- 1Department of Supply Chain Management, Faculty of Business and Economics, University of Pannonia, Veszprém, Hungary

- 2Department of Supply Chain Management, Faculty of Economics and Business, University of Groningen, Groningen, Netherlands

Introduction: This study investigates how enterprise departments influence blockchain adoption.

Methods: It applies Isomorphism Theory and AHP using data from 156 professionals across 10 countries.

Results: Finance had the most influence, followed by Marketing, Production, HRM, and Purchasing.

Discussion: Internal hierarchies and institutional pressures shape strategic adoption of blockchain.

1 Introduction

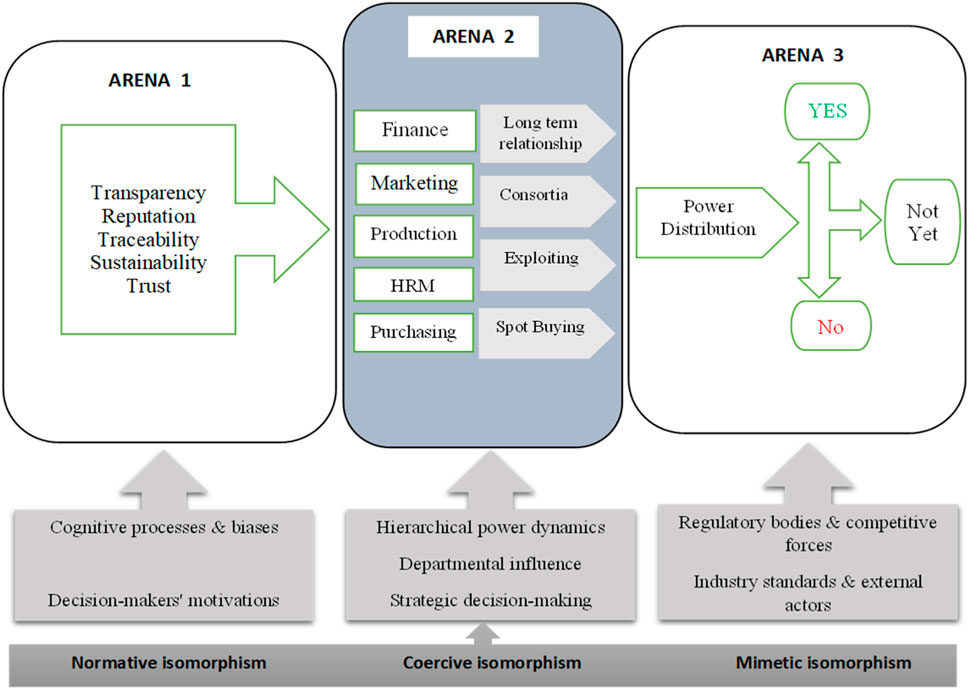

In today’s rapidly evolving business landscape, organizations face increasing pressure to adopt cutting-edge technologies like blockchain to maintain a competitive edge and enhance operational efficiency. It optimizes network infrastructures by reducing input/output overhead (Düdder et al., 2021), leading to faster data processing and improved transaction speeds, which are critical for managing large volumes of data in modern organizations. However, the promise of blockchain often clashes with the reality of organizational complexities (Staniszewski and Czarnecki, 2013). Drawing on the latest research, this study argues that blockchain adoption is not simply a technical matter, but a complex strategic decision shaped by organizational structures, power dynamics, and external pressures (Hou et al., 2023). To analyze these complexities, this study employs the 3 Arenas Model (Gharehdaghi and Kamann, 2024), providing a structured framework to examine the decision-making process for blockchain adoption, with a specific focus on the interplay between individual, organizational, and network-level influences.

The model is structured into three key arenas: Arena 1 (Individual Level) focuses on the cognitive processes, biases, and motivations that drive individual decision-makers. Arena 2 (Organizational Level) examines the influence of hierarchical structures and the role of key decision-makers in steering the strategic direction of the organization (highlighted in the grayed area of Model 1). Finally, arena 3 (Network Level) considers power dynamics and interactions with external stakeholders, such as competitors, regulators, and prevailing industry trends.

While blockchain technology has garnered considerable attention for its potential to enhance privacy, security, and efficiency (Zheng et al., 2017), its successful integration within organizations remains a complex undertaking shaped by diverse influences. Beyond technical capabilities, managerial decision-making is intricately interwoven with cognitive biases, internal hierarchical structures (Song et al., 2022), and external regulatory and competitive pressures (Al-Swidi et al., 2023). A comprehensive understanding of how these elements interact is crucial for organizations to effectively navigate blockchain adoption, balancing the promise of innovation with inherent strategic and operational constraints (Teece, 2010; Heshmati-alamdari et al., 2023). Existing literature, although substantial, primarily focuses on the technical advantages of blockchain (e.g., security, transparency, and efficiency) and its applications in specific domains such as supply chains and finance (Saberi et al., 2018; Grosse et al., 2021). There remains a significant gap, however, in understanding the organizational and managerial determinants that influence blockchain adoption decisions through a multi-level lens. Moreover, while Isomorphism Theory (DiMaggio and Powell, 1983) has been widely applied to explain organizational conformity and institutional pressures, its specific role in shaping blockchain adoption strategies within organizational hierarchies has yet to be thoroughly investigated. This study seeks to bridge this critical gap. To address these gaps, this research investigates the following questions:

RQ1. How do organizational hierarchies shape blockchain adoption decisions through the relative influence of functional departments?

RQ2. How do isomorphic pressures influence departmental prioritization of blockchain implementation?

2 Theoretical background

2.1 Arenas model and isomorphism theory

This study adopts a conceptual framework based on three interconnected arenas that shape managerial decision-making in blockchain adoption. The first arena examines internal cognitive processes, focusing on individual deliberations, judgments, and underlying motivations in adopting emerging technologies, the human element. The second arena shifts to organizational hierarchies, analyzing how decision-making structures, as outlined by Eden (1992), influence strategic adoption—the battleground of power. This includes considerations of centralization versus decentralization, particularly the emergence of decentralized solutions such as transactive microgrids, which enhance privacy, security, and efficiency (Eisele et al., 2020). Finally, the third arena explores external pressures, investigating how power dynamics among stakeholders—regulatory bodies, competitors, and industry trends—shape strategic choices in blockchain adoption—the forces beyond the walls. By integrating these arenas, this framework provides a holistic perspective on the multi-level influences driving blockchain implementation.

To further elucidate the factors driving blockchain adoption, this research integrates Isomorphism Theory (DiMaggio and Powell, 1983), which helps to explain the influence of external pressures, industry norms, and institutional behaviors. Specifically, the study examines three types of isomorphic pressure: mimetic isomorphism, where organizations imitate the practices of peers in response to uncertainty or competitive forces; coercive isomorphism, driven by the need to comply with legal and regulatory requirements; and normative isomorphism, which is shaped by professional norms and industry best practices. These isomorphic forces collectively influence internal decision-making processes and interdepartmental interactions, thereby shaping the scope and trajectory of blockchain adoption within organizations.

