- 1Department of Civil Engineering, Arak Branch, Islamic Azad University, Arak, Iran

- 2Industrial Management Department, Central Tehran Branch, Islamic Azad University, Tehran, Iran

- 3Department of Industrial Engineering, Arak Branch, Islamic Azad University, Arak, Iran

- 4Department of Chemical Engineering, Faculty Engineering, Islamic Azad University, Arak Branch, Arak, Iran

Introduction: Public–private partnerships (PPPs) are increasingly adopted as mechanisms for financing and delivering critical infrastructure. However, their resilience under climate-induced hazards, particularly floods, remains underexplored.

Methods: This study develops a hybrid framework that integrates Bayesian network (BN) modeling, Monte Carlo (MC) simulation, and Nash bargaining (NB) to evaluate flood losses and negotiate risk-sharing arrangements in PPP contracts. Using Gonbad-e Kavus, Iran, as a case study, four flood scenarios were analyzed: the 2019 historical flood, and 100-, 1,000-, and 10,000-year return periods.

Results: The BN–MC module quantified probabilistic losses across sectors (buildings, agriculture, and infrastructure), capturing both expected damages and associated uncertainties. These results were then embedded in a NB framework, where public and private stakeholders negotiated risk allocations under varying utility preferences. Validation against the 2019 flood demonstrated close alignment between simulated and observed damages, with error margins below 5%.

Discussion: The findings reveal that catastrophic flood scenarios shift a greater share of risks toward the private sector, while sensitivity analysis confirms the robustness of negotiated outcomes against changes in stakeholder utility weights. By linking probabilistic hazard modeling with governance-oriented bargaining, this research provides a novel contribution to PPP resilience studies and offers actionable insights for designing adaptive contracts in flood-prone regions.

1 Introduction

Public–private partnerships (PPPs) have become a widely adopted mechanism for financing and delivering critical infrastructure worldwide. They enable governments to mobilize private capital and expertise while distributing risks across stakeholders. According to Osei-Kyei and Ampratwum (2025), PPPs contribute to urban resilience by aligning the incentives of both sectors. Yet, the resilience of PPP-based infrastructure under large-scale natural hazards remains insufficiently studied. Evidence shows that PPP contracts often lack adequate risk allocation mechanisms, which can result in disputes and service disruptions during crises (Liu et al., 2020; Li et al., 2024).

Floods are among the most destructive hazards affecting urban infrastructure, especially in regions with limited adaptive capacity. Climate change projections indicate increases in both flood frequency and magnitude (Chapagain, 2019; Zhang et al., 2022; Chen et al., 2023). The catastrophic floods of March–April 2019 in Iran demonstrated how unusual atmospheric patterns and land-use changes amplified hazard severity (Fazel-Rastgar, 2020; Alborzi et al., 2022). In Golestan Province, GIS-based multi-criteria analyses revealed the high exposure of rural settlements located within 1 km of river corridors (Taherizadeh et al., 2023). Similarly, operational decisions at major dams such as Voshmgir (locally referred to as the Golestan Dam) on the Gorganrud River have been shown to either mitigate or exacerbate downstream flood risks (Zargari et al., 2023).

Studies in developing regions emphasize that infrastructure governance must evolve to address climate-induced uncertainties (Casady et al., 2024; Sharma et al., 2022). In flood-prone areas, the distribution of responsibilities between public and private partners extends beyond financing to include service continuity and equitable management of losses (Cheng, 2021). Existing PPP governance research has largely focused on financial efficiency, contractual design, and dispute resolution (Osei-Kyei and Chan, 2017; Hodge and Greve, 2018; Cruz and Marques, 2013). However, these studies often neglect explicit incorporation of natural hazard risks. For instance, Liu et al. (2020) noted that resilience-oriented governance structures remain underdeveloped, while Rouhanizadeh and Kermanshachi (2020) stressed that post-disaster reconstruction requires integrated risk-sharing frameworks rarely formalized in practice. Casady et al. (2024) similarly found that institutional readiness is frequently lacking, limiting the adaptability of PPP contracts to extreme events.

In parallel, flood risk modeling has advanced significantly. Bayesian networks (BNs) have been applied to capture interdependencies in hazard systems (Arnal et al., 2020; Huang et al., 2021; Zhang et al., 2022), while Monte Carlo (MC) simulations have been widely used to quantify uncertainties in damage estimation (Figueiredo et al., 2022; Wu et al., 2023). GIS-based spatial analysis further supports visualization of exposure and vulnerability patterns (Justine et al., 2021; Das et al., 2022; Ahmad et al., 2024). For Golestan Province, hybrid GIS–MCDM frameworks have been employed to identify flood-prone areas and prioritize mitigation (Taherizadeh et al., 2023). Despite their technical robustness, such methods usually stop at quantifying risk rather than informing governance decisions where risk allocation is contested.

Recent studies have sought to integrate resilience and governance. Nguyen et al. (2023) developed a fuzzy-based risk assessment model to align probabilistic risk analysis with governance mechanisms, while Lee et al. (2022) highlighted the integration of climate adaptation into PPP contracts. Negotiation-based frameworks have also emerged as a promising avenue for resilience governance. The Nash bargaining (NB) approach, for instance, has been recognized as an effective mechanism for optimizing risk allocation by balancing stakeholder utilities (Xu et al., 2020; Wang et al., 2025). Similarly, cooperative game theory has been applied to strengthen PPP resilience under uncertainty (Xiang et al., 2022; Dorfeshan et al., 2022; Biancardi et al., 2024).

At the same time, international evidence underscores the need for adaptive governance. Chen et al. (2023) showed how climate-induced uncertainties complicate infrastructure service delivery, while Cheng (2021) provided evidence that participatory risk-sharing improves trust in PPP contracts. In the flood management domain, studies have emphasized integrating probabilistic flood modeling with urban policy (de Bruijn et al., 2019; Koks et al., 2019; Ward et al., 2021), though these efforts rarely connect to PPP contractual arrangements.

Further advances include the application of computational intelligence for resilience planning. Recent studies have adopted hybrid machine learning–probabilistic approaches to refine flood damage estimates (Rahman et al., 2024; Fang et al., 2024) and ensemble techniques for uncertainty quantification (Wu et al., 2023; Qiu et al., 2024). Nevertheless, the governance dimension of resilience planning in PPPs remains underexplored.

This study addresses these gaps by proposing an integrated hazard–governance framework that links BNs, MC simulation, and NB to PPP decision-making. The framework first estimates flood-induced damages for multiple return periods in Gonbad-e Kavus, Iran. MC simulation propagates uncertainties across scenarios, while GIS analysis visualizes exposure and losses. These outputs inform a NB framework in which public and private stakeholders negotiate risk-sharing. Building on the insights of Liu et al. (2020), Casady et al. (2024), Nguyen et al. (2023), and others, the study advances PPP resilience research by offering a structured negotiation mechanism informed by probabilistic flood modeling.

