- 1College of Professional and Continuing Education, The Hong Kong Polytechnic University, Hong Kong, Hong Kong SAR, China

- 2The Hong Kong Polytechnic University, Hong Kong, Hong Kong SAR, China

The electric vehicle (EV) has proven to be a workable solution to minimizing environmental pollution. The EV has generally received substantial attention from both individual customers and corporate users. The EV has transformed remarkably and in recent years emerged as the most quickly developing section of the automobile industry. China has proven to be an outstanding country in enhancing the manufacture and marketing of EVs. Nevertheless, green environment, charging infrastructure and technology are the three main challenges leading to slowing down the penetration progress of EVs into the Greater Bay Area (GBA) of China. This study aims to report the existing development of the EV industry in China. Then, it elaborates on national policies to facilitate the enlargement of charging infrastructures, explains how to stimulate the development of charging infrastructure at the national level, discusses the implementation dilemma at the provincial and city levels, and highlights the challenges and policy gaps. Finally, it addresses some issues, challenges, progress and implications for improving the EV penetration in the GBA in the forthcoming years.

1 Introduction

Electric vehicle (EV) refers to automobiles that run using electric motors that derive power from batteries that receive charge from other sources (Hove and Sandalow, 2019). China has proven to be more technologically advanced in matters of EV charging utilities and has been identified as one of the largest consumers of EVs; a sizeable number of the consumers are from the middle class (Masiero et al., 2016). China has more technical development in EV charging infrastructures mainly because it is amongst the leading nations in the advancement of battery manufacturing. Pan (2020) claimed that China is the leading global EV charging station market. He points out that in 2019, the mainland set in place over 1,000 EV charging units daily. Recently, the majority of areas in China, especially the Greater Bay Area (GBA), possess an average estimate of 2,000 communal charging docks. Key factors such as the increased sales of EVs in China have contributed to the rise in the need for swift charging docks (Mordor Intelligence, 2022). Subsequently, technological advancements in charging infrastructures cater to the high demands. Recent technical advancements in China, specifically in the GBA include fast charging, bidirectional EV chargers, integrated chargers, wireless chargers and smart charging.

Amongst the current technological improvements in the EV charging utilities in the GBA is bidirectional EV chargers. For a while now, the EVs’ charging system mostly entails cables and plugs (Hove and Sandalow, 2019). Nevertheless, the charging business continues to progress due to the improvements in technology. The shift is more towards digital, smart technology. The most prevalent type of charging for EVs that has been utilized in Hong Kong is the unidirectional battery chargers (Tan et al., 2015). Unlike these unidirectional chargers, bidirectional EV chargers operate on the principle that the electric flow occurs in two directions instead of one. According to Tan et al. (2015), the technology comprises two main components, alternating current (AC) to direct current (DC) converters. The second element of bidirectional battery chargers is the DC to DC converters. The AC converters’ main function is to change the AC coming from the power grid into DC, which charges the batteries. The AC to DC converter also inverts the DC back to AC and drives it back to the main grid, hence the term “bidirectional” (Tan et al., 2015). GBA especially in Hong Kong, is set on utilizing bidirectional batteries because one of its main advantages is that it incorporates renewable energy resources similar to wind turbines. This benefit goes hand in hand with the strategy of the Hong Kong roadmap initiative administration to use clean energy amenities that do not harm the environment (Electric vehicle regulation and law in China, 2018). These resources are uncertain because they largely rely on the state of the climate. Sunny, calm weather (i.e., no air motion) are more favourable for better working conditions than rainy weather. Bidirectional charging technologies have made integrating such energy sources easier by exploiting the portability of EV charging infrastructure to function as an energy buffer depository and distributor.

Fast charging is also a recent technical progression that specialists have made in EV charging infrastructures. EV developers seek to advance EV charging infrastructures further to improve the dissemination of EVs because higher-quality materials attract several customers. One of the obstacles that hinder the purchase of EVs by the public is poor charging infrastructures. The impoverished charging infrastructures include long recharging hours, usually more than 8 h, which is the standard time for recharging. The developers exploit such shortcomings to bring about technological advancements. Hence, EV charging companies in China such as Wenzhou Bluesky Energy Technology Company have developed technologies that support the fast charging of batteries to eliminate time wastage (Yong et al., 2015). The government of Hong Kong has come up with a new framework called Hong Kong Roadmap on the Hong Kong Roadmap on Popularization of Electric Vehicles (2021) that outlines the incorporation of fast charging. According to the plans, the administration is determined to improve the effectiveness of chargers by upgrading from standard to medium chargers (Electric vehicle regulation and law in China, 2018). The fast charging of EVs is mainly supported by new battery inventions such as the lithium-based battery (Lin et al., 2010). These batteries enable fast charging because they have elevated energy densities and power density. The bidirectional technique also enables fast charging because of the additional DC to DC converters. These converters ensure that less energy is wasted by conserving power, thus resulting in swift charging.

Integrated, portable EV battery chargers are also new technologies in charging facilities for EVs in GBA (Yong et al., 2015). The charging mechanisms of the integrated battery transpire once the vehicle stops moving. Many benefits are associated with integrated EV battery chargers, such as low costs. Given that they use the components already used to build the vehicle, purchasing other elements to construct a battery is not needed. Integrated chargers also save space, which is especially beneficial in Hong Kong because of limited space (Yong et al., 2015). Hong Kong is a highly populated region, and the large population has been a hindrance to the construction of EV charging stations. In addition to integrated battery chargers, EV portable battery chargers are available. For a while now, the charging facilities mainly comprise immovable charging stations, and EV owners are forced to keep their vehicles stationary whilst recharging. However, developers have made progress by coming up with portable chargers that enable drivers to charge their batteries even when in transit (Yong et al., 2015). The mobile chargers have also helped solve the issue of limited spaces for installing charging stations.

The ongoing technical development for EV charging facility in Hong Kong is known as smart charging. EV manufacturing companies and some universities in Hong Kong such as the City University of Hong Kong have underway research projects for these smart technologies (Qiu et al., 2014). An example of smart technology that electric car developers have begun establishing is wireless charging facilities. Wireless charging is one of the latest developments in EV manufacture. In Hong Kong, a shortcoming in EV charging infrastructure is the need for different types of chargers because of various car models (Qiu et al., 2014). To solve such a critical issue, the Hong Kong government has been determined to spread wireless charging because it can be utilized by any type of EV model. Charging EV batteries wirelessly only requires a Wi-Fi connection, and wire cables are not needed. Worldwide research on this kind of charging is continuing to upgrade the technology further. One of the proposed models for wireless chargers depends on the resonant induction technique. The methodology fosters the transmission of electric charge from a charging compartment installed on the road onto another compartment constructed below the car’s body facing the road. The charging pad on the road also possesses a convenient wireless transmitter that signals the charger that an EV is right on top of it so that charging can begin. As a result, time is saved, and the service is offered to many individuals. Other advantages associated with wireless charging include ease of use (Hove and Sandalow, 2019). Unlike plug-in charging facilities, anyone can use wireless chargers without the need for instructions because the person does not do any work for charging to occur. In the future, wireless charging technology will be extremely valuable for public transport because it will save time.

