- Institute for Sustainable Future, University of Technology Sydney, Sydney, NSW, Australia

The Regenerative Finance (ReFi) movement is gaining traction in the Web3 space, with numerous blockchain-based initiatives claiming alignment with regenerative outcomes. However, many of these claims remain vague or structurally unsubstantiated. This study evaluates 40 self-identified ReFi initiatives to determine the extent to which their design, governance, capital structures, and impact logic align with foundational regenerative principles. Drawing from regenerative economics, living systems theory, and regenerative organizational design, a structured evaluation framework was developed covering six dimensions across three domains: regenerative finance, real-world impact, and regenerative organizational design. The framework informed two scoring-based questionnaires, enabling systematic assessment of regenerative and impact claims. Results revealed significant variation in alignment: 50% of initiatives were categorized as Regenerative Finance (ReFi), 45% as Sustainable DeFi, and 5% as Structurally Misaligned, reflecting limited coherence between regenerative claims and actual practice. The findings showed that team diversity and initiative maturity were positively correlated with regenerative performance, and that a lack of holistic impact evaluation—across thematic dimensions and throughout operational, direct, and indirect value chains—remains a key limitation across the sector. A typology of regenerative alignment and a replicable self-evaluation tool were developed to help funders, practitioners, and protocol developers assess which ReFi initiatives are structurally aligned with regenerative principles and which remain aspirational. This research advances conceptual and practical clarity around the term “regenerative” in Web3, supporting the evolution of more accountable, transparent, and transformation-oriented financial systems in service to the Global Commons.

1 Introduction

The Regenerative Finance (ReFi) movement has rapidly evolved as a field of experimentation within the Web3 ecosystem, combining decentralized finance (DeFi) technologies with aspirations for social and ecological regeneration. While many ReFi initiatives position themselves as advancing regenerative outcomes, questions persist about whether these claims are substantiated in practice—or whether they merely represent a continuation of traditional sustainable finance models in a digital, Web3 context.

This study builds on a previously published perspective article by the author, “The ReFi Movement in Web3: Implications for the Global Commons” (Bennett, 2025) which raised concerns about the growing misalignment between the regenerative ethos espoused by ReFi projects and the foundational principles of regenerative economics and practice. That article argued that without grounding in systems theory, ecological economics, and living design principles, the ReFi movement risks replicating the extractive logics of neoclassical finance under the guise of innovation. It called for self-regulatory mechanisms to ensure greater accountability and coherence within the ReFi ecosystem, especially given the absence of formal oversight in decentralized finance.

In response, this study presents an empirical evaluation of 40 self-identified ReFi initiatives within the Web3 space. Rather than asserting a fixed definition of regeneration, this study applies a structured, theory-informed framework grounded in established literature to assess whether project-level features such as economic model, governance structure, and impact logic align with regenerative principles.

This study has two objectives: (i) to assess the extent to which self-identified ReFi initiatives substantiate their regenerative claims; and (ii) to identify recurring patterns and features that distinguish regenerative-aligned projects from those rooted in more conventional sustainability approaches. The intent is to support deeper reflection and standard-setting within the ReFi ecosystem—offering a practical lens for developers, funders, and practitioners committed to advancing truly transformational approaches in Web3.

Section 2 situates the ReFi movement within its broader theoretical and technological context, drawing on principles from regenerative economics, systems theory, and organizational design. Section 3 outlines the evaluative framework and methodology used to assess 40 ReFi initiatives across eight core dimensions. Section 4 presents the findings, including alignment trends, structural gaps, and project-level insights. Section 5 discusses the implications of these results for practitioners, funders, and researchers, highlighting opportunities for more rigorous design, deeper accountability, and future inquiry into regenerative potential within Web3 systems.

2 Contextual and theoretical foundations

The ReFi movement has emerged as a rapidly evolving and self-defining domain within the broader Web3 ecosystem, uniting decentralized technologies with aspirations for social and ecological regeneration (Flynn, 2022; Neelakanti, 2022). While the term “regenerative finance” draws from a lineage of ecological economics and systems thinking, its application within Web3 remains both emergent and contested (Curve Labs, 2022). ReFi initiatives span a wide range of models and Web3 technologies including tokenized carbon markets, decentralized applications (dApps), governance platforms, oracles, NFTs, and community currencies, each purporting to advance regeneration through novel financial mechanisms.

Given the absence of a unified definition of “regeneration” in practice, this study does not attempt to define the term authoritatively. Instead, it applies a theory-informed evaluative framework grounded in regenerative literature, drawing from works that offer operational principles, evaluative criteria, and systemic design guidance. These include:

• Capital Institute’s eight principles of regenerative finance and economics (Fullerton, 2015; 2017; 2018);

• Regenesis Group’s regenerative practice frameworks (Mang and Haggard, 2016);

• Doughnut Economics (Raworth, 2017) and its principles of practice (Doughnut Economics Action Lab (DEAL), 2020);

• Steve Waddell’s work on transformation and system change (Waddell et al., 2015).

• Five Dimensions of Impact (Impact Frontiers, 2021a; 2021b), as developed through the Impact Management Project (IMP).

• Eduard Müller’s regenerative development framework (Muller, 2017), used to assess holistic systems thinking and integration across social, ecological, cultural, and political domains.

Together, these sources form a coherent evaluative lens, distinguishing regenerative approaches not merely by intent, but by structural and systemic alignment across finance, governance, and impact.

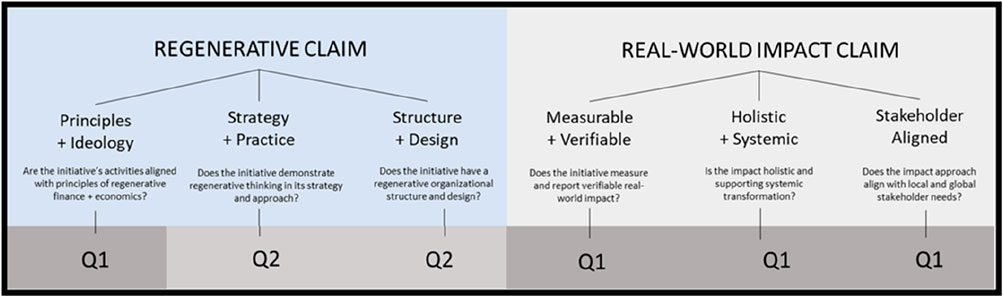

To operationalize these principles, the study translated regenerative theory into a structured set of evaluative criteria. Two theory-informed questionnaires were developed to assess alignment across six dimensions spanning regenerative finance, real-world impact, and organizational design. These dimensions served as the foundation for evaluation, enabling systematic comparison across 40 ReFi initiatives.

