance programs, highlights a weak track record of expedient reconstruction for affordable housing. Moreover, incentivizing rental repairs appears to be more difficult than channeling additional resources to homeowners or reconstructing market-rate rental units (Bernstein et al., 2006; Liu, 2006; GAO, 2010; Nguyen et al., 2017; Hamideh et al., 2018; Aurand and Emmanuel, 2019). Perceived alternative sources of assistance for rental property owners, like SBA loans or low-income tax credits have largely not kept pace with post-flood demand for affordable housing (Liu, 2006; GAO, 2010). Expressing recovery goals that favor the creation of mixed-income communities is not in itself a problem, but historically, a lack of communication and planning has left displaced low-income households with few options for returning (Liu, 2006; Hamideh et al., 2018). More effort toward prioritizing the recovery needs of displaced low-income renters and involving them in recovery decision-making are important steps toward more equitable recovery.

Differences in socio-economic status and housing tenure among minority populations further influence flood recovery in at least two ways. First, a disproportionate number of minorities are low-income, renters, or both. We found that all three conditions affect federal assistance access and adverse recovery outcomes. The national minority share of renters is approximately twice the minority share of owners, and median incomes for Hispanic and Black renting populations are approximately 15–30% lower than white renters (Joint Center for Housing Studies of Harvard University, 2011). The racial wealth gap is even more stark: the median net worth of white households is roughly seven times larger than Black and Hispanic households (Bhutta et al., 2020). Combined with our findings for housing tenure and income/wealth, these demographic differences likely contribute to slower expected recoveries for low-income minorities and minority renters relative to whiter populations. Lack of data on racial and ethnic identities of flood survivors at the household level further impede establishing these conclusions. Several studies have found statistically significant outcomes when stratifying for low-income, high minority share areas, including lower likelihoods of receiving assistance and increased wealth inequality (Billings et al., 2019; Howell and Elliott, 2019).

Second, there is growing evidence that de jure and de facto racial segregation have impacted disaster recovery for historically marginalized communities. Several sources articulate how low-income minority communities receive less federal disaster funding due to disinvestment practices and asymmetrical political power (Elliott and Pais, 2006; Morse, 2008), with examples of lack of funding for flood protection infrastructure, local zoning against tax credit funded apartments, or redirection of CDBG-DR funding from LMI areas. Instances like the formula for the Road Home Grant tangibly affecting assistance amounts for Black, low-income homeowners in the Lower Ninth Ward, exemplify how historical legacies of discrimination bleed into the recovery process. Some legal cases on behalf of minority populations have been successful, but as Morse (2008) notes, relying on Fair Housing Act litigation is unsustainable and often requires extensive documentation from affected communities. Institutionalizing guidance on incorporating civil rights and fair housing into recovery programs, with active engagement from affected communities, is one step toward reducing racial inequity in flood recovery (Sloan and Fowler, 2015).

Analyzing Recovery Needs of Vulnerable Populations Is Limited by low Data Availability and Transparency

Several key aspects of the disaster recovery process lack consistent data collection or monitoring, including identification of unmet housing and recovery needs (DHS, 2008; GAO, 2008; NJVOAD, 2016) and tracking displaced populations (Peacock et al., 2014; Aurand and Emmanuel, 2019). Additionally, many socio-demographic categories included in social vulnerability research are underrepresented in recovery-specific literature, including but not limited to disabilities and access and functional needs, indigenous people, gender, elderly, children, and undocumented immigrants. Several calls have been made for improvements (e.g., DHS, 2008; GAO, 2010, 2021; Pew Charitable Trusts, 2018; Aurand and Emmanuel, 2019), but little progress appears to have been made, at least with respect to public data dissemination. Reports from non-profit organizations, survey data, and interview-based research fill in some of these gaps, when available, but are limited to a small number of flood disasters.

