- College of Business Administration, Digital Transformation Research Center, Ajman University, Ajman, United Arab Emirates

The rapid advancement of Blockchain technology has significantly benefited banks with more efficiency, highly secured activities, compliance, fraud prevention, and risk control. All previous studies focused on stakeholders’ perceptions and ignored measuring the value of blockchain adoption. This study addresses this gap by quantifying and rating blockchain’s impact on reducing banking transaction costs. The data has been collected from 17 of 20 United Arab Emirates national banks over 2017–2023 and analyzed using the random forest method to assess the association between blockchain adoption and four transaction cost elements. The random forest technique accurately quantifies and classifies blockchain’s role in cost reduction. The findings indicate that blockchain adoption significantly reduces processing, transfer, and fraud costs. This study has a visible practical and theoretical contribution as it shifts focus to quantifying blockchain’s impact, providing useful insights for managers, and suggesting future research across different sectors and countries.

1 Introduction

Recent technological advancements are shaping the future trajectory of businesses. Digital technologies are increasingly accessible to all types of organizations, offering opportunities to enhance efficiency and profitability in diverse ways (Chan et al., 2022). The main objective of this research is to investigate how blockchain technology can reduce transaction costs, a practice that is becoming increasingly common. The analysis will focus on ways to unlock future property rights by eliminating intermediaries and using digital ledgers as electronic identities to store transactions (Li and Wan, 2021). Financial transactions appear when a third party is involved as an intermediary between the two parties of the transaction. This third party is mainly a bank and acts as a trusted authority figure or intermediary in the transactions and charges a fee for the rendered services. Decentralization and trust, the removal of intermediaries, transparency, security, and the digital technology that enables auditability are all key factors in ensuring data integrity and preventing manipulation.

Numerous past studies have delved into the theoretical aspects of blockchain (BC), examining its benefits, ethical considerations, level of awareness, reliability, and task performance accuracy (Ahmed, 2024; Alzoubi et al., 2022; Ducas and Wilner, 2017; Kurdi et al., 2022; Venni, 2024). However, there is less research that quantifies the value of adopting BC. Consequently, this study aims to assess the impact and significance of BC in reducing transaction costs within the banking sector.

Financial institutions play a crucial role in validating transactions, often charging fees known as “transaction costs,” They encompass all expenses incurred in buying or selling something. These costs vary widely; beyond the broker’s fee, there are costs associated with searching for goods or services. For instance, when a broker facilitates a stock market trade, the purchaser typically pays a market price higher than the prevailing trading price (Lang et al., 2020). This concept can be applied to blockchain technology, which decentralizes data, potentially reducing transaction costs in businesses.

Some of the techniques that significantly impact reducing transaction costs are ATM, mobile banking, Fintech, netting systems, and outsourcing of services (Li and Wan, 2021). By streamlining the various costs in financial transactions, blockchain has the potential to enhance productivity and economic growth across society (Lestari et al., 2023).

This study stands out from previous research in several ways: First, to the best of my knowledge, it is the first study to quantify blockchain’s impact on cost reduction in the banking sector as previous studies in this area surveyed and anticipated the usefulness of blockchain (Sakarneh and Kilani, 2024). Furthermore, it is the only study that rates the elements of banking transaction costs due to BC adoption. Second, it introduces a new approach by moving away from theoretical benefits and user perceptions, instead utilizing secondary data to quantify how BC reduces costs. This approach aids decision-makers in determining whether to adopt new technology or stick with existing practices. Unlike Dutta et al. (2020) who expect that reliance on the blockchain in financial services may contribute to cost reduction, this study measures the impact of blockchain on cost reduction and efficiency will surpass that of all previous techniques. Finally, the study assesses the association and impact of blockchain on specific components of costs, rather than providing a general and unmeasurable effect by applying an accurate classification machine learning technique, which is the random forest method (RFM).

One primary motivation for choosing this research topic stems from the persistent rise in transaction costs and their impact on price increases. These costs affect both parties involved in any transaction, be they consumers or producers. Therefore, many organizations started looking into new technologies to avoid or at least minimize transaction costs and also to speed up the time needed for transactions to be completed (Guo and Liang, 2016). They mentioned that international financial transactions require between three to 5 days to be settled.

With the rapid advancement of state-of-the-art technology, it is easy for industries that have not embraced digital transformation to become outdated (Atieh et al., 2025; World Bank Report, 2023). Digital payments have become integral to daily life. However, global transactions normally suffer from high processing costs and slow processing times due to reliance on the centralized conventional banking system. The traditional banking system requires all transaction details to be stored in a central database and verified by a server, which leads to high transaction costs and slow processing (Bush and Chui, 2022). Furthermore, this centralized system makes it easy for hackers seeking to steal the data. Transaction cost minimization will help in maintaining a stable economic environment. To enhance international trade and economic growth, it is necessary to have fast and low-cost transactions. Hence, this is the role of BC to offer a solution to this problem by enhancing the security and efficiency of distributed databases used for digital transactions and payments. The adoption of BC enhances security, improves the verification process, reduces the fraud risk, of payments and data. It is evidenced that if the technology specifically BC contributed to the speed-up of transactions and reduction of their costs, this will achieve the potential of enhancing trading relationships between countries and stimulate economic growth (Al-Qudah et al., 2024). Therefore, this study mainly aims to investigate the association between adopting BC in the banking sector and the different elements of transaction costs.

The paper first briefly explains the justifications, importance, benefits, and uses of blockchain technology. Then it presents the potential implications of BC with an emphasis on transaction costs, the theoretical background of BC, the costs of acquiring and operating BC, the transaction costs components, methodology, analysis, and finally discussion and conclusion.

2 Literature review

The efficiency of the banking sector can be directly assessed by the transaction costs incurred during transaction processing and activities. Inefficiencies in the banking sector lead to higher transaction costs borne by customers (Carlton, 2020). Traditional banks face a variety of costs in transaction processing, with one significant expense being the use of multiple intermediaries, such as correspondent banks, for cross-border transactions. These intermediaries often charge high fees, along with foreign exchange costs (Henten and Windekilde, 2020). The fees can vary widely, with some studies showing fees ranging from 2% to 10% of the payment amount. The complexity and opacity of pricing structures and associated networks make it challenging for banks and payment service providers to find the best deals. Yustika et al. (2014) posit that exchange transaction costs arise from imperfect information and the expenses of acquiring information.

By eliminating paperwork and automating transactions, both transaction time and costs are reduced (Higginson, et al., 2019). Traditional methods often take days to complete a transaction, but automation can shorten this to just a few hours or less. Automating document processing, contract execution, payment processing, and asset transfers through blockchain can greatly speed up and improve the accuracy of transactions, reducing the opportunities for fraud and thus lowering the costs associated with fraud detection and mitigation (Khadka, 2020). The banks incurred different types of transaction costs such as; processing the transactions, clearing and settlement, administrative expenses, communication, compliance, ATM security, risk, fraud prevention, and opportunity costs. As noted by De and Carlo, 2016, blockchain has the potential to decrease transaction costs and expedite money transfers in both peer-to-peer and business-to-business transactions. Furthermore, he suggested that utilizing blockchain could lower the costs of securities employed by exchange markets and banks. Furthermore, every transaction involving different parties often requires a trusted intermediary to oversee the process, increasing transaction costs. By implementing a secure, digitized process, reliance on a trusted intermediary is minimized, reducing the associated costs.

Banks also incur costs due to the liquidity needed for transactions. When processing a payment, a bank must ensure it has enough funds in the relevant currency (Lestari et al., 2023). This is especially challenging for cross-border payments, where the bank may not have an account in the payment currency, requiring pre-funding of nostro and vostro accounts. Maintaining these accounts in multiple currencies represents a significant opportunity cost for banks in terms of long-term liquidity holding. Reducing transaction costs to an efficient level can maximize profits (Baraka et al., 2019). Transaction costs are defined by (Saidah, 2018) as “the costs that are not included in the price of the item or service”. The transaction costs are costs that arise due to imperfect information (Carlton, 2020) or that result from limited access to information (Nilasari et al., 2019). Therefore, economists face incomplete information or uncertainty (Firmansyah, 2021). Moreover, liquidity requirements can change rapidly due to payment demands and macroeconomic fluctuations, as seen during the financial crisis. These factors lead to high operational costs for banks to manage liquidity efficiently and comply with regulations, including investments in staff, premises, and IT infrastructure. Banks must also invest heavily in compliance and monitoring to prevent fraud and meet regulatory standards, transferring some of the risks to customers through strong customer authentication, which can result in interoperability issues and potential loss of business (Seshadrinathan and Chandra, 2025).