This study is divided into eight key sections. The context and research settings are presented in Section 1. The penetration of EV into the GBA is described in Section 2. The challenges of EVs in the GBA, namely, green environment, charging infrastructures and technology, are identified in Section 3. National policies to support the enlargement of charging infrastructures and stimulate the development of charging infrastructure at the national level are elaborated in Sections 4, 5, respectively. The implementation dilemma at the provincial and city levels is tackled in Section 6. The challenges and policy gaps are addressed in Section 7. The concluding remarks and key points are highlighted in Section 8.

2 Penetration of electric vehicle into the Greater Bay Area

Many cities and regions all over the globe such as Seoul, Singapore, Tokyo, California and Norway are promoting EVs through specific measures and policies that attract citizens to adopt the use of EVs (Transport Department, 2022). The major reason for fostering the development of EVs is to reduce carbon emissions and lower urban air pollution (Zhang et al., 2017). Out of all the efforts by different countries, China has proven to be an outstanding country in enhancing the manufacture and marketing of EVs. The Chinese government has increased its efforts because China is regarded as a substantial contributor to environmental pollution, which results from its high economic growth (Vennemo et al., 2009). Despite the high sales of EVs in China, in the past few years, it has experienced shortages in terms of charging infrastructure (Wu et al., 2021). Less charging infrastructures affect the number of sales because people fail to see the need of buying a vehicle if recharging it is problematic. Therefore, a technique that the Chinese administration has utilized for promoting EV usage is policies that promote the improvement of charging infrastructure. The GBA of China that comprises Macau, Guangdong regions and Hong Kong uses various policies regarding EV charging facilities. Recently, Hong Kong has revealed its framework titled Hong Kong Roadmap on the Popularization of Electric Vehicles (2021), which includes such policies. The policies that have been implemented in the GBA include government strategies, rules and regulations, and financial and non-monetary incentives.

The Chinese government has come up with long-term strategies to increase EV charging infrastructure in the GBA. These plans involve disseminating the EV charging infrastructure network by ensuring at least one charging infrastructure per 2,000 cars (Charging facilities for electric vehicles, 2021). An area that encompasses 2,000 cars must have a minimum of one charging station. The government has also come up with plans for installing the charging stations in newly constructed public buildings such as the government house in Hong Kong. It has assigned 120 million dollars so that 1,000 more charging facilities can be affixed to public parking spaces by next year (Charging facilities for electric vehicles, 2021). The government’s framework for 2015–2020, called Electric Vehicle Charging Infrastructure Development Guidelines, contains some standards for charging utilities in the Guangdong region (Pan, 2020). According to the initiative, the charging docks for public use in eastern coastal regions must be one station per seven cars (Pan, 2020). The roadmap initiative details that the government is determined to ensure that 4 years from now, more than 150,000 parking spaces in residential and business establishments will possess EV charging infrastructures (Popularization of electric vehicles, 2021). The government has also employed some experts to examine potential areas in Hong Kong, Macau and Guangdong, where more charging stations can be installed. The government has provided research funds to facilitate the experts to study these regions to determine the feasibility. More than 2 million dollars have been divulged to help in this endeavour Hong Kong Roadmap on the Popularization of Electric Vehicles (2021). A major hindrance to the establishment of new charging ports is the lack of space. This problem is even more serious because most areas in the GBA are highly populated. To tackle this issue, the administration has some plans to convert fuel stations to charging stations for EVs.

Another form of policy that the GBA of China has utilized to promote the installation of charging stations is standards and regulations. In March of this year, the administration unveiled the Hong Kong Roadmap on the Popularization of the Electric Vehicles initiative. The roadmap comprises strict rules that ensure the expansion of charging stations in Hong Kong. The government specified that 30% of non-public parking spaces must have EV charging docks (Charging facilities for electric vehicles, 2021). Thus, many private building owners are forced to set up EV charging ports to avoid being penalized by the administration. The roadmap also includes purchase restrictions for vehicles other than EVs. The government is also looking into phasing out fuel-based vehicles. The administration is working towards preventing people from freely buying and registering vehicles that utilize fuel. Consequently, these individuals have to purchase EVs and end up proactively increasing the charging docks. Other standards and regulations include the set standard that all current apartments must be provided with a charging facility. The government has instructed each person recently building a residential apartment in GBA to install an electric car charging area.

Financial incentives are another type of policy on EV charging facilities in GBA. Most of the incentive measures the government has employed are aimed at sustainably expanding the usage of EVs, especially towards nature and our surroundings (Zhang et al., 2017). According to Lau et al. (2022), the government of China began using incentives and subsidies many years ago to promote the development of EV infrastructure, including charging facilities. Lau et al. (2022) states that at one time, the Hong Kong administration offered 15 billion dollars to the EV industry. Recently, the government has subsidized charging utilities (Pan, 2020). The Chinese government allocated more than $120 million from 2019 to 2020 to expand public EV infrastructure (Pan, 2020). The government has also offered subsidies to owners of private residential apartments in Hong Kong to encourage them to install charging docks in their buildings (Lau et al., 2022). The application procedures have also been simplified to enable more people to apply easily. Another financial incentive is offered by private EV companies (Electric vehicle regulation and law in China, 2018). Some of these firms offer their customers a variety of services that accompany the purchase of EVs. The services include the installation of a charging dock that leads to further expansion of EV charging infrastructure. The central government also offers financial incentives to the local governments of GBA to promote the utilization of EVs in those areas constantly (Electric vehicle regulation and law in China, 2018). The monetary subsidies given to local administrations are used in the establishment and operation of the charging stations. The financial support can be utilized to conserve and upgrade the charging networks, and facilitate the general standards of the charging infrastructures.

