- Department of Accountancy, College of Business and Economics, University of Johannesburg, Johannesburg, South Africa

Research question/Issue: Blockchain, as a disruptive technology, is reshaping organisational frameworks through its inherent immutability and robust security features. This offers significant potential to enhance corporate governance by fostering more efficient and effective governance models. This paper seeks to (1) critically assess the transformative influence of blockchain technology on corporate governance and (2) propose a “Holistic Governance Synthesis Framework” that identifies and evaluates the features, factors, benefits, risks and impacts of blockchain integration in corporate governance using various theoretical perspectives.

Research findings/Insight: A thematic analysis of 106 peer-reviewed articles on blockchain and corporate governance was conducted, with dataset retrieved from Web of science and Scopus. Analysis was carried out through manual review of papers and the use of research analysis tools. Analysis tools employed include Microsoft Excel, Harzing Publish or Perish (for data organisation, analysis and thematic coding), VOS viewer and LaTeX (for data visualisation). Identified key themes include critical features (e.g., immutability, smart contract, and traceability), impacts (e.g., investment efficiency, improved firm performance, and audit quality), risks and challenges (e.g., regulatory uncertainty, technical limitation and ethical concerns) associated with blockchain integration in corporate governance are discussed. Based on these emergent themes, conceptual frameworks were proposed to guide future blockchain applications in governance contexts.

Theoretical/Academic implications: Theories such as agency, institutional, stakeholder and transaction-cost economies were used to provide valuable insights for stakeholders. This is aimed at equipping management and shareholders with a nuanced understanding of the internal and external dynamics of blockchain adoption in corporate governance. It also offers implications for institutional bodies to develop regulations that recognize blockchain’s role, thereby enhancing monitoring mechanisms and mitigating associated risks.

Practitioner/Policy implications: This study offers insight to policymakers by advocating for regulatory frameworks that recognize and guide the integration of disruptive technologies, including blockchain, into corporate governance. Such policies should address the use of digital currencies and blockchain activities, enhancing tax recognition and reducing evasion.

1 Introduction

Blockchain technology has emerged as a transformative and disruptive innovation, redefining organisational paradigms through its decentralised, immutable, and secure architecture. Within corporate governance, this technology offers unprecedented potential to address longstanding challenges, including agency conflicts, information asymmetry, and transparency deficits, promising more accountable and efficient governance systems (Yermack, 2017). As organisations globally integrate blockchain to enhance stakeholder trust, operational integrity, and decision-making processes, the need for a systematic synthesis of prior research becomes critical. However, this study goes beyond mere compilation, aiming to critically evaluate the content, context, and evolution of blockchain’s integration with corporate governance.

Despite the growing academic and practical interest, literature reveals a significant gap in holistic examinations of blockchain’s governance implications. Previous review papers, such as Radonjić et al. (2024) examined blockchain inclusion in the public sector by focusing on its economic and legal impacts. However, the study did not focus on corporate governance. Meiryani et al. (2023) conducted an eleven-year (2011–2022) bibliometric analysis of disruptive technologies—including artificial intelligence, big data, machine learning, and blockchain—in relation to corporate governance, using Scopus and OpenAlex. However, their broad scope lacked a focused exploration of blockchain’s specific governance applications. Similarly, Pimentel and Boulianne (2020) carried out a review of blockchain’s impact on accounting, advocating for further investigation into its governance dimensions. These efforts, while valuable, fall short of offering a targeted synthesis. In response, this research addresses this gap by not only systematically analysing prior peer-reviewed studies to map publication trends, theoretical underpinnings, and practical outcomes. But, to also critically interrogate whether these trends truly resolve governance issues or introduce new complexities. Thus, moving beyond a descriptive summary to provide a more extensive critique.

Theoretically, blockchain aligns with agency theory by providing real-time, transparent data access, potentially reducing information asymmetry (Akhtar et al., 2024b; Chen et al., 2021; Du et al., 2023). However, this alignment warrants scrutiny: does enhanced transparency mitigate agency costs and reduce principal-agent conflicts? Or does the black box nature of blockchain algorithms exacerbate oversight challenges?

Furthermore, blockchain resonates with stakeholder theory, facilitating engagement with diverse stakeholders such as shareholders, investors, policymakers, governments, customers, and employees—via immutable records of financial and non-financial activities, such as environmental, social, and governance (ESG) reporting and corporate social responsibility (CSR) initiatives (Freeman, 2010; Kshetri, 2018). Yet, this engagement raises questions about inclusivity: are all stakeholders equally empowered, or do technical barriers favour elite actors?

Practically, blockchain’s decentralised ledger enables real-time auditing, minimises financial misreporting, and empowers stakeholders with accurate data for informed decisions (Mutamimah et al., 2023). These attributes have spurred research into themes such as smart contracts, tokenisation, and decentralised autonomous organisations (DAOs), reflecting blockchain’s multifaceted governance potential. But literature often overlooks whether these benefits scale across diverse organisational contexts or mask implementation costs.

The immutability nature of blockchain has led to better transparency of corporate governance activities. These activities include both the financial and non-financial activities, such as the preparation and presentation of financial statements. Activities related to accounting for environmental, social, and governance (ESG), and corporate social responsibility (CSR) are also fostered by blockchain technology (Comoli et al., 2023; Kanojia, 2023; Meiryani et al., 2023; Zhang and Luo, 2022).

Decentralised ledger system reduces agency problems by providing real-time access to organisational activities and data. Although it has been argued that this potentially lowers errors through integrated auditing (Singh et al., 2020), yet a critical perspective reveals tensions. While stakeholders gain access to real-time data for decision-making (Mutamimah et al., 2023), the rigidity of immutable records may hinder adaptive governance in dynamic markets, a gap underexplored in existing studies. This paper challenges the prevailing narrative by proposing that blockchain’s benefits are contingent on its adaptability, a dimension often assumed rather than tested.

Thus, rather than merely summarising past trends, this paper seeks to critically assess the direction of literature, identifying where blockchain enhances governance and where it falls short, thereby offering a foundation for future, more robust investigations. In addition, this paper provides a theoretically based framework that presents the features, adoption drivers and impact of blockchain integration within corporate governance. Based on these major objectives, five research questions have been interrogated by this research.

1.1 Research questions

1. To access the bibliometric productivity of publications, journals, and publishers in the dataset, evaluate the maturity and diversity of the research landscape.

2. To examine the themes that emerged from the prior literature that have explored blockchain technology in corporate governance, critically analysing their governance implications.

3. To evaluate the theoretical support for blockchain technology inclusion in corporate governance, questioning the adequacy of existing frameworks (e.g., agency, stakeholder) and proposing refinements.

4. To conceptualise the motivating factors influencing the adoption of blockchain technology in corporate governance, interrogating whether these drivers align with organisational realities.

5. To present a conceptual framework on the impact of blockchain technology on corporate governance, integrating critical insights to guide future applications and address identified gaps.

This review of past literature not only consolidates prior theories and identifies emergent trends but also proposes conceptual frameworks to guide future research and practice. By examining keyword trends and corporate contexts, including smart contracts, tokenisation, and decentralised ledger systems, among others, has been studied. The study offers actionable insights for management, shareholders, and regulators. For academics, it provides a foundation for empirical investigations; for practitioners, it informs strategies to leverage blockchain; and for policymakers, it highlights opportunities to develop regulations enhancing monitoring and mitigating risks. Detailed in the methodology section, this work bridges theoretical and empirical gaps, positioning blockchain as a cornerstone of future governance innovation. The result formed the major discussion of this study.

2 Literature review

2.1 Blockchain technologies

The paradigm shift in technological usage has led to the emergence of various new technologies, which have altered the previously established systems related to the initiation and completion of diverse activities, either individually or corporately (Al Shanti and Elessa, 2023; Daluwathumullagamage and Sims, 2020; Davidson, 2025; Ezzi et al., 2023; Saurabh et al., 2024). Artificial intelligence, big data, and blockchain are some of the disruptive technologies shaping the present world (Kimani et al., 2020; Singh et al., 2020; Vermeulen et al., 2018; Yang et al., 2024). Of these, blockchain has been growing in acceptance, adoption, and usage, due to its potential to revolutionise activities.

Blockchain technology is an emergent technology based on a decentralised ledger-based structure. It was initially used for cryptocurrency but has been found to be of potential benefits to organisations due to its great characteristics, such as its immutability, traceability, and security of organisational transactions (Singh et al., 2020). These characteristics of blockchain technologies can prevent errors, mistakes, and fraudulent activities within an organisation’s corporate governance. Some of the dimensions in which blockchain is effective in improving corporate governance include the improvement of accounting, financial, and audit performance within the organisation, improvement of both operational and strategic decision-making, mitigating agency risks, and reduction of information asymmetry between all the relevant stakeholders within the corporate governance structure (Adelowotan and Coetsee, 2021). The consensus-based features of blockchain have shown the capability to transform industries by improving cost minimisation, organisational efficiency, and effectiveness within the industry.

Research has been conducted on blockchain adoption in developed economies such as the United States. Studies have also examined blockchain in large economies such as China (Fang et al., 2023; Zhu and Zhou, 2016). These prior empirical studies suggest that blockchain, through its distinct features such as its immutability, can enhance operational capabilities and improve the financial performance of organisations. From these prior studies, the key dimensions of blockchain performance can be summarised as financial performance, operational efficiency, and competitive advantage (Comoli et al., 2023 Kanojia, 2023; Meiryani et al., 2023; Zhang and Luo, 2022).

2.2 Corporate governance

Corporate governance is the whole process of leading, directing, making decisions and coordinating the affairs of the organisation (Abdennadher and Cheffi, 2020; Bonnet and Teuteberg, 2024; Lo Monaco et al., 2025; Saurabh et al., 2024; Singh et al., 2020). Given that corporate governance is saddled with ensuring the maximisation of the firm’s wealth, it is necessary to ensure the alignment of the firm’s operations with workable and effective systems that will continue to guide firms towards the right path. For corporate governance effectiveness, it is imperative to establish a core structure that aligns with the transparency and credibility of activities, systems, and structures.

Research has examined corporate governance on several theories, chiefly among them are agency, stakeholder, and signalling theories (Akhtar et al., 2024a; Chen et al., 2021; Du et al., 2023). For instance, by integrating blockchain in corporate governance, conflicts arising between stakeholders such as the principals, agents, investors and employees can be mitigated (Abdennadher and Cheffi, 2020; Bonnet and Teuteberg, 2024; Lo Monaco et al., 2025; Saurabh et al., 2024; Singh et al., 2020). This can be achieved through the transparency of financial and non-financial activities, such as accounting and audit activities, and sustainability-related activities (Almaqtari, 2024; Guerin, 2022; Rijanto, 2024). Financially, blockchain enhances the transaction process by identifying cost-reduction structures in implementation and regulatory activities (Almaqtari, 2024; Guerin, 2022; Rijanto, 2024). Moreover, blockchain leads to improved supply chain initiatives and corporate social responsibility initiatives (Comoli et al., 2023; Rehman & Umar, 2025).

