- 1BIO.XYZ, Zug, Switzerland

- 2Lomonosov MSU,Episteme, Moscow, Russia

Introduction: This study explores the feasibility of embedding futarchy, specifically policy-binding conditional prediction markets anchored to democratically chosen key performance indicators (KPIs) in Decentralized Science (DeSci) governance. By externalizing belief formation to speculative markets while anchoring values democratically, futarchy offers a structurally distinct alternative to existing Decentralized Autonomous Organization (DAO) governance models.

Methods: Through an empirical analysis of governance data from 13 DeSci DAOs, this study examines governance, participation, and cadence patterns that condition futarchic adoption. A retrospective simulation using proposals from VitaDAO assessed the degree to which historical decisions align with futarchy-preferred outcomes.

Results: The results indicate full directional alignment under deterministic modeling, suggesting latent compatibility between futarchy and existing DeSci governance.

Discussion: The analysis further outlines the design principles for implementation, emphasizing measurable KPIs and epistemic diversity. Futarchy, if carefully instantiated, may serve as a governance alternative for funding truth-tracking science through probabilistic decision making and market-based information aggregation.

1 Introduction

Futarchy, first proposed by Hanson (2013), is a governance mechanism that aims to separate normative questions from empirical ones by allowing stakeholders to “vote on values but bet on beliefs.” In contrast to traditional democratic systems that determine policy outcomes based on majority votes, futarchy employs prediction markets to determine which policies are most likely to achieve collectively agreed-upon goals. The normative dimension, which should be optimized, is established through democratic processes such as value votes. The empirical dimension that leads to optimal outcomes is delegated to markets in which participants speculate about the expected impact of competing proposals. These markets aggregate dispersed information and incentivize accuracy through financial stakes, aiming to align governance outcomes with epistemically grounded forecasts (Hanson, 2013; Wolfers and Zitzewitz, 2004).

The practical implementation of futarchy has historically been limited owing to several factors, including institutional inertia, difficulty in defining appropriate and measurable success metrics, and concerns over market manipulation (Harkness Institute, 2025; Buterin, 2014). However, recent developments in blockchain-based governance have reignited interest in futarchy as a potentially viable mechanism for decentralized coordination. In particular, Web3-native contexts, such as Ethereum, Optimism, and MetaDAO, have begun to experiment with futarchy-informed decision-making, often in the context of grant funding or policy parameter adjustments (Alecse and Torché, 2024; Elizaoak (2025); Harkness Institute, 2025). Futarchy differs fundamentally from general prediction markets (Lim, 2021). While both rely on financial instruments to elicit probabilistic forecasts from distributed participants, futarchy explicitly couples market predictions with binding policy executions. Prediction markets on platforms such as Polymarket and Augur are typically standalone mechanisms for forecasting discrete events (e.g., “Will Candidate X win the election?”) (De la Rouviere, 2015). In contrast, futarchy is a governance procedure. It opens conditional markets on competing policies, ties each market to a preregistered KPI and settlement rule, and implements a policy whose conditional market implies a higher expected KPI (Hanson, 2013). For example, a DAO may ask, ‘If Proposal A passes, will the treasury balance exceed ten million USDC 6 months after enactment?’ The conventional prediction markets end in forecasting. Futarchy adds a binding selection step and supports multiple option policy menus by running one conditional market per branch. As a concrete example, Optimism’s Season-7 Futarchy Grants Contest employed conditional markets to rank 23 grant candidates and award funding to the five protocols forecast to boost Superchain TVL the most (Elizaoak (2025)). This alignment between informational accuracy and institutional action transforms prediction markets from passive forecasting tools to active governance decision making (Cowgill et al 2009; Hanson, 2013; Wolfers and Zitzewitz, 2006; De la Rouviere, 2015). In practice, two architectures have been developed. Asset-price futarchy (sometimes called “token-value accrual markets”) forecasts the DAO’s own token price under alternative policies and implements whichever branch maximizes the price. The KPI-conditional futarchy adopted here forecasts explicit success metrics, capital raised, milestone attainment, and reproducibility indices chosen via a prior value vote (Heavey, 2024; Dreber et al., 2015).

Notably, the growing maturity of the Web3 infrastructure has enabled a new generation of prediction markets to flourish in decentralized environments. Polymarket, a leading example, operates as a non-custodial, blockchain-based prediction platform, where users speculate on binary or categorical outcomes across domains, including politics, sports, and science (Puri, 2025; Chen et al., 2024). These platforms leverage decentralized finance (DeFi) primitives such as automated market makers (AMM) and centralized limit order books (CLOBs), ensuring transparency, immutability, and censorship resistance. Empirical analyses of Polymarket show that prediction markets exhibit high forecasting accuracy, albeit with known biases, such as sensitivity to liquidity dynamics (Puri, 2025; Brown et al., 2019; Buckley, 2017). Moreover, recent research has revealed that user behavior in decentralized prediction markets is not purely speculative, but often shaped by ideologically motivated betting, blending political beliefs, and financial interests (Chen et al., 2024; Canetti and Stewart, 1978). These behavioral insights are critical for futarchy, as they suggest that prediction markets can elicit high-quality signals even in politically charged or epistemically complex domains.

This intersection of futarchy and blockchain is especially relevant for emerging domains, such as Decentralized Science (DeSci), where governance decisions increasingly affect the direction of biomedical research, funding allocation, and protocol development (Ding et al., 2022a). DeSci represents an evolving ecosystem of blockchain-based initiatives aimed at restructuring the incentive architectures of science (Ding et al., 2022b; Weidener and Spreckelsen, 2024). At its core, DeSci seeks to replace opaque, centralized gatekeepers (e.g., funding agencies, journal editors, and proprietary data silos) with transparent, community-governed mechanisms for knowledge production and distribution (Weidener and Spreckelsen, 2024). This transformation is motivated by longstanding challenges in traditional science: skewed funding priorities, replication crises, and the monopolistic control of knowledge dissemination by major publishers (Larivière et al., 2015; Korbmacher et al., 2023; Piller, 2022; Wise, 2013). Initial experiments in DeSci began with tokenized platforms such as Gridcoin and Curecoin, which rewarded users for contributing computational power to distributed scientific projects (Cygnusxi, 2014; Gridcoin, 2013; 2022; Curecoin LLC, 2019). More recently, the ecosystem has evolved toward research coordination platforms that support decentralized peer review, open-access publication, and novel funding mechanisms (Wang et al., 2022; Franzoni and Sauermann, 2014).

A central innovation in this new paradigm is the rise of DeSci DAOs, decentralized autonomous organizations dedicated to funding and governing biomedical research. These DAOs often operate through multi-stage governance pipelines involving idea discussions on forums (e.g., Discord, Discourse), token-gated proposal submission, and formal voting via off chain tools such as Snapshot or on-chain smart contract platforms. This modularity enables rapid iteration and inclusive participation, but also exposes these systems to governance pathologies. Token-based voting, in particular, has been widely criticized for enabling plutocratic control, vote buying, and strategic collusion by large holders (“whales”) (Fan et al., 2024; Austgen et al., 2023; Netrovert, 2024).

In this context, futarchy presents a powerful alternative. By replacing direct vote counts with outcome-contingent bets, futarchy reduces the influence of capital-weighted voting and rewards those who are epistemically accurate, rather than economically powerful (Cowgill et al 2009; Wolfers and Zitzewitz, 2004). This epistemic turn in governance is particularly relevant for DeSci, where governance decisions (e.g., whether to fund a preclinical study or mint IP tokens for a new asset) are well suited to quantitative evaluation, as they originate in scientific hypotheses that define specific, measurable endpoints. Unlike political policy decisions, which often involve diffuse goals and ambiguous success criteria, scientific proposals can be evaluated on quantifiable outcomes, such as successful peer-reviewed publications, confirmation (or refusal) of a predefined hypothesis, or a pre-clinical milestone being reached.

Thus, the convergence of futarchy, prediction markets, and DeSci offers a promising frontier for institutional design (Rogers, 2021). Leveraging the information-processing power of markets, value alignment of democratic deliberation, and technological affordances of blockchain and futarchy in DeSci may constitute a superior governance model for allocating scientific funding, prioritizing research directions, and managing collective intellectual property (Surowiecki, 2005). However, critical questions remain: Can futarchy outperform traditional governance mechanisms in real-world DAOs? Are DeSci DAOs structurally ready for this shift? What informational, cultural, and technological preconditions must be met to enable successful futarchic implementation?

2 Objective

The objective of this research is to critically explore the application of futarchy within the context of DeSci. Specifically, this study focused on the following two sub-objectives:

1. Analysis of the current state of governance in DeSci to quantitatively characterize participation rates, token distribution, and decision outcomes of existing DeSci DAO governance mechanisms.

