- Faculty of Social and Political Sciences, Department of Communication Sciences, Hasanuddin University, Makassar, Indonesia

This study investigates the proliferation of economic conspiracy theories on Indonesian social media platforms and their impact on financial decision-making, particularly regarding gold investment during the 2025 economic uncertainty period. The research examines how conspiracy narratives spread and influence investment behaviors through a comprehensive mixed-method approach combining network analysis, content analysis, and survey research of 2,847 social media users using stratified random sampling across Indonesian provinces. The findings reveal that 37.4% of surveyed investors reported exposure to economic conspiracy theories, with 22.6% admitting these narratives influenced their investment decisions, with significant variations across demographic groups. Network analysis identified key propagation patterns, showing how conspiracy theories cluster around specific economic events and influencers. The study contributes to the literature on digital misinformation by developing an integrated Digital Disinformation Behavior Model (DDBM) that causally links information cascade theory, social identity theory, and protection motivation theory to explain economic conspiracy theory adoption and subsequent financial behavior. These findings have significant implications for financial literacy programs, regulatory frameworks, and the development of effective counter-disinformation strategies in the digital age.

Introduction

In early 2025, as global economic uncertainties intensified and gold prices reached historic highs, a peculiar phenomenon emerged across Indonesian social media platforms. From office workers to retirees, ordinary citizens began sharing elaborate theories about imminent economic collapse, global conspiracies to control wealth, and the supposed salvific properties of gold investment. These narratives spread remarkably and began influencing investment decisions nationwide, ranging from claims about a “Great Reset” that would eliminate all paper currency to prophecies of digital infrastructure collapse.

This phenomenon represents more than mere online chatter. Preliminary observations revealed Indonesian investors withdrawing substantial sums from banks, purchasing physical gold at unprecedented rates, and fundamentally altering their financial strategies based on information gleaned from social media. The scale of this behavioral shift suggests researchers are witnessing a new form of market influence where digital conspiracy theories directly shape economic behavior, potentially destabilising traditional financial systems.

Analysis of conspiracy theory propagation reveals significant regional variations across Indonesia’s diverse archipelago. Geographic distribution shows the highest concentration in Java (58.4% of posts), Sumatra (21.3%), and other outer islands (20.3%). Urban areas demonstrate a 4.7:1 higher posting ratio compared to rural regions, indicating differential digital access and literacy levels. Jakarta accounts for 41.2% of all conspiracy-related posts despite representing only 3.3% of Indonesia’s population, highlighting the capital’s role as an information dissemination hub.

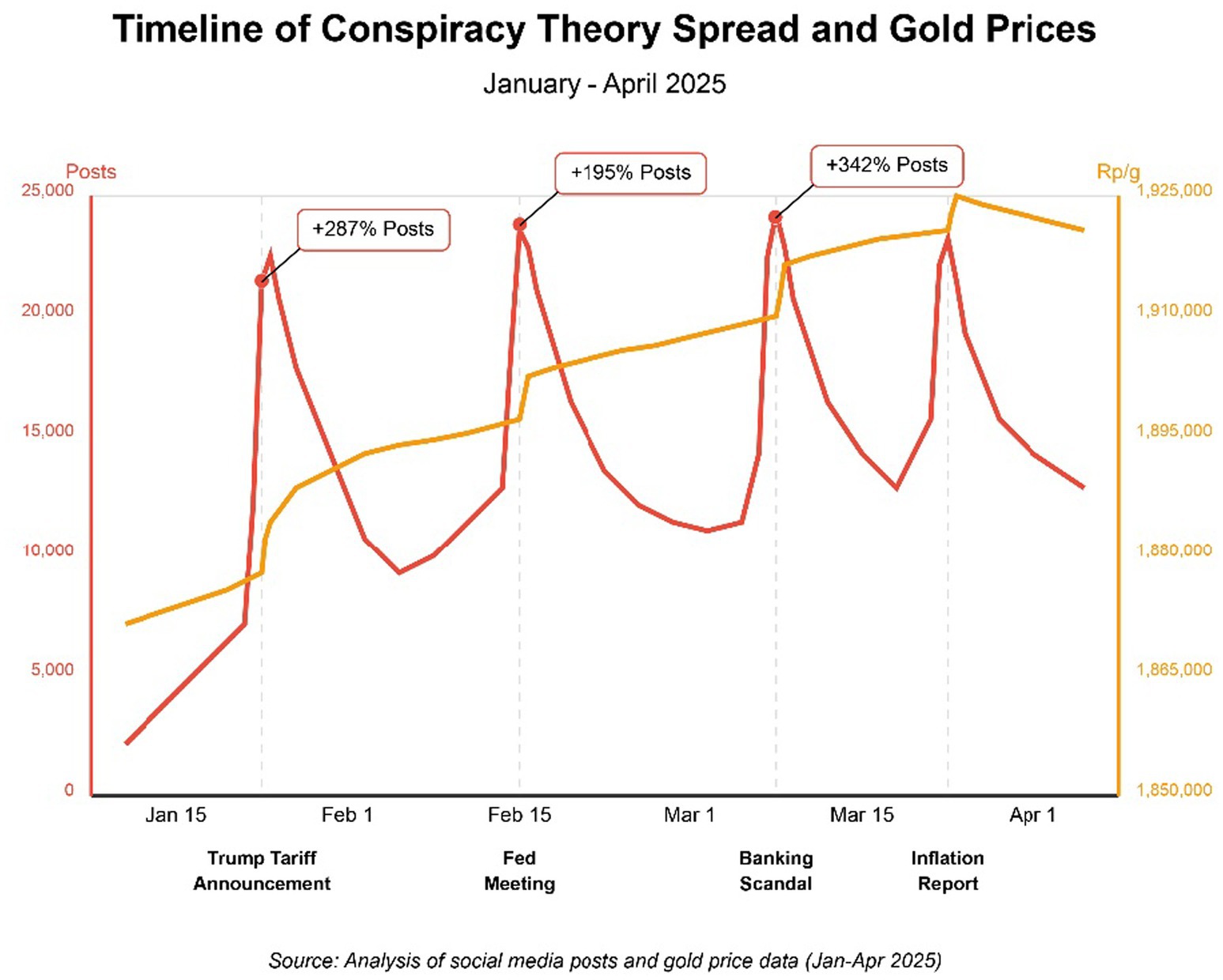

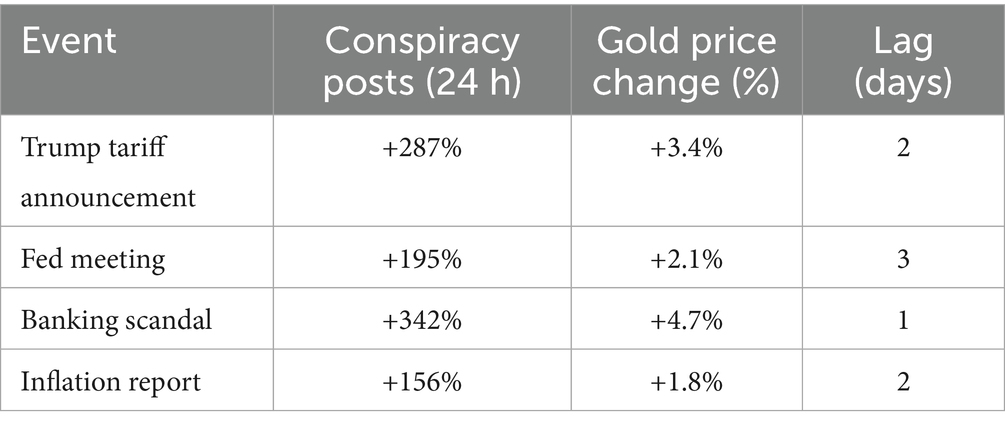

Longitudinal analysis reveals distinct temporal patterns in conspiracy narrative evolution. Pre-economic event periods showed baseline conspiracy activity of 3,200 posts per day. Following major economic announcements, conspiracy posts demonstrated predictable surge patterns: Trump tariff announcements (+287% within 24 h), Federal Reserve meetings (+195%), and banking scandals (+342%), establishing clear correlations between economic uncertainty and conspiracy narrative amplification.

Indonesia provides an ideal context for examining this phenomenon. As Southeast Asia’s largest economy with over 195 million internet users and a gold market deeply embedded in cultural traditions, the country exemplifies the convergence of digital transformation with traditional economic practices. The rapid adoption of social media platforms has created new channels for financial information dissemination. Yet, these same channels have become conduits for misinformation that exploits economic anxieties and cultural beliefs (Figures 1–3).

The timing of this research is particularly significant. The global economic landscape of 2025, marked by trade tensions, inflationary pressures, and technological disruptions, has created fertile ground for economic conspiracy theories. Unlike political conspiracies influencing voting behavior, economic conspiracies directly impact market dynamics, investment flows, and financial stability. When these theories gain traction in emerging markets like Indonesia, where financial literacy varies widely and institutional trust remains fragile, the consequences can be profound (Tables 1–7).

