- 1Falcuty of Transport Economic, University of Transport and Communications, Hanoi, Vietnam

- 2Institute of Transport Economics and Development, University of Transport Hochiminh City, Hochiminh, Vietnam

The demand for diversification of funding sources and promotion of private sector participation in infrastructure development is a necessity in Vietnam. Through the public-private partnership (PPP) model, approximately $30 billion has been mobilized for traffic infrastructure development. However, there are still many shortcomings, and growth has shown signs of stagnation. Many factors contribute to this situation, but one of the fundamental reasons is that the management policies and implementation of PPP projects in Vietnam have significant drawbacks. Based on the research results from both domestic and international sources, as well as practical experience, 20 factors relating to the role of the government in attracting infrastructure development investment projects in Vietnam were identified. Then, these factors can be categorized into five groups through factor analysis, as follows: (1) Establishing a suitable legal/regulatory framework, (2) Creating a favorable investment economic environment, (3) Establishing a coordinating and supporting agency, (4) Selecting appropriate franchise partners, (5) Actively participating in various stages of the project life cycle. Accurately assessing the current situation to develop solutions to resolve practical obstacles will be an important basis for mobilizing investment capital for traffic infrastructure development in Vietnam today.

1 Introduction

In recent years, the public-private partnership (PPP) model has attracted private sector investment in traffic infrastructure, contributing to both domestic and foreign investment. This approach has stimulated economic and social development, protected the environment, ensured national defense and security, and enhanced the country’s competitiveness. Compared to traditional investment methods, PPP has demonstrated higher efficiency in the use of public funds while opening up an attractive investment option. Many businesses have had the opportunity to participate in large projects, utilizing significant amounts of domestically produced raw materials, creating thousands of jobs for workers, and providing citizens with better quality services at reasonable costs. The success of PPP in infrastructure, particularly in traffic infrastructure, is closely linked to the establishment and implementation of a robust legal and policy framework for PPP in Vietnam. This framework has created a solid legal basis for investment activities in infrastructure projects under the PPP model.

In Vietnam, the projected investment demand is estimated to be around $30 billion by 2030. Developing a comprehensive infrastructure system is a key focus for the country to achieve sustainable development goals and enhance national competitiveness in a synchronized and modern manner, addressing the requirements for socio-economic development. However, the limited investment capital from the state budget poses a significant challenge to meeting this investment demand. In this context, Vietnam’s strategy is to maximize resources for infrastructure investment through socialization policies, with one of the main channels being the PPP model. Vietnam has enacted many policies for mobilizing and managing investments through this model, achieving some initial results. However, numerous shortcomings remain, and there are signs of stagnation. Many factors contribute to this situation, with one fundamental issue being the inadequacies in the policies governing the management and implementation of PPP projects. Accurately assessing the current government policies and developing solutions to address the practical challenges will be crucial for mobilizing investment capital for traffic infrastructure development in Vietnam through the PPP model.

