- Space Value Foundation, London, United Kingdom

The defining obstacle to our expansion into outer space is not technological, but conceptual. While our engineering ingenuity has already enabled extraordinary feats — from lunar landings to Martian rovers and artificial intelligence—our financial and monetary economics remain shackled to inadequate assumptions that prohibit the sustainable expansion of our footprint in outer space and drag us ever closer to the edge of an ecological catastrophe on Earth. Today, neither billionaires, corporations, nor governments are able to fund our multi-planetary or multi-habitat future. I argue that our expansion into outer space requires a fundamental rethink of our financial value framework, mathematics, and monetary architecture. To unlock the massive investments needed for outer space development and settlement, we must first integrate space as a foundational dimension of value in finance—heretofore built around risk and calendar time. The introduction of space as an analytical dimension in finance is a first step that leads to a new principle of value, the Space Value of Money (SVoM), which, in turn, triggers a profound change in our mathematics and architecture. These transformations make the monetisation of space possible, i.e., the creation of money based on space value creation. The monetisation of space is translated into systemic change through the introduction of new financial instruments designed for central bank purchase. Public Capitalisation Notes (PCNs) are proposed as a viable alternative that can help fund our sustainable multi-planetary future.

1 Introduction

It is estimated that the ‘space economy’ stood at $630bn in 2023 and is set to reach $1.8 trillion by 2035. Interestingly, outer space exploration is only a minuscule fraction, 2.4% in 2023, of this fast-growing sector (WEF-McKinsey, 2024). It seems that the ‘space economy’ is very much Earthbound. While estimates differ, the Q2 2025 Space Report finds that the ‘space economy’ has reached $613 billion in 2024 (Space Foundation, 2025), there is wide consensus that the vast majority of applications are primarily focused on the development and commercialisation of outer space-based infrastructure to deliver goods and services on Earth. Alternatively, on the public side, they are focused on their operationalisation for the purposes of national security. Fuelled by downstream services and the demand for digital and geospatial data, the proliferation of satellites in LEO, MEO, and GEO underscores this momentum—from 11,700 active satellites in orbit as of May 2025 (LiveScience, 2025) to a projected 100,000 by 2030 (SIA, 2025; ESA, 2025).

Facilitating this expansion is the record-breaking orbital launch industry. January 2024 was the “busiest start to a year since the Space Age dawned in 1957” (Space Foundation, 2024). Between Q12023 and Q12025, humanity achieved 546 orbital launches, 56.78% of which were achieved by1 providers based in the United States, 27.84% based in China, and 7.33% in Russia. The remaining 8.06% were achieved by providers in India, Japan, Europe/France/Germany, Iran, South Korea, North Korea, and Israel. These 546 orbital launches have sent a total of 6,696 spacecraft to orbit, with a total upmass of 4,187,371 kg—the vast majority being satellites. The leading launch providers are Space Exploration Technologies (SpaceX), China Aerospace Science & Technology Corporation (CASC), Roscosmos, and Rocket Lab. They have sent to orbit 5682, 377, 128, and 71 spacecrafts respectively (BryceTech, 2025; Papazian, 2024).

While the communications, navigational, Earth observation, and security applications of outer space technologies continue to inspire a positive outlook (TechCrunch, 2025), attracting fresh investments into the sector (Reuters. 2025), recent budget cuts (Financial Times, 2025) and the debate around fiscal policy (White, 2025) have raised deeper systemic concerns regarding the current and future reliability of government procurement as a stabilising force in the ‘space economy’ (Space News, 2025; Space, 2025). Given that private investors have always relied on government contracts to provide predictable demand and long-term partnerships that mitigate risks in space ventures, rising public debt and fiscal uncertainty raise critical questions. If governments are unable to sustain the current and relatively limited space budgets, how can they fund the massive investments needed to create, manufacture, deploy, and maintain the new habitats of the future? Can billionaires and corporations fill the gap when they are themselves reliant on government procurement?

Today, neither billionaires, corporations, nor governments are able to fund and sustain our multi-planetary or multi-habitat future. I argue that the defining obstacle to our expansion and settlement in outer space is not technological, but conceptual. While our engineering ingenuity has already enabled extraordinary feats — from lunar landings to Martian rovers and artificial intelligence—our financial and monetary economics remain shackled to inadequate assumptions that prohibit the sustainable expansion of our footprint in outer space and drag us ever closer to the edge of an ecological catastrophe on Earth. I argue that our multi-planetary future in outer space, beyond LEO, MEO, and GEO, requires a fundamental rethink of our financial value framework, mathematics, and monetary architecture. We can empower human productivity to achieve our most daring visions on Earth and in outer space — but not before we have reimagined money and value in finance (Papazian, 2022; 2023; 2024).

To unlock the massive investments needed for outer space development and settlement, we must first integrate space as a foundational dimension of value in finance — heretofore built around risk and calendar time. The introduction of space as an analytical dimension in finance is a first step that enables a new principle of value, the Space Value of Money (SVoM). This in turn ushers in a profound change in our mathematics and architecture, allowing the monetisation of space, i.e., the creation of money based on space value creation.