2 Study area and data

The study area is Gonbad-e Kavus, a flood-prone city in northeastern Iran that has historically experienced severe riverine floods, including the catastrophic events of August 2001 and March 2019 (Fazel-Rastgar, 2020; Alborzi et al., 2022). The Voshmgir Dam (commonly referred to in local sources as the Golestan Dam) plays a critical role in regulating flows of the Gorganrud River, mitigating downstream inundation while also creating challenges for balancing flood control, irrigation supply, and ecological requirements (Zargari et al., 2023; Taherizadeh et al., 2023). Recent GIS-based multi-criteria analyses further confirm that numerous villages in Golestan Province, particularly along the Qarasu watershed, remain highly exposed to flash-flood hazards (Taherizadeh et al., 2023).

The flood hazard and exposure data used in this study were generated by the authors through hydrological and hydraulic modeling. A high-resolution DEM was combined with rainfall–runoff records and historical hydrographs to simulate flood propagation in the Gorganrood River system under both regulated and unregulated dam conditions. Hydraulic simulations were carried out in HEC-RAS (v6.3) and processed in ArcGIS Pro to derive depth and extent maps for different scenarios, including the 2019 historical flood and synthetic return periods up to 10,000 years. Building footprints, agricultural land cover, and transportation networks were integrated from municipal GIS layers and cross-checked with field surveys. All flood depth maps presented in Figures 1–5 were produced by the authors as original outputs of this modeling workflow.

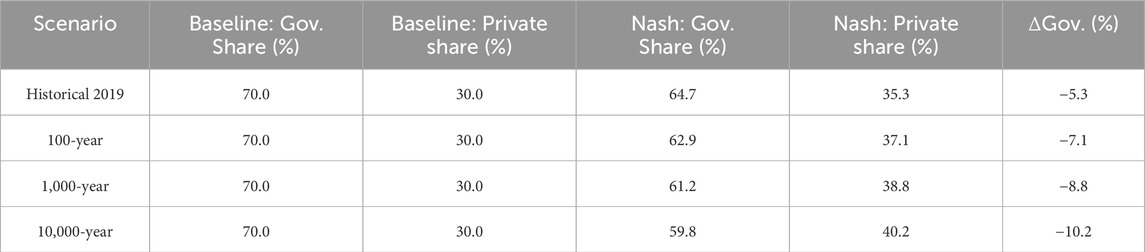

Figure 1. Flood depth map of the 2019 historical flood in Gonbad-e Kavus without dam regulation (WGS84/UTM Zone 40N; inset shows observed flood hydrograph).

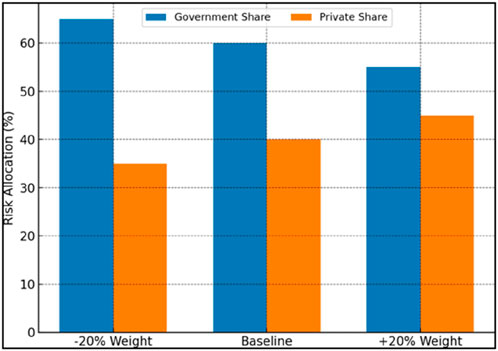

Figure 2. Flood depth map of the 2019 historical flood with Golestan Dam regulated at 62 m water level (WGS84/UTM Zone 40N; inset shows regulated hydrograph).

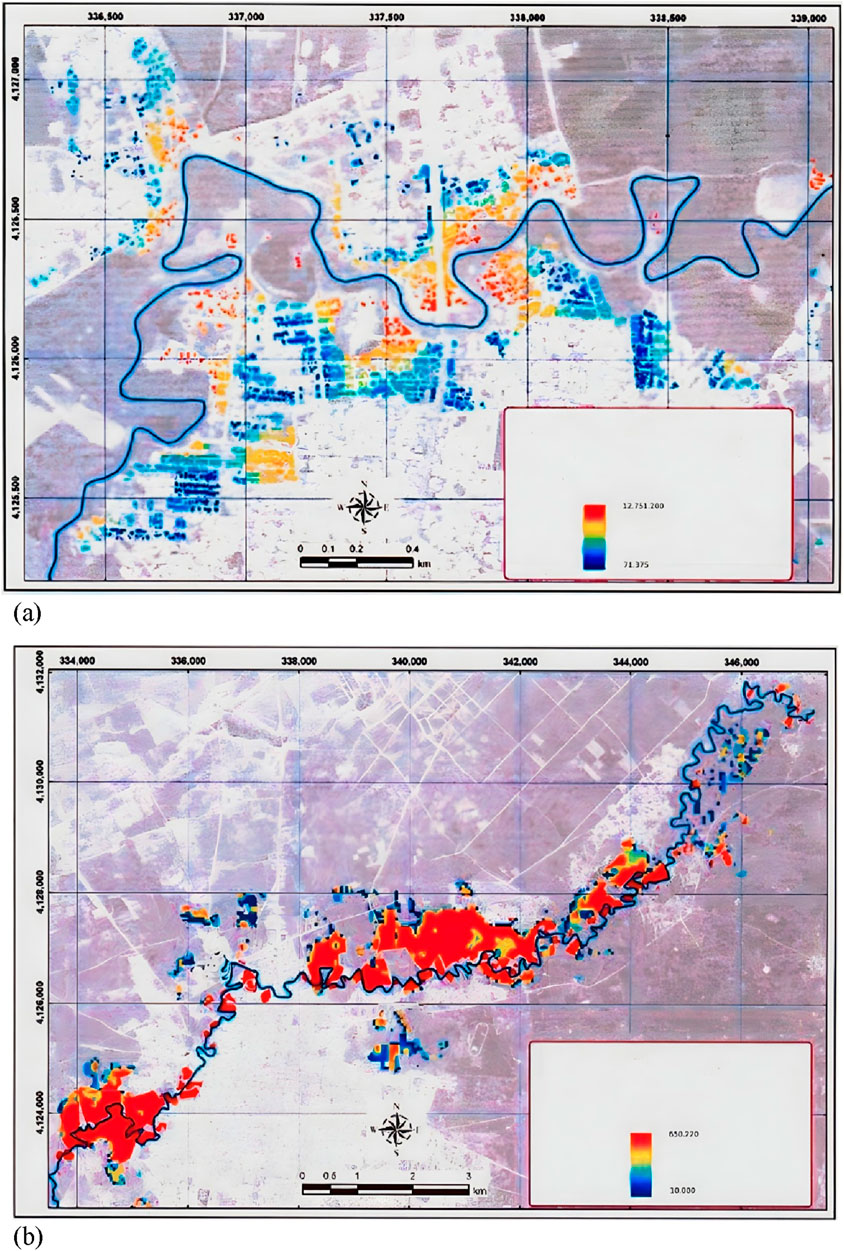

Figure 3. Spatial distribution of sectoral damages in the 2019 flood without dam regulation: (a) buildings, (b) agriculture (WGS84/UTM Zone 40N; inset shows depth–damage curve).