During a period marked by rapid Fintech growth, numerous key terms emerged between 2016 and 2018. These included the regulation of banking operations and digital currencies, the legal and accurate accomplishment of financial transactions, the role of global Fintech, and the emergence of new Fintech companies (Alblooshi, 2022). Additionally, there was significant exploration into advanced AI learning, blockchain, and other information technologies, alongside the development of digital wallets, mobile payment service models, P2P lending, and equity funding transactions (Marinakis and White, 2022; Calderon-Monge and Ribeiro-Soriano, D., 2024). Labbadi and Khelil (2022) conducted the sole study on blockchain’s application in the United Arab Emirates (UAE) banking sector. They discovered that the adoption of BC in the UAE banking sector revealed approximately 3.75 million fraudulent transactions annually, amounting to potential losses of 435 million USD. The study also suggests that the Know Your Customer (KYC) blockchain platform is expected to enhance the quality of assets in UAE banks mainly by reducing operational risk. The Emirates Blockchain Strategy is poised to revolutionize the use of blockchain technology in the UAE, with key objectives including Saving AED 11 billion annually currently spent on documents and other transactional records, eliminating the AED 398 million yearly expense on printing documents, streamlining transactions to save nearly 77 million labor hours annually through blockchain. The ambitious goal of migrate over 70% of all governmental transactions to blockchain platforms by the close of 2024.

In their review of the literature related to transaction costs, Alchian and Woodward (1988) explained the differences by distinguishing between exchange and contracting types of transactions. The exchange transactions are derived from the transfer of property rights while contracting transactions are related to negotiating and enforcing performance promises. Generally, transaction costs can be seen as the total costs related to engaging in exchange and contracting activities, which are different from the costs of production. Some authors argue that transaction costs are difficult to define or measure. One criticism by (Davis, 1986) is that the concept of transaction cost is general and not operationalized. More criticisms are there such as the difficulty of quantifying many elements of transaction costs (Masten et al., 1991), or the overlap between transformation and transaction activities mentioned by (Menard, 1997).

2.1 Techniques for reducing transaction costs

Numerous efforts have been made to reduce transaction costs by considering variables such as the number of transactions, time, number of intermediaries, transaction amount, currency exchange, and the geographical location of the parties involved (Li and Wan, 2021). Most of the techniques have concentrated on reducing the number of transactions such as netting, bilateral, and multilateral techniques. Equations 1 through 7 explain how cost reduction is expressed under the different systems.

The netting system is the approach of offsetting the value of many payments that are due to be exchanged between two or more parties. The huge number of transactions will be fewer after the netting, which results in reducing the total transaction costs. Bilateral netting occurs when two parties in a transaction agree to offset their mutual obligations to end up in a single payment. The total bilateral cost (TBC) is a function of the number of transactions (NT) and the cost per transaction (CT). Therefore

In contrast, multilateral netting is the one that results from finding multiple parties in a transaction agreeing to offset their obligations, also resulting in a single payment. The transaction cost under the multilateral system (TMC) depends on the number of participants (NP) and the cost per participant (CP). Therefore, the total transaction cost under the multilateral will be:

2.2 The blockchain and its role in the banking sector

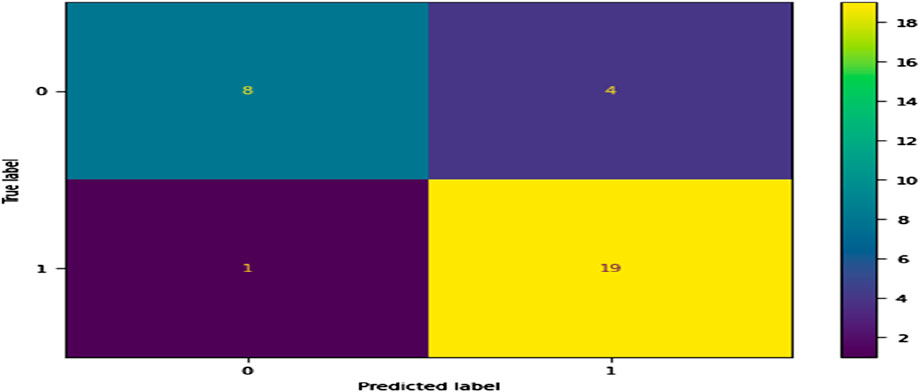

The term blockchain (BC) refers to a chain of blocks, where each block contains data, such as transaction information. It is important to distinguish this from merely copying data across computers, as true blockchains do not store data in a central, vulnerable location (Sadeghi et al., 2022). To qualify as a blockchain, data must be “distributed” across multiple computers, also known as a “distributed ledger.” When a new block is added to the entire network, every ledger on the network will be updated. This distributed ledger system allows anyone to access and verify the data, promoting transparency and democracy within the BC. This process, known as a “consensus algorithm,” is a crucial aspect of blockchain technology. Unlike traditional records, these blocks can store any digitally recorded data, purely in digital form (Rennie and Potts, 2024). A new block is added to the chain when the capacity is reached, creating a continuous BC. Each block contains a cryptographic hash of the previous block, transaction data, and a nonce. A nonce is a number added to a hashed message each time it is sent, ensuring its uniqueness and security. Transactions are recorded in blocks as a flat file and then organized in a specific format called a Merkle Tree. This tree lists all transactions in a block, creating a historical, periodical, and sensor data structure that is linked together. Each block refers to the previous one, forming a chain of blocks. Recently, the focus has shifted to how BC technology can reduce transaction costs, highlighting its potential impact. Figure 1 shows how blockchain technology initiates and processes transactions in the banking sector.

Figure 1. BC Role in the banking Sector: Source: OpenAI. (2024). ChatGPT [Large language model]. https://chatgpt.com.

Several authors (Tapscott and Tapscott, 2016; BiTA, 2018; Deloitte, 2017; Henten and Windekilde, 2020; CCI, 2024) explained the impact of BC on financial transactions in many sectors such as banking, food, real estate, supply chain, and many other sectors. Tapscott and Tapscott, (2016) stated that “blockchain is a technology that allows companies to eliminate transaction costs and provides efficient use of resources both on the inside and the outside”.

In banking, there are many uses of BC, and has been implemented in different banks’ cases. Santander Bank has a real case that identified 25 use cases with the main focus on smart contracts and outside payments. As per Hassani et al. (2018), 26 banks are exploring the use of BC. The technology has been adopted in various applications such as money transfers, digital currency exchanges, global payments, risk control, and investments. Cases related to Smart contracts have been adopted in capital markets, investment banking, commercial banks, retail banking, and insurance.

To adopt BC, banks have to fully understand their costs, benefits, risks, and opportunities. Osmani et al. (2021) stated that the adoption of BC has to be decided based on a comprehensive evaluation through SWOT analysis.

The blockchain sources estimated that by 2025, at least 10% of GDP will be stored in BC, which will be a turning point for banks to integrate BC technology into their different operations. This significant change reflects the importance for banks in the financial services sector to grasp BC technology, its expected impact, and potential applications. This makes BC a central topic and main concern in the banking sector over the next few years.

As per the World Bank data (2023), the G20 has aligned its work with the 2030 Agenda by adding a new target on remittances under SDG 10. SDG 10. The main purpose is to reduce the remittance cost to less than 3% and eliminate remittance corridors with costs higher than 5% by 2030. In today’s highly digitized and globalized business environment, companies face high transaction costs regularly, making it crucial to find ways to minimize them. As per blockchain statistics (2024), it predicts that blockchain technology, specifically in cloud applications for certain business segments, is expected to reach nearly 1,000 trillion U.S. dollars by 2032. The new prediction, from December 2023, suggests $943 billion in 2032, with a compound annual growth rate of around 56%. The market size of BC in banking and financial services has experienced exponential growth in recent years. Essentially, blockchain is a form of distributed ledger technology initially created to support Bitcoin. The advent of blockchain has significantly reduced transaction costs for businesses, banks, and government entities. Scholars believe that as blockchain technology continues to develop and be adopted widely, it will lead to a notable decrease in firm sizes across various industries (Lin, 2025; Li and Fang, 2022). This is because some traditional intermediary functions can be replaced by blockchain’s automatic execution and enforcement of pre-agreed-upon rules and operations.