For understudied demographics, increasing representation in recovery analyses is important for understanding unique long-term recovery needs. While this review focused on the three demographic segments with the most available literature, understanding recovery needs for other socio-demographic groups is also important. For example, research on populations with disabilities or access and functional needs describes issues with the language of disability-related questions on assistance applications and the need for case managers with experience navigating the disaster and disability service systems simultaneously (Stough et al., 2010, 2016; DRNC, 2019). Among the demographics we reviewed, we found that a lack of collection of racial and ethnic demographic information on assistance applications affects how these demographics are incorporated into analyses. Namely, previous studies on assistance receipt and recovery outcomes have relied on aggregated measures of race and ethnicity. While aggregated findings are suggestive of disparities, characterizing results for “applicants in areas with high block share minority population” (Billings et al., 2019), for example, is less than ideal. Standardizing the collection of race and ethnicity demographics would facilitate applicant-level analyses offering more directly interpretable findings on potential disparities in federal assistance.

A lack of transparency around rejected applications also limits understanding of recovery trajectories for vulnerable populations. Several sources describe that low-income and minority populations are rejected at disproportionately high rates (Sloan and Fowler, 2015; Mickelson et al., 2019). However, because federal agencies provide almost no information on rejected applications, it is difficult to differentiate between purported unfair rejections and instances where applicants are ineligible under current rules or fail to complete required components of the application process (e.g., not showing up for a damage inspection). Provision of specific, detailed information by federal agencies on the reasons for rejected applications would help clarify which barriers are most prevalent at-large and for different population groups. In turn, this could inform targeted remedies for specific concerns like deferred maintenance or difficulties meeting damage inspectors. More complete and consistent data would also help inform evaluations of whether current eligibility rules are unfairly restrictive for specific population groups.

Conclusion

This review synthesized academic and grey literature on flood recovery for vulnerable populations, with specific focus on access barriers in US federal disaster recovery programs and outcomes. The results identify both vulnerable populations in flood recovery and the drivers. We found the most evidence for access barriers and slow recoveries among renters, low-income, minorities, and their intersections. Common factors underlying inequitable access for vulnerable populations in federal programs include onerous application processes, restrictive identification requirements, and eligibility requirements linked to absolute economic loss. Beyond access barriers, recovery for vulnerable populations was most often slowed by persistent unmet housing and financial needs. Due to limitations in data availability, transparency, and long-term monitoring across population groups, uncertainty remains about the generalizability of these findings to all flood disasters. Nevertheless, our results point toward opportunities to improve equity in the distribution of resources to underserved communities affected by flood disasters.

An atypical feature of this review is the substantive incorporation of grey literature. Although grey literature is less consistently archived compared to academic sources, it frequently contained important and valuable information for understanding flood recoveries of vulnerable populations. Such information includes knowledge from non-profits working directly with disaster survivors (e.g., MRNY, 2014; NJVOAD, 2016), rapid post-disaster survey findings (e.g., Kaiser Family Foundation Episcopal Health Foundation, 2017), and investigative reports (e.g., GAO, 2010; Fair Share Housing Center, 2014). Synthesizing this information with academic research provided a more robust empirical understanding of how inequities develop and persist throughout the recovery process. The results can help guide the selection of social vulnerability indicators specific to flood recovery, addressing a current research need for social vulnerability indicators tailored to specific disaster phases (Rufat et al., 2015). Additionally, this review informs research on different financial schemes for flood recovery, particularly those considering social equity (e.g., Emrich et al., 2020; Slavíková et al., 2020). Other potential applications include emergency management, policy evaluation and analysis, project reporting, and advancing academic research.

As recovery funding for major flood disasters continues to increase, understanding which population groups struggle to access and benefit from disaster assistance has never been more important. Our crosscutting approach toward unifying knowledge at this intersection of flood recovery and vulnerable populations provides empirical support for program and policy change toward reducing recovery inequities.

Author Contributions

BW, ET, and CE conceived the main conceptual ideas and manuscript outline. BW reviewed literature and wrote the initial manuscript with support from ET and CE. All authors reviewed results, framed the discussion, and contributed to the final manuscript.

