- Putilov Institute for Informatics and Mathematical Modeling Kola Science Centre of the Russian Academy of Sciences, Apatity, Russia

Introduction: This article presents a method for short-term cryptocurrency price forecasting utilizing news headlines.

Methods: The study analyzes the impact of news on asset prices within one hour of publication, employing machine learning-based classification with BERT and GPT models, as well as GloVe vector representations.

Results: The proposed cascade classifier model enhances prediction accuracy by initially assessing the strength of a news item and subsequently forecasting the direction of price movement. Experimental results demonstrate the effectiveness of the developed classification model.

Discussion: The model achieves an accuracy of 79% in predicting price movements, confirming the potential of leveraging news headlines to improve short-term forecasts in cryptocurrency markets.

1 Introduction

With the advancement of artificial intelligence methods, there has been a surge in models utilizing sequential analysis of historical and real-time market data for short- and medium-term predictions. Despite significant progress in data mining and intelligent analysis, forecasting price fluctuations remains a highly uncertain task due to the complex and multifaceted nature of financial markets. The focus of this study is to examine the impact of public discourse shaped through news headlines on the market dynamics of highly volatile assets, using cryptocurrency as a case study. Particular attention is given to assessing the degree of predictability of these price fluctuations over a short-term time horizon.

Asset price changes are the result of interactions among a wide range of economic, political, behavioural, and external factors. Market value is undoubtedly influenced by quantitatively measurable indicators such as trading volume, transaction dynamics, market conditions, and other macroeconomic factors. However, price formation is also significantly affected by poorly formalized variables, including political events, investor behaviour, capitalization structure, and other exogenous factors. While these elements often possess high predictive relevance, they are rarely integrated into forecasting models comprehensively and systematically.

These factors are frequently reflected in the news landscape, which not only accompanies but can also trigger asset price fluctuations. The news environment particularly when represented through real-time news streams is highly dynamic and constitutes a critical source of information used by market participants when making investment decisions. Major capital movements themselves often become subjects of media coverage. This study aims to identify and quantitatively assess the relationship between news flows and changes in asset market value.

2 Literature review

Bitcoin, conceived in 2008 by Nakamoto (2008), stands as the pioneering and most widely recognized decentralized digital currency underpinned by blockchain technology. Its distinctiveness lies in the absence of a central governing authority, the transparency of all transactions recorded on a public ledger (the blockchain), and the cryptographic security measures that ensure network integrity. The inherent decentralized nature of Bitcoin and its finite supply contribute to a unique market dynamic that significantly diverges from traditional financial assets.

A crucial factor shaping Bitcoin’s dynamics and adoption is trust. As highlighted by Zarifis and Fu (2024), trust in blockchain technology, decentralized systems, and Bitcoin itself plays a pivotal role in its legitimization and proliferation. Notably, various facets of trust, such as trust in the protocol, the community, and economic incentives, may hold varying degrees of significance for different user groups. Furthermore, Steinmetz et al. (2021) points out that the adoption of cryptocurrencies, including Bitcoin, is heavily influenced by institutional trust and the perception of risks. Research indicates that trust-related factors can be fundamental to understanding the behavioural aspects within cryptocurrency markets, which in turn impacts pricing mechanisms. Chapter 6 of Baur et al. (2015) further delves into the concept of trust within digital systems, providing a theoretical foundation for comprehending how public discourse can shape this trust and influence market behaviour.

The broader field of financial forecasting has witnessed significant advancements, with a growing emphasis on hybrid models that integrate various analytical techniques. Traditionally, financial market prediction has relied on econometric models and statistical methods, such as ARIMA (Ariyo et al., 2014) and GARCH (Bauwens et al., 2006), which excel at capturing historical patterns and volatility. However, the complex and often non-linear nature of financial markets has led to the development of more sophisticated approaches. Recent advancements in artificial intelligence, particularly deep learning, have allowed for the processing of vast and diverse datasets, including textual information from news and social media. The work by Dalila Ressi et al. (2024) provides a comprehensive review of how AI is enhancing blockchain technology, highlighting opportunities in areas like financial forecasting, which underscores the synergistic potential of combining these fields.

Numerous studies have examined the reliability and accuracy of stock forecasting models based on historical data analysis. In Kraaijeveld and De Smedt (2020) demonstrated a correlation between Twitter sentiment and cryptocurrency price movements. This was one of the first studies to show that public opinion could be a valuable predictor of price trends, especially in the highly volatile cryptocurrency market.

In Poongodi’s work (Poongodi et al., 2020), deep neural networks were employed to forecast Ethereum prices using news signals. This approach showed high effectiveness but focused on more complex deep-learning architectures and day-level predictions.

The studies conducted by Altan et al. (2019) and Chowdhury et al. (2020) utilized machine learning techniques and sequence analysis for cryptocurrency price prediction; however, their work was oriented toward forecasting over longer horizons, such as weekly or daily intervals.

In the works of Seabe et al. (2023), Hamayel and Owda (2021), and Park (2022), a solution was proposed to address slippage issues in currency exchange using LSTM-based neural networks. While sequence analysis methods improved predictive accuracy, they also required longer intervals for generating predictions.

It is worth highlighting research that incorporates weakly formalized factors for forecasting the value of less volatile assets. For instance, Bareith’s study (Bareith et al., 2024) explored the impact of inflation on investment portfolios and stock price forecasting. The authors employed artificial intelligence models for risk analysis and asset management, demonstrating that modern algorithms can adapt to shifts in macroeconomic conditions.