2 Overview of research on the role of government in influencing the success of PPP investment projects

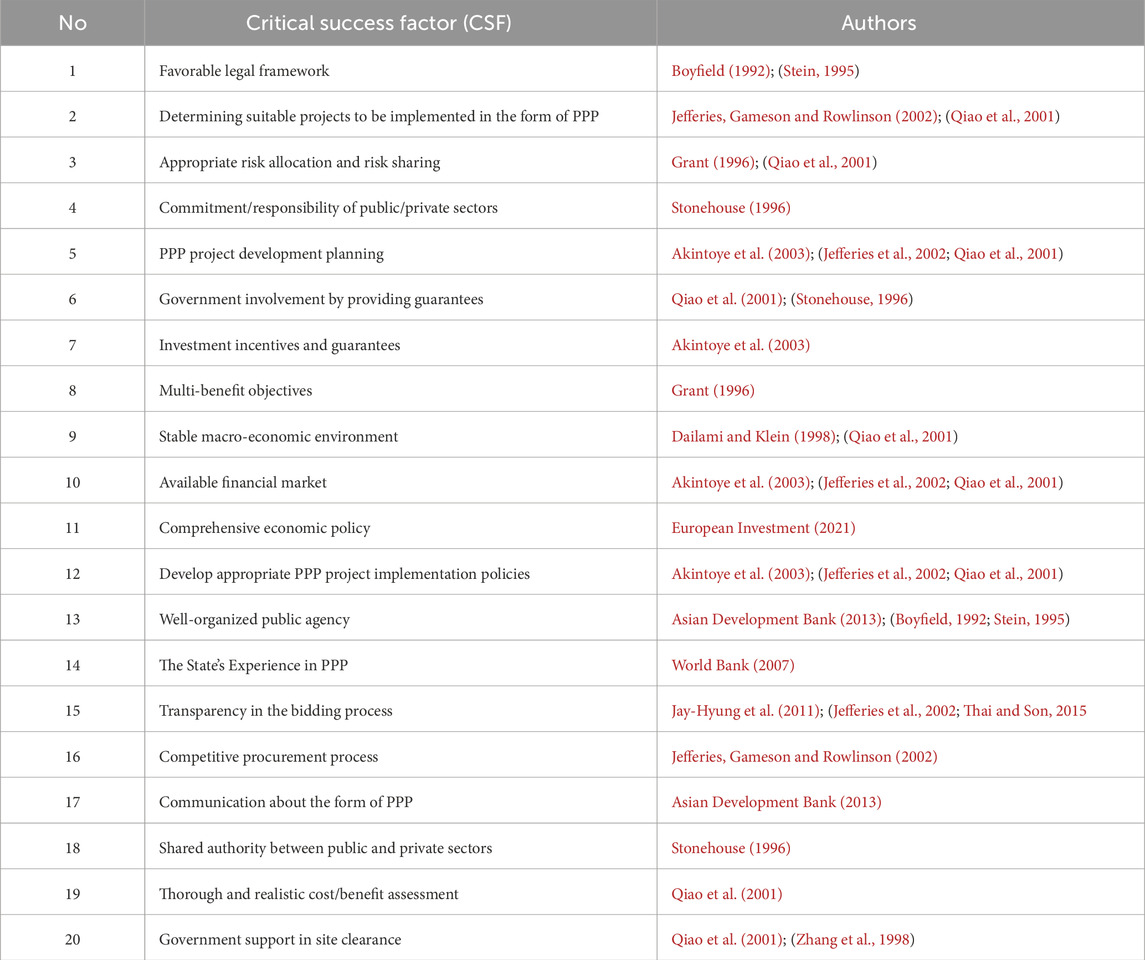

Research indicates that the government plays a crucial role in the success of public-private partnership (PPP) investment projects. Many organizations and individual researchers worldwide have published findings that clarify the government’s role in supporting PPP projects (Table 1).

Table 1. PPP Summary of research on the role and responsibilities of the government regarding PPP projects.

Besides the context of several countries metioned above, the Governments’ roles varied in the success of public-private partnership (PPP) projects across countries. Forexample, in China, strong local government capacity and credible institutional frameworks have been shown to significantly influence private sector participation, although state-owned enterprises still dominate many PPP contracts (Qin and Zhao, 2025). India faces persistent challenges related to land acquisition, limited public-sector experience, and high project risks, highlighting the need for stronger contract management and policy support (Malek and Gundaliya, 2023). Brazil offers lessons on the importance of post-award governance, as frequent contract renegotiations have revealed gaps in regulatory oversight and fiscal risk control (World Bank, 2020). In Vietnam, the government has made progress with a dedicated PPP law and growing experience in infrastructure delivery, but still faces challenges in investor selection, legal harmonization, and project risk allocation (Thai and Son, 2015; VCCI, 2023). To be more specific, as of November 2019, Vietnam has signed contracts for 336 PPP projects, of which 140 projects use the BOT contract type, 188 projects use the BT contract type, and 8 projects use other contract types. The total capital mobilized for the development of the national infrastructure system is approximately 1.6 trillion VND. Among them, the total number of transport infrastructure investment projects under the PPP model in Vietnam is 220 projects, with an investment of approximately 672,345 billion VND, including BOT investment with a total capital of 181,542 billion VND (accounting for 86.6% of the total investment) (VCCI, 2023). Over more than 20 years of implementing PPPs, certain contributions have been made. However, in practice, there are still many challenges and barriers that need to be overcome to enhance the effectiveness and develop PPP models for the upcoming period.