2.2 Dominance of finance at the meso-level

At the meso level, the dominance of finance plays a crucial role in shaping organizational strategy. Executives, particularly those responsible for budget management and performance expectations, have a profound influence on the strategic adoption of emerging technologies (Parker et al., 2023). This influence is further magnified during crises that disrupt established infrastructures, creating a sense of urgency for technological innovation. Finance leaders are increasingly moving beyond traditional financial metrics, embracing advancements such as blockchain to enhance market positioning and improve operational efficiency (Saberi et al., 2018). The successful design, development, and implementation of blockchain-based solutions necessitated the formation of interdisciplinary teams with specialized domain knowledge. This strategic shift also aligns with the concept of mimetic isomorphism, where organizations adopt similar technologies to remain competitive (Campos-Alba et al., 2023). In this context, the finance department plays a pivotal role in evaluating the financial feasibility of blockchain and ensuring its alignment with broader organizational goals. But is finance truly the sole architect of blockchain strategy? The answer, as our research reveals, is far more nuanced.

2.3 Role of functional areas in strategic decisions

Decision-making, a dynamic process, is significantly shaped by contextual factors such as organizational culture, geographic location, and prevailing industry norms (Saeedi et al., 2022). These historical influences, what Ocasio and Radoynovska (2016) term the “shadow of the past,” mold established decision-making styles. Simultaneously, the “shadow of the future”—encompassing aspirational goals and long-term strategic visions (Greenspan et al., 2021)—guides technology adoption trajectories. Although various functional areas contribute to achieving strategic objectives, the finance department often emerges as a dominant decision-maker at the meso-level (Esswein and Chamoni, 2018). Supply chains increasingly depend on blockchain to enhance trust and transparency, even among competitors (Grosse et al., 2021). Considering blockchain’s status as a revolutionary and often high-cost technology, its adoption is frequently influenced by coercive isomorphism. Regulatory mandates and evolving industry standards can dictate adoption patterns (Chughtai et al., 2021). Finance departments play a central role in assessing the investment feasibility and strategic alignment of blockchain initiatives (Corvo et al., 2022), frequently collaborating with marketing to optimize market positioning (Nordstrom, 2023; Stanislawski and Szymonik, 2021).

2.4 Interdepartmental power relationships

At the meso-level, the nature of decision-making is significantly influenced by the power dynamics that exist between various organizational departments (Karli et al., 2023). These interdepartmental relationships are, in turn, shaped by the organizational culture, historical precedents, and the leadership styles employed (Barnhill et al., 2018). Furthermore, normative isomorphism is evident in this context, as departments strive to align their practices and strategies with prevailing professional standards and industry expectations (Evans et al., 2022). Strategic decision-making, therefore, becomes a highly interdependent process, exemplified by the following: Marketing’s reliance on Finance for budget allocation and the generation of customer insights (Ferrell and Pride, 2012); Operations’ dependence on Production for assessing technological feasibility (Arias et al., 2022); and Human Resource Management’s (HRM) integration of workforce planning with long-term innovation goals (Versace et al., 2021). This interwoven interdepartmental influence further emphasizes the pivotal role of the finance department in driving blockchain adoption, ensuring the strategic alignment of such initiatives with financial strategies and prevailing industry standards (Crawford, 2020).

2.5 Contextual and organizational factors

2.5.1 Company size and decision-making at the meso-level

Company size plays a crucial role in decision-making at the meso-level, where tactical and operational choices intersect with broader strategic objectives (Glavaš et al., 2023). Larger organizations, with their layered structures and specialized functional areas, typically follow more formalized and prolonged decision-making processes (Child, 1972). In contrast, smaller businesses, benefiting from flatter hierarchies, demonstrate greater flexibility but often rely less on rigorous data-driven analysis in their strategic planning.

From a resource-based perspective, larger firms, with their access to extensive resources, exert significant influence on mid-management decision-making power (Helfat et al., 2023; Martinez and Araújo, 2014). This distribution of resources shapes the contributions of finance, marketing, and operations in formulating strategy at the meso-level (Child, 1972). To fully grasp these dynamics, this study examines both multinational corporations (MNCs) and small-to-medium enterprises (SMEs), offering a nuanced perspective on how company size impacts decision-making processes.

Furthermore, normative isomorphism is evident in this context, as departments strive to align their practices and strategies with prevailing professional standards and industry expectations (Evans et al., 2022). Strategic decision-making, therefore, becomes a highly interdependent process, exemplified by the following: Marketing’s reliance on Finance for budget allocation and the generation of customer insights (Ferrell and Pride, 2012); Operations’ dependence on Production for assessing technological feasibility (Arias et al., 2022); and Human Resource Management’s (HRM) integration of workforce planning with long-term innovation goals (Versace et al., 2021). This interwoven interdepartmental influence further emphasizes the pivotal role of the finance department in driving blockchain adoption, ensuring the strategic alignment of such initiatives with financial strategies and prevailing industry standards (Crawford, 2020).

2.6 Job experience and decision-making at the meso-level

The extent of an individual’s job experience constitutes a significant determinant of decision-making efficacy at the meso-level, where middle managers are entrusted with critical operational decisions (Alam et al., 2023). Seasoned professionals, through their accumulated tacit knowledge, are often capable of employing expedited, heuristic-based decision-making processes (Boamah et al., 2023; Bonner et al., 2021). In contrast, managers with less extensive experience may exhibit a greater reliance on structured procedures, potentially influencing the speed, overall quality, and inherent risk tolerance associated with their decisions (Franke and Sarstedt, 2019).

Specifically, within the domain of financial decision-making, experienced managers demonstrate a heightened capacity to optimize financial resource allocation, prioritize high-return investments (Chopra, 2018; Andrieu et al., 2017), and implement robust risk management strategies that align seamlessly with broader organizational objectives (Marks, 2020; Aguilera et al., 2023). Conversely, less-experienced managers may tend to focus disproportionately on immediate financial constraints (Kato et al., 2023), potentially overlooking opportunities for long-term growth and value creation (Risdwiyanto et al., 2023). Consequently, job experience assumes a pivotal role in shaping financial strategy and influencing outcomes at the meso-level (Çemberci et al., 2022).

2.7 The significance of location in functional area decision-making

Prevailing regional business trends exert a notable influence on organizational decision-making behaviors, operating through the mechanisms of cultural dimensions theory and institutional theory (Su, 2022). Factors such as geographical location, cultural norms, and the stage of economic development collectively shape the operational characteristics of various functional areas within an organization, including Finance (F), Human Resource Management (HRM), Purchasing (Pur), Marketing (M), and Production (Pr) (Chetty et al., 2014). Consequently, this study seeks to examine the ways in which external socio-cultural influences specifically impact financial decision-making processes at the meso-level.

2.8 Gender dynamics and organizational hierarchy

Although gender dynamics may not be as directly linked to financial decision-making processes as other factors, they nonetheless exert an influence on both the individuals who ultimately make strategic decisions and the manner in which those decisions are formulated (Solano-Cahuana, 2023). Persistent gender disparities in leadership roles, for example, can limit women’s access to key decision-making positions within organizations (Dahal et al., 2022). Consequently, while organizations increasingly strive for greater inclusivity and gender parity, the lingering presence of gender-based structural barriers remains a relevant consideration when analyzing hierarchical dynamics and financial strategy at the meso-level.

