- Department of Accounting, Mutah university, Mutah, Jordan

This study investigates the impact of blockchain technology adoption on the financial performance of major Australian banks, specifically Commonwealth Bank, Westpac, and ANZ, from 2016 to 2023. Using a descriptive research design and secondary data from annual reports, financial performance was assessed through Return on Assets (ROA) and Return on Equity (ROE). The findings indicate a positive relationship between blockchain adoption and improved financial performance, suggesting gains in efficiency, cost management, and profitability. The study focuses on the Australian banking sector within its unique regulatory and market context. The originality of this research lies in its localized empirical approach, providing context-specific evidence of blockchain’s strategic contribution to financial performance in banking.

1 Introduction

The financial sector is in a constant state of evolution, propelled by technological advancements that aim to enhance operational efficiency, security, and customer satisfaction (Saidat et al., 2022). In the panorama of cutting-edge technological progress, blockchain has risen as a groundbreaking innovation. Operating as a decentralized and allotted ledger, it ensures extraordinary ranges of transparency, security, and permanence in transactions via superior cryptographic protocols and consensus-primarily based totally validation. While it changed into initially designed for cryptocurrencies like Bitcoin, its use has extended into regions including finance, healthcare, and supply chain management, where it helps streamline operations and enhance trust among stakeholders, with banking being one of the most promising sectors (Saidat et al., 2022; Al-Khasawneh, 2022; Almahirah and Salameh, 2021).

Australian banks, recognized for their strong and innovative financial systems, are actively exploring blockchain technology to enhance their operations (Osmani et al., 2020). This growing interest stems from the need to remain competitive in the global financial market while addressing the increasing demand for faster, more secure banking services. Leading financial institutions, including the Commonwealth Bank (CBA), the Australia and New Zealand Banking Group (ANZ), and the Westpac Banking Corporation (Westpac), have already invested in blockchain research and pilot programs (Hart and Timoshanko, 2022). These efforts range from collaborating with tech startups and joining blockchain consortiums to developing in-house blockchain applications aimed at improving efficiency and security.

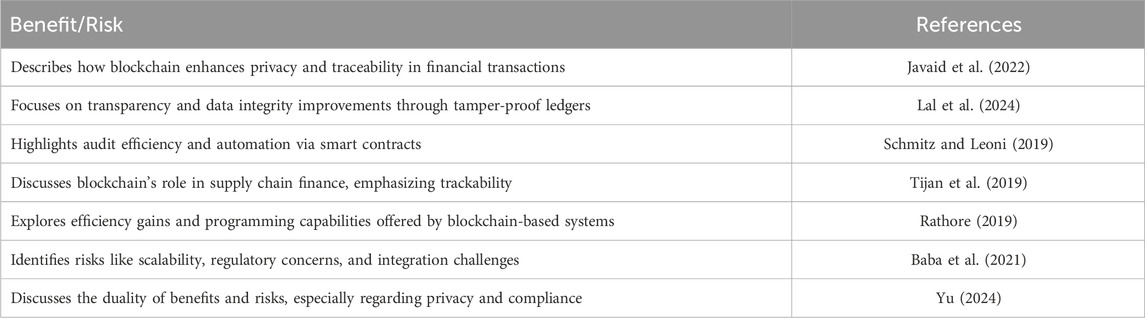

Blockchain technology has the potential to revolutionize banking by making processes faster, cutting costs, and boosting financial performance. By removing middlemen, automating tedious tasks like reconciliation, and offering a secure way to handle transactions, blockchain tackles many of the inefficiencies that have long plagued traditional banking systems (Kayani and Hasan, 2024). However, the adoption of blockchain is not without its challenges. Regulatory compliance, technical scalability, security concerns, and significant upfront investments are some of the hurdles that banks must overcome (Kayani and Hasan, 2024). Table 1 gives a rundown of key research that spells out the possible upsides and hurdles linked to embracing blockchain technology.

Given these potential benefits and challenges, it is crucial to understand the real impact of blockchain technology on the financial performance of Australian banks, and to evaluate how blockchain implementation influences efficiency, cost structures, risk management, and overall profitability within the Australian banking sector. Assessing blockchain’s impact on Australian banks is essential, particularly its influence on efficiency, costs, risk management, and profitability. While adoption has accelerated since 2019, especially with Westpac, CBA, and ANZ collaborating with IBM on digital bank guarantees (Silva, 2020), its long-term financial implications remain unclear. Through a comprehensive review of existing literature and empirical analysis, this study provides insights into the transformative potential of blockchain technology in enhancing the financial performance of Australian banks.

1.1 Statement of the problem

While blockchain has the potential to transform the financial sector, its impact on Australian banks’ financial performance remains largely unexplored (Malik et al., 2020). As Australian banks invest more in blockchain, assessing its impact on efficiency, cost reduction, risk management, and financial performance is essential.

While pilot projects by CBA and ANZ show promise in trade finance and cross-border payments, many remain in early stages, making their long-term financial impact uncertain (CBA, 2018; White, 2023). Empirical research is needed to determine whether blockchain adoption enhances cost efficiency, accelerates transactions, and strengthens financial stability in banking. Australia’s unique regulatory environment, market dynamics, and advanced technology infrastructure highlight the need for localized studies. While global research provides insights, it often overlooks the distinct characteristics of Australia’s highly regulated and technologically progressive financial sector (Djerriwarrh, 2023). Therefore, insights from global studies may not fully capture the nuances relevant to the Australian context.

