- 1School of Management, Shenyang University of Technology, Shenyang, China

- 2Faculty of Business, Economics and Accountancy, Universiti Malaysia Sabah, Kota Kinabalu, Malaysia

- 3Management College, Beijing Union University, Beijing, China

- 4School of International Business and Management, Sichuan International Studies University, Chongqing, China

Introduction: The development and growth of Asset-Backed Securitization (ABS) finance in the e-commerce supply chain is of great value in alleviating the capital constraints of enterprises. However, asset-backed securitization finance faces problems such as low cooperation efficiency and lack of trust mechanism. The consensus mechanism, encryption algorithm, traceability and other characteristics of blockchain can help strengthen cooperation between enterprises, improve the level of information sharing, and promote trust transmission. In the finance process, most managers are risk-averse, and managers are prone to overconfidence, overestimating returns and underestimating risks.

Methods: This paper studies asset-backed securitization finance in the e-commerce supply chain. Four models are constructed using game analysis: a non-cooperative model without blockchain, a cooperative model without blockchain, a non-cooperative model with blockchain, and a cooperative model with blockchain. The asset backed securitization finance strategy considering manager overconfidence and risk aversion with blockchain is analyzed to explore the optimal finance decision.

Results and Discussion: Through numerical analysis, it is found that blockchain helps to enhance the transparency and authenticity of financing information and increase the financing returns of e-commerce platforms. To a certain extent, the cooperation model can mitigate the negative impact of managers’ overconfidence on the financing returns of suppliers, e-commerce platforms and SPV. However, risk avoidance under the cooperative model is not conducive to the improvement of suppliers’ financing returns. The higher asset pool yield has significantly increased the financing returns of the SPV. The financing returns of suppliers and SPV will decline with the increase of the price sensitivity coefficient in the cooperative model, but it will be different in the non-cooperative model. This study strives to provide decision-making references for finance entities.

1 Introduction

The problem of capital constraints in the e-commerce supply chain has attracted much attention. Asset-Backed Securitization (ABS) financing can help alleviate the financing constraints of enterprises. Against the backdrop of the rapid expansion of emerging models such as live-streaming e-commerce, e-commerce supply chain enterprises are facing the dual challenges of a surge in orders and capital turnover pressure, and the issue of capital constraints has become increasingly prominent. The order volatility of live-streaming e-commerce platforms is large, and merchants need to prepare goods in advance but face the pressure of long payment periods on the platforms. In addition, the inventory backlog caused by promotional activities significantly raises the risk of interruption of funds (Shen et al., 2022). In this context, asset-backed securitization financing has become an important tool to alleviate corporate financing constraints. By integrating the trust of core firms, packaging and transferring the accounts receivable of upstream suppliers, and issuing asset-backed securities in the capital market, it realizes the liquidity of accounts receivable, and provides suppliers with a low-cost, long-term financing channel, effectively shortening the capital recovery cycle (Li et al., 2023). In the financing process, core enterprises can act as initiators themselves or cooperate with external initiators. Various cooperation models further improve the quality of financing. Since the launch of its first ABS product in 2015, it has effectively raised the cash flow turnover efficiency. Under this model, suppliers do not overly rely on traditional bank collateral and pledges. Instead, they package their scattered small accounts receivable into securities products with certain credit ratings through the structured design of securitization, which are then purchased by investment institutions to obtain financing. By setting up reserve accounts and introducing credit enhancement measures, potential liquidity and credit risks have been effectively hedged, safeguarding the rights and interests of investors and the safety of funds, and helping to attract more investors to alleviate the capital constraints of suppliers.

The financing entities of asset-backed securitization are all risk-averse, but the financing process may also lead to overconfidence among managers. As an important tool for financial innovation, the core goal of asset-backed securitization is to reduce the risk exposure of the financing entities through risk isolation and credit reconstruction. Therefore, the financing entities are usually risk-averse (Zhang, 2025), (Liu et al., 2025). However, in actual operations, the overconfidence of managers has become a hidden source of risk in this process, which may distort the decision-making logic and aggravate potential risks (Ro et al., 2025). Behavioral finance research shows that overconfidence is a common psychological bias among investors and managers, which manifests itself in overestimation of their own judgment ability, optimistic expectations of future returns, and underestimation of risks. This phenomenon is particularly prominent in the field of asset-backed securitization. Psychological mechanisms further explain this contradiction. Self-attribution bias causes managers to attribute past successes to their own abilities and blame failures on external factors. Confirmation bias strengthens their selective attention to specific information, overemphasizes the historical performance of the underlying assets in asset-backed securitization and ignoring changes in economic cycles or industry risks. Managers overestimate their own risk control capabilities and ignore the hidden dangers of the quality of the underlying assets. Research shows that overconfident investors trade 45% more than rational investors, but their annualized returns are 1.4% lower. In asset-backed securitization financing decisions, managers may frequently adjust the structure of securitization products or expand the issuance scale, which may aggravate information asymmetry and liquidity risks.

Blockchain helps optimize asset-backed securitization financing strategies and better alleviate the capital constraints of enterprises. Blockchain is deeply reconstructing the asset-backed securitization financing process through its decentralization, data immutability and smart contracts, and provides innovative solutions to alleviate the capital constraints of enterprises, to promote the digital transformation of enterprises (Liu et al., 2022), (Kou and Lu, 2025). In traditional asset-backed securitization financing, problems such as insufficient ability to verify the authenticity of underlying assets and low efficiency of multi-party collaboration have long existed, while the distributed ledger and consensus mechanism of blockchain have effectively solved these problems, which speed up the process of digitalization (Huang and Yan, 2025). Blockchain technology can achieve seamless integration of the entire process of asset-backed securitization business. Through real-time sharing of asset information on the chain, the information barriers between original rights holders, investors and intermediaries are eliminated, to ensure the authenticity of the underlying assets. Smart contracts automatically execute cash flow distribution and transaction settlement, to shorten the traditional process that takes weeks to minutes, significantly reducing the financing cycle and financing costs, and improve the efficiency of cooperation among financing entities (Miller et al., 2023). The Langxin Group’s new energy project in the Hong Kong Monetary Authority’s Ensemble sandbox uses Ant Digital’s blockchain + AIoT technology to upload charging pile operation data to the chain in real time, realize dynamic asset monitoring and digital issuance of income rights, shorten the underlying asset due diligence cycle by 70%. Blockchain effectively raises the realness and reliability of message, and strengthens cooperation between enterprises. The improvement of the regulatory framework further promotes the application of blockchain in ABS, to promote the development of digitalization. The Hong Kong Securities and Futures Commission approved Guotai Junan to issue tokenized securities, to allow digital bonds to circulate on the compliance chain. The EuroRWA Exchange relies on the EU MiCA framework to tokenize assets such as medical real estate and artworks and introduces blockchain technology to protect privacy and optimize the blockchain-driven supply chain financial ecosystem.

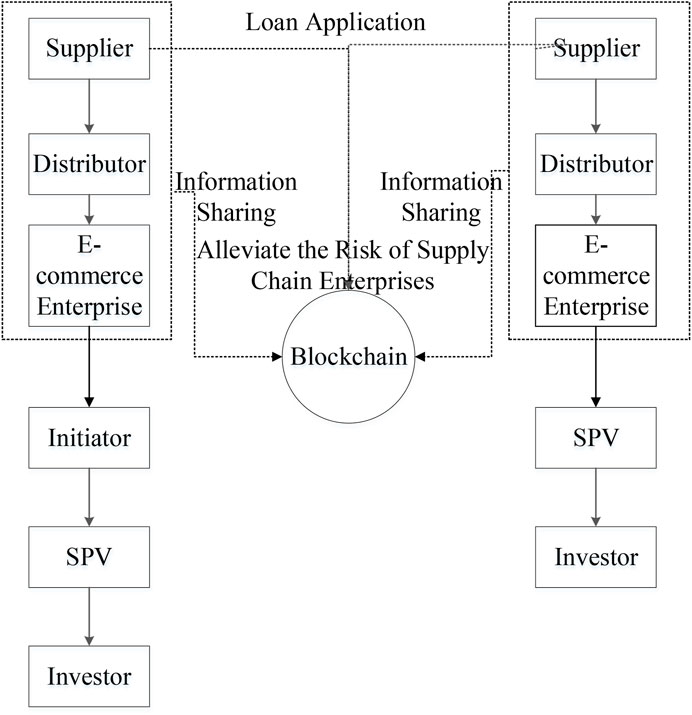

Based on this, we take ABS as the research object, considering the influence of managers’ overconfidence and risk aversion, and explores the equilibrium strategy of asset-backed securitization financing under blockchain. The main issues to be addressed are: (1) How can e-commerce supply chain enterprises achieve financing equilibrium in asset-backed securitization financing? (2) What is the impact of managers’ overconfidence and risk aversion on asset-backed securitization financing strategies? (3) How to use blockchain technology to optimize asset-backed securitization financing strategies? Suppliers with capital constraints apply for asset-backed securitization financing. In the financing process, managers have behavioral preferences such as overconfidence and risk aversion. As a core enterprise, e-commerce platforms can act as initiators to apply for financing from SPVs (non-cooperative model) or they can cooperate with external initiators to apply for ABS (cooperative model). E-commerce platforms put suppliers’ accounts receivable into the asset pool to apply for ABS. The assets are packaged and reorganized by the initiators and shifted to Special Purpose Vehicles (SPVs), thereby selling securitized assets to investors to obtain financing. This study helps managers to better formulate scientific and reasonable financing strategies.