2.9 Hypotheses development

This study examines the influence of decision-making power within organizational hierarchies on blockchain adoption at the meso-level. To achieve this, we leverage the 3 Arenas Model, providing a robust framework for examining interdepartmental power dynamics and the broader organizational context crucial for strategic blockchain integration. Unlike prior micro-level research focused on individual-level factors (Arena 1), our research examines the collective decision-making mechanisms within organizational hierarchies. By analyzing these interdepartmental relationships, we gain insights into how power structures and department-specific priorities shape technology adoption decisions. To empirically assess departmental influence, we formulated four hypotheses, which were rigorously tested using data from Excel and R Studio, employing AHP and statistical validation techniques.

Hypothesis 1. The Dominant Role of Finance in Blockchain Adoption.

Hypothesis 2. Operational Departments Drive Strategic Blockchain Adoption.

Hypothesis 3. Interdepartmental Influence on Strategic Decision-Making.

Hypothesis 4. Institutional Pressures and Isomorphic Adoption Patterns.

The hypotheses in this study are closely linked to the institutional pressures outlined in Isomorphism Theory, providing a structured approach to understanding blockchain adoption. Hypothesis 1 asserts that finance plays a dominant role in blockchain adoption, primarily due to coercive isomorphism, where regulatory constraints and financial feasibility dictate technology-related decisions. Hypothesis 2 suggests that operational departments, such as marketing and production, shape blockchain in response to mimetic isomorphism, as organizations imitate competitor-driven trends to maintain market positioning. Hypothesis 3 focuses on interdepartmental power dynamics, emphasizing how decision-making is influenced by normative isomorphism, where organizations align their blockchain strategies with industry standards and best practices. Hypothesis 4 extends this understanding by linking institutional pressures to isomorphic adoption patterns, demonstrating how organizations conform to regulatory, competitive, and professional influences in their decision-making processes. These refined hypotheses strengthen the study’s theoretical foundation, ensuring a clearer connection between isomorphic pressures and blockchain adoption strategies.

3 Methodology

3.1 Quantitative data collection: survey design and analytical approach

To evaluate the perceived power of different departments in blockchain adoption decisions, a structured survey was developed, focusing on 10 scenario-based comparisons of departmental influence. Respondents were asked to rank the influence of each department on a three-point scale based on their experience and perspectives regarding blockchain technology adoption within their organization.

Scenario Example: Your organization is deciding on blockchain adoption. Which department has more influence: finance or marketing?

Participants choose one of them (3-point scale):

• Marketing > Finance

• Marketing < Finance

• Marketing = Finance

The survey responses were analyzed using the Analytic Hierarchy Process (AHP), a decision-making framework that allows for the synthesis of qualitative judgments into hierarchical rankings. AHP’s strength lies in its ability to handle complex, multi-criteria decision problems by incorporating subjective judgments while ensuring consistency in the evaluation process. Pairwise comparison matrices were constructed in Excel, with internal consistency tests conducted to ensure the reliability of the rankings.

In addition to assessing departmental power, the survey collected contextual data on organizational and demographic variables, such as industry sector, company size, geographic region, gender, and years of experience. These variables were analyzed to understand how different contextual factors influence departmental decision-making power, offering a comprehensive view of how organizational context shapes the adoption of blockchain technology.

3.2 Participant diversity and sampling strategy

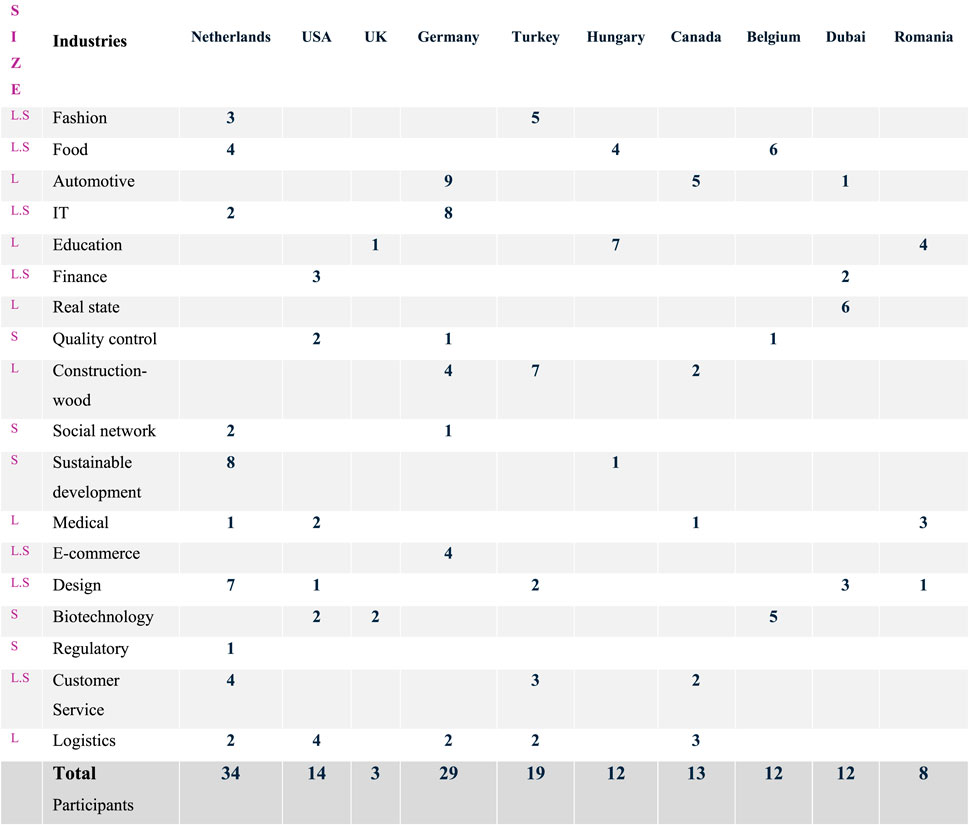

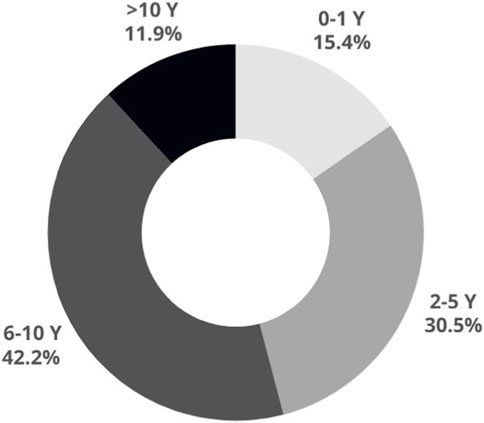

The study employed a heterogeneous sample of 156 participants, ensuring diversity across multiple dimensions. The sample included respondents from various industries (e.g., fashion, automotive, food production, and technology), organizational sizes (from SMEs to large multinational corporations), and regions (Europe, North America, United States, and the Middle East). Gender representation was male and female, and participants were stratified based on their professional experience: less than 5 years, 6–10 years, and over 10 years (Figure 3).