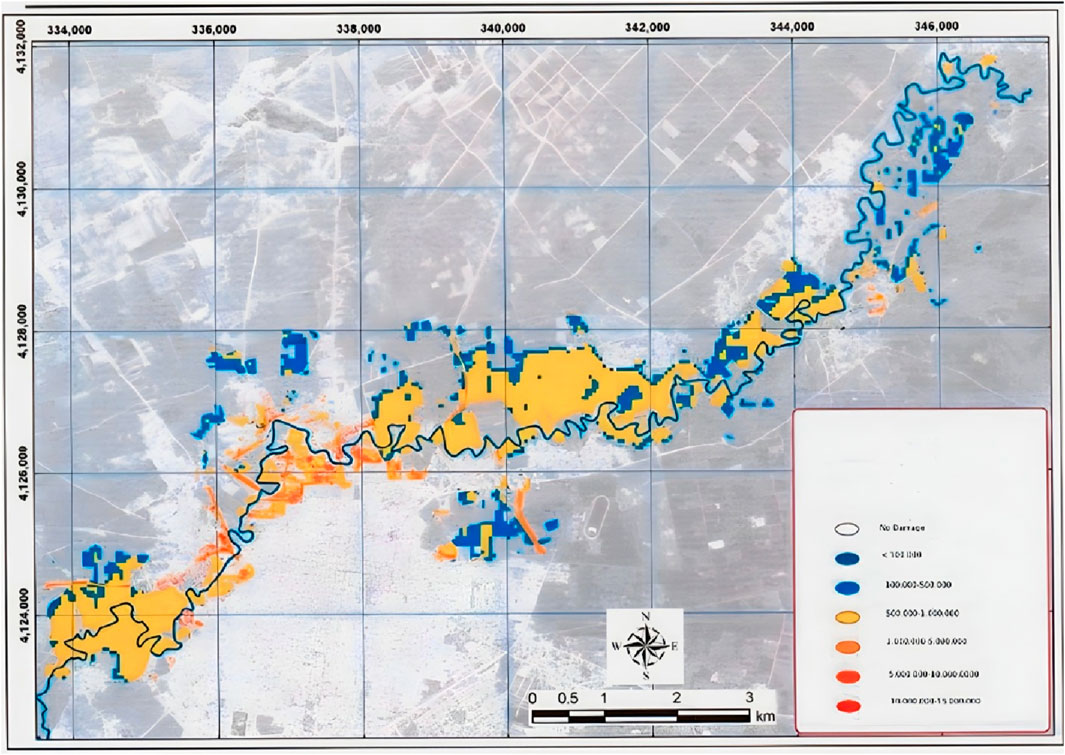

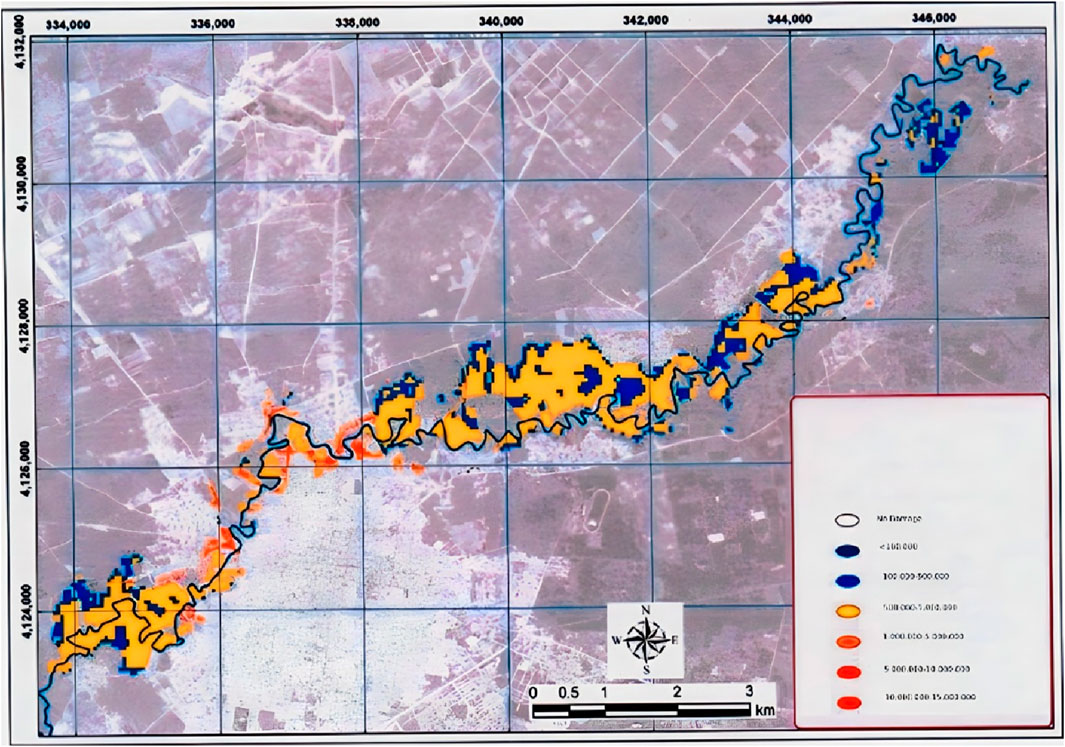

Figure 4. Aggregated distribution of flood-induced damages in Gonbad-e Kavus for the 2019 historical flood without dam regulation (WGS84/UTM Zone 40N; inset shows unregulated hydrograph).

Figure 5. Flood depth map under the 10,000-year return period scenario with reservoir level regulated at 62 m (WGS84/UTM Zone 40N; inset shows synthetic hydrograph).

Figure 1 illustrates the extent of inundation in the 2019 historical flood when no dam regulation is considered. Flood depths exceeded 1.0 m across the northern floodplain, particularly in peri-urban areas, highlighting the vulnerability of residential and agricultural land. The coordinates provide the spatial reference framework, while the inset hydrograph indicates the flood hydrograph used for scenario construction.

Compared to Figure 1, regulation at 62 m substantially reduced inundation depths across northern Gonbad-e Kavus by 0.2–0.6 m. The spatial extent of flooded areas greater than 1.0 m decreased by nearly 15%, indicating the significant flood-mitigation capacity of the Golestan Dam under this operational scenario (Figure 2).

Figure 3 demonstrates that building damages were concentrated in the northern districts of Gonbad-e Kavus, while agricultural losses were more widespread along the river corridor. The inset chart illustrates the depth–damage curves applied to estimate sectoral losses, showing that even moderate flood depths (>0.5 m) generated significant economic impacts.

Figure 4 highlights that the most severe damages overlapped with zones of high building density and agricultural productivity. The spatial pattern confirms the critical exposure of northern peri-urban wards, where damages exceeded 50% of building stock in several blocks.

Figure 5 illustrates the catastrophic scale of inundation expected under an extreme 10,000-year flood. Despite reservoir regulation, flood depths exceeded 2.0 m across large portions of the floodplain. These results emphasize that structural regulation alone cannot fully prevent extreme losses under rare, high-magnitude events.