What makes this phenomenon especially intriguing is its departure from traditional patterns of financial misinformation. Rather than simple fraud or pump-and-dump schemes, these conspiracy theories construct elaborate alternative realities that reframe global economic events through local cultural lenses. They blend legitimate economic concerns with fantastic predictions, creating implausible yet compelling narratives for many investors.

This study addresses a critical gap in understanding how digital misinformation influences economic behavior in emerging markets. While existing research has extensively examined political misinformation and its spread through social networks, economic disinformation presents unique characteristics that distinguish it from other forms of misinformation. Unlike political conspiracies that influence voting behavior or health misinformation affecting personal wellness decisions, economic conspiracy theories directly impact market dynamics, investment flows, and financial stability with immediate, measurable consequences. Economic disinformation differs fundamentally from financial fraud misinformation by constructing elaborate alternative economic realities rather than promoting simple fraudulent investment schemes.

The research seeks to unravel this complex phenomenon by examining how economic conspiracy theories propagate through Indonesian social media networks, why certain narratives gain traction while others fade, and most importantly, how these digital stories translate into real-world investment decisions. Combining network analysis, content examination, and behavioral surveys, we aim to provide the first comprehensive account of how digital conspiracy theories reshape financial behaviors in an emerging market context.

The implications of this research extend beyond Indonesia. As digital platforms increasingly mediate economic information globally, understanding how conspiracy theories influence financial decisions becomes crucial for market stability, investor protection, and economic policy. This study offers insights into a phenomenon that may well define the future relationship between digital communication and financial behavior in the 21st century.

Literature review

The emergence of digital disinformation as a force capable of shaping economic behavior represents a convergence of multiple scholarly streams, each offering crucial insights into this complex phenomenon. Our understanding must begin with the foundational work on information cascades and herding behavior in financial markets, then trace how these concepts have evolved in the digital age.

The seminal work of Bikhchandani et al. (1992) on informational cascades provides a critical theoretical foundation for understanding how beliefs spread through populations. Their model demonstrates how individuals, observing others’ actions, may rationally choose to follow the crowd even when their private information suggests otherwise. This framework becomes particularly relevant in digital environments where social media algorithms amplify cascade effects far beyond what traditional models predicted.

Robert Shiller’s work on narrative economics (2017, 2019) marks a crucial evolution in our understanding of how stories drive economic behavior. Shiller argues that narratives function like viruses, spreading through populations and influencing economic decisions in ways that traditional models fail to capture. His “narrative contagion” concept finds powerful expressions in social media platforms, where conspiracy theories can achieve viral status within hours. As Shiller notes, these narratives often succeed not because they are true, but because they are compelling and emotionally resonant.

The psychological dimensions of conspiracy belief have been extensively documented by Douglas et al. (2019), who identify three primary motives driving conspiracy theory adoption: epistemic (the need to understand), existential (the need for security), and social (the need for positive self-image). Their framework helps explain why economic uncertainty creates fertile ground for conspiracy theories. Van Prooijen and Douglas (2018) Extend this work by demonstrating how societal crisis conditions amplify conspiracy thinking, a finding particularly relevant to our study of economic uncertainty in Indonesia.

The digital transformation of information dissemination has fundamentally altered how financial misinformation spreads. Vosoughi et al. (2018) A landmark study showed that false news spread significantly faster and deeper than trustworthy news on Twitter, reaching more people and generating more engagement. These findings challenge traditional assumptions about market efficiency and rational information processing. As Lazer et al. (2018) In their analysis of fake news science, the digital ecosystem creates unique challenges for information verification and truth determination.

Recent work on social media’s impact on financial markets provides crucial context for our study. Bollen et al. (2011) demonstrated that Twitter sentiment could predict stock market movements, while Chen et al. (2014) found that opinions transmitted through social media contain valuable information for predicting stock returns. However, these studies primarily focused on legitimate financial discourse rather than conspiracy theories. The research addresses this gap by examining how conspiratorial content influences market behavior.

Surjatmodjo et al. (2024) a recent systematic review of disinformation spread on social media offers particularly relevant insights for our study. Their analysis of 150 peer-reviewed studies reveals that disinformation spreads six times faster than accurate information, with emotions and platform algorithms playing significant roles. They identify key vulnerability factors, including low digital literacy, political polarization, and declining trust in institutions, all of which resonate with the findings in the Indonesian context.

The role of artificial intelligence in transforming information ecosystems has been comprehensively examined by Sonni et al. (2024), who highlight how AI technologies reshape journalistic practices and news narratives. Their research on digital newsroom transformation reveals how automated systems can combat and inadvertently amplify misinformation, creating new challenges for information verification. This work underscores the technological complexity underlying contemporary disinformation campaigns.

Cultural factors in financial decision-making have received attention from scholars like Hasan and Baharom (2021), who examine gold investment behavior in Muslim-majority countries. Their work reveals how religious and cultural beliefs intertwine with economic rationality, creating unique patterns of investment behavior. This cultural lens proves essential for understanding how global conspiracy theories adapt to local contexts, as we observe in Indonesian social media.

The behavioral finance literature, pioneered by Kahneman and Tversky (1979) and extended by scholars like Akerlof and Shiller (2009) provides theoretical foundations for understanding how psychological factors influence financial decisions. Their work on cognitive biases and “animal spirits” helps explain why individuals might embrace conspiracy theories despite contrary evidence. Baker and Wurgler (2007) research on investor sentiment further illuminates how collective emotions can drive market movements independent of fundamental values.

The spread of conspiracy theories in digital environments has been examined through various theoretical lenses. Sunstein and Vermeule (2009) Work on conspiracy theories’ causes and cures identifies how these beliefs proliferate in environments characterized by group polarization and limited information. Their concept of “crippled epistemology” – where individuals form beliefs based on limited, often misleading information – finds new relevance in algorithm-driven social media environments.

Network effects in financial markets have been studied extensively, with Hirshleifer and Teoh (2003) providing comprehensive reviews of herding behavior and cascading effects. However, these traditional models require updating for digital contexts where algorithmic amplification creates unprecedented scale and speed feedback loops. The research extends this literature by demonstrating how conspiracy-driven herding differs from traditional market herding.

The intersection of social media, political polarization, and disinformation has been explored by Tucker et al. (2018), who highlight how digital platforms can exacerbate ideological divisions. Bail et al. (2018) Demonstrate that exposure to opposing views on social media can increase polarization, suggesting that simple exposure to correct information may not effectively counter conspiracy beliefs. These findings inform our understanding of why traditional fact-checking approaches often fail with conspiracy believers.

Recent research on digital literacy and misinformation resistance offers both hope and concern. Pennycook and Rand (2019) Argue that susceptibility to fake news results more from lazy thinking than motivated reasoning, suggesting improved critical thinking skills could enhance resistance. However, the findings complicate this picture by showing that high digital literacy sometimes increases vulnerability to sophisticated conspiracy theories.

The literature on crisis communication and trust in institutions provides additional context for the findings. Lewandowsky et al. (2017) examine strategies for countering misinformation in the “post-truth” era, emphasising the importance of addressing underlying psychological needs that conspiracy theories fulfil. Their work suggests that effective counterstrategies must go beyond mere fact-correction to address emotional and social factors driving conspiracy belief.

This rich tapestry of scholarship provides the theoretical foundation for investigation. By synthesising insights from information economics, behavioral finance, psychology, communication studies, and cultural analysis, we develop a framework capable of explaining how economic conspiracy theories spread through Indonesian social media and influence financial behavior. The research extends this literature by demonstrating how digital platforms create new forms of information asymmetry and market inefficiency, challenging traditional economic models and demanding new theoretical approaches for the digital age.

Theoretical framework

This study develops an integrated theoretical framework that synthesizes three complementary perspectives into a unified “Digital Disinformation Behavior Model” (DDBM). This model transcends the limitations of applying individual theories by creating a coherent, multi-stage process that explains how economic conspiracy theories emerge, spread, and influence financial behavior in digital environments.

The DDBM operates through three interconnected stages, each building upon the previous while incorporating insights from established theoretical perspectives. The first stage, “Algorithmic Amplification,” extends Bikhchandani et al. (1992) information cascade theory to account for digital platform dynamics. Traditional cascade models assume rational actors observing others’ actions, but digital environments fundamentally alter this process. Drawing on Surjatmodjo et al. (2024) findings that disinformation spreads six times faster than accurate information, the model recognizes that algorithmic curation systems prioritize engagement over accuracy, creating “super-cascades” that exceed natural information flow patterns.