2. Counterfactual retrospective data-driven simulations comparing actual historical governance decisions against hypothetical futarchy-informed outcomes for selected DeSci DAOs.

3 Methodology

This study employs a mixed-methods approach to investigate the potential implementation of futarchy as a governance mechanism within DeSci. Specifically, the methodology integrates (1) an empirical analysis of existing governance structures using Snapshot data, and (2) retrospective counterfactual simulations to evaluate the practical feasibility and decision quality improvements offered by futarchy in DeSci contexts.

3.1 Empirical analysis of governance data

This section provides a structured empirical analysis of proposal-level governance data across 13 DeSci DAOs with a focus on characterizing participation patterns, voting structures, and procedural consistency based on Snapshot data.

3.1.1 Compilation of governance records from snapshot

A structured empirical dataset was compiled from governance data sourced from Snapshot (https://snapshot.box), the primary off-chain governance platform used by 13 DeSci DAOs, including AthenaDAO (AthenaDAO, 2023), BiohackerDAO (BiohackerDAO, 2025), CerebrumDAO (CerebrumDAO, 2025), CryoDAO (CryoDAO, 2025), GenomesDAO (GenomesDAO, 2025), HairDAO (HairDAO, 2025), HippocratDAO (HippocratDAO, 2025), MoonDAO (MoonDAO, 2025), PsyDAO (PsyDAO, 2025), Quantum Biology DAO (Quantum Biology DAO, 2025), ResearchHub (ResearchHub, 2025), ValleyDAO (ValleyDAO, 2025), and VitaDAO (VitaDAO, 2024), spanning the period from January 2024 through April 2025. Snapshot data was utilized not to directly test futarchy, but to establish a baseline understanding of the existing governance behaviors within decentralized scientific communities.

3.1.2 Characterization of DAO governance structures

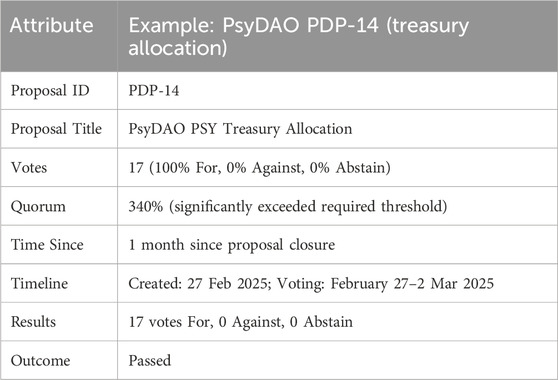

The collected Snapshot data was systematically analyzed at the proposal level, capturing key governance metrics to establish a clear empirical baseline for current decision-making practices. For each DAO proposal, the analysis focused on the following governance attributes:

Proposal ID and Title: Identification and categorization of proposals.

Votes: Number of votes cast and distribution of voting preferences (“For”, “Against”, “Abstain”).

Quorum: The extent to which proposal voting exceeds the required participation thresholds.

Timeline: Duration of each proposal’s voting period and recency (“Time Since” measure).

Results: Number of votes (for/against/abstained).

Outcome: Final decision results (passed/failed).

Table 1 presents the attribute schema applied to every proposal in the dataset, illustrated with PsyDAO’s Treasury-allocation proposal (PDP-14).

These detailed governance attributes were systematically extracted across proposals from all the selected 13 DAOs, providing foundational data for subsequent analyses and simulations.

3.1.3 Curation and normalization of proposal outcomes

Manual data curation: During the review of the collected governance data, it became apparent that certain proposals were marked as ‘closed’ by Snapshot, despite having received a clear majority of votes in favor. This discrepancy often originates from the use of customized voting formats, such as multiple-choice polling options, rather than the standard for/against/abstain configuration (e.g., VitaDAO, 2025). In such cases, Snapshot does not automatically register the definitive outcome. To ensure consistency and analytical comparability, proposals that employed alternative but semantically equivalent options (e.g., yes/no/comment or support/oppose) were retroactively coded as ‘passed’ if the majority of votes were in favor and quorum requirements were met.

No changes were made to the outcomes of the proposals from CerebrumDAO, CryoDAO, HairDAO, HippocratDAO, Quantum Biology DAO, ValleyDAO, and VitaDAO, as their voting outcomes were either already correctly recorded or lacked sufficient evidence to justify revision. Several proposals were changed from ‘closed’ to ‘passed’ following manual verification that the vast majority of recorded votes were in favor despite the absence of a quorum threshold in the proposed configuration. This applied to MoonDAO (MDP-156–157, 159–160, 162–163, 166–173, 175–176) and ResearchHub (RIP-18–20). This also applies to BiohackerDAO, in which all votes were in favor (BIOHACK-0–2). In cases where customized voting formats prevented Snapshot from issuing an automatic result, proposals were changed from ‘closed’ to ‘passed’ following manual verification that the majority of votes were in favor and quorum requirements were met. This applied to AthenaDAO (S&R-001, COM-001, ADP-005–010), GenomesDAO (‘Discontinue GenomesDAO Discord use’), and PsyDAO (‘Allocate up to 50 ETH to fund psychedelic research projects on Catalyst?’, ‘Closing the PSY token sale and adding liquidity via Uniswap V3 (Arrakis Pro)’, ‘Use 2.3% of PSY supply to buy $BIO in BIO Genesis round 2’, ‘Funding for Autonomous Research Discovery (ARD) System: PsyBEE’, ‘RX-π: ETH Treasury Strategy’, ‘PsyDAO & PSYC Governance Framework’, and ‘Withdraw funds from PSY TokenSale contract?’).

3.2 Counterfactual futarchy simulation

To assess whether futarchy-based governance might produce materially different outcomes compared with existing DAO voting procedures, a structured counterfactual simulation was conducted. This simulation evaluates historical proposals using a deterministic modeling framework grounded in prediction market logic.

3.2.1 Simulation design and modeling

Based on the governance analysis in Section 3.1, a counterfactual futarchy simulation was conducted. Whereas the cadence study examined proposals submitted between January 2024 and April 2025, the simulation imposed no creation-date filter: a proposal qualified if its outcome was (i) realized and publicly verifiable on or before April 2025, (ii) documented by public artifacts (e.g., Snapshot votes, on-chain transfers, company-registry entries, or grant-milestone reports), and (iii) expressible as a pass-versus-fail branch interpretable within a futarchic market framework. This outcome-based cutoff ensures that every simulated branch can be coded with concrete data while remaining comparable to the governance dataset.

For each proposal, two counterfactual branches were specified:

○ E [Outcome | Pass] = empirically observed result (e.g., $4 M raised, spin-out launched, governance index ↑ 0.5).

○ E [Outcome | Fail] = conservative status quo baseline.

For binary spin-out proposals (e.g., VDP-100), the grant outlay is booked as a cost in the pass branch; the fail branch assumes no launch and no grant expenditure.

The expected values were estimated by the authors using publicly available evidence (e.g., treasury snapshots, milestone reports, and token-price benchmarks) interpreted through domain expertise and current market insights. No live markets were run; instead, the decision-theoretic rule of Hanson (2013) was implemented in a retrospective, data-constrained setting. This is an exploratory heuristic, not a full behavioral simulation; liquidity, price discovery, and trader heterogeneity remain outside the scope. Because the authors are active participants in the DeSci community and were therefore aware of the Snapshot outcomes, blinding was not feasible; to minimize optimism bias all E [Fail] values were set to the most conservative non-negative baseline consistent with public data.

To avoid conflating conceptual modeling with operational prediction markets, it is necessary to emphasize that this simulation employs a deterministic framework rather than a probabilistic futarchy mechanism. Expected outcomes (E [Pass], E [Fail]) were assigned post hoc using heuristic estimation and were not the result of live market dynamics, trader behavior, or endogenous belief aggregation. While the logic of futarchy informs comparisons, the absence of real-time speculation, liquidity provision, and price formation precludes this exploration from constituting actual futarchic governance. Therefore, the results should be interpreted as a stylized approximation of futarchic alignment rather than as an empirical validation of market-based decision making.

Note. The simulation relies on KPI-conditional futarchy, where each branch forecasts a proposal-specific key performance indicator (e.g., capital raised, spin-out incorporation, governance-index uplift) rather than asset-price futarchy, which uses the DAO’s own token price as the objective function. This decision was made because early stage science DAOs are thinly traded and tightly coupled to broader crypto-market sentiments, making them a noisy proxy for research success. Therefore, focusing on explicit, democratically selected KPIs provides a cleaner test of futarchic alignment with substantive scientific outcomes while sidestepping exogenous price volatility.