3 Methodology

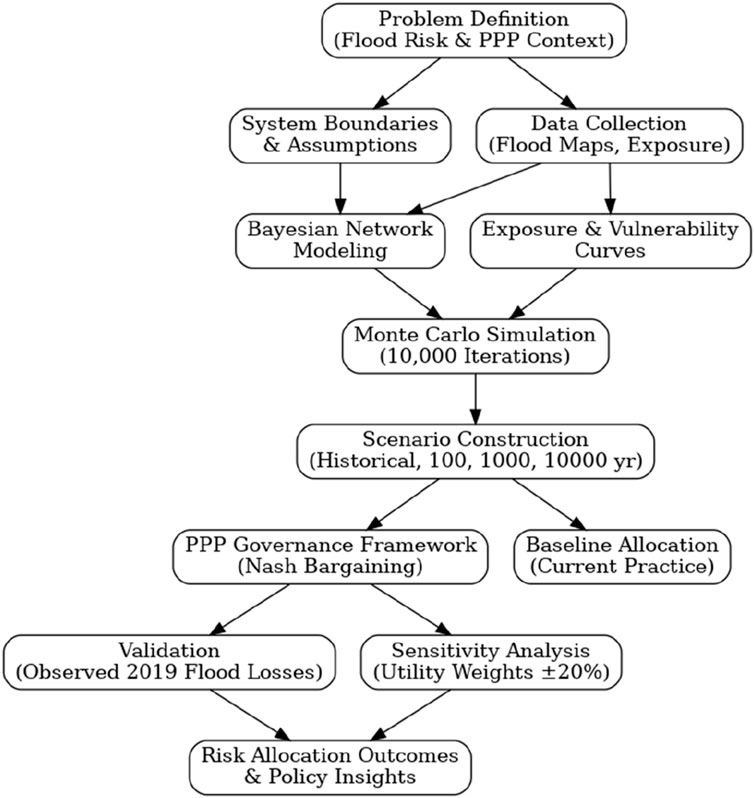

This section outlines the methodological framework employed in the study. The approach integrates probabilistic modeling of flood hazard and damage through BNs, scenario construction supported by MC simulations, and a negotiation-based risk-sharing mechanism using NB theory. The overall process ensures both technical rigor and practical relevance for PPP governance in flood risk management.

As shown in Figure 6, the methodological framework integrates technical modeling with governance analysis. The BN formalizes hazard–exposure–loss relationships, while MC simulation propagates uncertainty across multiple flood scenarios. These probabilistic outcomes then serve as inputs for the NB framework, enabling the negotiation of adaptive public–private risk-sharing arrangements. The validation and sensitivity modules close the loop by confirming predictive accuracy against the 2019 flood event and testing robustness to variations in stakeholder preferences.

Figure 6. Flowchart of the methodological framework combining BN modeling, MC simulation, NB allocation, and validation.

3.1 Bayesian network flood risk modeling

The BN model was developed to formalize the relationships between hazard intensity, exposure characteristics, and resulting damages. As shown in Figure 7, the BN structure consists of three primary nodes: Hazard (flood depth and extent), Exposure (buildings, agriculture, and infrastructure), and Consequences (economic loss categories). The conditional probability tables (CPTs) for these nodes were populated using flood maps (Figures 1–5) and exposure databases prepared for the study area. The outputs of the BN provide probability distributions of damages across sectors, which subsequently serve as the foundation for scenario construction (see Section 4.1).

Figure 7. Schematic representation of the BN structure linking hazard, exposure, and consequence nodes.

3.2 Scenario construction (MC-assisted)

Building on the BN structure, a set of flood scenarios is developed, including: (i) the 2019 historical flood, (ii) 100-year, (iii) 1,000-year, and (iv) 10,000-year return period floods. Each scenario is simulated through 10,000 MC iterations, sampling from the probability distributions of hazard intensity and exposure vulnerability. This process propagates epistemic and aleatory uncertainties, yielding expected losses with confidence intervals. The detailed distributions of simulated damages are presented in Section 4.1.

3.3 PPP risk-sharing framework (Nash Bargaining)

With the probabilistic loss distributions available, these results were embedded into a governance framework. The baseline contract assumes a 70%–30% risk split between government and private partners. Although this proportion does not represent a universal rule, it reflects a baseline assumption commonly adopted in previous PPP risk allocation studies (e.g., Xu et al., 2020; Li et al., 2024) and is consistent with observations that governments in developing contexts often retain a higher share of risk (Osei-Kyei and Ampratwum, 2025). This assumption provides a useful reference point for comparing bargaining-based outcomes. Two utility functions are defined:

• one for the public sector (minimizing fiscal burden and social disruption),

• and one for the private sector (ensuring investment returns under risk constraints).

The NB solution maximizes the Nash product, subject to the expected loss distributions from the BN–MC module. Negotiated allocations are compared against this baseline allocation, as reported in Section 4.2.

3.4 Validation and sensitivity analysis

The methodology incorporates validation and robustness checks. The 2019 historical flood is used as a benchmark: reported damages from governmental post-disaster assessments are compared with BN–MC simulated outputs. Error margins (MAE, RMSE) are calculated to assess predictive accuracy. Additionally, sensitivity tests are conducted by varying the weights in stakeholder utility functions (±20%) to observe the stability of Nash allocations. The validation results and sensitivity outcomes are discussed in Section 4.3.

4 Results

4.1 Flood scenarios and damage estimates

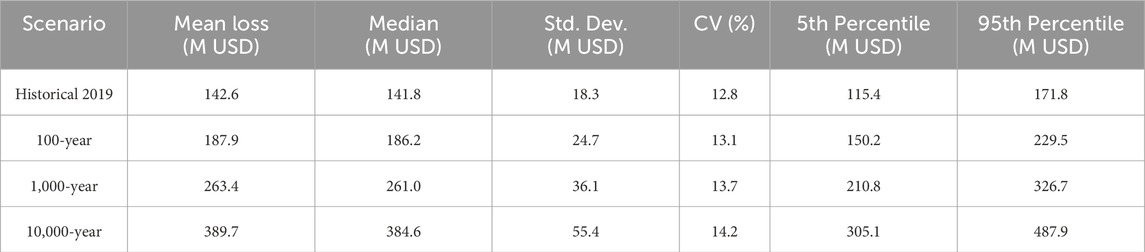

The integration of BN modeling with MC simulation provides a probabilistic characterization of flood-induced damages under different return period scenarios. Table 1 presents the statistical descriptors of the loss distributions generated from 10,000 MC iterations for each scenario. Results show that the mean economic losses increase from approximately USD 142.6 million in the 2019 historical flood to nearly USD 390 million in the 10,000-year scenario, with uncertainty bounds widening accordingly. The coefficient of variation (CV) increases from 12.8% for the 2019 event to 14.2% for the extreme case, underscoring the compounding influence of uncertainty in high-magnitude floods.

Table 1. Summary of simulated flood damage distributions for historical and hypothetical scenarios using MC simulation.