2 Spaceless finance: without impact and responsibility

The two core principles that define the analytical framework of finance are Risk and Return and Time Value of Money. The entire corpus of equations that define value and return in finance are structured around these two principles. Risk and Return states that the higher the risk the higher the expected return—given the risk-averse nature of investors, higher risks imply higher expectations of reward. Time Value of Money states that a dollar ($1) today is worth more than a dollar ($1) tomorrow—given that a dollar today can earn interest/return by tomorrow and be more than a dollar by tomorrow. The main stakeholder of these principles, and the equations they have given birth to, is the mortal risk-averse return-maximising investor. Planet and humanity are not formally recognised as relevant.

Furthermore, the current principles of value in finance leave our evolutionary investments in a blind spot. This is so because they negatively price distant returns and high risks, both key features of all our evolutionary challenges, including outer space expansion and settlement. “In fact, today, our evolutionary investments become plausible and ‘affordable’ only when they can be made to make sense within the preference framework of the mortal risk-averse return-maximising investor” (Papazian, 2023, 14).

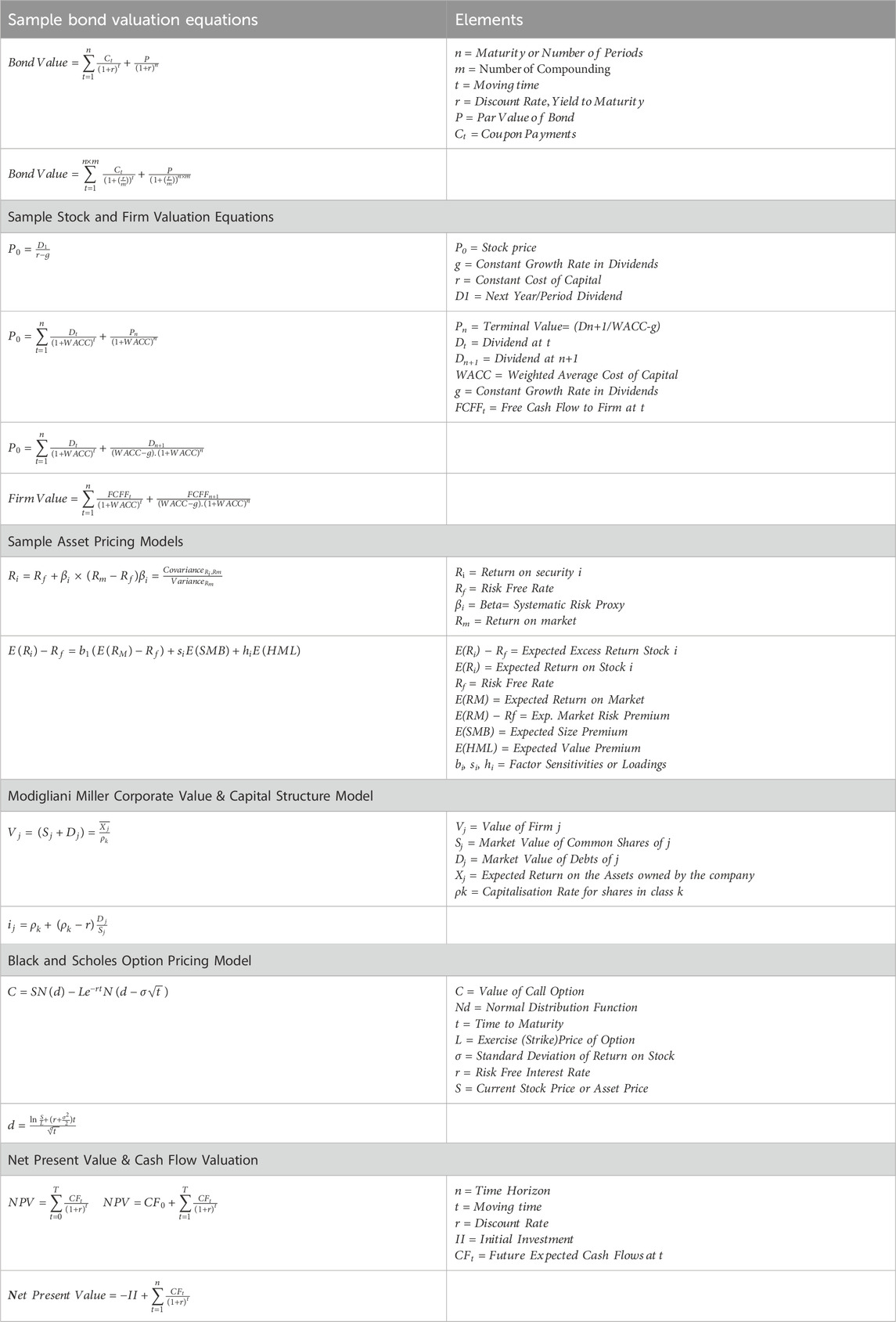

Table 1 provides a sample of the equations that have shaped the finance discipline and our investments across public and private markets, including stocks, bonds, firms, assets, and derivative instruments. None of them have any context parameters, risk and time proxies are used to assess the risk and time value of investments. The impact of cash flows on our physical context are left out from the analytical framework and the mathematics that define value and return.

In other words, our core analytical framework and mathematics in finance are spaceless. A review of finance textbooks and professional and academic literature supports this claim.2

The absence of space as an analytical dimension in our equations of value and return in finance has led us to the edge of an ecological catastrophe on Earth and has also limited our ability to invest and expand our reach in outer space. This is so because the absence of our physical context from our value framework has led to the omission of space impact from our models, absolving investors from their responsibility on the one hand, and ignoring the value of our footprint on the other. Going to the moon or Mars have no intrinsic value based on our financial framework and equations, unless they generate cash flows. Our atmosphere, land, and oceans represent no intrinsic value, and their responsible use is not entrenched in our models.

