- 1Guangzhou College of Technology and Business, Guangzhou, China

- 2Cavite State University, Cavite, Philippines

Background: Blockchain technology offers transformative potential for international intellectual property (IP) trade and protection, yet its adoption in China faces significant barriers.

Method: This study utilizes the Analytic Hierarchy Process (AHP) to quantitatively prioritize regulatory, technological, economic, and sociocultural barriers, drawing on data from expert interviews.

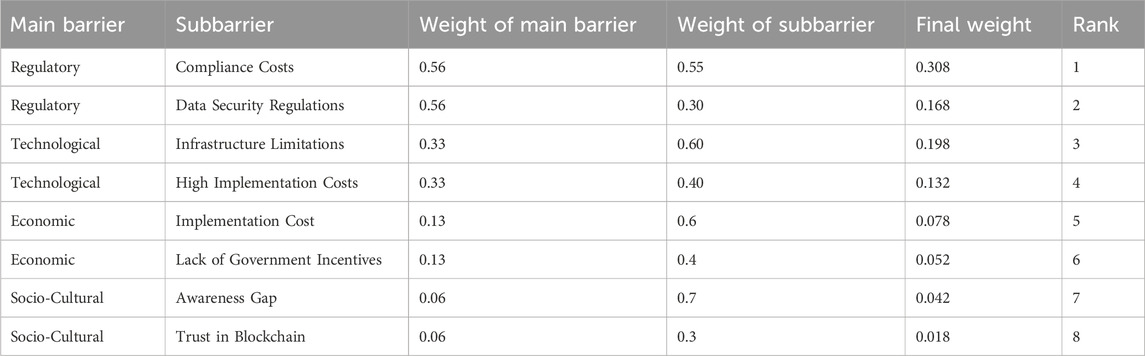

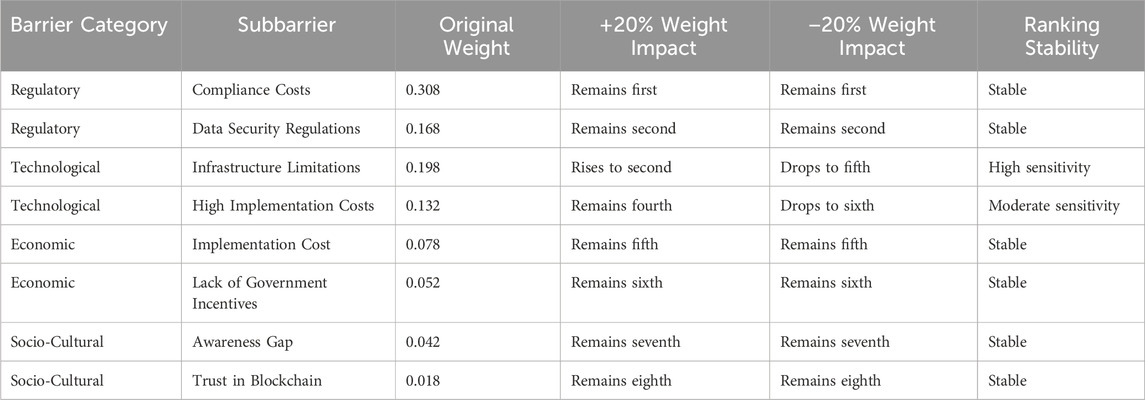

Findings: The analysis identifies regulatory barriers, particularly compliance costs (weight: 0.308) and data security regulations (0.168), as the primary challenges, largely due to stringent regulations such as China’s Cybersecurity Law. Technological barriers, including infrastructure limitations (0.198) and high implementation costs (0.132), are also significant. Economic and sociocultural barriers, such as awareness gaps and trust deficits, are less critical but still relevant. Addressing these challenges requires collaboration among policymakers, technology providers, and IP stakeholders.

Conclusion: This research offers actionable insights for advancing blockchain integration in China’s IP ecosystem. Future studies should expand sample sizes and explore alternative decision-making frameworks to improve generalizability.

1 Introduction

In recent years, distributed ledger technology has gained widespread acceptance across various fields, offering solutions that emphasize trust, security, and efficiency. Intellectual property (IP) encompasses creations of the mind, such as patents, copyrights, trademarks, and trade secrets. Beyond enhancing key aspects of IP management, this technology holds significant potential to combat counterfeiting, streamline licensing of IP assets, and safeguard intellectual property rights (IPRs) across borders (Mangla et al., 2022). Its distributed and tamper-proof nature mitigates vulnerabilities in centralized IP regimes, reducing fraud risks (Deng et al., 2024). However, adopting this technology for IP trade and management remains challenging in China, where IP issues intersect with international politics. This study aims to identify barriers to its implementation in China’s IP sector, using a quantitative approach to rank these obstacles effectively. The global IP environment faces threats like counterfeiting and piracy, leading to substantial financial losses and diminished innovation incentives (Duan et al., 2024). Distributed ledger systems can address these issues by securely and transparently recording IP ownership and transactions. For instance, they can automate IP registration and global trade, with open records reducing transaction costs by minimizing intermediaries (Liu and Zheng, 2024). These advantages position the technology as a valuable tool for IP rights owners and international commerce stakeholders in a competitive economy. As a leading manufacturing and innovation hub, China stands to gain significantly from leveraging such systems for IP management, where enforcement and security remain persistent challenges, both domestically and internationally. In China, where IP issues are central to trade and policy discussions, distributed ledgers can resolve fundamental problems in the current IP landscape (Kaur et al., 2024). Despite increasing domestic and international patent filings, China’s patent office faces enforcement challenges due to legal frameworks, regional disparities, and lack of transparency. Applying cryptographic distributed ledger systems could enhance transparency, reduce enforcement inconsistencies, and strengthen the Chinese IP framework. However, the limited adoption of these systems for IP management in China underscores the need for systematic study of the underlying barriers.

This study makes a significant contribution to the literature by applying the Analytic Hierarchy Process (AHP) to evaluate blockchain adoption barriers specifically within the context of China’s intellectual property (IP) trade and protection, an area underexplored in prior research. Unlike previous studies that broadly address blockchain adoption in supply chains or finance (e.g., Kaur et al., 2024; Farooque et al., 2020), this research focuses on the unique interplay of China’s regulatory, technological, economic, and sociocultural barriers, shaped by its centralized political system and stringent data security laws (e.g., Cybersecurity Law, Cryptography Law). The study’s novelty lies in its detailed quantitative prioritization of these barriers using AHP, offering actionable insights tailored to China’s IP sector. Furthermore, the inclusion of a diverse expert panel—comprising legal scholars, blockchain technologists, and international trade experts—ensures a comprehensive perspective on the multifaceted challenges, providing a robust foundation for policymakers and stakeholders to address IP protection in a globalized economy.

Intellectual property has been an area of interest in China’s economic strategy, especially over the years, as the country aims for technology powerhouse status. Despite significant advancements in creating and implementing IP laws in China, however, more stability and protection challenges related to IPs are still reported abroad, such as long patent examination durations, stringent enforcement measures, and counterfeits dominating markets, among others (Kumar et al., 2024). This is why these problems are highly manifested in a cross-border environment, where there is a disparity in regulatory frameworks and enforcement capacity. Moreover, the related influence has shown blockchain’s benefits in other industries for such challenges; however, it fails to deploy in China’s IP industry because of the disadvantages brought about by regulations, technology, and costs, which prompts the consideration of adoption barriers.

First, a regulatory issue arises from convoluted and stringent Chinese laws that prevent the use of blockchain technology outright in several ways—mainly through the rules governing data and security. New laws established recently, including the Cybersecurity Law and the Cryptography Law, have set high standards for data storage, encryption, and cross-border data transfers challenging to blockchain technology, which relies on distributed ledgers (Tian and Sarkis, 2024). Additionally, China has not been more liberal with respect to blockchain technology regulation because the technology is linked to cryptocurrency, which is prohibited nationwide. Hence, adopting firms in the field of blockchain technology for IP protection will have to incur high compliance costs and regulatory uncertainty, which also raises the risks and costs of adoption (Leung et al., 2023).

With the expanding body of scholarship on blockchain technology and IP protection, comparatively few studies have examined the challenges for blockchain technology adoption in the context of Chinese IP law. In other studies in other parts of the world, factors such as technical constraints, the absence of standardization, and scaling issues have been noted (Chin et al., 2021). However, these studies often broaden the adoption barriers without considering China’s political, social, and regulatory environment. For example, specific infrastructure problems are inherent to China’s highly centralized political system and to the legal constraints on data sharing in China, which are less relevant in a decentralized or free-market economy. In addition, prior research on blockchain technology adoption primarily employs barriers from a survey perspective regarding the relationships between factors; more comprehensive quantitative models that utilize mathematical methods can be more effective (Ogungbemi, 2024). Through a quantitative tool such as analytical hierarchy theory (AHP), this research intends to fulfill these objectives and estimate the barriers to adoption and their significance from the Chinese IP perspective.

Hence, this study enriches the current knowledge of blockchain technology adoption by presenting a qualitative analysis of the obstacles to China’s IP trade, with a focus on comparing the barriers in the Chinese market with those in other markets. The first research contribution is the AHP model, a quantitative operationalization of a hierarchical structure to process the obstacles identified in the literature and industry reports. Compared with conventional surveys, the AHP provides a deep level of prioritization of barriers and provides an understanding of which problem is most essential for solving and achieving practical blockchain technology applications in IP protection. This also provides a degree of validity check, strengthening the conclusions and providing practical utility to relevant stakeholders on how they might address the current state of the blockchain technology in China’s IP sector (Porras, 2023).

