- 1School of Business, Macau University of Science and Technology, Macau, China

- 2Business School, Shantou University, ShanTou, Guangdong, China

In recent years, with the rapid development of blockchain technology, the emergence of Non-Fungible Tokens (NFTs) has become a disruptive and innovative application that has attracted widespread attention and triggered frenzy. This study examines the momentous but may be easily neglected price factor in the NFT market. Using hand-collected daily data on the number of followers of 150 NFTs on Discord from April 18 to 15 October 2022, empirical results find that the fan economy on social media platforms has a positive impact on NFT pricing. Furthermore, this impact has a certain time-lagged effect. To ensure the robustness of the research, this paper also collects Twitter followers as an alternative indicator to measure the fan economy, and all the empirical results of the Twitter platform are significant. The findings of this paper are of great significance for studying the factors affecting the price of NFTs and provide certain assistance for the decision-making of NFT issuers and investors.

1 Introduction

In recent years, with the rapid development of blockchain technology, after the digital cryptocurrencies represented by Bitcoin (Lin et al., 2019) and Ether, the emergence of Non-Fungible Tokens (NFTs) has brought a profound change to blockchain. NFTs are essentially non-replicable digital certificate of authenticity stored on a blockchain or distributed ledger (Popescu, 2021). Compared to other fungible and homogenous assets, NFTs have many advantages. First, NFTs are derived from the Ethereum ERC-721 and ERC-1155 standards on the Ethereum blockchain, so they have the corresponding characteristics of the blockchain, such as verifiability, transparent execution, tamper-resistance in ownership records, etc. (Wang et al., 2021) and decentralization (John et al., 2022). Second, because NFTs have distinct identifiers and metadata (Umar et al., 2022), each token of NFTs is unique (Zhang et al., 2022), which ensures that NFTs are non-fungible. These advantages have enabled NFTs to revolutionize the way digital assets are traded in just a few years (Wilson et al., 2022), so NFTs have become a disruptive and innovative application (Braioni, 2022).

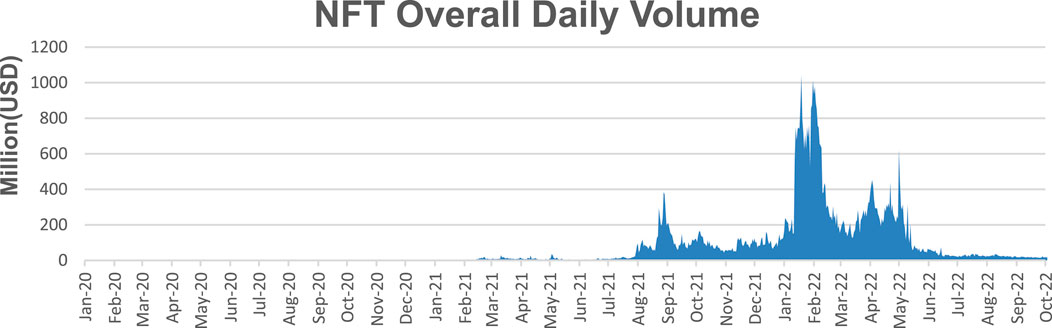

There are many types of NFTs. A picture, a tweet, an audio clip, or even a prop in a game can be NFTs. Various forms in a way open new blockchain markets. The landmark event that NFTs have attracted widespread attention in society was on 11 March 2021, when digital artist Beeple sold his work Everydays: The First 5000 Days for $69.346 million, which took 14 years to create. Subsequently, on 2 December 2021, renowned NFT artist Pak attracted more than 28,000 buyers to participate in the auction of the art project Merge and finally set a new NFT record with a total sale of $91.8 million. Meanwhile, after the publicity of major news reports and the hype of social media, the explosive growth of NFTs prompted the influx of capital into the market, triggering a frenzy in the NFT trading market. As illustrated in Figure 1, the total volume of the global NFT market has soared from $0.575 billion in 2020 to $52.6 billion in October 2022. For a frenzied NFT market, studying the influencing factors of this market price pattern would help us to better understand this new financial phenomenon and its economic effects.1,2

Figure 1. The daily trading volume from January 2020 to October 2022, with data from the Dune website.

Previous studies on NFTs have mainly focused on the characteristics (Ali and Bagui, 2021; Baals et al., 2022), technology (Murray, 2022; Das et al., 2021), benefits (Truby et al., 2022; Dos Santos et al., 2021) or other aspects of the NFT market. In the financial field of NFTs, research has mainly focused on the connection between the NFT market and other asset classes (Pinto-Gutiérrez et al., 2022; Apostu et al., 2022) or on a single NFT category or collection (Schaar and Kampakis, 2022; Yencha, 2022). However, there are no studies investigating the relationship between the fan economy and NFT pricing. Therefore, this paper contributes to the debate on the influencing factors of NFT pricing from the perspective of the fan economy.

Although the fan economy has been widely explored in fields like marketing and cultural studies, its financial implications, particularly in asset pricing—remain under-investigated. Much of the existing research has focused on consumer identity formation, engagement strategies, or community behavior, with limited attention to how fan activity might influence market valuation.

This study builds on that foundation by asking whether fan engagement—captured through follower counts on Discord and Twitter—correlates with NFT price dynamics in emerging digital asset markets. By treating social visibility as a quantifiable input, we aim to bridge the gap between behavioral attention metrics and financial performance in speculative environments.

The fan economy has attracted growing scholarly attention for its complex role in shaping both market value and investor behavior. In marketing research, social media–driven fan engagement is often linked to increased product visibility, stronger consumer participation, and heightened brand loyalty (Braga and Guillén, 2012; De Vries et al., 2012). More recently, financial studies have extended this view, suggesting that fan tokens and social followership can serve as early indicators of demand and help stimulate short-term market momentum (Foglia et al., 2024).

Yet this enthusiasm is not without risks. Several researchers caution that excessive reliance on fan-driven attention may distort price signals and magnify volatility. For instance, Foglia et al. (2024) reports persistent spillover effects between fan token ecosystems and traditional markets, implying that speculative enthusiasm may introduce broader financial instability. Similarly, Westland (2024) observes that NFT valuations often exhibit socially driven fluctuations that are disconnected from economic fundamentals.

These findings highlight an unresolved dilemma: fan engagement may be instrumental in mobilizing digital asset demand, but it can also intensify behavioral distortions and complicate the interpretation of price dynamics. Understanding this dual role is essential to any serious analysis of value formation in decentralized, hype-sensitive markets.

However, none of them empirically examine how observable fan metrics—such as social media follower counts—relate to the market valuation of blockchain-based assets like NFTs. Addressing this gap, our study investigates whether fan engagement, operationalized through community followership data, can meaningfully explain NFT pricing patterns.

First, this study manually tracks the daily changes in the relevant data of 150 NFTs and the number of fans on Discord platforms and finds that the fan economy will affect the fluctuation of NFT pricing. Second, the empirical results also conclude that the fan economy has a time-lagged effect on NFT pricing. The results of this paper provide entirely new insights for NFT issuers and investors and hopefully provide some direction for research on the NFT market.

The remainder of this paper is structured as follows: Section 2 provides the literature review, Section 3 presents the theoretical analysis and hypothesis development, Section 4 describes the data and methodology, Section 5 shows the empirical results and robustness tests, and Section 6 concludes the paper.

2 Literature review

2.1 NFT pricing

NFTs do appear to be a distinct (and exciting) new asset class (Dowling, 2021). There are various factors that affect the price of NFTs. Empirical results from NFTsAI (non-fungible tokens attention index) show that the NFT market is dominated by multiple markets, including cryptocurrency, DeFi, equity, bond, commodity, F.X and gold markets Wang (2022). In these dominant markets, the most closely related is the cryptocurrency market because the purchase and transaction of NFTs requires cryptocurrencies as a payment medium. Therefore, most of the current NFT literature focuses on studying the impact of such cross-trading. According to Osivand and Abolhasani (2021), the smaller NFT market is driven by the cryptocurrency market. Dowling (2022) used wavelet coherence analysis to demonstrate that there is a co-movement between the cryptocurrency market and the NFT market. Ante (2022) also verified that the pricing of cryptocurrencies such as BTC and ETH pricing would affect the NFT market.

In addition to cryptocurrencies, few papers have studied the feature factors that may influence the price of NFTs. For example, different skin tones of artworks will affect NFT pricing due to racial discrimination (Nguyen, 2022). Nadini et al. (2021) found that sales history and visual features are good predictors of NFT prices using simple machine learning algorithms. Chohan and Paschen (2023) showed that differences in appearance, utility, and many other properties affect the valuation of NFTs. In addition, factors such as the scarcity of NFTs (Mekacher et al., 2022) and the aesthetic preferences of investors (Kong and Lin, 2021) also affect the price of NFTs.