Chatterjee’s study (Chatterjee et al., 2024) investigated the impact of the COVID-19 pandemic on the accuracy of Bitcoin price forecasting models. The researchers tested various machine learning algorithms, including gradient boosting and LSTM, using data from January to July 2020. The results indicated that models accounting for macroeconomic events provided more accurate forecasts under crisis conditions. The study underscores the capability of recurrent neural networks to effectively identify temporal dependencies in digital asset price dynamics.

Recent research indicates that hybrid models combining time series analysis with deep neural architectures can achieve high prediction accuracy for cryptocurrency prices. These studies demonstrate that applying machine learning and artificial intelligence not only improves forecasting performance but also facilitates the inclusion of macroeconomic factors. However, the high volatility of the cryptocurrency market necessitates further model refinement, particularly under abrupt macroeconomic shifts. Additionally, most studies focus on daily time frames, limiting their ability to capture the short-term fluctuations characteristic of crypto markets.

The hypothesis of this study is that, given the rapid dissemination of information and the transparency of cryptocurrency financial markets, uncertainty stemming from economic indicators, political events, market sentiment, etc., is reflected in news streams in a leading manner.

To test the hypothesis, Bitcoin (BTC) was selected as the target asset due to its well-developed news landscape, high volatility, and widespread adoption. As of June 2024, the global number of cryptocurrency users was estimated at approximately 617 million (Matsuoka, 2024). According to Glassnode (2025), the daily transaction volume of Bitcoin reached $46.4 billion, surpassing that of both Visa and Mastercard.

This study proposes a method for short-term BTC price forecasting, treating the asset as one significantly influenced by news coverage and/or trending within news streams. While most similar studies focus on longer forecasting horizons typically daily intervals this research is centered on a 1-h time frame. This distinction makes the method particularly suitable for short-term applications, such as addressing the issue of price slippage (Wen and Huang, 2024).

The method involves monitoring and processing the textual content of news streams, specifically news headlines, using machine learning techniques. The analysis of the news stream was performed through classification using various machine learning models, including the Global Vectors for Word Representation (GloVe), Bidirectional Encoder Representations from Transformers (BERT), and the Generative Pre-trained Transformer (GPT). The proposed news analysis method has the potential for adaptation across various applied domains involving decision-making under uncertainty and/or incomplete data.

3 Data description

To validate the hypothesis, a dataset was collected from Google News, including exact timestamps of news publications and corresponding BTC price changes within the subsequent hour.

News monitoring was conducted over 18-month period by continuously processing the Google News RSS feed. Continuous monitoring was necessary due to the lack of precise timestamp data in archived news sources. In parallel, historical BTC price data was gathered via the Binance cryptocurrency exchange API. The difference in asset value was recorded between the moment the news was published and 1 hour afterward.

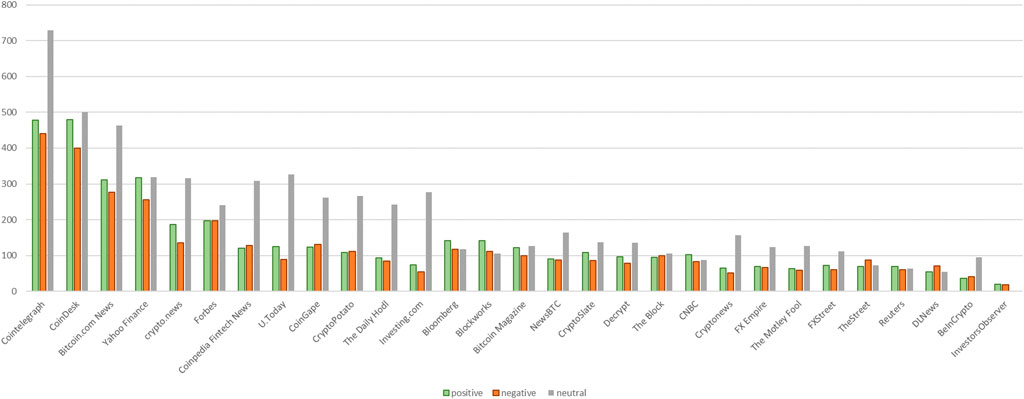

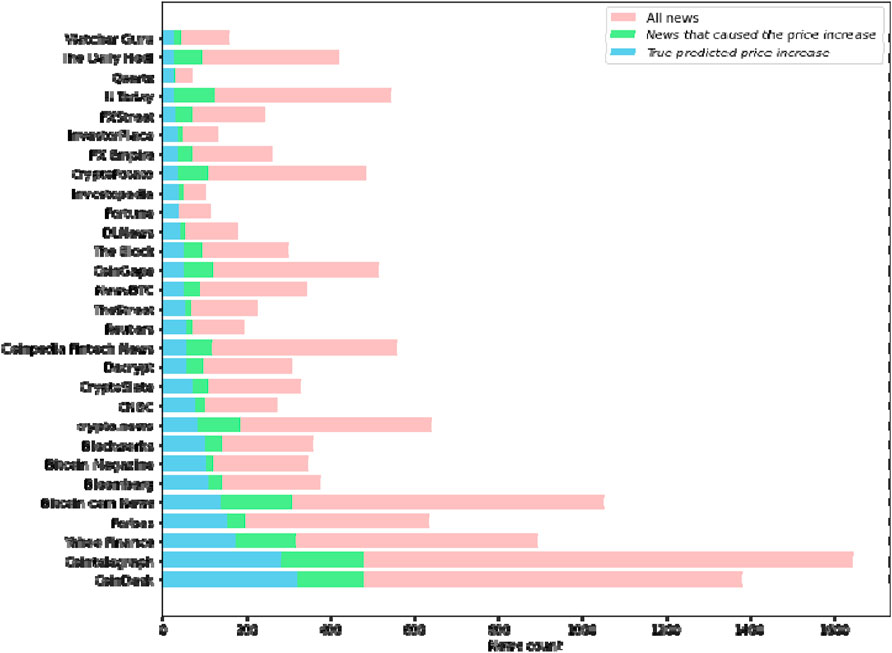

After removing entries lacking exact timestamps, the final dataset consisted of 23,423 records, each containing a news headline, its publication timestamp, and the corresponding change in BTC price. This dataset is publicly available in a repository (Dikovitsky, 2024). The dataset includes news headlines from 364 unique news sources. The following section presents the distribution of these sources and their corresponding market responses. Figure 1 illustrates the distribution of news by source and the corresponding market reaction.