The main contributions of this study are reflected in the following aspects: Firstly, the use of blockchain to optimize asset-backed securities financing strategies. Most previous studies have introduced blockchain technology into supply chain financing, primarily through case studies, with less focus on applying blockchain technology to asset-backed securities financing. However, many features of blockchain have good applications in asset-backed securities financing, which helps to optimize financing strategies. This study combines relevant practical cases and uses game theory analysis to quantitatively analyze the application of blockchain in asset-backed securities financing strategies, exploring the optimal financing decisions. Secondly, when studying financing strategies, it considers the manager’s overconfidence and risk-averse behavior. Managers have behavioral preferences such as overconfidence and risk aversion, and most previous studies have only applied the manager’s behavioral preferences to supply chain management. However, in the process of supply chain financing, the manager’s behavioral preferences cannot be ignored and will affect the formulation of financing decisions. In this study, when researching asset-backed securities financing strategies, it explores the impact of the manager’s behavioral preferences on financing strategies. Finally, it enriches the research on existing asset-backed securities financing models. Most previous literature, when studying asset-backed securities financing, has only considered traditional single financing methods. This study, combining the unique characteristics and actual operational situations of e-commerce supply chains, innovatively considers the cooperative model of e-commerce platforms collaborating with external initiators, as well as the non-cooperative model of e-commerce platforms creating their own financing channels, making the exploration of blockchain’s impact more aligned with real-world scenarios. Most previous studies have only applied risk-sharing contracts to supply chain management, but in the decision-making process of asset-backed securities financing, contract coordination helps promote cooperation between enterprises and improve financing efficiency. To optimize asset-backed securities financing strategies, this study introduces risk-sharing contracts into the cooperative model, coordinating the interest conflicts between e-commerce supply chain enterprises and better alleviating the financial difficulties of suppliers.

The remaining parts are arranged as follows: Section 2 summarizes the status of literature research in related fields and conducts a literature review. Section 3 explains the background of the research problem and proposes research hypotheses. Section 4 constructs a game model and conducts comparative analysis. Section 5 is a numerical analysis to explore the impact of various factors. Section 6 is the conclusion and outlook.

2 Literature review

2.1 Asset-backed securitization finance in supply chain

Supply chain asset-backed securitization financing is an innovative tool that integrates financial engineering and industrial chain. By converting liquidity-constrained assets such as accounts receivable into tradable securities in the capital market, it effectively solves the finance constraints of Small and Medium-sized Enterprises (SMEs) and optimizes the capital management efficiency of enterprises. This review systematically sorts out relevant research and reveals its development logic, which is mainly divided into three aspects: operational decision-making and practical exploration, financing mechanism and financial effect analysis, market mechanism and risk management.

In terms of operational decision-making and practical exploration, based on the Stackelberg game model, this paper explores the operation and financial strategies of suppliers and retailers of SMEs, and constructs a combined financing framework that considers capital constraints and tax factors. The study found that wholesale prices decrease as retailers’ cash flow increases, and the vendor’s finance rate is negatively correlated with its own capital; retailers with high product premiums or high capital are more susceptible to supplier price discounts; under capital constraints, risk tax rates or financing costs may not necessarily push up wholesale prices. When the supplier premium is moderate, trade credit and asset securitization combined finance can achieve a win-win for both parties. The study further reveals the optimization effect of the tax shielding effect on financing decisions and suggests that the government encourages SMEs to finance by adjusting tax rates, while promoting financial institutions to improve ABS services to promote supply chain financial innovation (Dong et al., 2020), (Lu and Yang, 2024). Based on the empirical analcites the propensity scores matching method (PSM), it is found that the average issuance rate of China’s green enterprise ABS is 36.97 basis points lower than that of conventional securities, which highlight its financing cost advantage. The study identified credit rating, published size, money rate expiry date and green property as core influencing factors. It indicates that green financial instruments can effectively support low-carbon transformation goals by optimizing financing structure and provide low-cost financing reference for green projects under the carbon neutrality path (Zhao et al., 2021). Based on the data of China’s bond market from 2014 to 2019, it is revealed that the reputation of underwriters has a significant negative effect on the publish margin of ABS products. Empirical results show that in the CLO and ABS markets, high-reputation underwriters can effectively compress the publish margin, but this impact is not seen in the ABN market; when nationalize firms or launch firms are the sponsors, the initial spread is significantly reduced; the higher the number of securities layers and the secondary ratio, the stronger the impact of reputation on price. Research shows that underwriters mitigate information asymmetry through reputation mechanisms, and their credit intermediary role is more prominent in securities products with more complex structures. The heterogeneous characteristics of different security types and sponsor attributes regulate the spread path of the standing influence (Liu and Wu, 2023).

From the perspective of financing mechanism and financial effect analysis, scholars focus on the success mechanism of ABS in China’s PPP refinancing (PPP-ABS). Through questionnaire surveys and structural equation models, four key success factors are identified: underlying asset quality (UAQ), original shareholder credit (OEHC), rationality of securities design (RoSD) and institutional maturity (MoRI). Empirical results show that UAQ and OEHC have a direct positive impact on the success of PPP-ABS, while issuance characteristics have an intercede function in the transmission between UAQ, RoSD and MoRI. The study reveals the interactive influence mechanism of the institutional environment, asset credit rating and product design on the financing efficiency of PPP securitization, to offer academic basis for optimizing the refinancing path of PPP projects, enhance investor confidence and policy formulation (Liu et al., 2021). Some scholars have constructed a comprehensive operation model of eco-restitution property securitization and a multi-state Markov appraisal frame. The model deviancy difference is 0.89% through case verification, confirming its effectiveness. The study found that when the net present value of the item is positive, the risk of ecological compensation can be reduced, and the return can be increased. Interest rate changes and default probability are the core sensitive factors for asset pool valuation. Based on the empirical results, policy recommendations are proposed to give practical paths for the securitization of ecological compensation, and to promote the coordinated innovation of environmental governance and economic development (Zhang and Bi, 2024). A two-stage low-carbon supply chain model is constructed to explore the mechanism of combined financing (bank loans/commercial credit/asset securitization) to alleviate the financing constraints of low-carbon supply chains. The study found that under the dual credit model, tax incentives can only encourage emission reduction when consumers are highly price sensitive; consumers’ low-carbon preferences will advance the prices of goods in the DC model and push up the prices of low-sensitivity products in the ABS + DC combined financing. Although combined financing can optimize cash flow, it still has higher liquidity pressure than the pure BL/DC model. In addition, the carbon emission reduction tax rate and deduction ratio will significantly sway the price and finance policy path under the three types of financing models under certain conditions. The study also incorporates multi-stage capital demand scenarios to reveal the complex dynamic relationship of low-carbon supply chain financial decisions (Dong et al., 2023). Based on the transaction data of Chinese corporate ABS, the connection between ABS publication and corporate finance feature is revealed. The data shows that about half of the ABS issuers are SMEs, and 70% of the issuance interest rates are lower than the bank loan benchmark level. Empirical research shows that the issuance of corporate ABS is positively correlated with the interest savings and credit constraints, and private enterprises are more responsive to the financing advantages of the ABS market than state-owned and foreign-funded enterprises. Research has confirmed that ABS, as an alternative financing tool, can effectively alleviate the pressure on corporate financing costs, especially in a credit crunch, and its role in supporting the finance of SMEs and private enterprises is more prominent (Gao et al., 2024). Based on the transaction data of China’s non-financial corporate ABS, the “perspective method” is used to determine the pragmatic initiator, and the impression of ABS on firm leverage is empirically tested. The study found that although the regulators viewed ABS as a deleveraging tool, it significantly increased corporate leverage, and this effect was common in state-owned enterprises, private enterprises, and enterprises of different sizes. Further mechanism analysis shows that ABS partially explains the increase in leverage by enhancing the internal financing capacity of enterprises, to reveal the regulatory blind spot that asset securitization may be alienated into a leverage means, which has a warning significance for policy making (Pang et al., 2024).

From the perspective of market mechanism and risk management research, based on a large-scale agent-flow consistent macroeconomic model, a securitization mechanism involving financial carrier companies and mutual funds is constructed to reveal the dual impact of loan and mortgage securitization on the economic cycle. Through regulatory capital arbitrage, securitization prompts banks to expand credit scale and stimulate investment and consumption, but excessive securitization leads to increased risk exposure after credit expansion, to aggravate the probability of corporate bankruptcy, and thus weakening banks’ credit capacity for consumer goods production and housing mortgages. Research shows that the intensity of securitization’s impact on the economy depends on the securitization tendency threshold and time dimension and presents a nonlinear dynamic balance between short-term stimulus and long-term risk accumulation (Mazzocchetti et al., 2018). Based on the information of firm ABS bond from 2017 to 2022, it reveals an outstanding negative correlation between underwriter standing and publication margin. Empirical results show that the bigger the underwriter’s prestige, the lower the ABS issuance spread, but state-owned enterprise issuers will weaken this effect. In addition, there are conspicuous otherness in reputation impact among issuers of different ownership natures, it indicates that underwriter reputation has a differentiated mechanism of action in asset securitization pricing. The study confirmed that the reputation premium is more significant in non-state-owned issues, and the institutional attributes regulate the transmission path of reputation to risk pricing through the ownership structure, to provide a new perspective for understanding the information asymmetry and credit intermediary function of the securitization market (Xu and Dong, 2023). The application value and implementation path of ABS in the finance of reproducible power source business are systematically explored. The study pointed out that this model can effectively alleviate the financing difficulties of enterprises by activating existing assets and enhancing credit and risk isolation advantages. Its feasibility is based on financing pain point analysis, basic asset adaptability, legal policy framework and international practical experience. The study proposed three securitization mechanisms and carried out case verification and found that their core advantage lies in high accessibility rather than cost optimization. At present, my country faces challenges such as insufficient subsidized assets, high securitization risk costs, patent securitization barriers and institutional defects. It is recommended that the government strengthen project income guarantees, reduce securitization risk costs, promote patent securitization practices and improve the basic institutional system (Zhang et al., 2023).