Non-monetary incentives on EV charging infrastructures in GBA are also provided. As per Electric vehicle regulation and law in China (2018), the Chinese government offers driving and parking facilities to individuals owning EVs. These people can drive their cars in lanes that are for specific kinds of vehicles only. Additionally, the government provides EV owners with designated parking spots that contain charging docks. The reserved parking spaces that come with a charging station can encourage individuals to own EVs. Some incentives involve advantageous treatment for charging docks (Electric vehicle regulation and law in China, 2018). The electric companies of China, such as the China Southern Power Grid, are the most common firms that install EV charging ports. Such firms also provide favourable treatment to other private enterprises that deal with providing charging infrastructure to the masses. Such benefits include the nullification of some fees that other customers need to shell out. Another favourable treatment as a kind of non-monetary incentive, such as offering parking facilities to EV owners, is by the government towards the EV industry. This policy on EV charging infrastructure is mainly in the sector of research and development (Zhang et al., 2017). Since 2018, the government of China has been enacting auxiliary policies for the research and development of EV facilities. The central government has purposed to ensure that the industry of EVs can employ very talented, smart individuals to conduct their research on charging infrastructure (Electric vehicle regulation and law in China, 2018). Employing numerous intelligent individuals, it will provide high chances of improvements and new inventions.

3 On the move: The challenges of electric vehicles in Greater Bay Area

3.1 Green environment

GBA is part of a region that has received heavy criticism for its role in the current environmental challenges the world is facing. According to the United Nations Agenda 21, EVs are part of the future and present an opportunity for the world to look towards renewable sources of energy instead of relying on the use of fossil fuels and geothermal power for energy. This development has led to declarations by many nations globally aiming to reduce their carbon footprints gradually. However, various nations including the United States and China have faced numerous challenges in reducing their carbon footprint. China in particular has increased its release of toxic gases including carbon dioxide and methane over the years despite its commitment to the reduction of greenhouse gases. It is also the largest global emitter of carbon dioxide (Fang et al., 2018). This fact poses a challenge as it increases the pressure on the nation to move towards sustainability. Other Asian countries including South Korea and Japan are in a similar situation. The increased commitment to the production and marketization of the EV in the GBA is a way for the region to comply with Agenda 21 and reduce its emission of greenhouse gases by promoting EVs (Holley and Lecavalier, 2017).

Similar to most regions globally, Hong Kong has experienced a rise in the number of toxic gases from car exhausts. In Hong Kong, the fleet-average NO2/NOx emission ratio increased from 6.7% in 2003 to 14.4% in 2015 (Wang et al., 2021). This figure is a remarkable rise in emissions considering that these toxic gases are environmental hazards that have to be reduced as stipulated by the United Nations and the regional accord. Statistics in Hong Kong also showed that despite the improved fuel economy in vehicles from 2003 to 2015, no equivalent reduction in carbon dioxide emissions was observed (Wang et al., 2021). Instead, carbon dioxide emissions increased in the period due to the growing number of vehicle owners in the region. EVs are a feasible solution to the high rate of emissions associated with these gases. In Hong Kong, air and water pollution have been major problems partly because of the dense population of Hong Kong and the lack of landfill space in the area. Hong Kong is almost out of landfill space and is having difficulty maintaining acceptable emission levels. Despite the changes in regulation on the quality of greenhouse gas emissions, the EV is seen as the “best” solution for the Hong Kong region. In 2014, an agreement in the GBA, the Cooperation Agreement on Regional Air Pollution Control and Prevention between Hong Kong, Guangdong and Macao, was signed to ensure a collaboration between the Greater Bay cities to improve air quality through collaborative efforts. The rise of EVs in the region is part of the strategy of the agreement. Apart from Hong Kong, the rest of mainland China, Guangdong and Macao, have contributed substantially to environmental pollution. One of the ways that EVs reduce environmental pollution is through the considerably small rate of pollution from car tyres. Conventional internal combustion engines use disk brakes. Disk brakes have a negative effect on the air quality due to the minute particles of tyre rubber that are released as the car’s brake (Choma et al., 2020). By contrast, EVs use regenerative braking to slow the car down. This method is positive because it does not harm the environment, and it charges the vehicle. Toxic tailpipe pollutants including NOx, HC and carbon monoxide (CO) considerably affect the quality of air. However, EVs eliminate tailpipe pollution because they do not release tailpipe gases. These benefits of EVs can have a remarkably positive influence on the environment and guarantee that EVs are favoured in the GBA and Hong Kong. However, despite the positive effect of EVs on the environment, tremendous pushback has been noted from activists in Hong Kong and the GBA due to the negative influence of EVs on the environment. Today, data on EVs remain scarce. However, researchers have argued that despite the positive effect of EVs after production, they remain dangerous to the environment. The reason is the production for EVs is considerably intensive and substantially damages the environment (Stromman, 2012). The production for EVs requires twice the energy requirements in manufacturing compared with ICE vehicles. China and Hong Kong are also criticized for the coal-fired plants where electricity is produced (Cui et al., 2021). The argument by most researchers is that EVs running on energy from coal-powered plants are unsustainable. Instead, the GBA needs to rely on renewable energy sources for the production of electricity.

3.2 Charging infrastructures

The EV industry is facing many current issues. Although the EV being relatively new in the industry, it is already experiencing many challenges and successes related to the global need for the technology. A current issue is the challenge of vehicle charging GBA is experiencing. Over the years, China has been attempting to drive its macro-economic policy, Made in China 2025, which aims to make China a manufacturing and industrial hub that is incomparable with any other region in the world (Wu and Guo, 2020). However, charging infrastructure has been a challenge in Hong Kong. In Hong Kong, marketing EVs has been challenging due to the lack of charging locations all over the city. In comparison, gas stations where ICEs obtain fuel are conveniently located across the city. Surpassing this challenge has been difficult due to the already established petrol and diesel vehicle industry. This challenge has not been observed in the GBA only. Most nations adopting EVs including the United Kingdom and the United States lack charging infrastructure in convenient locations. Another issue is the boost of the GBA industry during the COVID-19 pandemic. During the pandemic period, the EV industry has had massive improvements in its efficiency due to the breakthrough made by researchers on a global scale. A major improvement has been in the charge times associated with the technology. EVs run on lithium ion batteries. These batteries can be charged at higher voltages to charge faster. However, this often poses a challenge to engineers due to the heat generated whilst charging at higher voltages. During the COVID-19 pandemic, different firms including Porsche Taycan and Audi e-tron GT reduced the charge time for EVs to less than 30 min whilst charging the lithium ion battery at 800 V.