This research has important implications for policymakers, IP owners, and technology providers. Therefore, the results offer policymakers insight into what change in regulation would have the most significant effect on driving the adoption of blockchain technology. The research provides parties interested in deploying blockchain technology solutions for rights holders and technology firms with an understanding of the potential obstacles they face. Finally, this research offers an agenda for subsequent studies in which elaborate strategies to address each of the barriers mentioned earlier could be considered.

This study aims to address the research question: What are the primary barriers to blockchain technology adoption in China’s IP trade and protection, and how can they be prioritized to inform policy and practice? By employing the Analytic Hierarchy Process (AHP), this research fills a gap in the literature by providing a context-specific, quantitative prioritization of barriers, offering actionable insights for policymakers, IP stakeholders, and technology providers.

2 Literature review

This study adopts Rogers’ Diffusion of Innovations (DOI) theory to frame blockchain technology adoption barriers, categorizing them into relative advantage, compatibility, complexity, trialability, and observability. This framework guides the identification and prioritization of regulatory, technological, economic, and sociocultural barriers in China’s IP sector.

2.1 Blockchain’s advantages in IP management

Blockchain technology offers three core advantages in intellectual property (IP) management, addressing critical limitations of traditional centralized systems:

Transparency in ownership tracking: Distributed ledgers provide real-time, immutable records of IP ownership and transactions, reducing disputes by enabling all stakeholders to access consistent, verifiable data (Bonnet and Teuteberg, 2023).

Immutability for anti-counterfeiting: Once recorded, data on blockchain cannot be altered without consensus, making it a robust tool for combating counterfeiting and piracy—particularly in cross-border trade, where verification of IP authenticity is often cumbersome (Duan et al., 2024).

Smart contract automation for licensing: Self-executing smart contracts streamline royalty distribution, license renewals, and compliance checks, reducing administrative costs and delays associated with manual processes (Chaudhary and Nidhi, 2023).

2.2 Blockchain technology and intellectual property management

Blockchain technology’s transformative potential in intellectual property (IP) management stems from its core advantages—transparency, immutability, and smart contract automation—as detailed in Section 2.1. This section focuses on specific applications of blockchain in IP management, highlighting its role in addressing practical challenges across various sectors.

Several studies demonstrate blockchain’s ability to create stable ownership records and transaction histories for IP assets, including patents, copyrights, trademarks, and trade secrets. For instance, Tian and Sarkis (2024) show that blockchain enhances data integrity in IP disputes, ensuring the validity of ownership rights, particularly in international trade where ownership claims are often untraceable (Chaudhary and Nidhi, 2023). Blockchain’s timestamping capabilities further support dispute resolution by providing verifiable records accessible across borders. Article 21 of China’s Data Security Law (2021) mandates “the establishment of data classification and protection systems,” aligning with blockchain’s strengths in securing IP records (Zhou et al., 2023). Additionally, the 2023 Overall Layout Plan of Digital China Construction encourages exploring blockchain applications in cross-border IP transactions, providing policy support for such initiatives (Zhou et al., 2023).

Blockchain’s versatility enables its application across diverse industries. For example, Zreik (2024) highlights its use in pharmaceutical patents, where blockchain ensures that drug formulation data remain unaltered and accessible internationally, leveraging its immutability. Similarly, Wang et al. (2021) propose a blockchain-based mechanism for protecting digital IP in China’s museum sector, using smart contracts to ensure copyright authenticity, though regional enforcement disparities pose challenges. These applications underscore blockchain’s potential to address sector-specific IP management needs, yet its adoption remains constrained by regulatory, technological, and economic barriers, particularly in emerging economies (Wei, 2023).

2.3 Intellectual property protection challenges in China

China is currently at the forefront of intellectual property development as a growing world economy, but its enforcement system cannot support this growth. Since China is a country with a high frequency of IP-related litigation, it faces some challenges in independently preserving the efficiency of IP protection, especially in international trade (Jiang et al., 2022). According to Akram et al. (2024), counterfeiting products from China are still dominant, with clients losing much money from such fake products locally or internationally. This is coupled with substantial regional differences in enforcement, while large cities and areas receiving governmental support strictly implement IP rights, rural and remote regions lack the necessary physical and legal frameworks to protect IP rights fully (Tang and Rosli, 2024).

China’s fragmented policy system, divided along administrative regions, further exacerbates this problem. This fragmentation makes IP enforcement and protection issues for local innovators and foreign entities challenging. As reflected by Guan et al. (2023), the current IP structure has a loophole of inconsistency in enforcement, which enfeebles the comprehensive protection network. By providing an immutable and transparent IP registry that effectively decentralizes the management process, blockchain technology presents a possible solution to these concerns. However, merging this into the Chinese legal and IT environments presents a further issue, given compliance and infrastructure infrastructures.

2.4 Blockchain technology and intellectual property management

Recent advancements in digital twin and metaverse technologies highlight blockchain’s transformative potential in intellectual property (IP) management. For instance, a blockchain-enhanced digital twin platform, utilizing non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and distributed ledgers, ensures the traceability and integrity of IP assets, effectively combating counterfeit products in smart cities (Saad et al., 2023). Similarly, blockchain’s application in metaverse-based educational systems, such as gamified platforms for children’s road safety education, safeguards user data and copyright of educational content in virtual environments (Saeed et al., 2023). Furthermore, research on metaverse technologies emphasizes blockchain’s role in protecting multimodal content through NFTs and smart contracts, fostering trust in decentralized platforms (Khan et al., 2023). A blockchain-powered digital rights management (DRM) framework further enhances IP protection by providing robust mechanisms for asserting and securing digital rights, leveraging smart contracts for transparent and tamper-proof rights management (Madushanka et al., 2024). Additionally, generative AI in the metaverse leverages blockchain to protect multimodal content, further underscoring its significance in IP management (El Saddik et al., 2025). Despite these advancements, adoption barriers—such as technological complexity, lack of standards, regulatory delays, and China’s unique legal and policy constraints—remain significant challenges, particularly when integrating blockchain with IP protection in China’s distinct regulatory environment.

2.5 China-specific literature on blockchain technology and IP

China’s integration of blockchain technology with intellectual property (IP) management reflects a state-driven model prioritizing regulatory control and corporate efficiency, contrasting with decentralized Western approaches. This section reviews key studies on blockchain applications in China’s IP sector, focusing on their specific contributions, with the technology’s core advantages (e.g., transparency, immutability, smart contract automation) outlined in Section 2.1.

State-led initiatives, such as the digital yuan, social credit system, and “Belt and Road” data platforms, demonstrate blockchain’s role in centralized governance (Sigley and Powell, 2023; Powell, 2024). At the corporate level, blockchain supports environmental transparency and carbon management within China’s strict data governance frameworks (Zhang and Ruan, 2024; Deng et al., 2024). Wang et al. (2021) developed a blockchain-based mechanism for protecting digital IP in China’s museum sector, identifying regional enforcement disparities as a key challenge. Zou and Chen (2024) studied Guangdong’s 2024 IP dispute resolution platform, which reduced case processing times by 30%, and the Hangzhou Internet Court’s blockchain evidence platform, noting judicial admissibility issues. Huang et al. (2024) examined blockchain’s role in cross-border e-commerce IP protection, highlighting regulatory complexities as a barrier. Wang and Wang (2023) proposed a scalable framework for digital publication copyright protection, addressing data standardization.

These studies underscore China’s leadership in blockchain-IP integration while identifying barriers like data standardization, cross-chain interoperability, and legal admissibility. This study uses the Analytic Hierarchy Process (AHP) to prioritize these barriers, providing insights for policy and practice.

2.6 Global perspectives on blockchain technology adoption in IP management

While China’s state-driven blockchain-IP integration emphasizes regulatory control (Section 2.4), global approaches, particularly in the EU and US, leverage decentralized frameworks to enhance IP management efficiency, offering comparative insights for China’s context (Rejeb et al., 2021). The European Union Intellectual Property Office (EUIPO) has pioneered blockchain-based pilot projects for trademark and design registration, leveraging decentralized frameworks to enhance transaction speed and record reliability (Rejeb et al., 2021). Similarly, studies like Kaur et al. (2023) demonstrate that blockchain technology reduces IP infringement by providing immutable ownership records, streamlining cross-border IP transactions compared to traditional systems. These global advancements highlight blockchain’s potential to address inefficiencies in IP management, offering lessons for China’s IP sector.

However, global adoption faces challenges that resonate with China’s context, particularly in regulatory and technological domains. Privacy concerns are paramount, as public blockchains’ transparency risks exposing sensitive IP data, such as trade secrets or licensing agreements (Frolova and Kupchina, 2023). Private or permissioned blockchains mitigate this but introduce scalability and interoperability issues with public IP databases, limiting their effectiveness for cross-border applications. These global barriers align with China’s AHP findings, where regulatory barriers dominate due to compliance costs and data security regulations, driven by stringent laws like the Cybersecurity Law (2021) (Tian et al., 2024).

China’s centralized regulatory framework contrasts with the EU’s decentralized approach, creating unique adoption challenges. The Cybersecurity Law (2021) imposes strict data localization requirements, limiting cross-border data flows critical for blockchain-based IP systems (Zhang and Ruan, 2024). Technological infrastructure gaps also hinder scalability, requiring tailored blockchain solutions (Leung et al., 2023). China has initiated blockchain-IP integration efforts in cities like Shenzhen and Shanghai, exploring applications such as IP pledge financing and copyright registration.