The probability density functions in Figure 8 depict the nonlinear escalation of flood losses, with heavy right tails becoming particularly pronounced in the 1,000-year and 10,000-year scenarios. These tails indicate that rare but catastrophic outcomes retain non-negligible probabilities, underscoring the necessity of probabilistic assessments rather than reliance on deterministic averages. The distributions further highlight the ability of the BN–MC framework to incorporate both epistemic and aleatory uncertainties, thereby providing a more realistic representation of risk compared to conventional point-estimate approaches.

Figure 8. Probability distribution curves of simulated damages under different return period scenarios.

The originality of this stage lies in its integration of high-resolution exposure data with probabilistic hazard–loss propagation, which extends beyond traditional deterministic flood risk assessments commonly applied in similar Iranian case studies. By explicitly quantifying uncertainty ranges, the results provide a stronger basis for downstream governance and negotiation modeling.

4.2 PPP negotiation outcomes

The loss distributions used in the negotiation framework are empirical distributions obtained from the 10,000 Monte Carlo simulations presented in Section 4.1. These were represented through kernel density estimates (KDE), expressed as Equation 1:

where N is the number of iterations, h is the bandwidth, and K is the kernel function. This formulation ensures that the simulated outcomes in Section 4.1 serve as the probabilistic foundation for the Nash bargaining model.

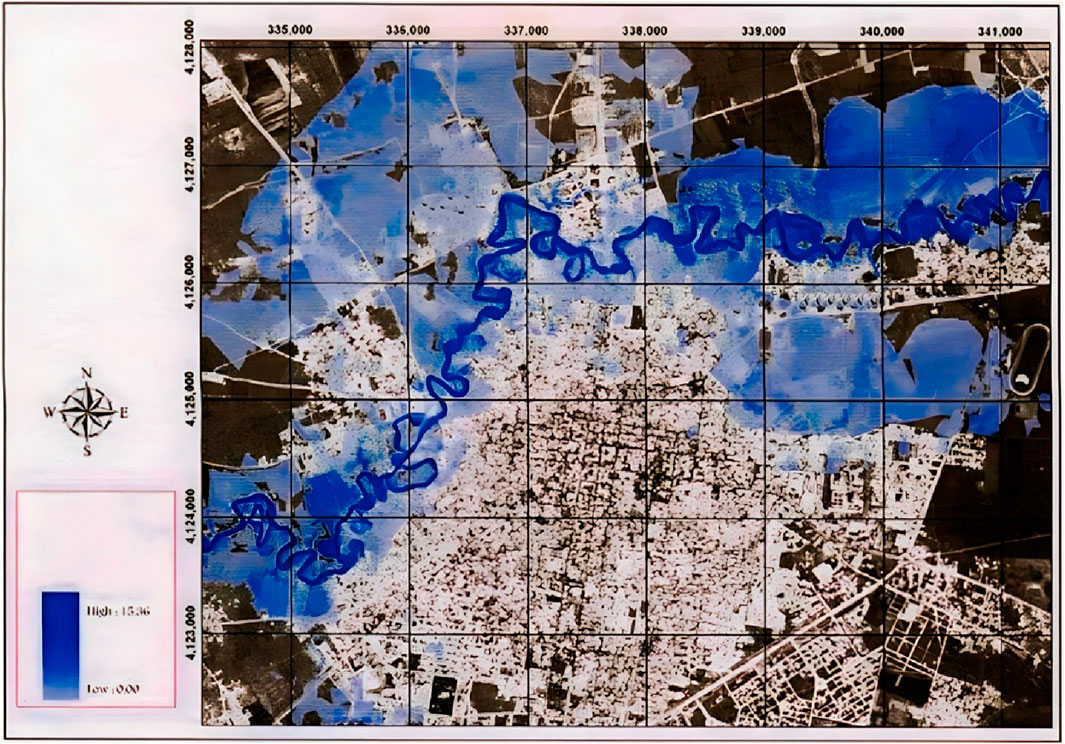

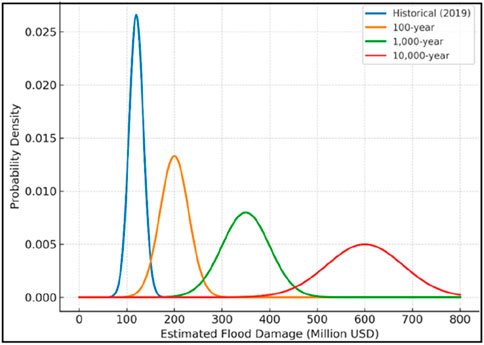

Table 2 summarizes the comparative allocations between a baseline contract (70% government – 30% private) and the NB solution. The results indicate that, across all flood scenarios, the Nash equilibrium consistently reallocates a greater share of losses to the private sector. The magnitude of adjustment ranges from −5.3% in the 2019 flood to −10.2% in the 10,000-year scenario, reflecting the tendency of bargaining outcomes to reduce the government’s fiscal exposure under high-magnitude risks.

The graphical comparison in Figure 9 complements the tabulated results in Table 2, highlighting how the bargaining-induced reallocations become more pronounced with increasing event severity. While the baseline contract remains static at a 70%–30% split, the NB outcomes adapt dynamically to the probabilistic loss magnitudes and stakeholder utilities. Under the 10,000-year scenario, for instance, the private sector’s share rises to 40.2%, representing a substantial rebalancing compared to the fixed baseline and underscoring the adaptive nature of negotiation-based frameworks.

Figure 9. Comparison of risk allocation outcomes between baseline contract and NB solution across different flood scenarios.

This result introduces a novel contribution: unlike conventional PPP studies that apply static or deterministic allocations, our model demonstrates a risk-responsive contract design in which the negotiated outcome adapts dynamically to probabilistic loss distributions. Such adaptability provides stronger resilience and credibility in PPP governance, particularly in data-scarce and high-uncertainty environments.

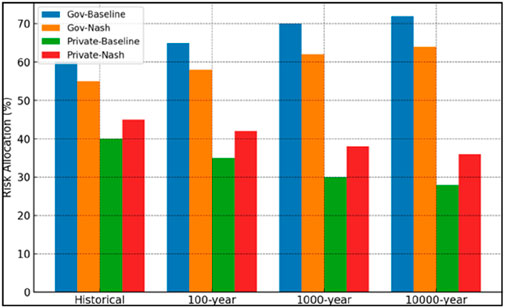

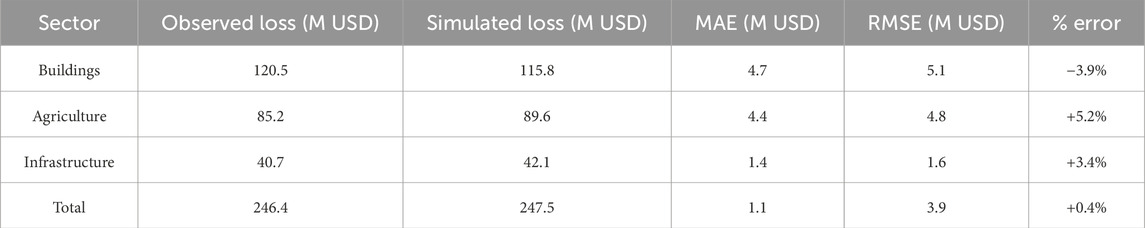

4.3 Sensitivity and robustness

Validation of the probabilistic damage model was carried out using the observed records from the 2019 flood. As summarized in Table 3, the simulated damages (USD 247.5 million) are in very close agreement with the reported figures (USD 246.4 million), corresponding to a marginal overall error of +0.4%. Sector-level deviations remain within ±5%, and both MAE and RMSE values confirm the high predictive accuracy of the BN–MC framework. These results strengthen the reliability of the model for scenario-based applications.