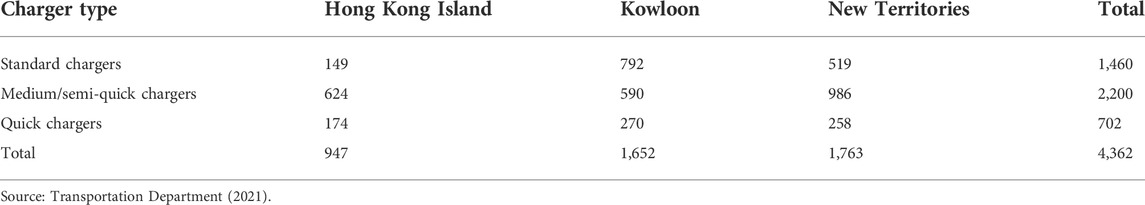

In Hong Kong, a current issue that the EV industry is facing is the high cost of EVs. In a 2012 survey conducted in Hong Kong, most people understand the environmental, economic and social benefits of EVs, but they prefer not to purchase electric cars because of the high costs. Average purchase willingness when the consumer faces a higher price is 2.10 out of 5 (Delang and Cheng, 2013). To date, EV companies in Hong Kong have been unable to make EVs affordable to the local community. The local population in Hong Kong is also reluctant to purchase EVs due to the lack of charging stations. The public electric car charger distribution is summarized in Table 1. According to the study, of the 7.1 million people living in Hong Kong as of 2013, most live in high-rise buildings that lack charging resources (Delang and Cheng, 2013). This figure makes people disinterested in the technology, causing many to prefer using ICEs due to convenience.

Other that the shortage of EV chargers in Hong Kong, their distribution is uneven. According to the Environmental Protection Department (2021), as many as 827 charging stations are in Kwun Tong, accounting for nearly 25% of the total EV chargers in Hong Kong. Amongst them, both Goldin Financial International Centre (157) and The Quayside (312) possess 469 chargers. However, less than 60 chargers are available in Tai Po, Tuen Mun and the Southern District.

3.3 Technology

The technology used to run EVs is an important concept that determines the performance of the commodity in the market, the perception of potential buyers and the efficiency of the vehicle. In the GBA, different regions have had varying rates of success in the development of EV technology. An example is the Huizhou region, where Xpeng Motors has been at the forefront of developing sustainable EV technology (Lee, 2021). The technology used to run EVs is similar globally, but technical tweaking is processed by most companies to improve the efficiency and marketability of the product. An EV technology contains different components including battery, motor, vehicle linkages, metal sheets for housing, autonomous smart components for autonomous vehicles and electric components including copper wire. The battery is one of the most important components in the technology, but it is one of the most divisive components due to the scarcity of materials used to make the battery and the ethics associated with the mining of materials used for EV batteries (lithium ion batteries). Most materials including lithium, nickel and cobalt are mined in the world. However, the conditions under which they are mined are questionable, and this has threatened the success of EVs in the GBA. China is world renowned for its efficiency in the development of different technologies. EV technology has been a remarkable success due to the diverse technologies developed in different regions in the GBA including Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhao Qing (Wu and Guo, 2020). Smart control, autonomous EVs have been a major success in these regions with autonomous vehicles becoming a reality in Hong Kong.

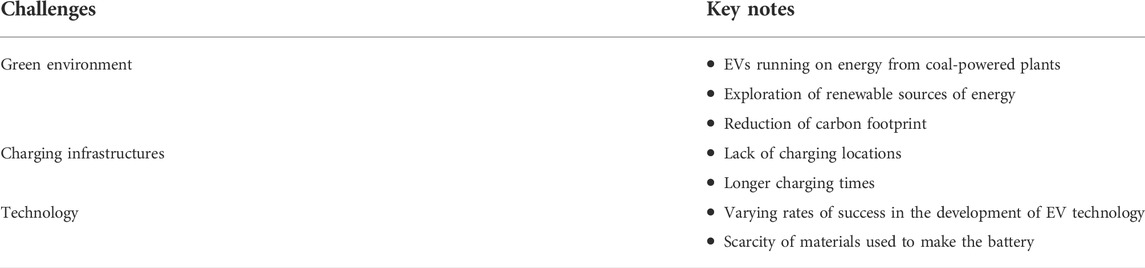

To sum up, the main challenges of EVs in GBA are summarized in Table 2.

4 National policies to stimulate the development of charging infrastructures

Despite the backdrop of the slowing down of EV subsidies in China, policy support for the EV industry has not disappeared, but the focus has shifted to infrastructure construction, and the construction of charging networks is one of the key points. The Announcement on Further Improving the Promotion and Application of Financial Subsidy Policies for Electric Vehicle issued by the Ministry of Finance (MoF) and four other ministries and commissions in March 2019 stipulated the following: After 25 June 2019, financial subsidies to support the construction of EV charging infrastructure and related operating services are to be implemented at the provincial level and city level. The policy also promoted an efficient collaboration between EVs and renewable energy. EV, wind power and solar energy are expected to coordinate with one another through well-organized scheduling. The construction of multifunctional integrated stations of solar energy storage and EV charging are specifically encouraged and financially supported.

The rapid development of the charging pile industry is inseparable from policy support. In September 2015, the General Office of the State Council issued the Guiding Opinions on Accelerating the Construction of Electric Vehicle Charging Infrastructure, which for the first time clarified the policy direction of the charging pile industry. Subsequently, the relevant departments of the state, provinces and cities have introduced policies to promote the development and construction of the charging pile industry. In the past few years, the National Energy Administration worked with relevant departments to strengthen the supervision and implementation of action plans related to charging infrastructure and solidly organize and promote the development of charging infrastructure, especially to encourage innovation for both technology breakthroughs and business models.