Comparatively, the EU’s decentralized blockchain technology frameworks offer flexibility but lack China’s centralized enforcement capabilities, which could streamline national IP registries if regulatory barriers are addressed. China could adopt hybrid public-private blockchain technology models, as suggested in the study’s practical implications, to balance transparency and data privacy. For example, public chains could store hash values for transparency, while private chains protect sensitive IP data, as implemented in Ant Chain’s cross-border trade platform. Policymakers could also draw on EUIPO’s pilot projects to develop national blockchain technology certification standards, reducing compliance costs and fostering cross-border IP collaboration.

These insights underscore the need for context-specific solutions in China’s IP sector. While global trends highlight blockchain’s transformative potential, China’s regulatory complexity and infrastructure gaps necessitate targeted reforms. By addressing the prioritized barriers identified in this study, stakeholders can leverage global practices to accelerate blockchain technology adoption, enhancing IP protection and international trade efficiency.

2.7 Barriers to blockchain technology adoption in China’s IP sector

This paper reveals that the use of blockchain technology in IP protection in China faces regulatory, technological, and socioeconomic barriers. The Chinese government has implemented multiple policies to strictly regulate the employment of blockchain technology and related technologies, mainly because of data security, cybersecurity issues, and blockchain technology links to digital currencies (Chen, 2024). A study by Wang et al. (2024) revealed that data security laws in China restrict public blockchains and other related networks. For example, the Chinese servers in any blockchain technology must participate and respect specific data storage and encryption principles; therefore, blockchain technology application for IP protection entails the challenge of cross-border data transfer.

Another factor that makes it hard to adopt blockchain technology is technology. The application of blockchain technology solutions for IP management at the national level demands enormous amounts of computing power and technical skills, which are expensive (Naseem et al., 2023). Blockchain technology solutions consume a good deal of computing resources and storage space: this may not augur well with the notion of scalability, which is often a paramount requirement in many IP applications. The enormous expense of adopting blockchain technology, the slow process of processing transactions, and the limited market capacity have limited the number of organizations that use blockchain technology for IP management (Yadav et al., 2020).

2.8 Socioeconomic and cultural challenges to adoption

Several factors related to China’s socioeconomic and cultural context create more challenges for using blockchain technology in IP protection. The cultural attitudes toward the IP are also different within China, as it is more committed to IP rights enforcement in cities than in rural areas, as the latter has been depicted as having a low level of IP consciousness (Marengo and Pagano, 2023). This division poses a significant challenge to implementing a rational blockchain technology system for IP management nationwide. Different attitudes and practices create disparities that make it difficult to standardize solutions nationwide. Additionally, local enterprises and startups, which are more sensitive to such cambios, fail to have financial and informational prerequisites for applying blockchain technology for IP control; thus, they fall into an informational gap that might hinder blockchain technology from becoming efficient for IP protection (Chen and Lloyd, 2024).

Other factors that define blockchain technology adoption include economic factors. Although large enterprises can afford to acquire blockchain technology solutions, SMEs can hardly afford the financial muscle to do so. On the basis of research by Nisar et al. (2024), the problem could be avoided with government subsidies and incentives to make the use of blockchain technology in IP protection more accessible. However, the current policies offer very few incentives in the form of funding that enable SMEs to integrate technology into their operations, which is a large blow to small businesses’ already strained IP protection against large corporations (Bonnet and Teuteberg, 2023).

2.9 Technological advancements and blockchain technology integration in IP systems

The ongoing studies of the rise of technologies provide fresh insights concerning new prospective ways of embedding blockchain technology within existing IP systems. AI and ML have been proposed as two supportive technologies that can increase the applicability of blockchain technology in IP management. For example, AI can identify IP infringement by monitoring blockchain technology network entities for IP misuse while delivering an extra safeguard (Balci and Surucu-Balci, 2021). On the other hand, Booking AI techniques can help strengthen the work of blockchain technology and improve its indicators necessary for increasing speed and increasing transactional scalability, which is one of the most critical weaknesses in the functioning of this technology (Farooque et al., 2020).

Another recent development is the attempt to introduce the concept of mixed public‒private blockchains. The implementation of hybrid architectures means that while IP-sensitive data, for example, its hash value, can be stored on private blockchains, where no one other than the owners has access rights, the public blockchains can track nonsensitive metadata as to the object’s location or the date of the last update (Jiang et al., 2021; Liu and Zhong, 2024). This approach has received interest from researchers and IP actors because it offers the potential for broader blockchain technology integration in IP management, alongside addressing data privacy issues. However, technical challenges such as cross-chain interoperability and scalability still need to be addressed, especially in cross-border IP scenarios (Zhao and Si, 2023).

The barriers identified in the literature—regulatory constraints, technological limitations, economic costs, and sociocultural gaps—provide a foundation for the Analytic Hierarchy Process (AHP) employed in this study. By quantifying the relative importance of these barriers, the AHP model offers a structured approach to prioritize challenges specific to China’s IP sector, as detailed in the following research methodology (Tian et al., 2024).

3 Research methodology

3.1 Research approach

On the basis of the research context presented above, this paper applies a quantitative method to assess the challenges to blockchain technology implementation in the context of IP safeguards and cross-border trading in China. The choice of the quantitative approach is justified by the need to identify the specific factors that cause the limited implementation of blockchain technology and enable the collection of formalized data and their analysis via statistical tools. While using them, one is likely to obtain a respondent’s perception of an issue, which is more flexible than the quantitative approach we will use to analyze each barrier’s relative importance. Since this study does not include a questionnaire survey, the AHP is used to allocate importance performance analysis priority scores to determine the level of obstacles to the adoption of blockchain technology.

3.2 Analytic hierarchy process (AHP) model

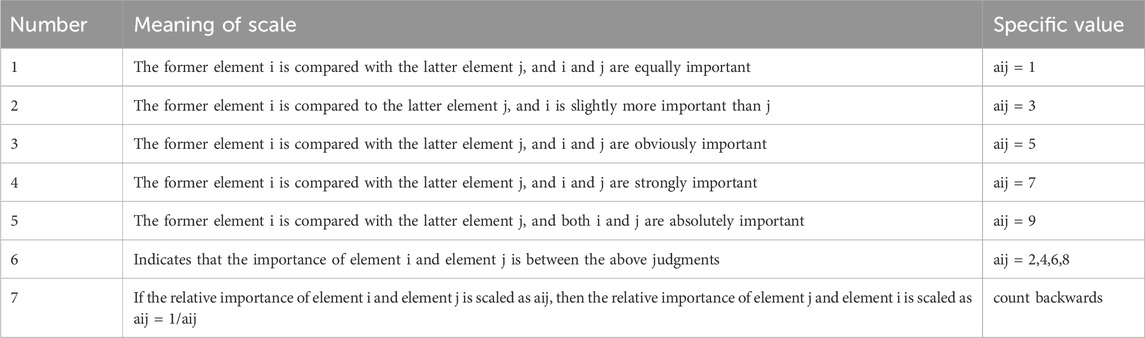

The AHP is a quantitative evaluation model that checks an issue’s priority. Judgment matrix is the basic component of the analytic hierarchy process. In the judgment matrix, elements at the same level should be compared with each other and assigned certain values. Generally, 9 scales from 1 to 9 are used as the judgment scale of the elements in the judgment matrix, as shown in Table 1.

3.2.1 Judgment matrix construction

There is a factor in the criterion layer, and the judgment matrix can be expressed as:

Where

3.2.2 Weight calculation

The eigenvector is calculated using the geometric mean method:

This formula calculates the weight value of each factor through operations on the elements of the judgment matrix. The numerator calculates the geometric mean of the comparisons between factor

3.2.3 Consistency check

Calculation of the maximum eigenvalue:

Consistency index:

Random consistency ratio:

When

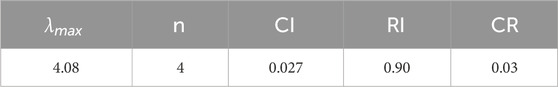

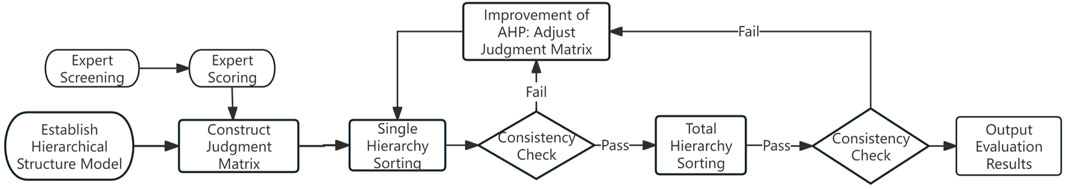

The maximum eigenvalue (λ_max) was calculated using Equation 3, where the judgment matrix is multiplied by the weight vector, and the resulting vector is divided by the weight vector to obtain λ_max = 4.08. The consistency index (CI) was then computed using Equation 4 as CI = (λ_max - n)/(n - 1) = (4.08–4)/(4–1) = 0.027. The consistency ratio (CR) was derived by dividing CI by the random consistency index (RI = 0.90 for n = 4), yielding CR = 0.027/0.90 = 0.03, using Equation 5, which is below the threshold of 0.1, confirming the reliability of the expert judgments.