The decentralized and trustless nature of blockchain technology plays a significant role in reducing transaction costs. The blockchain technology enables direct peer-to-peer secured and efficient transactions that help in eliminating the need for intermediaries like banks or brokers (Tilooby, 2018; Khatib, 2020). Such transactions will be achieved through the use of a distributed ledger and digital signatures, which ensure the security and validity of transactions without requiring a third-party trust agent. Therefore, all intermediaries’ costs, which are typically compensated for their role in facilitating and completing transactions, are eliminated. Whereas, the cost of the BC infrastructure is very low compared to what would be paid to intermediaries. As per the statistics provided by the Crypto Council for Innovation (2024), it is roughly computed that purchases from an international company through intermediaries incur around 3% of the transaction value. However, by using BC cryptocurrencies, this cost can be as little as 0.5%, This reduction in costs benefits both companies and customers and potentially leads to enhanced profitability.

Aside from cost savings, BC offers several other potential benefits to the banking sector. One of the major benefits is the potential less system failures. Before BC practices, banks relied on centralized IT systems to store data and run applications, leading to instances where bank systems were taken offline due to system failures.

Ensuring cyber resilience is increasingly important for banks. In the UK, the Treasury and the Bank of England have published a policy document outlining plans to improve the cyber resilience of the financial sector by 2021. BC also enhances physical resilience and security awareness (Xu Jennifer, 2016; Vlahavas et al., 2024). With data distributed globally and no single point of access, the risk of physical loss, damage, and interference is reduced. This is particularly advantageous for banking, as the industry transitions from physical structures to virtual ones.

Based on the presented literature, the gap in measuring the degree of association between BC and transaction costs has been identified. Therefore, the first hypothesis can be written as follows:

Hypothesis 1. There is a significant association between the adoption of blockchain and transaction costs.

The blockchain technology is not a free system. There are two major types of costs, namely, acquisition and operating costs. The cost of applying blockchain technology in banks can vary depending on many factors such as the size of the bank, the scope of the blockchain implementation, the complexity of the existing systems, and the specific use of BC. Some of the key BC acquisition costs are; purchase, development, integration in the bank’s system, implementation, and testing (Mhlanga, 2023). The operating expenses related to the adoption of BC in the banking sector may include Development and integration costs, training and education, regulatory compliance, security, network costs, maintenance and upgrades, consulting, testing and quality assurance, monitoring, scalability, and data management (Treiblmaier and Tumasjan, 2022).

Savings from the adoption of BC must be compared to the cost, challenges, and other implications to help managers decide on the implementation of BC or not. In some cases, the benefits derived from security enhancement, transparency, and efficiency may outweigh the initial costs of implementation. In contrast, some researchers have suggested that BC adoption may create challenges for the banks and may end with negative impacts, including cost increases, regulations, scalability issues, and performance (Hassani et al., 2018; Marr, 2018; Cheng et al., 2020; Li and Wan, 2021).

Numerous researchers (Tilooby, 2018; Guo and Liang, 2016; Henten and Windekilde, 2020) have explored blockchain’s potential to reduce transaction costs, improve settlement times, and enhance customer experiences. Moreover, the previously mentioned authors explained the major benefits of implementing BC across different sectors (Atieh et al., 2025). But still, no prior study has quantitatively measured this reduction. Previous studies have instead relied on questionnaires or interviews to gauge the perceptions of employees and decision-makers. Consequently, this study may be the first to measure the impact of adopting BC technology on transaction cost behavior in the banking sector.

To model the relationship between blockchain acquisition costs and banking transaction costs, you can use a basic cost-benefit analysis framework. Here’s a simplified approach that compares the cost of performing transactions through BC and the traditional transaction costs incurred by the bank before adopting BC. This comparison is defined and denoted as follows:

Cb: Blockchain acquisition costs; Ct: Banking transaction costs; Tb: Number of transactions processed using blockchain; Tt: Number of transactions processed using traditional methods.

The total cost of transactions (TC) is a function of the cost per transaction (Ct) and the number of transactions (T).

The total transaction costs incurred before implementation of BC:

Ct_before = Transaction cost (Ct) × Traditional number of transactions (Tt);

Implementation of BC will gradually replace the use of traditional approaches. Hence, the total cost of transactions after BC implementation = Transaction cost (Cb) × Number of transactions (Tb); hence;

The adoption of BC technology offers different advantages, including faster transaction times, lower transaction costs, and increased transaction volume completed by the banks. To estimate the potential cost savings from adopting BC:

According to this formula, the decrease in transaction costs will progressively replace traditional costs and align with the costs of transactions through BC adoption. This represents the minimum cost due to the elimination of barriers, swift processing, enhanced security, simultaneous transactions, and automated verification. Therefore, the second hypothesis will be:

Hypothesis 2. The adoption of blockchain has a significant impact on reducing the bank’s transaction costs.

3 The methodology and analysis

3.1 Data collection

Data was gathered from all national commercial banks operating in the UAE to assess the impact of blockchain on reducing banking transaction costs. Currently, there are 20 national commercial banks and approximately 28 branches of foreign banks in the UAE. The UAE’s banking sector witnessed high growth rates in 2023 in assets that reached more than AED 4 trillion, credit (around AED 2 trillion), deposits (2.5 trillion), and investments, supported by a strong economy. Four UAE banks have been classified within the top 50 largest banks in the Middle East and Africa (MEA). The study encompasses all national commercial banks but could obtain the necessary data from 17 out of the 20 banks (85% of the population). Three banks were excluded either because they commenced operations after 2017 or detailed transaction cost data was unavailable. Al-Qudah et al. (2024) investigate the continuous intention to use BC and FinTech innovations, focusing on the direct impact of user trust and perceived risks in the UAE. Alblooshi (2022) recommended that future research investigates FinTech in the UAE and its role in facilitating financial transactions. The Central Bank of UAE and the Saudi Central Bank agreed in 2021 to create payment systems that apply distributed ledger technology (BC) to complete local, regional, and international bank payments accurately. Based on the technology advances, and mature applications, the study selected the banking sector in UAE to be studied and a starting point to move to the region and beyond. The list of the designated banks and their basic characteristics are presented in Table 1, which shows 2023 data related to return on assets (ROA), bank size (total assets), market value, and shareholders’ equity. Data about four elements of transaction costs (processing, transfer, compliance, and risk and fraud) was collected from income statements and footnotes of each bank over 7 years (2017–2023).

In April 2018, the government of UAE introduced the “UAE Blockchain Strategy 2021,” aiming to be the world’s pioneering government in implementing this technology. The research revealed that the integration of BC in the UAE banking sector exposed approximately 3.75 million fraudulent transactions annually, amounting to potential losses of 435 million USD. The implementation of a KYC blockchain platform is anticipated to bolster the asset quality of UAE banks by notably reducing operational risks. Furthermore, it is suggested to promote and broaden the utilization of BC to enhance sustainability in the UAE banking sector. This study will fill the gap in identifying the role of BC in reducing and minimizing banks’ transaction costs.

As previously noted, various types of transaction expenses are incurred by banks. However, detailed data on each element is not readily available. Through an in-depth examination of transaction costs paid by the majority of banks in this study, the following elements have been identified:

1. Processing and transaction fees (Pc): They include the expenses associated with handling the transaction, such as human processing fees, technology expenses for maintaining the transaction systems, and expenses for ensuring transaction security.

2. Compliance Costs (Cc): Banks need to adhere to regulatory requirements, which incur costs for ensuring that transactions meet legal requirements, such as costs related to anti-money laundering and other compliance activities.

3. Risk and fraud prevention Costs (RFc): Include risks associated with transactions, such as credit risk, operational risk, and fraud risk.

4. Transfer and exchange rates Costs (TEc): Costs incurred when transactions involve multiple banks’ settlement processes, such as clearing and settlement fees charged by clearinghouses or payment networks plus the loss that results from exchange rates when the transfer is made for different types of currencies.