Based on the research results from both domestic and international sources, as well as practical experience regarding the role of the government in attracting infrastructure development investment projects in Vietnam, the research team summarizes the results of the study on the government’s influence on transportation infrastructure project development in Vietnam, as shown in Table 2.

3 Research survey design

3.1 Research theory

The overview study has indicated the factors related to the role and responsibilities of the government that influence the success of investment projects under the PPP model for developing transportation infrastructure in Vietnam. The research model has based on several theoretical framework for PPP effectiveness. The first theory is institutional theory, which show that multiple institutional factors inluding regulatory quality, political stability, rule of law, voice and accountability work in combination to drive private investment in infrastructure PPPs (Wang et al., 2024). This suggests that Vietnam’s PPP outcomes could be analyzed through an institutional lens, such as assessing whether legal frameworks, anti-corruption measures, and governance norms create an enabling environment. The second theoretical framework in PPP research mentioned by Qin and Zhao (2025) is transaction cost economics including the economics of contracting and risk-sharing. Their analysis finds that strong government credibility and capacity and an active local private sector significantly encourage private firms to participate, whereas higher project complexity or uncertainty tends to favor state-owned enterprise involvement. Therefore, this paper involves discussing how Vietnam’s government mitigates negotiation costs, uncertainty, and opportunistic behavior in PPP contracts. The third idea should be mentioned is Governance and Collaborative Frameworks. Hodge and Carsten (2019) emphasize governments leverage private capital and expertise to deliver public infrastructure, offloading financial risk to private partners in exchange for profit opportunities. In this paper, discussion of Vietnam’s PPP oversight structures, transparency measures, and stakeholder engagement in light of global best practices for PPP governance is ivestigated arcurately.

The critical factors have been listed from the huge litterature review and assessed by several experts in this field. A carefully selected experts, including private sector leaders, PPP policymakers offered diverse, high-level insights. Their contributions shaped the identification of key drivers and the design of a targeted questionnaire. Feedback was largely positive, with only minor wording suggestions, indicating strong consensus. Finally, the identified factors were indecated, showed in the Table 5.

3.2 Research survey

Based on the synthesis of factors related to the roles and responsibilities of the government that influence the success of transportation infrastructure investment projects under the PPP model in Vietnam (Table 5), the content of these factors was incorporated into a survey questionnaire sent to private sectors and public sectors in Vietnam. The questionnaire consists of two parts, including:

Part 1: Questions about the information of the surveyed organizations and individuals.

Part 2: Questions about the factors related to the roles and responsibilities of the government that affect the success of transportation infrastructure investment projects in Vietnam.

Out of 150 distributed surveys, 132 were returned, of which 122 were usable. Among these, 32 surveys came from public organizations (26.23%) and 90 from private organizations (73.77%). The completion rate of the survey was 61%. Table 3 below shows the roles of the respondents in PPP projects, indicating that the respondents have an average experience of 15.57 years Tables 3, 4 provide further details.

Tables 3, 4 provide an overview of the respondents’ backgrounds, offering insight into the diversity and experience of participants involved in PPP projects in Vietnam. Table 4 shows that 73.77% of the responses were from private sector organizations including state owned enterprises, private firms, and financial institutions, meanwhile the remaining 26.23% came from public agencies and academic institutions. This reflects a strong representation from the private sector, which is crucial for understanding investor perspectives. Table 4 highlights the distribution of professional experience among respondents, with a majority (65%) having over 10 years of experience in PPP-related roles, ensuring the reliability and relevance of the insights gathered through the survey.

3.3 Exploratory factor analysis (EFA)

Exploratory Factor Analysis (EFA) was employed in this study given the exploratory nature of the research and the absence of a well-established theoretical model specific to the Vietnamese context of PPP governance. EFA is particularly appropriate when the primary objective is to identify latent constructs and uncover the underlying structure of relationships among observed variables, without imposing a priori assumptions (Hair et al., 2019). This method facilitated the empirical classification of twenty government-related success factors into coherent dimensions based on the observed intercorrelations within the dataset. To address potential subjective biases commonly associated with Likert-scale survey instruments, the questionnaire was carefully designed to ensure neutrality in wording and clarity in interpretation. Furthermore, internal consistency of the data was assessed using Cronbach’s alpha, with all identified factors exceeding the commonly accepted reliability threshold of 0.70 (Nunnally and Bernstein, 1994), thereby reinforcing the robustness of the findings.