It is often used in scientific investigations for various problems grouped under a multicriteria decision-making process by Saaty (1980). This method makes every aspect relevant for evaluating the barriers to adopting blockchain technology in China’s IP sector. It allows for a top-down decision-making process in which every level comprises factors related to the overarching aim. The AHP approach involves three key stages: specifying the relative importance of barriers according to the hierarchical structure, evaluating and ranking in terms of significance in pairs, and calculating the weights for ranking the obstacles with the help of the pairwise method.

3.3 Research design

The study’s research design is descriptive and analytical and aimed at systematically examining and ranking blockchain technology adoption barriers. The research design involves several stages:

1. Identifying Barriers: First, a systematic review of the relevant literature was conducted to establish existing barriers to the implications of blockchain technology. The impediments were grouped into regulatory, technological, economic, and sociocultural because the four main bottlenecks that challenge deploying blockchain technology in enhancing IP protection were considered.

2. Hierarchical Structuring: The barriers were then categorized and sequenced according to the hierarchy. At the structure’s pinnacle is the overarching objective—assessing the barriers to blockchain technology adoption. The second level includes significant regulatory, technological, economic, and sociocultural barriers, and subdivisions of the third level contain subbarriers of each type.

3. Pairwise Comparisons and Weight Assignment: Like the AHP method, which demands a barrier ranking that can be obtained upon conducting pairwise comparisons. Legal scholars in IP law and blockchain technology, academicians from the university’s international business department, and layers with a background in international trade were interviewed to assess each barrier on the basis of its significance in a somewhat controlled fashion in the pairwise system. We operationalized each comparison by rating its importance on a scale ranging from 1 (equality) to 9 (strict importance of one factor over the other). This approach helps establish a uniform priority sequence and ensures a clear understanding of the extent of the barriers to blockchain technology adoption when managing IP.

3.3.1 Data collection process

Three rounds of anonymous scoring were performed using the Delphi method with a 2-week interval. Agreement was tested using the Kendall coordination coefficient (Equation 6), and the final W = 0.82 (p < 0.01), indicating a high degree of expert agreement. The expert panel consisted of 15 professionals selected through purposive sampling to ensure diverse and authoritative perspectives on blockchain adoption in China’s IP sector. The selection criteria included: (1) at least 10 years of experience in IP law, blockchain technology, or international trade; (2) active involvement in relevant fields, such as national blockchain projects, IP litigation, or corporate IP management, including 2 advisors to national IP policy committees; and (3) representation across legal (n = 5), technological (n = 6), and business (n = 4) domains. The panel comprised five legal experts (including two intellectual property judges), six blockchain technology experts from academia and industry (all participating in national projects), and four enterprise representatives managing IP departments in listed companies. To mitigate potential biases, such as overemphasis on regulatory or technological perspectives, the panel was balanced across these domains, and anonymous scoring via the Delphi method was employed to minimize groupthink and ensure impartiality. While purposive sampling may introduce selection bias due to its non-random nature, the diversity of expertise and the iterative Delphi process helped enhance the reliability of the judgments.

The Delphi method was employed to collect expert judgments through a structured, iterative process to achieve consensus. Three rounds of anonymous scoring were conducted over a 6-week period, with a 2-week interval between each round. In the first round, experts independently provided pairwise comparison scores for the main barriers and sub-barriers using the AHP scale (1–9). Feedback from the first round was aggregated and shared anonymously with the panel, highlighting areas of disagreement. In the second round, experts revised their scores based on this feedback, narrowing discrepancies. The third round finalized the scores, achieving a high degree of consensus, as evidenced by the Kendall coordination coefficient (W = 0.82, p < 0.01). This iterative process ensured that diverse perspectives were reconciled, enhancing the reliability of the AHP results. The use of anonymity minimized biases such as dominant personalities or groupthink, while the three-round structure allowed sufficient time for reflection and refinement of judgments.

3.3.2 Justification for AHP

The Analytic Hierarchy Process (AHP) was selected for its proven ability to quantify qualitative expert judgments in complex decision-making scenarios (Saaty, 1980). AHP structures qualitative interview data into a hierarchical framework, using pairwise comparisons to derive barrier weights, and employs consistency checks (CR = 0.03) to ensure reliability. Its application in blockchain technology adoption studies (Tian et al., 2024) validates its suitability for prioritizing barriers in China’s IP sector. Unlike purely qualitative methods, AHP provides actionable, ranked insights, aligning with the study’s policy-oriented objectives (Huang et al., 2024). The Delphi method (Kendall’s W = 0.82, p < 0.01) further ensures robust qualitative inputs, supporting AHP’s effectiveness.

3.3.3 Expert selection criteria

15 experts were selected based on: (1) at least 10 years of experience in IP law, blockchain technology, or international trade; (2) active involvement in relevant fields (e.g., national blockchain technology projects, IP litigation, or corporate IP management, including 2 advisors to national IP policy committees); and (3) representation across legal (n = 5), technological (n = 6), business (n = 4) domains. Regulatory stakeholders were excluded due to access constraints during the study period, but their inclusion is recommended for future research to enhance policy insights.

3.4 Data collection

Expert assessments of the rank of the envisaged barriers were collected to conduct the AHP analysis. Owing to the novelty of blockchain technology, especially with respect to IP protection in China, a purposive sampling technique was used by inviting cultural asset protection authorities and 5 law, technology, and business professionals with expertise in the sector. The research question was as follows: What is the relative importance of each barrier inside its type and across types? Their evaluations help develop the values for the pairwise comparison matrix of the AHP, which forms the backbone of arriving at the weights of each barrier. Since there were no questionnaires, the data collection was strictly based on expert opinions without mass surveys. This expert-driven emphasis enables a focused examination premised on the specifics of real-world practitioners in areas related to the study.

3.5 Data analysis

Data analysis was performed in three primary stages, using the AHP methodology to calculate the relative weight of each barrier:

1. Pairwise Comparison Matrix Construction: A matrix was developed for each barrier on the basis of available expert inputs. The relative importance values were entered for each comparison, thus producing matrices that equal each barrier level in the hierarchy they represent.

2. Normalization and Consistency Check: The AHP model normalizes priority values to make them easier to compare. A consistency ratio (CR) was also calculated to promote the reliability of the expert evaluation. If the CR is less than 0, the judgments are consistent; therefore, the comparison matrices are reliable if the CR is less than 0.1.

3. Priority Weight Calculation: Having ensured reliability, further steps in the analysis involved estimating priority weights according to each of the barriers. The weight of each barrier indicates its importance concerning the usage of blockchain technology in the Chinese IP industry. By summing these weights, the barriers were ranked, providing an understanding of the factors that significantly affect blockchain technology adoption.

3.6 Validity and reliability

The following steps were taken to improve the credibility and quality of this research. Pairwise comparisons were correctly selected because each selected expatriate possessed adequate knowledge of blockchain technology, IP management, or international trade. Using a normalized scale for comparison also introduces more reliability within the AHP model because all ratings reflect the format of the pairwise comparison. Moreover, the consistency ratio check reduces the subjectivity of the evaluations because only consistent comparisons are employed in determining the overall barrier rankings.

3.7 Ethical considerations

In this study, all ethical standards were complied with by guaranteeing the anonymity of the participating experts and using their inputs for purely research purposes. Each expert was given an overview of the study’s objective, and they agreed to participate. Moreover, in accordance with the nature of the data used in IP management and international trade, all the data were anonymized to reduce any risk of exposure to IP information.

3.8 Limitations of the methodology

The Analytic Hierarchy Process (AHP) is a robust method for prioritizing barriers to blockchain adoption, with its validity reinforced by the Delphi method (Kendall’s W = 0.82, p < 0.01) and consistency checks (consistency ratio, CR = 0.03), ensuring reliable expert judgments. However, translating qualitative expert language into AHP’s numerical scale (1–9) for pairwise comparisons introduces hermeneutic challenges, as subjective interpretations may oversimplify nuanced stakeholder perspectives. While consistency checks mitigate some subjectivity, the conversion of complex qualitative insights into standardized scores risks losing contextual depth. Additionally, the sample size (n = 15), though appropriate for AHP, limits generalizability. The exclusion of regulatory stakeholders, such as representatives from the China National Intellectual Property Administration (CNIPA), further restricts policy formulation insights, as their perspectives could inform regulatory alignment. Future research could enhance robustness by employing triangulation, such as Q-methodology, to capture subjective viewpoints more holistically alongside AHP’s quantitative prioritization. Including regulatory stakeholders and expanding the sample size would further strengthen applicability to China’s IP sector.

4 Data collection and analysis

4.1 Data collection

Data were gathered through expert interviews on how different barriers affect the use of blockchain technology in the IP sector in China. Given the sensitivity of the study, purposive sampling was employed to identify fifteen experts from related fields: including 5 legal experts (including 2 intellectual property judges), 6 blockchain technology experts (all participating in national projects), and 4 enterprise representatives (in charge of the intellectual property department of listed companies), with a working years of 10 years. Before the actual assessment, each expert was required to assess the relevance of the barriers to blockchain technology adoption classified as regulatory, technological, economic, or sociocultural.

Political and governmental experts rated each barrier’s relative importance in a pairwise comparison via a 1–9 matrix, where 1 = equally important and 9 = extremely more critical. This input was used to create the AHP pairwise comparison matrices.

