- Chair of Systems Design, ETH Zurich, Zurich, Switzerland

As recently argued in the literature, the reputation of firms can be channeled through their ownership structure. We use this relation to model reputation spillovers between transnational companies and their participated companies in an ownership network core of 1,318 firms. We then apply concepts of network controllability to identify minimum sets of driver nodes (MDSs) of 314 firms in this network. The importance of these driver nodes is classified according to their control contribution, their operating revenue, and their reputation. The latter two are also taken as proxies for the access costs when utilizing firms as driver nodes. Using an enrichment analysis, we find that firms with high reputation maintain the controllability of the network but rarely become top drivers, whereas firms with medium reputation most likely become top driver nodes. We further show that MDSs with lower access costs can be used to control the reputation dynamics in the whole network.

1 Introduction

Reputation is a precious value for social and economic actors, such as, individuals, organizations, or firms. Building up reputation may take a long time, but it can be destroyed very quickly. This asymmetry between growth and decay needs to be taken into account when we wish to model reputation dynamics (Zhang and Schweitzer, 2019; Schweitzer et al., 2020). In order to achieve such a model, we first need to think about ways to quantify reputation. In this article, we focus on the reputation of firms. Traditionally, a corporate reputation is evaluated via surveys. This often results in reputation rankings (Fombrun et al., 2015), that is, a comparison of relative, rather than absolute, reputation. This approach makes it quite difficult to compare the reputation of firms at a large scale, for instance, across different industrial sectors. Further, classical reputation rankings do not allow addressing the important problem of reputation spillover, that is, the increase/decrease of a firm’s reputation based on the increase/decrease of the reputation of other firms it depends on.

To overcome the problems of measuring reputation and quantifying reputation spillovers, we turn to a recently proposed framework that quantifies reputation by using information about the ownership structure (Zhang and Schweitzer, 2019). Because ownership relations can channel reputation spillovers between shareholders and the invested companies, we have constructed the ownership network and proposed a reputation dynamics on it. The main ideas of our reputation dynamics are further summarized in Section 2.2. Here, we build on this framework to address a more ambitious question, namely, how to control the reputation of firms. This requires us to first clarify what we mean by control. Nowadays, already the attempt to “control” social or economic actors raises ethical or legal concerns. We do not enter such discussions here. Instead, we point to two established research directions, network interventions and network controllability, which we also utilize in our article. Following these concepts, control means to influence a system such that it obtains a “better” state. In the socioeconomic realm, this can be a more resilient state for infrastructure networks, a state with higher capital per capita for countries, or a state of higher trust between individuals.

Systems design distinguishes two approaches to obtain such improvements (Schweitzer et al., 2019). The top-down approach tries to optimize boundary conditions, for example, tax rates or legal frameworks for all firms, to enable a positive development. The bottom-up approach, on the other hand, focuses on system elements, for example, single firms, that can be targeted as seeds for a positive development. In this study, we are interested in the second approach to improve the state of a system of firms, which means we want to influence individual firms, to obtain a better systemic outcome.

Already the classical game theory discusses the option to change either the payoff matrix or the available information such that a particular strategy, for example, cooperation, becomes more attractive to players. The concept of nudging has been built on this, subtly influencing the decision of social or economic actors in favor of a preferred outcome (Sugden, 2009). Network interventions further leverage this idea by using the interaction network as an amplifier (Valente, 2012; Valente, 2017). For example, changing the utility function of a single firm, or a user, impacts other firms and users directly or indirectly via the network (Casiraghi et al., 2020). This has proven to be an effective and a cost-efficient way to obtain an outcome that is more desirable from the perspective of a social planner (Leone Sciabolazza et al., 2020). This way, for instance, the resilience of social networks could be improved (Casiraghi and Schweitzer, 2020).

The concept of network interventions requires to know and to monitor the system state that should be achieved. This is very often hard to quantify. Here, the more abstract concept of network controllability comes into play (Liu et al., 2011; Wang et al., 2012; Cornelius et al., 2013). It derives from the control theory, originally developed in engineering and operations research. Network controllability focuses on the question what part of a network can be controlled if we steer a particular node, or a set of nodes, which are called driver nodes. Control means here that this part of the network can be driven into any possible state that is compatible with the assumed network structure and dynamics. Similar to network interventions, not all nodes in a network shall be targeted; ideally, the set of driver nodes is rather small. But different from network interventions, we do not need to specify the desired system state. Instead, the principal ability to influence (part of) the network is investigated.

Following this framework, in our article, we can assign each node in the network a “capacity” to influence the network. But not all nodes qualify as driver nodes. Hence, in a first step, we have to identify the set of driver nodes. To solve this problem, we need to know (i) the network structure and (ii) the dynamics that couples the nodes, which is the dynamics of reputation spillover.