2.2 Fan economy

The original “Fan Economy” refers to the value and revenue generated by interactions among individual fans, fan communities, and artists/stars (Liang and Shen, 2016). However, with the development of social media platforms, the meaning of the fan economy has gradually expanded, evolving into a new business model. For instance, the research in Demir et al. (2022) mentioned that in the football field of the cryptocurrency market, in addition to fan identity, fans are given the privilege of participating in club decisions through fan tokens, such as interactive voting on the choice of team uniforms. Moreover, increasingly more companies are beginning to pay attention to publicity and marketing on social media platforms, hoping to turn consumers into fans of their brands (Braga and Guillén, 2012). One of the specific ways is to create brand fan pages on social networking sites (De Vries et al., 2012). Today, consumers are not just passive acceptance of passively receiving marketing campaigns, either by posting comments, sharing information, participating in discussions (Geng et al., 2018) and engaging in a series of consumer engagement behaviors (CEB) that can positively affect sales (Oh et al., 2017). Saboo et al. (2016) defined such brand consumers on social media platforms as social followers (SFANS). It can be said that the development of social media platforms has led to the rise of the fan economy (Liao, 2021).

This paper argues that in the absence of entities in the NFT market, the behavioral willingness of NFT consumers will be affected by the fan economy on social media platforms. White et al. (2022) noted that traditional media has the educational function of facilitating transactions by, for example, providing a tutorial for purchases, shortening the learning curve for new participants and reducing start-up costs. With the popularization of the Internet, apart from succeeding in the features of traditional media, social media has also been proven to have an impact on price volatility (Jiao et al., 2020; Ortu et al., 2022; Liu et al., 2022). Similarly, this paper believes that the NFT market is still in the early stages of emerging and rapid development (Nobanee and Ellili, 2022), and many people are not as familiar with NFTs. Currently, social media plays an important role as a platform for NFT issuers to promote, hold events and communicate with their fans. NFT issuers provide various related information to buyers or bystanders through social media platforms, helping more people to know more about NFTs. At the same time, it will greatly increase the attraction of NFTs to new participants, enhance public interest and increase their desire to buy. When these consumers gather into fan groups, the fan economy is born.

2.3 Herd behavior

The fan economy is inseparable from herd behavior. In 1992, Banerjee (1992) explained herd behavior as people choosing to follow the herd when making their own decisions, even if the behavior of the herd is inconsistent with the information they have received. According to the adaptive market hypothesis, when NFT consumers are uncertain about the returns and risks of investments or unfamiliar with the NFT market, they are more likely to follow the “herd”. Ting (2022) noted that in social identity theory, individuals have natural trust in groups, which is the logic of the behavior of most current fan communities. Therefore, NFT consumers will tend to choose NFT collections that are more popular with fan groups to avoid the risks derived from investment uncertainty.

In speculative markets, prices may deviate from their “fundamental” values due to information frictions and the associated speculative activity and may result in price booms or busts (Singleton, 2014). Furthermore, in the research by White et al. (2022), it was argued that the NFT space is characterized by three major features: extreme growth, high skew, and uncertain returns. In other words, NFTs are typically speculative markets. Thus, in a highly speculative NFT market, it is not surprising that the fan economy might be accompanied by herd behavior. In fact, the existence of herding in NFT markets has been empirically examined in research by Bao et al. (2022). At the same time, Mattke et al. (2020) also concluded that there is herd behavior in social media through a qualitative comparative analysis (QCA).

Emerging literature increasingly points to the complex and, at times, destabilizing role that fan engagement can play in asset valuation. For example, Principe et al. (2024), in their review of fan tokens within the sports industry, observed that while these tokens often boost engagement levels, they are also prone to sharp price swings, unresolved regulatory challenges, and ethical dilemmas—factors that may erode investor confidence and undermine long-term market stability.

Westland (2024) adds to this perspective by showing that NFT pricing tends to follow erratic, fan-driven cycles rather than conventional financial trends. These bursts of activity are often unpredictable and only loosely tied to the assets’ intrinsic value, making them difficult to incorporate into traditional valuation models.

In a broader view of digital markets, He et al. (2023) noted the speculative and illiquid nature of NFTs, where valuations frequently appear to be inflated by hype rather than grounded in fundamentals. Here, fans-enthusiasm—especially when amplified through social media, can act as both a catalyst and a destabilizer, fueling momentum that may not be sustainable.

Additionally, Ouvrein (2024) explored the evolving nature of relationships within fan ecosystems, revealing how influence can shift into more toxic dynamics, such as anti-fan backlash. These shifts not only dilute commercial impact but may also pose reputational risks for creators and affiliated brands.

Therefore, this paper argues that under such herding behavior, as social media has the function of sharing and disseminating information (Wu et al., 2022), NFT consumers would more easily intensify the effect of the fan economy on social media platforms. As Bouri et al. (2019) pointed out in their study, when the participants are mostly young and inexperienced individual investors, they are more easily persuaded by the herd and rely more on social media and online chat forums. In addition, Nadini et al. (2021) also noted that with the current widespread access to social media, herding behavior might be stronger than ever.

3 Theoretical analysis and hypothesis development

Scholars have long focused on the number of followers on social media platforms in various fields. They generally believe that the more followers someone gets on social media platforms, the greater their social influence, aggregation power (Jin and Phua, 2014), social attractiveness (Utz, 2010), trustworthiness and credibility (Tong et al., 2008), and bridging social capital (Petty et al., 1983).

In the real economy, numerous studies have proven that the fan economy on social media plays an extremely important role. One is funding. Many followers on the founder’s social media were proven to help start-ups raise more funds in the early stages (Yang and Berger, 2017) and is positively correlated with the amount of money raised each year thereafter (Banerji and Reimer, 2019). The second is reputation. Having many followers is an effective advertising tool for social media accounts (Janssen et al., 2022), with more chances to transform the potential customer to customer (Agam, 2017). At the same time, more followers may lead to higher popularity to elicit stronger brand effects (De Veirman et al., 2017). In addition, this fan economy has been shown to have a positive impact on television ratings (Oh et al., 2015), team ticket sales performance (Kim, 2020), and to have a predictive effect on the performance of movies (Roy and Zeng, 2014).

In financial markets and cryptocurrencies, the fan economy on social media has also been used as an indicator in various studies. Sul et al. (2014) argued that Twitter users with many followers had a market impact like traditional news media and had a stronger immediate same-day impact on stock returns. Nofer and Hinz (2015) used the number of followers as the social character of mood states, demonstrating that increased positive follower-weighted social mood levels derived from Twitter lead to higher stock market returns while also predicting stock returns. In addition to the stock market, the fan economy has also been widely used in research on cryptocurrencies. For example, Trigka et al. (2022) proposed that the number of Twitter followers is an important component of measuring user influence and can be used to predict the popularity of cryptocurrencies. In the field of NFTs, Kapoor et al. (2022) also concluded that the number of user member lists is an important predictor of NFT value growth and virality.

The fan economy is an important market phenomenon on today’s social media platforms, which provides strong support for the exposure and influence of NFTs. When fans actively promote and publicize NFTs through social media platforms, the recognition and popularity of NFTs are improved, enhancing the attractiveness and competitiveness of NFTs in the market. As an increasing number of people enter the NFT market, more funds flow into the market, and the change in supply and demand inevitably leads to an increase in NFT pricing. In addition, the influence of the fan economy can also help to promote the market liquidity and transaction volume of NFTs, which would make NFTS more easily accepted by buyers and sellers, thereby pushing up the price of NFTs to some extent.

The core question underlying this hypothesis is whether, in a highly speculative and information-asymmetric market like NFTs, observable fan engagement can function as a proxy for perceived asset value. Drawing on insights from behavioral finance and studies on digital communities (e.g., Sul et al., 2014; Nofer and Hinz, 2015), we suggest that social signals—such as the number of followers—may shape investor expectations and influence asset demand.

While existing studies suggest that followers may exert a positive influence on NFT prices, this relationship is not always straightforward—or stable over time. For instance, the phenomenon of follower inflation on social media platforms, where accounts artificially inflate their numbers through program-controlled accounts or paid services, raises concerns about the authenticity of fan engagement (White et al., 2022). When such inflated metrics dominate, the assumed price-supporting effect of the fan economy may be significantly diluted.

