- 1BIO (bio.xyz), Berlin, Germany

- 2Molecule AG (molecule.xyz), Berlin, Germany

- 3Stem Cell Center Department, Ludwig Maximilian University of Munich, Munich, Germany

- 4Department of Molecular Biosciences, Northwestern University, Evanston, IL, United States

This study presents a systematic scoping review of delegated voting (DV) in decentralized autonomous organizations (DAOs), focusing on its governance implications, implementation forms, and challenges. DV refers to a mechanism through which token holders transfer their voting rights to other participants, often called delegates, who vote on their behalf. While DV is often adopted to address low participation and mitigate the cognitive burden of direct involvement, the existing literature highlights its potential to exacerbate centralization, particularly when whales or influential networks are disproportionate. This creates tension between the intended efficiency gains of the delegation and the unintended concentration of power. Various implementation models, including off-chain platforms (e.g., Snapshot), hybrid governance architectures, and token-based delegation systems, exhibit distinct trade-offs in transparency, cost, and adaptability. Although innovations such as quadratic voting, weighted delegation constraints, and reputation-based governance show promise for improving fairness and accountability, they also face vulnerabilities, such as gaming, collusion, and high implementation complexity. To explore the diverse approaches to DV, this review organizes and synthesizes key findings from recent scholarly publications examining its implementation, risks, and governance outcomes. Synthesizing insights from 13 publications, this review identifies key governance trade-offs, implementation patterns, and risks associated with DV. It also outlines future research directions, including multi-tiered governance structures and decision-support mechanisms, to guide more inclusive and context-aware DAO governance.

1 Introduction

Decentralized autonomous organizations (DAOs) represent a novel governance approach enabled by distributed ledger technology (DLT) that allows participants to collectively allocate resources, define operational frameworks, and pursue strategic objectives without centralized control (Kurniawan et al., 2022). Through the automation of governance processes via smart contracts, DAOs aim to establish transparent, tamper-resistant, and decentralized decision-making mechanisms (Fan et al., 2024). However, while smart contracts effectively encode and enforce predefined rules, they do not inherently ensure good governance or mitigate risks associated with misaligned incentives, coordination failures, or governance manipulation (Rikken et al., 2019). The vulnerabilities in early DAO implementations became evident in the collapse of The DAO in 2016, which suffered from an exploit that drained approximately tens of millions of dollars worth of Ether, leading to the controversial hard fork of the Ethereum blockchain (Mehar et al., 2017). Since then, the number of DAOs has grown, with prominent examples such as Uniswap DAO, MakerDAO, and Aave DAO collectively managing billions in decentralized finance assets and facilitating protocol upgrades, treasury allocations, and public goods funding (Kitzler et al., 2023). While decision-making lies at the core of DAO governance, it has received relatively limited attention in prior frameworks, despite its centrality to the operationalization of governance in blockchain systems (Schädler et al., 2023). Recent work has emphasized the importance of systematically analyzing decision-making processes to better understand the distribution and execution of governance power (Schädler et al., 2023).

Despite their promise of community-driven governance, DAOs face persistent structural and procedural inefficiencies that contradict their decentralized ideals. Low voter participation, driven by voter fatigue, governance complexity, and the cognitive burden of informed decision-making, has led to governance centralization in the hands of a few highly active participants (Özdemir et al., 2024). Empirical analyses reveal that in many DAOs, governance decisions are determined by less than ten percent of eligible token holders, raising concerns about legitimacy and representativeness (Sharma et al., 2024). This trend enables delegation monopolies, in which a small number of highly engaged actors, often early investors or core contributors, wield a disproportionate influence (Lu et al., 2024). Additionally, token-weighted voting systems, where governance power is directly proportional to token holdings, reinforce governance asymmetries by enabling well-resourced entities or “whales” to disproportionately shape DAO policies, sometimes at odds with the broader community’s interests (Kurniawan et al., 2022). Further complicating governance dynamics, stakeholder apathy, governance lethargy, and a high rate of abstentions contribute to decision-making stagnation, particularly in large and complex DAOs where proposal evaluation requires significant expertise (Gersbach et al., 2021). Furthermore, DAO governance extends beyond formal decision-making procedures to include essential governance functions, such as member onboarding and offboarding, role accountability, and contributor coordination, which are often underexamined in both research and implementation despite their importance for organizational resilience (Schädler et al., 2023).

To address these governance inefficiencies, many DAOs have adopted delegated voting (DV) as a mechanism to balance efficiency with decentralization (Fan et al., 2024). DV allows token holders to transfer their voting power to trusted representatives, who make governance decisions on their behalf (Kurniawan et al., 2022). This model can be considered a form of liquid democracy that blends elements of direct and representative democracy: token holders can vote directly on proposals or delegate their voting power to others, with the ability to revoke or reassign this delegation at any time (Lu et al., 2024; Gersbach et al., 2021; Ding et al., 2023a). While many DAOs implement DV in a more static manner, liquid democracy enables dynamic, real-time, and potentially issue-specific delegations. This structure allows context-sensitive representation while preserving individual agency, offering a flexible alternative to fixed representative systems (Lu et al., 2024; Casella et al., 2022). By enabling governance delegation to trusted community members, DAOs aim to enhance informed decision making while reducing voter fatigue. Nevertheless, although delegation is designed to enhance governance efficiency, its effectiveness depends on how delegation pathways are structured and how accountability is maintained (Lu et al., 2024). DV introduces governance risks that require critical evaluation and if left unregulated could exacerbate the governance issues it was trying to solve. Collusion, vote selling, and delegate misbehavior are increasingly observed in DAOs, where top delegates consolidate disproportionate power through opaque delegation networks, allowing them to extract governance influence without robust accountability mechanisms (Lu et al, 2024; Gersbach et al., 2021; Austgen et al., 2023). Additionally, strategic non-participation, in which influential delegates abstain from voting to avoid taking responsibility for controversial decisions, further weakens governance integrity (Kurniawan et al., 2022). Empirical studies suggest that, in some DAOs, delegation monopolies lead to highly concentrated governance, where a small number of delegates control the majority of delegated voting power, effectively replicating centralized governance structures (Austgen et al., 2023; Fritsch et al., 2024). Moreover, governance extraction through technical proposals, where delegates use their voting power to manipulate protocol rules in their favor, has emerged as a critical governance vulnerability (Lu et al., 2024; Fritsch et al., 2024). Although reputation-based delegation systems have been proposed as solutions, their efficacy in preventing disproportionate influence remains uncertain, particularly because reputational metrics can be manipulated or gamed by influential stakeholders (Kitzler et al., 2023).

While DV offers a potential pathway to balance participation and efficiency, its implementation varies widely across DAOs, and its implications remain insufficiently explored in the literature. This study conducts a systematic scoping review of DV in DAOs, synthesizing the existing scientific literature to assess its governance implications. Specifically, it examines how DV impacts governance functionality, the various implementation forms that facilitate delegation, best practices for optimizing delegation mechanisms, and the systemic challenges that impede their success. Through this analysis, this study aims to provide a comprehensive evaluation of the strengths, limitations, and trade-offs of DV systems in DAOs, offering insights that may inform governance innovation and contribute to more equitable, transparent, and resilient decentralized decision-making frameworks.

2 Objective

This study aims to synthesize and provide a comprehensive overview of the existing scientific literature on DV in DAOs. Specifically, it examines the impact on DAO governance, forms of implementation (e.g., tools), best practices, and challenges. The central research question guiding this review is:

What is the current state of academic literature on DV in DAOs, particularly regarding its implementation, associated best practices, and key governance challenges?

In this review, governance refers to formal and informal structures, processes, and institutions through which collective decisions are made and implemented within a DAO (Rhodes, 2007). This includes mechanisms for participation, rule-setting, dispute resolution, and oversight. Rather than equating governance with procedural formality or power distribution, it is more useful to understand the capacity of a system to formulate and enforce decisions effectively while remaining adaptive to evolving institutional contexts (Fukuyama, 2016). Governance frameworks shape how authority is exercised and decisions reached, but they also interact with broader patterns of influence and legitimacy, including the conditions under which accountability may emerge (Jessop, 1998; Peters, 2012). Governance inefficiencies are understood here as conditions that hinder effective, inclusive, or transparent decision making, such as low participation, procedural opacity, excessive concentration of voting power, or delegate behavior that undermines collective intent.

3 Methodology

To identify scientific publications relevant to the study objective, a systematic literature review was conducted following PRISMA-ScR methodology (Tricco et al., 2018). Recognizing the interdisciplinary nature of DAOs, the review utilized seven databases: ACM Digital Library, arXiv, IEEE Xplore, Web of Science, Scopus, SSRN, and Google Scholar. Given the prominence of preprint publications in the field of distributed ledger technology (DLT), which is fundamental to DAOs, databases such as arXiv, SSRN, and Google Scholar were explicitly selected to capture relevant studies that may not yet be peer-reviewed. The search covered 17 years, beginning in 2008 with the publication of the Bitcoin whitepaper, and ending on 31 December 2024. No scoping review protocol had been published before conducting the study. Given the theoretical nature of this research, which did not involve human or animal subjects, ethical approval was deemed nonapplicable.

3.1 Search strategy

Boolean operators (“AND,” “OR,” “NOT”) were employed to refine and specify the search results. The search utilized the following keywords: “Decentralized Autonomous Organizations,” “DAOs,” “DAO voting systems,” “Smart contract governance,” “Blockchain-based organizations,” “DAO tokenomics,” “Token-weighted voting,” “Governance tokens,” “Delegated voting,” “Liquid democracy,” “Delegative democracy,” “Proxy voting,” “Voting mechanisms,” “Decentralized governance,” “Blockchain governance,” “Decentralized decision-making,” “DAO governance,” “Token-based voting,” “Blockchain,” “Distributed ledger technology,” “Cryptographic voting,” “Voting protocols,” “Smart contracts,” “Consensus algorithms,” “Governance frameworks,” “Participatory governance,” “Collective decision-making,” “Crowdsourced decision-making,” “Organizational governance,” “Distributed organizations,” and “Delegation mechanisms.” To address the limitations of advanced search capabilities across some databases (e.g., Google Scholar, SSRN, arXiv), multiple shorter search queries were conducted.