Funding

The work that provided the basis for this publication was supported by funding under an award with the U.S. Department of Housing and Urban Development (Award #H21679CA). The substance and findings of the work are dedicated to the public. The authors and publisher are solely responsible for the accuracy of the statements and interpretations contained in this publication. Such interpretations do not necessarily reflect the views of the U.S. Government.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adams, A. (2018). Low-Income Households Disproportionately Denied by FEMA is a Sign of a System That is Failing the Most Vulnerable. Texas Housers. Available online at: https://texashousers.net/2018/11/30/low-income-households-disproportionately-denied-by-fema-is-a-sign-of-a-system-that-is-failing-the-most-vulnerable/ (accessed January 3, 2021).

American Flood Coalition (2020). Turning the Tide: Opportunities to Build Social Equity Through Federal Flood Disaster Policy. Available online at: https://assets.floodcoalition.org/2020/08/e77e13287e90914325f82c7063666448-American-Flood-Coalition-Turning-the-Tide-Toward-Equity-8.3.2020.pdf (accessed January 3, 2021).

Aurand, A., and Emmanuel, D. (2019). Highly Impacted Communities in Rental Housing: New Jersey After Superstorm Sandy. National Low Income Housing Coalition. Available online at: https://nlihc.org/resource/nlihc-releases-report-long-term-rental-recovery-after-superstorm-sandy (accessed January 3, 2021).

Bates, L., and Green, R. (2009). “Housing recovery in the ninth ward: disparities in policy, process, and prospects,” in: Race, Place, and Environmental Justice after Hurricane Katrina, ed R. Bullard (Boulder, CO: Westview Press), 229–245. doi: 10.4324/9780429497858-11

Begley, T. A., Gurun, U., Purnanandam, A., and Weagley, D. (2020). Disaster Lending: “Fair” Prices, But “Unfair” Access. SSRN. Available online at: https://papers.ssrn.com/abstract=3145298 (accessed January 3, 2021).

Bernstein, M. A., Kim, J., Sorensen, P., Hanson, M. A., Overton, A., and Hiromoto, S. (2006). Rebuilding Housing Along the Mississippi Coast: Ideas for Ensuring an Adequate Supply of Affordable Housing. RAND Corporation. Available online at: https://www.rand.org/pubs/occasional_papers/OP162.html (accessed June 20, 2021).

Bhutta, N., Chang, A. C., Dettling, L. J., and Hsu, J. W. (2020). Disparities in Wealth by Race and Ethnicity in the 2019. Survey of Consumer Finances. Washington, DC: Board of Governors of the Federal Reserve System. Available online at: https://www.federalreserve.gov/econres/notes/feds-notes/disparities-in-wealth-by-race-and-ethnicity-in-the-2019-survey-of-consumer-finances-20200928.htm (accessed August 1, 2021).

Billings, S. B., Gallagher, E., and Ricketts, L. (2019). Let the Rich Be Flooded: The Unequal Impact of Hurricane Harvey on Household Debt. SSRN. Available online at: https://www.ssrn.com/abstract=3396611 (accessed January 3, 2021).

Buchanan, M. K., Kulp, S., Cushing, L., Morrello-Frosch, R., Nedwick, T., and Strauss, B. (2020). Sea level rise and coastal flooding threaten affordable housing. Environ. Res. Lett. 15, 124020. doi: 10.1088/1748-9326/abb266

Cecire, H. M., and Jaroscak, J. V. (2019). The Community Development Block Grant's Disaster Recovery (CDBG-DR) Component: Background and Issues (CRS Report No. R46475). Congressional Research Service. Available online at: https://crsreports.congress.gov/product/pdf/R/R46475 (accessed March 19, 2021).