4 Analysis of survey data and results

4.1 Ranking the importance of government in influencing the success of infrastructure investment projects in transport under PPP in Vietnam

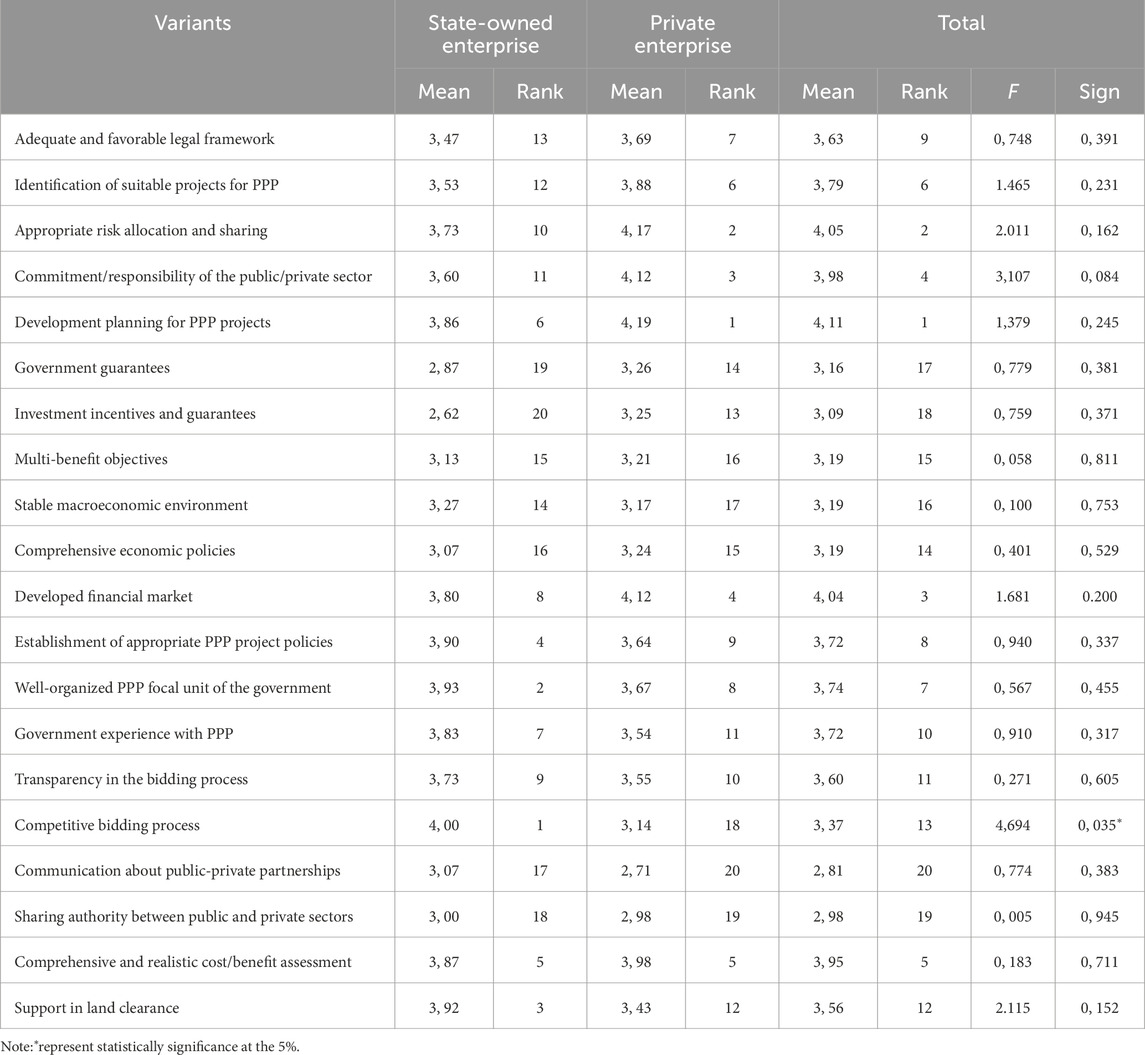

The analysis of the survey data has provided the average importance values for 20 variants regarding the role of the government in influencing the success of transport infrastructure development projects in Vietnam (Table 5).