This study examines the relationship between blockchain adoption and financial performance in Australian banks, assessing its impact on efficiency, cost structures, and profitability while identifying potential challenges. By offering deeper insights, it aims to help banks make informed investment decisions and develop strategies that maximize benefits while mitigating risks.

Hence, the above motivated the researcher to consider the impact of using blockchain technology on the financial performance of Australian banks, and therefore the researcher identified the problem of this study with the following main question: What is the Effect of Using Blockchain Technology on the Financial Performance of Australian Banks?

1.2 Objectives of the study and hypothesis development

This study primarily aims to assess whether blockchain technology enhances the financial performance of major Australian banks. In alignment with the research problem and objectives, the study tests the following main hypothesis.

H1. There is a positive relationship between the use of blockchain technology and the financial performance of major Australian banks.

Employing one clearly defined hypothesis is methodologically appropriate for studies with a narrow research objective and a specific variable relationship. This approach enables a more precise and in-depth analysis without introducing unnecessary complexity (Saunders et al., 2009; Creswell and Creswell, 2017). Introducing multiple hypotheses without a strong theoretical or empirical basis can dilute the purpose of the research and complicate the interpretation of results (Sekaran and Bougie, 2016). Therefore, the use of one hypothesis in this study is aligned with best practices in empirical business research.

2 Literature review

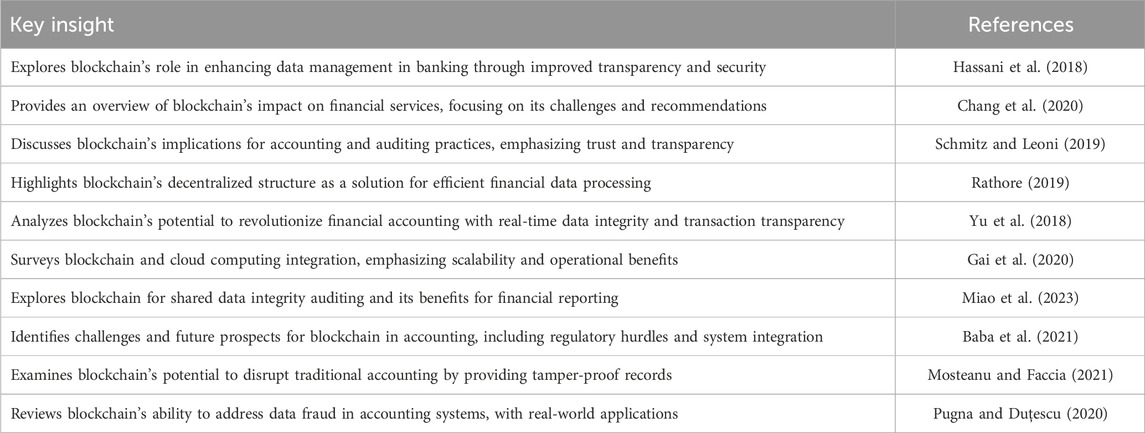

Previous studies have explored the utilization of blockchain technology in banks from various perspectives (Van Ha et al., 2023; Aketch et al., 2021; Al Shanti and Elessa, 2023). Consequently, particular emphasis will be placed on accounting research in this review. For example, (Treiblmaier, 2018), discusses how blockchain can streamline financial processes, reduce fraud, integrity, and increase transparency, leading to cost savings and improved financial performance. Similarly, research by (Lee and Shin, 2018) found that banks adopting blockchain technology experienced significant reductions in transaction costs and processing times (Javaid et al., 2022). emphasized the role of blockchain in facilitating faster, more cost-effective, and customized issuance of digital securities. Its adoption can expand the market for investors, reduce costs for issuers, and lower counterparty risk by allowing the customization of digital financial instruments to meet investor demands.

Further, a review by (Wang et al., 2019) examined the implications of blockchain for accounting transparency and audit processes, highlighting how the immutable nature of blockchain records can enhance the reliability of financial system and reduce the risk of fraud. According to (Li et al., 2021), blockchain is a versatile technology that enhances the financial system by providing the necessary security, trustworthiness, reliability, and integrity. Table 2 gives an overview of key research showing how blockchain has a revolutionary effect on finance and accounting.

In the Australian context, studies specifically examining the impact of blockchain on banks are emerging but still limited. Nonetheless, the available literature provides insights into the potential benefits and challenges (Bassilios, 2020). pointed out that blockchain will continue to deliver significant productivity, security, and efficiency gains for the Australian economy. There is a need to capitalize on opportunities and address challenges to foster the growth of blockchain technology across various sectors.

(Malik et al., 2020) identified a significant gap in research regarding the organizational adoption of blockchain technology in Australia. Their study developed a theoretical model based on semi-structured interviews with blockchain experts in the country. This model suggests that several factors influence the adoption of blockchain technology within organizations. These factors include perceived benefits, compatibility, complexity, organizational innovativeness, learning capability, competitive intensity, government support, trading partner readiness, and standards uncertainty. Overall, the unique features of blockchain technology are expected to significantly impact financial statement audits, a trend already recognized by accounting firms in Australia (Dyball and Seethamraju, 2022).