From operational decision-making, finance mechanisms to market risk management, relevant research focuses on green financial product innovation, the practical path of asset securitization and its impact on the economy and the environment. It reveals the key role of asset securitization financing in optimizing resource allocation, to reduce risks and promote sustainable development, and points out its challenges in policy support, risk management and market adaptability. However, previous studies rarely combine the advantages of new technologies to optimize financing strategies to meet financing challenges. New technologies such as blockchain can help strengthen cooperation between enterprises and improve the quality of financing. Explore cooperative and non-cooperative models under blockchain, to analyze the application of blockchain in asset securitization financing and analyze its impact on cooperative games and non-cooperative games. The risk issues in the process of asset securitization financing have always attracted the attention of many scholars, but the existing literature rarely takes managers’ risk aversion into account from the perspective of manager behavior and explores the impact of managers’ behavioral preferences on asset securitization financing strategies in the process of financing strategy formulation.

2.2 Behavioral finance in supply chain

In the process of operation, managers have behavioral preferences when making decisions. This study explains this from two aspects: manager overconfidence and risk aversion.

In terms of manager overconfidence, based on a sample of 570 listed construction companies in South Korea, it is found that supernally leveraged firms are more inclined to avoid debt internalization through property Project Finance (PF), because PF investment can list guarantees as contingent liabilities. Manager overconfidence strengthens the forward dependence relation between leverage and PF investment. Overly optimistic expected returns and business prospects lead to risky decisions when the financing environment deteriorates, to exacerbate the accumulation of financial risks (Ro et al., 2025). Based on the data of Chinese firms, it is found that adverse outside requirement shocks increase the firm financialization, but the dual regulatory effects of speculator sentiment and manager confidence weaken this effect. Specifically, although the shocks prompted companies to raise their configuration of property, speculator pessimism suppressed their financialization tendencies, and the reduction of manager overconfidence further eased the financialization trend. It is worth noting that the financialization response intensity of private firms to negative shocks is bigger than that of state business, to highlight the differences in their risk hedging needs and financial strategies (Guo et al., 2025). The study explored the impact of gender differences on financing of SMEs during the conjuncture and found that bank will give loans to female entrepreneurs because their proposals are more cautious and pragmatic. However, when female entrepreneurs show overconfidence, banks become conservative, while male overconfident entrepreneurs are not subject to similar restrictions. The study showed that the interaction between gender and confidence level affects credit decisions, and there is no discrimination on average, but female overconfidence may trigger risk aversion behavior, to reveal that banks implicitly have stereotyped differences in their evaluation of female leadership (Liu et al., 2024).

In terms of risk aversion, the performance of green investment portfolios is compared and analyzed to evaluate the role of ABS and digital finance in achieving zero-carbon goals. Using indicators such as return on investment and risk-adjusted return (ROMAD), combined with case analysis and empirical data, the balance mechanism between carbon footprint reduction and market stability in green investment is revealed to help enterprises avoid risks. The study found that digital finance and ABS can effectively improve the efficiency of ecological sustainable investment, but it is necessary to weigh cost-benefit and technical adaptability. The results provide a theoretical basis and practical path for policymakers, investors and financial institutions to optimize zero-carbon investment strategies and promote the coordinated realization of financial instrument innovation and carbon neutrality goals (Lei et al., 2024). An asset-backed note (ABN) issuance framework based on fundamental installation item use rights is proposed. Taking highway concession rights as an example, the risk aversion of enterprises is considered, and its sustainable financing mechanism is demonstrated. The interest rate of ABN are decided by combining cash, and option-adjusted spread (OAS), and risk indicators such as duration and convexity are analyzed to provide a quantitative model and pricing basis for infrastructure asset securitization and promote the innovation of green financial instruments (Zhang et al., 2021). The study explores the impact of customer risk on the securitization financing of accounts receivable of risk-averse enterprises. The study found that the bigger the buyer’s credit risk and dispersion, the lower the scale of corporate securitization financing and leverage ratio. Although the securitization design aims to isolate the original enterprise from the asset risk, the accounts receivable risk itself directly inhibits the asset securitization ability and indirectly weakens the external financing channels of the enterprise. The study reveals a new relationship between the financing ability of risk-averse suppliers in the supply chain. It indicates that rising risks will limit the effectiveness of monetary projects in created safe property, thereby affecting the company’s ability to obtain external capital (Liu et al., 2018). In response to the problems of imprecise expression and reliability verification in the development of smart contracts, the AS-SC specific field tongue and AS2EB transformation methods are proposed. Traditional DSL has limitations due to insufficient scenario coverage and lack of logic verification. AS-SC expands and simplifies syntax to enable financial experts to accurately describe securitization needs and help companies better avoid risks. AS2EB converts AS-SC code into Event-B language based on mathematical formalization methods, enable software engineers to strictly verify the contract logic. Experiments have shown that this combination method can significantly reduce communication costs and testing risks by ensuring semantic consistency. Case studies have shown that it has efficient and reliable application value in credit asset securitization scenarios (Li et al., 2024). Based on a supply chain composed of capital-constrained OEMs and risk-averse authorized remanufacturers, four financing models (no financing, debt/equity financing, and capital sufficiency scenarios) are constructed, and the influence of risk aversion on equilibrium strategies is analyzed by reverse induction. The study found that debt financing performs better in terms of environmental benefits and win-win for members and can maximize consumer surplus. The study innovatively attributes the risk aversion of remanufacturers to the uncertainty of remanufacturing costs and determines the applicable boundary of debt financing through the envelope theorem, to provide theoretical support for the finance tactics selection and pointing out the extended value of multi-period dynamic models and information asymmetry scenarios (Xia et al., 2023). An omni-channel fresh food supply chain optimization model is constructed, which combines robust and stochastic optimization methods to deal with the uncertainty of transportation costs, demand, and loss rates, and incorporates trade credit and bank loans into the financing decision-making framework. The model takes the retailer’s capital as a hard constraint, transforms it into a mixed integer programming through linearization, and uses the improved K-means clustering SAA algorithm to solve it. Numerical experiments verified the applicability and solution efficiency of the model, revealed the impact of risk-avoidance behavior on supply chain strategies, and provided theoretical support and practical guidance for omni-channel retailers to achieve collaborative optimization of multi-source procurement and multi-channel distribution under capital constraints (Guan et al., 2022).

Managerial overconfidence has an important impact on supply chain operations and financing, but few scholars have applied it to the field of asset securitization financing. This paper takes managerial overconfidence into consideration when studying asset securitization financing strategies and innovatively analyzes the impact of managerial overconfidence and other behavioral preferences on financing strategies. Managers pay more attention to risk management in the financing process and take a series of measures to prevent risks. In this paper, when studying asset-backed securitization financing, we consider the risk-averse behavior of enterprises and explore the optimal financing decision of risk-averse enterprises.

2.3 Blockchain in supply chain financing

Blockchain is profoundly changing the supply chain finance industry by reconstructing the trust mechanism and improving financial efficiency. It can effectively alleviate the problems of information asymmetry and low operational efficiency in the financing process. Related research is mainly elaborated from the aspects of technology application and scenario innovation, governance capacity and trust mechanism, financial efficiency and model innovation, risk management and compliance review, and policy and regulatory framework.

From the perspective of technology application and scenario innovation, this paper systematically explores the integration potential of Islamic bonds (Sukuk) and distributed ledger technology (DLTs). Through the case analysis of blockchain smart contracts and tokenization projects, it reveals the innovative value of DLTs in simplifying the Sukuk issuance process and improving transaction transparency. The study points out that DLTs technology may reshape the industry landscape in the competition between traditional finance and Islamic finance (IF), but the standardization barriers formed by differences in Shariah legal interpretation still need to be overcome. By constructing the Shariah Tech technical framework, the study proposes a new path to achieve compliance verification of Islamic financial products with smart contracts, to give a reference for regulators to formulate adaptive policies, promote the standardization of global Islamic financial instruments and enhance market competitiveness (Delle Foglie et al., 2025). Build a cascading deep learning framework, optimize financial data analysis in combination with blockchain technology, and develop innovative application scenarios. Through hierarchical feature transformation and enhanced feature selection strategies, a multi-layer feature combination method is proposed, and the blockchain encryption algorithm is used to realize transaction data encapsulation to ensure data transparency, traceability and security. Experiments show that increasing the model’s scale can raise sort precision, verify the value of blockchain technology in ensuring data credibility, and provide an innovative path for the integration of deep learning and distributed technology for intelligent analysis of financial data (Chen et al., 2020).