Therefore, the formula is written as follows: Transaction cost:

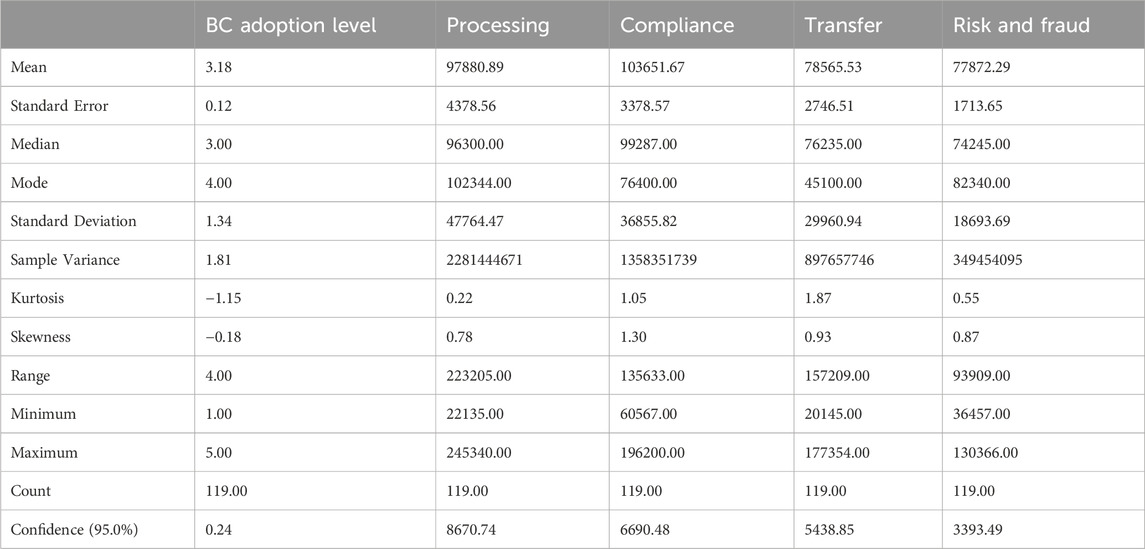

Table 2 shows the descriptive statistics of the data collected from UAE banks over 2017–2023.

The mean BC Adoption Level is 3.18, with a median of 3.00, indicating a moderate adoption level. The means of other variables are consistently higher than the medians, suggesting right-skewed distributions. Standard deviations reveal that Processing has the highest variability (47764.47), while BC Adoption Level has the lowest (1.34). This indicates that Processing values are more spread out compared to the other variables. All variables are positively skewed, with Compliance having the highest skewness (1.30).

3.2 The random forest method (RFM)

The study applies the random forest method (RFM) as one of the prominent machine learning algorithms that better classifies and computes accurate regressions in predicting the future impact of BC adoption on the different types of transaction costs. RFM is selected because of its accuracy in building current and future models as well as handling missing data (Sarica et al., 2017). Logunova (2022) states that RFM has a low bias, handles overfitting, and is more useful in the case of small sample data. The random forest starts by creating records and features, constructing a decision tree, generating the output of each decision tree, and the final output will be computed based on classification and regression. Predicting the impact of BC adoption on banking transaction costs has been generated through the RFM for the two models to estimate its impact on transaction costs first and then on cost savings. The findings of this analysis are explained below.

RFM starts by training data in a single decision tree, selecting a subset of features from the dataset, using the selected features to train the decision tree, repeating the previous three steps multiple times to create a collection of decision trees, and finally generating predictions and classifications.

3.3 Analysis and discussion

The analysis was conducted in two dimensions to test the hypotheses. It applies the RFM to examine the relationship between the adoption of BC technology and the four elements of transaction costs over the 7 years. Secondly, the study estimated the impact of adopting blockchain on cost reduction from 1 year to the next. This analysis illustrates the percentage of cost reduction [(Second-year cost–previous year cost)/Previous year cost] and its correlation with blockchain adoption.

Al-Qudah et al. (2024) stated a positive correlation between the size of the firm and the fintech applications. Li and Wan (2021) find a significant association between BC adoption and firms’ performance. Therefore, this study added two control variables: the bank size measured by total assets and bank performance measured by return on assets (ROA). A pre-test has been conducted and found that the size of the bank is the main significant influencer on the relationship between BC adoption and the costs of the transaction.

The adoption of blockchain is based on but different from the generic maturity model of Wang (2016), which is composed of a system development process (initial, repeatable, defined, manageable, and optimized). This study measures the adoption of BC through a five-level scale ranging from one to five. Level 1, is the early experimentation of BC. Level 2, where there is moderate implementation of BC in major transactions. Level 3, when BC is integrated into different stages of operations. Level 4, is efficiently utilized and linked to external organizations. Finally, level 5, is a widespread and innovative adoption of BC.

3.3.1 Analysis of the association between BC adoption levels and transaction costs

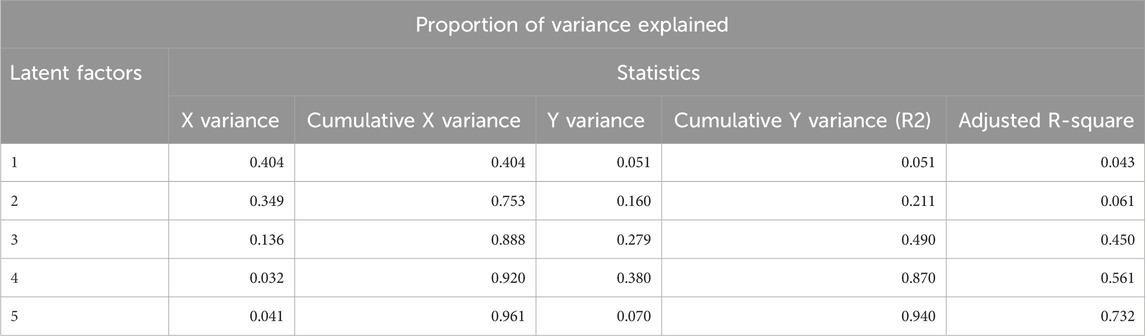

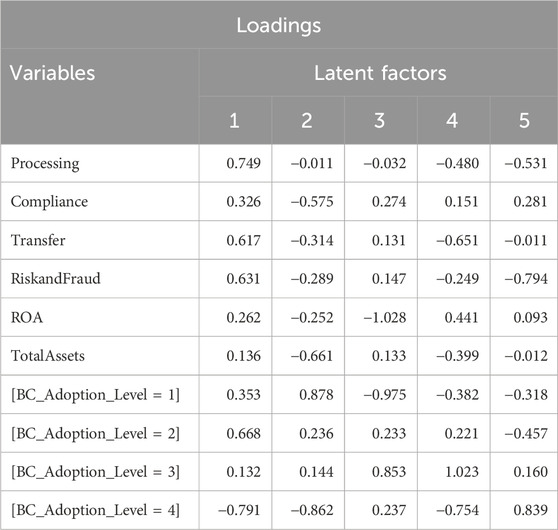

RFM has been applied to rate the significance of the levels of BC adoption. To explain how the model explains the data, a proportion of variance statistics has been generated. Table 3 shows the variances and the adjusted R-square at the five levels. It shows the contribution of each latent factor to the model. The first level of adoption explains 40% of the variance in the transaction costs and 40.4% of the variance in the adoption of BC. The predictors are highly explained by level 4 (38%). Level 2 to Level 4 explain more around 82% of the variance in transaction costs and 52% of the variance in the BC levels of adoption.

Table 3 shows the proportion importance of adding a new level of BC adoption. Level 1 has a very weak significance (4.3%) on the independent variables when added to Level 2, a slight change has happened. From level 3 (45%) to level 5 (73%). The findings show that the adjusted R2 increased significantly with more adoption of BC (level 1, 4.2%, level 2, 6.1%, level 3, 45%, level 4, 56%, and level 5%–73%).

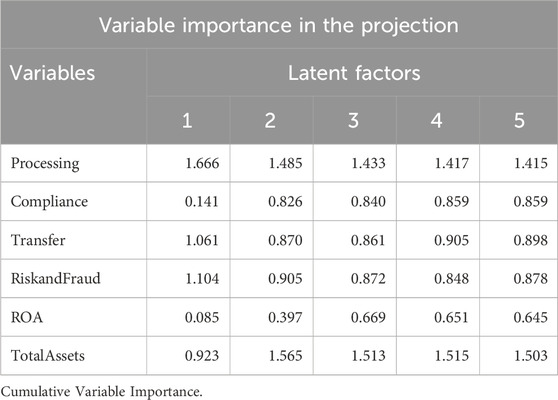

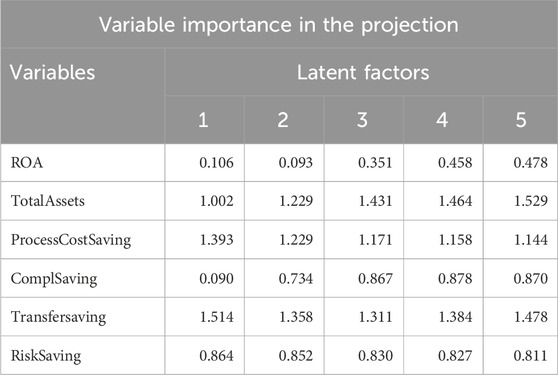

Table 4 explains the variable importance related to progress in the levels of BC adoption. The processing costs play a significant role as it grows consistently over the 5 levels of BC adoption ranging from 1.66 at level 1 to 1.415 at level 5. Risk and fraud costs come second in importance as they start with a high score at level 1 (1.10) and keep high scores across the different levels. Transfer costs are rated third in importance with systematic scores at all levels of BC adoption. The bank size measured by total assets shows that it is directly associated with the level of adoption of BC. The return on assets (ROA) is the least important and has no clear association with the levels. The compliance costs start with a very low score at level 1 (0.141) but steadily grow over the adoption levels. This indicates that the adoption of BC enhances compliance costs.