4.2 Development of the analytical hierarchy process (AHP) hierarchy

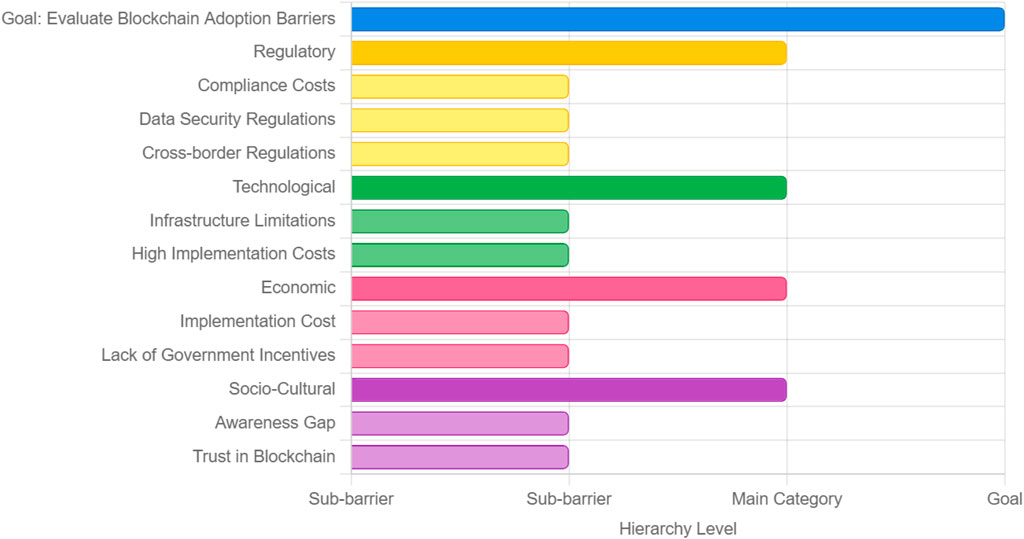

4.2.1 The AHP model structured the barriers into a three-level hierarchy

1. Goal (Top Level): To evaluate the barriers to blockchain technology adoption in the IP sector.

2. Main Categories of Barriers (Second Level): Regulatory, Technological, Economic, and SocioCultural.

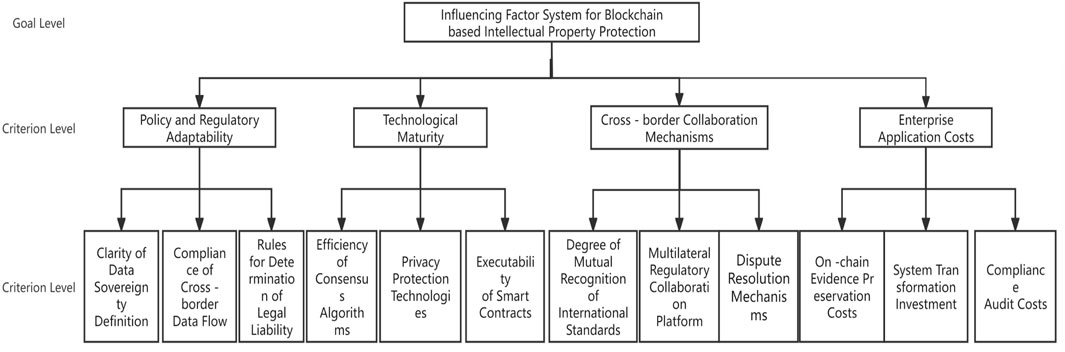

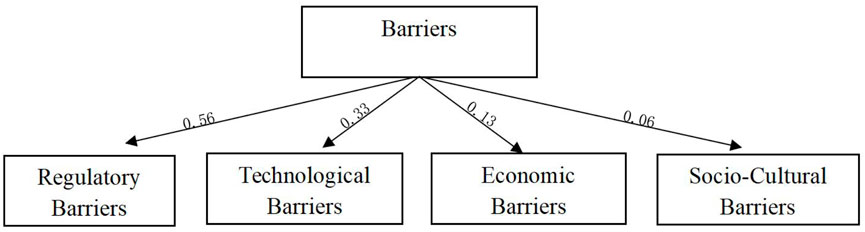

3. Subbarriers (Third Level): Specific issues within each category, such as compliance costs under regulatory, infrastructure limitations under technological, etc (See Figure 1).

A simplified hierarchy diagram is presented in Figure 1, illustrating the goal of evaluating blockchain adoption barriers, the main barrier categories, and their respective sub-barriers (See Figure 2).

Figure 2. AHP Hierarchy for blockchain technology adoption barriers in IP management (priority weight).

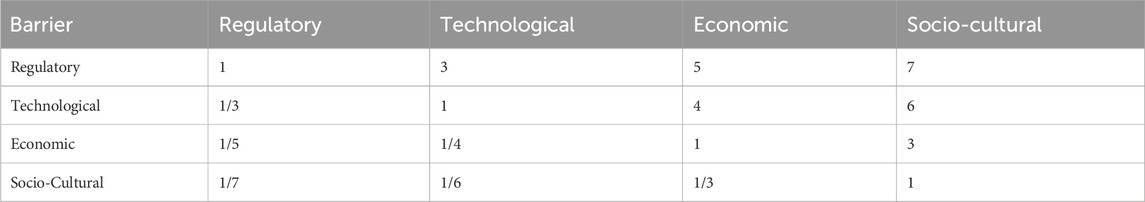

4.2.2 Pairwise comparison matrices

With the use of the AHP methodology, pairwise comparison matrices were developed to quantify the relative importance of each barrier. The expert evaluations were aggregated, resulting in the following pairwise comparison matrix for the four main categories Table 2 (Regulatory, Technological, Economic, and Socio-Cultural).

Table 2 Pairwise Comparison Matrix for Main Barrier Categories, showing the relative importance of Regulatory, Technological, Economic, and Socio-Cultural barriers to blockchain technology adoption in China’s IP sector, based on AHP evaluations by 15 experts with over 10 years of experience in IP law, blockchain technology, or international trade.

4.3 Calculating priority weights

Equation 7, identical to Equation 2, is applied here to calculate the weights for the main barrier categories in Table 2:

Calculation process:

4.3.1 Column normalization

This formula is used to normalize each column of the judgment matrix, making the sum of elements in each column equal to 1. It eliminates the influence of measurement units and facilitates the subsequent calculation of weights.

4.3.2 Calculate weights by row - averaging

By averaging each row of the normalized matrix via Equation 9, we can obtain the weight of each factor

4.3.3 Calculate the maximum eigenvalue

Based on the previously calculated weight

4.3.4 Consistency verification

Looking up the table, we get

Calculate the consistency index

The priority weights for each barrier category were calculated by normalizing the values in each column and then averaging each row. Table 3 The steps for obtaining priority weights are as follows:

1. Normalize each column: Divide each cell by the sum of its column.

2. The average of each row is calculated: This average represents the priority weight of each barrier category.

Table 3 Normalized Matrix and Priority Weights for Main Barrier Categories, derived from the pairwise comparison matrix (Table 1) using the AHP methodology, based on evaluations by 15 experts with over 10 years of experience in IP law, blockchain technology, or international trade.

4.4 Consistency ratio check

A critical component of AHP analysis is verifying consistency within expert judgments. The consistency ratio (CR) for each pairwise comparison matrix was calculated to ensure the reliability of expert judgments.

The process involved:

(1) Computing the maximum eigenvalue (λ_max) of the judgment matrix using Equation 3, where the judgment matrix is multiplied by the weight vector and divided by the weight vector elements.

(2) Calculating the consistency index (CI) using the formula CI = (λ_max - n)/(n - 1), where n is the number of factors in the matrix (e.g., n = 4 for the main barrier matrix).

(3) Determining the random consistency index (RI) from a standard RI table, where RI = 0.90 for n = 4.

(4) Computing the CR as CR = CI/RI. For the main barrier matrix (Table 2), λ_max = 4.08, resulting in CI = (4.08–4)/(4–1) = 0.027 and CR = 0.027/0.90 = 0.03, which is below the threshold of 0.1, indicating acceptable consistency (Table 4). This process was repeated for each sub-barrier matrix, with CR values consistently below 0.1, confirming the reliability of all expert evaluations. For the 2 × 2 sub-barrier matrices (Tables 5–7), CR is inherently zero, as 2 × 2 matrices are always consistent.

With a CR of 0.03, the consistency ratio is well within the acceptable limit, indicating that the expert judgments are consistent and reliable.

4.5 Priority ranking of subbarriers

Each main barrier category was further broken down into subbarriers, and pairwise comparisons were conducted.

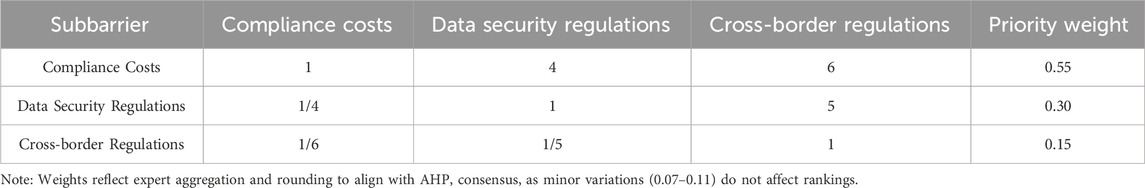

For the judgment matrix of regulatory sub - barriers in Table 8

Calculation process:

4.5.1 Calculate the geometric means

The geometric mean method is used to calculate the geometric means of the comparison values between each factor and other factors respectively, which prepares for the calculation of weights.

4.5.2 Normalize the weights

The geometric means of each factor are normalized to obtain the weights of each regulatory sub - barrier, clarifying their relative importance.