From the perspective of governance capacity and trust mechanism, based on game theory, this paper explores the impact of blockchain technology on the operational strategies of supply chain finance (SCF), with a focus on analyzing whether core enterprises should establish centralized decision-making through their own channels to enhance governance capabilities. The study found that when core enterprises mainly sell high-cost goods or the blockchain’s cost is too high, it is not advisable to establish their own channels; after establishing channels, manufacturers need to lower wholesale prices, while core enterprises may increase retail prices. Blockchain technology significantly reduces service rates and interest rates by improving market credit, and its impact on the price system is regulated by production costs. It is worth noting that when the blockchain’s cost is little enough, regardless of whether the firms adopts a centralized or decentralized model, the profits of all participants are improved, verify the strategic value of blockchain technology in optimizing SCF capital efficiency and enhancing system credit (Dong et al., 2021). Based on governance theory, the mechanism of blockchain in building trust in SCF is revealed, and it is proposed that trust comes from the synergy of the dual attributes of codability and verifiability. Through multiple case analysis, it is found that when both are high, blockchain governance is dominant; when a single attribute is prominent, blockchain governance and relationship governance form a mixed model; when both are low, contract governance is more efficient. The study breaks through traditional cognition and proves that blockchain does not generate trust in a one-way manner but needs to be dynamically adapted to governance mechanisms such as relationship networks and contract rules. This conclusion provides a theoretical framework for optimizing blockchain application scenarios and balancing technical characteristics and institutional environment and has practical guiding value for solving the trust crisis in the supply chain (Song et al., 2024). In response to the credit splitting problem of core firms in China’s SCF, a new blockchain-driven architecture is proposed. Through decentralization, tamper-proof and traceability characteristics, a credit splitting mechanism is constructed to optimize the efficiency of capital circulation and realize the digital reconstruction of traditional models such as accounts receivable financing and inventory financing. The research contribution lies in the design of the technical architecture and underlying implementation of the blockchain-driven SCF management system; the credit splitting mechanism based on blockchain breaks through the credit transmission bottleneck of core enterprises; and verifies the disruptive reconstruction value of blockchain for SCF (Chen et al., 2021).

From the perspective of financial efficiency and model innovation, the application potential of zero-knowledge dispersed ledger in alleviating information blocking in property market is evaluated. Through market data analysis, literature reviews and interviews with multiple stakeholders, a new securitization platform based on zero-knowledge proof is proposed. The platform uses the Ledger protocol developed by MIT Media Lab to achieve collaborative interaction among multiple participants while ensuring the privacy of loan-level data and provides real-time performance monitoring through encrypted data analysis. The research verifies that technology can improve market transparency without exposing sensitive information, inject the dual value of privacy protection and data sharing into the asset securitization process, and provide a technical paradigm for financial infrastructure innovation (Meralli, 2020), (Zhang and Lu, 2025). Based on the expectation theory, the cognitive adoption mechanism of blockchain-driven SCF (BSCF) is analyzed through the case studies of four fintech companies. The research reveals that BSCF can be divided into four application scenarios, and its success depends on three cognitive dimensions: expectation value (cognition of BSCF goals and scope), instrumentality (identification of blockchain features and other group), and value perception (differentiated value recognition). Empirical evidence shows that blockchain can effectively alleviate information asymmetry problems and promote business model innovation by enhancing transparency, traceability, and transaction verification capabilities. The innovation of the research lies in constructing an analytical framework based on expectation theory, systematically explaining the behavioral preconditions, applicable scenarios, and value realization paths of blockchain technology applications, and providing a cognitive dimension for fintech companies to optimize blockchain solutions (Song et al., 2023).

From the perspective of risk management and compliance review, this paper discusses the innovative application of decentralized finance driven by blockchain technology in SCF, focus on the empirical case of the Australian livestock supply chain. By constructing an asset tracking architecture based on DeFi, the study verifies that it can effectively alleviate the information asymmetry problem in the financing of SMEs, reduce financing costs and improve capital accessibility. Empirical results show that DeFi technology can achieve transparent transactions through distributed ledgers, but it still faces technology adoption risks in practical applications. Based on case analysis, the study proposes that SMEs should optimize DeFi investment strategies, strengthen the credibility of blockchain data and the safety of smart contracts, to maximize the value capture ability of DeFi and give a feasible path for the digital transformation of the agricultural supply chain (Miller et al., 2023). In view of the inefficiency and multiple pledge risks of warehouse document pledge in SCF, a blockchain-based digital asset platform (BDAP) is proposed. The platform uses the threshold ECDSA algorithm to realize multi-party authentication of asset authenticity, embeds the verifiable Byzantine fault tolerance (VBFT) mechanism to improve node security, and realize asset traceability through blockchain storage. Stress testing shows that the average response time under 100 concurrent users is only 1.441 s, verify its high throughput. However, only a few open banks access BDAP at present, and the trust building of traditional participants in technology still requires long-term market education, which restricts the large-scale application of blockchain in SCF scenarios (Liu et al., 2022). In view of the supply chain integration problem in the construction industry, a blockchain crypto asset solution is proposed. By binding payment and product flow through smart contracts, the dual advantages of atomicity and granularity of crypto assets in improving the integration of cash flow and product flow are verified. Empirical research shows that crypto assets can directly link on-chain and off-chain data. Two construction project cases verify the effectiveness of this model, but the study also points out that the uncertainty of the regulatory environment, the security of smart contracts and the risk of price fluctuations are still the main challenges, and recommends building a risk mitigation mechanism through technology iteration and policy coordination to provide an innovative path for the digital transformation of traditional engineering supply chains (Hamledari and Fischer, 2021). Based on the evolutionary game framework, an inventory pledge financing (IPF) system for banks, SMEs and third-party logistics is constructed to analyze the effect of cost structure and environment on the strategical interaction of participants before and after the implementation of blockchain technology. Through simulation, it is revealed that in traditional IPF, asset control capabilities and fraud penalties determine the equilibrium state, while after the implementation of blockchain, default losses and compliance benefits become key variables. The application of technology effectively reduces fraud risks and improves regulatory efficiency. The innovation lies in the first introduction of a dynamic behavior perspective into blockchain-driven IPF research. Through the integration of cost structure and compliance incentives, the framework of technology reconstruction on the finance ecosystem is revealed, providing a theoretical basis for optimizing supply chain financial supervision and risk prevention and control (Huang et al., 2025). Based on the Stackelberg model, the strategic differences of blockchain in four financial scenarios are compared and analyzed. The study found that the blockchain stage enhances the outer finance advantages of high capital-constrained retailers by lowering the interest rate threshold, while pushing up prices and order volumes; compared with bank finance, both interior and external finance enabled by blockchain achieve Pareto improvements, but it is necessary to balance the manufacturer’s platform fees and risk guarantee ratio. The innovation lies in the first quantification of the triple effects of blockchain platform establishment costs, service levels and technology-driven demand growth, to reveal its key influencing mechanism on the choice of financing model and provide theoretical support and decision-making framework for optimizing the blockchain financial ecology (Chen and Chen, 2023).

For the perspective of policy and regulatory framework, this paper systematically combined the research context of blockchain in the bank and financial fields from 2009 to 2021 through bibliometrics and content analysis. Based on 154 academic papers, a co-authorship network, knowledge graph and co-citation analysis were constructed to reveal four major research directions: financial intermediary transformation, application scenario innovation, regulation and network security, and sustainable blockchain development. The study found that in the future, it is necessary to focus on the construction of cross-border regulatory frameworks, multi-country comparative studies and the integration of interdisciplinary methods to give a map for blockchain research for academia and industry (Patel et al., 2022). Based on multiple cases, the BCT in SCF was explored. The study found that BCT can effectively solve the financing scope, cost, efficiency and risk management problems in traditional SCF. By building a blockchain platform through multi-subject collaboration, the advantages of resources and technology can be fully utilized, but internal and external adjustments and feedback loops are required. Unexpected problems in the pilot phase need to be solved through early reconstruction. The study recommends promoting the large-scale application of BCT through stakeholder incentives and regulatory innovation and proposes an implementation framework based on innovation adoption theory to provide guidance for organizations to adopt BCT (Gong et al., 2024). Through a literature review and quantitative analysis, this paper explores the blockchain in finance. Based on 149 articles in the Scopus database, six major research themes are identified. The study constructs a frame that includes elements, to reveal the reconstructive effect of blockchain on financial markets and business models. The research indicates that the current study needs to strengthen the methodological system and theoretical foundation construction. In the future, it should focus on the mechanism innovation of the deep integration of technology and finance, enhance policy and legal supervision, and provide theoretical support for the sustainable development of finance driven by blockchain (Sharma et al., 2024).

Blockchain technology, as an integrated innovation of distributed ledgers, smart contracts, and encryption algorithms, is profoundly reshaping the model of SCF. In recent years, domestic and foreign scholars have conducted systematic research on blockchain technology innovation, trust mechanism construction, efficiency optimization, risk prevention and control, and policy adaptation, to reveal its potential in solving the finance problems of SMEs, optimize resource allocation, and improve the stability of the financial ecology. At the same time, it also points out the challenges at the technical, governance, and regulatory levels. However, in previous literature studies on the application of blockchain technology in supply chain financing, it was rarely applied to asset-backed securitization financing business, and most of them were based on case studies or qualitative research. When this paper studies the financing business of asset-backed securitization, it considers the cooperative model of e-commerce platforms cooperating with external initiators and the non-cooperative model of e-commerce platforms creating original financing channels. This not only applies blockchain technology to specific financing fields but also innovates financing models to enrich existing research. This paper adopts the game analysis method to construct cooperative game and non-cooperative game models, quantitatively analyze the impact of blockchain on the financing strategy of asset-backed securitization, and explore the optimal financing equilibrium strategy under blockchain. Existing research indicates that contract governance helps improve efficiency. This study introduces risk-sharing contracts on this basis. The innovative application of risk-sharing contracts in the cooperation model of asset-backed securitization coordinates the conflicts of interest among enterprises to optimize financing strategies. Blockchain technology helps enhance the transparency of information in the supply chain, but it can easily lead managers to overly rely on the data on the blockchain, triggering overconfident behavior. When studying asset-backed securitization financing, it is necessary to consider the overconfidence of managers. Previous literature studies on supply chain financing decisions have overlooked this point. This study innovatively applies managers’ overconfidence to financing decisions to explore the impact of overconfidence on the optimal financing strategy. Existing literature indicates that blockchain technology is conducive to enhancing the risk prevention capabilities of enterprises. Based on this, this study applies the theory of behavioral finance, considers the risk-aversion behavior of managers, explores the impact of risk aversion on the financing strategy of asset-backed securitization, and analyzes the internal influence mechanism and action mechanism.

