- 1Department of Economics and Finance, College of Business Administration, University of Hail, Hail, Saudi Arabia

- 2Department of Management and Information System, College of Business Administration, University of Hail, Hail, Saudi Arabia

- 3Department of Business, UNICAF University in Zambia, Lusaka, Zambia

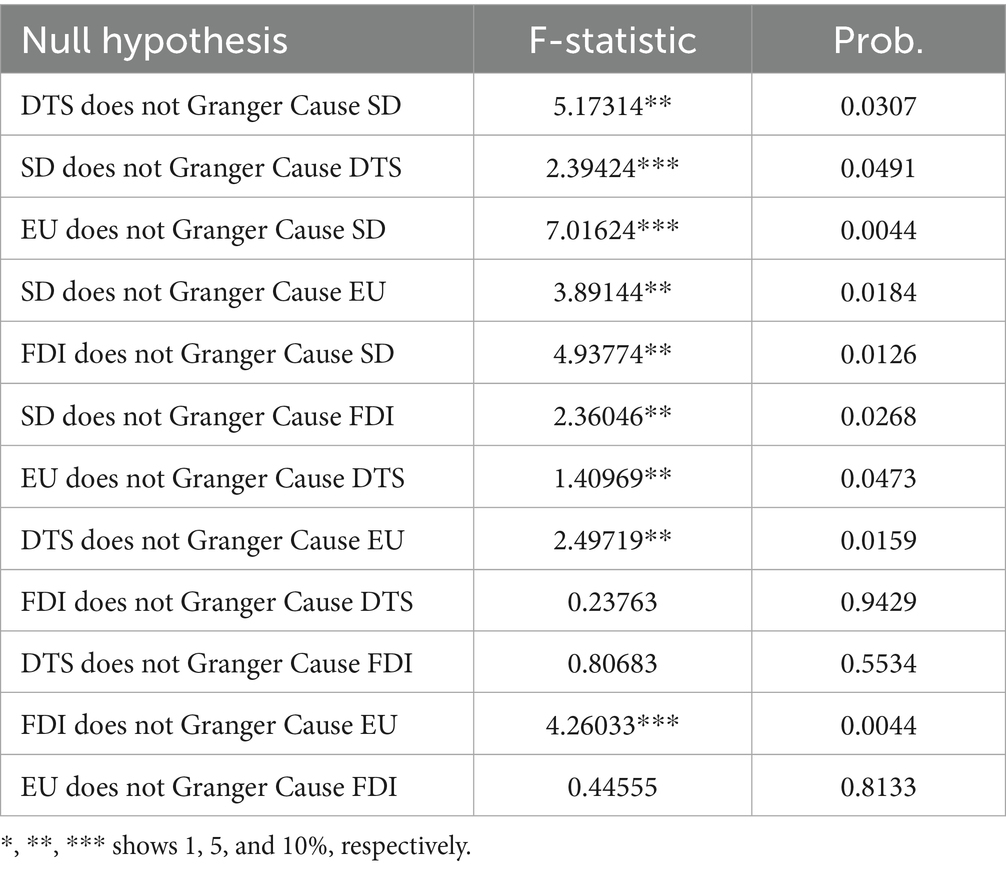

Sustainable development has been a fundamental component of long-term economic policies of resource-dependent nations, such as Saudi Arabia and the UAE. This study looks at how digital transformation, foreign direct investment, and energy use interact and affect sustainable development (SD) in two countries from 2000 to 2023. Utilizing sophisticated econometric techniques, including FMOLS, Johansen Co-integration, and Dumitrescu-Hurlin panel causality tests, the findings indicate that digital transformation and Foreign Direct Investment (FDI) exert a positive and substantial influence on sustainable development over the long term. Digital transformation (DT) significantly impacts the integration of technology to attain sustainability objectives. On the other hand, the impact on sustainable development is less significant, with several cases showing a statistically minor causal influence on energy consumption. The causality results reveal a mutual relationship between DT and SD in environmental policy and energy behavior. FDI directly causes SD but is also affected by SD, indicating their interdependence. However, FDI and DT do not show a causal relationship, and FDI Granger causes EU, while the reverse does not. The system remains closely coupled with energy, digital, and investment systems, contributing jointly to sustainable development pathways. These findings provide a valuable framework for governments aiming to foster sustainable growth in the digital realm via improved local technological advancement, effective foreign technical investment, and energy utilization.