3 The monetisation of risk and calendar time

Our current financial value framework, built around risk and time, is also evident in our monetary architecture, where money, at the central and commercial bank levels, is created through debt instruments and transactions. Money, in the form of currency, bank deposits, and central bank reserves, “represents an IOU from one sector of the economy to another” (McLeay et al., 2014a, 4).

In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood: the principal way is through commercial banks making loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money (McLeay et al., 2014b, 1).

The money we used to buy bonds when we were doing QE did not come from government taxation or borrowing. Instead, like other central banks, we can create money digitally in the form of ‘central bank reserves’. We use these reserves to buy bonds. Bonds are essentially IOUs issued by the government and businesses as a means of borrowing money (Bank of England, 2024).

Bonds are valued based on the equations listed in Table 1. Future coupon payments are discounted to the present to determine their risk and time value for the investor. Time here is calendar time as all government and corporate bonds used by central banks have a calendar time-based maturity and repayment schedule. Risk is the only other variable used to assess the eligibility of bonds for the purposes of money creation, i.e., mainly default risk assessed through credit ratings. The space impact of cash flows is not considered as relevant.

Money creation to date is fundamentally structured around calendar time. This is true for commercial bank loans as well as bonds purchased by central banks.

Our calendar time dependent monetary architecture chains us to a fixed and limited concept, undermining our ability to create the resources we need to explore and settle in worlds that are at great distances from our own, and have very different calendars of their own. In the vast landscape of space, calendar time linked debt-based money undermines our ability to explore what is relatively limitless, i.e., space (Papazian, 2024, 125).

The Gregorian calendar we use today is built upon Earth’s movements in outer space, rotation on itself (1 day) and revolution or orbit around the sun (1 year). In other words, a debt-based monetary architecture monetises the fixed movements of Earth but not Earth itself. It monetises the rotation and revolution of Earth in outer space but not outer space itself where other celestial bodies have very different orbits.3 Our debt-based monetary system reveals a human civilisation that monetises risk and calendar time, echoing a risk and time-based financial value framework and mathematics.

The Earthbound nature of the outer space economy can thus be explained by a risk and time based financial and monetary system that values cash flows and not space impact, that prefers less risky dollars today rather than riskier dollars tomorrow, that monetises the fixed movements of Earth but not Earth itself.

A spaceless financial value framework, mathematics, and monetary architecture constrain the public and private parts of the outer space economy. Given that all money supply, in all its forms, is on Earth, and all potential clients are on Earth, the non-negotiable necessity to generate cash flows and profits, or promise them, limit the reach and activities of private outer space organisations. Public agencies are free from such constraints, but they face their own limitations linked to the nature of their funding—government budgets are directly linked to the public debts that impose a variety of restrictions on agencies and departments.

4 The monetisation of space

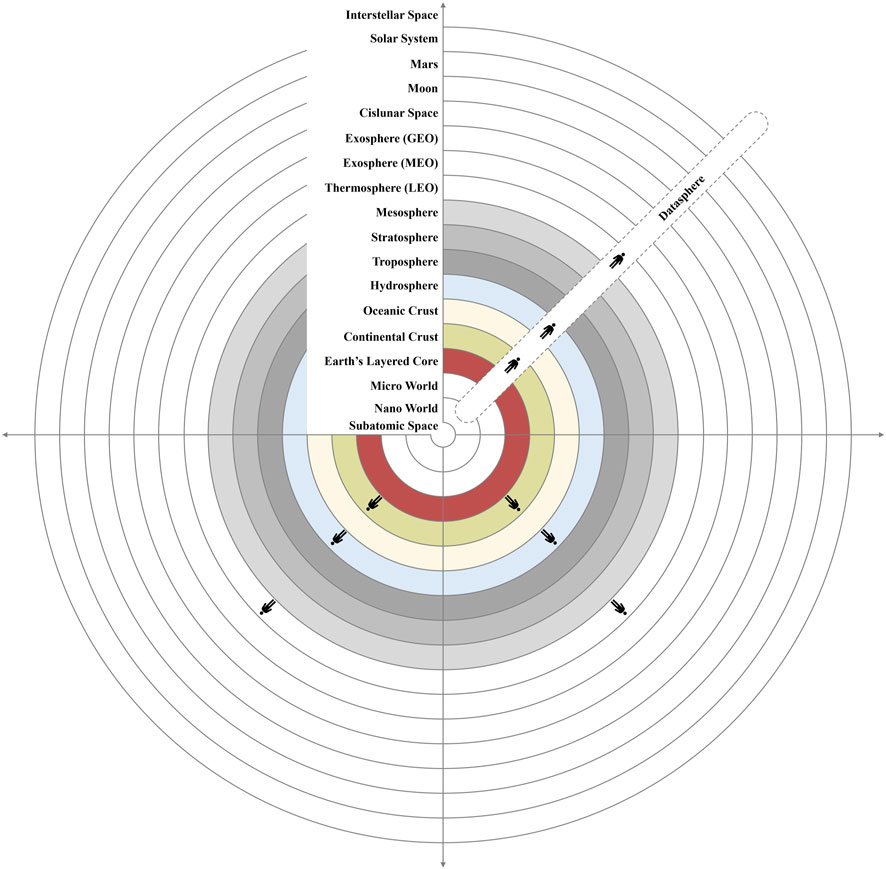

Introducing the missing dimension into finance, i.e., space, our physical context, must begin by offering a structured conceptual representation of what we mean by space. To avoid a common conflation, I define space as our physical context of matter, irrespective of constitution, composition, density, dynamics, and temperature, stretching from subatomic to interstellar space and every layer in between and beyond, where outer space is but a segment (Papazian, 2024). Introducing space as an analytical dimension into finance is necessary in order to provide the theoretical background through which space can be monetised. Figure 1 is a conceptualisation of space, our physical context, as defined above. It also includes the human body and the datasphere.