Chappell, W. F., Forgette, R. G., Swanson, D. A., and Van Boening, M. V. (2007). Determinants of government aid to Katrina survivors: evidence from survey data. South. Econ. J. 74, 344–362. doi: 10.1002/j.2325-8012.2007.tb00842.x

Cheatham, B., Healy, A., and O'Brien Kuusinen, B. (2015). Improving Disaster Recovery: Lessons Learned in the United States. McKinsey and Company. Available online at: https://www.mckinsey.com/~/media/mckinsey/business%20functions/risk/our%20insights/improving%20disaster%20recovery/improving_disaster_recovery_280615_final.ashx (accessed November 19, 2020).

de Vries, D. H., and Fraser, J. C. (2012). Citizenship rights and voluntary decision making in post-disaster U.S. floodplain buyout mitigation programs. Int. J. Mass Emerg. Disast. 30, 1–33. Available online at: https://hdl.handle.net/11245/1.369610

Deryugina, T., Kawano, L., and Levitt, S. (2018). The economic impact of Hurricane Katrina on its victims: evidence from individual tax returns. Amer. Econ. J. Appl. Econ. 10, 202–233. doi: 10.1257/app.20160307

DHS (2008). Special Needs Populations Impact Assessment. U.S. Department of Homeland Security. Available online at: https://www.readkong.com/page/special-needs-populations-impact-assessment-source-document-5118039 (accessed November 19, 2020).

Dillon-Merrill, R. L., Ge, L., and Gete, P. (2018). Natural Disasters and Housing Markets. The Tenure Choice Channel 2019. American Economic Association Annual Meeting. Available online at: https://www.aeaweb.org/conference/2019/preliminary/paper/YZ56fSb6 (accessed January 3, 2021).

Drakes, O., Tate, E., Rainey, J., and Brody, S. (2021). Social vulnerability and short-term disaster assistance in the United States. Int. J. Disast. Risk Reduc. 53, 102010. doi: 10.1016/j.ijdrr.2020.102010

DRNC (2019). The Storm After the Storm: Disaster, Displacement, and Disability Following Hurricane Florence. Disability Rights North Carolina (DRNC). Available online at: https://disabilityrightsnc.org/wp-content/uploads/2019/02/DRNC-Report_The-Storm-after-the-Storm-2.5.19.pdf (accessed November 19, 2020).

Edmiston, K. D. (2017). Financial Vulnerability and Personal Finance Outcomes of Natural Disasters. SSRN. Available online at: https://ssrn.com/abstract=3064155 (accessed January 3, 2021).

Elliott, J. R., Bellone Hite, A., and Devine, J. A. (2009). Unequal return: the uneven resettlements of New Orleans' uptown neighborhoods. Organ. Environ. 22, 410–421. doi: 10.1177/1086026609347184

Elliott, J. R., Brown, P. L., and Loughran, K. (2020). Racial inequities in the federal buyout of flood-prone homes: a nationwide assessment of environmental adaptation. Socius 6, 1–5. doi: 10.1177/2378023120905439

Elliott, J. R., and Pais, J. (2006). Race, class, and Hurricane Katrina: social differences in human responses to disaster. Soc. Sci. Res. 35, 295–321. doi: 10.1016/j.ssresearch.2006.02.003

Emrich, C. T., Tate, E., Larson, S. E., and Zhou, Y. (2020). Measuring social equity in flood recovery funding. Environ. Hazards 19, 228–250. doi: 10.1080/17477891.2019.1675578

Executive Order 13986 (2021). Advancing Racial Equity and Support for Underserved Communities Through the Federal Government. Federal Register. Available online at: https://www.federalregister.gov/documents/2021/01/25/2021-01753/advancing-racial-equity-and-support-for-underserved-communities-through-the-federal-government (accessed July 30, 2021).

Fair Share Housing Center (2014). The State of Sandy Recovery. Fair Share Housing Center. Available online at: https://www.hcdnnj.org/assets/documents/report%20state%20of%20sandy.pdf (accessed March 19, 2021).

FEMA (2020a). Reasons You Might Have Been Found Ineligible by FEMA. Federal Emergency Management Agency (FEMA). Available online at: https://www.fema.gov/fact-sheet/reasons-why-you-might-have-been-found-ineligible-fema (accessed July 30, 2021).

FEMA (2020b). Reasons Why FEMA May Have Found You Ineligible. Federal Emergency Management Agency (FEMA). Available online at: https://www.fema.gov/fact-sheet/4562/reasons-why-fema-may-have-found-you-ineligible (accessed August 2, 2021).