1 Introduction

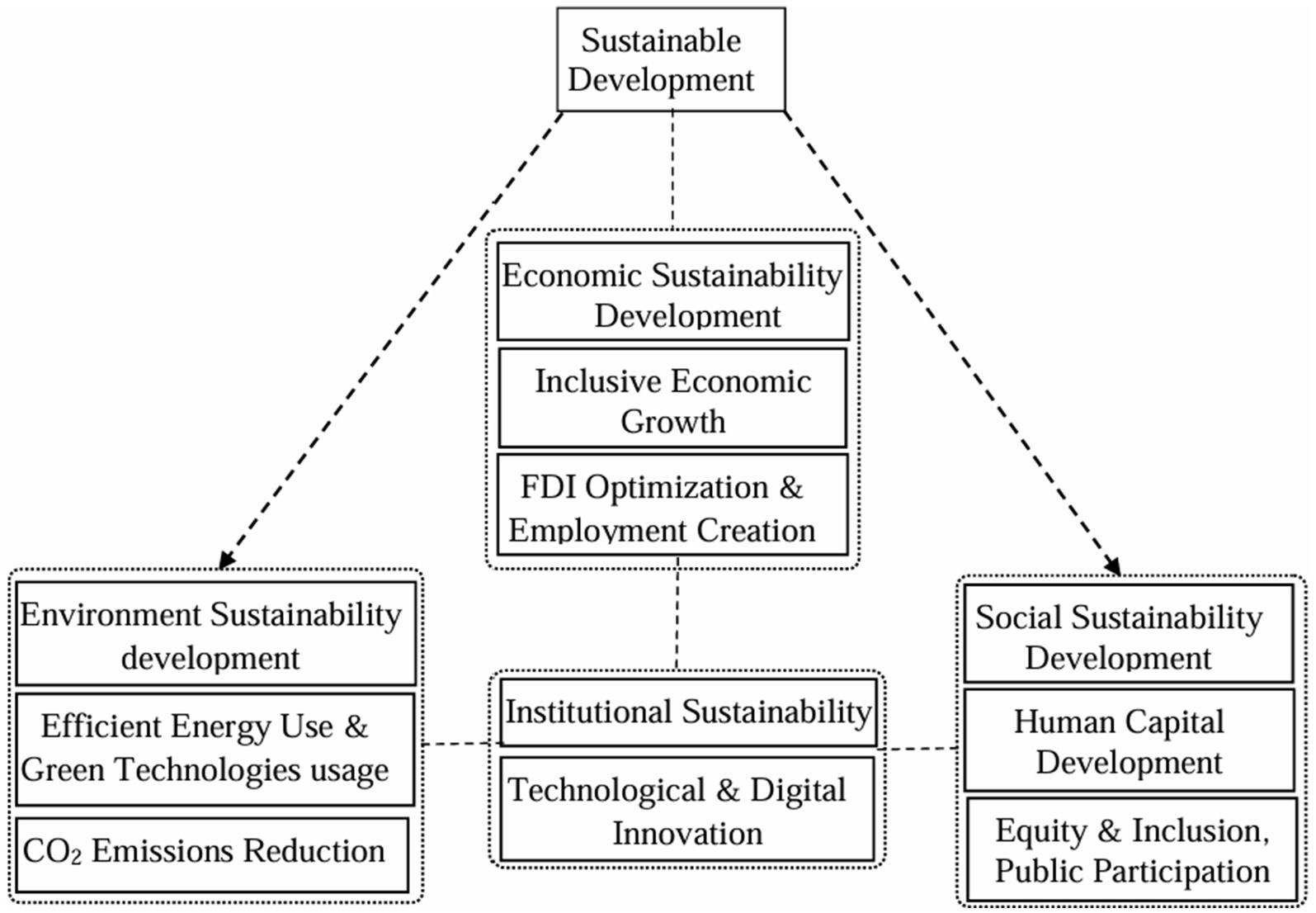

Developing nations regard sustainable development as an urgent priority to reconcile economic growth, environmental conservation, and social fairness (Sadiq et al., 2023). The initiative for sustainable development in the Middle East, particularly in KSA and UAE, is intricately connected to three revolutionary processes: digital transformation, foreign direct investment, and energy utilization (Sherif et al., 2023). These GCC countries, which were previously dependent on hydrocarbons, attempt to convert their economies in accordance with liberal sustainability standards with high emphasis on digitalization and green energy (Amin et al., 2023). These countries’ national policy agendas find realization in sustainable development through the interrelated processes represented by digital transformation, FDI, and energy consumption. This is important for capturing how well countries are performing and future strategies, such as Saudi Vision 2030 and UAE Vision 2050 (Ni et al., 2023), on how digital transformation, FDI, and energy consumption are interrelated. Changes in the economy and society with the digital revolution are changing our developmental paths. The KSA and the UAE governments are looking for digital technologies to improve service delivery, to diversify economy, and to achieve better environmental performance (Hariram et al., 2023). KSA’s National Transformation Program and the UAE’s Smart Government program aim to improve economic efficiency and environmental sustainability through the digitalization of infrastructure, governmental services, and business environments (Noureen et al., 2024). The new digital tools enable better monitoring of energy consumption, carbon emissions, and resource efficiency, effectively enriching the sustainable development framework (Chenlu et al., 2024). Sustained economic growth is catalyzes by foreign direct investment (FDI), which stimulates the transfer of capital, and technology innovation (Azmat et al., 2023). Within the GCC framework, foreign direct investment inflows shift from oil and gas to renewable energy, sophisticated manufacturing, information and communication technology, and sustainable urban development (ESCAP, U., ECA, U., ECE, U., ECLAC, U., ESCWA, U, 2023). The reorientation has been propelled by targeted economic changes aimed at improving the business climate and expanding sectors of the economy to foreign investment (Liu et al., 2024). Simultaneously, KSA and the UAE deregulated ownership, established special economic zones, and invested in infrastructure conducive to high-tech and green innovation (Ige et al., 2024). Nevertheless, the use of energy is a double-edged sword. Energy is essential for conducting economic and digital activities; nevertheless, it has been excessively and inefficiently utilized, with fossil fuel-based energy usage significantly contributing to greenhouse gas emissions (Kanval et al., 2024). The elevated per capita energy consumption is chiefly attributable to energy-intensive industrial operations, air-conditioned residences and structures, fossil fuel-dependent desalination, and extensive transportation networks, which are predominantly underpinned by heavily subsidized fossil energy (IEA, 2022). Currently, both nations are implementing aggressive energy transformation strategies. The Renewable Energy Project Development Office in Saudi Arabia and the Clean Energy Strategy 2050 in the United Arab Emirates aim to synchronize the energy mix with solar, wind, and nuclear sources (Adanma and Ogunbiyi, 2024). Technological breakthroughs in energy innovation are supported by foreign direct investment in renewable and digital solutions for energy efficiency to enhance these projects. The UN states that sustainable development addresses the needs of both present and future generations (Mishra et al., 2024). It requires comprehensive solutions that concurrently address the environmental, economic, and social dimensions. Digital transformation facilitates sustainability by reducing transaction costs, optimizing resource utilization, and implementing the intelligent infrastructure required for smart mobility, smart water systems, and smart waste management (World Bank, 2018). The enhanced use of AI, IoT, and big data analytics can facilitate the more efficient operation of energy grids, monitor environmental deterioration, and enhance catastrophe preparedness and response (Sadiq et al., 2023). The KSA and the UAE have considerably advanced in incorporating sustainability into their national goals and long-term strategies. An illustration of this scenario is Saudi Vision 2030, which emphasizes economic diversification through the advancement of the digital economy, green energy initiatives, and foreign direct investment in non-oil industries (Kwilinski, 2023). Similarly, the UAE’s Green Agenda 2030 and National Innovation Strategy focus on low-carbon growth, intelligent infrastructure, and innovation-driven development (Li and Wu, 2023). The objectives are aspirational and supported by legislation that includes financial mechanisms and worldwide collaborations with technology and energy companies. The relationship between digital transformation, foreign direct investment, and energy consumption is particularly significant for the sustainability implications in these Gulf nations (Sadiq et al., 2025). Ensuring high-quality foreign direct investment through cost-effective regulatory frameworks and digital access to public goods This, in turn, can accelerate the diffusion of modern technology with higher energy efficiency and lower damaging environmental effects via FDI. Reducing Operating Expense (OPEX) and enabling sustainable business models all of which are appealing to investors—via digital energy management systems (Osborn et al., 2015). A mixed literature has empirically distinguished the role of digitalization and foreign direct investment on sustainable development (Onwuka and Adu, 2024). Digital connection correlates with reduced energy intensity and enhanced productivity. In contrast, foreign direct investment in high-tech and green industries is connected with diminished carbon emissions and increased economic value-added (Abubakar et al., 2025). The influence of energy use on environmental sustainability remains context-dependent. Multinational corporations (MNCS) in energy-dependent developing nations have typically benefited from new, higher-carbon-locked-in FDI, which shows minimal correlation with digital transformation and decarbonization opportunities, an alarming issue where market dynamics impede the decarbonization of local economic activities (Alam et al., 2023). The Gulf’s plentiful solar radiation and other renewable energy resources provide a strategic advantage that may be leveraged through international investment and digital platforms. Futuristic, carbon-neutral smart cities like KSA’s NEOM and the UAE’s Masdar City are engineered to offer diverse economic activities while maintaining carbon neutrality and leveraging technology breakthroughs (Azam et al., 2023). The synergistic potential of digital transformation, energy innovation, and global financial flows is encapsulated by foreign direct investment in biotechnology, sustainable building, autonomous mobility, and digital services inside these mega projects (Mngumi et al., 2024). Nonetheless, several obstacles continue to endure despite these advancements. However, the digital divide, cybersecurity concerns, and laws may constrain the advantages of digital transformation (Shahzad et al., 2017). Furthermore, FDI could be unstable as a result of geopolitical rivalries, country economic instability, or regulatory uncertainty which are undermining long-run efforts to maintain a sustainable situation (Adanma and Ogunbiyi, 2024). The phasing out of subsidies and the integration of intermittent renewables into the grid is both a technical and societal challenge in energy (Amin et al., 2023). Continuous policy restructuring, institutional capacity building, and a systematic convergence of stakeholders are needed to achieve a cohesive and sustainable path of development (Razzaq et al., 2021). The interplay of digital transformation-fuelled international direct investment and energy consumption in KSA and the UAE is ushering these nations along a progressive path to sustainability. Digital revolution brings in efficiency and transparency, foreign direct investment brings in skills and capital while sustainable energy practices mitigate the environmental risks. These are the foundational cornerstones of a sustainable future in the Gulf. Future studies could consider the relationships between those factors, impact by individual sectors, and develop more integrated policy frameworks that cohere with the socio-economic conditions of Saudi Arabia and the UAE (see Figure 1).

2 Literature review

The framework of a literature review typically has three components, each serving a distinct purpose in establishing a cohesive academic foundation for the study. The three components can be delineated in according with the preceding framework of Sustainable Development and Digital Transformation; Sustainable Development and Energy Utilization; and Sustainable Development and Foreign Direct Investment as follows.

2.1 Sustainable development and digital transformation

Notably, as the globe shifts toward a knowledge economy, the convergence of digital transformation and sustainable development has become a significant focus of scholarly inquiry. It broadly denotes the integration of digital technology into business, government, and society. Digital technologies are a crucial facilitator of the UN Sustainable Development Goals (World Bank, 2018), especially in the domains of education, health, agriculture, and energy. Research indicates that digital transformation serves as a significant motivator for sustainability (Sarasini et al., 2024) contended that emerging digital technologies present opportunities for circular economy models, capable of enhancing impact and efficiency by utilizing existing resources more intelligently, thereby reducing ecological footprints. Similarly, Yousaf et al. (2021) indicate that digital finance can enhance financial inclusion and wellbeing in emerging economies. Digital transformation is seen as a crucial element of sustainable economic diversification under Saudi Arabia’s Vision 2030, particularly within the context of the Gulf area. The UAE is making substantial advancements, shown by the Smart Dubai effort, which aims to utilize digital technology to facilitate sustainability objectives in urban planning and public service provision (Khanna et al., 2021). Moreover, digital transformation includes intelligent infrastructure, such as smart grids and smart cities, as a component of sustainability. According to Albitar et al. (2020), smart city efforts facilitate reduced CO₂ emissions, optimized utility usage, and enhanced urban resilience. However, the implementation of digital technologies has its own challenges, including data security, digital inequality, and the environmental impacts of the necessary ICT infrastructure (Lozano et al., 2016).

2.2 Sustainable development and energy use

Nearly all energy types share a commonality: they facilitate sustainable growth. Energy consumption and sustainable development are closely interconnected, since energy serves as both a catalyst for economic advancement and a contributor to environmental deterioration, particularly when derived from fossil fuels. Emissions associated with energy from these sources account for approximately 73% of total global greenhouse gas emissions (IEA, 2022). A substantial body of literature explores the energy-sustainable development link. The research conducted by Apergis et al. (2020) revealed that renewable energy usage significantly impacts economic growth and environmental preservation (Omer, 2008; Dincer and Rosen, 1999) demonstrated a strong correlation between energy consumption and economic growth in emerging nations, while simultaneously confirming that over-reliance on non-renewable energy undermines environmental sustainability. Energy consumption in Saudi Arabia and the United Arab Emirates has predominantly favored fossil fuels. Recent policy modifications aim to diversify the energy portfolio. In 2021, Vision 2030 initiated the Saudi Green Initiative, aiming to derive 50% of the nation’s power from renewable sources by 2030. The UAE’s Energy Strategy 2050 similarly targets a comparable energy mix, consisting of 44% renewable energy (Zhe et al., 2024; Sarasini et al., 2024). Moreover, energy efficiency measures are integral to sustainable growth. According to Kaygusuz (2012), energy savings of 20–30% may be realized in industries, transportation, and buildings through enhancements in efficiency while maintaining equivalent functioning. Energy auditing and the implementation of sophisticated metering infrastructure have shown to be successful strategies for promoting energy saving and sustainability (Energy and Iea, 2020). Nonetheless, the rebound effect, where energy and carbon benefits from efficiency are diminished due to heightened consumption (higher throughput), remains a concern. Harmonizing energy consumption with sustainable development necessitates an equilibrium among energy accessibility, cost-effectiveness, and ecological preservation.