Figure 1. Space layers Source: Papazian (2024). Reproduced with permission from Palgrave Macmillan.

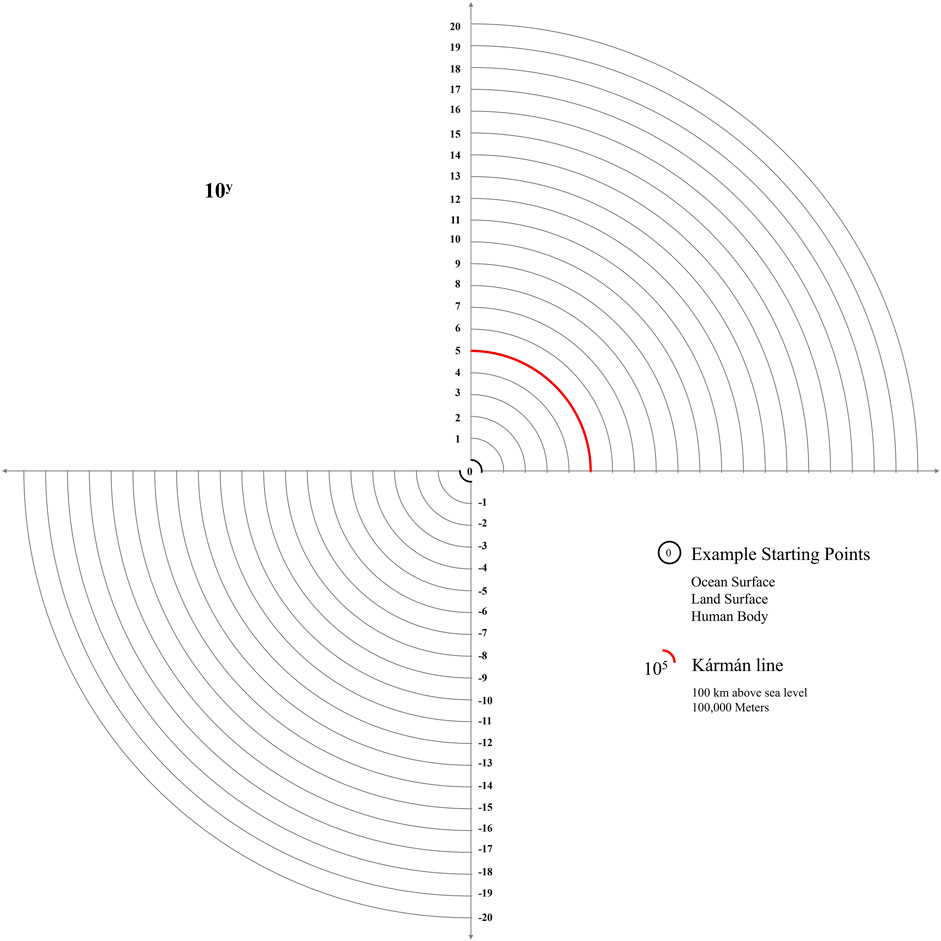

Naturally, these layers can be broken down into sublayers. Our physical context, from an analytical perspective, can also be presented in pure measurement form. An abstract conceptualisation can be depicted through a three-dimensional space of length l, starting from l = 100 m (1 m) and stretching towards the astronomical and the infinitesimal (Eames and Eames, 1977; Papazian, 2023). A purely measurement-based conceptualisation of our context can begin from any point of matter, including the human body, the ocean surface, or land surface (see Figure 2).

Figure 2. Space layers in metres (length=10y) from any point of matter: Papazian (2024). Reproduced with permission from Palgrave Macmillan.

Introducing space as an analytical dimension into finance is the first step and must be followed by the formulation of a complementary value principle to Risk and Return and Time Value of Money. Risk and Return defines our relationship with Risk, Time Value of Money defines our relationship with Time (calendar time), and Space Value of Money (SVoM) defines our relationship with space, our physical context. It establishes our spatial responsibility and requires that a dollar ($1) invested in space has, at the very least, a dollar’s ($1) worth of positive impact on space (Papazian, 2022, 104).