3 Methodology

This study employs two literature review structures for the analysis of the dataset. This was done to achieve the objectives of this research. The dataset in this regard refers to the total number of publications analysed and reviewed by this research. These two literature review formats include (1) a systematic literature review to synthesise existing studies on integrating blockchain in corporate governance, and (2) a bibliometric literature analysis to examine the overview of the datasets. For the systematic literature review, this study followed the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) process. This aims to provide a comprehensive analysis of the dataset (the prior literature) by analysing the content, context, and trends in this field. Using bibliometric analysis, this study used metrics such as the number of citations, the number of publications, and the year of publication, and authors for analysis, such as citations, highly cited articles, highly productive journals, and publishers. Metrics such as keywords and authors were used for visualisation, which include co-occurrence, co-authorship, and emerging themes.

3.1 Data source and search strategy

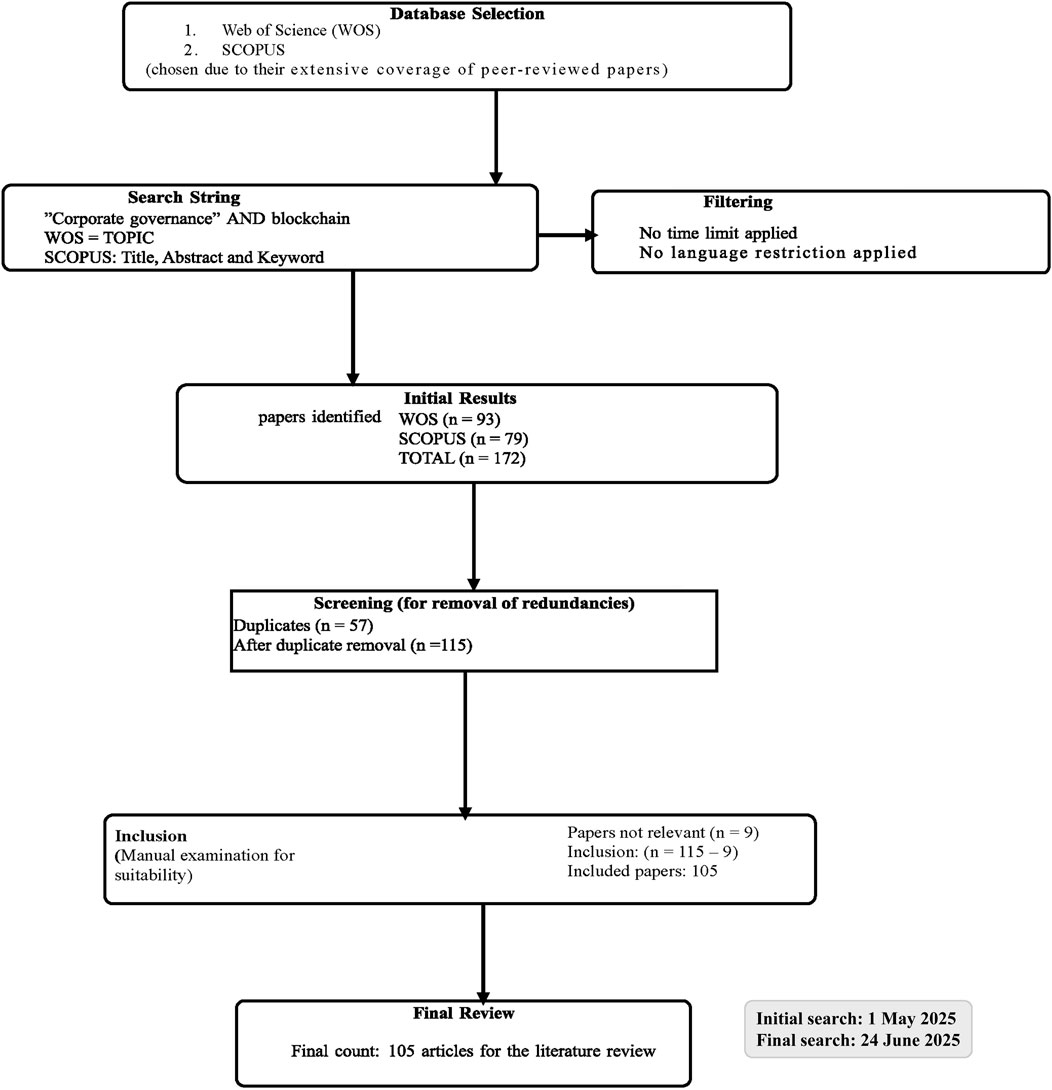

The literature search was conducted using two major academic databases: (1) Web of Science and (2) SCOPUS. These two databases are chosen based on their recognition for their extensive coverage of peer-reviewed papers. Also, journals that are in these databases are deemed to be credible since they follow the scientific format for academic-related research. For WOS, the search string “corporate governance” and blockchain (TOPIC) were used. This covers the title, abstract and keywords. For SCOPUS search, to ensure all relevant articles and to ensure a similar search format with WOS, the search string was “title, abstract, and keyword” fields, and the same search string “corporate governance” and blockchain was used. The search was conducted in June 24, 2025. For WOS, 93 studies were found to be related, while 79 studies were found in SCOPUS, totaling 172 records. The details regarding the data collection is presented in the PRISMA flow diagram in Figure 1. The extensive details regarding the data collection and screening, based on the systematic literature review format, have been presented in Supplementary Appendices SI and SII.

3.2 Analysis

A thematic analysis and a bibliometric analysis were carried out on the dataset. The thematic analysis was based on content examination of the documents. The CSV document was analysed using Microsoft Excel to get the merging themes based on their keywords and abstracts. The RIS document was used in the VOS viewer application to get the emerging themes. The full papers were also read to understand the literature. These emergent themes from Excel were coded using the Overleaf application, and LaTeX coding was used in generating the themes’ images. These data collection and analysis are presented in Supplementary Appendices SI and SII.

For the bibliometric analysis, Harzing’s Publish or Perish was used. First, there is a challenge to overcome, given that the articles are from different databases. Hence, the information on the WOS RIS and CSV domains was manually copied to SCOPUS RIS and CSV. The author ensured that the exact format followed by Scopus was strictly adhered to. This normalised the data and made it usable for use in Harzing POP and VOS viewer applications.

4 Result

4.1 Trend of publications over the years

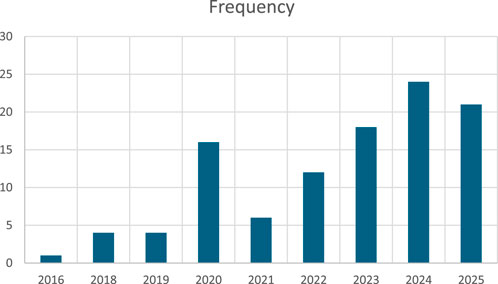

This sub-section achieves the first objective of this research, “to access the bibliometric productivity of publications, journals, and publishers in the dataset, evaluating the maturity and diversity of the research landscape”. This paper employed Microsoft Excel and Harzing POP to critically scrutinise not only productivity trends but also the maturity and potential biases in the research landscape. The result is presented in Table 1 and Figure 2. The result reveals that blockchain in corporate governance is a recent topic, as the first paper in our dataset was published in 2016 (Zhu and Zhou, 2016). Moreover, there are only 9 documents prior to 2020. This reflects that the literature on blockchain and corporate governance has emerged recently. Based on the constant growth all through the years, it can be interpreted that blockchain in corporate governance is a recent surge in interest rather than a mature research domain. This recent interest raises critical questions: does the lack of pre-2016 literature reflect a lag in recognising blockchain’s governance potential, or does it indicate a reactive academic response to industry adoption?

The observed constant growth in publications thereafter might suggest a growth stage, yet this interpretation warrants caution. Moreover, the absence of longitudinal studies limits our ability to assess whether this trend reflects substantial progress or merely hype-driven proliferation. This gap indicates the need for more empirical studies to be conducted on the inclusion of blockchain technologies in various dimensions of corporate governance.