While the study focuses on regenerative alignment, it recognizes that many initiatives operate from sustainability-oriented paradigms. These are not treated as inferior, but as structurally distinct, often emphasizing harm reduction, transparency, or incremental change within prevailing economic logics, rather than transformation of underlying systems.

An earlier version of the framework involved detailed, multi-indicator scoring per theoretical dimension (available on request), but this approach proved overly complex for consistent application. The final methodology retains the same theoretical grounding while adopting a streamlined, questionnaire-based format optimized for usability, transparency, and replicability. The framework structure is presented in Section 3, with theoretical references, questionnaire content, and scoring criteria outlined in the Supplementary Material.

3 Methodology

3.1 Study design and research objective

This study adopts a qualitative evaluative approach to assess the extent to which projects operating within the ReFi (Regenerative Finance) movement substantiate their claims to regeneration. The research focuses on Web3-native projects that explicitly identify as part of the ReFi movement, examining the extent to which they align with principles drawn from regenerative theory and practice.

Two core research questions guided the study:

1. To what extent do ReFi initiatives substantiate their claims to regeneration in the design of their financial, governance, and impact structures?

2. What characteristics differentiate ReFi initiatives that align with regenerative principles from those that operate within conventional sustainability paradigms?

Rather than beginning from a singular definition of regenerative finance, the study applies a structured evaluative framework grounded in established regenerative literature. The goal is not to judge intent, but to assess observable alignment between project design and regenerative principles, offering a practical lens for reflection, comparison, and self-regulation within the ReFi space.

3.2 Project identification and selection

A systematic, multi-step selection process was used to identify a representative sample of ReFi initiatives for evaluation. The objective was to ensure broad coverage across technologies, topics, and impact areas without applying regenerative criteria during selection. This distinction is critical: the projects were selected based on ecosystem relevance and visibility, not on any prior assumptions about their regenerative performance.

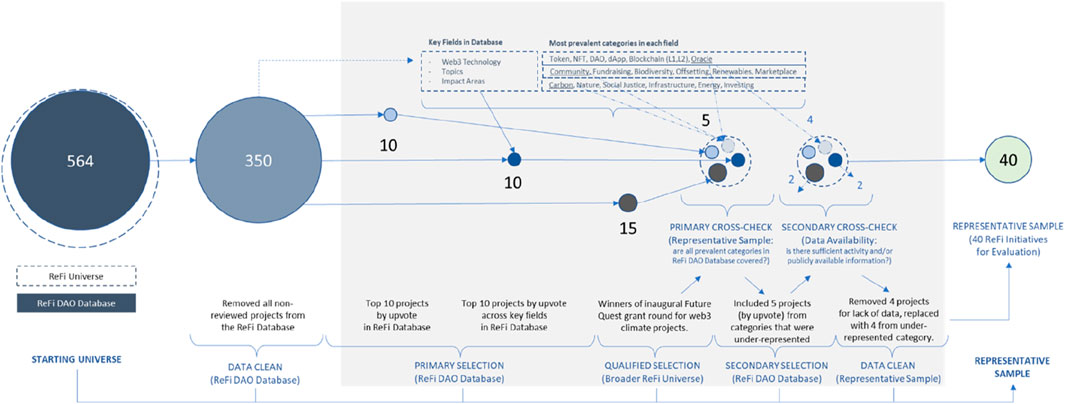

The process began with an open-source database of ReFi initiatives published by ReFi DAO, which included 564 entries at the time of extraction. The following steps were then undertaken (see Figure 1 for a visual summary):

1. Initial screening removed non-reviewed or duplicate entries, narrowing the dataset to 350 initiatives.

2. Top 10 projects by upvote were automatically included to reflect initiatives with high community engagement.

3. Top initiatives by category were selected across the most prevalent Web3 technologies, topics, and impact areas using pivot-table analysis, adding a further 10 projects.

4. 15 Future Quest grantees were added, selected by a cross-sector expert panel as part of ReFi’s largest climate-focused funding round to date.

5. A cross-check for representativeness led to the inclusion of one high-ranking oracle project, along with two additional community currency projects and two additional carbon initiatives—responding to observed gaps in the dataset.

6. Four projects were removed due to insufficient public data or evidence of inactivity.

7. To ensure diversity in Web3 tech coverage, four additional oracle-based projects were included—bringing the final evaluation sample to 40 initiatives.

Figure 1. Selection Process for Representative Sample of ReFi Initiatives*. * A higher-resolution version of this figure is available in Supplementary Appendix SAE.

This sampling strategy ensured a representative cross-section of the ReFi ecosystem, with projects spanning multiple financial models, governance structures, impact areas, and Web3 technologies. Importantly, this selection was conducted independently of the regenerative evaluation framework described in Section 3.3, allowing for an unbiased assessment of regenerative alignment. A full list of the 40 initiatives is provided in Appendix D.

3.3 Evaluative framework development

For clarity, the term framework refers to the overarching theoretical structure used to guide evaluation, anchored in regenerative economics, living systems theory, and organizational design. The tool refers to the structured questionnaires developed to operationalize this framework for evaluation. The methodology refers to the full evaluation process including scoring protocols, source validation, and dual-method triangulation. These terms are used consistently throughout the paper to distinguish theoretical foundations from applied evaluation mechanisms.

The evaluative framework used in this study was developed to assess the degree to which ReFi initiatives align with core principles of regeneration, as articulated in foundational literature across regenerative economics, living systems theory, and systems-oriented organizational design. The goal was to translate abstract theory into observable, comparable project features—enabling practical analysis across a diverse range of Web3 initiatives.

The framework was developed through an iterative process:

1. Literature mapping: Key regenerative sources including Fullerton (2015), Mang and Haggard (2016), Raworth (2017), Sanford (2022), Muller (2017), Waddell et al. (2015), Laloux (2014) and nRhythm, were reviewed and mapped to identify recurring principles across multiple domains, including finance, economics, systems design, and development practice.

2. Dimension clustering: These principles were then organized into two core evaluative claims, each broken down into three high-level dimensions.o Regenerative Claim:Principles and Ideology | Strategy and Practice | Structure and DesignThese dimensions evaluate whether the initiative is built on regenerative logic in its finance model, strategic approach, and organizational design—drawing on living systems theory, regenerative economics, and organizational patterns such as those defined by nRhythm and Laloux.o Real-World Impact Claim:Measurable and Verifiable | Holistic and Systemic | Stakeholder-AlignedThese dimensions assess how initiatives approach real-world outcomes—based on widely recognized impact frameworks such as the Sustainable Development Goals (SDGs), Five Dimensions of Impact, and systems change literature.(The theoretical foundations informing each dimension are detailed in Supplementary Appendix SA). Figure 2 summarizes the structure of the evaluation framework, mapping the six evaluative dimensions across the two core claims and their alignment with Questionnaire 1 (Q1) and Questionnaire 2 (Q2).3. Questionnaire design: The evaluation framework was operationalized through two structured questionnaires, each aligned to the six evaluative dimensions:oQuestionnaire 1 (Q1) assessed regenerative finance and real-world impacto Questionnaire 2 (Q2) assessed regenerative organizational design(Full questionnaire content is provided in Supplementary Appendix SB)Note: An initial application of the framework involved a highly granular scoring matrix across multiple criteria and subdimensions (original scoring matrix available upon request). While this enabled deep evaluation, it was ultimately too complex and time-intensive for practical replication. The revised approach–two simplified questionnaires aligned with six core dimensions–offered comparable insights with significantly improved usability and was therefore adopted as the primary tool for this study.