In Section 2.2, we summarize this dynamics for the reputation of firms. We also introduce the network that we want to leverage for influencing firms, which is their ownership network. Here, we build on a recent study that quantifies the relation between corporate reputation and ownership (Zhang and Schweitzer, 2019). Eventually, in Section 2.3, we summarize the algorithmic procedure to identify the set of driver nodes, following the concept of network controllability.

In Section 3, we present the results of our study. Our focus is on the question how the control contribution (Zhang et al., 2019) of firms, that is, their ability to steer the network dynamics, is related to their reputation, as measured by our framework. Naively, one could assume that the most influential firms, as measured by their control contribution, are the firms with the highest reputation. This would imply that utilizing such firms as drivers may become a costly endeavor because of their pronounced economic value. Our major finding is that this, in fact, does not hold. Instead, we could identify a larger number of less reputed firms to drive the network. This insight can open new ways to influence such economic systems.

2 Material and Methods

2.1 Data Set of Transnational Firms

The availability of large-scale data sets about firms has boosted research about economic networks in the recent decade (Schweitzer et al., 2009). To construct such networks, different types of interactions between firms have been analyzed, for example, knowledge transfer (Reagans and McEvily, 2003; Vaccario et al., 2018), financial relations (Battiston et al., 2012; Nanumyan et al., 2015), supply chains and trade networks (Garlaschelli and Loffredo, 2005; Fagiolo et al., 2010; Mizgier et al., 2013; Burkholz and Schweitzer, 2019), or ownership (Glattfelder and Battiston, 2009; Vitali et al., 2011; Mani and Moody, 2014; Garcia-Bernardo et al., 2017).

In this article, we build on the latter, by reusing a data set about the global ownership relations among firms (Vitali et al., 2011; Glattfelder and Battiston, 2009; Zhang and Schweitzer, 2019) obtained from the Orbis database of 2007.1 This reports information about the share firm A holds on firm B, that is, links in the ownership network are directed and weighed. Further information about the operating revenue of each firm is also available in this database. This data set has been previously analyzed to quantify corporate control (Glattfelder and Battiston, 2009; Vitali et al., 2011).

Similar to the mentioned works, in the following, we focus on transnational companies (TNCs) which, according to definition by the Organization for Economic Co-operation and Development (OECD), operate in more than one country. They are known to form the backbone on the ownership network (Glattfelder and Battiston, 2009). These TNCs directly or indirectly participate in other firms, called participated companies (PCs) which are mostly direct or indirect subsidiaries of TNCs.

Starting from the list of TNCs, we recursively include all companies that are participated by TNCs, or companies that are shareholders of TNCs, directly or indirectly. With this procedure, we end up with a large network that contains 600,508 economic entities connected by 1,006,987 ownership relations.

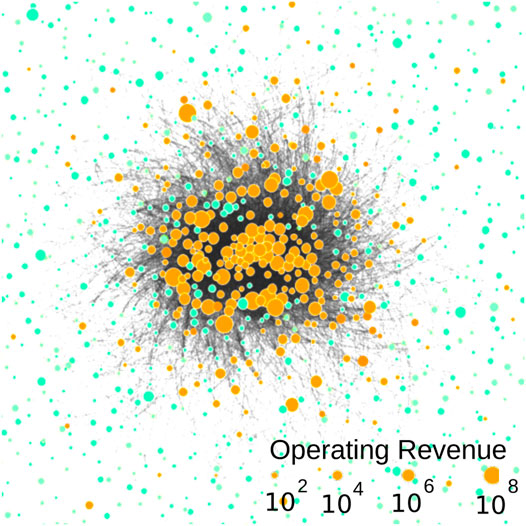

Our analysis is focused on the very small, but densely, connected core, that is, a strongly connected component, of this network (Vitali et al., 2011), which is also visualized in Figure 1. It comprises 1,318 firms that are connected by 12,184 ownership relations; that is, on average, each firm is connected to 20 other firms, and there is at least one directed path from any firm to other firm in this core. The overall operating revenue for firms in this core accounts for 20% of the operating revenue by all firms in the global ownership network. So, we are looking here at the heart of the global economy.

FIGURE 1. Visualization of the densely connected core of the global ownership network of 1,318 firms. Transnational companies (TNCs) are shown in orange, and participated companies (PCs) are shown in light green nodes. The size of each node is scaled according to the operating revenue of the firm. Note that for a visualization purpose, we only keep 33% of the edges with the largest weight.

We will use this ownership network to later explore the network controllability by identifying the set of driver nodes. For this, we also need to specify the dynamics that connect these firms.

2.2 Dynamics of Reputation

The ownership relations between firms do not only determine corporate influence but they also influence reputation (Fombrun and Shanley, 1990; Brammer and Pavelin, 2006; Delgado-García et al., 2010). For example, with sample data of selected firms at the country level, Fombrun and Shanley (1990); Brammer and Pavelin (2006); Delgado-García et al. (2010) reported that features of the ownership structure, such as the concentration of ownership in institutional investors, are correlated with corporate reputation. Further, Kang (2008) found that because of independent and active monitoring, institutional shareholders can greatly reduce the likelihood of negative reputation spillover.