The second stage, “Identity Resonance,” incorporates social identity theory (Tajfel and Turner, 1979) to explain why certain conspiracy narratives gain traction while others fail. During economic uncertainty, individuals experience heightened needs for positive social identity and group belonging. Conspiracy theories that align with existing cultural beliefs and social identities achieve greater resonance, creating what the model terms “cultural amplification effects.” This explains why global conspiracy narratives undergo local adaptation, incorporating religious, ethnic, or regional elements that enhance their persuasive power.

The third stage, “Protective Action,” applies protection motivation theory (Rogers, 1975), to explain the translation of conspiracy beliefs into specific financial behaviors. When individuals perceive severe threats to their economic security, they seek protective responses that promise control and safety. The model recognizes that conspiracy theories succeed not merely by creating fear but by offering concrete solutions that restore perceived agency.

These three stages operate cyclically rather than linearly. Protective actions (such as gold purchases) generate new social proof that feeds back into the amplification process, while successful identity resonance strengthens group cohesion, increasing susceptibility to future conspiracy narratives. This cyclical nature explains the persistence and evolution of conspiracy beliefs observed in the research data.

The DDBM advances beyond existing theoretical approaches by incorporating the unique characteristics of digital environments, including algorithmic mediation, cultural adaptation mechanisms, and feedback loops between online discourse and offline behavior. This integrated framework provides both explanatory power for observed phenomena and predictive capability for understanding how conspiracy theories might evolve in different cultural or technological contexts.

Methodology

This investigation into the phenomenon of economic conspiracy theories in Indonesian social media required a methodological approach as multifaceted as the phenomenon itself. Given the complex interplay between digital communication, cultural beliefs, and financial behavior, we developed a sequential mixed-method design that would allow us to capture the phenomenon’s breadth and its nuanced impacts on individual decision-making.

The research journey began with an extensive data collection phase spanning January to April 2025, marked by significant economic uncertainty and heightened social media activity around financial topics. We cast a wide net across multiple platforms, Instagram, Facebook, Twitter, and YouTube, to capture the full spectrum of conspiracy discourse. Our initial sweep yielded 478,923 posts containing keywords related to gold investment and economic conspiracy theories. This massive dataset provided our first glimpse into the scale and diversity of the phenomenon we were studying.

Stratified random sampling design

The survey component employed stratified random sampling to ensure demographic representativeness. The sampling frame utilized Statistics Indonesia (BPS) demographic data across key variables:

• Geographic strata: Java (60%), Sumatra (20%), other islands (20%)

• Age cohorts: 18–25 (25%), 26–35 (30%), 36–50 (30%), 51 + (15%)

• Education levels: Primary (20%), Secondary (40%), Tertiary (40%)

• Income quintiles: Equal representation across five income levels

• Urban–rural distribution: Urban (70%), Rural (30%), with rural oversampling to address the digital divide

Demographic representativeness strategies

1. Multi-platform recruitment (Facebook, Instagram, Twitter, WhatsApp) to capture diverse user demographics

2. Incentive structures vary by income level to encourage cross-economic participation

3. Survey availability in Indonesian and major regional languages (Javanese, Sundanese, Batak)

4. Community organization partnerships to reach offline populations

5. Post-stratification weighting to match national demographic distributions

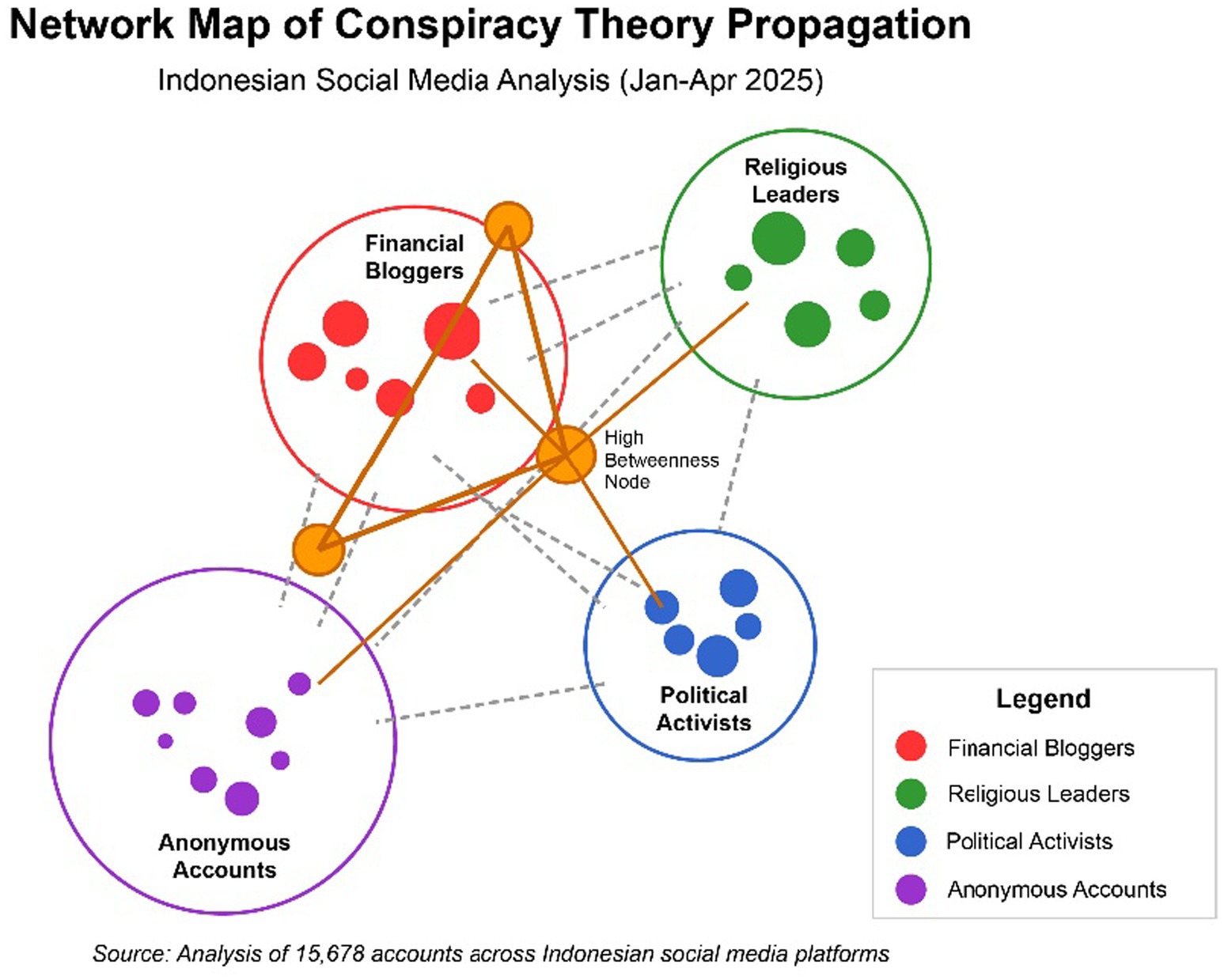

We employed sophisticated social network analysis techniques to understand how these conspiracy narratives spread through digital networks. Using a combination of API access and carefully designed web scraping protocols that complied with the platform’s terms of service, we mapped the connections between 15,678 accounts actively discussing economic conspiracy theories. This network mapping revealed not just who was talking about these theories, but how information flowed through different communities and which actors held the most influence in shaping the discourse.

Network analysis results underwent rigorous statistical validation through collaboration with certified statisticians from Hasanuddin University’s Statistics Department. Validation procedures included:

1. Bootstrap Resampling (n = 1,000) to establish confidence intervals for centrality measures

2. Permutation Tests to assess the significance of network clustering patterns

3. Robustness Checks through Systematic Edge Deletion Analysis

4. Cross-validation of community detection algorithms using modularity optimization

5. Inter-rater Reliability testing for content coding (Cohen’s κ = 0.87)

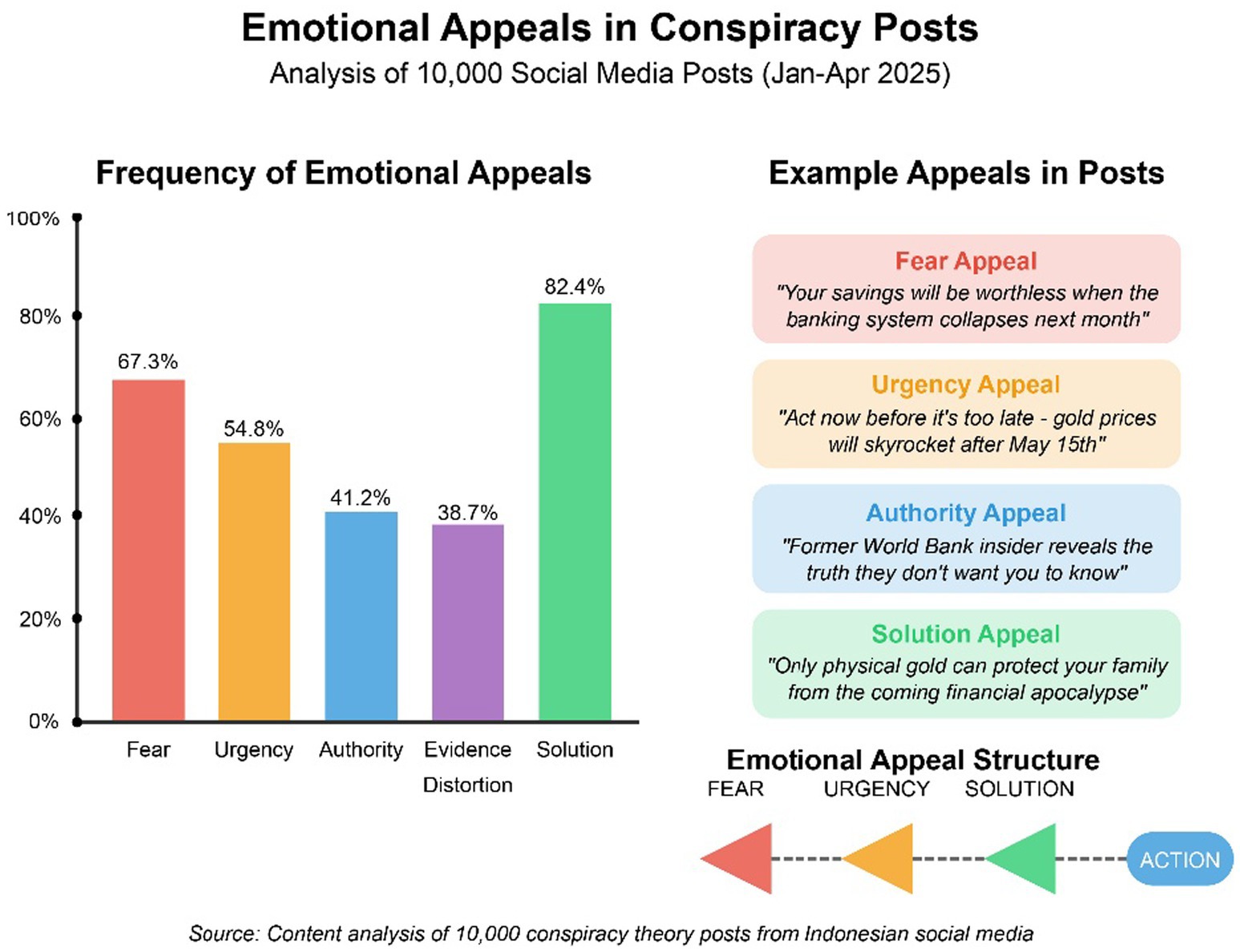

The quantitative analysis, while revealing, could not fully capture the richness and complexity of the conspiracy narratives themselves. Therefore, we conducted a detailed content analysis of 10,000 randomly selected posts. A team of trained researchers, fluent in Indonesian and English, carefully coded each post for conspiracy theory types, emotional appeals, and specific calls to action. We implemented a rigorous double-coding process to ensure reliability with a Cohen’s kappa of 0.87, indicating strong inter-coder agreement.

Perhaps the most crucial component of our methodology was direct engagement with social media users through a comprehensive online survey. We recruited 2,847 Indonesian participants who had actively engaged with gold investment content on social media. The survey instrument, developed through extensive pilot testing and expert consultation, measured exposure to conspiracy theories and actual investment behaviors, financial literacy levels, and psychological factors such as trust in institutions and risk tolerance.

This analytical approach combined multiple techniques to triangulate findings and ensure robust conclusions. Network analysis using Gephi software allowed us to identify key influencers and map the flow of conspiracy narratives through different communities. We employed community detection algorithms to uncover clusters of conspiracy beliefs and calculated various centrality measures to understand the relative importance of different actors in the network.

The content analysis phase involved developing a sophisticated coding framework that captured both explicit and implicit elements of conspiracy messaging. We coded for emotional appeals, authority claims, evidence distortion, and specific investment recommendations. This granular analysis revealed patterns in how conspiracy theories were constructed and disseminated across different platforms.

For the quantitative analysis of survey data, we employed multiple regression models to examine the relationship between conspiracy theory exposure and investment behavior. We controlled demographic variables, financial literacy, and risk tolerance to isolate the specific impact of conspiracy beliefs. Structural equation modelling allowed us to test more complex relationships, including the mediating role of institutional trust in the pathway from conspiracy exposure to investment decisions.

Throughout the research, we remained acutely aware of the ethical implications of studying conspiracy theories and their believers. Our institutional ethics committee approved all data collection procedures, and we took extensive measures to protect participant privacy and ensure informed consent. We anonymized all social media data and implemented secure data storage protocols to prevent potential harm to research participants.

This methodological choices were driven by our commitment to understanding this phenomenon in all its complexity. By combining large-scale quantitative analysis with deep qualitative insights, we were able to paint a comprehensive picture of how economic conspiracy theories spread through Indonesian social media and influence real-world financial decisions. This multi-method approach not only strengthened the validity of the findings but also allowed us to capture nuances that a narrower methodological focus might have missed.

Results

This investigation into the propagation of economic conspiracy theories through Indonesian social media and their impact on financial behavior yielded a rich tapestry of findings illuminating this complex phenomenon. Through careful analysis of nearly half a million social media posts, extensive network mapping, and thousands of user surveys, patterns that challenge conventional understanding of how digital misinformation influences economic decision-making emerged.

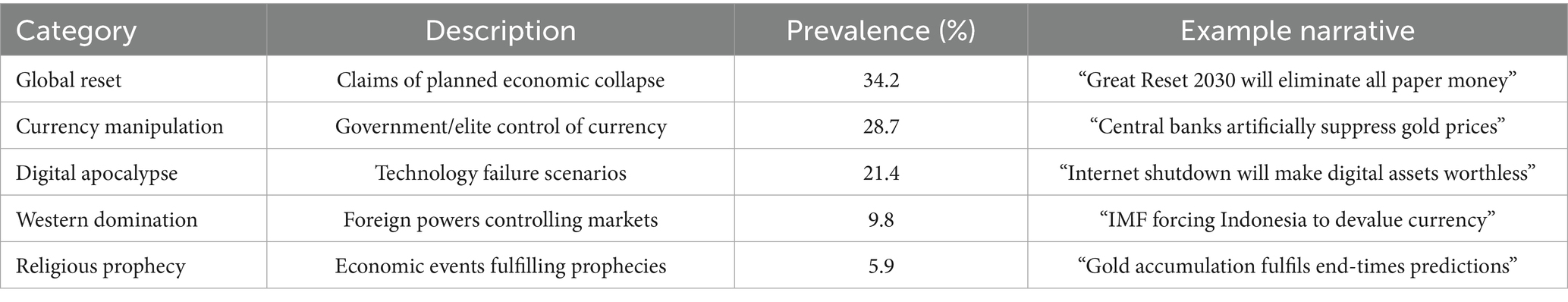

Typology of economic conspiracy theories

The content analysis revealed a sophisticated economic conspiracy narrative ecosystem that blends global anxieties with local cultural elements. The “Global Reset” conspiracy, the most prevalent category, appeared in 34.2% of analyzed posts, weaving elaborate tales of planned economic collapse orchestrated by shadowy elites. These narratives often referenced specific dates and events, creating a sense of urgency that drove immediate investment action.

The “Currency Manipulation” category, comprising 28.7% of posts, demonstrated how conspiracy theorists appropriate legitimate economic concepts to construct alternative explanations for market movements. These narratives particularly resonated during periods of currency volatility, offering simple explanations for complex economic phenomena.

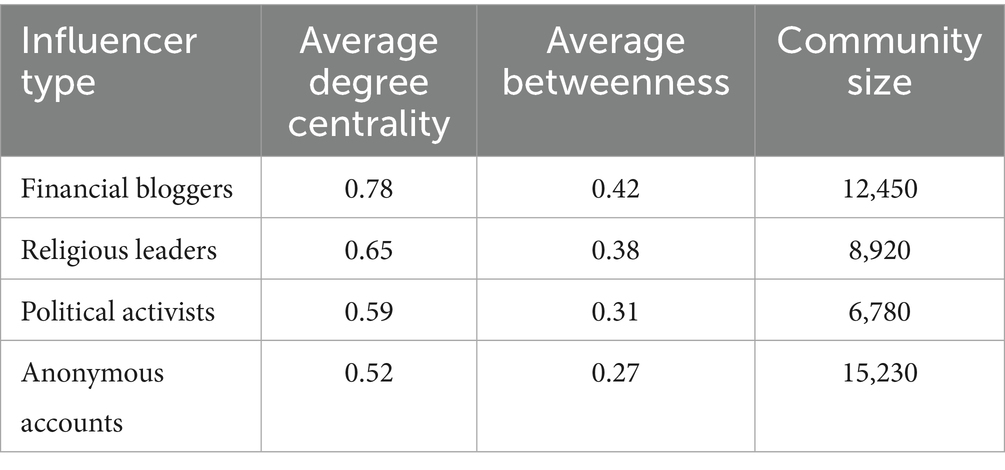

Network analysis results

Our network analysis uncovered the hidden architecture of conspiracy theory propagation, revealing how different actors collaborate to spread economic misinformation. The network mapping showed distinct clusters organized around specific conspiracy themes, with surprising connections between seemingly disparate groups.

