- 1Newcastle Business School, The University of Newcastle, Newcastle, NSW, Australia

- 2AUDC Pty Ltd., Melbourne, VIC, Australia

Introduction: Applications of Blockchain technology (BT) offer transformative innovations in organizations. Because of its effectiveness as an intermediary-free platform, researchers consider this technological platform to adopt disruptive developments. In banking sector, BT has been adopted massively for significant disruptions, but their landscape of studies to develop general understanding are still at its emergent stage, therefore it is imperative to define existing landscape of BT for greater benefits in the research community. This paper examines existing studies of BT adoption in banking sector, with a special focus to reveal on how BT architectures can bring disruptions.

Methods: The analysis has scrutizised 214 relevant articles from peer-reviewed journals across four vital databases (coverage from 2021 to 15 July 2025), through an intelligent review that represents a combined iterative approach adopting both methods of Latent Dirichlet Allocation (LDA) topic modelling and content analysis.

Results: From an information systems viewpoint, the study divided the findings into three phases: pre-adoption, adoption, and post-adoption, highlighting blockchain’s dimensions, applications in banking, the current banking landscape, and the challenges that inhibit widespread adoption of BT in banking systems.

Discussion/Conclusion: The synthesized findings indicate interesting directions for future research.

1 Introduction

Blockchain Technology (BT) was first introduced in the Bitcoin whitepaper (Nakamoto, 2008), challenging traditional centralized models, regulations, and customer expectations. BT offers a decentralized, immutable, and transparent ledger system. These features have contributed to support various sectors such as supply chain (Centobelli et al., 2022), healthcare, real estate (Miah et al., 2021), renewable energy, finance (Hendershott et al., 2021), cybersecurity (Luo and Choi, 2022; Masmali and Miah, 2023), data governance (Drummer and Neumann, 2020), and various online platforms such as the metaverse/Web 3.0 (Smethurst et al., 2023). The significant potential of BT to transform every information technology system following data driven innovation (Akter et al., 2024), such as in banking systems management (Hoang et al., 2023), from central bank functions to customer services is also widely recognized (Loan, 2024). This implies that BT is rapidly adopted by banks worldwide. The technology’s full integration into banking may take several years due to insufficient knowledge support. Therefore, it is imperative to conduct a comprehensive analysis of the growing trends of the current BT landscape that holds huge potential in the future (Yang et al., 2024).

Previous studies have proven that BT supports decentralization, transparency, immutability, privacy, provenance, security, traceability, and trust. In a decentralized system, the authority of the complete system is distributed and delegated among the participants instead of any central authority (Hoffman et al., 2020). To ensure transparency and trust, decentralized BT networks allow all participants access to transactions, processes, and data (Cheong, 2025). In BT-based transactions, once a value is written, it cannot be modified ever. BT ensures this immutability feature using hashing and digital signature algorithms, such as elliptic curve cryptography, byzantine fault tolerance, and replicated data storage (Kis and Singh, 2018). Though the transactions are available to be accessed by all participants, the personal information of individuals remains pseudonymous, ensuring privacy (Nakamoto, 2008). In BT networks, an auditable chain of transactions is recorded to ensure the provenance, traceability, and risk management, where the origin of each transaction can be traced (Vazquez Melendez et al., 2024). To maintain the chain of transactions, BT networks employ Merkle trees (Merkle, 1988) by hashing each record into a tree-like structure. Merkle trees ensure each block commits to the transactions and links to the previous block’s hash. Changing any record alters the Merkle root and the block hashes. This eventually breaks the chain and the tampering is detected, ensuring the security of the transactions. To ensure the security of the network, significant studies that shown how BT implements various consensus protocols that ensure end users follow specific rules of the protocol and the network cannot be harmed or taken over by external entities (Wang et al., 2019).