3.2 Study selection

Following the database search, the results were exported to literature management software (Mendeley Elsevier). The duplicate entries were systematically identified and removed. Subsequently, titles and abstracts of the remaining publications were screened to assess their relevance to the study objectives. Publications were excluded based on the following criteria: published before 2008, lacking thematic relevance to the research focus (e.g., studies not mentioning blockchain technology or decentralized autonomous organizations), written in languages other than English, examining governance models unrelated to the scope of the study, or lacking accessible full-text availability. Eligible publications were subjected to a full-text review to validate their alignment with the research objectives. To enhance the rigor and comprehensiveness of the review, reference mining was conducted to identify additional relevant studies cited within key publications. Given that this research specifically aimed to include pre-print articles due to the emerging and interdisciplinary nature of the topic, all pre-print articles adhering to certain academic standards and quality (e.g., inclusion of references and clear methodology) were treated as publications. Articles that failed to meet these quality standards, such as those lacking references or presenting purely opinion-based content, were excluded from the analysis.

3.3 Data extraction

Data from all studies deemed relevant and included in the analysis were systematically organized into a table using Google Sheets. For each publication, the following information was extracted: title, year, authors, methodology, key findings, impact on governance, implementation forms (e.g., tools), best practices, and challenges. The synthesis of governance-related categories emerged inductively from the extracted data. These categories were not predetermined but developed iteratively through a thematic analysis of recurring concepts across the selected publications.

4 Results

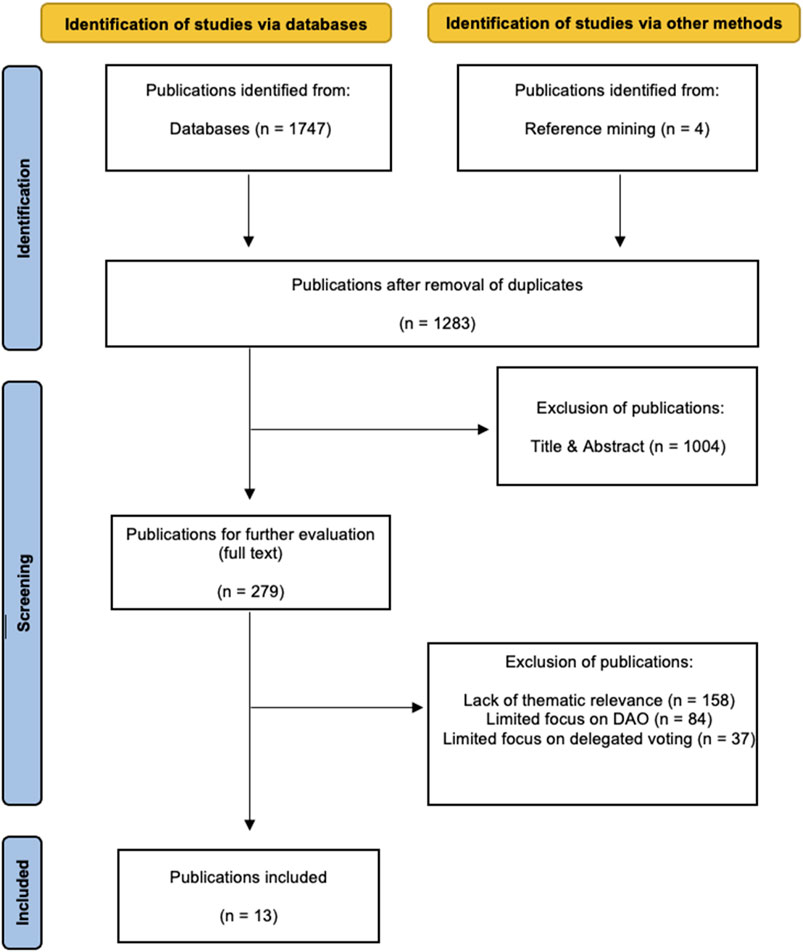

The systematic search of seven electronic databases yielded 1747 potentially relevant publications. Four additional records were identified using reference mining. After removing 464 duplicates, 1283 unique publications remained for title and abstract screening, leading to the exclusion of 1004 records. Of the 279 publications retrieved for full-text review, 266 did not meet the inclusion criteria due to a lack of thematic relevance (e.g., focused on general decentralization without addressing governance or delegation; n = 158), limited focus on DAOs (e.g., only briefly mentioned DAOs as examples without substantial analysis, focused primarily on traditional organizations, or used the term without engaging with DAO-specific governance structures; n = 84), or limited focus on DV (e.g., referenced delegation only briefly or as a secondary topic, without substantive theoretical discussion or empirical analysis; n = 37). Consequently, 13 publications were determined to be relevant to the study objectives and included in the final analysis. Figure 1 shows a flow diagram illustrating the search and selection process.

Figure 1. Flow chart of the systematic search and selection process as adaptation from PRISMA (Tricco et al., 2018).

4.1 Study characteristics

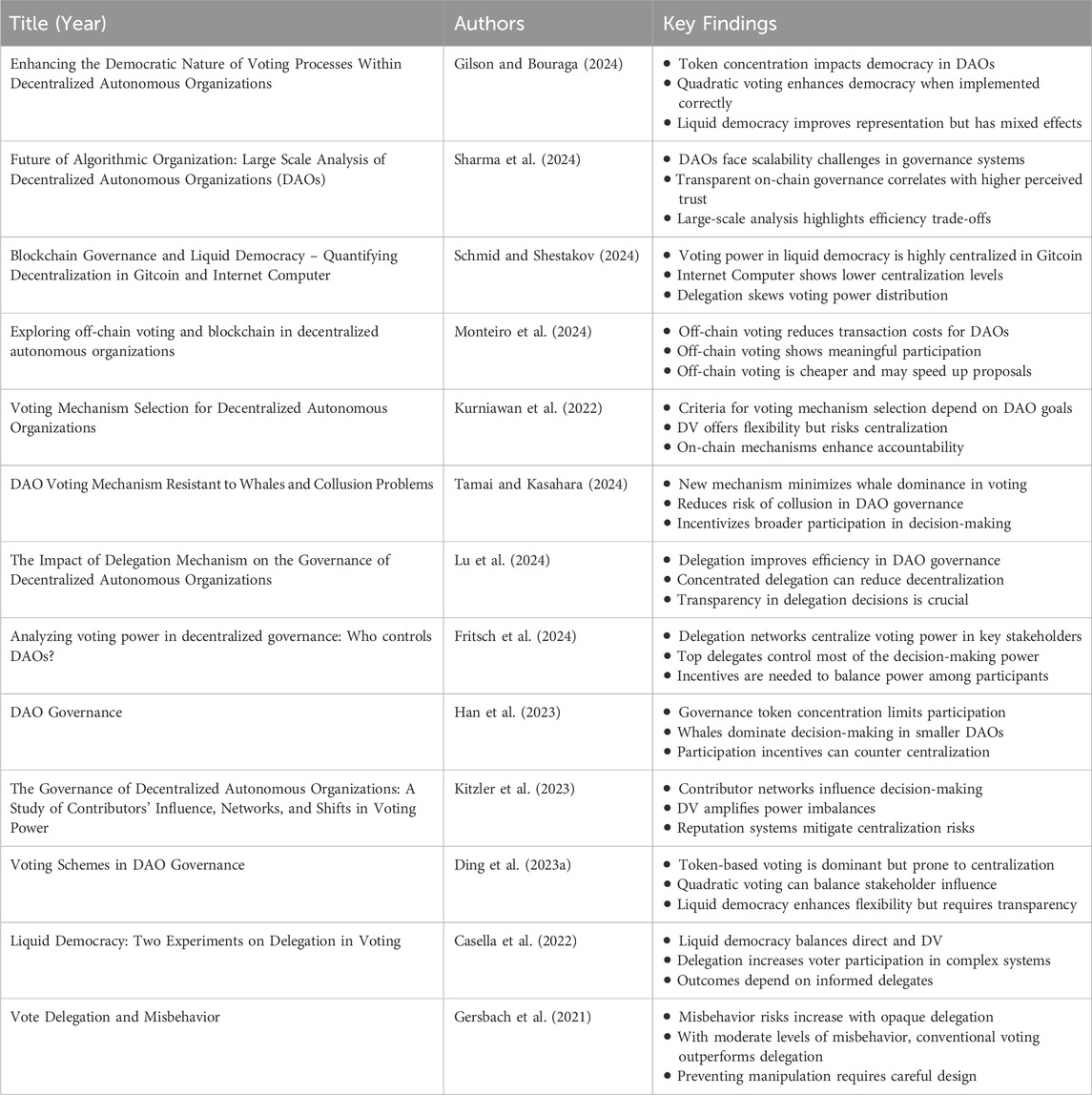

Seven of the included publications were published in 2024, four in 2023, and one each in 2022 and 2021, highlighting the recency of the topic. The most common study design was quantitative research, with seven studies (Kitzler et al., 2023, Gersbach et al., 2021, Austgen et al., 2023; Schmid and Shestakov, 2024; Monteiro et al., 2024; Han et al., 2023; Casella et al., 2022) employing empirical analyses, data modeling, or experimental methods. These studies primarily investigated voting power distributions, delegation effects, and empirical assessments of governance efficiency in DAOs. Three studies adopted a theoretical approach (Kurniawan et al., 2022, Tamai and Kasahara 2024, Ding et al., 2023a. These publications offered comparative analyses of existing voting mechanisms or proposed new governance models to address challenges, such as whale dominance and fairness in delegation. Finally, three studies used mixed-method approaches (Sharma et al., 2024; Lu et al., 2024) or qualitative research (Gilson and Bouraga, 2024). These investigations incorporated empirical case studies, expert interviews, and theoretical assessments to explore the DAO governance structures, delegation mechanisms, and decision-making efficiency. Table 1 presents a detailed summary of the included studies.