4. Scoring indicator development: Each questionnaire item was supported by a set of scoring indicators to guide evaluation. These indicators were drawn from regenerative theory and refined through pilot testing to ensure clarity and consistency across different project types. (See Supplementary Appendix SC for a detailed breakdown of indicators used.)

5. Evaluation protocol: A structured protocol was applied across the full sample of 40 initiatives. Projects were evaluated using publicly available documentation—including whitepapers, governance models, tokenomics, technical descriptions, and impact disclosures. The scoring process was qualitative in method but highly structured in application—emphasizing observable alignment with regenerative principles over stated intent.

3.4 Scoring process and classification

Each of the 40 initiatives was evaluated across six evaluative dimensions using a structured three-level scoring system (1–3). These dimensions, grouped under the Regenerative Claim and Real-World Impact Claim, were assessed through two structured questionnaires (see Section 3.3). The aim was to evaluate observable alignment with regenerative principles, rather than rely on stated intent alone.

Scoring levels were defined as follows:

• Score = 3 (High alignment): The initiative demonstrates strong alignment with regenerative principles within the dimension being evaluated. This may be reflected in original design features, embedded practices, or structural commitments that reinforce living systems logic (e.g., value cycles, distributed agency, or systemic feedback loops).

• Score = 2 (Moderate alignment): The initiative reflects partial or inconsistent alignment. Elements may appear regenerative in intent but are implemented through conventional financial or governance structures, limiting systemic depth.

• Score = 1 (Low alignment): The initiative operates primarily within traditional sustainability or DeFi models, with minimal evidence of regenerative intent, coherence, or structural integration.

A 1–3 scale was used instead of a 0-based system to avoid distortions in cumulative scoring and to ensure the lowest score reflected baseline alignment rather than absence or failure.

Each project was assessed using a qualitative review of publicly available materials, including whitepapers, platform documentation, governance portals, funding disclosures, and community forums. No single source was determinative; rather, emphasis was placed on consistency between stated goals, structural design, and documented practices.

Projects were not classified as “regenerative” or “non-regenerative.” Instead, scores across the six dimensions were aggregated to identify patterns of relative alignment. Initiatives with higher cumulative scores demonstrated deeper, systemic alignment with regenerative paradigms; lower-scoring projects tended to mirror conventional sustainable finance or market-efficiency models.

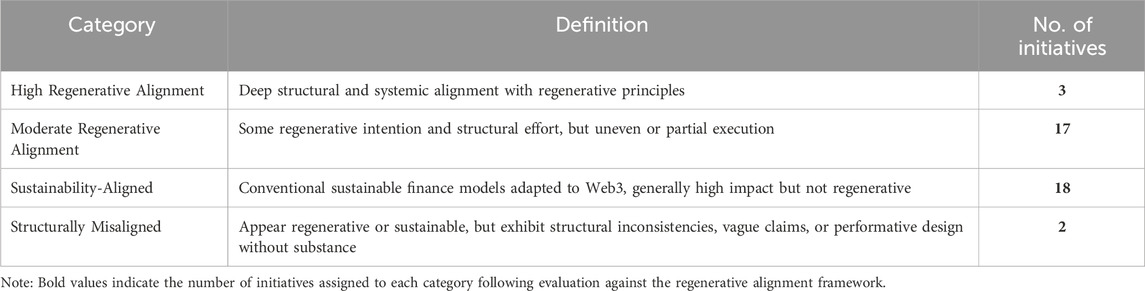

To support analysis, projects were grouped into four qualitative categories:

⁃ High Regenerative Alignment: strong coherence across regenerative finance, impact, and organizational design.

⁃ Moderate Regenerative Alignment: partial alignment with regenerative theory, often early-stage or inconsistently applied.

⁃ Sustainability-Aligned (Sustainable DeFi): positive impact or transparency but lacking regenerative structure or intent.

⁃ Structurally Misaligned: limited coherence between regenerative claims and actual practice.

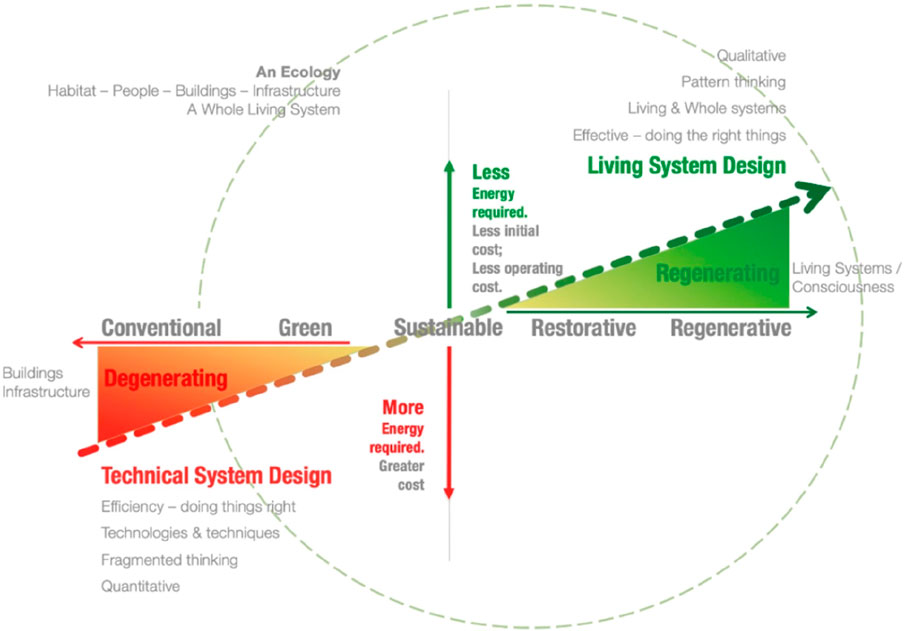

The categories reflect a broader conceptual continuum, from technical system design toward living system design. This continuum, originally developed by Bill Reed (2007) of the Regenesis Group, helps visualize the structural distinction between sustainability-oriented and regenerative approaches (see Figure 3), illustrating the shift from degenerative to regenerative system design via sustainability as a transitional zone.