Significant BT applications are being rapidly developed in Information Systems (IS) (Hendershott et al., 2021). Existing studies on BT can be viewed across various IS application areas within the banking sector, with numerous literature reviews highlighting emerging trends. For instance, BT is applied to banking operational transformation (Salila et al., 2024), the introduction of Central Bank Digital Currency (CBDC) by central banks (Zhang and Huang, 2021; Hoang et al., 2023), cybersecurity improvements in transactions (Ullah et al., 2024), fraud detection (Kanu et al., 2022), and anti-money laundering measures (Norton, 2024), among others. Most existing review studies on BT have employed top-down methods, analyzing documents within the current or adapted banking contexts. When new application areas are identified, these are often ad hoc features arising from purposively sampled data (Salila et al., 2024). Given the rapid growth of this field, early categorizations are unlikely to be broadly applicable beyond classification or to ensure stability over time. Alongside other systematic reviews on BT in Banking (BTB) adoption, the study offers an intelligent systematic literature review (IntelliSLR) that iteratively combines automatic and manual methods, adhering to PRISMA guidelines (Page et al., 2021) with topic modelling using Latent Dirichlet Allocation (LDA) and content analysis.

The study adopted a bottom-up approach to formalize the BTB application areas to broaden current understanding. The study conducted an IS-focused literature review and analysis using the IntelliSLR approach which is guided by LDA principles and qualitative content analysis (Creswell and Guetterman, 2018). The goal is to identify the potential scope and applications of design science research (DSR) in BTB adoption. Before the analysis, the study selected an IS design perspective following DSR guidelines in developing the IntelliSLR framework for exploring the BTB studies.

The study aims to accomplish three main objectives. First, the study highlights key methodological approaches to improve understanding and gain an overall perspective of the latest BTB adoption research and key BT features in the reviewed literature. Second, it develops a detailed understanding of the main IS application areas in the banking sector. Third, it identifies the methodological aspects of the reviewed literature and maps the methodological framework by DSR artifact design types in existing BT studies.

The paper is structured as follows: the next section provides an overview of the fundamentals of BTB innovations and previously reviewed literature on adopting BTB. The following section offers methodological details, followed by the study’s findings. The discussion section highlights the overall contributions of the research, and finally, the conclusion summarizes and discusses the limitations.

2 Study background

BT1 has introduced the concept of decentralization in the financial sector, where transactions are no longer conducted behind the scenes in financial software. Although they are open to audit, and immutable, the technology has combined features like trust, transparency, and privacy in banking transactions. This innovative technology has been extensively researched, but much remains to be explored, with numerous potential applications yet to be discovered, especially in the banking sector. This section discusses BT innovations and previously studied literature on BTB adoption.

2.1 BT innovations

BT facilitates the transition from centralized to decentralized banking, boosting security (Karadag et al., 2024; Chorey and Sahu, 2024; Shafin and Reno, 2024; Roy and Prabhakaran, 2025), fostering trust (Kumar A. et al., 2024; Peng et al., 2022; Gomathi and Jayasri, 2022; Hoffmann, 2021), and promoting transparency (Garg et al., 2023; Choudhary et al., 2024; Ghosh et al., 2024) across all levels. Many innovative BT solutions have been introduced to be adopted in this industry as part of broad financial system transformation. Currently, BT supports digital transformation initiatives in traditional banks (Domazet et al., 2024; Attarde et al., 2024; Cucari et al., 2021), as well as enhances support for countries to implement CBDCs (Islam and In, 2024; Lazcano, 2024; Tunzina et al., 2024). Its immutable characteristic makes BT a popular choice for digital, mobile, and retail banking globally. This option greatly improves cross-border payments and remittance services (Mor et al., 2024; Weerawarna and Miah, 2023), also in open banking (Ghosh et al., 2024; Liao et al., 2022; Riad and Elhoseny, 2022), enabling transparent auditing for all stakeholders. BT innovations enhance security through cybersecurity measures, advanced know-your-customer (KYC) procedures, anti-money laundering (AML) detection, fraud prevention, and asset recovery (Karadag et al., 2024; Chorey and Sahu, 2024; Shafin and Reno, 2024; Roy and Prabhakaran, 2025; Al-Zubaidie and Jebbar, 2024).