Following the previous line of research, in a recent article (Zhang and Schweitzer, 2019), we have distinguished two phases, which differ in the directionality for the reputation spillover. In an initial phase, the reputation of the owners, that is, the firms investing into a newly founded company, largely determines the reputation of this firm because with their reputation, early shareholders signal trust to invest in this yet unknown firm.

In the second phase, the reputation of the invested firm can feed back on the reputation of its stakeholders, both in positive and negative ways. We have seen many scandals that have shaken the business world because reputed stakeholders, who also represent a considerable corporate control, have been made responsible for the malfunction of their firms. For example, in Germany, the emission scandal of the car-building company Volkswagen led to a negative reputation spillover to its largest shareholder, Porsche SE, for neglecting its supervisory obligations. But investors also use the positive reputation of firms, for example, in the green energy sector, to brush up their own reputation—as the recent debate on ethical investments witnesses (Mallin et al., 1995; Michelson et al., 2004).

Thus, it is justified to discuss the reputation dynamics of firms by utilizing their ownership network. In the following paragraphs, we focus on the core of the ownership network, which represents a mature economy of established firms. This allows us to consider the second phase, where the directionality of the ownership links is opposite to the directionality of the reputation spillover, that is, reputation spills over from the invested firm to its shareholders.

To quantify reputation, we assign to each firm a scalar value, xi(t), that changes with time according to the following dynamics (Zhang et al., 2019):

The variables

This dynamics has been also applied to model the reputation dynamics in online social networks (Schweitzer et al., 2020). For application scenarios, it is more convenient to use relative reputation values

In matrix form, the previous linear dynamics can be conveniently expressed as follows:

The matrix AT contains the information about the network topology, and the vector

We set ϕ as the largest eigenvalue of A. This allows the dynamics of Eq. 2 to converge to an equilibrium with only positive entries, which are then used for the ranking. Here, we emphasize that with this configuration, we do not look at the time scale of the model, and we only use the equilibrium values.

Once we have identified the set of driver nodes, as described in the following section, we have to consider a control signal, that is, an induced change that modifies the reputation of only the driver nodes. The resulting linear dynamics can be then expressed as follows:

The vector

2.3 Identification and Classification of Driver Nodes

The recent framework of structural controllability for complex networks (Liu et al., 2011) allows to identify minimum sets of driver nodes, that is, a small number of nodes that can be utilized to control the whole network. This method can be applied to directed networks. Because we cannot repeat all details of the method here, we summarize the respective steps and refer to the literature for subsequent information (Wang et al., 2012; Cornelius et al., 2013; Zhang et al., 2016; Zhang et al., 2019).

A complex network of N nodes can be controlled by different sets of driver nodes. MDS denotes the minimum set of drivers to control the whole network, and the size of this set is

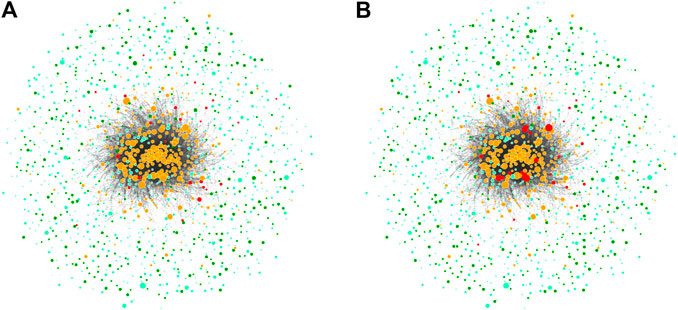

FIGURE 2. Visualizations of two MDSs in the ownership network. The node size is scaled proportional to the operating revenue of the firm. Transnational companies (TNCs) are shown in orange and in red, if they are also driver nodes. Participated companies (PCs) are shown in light green and in dark green, if they are also driver nodes.

In different MDSs, we usually find different nodes, but some of them appear in every MDS. The probability P(Di) that a given node i appears in an MDS is also known as control capacity

To eventually combine the control range and control capacity, we have proposed a new measure, controzl contribution

Applying the methods described earlier, we now have three different types of information for each firm in the ownership network: (i) its operating revenue

To quantify such relations, we perform an enrichment analysis, a statistical method which is commonly used to identify genes or proteins that are overrepresented (Wuchty, 2014). To illustrate the idea, suppose there are N balls characterized by colors s and types t. We have three colors, that is, s: (white, black, and grey) and two types t: (heavy and light). Enrichment analysis can, for example, tell whether heavy balls are more likely to be white balls or not. To do so, we need to compare the number of heavy balls whose color is also white,

Here, we apply this analysis to the firms that are part of the driver set of size Nd. Our “colors,” or categories, are now reputation values, that is,

Second, we specify which types l we are interested in, for example, whether firms have a low, medium, or high control contribution Ci.