2.3 Sustainable development and FDI

For decades, foreign direct investment has been a significant driver of sustainable development, particularly in developing and emerging nations. FDI is a vital source of finance, facilitates technological transfer and interchange, and is crucial in capacity building, which is essential for achieving the SDGs (Voica et al., 2015). As stated by the UN Conference on Trade and Development, FDI serves as a primary driver of sustainable economic growth globally, generating employment, enhancing productivity, and facilitating infrastructure development (Yousaf et al., 2021). The link between FDI and sustainable development is not unidirectional. FDI can either adversely affect or enhance the environment, contingent upon the attributes of the investment and the host nation. Foreign Direct Investment in pollution-intensive sectors will markedly exacerbate environmental pollution unless stringent environmental regulations are implemented (Samour et al., 2022). Foreign Direct Investment has been a fundamental component of economic diversification initiatives in the Gulf Cooperation Council area. As previously mentioned, Saudi Arabia’s Vision 2030 and the Emirati economic strategies focus on sustainable foreign direct investment in renewable energy, technology, and tourism. According to Imran et al. (2024), foreign direct investment in green technology has increased at an annual pace of 18% since the implementation of Vision 2030. The converse aspect of the award pertains to the quality of foreign direct investment and its origins. According to FDI Projection 03 (Samour et al., 2022; Sarfraz et al., 2022), the origin of FDI may influence their effect on sustainable development, with investments from nations adhering to rigorous environmental regulations favorably impacting sustainability. Conversely, foreign direct investment from nations with lax regulations may result in the emergence of a “pollution haven.’ Numerous empirical studies, such those by Abedi and Moeenian (2021) and Al Shammre and Alshahrani (2024), demonstrate that FDI exerts a dual influence on CO₂ emissions: it fosters economic growth while also contributing to environmental pollution, unless accompanied by environmental safeguards. Consequently, host nations have the difficulty of formulating policies that maximize developmental advantages from foreign direct investment while minimizing ecological impact (Deryag and Khalifa, 2024). The research indicates that sustainable development may be affected, either favorably or adversely, by the three primary factors studied in this paper: digital transformation, energy consumption, and foreign direct investment. Future research should pursue integrated frameworks that delineate the synergies and trade-offs among these factors, especially in resource-abundant nations like KSA and the UAE. The study comprises many components: the third section addresses the gap and novelty, the fourth section outlines the theoretical framework and methods, the fifth section presents the empirical analysis, and the final section concludes the study. Presented here are pertinent research enquiries:

RQ1: How can digital transformation contribute to the sustainable development of Saudi Arabia and the United Arab Emirates? This inquiry aims to evaluate the influence of digital technologies on economic, environmental, and social sustainability, innovation, resource efficiency, and intelligent governance.

RQ2: What is the significance of energy consumption and sustainable development in the Kingdom of Saudi Arabia and the United Arab Emirates? To examine the influence of energy consumption patterns, especially in high-energy-use countries, on achieving sustainability objectives and their repercussions for ecological degradation and economically viable lives.

RQ3: What is the interplay between FDI, energy consumption, and digital transformation in fostering sustainable development in KSA and the UAE? This assessment will evaluate the collective influence of capital inflows, technology transfer, and energy utilization on sustainability, while identifying potential synergies and trade-offs contributing to the Gulf region’s long-term sustainable trajectory.

2.4 Study literature gap and novelty

The Kingdom of Saudi Arabia and the United Arab Emirates achieved rapid economic advancement mostly via the extraction of natural resources and international investments. However, blossoming expansion results in sustainability challenges, particularly around carbon emission control, diversity of energy sources, and equitable development. While various studies have individually investigated the roles and effects of FDI, energy consumption, and digital transformation, to our knowledge, there is a paucity of research examining the interactive synergy of FDI, energy consumption, and digital transformation on sustainable development, especially in oil-dependent economies undergoing structural reform. To our knowledge, no prior research provides a thorough assessment that incorporates all of these predominantly separate primary variables into a unified model. The potential for this is promising in mitigating energy inefficiencies and facilitating intelligent solutions for environmental management; nevertheless, the impact of digital transformation, significantly undervalued in the Gulf context, remains unexamined. Secondly, the majority of research fail to compare several Gulf nations, despite their frequently analogous economic frameworks and shared policy goals (e.g., Saudi Vision 2030; UAE Net Zero 2050) (Mishra et al., 2024). Most current work relies on outdated data and too simplistic models, yielding conclusions with little accuracy and policy significance. This study addresses the identified gaps by analyzing updated data from 2000 to 2023 and employing advanced econometric approaches to examine the combined effects of digital transformation, foreign direct investment, and energy consumption on sustainable development in KSA and the UAE. The innovation is in employing cost–benefit analysis in a multi-variable, comparative framework with methodological rigor, revealing pathways for the long-term viability of these economies independent of oil reliance.

H1: Enhancing resource efficiency and facilitating low-carbon innovations: the systematic role of digital transformation in sustainable development in the context of KSA and the UAE.

H2: The Beneficial Impact of FDI on Sustainable Development in KSA and the UAE via Enhancement of Technological Capabilities and Economic Diversification.

H3: Energy consumption undermines the sustainability of growth in KSA and the UAE, which remain reliant on non-renewable energy sources, resulting in environmental damage.

3 Theoretical framework

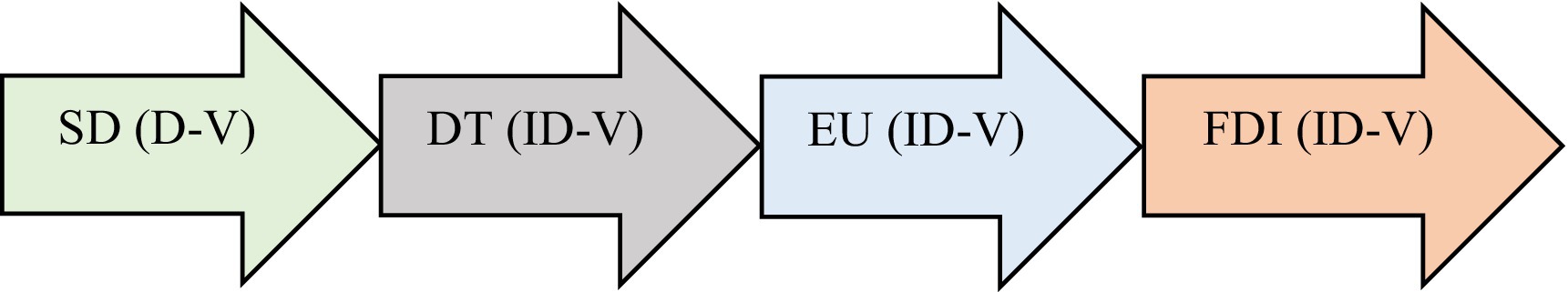

The literature presents many theoretical frameworks that elucidate the relationship among sustainable development, digital transformation, energy consumption, and FDI. The EKC hypothesis posits a nonlinear link between economic growth and environmental degradation, wherein pollution rises with GDP growth before declining due to the adoption of innovative technology as the economy develops. This notion is especially pertinent for resource-abundant nations transitioning from a resource- and pollution-driven economy to sustainable economic models. FDI is posited to influence this connection by facilitating the transfer of green technology and creating favorable conditions for improved production processes, enhancing sustainability results. Similarly, technological diffusion theory supports the idea that digital transformation acts as a catalyst for fostering sustainable growth through enhanced energy efficiency, intelligent infrastructure, and a smaller ecological footprint. The substantial energy consumption of these facilities, particularly from non-renewable sources, poses a significant obstacle to sustainability, necessitating a shift toward cleaner energy alternatives. The subsequent framework delineates the dependent and independent variables as seen in Figure 2.

This study utilizes time-series data from Saudi Arabia and the United Arab Emirates spanning from 2000 to 2023 to analyse these relationships. The research used correlation analysis, Co-integration tests, and the FMOLS technique to assess long-term and short-term correlations among the variables, yielding reliable estimates of critical factors influencing sustainable development while accounting for endogeneity and serial correlation. The Primary research model is presented in Equation 1:

We employ a logarithmic function on the model’s variables to diminish data responsiveness and enhance distributional characteristics before the model’s empirical application. The natural logarithm transformation mitigates issues of heteroscedasticity and autocorrelation (Kayani and Alzaid, 2024). The log-transformed and linear models produce comparable results; however, the log-transformed model is generally more dependable and appropriate. In Equation 2, carbon emissions are represented in a log-linear format.

Where , represent the elasticity of sustainable development concerning digital transformation, energy consumption, and foreign direct investment. The symbol I denote various cross sections; the natural logarithm is represented by ln, and time is specified from 2000 to 2023.