Additionally, the CBA has been a frontrunner in blockchain adoption. In 2016, CBA successfully used blockchain to complete a global trade transaction, demonstrating the technology’s potential to streamline international trade finance. This initiative reportedly reduced transaction times from days to hours and minimized the risk of fraud, suggesting a positive impact on financial performance (CBA, 2018). Similarly, ANZ Bank has been involved in blockchain-based projects aimed at improving cross-border payments. ANZ’s use of Ripple for interbank payments has sped up transactions and reduced costs. Early reports suggest it may lower operational expenses and boost customer satisfaction (Caffyn, 2021).

Comparisons with international banks show that while Australian banks are advancing in blockchain adoption, further implementation is needed. European banks like Santander and Deutsche Bank have reported financial gains from blockchain initiatives (Wewege et al., 2020), suggesting Australian banks could achieve similar benefits with wider adoption. Despite its benefits, blockchain adoption in Australian banks faces challenges, including regulatory uncertainty, integration issues, and high initial costs. Research (Bhuvana and Aithal, 2020) highlights that while blockchain can boost financial performance, overcoming these barriers is crucial for maximizing its potential.

Empirical evidence suggests that blockchain could enhance the financial performance of Australian banks through cost savings, efficiency gains, and improved security. However, further research is needed to quantify these benefits and address adoption challenges. Future studies should examine long-term financial impacts and the broader economic effects of blockchain integration.

2.1 Diversity in blockchain architectures

Blockchain architectures are classified into public and private, each serving distinct purposes. Public blockchains, such as Bitcoin and Ethereum, offer transparency and decentralization but face challenges with scalability and transaction speed (Nakamoto, 2008; Buterin, 2014; Zheng et al., 2017). In contrast, private blockchains like Hyperledger restrict access to approved users, making them ideal for enterprise applications requiring controlled access and scalability (Androulaki et al., 2018; Cachin, 2016). Hyperledger is particularly suited for regulated industries such as finance and accounting, as it enables private transactions, customizable consensus mechanisms, and operates without cryptocurrencies (Uchibeke et al., 2018; Puthal et al., 2018). The choice between public and private blockchains depends on the application’s needs—public blockchains suit decentralized initiatives like ESG finance, while private blockchains, such as Hyperledger, are better suited for banking and financial services requiring privacy, high transaction throughput, and regulatory compliance (Joshi et al., 2023; Xu et al., 2017).

2.2 Research gap and significance

The research topic is considered to be one of the emerging areas with limited studies conducted on it. This study adds to the current research by examining how blockchain’s features—such as enhanced transparency, operational efficiency, and reduced transaction costs—translate into measurable financial benefits. Specifically, the study investigates blockchain’s impact on the financial performance of major Australian banks during the period from 2016 to 2023. During this period Australian banks have shown an increasing interest in using blockchain technology to improve their operations. Past studies have looked at the possible upsides of blockchain. However, this research focuses on how these advantages turn into measurable financial performance indicators, like Return on Assets (ROA) and Return on Equity (ROE).

The results of this research are likely to be very useful for Australian bank leaders, employees, and financial experts those who focus on blockchain technology and measuring financial performance. Also, the knowledge gained is not just limited to Australia but can be helpful for banking industries in other parts of the world that are looking into using blockchain.

3 Methodology

3.1 Sample and data collection

The study adopts a descriptive research design to study the impact of using blockchain technology on the financial performance of Australian banks. Descriptive research is a systematic approach aims at gathering data to test a research hypothesis or answer questions pertaining to the present condition of the subject matter. The study sample comprises Australia’s major banks: CBA, Westpac, and ANZ. Secondary data was collected from annual reports published on the banks’ official websites, covering the period from 2016 to 2023. These reports are publicly available on the banks’ official websites (see Table 3). This dataset includes eight yearly observations for each bank, resulting in a total of 24 data points across the three banks. The dependent variables (ROA and ROE) and the independent variable (blockchain technology adoption) were derived from these reports, along with control variables such as R&D, bank size, leverage, and firm age.

As mentioned earlier, this period was selected due to its significance as a transitional phase in Australian banks’ adoption of blockchain technology, leading to partnerships among major Australian banks and the formation of the Lygon consortium. Established in 2019 in Melbourne, Victoria, Australia, Lygon aimed to digitize the bank guarantee process through its Lygon blockchain platform. The consortium successfully developed a blockchain-powered platform to streamline the guarantee issuance process, facilitating digital requests, negotiation, and storage of guarantees. In June 2020, the project achieved a significant milestone as executives from the Lygon consortium recognized the commercial potential of their solution. This prompted a decisive move towards implementation, with the consortium engaging IBM Global Technology Services to provision and manage a production platform. This marked a pivotal moment in the project’s progression, transitioning from development to the deployment of a commercially viable blockchain-based bank guarantee platform, poised to revolutionize the industry. The solution notably reduces processing time from up to 30 days to less than 1 day, benefiting all parties involved—applicants, beneficiaries, and issuers (IBM, 2024; Sinclair, 2023; Reuters, 2019).