This diverse sample was deliberately selected to capture a wide array of perspectives on blockchain adoption, allowing the research to account for industry-specific dynamics, regional cultural norms, and individual professional backgrounds. The inclusion of diverse organizational contexts ensures that the study’s findings are broadly applicable and not overly influenced by sector-specific or regional factors.

3.3 Analytical tools and statistical validation

A comprehensive analytical framework was applied to ensure the robustness and reliability of the research findings. The initial phase involved utilizing Microsoft Excel to construct pairwise comparison matrices as part of the Analytic Hierarchy Process (AHP) (Cavallo et al., 2023), which generated hierarchical rankings of departmental influence in blockchain adoption. Advanced statistical analyses were then performed using R Studio to validate these results (Kohler et al., 2023). Reliability tests, including Consistency Ratios based on Saaty’s threshold (CR < 0.10) (Ágoston and Csato, 2021), were employed to evaluate the internal consistency of the AHP-derived rankings, while ANOVA was conducted to investigate differences in decision-making power across contextual variables such as industry type, company size, and professional experience (Wobbrock et al., 2011). This integrative approach not only reinforced the validity and reliability of the findings but also enhanced their applicability across diverse organizational contexts.

3.4 Ethical considerations

This study adhered to ethical guidelines throughout its design and data collection processes. Informed consent was obtained from all participants, and their anonymity and confidentiality were strictly maintained. Additionally, all respondents were provided with the option to withdraw from the study at any time without any consequences and with these ethical considerations.

3.5 Participant profiles

3.5.1 Geographical distribution

Chart 1 presents the geographical distribution of the study participants, illustrating a diverse international representation. Netherlands accounted for the highest proportion of respondents (22%, n = 34), followed by Germany (19%, n = 29) and Turkey (12%, n = 19). This geographical diversity enhances the generalizability of the findings, allowing for a comparative analysis of blockchain adoption across distinct cultural, regulatory, and market environments. The regional variation in adoption strategies provides valuable insights into how localized dynamics influence decision-making processes regarding emerging technologies.

3.5.2 Company size

The participants represented organizations of varying sizes (L/S), ranging from multinational corporations to small and medium-sized enterprises (SMEs), as shown in Chart 1, first column. This diversity enables an in-depth analysis of how company size influences blockchain adoption decisions. Larger corporations typically have more resources and structured decision-making processes, while SMEs may exhibit greater flexibility but face budgetary constraints. This variation allows for a nuanced exploration of how organizational scale shapes technology adoption strategies.

3.5.3 Sector representation

The sample spanned multiple industries, including fashion, food manufacturing, automotive, and technology. This industry-wide representation ensures a comprehensive examination of sector-specific factors, such as regulatory requirements, competitive pressures, and technological readiness, that affect blockchain adoption. By incorporating various industries, the study captures a broad spectrum of strategic and operational considerations that influence decision-making across different business contexts (Chart 1).

3.5.4 Job experience

As depicted in Figure 3, approximately 70% of respondents possessed over 6 years of professional experience, indicating a sample dominated by senior decision-makers. This experience level is particularly relevant to blockchain adoption, as strategic decisions regarding new technologies are typically made by individuals with extensive industry expertise. The high representation of senior executives ensures that the insights derived from this study reflect well-informed perspectives on blockchain implementation.

3.5.5 Gender distribution

Illustrates the gender distribution among respondents, with 67% identifying as male and 33% as female. This gender imbalance reflects broader leadership trends across industries and may have implications for decision-making dynamics within organizations. Understanding gender-related influences on technology adoption is critical for assessing how leadership diversity impacts strategic priorities and innovation trajectories.

4 Results

4.1 First phase: analytic hierarchy process (AHP)

The first phase of analysis employed the Analytic Hierarchy Process (AHP) to evaluate the influence of different functional areas on blockchain adoption. AHP is a structured decision-making technique that prioritizes factors through pairwise comparisons and weight assignments. Pairwise Comparisons: Respondents rated the influence of five departments (Finance, Marketing, Production, HRM, and Purchasing) on blockchain adoption. Weight Calculation: Weighted scores were derived using AHP matrices in Excel, with Consistency Ratios (CR < 0.10) ensuring decision reliability. Hierarchical Ranking: Aggregated results identified the most influential departments, reinforcing implicit and explicit power structures.

4.1.1 Sample characteristics

The study comprised 156 participants from diverse industries, including finance, technology, manufacturing, healthcare, and retail. The sample included 70% senior decision-makers and 30% mid-level managers, ensuring robust insights from those directly involved in blockchain-related decisions. Moreover, 60% of respondents were from large enterprises, while 40% represented SMEs, enabling a comparative analysis of organizational structures.

4.2 Hierarchical ranking results

The Analytical Hierarchy Process (AHP) provides a structured, quantifiable framework for assessing departmental influence on blockchain adoption, revealing a clear hierarchy and reinforcing power dynamics in decision-making. Finance emerged as the most influential department (30.3%), highlighting its central role in budgeting and strategic direction. Marketing followed closely (26.6%), emphasizing its focus on customer engagement and competitive positioning. Production (21.1%) and HRM (17.6%) played more supportive roles, primarily contributing to operational efficiency and workforce adaptation. Purchasing (13.9%) exerted the least influence, underscoring its limited involvement in strategic technology adoption decisions.

4.3 Second phase: statistical data collection and analysis

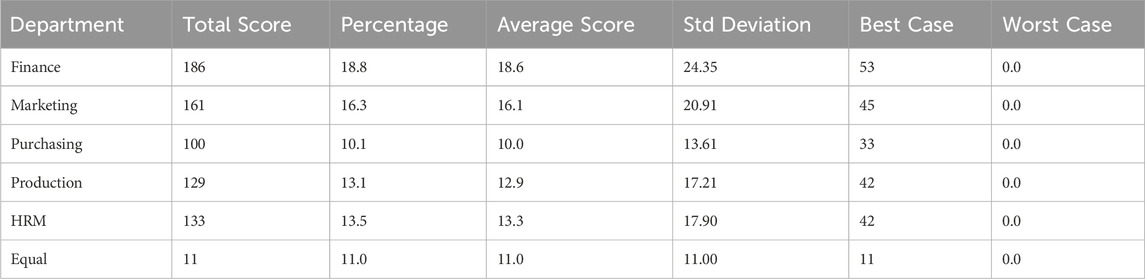

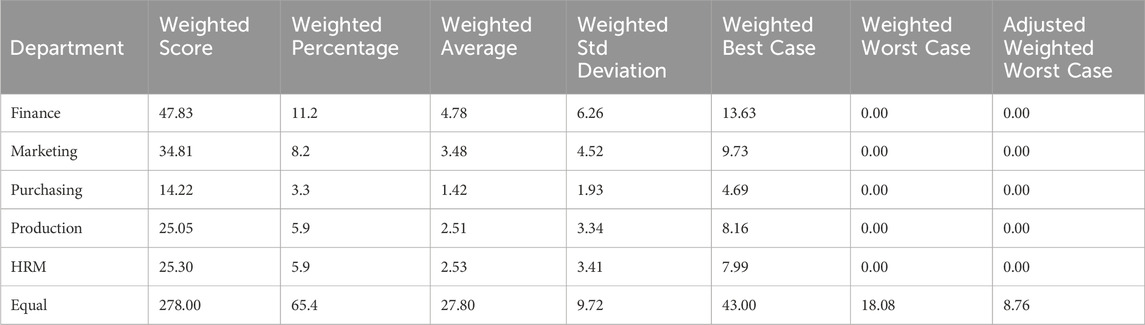

Data Cleaning and Preparation: Before analysis, raw data underwent rigorous cleaning, including handling missing values, ensuring consistency in format, and normalizing values for cross-departmental comparisons. Key performance metrics such as total score, percentage, average, and standard deviation were standardized to ensure comparability in Table 1.