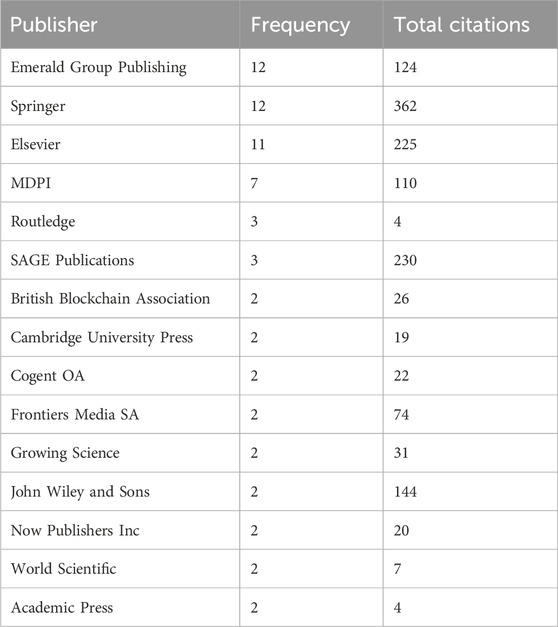

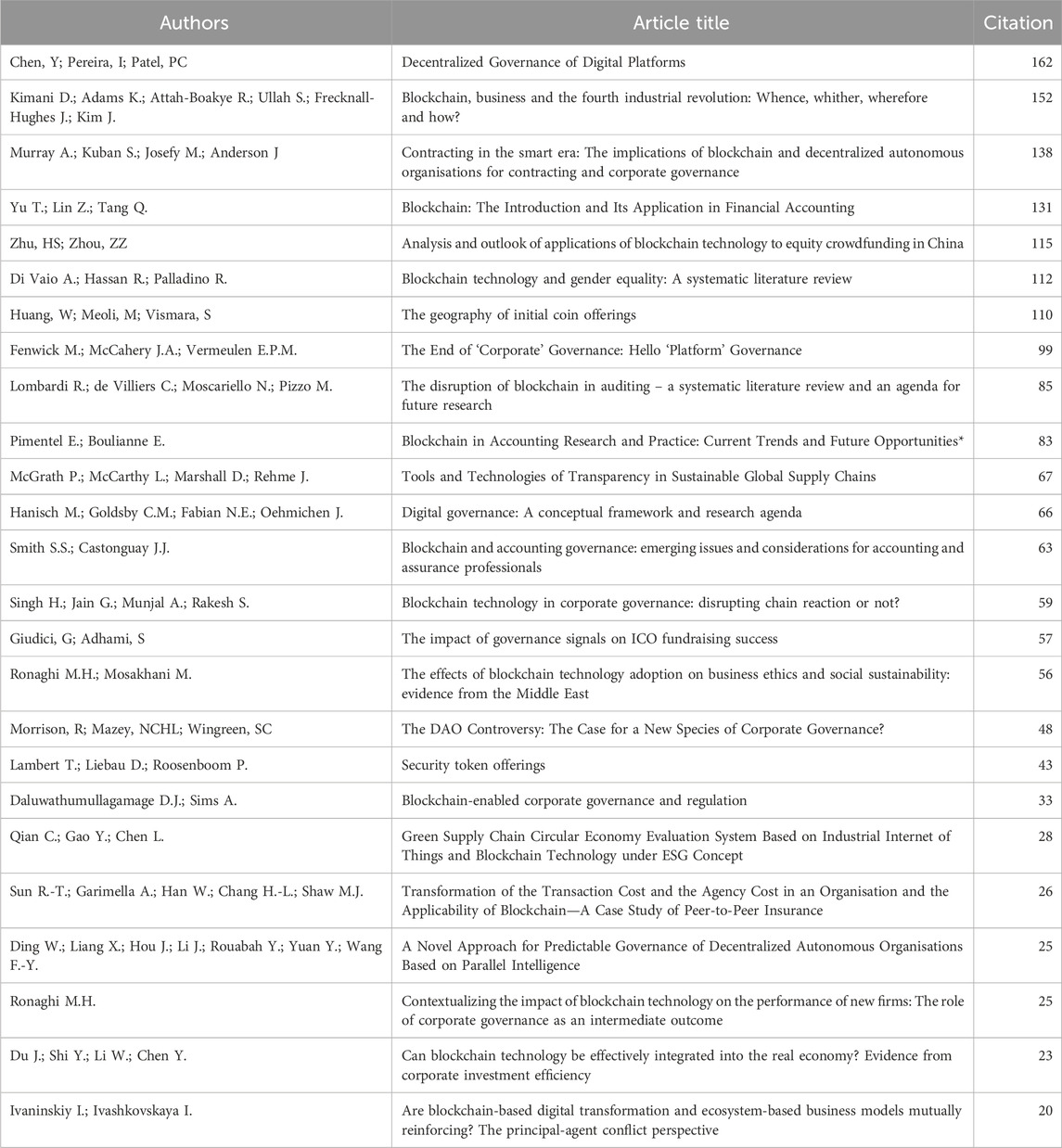

This study evaluated the most productive publishers by analysing the sources of articles within the dataset using Harzing’s Publish or Perish and Microsoft Excel. The results revealed that Emerald Group Publishing and Springer were the top publishers, leading in publication frequency. Additionally, Table 2 presents the citations accrued by these publishers, providing valuable insights for researchers interested in publishing on blockchain and corporate governance topics. A critical lens reveals potential biases, that is, the dominance of Western publishers (e.g., Emerald, Springer), which may translate that most research comes from high-income environments. Potentially, this can indicate that emerging market contexts may have limited representation in research output. This geographic concentration challenges the diversity claim and suggests a need for broader sourcing, a point that can be explored in future research.

This study evaluated article productivity using total citations as a metric, based on two datasets. Duplicates were removed during data cleaning by retaining the higher-cited version from Web of Science or Scopus. The analysis found “Decentralised Governance of Digital Platforms” (Chen et al., 2021) to be the most cited article, with 162 citations. Table 3 presents the papers with more than 20 citations. While these highly cited works provide a foundation for blockchain integration in corporate governance, their prominence raises critical issues: Does citation frequency reflect quality or merely network effects within established academic circles? While productivity may be based on quality, beyond that, as indicated in the trend in publication (as explained earlier), given that the literature landscape is emerging and few works have found the foundation of the topic, productivity may also be based on the availability of research works. Moreover, future studies can read these relevant, productive articles for a more in-depth understanding of the topic.

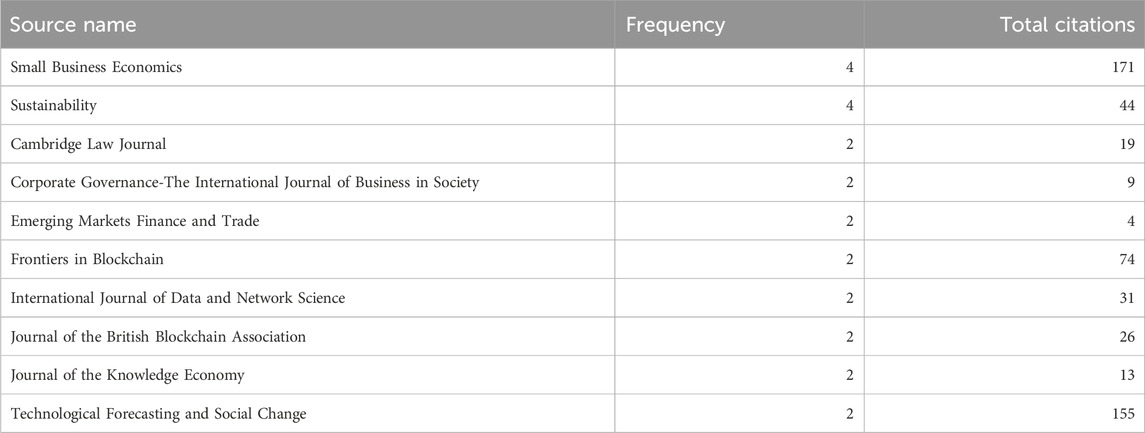

This study evaluated journals with the most publications on blockchain and corporate governance, with results summarised in Table 4. This offers guidance for researchers by identifying prominent journals suitable for publishing articles on blockchain integration in corporate governance. A critical perspective questions the representatives of these journals. Since some focus on technology, some on management, these may overshadow governance-specific nuances, potentially limiting the field’s interdisciplinary focus.

In summary, while the bibliometric results assess the growing field with contributors, they also expose limitations, which include geographic bias in journals and publishers, which challenge the diversity of the research landscape. These findings suggest that researchers interested in examining topics on blockchain and corporate governance should examine the productive papers for relevant information while also addressing the identified gaps for future research.

4.2 Emerged keywords

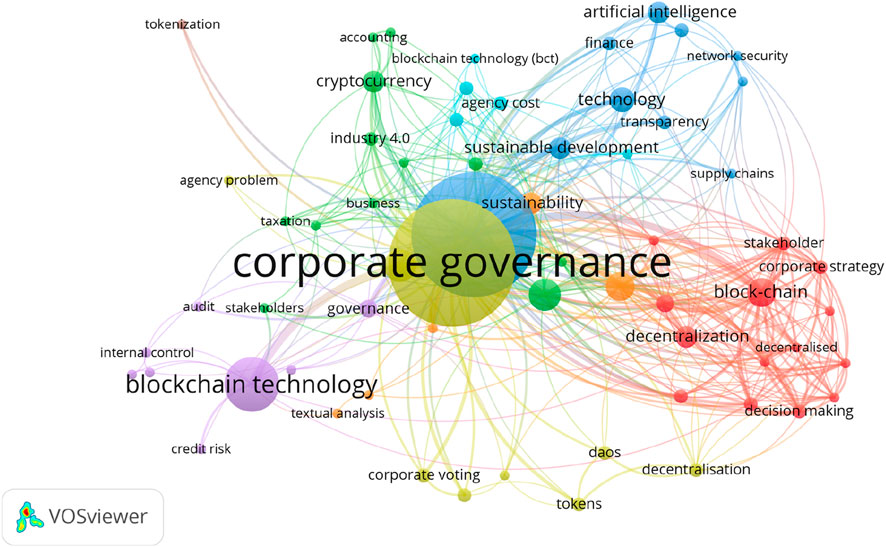

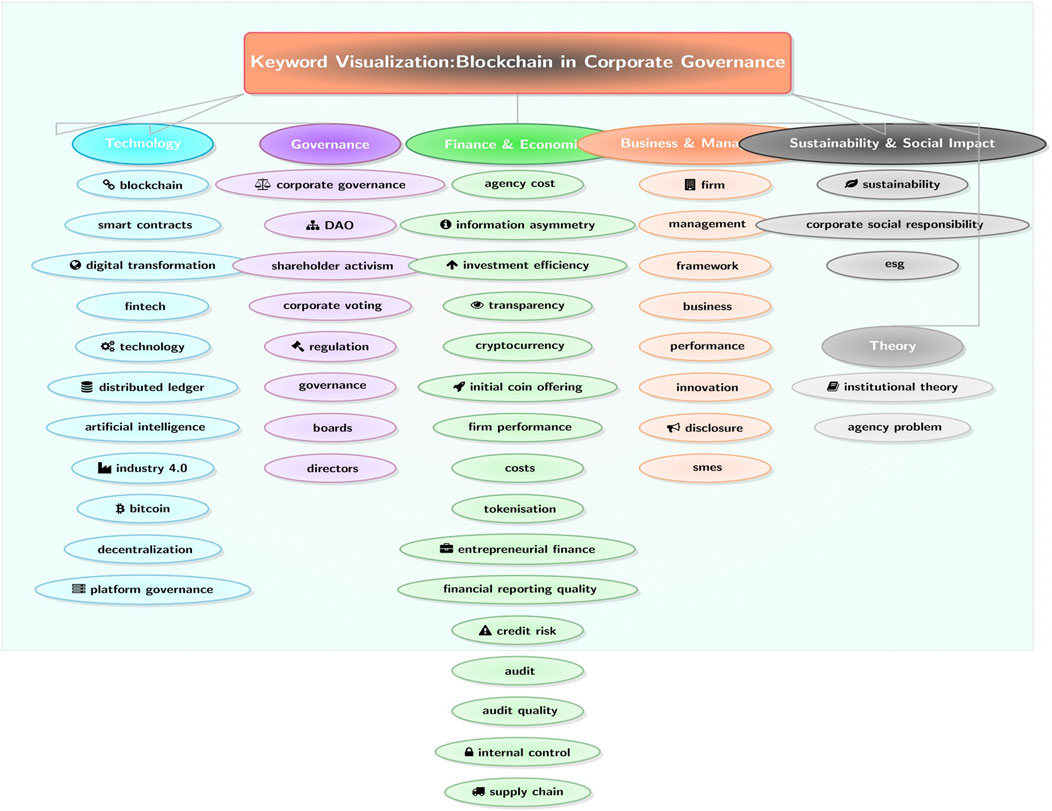

This sub-section achieves the second objective of this research, “to examine the themes that emerged from the prior literature that have explored blockchain technology in corporate governance, critically analysing their governance implications”. Analysis tools such as VOS viewer, Microsoft Excel and Overleaf applications were used. Based on the analysis of the keywords, blockchain appears the most, being the core technology that was mentioned in all the papers. VOS viewer was used in the co-occurrence analysis. This is presented in Figure 3. For the thematic analysis, the full papers were examined, and relevant themes were classified into sub-sections using Microsoft Excel and coded using LaTeX in the Overleaf application. These subsections are presented in Figure 4 which. Relevant themes were classified under these sub-sections. Sub-sections include technology, governance, finance and economics, business & management, sustainability & social impact and theory. for instance, under governance, themes such as DAO, shareholder activism and corporate voting. Themes that emerged under theory include institutional theory and agency.