4.2 Impact on governance

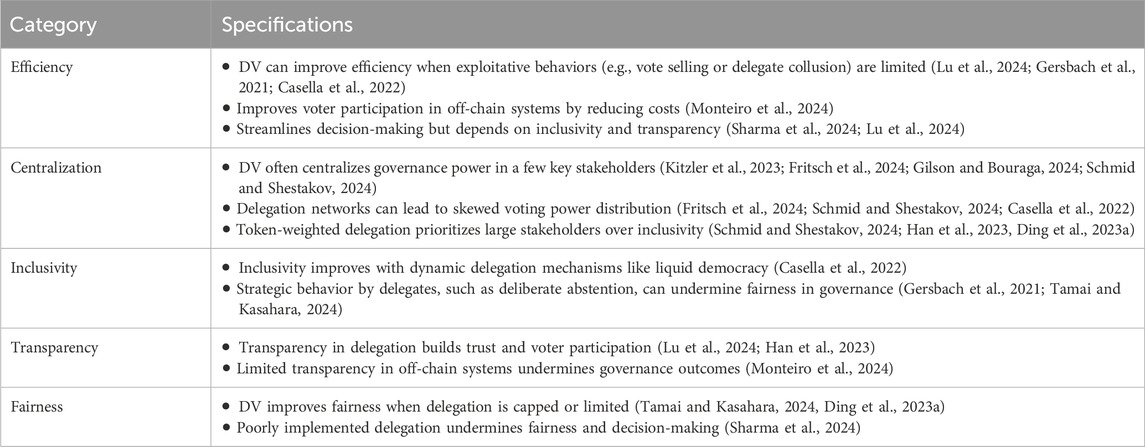

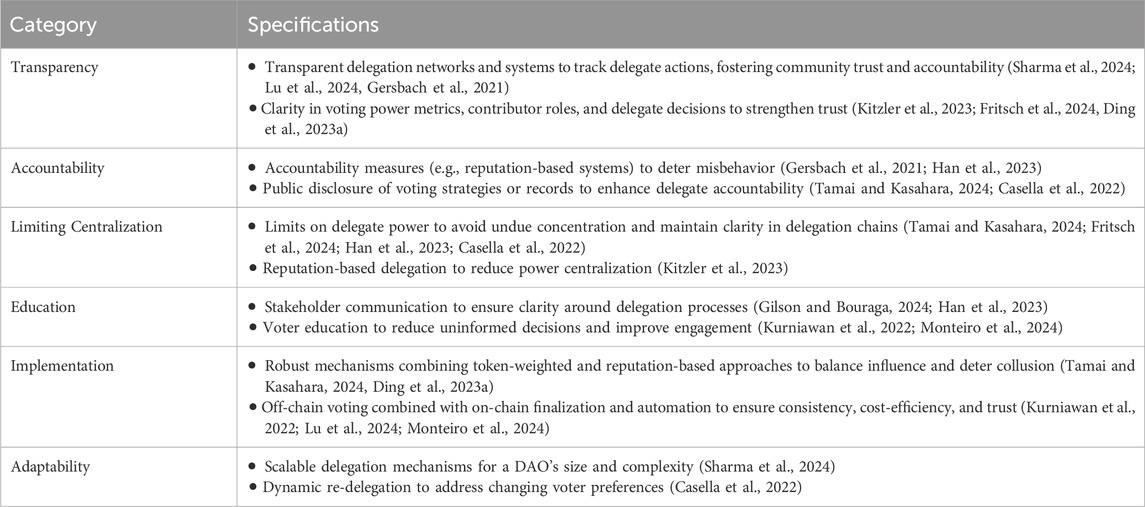

DV impacts DAO governance across five closely interconnected categories, efficiency, centralization, inclusivity, transparency, and fairness, and their respective specifications. Delegation can streamline decision-making, especially when off-chain processes reduce costs (Sharma et al., 2024; Lu et al., 2024; Gersbach et al., 2021; Monteiro et al., 2024; Casella et al., 2022). Some authors also link these benefits to broader organizational scale (Mehar et al., 2017). However, studies also note that high efficiency depends on inclusivity and transparency in the delegation processes (Sharma et al., 2024, Lu et al, 2024). Simultaneously, DV can exacerbate centralization if large stakeholders or influential networks consolidate power (Kitzler et al., 2023; Fritsch et al., 2024; Gilson and Bouraga 2024, Schmid and Bouraga, 2024, Ding et al., 2023a, Casella et al., 2022), especially through token-weighted systems that grant disproportionate influence to major holders (Schmid and Shestakov 2024; Monteiro et al., 2024, Ding et al., 2023a. By contrast, dynamic delegation approaches, such as liquid democracy, can boost inclusivity by enabling flexible vote reassignments and allowing participants to delegate their votes based on expertise or alignment of interests (Casella et al., 2022). However, exploitative behaviors by delegates, such as vote selling, collusion, and deliberate abstention have been observed in DAO governance, where powerful delegates strategically avoid voting to manipulate outcomes or consolidate long-term influence (Gersbach et al., 2021). Studies have highlighted the critical importance of transparency in delegation processes, showing that well-documented procedures such as tracking delegation records, maintaining auditable voting logs, ensuring publicly accessible governance documentation, and establishing clear delegation pathways enhance trust and promote broader stakeholder engagement (Lu et al., 2024; Fritsch et al., 2024; Monteiro et al., 2024; Han et al., 2023). Some studies suggest that implementing mechanisms to reduce delegate dominance, such as quadratic voting, weighted delegation constraints, and reputation-based governance, may improve fairness by counteracting power centralization (Tamai and Kasahara 2024, Ding et al., 2023a). Quadratic voting allows participants to express the intensity of their preferences by allocating votes quadratically, meaning that casting multiple votes costs increasingly more tokens, thereby limiting the disproportionate influence of large stakeholders and improving the representational balance (Tamai and Kasahara 2024, Ding et al., 2023a). Reputation-based governance assigns voting power based on participants’ historical contributions, performance, or peer endorsements, thereby aligning influence with demonstrated commitment rather than token holdings (Tamai and Kasahara 2024, Ding et al., 2023b). Additionally, poorly designed delegation mechanisms have been shown to contribute to governance inefficiencies and the overconcentration of voting power among a few influential delegates, undermining decision-making inclusivity (Kurniawan et al., 2022; Fritsch et al., 2024). In synthesis, the evidence suggests that DV holds promise for enhancing participation and decision-making efficiency, but it also raises ongoing concerns regarding concentrated power, lack of transparency, and uneven representation. The categories and specifications associated with each aspect of DV are summarized in Table 2.