Figure 3. The Regenerative Design Continuum. © Regenesis Group 2000–2023. Based on the original conceptual model by Bill Reed (2007). Used with permission.

These categories are intended to support reflection and pattern recognition, not to impose rigid labels or binary classifications. They help surface structural patterns in how regenerative intent is operationalized (or not) across different project designs. This reinforces the purpose of the framework as a practical tool for learning, critical reflection, and deeper alignment within the ReFi ecosystem.

3.5 Limitations and considerations

While the framework and evaluation process were designed to ensure methodological rigor and consistency, several limitations should be acknowledged:

Subjectivity in scoring

Despite the use of a structured protocol, the evaluation involved interpretive judgment based on qualitative review of publicly available sources. Regenerative alignment is complex and context-dependent, and while criteria were applied consistently, subjectivity cannot be fully eliminated. Future research could incorporate multi-reviewer panels or consensus-based scoring to enhance inter-rater reliability.

To increase reliability, scoring indicators were iteratively refined during a pilot phase and tested across a small subset of initiatives to ensure clarity and usability. Scores were derived from triangulated review of multiple public sources (e.g., whitepapers, governance forums, tokenomics documentation), minimizing reliance on any single disclosure. While interpretive judgment was unavoidable, the process emphasized replicability and transparency, and the tool was intentionally designed to enable participatory validation in future applications.

Desk-based methodology

The study relied exclusively on publicly accessible documentation such as whitepapers, tokenomics descriptions, governance frameworks, and blog posts. No direct interviews or participatory methods were used, which may have limited visibility into internal practices, stakeholder dynamics, or undocumented regenerative features. Despite this limitation, patterns in available documentation revealed broader governance trends, discussed further in Section 4.7.

Source of capital and funding models

Although capital flow and structure were included in the framework, the origin of funds (e.g., venture capital, DAO treasuries, grant funding, or extractive streams) was not systematically analyzed. Where visible, such factors were considered, but more detailed investigation of financial provenance and reinvestment logic would strengthen future evaluations.

Tokenomics and investment logic

While token design features (such as value logic, governance utility, and alignment with regenerative principles) were considered as part of the evaluation framework, this study did not assess the financial performance or investibility of the tokens themselves. Specifically, no analysis was undertaken of token yield mechanisms, speculative dynamics, or the material basis for token value appreciation. Future research could explore how regenerative alignment intersects with investor incentives, tokenomics, and longer-term value realization across different ReFi models.

Framework constraints

Like any structured model, this framework simplifies a dynamic reality. Regeneration is emergent, multi-layered, and deeply contextual. The six evaluative dimensions offer a practical lens, but they cannot fully capture the depth, nuance, or place-based specificity of regenerative practice.

Despite these constraints, the framework provides a constructive foundation for comparative evaluation of regenerative claims in the ReFi ecosystem. It is intended to support learning, self-reflection, and transparency—not to impose rigid definitions or exclusionary thresholds.

Future work may deepen and refine this approach through participatory validation, community-led scoring, or longitudinal tracking of initiatives as they evolve over time.

4 Results

4.1 Overview of evaluation results

Across the 40 ReFi initiatives evaluated, alignment with regenerative principles varied considerably. Each initiative was assessed using the evaluative framework outlined in Section 3, which examined six dimensions across three core domains: Regenerative Finance, Real-World Impact, and Regenerative Organizational Design.

Initiative-level scores are not reported in this study. This was a deliberate decision to prioritize learning and ecosystem reflection over comparison or ranking. The framework was developed as a tool for constructive dialogue and critical self-assessment, not to publicly classify or audit specific projects.

Scoring was based on a 1–3 scale per question, with each domain contributing a maximum of 24 points, resulting in a possible total score between 24 and 72. This structure enabled comparative analysis across projects while accounting for varying levels of visibility and disclosure. The average total score across all initiatives was 42, with individual project scores ranging from a high of 66 to a low of 24. This variation reflects the diverse interpretations and implementations of regenerative intent across the ReFi ecosystem.

Projects were grouped into four alignment categories based on cumulative performance across the three domains (see Table 1)1. While a small number of initiatives demonstrated deep structural alignment with regenerative principles, the majority exhibited partial or sustainability-oriented alignment. Notably, two initiatives were retained as a distinct group due to pronounced gaps between their stated regenerative or sustainability claims and their underlying design. These projects fall within a critical grey zone, where performative language may obscure limited systemic coherence or accountability.

The following sections outline key characteristics and design patterns observed across initiatives in each alignment category.

4.2 Characteristics of high-regenerative alignment initiatives

The three initiatives categorized as High Regenerative Alignment exhibited consistently strong scores across all three evaluative domains. Several shared characteristics emerged, distinguishing them from other projects in the broader ReFi landscape.

First, these initiatives take a holistic, systems-oriented approach to regenerative impact. Rather than focusing narrowly on ecological or financial dimensions, they integrate social, economic, cultural, ecological, and political concerns, often drawing from place-based development logic. Their models emphasize community grounding and local relational networks, often using community currencies or place-based tokenomics to stimulate localized, self-sustaining value flows.

Second, these projects prioritize interconnectedness and ecosystemic value, designing for network effects, cross-sectoral collaboration, and long-term systems health. This is reflected in both their governance structures and their approach to value creation, which tends to favor use-value over exchange-value.

Third, they demonstrate strong alignment with living systems principles in their financial and governance designs. Accessibility, inclusivity, and the mitigation of digital divides are explicitly prioritized. Impact measurement is grounded in real-world data and often includes qualitative dimensions of transformation and community wellbeing, not just quantitative outcomes.

Finally, a core differentiator across these projects is their relational ethic: regeneration is not viewed as a technological outcome, but as an ongoing process of engagement with local people, institutions, cultures, and ecologies. This orientation toward relationship over transaction—in both design and intent—is what most clearly distinguishes high-alignment initiatives from others in the space.

4.3 Characteristics of moderate-regenerative alignment initiatives

The 17 initiatives falling into the Moderate Regenerative Alignment category exhibit clear regenerative intent and meaningful alignment across several dimensions, but typically fall short of the systemic coherence and relational depth observed in the high-alignment group. This category spans early-stage projects, technical enablers, and ecosystem infrastructure initiatives.

Common characteristics among these initiatives include:

• Strong narrative coherence with regenerative values, particularly around ecosystems, networks, and community-centred design.

• A focus on bridging digital infrastructure with real-world outcomes, often using blockchain to track, verify, or fund ecological activity.