4 Methodology

4.1 Data and variables selection

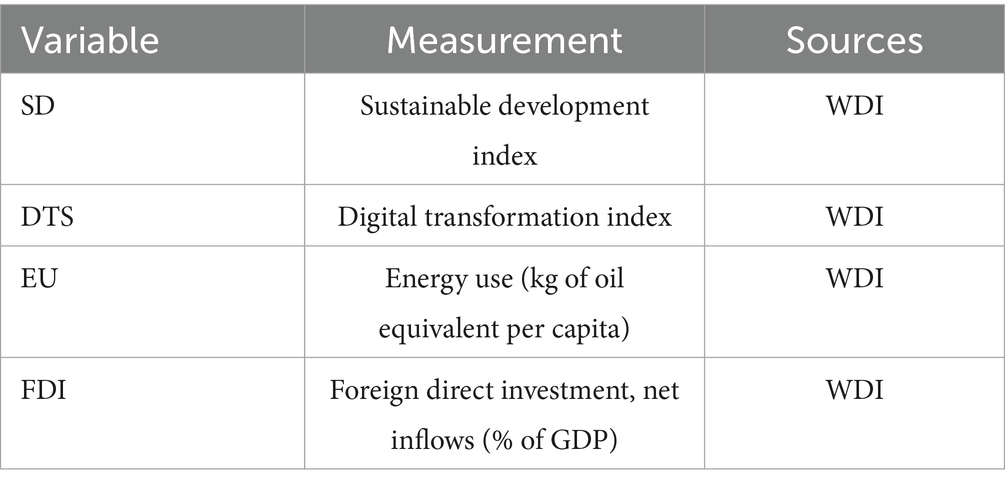

This research examines the relationship between sustainable development (see Appendix Tables 1, 2) and the trinity of digital transformation, energy consumption, and foreign direct investment in Saudi Arabia and the United Arab Emirates from 2000 to 2023. In this research, sustainable development is the dependent variable, while digital transformation, energy consumption, and foreign direct investment are the independent factors. WDI database, a publicly accessible and extensively utilized global development data repository (Al Shammre and Alshahrani, 2024). Expanding upon prior research on this topic, alternative studies have employed various methodological techniques. Researchers employed structural equation modelling and partial least squares methodologies utilizing World Bank data to assess the impact of FDI on economic growth within the Omani setting (Naseem et al., 2024). For the analytical process, we used Eviews-10. Additional studies examined the labor market by investigating the long-term effects of FDI on male and female unemployment, utilizing panel data from 1990 to 2018 and employing econometric methodologies such as FMOLS, variance decomposition, impulse response functions, and Granger causality tests to analyze both long-term and short-term dynamics (Majid, 2020). Co-integration tests and long-run estimate methodologies (FMOLS, quantile regression, wavelet coherency analysis, etc.) have been employed in the domain of sustainable development and green energy. This research employs the FMOLS approach, which robustly and reliably estimates the long-run equilibrium connection among variables, rendering the results highly useful for policy formation in the Gulf. The index variables and PCA techniques employed to produce the digital transformation index and sustainable development are shown in Appendix Tables 1, 2, respectively (Table 1).

4.2 Econometrics methodology

The FMOLS is a strong panel data model with little room for mixed stationarity variables. Considerably, it integrates both long-term and short-term dynamics, hence, especially suitable for analyzing the effects of digital transformation, energy consumption, and foreign direct investment on sustainable development. FMOLS is used to measure the impact of changes in digitalization, energy consumption, and capital influx on the growth paths of sustainable growth in KSA and the UAE. The addition of variance decomposition into the model also provides more information regarding causality and explains the percentage of variation in prediction errors that can be contributed to each predictor over time. In all countries, particularly those seeking to diversify from oil, FDI is relevant to long-term sustainable development and its apparent short-term environmental and economic impacts. This model could then be used to narrow further the analysis of FDI driven industrialization by examining the extent to which energy consumption and/or digital transformation is dispersed, as well as the resultant worsening or mitigation of environmental pressure. Also, the data are usually checked for stationarity and long-run correlation using unit root tests and Co-integration tests respectively, which adds to the robustness of the results. These diagnostic techniques are essential for assessing the dynamics of digital transformation, energy consumption, and foreign direct investment in relation to modelled sustainable development. This study utilizes FMOLS to provide empirical data about the temporal interaction among these factors, while also supporting KSA Vision 2030 and UAE Sustainability objectives through pertinent policy implications. This work aims to replicate such couplings in a dynamic context to yield insights for strategic approaches that would attain an economically progressive and ecologically sustainable result.

4.3 Unit root test

The unit root of each variable was validated using the stationarity tests conducted. The stationarity tests identified in the existing literature are already approximatively. Several broad tests include the Augmented Dickey-Fuller test (Dickey and Fuller, 1981; Im et al., 2003; Shin and Schmidt, 1992). The unit root test posits non-stationarity as the null hypothesis, with failure to reject the unit root signifying non-stationarity as the alternative hypothesis; hence, the unit root equation is presented below:

Where I = 1, N be a country-level panel; t = 1, T the period : capturing variables in the theoretical model, is the coefficient of auto-regression and is the error term. Condition >1, represent a stationary behavior, whereas = 1, results in a unit root in . The study of Im et al. (2003), also provides variables with different serial correlation orders and applies the Augmented Dicky Fuller test, so-called, the average:

If Equation 3 takes the place of Equation 4, we obtain Equation 6.

While the ADF can calculate by Equation 5:

Where ρi represents the number of lags in the ADF regression. T-bar statistics identified by Im et al. (2003), the ADF average of individual statistics as shown below:

The statistical alternative “t” allows all individuals to test a null hypothesis for the existence of a unit root. represents the estimation of ADF; t denotes the number of observations, and N is the number of individuals.

4.4 Dumitrescu-hurled causality (DH) test

The last step of an empirical analysis is the causality test that measures the intensity of the causal link between the variables in the model. Causation can be one-way (unidirectional), two-way (bidirectional), or non-existent. We employed the Dumitrescu Causality test by Dumitrescu and Hurlin (2012). What is a more effective tool for directional causality than the standard method (Dumitrescu and Hurlin, 2012). It includes the two main types of heterogeneity, i.e., the heterogeneity of the regression model and the heterogeneity of the causal effect.

The measurable cross-sections are denoted by x, y, and , , in Equation 7 respectively. Each observable has its own set of auto-regressive parameters and regression coefficients, expected to change over time. Behavior of one may be attributable to another panel list. Wald statistics can be used to test the following hypothesis based on Equation 8:

For each analyzed cross-sectional unit the Wald statistics is denoted by

4.5 Empirical findings

4.5.1 Variables description and correlation

These two notions are important to these two stages in time series analysis while the assessment of data normality and autocorrelation. Results Descriptive statistics (mean, standard deviation, and skewness) of some key variables are presented to capture the distribution of the data and where the data deviates. This method measures the strength and direction of linear relationships between pairs of variables, helping to discover possible dependencies or interactions. The second study lays the foundation for more elaborate methods such as Co-integration and dynamic modelling looking into long-run relationships and causal impact of variables (Alharthi et al., 2024).

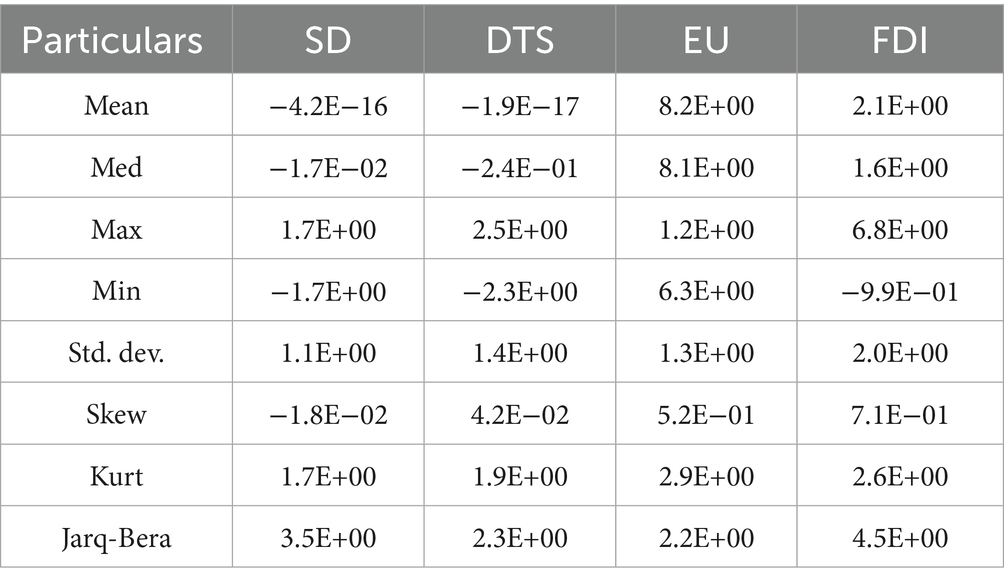

The descriptive data for the factors related to SD, DT, EU, and FDI in KSA and the UAE are shown in Table 2. The mean values for SD and DTS, being close to zero, reflect centred and normalized data, whereas the positive averages of EU and FDI demonstrate their consistent relevance in economic activity. FDI (2.0) and DT (1.4) have the biggest standard deviations, indicating moderate diversity in investment inflows and digital development among nations, as shown by these standard deviations. The skewness values indicate that EU and FDI are right-skewed, characterized by a substantial tail on the right side (high values), but SD and DTS are symmetric. The kurtosis values for all variables are below 3, indicating light tails and suggesting that the distribution is reasonably flat. The outcomes of the Jarque-Bera statistics exhibit minor deviations from the normal distribution; however, they remain within acceptable limits, so providing a foundation for the subsequent econometric analysis.

4.6 Variables correlation matrix interpretation

The Variables Correlation Matrix is a table that illustrates the strength and direction of the linear relationship among numerous pairs of variables within a single dataset. The values in the matrix vary from −1 to +1, where +1 signifies perfect positive correlation, −1 signifies perfect negative correlation, and 0 denotes the absence of linear correlation. A correlation approaching 1 or −1 denotes a robust and direct link, whereas values around 0 suggest the lack of a linear relationship. It offers a method for identifying possible multicollinearity issues and assists in the subsequent model definition.