At the same time, periods of heightened market sentiment can lead to sharp increases in NFT valuations fueled by collective enthusiasm from fan communities. These surges often resemble speculative bubbles, lacking fundamental value support and exposing investors to greater risk (Bao et al., 2022).

Moreover, from a behavioral economics standpoint, the effect of growing fan bases may not be linear. Beyond a certain point, additional followers tend to offer diminishing returns in terms of price impact—suggesting that the influence of social signals may taper off as saturation sets in. Taken together, these dynamics highlight the importance of not only recognizing the potential value of fan engagement but also remaining attentive to its limitations and unintended market distortions.

While recent studies have pointed to the volatility, sentiment cycles, and reputational risks associated with fan-driven markets (e.g., Principe et al., 2024; Westland, 2024; Ouvrein, 2024), they tend to emphasize the unpredictability of these effects rather than deny their existence. In fact, such behavioral complexity may be precisely what makes fan engagement an important, if unstable, factor in asset pricing.

Our aim is not to model price stability per se, but rather to explore whether fan attention—operationalized through observable metrics like follower counts—tracks with NFT price movement over time. In markets characterized by speculation and limited information transparency, social visibility often becomes a de facto signal of value, particularly in the absence of conventional fundamentals.

Behavioral finance offers a useful lens here. As shown by Banerjee (1992) and Shiller (2003), perceptions of popularity and collective behavior can drive asset demand in ways that deviate from rational pricing logic. Likewise, signaling theory suggests that in uncertain environments, publicly visible indicators—such as large social followings—can serve as heuristics for credibility or momentum (Spence, 1973).

By capturing daily follower data at the project level across both Discord and Twitter, our dataset allows for a more granular and timely investigation than prior studies relying on sentiment proxies or static measures. This design provides a unique opportunity to examine whether increased fan exposure corresponds with upward pricing pressure.

Given these theoretical considerations and empirical advantages, we anticipate a positive directional association between fan engagement and NFT prices, while acknowledging that the relationship is likely mediated by complex and context-specific mechanisms.

Based on the previous discussion, this paper suggests the first hypothesis as follows:

Hypothesis 1. There is a positive correlation between the number of fans and NFT pricing.

4 Data and methodology

4.1 Data

4.1.1 Explanatory variable

In the NFT fan community, Discord (https://discord.com/) has become the preferred social media platform for real-time communication due to its advantages of conciseness, ease of use, and rich functions. Most NFT issuers choose to establish their own communities on the Discord platform to publish various community rules, introductions, events, etc. As a gathering place for NFT information, fans send text, pictures, video and audio through Discord’s chat channel for real-time interaction and discussion to keep abreast of NFT market dynamics and trends. The Discord community has enabled NFT issuers to establish a closer relationship with fans, which also means that the number of members on the Discord platform reflects the popularity and market participation of NFTs to a certain extent. Therefore, this paper chooses the daily movement of Discord members to quantify the fan economy and examine the impact of the number of fans on the Discord platform on the NFT pricing indicators.

4.1.2 Explained variable and control variable

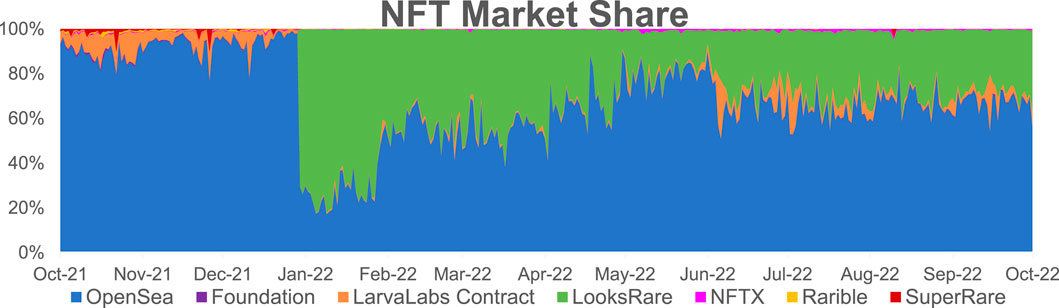

OpenSea (https://opensea.io/) is the world’s first online market for NFTs and crypto collectibles, which can be used to browse, create, buy, sell and auction NFTs. As illustrated in Figure 2, OpenSea occupies the largest NFT market share, and as the required dataset has not been collected in previous studies, this paper uses a hand-collected method to gather a total of 150 NFTs on the OpenSea website as research objects. The daily average price (ETH) change of these 150 NFTs is the explanatory variable, and Items, Owners, and Floor price are the control variables.3

Figure 2. The market share of NFTs from October 2021 to October 2022, with data from the Dune website.

The time span of the panel data sample in this paper is from April 18 to 15 October 2022. The research start date of April 18 was used as the beginning date of the dataset, and the website update date of October 15 was used as the ending date because the calculation method of the new dataset after the website update was no longer consistent with the previous one. Furthermore, according to the research of Paniagua and Sapena (2014), social media platforms have a significant impact on the stock prices of publicly traded companies, but this impact only occurs in companies with a critical mass of followers. Additionally, the moderating mediation analysis of Jin and Youn (2022) also revealed that peer users’ conversion exerts a positive impact on the outcome variables through cognitive and affective appraisals when the number of followers is high but not when it is low. Therefore, this paper believes that herd behavior is more likely to appear on NFTs with higher rankings. Correspondingly, the dataset of these 150 NFTs was ranked in descending order by the total trading volume on 18 April 2022.

4.2 Methodology

This study designed our data collection and modeling process with reproducibility in mind. The dataset comprises 150 NFT projects manually selected from OpenSea, based on total transaction volume rankings as of 18 April 2022. For each project, we tracked daily follower counts from their official Discord and Twitter communities between April 18 and 15 October 2022. In addition, key pricing and control variables—such as the number of items, owner counts, and floor prices—were retrieved directly from OpenSea listings. The research applied a High-Dimensional Fixed Effects (HDFE) regression model with robust standard errors to examine how changes in follower counts relate to NFT prices over time. Lagged variables were constructed from t–1 through t–36, and all estimations were conducted using Stata 17.0. To reduce the influence of extreme values, all continuous variables were winsorized at the 1% level.

Based on the above theory and data basis, to verify the hypotheses, this paper establishes the following empirical models:

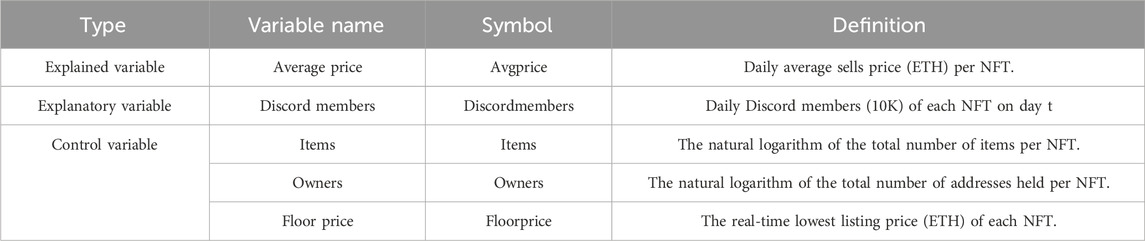

where i represent the ith NFT, t represents the tth day, and Avgprice represents the daily average price (Ether) of each NFT. Discord members represent the number of fans on the Discord platform. Items represent the number of each NFT projects, and Owners represents the number of each NFT owner. Floorprice is the lowest price (Ether) of each NFT, and ε is the random disturbance term. To better explain the impact of the fan economy on NFT pricing and address endogeneity issues, a lagged one-period treatment is performed on Avgprice. In addition, Collection and Date represent the control variables of NFT individual effect and time effect respectively. Definitions of variables are shown in Table 1.