Table 5 provides a detailed comparison of the perceived importance of 20 government-related success factors in PPP projects, based on responses from both public and private sector participants. Overall, the highest-rated factor across all respondents was “PPP project development planning” with a mean score of 4.11, followed by “appropriate risk allocation and sharing” (4.05), and “availability of financial markets” (4.04). These results underscore the critical importance of structured planning, risk-sharing mechanisms, and financial infrastructure in attracting private investment to PPP projects. The factor “competitive bidding process” showed a significant divergence, rated 4.00 by public sector respondents (Rank 1), but only 3.14 by private sector respondents, reflecting a possible difference in trust or satisfaction with current procurement practices. Similarly, “support in land clearance” was ranked 3rd by public sector respondents (mean 3.92), but 12th by the private sector (mean 3.43), indicating differing views on government performance in this area.

At the lower end of the spectrum, both groups rated “communication about PPP” (mean = 2.81) and “sharing authority between sectors” (mean = 2.98) among the least important, suggesting limited perceived value or unclear implementation in practice. Notably, private respondents assigned higher importance to “commitment/responsibility of the public/private sector” (4.12) than public respondents (3.60), highlighting the private sector’s emphasis on government accountability. Meanwhile, “investment incentives and guarantees” received a relatively low overall score (3.09), reflecting ongoing concerns about the adequacy or effectiveness of current incentive mechanisms. These results reveal sectoral divergences and confirm that while legal frameworks and financial arrangements are universally important, perceptions vary widely in areas such as bidding transparency, government guarantees, and operational coordination.

Next, exploratory factor analysis is used to uncover hidden relationships and underlying structures within the data related to government roles influencing PPP in Vietnam This technique is applied to survey data to explore potential groups among factors related to the roles and responsibilities of the government. The correlation matrix of 20 variables from the survey data has been calculated. The value of the Bartlett’s test of sphericity is high (Bartlett’s test = 464.4103) with a small significance level (p = 0.000), indicating that the correlation matrix is not an identity matrix. All variables show significant correlations at the 5% significance level, suggesting that there is no need to eliminate any variables in the principal component analysis. The Kaiser-Meyer-Olkin (KMO) statistic value of 0.754 is satisfactory for factor analysis.