• Emphasis on cross-sectoral collaboration, with many initiatives serving as intermediaries between traditional finance, Web3, and grassroots environmental efforts.

In terms of design features, most projects in this group:

• Partially align with regenerative finance principles, demonstrating innovative models, but often still anchored in market-based mechanisms, including tokenized commodities and externally driven capital deployment.

• Present strong governance and stakeholder inclusion narratives but show limited evidence of deep structural decentralization or community-led design.

• Incorporate real-world impact measurement, though often narrowly focused or early in development.

Some initiatives in this category act as infrastructure providers or enabling technologies, such as oracles, registries, or data protocols. While these may not generate direct impact themselves, their role in supporting regenerative ecosystems is significant. However, many currently lack robust mechanisms to evaluate their indirect or systemic impact, limiting their classification.

Several initiatives in this group show potential to evolve into high-alignment projects as they:

• Mature in their implementation and governance

• Expand impact tracking methodologies

• Deepen community integration and systemic design choices

The key takeaway from this category is directionality–these projects are not misaligned; they are just still evolving toward full regenerative coherence. Their current positioning reflects the practical and structural challenges of building regeneration into emerging, complex, and decentralized financial systems.

4.4 Characteristics of sustainability-aligned initiatives

The 18 initiatives categorized as Sustainability-Aligned reflect the growing maturity and professionalization of Web3-based approaches to sustainable finance. These projects demonstrate meaningful efforts to reduce environmental harm, increase financial inclusion, and deliver measurable outcomes. However, they remain structurally grounded in prevailing economic paradigms and typically emphasize efficiency and transparency over systemic transformation.

Common characteristics among these initiatives include:

• Use of established sustainability tools—such as carbon credits, ESG metrics, and CSR frameworks—to track and verify impact.

• Optimization of legacy models using Web3 technologies to improve traceability, data integrity, and operational efficiency.

• Emphasis on harm reduction, risk mitigation, and incremental reform, as opposed to transformational or relational design logic.

In terms of structure and design:

• Governance models tend to be centralized or top-down, even when framed in decentralized narratives.

• Community engagement is often limited to implementation rather than informing capital flow design or decision-making structures.

• Tokenization is frequently used to financialize environmental assets, reinforcing exchange-value dynamics rather than exploring relational alternatives.

Importantly, many initiatives in this category deliver substantial real-world value:

• Several contribute directly to climate mitigation, energy transition, and data verification goals.

• Their classification as “sustainability-aligned” is not a critique of outcomes but a reflection of systemic positioning - consistent with established definitions of sustainable finance as being predominantly impact-aligned rather than impact-generating (Busch et al., 2021; Weber, 2021).

• These projects operate on systems, optimizing them, rather than working within or in partnership with living systems.

4.5 Characteristics of structurally misaligned initiatives

Two initiatives were categorized as structurally misaligned, or “Fine Line” projects, in this evaluation. These projects occupy a grey zone in the ReFi landscape where strong regenerative or sustainability claims are made in public-facing narratives, yet significant structural misalignments were identified upon closer analysis. While not classified as greenwashing due to the absence of clear intent to mislead, both initiatives exhibit characteristics that raise questions about substance, coherence, and systemic integrity.

In both cases, public positioning emphasized climate action and carbon market reform. However, external media investigations and public disclosures have surfaced concerns about lack of transparency, weak underlying methodologies, and a disconnect between tokenized assets and verifiable ecological outcomes. While these projects made extensive use of regenerative rhetoric, the evaluative process found limited evidence of embedded regenerative principles in either financial design, governance structures, or community engagement strategies.

Common characteristics of this group included:

• Reliance on speculative token mechanics and trading dynamics, with limited mechanisms to ensure value flow to real-world impact

• Opacity in capital sourcing and reinvestment logic, often paired with centralized control over key operational levers

• Inconsistent or superficial application of community governance principles

• A clear disconnect between stated impact goals and system-level accountability

This classification does not presume intent. The shortcomings observed may stem from design immaturity, ecosystem constraints, or overly ambitious communications rather than deliberate misrepresentation. However, structural flaws were evident, and the gap between narrative and implementation was material enough to warrant separate categorization.

These projects highlight the importance of ongoing due diligence and critical evaluation within the ReFi space—especially in an unregulated environment where terminology can easily be adopted without corresponding systemic commitments. The “Fine Line” designation signals not only a cautionary note for funders and ecosystem builders, but also a call for enhanced transparency, coherence, and accountability from all projects operating under the regenerative finance banner.

4.6 Technology and design as alignment drivers

One of the most critical differentiators observed across the evaluated initiatives was the way in which Web3 technologies were applied. While all projects in the sample operate within blockchain ecosystems, their approaches to leveraging the technology varied considerably, and correlated strongly with regenerative alignment.

Initiatives that scored highly across all domains tended to use blockchain not merely to digitize existing financial processes, but to enable the emergence of new systems grounded in ecological and community logic. They leveraged the composability, decentralization, and programmability of Web3 to design novel mechanisms for value creation, coordination, and decision-making—often tied to place-based or bioregional dynamics.

In contrast, lower-alignment and sustainability-oriented projects frequently used blockchain to replicate off-chain processes-such as carbon credit issuance, lending structures, or identity verification-without materially shifting the underlying paradigms. While these may offer efficiencies, they do not represent a structural break from legacy systems.

This finding aligns with Waddell et al.’s (2015) distinction between systemic transformation and incremental reform, and highlights the need for more nuanced understanding of how blockchain’s affordances are activated–or underutilized–within the ReFi ecosystem.

4.7 Gaps, blind spots and ecosystem trends

Beyond individual initiative performance, the evaluation revealed several recurring gaps and systemic blind spots that cut across categories. These findings point not to failure, but to the evolving nature of the ReFi space, where emerging technologies and regenerative aspirations are still learning to coexist within coherent structural designs.

4.7.1 Replication of traditional logic

A significant proportion of initiatives, especially those in the sustainability-aligned category, used Web3 to digitize legacy financial and environmental instruments without fundamentally rethinking their structure or purpose. In these cases, blockchain served as an efficiency layer rather than a transformational enabler. This reflects a deeper challenge: using a revolutionary technology within pre-existing paradigms, rather than to design from regenerative first principles.

4.7.2 Superficial or non-systemic impact approaches

Many projects articulated strong impact intentions, but struggled to demonstrate holistic, systems-based approaches to tracking or generating that impact. Impact was often measured narrowly (e.g., volume of offsets, user adoption) rather than systemically (e.g., changes in community agency, resilience, or long-term feedback loops). This suggests a need to move beyond outcomes into patterns, aligning impact methodologies with regenerative theory.