5 Empirical results

5.1 Descriptive statistics

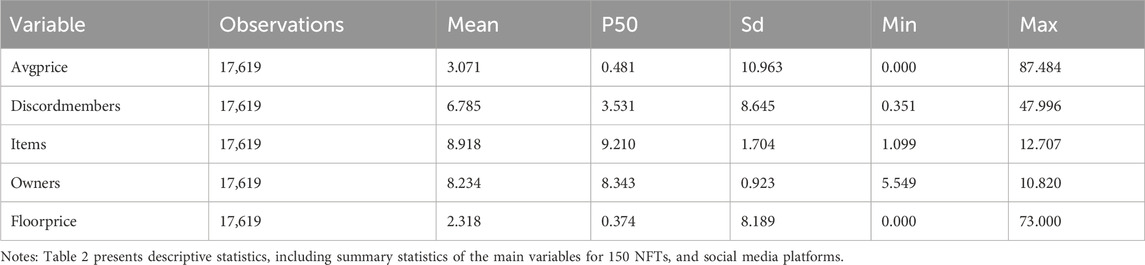

To further analyze the characteristics of NFTs, descriptive statistics are made on all the research variables of all samples in this paper, and the results are shown in Table 2. Before regression, this paper winsorizes each variable at the 1% level to reduce the influences of outliers. After deleting missing values, a total of 17,619 samples were obtained between 18 April 2022, and 15 October 2022. The panel data show that the maximum value of NFT pricing is 87.484 ETH, the minimum value is 0 ETH, and the average is 3.071 ETH, with 1 ETH being approximately 1200 USD, indicating a wide variation in NFT selling prices. The maximum number of Discord members is 479,960, the minimum value is 3510, indicating a significant range in fan size across Discord platforms. This suggests that measuring the fan economy through Discord members could be a reasonable metric for further research on the relationship between fan economy and NFT pricing.

5.2 Correlation

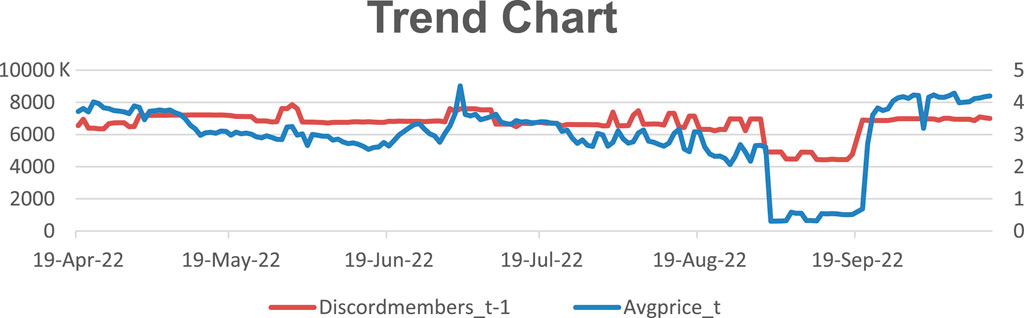

To conduct better comparison and analysis, this paper visualizes the data of Discord members and NFT pricing. The data trend chart of the number of Discord members on t-1 day and NFT pricing on t day is shown in Figure 3. It can be preliminarily seen from the high degree of overlap of the two trend lines that there is indeed a significant positive correlation between fan economy and prices.

The correlation coefficient matrix results show that the correlation between Discord members and Avgprice reaches 0.142, which is significant at the 1% level.

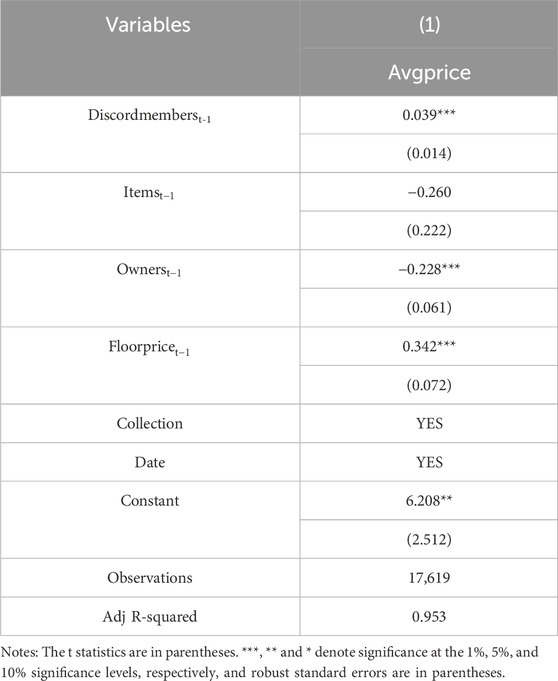

5.3 Regression results

To address the issues of fixed effects and multicollinearity in the panel data, correct the existence of heteroscedasticity and autocorrelation, and ensure that the results are more accurate and robust, this paper uses the High-Dimensional Fixed Effects (HDFE) model based on the Robust Standard Errors method and the Gauss-Seidel Iteration method for regression analysis. After controlling for subject and date, the regression results are shown in Table 3, and the p-value of the model is less than 0.00, indicating that the model is highly significant overall. Additionally, the coefficient of Discord members is positive and statistically significant at the 1% level, suggesting that Discord members have a positive impact on the price of NFTs. This result further verifies Hypothesis 1 that NFT pricing is positively correlated with the number of fans on social media platforms, the higher the number of Discord members, the higher the NFT pricing. At the same time, the adjusted R-value of the model is 0.953, reflecting that the model can better fit the sample data in this paper to some extent.

This result is consistent with existing findings in adjacent domains. For instance, Sul et al. (2014) and Nofer and Hinz (2015) found that social media mood and influencer presence significantly impacted stock returns. Similarly, Kapoor et al. (2022) showed that social signals on Twitter can predict NFT virality. However, unlike these studies that focus on sentiment or posting frequency, we directly examine quantitative fan engagement (follower count), which presents a more structural proxy for attention. These findings align with the hypothesis that visibility and community scale act as indirect demand drivers.

5.4 Further test

In general, there is time-lagged information dissemination on social media platforms. NFT issuers are willing to publish relevant news, activities, announcements and other content on social media platforms. These, however, often tend to spread over time. As the diffused contents become more widely known, people who are interested usually choose to follow the NFT collection, join the social media community and become a fan of the NFTs to learn more about detail for future purchase decisions. Moreover, consumer behavior can be affected by the psychology of consumers. There is a consideration period between the desire to purchase and the fulfillment of the purchase decision. For instance, some consumers choose to buy immediately due to impulsive consumption, while others need to observe for a period before making a purchase.

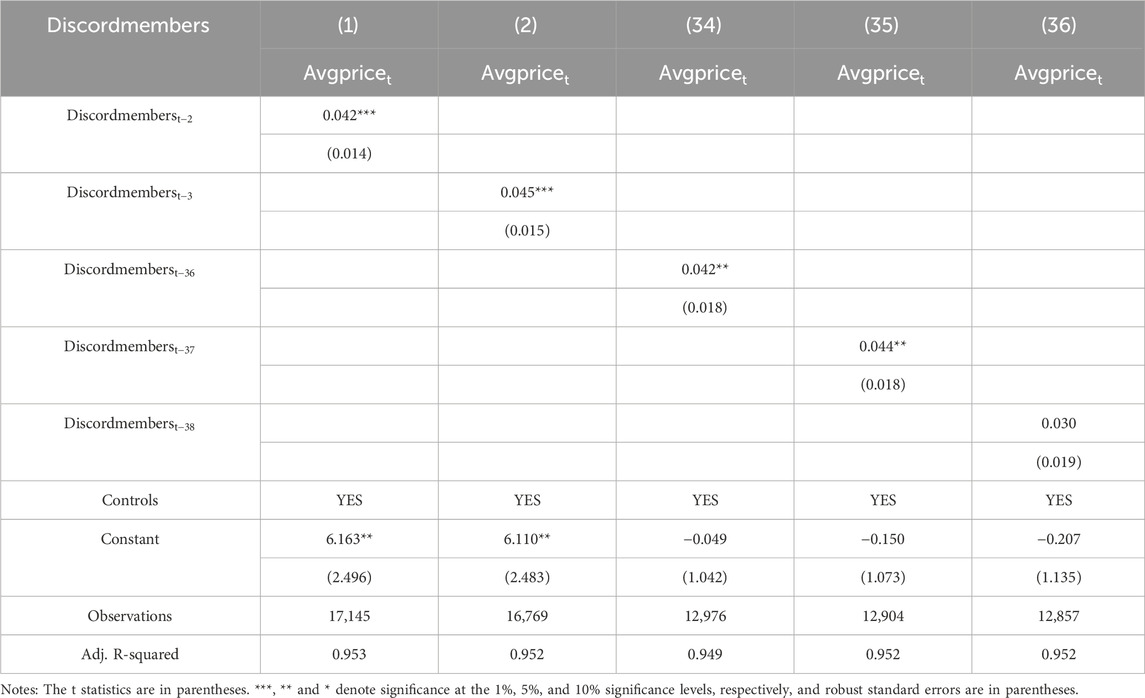

Therefore, to verify the existence of the time-lagged effect between the price of NFTs and the number of fans on social media platforms, this paper uses the Discord members variable for multiple lags and obtains Discord members with different periods of lag as the new explanatory variables. Where t-n refers to n days before day t, such as t-1 means 1 day before day t, t-2 means 2 days before day t, and so on. According to the analysis of the lag regression results in Table 4, there is a significant positive correlation between Discord members and Avgprice, which lasts until the 35th day. Meanwhile, as time goes by, the coefficient of the 36th day is no longer significant. These phenomena indicate that changes in the number of fans have a persistent lagging effect on NFT pricing, and this effect gradually weakens over time.