3.2 Measurement

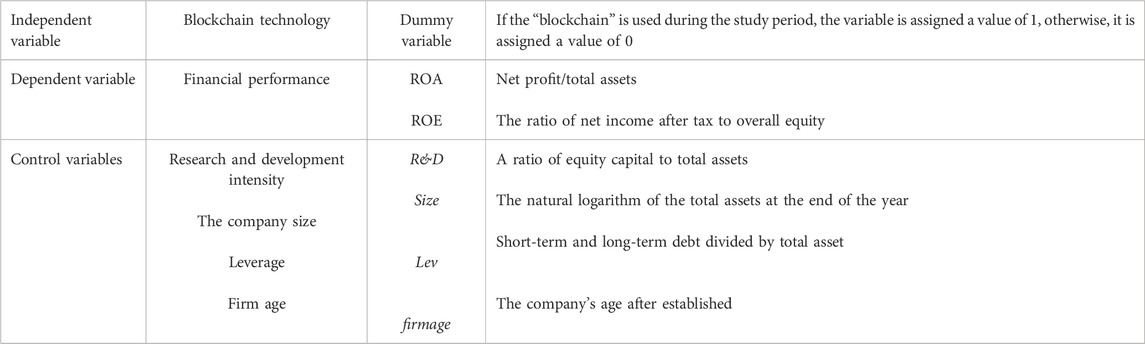

In this section, we discuss the definition of the study variables and the method of measuring them. Previous studies have employed various methods to measure blockchain technology (Aketch et al., 2021; Li and Wan, 2021) and financial performance (Kaura et al., 2019; Aketch et al., 2021; Li and Wan, 2021). The current study utilizes financial accounting ratios, specifically return on assets (ROA) and return on equity (ROE), to measure the financial performance variable. These metrics, renowned for their strategic importance across all business ventures, were selected due to their prominence as traditional indicators of banks’ financial performance (Kaura et al., 2019; Ekata, 2012). Moreover, blockchain technology was measured in this study as a dummy variable, indicating whether the bank used blockchain technology during the study period. We search the annual reports of the major Australian banks; if the “blockchain” is used during the study period, the variable is assigned a value of 1, otherwise, it is assigned a value of 0. This approach is widely used in empirical research evaluating the impact of technology adoption on firm performance (Li and Wan, 2021; Zhang and Ruan, 2024).

Variables such as research and development intensity, size, leverage, and firm age were identified as control variables. These variables are widely used in empirical research to account for firm specific characteristics that influence financial performance (Li and Wan, 2021; Ezzi et al., 2023). And are further supported by broader empirical research on firm performance determinants in innovation and firm growth contexts (e.g., Coad et al., 2016). Therefore, their inclusion helps isolate the effect of blockchain adoption while ensuring model robustness. Table 4 presents the definitions and measurements of all study’s variables.

3.3 Statistical tools and regression model

The study employed correlation analysis and regression analysis to test the study hypothesis which examines the impact of using blockchain technology on the financial performance of major banks in Australia. In order to test the study hypothesis, we set Formula 1, 2, 3. Python has been used due to its flexibility, scalability, and range of libraries (e.g., Statsmodels, Pandas, and NumPy).

Where;

FPit: Financial performance of banks, ROAit and ROEit represent the dependent variables and used as measures of financial performance of the major banks in Australia at time t.

BTit: Blockchain technology which represents the independent variable at time t.

Controlsit: Control variables which is R&D, size, lev, and firmage.

βk: Coefficient for the control variables.

εit: Error term.

4 Results and discussions

4.1 Descriptive statistics

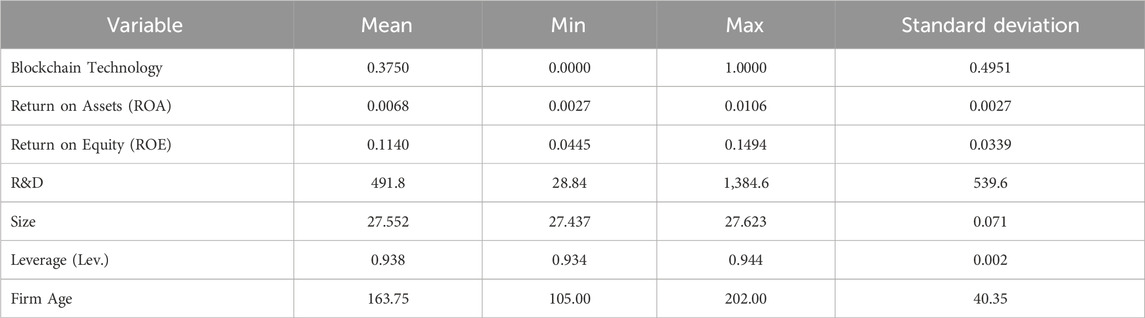

The descriptive statistics provide crucial insights into the financial performance and other key characteristics of the Australian banks, specifically in the context of examining the impact of blockchain technology. The average Return on Assets (ROA) of 0.68% indicates that, on average, the banks have a modest return on their assets, with a low variability as shown by the standard deviation of 0.27%. This suggests a relatively stable performance across the banks. Similarly, the Return on Equity (ROE) has a mean of 11.40%, reflecting a reasonable return for shareholders, with some variability indicated by a standard deviation of 3.39%, as shown in Table 5.