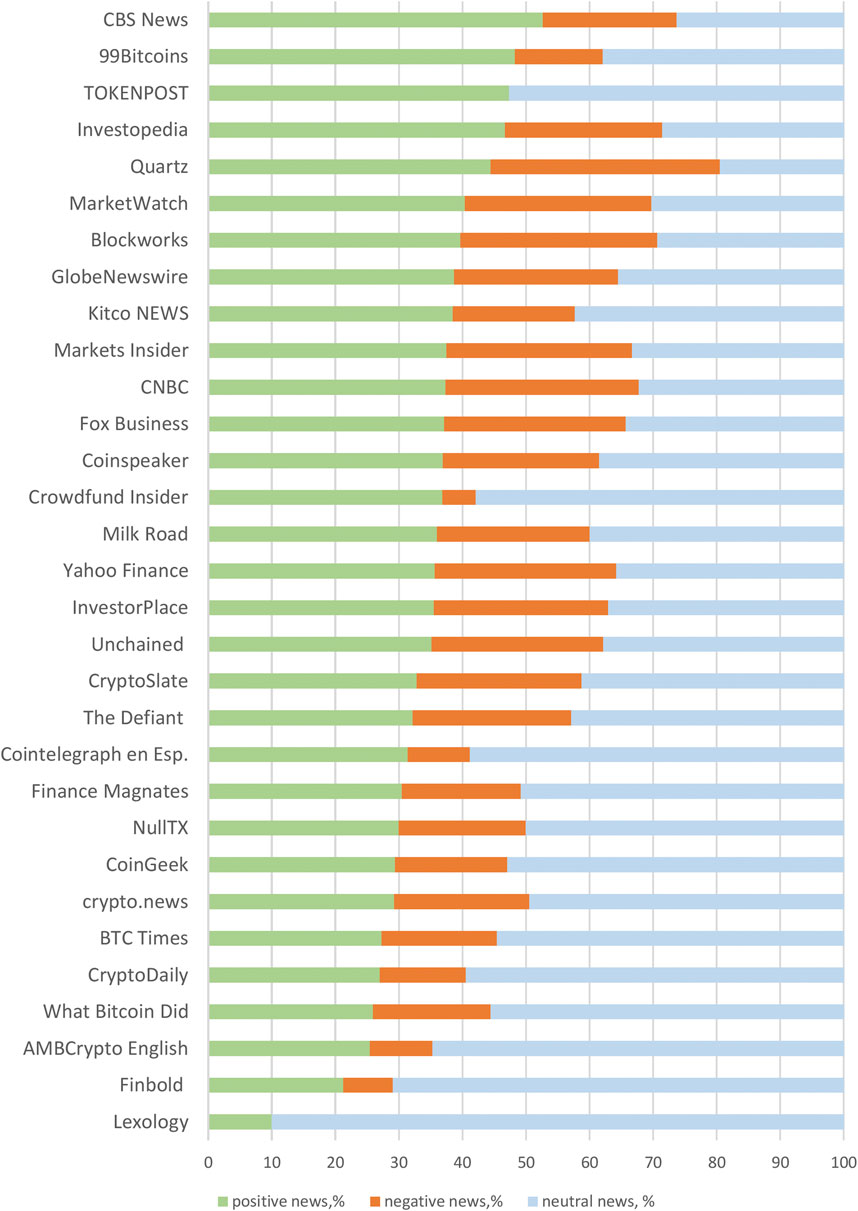

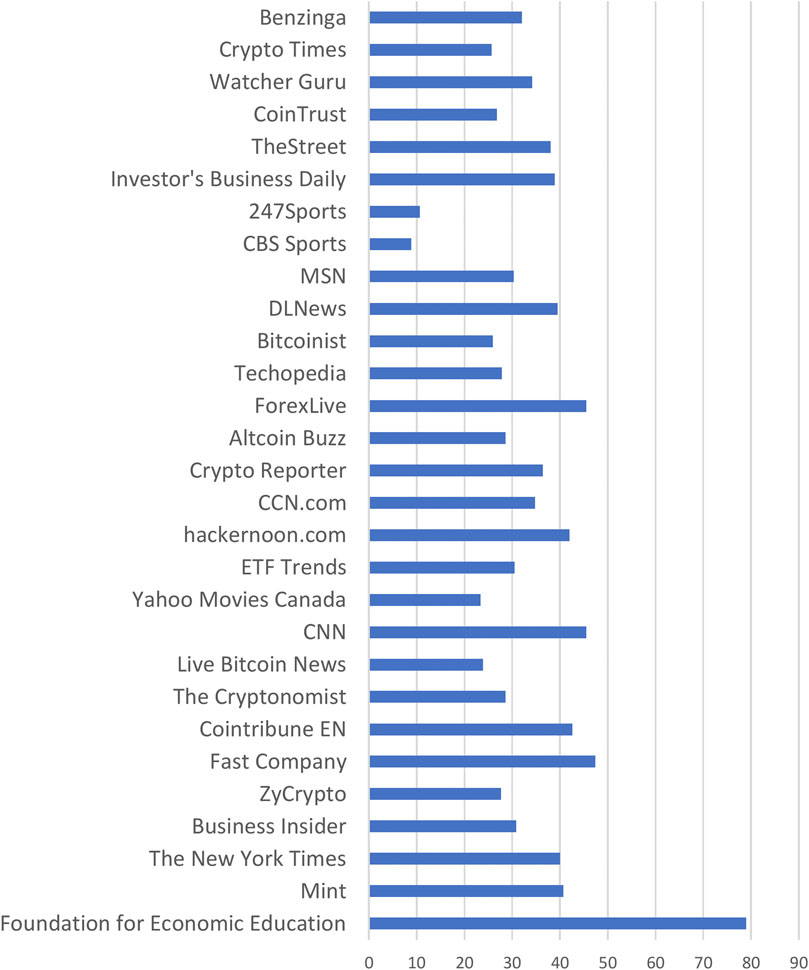

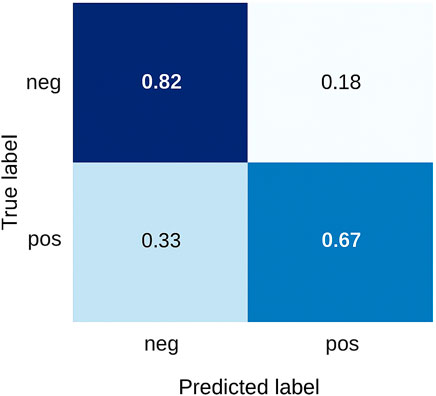

Among the news sources, we will highlight the 30 leading ones by the largest share of positive publications in relation to their total number (Figure 2).