Several frameworks have been created to tackle BT security challenges, such as safeguarding foreign exchange reserves (Mohammed et al., 2023), BT-based money laundering detection (Stavrova, 2021), secure transaction checkpoint methods (Chorey and Sahu, 2024), Ethereum-based BT frameworks for KYC (Thommandru and Chakka, 2024), zero knowledge proof (ZKP)2-trust security models for data breaches (Chaudhry and Hydros, 2023), and Hyperledger Fabric-based Internet-of-Things (IoT) systems (Al-Aboodi and Fard, 2024) for banking transactions. However, many of these efforts are issue-specific, theoretical, and fragmented, often lacking broad applicability.

2.2 Existing reviews of the BT literature

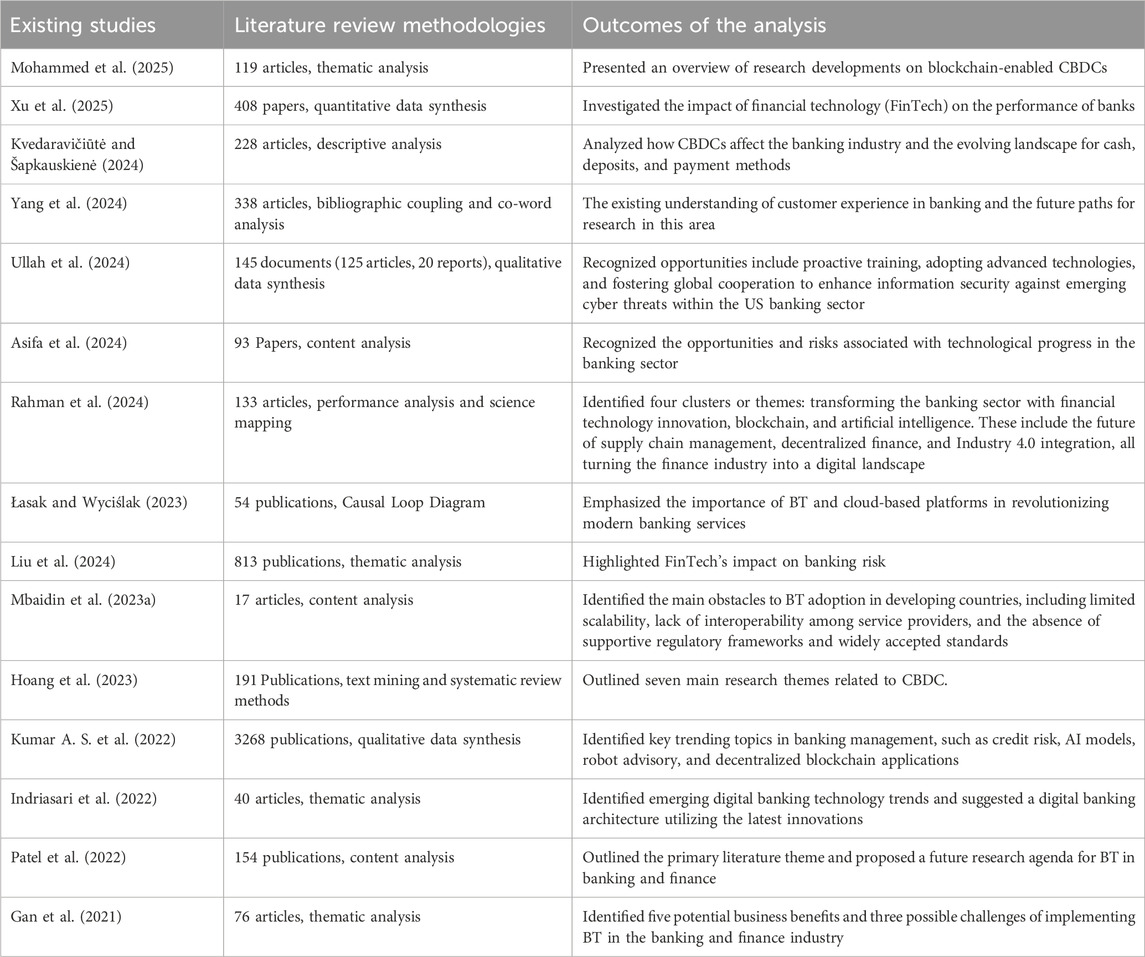

Many studies have conducted extensive literature reviews in this relatively new research domain. In their study, Gan et al. (2021) analyzed 76 articles through thematic analysis on BT applications in banking and finance up to the year 2020. They identified five key research areas, five potential business benefits, and three main challenges for implementing BT in these sectors. The primary research topics included cryptocurrencies, business models and process innovation, financial digitalization and disintermediation, financial regulation, and financial inclusion. The researchers have also identified several benefits and challenges. Patel et al. (2022) reviewed 154 publications using content analysis. They proposed four future research directions: (a) impact of financial intermediation, (b) financial applications, (c) cybersecurity and blockchain regulations, and (d) sustainable blockchain. Hoang et al. (2023) analyzed 191 publications via text mining and systematic review, identifying seven key research themes related to CBDCs: (1) central banks, (2) CBDC and other digital currencies, (3) CBDC and money markets, (4) CBDC and monetary policy, (5) CBDC design and technologies, (6) CBDC and payment systems, and (7) CBDC’s influence on financial stability and regulation. Some other notable literature review studies also identified several aspects of BT. Table 1 presents details about the previously reviewed literature on BTB adoption.