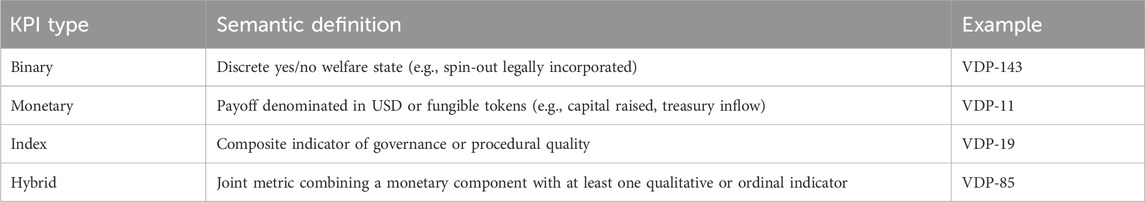

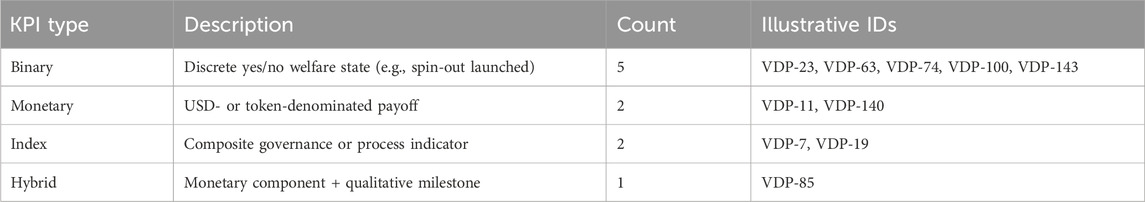

3.2.2 Classification framework for KPIs

Each proposal is mapped to one of the four KPI types, classified semantically by what the variable represents rather than how it is numerically stored. Table 2 summarizes the four KPI categories applied to every proposal and lists a representative VitaDAO proposal for each type.

Binary and monetary KPIs map directly onto observable outputs; index and hybrid KPIs require an analytic transformation (documented in Supplementary Table 5), but remain falsifiable. This typology standardizes the comparison across proposals and aligns each with the modelling assumptions used in the futarchic decision logic.

3.3 Ethical considerations

This study is entirely theoretical and computational in nature. All governance records, treasury snapshots, and milestone reports analyzed are publicly available online or in openly accessible community repositories; no private, personally identifiable, or proprietary data were accessed. Therefore, the research involved no human participants, no animal experiments, and no interventions that could generate physical, psychological, or financial risks.

4 Results

4.1 Governance data analysis

To quantitatively characterize participation rates, token distribution, and decision outcomes within the current governance landscape of DeSci, Snapshot data from 13 identified DeSci DAOs were systematically analyzed. This analysis aimed to assess the operational dynamics of DeSci governance using empirical voting data.

4.1.1 Governance structures and voting outcomes

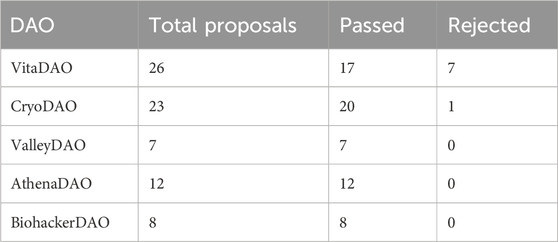

DeSci DAOs exhibit considerable variation in governance activity and proposal throughput. VitaDAO and CryoDAO were the most active within the observation period, with 26 and 23 proposals, respectively. While CryoDAO recorded one formal rejection, VitaDAO rejected seven proposals and a notable share were not explicitly marked as passed. In contrast, ValleyDAO, AthenaDAO, and BiohackerDAO each exhibited full passage of all proposals submitted, suggesting a highly streamlined, if potentially uncontentious, governance process.

These differences may reflect variations in organizational maturity, governance complexity, or issue salience. DeSci DAOs with higher proposal volumes and non-uniform outcomes, such as VitaDAO, may be more structurally aligned with futarchic governance mechanisms that benefit from frequent, evaluable decisions. Meanwhile, a consistently unanimous passage across smaller DAOs may point to more centralized or consensus-driven decision-making, which could limit the informational diversity needed for effective prediction-market-based governance. Table 3 summarizes proposal activity and outcomes for five active DAOs in the sample, indicating variations in passage rates and rejection frequencies across DeSci governance contexts.

4.1.2 Participation, dissent, and abstention

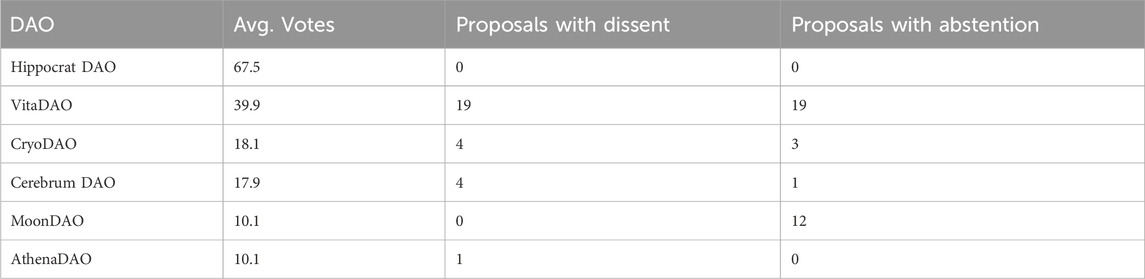

Participation patterns across the DeSci DAOs revealed substantial disparities in voter engagement and deliberative behavior. HippocratDAO and VitaDAO reported the highest average number of votes per proposal (67.5 and 39.9, respectively), suggesting broader contributor involvement and a more active governance culture. In contrast, DAOs such as CryoDAO, Cerebrum DAO, MoonDAO, and AthenaDAO exhibited significantly lower participation levels, with averages hovering at around 10–18 votes per proposal. To illustrate how low turnout could be, an AthenaDAO proposal on 16 October 2024 (AthenaDAO, 2024) received six votes, corresponding to an estimated turnout of ≈1.3% given a near-contemporaneous holder count of 470 addresses (14 October 2024).

Beyond vote counts, patterns of dissent and abstention provide insights into the expressiveness and ideological texture of governance communities. VitaDAO again stands out, with 19 proposals featuring dissent and 19 with abstentions, suggesting a governance environment in which disagreement is visible and decision-making is scrutinized. This aligns well with the epistemic requirements of futarchy, which depend on the aggregation of heterogeneous beliefs through incentivized forecasting.

In contrast, MoonDAO recorded no dissenting votes, but showed abstention in 12 proposals, a pattern that may reflect uncertainty, silent disagreement, or limited voter confidence. CryoDAO and Cerebrum DAO showed moderate dissent (four proposals each) and low abstention (three and one, respectively), whereas AthenaDAO recorded one instance of dissent but no abstentions, indicating minimal expressive variability. These low levels of contestation and ambiguity in many DAOs raise important questions regarding latent disengagement or procedural homogeneity. From the perspective of futarchy, such environments may restrict the informational diversity required for prediction markets to function as effective governance mechanisms. Table 4 compares participation intensity, dissent frequency, and abstention patterns across six DeSci DAOs, highlighting differences in governance behavior.

The presence of dissent and abstention not only enhances democratic legitimacy but also contributes to the epistemic heterogeneity necessary for futarchy to function as an effective governance mechanism. By contrast, environments characterized by low or absent contestation may lack the belief pluralism required for prediction markets to aggregate meaningful signals, thereby limiting their forecasting precision and governance utility.

4.1.3 Temporal rhythms and proposal cadence

The tempo of the proposal activity provides an important lens for the operational maturity and decisional throughput of DeSci DAOs. DAOs with higher governance cadence are more likely to benefit from futarchy’s policy-responsive mechanisms, as frequent decision making creates a regular stream of actionable policy options for prediction markets to evaluate.

CryoDAO emerged as the most active DAO in temporal terms, averaging approximately 1.44 proposals per month over the period from January 2024 to April 2025. Cerebrum DAO followed with exactly 1.00 proposal per month, while BiohackerDAO, GenomesDAO, and AthenaDAO operated at a more modest cadence of 0.50, 0.38, and 0.75 proposals per month, respectively. These corrected figures suggest that while some DAOs exhibit a governance tempo compatible with continuous outcome-based decision processes, such as futarchy, the majority currently operate below a threshold of one proposal per month. This cadence may reflect resource limitations, a narrower scope of engagement, or deliberate pacing of governance cycles. Table 5 presents proposal frequency statistics for five DeSci DAOs, illustrating variation in decisional throughput and temporal governance rhythms.