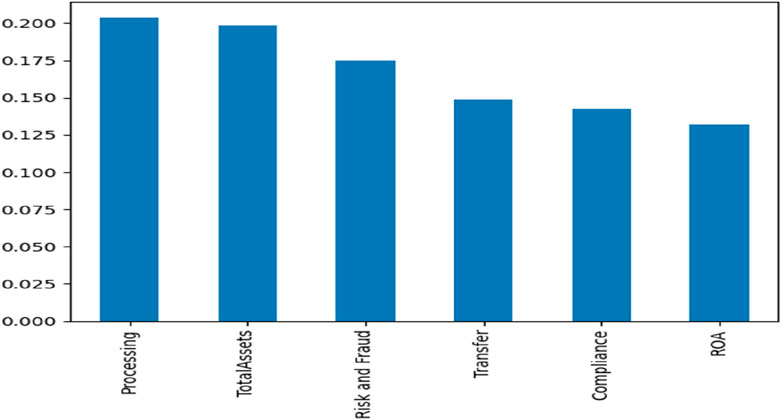

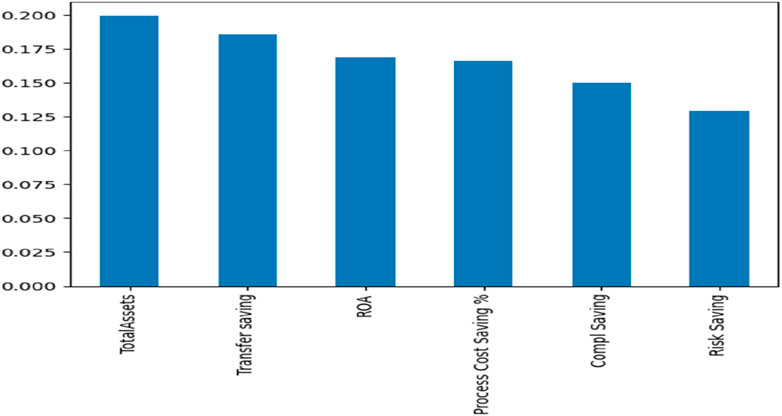

This result is illustrated by Figure 2, with 75% accuracy, which shows the ranking of elements of transaction costs related to the overall level of adoption. Figure 2 is the output of the RFM that ranks predictors from the most to the least significant. Overall, processing costs are the most affected by the level of BC adoption while transfer costs are the least affected.

Table 5 shows how each transaction cost is correlated with the level of BC adoption. The processing costs are highly positively correlated with level 1 (0.749) and then negatively correlated with all the remaining levels. This result explains the role of BC in consistently reducing processing costs. The second level of BC adoption is the only level that results in reducing compliance costs, whereas it is insignificantly positively correlated with the other four levels. Levels 2, 4, and 5 are negatively correlated with all other transaction costs and total assets. Overall, there is an obvious interaction and correlation between the different transaction costs and levels of BC adoption.

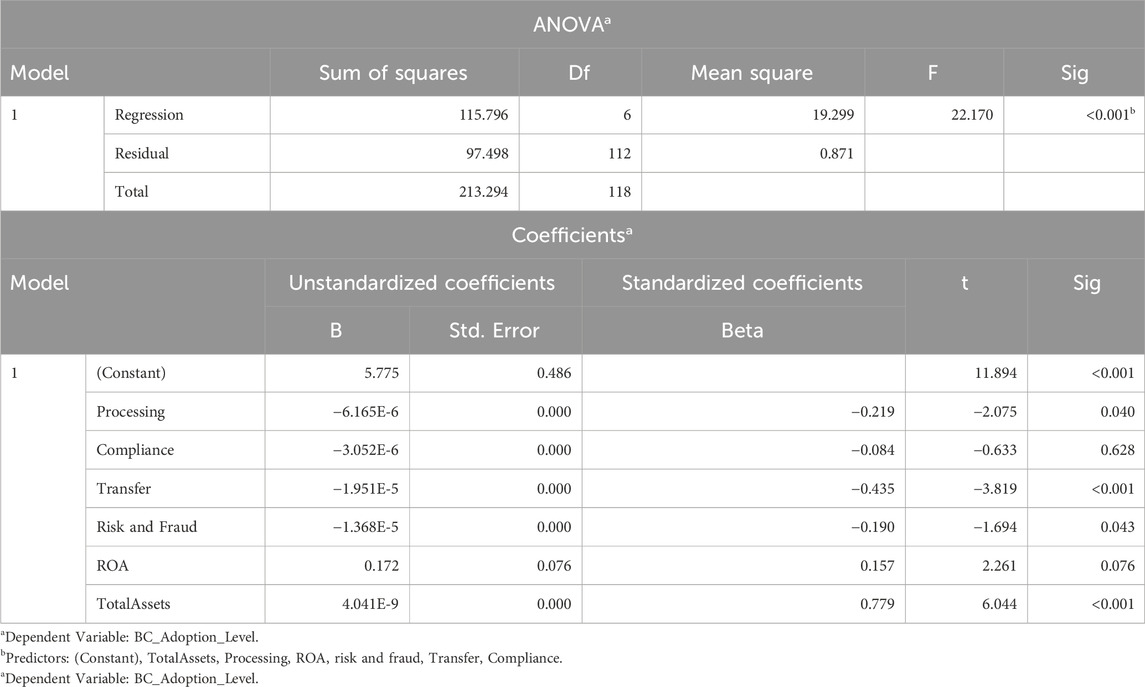

The regression analysis in Table 6 with a high F-test (22.17) and P-value of 0.001 indicates that the model is statistically significant. All the transaction costs are statistically significant as all are below 0.05 except compliance costs (0.628) and ROA (0.076), which are insignificant.

Therefore, we can write model 1 that explains the impact of BC on transaction costs as follows:

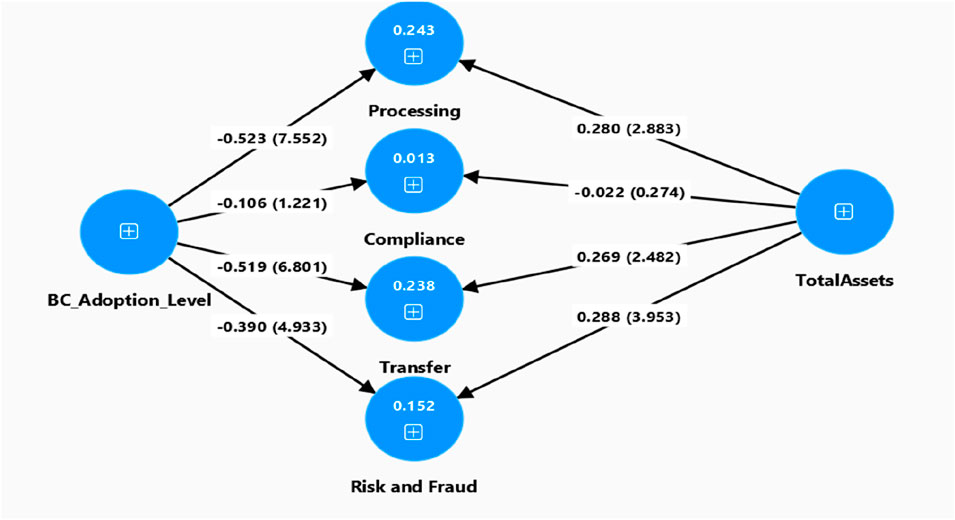

The first hypothesis predicts an association between the adoption of blockchain and transaction costs. The findings support the acceptance of this hypothesis as overall three of the elements of transaction costs were found to be negatively correlated and significantly affected by the level of BC adoption. In addition, the size of the bank is positively associated with the adoption of BC. All the large banks started adopting BC earlier and moved faster on the ladder of adoption.