Figure 3. Co-occurrence of keywords. Source: Author’s generated. Description: The presentation of the most occurring keywords in the dataset.

Figure 4. Keywords based on LaTeX coding. Source: Authors generated. Description: Classification of the dataset into sub-topics with their associated themes.

From the emerging themes in Figure 3, as expected, corporate governance and blockchain are the foundational concepts central to all the articles. The co-occurrence reveals secondary themes such as smart contracts, decentralised autonomous organisation (DAO), agency theory, shareholder activism, digital transformation, and sustainability, each linked to governance automation, emerging models, and ESG and CSR integration in governance. Figure 3 shares the visualisation of the central themes of the dataset. The data set in this regard refers to the papers used for this analysis.

4.3 Central theme: blockchain and corporate governance

4.3.1 Technological integration

Integration of technologies was examined by many studies in the dataset (Al Shanti and Elessa, 2023; Daluwathumullagamage and Sims, 2020; Ivaninskiy and Ivashkovskaya, 2022). This includes a description of blockchain as a disruptive technology (Kimani et al., 2020; Singh et al., 2020; Vermeulen et al., 2018; Yang et al., 2024). Blockchain is also seen as a form of digital transformation. Studies in fintech have also explained blockchain in line with financial technologies. Artificial intelligence was also discussed by several authors in this dataset. While the literature indicates blockchain integration improves the accounting system for reporting and auditing, potentially reducing errors (Almaqtari, 2024; Guerin, 2022; Rijanto, 2024). However, a critical perspective often overlooks the “black box” problem, where opacity may blur trust in automated systems. This suggests that technology integration, while promising, requires rigorous validation to ensure governance benefits outweigh associated risks.

4.3.2 Blockchain technologies

As expected, the major subject in the dataset is blockchain technologies. Most of the papers in this dataset explained blockchain by describing it, its attributes, and its technological significance. This includes blockchain, distributed ledger technology, smart contracts, tokenisation, cryptocurrency, digital ledger, blockchain governance, adoption, and innovation (Al Shanti and Elessa, 2023; Daluwathumullagamage and Sims, 2020; Davidson, 2025; Ezzi et al., 2023; Saurabh et al., 2024).

Studies also examined corporate governance concepts, which include organisations management, the relationships between the shareholders, the board, and the management (Guerin, 2022), corporate voting (the use of blockchain in corporate voting), board independence, shareholder activism, audit committees, principal-agent relationships, agency costs, ownership structure, government token, decentralisation, and vote-escrow token.

4.3.3 Corporate structures and entities

Corporate structures and entities were also discovered to be examined in papers in this dataset. The major corporate structure that was examined is the decentralised autonomous organisation (DAO).

4.3.3.1 Decentralised autonomous organisation (DAO)

DAO is an emerging structure that recent studies on blockchain in corporate governance have been focusing on. DAO focuses on blockchain transformation of corporate structures through a decentralised system, thus improving transparency and decision-making (Han et al., 2025; Morrison et al., 2020). Given that DAO enhances corporate governance decentralisation, transparent and participatory decision-making structures, the body of literature shows that DAO has the potential to transform corporate governance (Han et al., 2025; Morrison et al., 2020; Murray et al., 2021). Yet, regulatory challenges persist in their acceptance, adoption, and legal restrictions. Critically, while DAOs curb executive opportunism through verifiable records, their technical complexity may exclude non-expert stakeholders, challenging the responsible leadership theory’s equity principle. This underscores the need for inclusive DAO designs.

4.3.3.2 Other corporate structures

Other structures include stakeholders, shareholders, executive management, platform governance, and listed companies (Abdennadher and Cheffi, 2020; Bonnet and Teuteberg, 2024; Lo Monaco et al., 2025; Saurabh et al., 2024; Singh et al., 2020). A critical analysis suggests that while DAOs promise democratic governance, their reliance on technical expertise may exclude non-technical stakeholders, contradicting the equity focus. This gap highlights the need to balance technological innovation with inclusive governance structures.

4.3.4 Theoretical support of blockchain in corporate governance

Based on the prior studies, it can be deduced that blockchain in corporate governance can be explained through the lens of various theories. Chiefly among the theories used are agency and institutional theories. Agency theory discussed how blockchain impacts internal dynamics, that is, the relationships among the stakeholders, such as the management and shareholders. Whereas the institutional perspective discussed external dynamics, such as the regulations and legal influence on blockchain integration in corporate governance. Some other studies explained the topic from the perspective of transaction cost economics. This view is explained from the position of the cost-benefits of blockchain adoption and integration within corporate governance. These perspectives were discussed in Section 5.2.

5 Discussion

This section critically interprets the result of this literature review and synthesises the findings. Hence, this discussion section addresses the research questions three, four, and five: evaluating theoretical support for blockchain in corporate governance, conceptualising motivating factors for its adoption and proposing a conceptual framework for its impact. Moving beyond description, this discussion assesses the implications and gaps of previous studies and integrates critical insights by proposing a novel framework.

5.1 Factors in blockchain and corporate governance

This sub-section examines key factors in the context of blockchain’s application to corporate governance, supported by an appropriate citation from the dataset, ensuring alignment with the literature. The explanations not only address how technologies enhance governance mechanisms, structures, and stakeholder interactions, but also their limitations and unresolved challenges, fostering a critical dialogue that extends beyond the literature’s current scope.

5.1.1 Blockchain technologies

5.1.1.1 Distributed ledger technology (DLT)

Distributed ledger technology (DLT) operates as a decentralised database system that records transactions across multiple nodes, guaranteeing transparency, immutability, and security. In corporate governance, DLT archives records, allows certifiable voting systems, improves real-time auditing, and promotes a financial reporting structure that aligns with regulation. Termed “digital ledger” in some studies, DLT promotes financial integrity and transparency through reporting mistakes, errors, and potential fraud-related risks (Singh et al., 2020). It also supports engagements and fintech applications. Moreover, with DAO, DLT supports dynamic regulation and stakeholder coordination through tamper-proof ledgers (Kaal, 2020). However, the critical lens reveals that while DLT is capable of mitigating agency risks such as information asymmetry and promoting trust across stakeholders, the issue of scalability and the risk of data overload are rarely addressed. This questions its practical efficacy in large corporations. Thus, suggesting a need for extensive empirical validation.

5.1.1.2 Smart contracts

Smart contracts are self-implementing agreement codes certified on a blockchain, which automates corporate governance processes such as compliance, stock-related transactions, and voting (Cazazian, 2022; Meier and Sannajust, 2021; Murray et al., 2021). By eliminating third-party interferences (e.g., intermediaries), smart contracts reduce agency costs and mitigate risks. Thus, it enhances corporate governance efficiency and effectiveness. Saurabh et al. (2024) explained that smart contracts enable transparency within corporate governance and enhance automated decision-making, such as dividend distribution and regulatory compliance in DAOs. Yet, this optimism is tempered by critical concerns as to whether smart contracts transfer risks from human error to technical fragility. Hence, a balanced approach might integrate human oversight with a smart contract, which can be empirically assessed by future research.

5.1.1.3 Tokenisation

Tokenisation on a blockchain is the concept of converting assets into digital tokens (Daluwathumullagamage and Sims, 2020). This facilitates fractional ownership of digital tokens among various owners and enhances their seamless transfers. Tokenisation enhances corporate governance liquidity structure by making it possible for shareholders to access initial coin offerings (ICOs) and security token offerings. Being a disruptive technology, tokenisation poses a potential influence on corporate voting structures, enabling broader voting participation of shareholders. Governance tokens enable voting rights in DAOs by empowering shareholders to influence decisions, thus enhancing their activism. Through vote escrow tokens, governance tokens may be locked to improve shareholders’ voting power, incentivising long-term commitment (Han et al., 2025). While tokenisation plays a major role in democratic corporate governance structure by improving shareholders’ participation in organisations, it is needful to examine if it balances voting models or empowers some tech-savvy stakeholders (Agostini, 2024; Ante and Meyer, 2021; Lambert et al., 2022).

5.1.1.4 Cryptocurrency

Based on blockchain technologies, cryptocurrencies are digital currencies used for transactions, assets, and incentives within corporate governance (Ante and Meyer, 2021; Davidson, 2025; Reyes, 2020). Through governance tokens, cryptocurrencies can be used as a source of funding for DAOs and serve as a form of incentives to stakeholders, including wages, salaries, and all related payments to employees. While cryptocurrency has several potential applications within corporate governance, studies have also shown that factors such as its volatility pose serious risks to the holders. This is reflected in the value surging and plummeting at random times. While a surge in value can increase the asset holdings of stakeholders, the plummeting periods may lead to huge financial risk. Hence, there is a need for a regulatory framework that can stabilise cryptocurrency volatility, to provide a quantifiable risk.

5.1.1.5 Blockchain governance

Blockchain Governance, according to the dataset, refers to the governance protocols managing blockchain and its related activities within the corporate governance system. These are the institutionalised crypto economies whose role reduces centralised control in organisations. Through their consensus mechanisms, blockchain networks are coordinated, thus influencing corporate governance through decentralised decision-making. This, therefore, supports DOAs and ensures a transparent voting system. While decentralisation may improve governance, there is a need to assess the impact of fragmented authorities in complex organisations.

Moreover, in shareholders’ activism, while shareholders have the capacity to influence corporate policies through voting, proposals, and proxy contests, blockchain can enhance this activism by providing an accessible and secure voting system. Thus, reducing manipulation risks (Ivaninskiy and Ivashkovskaya, 2022). Also, given that blockchain has the capability of enhancing the digital transformation of shareholders through effective proxy contests and shareholder proposals, it also has the capability to reduce opportunism and agency costs. This is reflected in its improvement of the audit committee’s functionality in overseeing financial reporting and compliance structures (Cazazian, 2022; Lombardi et al., 2022; Smith and Castonguay, 2020). Furthermore, replicating the immutability characteristic of blockchain patterns in the audit trail may improve audit quality by providing a real-time auditing structure. Thus, leading to improved governance integrity, particularly with tokens and other forms of digital assets such as cryptocurrencies (Smith and Castonguay, 2020).