This temporal distribution indicates that only a subset of DAOs are currently well positioned for futarchic integration from a forecasting and decision-flow standpoint. Most operate at a cadence below one proposal per month, suggesting that further development of governance infrastructure and proposal throughput may be necessary before such DAOs can effectively sustain market-driven decision-making mechanisms.

4.2 Counterfactual futarchy simulation

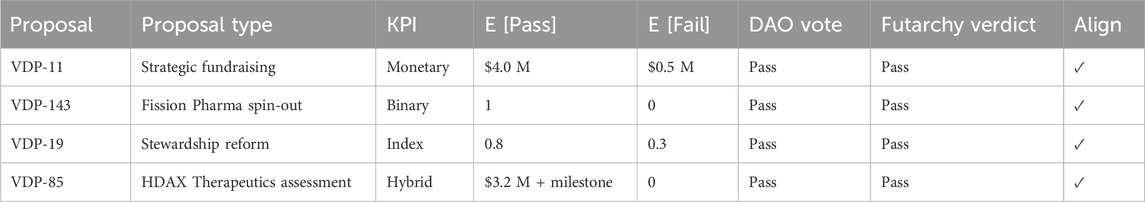

VitaDAO was chosen for simulation because, among the 13 DAOs analysed, it offers the densest set of proposals with publicly verifiable outcomes, providing the minimum empirical baseline needed for a meaningful counterfactual futarchy test. This choice is likely to introduce a positive selection of governance maturity and transparency. This makes the simulation tractable and allows clear KPI coding; however, it also sets a best-case baseline that may overstate alignment relative to DAOs with sparse documentation, low participation, or limited outcome verification. Ten VitaDAO proposals satisfied the three inclusion criteria outlined in Section 3.2.1: (i) a clearly defined, time-bounded outcome, (ii) realization and public documentation no later than April 2025, and (iii) an outcome space interpretable within prediction-market logic. Table 6 summarizes the typology and distribution of KPIs across the ten VitaDAO proposals included in the simulation, classified by KPI type and semantic category.

For every case, the futarchy-preferred branch coincided with the decision made by VitaDAO token-holders via Snapshot. Table 7 reports simulation inputs and alignment outcomes for four representative proposals, one from each KPI category, comparing the expected values under pass/fail counterfactuals with actual voting results.

The following four cases illustrate how the counterfactual futarchy simulation evaluated proposals across the monetary, binary, index, and hybrid KPI categories, and how the preferred actions aligned with the decisions actually taken by VitaDAO.

VDP-11 (Monetary): Minting an extra 10% of VITA tokens enabled a $4 M strategic raise (E [Pass]). A counterfactual, non-mint fund raise was benchmarked at $0.5 M (E [Fail]). The token holders approved 100%, matching futarchy.

VDP-143 (Binary): Funding Fission Pharma: incorporation and financing within 12 months (E [Pass] = 1) versus no launch (E [Fail] = 0). The proposal passed 51.6%, again aligning with futarchy.

VDP-19 (Index): Formalizing the steward elections yielded two completed cycles within the observation window. The governance-continuity index is coded on a 0–1 scale, where 0 = no formal cycle completed, 0.5 = one cycle, and 1 = two or more cycles. Accordingly, the proposal moved the index from 0.3 (status quo baseline, reflecting an incomplete prior cycle) to 0.8 (two full cycles minus minor procedural slippage). The motion passed by a wide “For” majority, aligning with the futarchy-preferred branch.

VDP-85 (Hybrid): HDAX Therapeutics secured $3.2 M and met maturity milestones (E [Pass]). Without funding, E [Fail] = 0.

The directional concordance suggests that, under VitaDAO’s conditions up to April 2025, conventional token-weighted voting reached the same choices as the prediction-market-driven futarchy would have favored. This finding is descriptive and not causal. This retrospective model omits liquidity, trader incentives, and price discoveries. Sensitivity checks (±20% on E [Fail]) leave the alignment intact, but larger perturbations could induce flips. Hence, the evidence indicates compatibility between VitaDAO’s governance culture and futarchy without demonstrating systemic substitutability or generalizability.

5 Discussion

The preceding analyses offer empirical and theoretical insights into the viability of futarchy as a governance model within DeSci DAOs. This discussion contextualizes the findings in light of the existing literature, interrogates the structural and cultural constraints observed across DAOs, and critically evaluates the implications of market-based governance.

5.1 Governance data analysis

The empirical analysis of governance patterns across the 13 DeSci DAOs reveals important yet heterogeneous characteristics that bear directly on the preconditions for futarchic governance. These divergences in participation, dissent, abstention, and proposal cadence reflect the underlying tensions in the institutional design of DAOs and highlight structural constraints that must be resolved before any meaningful integration of futarchy can occur. A key finding is the bifurcation between highly deliberative DAOs such as VitaDAO and seemingly harmonious yet arguably under-contested DAOs such as AthenaDAO and BiohackerDAO. While unanimity in voting outcomes may superficially signal alignment, such outcomes may equally signal apathy, voter disengagement, or the concentration of governance power dynamics consistently criticized in the literature as symptomatic of token plutocracy rather than decentralized deliberation (Austgen et al., 2023). In contrast, VitaDAO’s high incidence of dissent (19 out of 26 proposals) and abstention (19) is more congruent with a deliberative democratic ideal, where contestation enhances the epistemic value of decision making and creates the informational substrate necessary for futarchy to function (Hanson, 2013; Buterin, 2014).

However, high levels of dissent alone do not ensure robust governance. As highlighted in experimental analyses of Liquid Democracy, abstention can either serve as a proxy for epistemic humility or reflect voter confusion and misaligned incentives (Casella et al., 2022). In cases such as CryoDAO and Cerebrum DAO, abstention coexists with a complete absence of dissent, suggesting a failure to capture latent disagreement, a condition inimical to the predictive utility of futarchy that presupposes revealed preferences over possible futures. Token distribution and participation further problematize the democratic claims of many DeSci DAOs. While quorum rates are formally met in DAOs such as CryoDAO and GenomesDAO, these thresholds are often satisfied by a small number of large token holders rather than reflecting broad-based engagement. It has been shown that quorum attainment is a weak proxy for participatory legitimacy when the token distribution is skewed, and whale governance is rampant (Heavey, 2024; Austgen et al., 2023). In such settings, prediction markets are unlikely to reflect the distributed knowledge of a pluralistic community but rather the financially incentivized bets of a concentrated elite, an inversion of the futarchy’s informational premise. Token-weighted governance does not remove the risk of wealth shaping outcomes. When liquidity is low, a small number of large traders can move prices and set expectations, reducing the market’s ability to aggregate dispersed information and sideline knowledgeable but less-capitalized participants (Wolfers and Zitzewitz, 2004). Prices can then become partly self-reinforcing, pulling policy choices toward the preferences and risk tolerance of large-holders rather than the broader community.

Temporal cadence, often overlooked in governance analysis, emerges as a critical axis of futarchy readiness. DAOs, such as CryoDAO and Cerebrum DAO, exhibit high proposal throughput, a feature that aligns well with the design logic of futarchy, which requires a continuous flow of actionable decisions to maintain market relevance and incentive alignment (Harkness Institute, 2025; CerebrumDAO, 2019). However, throughput without deliberation risks procedural accelerationism, a condition in which governance becomes performative rather than substantive. While on-chain voting records provide a robust quantitative account of DAO decision-making, much of DeSci governance unfolds in informal, off chain spaces. Discussions on platforms such as Discord, Telegram, and dedicated governance forums shape proposal designs, build consensus, and surface dissent long before formal votes are cast. Core teams, advisors, and working groups frequently exert an outsized influence, especially in contexts that demand technical complexity or scientific expertise. Therefore, future futarchy models may incorporate qualitative governance layers including (1) pre-vote discussion sentiment, (2) core contributor influence, and (3) off chain coordination patterns. Integrating these dimensions will clarify whether token-level outcomes genuinely reflect collective intelligence or merely formalize prior informal consensus (Borch, 2007).

Snapshot voting records capture only the final stage of decision-making, whereas much of the DeSci governance occurs in off chain forums and coordination spaces that shape proposals long before a formal vote. In VitaDAO, the governance process proceeds through ideation, specification, and consensus on Discourse and Discord, using a standard proposal template and staged community signals before a Snapshot vote (Beutel, 2022). Working groups such as Longevity Dealflow review and refine projects, negotiate terms, and prepare assessments that later appear in proposals; some projects involve confidentiality agreements during evaluation. ValleyDAO’s Dealflow and Incubation group similarly prescreened and developed projects prior to community-wide consideration.