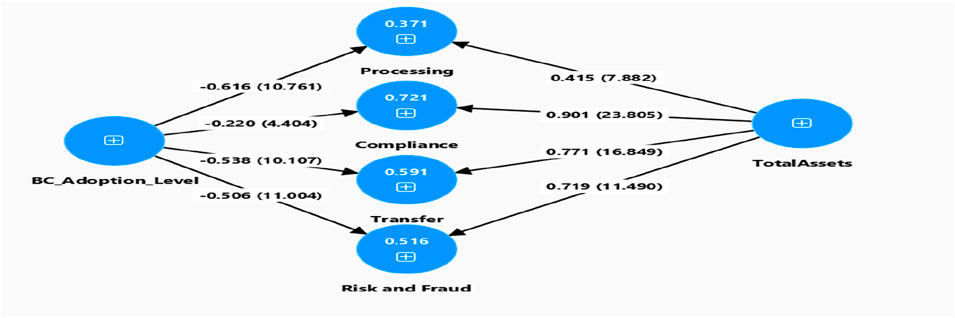

The RFM is accurate in classification and regression as well. The partial least square (PLS) has been applied because of the study’s relatively small size. Based on the previous findings, the study has excluded ROA as it has no significant impact. Figure 3 shows that all four elements of transaction cost are inversely affected by the adoption level of BC, which means that the higher the adoption level the lower the element of transaction cost. The processing cost is negatively affected by the level of BC adoption (−0.523) and with the highest coefficient of (7.55), followed by transfer cost in second place (−5.19), risk and fraud costs (−3.90). In contrast, the compliance cost (−0.106) shows a non-significant coefficient of (−1.22) and a coefficient less than 1.70. It is worth mentioning that when adding the size of the bank as a control variable all the coefficients except the compliance are above 1.7, which is consistent with the previous results. The compliance cost is the only cost that is negatively affected by the size of the bank.

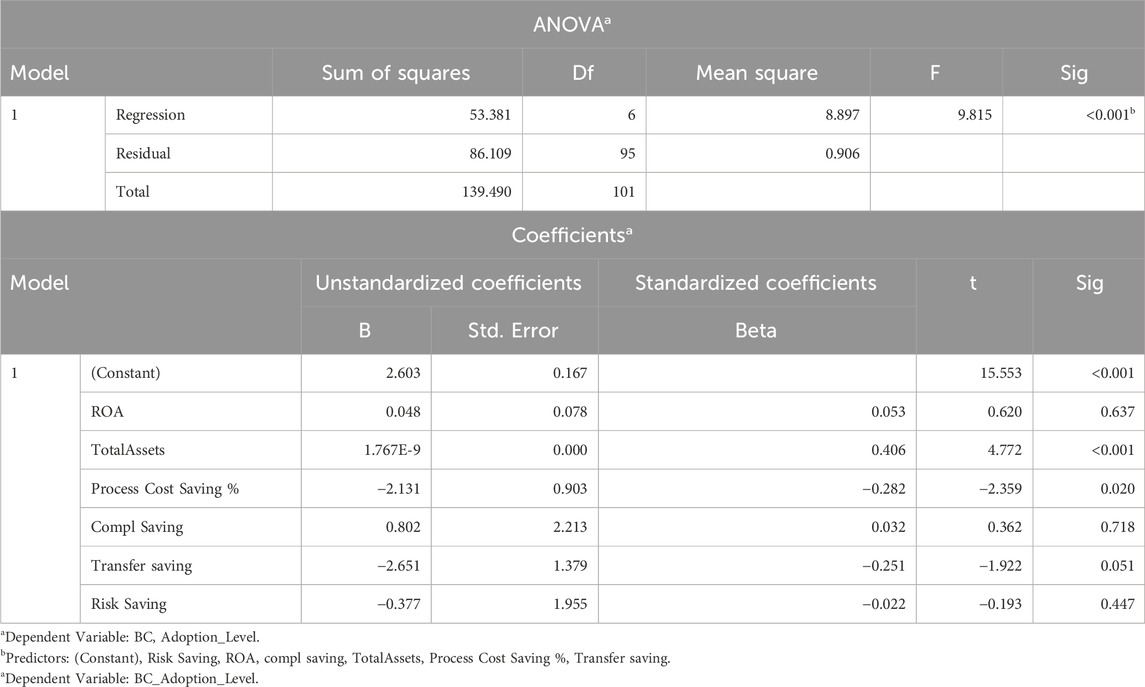

3.3.2 Analysis of the association between BC adoption levels and transaction cost savings

The second model considers the association between the adoption of BC and the cost savings.

Table 7 shows the impact of the progress in the BC adoption level on the savings of the four elements of transaction cost savings. The figures in the table show a negative relationship with the level of adoption of BC. Transfer cost savings have been significantly and negatively associated with the level of BC adoption as it decreases from 0.76 to −0.66 at level 4. The savings in processing costs are ranked second as the regression coefficient decreases from 0.48 at level 1, to −3.32 at level 4. Risk and fraud expenses are negatively affected by the level of adoption of BC as the coefficient decreased from 2.6 in level 1 to −6.64 in level 4. Compliance costs are not significantly associated with the levels of adoption of BC. The association of total assets, ROA, and risk savings are not significant as well.

Table 8 shows the variable importance and loadings of the cost savings when progressing at the adoption level. Transfer cost savings have been ranked after the control variable of total assets, followed by processing cost savings, and then compliance. ROA is insignificantly affected by the level of adoption of BC. This is also explained in Figures 3, 4.

Table 9 illustrates the relationships between transaction cost savings, control variables, and latent factors of BC adoption levels. All the variables show negative loads, which means a high adoption level leads to a reduction in the associated cost. However, only ROA and compliance cost savings are not declining.

Figure 4 explains the association of BC adoption level with the process cost saving, compliance saving, transfer saving, risk and fraud saving, ROA, and total assets. The ranking of the predictor from the most significant to the least significant one.

Figure 5 shows that all four transaction cost savings are inversely affected by the adoption level of BC, which means that the higher the adoption level the more the transaction cost savings.

The regression analysis of transaction cost savings presented in Table 10 has a P-value of 0.001 indicating that the model is statistically significant. Three of the transaction cost savings are statistically significant and are below 0.05 except compliance costs (0.718) and ROA (0.637), which are insignificant. Therefore, we can write the formula of the second model that explains the impact of BC on transaction cost savings as follows:

The second hypothesis predicts an association between the BC adoption and transaction cost savings. The findings support the acceptance of this hypothesis as overall three of the elements of transaction cost savings were found to be negatively correlated and significantly affected by the level of BC adoption. In addition, the size of the bank is positively associated with the adoption of BC.

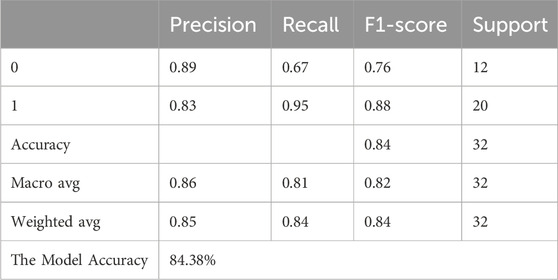

3.3.2.1 Accuracy and reliability

The RFM analysis is highly accurate, reliable, and valid as explained by the lower MSE and RMSE of 15% and 39% respectively. This finding explains close results of actual and predicted values. In addition, the overall precision of the model is around 84% as per Table 11.

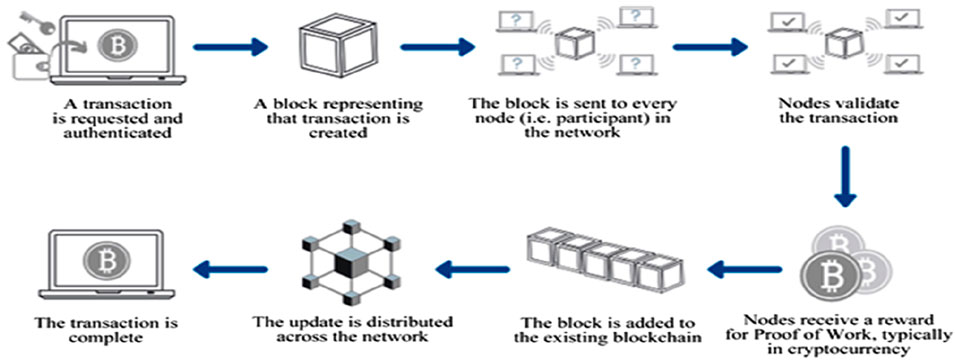

To describe the performance of classification through the RFM, the confusion matrix table has been used to determine the number of true and wrong predictions. The accuracy is measured by the percentage of true positives and negatives compared to the total observations (84%). Precision, or Positive Predictive Value, which measures the proportion of positive actual results that are actually correct, which shows a high precision as the weighted average is 85%. Recall, that measures the proportion of actual positives that are correctly determined with a weighted average of 84%.