4.3 Implementation forms

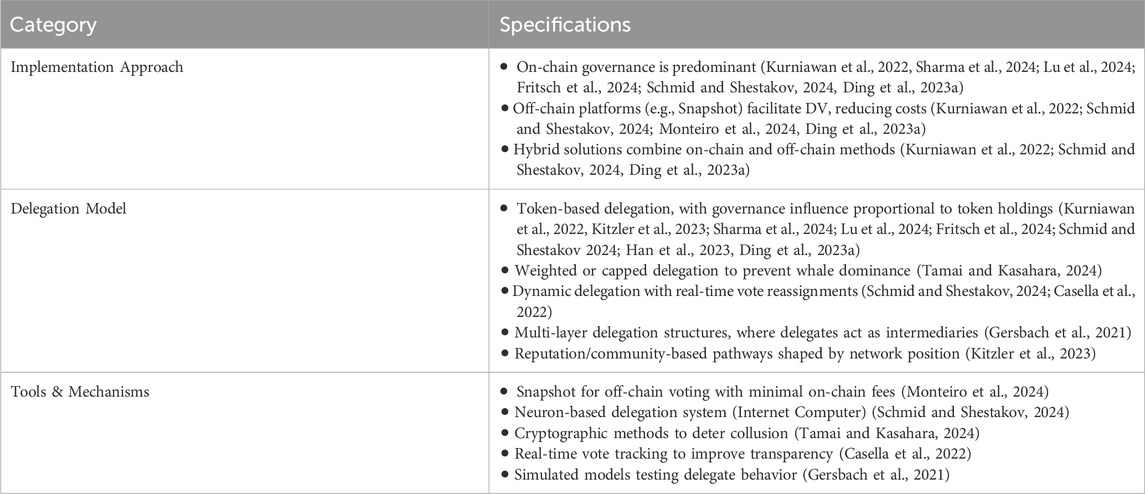

The included studies highlighted multiple approaches to implementing DV in DAOs, designed to balance efficiency, security, and community trust. On-chain governance tools (Kurniawan et al., 2022, Sharma et al., 2024; Lu et al., 2024; Fritsch et al., 2024; Schmid and Shestakov, 2024, Ding et al., 2023a) dominate many DAO architectures because of their capacity for automated execution, whereas off-chain platforms such as Snapshot reduce transaction costs, which can encourage greater participation (Kurniawan et al., 2022; Monteiro et al., 2024, Ding et al., 2023b). Several DAOs implement hybrid governance models that integrate on-chain execution with off-chain voting mechanisms, leveraging off-chain decision-making for flexibility and cost reduction, while preserving on-chain transparency and immutability for final governance execution (Kurniawan et al., 2022, Schmid and Shestakov 2024, Ding et al., 2023a). Token-based delegation ties voting power to token holdings (Kurniawan et al., 2022, Kitzler et al., 2023; Sharma et al., 2024; Lu et al., 2024; Fritsch et al., 2024; Schmid and Shestakov 2024; Han et al., 2023, Ding et al., 2023a), with capping delegation being explored to prevent whale dominance (Tamai and Kasahara, 2024). More dynamic models include real-time vote reassignments (Schmid and Shestakov, 2024; Casella et al., 2022) and multi-layer delegation structures in which delegates act as intermediaries for smaller holders (Gersbach et al., 2021). Some DAOs exhibit governance patterns in which contributors with sustained engagement and network centrality gain influence beyond token holdings (Kitzler et al., 2023). However, formal reputation-based delegation systems that assign voting power through predefined community metrics have not been widely implemented (Kitzler et al., 2023). The literature analysis suggests a range of tools and mechanisms that shape DV (Tamai and Kasahara, 2024; Schmid and Shestakov, 2024; Monteiro et al., 2024; Casella et al., 2022). Cryptographic mechanisms such as time-locked voting, Sybil-resistant quadratic voting, and bribery-resistant cost modeling aim to increase security and deter collusion (Tamai and Kasahara, 2024; Schmid and Shestakov, 2024). Real-time vote tracking (Casella et al., 2022) increases transparency, whereas simulated models assess potential delegate behaviors under various scenarios (Gersbach et al., 2021). Table 3 summarizes these categories and their specifications.

4.4 Challenges

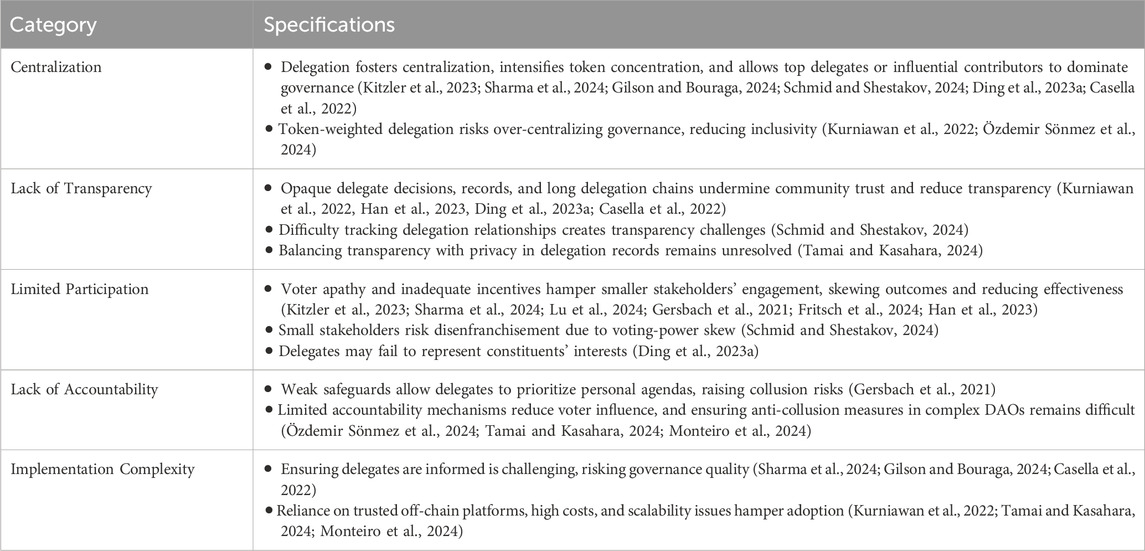

Despite the potential benefits of DV, the included studies underscored five persistent challenges: centralization, lack of transparency, limited participation, lack of accountability, and implementation complexity. Centralization arises when delegation intensifies token concentration, enabling dominant stakeholders or top delegates to exert an outsized influence on communal decisions (Kitzler et al., 2023; Sharma et al., 2024; Gilson and Bouraga, 2024; Schmid and Shestakov, 2024; Ding et al., 2023a; Casella et al., 2022). Token-weighted delegation can exacerbate this effect, shifting the balance of power away from smaller token holders and thus limiting broader inclusivity (Kurniawan et al., 2022; Lu et al., 2024). This dynamic not only risks reducing the diversity of thought in governance processes but also erodes trust as participants may perceive that their votes are overshadowed by concentrated voting blocs (Kitzler et al., 2023; Tamai and Kasahara, 2024; Schmid and Shestakov, 2024). A lack of transparency compounds centralization risks by making delegate decisions, voting records, and delegation chains opaque (Kurniawan et al., 2022; Han et al., 2023, Ding et al., 2023a; Casella et al., 2022). Moreover, tension persists between the desire for greater oversight and the need to protect privacy—an ongoing debate highlighted by the difficulty of balancing publicly accessible voting records against potential privacy violations (Kitzler et al., 2023; Lu et al., 2024). Limited participation further skews outcomes, especially when smaller stakeholders lack incentives or feel apathetic toward the voting process (Kitzler et al., 2023; Sharma et al., 2024; Lu et al., 2024; Gersbach et al., 2021; Fritsch et al., 2024; Han et al., 2023). These conditions often lead to the disenfranchisement of those without significant token holdings, and delegates may not always act in the best interests of their constituents (Schmid and Shestakov, 2024, Ding et al., 2023a). A lack of accountability compounds the above issues, with minimal safeguards permitting delegates to privilege personal agendas or engage in collusive behavior (Lu et al., 2024; Gersbach et al., 2021; Tamai and Kasahara, 2024; Monteiro et al., 2024). Implementation complexity remains a key barrier for effective governance. Beyond the technical challenge of ensuring that delegates are well informed (Sharma et al., 2024; Gilson and Bouraga, 2024; Casella et al., 2022), reliance on off-chain platforms can introduce higher costs and scalability limitations (Kurniawan et al., 2022; Tamai and Kasahara, 2024; Monteiro et al., 2024). These challenges are particularly problematic for DAOs seeking both rapid decision making and widespread stakeholder inclusion. Together, these five challenges underscore the multifaceted nature of DV, suggesting that any governance model must holistically address each concern. Table 4 provides a concise overview of the challenges encountered in the included studies.

4.5 Best practices

The identified and selected studies proposed several best practices to enhance DV systems in DAOs, including transparency, accountability, limiting centralization, education, implementation, and adaptability. Transparency is a fundamental requirement for building community confidence in DV. Several authors highlight how publicly accessible delegate actions, thorough recordkeeping, and clear tracking of vote distribution improve accountability while reducing opportunities for collusion (Sharma et al., 2024; Lu et al., 2024, Gersbach et al., 2021). In tandem, well-defined voting power metrics and explicit information on contributor roles can enable voters to make more informed choices, thereby boosting overall trust (Kitzler et al., 2023; Fritsch et al., 2024, Ding et al., 2023a). Reputation-based systems, in particular, provide a means to reward responsible delegates and penalize misconduct (Gersbach et al., 2021; Han et al., 2023). However, DAOs define what constitutes misconduct based on their governance frameworks as no universal enforcement standard exists (Fan et al., 2024; Rikken et al., 2019). Public disclosure of voting strategies or records adds another layer of oversight, offering tangible proof of how delegates act on behalf of their constituents (Tamai and Kasahara, 2024; Casella et al., 2022). A recurring concern among the studies is limiting centralization, which typically manifests when a small subset of high-stake token-holders wields outsized influence. Capping or restricting delegate voting power, whether through formal limits or gradual weighting adjustments, fosters more equitable representation (Tamai and Kasahara, 2024; Fritsch et al., 2024; Han et al., 2023; Casella et al., 2022). Reputation-based delegation could further mitigate power imbalances by introducing nonmonetary criteria into the governance process (Kitzler et al., 2023). Another critical factor is education that encompasses stakeholder communication and clear instructional resources. Several authors have pointed out that uninformed delegation can undermine both fairness and efficiency, emphasizing that stronger voter awareness is key to mitigating blind or apathetic delegation (Kurniawan et al., 2022, Gilson and Bouraga, 2024; Monteiro et al., 2024; Han et al., 2023). Using dual systems that combine token weighting with reputation checks is frequently recommended, thus distributing influence beyond token balances (Tamai and Kasahara, 2024, Ding et al., 2023a). This is often paired with off-chain voting solutions for cost savings, supplemented by on-chain finalization and automated processes to maintain trust and consistency (Kurniawan et al., 2022; Lu et al., 2024; Monteiro et al., 2024). Dynamic re-delegation grants voters flexibility to adapt to changing governance contexts, helping DAOs remain responsive and scalable (Sharma et al., 2024; Casella et al., 2022). Table 5 provides a detailed summary of these best practices, aligning each recommendation with studies that explicitly support it.

5 Discussion

The complexities of DV in DAOs extend beyond theoretical frameworks to the practical challenges that shape governance outcomes. While delegation mechanisms are implemented to enhance efficiency and inclusivity, their impact depends on the intricate balance between decentralization, transparency, and functional governance structures. The following discussion explores these dimensions, questioning whether the existing models achieve their intended goals or merely introduce new risks and inefficiencies.

5.1 Impact on governance

Transparency in delegation processes is widely regarded as a fundamental pillar of accountable governance in DAOs. The ability to track delegation records, maintain auditable voting logs, and ensure publicly accessible governance documentation is critical to fostering trust and preventing governance manipulation (Lu et al., 2024; Fritsch et al., 2024; Monteiro et al., 2024; Han et al., 2023). However, the assumption that transparency alone guarantees equitable governance deserves further scrutiny. While valuable, transparency mechanisms can inadvertently introduce centralization risks if they require an entity, such as a core DAO team or an external governance facilitator, to oversee and maintain records (Lloyd et al., 2024). This creates a paradox in which transparency efforts aimed at decentralization may reinforce dependence on centralized infrastructure (Axelsen et al., 2023). Furthermore, the sheer volume of governance data, when not properly structured, may overwhelm participants rather than empower them, leading to de facto reliance on governance analysts or power users, who can process and interpret this information effectively (Fan et al., 2024). The challenge, then, is not only ensuring transparency but also designing it in a way that remains accessible and actionable for all participants, rather than reinforcing elite governance structures.