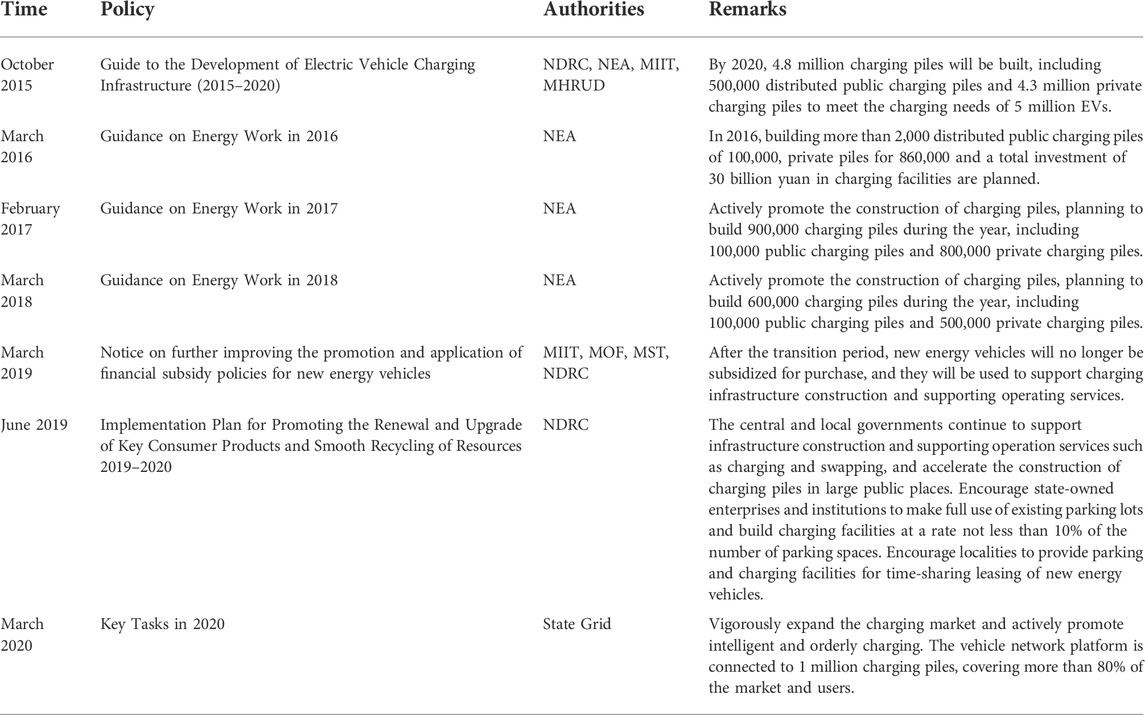

4.1 Policy incentives for charging infrastructures

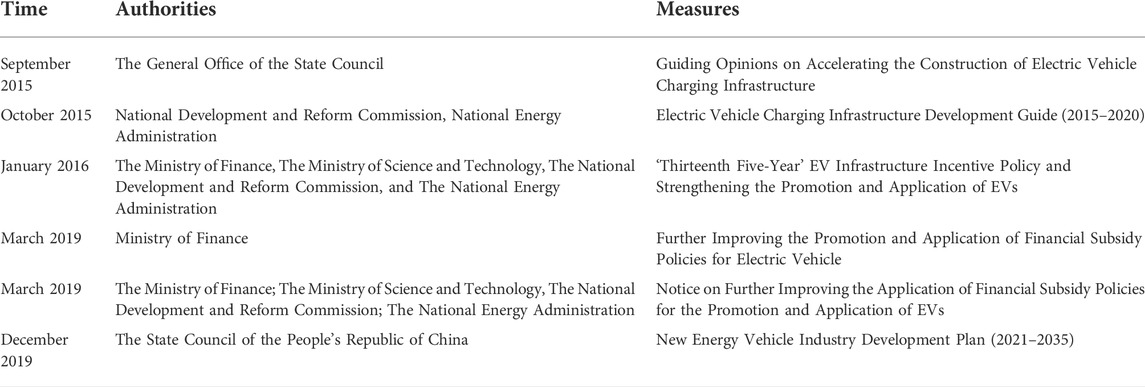

In October 2015, the Electric Vehicle Charging Infrastructure Development Guide (2015–2020) proposed that according to the deployment of the National Energy Administration, China planned to build 4.8 million charging piles to meet the charging need of 5 million EVs by the end of 2020, including 0.5 million decentralized public charging piles and 4.3 million private charging piles. In the past few years, many policy incentives to promote the construction of charging piles were introduced. Table 3 highlights policy incentives for EV charging infrastructures at the national level.

In January 2016, the MoF, the Ministry of Science and Technology, the National Development and Reform Commission and the National Energy Administration jointly issued the Announcement of Introducing “Thirteenth Five-Year” EV Infrastructure Incentive Policy and Strengthening the Promotion and Application of EVs. In March 2019, the four ministries and commissions issued the Notice on Further Improving the Application of Financial Subsidy Policies for the Promotion and Application of EVs, which stipulated that after the transition period, EVs will no longer be subsidized by purchase subsidies. Those financial subsidies will be converted to support the construction and operation of charging infrastructure. Thus far, most provinces and cities in China have issued subsidy policies for the construction and operation of EV charging facilities to guide the construction and operation of local charging piles effectively.

Despite the slowdown of EV financial subsidies, policy support for the EV industry has not disappeared, but the focus has shifted to infrastructure construction, and the construction of charging pile networks is one of the key points. The Announcement on Further Promotion and Application of EV Related Financial Subsidies issued by the MoF and four other ministries and commissions in March 2019 stipulated the following: After June 2019, the local finance will no longer provide financial subsidies directly for EV purchase, and those financial subsidies will be used to support the construction of charging infrastructure and supporting operating services.

On 3 December 2019, the New Energy Vehicle Industry Development Plan (2021–2035) was officially released for the first time, indicating the development direction of high-power, intelligent and network platforms for charging and discharging facilities, and proposed to accelerate the charging infrastructure construction such as power exchange, hydrogenation, information and communication, and road transportation that will improve the level of interconnection and use efficiency and encourage business model innovation. Indicative requirements were made for the construction of new energy vehicle charging and discharging infrastructure from three aspects: accelerating construction of charging facilities, improving service quality and encouraging technological and business innovation.

The timeline regarding the national policies’ encouragement of charging infrastructure development is summarized in Table 4.

TABLE 4. Timeline regarding the national policies encouragement of charging infrastructure development.

4.1.1 Accelerating construction of charging facilities

Strengthen the energy interaction between new energy vehicles and the power grid (vehicle to grid, V2G). Encourage local governments to develop V2G demonstration applications, coordinate the needs of new energy vehicles for charging and discharging, and power dispatching, and comprehensively use policies and economic measures to achieve efficient energy interaction between new energy vehicles and the grid, reduce the cost of new energy vehicles, and increase peak and frequency regulation of the grid and security emergency response capabilities. Promote efficient collaboration between new energy vehicles and renewable energy. Manage the coordination of new energy vehicle energy utilization and wind power photovoltaic coordinated scheduling, and encourage the construction of a ‘photovoltaic storage and discharge’ multifunctional integrated station.

4.1.2 Improving service quality

Jointly improve the service quality of charging infrastructure and guide various enterprises in different regions to establish a charging facility operation service platform, strengthen the technical research and development of charging equipment and power distribution system safety monitoring and early warning, and regulate the electromagnetic spectrum of wireless charging facilities. Reasonable layout of charging and swapping infrastructure, speed up the formation of a moderately advanced, slow charging mainly, emergency fast charging supplemented by a charging network, and strengthen the intelligent and orderly charging, high-power charging and other new charging technology research and development.

4.1.3 Encouraging technological and business innovation

Encourage both technological and business model innovation and support cooperation models such as multiple vehicles in a residential area and sharing of adjacent parking spaces, and encourage the combination of charging stations and commercial real estate. Improve the charging facility insurance system to reduce the risks to business operations and users. Non-operating vehicle charging services enjoy residents’ electricity prices.

5 Stimulated development of charging infrastructure at the national level

Recently, the State Administration of Market Supervision and Administration announced the National Catalogue for the Supervision of the Quality and Safety of Key Industrial Products (2020 Edition), which defined that lithium-ion batteries, EVs, EV charging piles and EV chargers are essential industrial products and are of great importance for China shortly.