To exemplify the differences between Discourse and Snapshot, VDP-143 [Funding] Fission Pharma - Revised can be explored (Paolo Binetti, 2024; VitaDAO, 2024). Compared to Snapshot, Discourse adds a research plan expansion that presents a full budget and milestone schedule, financing terms, and IP-NFT ownership split across VitaDAO, Cerebrum DAO, the principal investigator, the employee option pool, the entrepreneur in residence, and the deal squad, together with a senior review digest that reports the average category scores and qualitative endorsements. The thread includes a preliminary forum poll and an open discussion that refines terms prior to the formal vote, with 20 votes and 18 agreeing (one revision requested, one disagree).

With respect to futarchy, these off chain steps can raise or lower the quality of the market signal by shaping the object of prediction itself. When templates and senior reviews require proposers to register a single KPI, fixed evaluation window, named oracle, and identified data sources, they reduce ambiguity and allow traders to price clearly defined states. When KPI definitions remain adjustable, when composite indices use proposer-selected weights, or when the same team controls both the proposal and oracle, the market prices a moving target rather than a stable outcome. Early forum polls, summary posts, and sponsor announcements can anchor beliefs before markets open, and undisclosed private diligence can create informational advantages for insiders who trade. Liquidity seeded by a beneficiary or subsidies tied to a preferred branch can tilt prices through order flows rather than information. To keep informal governance complementary rather than distortive, parameters should be locked before trading, oracles should be independent, conflicts should be declared, and any change to KPI definitions or timelines should be logged and trigger a restart of the market.

Foreseeable implementation risks include price manipulation in thin markets, misinformation that primes beliefs before markets open, coordinated trading by large holders, and oracle or data errors. A minimum liquidity requirement raises the cost of manipulation and filters spam by requiring proposers to lock liquidity in the markets before trading begins, with the amount set by each DAO (MetaDAO, 2024a). An AMM-based on the logarithmic market scoring rule provides continuous prices and limits the treasury’s maximum loss using a single liquidity parameter (Hanson, 2002). Settlement relies on a time-weighted average (TWAP) price rather than a spot print, and manipulation resistance can be increased by limiting the maximum change per update (MetaDAO, 2024b; Aspembitova and Bentley, 2023). Governance controls should reinforce market design. The parameters are immutable once trading begins to preclude retroactive gaming. The position limits per address constrain the individual price impact and reduce the probability of a single holder inducing a passage. Conflict of interest disclosures allow participants to interpret signals appropriately, and the institutional separation of the oracle and proposer prevents self-verification. A brief dispute process with fixed deadlines permits challenges to oracle reads or KPI measurement and pauses finalization, while evidence is evaluated. Hybrid governance serves as a backstop by conditioning disbursements on both the market signal and independent working group review.

Many DAOs operate with minimal checks on propositional integrity or process accountability. Token-based governance often lacks internal minority protection, enabling governance capture, treasury raids, or rubber-stamp voting behavior (Fan et al., 2024; Lustenberger et al., 2025). The structural vulnerability of DAOs calls questions the readiness for futarchy, which depends not merely on metric-driven decisions, but on institutional mechanisms capable of ensuring fair participation, verifiable outcomes, and dispute resolution. Finally, the structural integrity of DAO governance frameworks must be investigated.

5.2 Counterfactual futarchy simulation

The counterfactual futarchy simulation offers an empirically anchored, retrospective exploration of how prediction-market-based governance could interact with VitaDAO’s decision flow up to April 2025. Consistent with the KPI-conditional architecture adopted in section 3.2.1 (as opposed to the asset-price variant; Heavey, 2024), alignment is evaluated against explicit proposal-level KPIs rather than token-price movements. Re-scoring ten proposals with the semantic KPI rubric (five binary, two monetary, two index, and one hybrid) produced relevant results. In every case, the branch with the higher expected value, E [Pass] versus E [Fail], matched the action ratified by token-holders on Snapshot or via on-chain execution. This full concordance is notable, given the criticisms leveled at token voting, low turnout, plutocratic bias, and limited expressiveness (Austgen et al., 2023; Fan et al., 2024). VitaDAO’s governance record, high proposal cadence, visible dissent and abstention, and post hoc data appear to have created an institutional baseline that could be suitable for futarchy.

Straightforward items, such as VDP-11 (mint 10% VITA to raise $4 M) and VDP-143 (fund Fission Pharma spin-out), map cleanly onto monetary and binary benefit states and can be audited through on-chain treasury inflows, token distributions, and incorporation filings. More intricate cases, for example, VDP-85, with its $3.2 M seed round plus qualitative milestones, remained tractable by pairing a hybrid index with market-based priors. Although E [Fail] valuations are conservative and point estimated, this approach mirrors the way live futarchy markets initialize counterfactual states (Hanson, 2013; Alecse and Torché, 2024).

However, the deterministic model cannot capture endogenous market mechanics, such as liquidity, adverse-selection risk, or heterogeneous beliefs. Nor does it penalize the strategic behavior that might surface in live trading. Accordingly, alignment should be read as directional, not evidentiary, of functional equivalence. However, the exercise highlights why science-centric DAOs may be unusually well matched to futarchy: biotechnology proposals generate measurable artifacts, preclinical milestones, IP tokens, and capital raises, which translate naturally into market-resolvable KPIs. This structural clarity contrasts with multi-purpose DAOs, where ambiguous goals and subjective success metrics dilute the prediction-market efficacy (Harkness Institute, 2025). Thus, the integration of futarchy in this context leverages the epistemic affordances of science, rigor, falsifiability, and measurement, while exploiting the programmability and transparency of blockchain-based coordination. Nevertheless, the use of realized historical outcomes as proxies for the prediction of market preferences entails nontrivial limitations. First, retrospective modeling abstracts away from the informational asymmetries that characterize live governance environments. Second, it ignores the incentive structure underpinning the prediction of market participation, such as the role of collateral risk, belief dispersion, and liquidity concentration (Wolfers and Zitzewitz, 2004). Third, the ex post specification of E [Pass] and E [Fail] outcomes introduces observer bias, even when care is taken to ground these in verifiable metrics. Despite these limitations, the simulation offers a compelling proof of concept: in a high-readiness setting such as VitaDAO, where proposals are frequent, outcomes are measurable, and governance is expressive, futarchy can plausibly yield similar (if not superior) policy outcomes to token voting. This insight aligns with recent findings from MetaDAO and Optimism experiments, which suggest that when institutional preconditions are met, conditional prediction markets within a futarchic framework can serve not just as informational supplements, but as primary decision-making substrates (Harkness Institute, 2025).

Beyond aligning governance decisions with outcome-optimized forecasts, futarchy offers a latent capacity to restructure participatory dynamics within DAO governance. Existing token-based systems often suffer from concentrated voting power, low turnout, and weak incentives for epistemic engagement (Austgen et al., 2023; Fan et al., 2024). Futarchy addresses these limitations by decoupling the influence of token holdings and reward-predictive accuracy. Participants are incentivized to contribute to forecasts that maximize informational value, rather than vote weights. This mechanism opens new pathways for underrepresented yet knowledgeable contributors, such as scientific experts, data analysts, and domain-specific forecasters, to meaningfully shape governance outcomes without needing large token stakes (Cowgill et al 2009). As such, futarchy could potentially not only lead to better governance outcomes, but also broader and more meritocratic participation. It reframes governance as an epistemic process grounded in forecasting, not allegiance, and redistributing influence based on informational performance, rather than wealth.