In traditional corporate governance, DV is commonly implemented through proxy voting, typically accompanied by formal proxy statements. These statements detail voting procedures, outline proposals, and disclose potential conflicts of interest, thereby serving as transparency-enhancing instruments (Green-Armytage, 2014; Agrawal, 2012). Despite criticisms of opacity, vote dilution, and coordination problems in public institutions, the structured nature of corporate proxy voting offers a reference point for decentralized governance systems (Panisi et al., 2019). In particular, the introduction of proxy statements such as DAO-native artifacts could provide a mechanism to standardize disclosures on delegate motivations, voting history, financial incentives, and affiliations. This approach mirrors blockchain proposals to improve shareholder democracy by enabling real-time identification of beneficial shareholders and immutable records of voting actions (Panisi et al., 2019). Such transparency may strengthen procedural legitimacy and counterbalance some risks associated with delegation, such as vote hijacking or unaccountable proxy behavior. However, the challenge lies in reconciling the formalization of these mechanisms with the ethos of openness, anonymity, and permissionless participation that characterize many DAOs.

Efforts to counterbalance governance centralization, particularly through quadratic voting, weighted delegation constraints, and reputation-based governance, offer promising, but imperfect solutions (Tamai and Kasahara, 2024; Ding et al., 2023a; Van Vulpen et al., 2024). For instance, quadratic voting has been praised for mitigating the influence of dominant stakeholders by increasing the cost of additional votes. However, its implementation could introduce strategic loopholes. The potential for large token holders to distribute their holdings across multiple wallets effectively circumventing the quadratic cost function raises concerns about the system’s resistance to manipulation (Austgen et al., 2023). Additionally, the cognitive and technical overheads associated with quadratic voting may alienate less engaged participants, making governance participation disproportionately accessible to those with the knowledge and resources to navigate these complexities (Kim, 2024; Han et al., 2024). Reputation-based governance, often cited as an alternative to purely token-weighted systems, faces the issue of definitional ambiguity. What constitutes a “reputable” contributor? Who determines which reputational metrics are valid? (Ding et al., 2023b)? The risk of reputation gaming, where influential actors accumulate social capital without necessarily acting in the best interest of the DAO, complicates its viability as a reliable governance mechanism (Appel and Grennan, 2024). Moreover, reputation systems may inadvertently concentrate governance influence on highly visible individuals or symbolic leaders, regardless of formal voting weight. The prominence of figures such as Vitalik Buterin within the Ethereum ecosystem illustrates how reputational capital can informally centralize agenda-setting power in decentralized systems. While innovative, these mechanisms highlight the inherent trade-offs in designing governance systems that are both equitable and efficient.

Reducing delegate dominance is often framed as an essential step toward democratic governance, the role of centralization in DAOs is more nuanced than commonly acknowledged. Large stakeholders, especially those with substantial financial interests, may play a stabilizing role by ensuring continuity, preventing governance stagnation, and safeguarding against voter apathy (Kitzler et al., 2023; Fritsch et al., 2024; Gilson and Bouraga, 2024; Schmid and Shestakov, 2024; Ding et al., 2023a; Casella et al., 2022). This perspective aligns with research on governance dynamics in decentralized ecosystems, where strategic centralization in the early stages can facilitate decision-making agility and long-term sustainability (Ding et al., 2023b). In practice, governance bottlenecks such as low voter turnout, indecisive voting patterns, and an inability to reach quorum can render DAOs ineffective, making some degree of governance concentration an operational necessity rather than a flaw (Lloyd et al., 2024; Falk et al., 2024). However, over-reliance on a small group of decision-makers, even if initially beneficial, can create governance hierarchies that are difficult to dismantle later, raising concerns about long-term resilience and adaptability (Rikken et al., 2019). The challenge is not merely decentralizing for its own sake but determining when and how centralization may serve a constructive role without undermining participatory governance principles. The relationship between governance structures and power consolidation is further complicated by the evolving nature of delegations. While delegation is intended to distribute governance responsibility, empirical evidence suggests that it often leads to governance clustering, in which a small number of delegates accumulate a disproportionate share of voting power (Schmid and Shestakov, 2024; Han et al., 2023, Ding et al., 2023b). This raises the question of whether delegation, rather than dispersing influence, reshapes centralization in an opaquer manner. The emergence of “delegate cartels” and informal voting blocs further underscores how delegation can reinforce governance monopolization rather than mitigate it (Austgen et al., 2023; Lloyd et al., 2024). Additionally, the strategic abstention of influential delegates, where key figures deliberately refrain from voting to avoid public accountability for controversial decisions, compounds governance opacity and erodes trust in delegation systems (Gersbach et al., 2021). While transparency is widely regarded as a prerequisite for governance accountability, its effectiveness is contingent on meaningful participation and inclusivity (Gilson and Bouraga, 2024). Without broad participation in the delegation process and equitable access to decision-making tools, transparency risks become a performative layer rather than a functional safeguard (Monteiro et al., 2024). Fairness, often cited as a standalone governance principle, depends on both inclusive participation and transparent procedures (Gilson and Bouraga, 2024). Accountability, in turn, emerges not merely from auditability, but from a governance environment in which participants can actively engage, contest decisions, and observe the rationale behind delegate actions (Fukuyama, 2016). This interdependence suggests that, rather than treating these concepts as discrete criteria, effective governance design should sequence them as mutually reinforcing inclusivity and participation enable transparency, which makes accountability possible, and together they foster perceived and procedural fairness (Fukuyama, 2016).

5.2 Implementation forms

The integration of off-chain voting mechanisms such as Snapshot has been widely adopted in DAOs because of its ability to reduce transaction costs and encourage broader participation (Kurniawan et al., 2022; Schmid and Shestakov, 2024; Monteiro et al., 2024, Ding et al., 2023a). However, reliance on off-chain voting has several disadvantages that fundamentally contradict the principles of autonomous execution and trustless governance (Zhou et al., 2024). Although off-chain platforms mitigate direct on-chain transaction fees, they introduce an intermediary layer that requires additional verification and manual enforcement to integrate decisions back into the blockchain (Falk et al., 2024). This dependency on centralized or semi-centralized infrastructure creates vulnerabilities, as DAOs become reliant on off-chain platforms that may not offer the same level of immutability, censorship resistance, or transparent auditability as their on-chain counterparts (Axelsen et al., 2023). The requirement to synchronize off-chain decisions manually with on-chain smart contracts increases coordination costs and introduces latency, which can be particularly detrimental in governance models requiring frequent decision cycles or the rapid execution of time-sensitive proposals (Fan et al., 2024; Zhou et al., 2024). Additionally, concerns about vote validity and manipulation arise owing to the necessity of external verification mechanisms to ensure the integrity of results before they are recorded on the chain (Falk et al., 2024). These challenges the fundamental assumption that DAOs operate as self-executing, autonomous entities, making governance execution less deterministic and more reliant on external actors who may introduce biases or operational inefficiencies (Nabben, 2023). This issue is not just theoretical but has already materialized in practice, most notably in the Tribe/Fei DAO case, where off-chain voting results were not enforced, calling into question the autonomy of the organization. This raises concerns about whether such systems can still be classified as DAOs and may warrant reclassification as Decentralized Organizations (DOs) or Decentralized Partially Autonomous Organizations (DPAOs) (Rikken et al., 2023).

Capping or restricting delegate voting power through mechanisms such as formal limits or gradual weighting adjustments is often proposed as a solution to mitigate governance monopolization and encourage broader representation (Tamai and Kasahara, 2024; Fritsch et al., 2024; Han et al., 2023; Casella et al., 2022). However, this approach raises questions regarding the fairness of such restrictions. In particular, if governance power is deliberately capped, it could deter significant token investments from those most financially committed to the DAO’s success (Austgen et al., 2023). Unlike traditional financial systems, where larger investors are given greater voting influence due to their financial stakes, DAO governance models that limit large token holders may inadvertently discourage strategic investments and long-term commitments (Appel and Grennan, 2024). This creates a fundamental dilemma: should governance power be proportional to financial risk and investment, or should it be redistributed to ensure a more democratic voting process, even if it comes at the expense of efficiency and capital incentives? Additionally, while capping mechanisms may prevent governance centralization, they also risk favoring less engaged participants who do not have the same level of exposure or vested interest in the DAO’s long-term outcomes, potentially leading to uninformed decision-making or lower-quality governance resolutions (Rikken et al., 2019). The introduction of dynamic delegation models, such as real-time vote reassignments and trust-based delegation systems, offers a more flexible governance structure by allowing participants to delegate votes based on their expertise or alignment of interests (Gersbach et al., 2021; Schmid and Shestakov, 2024; Casella et al., 2022). However, such systems inherently create trust dependencies, shifting the governance structure from a purely stake-based model to one that relies on subjective assessments of credibility and expertise. This raises the question of how trust is defined in this context: who determines which delegates are trustworthy and by what metrics (Kim, 2024)? Reputation-based systems, often proposed as a means of counterbalancing wealth-driven governance concentrations, face implementation challenges. Reputation metrics must be carefully designed to avoid becoming an additional attack vector, particularly if social engagement indicators, such as Discord activity, forum presence, or proposal participation, are used to determine governance influence (Han et al., 2024). The potential for gaming reputation scores through multi-accounting, coordinated upvoting, or delegate collusion presents a significant risk, as socially connected individuals or organized syndicates could manipulate governance power without necessarily acting in the best interests of the broader DAO community (Austgen et al., 2023). This highlights a fundamental concern in reputation-based delegation: while it can help diversify governance beyond wealth-based power structures, it introduces new vulnerabilities tied to social engineering and network effects, rather than purely financial or technical expertise (Ding et al., 2023b).