The adoption of blockchain technology is an essential aspect of this study. The mean value of 0.375 for blockchain technology suggests that about 37.5% of the observations involve the use of this technology, indicating a moderate level of adoption across the banks. The high standard deviation of 0.4951 points to significant variability in the adoption rates.

Research and Development (R&D) expenditures, a critical control variable, have a mean of 491.8 units, but with substantial variability (standard deviation of 539.6), suggesting differing levels of investment in innovation and technology among the banks. The size of the banks, measured by the log of total assets, shows minimal variability with a mean of 27.552 and a standard deviation of 0.071, indicating that the banks are relatively similar in size.

Leverage ratios, with a mean of 0.938 and a very low standard deviation of 0.002, show that the banks have similar debt-to-equity structures. Lastly, firm age, averaging at 163.75 years with a significant standard deviation of 40.35, indicates a wide range of operational histories among the banks, from relatively younger institutions at 105 years to well-established ones at 202 years.

4.2 Correlation analysis

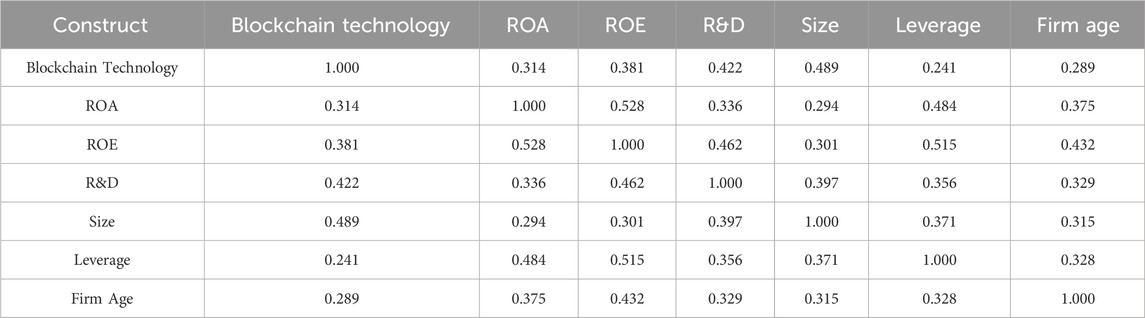

Blockchain technology exhibits a moderate positive correlation with ROA (0.314) and ROE (0.381), as shown in Table 6. While both correlations align with the hypothesis that blockchain technology positively impacts financial performance, it is notable that the correlation with ROA is the lowest among the variables analyzed. These results suggest that the adoption of blockchain technology is associated with improved financial performance, particularly in terms of equity returns (ROE). Statistical significance testing confirms that these correlations are meaningful, further underscoring the potential benefits of adopting blockchain technology in the banking sector. The relationships between other variables provide a holistic view of the factors influencing financial performance, supporting a comprehensive understanding of the study’s context. These findings align with the broader hypothesis and suggest practical implications for financial institutions exploring blockchain adoption.

4.3 Explanation of the variance

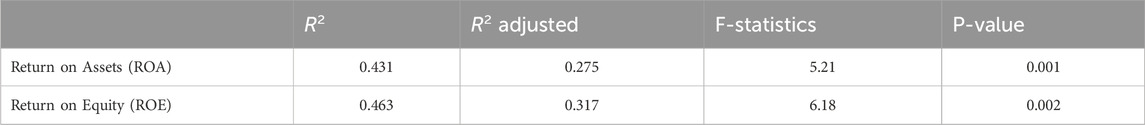

As illustrated in Table 7, the variance explained by the regression models indicates that blockchain technology significantly contributes to the financial performance of Australian banks. The R Square and Adjusted R Square values for both ROA and ROE demonstrate that the adoption of blockchain technology, along with investments in R&D, bank size, leverage, and firm age, are key factors driving financial efficiency and shareholder returns. Furthermore, the F-statistics and their associated p-values (p < 0.01 for both models) confirm the statistical significance of the models. The 95% confidence intervals for the blockchain technology variable further reinforce its positive association with financial performance. These findings validate the strategic importance of blockchain technology in the banking sector, providing empirical evidence of its positive impact on financial performance.

4.4 Regression results

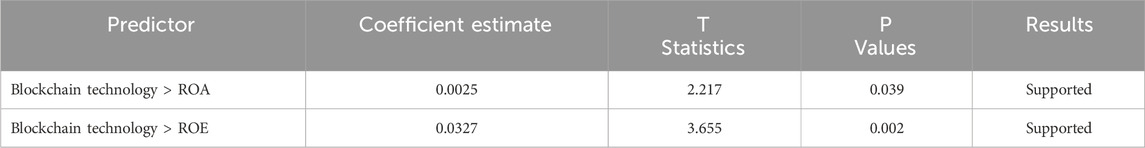

The findings show that blockchain technology has a statistically significant positive effect on both ROA and ROE, as shown in Table 8. Specifically, the estimated regression coefficient for blockchain technology’s impact on ROA is 0.0025, with a t-statistic of 2.217 and a p-value of 0.039, indicating strong support for the hypothesis that blockchain technology improves ROA. Similarly, the effect on ROE is even more pronounced, with a coefficient of 0.0327, a t-statistic of 3.655, and a highly significant p-value of 0.002. These results, denoted as “supported” in the table, suggest that the adoption of blockchain technology is beneficial for the financial performance of banks, enhancing both asset returns and equity returns. The analysis was conducted using panel regression methods suitable for firm level secondary data.