3 Problem description and research hypothesis

3.1 Problem description

Analyze a digital supply chain comprising suppliers, distributors, and an online marketplace platform. The supplier produces green products at a unit cost of

In the ABS, the supplier, based on its financing needs, identifies the target assets for securitization as accounts receivable. It selects assets with stable cash flows and high credit quality to pool into an asset pool, to form the underlying asset portfolio for securitization. An external institution establishes an independent originator and a SPV to achieve bankruptcy remoteness between the assets and the shareholding bearer. The originator transfers the property to the SPV, and a professional rating agency is hired to assess the credit rating of the property pool and the securitized products to attract investors. Based on the rating results, trenched securities are designed, and parameters such as issuance size, maturity, and interest rates are determined. During issuance, the SPV management institution allocates the raised funds to the originator or relevant entities to complete the purchase of the underlying assets. During the term, the asset servicer is responsible for the daily management of the underlying assets. At maturity, cash flows from the underlying assets are routed through the exchange account to the SPV custody account. The custodian bank distributes the cash flows, net of fees, to investor accounts according to the plan. The SPV management institution may initiate early redemption requests. If the originator agrees, the underlying assets can be returned to the original equity holder. Through a revolving purchase mechanism, the SPV can continue acquiring new assets to maintain the securities’ existence. Regular disclosures on the asset pool status, cash flow distributions, and default conditions ensure transparency. Once the underlying property fully covers the securities’ principal and interest, the SPV completes the final distribution, and the securities exit the market. If the asset pool is settled early, the securities’ existence can be terminated via early redemption or reinvestment. Legal measures are taken to recover defaulted assets, or losses are absorbed by subordinate tranches. The core enterprise’s credit risk is mitigated through guarantee clauses or alternative liquidity support.

In the Blockchain-driven ABS, e-commerce can directly act as the originator to approach the SPV (non-cooperative mode) or collaborate with an external originator (cooperative mode). In the non-cooperative mode, e-commerce establishes its own original financing channel to provide ABS services to the supplier. Here, e-commerce acts as the originator and directly engages the SPV to execute ABS financing. Let

ABS plays a significant role in promoting risk aversion among supply chain members and originators, and managerial overconfidence exists during the financing process. Under ABS, the originator prioritizes funding for capital-constrained enterprises. It then raises funds by issuing bonds in the bond market, to earn additional returns from the ABS bonds at an interest rate

Based on this, we employ game-theoretical analysis to explore optimal financing strategies and consider managerial overconfidence and risk aversion. Non-cooperative game models without blockchain technology, Cooperative game model without blockchain, non-cooperative game model with blockchain technology, Cooperative game model with blockchain technology models are constructed. The notation is defined in Table 1. Here,

3.2 Research hypothesis

Based on the analysis, this study proposes the hypotheses.

1. To describe uncertain market demand, reference studies by Li et al. (2021) and Zhang et al. (2021), we assume consumer market demand satisfies

2. Supply chain managers exhibit overconfidence, often overestimate market demand and underestimate risks. Draw on research by Tian et al. (2018) and Zhong et al. (2022), under managerial overconfidence, market demand becomes

3. Consider that supply chain members are risk-averse, follow the approach of Choi (2019) (Choi et al., 2019) and Gupta & Ivanov (2020) (Gupta and Chen, 2020), we introduce the mean - standard deviation method to describe risk-averse. The utility function is

4 Model construction

4.1 Non-cooperative model without blockchain

In the non-cooperative model without blockchain technology, the online retailers, as the core firm in ABS, establishes an original financing channel and acts as the originator to directly engage an external SPV for ABS financing.

The probability of successful ABS issuance is

For the SPV, if issuance is successful, the cash inflow is

In the financing and operations, the supplier’s primary cash inflow comes

The distributor’s cash flows comprise revenue

Here,

Considering that e-commerce supply chain firms are risk-averse, we use the mean - standard deviation to describe their risk-averse behavior, while managers exhibit overconfidence tendencies during financing. Using backward induction in the Stackelberg game, we derive the best decision variables for the supplier, distributor, e-commerce platform, and SPV.

Proposition 1. The supplier’s best wholesale price is

proof: Supply chain members exhibit high sensitivity to market uncertainty and adopt a risk-averse attitude, which is characterized by using the mean - standard deviation method to capture the risk-averse of vendors, distributors, and online retailers. Additionally, supply chain enterprises demonstrate managerial overconfidence. From the random profit functions of the vendor, distributor, and online retailers, the expected profits of the supply chain firms, account for managerial overconfidence and risk aversion, are derived as follows:

Corollary 1. In the non-cooperative model without blockchain technology, the supplier’s wholesale price increases with product greenness

4.2 Cooperative model without blockchain

In the cooperative model without blockchain technology, the online retailer, as the core enterprise, collaborates with an external originator to engage an SPV for issuing bonds in the securities market to apply for asset-backed securitization financing.

For the originator, since the asset pool’s cash flow

For the SPV, with probability

The supplier’s sales revenue is

For the distributor, the cash inflow primarily consists of product sales revenue

For the e-commerce platform, cash inflows mainly include product sales revenue

Considering that e-commerce supply chain firms are risk-averse, the mean - standard deviation is used to picture their risk-averse, while managerial overconfidence tendencies are also accounted for. Using backward induction in the Stackelberg game, the optimal decision variables can be got.

Proposition 2. The vendor’s best price is

proof: The proof process is like Proposition 1.

Corollary 2. The supplier’s optimal wholesale price increases with product greenness

4.3 Non-cooperative model with blockchain

In the non-cooperative model with blockchain technology, online retailers, as the core enterprise, do not collaborate with external originators but establishes its own original financing channel to conduct asset-backed securitization financing. Although the adoption of blockchain increases technological costs, it promotes information sharing and reduces information verification costs.

For the online retailers, the funds in the asset pool amount to

For the SPV, with probability

For the vendor, the cash consists of revenue from sales to the distributor is

For the distributor, the cash is product sales revenue

We consider that firms are risk-averse, the mean - standard deviation method is used, while managerial overconfidence is also accounted for in the financing process. Using backward induction in the Stackelberg game, the optimal decision variables can be derived.

Proposition 3. The vendor’s best price is

proof: The proof process is like Proposition 1 and is omitted here.

Corollary 3. The vendor’s optimal wholesale price

4.4 Cooperative model with blockchain

In the cooperative model with blockchain technology, online retailers, as the core enterprise, collaborate with an external originator to apply for ABS financing through an SPV. The adoption of blockchain technology enhances the core enterprise’s market reputation, which increase from

The originator earns additional income

For the SPV, with blockchain technology, the cash inflow is

The adoption of blockchain helps firms better mitigate credit risks and effectively enhances their reputation. For the vendor, the cash under blockchain technology is product sales revenue

For the distributor, as an intermediary in supply chain operations, the cash inflow primarily consists of product sales revenue

For online retailers, the cash inflow is primarily product sales revenue

Supply chain members are sensitive to market uncertainty and exhibit risk-averse behavior, characterized using the mean - standard deviation method for the supplier, distributor, and e-commerce platform. Additionally, managers display overconfidence tendencies during financing. Using backward induction in the Stackelberg game, the optimal decision variables can be derived.

Proposition 4. The vendor’s best price is

proof: The proof process is like Proposition 1 and is omitted here.

Corollary 4. The vendor’s wholesale price

4.5 Comparative analysis

We compare the equilibrium strategies of asset-backed securitization financing under both cooperative and non-cooperative modes.

Proposition 5. In the non-cooperative mode, the originator’s optimal service fee rate to the SPV satisfies

proof: In the non-cooperative mode without blockchain, the originator’s optimal service fee rate to the SPV is

Corollary 5. Blockchain technology enhances the transparency of financing information, reduces information verification costs, and effectively lowers the service fee rate charged by the originator to the SPV. This not only improves the originator’s financing returns but also helps suppliers alleviate capital constraints while reducing financing costs.

Proposition 6. In the cooperative mode, when

proof: In the cooperative mode without blockchain, the best risk-sharing ratio is

Corollary 6. When the adoption of blockchain technology exceeds a certain threshold range, the optimal risk-sharing ratio decreases, the risks faced are reduced, and the financing returns of itself are effectively improved. Blockchain technology helps enhance the transparency of financing information, lower financing interest rates, reduce financing costs, increase financing returns, and better alleviate the financial constraints of suppliers.