Flavelle, C. (2021). How disaster aid favors white people. The New York Times. Available online at: https://www.nytimes.com/2021/06/09/climate/nyt-climate-newsletter-fema.html (accessed July 30, 2021).

Fletcher, M. A. (2011). HUD to Pay $62 Million to LA. Homeowners to Settle Road Home Lawsuit. Available online at: https://www.washingtonpost.com/business/economy/hud-to-pay-62-million-to-la-homeowners-to-settle-road-home-lawsuit/2011/07/06/gIQAtsFN1H_story.html (accessed October 1, 2021).

Friedman, S., and Read, P. (2020). Legal Requirements for Equitable Design and Implementation of Flood Buyout Programs in Rhode Island. Marine Affairs Institute at Roger Williams University School of Law. Available online at: https://seagrant.gso.uri.edu/wp-content/uploads/2020/08/Equity-and-Flood-Buyouts-FINAL.pdf (accessed November 19, 2020).

Fussell, E. (2015). The long term recovery of New Orleans' population after Hurricane Katrina. Am. Behav. Sci. 59, 1231–1245. doi: 10.1177/0002764215591181

Fussell, E., and Harris, E. (2014). Homeownership and housing displacement after Hurricane Katrina among low-income African-American mothers in New Orleans. Soc. Sci. Q. 95, 1086–1100. doi: 10.1111/ssqu.12114

Gallagher, J., and Hartley, D. (2017). Household finance after a natural disaster: the case of Hurricane Katrina. Amer. Econ. J. Econ. Policy 9, 199–228. doi: 10.1257/pol.20140273

GAO (2008). Past Experiences Offer Insights for Recovering from Hurricanes Ike and Gustav and Other Recent Natural Disasters. Government Accountability Office.

GAO (2010). Federal Assistance for Permanent Housing Primarily Benefited Homeowners; Opportunities Exist to Better Target Rental Housing Needs. Government Accountability Office. Available online at: https://www.gao.gov/assets/310/300098.pdf (accessed June 4, 2020).

GAO (2017). FEMA's Progress in Aiding Individuals with Disabilities Could Be Further Enhanced. Government Accountability Office. Available online at: https://www.gao.gov/assets/690/682752.pdf (accessed March 19, 2021).

GAO (2021). Disaster Recovery: Efforts to Identify and Address Barriers to Receiving Federal Recovery Assistance. Government Accountability Office. Available online at: https://www.gao.gov/assets/gao-22-105488.pdf (accessed November 13, 2021).

Gotham, K. F. (2014). Reinforcing inequalities: the impact of the CDBG program on post-Katrina rebuilding. Hous. Policy Debate 24, 192–212. doi: 10.1080/10511482.2013.840666

Graham, L. (2012). Razing Lafitte: Defending Public Housing from a Hostile State. CUNY Publications and Research. Available online at: https://academicworks.cuny.edu/gc_pubs/165 (accessed January 3, 2021).

Green, R., Bates, L. K., and Smyth, A. (2007). Impediments to recovery in New Orleans' upper and lower ninth ward: one year after Hurricane Katrina. Disasters 31, 311–335. doi: 10.1111/j.1467-7717.2007.01011.x

Groen, J. A., Kutzbach, M. J., and Polivka, A. E. (2020). Storms and jobs: the effect of hurricanes on individuals' employment and earnings over the long term. J. Labor Econ. 38, 653–685. doi: 10.1086/706055

Hamideh, S., Peacock, W. G., and Van Zandt, S. (2018). Housing recovery after disasters: primary versus seasonal and vacation housing markets in coastal communities. Nat. Hazards Rev. 19, 04018003. doi: 10.1061/(ASCE)NH.1527-6996.0000287

Hamideh, S., and Rongerude, J. (2018). Social vulnerability and participation in disaster recovery decisions: public housing in Galveston after Hurricane Ike. Nat. Hazards 93, 1629–1648. doi: 10.1007/s11069-018-3371-3

Hersher, R., and Benincasa, R. (2020). How Federal Disaster Money Favors The Rich. Available online at: https://www.kunc.org/post/how-federal-disaster-money-favors-rich (accessed June 30, 2020).