5.5 Robustness test

5.5.1 Group regression

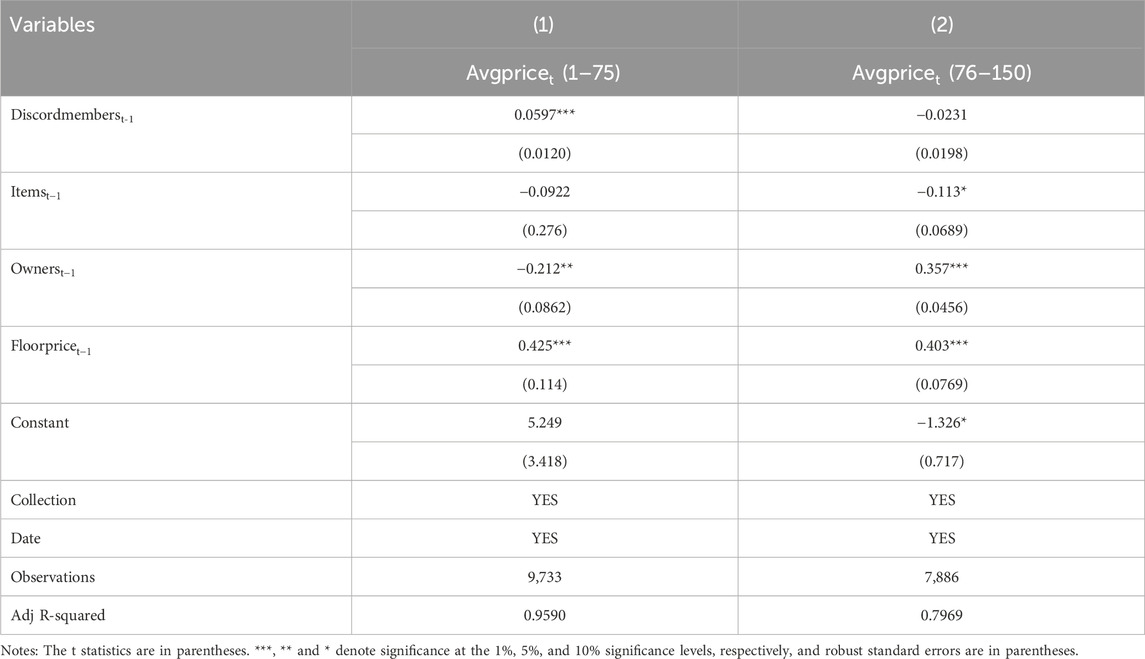

To better test whether the fan economy on social media platforms is indeed significantly positively correlated with the price of NFTs, this paper sums up the number of Discord members for each NFT subject during the research period and divides the 150 NFTs into two groups based on ranking for regression analysis. The robust test results are shown in Table 5. After grouping, the regression coefficient between Discord members and Avgprice changed from positive to negative, and the adjusted R2 dropped from 95.9% to 79.7%. Additionally, the regression of the second group is no longer significant. This suggests that the influence of the number of fans on social media platforms on NFT pricing would indeed weaken with the gradual attenuation of the fan economy effect. This result verifies the robustness of Hypothesis 1.

5.5.2 Substituting the core explanatory variable

In the robustness test, this paper refers to the relevant literature of predecessors and chooses the number of fans on the official Twitter (https://twitter.com/) account set up by NFTs as an alternative indicator of the fan economy. Kalampokis et al. (2013) summarized the research on the predictive power of social media data for various domains. However, depending on the popularity of social media, most researchers choose the Twitter platform as the data source. As Shen et al. (2019) argued, compared with other platforms, using the number of tweets on Twitter to measure investor attention would be a better measure. In addition to the number of tweets, researchers have also studied the impact of tweet sentiment. Zhang and Zhang (2022) proposed that investors may interpret the sentiment of each new tweet posted by a cryptocurrency issuer as a new signal of its recent performance and may lead to price changes and a surge in trading volume. Bollen et al. (2011) also predicted the price of stocks by analysing the user sentiment of tweets on Twitter. In the latest study, Kapoor et al. (2022) also used Twitter as a proxy for social media and showed how Twitter features affect NFT valuation through multiple machine learning and deep learning models. These all showed that Twitter is a powerful platform for studying consumer behaviours (Hutchins, 2011).

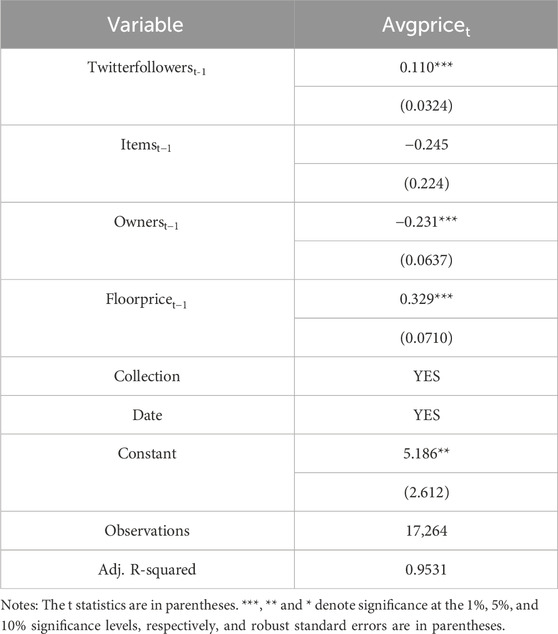

Therefore, in this paper, according to the popularity of social platforms in the NFT market, the Twitter platform is chosen to test the robustness of the model and the validity of the hypotheses again, with the core explanatory variable replaced by the number of followers on the Twitter platform. The HDFE regression results show that replacing the core explanatory variable does not change the results, and there is still a positive and significant relationship at the 1% level.

The robustness test establishes the following econometric models.

where Avgprice represents the last 7-day average price (Ether) of NFTs. Twitterfollowers represents the number of followers on the Twitter platform. Twitterfollowers is the core explanatory variable, and Items, Owners, and Floorprice are the control variables.

Table 7 presents the new regression result replacing the core explanatory variable. The adjusted R-squared is 95.3%, which means that the model in this paper is capable of effectively explaining the relationship between the number of Twitter followers and the price of NFTs. Consistent with previous regression results, there is a significant positive correlation between the number of Twitter followers and NFT pricing at the 1% level. This once again proves that the number of fans on social media platforms has a certain impact on NFT pricing. The higher the number of followers on the social media platform, the higher the price of NFTs. This result further confirms the robustness of Hypothesis 1.