5 Numerical analysis

To explore the impact of various factors on financing policy in ABS, a numerical analysis is conducted. We draw on Wu et al. (2023), An et al. (2023), Zhu et al. (2023), combined with the actual operation of asset-backed securitization financing in e-commerce supply chain, the parameter are set:

5.1 Impact of blockchain

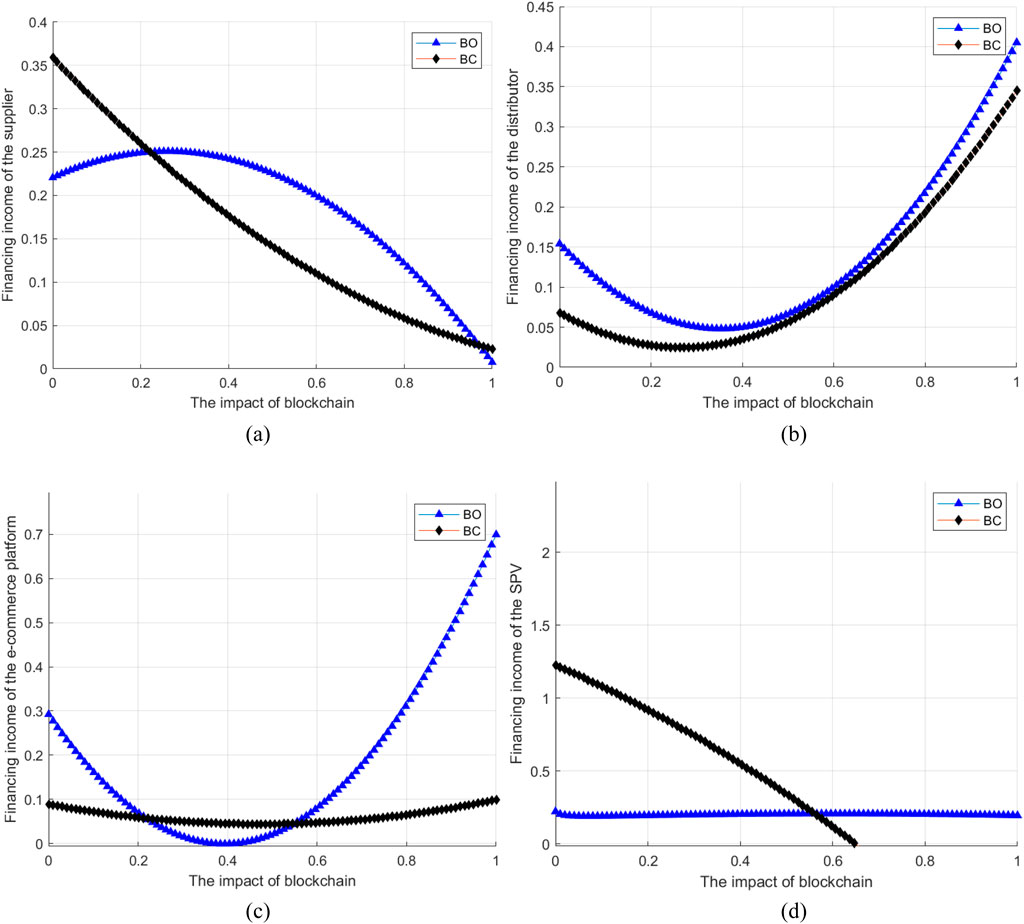

To study the influence of blockchain on asset-backed securitization financing strategies, a numerical analysis was conducted, with the results illustrated in Figure 2.

Figure 2. Impact of blockchain on financing strategy. (a) Impact on suppliers. (b) Impact on distributors. (c) Impact on e-commerce platform. (d) Impact on SPV.

For suppliers, finance income will drop with the rise of blockchain costs. In the non-cooperative model, finance income will first increase and then drop with the rise of blockchain costs. Lower blockchain costs help to improve suppliers’ finance income. In the cooperative model, finance income will drop with the rise of blockchain costs. However, under lower blockchain costs, the cooperative model can bring more finance income to suppliers than the non-cooperative model and ease its own capital constraints.

For distributors, finance income will first fall and then ascend with the rise of blockchain. When blockchain exceeds a range, finance income will rise with the rise of the blockchain. More introduction of blockchain can bring more incremental income to distributors and promote the development of enterprises. Compared with the cooperative model, the non-cooperative model is more conducive to improving the income of distributors.

For e-commerce platforms, finance income will first decrease and then increase with the blockchain. In the non-cooperative model, when blockchain is within a range, finance income will decline temporarily, but after exceeding a certain threshold, finance income will increase with the degree of introduction of blockchain, and the growth rate is large. In the cooperative mode, with the introduction of blockchain, the finance income first decreases and then increases, but the change is smaller than that in the cooperative mode.

For SPV, the finance income will decrease with the introduction of a blockchain. In the non-cooperative mode, the finance income is not greatly affected by blockchain. However, in the cooperative mode, the finance income will drop sharply with the introduction of blockchain, and the decline is big. The impact of blockchain will be different in different modes. Blockchain has an impact on the finance income of SPV in cooperative mode. Managers should reasonably choose appropriate financing methods.

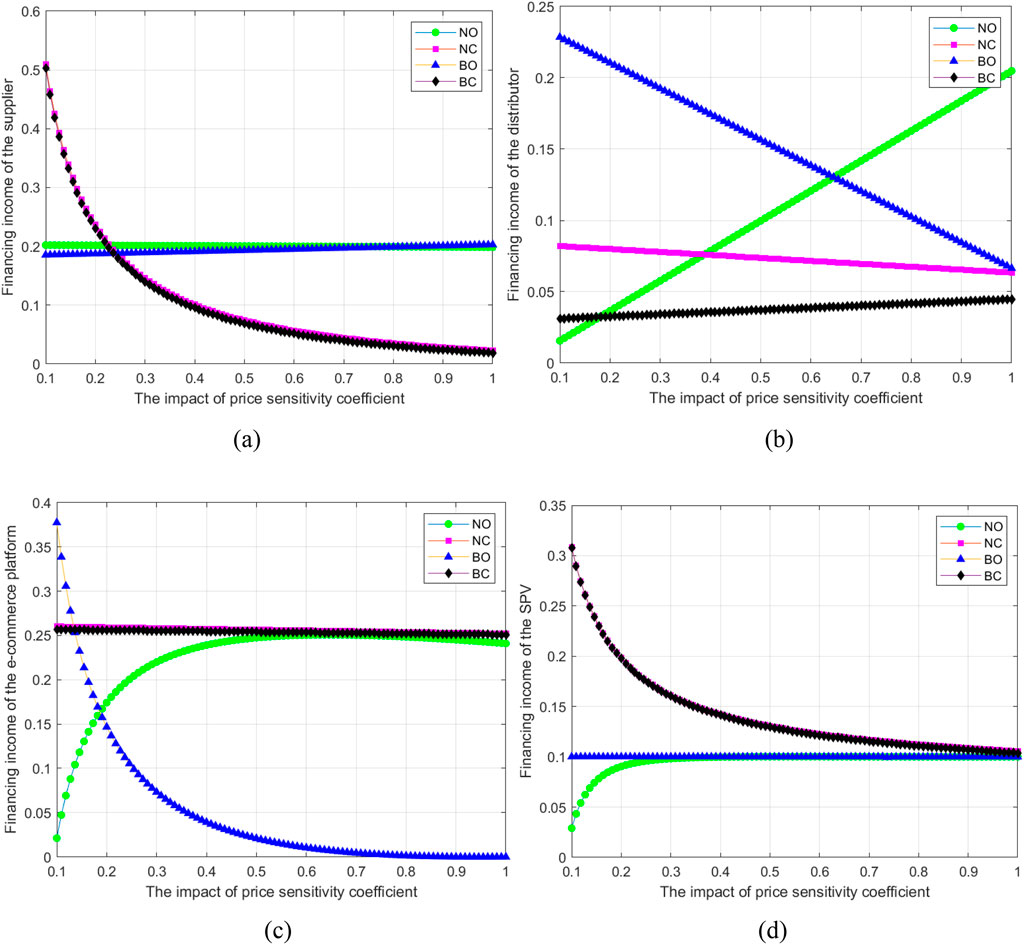

5.2 Impact of overconfidence

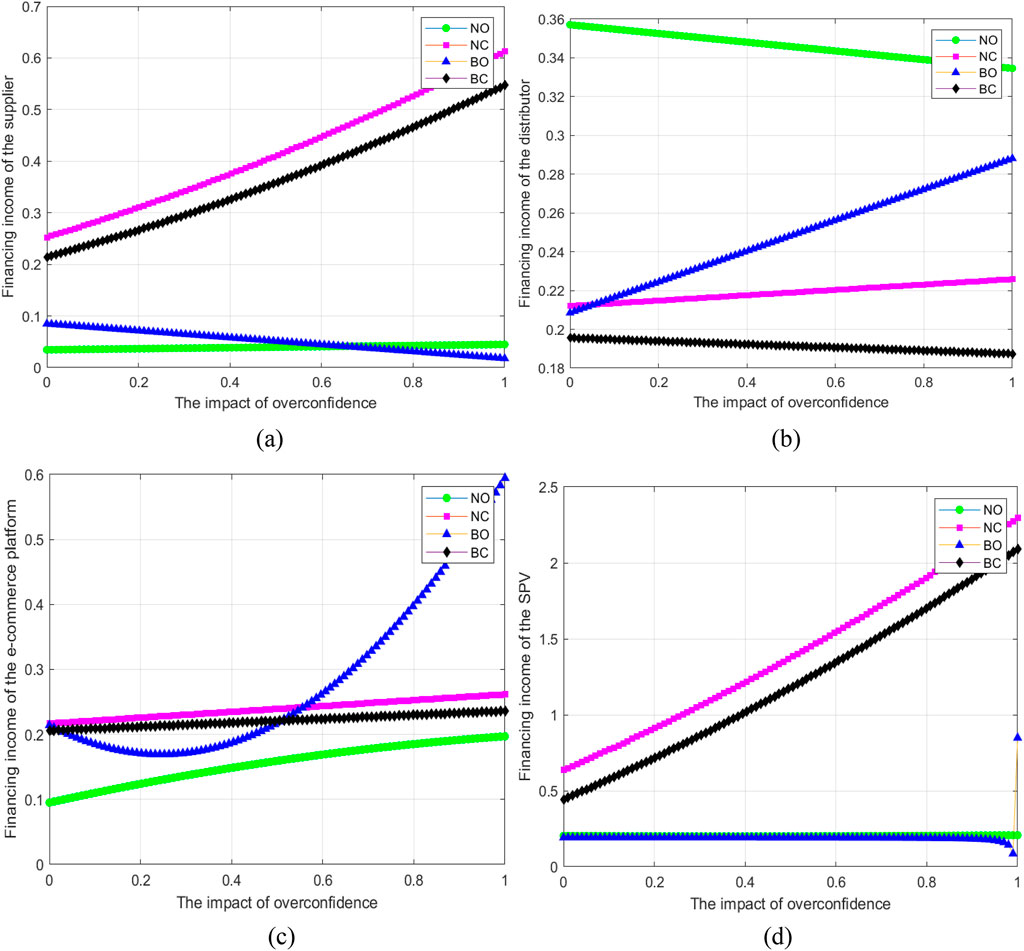

To explore the influence of managerial overconfidence on financing strategies, a numerical analysis was conducted, with the results shown in Figure 3.