The process for calculating subbarrier weights mirrors the steps for the main barriers, using normalized matrices to derive priority weights. For example, the priority weights for subbarriers within the regulatory category are below in Table 8.

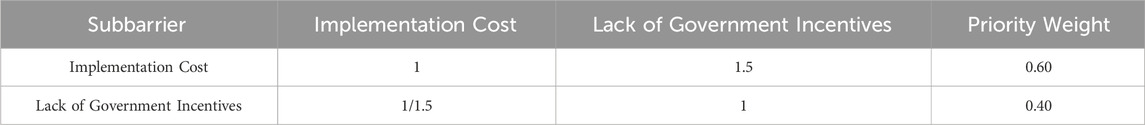

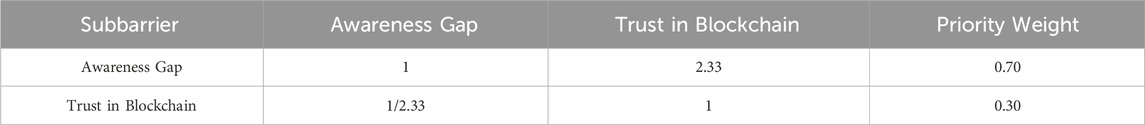

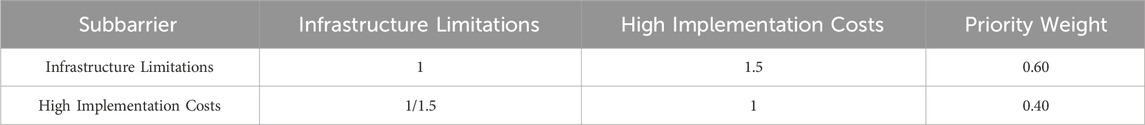

The subbarrier compliance costs emerged as the most significant for the regulatory category, with a priority weight of 0.55, followed by the data security regulations (0.30) and cross-border regulations (0.15). To ensure transparency and reproducibility, pairwise comparison matrices for the sub-barriers within the technological, economic, and sociocultural categories are presented below, following the same AHP methodology as the main barrier matrix (Table 1). These matrices were constructed based on expert evaluations and aggregated using the geometric mean method (see Table 5).

The priority weights for each sub-barrier were calculated using the same normalization and row-averaging process described in Section 4.2 (Equations 7, 8). These matrices provide a detailed breakdown of expert judgments, ensuring that the prioritization of sub-barriers is transparent and replicable (see Table 6).

4.6 Final ranking of barriers

Combining the weights of the main categories and subbarriers provides an overall ranking of all the barriers to blockchain technology adoption. This is achieved by multiplying the subbarrier weights by their respective main category weights in Table 7.

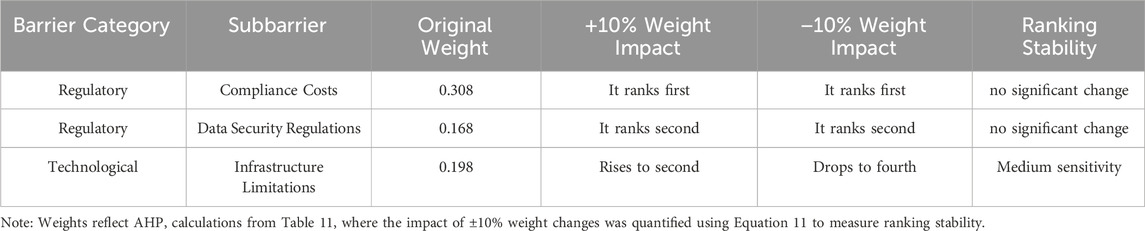

After the weight of the first-level index is ±10%, when the weight of ‘Infrastructure Limitations’ is reduced from 0.198 to 0.178, the ranking of ‘Infrastructure Limitations’ is reduced from third to fifth place (see Table 7). To further evaluate the robustness of the AHP rankings, a comprehensive sensitivity analysis was conducted by varying the pairwise comparison scores for each main barrier category by ±10% (Equation 10) and ±20%. This analysis assessed how changes in expert judgments affect the final rankings of both main barriers and sub-barriers. Table 9 below presents the results for a ±20% variation in the weights of the main barrier categories, complementing the ±10% analysis in Table 9.

The results indicate that the rankings are generally robust, with regulatory barriers consistently ranking highest. However, technological barriers, particularly infrastructure limitations, show higher sensitivity to weight changes, suggesting that their ranking is more susceptible to variations in expert judgments. This underscores the need for targeted technological improvements to stabilize blockchain adoption prospects.

Figure 3 Hierarchy of Blockchain Adoption Barriers in China’s IP Sector, illustrating regulatory, technological, economic, and sociocultural barriers prioritized via AHP, aligned with findings from Huang et al. (2024) and Zou and Chen, 2024).

The sensitivity analysis (Table 10) indicates that the ranking of Infrastructure Limitations is sensitive to ±10% weight changes, shifting from third to second or fourth place. This sensitivity reflects the critical role of technological infrastructure in blockchain adoption, where slight variations in perceived importance significantly impact prioritization, highlighting the need for robust technological investments.

Flowchart (Figure 4) illustrates the AHP process, from barrier identification to weight calculation, enhancing methodological transparency and replicability.

4.7 Analysis summary

The AHP model shows that regulatory compliance costs and data security regulations are the highest priority impediments to blockchain technology adoption in IP protection in China. With respect to technological factors, infrastructure and implementation constraints constitute the second most significant challenge. Thus, not only do economic factors matter, but sociocultural factors also rank lower, indicating that enhancements in regulations and technologies would have the greatest influence on the shift in blockchain technology usage.

In fact, prioritizing these barriers is valuable knowledge for stakeholders, as it reveals which policy adjustments and technological advances merit the most attention. Using the AHP model, which was found to be context independent and quantifiable, the results can be easily implemented to evaluate the barriers to blockchain technology adoption in other contexts that involve similar concerns.

5 Discussion

Building on the AHP analysis, which prioritizes regulatory and technological barriers (Table 7), this discussion translates these findings into practical strategies for blockchain adoption in China’s IP sector. The high weight of compliance costs (0.308) and infrastructure limitations (0.198) underscores the need for targeted regulatory reforms and technological investments, as supported by judicial practices (Zou and Chen, 2024) and stakeholder insights (Section 3.3). By constructing the judgment matrix (Equation 1) and calculating the feature vector (Equation 2), we establish a quantitative decision model. The consistency ratio

On the basis of the data collected through the AHP, this study presents a valuable understanding of the factors that remain obstacles to blockchain technology application in the IP trade and protection field in China. These priorities thus present a nuanced vision of the hurdles and valuable guides for practitioners, policymakers, developers of related technologies, and officials of agencies that regulate and oversee IP use.

Short-term (before 2025): Pilot blockchain technology cross-border IP registration platform in Hainan Free Trade Port and Shanghai Lingang New Area, allowing foreign companies to quickly confirm their rights through hash value storage certificate (citing Article 15 of the Regulations on Intellectual Property Protection of Hainan Free Trade Port).

Mid-term (2026–2030): Establish the national blockchain technology certification standard, requiring the depository nodes to include at least 3 notary offices (refer to the revised draft of the Regulations on the Management of blockchain technology Information Services).

Adopt ‘public chain + private chain’ hybrid architecture: public chain storage hash value to ensure transparency, private chain storage contract full text and other sensitive data. In cross-border collaboration, the ownership is verified by zero-knowledge proof (ZKP) to avoid original data leakage (example: Ant Chain cross-border trade platform scheme).

5.1 Strengthened practical implications

The AHP analysis reveals that regulatory barriers, particularly compliance costs (weight: 0.308), are the primary obstacles to blockchain technology adoption in China’s IP sector. Policymakers should consider streamlining their data security regulations and offer incentives like tax credits to reduce compliance burdens, as suggested by Huang et al. (2024). Technology providers should focus on scalable, cost-effective solutions tailored to China’s China infrastructure limitations, as noted by Chen and Lloyd (2024). The IP stakeholders should also invest in awareness campaigns to bridge the knowledge gaps.

Blockchain technology’s association with cryptocurrencies, banned in China due to financial regulatory concerns, complicates its adoption for IP protection, as regulatory scrutiny extends to decentralized technologies, increasing compliance costs and uncertainty (Tian et al., 2024). This challenge is echoed in stakeholder interviews, which highlight judicial skepticism toward blockchain-based evidence due to its cryptocurrency associations. Stakeholder interviews reveal judicial concerns about blockchain evidence authenticity, as courts require complete digital footprints from creation to ensure ownership, underscoring the need for robust legal frameworks (Zou and Chen, 2024).

5.2 Regulatory barriers: a dominant concern

The study identifies regulatory hurdles as the significant factor discouraging the implementation of blockchain technology, where compliance costs are seen as the most critical subfactor. This outcome shows that simple compliance with existing laws is challenging and that there are financial costs associated with making blockchain technology systems compatible with rigorous legal rules on IPs. Data security regulations, particularly China’s Cybersecurity Law (2021) and Cryptography Law, impose stringent data localization and encryption requirements, limiting blockchain’s decentralized functionality for cross-border IP management (Tian et al., 2024). These restrictions, compounded by judicial uncertainties in evidence admissibility (Liu and Zheng, 2024), elevate compliance costs and hinder adoption. The lower weight of cross-border regulations indicates that even though significant, this constraint can be viewed as secondary to compliance and data protection concerns, which are paramount concerns. These observations corroborate previous studies that focused on the regulatory issues of blockchain technology implementation. For example, Li et al. (2022) opined that where there are irregular or rigid rules of the land, they influence the lack of adoption of the blockchain technology in sectors with many cross-border activities. Solving these issues and challenges will presuppose the existence of coherent legal regulation at the international level, possibly within the framework of worldwide IP governing bodies. The high weight of compliance costs (0.308) reflects China’s stringent Cybersecurity Law and Cryptography Law, which impose significant financial and operational burdens on blockchain technology implementation. This finding underscores the tension between blockchain’s decentralized nature and China’s centralized regulatory framework, a dynamic less pronounced in decentralized economies like the EU.