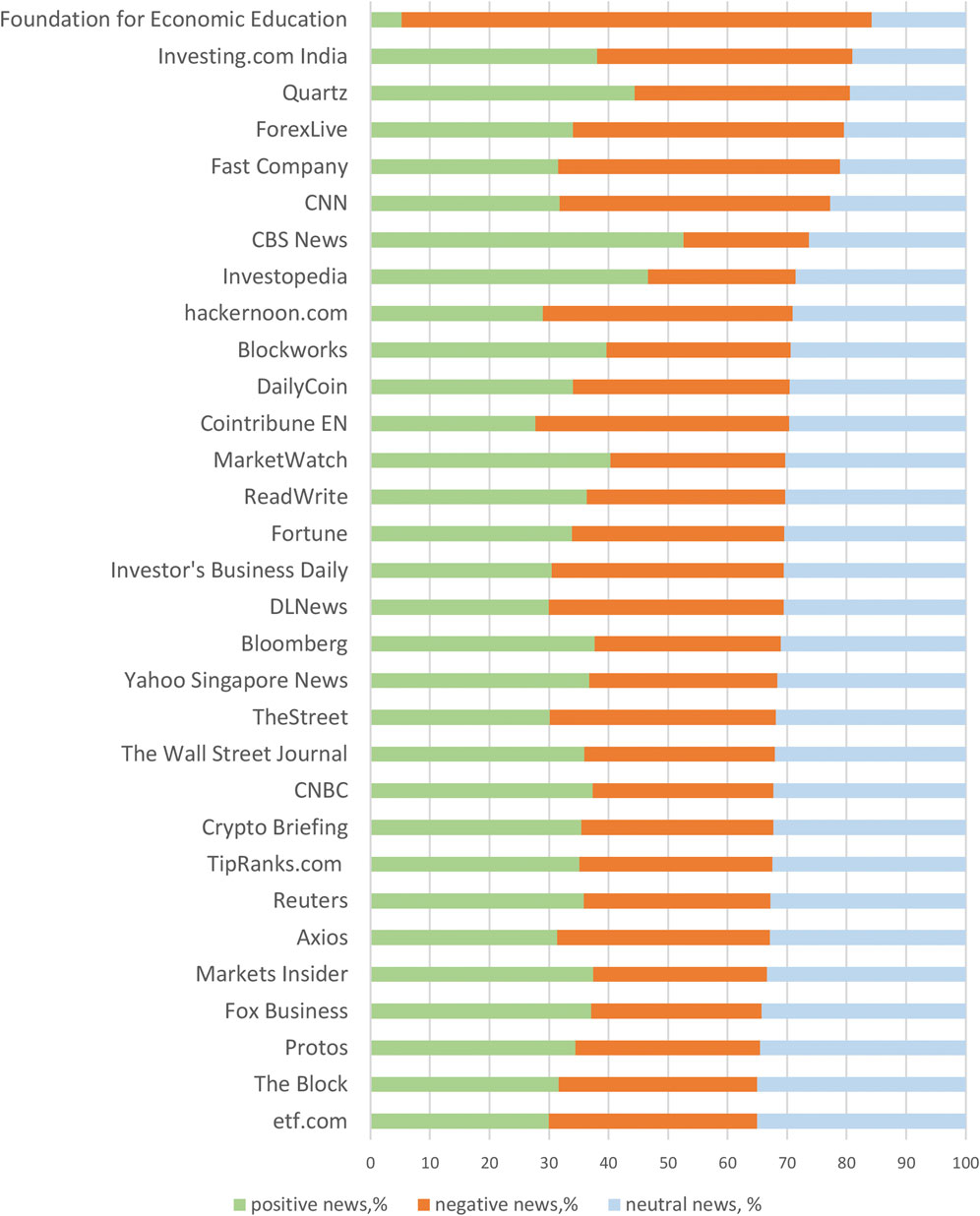

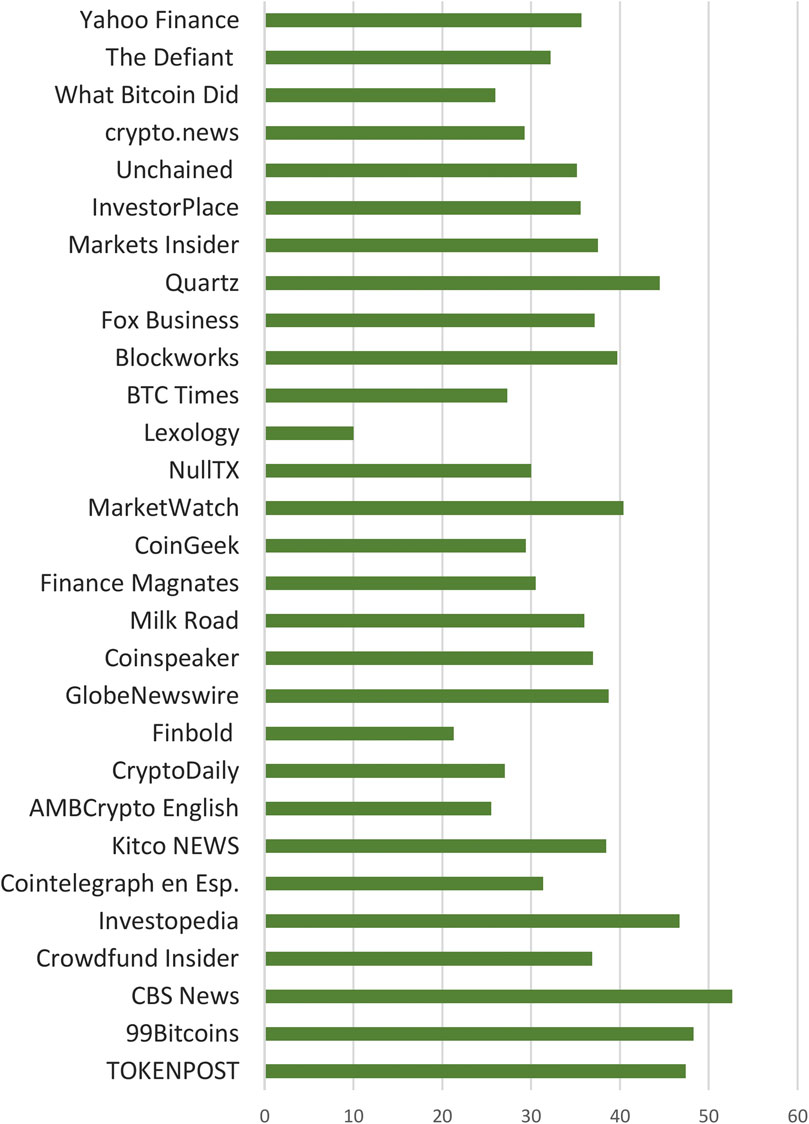

Figure 3 highlights the 30 publications whose news had the most significant impact (both negative and positive) on the asset’s value. Figures 4, 5 display the share of positive and negative news among the top-30 publishers, ranked by the number of positive and negative reactions.

4 Methods

Previous research (Shishaev et al., 2023) rigorously evaluated the semantic extraction capabilities of the GloVe (Global Vectors for Word Representation) contextualized vector model within the domain of SKOS (Simple Knowledge Organization System) ontology construction. Their empirical analysis demonstrated that the contextual embeddings generated by GloVe encode substantial semantic information, sufficient for establishing hierarchical and associative ontological relationships (e.g., broader, narrower, and related) between lexical pairs.

This model was selected as our baseline for comparative analysis due to its demonstrated semantic richness despite the relatively constrained corpus size utilized in the original study. To ensure a comprehensive evaluation of semantic representation capabilities across different embedding paradigms, we extended our methodological framework by benchmarking these results against classifier architectures founded on more recent transformer-based models specifically BERT (Bidirectional Encoder Representations from Transformers) and GPT (Generative Pre-trained Transformer). This comparative approach allows for a systematic assessment of how different embedding technologies capture the nuanced semantic content of financial news headlines.