Figure 3. Impact of overconfidence on finance strategy. (a) Impact on suppliers. (b) Impact on distributors. (c) Impact on e-commerce platform. (d) Impact on SPV.

For suppliers, the changes in finance benefits with the level of manager overconfidence under different modes will be different. In the cooperative mode, finance benefits will rise with the rise of manager overconfidence, but in the non-cooperative mode using blockchain, finance benefits will decrease with the increase of manager overconfidence. In terms of the magnitude of change, the influence of manager overconfidence on finance benefits is greater in the cooperative mode. In the cooperative mode without blockchain, suppliers have the highest finance benefits.

For distributors, in the non-cooperative mode without blockchain and the cooperative mode with blockchain, finance benefits will decrease with the increase of manager overconfidence. In the cooperative mode without blockchain and the non-cooperative mode with blockchain, finance benefits will increase with the increase of manager overconfidence. We consider the influence of manager overconfidence; distributors have the highest finance benefits in the non-cooperative mode without blockchain.

For e-commerce platforms, finance benefits will increase with the increase of manager overconfidence. In the non-cooperative mode using blockchain, finance benefits are most affected by the level of manager overconfidence and will increase sharply with the increase of manager overconfidence. At a higher level of overconfidence, the non-cooperative mode using blockchain is more conducive to improving the finance benefits of e-commerce. In the non-cooperative model without blockchain technology, the finance benefits obtained are limited.

For SPV, the cooperative model and non-cooperative model have different effects on the manager’s overconfidence. In the cooperative model, the finance benefits will increase with the increase of the manager’s overconfidence level. In the non-cooperative model, the finance benefits are less affected by the manager’s overconfidence. In the cooperative model, we consider the impact of manager overconfidence, not using blockchain can obtain higher finance benefits.

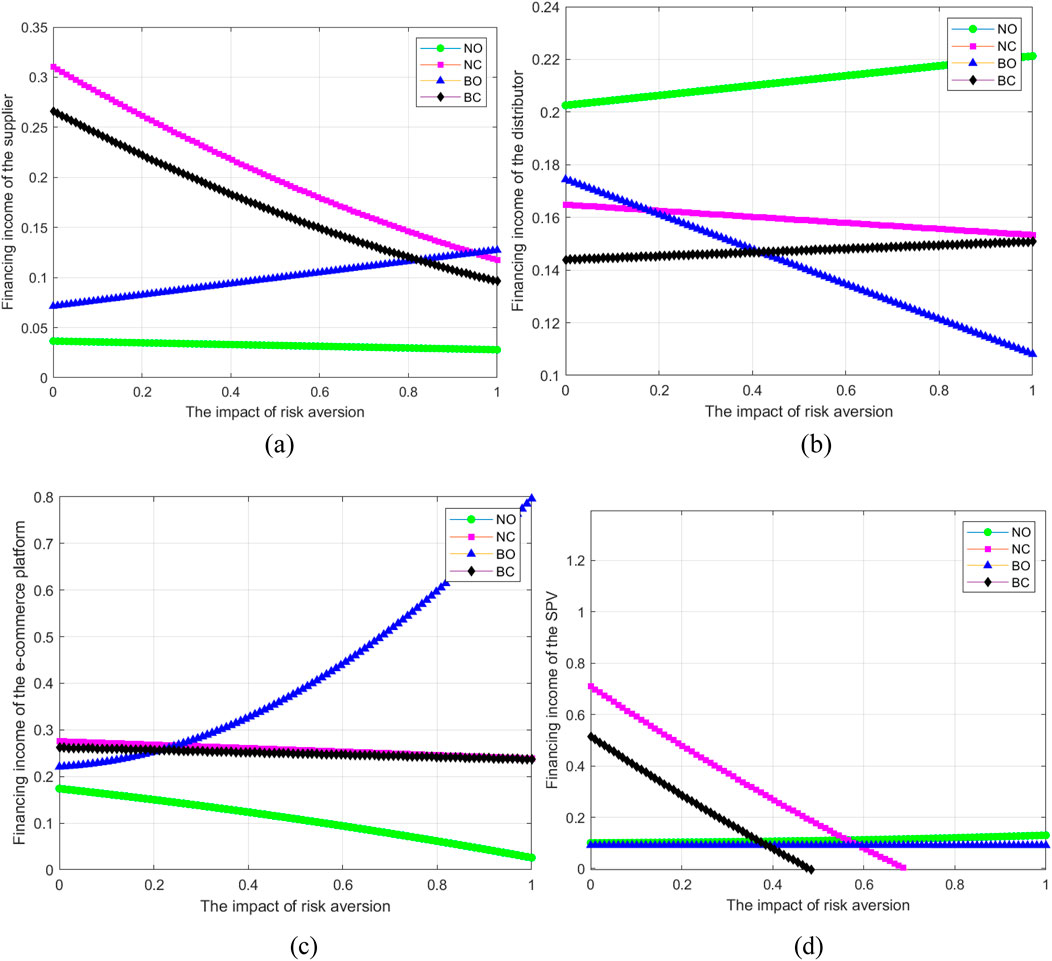

5.3 Impact of risk aversion

To analyze the effect of risk aversion on financing strategies, a comparative study was conducted on how risk aversion influences, with results presented in Figure 4.

Figure 4. Impact of risk aversion on finance strategy. (a) Impact on suppliers. (b) Impact on distributors. (c) Impact on e-commerce platform. (d) Impact on SPV.

For suppliers, the impact of risk aversion coefficients in different modes will be different. In the non-cooperative mode without blockchain, the cooperative mode without blockchain, and the cooperative mode with blockchain, the finance income will drop as the risk aversion rise. However, in the non-cooperative mode with blockchain, the finance income will increase as the risk aversion rises. Managers should reasonably control their own risk aversion behavior and choose financing methods reasonably.

For distributors, in the non-cooperative mode without blockchain and the cooperative mode with blockchain, the finance income will increase as the risk aversion increases. In the cooperative mode without blockchain and the non-cooperative mode with blockchain, the finance income will drop as the risk aversion rises. Affected by the risk aversion, distributors have the best finance income in the non-cooperative mode without blockchain.

For e-commerce platforms, only in the non-cooperative mode with blockchain technology, will the finance income increase as the risk aversion rises. In other modes, the finance income will decrease as the risk aversion coefficient increases. Managers should actively introduce blockchain technology and allow full play to the advantages of blockchain. In addition, it is necessary to reasonably avoid their own risk aversion behavior and improve the overall level of finance income.

For SPV, in the cooperative mode, the finance income will decrease as the risk aversion rises. In the non-cooperative mode, the finance income is not greatly affected by the risk aversion. When the risk aversion is within a range, in the cooperative mode without blockchain, SPV can obtain better finance income.

5.4 Impact of asset pool yield

To investigate the influence of the originator’s additional returns from the asset pool on financing strategies, a sensitivity analysis was conducted, with the results shown in Figure 5.

Figure 5. Impact of asset pool yield on finance strategy. (a) Impact on suppliers. (b) Impact on distributors. (c) Impact on e-commerce platform. (d) Impact on SPV.

For suppliers, in the non-cooperative model, the impact of interest rates on finance income before and after blockchain will be different. In the non-cooperative model with blockchain, the finance income of suppliers is greatly affected by interest rates. When the interest rate is within a range, the finance income will drop sharply. When the interest rate exceeds a certain range, the finance income tends to stabilize. In the non-cooperative model without blockchain, the finance income will increase with the rise of interest rates. In the cooperative model, the impact of interest rates on finance income is limited.

For distributors, the impact of interest rates on finance income is greater in the non-cooperative model, but in the cooperative model, the finance income is not greatly affected by interest rates. In the non-cooperative model without blockchain, the finance income will drop sharply with the rise of interest rates, and the decline is large. In the non-cooperative model with blockchain, the finance income will show a trend of first rising and then falling with the rise of interest rates. The impact of interest rates at different stages on financing strategies will be different.

For e-commerce, the effect of interest rates on finance income will be different before and after blockchain in the non-cooperative model. In the non-cooperative model without blockchain, the finance income will show a trend of first rising and then falling with an increase of interest rates. However, in the non-cooperative model using blockchain, the finance income will show a trend of first falling and then rising as the interest rate increases. When the interest rate exceeds a range, the non-cooperative model using blockchain can bring more finance income to the e-commerce.