5 Conclusion

This study provides valuable insights into the impact of blockchain technology on the financial performance of Australian banks. The findings confirm that blockchain adoption significantly enhances financial performance, evidenced by improved ROA and ROE. By streamlining processes, reducing costs, and increasing transaction security, blockchain technology has proven to be a transformative tool for the banking sector. However, the study also highlights the challenges associated with blockchain implementation, such as regulatory compliance and initial investment costs. These insights are crucial for banking executives and policymakers to make informed decisions about blockchain investments. The results not only benefit the Australian banking sector but also offer a reference point for global financial institutions considering similar technological integrations. Future research should focus on long-term impacts and broader economic implications to further validate and expand upon these findings. While the current study focuses on quantitative analysis, future research could examine different methodologies, including qualitative analysis.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

RA: Conceptualization, Data curation, Investigation, Methodology, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

During the preparation of this work the author used ChatGPT in order to improve readability and language. After using this service, the author reviewed and edited the content as needed.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aketch, S., Mwambia, F., and Baimwera, B. (2021). Effects of blockchain technology on performance of financial markets in Kenya. Int. J. Finance Account. 6, 1–15. doi:10.47604/ijfa.1237

Al-Khasawneh, R. O. (2022). The Impact used of block chain technology on improvement of performance quality of economic sectors used it in Jordan. J. Manag. Inf. Decis. Sci. 25, 1–15.

Almahirah, Z., and Salameh, M. (2021). The effect of smart blockchain contracts on the financial services industry in the banking sector in Jordan. Ilk. Online 20. doi:10.17051/ilkonline.2021.05.203

Al Shanti, A. M., and Elessa, M. S. (2023). The impact of digital transformation towards blockchain technology application in banks to improve accounting information quality and corporate governance effectiveness. Cogent Econ. and Finance 11, 2161773. doi:10.1080/23322039.2022.2161773

Androulaki, E., Barger, A., Bortnikov, V., Cachin, C., Christidis, K., De Caro, A., et al. (2018). “Hyperledger fabric: a distributed operating system for permissioned blockchains,” in Proceedings of the thirteenth EuroSys conference, 1–15.

Baba, A. I., Neupane, S., Wu, F., and Yaroh, F. F. (2021). Blockchain in accounting: challenges and future prospects. Int. J. Blockchains Cryptocurrencies 2, 44–67. doi:10.1504/ijbc.2021.117810

Bassilios, J. (2020). Australian Senate: blockchain will have a profound impact on the economy. Available online at: https://hallandwilcox.com.au/thinking/australian-senate-blockchain-will-have-a-profound-impact-on-the-economy/#_ftnref2 (Accessed August 08, 2024).

Bhuvana, R., and Aithal, P. (2020). Blockchain based service: a case study on IBM blockchain services and hyperledger fabric. Int. J. Case Stud. Bus. IT, Educ. (IJCSBE) 4, 94–102. doi:10.5281/zenodo.3822411

Buterin, V. (2014). A next-generation smart contract and decentralized application platform. white Pap. 3, 2–1.

Cachin, C. (2016). “Architecture of the hyperledger blockchain fabric,” in Workshop on distributed cryptocurrencies and consensus ledgers (Chicago, IL), 1–4.

Caffyn, G. (2021). Australian banks westpac and ANZ experiment with Ripple. Available online at: https://www.coindesk.com/markets/2015/06/09/australian-banks-westpac-and-anz-experiment-with-ripple/(Accessed August 08, 2024).

CBA (2018). COMMONWEALTH BANK COMPLETES NEW BLOCKCHAIN-ENABLED GLOBAL TRADE EXPERIMENT. Available online at: https://www.commbank.com.au/guidance/newsroom/commonwealth-bank-completes-new-blockchain-enabled-global-trade--201807.html (Accessed August 08, 2024).

Chang, V., Baudier, P., Zhang, H., Xu, Q., Zhang, J., and Arami, M. (2020). How Blockchain can impact financial services–The overview, challenges and recommendations from expert interviewees. Technol. Forecast. Soc. change 158, 120166. doi:10.1016/j.techfore.2020.120166

Coad, A., Segarra, A., and Teruel, M. (2016). Innovation and firm growth: does firm age play a role? Res. policy 45, 387–400. doi:10.1016/j.respol.2015.10.015

Creswell, J. W., and Creswell, J. D. (2017). Research design: qualitative, quantitative, and mixed methods approaches. Thousand Oaks, California: Sage publications.

DJERRIWARRH (2023). Why Australian banks are superior. Available online at: https://www.djerri.com.au/news/why-australian-banks-are-superior (Accessed August 08, 2024).