The experimental dataset comprises 23,423 cryptocurrency-related news items collected over a 17-month period from September 2023 to February 2025. Each record in the dataset contains four key elements:

1. News headline text

2. Publication source identifier

3. Publication timestamp

4. Corresponding change in the BTC/USDT exchange rate on Binance within a 1-h window following publication

The cryptocurrency price data was programmatically retrieved using the Ccxt (CryptoCurrency eXchange Trading) library interfacing with the Binance API, ensuring standardized and reliable financial data acquisition. News content was systematically collected by parsing the RSS feed from news.google.com using the specific query string: “BTC blockchain bitcoin cryptocurrency”. This approach ensured a comprehensive capture of relevant news items while minimizing noise from unrelated financial news.

In the initial phase of our experimental framework, we constructed and trained a binary classifier based on vector embeddings implemented through a feedforward neural network (FNN) architecture. This approach was selected for its demonstrated efficacy in classification tasks with fixed-length input vectors.

Since our classifier was designed for discrete, single-news classification rather than sequence analysis, each headline was processed independently. The headlines were vectorized using the pre-trained glove.6B.300d embedding model, which contains 300-dimensional vectors for 6 billion tokens trained on a corpus of Wikipedia articles and Gigaword. This embedding approach transforms each headline into a dense vector representation that captures semantic relationships between words.