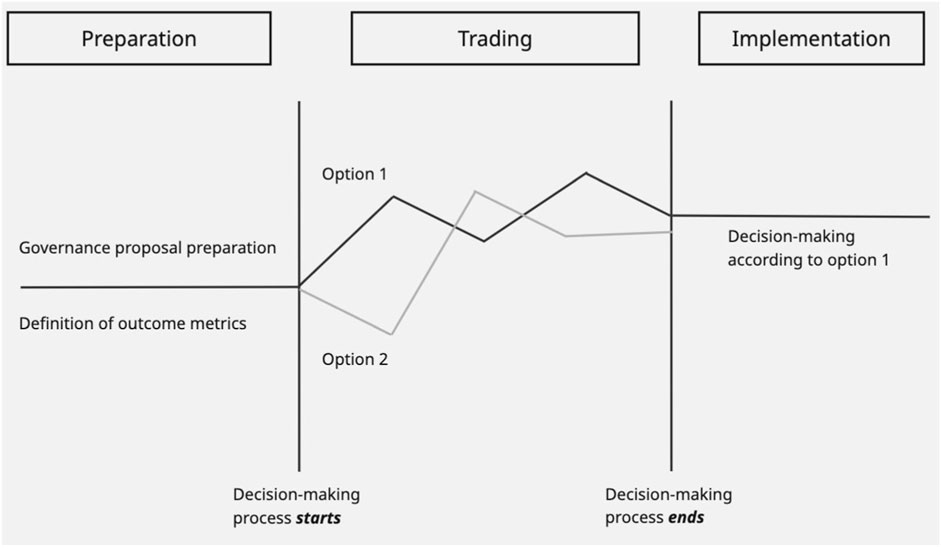

Figure 1 highlights the core architecture of futarchy-based governance in the DAOs. The Preparation phase encompasses two critical components: the value vote and the formulation of competing proposals. In this context, a value vote refers to the selection of measurable KPIs intended to guide governance, such as reproducibility, token stability, or milestone completion. While futarchy traditionally envisions this step as a democratic process, in the specific context of DeSci DAOs, such metrics are more likely to be defined by specialized working groups, particularly scientific or dealflow committees, rather than by the general tokenholder base (Weidener et al., 2024). The Trading phase then opens conditional prediction markets, allowing participants to speculate on the expected KPI performance for each proposal. In the Implementation phase, the defined outcome associated with the highest market-implied expected value is executed. The diagram captures how futarchy shifts governance away from direct voting and toward incentive-aligned belief aggregation, enabling governance to function as a continuous information processing system grounded in epistemic incentives.

Figure 1 illustrates the procedural logic of a futarchy-based governance model for the DAOs. The flow begins with a value vote in which stakeholders specify outcome-based KPIs that encode collective priorities. These KPIs anchor a set of policy-binding conditional prediction markets that open during the trading phase, where participants forecast the expected KPI impact of each governance option. After market closure, the option with the highest expected KPI value is executed on the chain, and the realized KPI is later audited against the agreed oracle.

Despite the ideological promise of decentralization, empirical research has consistently shown that DAO governance is far from egalitarian (Gilson and Bouraga, 2024). Voting power is routinely concentrated among a small number of “whale” participants, leading to oligarchic dynamics, collusion, and lack of meaningful deliberation (Austgen et al., 2023; Tan et al., 2023; Fan et al., 2024). Even proposals with far-reaching financial consequences often pass on with minimal participation and no contestation, undermining the legitimacy and resilience of these systems (Austgen et al., 2023; Heavey, 2024). By contrast, futarchy decouples governance influence from token weight and redistributes it to those who can demonstrably predict outcomes, a shift that reorients governance around epistemic merit rather than capital dominance (Cowgill et al 2009; Wolfers and Zitzewitz, 2004). By replacing symbolic voting with performance-based forecasting, futarchy offers a mechanism to level the playing field, reduce coordination capture, and open up governance participation to those with relevant expertise rather than an economic clout. In this respect, futarchy does not merely optimize decisions; it could reconfigure the structure of who gets to decide.

5.3 Limitations

This study makes a novel empirical contribution to the emerging discourse on futarchic governance in DeSci. Several limitations constrain the interpretive and generalizable scope of the findings. Although methodologically tractable, counterfactual simulation operates within a retrospective and deterministic framework that cannot replicate the endogenous dynamics of live prediction markets. Without actual trading behavior, liquidity variation, or incentive structures, the simulation necessarily omits the core epistemic features of futarchy, such as price discovery, belief updating, and incentive-aligned forecasting (Cowgill et al., 2008; Wolfers and Zitzewitz, 2006). The modeling of expected outcomes (E [Pass] and E [Fail]) relied on heuristic functions derived from historical performance and ex post realizations. Although conservative estimates were used for counterfactual baselines, the possibility of hindsight bias and endogenous outcome shaping remains nontrivial, particularly in cases where successful project completion may be contingent on the proposal’s passage itself. As the valuation exercise is unblinded and retrospective, residual optimism may persist. Any upward bias in E [Fail] would inflate the observed concordance; therefore, the results should be interpreted as suggestive, rather than definitive, evidence of futarchy’s equivalence to token-weighted voting. As such, these modeled expectations reflect structured rather than counterfactual causal inferences. Case selection poses another limitation. The exclusive focus on VitaDAO introduced a clear positive selection bias. VitaDAO’s institutional maturity, transparent governance practices, and active proposal flow may not represent the broader DeSci DAO landscape. DAOs with lower participation rates, less dissent, or limited documentation may exhibit substantially different alignments between futarchic and token-based governance. A broader multi-DAO test was beyond the present scope and therefore remains unsubstantiated. Accordingly, the alignment reported here should be read as an upper bound that reflects the conditions of high transparency and proposal throughput rather than a typical DeSci environment. Generalizability requires replication in a stratified multi DAO sample that includes lower maturity organizations with sparse documentation, lower participation, and more ambiguous KPIs, preferably under preregistered inclusion criteria and coding rules. Snapshot data, as the primary source of proposal-level governance metrics, introduce its own limitations. Quantitative concentration metrics such as Lorenz curves and Gini coefficients have not been reported, limiting the analysis of potential correlations between governance concentration, participation patterns, and the simulated alignment between token weighted voting and futarchy. While it enables the systematic capture of voting behavior, it obscures off chain deliberation, core team influence, and informal governance dynamics, all of which play an outsized role in DAO decision-making but remain difficult to quantify or observe (Austgen et al., 2023; Fan et al., 2024). Moreover, token-based voting systems often conflate economic weight with epistemic validity, undermining the assumptions of preference pluralism and informational independence that futarchy requires to effectively function (Pickles, 2024; Hanson, 2013). Finally, futarchy itself remains a theoretical ideal with limited operational instantiation. Its foundational premises, informational efficiency of speculative markets, incentive alignment under risk, and objectivity of welfare metrics remain open to contestation in both the economic and cryptoeconomic literature (Cowen, 2007). While DeSci presents a promising testbed because of its emphasis on measurable scientific outputs and on-chain data richness, any extrapolation of results must contend with the conceptual fragility and institutional immaturity that still characterize the broader DAO governance ecosystem.

5.4 Outlook

This study highlights both the theoretical plausibility and empirical feasibility of applying futarchy to decentralized scientific governance. Several concrete recommendations follow from these findings aimed at advancing futarchy readiness and enhancing decision-making within DeSci DAOs more broadly. First, the DAOs should establish clearly defined, time-bound, and quantifiable KPIs for their proposals. While such metrics are a prerequisite for futarchy, they also foster transparency, accountability, and retrospective evaluation, benefiting governance, regardless of whether futarchy is implemented. Especially in research funding proposals involving IP tokenization, establishing objective indicators, such as capital raised, project milestones, or post-tokenization trading behavior, can serve as robust proxies for impact. Second, the DeSci ecosystem presents a particularly promising domain for piloting futarchy given its inherent alignment with hypothesis testing, measurable outputs, and scientific epistemologies. This natural compatibility should be leveraged through targeted trial implementation, for example, by launching futarchic markets on a limited set of grant-related decisions. These trials would not only generate critical live data but also surface behavioral and technical challenges in real time. Third, hybrid governance models that integrate futarchy with complementary outcome based resource allocation models (Pet3rpan-1kx, 2022), milestone-based budgeting, or quadratic voting could mitigate the limitations of futarchy while enhancing its epistemic value. Future research should rigorously compare these alternatives and explore composable governance primitives suited to scientific DAOs. Finally, low participation and limited dissent remain endemic to the DAO governance. While futarchy is not a cure-all, its incentive-aligned, outcome-oriented design may help re-engage contributors, a hypothesis that future live-market experiments should be tested by rewarding informed forecasting rather than symbolic signaling. To materialize, governance teams must invest in participant education, user-friendly interfaces, and meaningful reward structures. The introduction of futarchy should be accompanied by a cultural shift that frames voting as an epistemic contribution, rather than a mere preference expression.