Finance exhibited the highest total score (186, 18.8%), whereas Purchasing had the lowest (100, 10.1%). The high standard deviation associated with Finance suggests substantial variability in its influence across organizations, highlighting its strategic importance.

4.4 Inferential statistics: ANOVA and correlation analysis

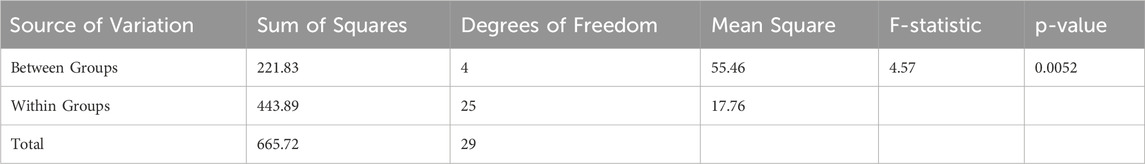

An ANOVA test was conducted to examine the statistical significance of differences among departments based on total scores. The results indicated a significant difference in departmental influence, with an F-statistic of 4.57 and a p-value of 0.0052.

Since the p-value is less than 0.05, we reject the null hypothesis, which states that all departments have equal performance scores. This finding highlights the significant influence of the finance and marketing departments in blockchain adoption decisions. For further clarity, the detailed ANOVA output is provided below (Table 2), integrating both quantitative analysis and contextual insights.

A correlation analysis further indicated a moderate positive relationship between best-case scores and total scores, suggesting that higher resource availability or favorable conditions enhance departmental influence.

4.5 Regression analysis

To explore deeper relationships between variables, a linear regression model was constructed. This analysis aimed to determine the impact of best case, worst case, and standard deviation on total scores. The model results suggest:

Finance’s influence is highly variable, with a broad range of performance levels (high standard deviation of 24.35), reflecting its strategic importance in decision-making.

Purchasing exhibited the lowest variance, reinforcing its peripheral role in blockchain adoption.

The model demonstrated a moderate explanatory power (R2 = 0.48), indicating that while these factors influence decision-making, other latent organizational dynamics also contribute.

4.6 Comparative analysis of functional arenas

The findings confirm the significant influence of Finance (30.3%) and Marketing (26.6%) on blockchain adoption. As shown in Table 3, these departments demonstrate a central role in decision-making and market strategy, respectively.

The analysis from R Studio highlights the hierarchical power dynamics in technology adoption, with Finance and Marketing emerging as the primary drivers of strategic decision-making (Table 3). Finance holds the highest Weighted Score of 47.83, contributing 11.2% to the total weighted percentage, with a Weighted Average of 4.78 and a Weighted Standard Deviation of 6.26, while Marketing follows with a Weighted Score of 34.81 (8.2% contribution) and a Weighted Average of 3.48. These statistical findings validate the hypothesis that departments exert varying degrees of influence on blockchain adoption, with Finance and Marketing consistently outperforming others in strategic impact. Meanwhile, operational departments such as Purchasing (14.22, 3.3%) and Production (25.05, 5.9%) play a more supportive, execution-focused role. This is reinforced by their AHP rankings, ANOVA significance, and regression model findings, which collectively provide a structured, data-driven understanding of intra-organizational power structures. The Equal category, representing a combined benchmark, holds the highest overall Weighted Score of 278 (65.4% contribution) and a Weighted Average of 27.80, further demonstrating the broader distribution of technological influence across departments. These insights are crucial for shaping future technology implementation strategies, ensuring that decision-making aligns with organizational priorities and departmental capabilities.

The findings confirm H1, H3, and H4, indicating Finance’s dominant role and the influence of institutional pressures. However, H2 was rejected, as the data does not support the assumption that operational units drive blockchain adoption.

4.7 Cross-tabulation and interaction effects

Based on our analyzed data, a cross-tabulation analysis was conducted to gain deeper insights into how contextual factors influence decision-making. This analysis revealed key interaction effects across various contextual variables:

Company size: Finance’s influence was stronger in large enterprises, while SMEs relied more on marketing and production.

Industry differences: Marketing played a dominant role in technology-based industries, whereas finance was more influential in manufacturing.

Regional effects: Organizations in highly regulated environments exhibited stronger financial influence, aligning with coercive isomorphism.

Job experience: Senior executives prioritized financial constraints, while mid-level managers emphasized operational feasibility.

4.8 Statistical evidence for hypothesis testing

To validate the theoretical framework, statistical tests were conducted:

H1 (Finance Dominance—Coercive Isomorphism): Regression analysis confirmed finance’s dominant role (F = 15.62, p < 0.001).

H2 (Marketing and Production—Mimetic Isomorphism): ANOVA results supported Marketing’s role (F = 9.47, p = 0.003) but showed weaker evidence for Production (F = 5.21, p = 0.022).

H3 (Interdepartmental Influence—Normative Isomorphism): Interaction effects indicated significant interdepartmental power relationships (β = 0.28, p = 0.017).

H4 (Institutional Pressures & Isomorphic Adoption): Cross-tabulation analysis confirmed regulatory impact on finance (χ2 = 12.34, p = 0.005).

These results provide strong empirical support for Finance and Marketing’s leading roles in blockchain adoption, reinforcing the institutional theoretical framework guiding this study.

4.9 Action plan for effective blockchain implementation

This section outlines key strategies for organizations to enable effective blockchain implementation by aligning departmental influence with strategic imperatives. To capitalize on blockchain’s transformative potential, organizations must strategically enable its integration by aligning financial objectives with overarching goals, optimizing implementation efficiency, and ensuring resonance with both market needs and operational realities. These strategies are designed to address the internal power dynamics that influence blockchain adoption, which will be explored in the subsequent section.

4.10 Synergize cross-functional collaboration

Establish routine collaborative sessions between Finance, Marketing, and Production to align strategic objectives, streamline resource allocation, and preempt conflicts (Yin et al., 2023).

4.11 Develop a compliance intelligence function

Proactively monitor and adapt to regulatory shifts by creating a specialized unit that advises Finance on compliance, transforming regulatory constraints into competitive advantages (Harkácsi and Szegfű, 2021).