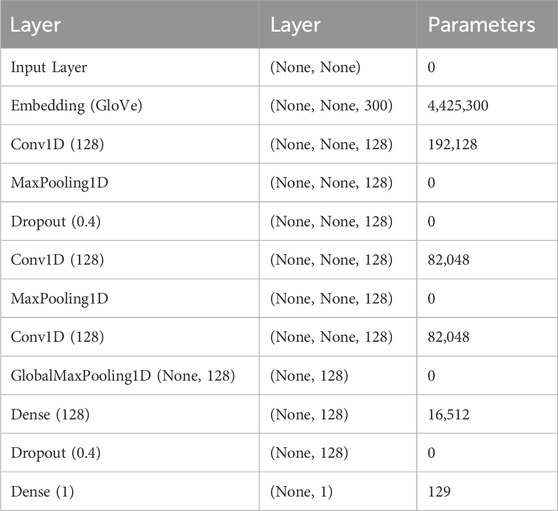

The architecture that achieves the balance between model complexity and generalization capability, as demonstrated by our cross-validation experiments is presented below (Table 1).

The final number of parameters in the model was 4,798,165. Binary cross-entropy was used as the loss function, with a batch size of 128. To prevent overfitting Dropout rate of 0.4 was used. And L2 regularization coefficient of 1e-6 to constrain model complexity.

The classification accuracy on the validation set reached 72.1%, with a loss value of 0.6029.

The binary classifier based on BERT demonstrated a higher accuracy in predicting the direction of price movement, achieving an accuracy of 0.80 with a loss value of 0.49.

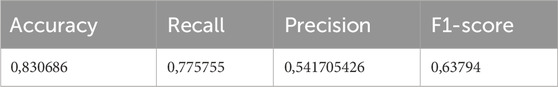

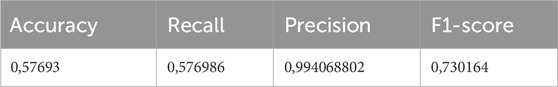

To improve performance and reduce loss, a task decomposition approach was applied. The original dataset was split into two separate training sets: one for classifying the influence strength of a news item on the market (regardless of price movement direction), and the other for classifying the direction of price movement. A cascade classification architecture was implemented using two feedforward neural network (FNN) classifiers. The first classifier determines whether a news item significantly impacts the asset price (i.e., increases or decreases it by more than 0.5%). The second classifier predicts the direction of price movement (upward or downward). The results are presented in Tables 2, 3.

To assess the performance of both classifiers, several standard classification metrics were applied:

Accuracy measures the proportion of correct predictions among all predictions:

Recall (also called Sensitivity) measures the proportion of actual positives that were correctly identified:

Precision quantifies the number of correct positive predictions relative to the total number of predicted positives:

F1-score is the harmonic mean of precision and recall:

where TP = True Positives, TN = True Negatives, FP = False Positives, and FN = False Negatives.

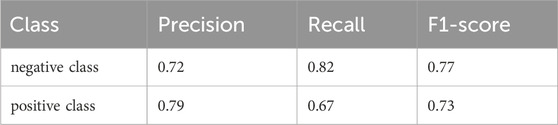

In the price direction classification task, the best result was shown by the classifier based on GPT with 1.5 billion parameters. Table 4 presents the results of GPT training for price direction classification.

The distribution of predicted and actual classes for the model is presented in the confusion matrix (Figure 6).