4.7.3 Lack of transparency in capital flows and funding models

As noted in Section 3.5, the study did not systematically trace capital origin. However, even within publicly disclosed data, a lack of transparency around capital flows and reinvestment models emerged as a broader ecosystem trend. Funding sources were opaque, tokenomics were under-documented, and reinvestment logic was rarely disclosed. This not only undermines trust, but limits the ability to assess whether projects are building self-sustaining, circular economies—a key principle of regeneration.

4.7.4 Governance misalignment

While many initiatives claimed decentralization or community governance, few offered clear evidence of how decisions were made, who had agency, or how accountability was structured. In some cases, governance tokens existed but had no meaningful influence on protocol-level decisions. True regenerative governance requires more than distribution: it requires relationship-based coordination, ongoing feedback, and shared stewardship.

4.7.5 Underutilization of Web3’s unique capabilities

As noted in Section 4.1.1, some of the most aligned projects used Web3 to create new relational and regenerative structures, not just port legacy systems on-chain. However, many initiatives underutilized blockchain’s potential for dynamic value flows, composable governance, programmable incentives, or verifiable accountability. A significant opportunity remains to design systems where technology serves regeneration, rather than merely hosting it.

These findings suggest that the regenerative potential of ReFi is not a given: it must be consciously designed, transparently evaluated, and iteratively evolved. The ReFi movement is rich with possibility but will only fulfill its promise if it moves beyond narrative coherence into structural integrity.

4.7.6 Team diversity and regenerative alignment

One of the strongest and most unexpected correlations to emerge from the data was the relationship between team diversity and overall regenerative alignment. Initiatives with higher gender and geographic diversity in their founding or leadership teams consistently scored higher across all three evaluation domains: Regenerative Finance, Real-World Impact, and Organizational Design.

A basic diversity index was created using the proportion of women and number of countries represented in core teams. Projects classified as having high diversity (40%–60% women, >3 countries) scored an average of 48 out of 72, compared to just 38 for those with low diversity (<25% women, <3 countries). This suggests that more diverse teams are not only more inclusive, but also more structurally regenerative, likely due to greater systemic awareness, plural perspectives, and stakeholder responsiveness.

While causality cannot be inferred, the data supports broader findings in organizational systems research that diversity enhances complexity literacy, adaptability, and stakeholder alignment—all central to regenerative design.

4.7.7 Initiative maturity and design depth

A second pattern observed was the positive correlation between initiative maturity and regenerative alignment. While many ReFi projects were founded in 2021–2022 during a surge of ecosystem interest, the highest-scoring initiatives tended to be those founded 5+ years prior, often before “ReFi” entered mainstream blockchain discourse.

Older projects scored higher not only because they had more time to demonstrate real-world impact, but also because their models were often more deeply considered, place-based, and structurally adaptive. In contrast, many newer initiatives focused heavily on carbon markets, DeFi primitives, or tokenized environmental assets, reflecting a trend toward digitizing sustainability rather than reimagining systemic relationships.

This suggests that time-in-system may be a key enabler of regenerative design depth, and reinforces the importance of evolutionary development over hype cycles in this space.

4.7.8 The myth of environmental regeneration: the need for holism

A critical blind spot across the ecosystem was the tendency to equate “regeneration” with environmental impact alone. While ecological restoration is essential, regenerative practice is fundamentally holistic, grounded in the interdependence of social, ecological, cultural, and economic systems.

Many evaluated initiatives focused narrowly on carbon credits, reforestation, or ecological restoration without incorporating community agency, stakeholder inclusion, or socio-economic feedback loops. This lack of holism not only limits regenerative potential, it may also cause harm, reinforcing extractive dynamics under the guise of impact.

One documented case revealed that failure to engage local stakeholders or assess socio-economic impact resulted in significant disruption to local institutions and the loss of project partnerships (Reuters, 2022). This aligns with broader critical literature, which has long warned that conservation and environmental markets can have highly negative social outcomes if implemented without local integration (Joseph, 2019; Miller et al., 2017; Osborne and Shapiro-Garza, 2018).

For ReFi to achieve true regenerative alignment, the human and relational dimensions must be fully integrated into financial design, governance models, and impact frameworks. Environmental regeneration is not sufficient—and when isolated, may even be antithetical to regeneration as a living systems paradigm.

5 Discussion

5.1 ReFi’s identity crisis: a movement in flux

The ReFi movement represents one of the most ambitious and rapidly evolving domains in the Web3 ecosystem, positioning itself as a new frontier for regenerative economic design. Yet, the findings of this study suggest that ReFi is experiencing an identity crisis. While the narrative of regeneration is widely embraced across projects, the structural reality of implementation often lags behind the rhetoric.

This tension reflects a broader pattern observed throughout the evaluation: many initiatives adopt the language of regeneration without embedding the relational, systemic, and participatory principles that define it in theory. In some cases, this reflects a genuine desire to align over time. In others, it reveals a superficial attachment to brand identity, where the use of “regenerative” becomes a signifier of ethos rather than an expression of embedded design.

This identity gap is further complicated by the self-defining nature of the ReFi ecosystem. Without shared standards or accountability mechanisms, projects can enter the space with vastly different interpretations of what regeneration means, ranging from ecological restoration to tokenized sustainability metrics, to entirely new relational economies. While this pluralism is not inherently problematic, it creates confusion for users, funders, and collaborators, and risks diluting the transformational potential that regenerative finance holds.

The analysis presented here does not seek to gatekeep the ReFi label. Rather, it calls attention to the need for shared language, structure, and evaluative tools that can distinguish incremental improvements from paradigm-shifting designs. As the movement matures, it must confront the question: is ReFi a tech-enabled narrative, a financial design methodology, or a systems-level economic reimagination? The answer will determine not just how it is perceived, but whether it can actually regenerate.

5.2 Definitional fluidity vs. empirical clarity

A persistent tension in regenerative finance discourse is whether it is possible (or even desirable) to draw structured distinctions between sustainability and regeneration. These terms are often used interchangeably outside the field, contributing to perceptions that they are conceptually vague or ideologically driven. Yet within sustainability and regenerative development communities, this distinction is both well-theorized and widely accepted. Scholars working in ecological economics, regenerative design, and place-based development have long articulated the paradigm shift that regeneration entails: from reducing harm within existing systems, to actively cultivating the conditions through which life, systems, and relationships can evolve and thrive.

The perceived ambiguity often arises from adjacent disciplines, particularly those less familiar with systems thinking, relational design, or post-extractive economic theory. In these contexts, “regenerative” can appear as little more than an aspirational label. But in practice, the distinction is substantive, and foundational to the evaluation presented in this study.

This framework does not seek to impose a fixed definition of regeneration. Rather, it offers a lens of structural observability, designed to assess whether regenerative claims are meaningfully embedded in project architecture, not simply stated in project narratives. Without such a lens, the risk is what some scholars have called narrative inflation: where “regenerative” becomes a proxy for “good” and loses its conceptual rigor and operational utility.