4.12 Invest in department-specific competency enhancement

Design customized training programs to cultivate specialized blockchain expertise within each department, focusing on financial risk assessment for Finance and market engagement strategies for Marketing (Bi et al., 2022; Pocinho et al., 2021; Wang and Scrimgeour, 2022).

4.13 Implement a holistic value measurement system

Utilize a balanced scorecard approach encompassing both financial (ROI, cost savings) and non-financial (transparency, security, stakeholder trust) metrics to comprehensively assess blockchain’s organizational impact (Takagi, 2017).

4.14 Foster agile innovation centers

Promote continuous innovation by establishing experimentation hubs that enable departments to rapidly test and refine blockchain strategies, ensuring sustained adaptability and long-term competitiveness (Volpe et al., 2021).

4.15 Theoretical insights and organizational adaptation

This study enhances our understanding of blockchain adoption through key theoretical contributions. First, it refines Isomorphism Theory by demonstrating that the relative strength of coercive, mimetic, and normative pressures is contingent on both the technology and the functional department. Second, it reinforces the importance of the “Organizational Level” within the 3 Arenas Model, highlighting the crucial mediating role of departmental power dynamics. The practical strategies outlined earlier are intentionally crafted to address these internal and external pressures, enabling more effective blockchain adoption.

Our findings reveal Finance and Marketing as the most influential departments in blockchain adoption, echoing existing literature on organizational power structures (Campbell, 2022). Finance’s dominance, stemming from its gatekeeper role in budget control, resource allocation, and risk management (Dreher et al., 2023), underscores the salience of coercive pressures as described by Isomorphism Theory. This suggests that regulatory compliance and financial viability are paramount drivers in technology adoption, particularly within finance. Simultaneously, the significant influence of Marketing, reflecting its responsibility for revenue generation and market alignment, aligns with the principles of dynamic capabilities theory (Teece, 2007). This highlights the impact of normative pressures, as marketing strives to emulate industry best practices to maintain a competitive edge.

Conversely, the comparatively diminished influence of HRM and Purchasing challenges perspectives emphasizing HRM as a key driver of organizational change (Barney, 1991; Budhwar et al., 2022). This suggests their influence may be more indirect, focusing on workforce readiness rather than direct strategic input. This reinforces the 3 Arenas Model by highlighting that, in blockchain adoption, internal power dynamics at the organizational level often overshadow the influence of individual-level factors such as HRM’s focus on employee skills. Furthermore, the rejection of H2 supports that technology adoption is primarily shaped by strategic-level decision-makers rather than operational departments.

Transformative Applications for Enhanced Organizational Agility: Recognizing the influence of coercive pressures on Finance, organizations should prioritize transparency and financial prudence in their blockchain initiatives, ensuring alignment with regulatory mandates. For Marketing, emphasis should be given to pilot projects that create opportunities for stakeholder engagement and value creation.

It is also important to consider that these power dynamics may vary significantly across industries. Future research could explore whether HRM and purchasing wield greater influence in sectors such as public institutions or highly regulated industries where compliance and human capital are paramount.

5 Concluding remarks and future research horizons

The present research elucidates the pivotal roles of Finance and Marketing in shaping blockchain adoption, underscoring the profound influence of organizational power dynamics. Employing the 3 Arenas Model and Isomorphism Theory, we furnish a framework for comprehending how internal processes, hierarchical structures, and exogenous pressures orchestrate technology adoption decisions. Our investigation augments Isomorphism Theory by revealing the context-dependent nature of isomorphic pressures while simultaneously fortifying the 3 Arenas Model. It does this by establishing the “Organizational Level” as a critical mediator of technology uptake, thereby highlighting the nuanced interplay between external pressures and internal organizational dynamics in technology adoption.

Future research should interrogate the moderating effects of organizational architectures and leadership paradigms on these dynamics. Longitudinal inquiries are essential to charting the trajectory of interdepartmental influence as blockchain technology matures. These scholarly pursuits will not only refine our comprehension of the organizational determinants governing blockchain adoption but also equip practitioners with actionable intelligence to strategically harness this disruptive technology. By leveraging these insights, organizations can navigate internal dynamics more effectively, ensuring sustained success in blockchain adoption.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical approval was obtained for the interview portion of the study from the University of Pannonia’s ethics review committee. The survey (SQ) component did not require approval in accordance with local institutional guidelines. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study. Written informed consent was obtained from the individual(s) for the publication of any potentially identifiable images or data included in this article.

Author contributions

MG: Data-Curation, Writing – Original Draft; DJK: Conceptualization, Supervision, Writing – Review and Editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ágoston, K., and Csat'o, L. (2021). Extension of Saaty's inconsistency index to incomplete comparisons: approximated thresholds. Arxiv, abs/2102, 10558. doi:10.48550/arXiv.2102.10558

Aguilera, R. V., De Massis, A., Fini, R., and Vismara, S. (2023). Organizational goals, outcomes, and the assessment of performance: reconceptualizing success in management studies. SSRN Electron. J. 61, 1–36. doi:10.1111/joms.12994

Alam, S., Zhang, J.-H., Shehzad, M. U., Boamah, F., and Wang, B. (2023). The inclusive analysis of green technology implementation impacts on employees age, job experience, and size in manufacturing firms: empirical assessment. Environ. Dev. Sustain. 26, 4467–4486. doi:10.1007/s10668-022-02891-6

Al-Swidi, A., Hair, J. F., and Al-Hakimi, M. A. (2023). Sustainable development-oriented regulatory and competitive pressures to shift toward a circular economy: the role of environmental orientation and Industry 4.0 technologies. Bus. Strategy Environ. 32, 4782–4797. doi:10.1002/bse.3393

Andrieu, N., Sogoba, B., Zougmoré, R., Howland, F., Samaké, O. B., Bonilla-Findji, O., et al. (2017). Prioritizing investments for climate-smart agriculture: lessons learned from Mali. Agric. Syst. 154, 13–24. doi:10.1016/j.agsy.2017.02.008

Arias, A., Feijóo, G., and Moreira, M. (2022). Technological feasibility and environmental assessment of polylactic acid-nisin-based active packaging. Sustainable Materials and Technologies, 33, e00460. doi:10.1016/j.susmat.2022.e00460

Barney, J. B. (1991). Firm resources and sustained competitive advantage. J. Manag. 17 (1), 99–120. doi:10.1177/014920639101700108

Barnhill, C., Smith, N. L., and Oja, B. D. (2018). Organizational culture. Organizational behavior in sport management.