5.3 Challenges

Centralization remains one of the most contentious challenges in DAO governance, particularly when delegation mechanisms lead to power concentration among a small subset of influential stakeholders (Kitzler et al., 2023; Sharma et al., 2024; Gilson and Bouraga 2024; Schmid and Shestakov 2024, Ding et al., 2023a; Casella et al., 2022). However, the fundamental question remains: What level of centralization is acceptable within a DAO? While excessive governance concentration contradicts the principles of decentralization, some degree of centralization may be necessary to facilitate efficiency and strategic decision-making, particularly in early stage DAOs, where governance structures are still developing (Axelsen et al., 2023). A completely decentralized system, where every token holder has an equal say regardless of expertise or stake, may result in a decision-making gridlock, whereas limited centralization in the hands of engaged, knowledgeable participants could enhance governance responsiveness. However, there is an inherent trade-off between efficiency and inclusivity, and concentrated governance power risks to reduce the diversity of thought, potentially weakening the adaptability and resilience of DAOs over time (Falk et al., 2024). Ensuring that DAOs find an optimal balance between decentralization and structured governance remains an open challenge that requires continuous iteration.

The tension between oversight and privacy further complicates governance design, as DAOs must decide how much visibility to grant to voting records and delegate behavior (Tamai and Kasahara, 2024; Schmid and Shestakov, 2024). Publicly accessible voting records and delegation pathways enhance accountability but also create vulnerabilities. High transparency may expose governance participants to targeted attacks, including sophisticated phishing campaigns aimed at compromising key delegates and acquiring governance controls (Austgen et al., 2023; Tan et al., 2023). This raises the need for technical solutions that can verify governance actions, while preserving individual privacy. Zero-knowledge proofs (ZKPs) offer a promising approach for enabling verifiable yet anonymous participation in DAO governance, allowing participants to prove that they have voted or delegated without revealing specific details (Fan et al., 2024; Zarifis and Fu, 2024). However, integrating ZKP-based systems introduces additional complexity, requiring technical expertise, which many DAOs, particularly newer ones, may lack. Furthermore, although ZKPs may mitigate the risks of targeted attacks, they do not fully address the broader challenge of balancing transparency and governance legitimacy. A DAO that hides too much risks undermining trust, while excessive exposure may deter participation because of privacy concerns.

Delegation mechanisms often exacerbate disenfranchisement because those without substantial token holdings may feel excluded from meaningful governance participation (Schmid and Shestakov 2024, Ding et al., 2023a). Although many challenges associated with DV, such as delegate apathy, misalignment of interests, and centralization, are well documented in traditional voting contexts, the DAO environment introduces distinct affordances and constraints. DV in DAOs is typically implemented via smart contracts, allowing delegation to be programmable, conditional, and publicly auditable (Özdemir Sönmez et al., 2024; Tamai and Kasahara, 2024). This enables features such as real-time revocability, delegation caps, or slashing mechanisms to respond to delegate misbehavior (Tamai and Kasahara, 2024; Zhou et al., 2024). Additionally, DAOs frequently link voting power to token holdings, intertwining governance rights with economic incentives and creating susceptibility to vote buying, signaling games, or delegate capture (Gersbach et al., 2021; Austgen et al., 2023). The visibility of on-chain delegation graphs and vote histories can increase transparency, but also introduce new attack surfaces, including targeted bribery or collusion among token whales (Kitzler et al., 2023; Zhou et al., 2024). These characteristics differentiate DV in DAOs from their analogs in corporate or political systems, making it a uniquely fertile ground for both innovation and governance risk.

While delegation is intended to increase participation by allowing fewer active members to transfer their governance rights to trusted representatives, the effectiveness of this system depends on whether delegates genuinely act in the best interests of the broader community. A persistent issue is that delegates, once empowered, may prioritize personal agendas or act in coordination with select groups rather than serving as neutral representatives of the community’s interests (Özdemir Sönmez et al., 2024, Gersbach et al., 2021, Tamai and Kasahara, 2024; Monteiro et al., 2024; Zhou et al., 2024). This raises the question of how DAOs can incentivize delegates to align with collective governance objectives. Mechanisms such as stake-weighted reputation systems, in which delegates accumulate governance credibility based on past decision-making performance, can help enforce accountability (Ding et al., 2023b). However, such systems require careful design to prevent reputation gaming and social manipulation, as actors can collude and artificially inflate credibility scores (Austgen et al., 2023).

A lack of accountability among delegates not only leads to governance inefficiencies, but also enables collusive behavior, where powerful actors coordinate to push through self-serving proposals with minimal resistance (Özdemir Sönmez et al., 2024; Gersbach et al., 2021; Tamai and Kasahara, 2024; Monteiro et al., 2024). Addressing this issue requires the introduction of cryptoeconomic deterrents, which impose penalties on governance misconduct. On-chain penalties, such as slashing mechanisms that deduct a portion of a delegate’s stake when collusion or malicious voting behavior is detected, present a potential solution (Appel and Grennan, 2024). Additionally, multi-signature governance models, in which high-stakes governance decisions require approval from multiple independent parties, could serve as a check against unilateral decision-making (Nabben, 2023). However, implementing such deterrents introduces additional complexity; new DAOs, in particular, may lack the necessary technical infrastructure to effectively enforce cryptoeconomic penalties. If the cost of implementing such security mechanisms outweighs its benefits, they may serve as a barrier to governance participation, deterring contributors who fear unintended penalties for governance missteps. Moreover, while slashing mechanisms provide strong disincentives for malicious behavior, they also raise concerns about the due process: How are governance violations adjudicated, and who decides when penalties are justified?

The broader challenge faced by DAOs is that every safeguard introduced to prevent governance abuse adds another layer of complexity to governance participation. While highly sophisticated cryptoeconomic models may offer effective deterrence against collusion and delegate misconduct, they could also make DAO governance prohibitively difficult for new participants to navigate (Rikken et al., 2019). The trade-off between security, efficiency, and accessibility must be carefully managed, particularly as DAOs evolve and scale. While inclusiveness and transparency remain foundational governance goals, DAOs introduce distinct tensions around decentralization and efficiency, concepts often underemphasized or treated only implicitly in classical governance frameworks (Rhodes, 2007; Fukuyama, 2016). Efficiency, in particular, has historically been a concern of administrative science and public management (e.g., New Public Management) but is rarely framed as a core governance value in political science (Fukuyama, 2016). In contrast, DAOs operationalize efficiency through protocol-level automation and smart contract execution, enabling governance processes to scale without relying on hierarchical oversight (Lu et al., 2024). Similarly, while decentralization in conventional governance is typically institutionalized as a constitutional or administrative feature, in DAOs, it emerges dynamically through token distribution, delegation patterns, and fluctuating voting participation (Fritsch et al., 2024). Distinguishing these newer concerns from classical values adds conceptual clarity and highlights the governance innovations introduced by the DAOs.

It is worth noting that this review focuses on token-based DV, and that not all DAOs rely on financial equity or token ownership to structure governance. Some DAOs experiment with alternative models, such as one-person-one-vote schemes, contribution-based voting, or reputation-weighted systems that attempt to decouple the influence from financial wealth (Fan et al., 2024; Monteiro et al., 2024). These models are still emerging, but they hold promise for reducing governance imbalances exacerbated by token concentration, a challenge not unique to DAOs, but particularly acute in blockchain-native contexts (Austgen et al., 2023; Zhou et al., 2024). Moreover, DAOs provide programmable infrastructure that is uniquely suited to implement DV. Delegation can be time-limited, revocable, and conditional, allowing voters to dynamically transfer and reclaim influence in ways unavailable in most traditional systems (Gersbach et al., 2021, Tamai and Kasahara, 2024; Casella et al., 2022; Green-Armytage, 2014). These affordances offer a testbed for rethinking democratic representation by combining the responsiveness of direct voting with the scalability of delegation. In many cases, the simplest solutions, such as increasing community engagement, encouraging active participation, and reinforcing social norms around ethical governance, may prove to be just as effective, if not more so, than complex on-chain enforcement mechanisms. It is worth noting again the recency of the publications cited in this review. The topic of effective governance within DAOs is barely a few years old and, while it is useful to speculate on the most effective way to do this, the only way to make a true evaluation is for DAOs to experiment with the different tools at their disposal. Future governance models may benefit from hybrid approaches that combine technical deterrents with social incentives to ensure that DAOs remain resilient and accessible to a broad range of participants (Davidson, 2024). While a perfect solution may not yet exist, one that upholds DAO integrity while enabling effective governance for a broad community remains an achievable goal worth pursuing through continuous refinement and experimentation.