Figures 6, 7 on the confusion matrix below have been provided as evidence for the calculation of the model accuracy, precision, and Recall that are explained in Table 11.

4 Conclusion

The main purpose of this study is to investigate the impact of the adoption of blockchain technology on banking transaction costs. There are many types and elements of transaction costs in the banking sector. However, data is not available for all in detail, which leads the author to classify the transaction costs into four major classes: processing costs, transfer costs, compliance costs, and risk and fraud costs. This study tries to be distinguished from previous studies and moves from perception, questionnaires, and interview studies to rely on secondary data to measure the real impact of blockchain on cost savings. The data has been collected from 17 national banks out of the 20 UAE national commercial banks over 7 years-period (2018–2023). Two dimensions of analysis have been conducted. One way is to test the association between the adoption of BC technology and the four types of transaction costs. The other dimension is to measure the impact of adopting BC on cost savings. The random forest technique has been applied to predict the impact of BC adoption on transaction costs and savings as a result of the adoption. The feature importance has ranked processing cost as the first under both models.

The findings of this study indicate a notable negative correlation between BC adoption and transaction costs over the 7 years, except compliance costs, which increased with the application of BC. This outcome lends support to the acceptance of the first hypothesis. Additionally, the second key finding reveals that BC adoption has led to cost savings or reductions in three out of four cost elements (processing, transfer, and risk and fraud). This finding has a positive implication on banking performance and is consistent with Ahmed Al-Dmour et al. (2024) and Rawashdeh et al. (2023) as their study shows a robust positive effect of Blockchain on the quality of accounting information systems, which significantly enhanced banking performance.

This is expected to have significant implications for both theory and practice, contributing substantially to the knowledge as it provides theoretical implications by shifting the focus from qualitative perceptions to quantitative analysis. It will also pave the way for new research avenues and enable practitioners and decision-makers to lower costs and reconsider the role of intermediaries, potentially leading to their elimination. The key implications of this study are as follows: it aligns with the perspectives of decision-makers and various stakeholders, as indicated in prior studies (Henten and Windekilde, 2020; Tilooby, 2018; Ducas and Wilner, 2017; Xu Jennifer, 2016). The study significantly contributes to practical applications by guiding decision-makers in conducting cost-benefit analyses to determine the potential savings from implementing new technology. Most of the previous studies were perception testing based on questionnaires and primary data, this study is one of the few studies to rely on secondary data, which was generated and computed to quantify the cost savings resulting from blockchain adoption.

This study is not free of limitations. The main limitation is the small size of the sample as the study concentrated on UAE banks. This may be a chance for future research to include banks from different countries regionally or globally. Another limitation is the difficulty in computing and classifying transaction costs. The data is not ready and published in financial reports and it needs more effort and time to access the raw data, which was difficult to get for some banks.

A summary of significant impacts and implications provided by this study are:

Societal impact: By eliminating intermediaries, and saving transaction costs, BC enhances financial inclusion and provides services to many uncovered users and areas. This technology may replace some jobs but creates new employment opportunities.

Managerial impact: When adopting BC technology, managers will save time and costs to be utilized in thinking in innovative and strategic decisions and policies. Also, enhances risk management and reduces reliance on central authorities through more decentralization.

Economic impact: The economic impact can be achieved in many dimensions, such as; affordable financial services for both banks and customers, improved market operations and efficiency of the financial system, and enhanced investment in technology.

Furthermore, this study paves the way for future research in several areas. It opens avenues for testing the impact of BC on profitability, sustainability, and the quality of disclosure within the banking sector, as well as in other profit and non-profit organizations.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

IA: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. The author acknowledges that the publication fees were covered by Ajman University.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that Generative AI was used in the creation of this manuscript. Only one figure (Figure 1) about the use of blockchain in the banking sector was generated from ChatGPT, OpenAI.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmed, I. E. (2024). “Accountants’ perception and essential skills on blockchain technology,” in Studies in big data (Studies in Big Data. Springer Science and Business Media Deutschland GmbH), 147, 125–140. doi:10.1007/978-3-031-55221-2_7

Alblooshi, F. S. A. K. (2022). FinTech in the United Arab Emirates: a general introduction to the main aspects of financial technology. 163, 178. doi:10.1108/978-1-80071-517-220221010

Alchian, A. A., and Woodward, S. L. (1988). The firm is dead; long live the firm: a review of oliver E. Williamson’s the economic institutions of capitalism. J. Econ. Literature, Am. Econ. Assoc. 26 (1), 65–79, March.

Al-Dmour, A., Al-Dmour, R., Al-Dmour, H., and Al-Adwan, A. (2024). Blockchain applications and commercial bank performance: the mediating role of AIS quality. J. Open Innovation Technol. Mark. Complex. 10 (2), 100302. doi:10.1016/j.joitmc.2024.100302

Al-Qudah, A. A., Al-Okaily, M., and Yadav, M. P. P. (2024). The growth of FinTech and blockchain technology in developing countries: UAE’s evidence. Int. J. Account. and Inf. Manag. doi:10.1108/ijaim-02-2024-0065

Alzoubi, H., Alshurideh, M., Kurdi, B. A., Akour, I., and Aziz, R. (2022). Does BLE technology contribute towards improving marketing strategies, customers’ satisfaction and loyalty? The role of open innovation. Int. J. Data Netw. Sci. 6 (2), 449–460. doi:10.5267/j.ijdns.2021.12.009

Atieh, A. A., Abu Hussein, A., Al-Jaghoub, S., Alheet, A. F., and Attiany, M. (2025). The impact of digital technology, automation, and data integration on supply chain performance: exploring the moderating role of digital transformation. Logistics 9 (1), 11. doi:10.3390/logistics9010011

Baraka, B., Mburu, J., and Muriithi, B. (2019). Transaction costs magnitudes, market participation, and smallholder profitability in rural-urban vegetable supply chain. Int. J. Veg. Sci. 27 (1), 54–64. doi:10.1080/19315260.2019.1700204

Blockchain in Transport Alliance (BiTA). (2018). Collaboration key to Blockchain in Transportation Alliance. Supply & Demand Chain Executive. Available online a: https://www.sdcexec.com/software-technology/automation/article/21001515/collaboration-key-to-blockchain-in-transportation-alliance.

Bush, J., and Chui, M. (2022). Forward thinking on tech and the unpredictability of prediction with benedict evans. Blockchain website.

Calderon-Monge, E., and Ribeiro-Soriano, D. (2024). The role of digitalization in business and management: a systematic literature review. Rev. Manag. Sci. 18, 449–491. doi:10.1007/s11846-023-00647-8

Carlton, D. W. (2020). Transaction costs and competition policy. Int. J. Industrial Organ. 73, 102539. doi:10.1016/j.ijindorg.2019.102539

CCI (2024). Crypto and remittances – overview, challenges, and progress ahead. Available online at: https://cryptoforinnovation.org/crypto-and-remittances-overview-challenges-and-progress-ahead/.

Chan, Y. E., Krishnamurthy, R., and Sadreddin, A. (2022). Digitally-enabled university incubation processes. Technovation 118, 102560. doi:10.1016/j.technovation.2022.102560

Cheng, S. F., De Franco, G., Jiang, H., and Lin, P. (2020). Riding the blockchain mania: public firms’ speculative 8-K disclosures. Manag. Sci. 65 (12), 5901–5913. doi:10.1287/mnsc.2019.3357

Chia-Ying, Li, and Fang, Y.-H. (2022). The more we get together, the more we can save? A transaction cost perspective. Int. J. Inf. Manag. 62, 0268–4012. doi:10.1016/j.ijinfomgt.2021.102434

Davis, F. D. (1986). A technology acceptance model for empirically testing new end-user information systems: Theory and results (Doctoral dissertation, Massachusetts Institute of Technology).