Table 3. Validation of simulated damages against observed 2019 flood losses (MAE, RMSE, percentage error).

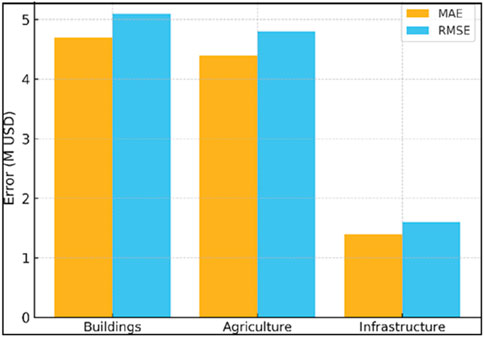

To complement the tabulated results, Figure 10 illustrates the MAE and RMSE values for buildings, agriculture, and infrastructure. The bar chart confirms that error levels remain low across all sectors, with both MAE and RMSE below 6 M USD, thereby reinforcing the strong predictive accuracy of the BN–MC framework.

Figure 10. MAE and RMSE values for buildings, agriculture, and infrastructure in the 2019 flood validation.

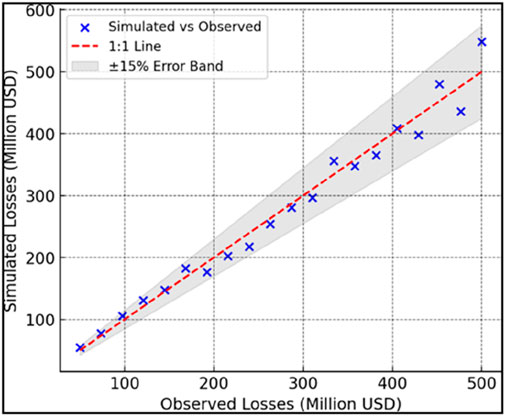

The scatterplot in Figure 11 further validates this consistency, demonstrating that observed and simulated losses cluster closely around the 1:1 reference line. The inclusion of confidence bands shows that nearly all sectoral data points fall within the expected range, indicating robust predictive performance. Such alignment reinforces the applicability of the BN–MC framework in contexts with scarce empirical calibration data, where uncertainty quantification is particularly critical.

Figure 11. Comparison between observed and simulated losses for the 2019 flood (scatterplot with error bands).

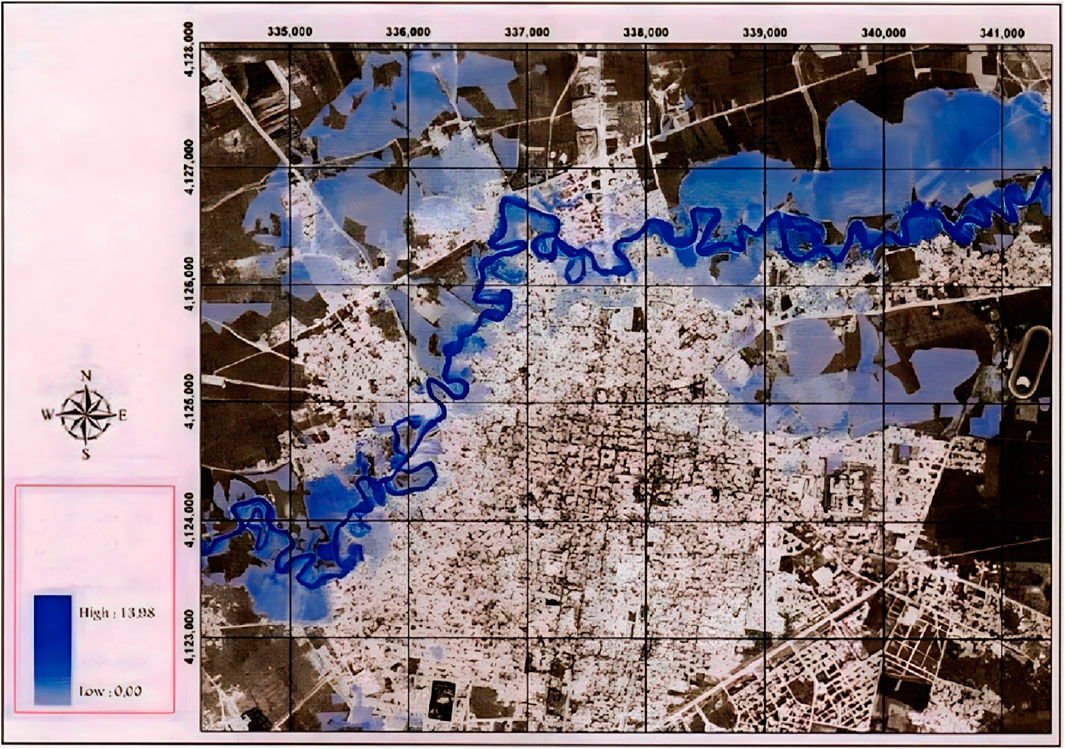

Beyond validation, sensitivity analysis was conducted by varying stakeholder utility weights ±20%. Figure 12 shows that even under these perturbations, the government’s share changes by no more than 3 percentage points, suggesting strong robustness of the NB outcomes.

This robustness is significant: many existing PPP studies are criticized for sensitivity to arbitrary parameter choices, but here the outcomes remain stable under plausible variations. The implication is that our framework can withstand negotiation biases and preference uncertainties, an essential property for governance in practice.

4.4 Policy implications

The integrated results highlight several important implications. First, the nonlinear scaling of damages with return period demonstrates that extreme events disproportionately threaten fiscal stability, justifying the need for probabilistic governance rather than deterministic contingency planning. Second, the dynamic adjustments in PPP allocations under the Nash framework illustrate a more equitable and resilient model compared to static contracts. Third, the strong validation and robustness performance underscores the reliability of the proposed approach, even in contexts where high-quality long-term data are scarce.

Taken together, these findings advance the literature on both flood risk modeling and PPP governance. Whereas most prior studies have treated flood loss estimation and PPP risk-sharing as separate problems, our work demonstrates that probabilistic hazard modeling can be directly embedded into contract negotiation frameworks, producing risk-adaptive and evidence-based allocation rules.