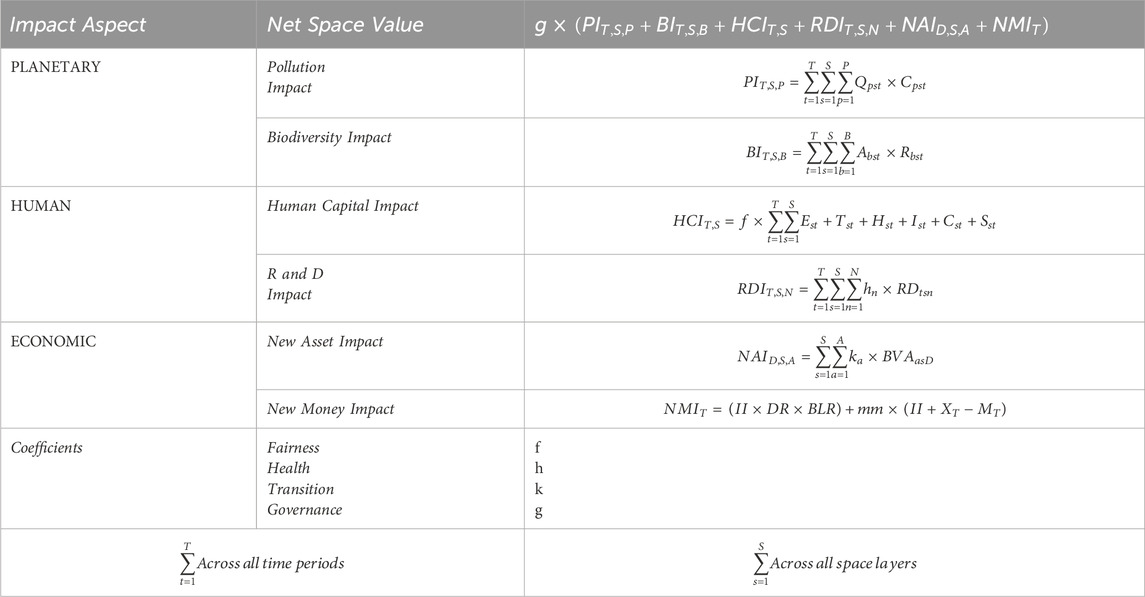

The introduction of a space value of money principle leads to new equations of space impact that allow us to transform our financial mathematics of value and return. I do not derive the equations of space impact in this article, for further details see Table 2; Papazian (2024), Papazian (2023), Papazian (2022). The principle and equations of space value achieve respect for space and provide the tools through which we can value and invest in space and outer space. “These changes are needed and necessary to allow the proper valuation of our evolutionary investments, and to remove the bias against highly risky investments with distant returns. The preferences of the mortal risk-averse return-maximising investor can now be balanced with the priorities of the species and the planet. Indeed, beyond Earthly money supply, our impact on and in space can now be valued and considered” (Papazian, 2024, 191).

Figures 1, 2 provide conceptualisations of the ‘units of space’ to look at across all the units of time under consideration. A space-adjusted financial value framework and mathematics are necessary prerequisites for the transformation of our monetary architecture, to take us beyond the monetisation of risk and calendar time and introduce the monetisation of space, i.e., the creation of money based on space value creation.