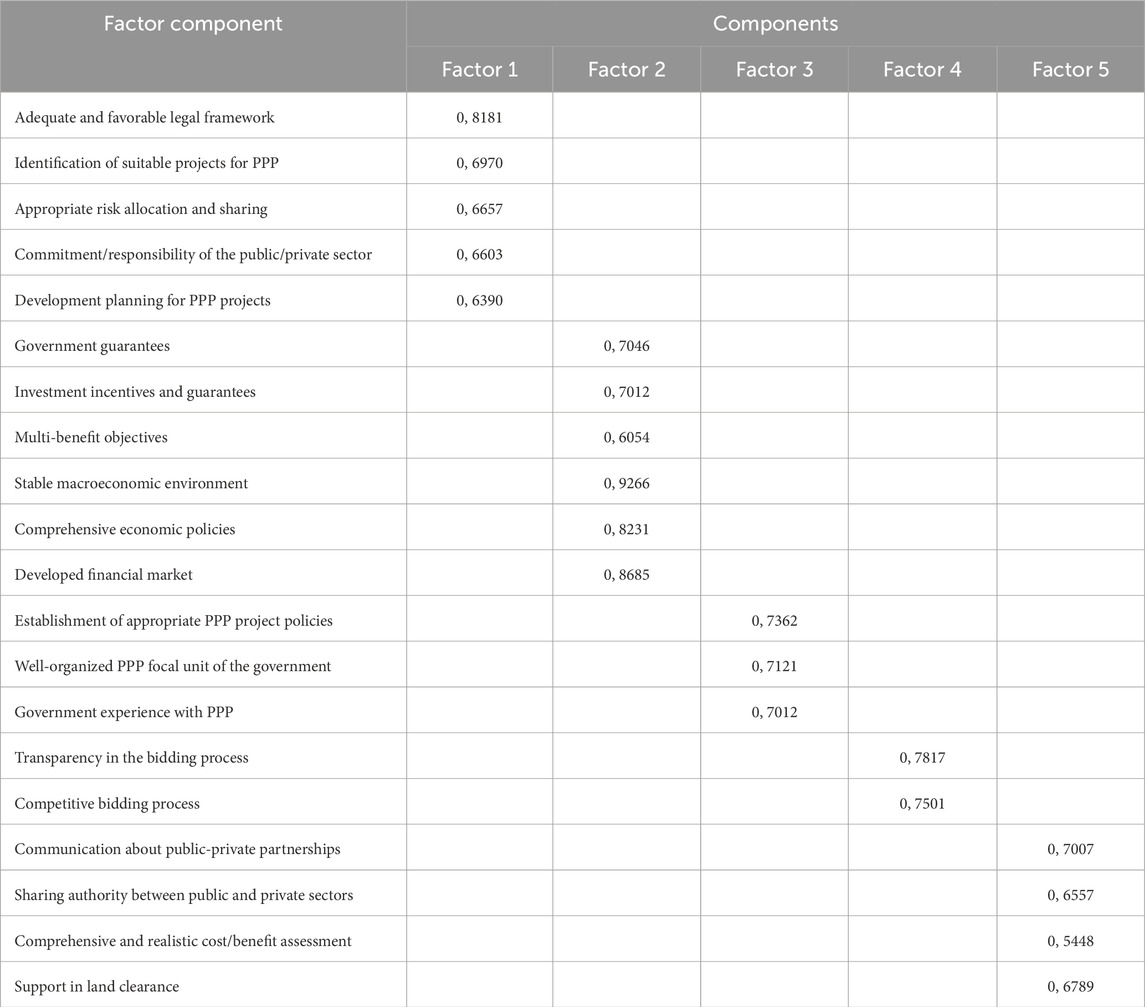

Table 6 summarizes the results of the exploratory factor analysis (EFA), identifying five key dimensions underlying the 20 government-related success factors. These groups are named: (1) Legal and Regulatory Framework, (2) Financial and Risk Management, (3) Government Capacity and Commitment, (4) Project Planning and Implementation, and (5) Stakeholder Coordination. All factor loadings exceed the 0.5 threshold, indicating strong construct validity, and the cumulative variance explained is satisfactory. The grouping reflects logical thematic clusters, supporting the structural integrity of the model.

Table 6. Factor rotation matrix for the role of the government in developing transportation infrastructure through the PPP model in Vietnam.

4.2 Discussions on the roles and responsibilities of the government in transport infrastructure development projects in the form of PPP

The results of the exploratory factor analysis (Table 6) provide empirical support for the classification of 20 government-related success factors into five distinct thematic dimensions: (1) Legal and Regulatory Framework, (2) Financial and Risk Management, (3) Government Capacity and Commitment, (4) Project Planning and Implementation, and (5) Stakeholder Coordination. This classification aligns with existing literature and highlights the multifaceted role of the public sector in shaping successful PPP outcomes.

Among these dimensions, the “Legal and Regulatory Framework” emerged as the most influential, with strong factor loadings on items such as the clarity of laws, enforceability of contracts, and transparency in procurement processes. This underscores the critical importance of a stable and predictable institutional environment in fostering investor confidence. This conclusion widely supported in global PPP studies (Hodge and Carsten, 2019; Malek and Shah, 2024). In Vietnam, a law on PPP has been enacted, effective from 1 January 2021; however, its implementation depends on other subordinate legal documents, which raises concerns among private investors about the stability and consistency of the system of subordinate legal documents to ensure that the PPP law is effectively and conveniently put into practice. An important factor in this group is Identification of suitable projects for PPP (mean value of 3.79), which is crucial for the private sector to secure a PPP contract. Project enterprises must demonstrate that the proposed project will meet all relevant legal requirements. For example, in the Ben Thuy Bridge investment project and the Cai Lay–Tien Giang bypass road project under the PPP model, when the toll collection location under the BOT model was deemed unreasonable due to pressure from the public, the project enterprise was forced to allow free passage and adjust the toll collection level and location, which affected the project’s revenue until a suitable toll collection plan was proposed.