Hirsch, A. R., and Levert, L. (2009). The Katrina conspiracies: the problem of trust in rebuilding an American city. J. Urban Hist. 35, 207–219. doi: 10.1177/0096144208327908

Hodde, H. (2012). The Damage Assessment Process: Evaluating Coastal Storm Damage Assessments in Texas after Hurricane Ike. Thesis, University of Houston-Clear Lake. Available online at: https://www.proquest.com/openview/8d8a0ebdae5bbd5202f09605b6217435/1?pq-origsite=gscholarandcbl=18750 (accessed January 3, 2021).

Hoopes Halpin, S. (2013). The Impact of Superstorm Sandy on New Jersey Towns and Households. Fund for New Jersey and United Way of Northern New Jersey.

Hori, M., and Schafer, M. J. (2010). Social costs of displacement in Louisiana after Hurricanes Katrina and Rita. Popul. Environ. 31, 64–86. doi: 10.1007/s11111-009-0094-0

Howell, J., and Elliott, J. R. (2019). Damages done: the longitudinal impacts of natural hazards on wealth inequality in the United States. Soc. Probl. 66, 448–467. doi: 10.1093/socpro/spy016

HUD (2017). Tenant Assisstance, Relocation and Real Property Acquisition. HUD Handbook (1378). CHG-15. U.S. Department of Housing and Urban Development (HUD). Available online at: https://www.hud.gov/sites/dfiles/OCHCO/documents/1378CPDH.pdf (accessed January 10, 2021).

HUD (2020). Allocations, common application, waivers, and alternative requirements for disaster community development block grant disaster recovery grantees. Feder. Regist. 85, 4681–4690.

Jaroscak, J. V. (2021). Community Development Block Grants: Funding and Allocation Processes (CRS Report No. R46733). Congressional Research Service. Available online at: https://crsreports.congress.gov/product/pdf/R/R46733 (accessed March 19, 2021).

Jay, A., Reidmiller, D. R., Avery, C. W., Barrie, D., DeAngelo, B. J., Dave, A., et al. (2018). “Chapter 1 : Overview,” in Impacts, Risks, and Adaptation in the United States: The Fourth National Climate Assessment, Volume II. U.S. Global Change Research Program. Available online at: https://nca2018.globalchange.gov/chapter/1/ (accessed August 30, 2020).

Joint Center for Housing Studies of Harvard University (2011). America's Rental Housing: Meeting Challenges, Building on Opportunities. Joint Center for Housing Studies of Harvard University. Available online at: https://www.jchs.harvard.edu/research-areas/reports/americas-rental-housing-meeting-challenges-building-opportunities (accessed August 1, 2021).

Kaiser Family Foundation Episcopal Health Foundation (2017). An Early Assessment of Hurricane Harvey's Impact on Vulnerable Texans in the Gulf Coast Region. Kaiser Family Foundation and Episcopal Health Foundation. Available online at: https://www.kff.org/other/report/an-early-assessment-of-hurricane-harveys-impact-on-vulnerable-texans-in-the-gulf-coast-region-their-voices-and-priorities-to-inform-rebuilding-efforts/ (accessed March 19, 2021).

Kamel, N. (2012). Social marginalisation, federal assistance and repopulation patterns in the New Orleans metropolitan area following Hurricane Katrina. Urb. Stud. 49, 3211–3231. doi: 10.1177/0042098011433490

Kane, C., Beaugh, S., and Sias, G. (2019). Addressing Heirs' Property in Louisiana: Lessons Learned, Post-Disaster. Gen. Tech. Rep. SRS-244. Asheville, NC: U.S. Department of Agriculture Forest Service, Southern Research Station, 89–92.