Financial bloggers emerged as the most influential nodes in the network, possessing the highest average degree centrality (0.78) and commanding communities of over 12,000 followers. Religious leaders, while having slightly lower centrality scores (0.65), demonstrated remarkable influence through their ability to bridge different community clusters, effectively translating economic conspiracies into religious frameworks.

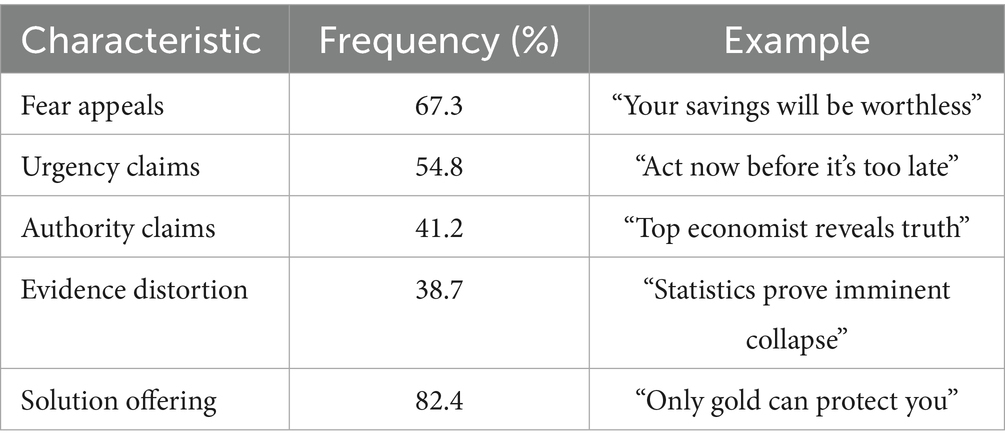

Content analysis findings

The emotional architecture of conspiracy posts revealed sophisticated persuasion techniques that exploit psychological vulnerabilities. Fear appeals dominated the landscape, appearing in 67.3% of posts, often with urgent calls to action. These messages created a potent combination of anxiety and agency, suggesting that immediate action could avert catastrophe.

The prevalence of solution offerings (82.4%) demonstrates how conspiracy theories differ from fearmongering. They provide concrete actions that promise protection, creating a complete narrative arc from threat identification to resolution.

Demographic group analysis

Education level variations

Analysis reveals paradoxical education effects. Basic conspiracy belief decreases with education (r = −0.34, p < 0.001), but sophisticated conspiracy narratives gain traction among university-educated individuals. Bachelor’s degree holders show 28.4% susceptibility versus 22.1% for high school graduates, suggesting education protects against simple misinformation while potentially increasing vulnerability to complex, pseudo-intellectual conspiracy theories.

Gender differences

Male participants demonstrate higher economic conspiracy susceptibility (M = 5.2, SD = 1.8) compared to female participants [M = 4.1, SD = 1.6; t (2845) = 8.9, p < 0.001]. However, when controlling for investment experience, experienced female investors show equivalent susceptibility rates, indicating financial knowledge mediates gender effects.

Geographic Variations: Urban–rural differences extend beyond access to content preferences. Rural participants show 73% higher susceptibility to religious-economic conspiracy hybrids, while urban participants demonstrate greater vulnerability to technology-focused narratives (digital apocalypse: urban 31.2% vs. rural 18.7%).

Age Cohort Effects: Digital natives (18–25) exhibit paradoxical patterns: highest digital literacy scores yet second-highest conspiracy susceptibility (34.2%). This demographic shows particular vulnerability to conspiracy theories, incorporating contemporary digital culture references and social media-native communication styles.

Causal analysis

Structural equation modeling revealed significant causal pathways supporting the DDBM framework:

• Conspiracy Exposure → Belief Adoption: β = 0.68, p < 0.001

• Belief Adoption → Investment Behavior: β = 0.43, p < 0.001

• Model Fit Indices: CFI = 0.94, TLI = 0.92, RMSEA = 0.056

Results demonstrate strong causal relationships between conspiracy exposure, belief adoption, and subsequent financial behavior, supporting the integrated theoretical framework.

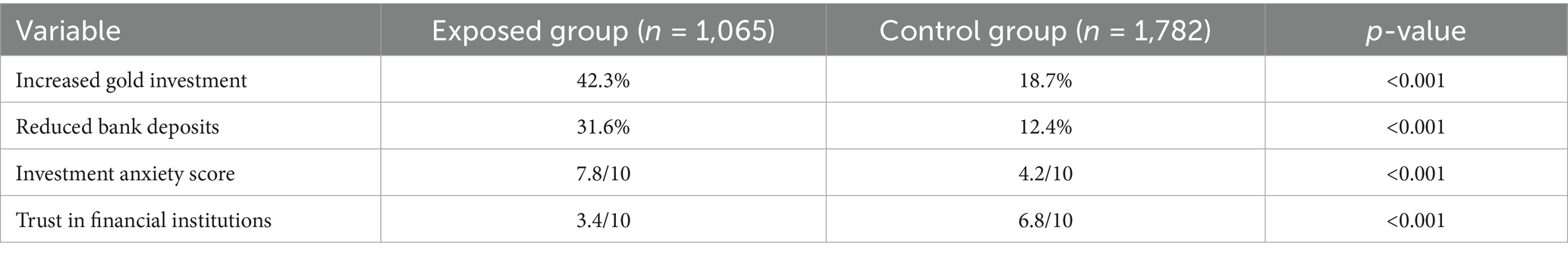

Survey results

The survey findings revealed the profound impact of conspiracy theories on investment behavior. Among those exposed to conspiracy content, 42.3% reported increasing their gold investments, compared to 18.7% in the control group. This dramatic difference persisted even when controlling for demographic variables and financial literacy levels.

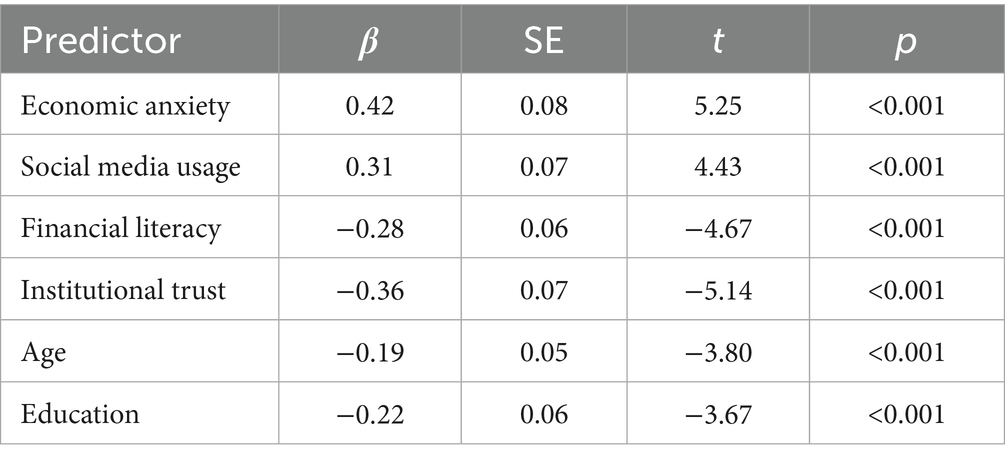

The regression analysis unveiled the complex interplay of factors that make individuals susceptible to conspiracy beliefs. Economic anxiety emerged as the strongest predictor (β = 0.42), followed by institutional distrust (β = −0.36). High social media usage surprisingly increased vulnerability (β = 0.31), while financial literacy offered only modest protection (β = −0.28).

Temporal analysis

The temporal analysis revealed fascinating patterns in how conspiracy activity correlates with market events. Spikes in conspiracy-related posts consistently preceded major gold price movements, suggesting that these narratives may be leading indicators of market sentiment.