3 Research methodology

3.1 Formulation of review framework

Carrying out an effective SLR required a highly organized process that helps researchers identify, assess, and interpret existing research on a specific topic. SLRs provide a valuable way to understand complex issues by systematically documenting how relevant studies are sourced and analyzed within a given field. Researchers mostly choose between qualitative or quantitative analysis approaches, but a mixed systematic review method brings out the best outcome from a substantial stack of literature (Masmali and Miah, 2021). This study employs an intelligent SLR (IntelliSLR) approach to deepen understanding of the adoption of BTB. Following the PRISMA protocol (Page et al., 2021), this IntelliSLR analyses the decision-making process regarding published research and its outcome. The primary aim of the IntelliSLR is to examine how BT is adopted and integrated from an organizational viewpoint. Specifically, the study seeks to identify different phases, methodologies, and BT features, as well as trace the BT adoption in various application areas in the banking sector. The study develops the IntelliSLR following the DSR guidelines and maps the developed BTB artifacts of the reviewed articles on DSR artifact types. The study based the review on a set of clearly defined research questions to identify relevant findings, which guided the IntelliSLR framework. The following research questions were created to direct the literature search and subsequent analysis:

RQ1: What are the associated phases, methodological types of artifacts, and focused BT features in the BTB literature?

RQ2: Which banking application areas with significant pain points demonstrate the strongest need-solution fit for BT adoption?

RQ3: How can these studies generate actionable knowledge and promote effective BT artifact design for future researchers?