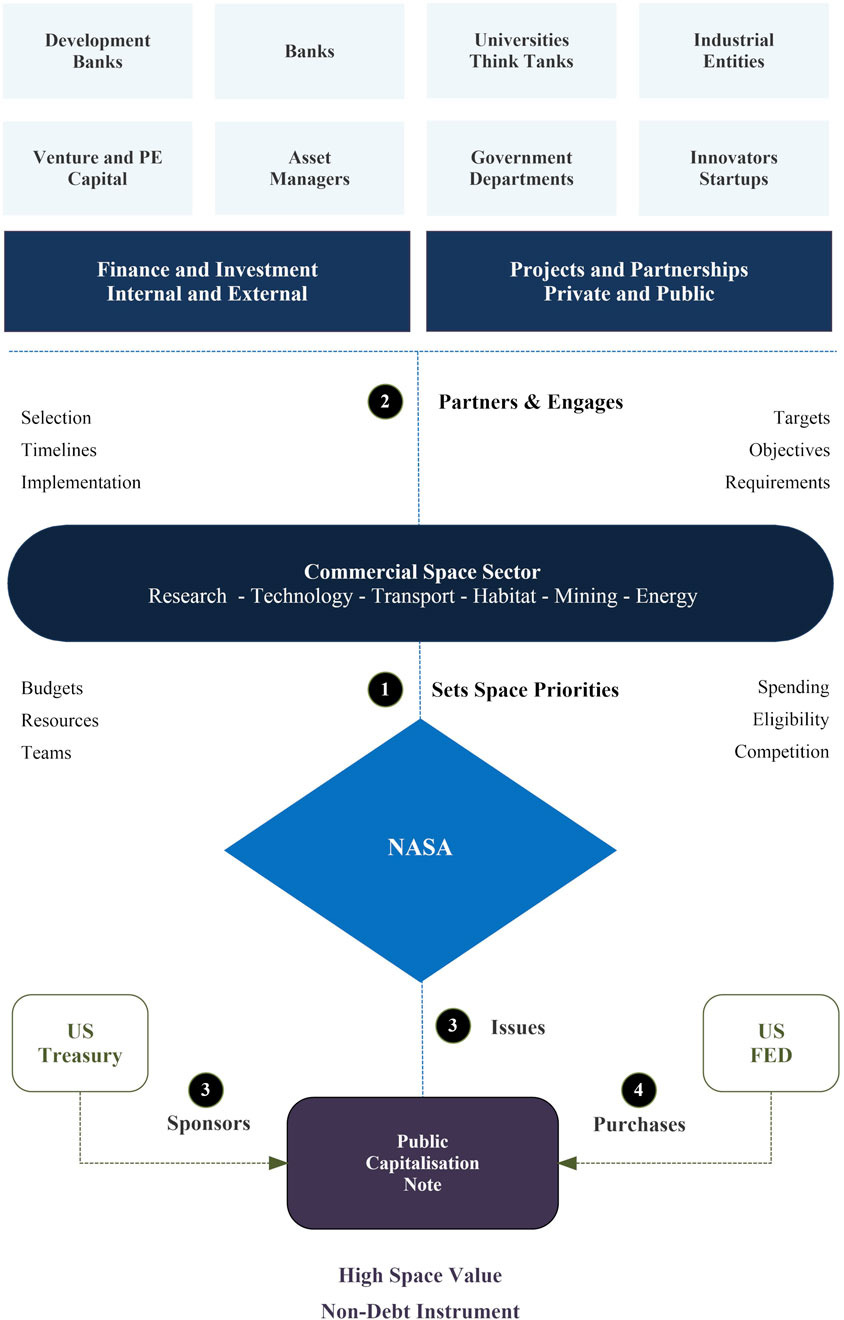

The monetisation of space can be achieved without any systemic shocks, through a new financial instrument designed for the creation of new money by central banks—an alternative to corporate and government bonds that can be used to inject new money without debt. I have offered the conceptual design of such an instrument, i.e., Public Capitalisation Notes (PCNs). PCNs are not debt instruments and introduce a new logic of money creation founded on space value creation. Figure 3 describes the general flow and key features of a proposed NASA PCN (Papazian, 2024).4

Figure 3. Value Easing (VE) through a NASA PCN Source: Papazian (2024). Reproduced with permission from Palgrave Macmillan.

Echoing Quantitative Easing (QE) and Credit Easing (CE), I have described the process as Value Easing. “Value Easing (VE) is the transactional process undertaken by a central bank that consists in purchasing non-debt, no-maturity, equity-like, high space impact, value creating instruments from qualified government agencies and/or public private partnerships (PPP), with relevant Treasury sponsorship, that increases the central bank’s balance sheet and injects new liquidity outside the banking system” (Papazian, 2023). Value Easing and PCNs are enabled through the introduction of space, the space value of money principle, and ensuing equations. In other words, PCNs translate the proposed theoretical and mathematical transformations into tangible systemic change.

5 Conclusion

The omission of space as an analytical dimension in finance has led to the abstraction of space impact from our models. This exclusion has had far reaching consequences for our sustainability as well as expansion in space, i.e., our physical context of matter, stretching from subatomic to interstellar space and every layer in between and beyond, where outer space is but a segment.

To date, our evolutionary investments have been left at the mercy of the mortal risk-averse return-maximising investor and his/her/their preferences. Given the high risks and distant returns involved in outer space exploration and settlement investments, the latter have been at odds with our principles and equations of value in finance. To survive and grow, the private outer space economy has been, and is, in pursuit of Earthly money supply. Meanwhile, the public outer space economy is continuously constrained by governmental budgets and debts.

Our multi-planetary future is an evolutionary challenge, and it is directly affected by a spaceless financial value framework and monetary architecture. Indeed, a framework and equations of value that omit space are structurally incapable of funding our multi-planetary and multi-calendar future. To initiate the hazardous long-horizon and massive investments needed to invent, manufacture, deploy, and maintain the new habitats of the future, we must first reinvent money and value in finance in order to allow the monetisation of space.

To achieve an evolutionary leap from a civilisation that monetises risk and calendar time, we must first introduce space, as analytical dimension and our physical context, into our financial value framework and equations. This is a critical first step that must be accompanied with a principle that establishes the space value of money, which in turn leads to fundamental transformations in our mathematics and monetary architecture.

The above can be achieved, without systemic shocks, through a new financial instrument designed for the purpose: Public Capitalisation Notes. PCNs are conceived as monetisation tools for central bank purchase. Like bonds and Mortgage-backed Securities, they can be used to inject new money into the economy, without debt, focused on impact and space value creation, aimed at achieving our sustainable multi-planetary future and addressing the many pressing evolutionary challenges we face as a human collective.

The transformations proposed in this paper could secure long-term sustainability and enable humanity’s expansion into outer space, but they require a fundamental re-examination of the assumptions underlying contemporary financial and monetary economics.

Author’s Note

The author is a Founder and Director of the Space Value Foundation, UK, and a Visiting Associate Professor of Space Economics at the American University in Dubai, UAE.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

AP: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review and editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

I would like to thank the editors, Joseph N. Pelton, Thais Russomano, and Bernard Foing, for their valuable support, and the reviewers referees for their constructive suggestions that have helped improve the quality of this paper.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Low Earth Orbit, Medium Earth Orbit, Geostationary Earth Orbit.

2See Brealey et al., 2020; Pike et al., 2018; Watson and Head, 2016; Williams, 1938; Fama and French, 1992, 1993, 1996, 2004, 2015; Gordon, 1959; Friedman, 1970; Gordon and Gordon, 1997; Gordon and Shapiro, 1956; Markowitz, 1952; Modigliani and Miller, 1958; Ross, 1976, 1978; Roll and Ross, 1980; Sharpe, 1963, 1964; Lintner, 1965; Merton, 1973; Black and Scholes, 1973; Nobel, 1997; Graham and Harvey, 2002; Harvey et al., 2016; Koller et al., 2011, 2015; Choudhry, 2012, 2018; Damodaran 2012, 2017; Yescombe, 2014; Rosenbaum and Pearl, 2013; Isaac and O’Leary, 2013. See also Papazian (2024), Papazian (2023), Papazian (2022) for further details and a detailed discussion.