The construction of public charging piles has begun to accelerate. As of November 2019, China has built 496,000 public charging piles. The number of new energy vehicles in China has reached a certain level, and the proportion of vehicle piles has been unevenly developed. With the subsidy for new energy vehicle purchases subsiding, the construction of public charging piles has accelerated after the second half of 2019. The AC pile technology has developed more maturely, the market is relatively stable and the DC pile is still developing in the direction of greater power.

In recent years, the number of charging facilities in both public and private sectors have dramatically increased in China, from 507,000 units in 2016 to 3,521,000 units in 2021, as a result of policy incentives. However, the development of charging facilities remains behind rocket-increasing EV sales, as illustrated in Figure 1, according to the data from China Electric Vehicle Charging Infrastructure Promotion Alliance.

Chinese operators are optimistic about the future development of new energy vehicles and charging industries. At present, regulatory requirements are imposed on the price ceilings of EV charging fees in China to attract more consumers to drive EVs and save their driving costs. However, some provinces and cities may gradually cancel such a limit of price ceilings for charging fees. Related charging service providers and enterprises may have some autonomy in pricing. Higher charging fees and service fees can be charged to increase profits in some regions in the future.

The AC pile technology has developed more maturely, and the market is relatively stable. The DC pile is still developing towards greater power. The improvement of the DC fast charging power will help shorten the charging time, facilitate the user to charge at any time, and help improve the efficiency of the charging pile and obtain greater benefits.

The current development of the EV industry in China heavily relies on government subsidies. Therefore, it lacks the capability to integrate with market-oriented participation. Reducing manufacturing costs and application costs may take China a long time. In this context, the guiding role of national policy should be exerted. For example, insufficient post sales service networks and high maintenance costs are consumers’ concerns when buying and driving EVs. To resolve this concern, the economic effect of tax subsidies and tax deductions will contribute and help. Such financial benefits will raise customers’ purchase intention of EVs.

To boost the development of charging facilities, government procurement via the public transportation sector could help for demonstrative purposes. EVs in government procurement could account for a certain proportion of total vehicles’ equipment. This practice could play an inspiring role in the promotion of EVs in the whole society. Demonstration in the public domain refers to focusing on public transport, rental and leasing to drive the consumption ratio of EVs in public services such as municipal and logistics, thereby creating a demonstration effect of green travel for consumers. As such, the smart city could be sustained in the future.

Continuing financial subsidies for EV purchase has been proven to be an effective regime to stimulate EV deployment in the private transportation sector, especially for individual customers. Purchase subsidies, tax incentives and insurance premium discounts have been introduced in pilot regions to promote potential consumers to purchase EVs. Specifically, purchase subsidies refer to special funds arranged by the central finance and local governments to support private purchases, and consumers can directly enjoy preferential measures for car purchases using a certain number of subsidies when purchasing. Tax relief is another promotion approach, related purchase tax and vehicle registration tax, introduced to reduce the tax burden on consumers purchasing new EVs. Preferential insurance premiums refer to the financial subsidy for private consumers who pay for compulsory insurance premiums for automobile and traffic responsibilities, which has been implemented on a pilot basis in pilot cities.

In addition, an appropriate policy regime for EV charging benefits will continue to support EV users after the vehicle purchase. Financial subsidies, such as preferential charging fees and the construction of charging facilities, will directly reduce the driving costs of EVs, which will attract users to drive more EVs than conventional cars. Preferential electricity price refers to the implementation of a supportive electricity price for EV users to charge their cars for a certain period every day, making full use of price leverage to promote the use of EVs and reduce operational costs. A supportive regime for charging facilities refers to encouraging the construction of various charging piles and charging stations for both private transport and public transport sectors. For example, to encourage individual consumers to build charging piles in their own parking spaces, government authorities could consider providing certain subsidies to consumers who would install and build charging piles in their own parking spaces.