5.3 Case studies on blockchain applications in China’s IP sector

To enhance the practical relevance of our AHP findings, we highlight real-world applications of blockchain in China’s IP sector, complementing the prioritized barriers (Table 9). The Hangzhou Internet Court’s blockchain evidence platform, used routinely for copyright disputes, leverages immutable ledgers to ensure authenticity, though judicial admissibility remains a challenge due to concerns over data tampering (Zou and Chen, 2024). Similarly, Guangdong’s 2024 IP dispute resolution platform, which reduced case processing times by 30%, demonstrates blockchain’s efficiency in streamlining IP management, yet faces regulatory hurdles (Zou and Chen, 2024). Ant Chain’s cross-border trade platform employs a hybrid public-private blockchain architecture, using public chains for hash value transparency and private chains for sensitive IP data, addressing compliance costs (weight: 0.308) and data security regulations (weight: 0.168) (Section 5.1).

5.4 Technological barriers: infrastructure and costs

Second, there are technological constraints, restricted technological infrastructure, and high implementation costs. Blockchain technology requires a solid technological infrastructure to support minimum security, availability, and interconnectivity of blockchain technology infrastructures and networks. However, the findings show that infrastructure deficiencies pose severe problems for progress, especially in developing countries or parts of the world where digital infrastructure is still in its infancy.

The implementation costs are high, thus magnifying this challenge. The vast initial adoption cost of blockchain technology includes software, hardware, and specialized personnel, although it provides significant benefits. Consistent with this, Kumar et al. (2024) stressed that cost is the greatest challenge for SMEs when implementing blockchain technology systems. One possible approach is to use partnerships and cooperation with private providers in addition to direct state investment to correct initial market failure and stimulate technology transfer.

5.5 Economic barriers: financial constraints

Considering the three broad categories of factors that may hinder the use of blockchain technology, economic factors rank after regulatory and technological hurdles, but they are equally important. The study reveals that the cost of implementation continues to be a significant factor of consideration, particularly for organizations still operating within slender resource envelopes. This finding supports the belief that many stakeholders tend to doubt the economic efficiency of solutions based on blockchain technology, even if industries such as IP management do not produce immediate benefits. As noted by Chin et al. (2021), ROI from blockchain technology will be attained in the future, which means that organizations with constrained funding are discouraged from implementing the technology. This problem could be solved by incentives such as tax credits or grants so that more individuals use the equipment.

5.6 Sociocultural barriers: awareness and trust

The AHP results prioritize every aspect of the sociocultural barriers at the lowest rank: awareness and trust. Even though these are not the worst problems, gaining more insight into these problems cannot be considered unimportant. Many stakeholders in the IP sector are still unfamiliar with blockchain technology, resulting in skepticism and a poor understanding of what this technology can offer. Other factors, such as trust in data privacy and blockchain technology transactions, make its acceptance even harder.

The results align with those of the study by Porras, (2023), which noted that awareness interventions and educational programs could lower resistance to blockchain technology adoption. Making people trust blockchain technology will require consistent efforts to prove that it is secured to protect shared information, including sensitive IP data.

5.7 Comparative insights and implications

The analysis undertaken using the AHP for prioritization provides relative insights into the impediments to blockchain technology adoption in the IP sector. The two categories are mainly regulatory and technological, indicating that only structural and systemic barriers should be fixed to fix economic and sociocultural barriers. This prioritization suggests that the use of blockchain technology requires an evolutionary approach, starting with policy changes and infrastructure enhancement. This study provides important insights for policymakers, who recommend that regulations be rationalized and that compliance costs be reduced but that data protection be strong. For technology suppliers, emphasis should be placed on identifying robust, inexpensive products that would best meet the requirements of the IP industry. Finally, and for the actors involved, namely, the IP owners and the enforcement authorities, advocacy and capacity development programs should be implemented to increase confidence in blockchain technology.

5.8 Theoretical and practical contributions

This research adds to the current literature on blockchain technology adoption by adopting the AHP in a domain context. The methodological approach can effectively set a realizable procedure for prioritizing barriers in other particular sectors or regions where similar challenges occur in the adoption process. In that context, the study offers practical suggestions for addressing the main challenges, thus supplying the stakeholders with the insights necessary to decide on the future use of blockchain technology in managing IP assets.

5.9 Limitations and future research directions

However, several limitations should be mentioned. Nonetheless, the study provides important insights for the investigation. Using expert opinions to judge pairwise comparisons may introduce subjectivity issues despite the checks and balances in judging the matter. Further research may improve the reliability of outcomes on the basis of the selected indices and include new datasets or other decision-making frameworks, such as the fuzzy AHP and multicriteria decision-making (MCDM). In addition, although this research explicitly investigates the Chinese IP sector, blockchain technology adoption limitations could differ from country to country and industry to industry. Such differences could be further investigated by comparative studies, which will help develop a more robust understanding of the characteristics of blockchain technology adoption. This study was limited by the expert sample size (n = 15) and the subjectivity of the AHP method. In the future, representatives of regulatory authorities should be included, and the conclusion should be verified compared with the actual enterprise data (such as the processing prescription of Aliyun blockchain technology storage cases). Finally, future research on the residuals of regulatory and technical innovations in blockchain technology implementation might advance the conclusions of this study.

The While AHP effectively prioritizes barriers, its reliance on expert judgments may introduce subjectivity, despite consistency checks (CR = = 0.03). The sample size of (n = 15), though suitable for AHP, limits generalizability. Sensitivity analysis (Table 11) confirms ranking stability, but future studies could employ complementary methods like fuzzy AHP, to address AHP’s uncertainty in qualitative inputs. Structural equation modeling, as suggested by (Tian et al., 2024), could validate causal relationships among barriers. Expanding the sample size or incorporating cross-country comparisons, as proposed by (Chen and Lloyd, 2024), would further enhance robustness. Longitudinal studies tracking regulatory and technological changes in China’s IP Sector would provide further dynamic insights into blockchain technology adoption insights.

5.10 Future directions

Further studies should continue by investigating the extent of the barriers to adopting blockchain technology in other sectors or countries to identify the similarities and differences in the systems. Certain comparative studies could add more international views to the given adoption trends of blockchain technology. Furthermore, including other decision-making methodologies, such as the fuzzy application of the AHP or other combinations of MCDM systems, may improve the effectiveness of the results. An observational longitudinal analysis of the effects of regulation and technology changes on blockchain technology would also provide further perspectives on how these barriers change with time.

6 Conclusion

They analyze the application of blockchain technology in international IP trade and protection in China, employing practical surveys and AHP studies. The study shows that the comprehensiveness of these challenges leads to the following conclusions: regulatory barriers are seen as the most significant challenge by the respondents, which is manifested through compliance costs with data security regulations; technology, economic, and sociocultural barriers constitute the following most essential challenges, as observed by the respondents. In prioritizing these barriers, the study also formulates a roadmap of the structural and systemic factors that prevent the effective adoption of blockchain technology in the IP sector. These problems call for massive cooperation among policymakers, technology suppliers, and users to promote the effective use of blockchain technology in IP management, which is more secure, transparent, and efficient. This study identifies regulatory barriers as the primary challenge to blockchain technology adoption in China’s IP sector, followed by technological, economic, and sociocultural factors. Collaborative efforts among policymakers, technology providers, and IP stakeholders are essential to address these barriers. Short-term strategies include piloting blockchain technology platforms in regions like Hainan Free Trade Port, while mid-term efforts should focus on national certification standards and hybrid blockchain technology architectures.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Ethics statement

The studies involving humans were approved by Guangzhou College of Technology and Business. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

QL: Conceptualization, Data curation, Formal Analysis, Resources, Visualization, Writing – original draft, Writing – review and editing. XW: Writing – review and editing, Data curation. ZW: Conceptualization, Data curation, Investigation, Methodology, Software, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

We express our sincere gratitude to the team members and the school’s innovation team who have contributed to this study. First of all, we would like to thank our teammates. Zijing Wu provided crucial insights based on his in-depth knowledge during the conception stage of this study. His constructive feedback on our initial ideas, along with his role as the corresponding author, helped us refine our research questions and methodology.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbloc.2025.1608181/full#supplementary-material

References

Akram, M. W., Akram, N., Shahzad, F., Rehman, K. U., and Andleeb, S. (2024). Blockchain technology in a crisis: advantages, challenges, and lessons learned for enhancing food supply chains during the COVID-19 pandemic. J. Clean. Prod. 434, 140034. doi:10.1016/j.jclepro.2023.140034

Balci, G., and Surucu-Balci, E. (2021). Blockchain adoption in the maritime supply chain: examining barriers and salient stakeholders in containerized international trade. Transp. Res. Part E Logist. Transp. Rev. 156, 102539. doi:10.1016/j.tre.2021.102539

Bonnet, S., and Teuteberg, F. (2023). Impact of blockchain and distributed ledger technology for the management, protection, enforcement and monetization of intellectual property: a systematic literature review. Inf. Syst. E-Business Manag. 21 (2), 229–275. doi:10.1007/s10257-022-00579-y

Chaudhary, G., and Nidhi, A. (2023). Artificial intelligence and blockchain: a breakthrough collaboration in IP law. J. Intellect. Prop. Rights (JIPR) 28 (5), 383–391. doi:10.56042/jipr.v28i5.981

Chen, X., and Lloyd, A. D. (2024). Understanding the challenges of blockchain technology adoption: evidence from China’s developing carbon markets. Inf. Technol. and People. doi:10.1108/ITP-05-2021-0379

Chen, Y. (2024). How blockchain adoption affects supply chain sustainability in the fashion industry: a systematic review and case studies. Int. Trans. Operational Res. 31 (6), 3592–3620. doi:10.1111/itor.13273

Chin, T., Wang, W., Yang, M., Duan, Y., and Chen, Y. (2021). The moderating effect of managerial discretion on blockchain technology and the firms’ innovation quality: evidence from Chinese manufacturing firms. Int. J. Prod. Econ. 240, 108219. doi:10.1016/j.ijpe.2021.108219

Cybersecurity Law (2021). Cybersecurity Law. Available online at: https://www.fangxian.gov.cn/xxgk/bmxzdh/zfbm/yjglj/zfxxgk/zc/zfbwj/202110/t20211026_3394514.shtml.