Dyball, M. C., and Seethamraju, R. (2022). Client use of blockchain technology: exploring its (potential) impact on financial statement audits of Australian accounting firms. Account. Auditing and Account. J. 35, 1656–1684. doi:10.1108/aaaj-07-2020-4681

Ekata, G. E. (2012). The IT productivity paradox: evidence from the Nigerian banking industry. Electron. J. Inf. Syst. Dev. Ctries. 51, 1–25. doi:10.1002/j.1681-4835.2012.tb00361.x

Ezzi, F., Jarboui, A., and Mouakhar, K. (2023). Exploring the relationship between Blockchain technology and corporate social responsibility performance: empirical evidence from European firms. J. Knowl. Econ. 14, 1227–1248. doi:10.1007/s13132-022-00946-7

Gai, K., Guo, J., Zhu, L., and Yu, S. (2020). Blockchain meets cloud computing: a survey. IEEE Commun. Surv. and Tutorials 22, 2009–2030. doi:10.1109/comst.2020.2989392

Hart, C., and Timoshanko, A. (2022). Ready for a reboot: law schools need to reboot and upgrade the law curriculum now to better meet the impacts of technology. Caroline Hart Aaron Timoshanko,‘Ready a Reboot Law Sch. Need Reboot Upgrade Law Curriculum Now Better Meet Impacts Technol., 15.

Hassani, H., Huang, X., and Silva, E. (2018). Banking with blockchain-ed big data. J. Manag. Anal. 5, 256–275. doi:10.1080/23270012.2018.1528900

IBM (2024). Bank guarantees: jumping from paper to blockchain. Available online at: https://www.ibm.com/case-studies/lygon (Accessed August 08, 2024).

Javaid, M., Haleem, A., Singh, R. P., Suman, R., and Khan, S. (2022). A review of Blockchain Technology applications for financial services. BenchCouncil Trans. Benchmarks, Stand. Eval. 2, 100073. doi:10.1016/j.tbench.2022.100073

Joshi, P., Tewari, V., Kumar, S., and Singh, A. (2023). Blockchain technology for sustainable development: a systematic literature review. J. Glob. Operations Strategic Sourc. 16, 683–717. doi:10.1108/jgoss-06-2022-0054

Kaura, P., Dharwal, M., Kaur, H., and Kaur, P. (2019). Impact of corporate governance on financial performance of information technology companies. Int. J. Recent Technol. Eng. 8, 7460–7464. doi:10.35940/ijrte.c5603.098319

Kayani, U., and Hasan, F. (2024). Unveiling cryptocurrency impact on financial markets and traditional banking systems: lessons for sustainable blockchain and interdisciplinary collaborations. J. Risk Financial Manag. 17, 58. doi:10.3390/jrfm17020058

Lal, R., Chhabra, A., Singla, S., and Sharma, D. (2024). “Blockchain technology: revolutionizing trust, transparency, and transaction efficiency,” in 2024 international conference on knowledge engineering and communication systems (ICKECS) (IEEE), 1–5.

Lee, I., and Shin, Y. J. (2018). Fintech: ecosystem, business models, investment decisions, and challenges. Bus. horizons 61, 35–46. doi:10.1016/j.bushor.2017.09.003

Li, R., and Wan, Y. (2021). Analysis of the negative relationship between blockchain application and corporate performance. Mob. Inf. Syst. 2021, 9912241–9912318. doi:10.1155/2021/9912241

Li, X., Wang, X., Kong, T., Zheng, J., and Luo, M. (2021). “From bitcoin to solana–innovating blockchain towards enterprise applications,” in International conference on blockchain, 2021 (Springer), 74–100.

Malik, S., Chadhar, M., Chetty, M., and Vatanasakdakul, S. (2020). “An exploratory study of the adoption of blockchain technology among australian organizations: a theoretical model. Information Systems: 17th European,” in Mediterranean, and Middle Eastern Conference, EMCIS 2020, Dubai, United Arab Emirates, November 25–26, 2020 (Springer), 205–220.

Miao, Y., Gai, K., Zhu, L., Choo, K.-K. R., and Vaidya, J. (2023). Blockchain-based shared data integrity auditing and deduplication. IEEE Trans. Dependable Secure Comput. 21, 3688–3703. doi:10.1109/tdsc.2023.3335413

Mosteanu, N. R., and Faccia, A. (2021). Fintech frontiers in quantum computing, fractals, and blockchain distributed ledger: paradigm shifts and open innovation. J. Open Innovation Technol. Mark. Complex. 7, 19. doi:10.3390/joitmc7010019

Nakamoto, S. (2008). Bitcoin: a peer-to-peer electronic cash system. Satoshi Nakamoto. Available online at: https://ssrn.com/abstract=3440802.