Arguments can therefore be made that the transparent structure of the digital ledgers and smart contracts, the feedback mechanisms and the monitoring structure backed by blockchain, have the capability to reduce conflicts of interest among stakeholders (Cazazian, 2022; Ivaninskiy et al., 2023; Ivaninskiy and Ivashkovskaya, 2022; Murray et al., 2021). This is based on the justification that, while blockchain goes beyond its effectiveness in mitigating executive opportunism through transparent disclosures, management can also leverage it to execute corporate strategies, improve accountability and provide verifiable evidence (records of decisions and organisational activities). Overall, blockchain, when employed correctly, can help in achieving the maximisation of stakeholders’ wealth.

5.1.1.6 Platform governance

Platform governance manages digital-based ecosystems, aligning with DAO to promote trust, open innovation and fair interactions (Chen et al., 2021). It reduces listing restrictions for companies and enhances ESG reporting and green innovation (Fang and Jiang, 2024). While platform governance ensures that organisations comply with strict rules that may be defined on the smart contracts, the literature lacks evidence on shareholder fairness in these platforms. There is therefore a need to democratise the platforms (Fang and Jiang, 2024; Sun et al., 2024).

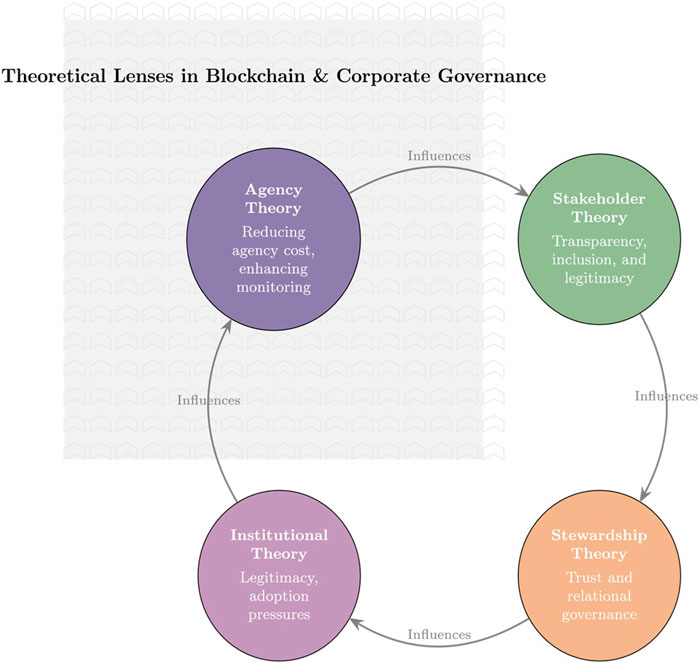

5.2 Theoretical framework: blockchain in corporate governance

This section fulfils objective three, which evaluates the theoretical support for blockchain technology inclusion in corporate governance, questioning the adequacy of existing frameworks (e.g., agency, stakeholder) and proposing refinements. The analysis reveals a multi-faceted theoretical landscape, each lens offering insights but also exposing gaps that challenge blockchain’s transformative potential.

Agency theory argues that blockchain mitigates principal-agent problems through real-time audits and an immutable ledger structure. Thus, mitigating agency problems (e.g., information asymmetry and managerial opportunities) between shareholders and management (Akhtar et al., 2024b; Chen et al., 2021; Du et al., 2023). Through smart contracts, compliance with regulations may be automated (Dong et al., 2025; Singh et al., 2020). Despite these agency theory-based arguments for blockchain, its efficiency is tempered by new conflicts in DAO, such as token-based power imbalances, as highlighted by Han et al. (2025) and Murray et al. (2021). This suggests that while agency theory explains reduced oversight costs, it struggles to address emergent governance complexities, necessitating a stewardship perspective where blockchain audit trails enhance trust and long-term relational governance.

Stakeholder theory highlights blockchain technology empowerment of marginalised stakeholders and accountability, significantly improving the traceability of both financial and non-financial data (Allen and Berg, 2020; Fahlevi and Pramesti, 2022; Zhang and Luo, 2022). An example is the ESG reporting, where blockchain fosters ethical governance. However, the clarity on whether all stakeholders benefit equally has not been defined, which raises questions about inclusivity.

Institutional theory frames blockchain adoption through regulatory legitimacy driven by normative and mimetic pressures (Comoli et al., 2023; Di Vaio et al., 2023; Kanojia, 2023; Tran et al., 2024), especially in financial sectors (Saurabh et al., 2024). Although it explains how sustainability and cultural pressures shape blockchain adoption, yet, its focus on external constraints neglects internal resistance, suggesting a need for a more holistic approach. Complementarily, from the transaction cost economics perspective, blockchain adoption and usage can be evaluated to understand implementation costs, which can serve as a barrier. This requires firms to balance cost against governance benefits (Murray et al., 2021; Qian et al., 2023; Sun et al., 2020; Zhu and Zhou, 2016). While current empirical data on cost-benefit trade-offs is scarce, future studies may assess them.

Collectively, these theories (agency, stakeholder, stewardship, institutional and transaction-cost economies) offer a lens to evaluate blockchain’s dynamics and external pressures. Figure 5 illustrates their interconnected roles, yet a critical analysis reveals imbalances. For instance, agency and institutional theories dominate, while stewardship and transaction costs perspectives are underexplored. This imbalance suggests that current frameworks prioritise technical efficiency over relational and economic viability, risking an over-optimistic view of blockchain’s impact. As depicted in Figure 5, to achieve its transformative potential, a balanced integration of these lenses is essential.

Figure 5. Theoretical lenses in blockchain and corporate governance. Source: Author’s generated from the dataset.

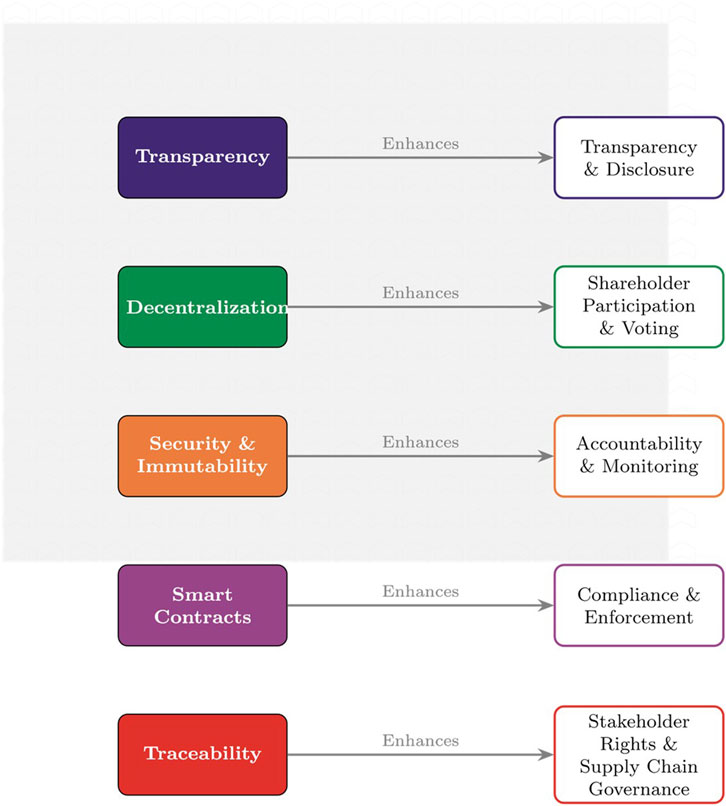

5.3 Blockchain capabilities in influencing improved corporate governance

This paper identified several blockchain capabilities which are classified as drivers of improved corporate governance. These include transparency, security, immutability, decentralisation, smart contracts, and traceability. By addressing their implications beyond their descriptions, this paper extends to the tensions that challenge their universal efficacy. Transparency, facilitated by blockchain, makes corporate activities visible to shareholders and relevant stakeholders such as regulators (Fenwick et al., 2019; Vermeulen et al., 2018). Thus, it mitigates corporate fraud and increases stakeholders’ confidence in corporate governance. However, the assumption that visibility equates to understanding is questionable. Technical complexity may exclude non-expert stakeholders, a gap underexplored by the body of literature.

Immutability as a core characteristic of blockchain ensures that records cannot be altered or manipulated, thus enhancing governance credibility and integrity. Immutability may be translated to positive effects as evidenced in seamless financial transactions and activities. Its impact also extends to improved democratic structure within the corporate system. This is evidenced in voting, where vote manipulations are mitigated. Moreover, through the digital ledger structure, accountability and trust are supported. This is reflected in the audit structure, where audit committee oversight and internal audit ensure that financial records are reliable. In taxation, blockchain immutability ensures governance risks are reduced, and tax evasion is minimised (Brender et al., 2024; Smith and Castonguay, 2020; Fang et al., 2023; Pimentel and Boulianne, 2020). While the immutability feature of blockchain is greatly transformative, yet, its rigidity may hinder adaptive governance in dynamic markets, raising an argument as to whether immutability strengthens integrity or constrains flexibility. Figure 6 visualises these characteristics as drivers for adoption.

Figure 6. Features of blockchain. Source: Authors generated. Description: Characteristics of blockchain and their corresponding transformative impacts on corporate governance.

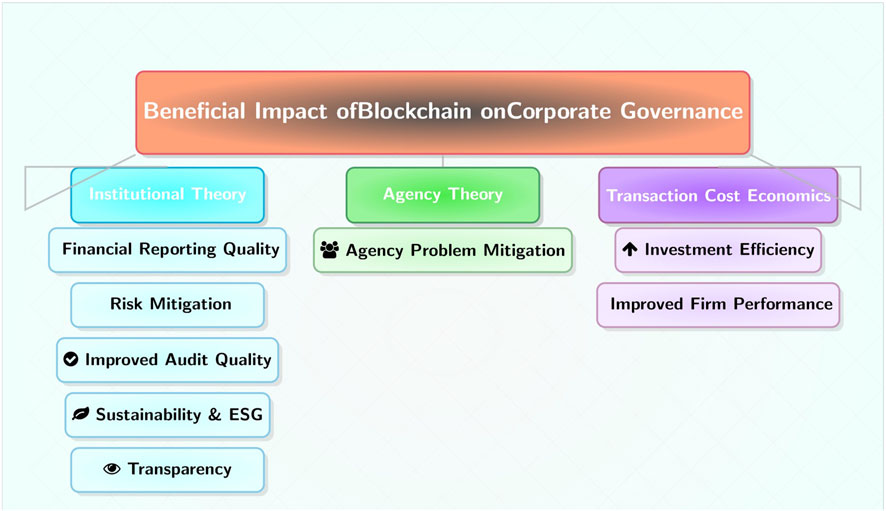

5.4 Blockchain impact on corporate governance

This section achieves the fourth objective of this research to “conceptualise the motivating factors influencing the adoption of blockchain technology in corporate governance, interrogating whether these drivers align with organisational realities”. The conceptualisation of the emerged motivating factors is presented in Figure 7. These factors include investment efficiency, financial reporting quality, firm performance, risk mitigation, audit quality, agency problem resolution, regulatory and sustainability advancement, transparency, immutability, and accounting improvements.