Deng, N., Gong, Y., and Wang, J. (2024). Promoting blockchain technology in low-carbon management to achieve firm performance from a socioeconomic perspective: empirical evidence from China. J. Clean. Prod. 448, 141686. doi:10.1016/j.jclepro.2024.141686

Duan, K., Onyeaka, H., and Pang, G. (2024). Leveraging blockchain to tackle food fraud: innovations and obstacles. J. Agric. Food Res. 18, 101429. doi:10.1016/j.jafr.2024.101429

El Saddik, A., Ahmad, J., Khan, M., Abouzahir, S., and Gueaieb, W. (2025). “Unleashing creativity in the metaverse: generative AI and multimodal content,” in ACM Transactions on Multimedia Computing, Communications, and Applications. New York, USA: ACM (Association for Computing Machinery). doi:10.1145/3713075

Farooque, M., Jain, V., Zhang, A., and Li, Z. (2020). Fuzzy DEMATEL analysis of barriers to Blockchain-based life cycle assessment in China. Comput. and Industrial Eng. 147, 106684. doi:10.1016/j.cie.2020.106684

Frolova, E. E., and Kupchina, E. V. (2023). Digital tools for the protection of intellectual property rights: a case study of blockchain and artificial intelligence. Perm. U. Her. Jurid. Sci. 61, 479–498. doi:10.17072/1995-4190-2023-61-479-498

Guan, W., Ding, W., Zhang, B., and Verny, J. (2023). The role of supply chain alignment in coping with resource dependency in blockchain adoption: empirical evidence from China. J. Enterp. Inf. Manag. 36 (2), 605–628. doi:10.1108/JEIM-11-2021-0491

Huang, C., Cao, C., and Coreynen, W. (2024). Stronger and more just? Recent reforms of China’s intellectual property rights system and their implications. Asia Pac. J. Innovation Entrepreneursh. 18 (3), 210–223. doi:10.1108/APJIE-04-2023-0081

Jiang, N., Liu, X., and Xu, M. (2021). Evaluating blockchain technology and related policies in China and the USA. Sci. Public Policy 48 (4), 562–575. doi:10.1093/scipol/scab032

Jiang, S., Jakobsen, K., Bueie, J., Li, J., and Haro, P. H. (2022). A tertiary review on blockchain and sustainability with focus on sustainable development goals. IEEE Access 10, 114975–115006. doi:10.1109/ACCESS.2022.3217683

Kaur, A., Kumar, P., Özen, E., and Vurur, S. (2023). “Unveiling the blockchain technology: an analysis of adoption and inventions,” in Digital transformation, strategic resilience, cyber security and risk management (West Yorkshire, UK: Emerald Publishing), 33–48. doi:10.1108/S1569-37592023000111A003

Kaur, J., Kumar, S., Narkhede, B. E., Dabić, M., Rathore, A. P. S., and Joshi, R. (2024). Barriers to blockchain adoption for supply chain finance: the case of Indian SMEs. Electron. Commer. Res. 24 (1), 303–340. doi:10.1007/s10660-022-09566-4

Khan, M. S., El Saddik, A., and Gueaieb, W. (2023). “Metaverse key technologies and blockchains: impacts and considerations,” in 2023 IEEE international conference on metaverse computing, networking and applications (MetaCom) (IEEE), 622–626. doi:10.1109/MetaCom57706.2023.00109

Kumar, J., Rani, G., Rani, M., and Rani, V. (2024). Blockchain technology adoption and its impact on SME performance: insights for entrepreneurs and policymakers. J. Enterprising Communities People Places Glob. Econ. 18 (5), 1147–1169. doi:10.1108/JEC-02-2024-0034

Leung, W. K. S., Chang, M. K., Cheung, M. L., Shi, S., and Chan, P. C. K. (2023). Understanding the determinants of blockchain adoption in supply chains: an empirical study in China. doi:10.1080/2331186X.2024.2334585

Li, N., Zhang, H., Du, R., Ai, S., Zheng, Y., and Brugha, C. M. (2022). Blockchain technology and intellectual property protection: a systematic literature review. Int. J. Blockchains Cryptocurrencies 3 (2), 112–130. doi:10.1504/IJBC.2022.124008

Liu, S., and Zheng, Q. (2024). A study of a blockchain-based judicial evidence preservation scheme. Blockchain Res. Appl. 5 (2), 100192. doi:10.1016/j.bcra.2024.100192

Liu, S., and Zhong, C. (2024). Green growth: intellectual property conflicts and prospects in the extraction of natural resources for sustainable development. Resour. Policy 89, 104588. doi:10.1016/j.resourpol.2023.104588

Madushanka, T., Kumara, D. S., and Rathnaweera, A. A. (2024). SecureRights: a blockchain-powered trusted DRM framework for robust protection and asserting digital rights. arXiv. doi:10.48550/arXiv.2403.06094

Mangla, S. K., Kazançoğlu, Y., Yıldızbaşı, A., Öztürk, C., and Çalık, A. (2022). A conceptual framework for blockchain-based sustainable supply chain and evaluating implementation barriers: a case of the tea supply chain. Bus. Strategy Environ. 31 (8), 3693–3716. doi:10.1002/bse.3027

Marengo, A., and Pagano, A. (2023). Investigating the factors influencing the adoption of blockchain technology across different countries and industries: a systematic literature review. Electronics 12 (14), 3006. doi:10.3390/electronics12143006

Naseem, M. H., Yang, J., Zhang, T., and Alam, W. (2023). Utilizing fuzzy AHP in the evaluation of barriers to blockchain implementation in reverse logistics. Sustainability 15 (10), 7961. doi:10.3390/su15107961

Nisar, U., Zhang, Z., Wood, B. P., Ahmad, S., Ellahi, E., Ul Haq, S. I., et al. (2024). Unlocking the potential of blockchain technology in enhancing the fisheries supply chain: an exploration of critical adoption barriers in China. Sci. Rep. 14 (1), 10167. doi:10.1038/s41598-024-59167-4

Ogungbemi, O. S. (2024). Smart contracts management: the interplay of data privacy and blockchain for secure and efficient real estate transactions. J. Eng. Res. Rep. 26 (8), 278–300. doi:10.9734/jerr/2024/v26i81245

Porras, E. R. (2023). Intellectual property and the blockchain sector, a world of potential economic growth and conflict. Intellect. Property-Global Perspective Adv. Challenges. doi:10.5772/intechopen.1001882

Powell, W. (2024). China, trust and digital supply chains: dynamics of a zero trust world. London, United Kingdom: Routledge. doi:10.4324/9781032026831

Rejeb, A., Rejeb, K., Simske, S., and Treiblmaier, H. (2021). Blockchain technologies in logistics and supply chain management: a bibliometric review. Logistics 5 (4), 72. doi:10.3390/logistics5040072

Saad, M., Khan, M., Saeed, M., El Saddik, A., and Gueaieb, W. (2023). “Combating counterfeit products in smart cities with digital twin technology,” in Proceedings of the 2023 IEEE international smart cities conference (ISC2) (IEEE), 1–5. doi:10.1109/ISC257844.2023.10293496

Saaty, T. L. (1980). The analytic hierarchy process: planning, priority setting, resource allocation. McGraw-Hill International Book Company.

Saeed, M., Khan, A., Khan, M., Saad, M., El Saddik, A., and Gueaieb, W. (2023). “Gaming-based education system for children on road safety in metaverse towards smart cities,” in Proceedings of the 2023 IEEE international smart cities conference (ISC2) (IEEE), 1–5. doi:10.1109/ISC257844.2023.10293623

Security Law (2021). Security Law. Available online at: https://www.gov.cn/xinwen/2021-06/11/content_5616919.htm.

Sigley, G., and Powell, W. (2023). Governing the digital economy: an exploration of blockchains with Chinese characteristics. J. Contemp. Asia 53 (4), 648–667. doi:10.1080/00472336.2022.2093774

Tang, C., and Rosli, R. (2024). Internet technology in legal economics and policy: strategic enterprise innovations in the US‒China trade relationship. China WTO Rev. 10 (1), 28–45. doi:10.52152/cwr.2024.10.1.03