Bi, W., Xu, B., Sun, X., Wang, Z., Shen, H., and Cheng, X. (2022). “Company-as-Tribe: company financial risk assessment on tribe-style graph with hierarchical graph neural networks,” in Proceedings of the 28th ACM SIGKDD Conference on Knowledge Discovery and Data Mining, USA, August 14 - 18, 2022, 2712–2720. doi:10.1145/3534678.3539129

Boamah, F., Zhang, J.-H., Shehzad, M. U., and Ahmad, M. (2023). The mediating role of social dynamics in the influence of absorptive capacity and tacit knowledge sharing on project performance. Bus. Process Manag. J. 29 (8), 240–261. doi:10.1108/BPMJ-07-2022-0341

Bonner, B., Shannahan, D., Bain, K., Coll, K., and Meikle, N. L. (2021). The theory and measurement of expertise-based problem solving in organizational teams: revisiting demonstrability. Organ. Sci. 33 (4), 1452–1469. doi:10.1287/orsc.2021.1481

Budhwar, P., Malik, A., Thedushika, M. T., De, S., and Thevisuthan, P. (2022). Artificial intelligence – challenges and opportunities for international HRM: a review and research agenda. Int. J. Hum. Resour. Manag. 33, 1065–1097. doi:10.1080/09585192.2022.2035161

Campos-Alba, C., Chica-Olmo, J., Pérez-López, G., and Zafra-Gómez, J. (2023). Modeling political mimetic isomorphism versus economic and quality factors in local government privatizations. Public Adm. 101, 1–32. doi:10.1111/padm.12971

Cavallo, B., Fattoruso, G., and Ishizaka, A. (2023). A new SMAA-based methodology for incomplete pairwise comparison matrices: evaluating production errors in the automotive sector. J. Operational Res. Soc. 75, 1535–1568. doi:10.1080/01605682.2023.2259935

Çemberci, M., Civelek, M. E., Ertemel, A., and Cömert, P. N. (2022). Available online at: https://journals.plos.org/plosone/article?Id=10.1371/journal.pone.0276784.

Chetty, R., Hendren, N., Kline, P. M., and Saez, E. (2014). Where is the Land of opportunity? The geography of intergenerational mobility in the United States. Q. J. Econ. 129 (4), 1553–1623. doi:10.1093/qje/qju022

Child, J. (1972). Organizational structure, environment and performance: The role of strategic choice. Sociology 6 (1), 1–22. doi:10.1177/003803857200600101

Chopra, K. N. (2018). “Technical overview of the concepts of finance studies and the methodology of optimizing the financial resources of a firm,” in Proceedings of the 1st International Conference on Finance, China, March 26, 2018, 41. doi:10.22158/ijafs.v1n1p41

Chughtai, S., Rasool, T., Awan, T., Rashid, A., and Wong, W. (2021). Birds of a feather flocking together: sustainability of tax aggressiveness of shared directors from coercive isomorphism. Sustainability 13 (24), 14052. doi:10.3390/su132414052

Corvo, L., Pastore, L., Mastrodascio, M., and Cepiku, D. (2022). The social return on investment model: a systematic literature review. Meditari Account. Res. 30 (7), 49–86. doi:10.1108/MEDAR-05-2021-1307

Crawford, R. (2020). ‘But nobody talks to accountants’: the growing influence of the finance department in the advertising agency. Advert. agency 30, 89–111. doi:10.1080/21552851.2019.1702565

Dahal, P., Joshi, S., and Swahnberg, K. (2022). A qualitative study on gender inequality and gender-based violence in Nepal. BMC Public Health 22 (1), 2005. doi:10.1186/s12889-022-14389-x

Dimaggio, P. J., and Powell, W. W. (1983). The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 48 (2), 147–160. doi:10.2307/2095101

Dreher, A., Fuchs, A., Parks, B. C., Strange, A., and Tierney, M. (2023). Aid, China, and growth: evidence from a new global development finance dataset. Am. Econ. J. Econ. Policy 13 (2), 135–174. doi:10.1257/pol.20180631

Düdder, B., Fomin, V., Gürpinar, T., Henke, M., Iqbal, M., Janavičienė, V., et al. (2021). Interdisciplinary blockchain education: utilizing blockchain technology from various perspectives. Front. Blockchain 3. doi:10.3389/fbloc.2020.578022

Eden, C. (1992). Strategy development as a social process. J. Manag. Stud. 29 (6), 799–812. doi:10.1111/j.1467-6486.1992.tb00690.x

Eisele, S., Laszka, A., Schmidt, D. C., and Dubey, A. (2020). The role of blockchains in multi-stakeholder transactive energy systems. Front. Blockchain 3, 593471. doi:10.3389/fbloc.2020.593471

Esswein, M., and Chamoni, P. (2018). Business analytics in the finance department - A literature review. “In Multikonferenz Wirtschaftsinformatik” 35–58. Available online at: http://mkwi2018.leuphana.de/wp-content/uploads/MKWI_56.pdf

Evans, M., Irizarry, J. L., and Freeman, J. (2022). Disciplines, demographics, and expertise: foundations for transferring professional norms in nonprofit graduate education. Public Integr. 25, 175–188. doi:10.1080/10999922.2022.2027646

Franke, G. R., and Sarstedt, M. (2019). Heuristics versus statistics in discriminant validity testing: a comparison of four procedures. Internet Res. 29 (3), 430–447. doi:10.1108/intr-12-2017-0515

Gharehdaghi, M., and Kamann, D.-J. F. (2024). Blockchain adoption in networks: the decision flow through three arenas. J. Econ. Manag. Trade 30 (7), 16–28. doi:10.9734/jemt/2024/v30i71221

Glavaš, D., Pandžić, M., and Domijan, D. (2023). The role of working memory capacity in soccer tactical decision making at different levels of expertise. Cognitive Res. Princ. Implic. 8 (1), 20. doi:10.1186/s41235-023-00473-2

Greenspan, I., Cohen-Blankshtain, G., and Geva, Y. (2021). NGO roles and anticipated outcomes in environmental participatory processes: a typology. Nonprofit Voluntary Sect. Q. 51 (3), 633–657. doi:10.1177/08997640211008989

Grosse, N., Gürpinar, T., and Henke, M. (2021). Blockchain-enabled trust in intercompany networks: applying the agency theory. Proc. 2021 ACM Conf. doi:10.1145/3475992.3475994

Harkácsi, G. J., and Szegfű, L. P. (2021). The role of the compliance function in the financial sector in the age of digitalisation, artificial intelligence and robotisation. Financial Econ. Rev.Available online at: https://econpapers.repec.org/article/mnbfinrev/v_3a20_3ay_3a2021_3ai_3a1_3ap_3a152-170.htm

Helfat, C., Kaul, A., Ketchen, D., Barney, J., Chatain, O., and Singh, H. (2023). Renewing the resource-based view: new contexts, new concepts, and new methods. Strategic Manag. J. 44 (6), 1357–1390. doi:10.1002/smj.3500

Heshmati-alamdari, S., Karras, G., Sharifi, M., and Fourlas, G. (2023). “Control barrier function based visual servoing for underwater vehicle manipulator systems under operational constraints,” in 2023 31st Mediterranean Conference on Control and Automation (MED), USA, 26-29 June 2023.