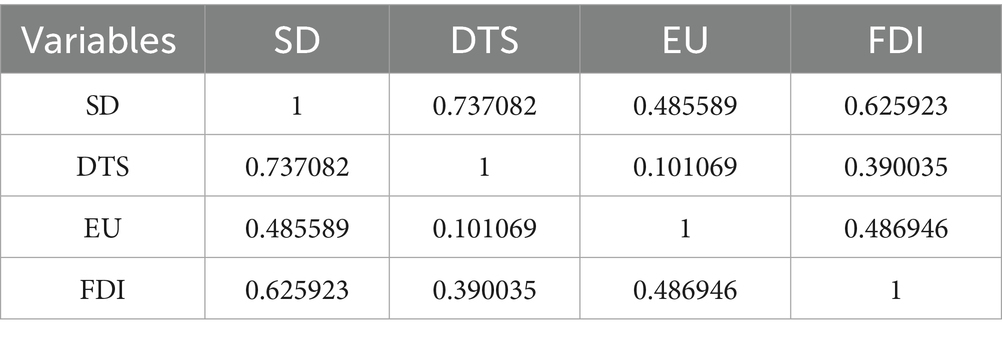

Table 3 correlation coefficients among SD, DT, EU, and FDI for the models of KSA and UAE A substantial positive connection exists between SD and DT (r = 0.737), indicating that digital technologies influence and advance sustainable development in alignment with national visions established for their respective areas, such as Saudi Vision 2030 and UAE Vision 2021. Likewise, SD has a substantial positive association with FDI (r = 0.626), suggesting that foreign capital supports sustainable initiatives, either through green investments or technological spillover. Despite a weak correlation between SD and EU (r = 0.486), it suggests that energy consumption, seen as a metric of economic and industrial advancement, might potentially facilitate sustainable development, provided that efficiency rules govern these initiatives. DT exhibits a poor correlation with EU (r = 0.101); digitalization has not yet directly influenced energy consumption (Alam et al., 2020), or this impact may manifest through efficiency improvements. In summary, the matrix elucidates the correlation among these factors and substantiates their collective impact on sustainability outcomes in the two nations.

4.7 Stationarity and correlation test

Unit root tests, sometimes referred to as individual variable stationary tests, are a crucial first phase in time series analysis. The ADF, IPS, and KPSS tests assess whether a time series variable is stationary or requires differencing to achieve stationarity. Stationarity is crucial, as non-stationary data may lead to the identification of spurious correlations between variables (Rehman et al., 2021).

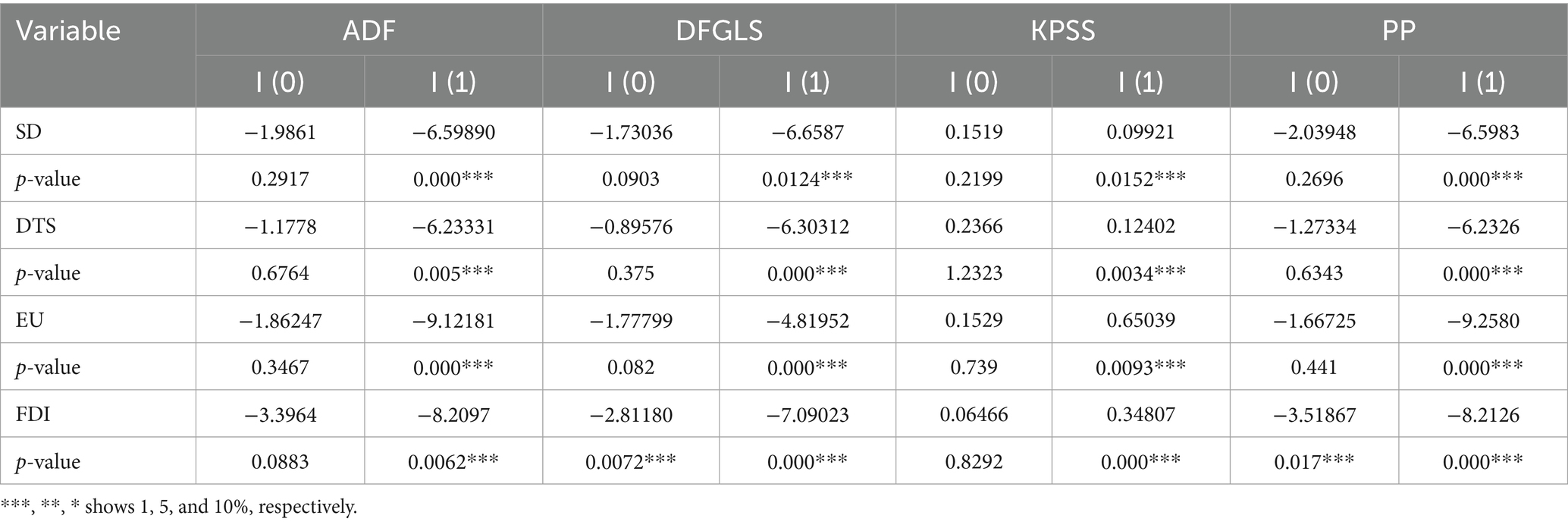

Table 4 presents stationarity diagnostics for the variables SD, DT, EU, and FDI, employing several unit root specifications, including ADF, DF-GLS, KPSS, and PP tests. The variables SD, DT, EU, and FDI are non-stationary at level I (0) but attain stationarity at the first difference level I (1), indicating that they are integrated of order one. In other words, they are not stationary at level; but, at first difference, ADF and PP tests produce extremely significant p-values (p < 0.01), so demonstrating stationarity at I (1). Similarly, the DF-GLS test corroborates this finding, indicating that all variables are stable following initial differencing (p < 0.01). Conversely, stationarity at the level is denied (with values over the crucial limit), although it is affirmed at the first difference (with values significantly below the threshold), corroborated by the KPSS test with SD (0.1519–0.0992) and EU (0.1529–0.65039) (Xie et al., 2024). These findings confirm that all series are integrated of the same order, hence validating the use of co-integration approaches from a long-run viewpoint and enhancing econometric modeling in the analysis of sustainable development drivers in KSA and the UAE.

4.8 Co-integration test analysis

Co-Integration Test The initial and most critical stage in time-series analysis is to ascertain the existence of a long-term link among the variables. The co-integration test (Drake, 1993; Johansen, 1992), is a prevalent approach employing maximum likelihood estimation to ascertain the existence of a co-integrated connection among various time series variables under analysis. The VAR model of vector k is characterized by an integration order of I (1) (Johansen, 1992).

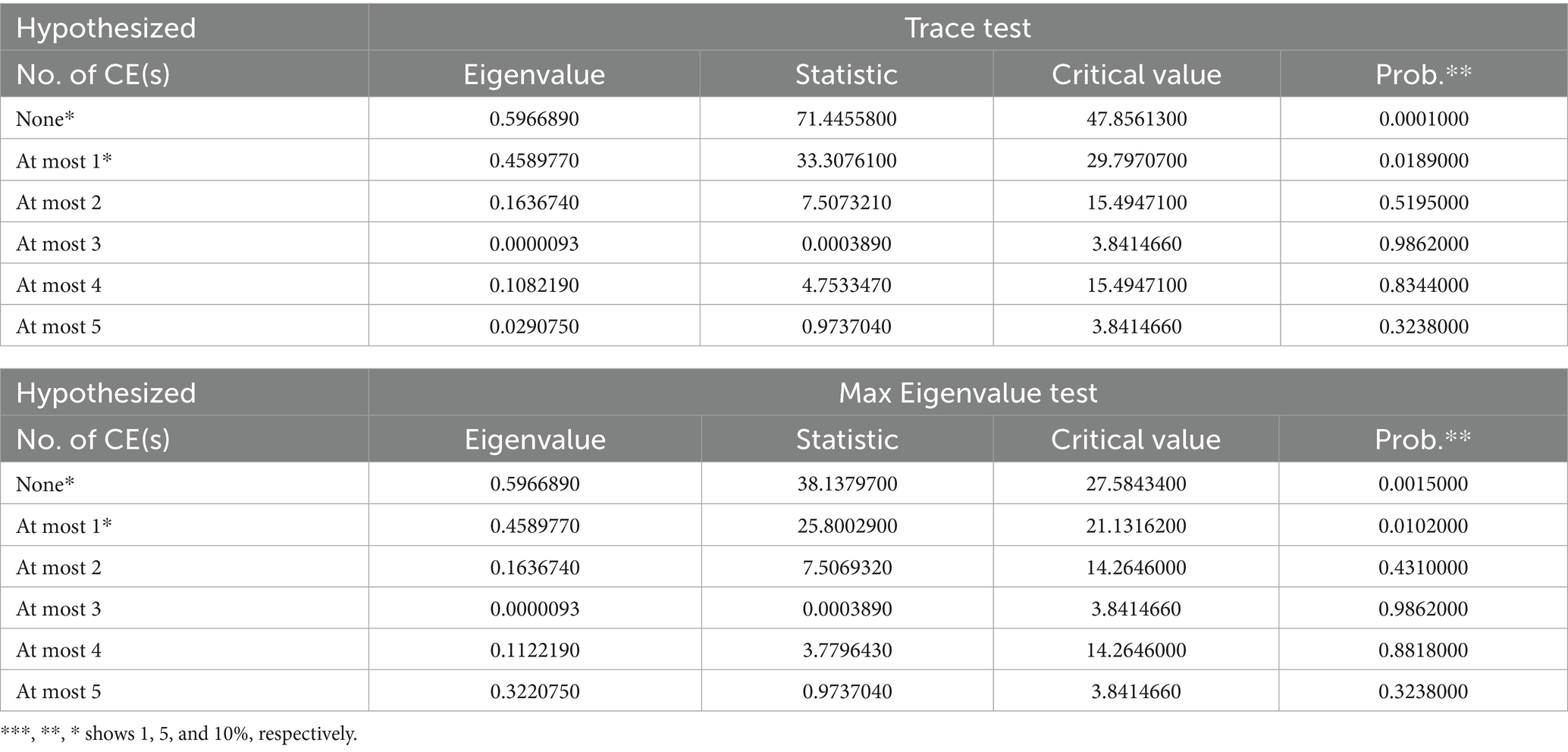

The outcomes of the Johansen co-integration test for SD, DTE, Energy Use (EU), and FDI in KSA and UAE are presented in Table 5. The Trace and Max-Eigenvalue statistics for evaluating the maximum rank of co-integrating equations, for both, at the 5% critical value. Utilizing the Trace test, we see test statistics of 71.45 and 33.31, which surpass the essential values of 47.85 and 29.80, respectively. Consequently, the null hypotheses of “no co-integration” and “at most one” are rejected, with p-values of 0.0001 and 0.0189, respectively and 0.0001 and 0.0189, respectively. Similarly, the Max-Eigenvalue test corroborates these findings by rejecting the null hypotheses of “none” and “at most one,” both associated with considerably greater p-values (0.0015 and 0.0102, respectively), results that align with those of Zaheer and Rashid (2014) and Liu et al. (2022). The findings indicate the existence of a minimum of two long-term equilibria among the variables. It already carries the assumption that digital transformation is not only dynamically submerged in a set of interconnections with sustainable development, but also dynamically coincide in terms of adaptive optimization with sustainable digital development in the long run, reaching an optimal state for both. The results confirm the robustness of the VECM framework and highlight that coordinated policies promoting simultaneous digitalization, sustainable energy consumption, and foreign direct investment might contribute positively to the long-run sustainability performance in both regions.