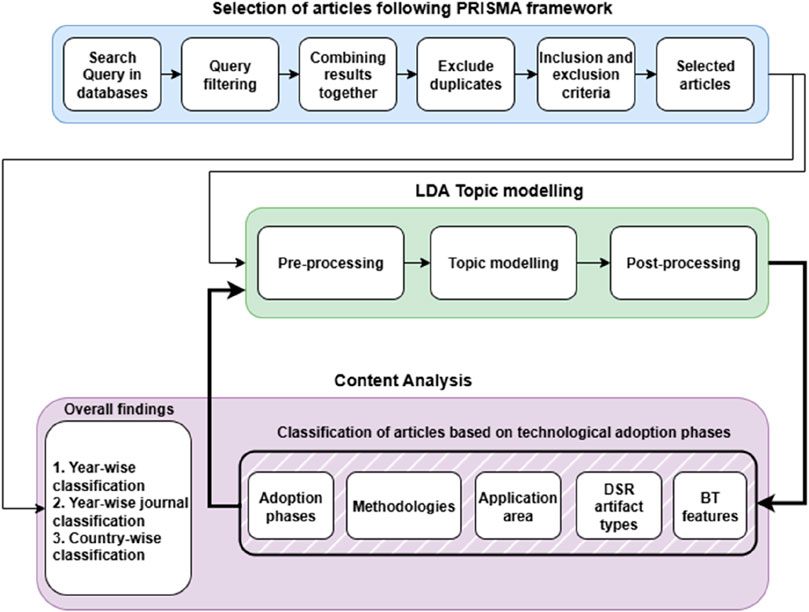

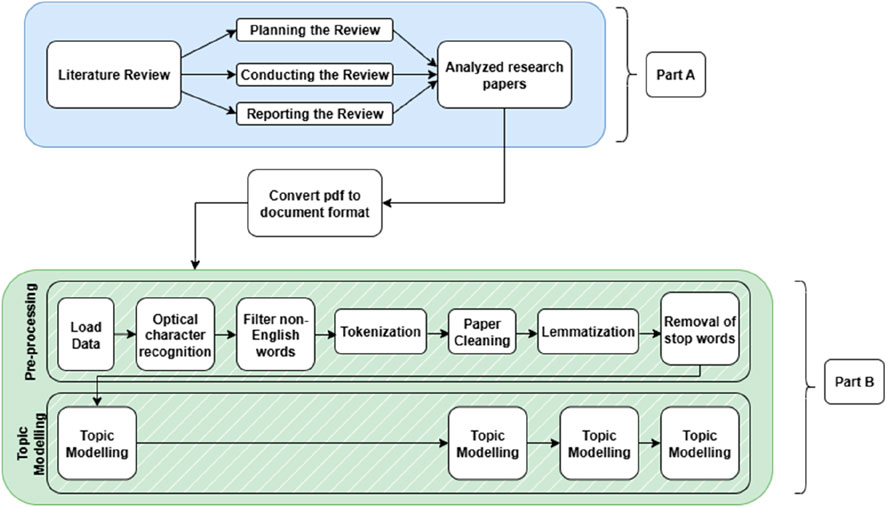

Unlike the conventional literature review (e.g., Kushwaha et al., 2021; Mohammed et al., 2025; Asifa et al., 2024), this study designed IntelliSLR to combine an intelligent topic modeling technique like LDA with a traditional review method like content analysis, following PRISMA guidelines in an iterative approach. Figure 1 illustrates the overview of the intelliSLR framework. The study includes a search strategy, inclusion and exclusion criteria, a selection process, and a data extraction and analysis process.