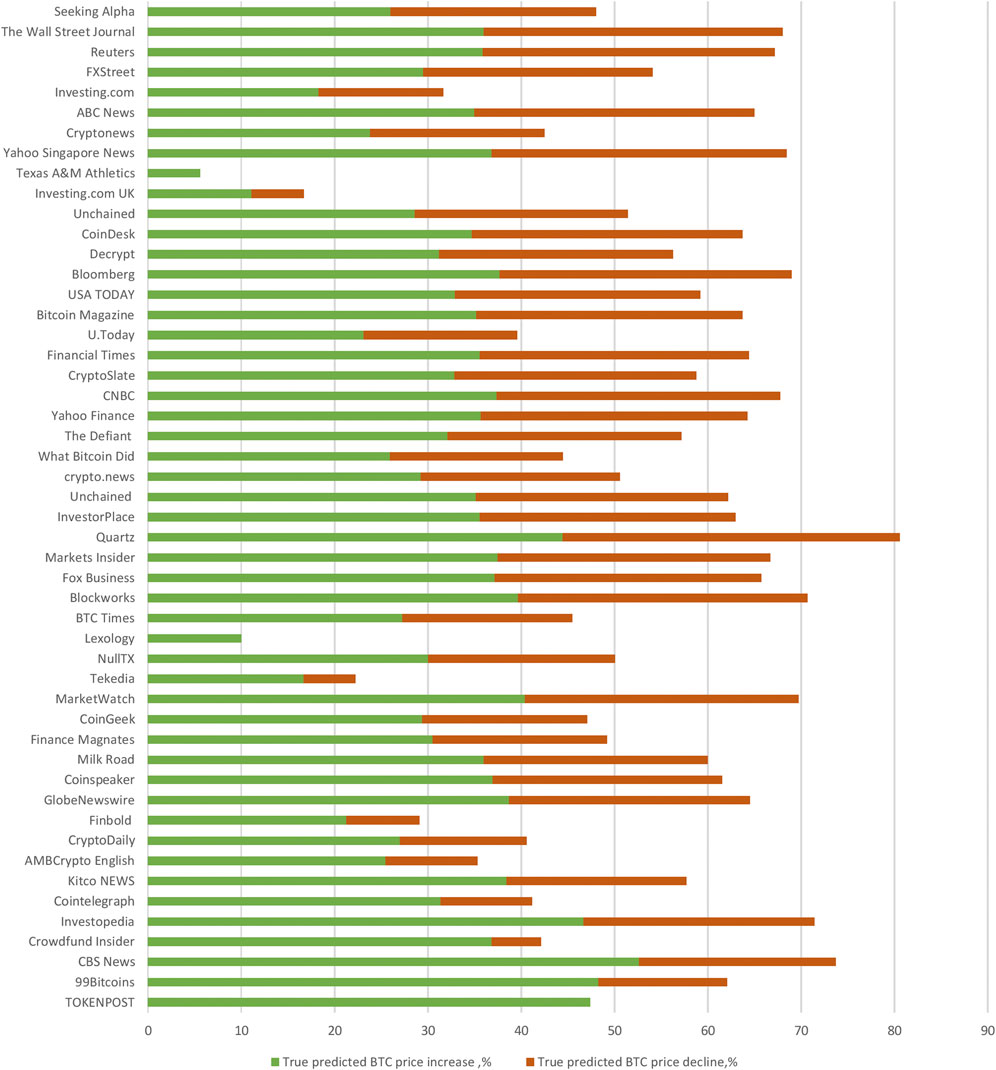

The results of testing the cascade classifier, which sequentially determines the news impact strength and the price movement direction, are presented below. A subset of news publishers whose headlines yielded the highest prediction accuracy was identified. A histogram of the top 30 publishers is shown, ranked by overall accuracy, as well as by true positive and true negative predictions (Figure 7).

Figure 8 illustrates the distribution of predictions per publisher, relative to the total number of news items published by each source.

Figure 8. Distribution of news items that triggered price increases, correctly predicted cases, and the total number of news items per publisher.

5 Discussion

The results presented in this study represent an initial stride towards understanding the intricate relationship between news headlines and short-term Bitcoin price fluctuations. While our findings demonstrate promising avenues for incorporating public discourse into predictive models, it is crucial to acknowledge that these outcomes serve as a foundational step and are subject to further refinement and enhancement.

Error analysis revealed that the model most frequently misclassifies headlines that lack explicit references to price movement but may exert indirect influence. For instance, headlines mentioning technical updates in blockchain networks are often incorrectly classified as weak news, despite potentially having a strong market impact. This indicates a limitation in capturing the nuanced or indirect impact of certain news categories based solely on headlines.

A significant methodological limitation of the current approach lies in its primary reliance on headline-level analysis without comprehensive full-text contextual integration. Headlines offer a limited context and can sometimes be intentionally misleading, such as in the case of “clickbait” titles, potentially altering the intended meaning. To mitigate this, our study incorporates distribution across publications as a filtering mechanism. However, for enhanced predictive reliability and to address the misclassification of indirectly influential headlines, the inclusion of additional data specifically, the full text of news articles is proposed to enhance contextual understanding.

Furthermore, improving the accuracy in classifying “weak news” significantly boosts the overall performance of the cascade classifier. This highlights the importance of a nuanced understanding of news impact, where less direct information can collectively contribute to market dynamics. Although BERT delivers excellent results in text processing due to its deep contextual understanding, GloVe offers distinct advantages due to its lower computational complexity. This makes GloVe preferable in resource-constrained environments, especially in real-time applications such as automated trading systems, where speed is paramount.

6 Conclusion

This study proposes a cascade classifier approach, which first classifies news headlines as either “strong” or “weak” based on their influence on price movement. For headlines deemed strong, a second classifier is used to predict the direction of the price change. This approach shows promise for applications in short-term cryptocurrency price forecasting.

Future work will focus on enhancing the classifier’s performance by incorporating additional features for direction prediction, such as market indicators and historical sentiment analysis data. Moreover, tuning regularization and hyperparameters is a priority. Applying more aggressive regularization techniques (e.g., Dropout and L2 regularization) may help reduce overfitting, particularly in stages involving limited data. Future research also directly addresses methodological limitations and aims to improve the robustness of our forecasting model. This includes a comprehensive analysis of news sequences to reduce noise and track delayed impacts of information. By examining a series of news events over time, we anticipate being able to better filter out transient fluctuations and identify more stable trends. Furthermore, improvement involves expanding the input data to encompass not only news headlines but also the full text of news articles. Current vectorization methods, constrained by vector size, often cannot accommodate the entire news content, limiting the depth of semantic understanding. To overcome this, future work will explore the application of larger language models (LLMs) and advanced “deep thinking” models. These models, with their enhanced capacity for understanding complex textual relationships, hold the potential to extract logical implications and perform inference based on news events. This would allow for the creation of a more “meaningful vector” that captures the nuanced logic and reasoning embedded within news narratives, moving beyond simple keyword or sentiment analysis.

The rapid execution time for headline analysis (milliseconds per headline) is a notable advantage, facilitating the deployment of our trained classifier in real-time applications. This speed is also crucial for implementing an analysis of news streams to track trends and counteract noise caused by erroneous predictions. By continuously monitoring the flow of news, we can identify sustained patterns of information and potentially correct for isolated misleading signals, thereby enhancing the overall stability and accuracy of the short-term forecasts.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

VD: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Altan, A., Karasu, S., and Bekiros, S. (2019). Digital currency forecasting with chaotic metaheuristic bio-inspired signal processing techniques. Chaos, Solit. and Fractals 126, 325–336. doi:10.1016/J.CHAOS.2019.07.011

Ariyo, A. A., Adewumi, A. O., and Ayo, C. K. (2014). “Stock price prediction using the ARIMA model,” in 2014 UKSim-AMSS 16th international conference on computer modelling and simulation. IEEE.