For this comparison, we need a random set R that has the same size Nd/3 but is sampled from all N firms with respect to the feature l.

Obviously, a positive z-score shows an enrichment of the given category s in the type l. Enrichment means that firms with a given type l appear more frequently in the category s than expected at random. Additionally, we report the probability p in which

3 Results

3.1 Driver Nodes and Access Costs

To classify firms as driver nodes, we first need to determine the size of the MDS. We find that from the 1,318 firms in the ownership network, we need to control a minimum number of Nd = 341 firms directly in order to control the whole network. Note that the size of the MDS is mainly determined by characteristics of the network topology, such as the degree distribution. Then, out of the large number of possible MDSs with the same size, we have to generate 10.000 random samples, on which our further analysis is based.

As an illustration, Figure 2 presents visualizations of two random MDSs embedded in the ownership network shown in Figure 1. We notice that both MDSs only have a few driver nodes in common. Further, the right MDS contains more TNCs with high operating revenue as driver nodes, whereas the left contains mostly PCs with lower operating revenue.

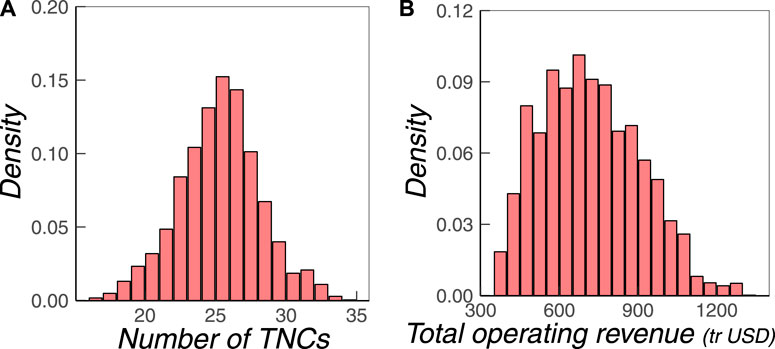

To further quantify these differences, we first investigate how many TNCs are present in a randomly sampled MDS. The distribution obtained from 10.000 MDS is shown in Figure 3A. We find that on average, about 26 TNCs are present in an MDS of size 341, that is, <10%. One could naively assume that because of their economic importance, TNCs would also be the most important driver nodes and thus should appear more often. Interestingly, this is not the case. Even more, the average of 26 TNCs, which corresponds to 8.7% of all TNCs in the core of the ownership network, is far below the expected number of TNCs obtained from a random sample of firms, which is 28.8%. This leads to the conclusion that TNCs are statistically underrepresented in the sets of driver nodes.

FIGURE 3. Distribution of (B) the number of TNCs, and (B) their total operating revenue (in trillion USD) sampled from 10.000 MDSs.

Further, the distribution is well-formed between a minimum of 17 and a maximum of 34 TNCs, which means we can find indeed MDSs in which the number of TNCs is only about 5%. Why is this of interest? These MDSs because of the different number of TNCs also represent a very different economic value, as proxied by the operating revenue

We remind that all MDS fulfill the same purpose, namely, to control the whole network. But a “cheap” MDS, as proxied by the total operating revenue, with a low number of TNCs would potentially be more easily accessible. Remember that network controllability requires us to apply a control signal to a firm, which means we need to consider some sort of access cost to utilize a given firm as a driver node. It is likely more expensive to access a TNCs of high operating revenue than a PC of low operating revenue. Because we have no way to directly quantify the access cost, in the following, we take the operating revenue

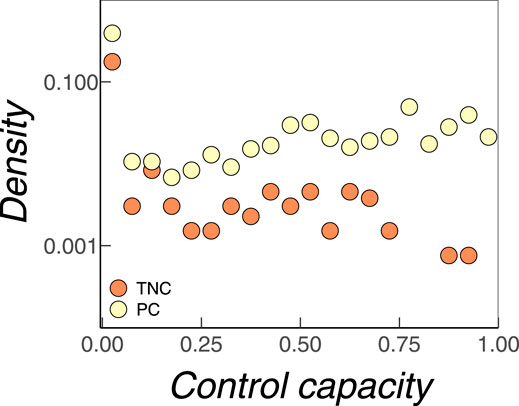

One could still argue that firms from a “cheap” MDS are less likely to be chosen as driver nodes because they are more often PCs. Again, this reflects the underlying assumption that TNCs should be more important as driver nodes and therefore should also be more often present in different MDSs. To refute this argument, we have investigated the distribution of the control capacities

Thus, in conclusion, firms that are PCs are most often present as driver nodes. Second, their access cost should be considerably lower than for TNCs. Therefore, we can safely choose “cheap” MDSs with a high fraction of PCs, to reach an efficient control of the whole network. This is an important insight because it links network controllability to economic measures and allows for policy advice.