Figure 7. Impact of blockchain on corporate governance. Source: Author’s generated. Description: Theoretically classifying motivating factors for blockchain inclusion in corporate governance

5.4.1 Investment efficiency

Blockchain improves investment efficiency by providing transparent, real-time data that mitigates risks and optimises resource allocation. This serves as a positive signal to investors who may want to analyse the company’s feasibility by themselves. Access to real-time information backed up by blockchain ensures adequate analysis using various factors, ratios, and percentages. DLT ensures precise tracking of transactions, enabling improved decision-making for investors, thus promoting capital investments. Access to sufficient information aligns organisations’ resources with strategic goals. Also, blockchain enhances corporate governance mechanisms, shareholders’ oversight, and managerial accountability (Du et al., 2023; Ezzi et al., 2023) which boosts trust in organisations. Aside from investors in a firm, firms also make investment decisions. Blockchain, through the improvement in analysis of the capital structure of the firm, impacts organisation capital investment decisions, thus eliminating risks of overinvestment or underinvestment (Du et al., 2023).

5.4.2 Firm performance

Blockchain streamlines governance processes, reduces operational and strategic costs through smart contract automation, thereby improving performance (Akhtar et al., 2024a; Akhtar et al., 2024b). While the assumption that strong ownership structure leads to better ownership structure can be proven using blockchain technologies in stock-related matters (Akhtar et al., 2024a; Ronaghi and Mosakhani, 2022), the assumption that technical efficiency translates to strategic success is unproven. Although few studies link performance to long-term outcomes, there is an existing gap between operational gains and sustainable growth. Future research can extensively scrutinise these.

5.4.3 Improved financial reporting quality and auditing

Through the immutable and transparent structure of blockchain backed by the digital ledger, financial reporting quality has been improved (Bruner, 2020). DLT’s strong point is its data integrity, which ensures accurate and timely financial disclosures (Fang et al., 2023). A high-quality financial reporting structure is ensured using blockchain technology, thus increasing stakeholders’ confidence (Ezzi et al., 2023).

Blockchain technology also improves the audit quality by strengthening the internal audit functions and enhancing governance oversight through the integration of defense lines (Brender et al., 2024). Moreover, blockchain streamlines the auditing process by providing a real-time audit trail, which reduces the possibility of misreporting financial transactions. Although the literature reveals that the audit committee can leverage blockchain technology in transaction verification and ensuring compliance with regulatory requirements (Fang et al., 2023), emphasis on technical accuracy overlooks human judgment in auditing. This poses new concerns about the impact of over-automation on accountability. Future studies may explore and empirically validate these over-automation concerns.

5.4.4 Risk and agency problems mitigation

Blockchain technology mitigates risks in corporate governance. Risks such as credit risks, macroeconomic and agency risks are reduced through transparent and traceable data, which aids in risk assessment and management (Chen et al., 2023; Mutamimah et al., 2023). Moreover, tokenisation and smart contracts are some of the blockchain structures that can be used in risk assessment and management. Although the focus of the existing body of literature has been on technical solutions, it often ignores behavioural factors such as managerial resistance. A holistic risk framework that examines both the technical and behavioural factors can be assessed for hedging macroeconomic uncertainties. Future research works can examine these in the context of stabilising corporate risk profiles and supporting governance resilience.

5.4.5 Regulatory, ethical and sustainable concerns

Blockchain addresses regulatory, ethical and sustainability concerns by providing auditable ESG records, aligning with corporate social responsibility (Comoli et al., 2023; Kazakov et al., 2023; Rodríguez, 2024; Ronaghi and Mosakhani, 2022). It promotes green innovation and inclusivity (Meiryani et al., 2023). This clarifies the position of technology in DAO. While technological inclusion through digital and financial inclusion can align blockchain with ESG and sustainable development, these benefit lacks evidence on stakeholder’s engagement, questioning their practical impact (Di Vaio et al., 2023). This gap calls for empirical validation of blockchain ethical governance claims.

Based on the previous discussions, there is a need for a comprehensive conceptual framework visualising factors driving blockchain adoption in corporate governance. Figure 7 visualises these impacts based on diverse theoretical perspectives of institutional, agency theories and transaction-cost economies. Using blockchain adoption as the dependent variable, these factors can be empirically assessed by researchers. The empirical research will determine if the factors have significant relationships with blockchain adoption in corporate governance or not.

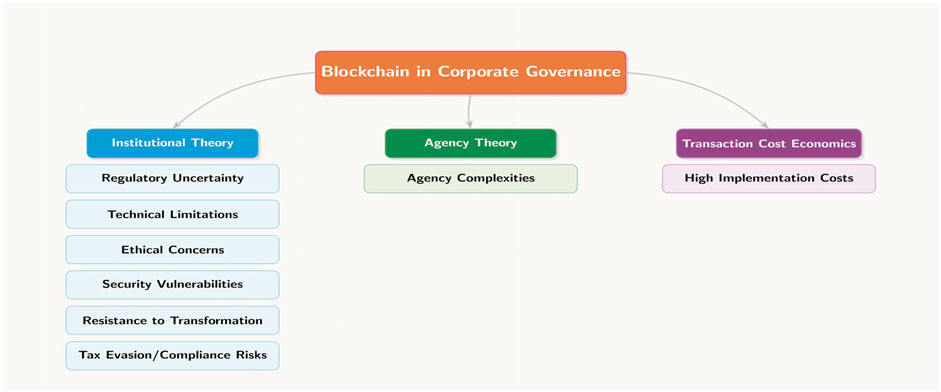

5.5 Challenges and risks of blockchain in corporate governance

Although blockchain introduces a transformative technological potential for corporate governance, it also introduces some challenges and significant risks that must be addressed by organisations. This achieves the fifth objective of this research, “to present a conceptual framework for the impact of blockchain technology on corporate governance, integrating critical insights to guide future applications and address identified gaps”.

Based on the literature analysis, this study defined these impacts as the risks and challenges of blockchain adoption in corporate governance. These impacts are categorised as legal uncertainty, technical limitations, ethical and sustainability concerns, governance complexities, high implementation costs, security vulnerability, resistance to digital transformations, and tax evasion risks. Each of these factors is discussed based on its theoretical justifications. The factors translate to a conceptual model, which was presented in Figure 8.

Figure 8. Risk and challenges associated with blockchain in corporate governance. Source: Author’s generation. Description: The risk and challenges associated with blockchain inclusion in corporate governance based on theoretical justification

5.5.1 Legal challenges

Institutional theory describes the role of regulatory and normative constraints, yet, the ambiguous legal positions hinder blockchain integration (such as corporate voting or tokenisation) into governance systems (Kaal, 2020). Studies on BRICS countries’ highlight regulatory challenges among the member countries, noting that unclear blockchain regulations complicate governance applications. Studies on the UAE also explain the difficulty faced because of the non-recognition of digital currency (Ronaghi and Mosakhani, 2022). Firms in these countries may face potential legal penalties or operational restrictions, further complicating compliance. Critically, this ambiguity may deter adoption not just by lacking structure, but by exposing firms to untested liabilities. This study, therefore, advocates for a refined approach for adaptive regulatory sandboxes to test legal alignments, thus bridging the gap between innovation and enforcement.

5.5.2 Technical limitations and scalability issues

Blockchain scalability constraints, high energy consumption, and integration challenges with legacy systems undermine their governance potential. This perception aligns with institutional theory, which posits that industry norms and technical infrastructure influence adoption (Di Vaio et al., 2023). Limited transactions globally hamper the ability of blockchain to support large-scale governance processes. This is found to be the major reason for Maersk’s Tradelens ending the blockchain structure for its logistics in 2023. Technical barriers hinder blockchain adoption (Drljevic et al., 2022). The inefficiency caused by technical delays, increased cost reduces governance effectiveness. The risks of coding errors in smart contracts could disrupt governance operations and cause significant problems in compliance (Culinovic-Herc, 2022).

Another technical-related issue is resistance to digital transformation, backed by organisational and cultural resistance (Ronaghi and Mosakhani, 2022). While institutional theory highlights normative pressures, such as traditional governance structures, as barriers to change, innovation capabilities gaps exacerbate resistance. Resistance risks delayed adoption, causing inefficiencies. The resistance to blockchain technology makes organisations lose the associated accruing benefits, such as increased transparency and accountability (Tran et al., 2024).

Moreover, due to the energy-intensive processes associated with blockchain, its adoption may be minimised. This intensive energy consumption may negate the major goals of sustainability, which aim to reduce carbon emissions and usage. It is imperative to assess whether these technical barriers outweigh the associated benefits. For example, firms adopting blockchain may need to create a balance in sustainability since high energy consumption risks reputational damage and misalignment with ESG criteria (Ronaghi and Mosakhani, 2022). This suggests a need for hybrid systems that balance efficiency with environmental impacts.

5.5.3 High implementation and transaction costs

Blockchain technologies’ adoption requires significant capital investment in infrastructure, technology, training, and integration, posing significant financial challenges. Transaction-cost economics argues that firms adopt technologies to reduce costs, but the high upfront expenses on blockchain adoption can deter its implementation and acceptance in organisations’ corporate governance (Murray et al., 2021; Sun et al., 2020). High cost of adoption, implementation, and transaction risk, financial strain, particularly for small and medium-sized enterprises (Mutamimah et al., 2023). The cost barriers may oppose the credit risk mitigation objectives, which may affect blockchain adoption in resource-constrained firms. For instance, the blockchain cost structure may limit its applicability in a governance system like voting (Sun et al., 2020). Hence, there is a need for short-term and long-term cost-effectiveness models to guide the adoption of blockchain in corporate governance. This will guide firms in making informed decisions regarding blockchain adoption and implementation.

5.5.4 Agency problems and governance complexities

Although blockchain technology’s immutability and transparency structure eliminates several agency problems, it can also introduce new agency problems. For instance, DAO is a decentralised governance system backed by blockchain that operates by tokenisation. Agency theory suggests that misaligned interests between principals and agents persist in decentralised structures (Murray et al., 2021). While DAO uses governance tokens and a token-based voting system, using a vote escrow token may create power imbalances. In situations where there is ownership concentration, there is a high risk of governance failure since large token holders dominate decision-making. Hence, vote escrow token amplifies the influence of “whales,” creating new agency conflict (Han et al., 2025). This suggests a need to refine governance tokens and equity thresholds to mitigate concentration risks, a novel adjustment to enhance decentralised accountability.