Concrete actionable recommendations for practice could include the following. DAOs should set explicit readiness requirements for any pilot, including the registration of a single auditable KPI, fixed evaluation window, named oracle, and documented data sources. In addition, they should set a proposal time and pass the threshold for finalization. Proposal templates must record these commitments and lock parameters before trading, and any subsequent change should be logged and treated as a new proposal. Before markets open, informal governance should follow a transparent sequence that includes a KPI design session with proposers, reviewers, and working group leads; publication of a short diligence memo and a public response to comments; maintenance of a visible change log; and a freeze period during which KPI definitions, timelines, and oracle details cannot be altered. All off chain artifacts, including endorsement posts, forum polls, and working group recommendations, should be linked from the proposal page, such as Snapshot, and archived in a public repository, with conflicts of interest disclosed for each contributor. Pilots should begin with a narrow scope, such as grant-related decisions, run markets for three to 10 days, and publish a treasury risk budget that specifies who provides liquidity, the size of any subsidies, and the caps that apply to them. Governance should implement position limits per address and require conflict of interest disclosures for proposers, reviewers, liquidity providers, and traders, and oracle and proposer roles should remain independent. Core contributors with access to nonpublic diligence should either observe a trading blackout until resolution or disclose positions in advance, and any liquidity seeded by a beneficiary should be declared and subject to the same caps. The rollout should include a short education cycle that provides one seminar, a written forecasting guide, and a practice market using a small test pool, which should release a public recapitulation that reports oracle reads, realized KPI values, participation, forecast accuracy, and any rule changes.

6 Conclusion

This study critically examined the potential of futarchy to serve as a viable governance model within the emerging landscape of DeSci. Through an empirical analysis of governance data from 13 DeSci DAOs and a counterfactual simulation based on historical proposals from VitaDAO, this research provides evidence of both the conceptual alignment and practical feasibility of integrating futarchy in this context. Translating these insights into practice suggests three design principles: First, KPI design should employ time-bounded, falsifiable metrics with transparent on-chain verification of the underlying data feeds; second, governance integration ought to embed policy-binding conditional markets seamlessly within existing Snapshot or on-chain workflows; third, participation incentives should couple forecast accuracy rewards with intuitive user interfaces and contributor education. The findings underscore significant heterogeneity in governance maturity, participation, and expressiveness across DAOs, revealing both strengths and structural deficits in current decision-making processes. Despite methodological limitations, this work establishes a foundational basis for future research and experimentation in futarchic governance. DeSci, with its emphasis on measurable research outcomes and scientific accountability, presents a particularly promising niche for piloting such innovations. Integrating futarchy with other governance primitives and collecting live market data is a critical step toward operationalizing futarchic, prediction-market-based governance. Ultimately, this study contributes to the broader discourse on reimagining collective decision-making in scientifically and technically complex domains. Future research should extend the simulation beyond VitaDAO to a stratified sample of DeSci DAOs that vary in participation rates, dissent frequency, voter concentration, and documentation quality. A preregistered protocol should set inclusion criteria, KPI coding rules, oracle identification, and normalization procedures, and should publish a reproducible dataset with code. Future research should incorporate proposal-level concentration diagnostics, such as Lorenz curves, Gini coefficients, top five voter shares, and the effective number of voters, to quantify governance concentration and assess its relationship to participation and to the alignment between futarchy and token weighted voting. Comparative analyses should test whether alignment between token weighted voting and futarchy persists across maturity levels, and should include sensitivity checks for liquidity, position limits, and evaluation windows.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

LW: Writing – review and editing, Methodology, Writing – original draft, Investigation, Formal Analysis, Conceptualization, Data curation, Visualization. SS: Formal Analysis, Writing – original draft, Methodology, Software, Data curation, Writing – review and editing, Conceptualization.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

Author LW was employed by BIO.XYZ. The authors are actively involved in the DeSci ecosystem and hold investments in the following projects: BIO, AthenaDAO, PsyDAO, HairDAO, Quantum Biology DAO, VitaDAO, ResearchHub, and ValleyDAO. The authors declare no other competing interests.

Generative AI statement

The author(s) declare that Generative AI was used in the creation of this manuscript. During the preparation of this manuscript, the authors used OpenAI’s ChatGPT (version 4o) to assist with grammar correction, spelling, formatting, and reformulation of selected passages for clarity and style. All content generated through this tool was critically reviewed, edited, and approved by the authors. The authors take full responsibility for the integrity and accuracy of the final manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.”

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbloc.2025.1650188/full#supplementary-material

References

Alecse, A., and Torché, E. (2024). The silent majority: healing democracy with futarchy. Review of European and transatlantic affairs. Available online at: https://static1.squarespace.com/static/600a1d923babe5139207aed2/t/665a16eb20ec1d496b046ccf/1717180146690/RETA_2024_Final.pdf.

Aspembitova, A. T., and Bentley, M. A. (2023). Oracles in decentralized finance: attack costs, profits and mitigation measures. Entropy 25 (1), 60. doi:10.3390/e25010060

AthenaDAO (2023). AthenaDAO snapshot page. Available online at: https://snapshot.box/#/s:athenadao.eth.

AthenaDAO (2024). ADP-009: Tokenization of AthenaDAO’s first IP-NFT “Understanding the role of the cGAS-STING pathway and senescence in ovarian aging”. Available online at: https://snapshot.box/#/s:athenadao.eth/proposal/0x9dd3670263ae351c6530558b14fa265094fbaa8f882decd44b1a6e3449658189.

Austgen, J., Fábrega, A., Allen, S., Babel, K., Kelkar, M., and Juels, A. (2023). DAO decentralization: voting-Bloc entropy, bribery, and dark daos. arXiv Prepr. arXiv:2311.03530. doi:10.48550/arXiv.2311.03530

Beutel, T. (2022). VitaDAO governance. Available online at: https://gov.vitadao.com/t/vitadao-governance/787.

BiohackerDAO (2025). BiohackerDAO snapshot page. Available online at: https://snapshot.box/#/s:biohackerdao.eth.

Borch, C. (2007). Crowds and economic life: bringing an old figure back in. Econ. Soc. 36 (4), 549–573. doi:10.1080/03085140701589448

Brown, A., Reade, J. J., and Vaughan Williams, L. (2019). When are prediction market prices Most informative? Int. J. Forecast. 35 (1), 420–428. doi:10.1016/j.ijforecast.2018.05.005

Buckley, P. (2017). Evidencing the forecasting performance of predication markets: an empirical comparative study. J. Predict. Mark. 11 (2), 60–76. doi:10.5750/jpm.v11i2.1383

Buterin, V. (2014). An introduction to futarchy. Zug, Switzerland: Ethereum Foundation Blog. Available online at: https://blog.ethereum.org/2014/08/21/introduction-futarchy.

Casella, A., Campbell, J., de Lara, L., and Mooers, V. (2022). Liquid democracy. Two experiments on delegation in voting (december 19, 2022). Available online at: https://ssrn.com/abstract=4307183. doi:10.2139/ssrn.4307183

CerebrumDAO (2019). CDP-9: governance framework V1.2 - implementation of a soft governance mechanism. Snapshot. Available online at: https://snapshot.box/#/s:cerebrumdao.eth/proposal/0xbb840e0282de8baff213947313e4c5084d5281b0655b8e9565b03ab949934206.

CerebrumDAO (2025). CerebrumDAO snapshot page. Available online at: https://snapshot.box/#/s:cerebrumdao.eth.

Chen, H., Duan, X., El Saddik, A., and Cai, W. (2024). Political leanings in Web3 betting: decoding the interplay of political and profitable motives. arXiv. arXiv Preprint No. 2407.14844). doi:10.48550/arXiv.2407.14844

Cowen, T. (2007). Where do I disagree with robin hanson? Marg. Revolut. Available online at: https://marginalrevolution.com/marginalrevolution/2007/08/where-do-i-disa.html.

Cowgill, B., Wolfers, J., and Zitzewitz, E. (2009). Using prediction markets to track information flows: evidence from google. In: Das, S., Ostrovsky, M., Pennock, D., Szymanksi, B. (eds) Auctions, Market Mechanisms and Their Applications. AMMA 2009. Lecture Notes of the Institute for Computer Sciences, Social Informatics and Telecommunications Engineering, vol 14. Springer, Berlin, Heidelberg. doi:10.1007/978-3-642-03821-1_2

CryoDAO (2025). CryoDAO snapshot page. Available online at: https://snapshot.box/#/s:vote.cryodao.eth.

Curecoin LLC (2019). White paper: 2019 curecoin model (white paper draft – english). Available online at: https://curecoin.net/white-paper/.

Cygnusxi (2014). ANN CureCoin 2.0 is live – mandatory update is available now. Bitcoin Forum. Available online at: https://bitcointalk.org/index.php?topic=603757.0.

De la Rouviere, S. (2015). Why & how decentralized prediction markets will change just about everything. Available online at: https://medium.com/@Consensys/why-how-decentralized-prediction-markets-will-change-just-about-everything-15ff02c98f7c.