3.2 Different Roles of Nodes

So far, we have mainly explored the economic and control properties of the firms that are part of the sets of driver nodes. Now, we focus on the different types l of nodes, specifically the roles of firms in (a) maintaining controllability and (b) controlling the network. We start from our reputation ranking of firms, which lead to the formation of groups of size Nd/3 with s: (low, medium, and high) reputation, as described in Section 2.3.

We first analyze how these groups to correlate with the roles of firms in maintaining control. This requires us to specify the node types l accordingly. Maintaining control means that the set of driver nodes is still able to fully control the network, if a respective node i would be isolated. Following Vinayagam et al. (2016), we can then distinguish three types l of driver nodes: nolistsep.

(a) node is indispensable if after its isolation, more driver nodes are needed to control the rest of the network;

(b) node is redundant if its isolation does not change the required number of driver nodes;

(c) node is dispensable if after its isolation, the network is controllable with fewer driver nodes.

Based on this classification, to identify the role l of firm i in maintaining controllability, we need to calculate the minimum number of driver nodes if i is isolated and compare it with the minimum number of driver nodes if i is not isolated. We have to keep in mind that isolating a node implies changing its local ownership relations, which definitely impacts the size of the minimum set of drivers. An MDS of size 341 only holds for the non-perturbed network. Also, different from Vinayagam et al. (2016) in which a protein can be knocked out, we cannot remove a firm from the ownership network even it is bankrupt. Instead, we can isolate a firm by removing all its ownership relations.

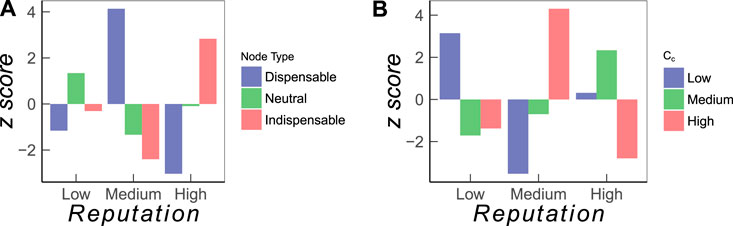

The results are shown in Figure 5A in terms of the z-score defined in Eq. 4. Firms in each group with low, medium, and high reputation do contain all three types of driver nodes, indispensable, redundant, and dispensable. But the z-score tells us whether such roles are enriched in a particular group. We see that indispensable nodes are most enriched (p = 100%) in the set of high-reputation firms; this is in accordance with our expectation that the most reputable firms channel control signals through the ownership network. Interestingly, indispensable nodes are mostly underrepresented (p = 99.8%) in the group with medium reputation, instead of low reputation. This can be partly explained from the fact that the ownership network forms a strongly connected component. Therefore, the isolation of a low-degree node, which is likely a firm of medium to low reputation, may leave some nodes with no incoming links, which have to be controlled directly with additional drivers. In conclusion, this analysis shows the importance of firms with high reputation in maintaining controllability.

FIGURE 5. Enrichment analysis for firms classified according to their reputation value. (A) Role of firms in maintaining control and (B) role of firms with respect to control contribution,

Second, we analyze how the three reputation groups correlate with the role of firms in controlling the network. In this case, we have to specify the types l of nodes with respect to their control contribution

The results are shown in Figure 5B in terms of z-score defined in Eq. 4. We find that the top driver nodes are mostly firms with medium reputation, not with high reputation, which is a very interesting result. Firms with high reputation are strongly embedded into the ownership network and connected to other firms with high reputation. Consequently, to utilize such firms as driver nodes would imply a considerable access cost. But this is not needed. Instead, network controllability can be best achieved with firms of medium reputation.

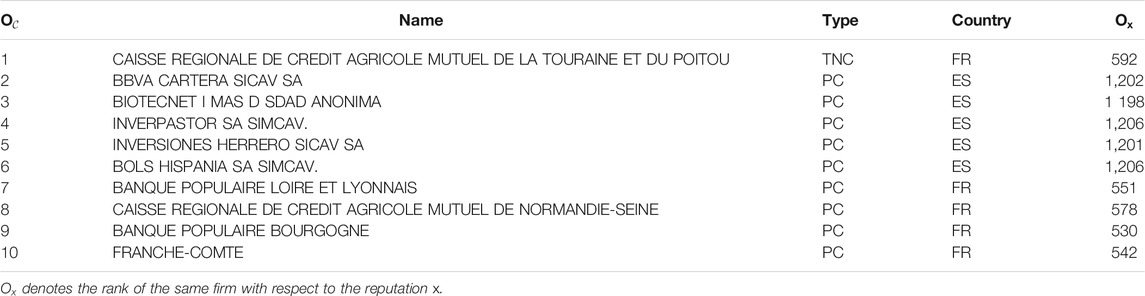

In Table 1, we also list the top 10 driver nodes with respect to their control contribution Ci and provide their reputation rank. We observe that none of these firms has a high reputation, and only one of them is a TNC. This confirms that the top drivers are likely not firms with high reputation in the ownership network.