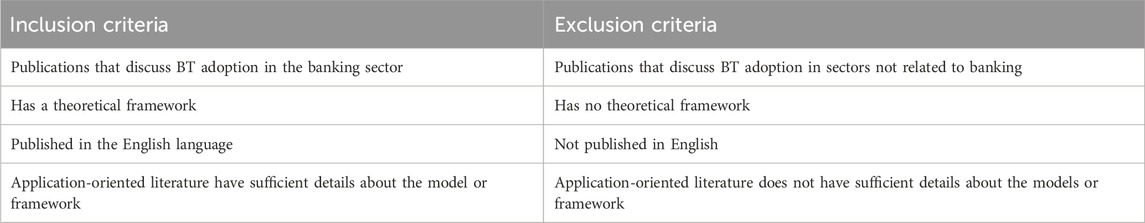

3.2 Inclusion and exclusion criteria

After identifying publications via the database search, they were selected based on specific inclusion and exclusion criteria. These criteria were developed and refined according to the study’s evolving topic and objectives. Multiple factors were considered to narrow the scope, broaden the study’s focus, and include only relevant publications. All these criteria are detailed in Table 2. Among the retrieved publications, only those that developed any IS artifact in any application areas in the banking sector were selected. Some application areas include digital adoption for traditional banking, CBDCs, digital and mobile banking, cybersecurity, open banking concept, financial sustainability, and other similar applications. A theoretical framework provides a structured map and a systematic foundation that guides the research and helps explain the “why” behind the application. A theoretical framework also enhances the rigor and validity of findings. It enables knowledge to be built and shared more effectively within a broad field of study. Without this structure, an application-oriented article lacks depth, content, and systematic analysis (Evans et al., 2011). That leads this study to include only the publications with a theoretical framework. Additionally, an application-oriented literature requires sufficient model or framework details for readers to understand the research basis, study structure, methodological choice, rationale for evaluated results, and future artifact replication (Luft et al., 2022). Along with that, this study also maps the selected publications into five DSR artifact types based on the details of the model. This leads this study to include only publications that provide sufficient details regarding the model or framework of the designed artifact.