The “Financial and Risk Management” factor highlights the need for well-structured risk-sharing mechanisms and accessible financial markets. The high ranking of these elements, particularly from private sector respondents, reflects concerns about fiscal guarantees, return on investment, and cost recovery—all of which are decisive in private participation (Qin and Zhao, 2025). In the Vietnamese context, the lack of credit enhancement tools and limited participation of domestic banks in long-term project finance has been a recurring barrier, as seen in cases like the Dau Giay–Phan Thiet expressway project, which faced funding delays.

The “Government Capacity and Commitment” dimension further reinforces the necessity of strong leadership, administrative capability, and sustained political will in PPP delivery. This is particularly relevant in Vietnam, where decentralized responsibilities can pose coordination challenges. For example, inconsistencies between central ministries and provincial departments in project approvals and land clearance have led to delays in infrastructure development. The data reveal differing perceptions across sectors, with private stakeholders placing more emphasis on public sector accountability.

The dimension “Project Planning and Implementation” emphasizes the foundational role of comprehensive feasibility studies, clear objectives, and readiness criteria in mitigating project-level uncertainties. Empirical evidence from other emerging markets such as Malaysia and Brazil, confirms that robust pre-implementation frameworks are critical to long-term PPP performance (Malek and Gundaliya, 2023). In Vietnam, projects such as the Ben Luc–Long Thanh expressway have demonstrated how insufficient pre-feasibility assessments and shifting investment structures can compromise timelines and cost efficiency.

Finally, the “Stakeholder Coordination” factor which received lower average rating points to underlying issues in cross-sector collaboration, communication, and authority sharing. This reflects broader governance challenges in transitional economies and underscores the need for institutionalized dialogue platforms. In practice, PPP projects in Vietnam often face fragmented coordination between agencies, resulting in overlapping responsibilities and unclear accountability issues noted by the Vietnam Chamber of Commerce and Industry (VCCI) and other independent assessments.

5 Conclusion and recommendations

It can be affirmed that the government is the decision-making entity in creating the most favorable investment environment to unlock resources and promote the development of public-private partnerships (PPP) and projects that provide numerous net benefits to society, including: enhancing government capacity; innovation in public service delivery; reducing project costs and timelines; and transferring primary risks to the private sector. This is influenced by five groups of factors with 20 categories of elements that reflect the government’s role and responsibilities, arranged in order of importance from highest to lowest impact on the success of PPP projects in Vietnam’s transportation infrastructure. The factor analysis provides both theoretical and practical insights into how the Vietnamese government can enhance PPP performance. By aligning national efforts with global benchmarks and addressing specific governance gaps such as inter-agency coordination, financial instrument development, and transparent regulatory enforcement. The findings contribute to a more nuanced understanding of public sector roles in infrastructure partnerships. These results may also hold transferable relevance for other developing economies with similar institutional contexts. Besides, the majority of respondents have come from private sector, which seen as the research limitation and will improve in the further research.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

NT: Methodology, Writing – review and editing, Investigation, Writing – original draft, Funding acquisition, Data curation, Formal Analysis, Conceptualization. TP: Data curation, Formal Analysis, Methodology, Conceptualization, Writing – review and editing, Funding acquisition, Investigation, Writing – original draft. HT: Resources, Visualization, Validation, Project administration, Supervision, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbuil.2025.1644333/full#supplementary-material

References

Abdel, A. (2007). Successful delivery of public-private partnerships for infrastructure development. J. Constr. Eng. Manag. 133 (12), 918–931. doi:10.1061/(asce)0733-9364(2007)133:12(918)

Akintoye, A., Cliff, H., Matthias, B., Ezekiel, C., and Asenova, D. (2003). Achieving best value in private finance initiative project procurement. Constr. Manag. Econ. 21 (5), 461–470. doi:10.1080/0144619032000087285

Asian Development Bank (2013). Public-private partnership handbook. Philippines: Asian Development Bank.

Boyfield, K. (1992). Private sector funding of public sector infrastructure. Public Money and Manag. 12 (2), 41–46. doi:10.1080/09540969209387708

Dailami, M., and Klein, M. U. (1998). Government support to private infrastructure projects in emerging markets (English). Washington, D.C.: World Bank Group. Available online at: http://documents.worldbank.org/curated/en/589411468741340769.

Durchslag, S., Puri, T., and Rao, A. (1994). The promise of infrastructure privatization. McKinsey Quarterly, 3.