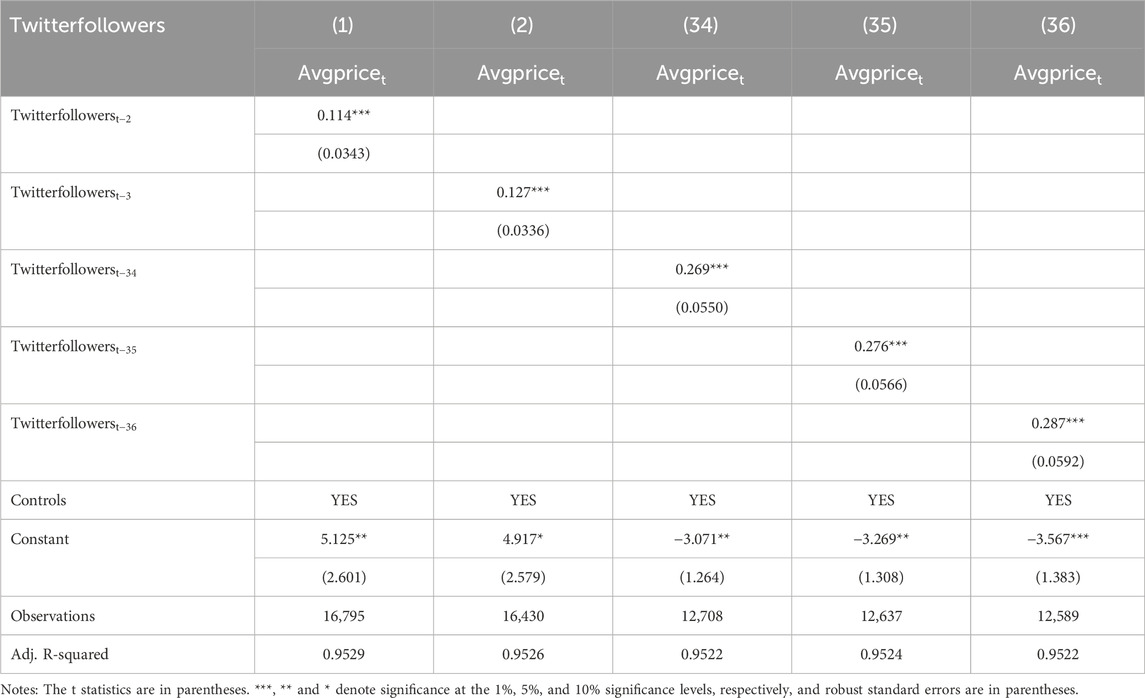

According to the robust test results in Table 8, the lagged regression of the number of Twitter followers on NFT volume is still significantly positively correlated at the 1% level. In addition, the lagged effect of the Twitter platform is not consistent with that of the Discord platform, and the lagged effect of the Twitter platform will be longer, reaching 53 days. This is probably because the main function of the Discord platform is real-time communication, and past information is easily overwritten by the latest information. Instead, on the Twitter platform, as NFT issuers’ tweets are retweeted more often, the spread will be wider, resulting in a longer lagged effect.

The analysis identifies a statistically significant and positive association between NFT prices and followers counts across Discord and Twitter. This finding lends empirical support to the idea that visible fan engagement can serve as a form of social signaling, shaping investor perceptions in markets where traditional valuation metrics are limited or absent.

Yet the influence of fan metrics likely operates through more than just rational expectations. In speculative environments, social media attention has been shown to amplify behavioral tendencies such as herd dynamics and momentum-driven trading (Westland, 2024; He et al., 2023). These factors may help explain why pricing patterns respond to shifts in follower volume, even when there is no corresponding change in the underlying asset’s intrinsic characteristics.

Rather than contradicting conventional valuation theory, these results expand it by emphasizing the role of visibility and perceived popularity in price formation. In markets defined by information asymmetry and emotional volatility, the presence of an active fan base may function less as a reflection of value and more as a generator of it. While our findings clarify the strength and direction of this relationship, the precise mechanisms—especially those rooted in collective behavior—deserve further exploration.

6 Conclusion and limitations

6.1 Discussion and implication

This study contributes to the emerging dialogue at the intersection of behavioral finance, digital asset valuation, and community-driven economics by positioning the “fan economy” as a quantifiable factor in NFT pricing. By empirically linking social followership—through platforms like Discord and Twitter—to asset performance in blockchain markets, it offers new insight into how non-financial signals influence speculative valuation. In doing so, it extends prior literature that has largely treated social metrics as peripheral or anecdotal.

From a practical standpoint, the findings highlight the growing importance of community management in digital asset ecosystems. NFT project teams may benefit from sustained investment in user engagement and fan retention, not simply as a marketing strategy, but as a potential driver of price behavior. For investors, follower trends can serve as early indicators of demand surges or sentiment shifts, particularly in illiquid or highly volatile markets. The results may also carry implications for regulators and platform designers, who might begin to view fan concentration as a proxy for market sensitivity—or even a warning sign of speculative excess.

We believe that the fan economy provides a market signal that can help judge the market sentiment of NFTs. If fans on social media platforms consistently show optimistic sentiment toward a certain NFT, it may trigger more people’s investment interest and drive up its price. In contrast, it may trigger selling behavior and push down NFT pricing. Therefore, for investors, these market signals can be used to predict market trends and price changes to make more informed investment decisions. For NFT issuers, these signals have a certain reference and guiding significance, which can help NFT issuers better adjust pricing and marketing strategies and enhance market confidence.

The findings are also broadly aligned with research in adjacent areas. For example, Principe et al. (2024) and Mazur and Vega (2023) document that assets tied to fandom—such as fan tokens or sports-linked instruments—often experience substantial price volatility and display weak alignment with fundamental indicators. Toufaily and Zalan (2024) further note that NFT communities tend to act more like speculative clusters than rational investor groups, with price movements often driven by momentum rather than intrinsic value.

Taken together, these studies underscore how behavioral dynamics—such as social imitation, emotional contagion, and collective speculation—can shape asset pricing in markets where traditional valuation anchors are absent. The relationship we observe between follower metrics and NFT prices may therefore reflect not only informational signaling, but also the influence of socially coordinated market behavior.

6.2 Conclusion and limitations

In conclusion, this study confirms the influence of fan metrics on NFT pricing while acknowledging several key limitations. The NFT pricing is highly correlated with the fan economy of the corresponding social media platform. The lagged effect of the Discord platform and the Twitter platform on NFT pricing was also verified through lagged variable regression. Therefore, based on the above studies, we can conclude that the more exposure an NFT has on social media platforms, the higher the price of that NFT will be accordingly. There is also a time-lagged effect between the increase in the number of fans on the platform and the increase in NFT pricing. Obviously, the fan economy has an important impact on the development of NFTs and deserves attention from all parties.

In addition, the fan economy can promote the construction and development of the NFT community. When NFT fans gather on social media to discuss and promote NFTs, a large NFT community is formed. This community can provide strong support and assistance for the promotion and development of NFTs. The fan economy can also help NFTs better open the Internet market and promote the use and transaction of NFTs on social networks. At the same time, it also plays a certain role in public opinion, supervision and suggestions.

There are some limitations in our study, for example, we only collected fan numbers and price metrics, not more detailed metrics such as user sentiment and NFT type regressions. In addition, due to manual collection, the relatively small number of samples available is a more obvious limiting factor. In this study, our main goal is not to prove that the fan economy of social media platforms can predict the price of NFTs; instead, we take more consideration into the impact of the fan economy of social media platforms in the NFT market on NFT pricing, which provides an alternative focus for NFT purchasers to make decisions. However, it is undeniable that in subsequent studies, further learning algorithms to collect datasets on NFTs and social media platforms over a longer period, as well as a greater number of individual dimensions, could help predict the price of NFTs to some extent.

One key limitation of this study is its reliance on a purely quantitative measure of follower count, without assessing the behavioural quality or actual engagement levels within fan communities. As a result, the analysis does not distinguish between active and passive followership, nor does it account for cases where the fan economy may fail to exert meaningful influence on pricing outcomes.

Future research may benefit from a more multidimensional approach—incorporating variables such as user activity levels, interaction frequency, or even sentiment indicators derived from social media content. Natural language processing techniques, for example, could offer valuable insight into the emotional tone and engagement dynamics of fan behaviours across platforms like Twitter and Discord. In addition, differentiating among NFT categories may help clarify the contexts in which social signals support, fail to support, or even distort price discovery processes.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical approval was not required for the study involving human data in accordance with the local legislation and institutional requirements. Written informed consent was not required, for either participation in the study or for the publication of potentially/indirectly identifying information, in accordance with the local legislation and institutional requirements. The social media data was accessed and analyzed in accordance with the platform’s terms of use and all relevant institutional/national regulations.

Author contributions

JZ: Writing – review and editing. QC: Writing – original draft, Writing – review and editing. RW: Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. Macau University of Science and Technology, FGR-23-029-MSB.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbloc.2025.1588837/full#supplementary-material

Footnotes

1The data on the total volume of the NFT market is obtained from the Dune website (https://dune.com/home), and the sum of the volume is calculated based on daily movements.

2Data source: https://dune.com/home

3Data source: https://dune.com/home

References

Agam, D. N. L. A. (2017). Followers ratio on instagram affects the product’s brand awareness. Aust. J. Acc. Econ. Finance (AJAEF) 3 (2), 86. Available online at: https://www.researchgate.net/publication/319623721 (Accessed June 13, 2025).

Ali, M., and Bagui, S. (2021). Introduction to NFTs: the future of digital collectibles. Int. J. Adv. Comput. Sci. Appl. 12 (10). doi:10.14569/ijacsa.2021.0121007

Ante, L. (2022). The non-fungible token (NFT) market and its relationship with Bitcoin and Ethereum. FinTech 1 (3), 216–224. doi:10.3390/fintech1030017

Apostu, S. A., Panait, M., Vasa, L., Mihaescu, C., and Dobrowolski, Z. (2022). NFTs and cryptocurrencies—the metamorphosis of the economy under the sign of blockchain: a time series approach. Mathematics 10 (17), 3218. doi:10.3390/math10173218

Baals, L. J., Lucey, B. M., Vigne, S. A., and Long, C. (2022). A research agenda on the financial economics of NFTs.