TABLE 1. List of the firms that are the top 10 driver nodes ranked by their control contributions,

A summary our findings from the two enrichment analyses is given as follows: (a) firms with high reputation maintain the controllability of the network but are unlikely to become top driver nodes and (b) firms with medium reputation are most likely to become top driver nodes, but they are also dispensable for maintaining controllability.

4 Discussion

Our analysis makes two major contributions to the state of the art in network science: (i) we provide new ways of quantifying the importance of firms and (ii) we link two strands of research that are so far largely disconnected: network controllability and economic networks. In the following, we comment on these achievements.

Starting from network science, the importance of nodes in a network should capture the fact that networks serve a purpose, links have a meaning, and nodes have an intrinsic dynamics. This is reflected in different centrality measures (Borgatti, 2005; Landherr et al., 2010; Das et al., 2018), which have been recently extended also to temporal networks (Scholtes et al., 2016). There is no general “importance” but importance with respect to a given process that we want to describe. Our application scenario is reputation spillover. This requires us to quantify (a) the reputation of firms and (b) the process of reputation spillover. For this, we have utilized a recent framework to model reputation dynamics (Schweitzer et al., 2020). But, to become relevant and applicable, this approach needs an economic interpretation. This problem was also solved in a recent study that links reputation spillovers to ownership relations (Zhang and Schweitzer, 2019), which means at this point, we have a new way to quantify the importance of firms by means of a reputation value that reflects ownership relations. This complements other importance measures for firms, such as their operating revenue.

In this study, we go one step further by linking these importance measures to the role of firms in network control. Using the topology of the ownership network and the dynamics of reputation spillover, we can apply the recent concept of network controllability (Liu et al., 2011; Cornelius et al., 2013). It allows identifying those firms that can become driver nodes to steer the reputation dynamics. We find that out of the 1,318 firms that form the core of the ownership network, an MDS of only 341 firms, that is, 26%, about one-quarter, is needed to control the dynamics of the whole network. To characterize the control contribution of each firm, we have calculated a new measure

Hence, we now have two importance measures, in addition to the operating revenue

Precisely, our enrichment analysis tells whether firms of low, medium, or high reputation are more often than expected involved in maintaining or exerting control. Again, one could naively expect that large firms with high operating revenue, such as TNCs, or firms with the highest reputation play the most important role. As our analysis shows, this is not the case. TNCs are underrepresented in the minimum sets of driver nodes, which are dominated by PCs. And firms with a high reputation are less likely to become top driver nodes. Instead, we find that firms with medium reputation play the most important role as top drivers.

This is not an abstract insight and it can be given an economic interpretation, this way linking network controllability and economic networks. The nodes of our network are not abstract entities; they are economic actors characterized by their ownership structure,

Network controllability implies that control signals need to be applied to certain nodes. Hence, in an economic setting, there are costs involved, not only for the control signal but also for accessing the node. As we demonstrate, among the various sets of driver nodes that control the whole network, there are many MDSs composed of PCs of lower total operating revenue. If operating revenue is taken as a proxy for the access cost, these MDS would be quite “cheap” to access, while still allowing for full control. A similar argument holds for firms with high reputation, which are likely TNCs with high operating revenue. As we have shown, firms of a medium reputation play a major role in controlling the network. These are mostly PCs with lower operating revenue and, hence, with a lower access cost.

In conclusion, using these economic criteria, we can select sets of driver nodes that are less costly to access but still allow for a full control of the network. Here, we emphasize that while our finding opens new ways of discussing the economic importance of firms, it should be carefully interpreted within the scope where “control” and “reputation” are defined the same. It also paves the way for possible future works: One direction is to build up agent-based models in which economic agents are utilized as drivers to influence the reputation of other agents. This may further provide posteriors that can help interpret our current results. Another direction is to explore how particular economic structures and dynamics influence controllability.

Data Availability Statement

The data analyzed in this study are subject to the following licenses/restrictions: We used a commercial data set from the ORBIS data base (Bureau van Dyck). Requests to access these datasets should be directed to enVyaWNoQGJ2ZGluZm8uY29t

Author Contributions

FS and YZ designed the study and wrote the manuscript. YZ did the data analysis and the numerical calculations.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Footnotes

References

Battiston, S., Puliga, M., Kaushik, R., Tasca, P., and Caldarelli, G. (2012). DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk. Sci. Rep. 2 (1), 541. doi:10.1038/srep00541

Borgatti, S. P. (2005). Centrality and Network Flow. Social Networks. 27 (1), 55–71. doi:10.1016/j.socnet.2004.11.008

Brammer, S. J., and Pavelin, S. (2006). Corporate Reputation and Social Performance: The Importance of Fit. J. Management Stud. 43, 435–455. doi:10.1111/j.1467-6486.2006.00597.x