European Investment, B. (2021). EPEC guide to public-private partnerships. Luxembourg: The European PPP Expertise Centre (EPEC).

Hair, J. F., Black, W. C., Babin, B. J., and Anderson, R. E. (2019). Multivariate data analysis. 8th Edition. Upper Saddle River: Pearson.

Hodge, G. A., and Carsten, G. (2019). The logic of public–private partnerships, The enduring interdependency of politics and markets. 1st ed. Cheltenham, UK: Edward Elgar Publishing.

Jay-Hyung, K., Jungwook, K., Sunghwan, S., and Seung-yeon, L. (2011). Public–private partnership infrastructure projects: case studies from the Republic of Korea. Philippines: Asian Development Bank.

Jefferies, M., Gameson, R., and Rowlinson, S. (2002). Critical success factors of the BOOT procurement system: reflections from the Stadium Australia case study. Eng. Constr. Archit. Manag. 9 (4), 352–361. doi:10.1108/eb021230

Koch, C., and Buser, M. (2006). Emerging metagovernance as an institutional framework for public private partnership networks in Denmark. Int. J. Proj. Manag. 24 (7), 548–556. doi:10.1016/j.ijproman.2006.07.001

Kumaraswamy, M. M., and Zhang, X. Q. (2001). Governmental role in BOT-led infrastructure development. Int. J. Proj. Manag. 19 (4), 195–205. doi:10.1016/s0263-7863(99)00069-1

Malek, M. S., and Gundaliya, P. J. (2023). Negative factors in implementing public-private partnership in Indian road projects. Int. J. Constr. Manag. 23 (02), 234–242. doi:10.1080/15623599.2020.1857672

Pongsiri, N. (2002). Regulation and public-private partnerships. Int. J. Public Sect. Manag. 15 (6), 487–495. doi:10.1108/09513550210439634

Qiao, L., Wang, S. Q., Tiong, R. L., and Chan, T.-S. (2001). Framework for critical success factors of BOT projects in China. J. Proj. Finance 7 (1), 53–61. doi:10.3905/jsf.2001.320244

Qin, S., and Zhao, J. (2025). Public-private or public-public? Exploring factors affecting private participation in China’s public-private partnerships. Rev. Policy Res. 42 (3), 711–735. doi:10.1111/ropr.70001

Stonehouse, J. H. (1996). Private-public partnerships: the Toronto Hospital experience. Can. Bus. Rev. 23 (2), 17–21.

Thai, N. H., and Son, T. T. (2015). Research on risk and risk allocation in investment of transportation inftrastruture project under Public - private Partnership. Hanoi, Vietnam: Transportation Publisher.

VCCI (2023). Report review of BOT contrcts, BLT contracts and O&M contract in Vietnam, Vietnam federation of commerce and industry Vietnam.

Wang, L., Sun, Y., and Tiong, R. L. K. (2024). Institutional quality configuration for encouraging private capital participation in PPP projects: evidence from 36 Belt and Road countries. Int. J. Manag. Proj. Bus. 17 (6/7), 898–922. doi:10.1108/IJMPB-06-2024-0144

World Bank (2007). Public private partnership units: lessons for their design and use in infrastructure. Washington, DC: World Bank.

World Bank (2020). Benchmarking infrastructure development 2020: assessing regulatory quality. Washington D.C.: World Bank.

Keywords: public-private Partnership, infrastructure project, roles of government, legal and regulatory framework, government capacity and commitment

Citation: Thai NH, Phu TQ and Thao HTY (2025) Assessing governmental roles in the success of infrastructure projetcs implemented through public-private partnership in Vietnam. Front. Built Environ. 11:1644333. doi: 10.3389/fbuil.2025.1644333

Received: 10 June 2025; Accepted: 30 July 2025;

Published: 26 August 2025.

Edited by:

Tiep Nguyen, International University, VietnamReviewed by:

Duong Vuong, Mientrung University of Civil Engineering, VietnamMohammedShakil Malek, Gujarat Technological University, India

Copyright © 2025 Thai, Phu and Thao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tran Quang Phu, cGh1LnRyYW5AdXQuZWR1LnZu

Nguyen Hong Thai

Nguyen Hong Thai Tran Quang Phu

Tran Quang Phu Huynh Thi Yen Thao

Huynh Thi Yen Thao