Banerjee, A. V. (1992). A simple model of herd behavior. Q. J. Econ. 107 (3), 797–817. doi:10.2307/2118364

Banerji, D., and Reimer, T. (2019). Startup founders and their LinkedIn connections: are well-connected entrepreneurs more successful? Comput. Hum. Behav. 90, 46–52. doi:10.1016/j.chb.2018.08.033

Bollen, J., Mao, H., and Zeng, X. (2011). Twitter mood predicts the stock market. J. Comput. Sci. 2 (1), 1–8. doi:10.1016/j.jocs.2010.12.007

Bouri, E., Gupta, R., and Roubaud, D. (2019). Herding behaviour in cryptocurrencies. Finance Res. Lett. 29, 216–221. doi:10.1016/j.frl.2018.07.008

Braga, B., and Guillén, D. (2012). Working under pressure: evidence from the impacts of soccer fans on players’ performance. Econ. Lett. 114 (2), 212–215. doi:10.1016/j.econlet.2011.10.017

Braioni, S. (2022). NFTs through the lenses of the author’s rights: a view of challenges and opportunities in the art world. (Unpublished/No journal information provided – please specify if available).

Chohan, R., and Paschen, J. (2023). NFT marketing: how marketers can use nonfungible tokens in their campaigns. Bus. Horiz. 66 (1), 43–50. doi:10.1016/j.bushor.2021.12.004

Das, D., Bose, P., Ruaro, N., Kruegel, C., and Vigna, G. (2021). Understanding security issues in the NFT ecosystem. arXiv Prepr. arXiv:2111.08893. Available online at: https://arxiv.org/abs/2111.08893 (Accessed June 13, 2025).

Demir, E., Ersan, O., and Popesko, B. (2022). Are fan tokens fan tokens? Finance Res. Lett. 47, 102736. doi:10.1016/j.frl.2022.102736

De Veirman, M., Cauberghe, V., and Hudders, L. (2017). Marketing through Instagram influencers: the impact of number of followers and product divergence on brand attitude. Int. J. Advert. 36 (5), 798–828. doi:10.1080/02650487.2017.1348035

De Vries, L., Gensler, S., and Leeflang, P. S. (2012). Popularity of brand posts on brand fan pages: an investigation of the effects of social media marketing. J. Interact. Mark. 26 (2), 83–91. doi:10.1016/j.intmar.2012.01.003

Dos Santos, R. B., Torrisi, N. M., and Pantoni, R. P. (2021). Third party certification of agri-food supply chain using smart contracts and blockchain tokens. Sensors 21 (16), 5307. doi:10.3390/s21165307

Dowling, M. (2021). Is fungible token pricing driven by cryptocurrencies? Finance Res. Lett. 44, 102097. doi:10.1016/j.frl.2021.102097

Dowling, M. (2022). Fertile LAND: pricing non-fungible tokens. Finance Res. Lett. 44, 102096. doi:10.1016/j.frl.2021.102096

Foglia, M., Maci, G., and Pacelli, V. (2024). FinTech and fan tokens: understanding the risks spillover of digital asset investment. Res. Int. Bus. Finance 68, 102190. doi:10.1016/j.ribaf.2023.102190

Geng, R., Wang, S., and Chen, X. (2018). “Spillover effect of content marketing in ecommerce platform under the fan economy era,” in Int. Conf. Inf. Resour. Manag. (CONF-IRM). Assoc. Inf. Syst.

He, Y., Li, W., Liu, L., and He, W. (2023). NFTs – a game changer or a bubble in the digital market? J. Glob. Inf. Technol. Manag. 26 (1), 1–8. doi:10.1080/1097198x.2023.2167561

Hutchins, B. (2011). The acceleration of media sport culture: twitter, telepresence and online messaging. Inf. Commun. Soc. 14 (2), 237–257. doi:10.1080/1369118x.2010.508534

Janssen, L., Schouten, A. P., and Croes, E. A. (2022). Influencer advertising on Instagram: product-influencer fit and number of followers affect advertising outcomes and influencer evaluations via credibility and identification. Int. J. Advert. 41 (1), 101–127. doi:10.1080/02650487.2021.1994205

Jiao, P., Veiga, A., and Walther, A. (2020). Social media, news media and the stock market. J. Econ. Behav. Organ. 176, 63–90. doi:10.1016/j.jebo.2020.03.002

Jin, S. A. A., and Phua, J. (2014). Following celebrities’ tweets about brands: the impact of twitter-based electronic word-of-mouth on consumers’ source credibility perception, buying intention, and social identification with celebrities. J. Advert. 43 (2), 181–195. doi:10.1080/00913367.2013.827606

Jin, S. V., and Youn, S. (2022). “They bought it, therefore I will buy it”: the effects of peer users' conversion as sales performance and entrepreneurial sellers' number of followers as relationship performance in mobile social commerce. Comput. Hum. Behav. 131, 107212. doi:10.1016/j.chb.2022.107212

Kalampokis, E., Tambouris, E., and Tarabanis, K. (2013). Understanding the predictive power of social media. Internet Res. 23, 544–559. doi:10.1108/intr-06-2012-0114

Kapoor, A., Guhathakurta, D., Mathur, M., Yadav, R., Gupta, M., and Kumaraguru, P. (2022). “Tweetboost: influence of social media on NFT valuation,” in Companion proc. Web conf. 2022, 621–629.

Kim, B., Yong, H., and Digit, J. (2021). Issues and perspective on the NFT art market. Art. Eng. Multimed. 8 (3), 325.

Kim, R. Y. (2020). The value of followers on social media. IEEE Eng. Manag. Rev. 48 (2), 173–183. doi:10.1109/emr.2020.2979973

Kong, D. R., and Lin, T. C. (2021). Alternative investments in the Fintech era: the risk and return of Non-Fungible Token (NFT).

Liang, Y., and Shen, W. (2016). Fan economy in the Chinese media and entertainment industry: how feedback from super fans can propel creative industries’ revenue. Glob. Media China 1 (4), 331–349. doi:10.1177/2059436417695279

Liao, Z. (2021). Fan culture under the influence of media development. Open J. Soc. Sci. 9 (12), 88–93. doi:10.4236/jss.2021.912007

Lin, K., Cao, Q., and Chen, Z. (2019). Legal regulation and risk prevention of virtual currencies and token issuance financing from an international perspective. Tsinghua Financ. Rev. (05), 110–112. doi:10.19409/j.cnki.thf-review.2019.05.033

Liu, Q., Lee, W. S., Huang, M., and Wu, Q. (2022). Synergy between stock prices and investor sentiment in social media. Borsa istanb. Rev. doi:10.1111/jofi.13123

Mattke, J., Maier, C., Reis, L., and Weitzel, T. (2020). Herd behavior in social media: the role of Facebook likes, strength of ties, and expertise. Inf. Manag. 57 (8), 103370. doi:10.1016/j.im.2020.103370

Mazur, M., and Vega, M. (2023). Football and cryptocurrencies: Fan tokens and their performance. Finance Res. Lett. 55, 102938. doi:10.1016/j.frl.2023.102938

Mekacher, A., Bracci, A., Nadini, M., Martino, M., Alessandretti, L., Aiello, L. M., et al. (2022). Heterogeneous rarity patterns drive price dynamics in NFT collections. Sci. Rep. 12 (1), 13890–13899. doi:10.1038/s41598-022-17922-5

Murray, M. D. (2022). NFTs rescue resale royalties? The wonderfully complicated ability of NFT smart contracts to allow resale royalty rights. Wonderfully Complicat. Abil. NFT Smart Contracts Allow Resale R. Rights. doi:10.5860/0730306

Nadini, M., Alessandretti, L., Di Giacinto, F., Martino, M., Aiello, L. M., and Baronchelli, A. (2021). Mapping the NFT revolution: market trends, trade networks, and visual features. Sci. Rep. 11 (1), 20902–20911. doi:10.1038/s41598-021-00053-8

Nguyen, J. K. (2022). Racial discrimination in non-fungible token (NFT) prices? CryptoPunk sales and skin tone. Econ. Lett. 218, 110727. doi:10.1016/j.econlet.2022.110727

Nobanee, H., and Ellili, N. O. D. (2022). Fungible tokens (NFTs): a bibliometric and systematic review, current streams, developments, and directions for future research. Int. Rev. Econ. Finance. doi:10.1016/j.iref.2022.11.014

Nofer, M., and Hinz, O. (2015). Using Twitter to predict the stock market: where is the mood effect? Bus. Inf. Syst. Eng. 57, 229–242. doi:10.1007/s12599-015-0390-4

Oh, C., Roumani, Y., Nwankpa, J. K., and Hu, H. F. (2017). Beyond likes and tweets: consumer engagement behavior and movie box office in social media. Inf. Manag. 54 (1), 25–37. doi:10.1016/j.im.2016.03.004

Oh, C., Yergeau, S., Woo, Y., Wurtsmith, B., and Vaughn, S. (2015). “Is Twitter psychic? Social media analytics and television ratings,” in Proc. 2nd int. Conf. Comput. Technol. Inf. Manag. (ICCTIM) (IEEE), 150–155.