Ding, W., Hou, J., Li, J., Guo, C., Qin, J., Kozma, R., et al. (2022a). DeSci based on Web3 and DAO: a comprehensive overview and reference model. IEEE Trans. Comput. Soc. Syst. 9 (5), 1563–1573. doi:10.1109/TCSS.2022.3204745

Ding, W., Liang, X., Hou, J., Li, J., Rouabah, Y., Yuan, Y., et al. (2022b). A novel approach for predictable governance of decentralized autonomous organizations based on parallel intelligence. IEEE Trans. Syst. Man, Cybern. Syst. 53 (5), 3092–3103. doi:10.1109/TSMC.2022.3224250

Dreber, A., Pfeiffer, T., Almenberg, J., Isaksson, S., Wilson, B., and Johannesson, M. (2015). “Using prediction markets to estimate the reproducibility of scientific research,” in Proceedings of the national academy of sciences. doi:10.1073/pnas.1516179112

Elizaoak, A. (2025). Experimenting with Futarchy for optimism grant allocation decisions. Optimism Collective Governance Forum. Available online at: https://gov.optimism.io/t/experimenting-with-futarchy-for-optimism-grant-allocation-decisions/9678

Fan, Y., Zhang, L., Wang, R., and Imran, M. A. (2024). Insight into voting in DAOs: conceptual analysis and a proposal for evaluation framework. IEEE Netw. 38 (3), 92–99. doi:10.1109/MNET.137.2200561

Franzoni, C., and Sauermann, H. (2014). Crowd science: the organization of scientific research in open collaborative projects. Res. Policy 43 (1), 1–20. doi:10.1016/j.respol.2013.07.005

GenomesDAO (2025). GenomesDAO snapshot page. Available online at: https://snapshot.box/#/s:genomesdao.eth.

Gilson, C., and Bouraga, S. (2024). Enhancing the democratic nature of voting processes within decentralized autonomous organizations. Digital Policy, Regul. Gov. 26, 169–187. doi:10.1108/DPRG-09-2023-0126

Gridcoin (a) (2013). Gridcoin (GRC) – first coin utilizing BOINC – official thread [online forum post]. Bitcoin Forum. Available online at: https://bitcointalk.org/index.php?topic=324118.0.

Gridcoin (b) (2022). Gridcoin white paper draft [white paper draft]. Available online at: https://gridcoin.us/assets/docs/whitepaper.pdf.

HairDAO (2025). HairDAO snapshot page. Available online at: https://snapshot.box/#/s:hairdao.eth.

Hanson, R. (2002). Logarithmic market scoring rules for modular combinatorial information aggregation. Department of Economics, Fairfax, VA George Mason University. doi:10.5750/jpm.v1i1.417

Hanson, R. (2013). Shall we vote on values, but bet on beliefs? J. Political Philosophy 21 (2), 151–178. doi:10.1111/jopp.12008

Harkness Institute (2025). Futarchy: the future of DAO governance. TURBIN3. Available online at: https://medium.com/@hrknsinst/futarchy-the-future-of-dao-governance-9dd00a18a423.

Heavey, K. (2024). Futarchy as trustless joint ownership. Available online at: https://www.umbraresearch.xyz/writings/futarchy.

HippocratDAO (2025). HippocratDAO snapshot page. Available online at: https://snapshot.box/#/s:hippocratdao.eth.

Korbmacher, M., Azevedo, F., Pennington, C. R., Hartmann, H., Pownall, M., Schmidt, K., et al. (2023). The replication crisis has led to positive structural, procedural, and community changes. Commun. Psychol. 1 (3), 3–12. doi:10.1038/s44271-023-00003-2

Larivière, V., Haustein, S., and Mongeon, P. (2015). The oligopoly of academic publishers in the digital era. PLOS ONE 10 (6), e0127502. doi:10.1371/journal.pone.0127502

Lim, D. (2021). A deep dive into futarchy. Coinmonks. Available online at: https://medium.com/coinmonks/a-deep-dive-into-futarchy-what-national-governments-and-private-organisations-can-learn-from-a-9408aa2fb887.

Lustenberger, M., Küng, L., and Spychiger, F. (2025). Designing community governance: learnings from DAOs. JBBA. 8, 1–9. doi:10.31585/jbba-8-1-(4)2025

MetaDAO (2024a). “Creating a DAO,” in MetaDAO documentation. Available online at: https://docs.metadao.fi/using-the-platform/creating-a-dao.

MetaDAO (2024b). “Program architecture,” in MetaDAO documentation. Available online at: https://docs.metadao.fi/implementation/program-architecture.

MoonDAO (2025). MoonDAO snapshot page. Available online at: https://snapshot.box/#/s:tomoondao.eth.

Netrovert (2024). Futarchy: redefining DAO governance. Medium. Available online at: https://medium.com/@netrovert/futarchy-redefining-dao-governance-5f554d523dee.

Paolo Binetti (2024). VDP group. Available online at: https://gov.vitadao.com/t/vdp-143-funding-fission-pharma-revised/1629.

Pet3rpan-1kx (2022). Safe DAO resource allocation model (OBRA). Safe Community Forum. Available online at: https://forum.safe.global/t/discussion-safe-dao-resource-allocation-model-obra/1001.

Pickles, A. (2024). “Gambling crowds as crypto-oracles? Bridging the real and the blockchain through utopian markets and oracular shenanigans,” in Crypto crowds: singularities and multiplicities on the blockchain, 21–66. doi:10.2307/jj.10121666.6

PsyDAO (2025). PsyDAO snapshot page. Available online at: https://snapshot.box/#/s:psydao.eth.

Quantum Biology DAO (QBIO) (2025). QBIO snapshot page. Available online at: https://snapshot.box/#/s:qbio.eth.

ResearchHub (2025). ResearchHub snapshot page. Available online at: https://snapshot.box/#/s:researchhub.eth.

Rogers, G. (2021). Speculation: a cultural history from aristotle to AI. Columbia University Press. Available online at: https://www.jstor.org/stable/10.7312/roge20020.

Tan, J., Merk, T., Hubbard, S., Oak, E. R., Rong, H., and Boneh, D. (2023). Open problems in daos. arXiv Prepr. arXiv:2310.19201. doi:10.48550/arXiv.2310.19201

ValleyDAO (2023). ValleyDAO snapshot page. Available online at: https://snapshot.box/#/s:valleybio.eth.

VitaDAO (2024). VDP-143. Available online at: https://snapshot.box/#/s:vote.vitadao.eth/proposal/0x675271b25ccc7fae08b24d62650e0f1ecb449c140ddc32d5e54f96c33f81041f.

VitaDAO (2025). VitaLabs voting proposal: selection of projects for incubation. Available online at: https://snapshot.box/#/s:vote.vitadao.eth/proposal/0xeecfa48211292fe7ba8dd5dde7a6f39707eff243058744b5ab1bca6592d4fda4.

Wang, Q., Yu, G., Sai, Y., Sun, C., Nguyen, L. D., Xu, S., et al. (2022). An empirical study on snapshot DAOs. arXiv Prepr. arXiv:2211.15993. doi:10.48550/arXiv.2211.15993

Weidener, L., and Spreckelsen, C. (2024). Decentralized science (DeSci): definition, shared values, and guiding principles. Front. Blockchain 7, 1375763. doi:10.3389/fbloc.2024.1375763

Weidener, L., Greilich, K., and Melnykowycz, M. (2024). Adapting Mintzberg’s organizational theory to DeSci: the decentralized science pyramid framework. Front. Blockchain 7, 1513885. doi:10.3389/fbloc.2024.1513885

Wolfers, J., and Zitzewitz, E. (2004). Prediction markets. J. Econ. Perspect. 18 (2), 107–126. doi:10.1257/0895330041371321

Wolfers, J., and Zitzewitz, E. (2006). Interpreting prediction market prices as probabilities. NBER Work. Pap. No. 12200, 1.000–22.00. Available online at: https://hdl.handle.net/10419/33261.doi:10.24148/wp2006-11

Keywords: futarchy, conditional prediction markets, decentralized science (DeSci), decentralized autonomous organizations (DAOs), market-based governance

Citation: Weidener L and Shilina S (2025) Futarchy in decentralized science: empirical and simulation evidence for outcome-based conditional markets in DeSci DAOs. Front. Blockchain 8:1650188. doi: 10.3389/fbloc.2025.1650188

Received: 19 June 2025; Accepted: 22 September 2025;

Published: 06 October 2025.

Edited by:

Qin Wang, Commonwealth Scientific and Industrial Research Organisation (CSIRO), AustraliaReviewed by:

John Anthony Rose EE, Ritsumeikan Asia Pacific University, JapanAntonia Damvakeraki, University of Nicosia, Cyprus

Copyright © 2025 Weidener and Shilina. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: L. Weidener, bHVrYXNAd2VpZGVuZXIuZXU=

L. Weidener

L. Weidener S. Shilina

S. Shilina