5.5.5 Security-based challenges

Security vulnerabilities in smart contracts and token-based exchange systems threaten blockchain reliability in governance. Institutional theory suggests that trust in technology depends on perceived security. While blockchain is known for its high security, as it can be accessed by only those who have the ledger codes. But if hacked, breaches could potentially expose sensitive data, breach confidentiality and incur legal liabilities (Alaba, 2024; Ogedengbe et al., 2025). Coding errors can compromise smart contracts. Hacks can also compromise the blockchain system, such as voting platforms. Breaches risk financial losses and governance disruptions (Culinovic-Herc, 2022). This suggests a need for robust encryption standards and real-time monitoring protocols to safeguard governance systems.

Based on the discussion and prior body of literature, as presented in Figure 8, this paper presents a conceptual model highlighting the risks and challenges of blockchain adoption in corporate governance. These are classified based on underlying theories.

6 Conclusion

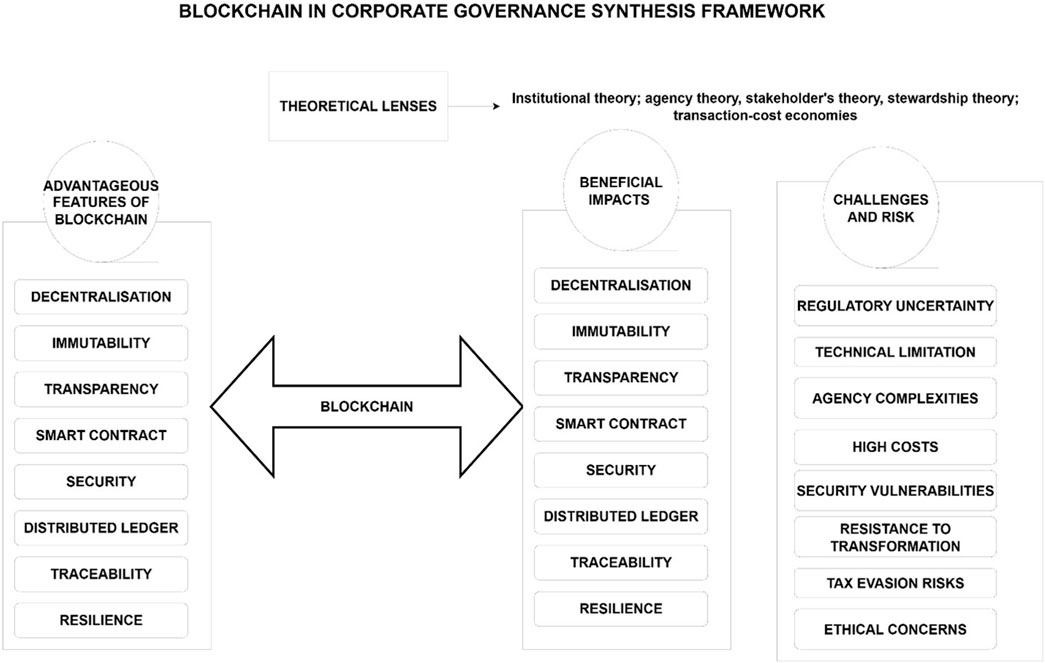

This paper is a critical review of 106 peer-reviewed papers from Scopus and Web of Science databases. By employing a search string without time or literature structure constraints, an evaluation was performed to assess blockchain integration in corporate governance. Moving beyond a mere summary, this paper synthesises theoretical frameworks (agency theory, stakeholder theory, stewardship theory, and institutional theory) drawn from the literature to assess the topic concept. Furthermore, this paper highlights blockchain’s potential to enhance accountability and efficiency, yet critically reveals limitations, such as technical vulnerabilities and equity gaps that challenge its universal adoption.

By mapping blockchain capabilities (e.g., transparency and immutability), synthesising its impacts on governance (e.g., efficiency, risk mitigation) and the associated risks (e.g., legal constraint, scalability), some conceptual frameworks have emerged from the study. These frameworks have been used in extending the literature to propose a “Holistic Governance Synthesis Framework”. As presented in Figure 9, the model integrates refined elements of the blockchain features, the drivers of adoption and the risks and challenges associated with its integration in corporate governance to balance technical and relational dynamics.

Figure 9. Holistic governance synthesis framework. Source: Authors generated. Description: Model showing the overview of the dataset (features, adoption drivers, impact) and theoretical justification of blockchain integration in corporate governance.

However, this paper’s reliance on two databases limits the body of literature assessed in the dataset. Future studies may expand the literature to cover other databases. Future studies should also leverage this paper and framework for empirical validation. Studies can be explored in industry-specific areas (e.g., accounting and the financial sectors), and country-specific settings. Comparisons can be made between these countries and industries. By expanding research, researchers can mitigate regional biases, thus enhancing the framework’s generalizability.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

FO: Resources, Funding acquisition, Software, Writing – review and editing, Formal Analysis, Data curation, Validation, Writing – original draft, Methodology, Project administration, Conceptualization, Visualization, Investigation. MA: Supervision, Funding acquisition, Writing – review and editing, Writing – original draft.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by University of Johannesburg covered the article publication charge (APC) for this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbloc.2025.1654633/full#supplementary-material

References

Abdennadher, S., and Cheffi, W. (2020). The effectiveness of e-corporate governance: an exploratory study of internet voting at shareholders’ annual meetings in France. Corp. Governance-the Int. J. Bus. Soc. 20 (4), 673–702. doi:10.1108/CG-04-2019-0116

Adelowotan, M., and Coetsee, D. (2021). Blockchain technology and implications for accounting practice. Acad. Account. Financial Stud. J. 25 (S4), 1–14.

Agostini, M. (2024). Transforming corporate governance: exploring tokenization’s impact on transparency and ownership — a research agenda. Risk Gov. Control Financial Mark. Institutions 14 (3), 47–56. doi:10.22495/rgcv14i3p5

Akhtar, T., Afridi, M. A., and Islam, M. D. S. (2024a). Corporate governance, blockchain technology and firm performance. Singap. Econ. Rev., 1–32. doi:10.1142/S0217590824500449

Akhtar, T., Chen, L. Q., and Tareq, M. A. (2024b). Blockchain technology enterprises ’ ownership structure and cash holdings. Sustain. Futur. 8, 100229. doi:10.1016/j.sftr.2024.100229

Al Shanti, A. M., and Elessa, M. S. (2023). The impact of digital transformation towards blockchain technology application in banks to improve accounting information quality and corporate governance effectiveness. Cogent Econ. Finance 11 (1), 2161773. doi:10.1080/23322039.2022.2161773

Alaba, O. F. (2024). Investigating the influence of IT inaccessibility and social pressure on employees shadow cloud IT usage during the COVID-19 pandemic MCO period. Int. J. Bus. Inf. Syst. 47 (Issue 4), 495–522. doi:10.1504/ijbis.2024.143870

Allen, D. W. E., and Berg, C. (2020). Blockchain governance: what we can learn from the economics of corporate governance. J. Br. Blockchain Assoc. 3 (1), 46–52. doi:10.31585/jbba-3-1-(8)2020

Almaqtari, F. A. (2024). The role of IT governance in the integration of AI in accounting and auditing operations. Economies 12 (8), 199. doi:10.3390/economies12080199

Ante, L., and Meyer, A. (2021). Cross-listings of blockchain-based tokens issued through initial coin offerings: do liquidity and specific cryptocurrency exchanges matter? Decis. Econ. Finance 44 (2), 957–980. doi:10.1007/s10203-021-00323-0

Bonnet, S., and Teuteberg, F. (2024). Decentralized autonomous organizations: a systematic literature review and research agenda. Int. J. Innovation Technol. Manag. 21 (04), 2450026. doi:10.1142/S0219877024500263

Brender, N., Gauthier, M., Morin, J. H., and Salihi, A. (2024). Three lines model paradigm shift: a blockchain-based control framework. J. Appl. Account. Res. 25 (1), 149–170. doi:10.1108/JAAR-06-2022-0143

Bruner, C. M. (2020). Distributed ledgers, artificial intelligence and the purpose of the corporation. Camb. Law J. 79 (3), 431–458. doi:10.1017/S0008197320000756

Cazazian, R. (2022). Smart contracts in blockchain-based accounting information systems and artificial intelligence-enabled auditing techniques. Analysis Metaphys. 21, 58–73. doi:10.22381/AM2120224

Chen, Y., Pereira, I., and Patel, P. C. (2021). Decentralized governance of digital platforms. J. Manag. 47 (5), 1305–1337. doi:10.1177/0149206320916755

Chen, W. Y., He, K., and Wang, L. F. (2023). Blockchain technology, macroeconomic uncertainty and investment efficiency. Int. J. Emerg. Mark. 18 (7), 1493–1514. doi:10.1108/IJOEM-10-2020-1250

Comoli, M., Tettamanzi, P., and Murgolo, M. (2023). Accounting for “ESG” under disruptions: a systematic literature network analysis. Sustainability 15 (8), 6633. doi:10.3390/su15086633

Culinovic-Herc, E. (2022). Abuses of blockchain technology and impact on companies. Zb. Pravnog Fak. Sveucilista U Rijeci 43 (3), 697–716. doi:10.30925/zpfsr.43.3.9

Daluwathumullagamage, D. J., and Sims, A. (2020). Blockchain-enabled corporate governance and regulation. Int. J. Financial Stud. 8 (2), 1–41. doi:10.3390/ijfs8020036

Davidson, S. (2025). Corporate governance in a crypto-world. Regul. and Gov. 19, 777–788. doi:10.1111/rego.12661

Di Vaio, A., Hassan, R., and Palladino, R. (2023). Blockchain technology and gender equality: a systematic literature review. Int. J. Inf. Manag. 68, 102517. doi:10.1016/j.ijinfomgt.2022.102517

Dong, X., Zhou, N., Zhao, X. M., and Yang, S. B. (2025). The impact of artificial intelligence on corporate green innovation: can “increasing quantity” and “improving quality” go hand in hand? J. Environ. Manag. 376, 124439. doi:10.1016/j.jenvman.2025.124439

Drljevic, N., Aranda, D. A., and Stantchev, V. (2022). An integrated adoption model to manage blockchain-driven business innovation in a sustainable way. Sustain. 14 (5), 2873. doi:10.3390/su14052873

Du, J., Shi, Y., Li, W., and Chen, Y. (2023). Can blockchain technology be effectively integrated into the real economy? Evidence from corporate investment efficiency. China J. Account. Res. 16 (2), 100292. doi:10.1016/j.cjar.2023.100292