Bareith, T., Tatay, T., and Vancsura, L. (2024). Navigating inflation challenges: AI-based portfolio management insights. Risks 12, 46. doi:10.3390/risks12030046

Baur, A. W., Bühler, J., Bick, M., and Bonorden, C. S. (2015). “Cryptocurrencies as a disruption? Empirical findings on user adoption and future potential of bitcoin and Co,” in Open and big data management and innovation. I3E 2015. Lecture notes in computer science. Editor M. Janssen (Cham: Springer), 9373. doi:10.1007/978-3-319-25013-7_6

Bauwens, L., Laurent, S., and Rombouts, J. V. K. (2006). Multivariate GARCH models: a survey: a Surv.//Journal Appl. Econ. 21. 1, 79–109. doi:10.1002/jae.842

Chatterjee, I., Chakraborti, S., and Tono, T. (2024). A comparative study of bitcoin price prediction during pre-Covid19 and whilst-Covid19 period using time series and machine learning models. Discov. Anal. 2, 19. doi:10.1007/s44257-024-00024-z

Chowdhury, R., Arifur Rahman, M., Sohel Rahman, M., and Mahdy, M. R. C. (2020). An approach to predict and forecast the price of constituents and index of cryptocurrency using machine learning. Phys. A Stat. Mech. its Appl. 551, 124569. doi:10.1016/j.physa.2020.124569

Dikovitsky, V. (2024). News dataset. San Francisco, CA: GitHub repository. Available online at: https://github.com/Dikovitsky-Vladimir/Dataset_btc_news.

Glassnode (2025). Digital assets insights and market trends. Available online at: https://get.glassnode.com/cryptocurrency-trends-2024-h1-report.

Hamayel, M. J., and Owda, A. Y. (2021). A novel cryptocurrency price prediction model using GRU, LSTM and bi-LSTM machine learning algorithms. 2 4 477–496. doi:10.3390/ai2040030

Kraaijeveld, O., and De Smedt, J. (2020). “The predictive power of public Twitter sentiment for forecasting cryptocurrency prices,”, 65. Elsevier. doi:10.1016/j.intfin.2020.101188J. Int. Financial Mark. Institutions Money101188C

Matsuoka, D. (2024). State of crypto report 2024: new data on swing states, stablecoins, AI, builder energy, and more. Available online at: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/.

Nakamoto, S. (2008). Bitcoin: a peer-to-peer electronic cash system. Available online at: www.bitcoin.org.

Park, H. (2022). “Dynamic constant product market maker using cryptocurrency price prediction based on deep learning: дис,”. Gwangju Institute of Science and Technology. Available online at: https://heungno.net/wp-content/uploads/2022/08/20201123_Ha-youngPark.pdf.

Poongodi, M., Sharma, A., Vijayakumar, V., Bhardwaj, V., Sharma, A. P., Iqbal, R., et al. (2020). Prediction of the price of ethereum blockchain cryptocurrency in an industrial finance system. Comput. and Electr. Eng. 81, 106527. doi:10.1016/J.COMPELECENG.2019.106527

Ressi, D., Almenara, C. A., Ristau, S., and Rossi, S. (2024). AI-enhanced blockchain technology: a review of advancements and opportunities. J. Netw. Comput. Appl. 225, 103858. doi:10.1016/j.jnca.2024.103858

Seabe, P. L., Moutsinga, C. R. B., and Pindza, E. (2023). Forecasting cryptocurrency prices using LSTM, GRU, and bi-directional LSTM: a deep learning approach. Fractal Fract. Т. 7, 203. doi:10.3390/fractalfract7020203

Shishaev, M., Dikovitsky, V., Pimeshkov, V., Kuprikov, N., Kuprikov, M., and Shkodyrev, V. (2023). Extracting relations from texts using vector language models and a neural network classifier. PeerJ Comput. Sci. 9, e1636. doi:10.7717/peerj-cs.1636

Steinmetz, F., von Meduna, M., Ante, L., and Fiedler, I. (2021). Ownership, uses and perceptions of cryptocurrency: results from a population survey. Technol. Forecast. Soc. Change 173, 121073. doi:10.1016/j.techfore.2021.121073

Wen, Y.-F., and Huang, C.-M. (2024). “Stability analysis of market-making mechanisms for decentralized cryptocurrency exchanges,” in 2024 IEEE international conference on blockchain and cryptocurrency (ICBC), Dublin, Ireland, 299–301. doi:10.1109/ICBC59979.2024.10634337

Keywords: cryptocurrency, short-term forecasting, machine learning, Global Vectors for word representation (GloVe), bidirectional encoder representations from transformers (BERT), Generative Pre-trained Transformer (GPT), Bitcoin (BTC)

Citation: Dikovitsky V (2025) Short-term cryptocurrency price forecasting based on news headline analysis. Front. Blockchain 8:1627769. doi: 10.3389/fbloc.2025.1627769

Received: 13 May 2025; Accepted: 14 July 2025;

Published: 30 July 2025.

Edited by:

Carlo Campajola, University College London, United KingdomReviewed by:

Alex Zarifis, University of Southampton, United KingdomSabina Rossi, Ca’ Foscari University of Venice, Italy

Copyright © 2025 Dikovitsky. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Vladimir Dikovitsky, ZGlrb3ZpdHNreUBnbWFpbC5jb20=

Vladimir Dikovitsky

Vladimir Dikovitsky