For SPV, in different models, the finance income will increase with an increase in interest rate. The rise in interest rate will help to raise the finance income of SPV, but the impact will be different in different models. In the cooperative model without blockchain, SPV can obtain better finance income.

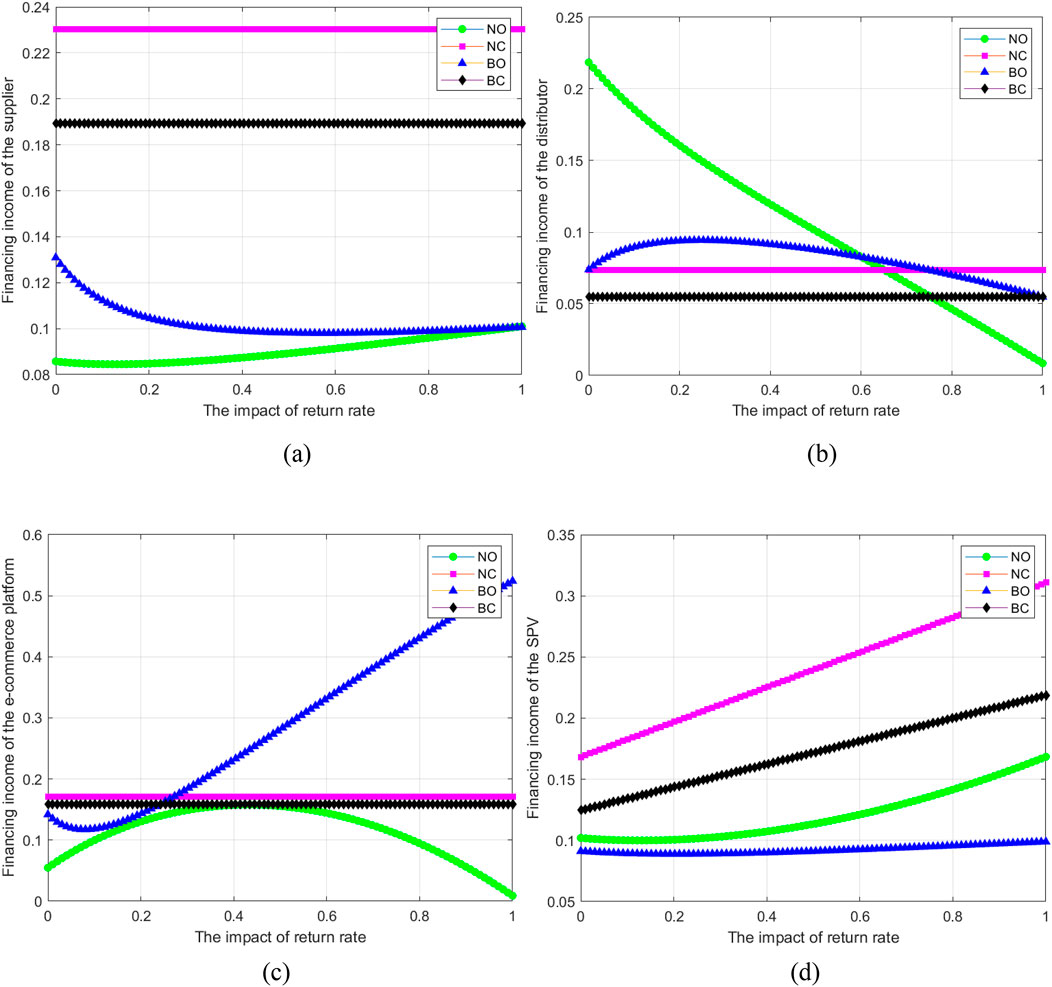

5.5 Impact of price sensitivity coefficient

To explore the influence of the price sensitivity coefficient, a numerical analysis was conducted, with the results presented in Figure 6.

Figure 6. Impact of price sensitivity coefficient on finance strategy. (a) Impact on suppliers. (b) Impact on distributors. (c) Impact on e-commerce platform. (d) Impact on SPV.

For suppliers, in the cooperative mode, the finance income will decrease as the price sensitivity coefficient rises. When it is within a certain threshold range, the decline in finance income is large. In the non-cooperative mode, the finance income is not greatly affected by that. In the non-cooperative mode with blockchain, the finance income will increase as it rises.

For distributors, the impact of price sensitivity coefficients will be different in different modes. In the non-cooperative mode without blockchain and the cooperative mode with blockchain, the finance income will increase as it rises. In the non-cooperative mode with blockchain and cooperative mode without blockchain, the finance income will decrease as it rises.

For e-commerce, in the non-cooperative mode, the finance income is greatly affected by it. In the non-cooperative mode without blockchain, the finance income will increase as it rises. When it exceeds a certain threshold range, the finance income tends to stabilize. In the non-cooperative mode with blockchain, the finance income will decrease as it rises, and the decline is large.

For SPV, in the cooperative mode, the finance income will decrease as it rises. When tit is within a certain threshold range, the finance income is greatly affected by it and the decline is obvious. In a non-cooperative model without blockchain, the finance income will increase with the increase of it. However, after it exceeds a certain threshold range, the finance income tends to be stable.

6 Conclusion

Against the backdrop of the increasing complexity and capital constraints of global supply chain finance, this study focuses on the enabling role of blockchain technology in the financing of supply chain asset-backed securities (ABS), considers the impact of managers’ overconfidence and risk aversion, and constructs a three-level supply chain model including suppliers, distributors and e-commerce enterprises. Based on four scenarios (NO, NC, BO, BC) of cooperative and non-cooperative models and whether blockchain technology is applied or not, the optimal financing decisions and equilibrium strategies of supply chain members were systematically explored. Through theoretical modeling and numerical simulation, the influence mechanisms of blockchain, managers’ overconfidence, risk aversion, asset pool return rate, and price sensitivity coefficient on financing strategies have been revealed, providing theoretical basis and practical paths for the innovation of supply chain finance.

Research has found that although the introduction of blockchain increases technical costs, as the degree of technology introduction increases, blockchain significantly enhances the financing returns of distributors and e-commerce platforms. E-commerce platforms should actively introduce blockchain technology. A certain degree of overconfidence of managers in the cooperative model can help increase the financing returns of suppliers, e-commerce platforms and SPVS. However, under the cooperative model, the risk aversion coefficient is not conducive to the improvement of financing returns for suppliers, e-commerce platforms and SPVS. Managers should reasonably control their own risk aversion tendencies. The financing interest rate in the asset pool helps to increase the financing returns of SPVS, but it has varying degrees of impact on the financing returns of distributors and e-commerce platforms. A higher price sensitivity coefficient in the cooperative model will affect the improvement of financing returns for suppliers and SPVS.

Blockchain reduces information asymmetry by enabling real-time, transparent and tamper-proof data sharing among supply chain participants. Blockchain plays a significant role in addressing the issue of information silos in ABS. Managers’ overconfidence and risk aversion have a close impact on the formulation of financing decisions. Overconfident managers may overestimate asset quality, exaggerate market demand, and tend to choose high-risk and high-return investment and financing activities. Risk-averse managers may choose financial activities with low risks and low returns as much as possible and tend to adopt conservative and stable development strategies. Higher financing returns in the asset pool will dampen the enthusiasm of financiers, but they will attract more investors and bring more financing returns to them. When e-commerce platforms cooperate with external initiators, the higher the price sensitivity coefficient, the lower the profits of both suppliers and SPVS will be.

At the practical level, managers should actively take measures to optimize financing strategies. Dynamically assess the balance point between the cost and long-term benefits of blockchain technology. In the early stage of technology maturity, focus on low-cost application scenarios. Promote collaborative cooperation among supply chain members, leverage blockchain to facilitate information sharing, enhance information quality, and mitigate the negative impacts of managers’ overconfidence. Managers should reasonably control their risk-averse tendencies and actively introduce new technologies during the financing process to prevent risks. Design differentiated financing plans based on changes in financing interest rates to attract more diversified investors. Pay close attention to market demands in a timely manner, choose scientific and reasonable operation and financing methods, and reduce the negative impact of the price sensitivity coefficient. Actively adopt blockchain technology to optimize the information disclosure and process automation of the underlying assets of ABS, especially in cross-border transactions and complex securitization structures, where technological investment needs to be strengthened. It is suggested that the China Banking and Insurance Regulatory Commission incorporate blockchain ABS into the regulatory sandbox and establish an asset penetration management mechanism based on DLT.

This study comprehensively explores the application of blockchain technology in asset securitization financing, but it still has certain limitations. Further in-depth research can be conducted in the future. This study did not fully discuss the impact of sunk costs in the early stage of technology deployment on the short-term financial pressure of enterprises. In the future, dynamic cost models can be constructed to quantify the input-output ratio of blockchain technology at different application stages, providing cost optimization paths for enterprises to implement decisions in stages. This study focuses on the application of blockchain technology and does not involve the potential impact of cross-chain technology and multi-chain collaboration on the liquidity of ABS. In the future, research on cross-chain interoperability can be combined to explore the circulation efficiency and risk management model of securitized assets under a multi-chain architecture. This study only considered the behavioral preferences of managers such as overconfidence and risk aversion. In the future, more behavioral preferences of managers such as fairness concerns or reciprocity preferences can be incorporated to enrich the existing research. This study has simplified the market demand function. In the future, it is possible to consider incorporating market demand uncertainties, policy uncertainties, etc., to make the constructed model more in line with the actual situation.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

LY: Writing – original draft, Methodology, Conceptualization, Writing – review and editing. JS: Writing – review and editing, Supervision, Resources, Funding acquisition. KY: Formal Analysis, Writing – review and editing, Validation.

Funding