Burkholz, R., and Schweitzer, F. (2019). International Crop Trade Networks: The Impact of Shocks and Cascades. Environ. Res. Lett. 14, 114013. doi:10.1088/1748-9326/ab4864

Casiraghi, G., and Schweitzer, F. (2020). Improving the Robustness of Online Social Networks: A Simulation Approach of Network Interventions. Front. Robot. AI. 7, 57. doi:10.3389/frobt.2020.00057

Casiraghi, G., Zhang, Y., and Schweitzer, F. (2020). Intervention Scenarios to Enhance Knowledge Transfer in a Network of Firms. Front. Phys. 8, 382. doi:10.3389/fphy.2020.00382

Cornelius, S. P., Kath, W. L., and Motter, A. E. (2013). Realistic Control of Network Dynamics. Nat. Commun. 4, 1942. doi:10.1038/ncomms2939

Das, K., Samanta, S., and Pal, M. (2018). Study on Centrality Measures in Social Networks: a Survey. Soc. Netw. Anal. Min. 8 (1), 13. doi:10.1007/s13278-018-0493-2

Delgado-García, J. B., De Quevedo-Puente, E., and De La Fuente-Sabaté, J. M. (2010). The Impact of Ownership Structure on Corporate Reputation: Evidence from Spain. Corporate Governance: Int. Rev. 18, 540–556. doi:10.1111/j.1467-8683.2010.00818.x

Fagiolo, G., Reyes, J., and Schiavo, S. (2010). The Evolution of the World Trade Web: a Weighted-Network Analysis. J. Evol. Econ. 20 (4), 479–514. doi:10.1007/s00191-009-0160-x

Fombrun, C. J., Ponzi, L. J., and Newburry, W. (2015). Stakeholder Tracking and Analysis: The RepTrak System for Measuring Corporate Reputation. Corp Reputation Rev. 18 (1), 3–24. doi:10.1057/crr.2014.21

Fombrun, C., and Shanley, M. (1990). What's in a Name? Reputation Building and Corporate Strategy. Amj. 33 (2), 233–258. doi:10.5465/256324

Garcia-Bernardo, J., Fichtner, J., Takes, F. W., and Heemskerk, E. M. (2017). Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network. Sci. Rep. 7 (1), 6246–6310. doi:10.1038/s41598-017-06322-9

Garlaschelli, D., and Loffredo, M. I. (2005). Structure and Evolution of the World Trade Network. Physica A: Stat. Mech. its Appl. 355 (1), 138–144. doi:10.1016/j.physa.2005.02.075

Glattfelder, J. B., and Battiston, S. (2009). Backbone of Complex Networks of Corporations: The Flow of Control. Phys. Rev. E. 80 (3), 36104. doi:10.1103/physreve.80.036104

Jia, T., and Barabási, A.-L. (2013). Control Capacity and a Random Sampling Method in Exploring Controllability of Complex Networks. Sci. Rep. 3, 2354. doi:10.1038/srep02354

Kang, E. (2008). Director Interlocks and Spillover Effects of Reputational Penalties from Financial Reporting Fraud. Amj. 51 (3), 537–555. doi:10.5465/amj.2008.32626007

Landherr, A., Friedl, B., and Heidemann, J. (2010). A Critical Review of Centrality Measures in Social Networks. Bus Inf. Syst. Eng. 2 (6), 371–385. doi:10.1007/s12599-010-0127-3

Leone Sciabolazza, V., Vacca, R., and McCarty, C. (2020). Connecting the Dots: Implementing and Evaluating a Network Intervention to foster Scientific Collaboration and Productivity. Soc. Networks. 61, 181–195. doi:10.1016/j.socnet.2019.11.003

Liu, Y.-Y., Slotine, J.-J., and Barabási, A.-L. (2011). Controllability of Complex Networks. Nature. 473 (7346), 167–173. doi:10.1038/nature10011

Lundgren, T. (2011). A Microeconomic Model of Corporate Social Responsibility. Metroeconomica. 62 (1), 69–95. doi:10.1111/j.1467-999x.2010.04087.x

Mallin, C. A., Saadouni, B., and Briston, R. J. (1995). The Financial Performance of Ethical Investment Funds. J. Bus Fin Acc. 22 (4), 483–496. doi:10.1111/j.1468-5957.1995.tb00373.x

Mani, D., and Moody, J. (2014). Moving beyond Stylized Economic Network Models: The Hybrid World of the Indian Firm Ownership Network. Am. J. Sociol. 119 (6), 1629–1669. doi:10.1086/676040

Michelson, G., Wailes, N., Van Der Laan, S., and Frost, G. (2004). Ethical Investment Processes and Outcomes. J. Business Ethics. 52 (1), 1–10. doi:10.1023/b:busi.0000033103.12560.be