De, M., and Carlo, R. W. (2016). The UK and Blockchain technology: a balanced approach. J. Payments Strategy and Syst. Henry Stewart Publ. 9 (4), 220–229. doi:10.69554/QQHO1595

Deloitte. (2017). Rewriting the rules for the digital age: 2017 Deloitte Global Human Capital Trends. Deloitte University Press. Available online at: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/HumanCapital/hc-2017-global-human-capital-trends-gx.pdf

Ducas, E., and Wilner, A. (2017). The security and financial implications of blockchain technologies: regulating emerging technologies in Canada. Int. J. 72 (4), 538–562. doi:10.1177/0020702017741909

Dutta, P., Choi, T. M., Somani, S., and Butala, R. (2020). Blockchain technology in supply chain operations: applications, challenges and research opportunities. Transp. Res. part e Logist. Transp. Rev. 142, 102067. doi:10.1016/j.tre.2020.102067

Firmansyah, H. (2021). Theory of rationality in the view of islamic economics. El-Ecosy J. Islamic Econ. Finance 1 (1), 34–50. doi:10.35194/eeki.v.1i1.1136

Guo, Y., and Liang, C. (2016). Blockchain application and outlook in the banking industry. Financ. Innov. 2, 24. doi:10.1186/s40854-016-0034-9

Hassani, H., Huang, X., and Silva, E. (2018). Banking with blockchain-ed big data. J. Manag. Anal. 5 (4), 256–275. doi:10.1080/23270012.2018.1528900

Henten, A. H., and Windekilde, I. M. (2020). Blockchains and transaction costs. Nordic Baltic J. Inf. Commun. Technol. 2020 (1), 33–52. doi:10.13052/nbjict1902-097X.2020.002

Higginson, M., Hilal, A., and Yugac, E. (2019). Blockchain and retail banking: making the connection. Mckinsey and Company. Available online at: https://www.mckinsey.com/industries/financial-services/our-insights/blockchain-and-retail-banking-making-the-connection.

Khadka, R. (2020). The impact of blockchain technology in banking: how can blockchain revolutionize the banking industry? Master Thesis. Central University of Applied Science.

Khatib, H. (2020). Top UAE banks that adopted blockchain technology and why. Available online at: https://www.globalethicalbanking.com/top-uae-banks-adopted-blockchain-technology/.

Kurdi, B., Alzoubi, H., Akour, I., and Alshurideh, M. (2022). The effect of blockchain and smart inventory system on supply chain performance: empirical evidence from retail industry. Uncertain. Supply Chain Manag. 10 (4), 1111–1116. doi:10.5267/j.uscm.2022.9.001

Labbadi, H., and Khelil, A. (2022). Blockchain technology application in the UAE banking industry. J. Econ. Finance (JEF) 08 (N0 00/2022), 280–294.

Lang, B., Botha, E., Robertson, J., Kemper, J. A., Dolan, R., and Kietzmann, J. (2020). How to grow the sharing economy? Create prosumers. Australas. Mark. J. 28 (3), 58–66. doi:10.1016/j.ausmj.2020.06.012

Lestari, D., and Rahmanto, B. T. (2023). Fintech and its challenge for banking sector. Manag. J. BINANIAGA 6 (01), 55–70. doi:10.33062/mjb.v6i1.428

Li, R., and Wan, Y. (2021). Analysis of the negative relationship between blockchain application and corporate performance. Mob. Inf. Syst. 2021, 9912241–9912318. doi:10.1155/2021/9912241

Lin, H. F. (2025). Examining the determinants of blockchain technology-enabled maritime supply chain system adoption intention: does market turbulence play a moderating role? Mar. Policy 174, 106616. doi:10.1016/j.marpol.2025.106616

Logunova, I. (2022). Random forest classifier: basic principles and applications. Serokell. Available online at: https://serokell.io/blog/random-forest-classification.

Marinakis, Y. D., and White, R. (2022). Hyperinflation potential in commodity-currency trading systems: implications for sustainable development. Sustain Technol Entrepren 1 (1), 100003. doi:10.1016/j.stae.2022.100003

Marr, B. (2018). The 5 big problems with Blockchain everyone should be aware of. Retrieved March 06, 2021, Available online at: https://www.forbes.com/sites/bernardmarr/2018/02/19/the-5-big-problems-with-blockchain-everyone-should-be-aware-of/?sh=64758e211670

Masten, E., Scott, W., Meehan, J., and Snyder, E. (1991). The costs of organization. J. Law, Econ. Organ. 7 (1), 1–25. doi:10.1093/oxfordjournals.jleo.a037001

Menard, C. (1997). Transaction cost economics: recent developments. Edward Elgar Publishing Cheltenham, United Kingdom. Available online at: https://EconPapers.repec.org/RePEc:elg:eebook:1150.

Mhlanga, D. (2023). Blockchain technology for digital financial inclusion in the industry 4.0, towards sustainable development? Front. Blockchain 6, 1035405. doi:10.3389/fbloc.2023.1035405

Nilasari, A. P., Hutajulu, D. M., Retnosari, R., and Astutik, E. P. (2019). “Strategi pemberdayaan dan kontribusi UMKM menghadapi ekonomi digital,” in Prosiding seminar nasional fakultas ekonomi untidar 2019.

Osmani, M., El-Haddadeh, R., Hindi, N., Janssen, M., and Weerakkody, V. (2021). Blockchain for next generation services in banking and finance: cost, benefit, risk and opportunity analysis. J. Enterp. Inf. Manag. 34 (3), 884–899. doi:10.1108/JEIM-02-2020-0044

Rawashdeh, A., Bakhit, M., and Abaalkhail, L. (2023). Determinants of artificial intelligence adoption in SMEs: the mediating role of accounting automation. Int. J. Data Netw. Sci. 7 (1), 25–34. doi:10.5267/j.ijdns.2022.12.010

Rennie, E., and Potts, J. (2024). Contribution systems: a new theory of value. Work. Pap. Available online at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4754267

Sadeghi, M., Mahmoudi, A., and Deng, X. (2022). Adopting distributed ledger technology for the sustainable construction industry: evaluating the barriers using Ordinal Priority Approach. Environ. Sci. Pollut. Res. 29, 10495–10520. ISSN 1614-7499. PMC 8443118. PMID 34528198. doi:10.1007/s11356-021-16376-y

Saidah, N. (2018). Corporate governance and firm performance: Evidence from Indonesia. Asian Journal of Accounting Research. 3 (1), 45–55. doi:10.1108/AJAR-07-2018-0025

Sakarneh, B., and Kilani, Y. M. (2024). The role of blockchain technology in managing efficiency and cost reduction in the banking sector in Jordan. J. Syst. Manag. Sci. 14 (5), 251–267. doi:10.33168/JSMS.2024.0516

Sarica, A., Cerasa, A., and Quattrone, A. (2017). Random forest algorithm for the classification of neuroimaging data in alzheimer's disease: a systematic review. Front. Aging Neurosci. 9, 329. doi:10.3389/fnagi.2017.00329

Seshadrinathan, S., and Chandra, S. (2025). Trusting the trustless blockchain for its adoption in accounting: theorizing the mediating role of technology-organization-environment framework. Financ. Innov. 11, 44. doi:10.1186/s40854-024-00685-5

Tapscott, D., and Tapscott, A. (2016). Blockchain revolution: how the technology behind bitcoin is changing money, business, and the world. New York: Penguin. Available online at: https://www.amazon.com/Blockchain-Revolution-Technology.

Tilooby, Al. (2018). The impact of blockchain technology on financial transactions. Dissertation: Georgia State University. doi:10.57709/12552634

Treiblmaier, H., and Tumasjan, A. (2022). Editorial: economic and business implications of blockchain technology. Front. Blockchain 5. doi:10.3389/fbloc.2022.857247

Venni, V. K. (2024). AI and contemporary challenges: the good, bad and the scary. J. Open Innovation Technol. Mark. Complex. 10 (Issue 1), 2199–8531. doi:10.1016/j.joitmc.2023.100178

Vlahavas, G., Karasavvas, K., and Vakali, A. (2024). Unsupervised clustering of Bitcoin transactions. Financ. Innov. 10, 25. doi:10.1186/s40854-023-00525-y

World Bank Reports (2023). Available online at: https://remittanceprices.worldbank.org/resourcesfortheRemittancePricesWorldwideQuarterlyReports.

Xu Jennifer, J. (2016). Are blockchains immune to all malicious attacks? Financ. Innov. 2 (1), 25. doi:10.1186/s40854-016-0046-5

Keywords: blockchain technology, transaction costs, blockchain and cost saving, processing and transfer costs, random forest method

Citation: Ahmed IE (2025) Analyzing the impact of blockchain technology on banking transaction costs using the random forest method. Front. Blockchain 8:1551970. doi: 10.3389/fbloc.2025.1551970

Received: 26 December 2024; Accepted: 16 April 2025;

Published: 30 April 2025.

Edited by:

Marcelle Michelle Georgina Maria Von Wendland, Bancstreet Capital Partners Ltd., United KingdomReviewed by:

Piotr Soja, Kraków University of Economics, PolandSakila Akter Jahan, Illinois State University, United States

Copyright © 2025 Ahmed. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ibrahim Elsiddig Ahmed, aS5hbHNpZGRpcWVAYWptYW4uYWMuYWU=

Ibrahim Elsiddig Ahmed

Ibrahim Elsiddig Ahmed