Ortu, M., Uras, N., Conversano, C., Bartolucci, S., and Destefanis, G. (2022). On technical trading and social media indicators for cryptocurrency price classification through deep learning. Expert Syst. Appl. 198, 116804. doi:10.1016/j.eswa.2022.116804

Osivand, S., and Abolhasani, H. (2021). Effect of Bitcoin and Etherium on fungible token (NFT). IOSR J. Business Manage. (IOSR-JBM), 23 (9), 49–51. Available online at: http://www.iosrjournals.org/iosr-jbm/papers/Vol23-issue9/Series-2/I2309024951.pdf (Accessed June 13, 2025).

Ouvrein, G. (2024). Followers, fans, friends, or haters? A typology of the online interactions and relationships between social media influencers and their audiences. New Media Soc. 26, 2295–2314. doi:10.1177/14614448221086296

Paniagua, J., and Sapena, J. (2014). Business performance and social media: love or hate? Bus. Horiz. 57 (6), 719–728. doi:10.1016/j.bushor.2014.07.005

Petty, R. E., Cacioppo, J. T., and Schumann, D. (1983). Central and peripheral routes to advertising effectiveness: the moderating role of involvement. J. Consum. Res. 10 (2), 135–146. doi:10.1086/208954

Pinto-Gutiérrez, C., Gaitán, S., Jaramillo, D., and Velasquez, S. (2022). The NFT hype: what draws attention to non-fungible tokens? Mathematics 10 (3), 335. doi:10.3390/math10030335

Popescu, A. D. (2021). “Non-fungible tokens (NFT)–Innovation beyond the craze,” in Proc. 5th int. Conf. Innov. Bus. Econ. Mark. Res.

Principe, V. A., da Silva, G. C. P. S. M., Vale, R. G. S., and Nunes, R. A. M. (2024). Blockchain and sports industry: a systematic literature review of fan tokens and their implications. Retos 60, 823–840. doi:10.47197/retos.v60.107125

Roy, S. D., and Zeng, W. (2014). “Influence of social media on performance of movies,” in Proc. 2014 IEEE int. Conf. Multimedia expo workshops (ICMEW) (IEEE), 1–6.

Saboo, A. R., Kumar, V., and Ramani, G. (2016). Evaluating the impact of social media activities on human brand sales. Int. J. Res. Mark. 33 (3), 524–541. doi:10.1016/j.ijresmar.2015.02.007

Schaar, L., and Kampakis, S. (2022). Fungible tokens as an alternative investment: evidence from Cryptopunks. J. Br. Blockchain Assoc., 31949. doi:10.31585/jbba-5-1-(2)2022

Shen, D., Urquhart, A., and Wang, P. (2019). Does twitter predict Bitcoin? Econ. Lett. 174, 118–122. doi:10.1016/j.econlet.2018.11.007

Shiller, R. J. (2003). From efficient market theory to behavioral finance. J. Econ. Perspect. 17, 83–104. doi:10.1257/089533003321164967

Singleton, K. J. (2014). Investor flows and the 2008 boom/bust in oil prices. Manag. Sci. 60 (2), 300–318. doi:10.1287/mnsc.2013.1756

Sul, H., Dennis, A. R., and Yuan, L. I. (2014). “Trading on Twitter: the financial information content of emotion in social media,” in Proc. 47th Hawaii int. Conf. Syst. Sci. (IEEE), 806–815.

Ting, W. (2022). Fan community management from fan culture in China. J. Soc. Sci. Humanit. 1811, 1564. doi:10.53469/jssh.2022.4(05).18

Tong, S. T., Van Der Heide, B., Langwell, L., and Walther, J. B. (2008). Too much of a good thing? The relationship between number of friends and interpersonal impressions on Facebook. J. Comput.-Mediat. Commun. 13 (3), 531–549. doi:10.1111/j.1083-6101.2008.00409.x

Toufaily, E., and Zalan, T. (2024). In blockchain we trust? Demystifying the “trust” mechanism in blockchain ecosystems. Technol. Forecast. Soc. Change 206, 122367. doi:10.1016/j.techfore.2023.122367

Trigka, M., Kanavos, A., Dritsas, E., Vonitsanos, G., and Mylonas, P. (2022). The predictive power of a Twitter user’s profile on cryptocurrency popularity. Big Data Cogn. Comput. 6 (2), 59. doi:10.3390/bdcc6020059

Truby, J., Brown, R. D., Dahdal, A., and Ibrahim, I. (2022). Blockchain, climate damage, and death: policy interventions to reduce the carbon emissions, mortality, and net-zero implications of non-fungible tokens and Bitcoin. Energy Res. Soc. Sci. 88, 102499. doi:10.1016/j.erss.2022.102499

Umar, Z., Abrar, A., Zaremba, A., Teplova, T., and Vo, X. V. (2022). The return and volatility connectedness of NFT segments and media coverage: fresh evidence based on news about the COVID-19 pandemic. Finance Res. Lett. 49, 103031. doi:10.1016/j.frl.2022.103031

Utz, S. (2010). Show me your friends and I will tell you what type of person you are: how one's profile, number of friends, and type of friends influence impression formation on social network sites. J. Comput.-Mediat. Commun. 15 (2), 314–335. doi:10.1111/j.1083-6101.2010.01522.x

Wang, Q., Li, R., Wang, Q., and Chen, S. (2021). Fungible token (NFT): overview, evaluation, opportunities and challenges. arXiv preprint arXiv:2105.07447.

Wang, Y. (2022). Volatility spillovers across NFTs news attention and financial markets. Int. Rev. Financ. Anal. 83, 102313. doi:10.1016/j.irfa.2022.102313

Westland, J. C. (2024). Periodicity, Elliott waves, and fractals in the NFT market. Sci. Rep. 14, 4480. doi:10.1038/s41598-024-55011-x

White, J. T., Wilkoff, S., and Yildiz, S. (2022). The role of the media in speculative markets: evidence from fungible tokens (NFTs).

Wilson, K. B., Karg, A., and Ghaderi, H. (2022). Prospecting non-fungible tokens in the digital economy: stakeholders and ecosystem, risk and opportunity. Bus. Horiz. 65 (5), 657–670. doi:10.1016/j.bushor.2021.10.007

Wu, C., Xiong, X., Gao, Y., and Zhang, J. (2022). Does social media coverage deter firms from withholding bad news? Evidence from stock price crash risk. Int. Rev. Financ. Anal. 84, 102397. doi:10.1016/j.irfa.2022.102397

Yang, S., and Berger, R. (2017). Relation between start-ups’ online social media presence and fundraising. J. Sci. Technol. Policy Manag. 8 (2), 161–180. doi:10.1108/jstpm-09-2016-0022

Yencha, C. (2022). Spatial heterogeneity and non-fungible token sales: evidence from Decentraland land sales.

Zhang, J., and Zhang, C. (2022). Do cryptocurrency markets react to issuer sentiments? Evidence from Twitter. Res. Int. Bus. Finance 61, 101656. doi:10.1016/j.ribaf.2022.101656

Keywords: NFTs, blockchain, fan economy, social media platforms, time-lagged effect

Citation: Zhang J, Cao Q and Wen R (2025) Has the fan economy affected the price of non-fungible tokens (NFTs)?. Front. Blockchain 8:1588837. doi: 10.3389/fbloc.2025.1588837

Received: 06 March 2025; Accepted: 09 June 2025;

Published: 27 June 2025.

Edited by:

Roxana Voicu-Dorobantu, Bucharest Academy of Economic Studies, RomaniaReviewed by:

Hyojung Sun, University of York, United KingdomEmmanuel O. C. Mkpojiogu, Veritas University, Nigeria

Copyright © 2025 Zhang, Cao and Wen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qun Cao, Y2FvcXVuODgxMDEzQDEyNi5jb20=

JinYuan Zhang

JinYuan Zhang Qun Cao

Qun Cao RiGuang Wen2

RiGuang Wen2