5.4 Best practices

Encouraging thoughtful engagement among token holders is crucial for ensuring that delegation mechanisms function as intended. While DAOs often seek to improve governance efficiency through delegation, a key challenge lies in educating participants on the nuances of delegation. Some of the included publications advocate for dual systems that combine token weighting with reputation checks to distribute influence beyond simple token balances (Gersbach et al., 2021; Tamai and Kasahara, 2024, Ding et al., 2023a). However, the integration of reputation-based checks in Web3 environments raises concerns because such systems often conflict with the ethos of anonymity and permissionless participation that underpin many decentralized networks (Nabben, 2023; Kaal, 2021). The fundamental question is whether requiring reputation assessments inadvertently introduces barriers that contradict the open-access principles of DAOs. While credentials and identity verification mechanisms might improve governance integrity, they also risk excluding pseudonymous or privacy-focused participants, shifting DAO governance toward a model that resembles traditional institutions, rather than preserving its decentralized roots (Appel and Grennan, 2024). Moreover, the trade-off between oversight and privacy remains contentious. Greater accountability, particularly in mitigating collusion or governance abuse, often demands more transparent governance records. However, excessive transparency can deter participation by making delegates vulnerable to external pressures or reputational risks (Tamai and Kasahara, 2024; Schmid and Shestakov, 2024). For example, if every voting decision is permanently recorded and publicly attributed, delegates may choose to strategically abstain from controversial decisions rather than risk backlash, thus undermining governance responsiveness (Austgen et al., 2023). This dilemma highlights the need for nuanced transparency mechanisms that ensure accountability, without exposing participants to undue scrutiny or potential retaliation. Although transparency and recordability are often cited as trust-enhancing features in blockchain-based governance, it is important to recognize that trust is not automatically guaranteed by technological means. Rather than eliminating the need for trust, blockchain systems often redistribute trust from interpersonal relationships to protocols, platforms, and governance structures (De Filippi et al., 2020). Research in this area has highlighted that so-called “trustless” technologies actually rely on layered forms of institutional, infrastructural, and social trust (De Filippi et al., 2020). Empirical findings confirm that perceived trust in decentralized systems depends not only on technical assurances but also on institutional and social factors, such as regulatory clarity, user familiarity, and the perceived credibility of platforms (Zarifis and Fu, 2024; Smits and Hulstijn, 2020). Confidence in the correctness of code and game-theoretic incentives may substitute for direct human trust, but trust in surrounding systems, such as developers, governance facilitators, or community norms, remains central. User studies further demonstrate that, even in technologically secure environments, trust is shaped by broader sociotechnical dynamics, including usability, design interaction, and expectations of institutional oversight (Zarifis and Fu, 2024; Smits and Hulstijn, 2020). Enforcing transparency requires a structured mechanism for data storage, verification, and presentation, raising the question of who maintains these records and how they ensure integrity without introducing centralization risks. The balance between transparency and functional governance remains a delicate issue, particularly for DAOs that rely on off-chain discussions and informal governance structures where enforcing transparency may not be straightforward (Fan et al., 2024).

Additionally, while reputation-based systems can penalize misconduct (Gersbach et al., 2021; Han et al., 2023), the absence of a universally agreed upon definition of misconduct complicates enforcement. Without a standardized framework, each DAO must independently establish its criteria for responsible governance, leaving gaps in the identification and penalization of misbehavior (Falk et al., 2024). Future research could explore the feasibility of DAO-wide consensus mechanisms or tooling that provide standardized misconduct definitions while preserving flexibility for individual governance structures. Furthermore, although dual systems that combine token weighting with reputation checks are recommended (Gersbach et al., 2021; Tamai and Kasahara, 2024, Ding et al., 2023a), their implementation introduces additional complexity, necessitating extensive voter education. However, the question remains: Who is responsible for educating the participants? Given that DAO governance structures may lack centralized leadership, the burden of governance literacy often falls on engaged community members, which may create disparities in information access and reinforce power asymmetries (Ding et al., 2023b, Berthelsen and Bjellerås 2023). Education is not only about explaining governance rules; it must also include guidance on evaluating delegates, understanding governance risks, and making informed decisions in a rapidly evolving landscape. Without structured educational initiatives, governance complexity may serve as a barrier to participation, limiting engagement to those already well versed in the system while discouraging newcomers from meaningful involvement (Rikken et al., 2019).

The introduction of real-time or dynamic re-delegation mechanisms provides greater flexibility for participants to adjust their governance strategies in response to changing contexts (Sharma et al., 2024; Casella et al., 2022). However, such mechanisms place additional strain on governance planning, raising concerns regarding whether they are more viable in smaller DAOs than in large complex governance structures. In smaller DAOs, frequent delegation adjustments may be feasible, allowing iterative governance refinements. In contrast, larger DAOs may struggle with coordination challenges, as frequent re-delegation could lead to governance instability, complicating proposal execution and long-term decision-making (Austgen et al., 2023). Although well-defined voting power metrics and explicit information on contributor roles can enhance informed decision-making and boost trust (Kitzler et al., 2023; Fritsch et al., 2024, Ding et al., 2023), information overload remains a significant risk. Providing too much granular detail on governance metrics may make it difficult for new participants to engage effectively, as the learning curve for understanding DAO structures can be overwhelming (Falk et al., 2024). Ensuring clarity without overwhelming users requires a careful balance between detail and accessibility, potentially through modular educational content or tiered governance frameworks.

The challenge of uninformed delegation remains a pressing issue because blind or apathetic delegation can undermine governance fairness and efficiency (Kurniawan et al., 2022, Gilson and Bouraga, 2024; Monteiro et al., 2024; Han et al., 2023). However, mitigating uninformed delegation requires more than just educational resources; it requires structural incentives that encourage active participation. Potential solutions include implementing mechanisms that reward informed delegation through performance-based incentives, delegate ranking systems based on verifiable contributions, or mandatory periodic reevaluation of delegation choices. However, the effectiveness of these approaches depends on whether DAOs can cultivate a governance culture that prioritizes engagement without introducing undue burdens to participants (Appel and Grennan, 2024). In the absence of meaningful incentives, uninformed delegation may persist, reinforcing passive governance structures in which a small subset of delegates continues to wield a disproportionate influence over decision-making. Recent research shows that incentive structures do not universally strengthen DAO governance. In some cases, particularly in DAOs with nonfinancial or mission-driven objectives, the absence of direct incentives may support greater sustainability (Rikken, 2024). The interaction between incentive mechanisms and a DAO’s underlying purpose plays a critical role in determining governance outcomes, suggesting that mechanisms designed for finance oriented DAOs may not translate effectively into other domains (Rikken, 2024). Therefore, misalignment between governance structures and organizational objectives can undermine long-term viability (Rikken, 2024). Large-scale empirical research confirms that DAO size, design, and participation incentives often correlate with increasing power concentration, highlighting the need to tailor governance structures not only to a DAO’s goals but also to its anticipated scale and community dynamics (Peña-Calvin et al., 2024).

5.5 Limitations

This study has several limitations that warrant acknowledgment. The reliance on a systematic literature review introduces an inherent scope and selection constraints. Although substantial efforts were made to capture key literature, the selection remained constrained by full-text access and English-only studies. Additionally, the study included preprint repositories such as arXiv and SSRN to account for emerging research. However, preprints lack formal peer review, which can introduce biases in the methodological rigor and findings. Even with screening for academic quality, the lack of peer review from some sources remains a limitation. Moreover, publication biases may skew results if studies highlighting governance inefficiencies or challenges gain disproportionate attention compared with those presenting neutral or positive findings. DAOs also evolve rapidly; therefore, the state of governance mechanisms at the time of publication may not fully reflect ongoing innovation. The majority of included studies focused on financial and technological DAOs, potentially limiting transferability to other domains, such as social or art-related (e.g., NFTs). Furthermore, significant variations in governance structures, delegation models, and tokenomics complicate broad generalizations across all DAOs. Additionally, while this review synthesizes DV mechanisms, it excludes primary stakeholder perspectives, such as DAO contributors, token holders, or governance participants. Future work should complement these findings with qualitative interviews or survey-based assessments of real-world user experiences. Given the dynamic nature of blockchain governance, these results may not capture the latest iterations or adaptations; as DAOs continue to refine delegation, real-world practices may outpace academic research. The relatively small number of included publications (13) warrants critical reflection. While this may partially stem from the narrow scope of this review, which focuses specifically on DV mechanisms within DAOs, it also reveals a notable gap in academic literature. During the selection process, it became apparent that many studies mentioned DV only peripherally, often without theoretical or empirical analysis. This lack of sustained engagement suggests that despite its practical relevance, DV has yet to receive proportionate scholarly attention within the broader discourse on DAO governance. Moreover, although secondary literature of non-peer-reviewed sources, such as governance forums, technical blogs, and DAO documentation, the exclusion of these sources for methodological reasons further underscores the disconnection between practice and academic research. The limited academic focus of DV may also reflect a broader trend within DAO scholarship to prioritize structural and financial concerns (e.g., tokenomics, coordination, scalability) over political and procedural dimensions. This may highlight the need for a more deliberate research agenda that focuses on the mechanisms, consequences, and normative implications of delegation in decentralized systems. Despite these limitations, this study provides a structured synthesis of current research on DV in DAOs, offering insights into governance outcomes, best practices, and challenges ahead. Future research could address these gaps by integrating empirical assessments, stakeholder perspectives, and real-time governance data from active DAOs.

6 Conclusion

DV in DAOs presents a fundamental trade-off between efficiency and decentralization. While designed to relieve voter fatigue and reward informed decision making, it can inadvertently centralize power if transparency and accountability measures are inadequate. The literature reviewed in this study underscores five interconnected challenges that collectively determine DV effectiveness in practice: power centralization, insufficient transparency, low participation rates, weak accountability mechanisms, and implementation complexity. Notably, token-weighted systems remain the dominant approach to governance, although attempts to moderate concentration through mechanisms such as capping, progressive weighting, and reputation-based checks have yielded mixed outcomes. Emerging innovations such as multilayer or tiered governance pathways that segment decisions by complexity show potential in reconciling domain expertise with broad-based membership control. However, these solutions introduce new layers of complexity, which can hamper usability and deter new participants. Designing a balance between efficiency and inclusivity remains an open research topic. The resulting tension suggests that neither delegation nor direct token voting in isolation can fully address governance pitfalls such as misaligned incentives or collusion. Instead, adaptive and context-specific models are needed that actively incorporate user education, advanced cryptoeconomic security, and flexible oversight structures. Building on the findings of this review, future research should focus on encouraging DV in more transparent, equitable, and iterative ways to preserve genuinely decentralized ethics while sustaining functional governance.