Importantly, the evaluative criteria used here are drawn directly from established theoretical sources including regenerative economics (Fullerton, 2015), living systems design (Mang and Haggard, 2016), and regenerative organizational models (Sanford, 2022; Laloux and Parker, 2014). These frameworks were not adapted to fit the blockchain context; rather, they were applied as originally conceived to assess whether regenerative principles are being meaningfully operationalized within Web3-native infrastructure. A full breakdown of these theoretical foundations and how they differentiate sustainability from regeneration is provided in Supplementary Appendix SA1, SA2.

In blockchain ecosystems where programmability, composability, and transparency are core affordances, this kind of evaluative clarity is not only possible, it is essential. Without clear reference points for regenerative alignment, ReFi risks replicating the extractive, commodified, and technocratic logics it aims to transcend. If the movement is to move from narrative coherence to structural integrity, it must begin with the willingness to interrogate its own design choices and be held accountable to its stated values.

5.3 Blockchain as an enabler of regenerative design

While blockchain is often framed as a neutral infrastructure layer, this study reinforces the view that technology design choices are never value-neutral. In the context of regenerative finance, blockchain’s affordances (decentralization, composability, programmability, and transparency) create meaningful opportunities to reimagine how capital flows, value is created, and governance is enacted.

High-alignment initiatives in this study consistently used these affordances not simply to replicate legacy systems on-chain, but to generate new patterns of interaction, feedback, and value creation. In these cases, blockchain technology enabled relational accountability, local economic circulation, and emergent forms of organizational agency that would be difficult to implement through traditional financial infrastructure.

By contrast, lower-alignment and sustainability-aligned projects tended to use blockchain primarily as a tool for record-keeping, asset tokenization, or transaction automation: functions that may increase efficiency or traceability, but do not by themselves constitute regenerative design. In many cases, the logic of extraction remained embedded in tokenomics, governance models, or incentive structures, even when layered with environmental intent.

This finding points to a critical distinction: it is not blockchain itself that enables regeneration, but the intentional application of its design capabilities in service of regenerative paradigms. Without that intentionality, the technology risks reinforcing the very dynamics it seeks to disrupt. Tokenization of nature, for instance, may deepen commodification unless paired with decentralized stewardship, relational governance, and living systems feedback loops.

If ReFi is to fulfill its promise, it must move beyond simply “building on blockchain” to ask: What is blockchain uniquely good at in the context of regeneration? What new possibilities can programmable finance enable? What needs to be unlearned or restructured to ensure that regenerative principles are not lost in translation?

These are not technological questions alone; they are design, governance, and epistemological questions. But blockchain offers a fertile testing ground for asking them, and for building the infrastructure of regenerative futures from the protocol layer up. Initiatives such as the Regenerative Technology Project have emerged precisely to support this process, offering a shared language and evaluative scaffolding for assessing whether technology design and use aligns with regenerative paradigms. In doing so, they move the conversation from can blockchain support regeneration, to how must it be designed in order to do so.

5.4 Implications for practitioners and funders

For both practitioners and funders operating in the ReFi space, this study offers a clear message: regenerative alignment cannot be inferred from language, branding, or even intended impact. It must be observed in the architecture of financial design, governance, and value creation.

Practitioners, especially project founders, protocol designers, and community stewards, can use the evaluative framework presented here as a tool for internal reflection and iterative alignment. Rather than treating regenerative principles as abstract aspirations, this study shows how they can be translated into practical design criteria: from sourcing capital and structuring tokenomics, to enabling community agency and systemic learning. For early-stage projects, the framework can serve as a design scaffold; for more mature initiatives, it can support evaluation, communication, and course correction.

For funders, including DAOs, philanthropic capital providers, and impact-aligned investors, the findings underscore the need for rigorous due diligence. ReFi is a promising but uneven space, where claims of regeneration are common, but systemic alignment is rare. Using this framework, or building on its dimensions, can help funders assess whether projects align not just with impact goals, but with transformational design logic. This is especially relevant for those seeking to fund beyond carbon markets or tokenized offsets, and toward whole-system interventions.

Importantly, this study does not offer a scoring system to be used punitively or prescriptively. Instead, it invites practitioners and funders to treat regeneration as a journey of structural coherence, one that requires transparency, adaptability, and ongoing reflection. By creating shared tools for evaluation, the ReFi ecosystem can begin to self-regulate with integrity, and evolve beyond aspirational signalling toward embedded practice.

5.5 Future research directions

This study provides an initial framework for evaluating regenerative alignment in ReFi initiatives, but much remains to be explored. As the field matures, future research can expand and deepen this work in several key directions.

First, there is a need for participatory validation. While this study relied on desk-based analysis, future research could engage directly with project teams, communities, and stakeholders to co-validate or challenge evaluative outcomes. This would deepen understanding of not only what is visible externally, but how internal decision-making and learning structures operate in practice.

Second, the application of this framework to a larger, more longitudinal dataset could reveal ecosystem-level dynamics and maturation patterns. Tracking changes over time would enable researchers to examine how initiatives evolve their regenerative alignment (or drift from it) as they scale, pivot, or encounter trade-offs. This could also support the development of leading indicators of systemic alignment or erosion.

Third, there is space for protocol-level experimentation. Many of the regenerative principles outlined here could be embedded more directly into smart contracts, DAO governance modules, and token design logic. This raises important questions for technologists and designers: Can regenerative accountability be encoded? What does relational governance look like at the protocol layer? How can feedback loops be systematized without becoming rigid?

Finally, future work could explore how frameworks like this one interact with other evaluative methodologies such as ESG scoring, the Impact Management Project, or evolving regenerative finance indices. Doing so would enable more robust cross-comparison and support the development of shared language across sectors, from crypto-native actors to institutional capital allocators.

In short, this study is not the final word: it is a provocation. If ReFi is to fulfill its potential, it must be continuously questioned, iterated, and held to account. Research has a critical role to play in that process—not to gatekeep, but to ground, stretch, and support the evolution of the field.

6 Conclusion

As the ReFi movement continues to evolve within the broader Web3 ecosystem, questions of legitimacy, accountability, and coherence are becoming increasingly urgent. This study offers an empirically grounded approach to evaluating whether projects that claim regenerative intent are structurally aligned with regenerative principles and, if not, where the gaps lie.

Drawing on interdisciplinary theory from regenerative economics, living systems design, and organizational development, the evaluative framework developed here was applied to 40 ReFi initiatives across six core dimensions. The results revealed a wide spectrum of alignment: from deeply embedded, systemic models of regenerative practice to sustainability-oriented or structurally misaligned projects operating under a regenerative banner.