4.9 Fully modified least squares method (FMOLS)

There is a need for a method (FMOLS) which enables estimating long-term relationships inside Co-integrated variables restricting inessential statistical assumptions. This approach increases the reliability of the inference from the large amount of equation measurements because the errors between the equations are correlated. Employing this semi-parametric framework with FMOLS restricts the complexity of the estimation and leads to faster convergence rates, especially in the case of multi-co-integrated systems. FMOLS has many advantages; nevertheless, it is still limited to some constraints. When testing hypotheses in particular contexts, it may be conservative, making conclusions based on the results of the analysis less generalizable (Abid et al., 2022; Ur Rehman et al., 2023; Naseem et al., 2023).

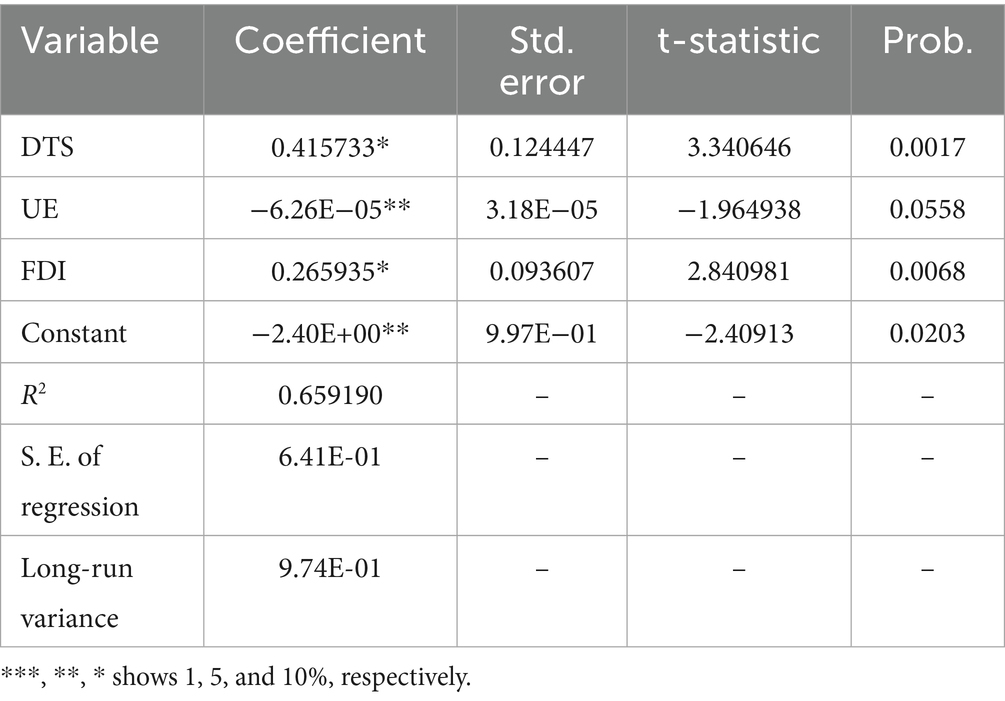

The long-term relationship effects of DT, EU, and FDI on SD in KSA and UAE are assessed using the FMOLS estimate in steps 2 and 3, as demonstrated in Table 6. The FMOLS technique accounts for endogeneity and serial correlation, consistent long-term coefficient estimates. The results reveal that the coefficient for DT is positive and statistically significant (β = 0.4157, p = 0.0017), underscoring a substantial contribution of digital transformation to sustainable development in the region. FDI demonstrates a positive and substantial effect (β = 0.2659, p = 0.0068), indicating that the influx of foreign capital fosters sustainability, maybe by transferring cleaner technology and innovative practices (Kalam, 2020; Mohsin et al., 2024). The EU exhibits a negative but minimal significant coefficient (β = −0.0000626, p = 0.0558), albeit weakly indicating a potential unfavorable association between increased energy consumption and sustainable development. The model demonstrates a robust fit, evidenced by an R-squared value of 0.659, signifying that 66% of the variation in sustainable development is accounted for by the independent variables. These findings underscore the strategic significance of both digitalization and foreign investment in achieving sustainable development objectives in the Gulf region.

4.10 Robustness test Dumitrescu-Hurlin causality

Table 7 illustrates the Dumitrescu-Hurlin causality test, a panel causality test designed to ascertain if one indicator may predict another within a panel dataset. Unlike classic causality tests, it considers the variety of dynamics within the interaction system across cross-sectional units, making it more suitable for panel data where correlations may differ among units. The DH test consolidates the results of individual cross-section causality, so offering a robust methodology for examining directional correlations in heterogeneous panels (Dumitrescu and Hurlin, 2012).

Results from the DH panel causality test reveal that nearly all variables are connected to each other with statistically significant bidirectional causal relationships, denoting persistent and strong dynamic interdependencies. In particular, information technology as a DT is found to Granger cause SD and vice-versa, pointing toward a mutual feedback relationship. Also, the EU Granger causes SD; on the other hand, SD Granger causes EU, thus suggesting a bounce feedback loop between environmental policy and energy behavior (Feedback loop interacts between environmental policy and energy behavior). Likewise, FDI directly causes SD but it is also affected by SD, revealing their mutual interdependence in sustainability. Thus, DTS could be Granger-caused by energy use, signifying the other side of the coin. On the other hand, FDI and DTS do not display a causal relationship, in either direction, with no significant causality between them (Khurshid et al., 2020; Imran et al., 2024). Moreover, FDI Granger causes EU, while the reverse does not occur, indicating that there is a one-way impact of capital inflow onto energy dynamics but not the other way around. The results show that the system remains tightly coupled with energy, digital and investment systems jointly contributing to sustainable development pathways (Salahuddin and Alam, 2016).

5 Discussion

This study investigates the relationships among DT, FDI, the EU, and SD in KSA and the UAE from 2000 to 2023. The findings provide significant insights into the interaction of economic, technical, and sustainability aspects in resource economies. The variables have a normal distribution, as indicated by descriptive statistics, notwithstanding slight skewness in the FDI and the EU values. The correlation matrix indicates a substantial positive association between SD and DTS (r = 0.737), as well as between SD and FDI (r = 0.626), demonstrating that enhanced digital infrastructure and capital inflows are linked to sustainability. The diminished association between EU and SD (r = 0.486) suggests a more intricate or indirect influence of energy use on sustainability. The outcomes of unit root tests (ADF, DFGLS, KPSS, and PP) indicate that the variables are integrated of order one, signifying non-stationarity and necessitating co-integration; hence, first differencing is the suitable transformation method (Table 1). The Johansen co-integration test indicates the presence of at least two statistically significant co-integrating equations, providing evidence of a long-run equilibrium connection among the variables examined. The findings endorse using DTS and/or FDI in sustainability models over an extended duration. The FMOLS regression results provide robust empirical validation for the theoretical assumptions. Digital transformation (β = 0.415, p < 0.01) is the most influential variable enhancing sustainable development, underscoring the importance of digital ecosystems in advancing resource efficiency, innovation, and governance. FDI exerts a substantial positive influence (β = 0.266, p < 0.01), highlighting the role of foreign capital in the dissemination of green technology, job creation, and economic diversification. The impact of energy consumption is minimal (β = −0.00006, p = 0.055) and statistically insignificant, implying that the kind of energy utilised or its efficiency may be more significant than the quantity of energy expended. The study reveals a mutual feedback relationship between DT and SD in the context of environmental policy and energy behavior. FDI directly causes SD but is also affected by SD, indicating their mutual interdependence in sustainability. However, FDI and DTS do not display a causal relationship in either direction, with no significant causality between them. FDI Granger causes EU, while the reverse does not occur, indicating a one-way impact of capital inflow onto energy dynamics. The results show that the system remains tightly coupled with energy, digital, and investment systems, jointly contributing to sustainable development pathways. This indicates that sustainability policies can influence appropriate energy consumption behaviors. The results suggest that energy consumption remains essential; nonetheless, it is digitalization and foreign direct investment upon which Gulf nations rely for sustainable growth. This dual causation indicates that synchronizing policy actions with the continuous development of digital capabilities is essential for achieving enduring sustainability advantages. The distinctions are significant for aligning economic growth with the environmental objectives of Vision 2030 for the sustainable development of Saudi Arabia and the UAE, hence accepting H1, H2, and H3.