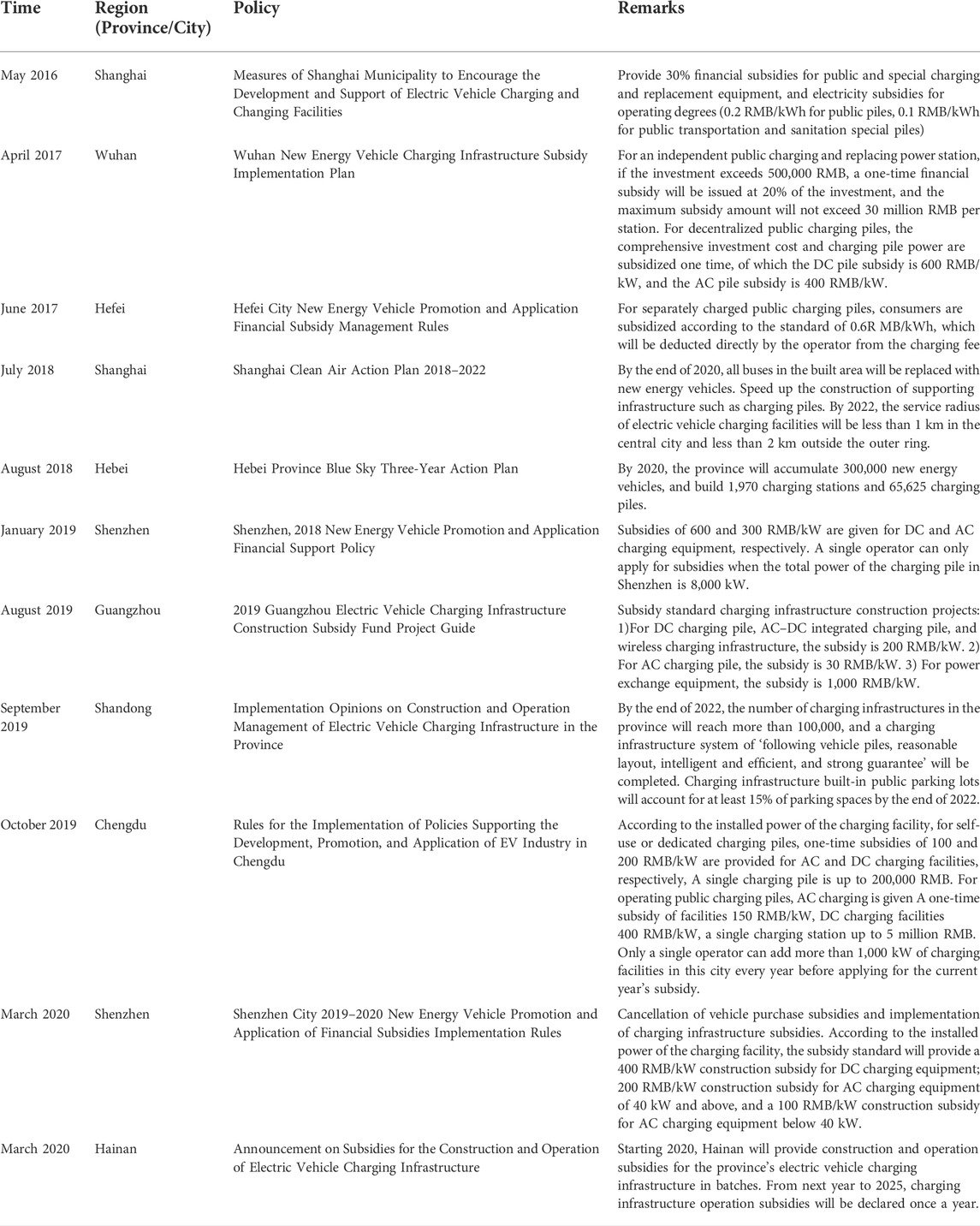

6 Implementation dilemma at provincial and city levels

With the support of the central government, various local governments have actively granted subsidies for the construction of charging stations and charging piles. Those financial subsidies were provided for not only construction work but also operational services. Affected by the decline of subsidies, the EV market has been in a downturn since the second half of 2019, and the growth rate of electric power consumed by charging facilities has slowed down. At the same time, the construction speed of charging piles has accelerated, and the growth rate of the two is gradually approaching. Table 5 identifies selected policy incentives for EV charging infrastructures at the regional level.

7 Challenges and policy gaps

In the past, the laying of charging piles was mainly dominated by State Grid Corporation, but for various reasons, it has gradually faded in recent years. With the opening of the market, friendly policies and State Grid’s insufficient experience and capabilities in 2C, several market-oriented operating platforms have emerged.

Since 2019, the charging capacity of the domestic charging pile industry has rapidly grown, and the overall utilization rate has increased. However, a good location of the pile results in a better utilization rate, and a poor location is unused, so the utilization rate of each enterprise is different. If all the AC piles or all DC piles are built, the utilization rate gap is very large (charging time factor), so it is also why State Grid Corporation stopped bidding for AC piles in 2019.

7.1 Slowdown of building private charging piles

The development trend of China’s EV industry has reached a temporary bottleneck. At present, China’s EV ownership has reached a certain scale, and supporting construction such as charging piles has been in a relatively backward stage. Upon declining financial subsidies for EV sales and purchases, national policy has shifted the support to the construction of charging infrastructure. In the past year, although both EVs and charging piles grew, the growth rate of charging piles is substantially faster than that of EVs. This phenomenon shows that the policy incentives of charging piles have a positive effect. In the next few years, the charging piles will usher in rapid development.

Revenue from charging pile operators is mainly generated from service fees, electricity price differences, subsidies and value-added services. Charging electricity fees and service fees are the most basic profit methods for most operators. However, due to the high initial investment cost of charging piles, long investment recovery period and low utilization rate of charging piles, most of the charging pile operating enterprises on the market are in a state of loss.

7.2 Technological and business innovation

With the continuous improvement of users’ demand for travel service quality, EV charging information services have also emerged, and various operators have begun to explore new operating models. Examples are a business model focusing on providing package solutions and a big-data business model on charging services plus additional value-added services.

The traditional infrastructure model mainly emphasizes investment in hardware and pursues quantitative benefits in scale. Under the new infrastructure model, the integration of charging piles with communications, cloud computing, smart grid and the Internet of Vehicles can use big data to optimize the layout of charging piles, enhance utilization and directly improve the profitability of the charging pile industry. Charging time can be reasonably arranged to smooth the load curve of the grid and improve social and economic benefits. More business models and application scenarios will appear around the charging pile, such as V2G and vehicle to everything. The improvement of technologies related to smart energy communities is all future trends.

8 Conclusion

The Chinese government is highly involved in the promotion of EVs mainly because EVs have proven to be a solution for reducing environmental pollution, to which China is a great contributor. The administration helps spread the usage of EVs in various manners, and it mainly involves the enactment of policies. Various policies regarding EV charging infrastructure include standards and regulations, governmental strategies and incentives. Most of the policies are also outlined in the new Hong Kong roadmap initiative. The administration of the regions in the GBA has specified their long-term strategies for promoting charging stations, specifically increasing their numbers in the area. Numerous plans to ensure at least one charging station for every 2,000 EV cars in an area. Each new government building is also outfitted with charging infrastructure. Some strategies aim to examine areas in the GBA for charging station installations. Another policy involves regulations in place to support the installation of charging facilities in GBA. In addition, some strict proclamations from the government that the owner of new residential apartments must ensure charging stations are constructed. Nevertheless, some policies that are still not underway but have been outlined involve phasing out non-EV vehicles. Administrations have also utilized incentives to attract more customers and developers of charging stations. Various administrations have offered private building owners subsidies so that they can install charging docks in their buildings. Some non-monetary subsidies include reserved parking with charging ports. To a certain extent, the GBA has contributed immensely to the rapid development of Asia as a hub for EV manufacturing and production. Today, China is seen as a hub for the manufacture and development of EVs. However, it has also been considered one of the largest emitters of greenhouse globally, and this has played a role in the recent moves to reduce the carbon footprint of the nation through sustainable methods such as EV adoption. Hong Kong, an autonomous region, has benefitted immensely from its autonomy to speed up the adoption of EVs in the region. Today, the Hong Kong government has developed policies to increase the popularity of EVs and reduce the barriers that threaten the industries by finding solutions. Examples are the investment in charging stations and the cost incentives involved with EV purchase. EV technology is important today due to the environmental implications of ICEs. EVs are considered less destructive to the environment and more sustainable.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

LY and WY: conceptualization and validation. LY and WY: methodology. LY and MW: formal analysis and writing-original draft preparation. LY, and WY: data curation. LY and WY: writing-review and editing, and project administration. WY: funding acquisition. All authors have read and agreed to the published version of the manuscript.

Funding

The research work discussed in this paper is funded by (1) the Research Grant Council of Hong Kong SAR, project reference number UGC/IIDS24/E01/20, and (2) PolyU CPCE Research Fund, project reference number SEHS-2021-228(J).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Charging facilities for electric vehicles (2021). The government of Hong Kong special administrative region. Available at: https://www.info.gov.hk/gia/general/202104/28/P2021042800340.htm.

Choma, E. F., Evans, J. S., Hammitt, J. K., Gómez-Ibáñez, J. A., and Spengler, J. D. (2020). Assessing the health impacts of electric vehicles through air pollution in the United States. Environ. Int. 144 (1), 106015. doi:10.1016/j.envint.2020.106015

Cui, R. Y., Hultman, N., Cui, D., McJeon, H., Yu, S., Edwards, M. R., et al. (2021). A plant-by-plant strategy for high-ambition coal power phaseout in China. Nature Commun. 12 (1), 1468.