3See Papazian (2024) for a detailed discussion of how debt-based money acts as a muzzle and leash when it comes to our ability to invest and expand in outer space.

4As I have argued in Papazian (2024), Papazian (2023), Papazian (2022), the introduction of PCNs to fund economy wide investments in outer space exploration and settlement can also be replicated to address other evolutionary challenges. Moreover, PCNs can also help us address the US public debt question and transform the debt ceiling into a wealth floor.

References

Bank of England (2024). Quantitative easing. London, United Kingdom: The Bank of England. Available online at: https://www.bankofengland.co.uk/monetary-policy/quantitative-easing (Accessed July 12, 2025).

Black, F., and Scholes, M. (1973). The pricing of Options and corporate Liabilities. J. Political Econ. 81, 637–654. doi:10.1086/260062

Brealey, A. R., Myers, C. S., and Allen, F. (2020). Principles of corporate finance. 13th Ed. New York: McGraw Hill.

Economist (2025). Satellites are polluting the stratosphere. Available online at: https://www.economist.com/science-and-technology/2025/03/05/satellites-are-polluting-the-stratosphere (Accessed July 10, 2025).

ESA (2025). Around 100 000 satellites are expected to be in orbit by 2030. Available online at: https://www.esa.int/ESA_Multimedia/Images/2025/04/Around_100_000_satellites_are_expected_to_be_in_orbit_by_2030 (Accessed July 10, 2025).

Fama, E. F., and French, K. R. (1992). The Cross-Section of expected stock returns. J. Finance 47, 427–465. doi:10.2307/2329112

Fama, E. F., and French, K. R. (1993). Common risk factors in the returns on stocks and bonds. J. Financial Econ. 33, 3–56. doi:10.1016/0304-405X(93)90023-5

Fama, E. F., and French, K. R. (1996). Multifactor Explanations of asset pricing anomalies. J. Finance 51, 55–84. doi:10.1111/j.1540-6261.1996.tb05202.x

Fama, E. F., and French, K. R. (2004). The capital asset pricing model: Theory and evidence. J. Econ. Perspect. 18, 25–46. doi:10.1257/0895330042162430

Fama, E. F., and French, K. R. (2015). A five-factor asset pricing model. J. Financial Econ. 116, 1–22. doi:10.1016/j.jfineco.2014.10.010

Financial Times (2025). US space industry sounds alarm over budget cut to collision alert system. Available online at: https://www.ft.com/content/7832459f-50a4-4aa2-866a-3197e0e1cea9 (Accessed July 8, 2025).

Friedman, M. (1970). A Friedman doctrine—the social responsibility of business is to increase its profits. N. Y. Times. Available online at: https://www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html (Accessed June 12, 2025).

Gordon, M. J. (1959). Dividends, earnings, and stock prices. Rev. Econ. Statistics 41, 99–105. doi:10.2307/1927792

Gordon, J. R., and Gordon, M. J. (1997). The finite horizon expected return model. Financial Analysts J. 53, 52–61. doi:10.2469/faj.v53.n3.2084

Gordon, M. J., and Shapiro, E. (1956). Capital Equipment Analysis: the required rate of profit. Manag. Sci. 3.

Graham, J., and Harvey, C. (2002). How CFOs make capital budgeting and capital structure Decisions. J. Appl. Corp. Finance 15, 8–23. doi:10.1111/j.1745-6622.2002.tb00337.x

Harvey, R., Liu, Y., and Zhu, H. (2016). And the Cross-Section of expected returns. Rev. Financial Stud. 29, 5–68. doi:10.1093/rfs/hhv059

Isaac, D., and O’Leary, J. (2013). Property valuation Techniques. 3rd Ed. London: Palgrave Macmillan.

Koller, T., Dobbs, R., and Huyett, B.McKinsey and Company (2011). Value: the Four Cornerstones of corporate finance. 6th Ed. New Jersey: Wiley.

Koller, T., Goedhart, M., and Wessels, D.McKinsey and Company (2015). Valuation: Measuring and Managing the value of Companies. 6th Ed. New Jersey: Wiley.

Lakonishok, J., and Shapiro, A. C. (1986). Systematic risk, total risk and size as determinants of stock market returns. J. Bank. & Finance 10, 115–132. doi:10.1016/0378-4266(86)90023-3

Lintner, J. (1965). The valuation of risk assets and the Selection of risky investments in stock Portfolios and capital budgets. Rev. Econ. Statistics 47, 13–37. doi:10.2307/1924119

LiveScience (2025). How many satellites orbit Earth? Available online at: https://www.livescience.com/how-many-satellites-orbit-earth (Accessed July 10, 2025).

McLeay, M., Radia, A., and Thomas, R. (2014a). Money in the modern economy: an introduction. London, United Kingdom: Bank of England. Available online at: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-in-the-modern-economy-an-introduction.pdf (Accessed July 4, 2025).

McLeay, M., Radia, A., and Thomas, R. (2014b). Money creation in the modern economy. London, United Kingdom: Bank of England. Available online at: https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy (Accessed July 4, 2025).

Merton, R. (1973). An Intertemporal capital asset pricing model. Econometrica 41, 867–887. doi:10.2307/1913811

Modigliani, F., and Miller, M. H. (1958). The Cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 48, 261–297. Available online at: https://www.jstor.org/stable/1809766 (Accessed July 10, 2025).