Kousky, C., and Shabman, L. (2012). The Realities of Federal Disaster Aid: The Case of Floods. Resources for the Future. Available online at: https://www.rff.org/publications/issue-briefs/the-realities-of-federal-disaster-aid-the-case-of-floods/ (accessed August 1, 2021).

Kousky, C., and Shabman, L. (2017). Policy nook: “federal funding for flood risk reduction in the us: pre- or post-disaster?” Water Econ. Policy 3, 1771001. doi: 10.1142/S2382624X17710011

Kuran, C. H. A., Morsut, C., Kruke, B. I., Krüger, M., Segnestam, L., Orru, K., et al. (2020). Vulnerability and vulnerable groups from an intersectionality perspective. Int. J. Disast. Risk Reduct. 50, 101826. doi: 10.1016/j.ijdrr.2020.101826

Lee, J. Y., and Van Zandt, S. (2019). Housing tenure and social vulnerability to disasters: a review of the evidence. J. Plann. Liter. 34, 156–170. doi: 10.1177/0885412218812080

Levine, J. N., Esnard, A.-M., and Sapat, A. (2007). Population Displacement and housing dilemmas due to catastrophic disasters. J. Plann. Liter. 22, 3–15. doi: 10.1177/0885412207302277

Lindsay, B., and Webster, E. M. (2019). FEMA and SBA Disaster Assistance for Individuals and Households: Application Processes, Determinations, and Appeals (CRS Report No. R45238). Available online at: https://crsreports.congress.gov/product/details?prodcode=R45238 (accessed March 19, 2021).

Lingle, B., Kousky, C., and Shabman, L. (2018). Federal Disaster Rebuilding Spending: A Look at the Numbers. Risk Management and Decision Processes Center. Available online at: https://riskcenter.wharton.upenn.edu/lab-notes/federal-disaster-rebuilding-spending-look-numbers/ (accessed July 30, 2021).

Liu, A. (2006). Building a Better New Orleans: A Review of and Plan for Progress One Year after Hurricane Katrina. Brookings Instituion. Available online at: https://www.brookings.edu/wp-content/uploads/2016/06/200608_katrinareview.pdf (accessed August 1, 2020).

Mach, K. J., Kraan, C. M., Hino, M., Siders, A. R., Johnston, E. M., and Field, C. B. (2019). Managed retreat through voluntary buyouts of flood-prone properties. Sci. Adv. 5:eaax8995. doi: 10.1126/sciadv.aax8995

Martin, C., Gilbert, B., Teles, D., Theodos, B., Daniels, R., Srini, T., et al. (2019). Housing Recovery and CDBG-DR: A Review of the Timing and Factors Associated with Housing Activities in HUD's Community Development Block Grant for Disaster Recovery Program. HUD Office of Policy Development and Research. Available online at: https://www.huduser.gov/portal/publications/HousingRecovery-CDBG-DR.html (accessed October 28, 2021).

Massarra, C. (2012). Hurricane Damage Assessment Process for Residential Buildings. LSU Master's Theses. Available online at: https://digitalcommons.lsu.edu/gradschool_theses/520 (accessed March 19, 2021).

McCarthy, F. X. (2010). FEMA Disaster Housing: From Sheltering to Permanent Housing (CRS Report No. R40810). Retrieved from Congressional Research Service website: Available online at: https://fas.org/sgp/crs/misc/R40810.pdf (accessed March 19, 2021).

McDonnell, S., Ghorbani, P., Desai, S., Wolf, C., and Burgy, D. M. (2018). Potential challenges to targeting low- and moderate-income communities in a time of urgent need: the case of CDBG-DR in New York state after superstorm sandy. Hous. Policy Debate 28, 466–487. doi: 10.1080/10511482.2017.1385504

Mickelson, S. S., Paton, N., Gordon, A., and Rammler, D. (2019). Fixing America's Broken Housing Recovery System Part One: Barriers to a Complete and Equitable Recovery. National Low Income Housing Coalition and Fair Share Housing Center. Available online at: https://nlihc.org/sites/default/files/Fixing-Americas-Broken-Disaster-Housing-Recovery-System_P1.pdf (accessed March 19, 2021).