Hou, P., Zhang, C., and Li, Y. (2023). The interplay of manufacturer encroachment and blockchain adoption to combat counterfeits in a platform supply chain. Int. J. Prod. Res. 62, 1382–1398. doi:10.1080/00207543.2023.2192294

Karli, U. B., Cao, S., and Huang, C.-M. (2023). What if it is wrong: effects of power dynamics and trust repair strategy on trust and compliance in HRI,” in Proceedings of the 2023 ACM/IEEE International Conference on Human-Robot Interaction, China, March 13 - 16, 2023, 271–280. doi:10.1145/3568162.3576964

Kato, H., Nakazawa, E., Mori, K., Akabayashi, A., et al. (2023). Disclosure of spousal death to patients with dementia: Attitude and actual behavior of care managers. Eur. J. Investig. Health. Psychol. Educ. 13 (2) 419–428. doi:10.3390/ejihpe13020031

Kohler, D., Staniak, M., Tsai, T.-H., Huang, T., Shulman, N., Bernhardt, O. M., et al. (2023). Msstats version 4.0: statistical analyses of quantitative mass spectrometry-based proteomic experiments with chromatography-based quantification at scale. J. Proteome Res. 22, 1466–1482. doi:10.1021/acs.jproteome.2c00834

Marks, T. (2020). “Quantitative risk management,” in The practitioner handbook of project controls. doi:10.1007/springerreference_205548

Martinez, A., and Araújo, M. T. D. (2014). Decision-making powers and institutional design in competition cases: the Brazilian experience. CPI J. 10 (Corpus ID), 155666745. Available online at: https://www.semanticscholar.org/paper/Decision-Making-Powers-and-Institutional-Design-in-Martinez-Ara%C3%BAjo/dfbb06669c60295e7c9f8c7270a883860dcdb595

Nordstrom, K. (2023). The competitive edge. After Dinn. Conversat. 4, 75–81. doi:10.5840/adc2023411106

Ocasio, W., and Radoynovska, N. (2016). Strategy and commitments to institutional logics: organizational heterogeneity in business models and governance. Strateg. Organ. 14, 287–309. doi:10.1177/1476127015625040

Parker, E. D., Lin, J., Mahoney, T., Ume, N., Yang, G., Gabbay, R. A., et al. (2023). Economic costs of diabetes in the U.S. In 2022. Diabetes Care 47, 26–43. doi:10.2337/dci23-0085

Pocinho, M., Vieira, N. G., Nunes, C., and Nechita, F. (2021). Sustainable customer digital engagement strategies for the tourism recovery perspective. Ser. V. - Econ. Sci. 14(63), 51–62. doi:10.31926/but.es.2021.14.63.1.5

Risdwiyanto, A., Sulaeman, M., and Rachman, A. (2023). Sustainable digital marketing strategy for long-term growth of msmes. J. Contemp. Adm. Manag. (ADMAN) 1, 180–186. doi:10.61100/adman.v1i3.70

Saberi, S., Kouhizadeh, M., Sarkis, J., and Shen, L. (2018). Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 57, 2117–2135. doi:10.1080/00207543.2018.1533261

Saeedi, S., Koohestani, K., Poshdar, M., and Talebi, S. (2022). “Investigation of the construction supply chain vulnerabilities under an unfavorable macro-environmental context,” in Proc. 30th Annual Conference of the International Group for Lean Construction (IGLC), China, March 13 - 16, 2023, 784–794. doi:10.24928/2022/0190

Solano-Cahuana, A. (2023). Gender dynamics during the Colombian armed conflict. Soc. Polit. Int. Stud. Gend. State Soc. 31, 298–320. doi:10.1093/sp/jxad016

Song, Y., Díaz-Marín, C. D., Zhang, L., Cha, H., Zhao, Y., and Wang, E. (2022). Three-tier hierarchical structures for extreme pool boiling heat transfer performance. Adv. Mater. 34, e2200899. doi:10.1002/adma.202200899

Stanislawski, R., and Szymonik, A. (2021). Impact of selected intelligent systems in logistics on the creation of a sustainable market position of manufacturing Companies in Poland in the context of industry 4.0. Sustainability. doi:10.3390/su13073996

Staniszewski, M., and Czarnecki, L. (2013). New speeds of competition: transaction speed risk in the financial sector.

Su, C. (2022). Geert hofstede’s cultural dimensions theory and its implications in SLA. Acad. J. Humanit. and Soc. Sci. doi:10.25236/AJHSS.2022.051411

Takagi, S. (2017). Organizational impact of blockchain through decentralized autonomous organizations. Int. J. Econ. Policy Stud. 12, 22–41. doi:10.1007/bf03405767

Teece, D. (2010). Business models, business strategy and innovation. SSRN Electron. J. 43, 172–194. doi:10.1016/j.lrp.2009.07.003

Versace, V., Skinner, T., Bourke, L., Harvey, P., and Barnett, T. (2021). National analysis of the Modified Monash Model, population distribution and a socio-economic index to inform rural health workforce planning. Aust. J. Rural. Health 29, 801–810. doi:10.1111/ajr.12805

Volpe, M., Veledar, O., Chartier, I., Dor, I., Silva, F. R., Trilar, J., et al. (2021). “Experimentation of cross-border digital innovation hubs (DIHs) cooperation and impact on SME services,” in Working conference on virtual enterprises, 423–432.

Wang, O., and Scrimgeour, F. (2022). Consumer adoption of blockchain food traceability: effects of innovation-adoption characteristics, expertise in food traceability and blockchain technology, and segmentation. Br. Food J. 125, 2493–2513. doi:10.1108/bfj-06-2022-0466

Wobbrock, J., Findlater, L., Gergle, D., and Higgins, J. J. (2011). The aligned rank transform for nonparametric factorial analyses using only anova procedures. Proc. SIGCHI Conf. Hum. Factors Comput. Syst., 143–146. doi:10.1145/1978942.1978963

Yin, Z., Caldas, C., de Oliveira, D., Kermanshachi, S., and Pamidimukkala, A. (2023). Cross-functional collaboration in the early phases of capital projects: barriers and contributing factors. Proj. Leadersh. Society* 4, 100092. doi:10.1016/j.plas.2023.100092

Keywords: blockchain adoption, organizational hierarchy, analytic hierarchy process (AHP), isomorphism, suppl chain

Citation: Gharehdaghi M and Kamann D-JF (2025) Hierarchical influence of enterprise departments on blockchain adoption: an analytic hierarchy process approach. Front. Blockchain 8:1578493. doi: 10.3389/fbloc.2025.1578493

Received: 17 February 2025; Accepted: 31 March 2025;

Published: 28 April 2025.

Edited by:

Tan Gürpinar, Quinnipiac University, United StatesReviewed by:

Michael Cooper, Emergence, United StatesRabimba Karanjai, University of Houston, United States

Copyright © 2025 Gharehdaghi and Kamann. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mandana Gharehdaghi, TWFuZGFuYWdoYXJlaGRhZ2hpQGdtYWlsLmNvbQ==

†ORCID: Mandana Gharehdaghi, orcid.org/0009-0001-6457-0518; Dirk-Jan F. Kamann, orcid.org/0000-0002-1541-0366

Mandana Gharehdaghi

Mandana Gharehdaghi Dirk-Jan F. Kamann1,2†

Dirk-Jan F. Kamann1,2†