The findings underscore that regeneration is not a narrative, a brand, or a marketing aesthetic. It is a systems-based design orientation; one that requires coherence between values, mechanisms, and lived experience. Blockchain technology offers powerful tools to support this shift, but only if used with intention, reflection, and relational awareness.

For ReFi to mature into a transformative force, it must move beyond aspiration and into architectural integrity. This will require ongoing inquiry, participatory accountability, and the development of shared frameworks that evolve with the field. The work presented here is one contribution to that process—an invitation to reflect more deeply, build more consciously, and regenerate not only systems, but the relationships that sustain them.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Ethics statement

Ethical approval was not required for the study involving human data in accordance with the local legislation and institutional requirements. Written informed consent was not required, for either participation in the study or for the publication of potentially/indirectly identifying information, in accordance with the local legislation and institutional requirements. The social media data was accessed and analyzed in accordance with the platform’s terms of use and all relevant institutional/national regulations.

Author contributions

KB: Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. The author is a PhD student supported by an Australian Government Research Training Program Stipend, funded by the Commonwealth Department of Education and Training, and has also received a Top-Up Scholarship from the Digital Finance Cooperative Research Centre (DFCRC). There were no additional funding sources for this specific research.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that Generative AI was used in the creation of this manuscript. Generative AI (ChatGPT, OpenAI) was used to assist with editing, restructuring, and phrasing during the manuscript review process. All original content was generated by the author, and all revisions were critically reviewed and finalized by the author.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbloc.2025.1564083/full#supplementary-material

Footnotes

1A more granular eight-category schema was originally used to reflect nuances in both regenerative alignment and impact performance (see Supplementary Appendix SAB). For the purpose of analysis and presentation, these were consolidated into four broader categories aligned with the scoring framework.

References

Bennett, K. (2025). The ReFi movement in Web3: implications for the global commons, Front. Blockchain. 8, doi:10.3389/fbloc.2025.1564073

Busch, T., Bruce-Clark, P., Derwall, J., et al. 2021. Impact investments: a call for (re)orientation. SN Bus. Econ.

Curve Labs (2022). The Promises and Pitfalls of Regenerative Finance: Towards a Critical Yet Constructive Dialogue. Available online at: https://blog.curvelabs.eu/the-promises-and-pitfalls-of-regenerative-finance-4910f0f6f690.

Doughnut Economics Action Lab (DEAL) (2020). Doughnut principles of practice. Available online at: https://doughnuteconomics.org/principles-and-guidelines.

Flynn, S. (2022). ReFi, DeFi and DeSci: What Do They Mean? Available online at: https://hackernoon.com/refi-defi-and-desci-what-do-they-mean.

Fullerton, J. (2015). Regenerative capitalism: how universal principles and patterns will shape our new economy.

Fullerton, J. (2018). “Moving money from harm to healing,” in A finer future: creating an economy in service to life. Editors S. Wallis, L. H. Lovins, A. Wijkman, and J. Fullerton (Gabriola Island, CA: New Society Publishers).

Impact Frontiers (2021a). The five dimensions of impact. Available online at: https://impactfrontiers.org/norms/five-dimensions-of-impact/.

Impact Frontiers (2021b). A guide to classifying the impact of an investment. Available online at: https://impactfrontiers.org/wp-content/uploads/2022/05/A-Guide-to-Classifying-the-Impact-of-an-Investment-2021.pdf.

Joseph, S. (2019). Commodity Frontiers and global capitalist expansion social, Ecological and political Implications from the nineteenth Century to the present day, 1st 2019. edn, Springer International Publishing, Cham.

Laloux, F. d.r. (2014). Reinventing organizations: a guide to creating organizations inspired by the next stage of human consciousness, First edition. edn, N. Parker, Brussels, Belgium.

Laloux, F. d.r. (2025). Reinventing organizations wiki. Available online at: https://reinventingorganizationswiki.com/en/pages/tealconcepts/.

Mang, P., and Haggard, B. (2016). Regenesis group 2016, regenerative Development and design: a Framework for evolving sustainability. 1 edn. Incorporated, Newark: John Wiley and Sons.

Miller, D. C., Rana, P., and Benson Wahlén, C. (2017). A crystal ball for forests? analyzing the social-ecological impacts of forest conservation and management over the long term. Environ. Soc. 8 (1), 40–62. doi:10.3167/ares.2017.080103

Muller, E. (2017). Regenerative development, the way forward to saving our civilization. Available online at: https://ucipfg.com/Repositorio/GSPM/manuales/Regenerative_development_EM.pdf.

Neelakanti, N. (2022). Regenerative Finance 101: A Guide to Crypto’s ReFi Movement. Available online at: https://coincentral.com/regenerative-finance-101/.

Osborne, T., and Shapiro-Garza, E. (2018). Embedding carbon markets: complicating commodification of ecosystem services in Mexico's forests. Ann. Am. Assoc. Geogr. 108 (1), 88–105. doi:10.1080/24694452.2017.1343657

Raworth, K. (2017). Doughnut economics: seven ways to think like a 21st century economist. White River Junction, Vermont: Chelsea Green Publishing.

Reed, B. (2007). Shifting from ‘sustainability’ to regeneration. Build. Res. and Inf. 35 (6), 674–680. doi:10.1080/09613210701475753

Reuters, T. (2022). Fears of 'subprime' carbon assets stall crypto mission to save rainforest. Available online at: https://www.reuters.com/article/crypto-currency-carbontrading-environmen-idINL8N2ZM7XE.

Sanford, C. (2022). “Indirect work: a regenerative change theory for businesses,” in Communities, institutions and humans. InterOctave Inc.

Waddell, S., Waddock, S., Cornell, S., Dentoni, D., McLachlan, M., and Meszoely, G. (2015). Large system change: an emerging field of transformation and transitions. J. Corp. Citizsh. 58, 5–30. doi:10.9774/GLEAF.4700.2015.ju.00003

Keywords: regenerative finance, Web3, ReFi movement, sustainable finance, blockchain for impact, self-evaluation framework, global commons, systems change

Citation: Bennett K (2025) An evaluation of the regenerative claims of Web3’s ReFi movement. Front. Blockchain 8:1564083. doi: 10.3389/fbloc.2025.1564083

Received: 21 January 2025; Accepted: 12 May 2025;

Published: 02 June 2025.

Edited by:

Leanne Ussher, Bard College, United StatesReviewed by:

Larry C. Bates, Independent Researcher, Detroit, United StatesDick Bryan, The University of Sydney, Australia

Copyright © 2025 Bennett. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kate Bennett, a2F0ZS5iZW5uZXR0QHN0dWRlbnQudXRzLmVkdS5hdQ==

Kate Bennett

Kate Bennett