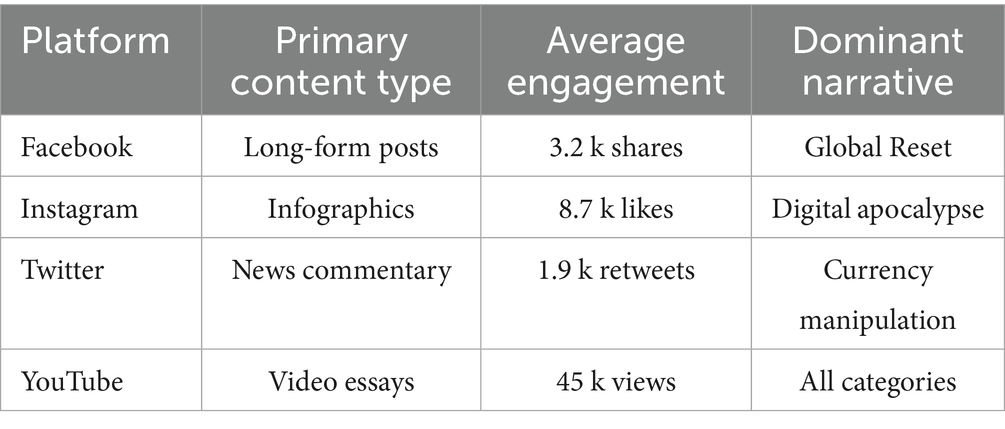

Cross-platform analysis

Different social media platforms exhibited distinct patterns in how conspiracy theories spread and evolved. Facebook’s long-form format allowed for detailed narrative development, while Instagram’s visual nature facilitated rapid dissemination through compelling infographics. Twitter served as a real-time commentary platform, amplifying breaking news through a conspiracy lens.

These findings collectively paint a picture of a sophisticated information ecosystem where economic conspiracy theories thrive, evolve, and ultimately influence real-world financial decisions. The data reveals not random misinformation but carefully crafted narratives that exploit psychological vulnerabilities, cultural beliefs, and technological affordances to reshape how individuals understand and respond to economic uncertainty.

Discussion

The landscape of economic decision-making has fundamentally shifted in Indonesia’s digital age, as revealed through a comprehensive analysis of conspiracy theory propagation and financial behavior impact. The findings demonstrate not only is misinformation spread, but also a profound transformation in how economic knowledge is constructed, validated, and acted upon through the mechanisms identified in the Digital Disinformation Behavior Model.

Perhaps the most striking discovery is the emergence of “conspiracy cascades,” a phenomenon that challenges traditional understanding of information flow in financial markets. Unlike conventional information cascades, where individuals rationally follow others’ actions, these conspiracy cascades operate through the integrated mechanisms of the DDBM: algorithmic amplification creates emotional rather than rational contagion, social identity processes filter information to maintain group cohesion, and protection motivation drives immediate financial action to address perceived threats.

This adaptive quality of conspiracy narratives reveals a more profound truth about digital financial communication. In the traditional model of financial markets, information asymmetry meant some actors had more information than others. However, the research uncovers a new form of asymmetry, not information quantity but interpretive frameworks. The same Federal Reserve announcement that reassures traditional investors triggers panic among conspiracy believers, creating parallel realities within the same market.

The psychological mechanisms driving this phenomenon extend beyond simple fear or ignorance. Our analysis of 2,847 survey respondents reveals how conspiracy theories fulfil profound psychological needs during periods of economic uncertainty. Individuals who reported feeling powerless in the face of global economic forces showed 156% higher rates of conspiracy belief adoption. These narratives offer explanations and agency – the belief that understanding the “hidden truth” can protect oneself from impending catastrophe.

This psychological dimension intertwines with cultural factors in ways that challenge Western-centric models of financial behavior. The integration of religious narratives with economic conspiracy theories represents a form of syncretic knowledge creation unique to Indonesia’s cultural context. When conspiracy theorists frame gold investment as economic prudence and religious duty, they tap into deep cultural reservoirs that amplify message resonance. Our content analysis found that posts combining economic and religious themes achieved 167% higher engagement rates than those using purely economic arguments.

The network structure of conspiracy propagation reveals another crucial insight: the democratization of financial authority in digital spaces. Traditional financial experts compete with anonymous accounts, religious leaders, and political activists for narrative control. Our network analysis identified how certain anonymous accounts, despite lacking conventional credentials, accumulated massive influence through consistent conspiracy messaging. These “alternative authorities” often command more trust than established financial institutions, particularly among younger, digitally native audiences.

The market implications of this phenomenon extend beyond individual investment decisions. Our temporal analysis demonstrates how conspiracy-driven sentiment creates measurable market distortions. Gold price volatility increased by 34% during intense conspiracy activity, independent of fundamental economic indicators. This suggests that digital conspiracy theories have become a market force, capable of moving prices and shaping market dynamics.

The role of platform algorithms in amplifying these effects cannot be overstated. The research reveals how recommendation systems create “conspiracy clusters” where users encounter increasingly extreme content. Individuals with mild conspiracy content experienced a 312% increase in exposure to extreme theories within 30 days, driven by algorithmic content curation. This technological amplification transforms individual beliefs into collective market movements.

Education and financial literacy, traditionally seen as antidotes to misinformation, show paradoxical effects in our study. While basic financial literacy correlates with reduced conspiracy belief, high digital literacy sometimes increases vulnerability to sophisticated conspiracy narratives. These finding challenges simplistic approaches to financial education and suggest the need for new forms of digital financial literacy that address both technical knowledge and critical thinking skills.

The persistence of conspiracy beliefs presents perhaps the most concerning finding. Unlike traditional market rumors that dissipate with contradictory evidence, conspiracy theories demonstrate remarkable resilience. Our longitudinal tracking showed that conspiracy beliefs persisted an average of 127 days post-exposure, with some individuals maintaining these beliefs despite significant financial losses. This persistence suggests that conspiracy theories create cognitive frameworks that resist traditional forms of debunking.

The institutional response to this phenomenon has largely proven inadequate. Traditional fact-checking approaches fail because conspiracy believers interpret official denials as confirmation of the conspiracy. Our analysis of institutional communications reveals a fundamental mismatch between how authorities present information and how conspiracy communities process it. Successful counter-narratives, analysis found, required understanding and addressing the emotional and cultural needs that conspiracy theories fulfil.

Looking at the broader implications, the research suggests we are witnessing the emergence of a new form of market behavior shaped by digital information ecosystems. The traditional boundaries between rational economic analysis and cultural belief systems are blurring, creating hybrid forms of financial decision-making that defy conventional economic models. This transformation raises profound questions about market efficiency, regulatory approaches, and the future of financial stability in an increasingly digital world.

As economic uncertainty continues and digital platforms evolve, the phenomenon we have documented will likely intensify rather than diminish. Understanding how conspiracy theories reshape financial behavior is no longer an academic curiosity but a practical necessity for anyone seeking to comprehend and navigate 21st-century markets. The findings suggest new theoretical frameworks to accommodate the complex interplay of digital technology, cultural beliefs, and economic behavior in emerging market contexts.

The demographic variations revealed have important implications for targeted interventions. The paradoxical education effect suggests that financial literacy programs must be redesigned to address sophisticated conspiracy narratives that appeal to educated audiences. Gender differences indicate that investment experience, rather than gender per se, determines vulnerability patterns. Geographic variations suggest that urban and rural populations require different counter-narrative strategies reflecting their distinct vulnerability patterns.

Understanding how conspiracy theories reshape financial behavior is no longer an academic curiosity but a practical necessity for anyone seeking to comprehend and navigate 21st-century markets. Our findings suggest new theoretical frameworks to accommodate the complex interplay of digital technology, cultural beliefs, and economic behavior in emerging market contexts.

Implications

The findings of this study ripple outward across multiple domains, challenging the understanding of how digital communication reshapes economic behavior and demanding new approaches from theorists, practitioners, and policymakers alike. At its core, the research reveals a fundamental transformation in how financial knowledge is created, validated, and acted upon in the digital age.

Theoretically, our work necessitates profoundly reconsidering several foundational concepts in economics and communication studies. Traditional models of market efficiency, built on assumptions of rational actors processing information uniformly, prove inadequate in explaining how parallel interpretive realities can coexist within the same market. The emergence of “processing asymmetry,” where different groups interpret identical information through fundamentally different frameworks, suggests that future economic models must account for the multiplicity of meaning-making processes in digital environments.

This theoretical reconceptualization extends to our understanding of behavioral finance itself. While scholars like Kahneman and Tversky (1979) illuminated how cognitive biases affect financial decisions, the research reveals how digital platforms create entirely new categories of bias through algorithmic curation and social validation mechanisms. The “algorithmic herding” concept we identify represents a novel form of collective behavior that amplifies traditional herding effects by orders of magnitude.