5 Discussion

The probabilistic results derived from the BN–MC framework provide a comprehensive view of potential flood losses and their uncertainties, directly addressing the first research question of how damages scale across historical and extreme return-period scenarios. As illustrated in Table 1 and Figure 8, the distribution of damages broadens substantially when moving from the 100-year to the 10,000-year flood scenario, with the coefficient of variation rising from about 13% to over 14%. This trend highlights that not only do average losses escalate with hazard intensity, but the uncertainty around those losses also expands, underscoring the limitations of deterministic planning. In contrast, the 2019 flood scenario shows narrower bounds, reflecting its calibration against observed data.

Building on this, the second research question is addressed by embedding these results into the PPP governance framework. Table 2 and Figure 9 show that, compared to a baseline government-heavy allocation, the NB solution consistently shifts a greater share of risk toward the private sector, especially under extreme scenarios. For instance, under the 10,000-year flood, the government’s share decreases by more than 10 percentage points relative to the baseline. This adjustment reflects how utilities balance under catastrophic risk conditions: governments seek to limit fiscal exposure, while private actors tolerate additional risk in pursuit of long-term returns. Such dynamics suggest the necessity of adaptive PPP contracts, with renegotiation clauses linked to hazard intensity.

The third research question concerned the robustness and validity of the framework. The sensitivity tests in Figure 12 reveal that even with ±20% changes in stakeholder utility weights, the overall allocation patterns remain stable, confirming the structural resilience of the bargaining outcomes. Furthermore, the validation against the 2019 flood (Table 3; Figure 11) demonstrates close alignment between simulated and observed damages, with error margins below 5%. These results enhance confidence in the applicability of the proposed methodology.

Collectively, these findings distinguish the present study from earlier works. Traditional flood risk assessments often rely on deterministic hazard–damage curves, while most PPP studies treat risk allocation qualitatively without quantitative links to hazard modeling. By combining probabilistic risk assessment with bargaining theory, this research provides an integrative methodology that advances both domains. Nonetheless, several limitations should be acknowledged. The exposure dataset, though extensive, may omit smaller-scale assets and therefore underestimate localized damages. The utility functions were modeled in simplified linear forms that may not fully reflect real-world bargaining behaviors. Additionally, the framework considered only a dyadic negotiation between government and private actors, whereas in practice, insurers, donors, and communities also influence outcomes.

Overall, the study demonstrates that integrating Bayesian risk modeling with NB can capture both the technical uncertainties of flood hazards and the institutional complexities of PPP governance. This dual perspective enables more resilient contractual arrangements and provides a novel contribution to the literature on infrastructure risk management.

6 Conclusion

This study developed an integrated framework that combines Bayesian Network modeling, Monte Carlo simulation, and Nash Bargaining to strengthen PPP governance under climate-induced flood risk. The results demonstrated that flood damages escalate non-linearly with increasing return periods and that negotiated allocations adaptively shift risks from the public to the private sector under extreme scenarios. Validation against the 2019 flood and sensitivity analyses confirmed the robustness of the approach, highlighting its reliability even under uncertainty. Overall, the research provides a novel methodological link between probabilistic hazard modeling and contractual negotiation, offering practical insights for designing more resilient PPP contracts in flood-prone regions, with future work extending to multi-stakeholder settings and compound climate hazards.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

AK: Formal Analysis, Writing – review and editing, Data curation, Writing – original draft, Software, Visualization. ST: Validation, Supervision, Writing – original draft, Writing – review and editing. ME: Writing – review and editing, Supervision, Project administration, Software. HM: Funding acquisition, Writing – review and editing, Conceptualization, Methodology, Investigation.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that Generative AI was used in the creation of this manuscript. In preparing this manuscript, we have utilized artificial intelligence (AI) tools for grammar checking, language enhancement, and assisting in identifying relevant references. However, all intellectual contributions, research methodologies, analysis, and conclusions are solely the work of the authors. The AI tools were used to refine clarity and improve readability without altering the scientific content or originality of the study.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmad, S., Khan, A., Tariq, S., Jigena-Antelo, B., and Prates, G. (2024). Evaluation and modelling of the coastal geomorphological changes of deception island since the 1970 eruption and its involvement in research activity. Remote Sens. 16 (3), 512. doi:10.3390/rs16030512

Alborzi, A., Zhao, Y., Nazemi, A., Mirchi, A., Mallakpour, I., Moftakhari, H., et al. (2022). The tale of three floods: from extreme events and cascades of highs to anthropogenic floods. Weather Clim. Extrem. 38, 100495. doi:10.1016/j.wace.2022.100495

Arnal, L., Wood, A., Stephens, E., Cloke, H., and Pappenberger, F. (2020). The challenges of probabilistic flood forecasting. Wiley Interdiscip. Rev. Water 7 (6), e1466. doi:10.1002/wat2.1466

Biancardi, M., Bufalo, M., Di Bari, A., and Villani, G. (2024). A strategic options game approach to support PPP investment decisions under risk-sharing mechanisms. Ann. Operations Res. doi:10.1007/s10479-024-06155-6

Casady, C. B., Cepparulo, A., and Giuriato, L. (2024). Public–private partnerships for low carbon, climate resilient infrastructure: insights from the literature. J. Clean. Prod. 470, 143338. doi:10.1016/j.jclepro.2024.143338

Chapagain, A. K. (2019). Changes in riverine flood frequency under climate change: a global synthesis. J. Hydrology 575, 120–135. doi:10.1016/j.jhydrol.2019.05.041

Chen, J., Chen, Y., Li, H., and Yusuf, I. (2023). Farm to fork: indigenous chicken value chain modelling using system dynamics approach. Sustainability 15 (2), 1402. doi:10.3390/su15021402

Cheng, M., Liu, G., Xu, Y., and Chi, M. (2021). Enhancing trust between PPP partners: the role of contractual functions and information transparency. SAGE Open 11 (4), 21582440211038245. doi:10.1177/21582440211038245

Cruz, C. O., and Marques, R. C. (2013). Flexible contracts to cope with uncertainty in public–private partnerships. Int. J. Proj. Manag. 31 (3), 473–483. doi:10.1016/j.ijproman.2012.09.006

Das, S., Ghosh, S., and Basu, S. (2022). A GIS–multi-criteria framework for urban flood vulnerability mapping. Environ. Monit. Assess. 194, 730. doi:10.1007/s10661-022-10378-2

de Bruijn, K. M., Buurman, J., Mens, M., Dahm, R., and Klijn, F. (2019). Resilience in practice: five principles to enable societies to cope with extreme weather events. Environ. Sci. and Policy 94, 87–95. doi:10.1016/j.envsci.2019.01.001

Dorfeshan, Y., Taleizadeh, A. A., and Toloo, M. (2022). Assessment of risk-sharing ratio in public–private partnership projects. Expert Syst. Appl. 203, 117245. doi:10.1016/j.eswa.2022.117245

Fang, S., Johnson, J. M., Yeghiazarian, L., and Sankarasubramanian, A. (2024). Improved national-scale above-normal flow prediction for gauged and ungauged basins using a spatio-temporal hierarchical model. Water Resour. Res. 60 (1), e2023WR034557. doi:10.1029/2023WR034557