5.1 Study limitations and future directions

Constraints of the research about the impact of Foreign Direct Investment on sustainable economic growth in the Kingdom of Saudi Arabia. The primary constraint is its reliance solely on secondary data sources (e.g., the World Bank), which may constrain the depth and specificity of the research. Robustness may be enhanced if further research integrates more granular sectorial data or does micro-level analysis to examine the effects of FDI on specific industries. The current study overlooks significant factors influencing growth, such as institutional quality and domestic economic reforms, which may not have remained consistent or easily measurable during this period or among different nations, unlike economic growth. Integrating these aspects in the future may enhance the capacity to discern the ramifications of internal governance and external market signals for FDI. Consequently, the environmental aspect of sustainability, a crucial component of the KSA Vision 2030 policy, remains inadequately explored. Subsequent studies ought to investigate how foreign direct investment affects environmental outcomes, including case studies, qualitative analysis, or firm-level surveys. These methodologies would improve the comprehension of FDI and its impacts, especially regarding the transformation of spillover effects at critical periods and the transition of employment and economic restructuring from non-oil industries.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found at: https://databank.worldbank.org/source/world-development-indicators# and https://ourworldindata.org/.

Author contributions

SM: Data curation, Formal analysis, Methodology, Writing – original draft. AS: Conceptualization, Data curation, Writing – original draft. AT: Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fhumd.2025.1523887/full#supplementary-material

References

Abubakar, Y. A., Haini, H., Saridakis, G., and Loon, P. W. (2025). Do production structures affect the relationship between foreign investment and entrepreneurship?. J. Entrep. Emerg. Econ. doi: 10.1108/JEEE-03-2024-0098

Abedi, S, and Moeenian, M. (2021). Investigating the effects of environmental patents and climate change mitigation technologies on sustainable economic growth in the Middle East. Int. J. Low-Carbon Technol. 16, 910–920. doi: 10.1093/ijlct/ctab007

Abid, A., Mehmood, U., Tariq, S., and Haq, Z. U. (2022). The effect of technological innovation, FDI, and financial development on CO2 emission: evidence from the G8 countries. Environ. Sci. Pollut. Res. 29, 11654–11662. doi: 10.1007/s11356-021-15993-x

Adanma, U. M., and Ogunbiyi, E. O. (2024). A comparative review of global environmental policies for promoting sustainable development and economic growth. Int. J. Appl. Res. Soc. Sci. 6, 954–977. doi: 10.51594/ijarss.v6i5.1147

Al Shammre, A. S., and Alshahrani, M. N. (2024). A dynamic analysis of sustainable economic growth and FDI inflow in Saudi Arabia using ARDL approach and VECM technique. Energies 17:4663. doi: 10.3390/en17184663

Alam, S. L., Naseem, S., and Mohsin, M. (2020). Is exchange rate volatility influenced by macroeconomic variables context of Pakistan. Int. J. Emerg. Technol. 11, 397–402. Available at: https://www.researchtrend.net/ijet/pdf/57%20Is%20Exchange%20Rate%20Volatility%20Influenced%20by%20Macroeconomic%20Variables%20%20In%20Context%20of%20Pakistan-3294.pdf

Alam, I., Lu, S., Sarfraz, M., and Mohsin, M. (2023). The interplay of green technology and energy consumption: a study of China’s carbon neutrality and sustainable digital economy. Energies 16:6184. doi: 10.3390/en16176184

Albitar, K., Gerged, A. M., Kikhia, H., and Hussainey, K. (2020). Auditing in times of social distancing: the effect of COVID-19 on auditing quality. Int. J. Account. Inf. Manag. 29, 169–178. doi: 10.1108/IJAIM-08-2020-0128

Alharthi, M., Islam, M. M., Alamoudi, H., and Murad, M. W. (2024). Determinants that attract and discourage foreign direct investment in GCC countries: do macroeconomic and environmental factors matter? PLoS One 19:e0298129. doi: 10.1371/journal.pone.0298129

Amin, H., Zaman, A., and Tok, E. (2023). Education for sustainable development and global citizenship education in the GCC: a systematic literature review. Global. Soc. Educ. 10, 1–16. doi: 10.1080/14767724.2023.2265846

Apergis, N., Payne, J. E., and Rayos-Velazquez, M. (2020). Carbon dioxide emissions intensity convergence: evidence from central American countries. Front. Energy Res. 7:158. doi: 10.3389/fenrg.2019.00158

Azam, T., Alam, I., Sarfraz, M., and Mohsin, M. (2023). Energizing sustainable development: renewable energy’s impact on south Asian environmental quality. Environ. Sci. Pollut. Res. 30, 109331–109342. doi: 10.1007/s11356-023-30045-2

Azmat, F., Lim, W. M., Moyeen, A., Voola, R., and Gupta, G. (2023). Convergence of business, innovation, and sustainability at the tipping point of the sustainable development goals. J. Bus. Res. 167:114170. doi: 10.1016/j.jbusres.2023.114170

Chenlu, L., Chen, X., and Di, Q. (2024). Path to pollution and carbon reduction synergy from the perspective of the digital economy: fresh evidence from 292 prefecture-level cities in China. Environ. Res. 252:119050. doi: 10.1016/j.envres.2024.119050

Deryag, E. M., and Khalifa, W. (2024). A panel analysis on the nexus between financial development, oil production, and trade-openness and its impact on sustainable economic growth: evidence from selected Arab economies. Sustain. For. 16:5192. doi: 10.3390/su16125192

Dickey, D. A., and Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49, 1057–1072. doi: 10.2307/1912517

Dincer, I., and Rosen, M. A. (1999). Energy, environment and sustainable development. Appl. Energy 64, 427–440. doi: 10.1016/S0306-2619(99)00111-7

Drake, L. (1993). Modelling UK house prices using cointegration: an application of the Johansen technique. Appl. Econ. 25, 1225–1228. doi: 10.1080/00036849300000183

Dumitrescu, E.-I., and Hurlin, C. (2012). Testing for granger non-causality in heterogeneous panels. Econ. Model. 29, 1450–1460. doi: 10.1016/j.econmod.2012.02.014

Energy, I. W., and Iea, A. (2020). IEA. Renewable Energy Market Update. Available at: https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=4f97988b4507735bd6f6349a98535db0838d4030

ESCAP, U., ECA, U., ECE, U., ECLAC, U., ESCWA, U. (2023). Digital and sustainable trade facilitation: global report 2023. Available at: https://repository.unescap.org/items/dc64e32e-72bc-47f9-91d4-19ab79cffe73

Hariram, N., Mekha, K., Suganthan, V., and Sudhakar, K. (2023). Sustainalism: an integrated socio-economic-environmental model to address sustainable development and sustainability. Sustain. For. 15:10682. doi: 10.3390/su151310682

IEA (2022). World energy outlook 2022. Paris: International Energy Agency (IEA). Available at: https://www.taylorfrancis.com/chapters/edit/10.4324/9781003292548-126/international-energy-agency%E2%80%94iea-ileana-citaristi

Ige, A. B., Kupa, E., and Ilori, O. (2024). Aligning sustainable development goals with cybersecurity strategies: ensuring a secure and sustainable future. GSC Adv. Res. Rev. 19, 344–360. Available at: https://www.greenfriendlylabs.com/wp-content/uploads/Aligning_sustainable_development_goals_with_cybers.pdf

Im, K. S., Pesaran, M. H., and Shin, Y. (2003). Testing for unit roots in heterogeneous panels. J. Econom. 115, 53–74. doi: 10.1016/S0304-4076(03)00092-7

Imran, M., Khan, M. K., Alam, S., Wahab, S., Tufail, M., and Jijian, Z. (2024). The implications of the ecological footprint and renewable energy usage on the financial stability of south Asian countries. Financ. Innov. 10:102. doi: 10.1186/s40854-024-00627-1

Johansen, S. (1992). Cointegration in partial systems and the efficiency of single-equation analysis. J. Econom. 52, 389–402. doi: 10.1016/0304-4076(92)90019-N

Kalam, K. (2020). The effects of macroeconomic variables on stock market returns: evidence from Malaysia’s stock market return performance. J. World Bus. 55, 1–13. Available at: https://www.researchgate.net/publication/344158504_The_Effects_of_Macroeconomic_Variables_on_Stock_Market_Returns_Evidence_from_Malaysia’s_Stock_Market_Return_Performance

Kanval, N., Ihsan, H., Irum, S., and Ambreen, I. (2024). Human capital formation, foreign direct investment inflows, and economic growth: a way forward to achieve sustainable development. J. Manage. Prac. Hum. Soc. Sci. 8, 48–61. doi: 10.33152/jmphss-8.3.5

Kayani, F. N., and Alzaid, O. (2024). Navigating the classical relationship between foreign direct investment and economic growth: a case of Saudi Arabia. Int. J. Sustain. Dev. Plann. 19, 4315–4322. doi: 10.18280/ijsdp.191120

Kaygusuz, K. (2012). Energy for sustainable development: a case of developing countries. Renew. Sust. Energ. Rev. 16, 1116–1126. doi: 10.1016/j.rser.2011.11.013

Khanna, T. M., Baiocchi, G., Callaghan, M., Creutzig, F., Guias, H., Haddaway, N. R., et al. (2021). A multi-country meta-analysis on the role of behavioural change in reducing energy consumption and CO2 emissions in residential buildings. Nat. Energy 6, 925–932. doi: 10.1038/s41560-021-00866-x

Khurshid, K., Noureen, S., and Hussain, B. (2020). Implementing the sustainable development goals for quality education in institutions of higher education in Pakistan: a qualitative analysis. IJITL 6, 159–173. doi: 10.35993/ijitl.v6i1.913