Delang, C. O., and Cheng, W. T. (2013). Hong Kong people’s attitudes towards electric cars. Int. J. Electr. Hybrid Veh. 5 (1), 15. doi:10.1504/ijehv.2013.053465

Electric vehicle regulation and law in China (2018). CMS: Law, tax, future. Available at: https://cms.law/en/int/expert-guides/cms-expert-guide-to-electric-vehicles/china.

Environmental Protection Department (2021). Environmental protection department. Available at: https://www.epd.gov.hk/epd/english/environmentinhk/air/prob_solutions/promotion_ev.html (Accessed on 4 March 2022).

Fang, J., Yu, G., Liu, L., Hu, S., and Chapin, F. S. (2018). Climate change, human impacts, and carbon sequestration in China. Proc. Natl. Acad. Sci. U. S. A. 115 (16), 4015–4020. doi:10.1073/pnas.1700304115

Holley, C., and Lecavalier, E. (2017). Energy governance, energy secuity and environmental sustainability: A case study from Hong Kong. Energy Policy 108, 379–389.

Hove, A., and Sandalow, D. (2019). Electric vehicle charging in China and the United States. Columbia: School of International and Public Affairs, Center on Global Energy Policy. Available at: https://energypolicy.columbia.edu/sites/default/files/file-uploads/EV_ChargingChina-CGEP_Report_Final.pdf (Accessed on 22 December 2022).

Lau, Y. Y., Wu, Y. A., and Mak, W. Y. (2022). A way forward for electric vehicle in Greater Bay Area: Challenges and opportunities for the 21st century. Vehicles 4, 420–432.

Lee, G. (2021). Autonomous driving firm Desay allows Huizhou to steer EV sector. Hong Kong: South China Morning Post. Available at: https://www.scmp.com/business/companies/article/3136836/chinese-autonomous-driving-firm-desay-allows-greater-bay-area.

Lin, C. H., Hsieh, C. Y., and Chen, K. H. (2010). A Li-ion battery charger with smooth control circuit and built-in resistance compensator for achieving stable and fast charging. IEEE Trans. Circuits Syst. I. 57 (2), 506–517. doi:10.1109/tcsi.2009.2023830

Masiero, G., Ogasavara, M. H., Jussani, A. C., and Risso, M, L. (2016). Electric vehicles in China: BYD strategies and government subsidies. Rev. Adm. Inovação 13 (1), 03. doi:10.11606/rai.v13i1.110227

Mordor Intelligence (2022). China electric vehicle charging infrastructure market - growth. Trends, COVID-19 impact, and Forecasts (2022 - 2027). Available at: https://www.mordorintelligence.com/industry-reports/china-electric-vehicle-charging-infrastructure (Accessed on 3 March 2022).

Pan, F. (2020). How China’s Electric Vehicle (EV) Policies have shaped the EV market. Sustainalytics. Available at: www.Sustainalytics.com (Accessed July 31, 2021).

Hong Kong Roadmap on Popularization of Electric Vehicles (2021). Environmental Protection Department. Hong Kong: The Government of Hong Kong Special Administrative Region.

Qiu, C., Chau, K. T., Ching, T. W., and Liu, C. (2014). Overview of wireless charging technologies for electric vehicles. J. Asian Electr. Veh. 12 (1), 1679–1685. doi:10.4130/jaev.12.1679

Shenzhen, (2018). Shenzhen ‘New energy’ vehicle promotion. Available at: https://www.c40.org/case-studies/shenzhen-new-energy-vehicle-promotion/ (Accessed June 6, 2021).

Stromman, H. (2012). Electric vehicles “pose environmental threat. London: BBC News. Available at: https://www.bbc.com/news/business-19830232.

Tan, K. M., Ramachandaramurthy, V. K., and Yong, J. Y. (2015). Integration of electric vehicles in smart grid: A review on vehicle to grid technologies and optimization techniques. Renew. Sustain. Energy Rev. 53, 720–732. doi:10.1016/j.rser.2015.09.012

Transport Department (2022). Transport department. Available at: https://www.td.gov.hk/en/transport_in_hong_kong/public_transport/taxi/index.html (Accessed on 2 March 2022).

Vennemo, H., Aunan, K., Lindhjem, H., and Seip, H. M. (2009). Environmental pollution in China: Status and trends. Rev. Environ. Econ. Policy 3, 209–230. doi:10.1093/reep/rep009

Wang, X., Chen, L.-W. A., Ho, K.-F., Chan, C. S., Zhang, Z., Lee, S.-C., et al. (2021). Comparison of vehicle emissions by EMFAC-HK model and tunnel measurement in Hong Kong. Atmos. Environ. 256 (1), 118452. doi:10.1016/j.atmosenv.2021.118452

Wu, S., and Yang, Z. (2020). Availability of public electric vehicle charging pile and development of electric vehicle: Evidence from China. Sustainability 12, 6369. doi:10.3390/su12166369

Wu, Y. A., and Guo, S. N. (2020). Penetration of electric vehicles into the greater Bay area in Editor J. Fu, and A. W. Ng. Sustain. Energy Green Finance a Low-Vehiclebon Econ. 1 (2), 111–128.

Wu, Y. A., Ng, A. W., Yu, Z., Huang, J., Meng, K., and Dong, Z. Y. (2021). A review of evolutionary policy incentives for sustainable development of electric vehicles in China: Strategic implications. Energy Policy 148, 111983. doi:10.1016/j.enpol.2020.111983

Yong, J. Y., Ramachandaramurthy, V. K., Tan, K. M., and Mithulananthan, N. (2015). A review on the state-of-the-art technologies of electric vehicle, its impacts and prospects. Renew. Sustain. Energy Rev. 49, 365–385. doi:10.1016/j.rser.2015.04.130

Keywords: electric vehicle, China, Greater Bay Area, charging infrastructure, national policy

Citation: Lau Y-y, Andrew Wu Y and Wing Yan M (2022) Electric vehicle charging infrastructures in the Greater Bay Area of China: Progress, challenges and efforts. Front. Future Transp. 3:893583. doi: 10.3389/ffutr.2022.893583

Received: 18 May 2022; Accepted: 26 July 2022;

Published: 19 August 2022.

Edited by:

Yuche Chen, University of South Carolina, United StatesReviewed by:

Xing Wu, Lamar University, United StatesLei Zhu, University of North Carolina at Charlotte, United States

Copyright © 2022 Lau, Andrew Wu and Wing Yan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yui-yip Lau, eXVpeWlwLmxhdUBjcGNlLXBvbHl1LmVkdS5oaw==

Yui-yip Lau

Yui-yip Lau Yang Andrew Wu1

Yang Andrew Wu1