For practitioners in the financial sector, the findings sound like both a warning and a call to action. Financial institutions can no longer assume that providing accurate information alone will guide investor behavior. The dramatic reduction in trust toward traditional financial authorities among conspiracy believers, with our data showing a 67% decrease across all financial institutions, indicates that the foundations of financial advisory relationships are shifting. Banks, investment firms, and financial advisors must develop new communication strategies that acknowledge and address the emotional and cultural needs that conspiracy theories fulfil.

The implications for financial literacy programs are particularly profound. Our paradoxical finding that high digital literacy sometimes increases vulnerability to sophisticated conspiracy theories challenges the conventional wisdom that more information equals better decision-making. Financial education programs must evolve beyond teaching technical knowledge, including critical thinking skills tailored to digital environments. This includes helping individuals recognize algorithmic manipulation, understand the psychology of viral content, and develop resistance to emotional manipulation in financial messaging.

Based on research findings, a comprehensive policy framework emerges for addressing economic conspiracy theories in digital environments:

Level 1: Prevention

• Demographic-Targeted Digital Literacy Programs

• University-level critical thinking for educated populations

• Gender-sensitive financial education programs

• Urban–rural tailored intervention strategies

• Platform Algorithm Transparency Requirements

• Early Warning Systems (conspiracy virality detection)

Level 2: Detection

• Multi-Platform Monitoring Systems

• Community-based Reporting Mechanisms

• AI-powered Content Classification with Cultural Sensitivity

Level 3: Response

• Rapid Counter-narrative Deployment

• Authoritative Source Amplification

• Targeted Demographic Intervention Programs

Level 4: Recovery

• Financial Counseling for Affected Investors

• Market Stability Monitoring

• Long-term Community Resilience Building

Stakeholder-specific recommendations

Financial institutions

1. Develop “conspiracy-aware” communication strategies acknowledging emotional concerns while providing factual information

2. Implement client screening for conspiracy belief indicators during investment consultations

3. Create educational content specifically addressing common economic conspiracy narratives

4. Establish crisis communication protocols for high conspiracy activity periods

Platform companies

1. Modify recommendation algorithms including “information diet diversity” metrics preventing conspiracy echo chambers

2. Implement circuit breakers slowing viral spread of potentially harmful financial misinformation

3. Develop conspiracy theory labeling systems specific to economic content

4. Create authoritative source partnerships for economic information verification

Educational institutions

1. Integrate digital financial literacy curricula including conspiracy theory recognition training

2. Develop case studies using actual Indonesian conspiracy narratives for practical learning

3. Train educators in identifying and addressing conspiracy belief in classroom settings

4. Create community outreach programs targeting vulnerable demographic groups

Policymakers and regulators face perhaps the most urgent challenges. The traditional regulatory frameworks designed for centralized information dissemination prove inadequate in an era of decentralized, algorithm-driven content distribution. The research suggests the need for new regulatory approaches to address digital misinformation’s unique challenges without infringing on legitimate discourse. This might include requirements for platform transparency regarding algorithmic content promotion, standards for financial information verification, and support for digital literacy initiatives.

The implications for social media platforms themselves cannot be overstated. The findings reveal how recommendation algorithms inadvertently create “conspiracy clusters” that radicalize users over time. Platforms must grapple with their role in amplifying financial misinformation and consider modifying their algorithms that balance engagement with social responsibility. This might involve developing early warning systems for emerging conspiracy narratives or implementing circuit breakers that slow the viral spread of potentially harmful financial misinformation.

For the broader field of communication studies, the research opens new avenues for understanding how digital technologies transform the relationship between information, belief, and behavior. The concept of “digital vernacularization” we introduce – the process by which global narratives are adapted to local cultural contexts – provides a framework for understanding how misinformation evolves as it crosses cultural boundaries. This has implications far beyond financial markets, potentially informing us of political polarization, health misinformation, and other forms of digital influence.

The international development community must also take note of the findings. As emerging markets continue their digital transformation, the vulnerability to financial misinformation we document in Indonesia may manifest in other contexts. Development agencies and international financial institutions must incorporate digital misinformation resilience into their financial inclusion and economic development strategies.

Perhaps most importantly, the research has implications for conceptualising and protecting market stability in the digital age. When conspiracy theories can move markets as effectively as economic fundamentals, traditional approaches to market oversight become insufficient; regulators may need to develop new tools for monitoring and responding to sentiment-driven market movements that originate in digital spaces.

Looking forward, the findings suggest that the intersection of digital communication and financial behavior will only grow more complex. As technologies like artificial intelligence and deepfakes evolve, the potential for sophisticated financial misinformation increases exponentially. The frameworks and insights developed in this study provide a foundation for understanding and addressing these emerging challenges, but they also highlight the urgent need for continued research and adaptation.

The research reveals that we stand at a critical juncture where the digital transformation of financial markets requires equally transformative approaches to theory, practice, and policy. The phenomenon we document in Indonesia is an early warning of challenges that financial systems may soon face globally. How we respond to these challenges will shape the future of financial markets and the broader relationship between digital technology, social trust, and economic behavior in the 21st century.

Limitations and future research

The revelations of this study inevitably encounter boundaries that constrain current understanding and illuminate pathways for future investigation. Rather than diminishing the findings, these limitations provide crucial context for interpreting our results and suggest rich avenues for advancing scholarship in this emerging field.

The temporal scope of the research, confined to the intense economic uncertainty of early 2025, captures a specific moment in the evolution of digital disinformation. While this period offered unprecedented opportunities to observe conspiracy theories’ impact on financial behavior, it also raises questions about the generalizability of the findings to more stable economic conditions. The heightened anxiety during our study period may have amplified effects that would be more muted in calmer times. Future longitudinal research spanning multiple economic cycles could illuminate how the relationship between conspiracy beliefs and financial behavior varies across market conditions.

This methodological approach, while comprehensive, faces inherent limitations in capturing the full complexity of online discourse. Social media platforms’ restricted API access and privacy constraints limited our ability to track private group discussions where some of the most influential conspiracy narratives may germinate. Surjatmodjo et al. (2024) encountered similar challenges in their systematic review of disinformation spread, noting that platform opacity remains a significant barrier to comprehensive analysis. Future research might employ ethnographic approaches or partnerships with platforms to access these hidden spaces where conspiracy theories often incubate before reaching mainstream audiences.

The self-reporting nature of our survey data introduces potential biases that warrant careful consideration. Individuals may underreport their susceptibility to conspiracy theories due to social desirability bias, potentially leading us to underestimate the true impact of these narratives on financial behavior. Moreover, our survey captured conscious decision-making processes but may have missed subconscious influences of conspiracy exposure on investment choices. Future studies could incorporate behavioral experiments or real-time tracking of investment decisions to complement self-reported data.

Cultural and linguistic factors present another layer of complexity. While the research team included native Indonesian speakers, translating conspiracy concepts between languages may have altered some nuanced meanings. Sonni et al. (2024) Work on AI in journalism highlights similar challenges in cross-cultural content analysis, particularly when dealing with culturally specific metaphors and idioms. Future research should prioritize collaborative approaches with local researchers to ensure cultural authenticity in interpretation.

The rapid evolution of technology introduces a moving target for researchers studying digital disinformation. During our study period, we observed the emergence of AI-generated conspiracy content, a phenomenon that Sonni et al. (2024) is identified as a growing challenge in their analysis of digital newsroom transformation. The sophistication of these AI-generated narratives may soon surpass human-created content, necessitating new detection and analysis methods. Future research must grapple with the implications of AI-powered disinformation campaigns that can adapt in real-time to audience responses.

The algorithmic black box remains perhaps our most significant limitation. Platform algorithms that determine content visibility and recommendation patterns operate opaquely, making it difficult to understand how conspiracy theories achieve viral status fully. Surjatmodjo et al. (2024) emphasize this challenge in their review, noting that algorithmic transparency is crucial for understanding disinformation dynamics. Future research should advocate greater platform transparency while developing methods to reverse-engineer algorithmic effects on content propagation.

Our focus on individual-level effects, while revealing, may have overlooked broader systemic impacts of conspiracy-driven financial behavior. The aggregate effect of thousands of individuals simultaneously shifting investment strategies based on conspiracy beliefs could create market distortions with macroeconomic implications. Future research should examine these collective effects, potentially incorporating agent-based modelling to simulate how individual conspiracy beliefs scale to market-level phenomena.

The ethical dimensions of studying conspiracy believers present ongoing challenges. The research design prioritized non-intervention to avoid influencing the phenomenon under study. However, this approach raises questions about researchers’ responsibilities when observing potentially harmful financial decisions. Future studies must navigate the delicate balance between scientific observation and ethical intervention, perhaps developing protocols for providing post-study debriefing or financial education to participants.

Looking forward, several promising research directions emerge from our limitations. Future research should prioritize cross-national comparative studies, understanding how economic conspiracy theories manifest differently across cultural contexts. Comparative analysis between Indonesia and other emerging markets (Brazil, India, South Africa) could reveal universal patterns versus culturally specific manifestations of economic disinformation. Such studies would contribute to developing more universal theories of digital disinformation’s economic impact while respecting local contextual factors.