Ezzi, F., Abida, M., and Jarboui, A. (2023). The mediating effect of corporate governance on the relationship between blockchain technology and investment efficiency. J. Knowl. Econ. 14 (2), 718–734. doi:10.1007/s13132-022-00892-4

Fahlevi, M., and Pramesti, R. M. (2022). Blockchain technology in corporate governance and future potential solution for agency problems in Indonesia. Int. J. Data Netw. Sci. 6 (3), 721–726. doi:10.5267/j.ijdns.2022.3.010

Fang, X., and Jiang, Y. S. (2024). Blockchain applications: promotion of green innovation. Manag. Decis. 63, 709–733. doi:10.1108/MD-08-2023-1452

Fang, B., Liu, X., Ma, C., and Zhuo, Y. (2023). Blockchain technology adoption and accounting information quality. Account. Finance 63 (4), 4125–4156. doi:10.1111/acfi.13088

Fenwick, M., McCahery, J. A., and Vermeulen, E. P. M. (2019). The end of ‘Corporate’ Governance: hello ‘Platform’ governance. Eur. Bus. Organ. Law Rev. 20 (1), 171–199. doi:10.1007/s40804-019-00137-z

Freeman, R. E. (2010). Strategic management: a stakeholder approach. Cambridge: Cambridge University Press. doi:10.1017/CBO9781139192675

Guerin, T. (2022). Questions that board directors should be asking about emerging governance issues and risk: a practitioner’s view and implications for the extractive industries. Mineral. Econ. 35 (2), 221–237. doi:10.1007/s13563-021-00278-z

Han, J., Lee, J., and Li, T. (2025). A review of DAO governance: recent literature and emerging trends. J. Corp. Finance 91, 102734. doi:10.1016/j.jcorpfin.2025.102734

Ivaninskiy, I., and Ivashkovskaya, I. (2022). Are blockchain-based digital transformation and ecosystem-based business models mutually reinforcing? The principal-agent conflict perspective. Eurasian Bus. Rev. 12 (4), 643–670. doi:10.1007/s40821-022-00209-0

Ivaninskiy, I., Ivashkovskaya, I., and McCahery, J. A. (2023). Does digitalisation mitigate or intensify the principal-agent conflict in a firm? J. Manag. Gov. 27 (3), 695–725. doi:10.1007/s10997-021-09584-8

Kaal, W. A. (2020). Decentralized corporate governance via blockchain technology. Ann. Corp. Gov. 5 (2), 101–147. doi:10.1561/109.00000025

Kanojia, S. (2023). Application of blockchain in corporate governance: adaptability, challenges and regulation in BRICS. BRICS Law J. 10 (4), 53–67. doi:10.21684/2412-2343-2023-10-4-53-67

Kazakov, A., Denisova, S., Barsola, I., Kalugina, E., Molchanova, I., Egorov, I., et al. (2023). ESGify: automated classification of environmental, social, and corporate governance risks. Dokl. Math. 108, S529–S540. doi:10.1134/S1064562423701673

Kimani, D., Adams, K., Attah-Boakye, R., Ullah, S., Frecknall-Hughes, J., and Kim, J. (2020). Blockchain, business and the fourth industrial revolution: whence, whither, wherefore and how? Technol. Forecast. Soc. Change 161, 120254. doi:10.1016/j.techfore.2020.120254

Kshetri, N. (2018). The Indian blockchain landscape: regulations and policy measures. Asian J. Res. 9 (2), 56–71. Available online at: https://libres.uncg.edu/ir/uncg/listing.aspx?id=25549

Lambert, T., Liebau, D., and Roosenboom, P. (2022). Security token offerings. Small Bus. Econ. 59 (1), 299–325. doi:10.1007/s11187-021-00539-9

Lo Monaco, V., Momtaz, P., and Vismara, S. (2025). Distributed governance and value creation in decentralized autonomous organizations: evidence from a regression discontinuity design. Econ. Lett. 248, 112233. doi:10.1016/j.econlet.2025.112233

Lombardi, R., de Villiers, C., Moscariello, N., and Pizzo, M. (2022). The disruption of blockchain in auditing – a systematic literature review and an agenda for future research. Account. Auditing Account. J. 35 (7), 1534–1565. doi:10.1108/AAAJ-10-2020-4992

Meier, O., and Sannajust, A. (2021). The smart contract revolution: a solution for the holdup problem? Small Bus. Econ. 57 (2), 1073–1088. doi:10.1007/s11187-020-00339-7

Meiryani, M., Warganegara, D. L., and Andini, V. (2023). Big data, machine learning, artificial intelligence and blockchain in corporate governance. Foresight STI Gov. 17 (4), 69–78. doi:10.17323/2500-2597.2023.4.69.78

Morrison, R., Mazey, N., and Wingreen, S. C. (2020). The DAO controversy: the case for a new species of corporate governance? Front. Blockchain, 3 3, 25. doi:10.3389/fbloc.2020.00025

Murray, A., Kuban, S., Josefy, M., and Anderson, J. (2021). Contracting in the smart era: the implications of blockchain and decentralized autonomous organizations for contracting and corporate governance. Acad. Manag. Perspect. 35 (4), 622–641. doi:10.5465/amp.2018.0066

Mutamimah, M., Alifah, S., and Adnjani, M. D. (2023). Corporate governance innovation framework to reduce credit risk in MSMEs using blockchain technology. Cogent Bus. Manag. 10 (3), 2250504. doi:10.1080/23311975.2023.2250504

Ogedengbe, F. A., Abdul Talib, Y. Y., and Rusly, F. H. (2025). Understanding shadow IT usage: the interplay of IT accessibility, work overload, and employee strain. Rev. Adm. Mackenzie 26 (1), eRAMR250152. doi:10.1590/1678-6971/eRAMR250152

Pimentel, E., and Boulianne, E. (2020). Blockchain in accounting research and practice: current trends and future opportunities. Account. Perspect. 19 (4), 325–361. doi:10.1111/1911-3838.12239

Qian, C., Gao, Y., and Chen, L. (2023). Green supply chain circular economy evaluation system based on industrial internet of things and blockchain technology under ESG concept. Processes 11 (7), 1999. doi:10.3390/pr11071999

Radonjić, L., Bojić, L., and Novaković, M. (2024). Blockchain integration in public sector: a comprehensive review of economic and legal challenges. Ekon. Preduzeca 72 (5–6), 305–321. doi:10.5937/ekopre2406305r

Rehman, A., and Umar, T. (2025). Literature review: industry 5.0. leveraging technologies for environmental, social and governance advancement in corporate settings. Corp. Governance-The Int. J. Bus. Soc. 25 (2), 229–251. doi:10.1108/CG-11-2023-0502

Rijanto, A. (2024). Blockchain technology roles to overcome accounting, accountability and assurance barriers in supply chain finance. Asian Rev. Account. 32 (5), 728–758. doi:10.1108/ARA-03-2023-0090

Rodríguez, N. (2024). Nueva gobernanza empresarial: criterios ESG y blockchain. Rev. E-Mercatoria 23 (1), 187–204. doi:10.18601/16923960.v23n1.07

Ronaghi, M. H., and Mosakhani, M. (2022). The effects of blockchain technology adoption on business ethics and social sustainability: evidence from the Middle East. Environ. Dev. Sustain. 24 (5), 6834–6859. doi:10.1007/s10668-021-01729-x

Saurabh, K., Rani, N., and Upadhyay, P. (2024). Towards novel blockchain decentralised autonomous organisation (DAO) led corporate governance framework. Technol. Forecast. Soc. Change 204, 123417. doi:10.1016/j.techfore.2024.123417

Singh, H., Jain, G., Munjal, A., and Rakesh, S. (2020). Blockchain technology in corporate governance: disrupting chain reaction or not? Corp. Gov. (Bingley) 20 (1), 67–86. doi:10.1108/CG-07-2018-0261

Smith, S. S., and Castonguay, J. J. (2020). Blockchain and accounting governance: emerging issues and considerations for accounting and assurance professionals. J. Emerg. Technol. Account. 17 (1), 119–131. doi:10.2308/jeta-52686

Sun, R. T., Garimella, A., Han, W. C., Chang, H. L., and Shaw, M. J. (2020). Transformation of the transaction cost and the agency cost in an organization and the applicability of blockchain—A case study of peer-to-peer insurance. Front. Blockchain, 3 3, 24. doi:10.3389/fbloc.2020.00024

Sun, C., Jiang, G., and Zhang, J. (2024). An analysis of hotspots, subject structure, and emerging trends in digital governance research. SAGE Open 14 (3), 21582440241268756. doi:10.1177/21582440241268756

Tran, N. P., Le, Q. T. T., Vo, A. T., and Vo, D. H. (2024). Digital transformation and corporate restructuring: does corporate governance matter? J. Strategy Manag. 1 (1). doi:10.1108/JSMA-04-2023-0084

Vermeulen, E. P. M., Fenwick, M., and Kaal, W. (2018). Why blockchain will disrupt corporate organizations: what can be learned from the “Digital Transformation”. J. Br. Blockchain Assoc. 1 (2), 1–10. doi:10.31585/jbba-1-2-(9)2018

Yang, S. L., Tai, Y. F., and Liu, J. N. (2024). Mechanism analysis and path study of digital transformation on corporate governance: evidence from Chinese listed companies. Sustainability 16 (21), 9245. doi:10.3390/su16219245

Yermack, D. (2017). Corporate governance and blockchains. Rev. Financ. 21 (1), 7–31. doi:10.1093/rof/rfw074

Zhang, S., and Luo, S. (2022). Evolution analysis of corporate governance structure based on blockchain network security and complex adaptive system. Sustain. Energy Technol. Assessments 53, 102715. doi:10.1016/j.seta.2022.102715

Keywords: blockchain technology, corporate governance, decentralised autonomous organisation, smart contract, systematic review

Citation: Ogedengbe FA and Adelowotan MO (2025) Revolutionising corporate governance: blockchain’s transformative impact and potential. Front. Blockchain 8:1654633. doi: 10.3389/fbloc.2025.1654633

Received: 26 June 2025; Accepted: 01 October 2025;

Published: 23 October 2025.

Edited by:

Hamid Mattiello, Fachhochschule des Mittelstands, GermanyReviewed by:

Jamil Ahmad, University of Malakand, PakistanMarko Novakovic, Institut za Medunarodnu Politiku I Privredu, Serbia

Copyright © 2025 Ogedengbe and Adelowotan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Fowokemi Alaba Ogedengbe, Zm9nZWRlbmdiZUB1ai5hYy56YQ==, b2dlZGZvd29rZW1pQGdtYWlsLmNvbQ==

Fowokemi Alaba Ogedengbe

Fowokemi Alaba Ogedengbe Micheal Olajide Adelowotan

Micheal Olajide Adelowotan