7 Outlook

The following Outlook section outlines possible future directions for research and design in DV systems for DAOs. It is important to note that these considerations are not solely grounded in the 13 included studies but are informed by broader learnings from the review process and the authors' practical involvement in DAO governance.

Multiple studies have suggested that uniform governance structures may either impede expert-driven refinements or exclude broad token-holder participation (Gilson and Bouraga, 2024; Casella et al., 2022; Ding et al., 2023a). One promising direction is a tiered governance model that segments proposals by complexity: technical upgrades could be reviewed by domain experts, whereas treasury allocations and high-level policy decisions remain open to all token holders. Periodic reviews (e.g., biannual) could recalibrate delegation settings based on evolving expertise and stakeholder feedback. Such an approach may be especially beneficial in hybrid DAOs such as BioDAOs, which combine domain-specific knowledge with broad member involvement, meriting future empirical evaluations.

The success of DV also depends on voters’ abilities to understand complex proposals. Several studies have highlighted how information overload and lack of clarity contribute to blind delegation and apathy (Sharma et al., 2024; Gersbach et al., 2021; Casella et al., 2022). To mitigate this, future research could explore the role of artificial intelligence (AI) in DAO governance. AI, which is a computational system capable of tasks such as learning, reasoning, and natural language processing (Russell and Norvig, 2021), can be leveraged to summarize proposals, flag key divergences, and match voter preferences with delegate histories. Cryptographic proofs could preserve data integrity, whereas transparency disclosures would ensure that users understand that these are advisory tools. Such systems may help lower cognitive barriers and promote informed and inclusive participation.

In addition to AI, user interface design is an important frontier. Complex governance platforms discourage engagement (Kurniawan et al., 2022; Fritsch et al., 2024; Monteiro et al., 2024). A unified dashboard could integrate on- and off-chain data, visualize delegation networks, and display proposal summaries, historical voting patterns, and personalized governance panels. Interactive onboarding tools, including guided tutorials, concept quizzes (e.g., on quorum or abstention), and tiered modes for novice versus advanced users, could support both new and experienced participants. Real-time governance activities or integration with communication platforms could reduce friction and increase engagement.

Another underexplored design space concerns mechanisms for reducing the dominance of large stakeholders. Unconditional token-weighted delegation enables whales to shape outcomes disproportionately. A progressive capping system, where the marginal weight of delegated tokens decreases past predefined thresholds, could redistribute influence more equitably (Tamai and Kasahara, 2024; Casella et al., 2022). Additional design layers, such as cooling periods or vesting schedules for newly delegated tokens, could further deter strategic manipulation.

Combining capital- and reputation-based mechanisms may be necessary to mitigate collusion and ensure delegation accountability. For example, a nomination committee (NomCom) certifies delegate eligibility based on past contributions, while holding no direct voting power. Non-transferable “credit tokens” issued for meaningful participation would need to be actively allocated or expired, reducing passive influence. Delegates with broad endorsements gain legitimacy, while misconduct could penalize not only the delegate but also endorsers through token slashing. This layered approach blends social trust and economic commitment to limit governance distortions (Cardaso, 2022; Gilson and Bouraga, 2024; Casella et al., 2022). Finally, it is important to acknowledge that the design concepts discussed here remain underexplored in scientific literature. Their feasibility, risks, and effects require further systematic study before conclusions can be drawn.

Author contributions

LW: Writing – review and editing, Methodology, Writing – original draft, Investigation, Formal Analysis, Conceptualization. FL: Conceptualization, Investigation, Writing – original draft, Writing – review and editing. KK: Formal Analysis, Writing – original draft, Conceptualization, Writing – review and editing, Investigation. KC: Conceptualization, Writing – review and editing, Investigation, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors are affiliated with Molecule (molecule.xyz; FL, KK, KC) and BIO (bio.xyz; LW), organizations dedicated to advancing DAOs in the scientific field. These affiliations did not influence the content or conclusions of this study.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Agrawal, A. K. (2012). Corporate governance objectives of labor union shareholders: evidence from proxy voting. Rev. Financial Stud. 25 (1), 187–226. doi:10.1093/rfs/hhr081

Appel, I., and Grennan, J. (2024). Decentralized governance and digital asset prices. Darden Business School Working Paper No. 4367209. doi:10.2139/ssrn.4367209

Austgen, J., Fábrega, A., Allen, S., Babel, K., Kelkar, M., and Juels, A. (2023). DAO decentralization: voting-bloc entropy, bribery, and dark DAOs. arXiv preprint. doi:10.48550/arXiv.2311.03530

Axelsen, H., Jensen, J. R., and Ross, O. (2023). When is a DAO decentralized? arXiv preprint arXiv:2304.08160. J. Complex Syst. Inf. Model. Q., 51–75. doi:10.7250/csimq.2022-31.04

Berthelsen, A. S., and Bjellerås, E. (2023). Best practices in decentralized autonomous organization (DAO) venture capital: a bibliometric analysis and systematic review. Master’s thesis, University of Agder. Available online at: https://hdl.handle.net/11250/3081667. (Accessed May 9, 2025).

Cardoso, A. G. (2022). Decentralized autonomous organizations – DAOs: the convergence of technology, law, governance, and behavioral economics. SSRN. doi:10.2139/ssrn.4341884

Casella, A., Campbell, J., de Lara, L., Mooers, V., and Ravindran, D. (2022). Liquid democracy: two experiments on delegation in voting. SSRN. doi:10.2139/ssrn.4307183

Davidson, S. (2024). The private provision of public goods: the case of decentralized autonomous organizations. SSRN. doi:10.2139/ssrn.5041735

De Filippi, P., Mannan, M., and Reijers, W. (2020). Blockchain as a confidence machine: the problem of trust and challenges of governance. Technol. Soc. 62, 101284. doi:10.1016/j.techsoc.2020.101284

Ding, Q., Liebau, D., Wang, Z., and Xu, W. (2023b). A survey on decentralized autonomous organizations (DAOs) and their governance. World Sci. Annu. Rev. Fintech 1, 2350001. doi:10.2139/ssrn.4378966

Ding, Q., Xu, W., Wang, Z., and Lee, D. K. C. (2023a). Voting schemes in DAO governance. World Sci. Annu. Rev. Fintech 1, 2350004. doi:10.1142/S2811004823500045

Falk, B., Pathan, T., Rigas, A., and Tsoukalas, G. (2024). Blockchain governance: an empirical analysis of user engagement on DAOs. arXiv preprint arXiv:2407.10945.

Fan, Y., Zhang, L., Wang, R., and Imran, M. A. (2024). Insight into voting in DAOs: conceptual analysis and a proposal for evaluation framework. Netw. Mag. Glob. Internetworking 38 (3), 92–99. doi:10.1109/MNET.137.2200561

Fritsch, R., Müller, M., and Wattenhofer, R. (2024). Analyzing voting power in decentralized governance: who controls DAOs? Blockchain Res. Appl. 5 (3), 100208. doi:10.1016/j.bcra.2024.100208

Fukuyama, F. (2016). Governance: what do we know, and how do we know it? Annu. Rev. Political Sci. 19, 89–105. doi:10.1146/annurev-polisci-042214-044240

Gersbach, H., Mamageishvili, A., and Schneider, M. (2021). Vote delegation and misbehavior. arXiv preprint. doi:10.48550/arXiv.2102.08823

Gilson, C., and Bouraga, S. (2024). Enhancing the democratic nature of voting processes within decentralized autonomous organizations. Digital Policy, Regul. Gov. 26 (2), 169–187. doi:10.1108/DPRG-09-2023-0126

Green-Armytage, J. (2014). Direct voting and proxy voting. Const. Polit. Econ. 26 (2), 190–220. doi:10.1007/s10602-014-9176-9

Han, J., Lee, J., and Li, T. (2024). A review of DAO governance: recent literature and emerging trends. SSRN. doi:10.2139/ssrn.5074046

Jessop, B. (1998). The rise of governance and the risks of failure: the case of economic development. Int. Soc. Sci. J. 50 (155), 29–45. doi:10.1111/1468-2451.00107

Kaal, W. A. (2021). A decentralized autonomous organization (DAO) of DAOs. SSRN. doi:10.2139/ssrn.3799320

Kim, S. H. (2024). Transitive delegation in social networks: theory and experiment. Eur. J. Political Econ. 82, 102531. doi:10.1016/j.ejpoleco.2024.102531

Kitzler, S., Balietti, S., Saggese, P., Haslhofer, B., and Strohmaier, M. (2023). The governance of decentralized autonomous organizations: a study of contributors’ influence, networks, and shifts in voting power. 313, 330. doi:10.1007/978-3-031-78679-2_17

Kurniawan, W., Jansen, S., and van der Werf, J. M. (2022). Voting mechanism selection for decentralized autonomous organizations. Available online at: https://secureseco.org/wp-content/uploads/2022/08/Voting_Mechanism_Selection_for_Decentralized_Autonomous_Organizations-3-1.pdf (Accessed May 9, 2025).

Lloyd, T., O'Broin, D., and Harrigan, M. (2024). “The on-chain and off-chain mechanisms of DAO-to-DAO voting,” in IEEE international conference on blockchain (blockchain) (Copenhagen), 649–655. doi:10.1109/Blockchain62396.2024.00095

Lu, C., Liu, Z., and He, P. (2024). The impact of delegation mechanism on the governance of decentralized autonomous organizations. PACIS 2024 Proc. 3. Available online at: https://aisel.aisnet.org/pacis2024/track15_govce/track15_govce/3. (Accessed May 9, 2025).