Fazel-Rastgar, F. (2020). Extreme weather events related to climate change: widespread flooding in Iran, March–April 2019. SN Appl. Sci. 2, 2166. doi:10.1007/s42452-020-03964-9

Figueiredo, R., Martina, M. L. V., and Neal, J. (2022). Monte Carlo-based flood damage estimation: methods, applications and challenges. Nat. Hazards Earth Syst. Sci. 22 (3), 927–947. doi:10.5194/nhess-22-927-2022

Hodge, G. A., and Greve, C. (2018). Contemporary public–private partnership: towards a global research agenda. Financial Account. and Manag. 34 (1), 3–16. doi:10.1111/faam.12132

Huang, S., Wang, H., Xu, Y., She, J., and Huang, J. (2021). Key disaster-causing factors chains on urban flood risk based on bayesian network. Land 10 (2), 210. doi:10.3390/land10020210

Justine, M. F., Ouma, Y. O., Nyandwaro, E. O., Chhipi-Shrestha, G., Nahiduzzaman, K. M., Hewage, K., et al. (2021). Enhancing urban flood resilience: a holistic framework incorporating historic worst flood to Yangtze River Delta, China. Int. J. Disaster Risk Reduct. 61, 102355. doi:10.1016/j.ijdrr.2021.102355

Koks, E. E., Rozenberg, J., Zorn, C., Tariverdi, M., Vousdoukas, M., Fraser, S. A., et al. (2019). A global multi-hazard risk analysis of road and railway infrastructure assets. Nat. Commun. 10, 2677. doi:10.1038/s41467-019-10442-3

Lee, J., Park, S., and Kim, H. (2022). Socio-economic drivers of community acceptance of sustainable social housing: evidence from Mumbai. Sustainability 14 (15), 9321. doi:10.3390/su14159321

Li, J., Liu, B., Wang, D., and Casady, C. B. (2024). The effects of contractual and relational governance on public–private partnership sustainability. Public Adm. 102 (4), 1418–1449. doi:10.1111/padm.12982

Liu, Z., Wang, N., Skitmore, M., Akram, S., Afaq, A., and Shad, M. A. (2020). Sustainable innovation in small medium enterprises: the impact of knowledge management on organizational innovation through a mediation analysis by using SEM approach. Sustainability 12 (6), 2407. doi:10.3390/su12062407

Nguyen, H. D., Nguyen, V. T., and Nguyen, T. H. (2023). A comprehensive risk assessment model based on a fuzzy approach considering impact and probability. Eng. Constr. Archit. Manag. 30 (9), 4205–4228. doi:10.1108/ECAM-09-2021-0824

Osei-Kyei, R., and Ampratwum, G. (2025). Public–private partnerships and urban resilience: a review. Buildings 15 (12), 2023. doi:10.3390/buildings15122023

Osei-Kyei, R., and Chan, A. P. C. (2017). Implementation constraints in public–private partnerships: empirical comparison between developing and developed countries. Proj. Manag. J. 48 (6), 80–94. doi:10.1177/875697281704800407

Qiu, J., Liu, P., Li, Z., and Wang, H. (2024). Quantifying the flood coincidence likelihood between Huai River and its tributaries considering the nonstationarity. J. Hydrol. 635, 131010. doi:10.1016/j.jhydrol.2024.131010

Rahman, M. S., Haque, A., Das, S., and Hossain, M. B. (2024). An index-based holistic approach to evaluate flood preparedness: evidence from Bangladesh. Front. Clim. 6, 1479495. doi:10.3389/fclim.2024.1479495

Rouhanizadeh, B., and Kermanshachi, S. (2020). Investigating and prioritizing effective project resilience indicators during disasters. Int. J. Disaster Risk Reduct. 50, 101749. doi:10.1016/j.ijdrr.2020.101749

Sharma, S., Ghimire, G. R., Talchabhadel, R., Lee, B. S., Sun, F., Baniya, R., et al. (2022). Bayesian characterization of uncertainties surrounding fluvial flood hazard estimates. Hydrological Sci. J. 67 (10), 277–286. doi:10.1080/02626667.2021.1999959

Taherizadeh, M., Niknam, A., Nguyen-Huy, T., Mezősi, G., and Sarli, R. (2023). Flash flood-risk areas zoning using integration of DEMATEL and GIS-based ANP with satellite-derived information: Golestan Province, Iran. Nat. Hazards 118, 2309–2335. doi:10.1007/s11069-023-06089-5

Wang, Y., Liu, Y., and Du, J. (2025). The governance of PPP project resilience: a hybrid DMATEL-ISM approach. Systems 13 (4), 277. doi:10.3390/systems13040277

Ward, P. J., Jongman, B., and Aerts, J. C. J. H. (2021). Aqueduct Floods methodology: estimating present and future river flood risk at high spatial resolution. Hydrology Earth Syst. Sci. 25 (12), 6163–6186. doi:10.5194/hess-25-6163-2021

Wu, X., Zhang, Y., and Chen, W. (2023). Uncertainty quantification in flood damage modeling under climate change: a hybrid approach. J. Hydrology 617, 128992. doi:10.1016/j.jhydrol.2023.128992

Xiang, P., Wang, Y., Li, Y., and Wu, X. (2022). Operational risk allocation in urban rail transit PPP: a cooperative game theory approach. Front. Environ. Sci. 10, 900322. doi:10.3389/fenvs.2022.900322

Xu, Y., Wang, H., and Li, J. (2020). Nash bargaining for risk allocation in PPP projects under uncertainty. J. Constr. Eng. Manag. 146 (12), 04020133. doi:10.1061/(ASCE)CO.1943-7862.0001937

Zargari, A., Salarijazi, M., Ghorbani, K., and Dehghani, A. A. (2023). Effect of dam construction on changes in river’s environmental flow (Gorganrud River, south of the Caspian Sea). Appl. Water Sci. 13, 177. doi:10.1007/s13201-023-02011-3

Keywords: public–private partnerships, bayesian networks, Monte Carlo simulation, floodrisk modeling, nash bargaining, infrastructure resilience, risk allocation, climate change adaptation

Citation: Khoshnoud A, Tayaran S, Ehsanifar M and Mazaheri H (2025) Governance of PPPs under climate-induced flood risk: a bayesian and bargaining-based approach. Front. Built Environ. 11:1688067. doi: 10.3389/fbuil.2025.1688067

Received: 18 August 2025; Accepted: 19 September 2025;

Published: 13 October 2025.

Edited by:

Prince Antwi-Afari, University of Adelaide, AustraliaReviewed by:

Benjamin Botchway, The University of Newcastle, AustraliaSyed Shahid Shah, Beihang University, China

Copyright © 2025 Khoshnoud, Tayaran, Ehsanifar and Mazaheri. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shahrzad Tayaran, c2gudGF5YXJhbkBpYXUuYWMuaXI=

Amin Khoshnoud1

Amin Khoshnoud1 Shahrzad Tayaran

Shahrzad Tayaran