Mizgier, K. J., Jüttner, M. P., and Wagner, S. M. (2013). Bottleneck Identification in Supply Chain Networks. Int. J. Prod. Res. 51 (5), 1477–1490. doi:10.1080/00207543.2012.695878

Nanumyan, V., Garas, A., and Schweitzer, F. (2015). The Network of Counterparty Risk: Analysing Correlations in OTC Derivatives. PLOS ONE. 10, e0136638. doi:10.1371/journal.pone.0136638

Reagans, R., and McEvily, B. (2003). Network Structure and Knowledge Transfer: The Effects of Cohesion and Range. Administrative Sci. Q. 48 (2), 240–267. doi:10.2307/3556658

Scholtes, I., Wider, N., and Garas, A. (2016). Higher-Order Aggregate Networks in the Analysis of Temporal Networks: Path Structures and Centralities. Eur. Phys. J. B 89 (3), 1–15. doi:10.1140/epjb/e2016-60663-0

Schweitzer, F., Fagiolo, G., Sornette, D., Redondo, F. V., and White, D. R. (2009). Economic Networks: What Do We Know and what Do We Need to Know? Adv. Complex Syst. 12 (04), 407–422. doi:10.1142/s0219525909002337

Schweitzer, F., Mavrodiev, P., Seufert, A. M., and Garcia, D. (2020). Modeling User Reputation in Online Social Networks: The Role of Costs, Benefits, and Reciprocity. Entropy 22 (10), 1073. doi:10.3390/e22101073

Schweitzer, F. (2019). “The Bigger Picture: Complexity Meets Systems Design,” in Design. Tales of Science and Innovation. Editors G. Folkers, and M. Schmid (Zurich: Chronos Verlag), 77–86. 978-3-0340-1525-7

Sugden, R. (2009). On Nudging: A Review ofNudge: Improving Decisions about Health, Wealth and Happinessby Richard H. Thaler and Cass R. Sunstein. Int. J. Econ. Business. 16 (3), 365–373. doi:10.1080/13571510903227064

Vaccario, G., Tomasello, M. V., Tessone, C. J., and Schweitzer, F. (2018). Quantifying Knowledge Exchange in R&D Networks: a Data-Driven Model. J. Evol. Econ. 28 (3), 461–493. doi:10.1007/s00191-018-0569-1

Valente, T. W. (2012). Network Interventions. Science. 337 (6090), 49–53. doi:10.1126/science.1217330

Valente, T. W. (2017). Putting the Network in Network Interventions. Proc. Natl. Acad. Sci. USA. 114 (36), 9500–9501. doi:10.1073/pnas.1712473114

Vinayagam, A., Gibson, T. E., Lee, H. J., Yilmazel, B., Roesel, C., Hu, Y., et al. (2016). Controllability Analysis of the Directed Human Protein Interaction Network Identifies Disease Genes and Drug Targets. Proc. Natl. Acad. Sci. U.S.A. 113, 4976–4981. doi:10.1073/pnas.1603992113

Vitali, S., Glattfelder, J. B., and Battiston, S. (2011). The Network of Global Corporate Control. PLoS ONE. 6 (10), e25995. doi:10.1371/journal.pone.0025995

Wang, B., Gao, L., and Gao, Y. (2012). Control Range: a Controllability-Based index for Node Significance in Directed Networks. J. Stat. Mech. 2012, P04011. doi:10.1088/1742-5468/2012/04/p04011

Wuchty, S. (2014). Controllability in Protein Interaction Networks. Proc. Natl. Acad. Sci. 111, 7156–7160. doi:10.1073/pnas.1311231111

Zhang, Y., Garas, A., and Schweitzer, F. (2016). Value of Peripheral Nodes in Controlling Multilayer Scale-free Networks. Phys. Rev. E. 93, 012309. doi:10.1103/PhysRevE.93.012309

Zhang, Y., Garas, A., and Schweitzer, F. (2019). Control Contribution Identifies Top Driver Nodes in Complex Networks. Adv. Complex Syst. 22 (7&8), 1950014. doi:10.1142/s0219525919500140

Keywords: network analysis, reputation, companies/firms, ownership, controllability

Citation: Zhang Y and Schweitzer F (2021) Quantifying the Importance of Firms by Means of Reputation and Network Control. Front. Big Data 4:652913. doi: 10.3389/fdata.2021.652913

Received: 14 January 2021; Accepted: 03 May 2021;

Published: 16 June 2021.

Edited by:

Michele Coscia, IT University of Copenhagen, DenmarkReviewed by:

Giacomo Livan, University College London, United KingdomCarolina Mattsson, Leiden University, Netherlands

Fabrizio Lillo, University of Bologna, Italy

Copyright © 2021 Zhang and Schweitzer. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Frank Schweitzer, ZnNjaHdlaXR6ZXJAZXRoei5jaA==

Yan Zhang

Yan Zhang Frank Schweitzer

Frank Schweitzer