Modigliani, F., and Miller, M. H. (1963). Corporate Income Taxes and the Cost of capital: a Correction. Am. Econ. Rev. 53, 433–443. Available online at: https://www.jstor.org/stable/1809167 (Accessed July 10, 2025).

Nobel, P. (1997). “For a new method to determine the value of derivatives,” in The Nobel prize. Stockholm, Sweden: Press Release. Available online at: https://www.nobelprize.org/prizes/economic-sciences/1997/press-release/(Accessed June 8, 2025).

Papazian, A. (2022). The space value of money: rethinking finance beyond risk and time. New York: Palgrave Macmillan. doi:10.1057/.978-1-137-59489-1

Papazian, A. (2023). Hardwiring sustainability into financial mathematics: Implications for money Mechanics. New York: Palgrave Macmillan. doi:10.1007/978-3-031-45689-3

Papazian, A. (2024). Financing the Race to space: how to value, invest, and explore the Universe. New York: Palgrave Macmillan. doi:10.1007/978-3-031-73102-0

Pike, R., Neale, B., Akbar, S., and Linslley, P. (2018). Corporate finance and investment. 9th Ed. London: Pearson.

Reinganum, M. R. (1981). Misspecification of capital asset pricing: Empirical anomalies based on earnings' yields and market values. J. Financial Econ. 9, 19–46. doi:10.1016/0304-405X(81)90019-2

Reuters (2025). Space startups face uncertainty as US cuts federal spending, report says. Available online at: https://www.reuters.com/business/aerospace-defense/space-startups-face-uncertainty-us-cuts-federal-spending-report-says-2025-04-11/(Accessed July 10, 2025).

Roll, R., and Ross, S. A. (1980). An Empirical Investigation of the Arbitrage pricing theory. J. Finance 35, 1073–1103. doi:10.1111/j.1540-6261.1980.tb02197.x

Ross, S. A. (1976). The Arbitrage theory of capital asset pricing. J. Econ. Theory 13, 341–360. doi:10.1016/0022-0531(76)90046-6

Ross, S. A. (1978). The current Status of the capital asset pricing model (CAPM). J. Finance 33, 885–890. doi:10.2307/2326486

Sharpe, W. F. (1963). A Simplified model for Portfolio Analysis. Manag. Sci. 9, 277–293. Available online at:. doi:10.1287/mnsc.9.2.277

Sharpe, W. F. (1964). Capital asset prices: a theory of market Equilibrium under Conditions of risk. J. Finance 19, 425–442. doi:10.1111/j.1540-6261.1964.tb02865.x

SIA (2025). Historic Number of launches Powers commercial satellite industry Growth – Satellite industry Association Releases the 28th annual state of the satellite industry report. Available online at: https://sia.org/historic-number-of-launches-powers-commercial-satellite-industry-growth-satellite-industry-association-releases-the-28th-annual-state-of-the-satellite-industry-report/(Accessed July 10, 2025).

Space (2025). Nearly 300 NASA scientists sign 'Voyager Declaration' to protest Trump space science budget cuts. Space. Com. Available online at: https://www.space.com/space-exploration/nearly-300-nasa-scientists-sign-voyager-declaration-to-protest-trump-space-science-budget-cuts (Accessed July 24, 2025).

Space Foundation (2024). Launch records topple in 2024 with busiest January of space age. Available online at: https://www.thespacereport.org/resources/launch-records-topple-in-2024-with-busiest-january-of-space-age/(Accessed July 10, 2025).

Space Foundation (2025). Global space economy reaches $613B as commercial revenues, government support continue to climb. Available online at: https://www.thespacereport.org/resources/space-economy-reaches-613-billion/(Accessed August 1, 2025).

Space News (2025). Commercial space industry groups ask Congress to fully fund TraCSS. Available online at: https://spacenews.com/commercial-space-industry-groups-ask-congress-to-fully-fund-tracss/? (Accessed July 19, 2025).

TechCrunch (2025). Firefly Aerospace files for an IPO. Available online at: https://techcrunch.com/2025/07/11/firefly-aerospace-files-for-an-ipo/(Accessed July 12, 2025).

Watson, D., and Head, A. (2016). Corporate finance: principles and Practice. 7th ed. London: Pearson.

WEF-McKinsey (2024). Space: the $1. 8 Trillion Oppor. Glob. Econ. Growth. Available online at: https://www3.weforum.org/docs/WEF_Space_2024.pdf (Accessed July 10, 2025).

White, H. (2025). President Trump’s one Big Beautiful Bill is now the Law. Available online at: https://www.whitehouse.gov/articles/2025/07/president-trumps-one-big-beautiful-bill-is-now-the-law/(Accessed July 10, 2025).

Keywords: space, risk, time, money, finance, investment, multi-planetary, sustainability

Citation: Papazian AV (2025) The monetisation of space. Front. Space Technol. 6:1679127. doi: 10.3389/frspt.2025.1679127

Received: 04 August 2025; Accepted: 01 September 2025;

Published: 26 September 2025.

Edited by:

Joseph N. Pelton, International Space University, United StatesReviewed by:

Walter Dr. Peeters, International Space University, FranceCopyright © 2025 Papazian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Armen V. Papazian, YXJtZW5Ac3BhY2V2YWx1ZWZvdW5kYXRpb24uY29t

†Present address: Armen V. Papazian, American University in Dubai, Business School, Dubai, UAE

Armen V. Papazian

Armen V. Papazian