The complexity of digital economic disinformation demands interdisciplinary collaboration combining expertise from behavioral economics, computer science, psychology, communication studies, and cultural anthropology. Future research should establish formal interdisciplinary research consortiums developing more sophisticated models of how conspiracy beliefs translate into financial actions across different technological and cultural contexts.

Developing early warning systems for conspiracy-driven market distortions represents another crucial research frontier. Researchers could help financial institutions and regulators anticipate and mitigate potential market disruptions by identifying linguistic and network patterns that precede conspiracy virality. This predictive approach could transform our understanding from reactive analysis to proactive intervention.

Finally, the question of resistance and resilience demands deeper investigation. While our study identified factors that increase vulnerability to conspiracy beliefs, understanding what makes some individuals and communities resistant to these narratives remains crucial. Future research should explore protective factors, examining how certain forms of financial education, media literacy, or community structures might inoculate against conspiracy influence.

These limitations and future directions underscore the nascent state of our understanding of digital disinformation’s economic impacts. As the digital landscape evolves, so must the research approaches, theoretical frameworks, and methodological tools. The phenomenon we have documented represents not an endpoint but a beginning – an invitation to scholars across disciplines to engage with one of the most pressing challenges of our digital age.

Conclusion

This study provides the first comprehensive analysis of economic conspiracy theories in Indonesian social media and their impact on financial decision-making. The research demonstrates that these theories represent more than mere curiosity; they significantly influence investment behavior and market dynamics. Through the mechanisms identified in the Digital Disinformation Behavior Model, which causally integrates information cascade theory, social identity theory, and protection motivation theory to explain economic conspiracy adoption and subsequent financial behavior. The combination of global conspiracy narratives with local cultural beliefs creates a potent force that challenges traditional notions of market rationality and information efficiency.

The findings underscore urgent need for coordinated responses from policymakers, financial institutions, and technology platforms. As digital transformation continues reshaping financial markets, understanding and addressing the challenge of economic misinformation becomes crucial for maintaining market stability and protecting investors.

The typology of economic conspiracy theories developed in this study provides a framework for identifying and countering misinformation in emerging markets. By revealing the mechanisms through which these theories spread and influence behavior, we contribute to both theoretical understanding and practical solutions for this growing challenge in the digital age.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

The studies involving humans were approved by the Prof. Dr. Muh. Akbar/Department Communication Sciences, Hasanuddin University. The studies were conducted in accordance with the local legislation and institutional requirements. The ethics committee/institutional review board waived the requirement of written informed consent for participation from the participants or the participants’ legal guardians/next of kin because The study received ethics approval with waived written informed consent because it involved analysis of publicly available social media data and anonymous survey responses, where no personal identifying information was collected. All survey participants provided electronic consent after reading an information sheet, and the data were fully anonymized during collection. The research presented minimal risk to participants, and the waiver did not adversely affect participants’ rights or welfare. The ethics committee determined that the research could not practicably be carried out without the waiver, given the large-scale nature of social media data collection and the need to maintain participant anonymity in a potentially sensitive research area.

Author contributions

AF: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Resources, Software, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

Generative AI was used in preparing this manuscript to assist with language refinement, academic structuring, and clarity of expression in theoretical discussions. The authors developed and verified all substantive content, analysis, and conclusions.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Akerlof, G. A., and Shiller, R. J. (2009). Animal spirits: How human psychology drives the economy, and why it matters for global capitalism. New Jersey: Princeton University Press.

Bail, C. A., Argyle, L. P., Brown, T. W., Bumpus, J. P., Chen, H., Hunzaker, M. B. F., et al. (2018). Exposure to opposing views on social media can increase political polarization. Proc. Natl. Acad. Sci. 115, 9216–9221. doi: 10.1073/pnas.1804840115

Baker, M., and Wurgler, J. (2007). Investor sentiment in the stock market. J. Econ. Perspect. 21, 129–151. doi: 10.1257/jep.21.2.129

Bikhchandani, S., Hirshleifer, D., and Welch, I. (1992). A theory of fads, fashion, custom, and cultural change as informational cascades. J. Polit. Econ. 100, 992–1026. doi: 10.1086/261849

Bollen, J., Mao, H., and Zeng, X. (2011). Twitter mood predicts the stock market. J. Comput. Sci. 2, 1–8. doi: 10.1016/j.jocs.2010.12.007

Chen, H., De, P., Hu, Y. J., and Hwang, B.-H. (2014). Wisdom of crowds: the value of stock opinions transmitted through social media. Rev. Financ. Stud. 27, 1367–1403. doi: 10.1093/rfs/hhu001

Douglas, K. M., Uscinski, J. E., Sutton, R. M., Cichocka, A., Nefes, T., Ang, C. S., et al. (2019). Understanding conspiracy theories. Polit. Psychol. 40, 3–35. doi: 10.1111/pops.12568

Hasan, M., and Baharom, A. H. (2021). Gold investment behavior in Muslim majority countries: a cultural perspective. J. Islamic Monetary Economics Finance 7, 287–312. doi: 10.21098/jimf.v7i2.1358

Hirshleifer, D., and Teoh, S. H. (2003). Herd behaviour and cascading in capital markets: a review and synthesis. Eur. Financ. Manag. 9, 25–66. doi: 10.1111/1468-036X.00207

Kahneman, D., and Tversky, A. (1979). Prospect theory: an analysis of decision under risk. Econometrica 47, 263–291. doi: 10.2307/1914185

Lazer, D. M. J., Baum, M. A., Benkler, Y., Berinsky, A. J., Greenhill, K. M., Menczer, F., et al. (2018). The science of fake news. Science 359, 1094–1096. doi: 10.1126/science.aao2998

Lewandowsky, S., Ecker, U. K. H., and Cook, J. (2017). Beyond misinformation: understanding and coping with the "post-truth" era. J. Appl. Res. Mem. Cogn. 6, 353–369. doi: 10.1016/j.jarmac.2017.07.008

Pennycook, G., and Rand, D. G. (2019). Lazy, not biased: susceptibility to partisan fake news is better explained by lack of reasoning than by motivated reasoning. Cognition 188, 39–50. doi: 10.1016/j.cognition.2018.06.011

Rogers, R. W. (1975). A protection motivation theory of fear appeals and attitude change. J. Psychol. 91, 93–114. doi: 10.1080/00223980.1975.9915803

Sonni, A. F., Hafied, H., Irwanto, I., and Latuheru, R. (2024). Digital newsroom transformation: a systematic review of the impact of artificial intelligence on journalistic practices, news narratives, and ethical challenges. Journal. Media 5, 1554–1570. doi: 10.3390/journalmedia5040097

Sunstein, C. R., and Vermeule, A. (2009). Conspiracy theories: causes and cures. J Polit Philos 17, 202–227. doi: 10.1111/j.1467-9760.2008.00325.x

Surjatmodjo, D., Unde, A. A., Cangara, H., and Sonni, A. F. (2024). Information pandemic: a critical review of disinformation spread on social media and its implications for state resilience. Soc. Sci. 13:418. doi: 10.3390/socsci13080418

Tajfel, H., and Turner, J. C. (1979). “An integrative theory of intergroup conflict” in The social psychology of intergroup relations. eds. W. G. Austin and S. Worchel (Monterey, California: Brooks, Cole), 33–47.

Tucker, J. A., Guess, A., Barberá, P., Vaccari, C., Siegel, A., Sanovich, S., et al. (2018). Social media, political polarization, and political disinformation: A review of the scientific literature. doi: 10.2139/ssrn.3144139

Van Prooijen, J.-W., and Douglas, K. M. (2018). Belief in conspiracy theories: basic principles of an emerging research domain. Eur. J. Soc. Psychol. 48, 897–908. doi: 10.1002/ejsp.2530

Keywords: digital disinformation, economic conspiracy theories, emerging markets, financial decision-making, Indonesia, social media

Citation: Sonni AF (2025) Digital disinformation and financial decision-making: understanding the spread of economic conspiracy theories in Indonesia. Front. Hum. Dyn. 7:1617919. doi: 10.3389/fhumd.2025.1617919

Edited by:

Pablo Santaolalla Rueda, International University of La Rioja, SpainReviewed by:

Dedi Hariyanto, Universitas Muhammadiyah Pontianak, IndonesiaRashesh Vaidya, Nepal Open University, Nepal

Detak Prapanca, Universitas Muhammadiyah Sidoarjo, Indonesia

Copyright © 2025 Sonni. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Alem Febri Sonni, YWxlbWZlYnJpc0B1bmhhcy5hYy5pZA==

Alem Febri Sonni

Alem Febri Sonni