Kwilinski, A. (2023). The relationship between sustainable development and digital transformation: bibliometric analysis. Virtual Econ. 6, 56–69. doi: 10.34021/ve.2023.06.03(4)

Li, P., and Wu, J. (2023). Water resources and sustainable development. Water 16:134. doi: 10.3390/w16010134

Liu, S., Gao, L., Hu, X., Shi, J., Mohsin, M., and Naseem, S. (2022). Does industrial eco-innovative development and economic growth affect environmental sustainability? New evidence from BRICS countries. Front. Environ. Sci. 10:955173. doi: 10.3389/fenvs.2022.955173

Liu, B., Qiu, Z., Hu, L., Hu, D., and Nai, Y. (2024). How digital transformation facilitate synergy for pollution and carbon reduction: evidence from China. Environ. Res. 251:118639. doi: 10.1016/j.envres.2024.118639

Lozano, R., Nummert, B., and Ceulemans, K. (2016). Elucidating the relationship between sustainability reporting and organizational change management for sustainability. J. Clean. Prod. 125, 168–188. doi: 10.1016/j.jclepro.2016.03.021

Majid, M. (2020). Renewable energy for sustainable development in India: current status, future prospects, challenges, employment, and investment opportunities. Energy Sustain. Soc. 10, 1–36. doi: 10.1186/s13705-019-0232-1

Mishra, M., Desul, S., Santos, C. A. G., Mishra, S. K., Kamal, A. H. M., Goswami, S., et al. (2024). A bibliometric analysis of sustainable development goals (SDGs): a review of progress, challenges, and opportunities. Environ. Dev. Sustain. 26, 11101–11143.

Mngumi, F., Huang, L., Xiuli, G., and Ayub, B. (2024). Financial efficiency and CO2 emission in BRICS. Dose digital economy development matter? Heliyon 10:e24321. doi: 10.1016/j.heliyon.2024.e24321

Mohsin, M., Xuhua, H., Sarfraz, M., and Naseem, S. (2024). Going green for good: how sustainable economic development and green energy resources are driving carbon neutrality in G-7 countries? Sustain. Dev. 32, 1226–1242. doi: 10.1002/sd.2734

Naseem, S., Hu, X., Sarfraz, M., and Mohsin, M. (2024). Strategic assessment of energy resources, economic growth, and CO2 emissions in G-20 countries for a sustainable future. Energy Strateg. Rev. 52:101301. doi: 10.1016/j.esr.2024.101301

Naseem, S., Mohsin, M., and Zhao, X. (2023). The influence of land utilization and urbanization, on environmental decay in G-20 countries: novel implications for sustainable urban growth. Acta Polytech. Hung. 20:10. doi: 10.12700/APH.20.10.2023.10.4

Ni, L., Ahmad, S. F., Alshammari, T. O., Liang, H., Alsanie, G., Irshad, M., et al. (2023). The role of environmental regulation and green human capital towards sustainable development: the mediating role of green innovation and industry upgradation. J. Clean. Prod. 421:138497. doi: 10.1016/j.jclepro.2023.138497

Noureen, T., Malik, M. Z., Khuhro, N. A., and Zafar, M. A. (2024). Exploring the dynamics of CO2 emissions, FDI, and technological innovation on economic growth: evidence from BRICS nations by using CS-ARDL. Pakistan J. Hum. Soc. Sci. 12, 2456–2469. doi: 10.52131/pjhss.2024.v12i3.2448

Omer, A. M. (2008). Energy, environment, and sustainable development. Renew. Sust. Energ. Rev. 12, 2265–2300. doi: 10.1016/j.rser.2007.05.001

Onwuka, O. U., and Adu, A. (2024). Technological synergies for sustainable resource discovery: enhancing energy exploration with carbon management. Eng. Sci. Technol. J. 5, 1203–1213. doi: 10.51594/estj.v5i4.996

Osborn, D., Cutter, A., and Ullah, F. (2015). Universal sustainable development goals. Understanding Transform. Challenge Dev. Countries 2, 1–25. Available at: https://sustainabledevelopment.un.org/content/documents/1684SF_-_SDG_Universality_Report_-_May_2015.pdf

Razzaq, A., Sharif, A., Ahmad, P., and Jermsittiparsert, K. (2021). Asymmetric role of tourism development and technology innovation on carbon dioxide emission reduction in the Chinese economy: fresh insights from QARDL approach. Sustain. Dev. 29, 176–193. doi: 10.1002/sd.2139

Rehman, A., Ullah, I., Afridi, F.-e.-A., Ullah, Z., Zeeshan, M., Hussain, A., et al. (2021). Adoption of green banking practices and environmental performance in Pakistan: a demonstration of structural equation modeling. Environ. Dev. Sustain. 23:1206. doi: 10.1007/s10668-020-01206-x

Sadiq, S., Kaiwei, J., Aman, I., and Mansab, M. (2025). Examine the factors influencing the behavioral intention to use social commerce adoption and the role of AI in SC adoption. Eur. Res. Manag. Bus. Econ. 31:100268. doi: 10.1016/j.iedeen.2024.100268

Sadiq, M., Ngo, T. Q., Pantamee, A. A., Khudoykulov, K., Ngan, T. T., and Tan, L. P. (2023). The role of environmental social and governance in achieving sustainable development goals: evidence from ASEAN countries. Econ. Res.-Ekon. Istraž. 36, 170–190. doi: 10.1080/1331677X.2022.2072357

Salahuddin, M., and Alam, K. (2016). Information and communication technology, electricity consumption and economic growth in OECD countries: a panel data analysis. Int. J. Electr. Power Energy Syst. 76, 185–193. doi: 10.1016/j.ijepes.2015.11.005

Samour, A., Baskaya, M. M., and Tursoy, T. (2022). The impact of financial development and FDI on renewable energy in the UAE: a path towards sustainable development. Sustain. For. 14:1208. doi: 10.3390/su14031208

Sarasini, S., Bocken, N., Diener, D., Velter, M., and Whalen, K. (2024). Reviewing the climatic impacts of product service systems: implications for research and practice. J. Clean. Prod. 452:142119. doi: 10.1016/j.jclepro.2024.142119

Sarfraz, M., Naseem, S., and Mohsin, M. (2022). Adoption of renewable energy, natural resources with conversion information communication technologies and environmental mitigation: evidence from G-7 countries. Energy Rep. 8, 11101–11111. doi: 10.1016/j.egyr.2022.08.248

Shahzad, S. J. H., Kumar, R. R., Zakaria, M., and Hurr, M. (2017). Carbon emission, energy consumption, trade openness, and financial development in Pakistan: a revisit. Renew. Sust. Energ. Rev. 70, 185–192. doi: 10.1016/j.rser.2016.11.042

Sherif, M., Liaqat, M. U., Baig, F., and Al-Rashed, M. (2023). Water resources availability, sustainability and challenges in the GCC countries: an overview. Heliyon 9:e20543. doi: 10.1016/j.heliyon.2023.e20543

Shin, Y., and Schmidt, P. (1992). The KPSS stationarity test as a unit root test. Econ. Lett. 38, 387–392. doi: 10.1016/0165-1765(92)90023-R

Ur Rehman, M. Z., Alam, I., Shichang, L., Razzaq, S., Mohsin, M., and Azam, T. (2023). The investigations of long and short-term relationships between macroeconomic variables and stock markets: evidence from China and Pakistan. Comput. Math. Appl. 1, 21–30. doi: 10.17352/cma.000003

Voica, M. C., Panait, M., and Haralambie, G. A. (2015). The impact of foreign direct investment on sustainable development. Petroleum-Gas Univ. Ploiesti Bullet. Tech. Series 67, 89–103. Available at: http://upg-bulletin-se.ro/old_site/archive/2015-3/10.Voica_Panait_Haralambie.pdf

World Bank (2018). Pathways for peace: Inclusive approaches to preventing violent conflict. London: World Bank. Available at: https://www.worldbank.org/en/topic/fragilityconflictviolence/publication/pathways-for-peace-inclusive-approaches-to-preventing-violent-conflict

Xie, J., Ahmed, Z., Zhang, P., Khan, S., and Alvarado, R. (2024). Financial expansion and CO2 mitigation in top twenty emitters: investigating the direct and moderating effects of the digital economy. Gondwana Res. 125, 1–14. doi: 10.1016/j.gr.2023.07.013

Yousaf, Z., Radulescu, M., Sinisi, C. I., Serbanescu, L., and Păunescu, L. M. (2021). Towards sustainable digital innovation of SMEs from developing countries in the context of the digital economy and frugal environment. Sustain. For. 13:5715.

Zaheer, A., and Rashid, K. (2014). Time series analysis of the relationship between macroeconomic factors and the stock market returns in Pakistan. Yaşar Üniversitesi E-Dergisi 9, 6361–6370.

Keywords: sustainable development, digital transformation, energy use, FMOLS, technology development

Citation: Muneer S, Singh A and Tripathi A (2025) Economic evolution in the digital age: assessing the influence of digital transformation and energy consumption on sustainable development. Front. Hum. Dyn. 7:1523887. doi: 10.3389/fhumd.2025.1523887

Edited by:

Taner Güney, Karamanoğlu Mehmetbey University, TürkiyeReviewed by:

Bibhu Dash, University of the Cumberlands, United StatesMaria Mavri, University of the Aegean, Greece

Copyright © 2025 Muneer, Singh and Tripathi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Saqib Muneer, c2EubXVuZWVyQHVvaC5lZHUuc2E=

Saqib Muneer

Saqib Muneer Ajay Singh

Ajay Singh Abhishek Tripathi3

Abhishek Tripathi3