Osmani, M., El-Haddadeh, R., Hindi, N., Janssen, M., and Weerakkody, V. (2020). Blockchain for next generation services in banking and finance: cost, benefit, risk and opportunity analysis. J. Enterp. Inf. Manag. 34, 884–899. doi:10.1108/jeim-02-2020-0044

Pugna, I. B., and Duţescu, A. (2020). Blockchain–the accounting perspective. Proc. Int. Conf. Bus. Excell. 14, 214–224. doi:10.2478/picbe-2020-0020

Puthal, D., Malik, N., Mohanty, S. P., Kougianos, E., and Yang, C. (2018). The blockchain as a decentralized security framework [future directions]. IEEE Consum. Electron. Mag. 7, 18–21. doi:10.1109/mce.2017.2776459

Rathore, B. (2019). Blockchain revolutionizing marketing: harnessing the power of distributed ledgers for transparent, secure, and efficient marketing practices. Int. J. New Media Stud. Int. Peer Rev. Sch. Index. J. 6, 34–42. doi:10.58972/eiprmj.v6i2y19.123

REUTERS (2019). Top Australian banks join IBM. Scentre blockchain Proj. Available online at: https://www.reuters.com/article/us-australia-banks-blockchain/top-australian-banks-join-ibm-scentre-in-blockchain-project-idUSKCN1TZ01V/(Accessed August 08, 2024).

Saidat, Z., Silva, M., Al-Daboubi, D., Al-Naimi, A. A., and Aldomy, R. (2022). How can blockchain revolutionize the Jordanian banking sector? J. Southwest Jiaot. Univ. 57, 311–325. doi:10.35741/issn.0258-2724.57.3.25

Saunders, M., Lewis, P., and Thornhill, A. (2009). Research methods for business students. Pearson Educ.

Schmitz, J., and Leoni, G. (2019). Accounting and auditing at the time of blockchain technology: a research agenda. Aust. Account. Rev. 29, 331–342. doi:10.1111/auar.12286

Sekaran, U., and Bougie, R. (2016). Research methods for business: a skill building approach. john wiley and sons.

Sinclair, S. (2023). IBM, top Australian banks execute country's first blockchain bank guarantee. Available online at: https://www.coindesk.com/business/2021/02/10/ibm-top-australian-banks-execute-countrys-first-blockchain-bank-guarantee/(Accessed August 08, 2024).

Tijan, E., Aksentijević, S., Ivanić, K., and Jardas, M. (2019). Blockchain technology implementation in logistics. Sustainability 11, 1185. doi:10.3390/su11041185

Treiblmaier, H. (2018). The impact of the blockchain on the supply chain: a theory-based research framework and a call for action. Supply chain Manag. Int. J. 23, 545–559. doi:10.1108/scm-01-2018-0029

Uchibeke, U. U., Schneider, K. A., Kassani, S. H., and Deters, R. (2018). “Blockchain access control ecosystem for big data security,” in 2018 IEEE International Conference on Internet of Things (iThings) and IEEE Green Computing and Communications (GreenCom) and IEEE Cyber, Physical and Social Computing (CPSCom) and IEEE Smart Data (SmartData) (IEEE), 1373–1378.

Van Ha, N., Phuc, V. T. D., Giang, P. H., Giang, P. T. H., and Le, K. G. (2023). Corporate social responsibility and financial performance in the banking industry: a comparative study of Australia and Vietnam. J. Int. Econ. Manag. 23, 70–90. doi:10.38203/jiem.023.1.0062

Wang, Y., Singgih, M., Wang, J., and Rit, M. (2019). Making sense of blockchain technology: how will it transform supply chains? Int. J. Prod. Econ. 211, 221–236. doi:10.1016/j.ijpe.2019.02.002

Wewege, L., Lee, J., and Thomsett, M. C. (2020). Disruptions and digital banking trends. J. Appl. Finance Bank. 10, 15–56.

White, S. (2023). The invisible engine of banking’s future. Available online at: https://www.anz.com/institutional/insights/articles/2023-11/the-invisible-engine-of-bankings-future/(Accessed August 08, 2024).

Xu, X., Weber, I., Staples, M., Zhu, L., Bosch, J., Bass, L., et al. (2017). “A taxonomy of blockchain-based systems for architecture design,” in 2017 IEEE international conference on software architecture (ICSA), USA, 3-7 April 2017 (IEEE), 243–252.

Yu, T. (2024). “Blockchain technology and the improvement of ESG information transparency,” in Disruptive human resource management (Amsterdam, Netherlands: IOS Press).

Yu, T., Lin, Z., and Tang, Q. (2018). Blockchain: the introduction and its application in financial accounting. J. Corp. Account. and Finance 29, 37–47. doi:10.1002/jcaf.22365

Zhang, J., and Ruan, C. (2024). Blockchain technology and corporate performance: empirical evidence from listed companies in China. Sustainability 16, 9177. doi:10.3390/su16219177

Keywords: blockchain technology, return on assets (ROA), return on equity (ROE), banking sector, financial performace

Citation: Almadadha R (2025) Blockchain and financial performance: empirical evidence from major Australian banks. Front. Blockchain 8:1463633. doi: 10.3389/fbloc.2025.1463633

Received: 12 July 2024; Accepted: 16 April 2025;

Published: 28 April 2025.

Edited by:

Marcelle Michelle Georgina Maria Von Wendland, Bancstreet Capital Partners Ltd, United KingdomReviewed by:

Bikrant Kesari, Maulana Azad National Institute of Technology, IndiaAli Raza, Oxford Business College, United Kingdom

Copyright © 2025 Almadadha. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rula Almadadha, cnVsYS5tYWRhZGhhQG11dGFoLmVkdS5qbw==

Rula Almadadha

Rula Almadadha