Morse, R. (2008). Environmental Justice Through the Eyes of Hurricane Katrina. Joint Center for Political and Economic Studies. Available online at: https://inequality.stanford.edu/sites/default/files/media/_media/pdf/key_issues/Environment_policy.pdf (accessed March 19, 2021).

MRNY (2014). Treading Water: Renters in Post-Sandy New York Make the Road New York. Make the Road New York (MRNY). Available online at: https://www.maketheroadny.org/pix_reports/MRNY%20Treading%20Water%20_Sandy_Report_f_Interactive-FINAL.pdf (accessed March 19, 2021).

Muñoz, C. E., and Tate, E. (2016). Unequal recovery? Federal resource distribution after a Midwest flood disaster. Int. J. Environ. Res. Public Health 13, 507. doi: 10.3390/ijerph13050507

National Academies of Sciences, Engineering, and Medicine (2019). Framing the Challenge of Urban Flooding in the United States. Available online at: https://www.nap.edu/catalog/25381/framing-the-challenge-of-urban-flooding-in-the-united-states (accessed July 25, 2021).

Nguyen, M. T., Frescoln, K., Martin, A., Peterson, J., and Farley, S. (2017). 1 Department of City and Regional Planning, Recovering Affordable Housing in Eastern North Carolina Post-Hurricane Matthew: A Strategy Forward. The North Carolina Policy Collaboratory.

Nguyen, M. T., and Salvesen, D. (2014). Disaster recovery among multiethnic immigrants: a case study of Southeast Asians in Bayou La Batre (AL) after Hurricane Katrina. J. Amer. Plann. Assoc. 80, 385–396. doi: 10.1080/01944363.2014.986497

NJVOAD (2016). New Jersey Non-Profit Long-Term Recovery Assessment. New Jersey Voluntary Organizations Active in Disaster. Available online at: http://www.njvoad.org/wp-content/uploads/2017/01/NJ-Non-Profit-Long-Term-Recovery-Assessment-print-version.pdf (accessed June 17, 2020).

Ortiz, G., Schultheis, H., Novack, V., and Holt, A. (2019). Extreme Weather as an Affordable Housing Crisis Multiplier. Center for American Progress. Available online at: https://www.americanprogress.org/issues/green/reports/2019/08/01/473067/a-perfect-storm-2/ (accessed June 17, 2020).

Peacock, W. G., Van Zandt, S., Zhang, Y., and Highfield, W. E. (2014). Inequities in long-term housing recovery after disasters. J. Amer. Plann. Assoc. 80, 356–371. doi: 10.1080/01944363.2014.980440

Perry, A., Rothwell, J., and Harshbarger, D. (2018). The Devaluation of Assets in Black Neighborhoods: The Case of Residential Property. Metropolitian Policy Institute at Brookings.

Pew Charitable Trusts (2018). What We Don't Know About State Spending on Natural Disasters Could Cost Us. Pew Charitable Trusts. Available online at: https://www.pewtrusts.org/-/media/assets/2018/06/statespendingnaturaldisasters_v4.pdf (accessed December 16, 2020).

Pippin, S., Jones, S., and Gaither, C. J. (2017). Identifying Potential Heirs Properties in the Southeastern United States: A New GIS Methodology Utilizing Mass Appraisal Data. e-Gen. Tech. Rep. SRS-225. Asheville, NC: U.S. Department of Agriculture Forest Service, Southern Research Station, 1–58. doi: 10.2737/SRS-GTR-225

Ratcliffe, C., Congdon, W. J., Stanczyk, A., Martín, C., and Kotapati, B. (2019). Insult to Injury: Natural Disasters and Residents' Financial Health. The Urban Institute.

Rathfon, D., Davidson, R., Bevington, J., Vicini, A., and Hill, A. (2013). Quantitative assessment of post-disaster housing recovery: a case study of Punta Gorda, Florida, after Hurricane Charley. Disasters 37, 333–355. doi: 10.1111/j.1467-7717.2012.01305.x