3.3 Search strategy and data extraction

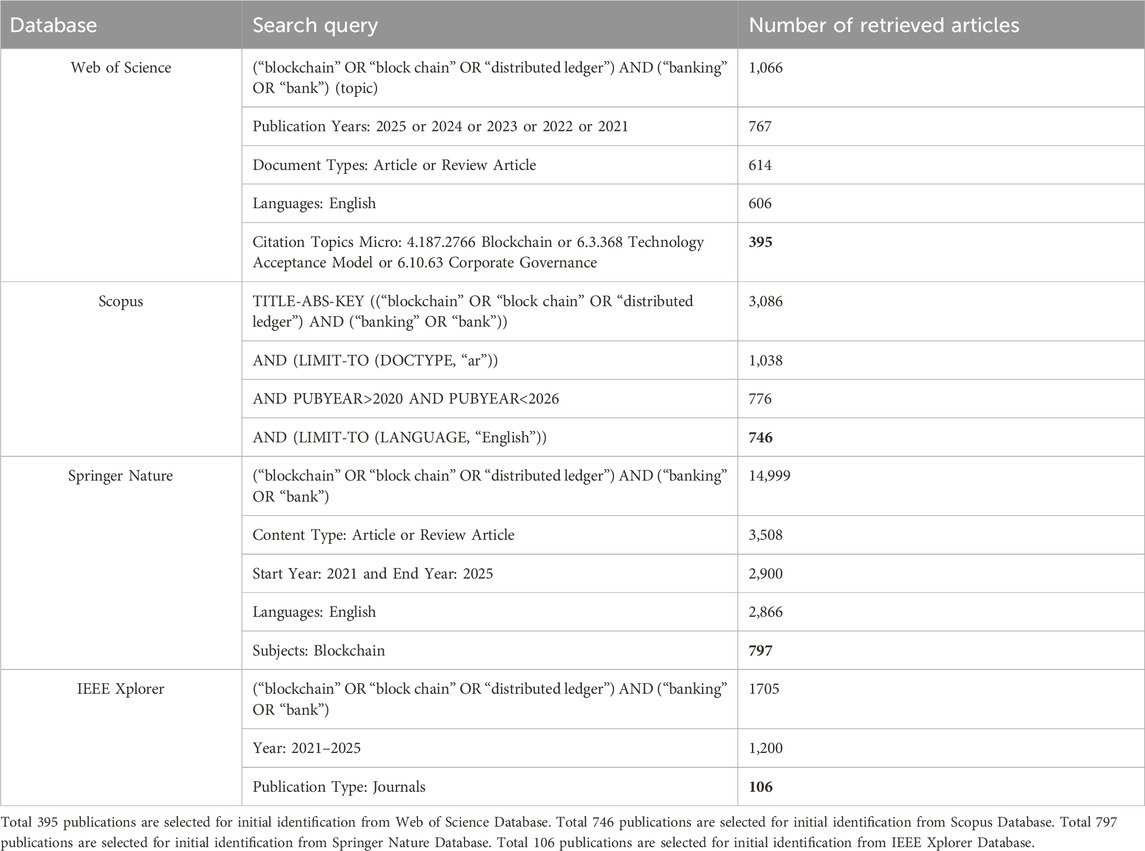

The study used a bottom-up approach to collect sample articles. Following the approach, the study did not initially select the specific outlets for selecting the sample articles. However, the study conducted an independent search using keywords across vital research databases such as Web of Science, Elsevier Scopus, Springer Nature, and IEEE Xplorer. Keywords represent the essence of articles and indicate new literature to examine. The study focused on recent literature, and filtered from 2021 to 15 July 2025, to gather the literature from the past 5 years. Given that the research topic is related to BTB adoption, the terms “blockchain” and “banking” combined with the Boolean operator “AND” were used to identify relevant research about BT adoption in the banking sector. Several other terms, including “block chain,” “bank,” and “distributed ledger,” were also used. Table 3 presents the search terms used on the databases selected for the literature search.

3.4 Content analysis

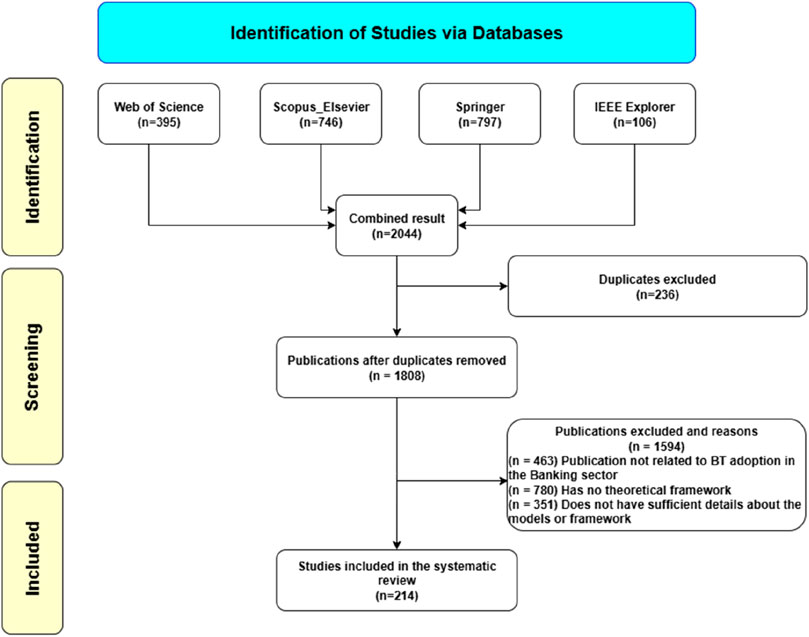

Content analysis is a versatile method that employs both qualitative and quantitative research techniques. It can explore and analyze data or content obtained directly from written documents and human interaction processes (Forman and Damschroder, 2007). Many IS researchers have applied content analysis across various IS research domains for qualitative and quantitative purposes. For instance, Al-Debei and Avison (2010) used content analysis to examine business model concepts within IS literature, while Arnott and Pervan (2012) analysed previous DSR articles related to decision support systems (DSS) design research. Miah et al. (2017) also conducted qualitative content analysis on DSR articles to examine how these studies utilise DSR methods in IS research. The study adopted Arnott and Pervan’s (2012) approach to analyze extracted articles, which helped generate valuable insights into the current state of BTB research. Figure 2 illustrates how relevant papers were selected based on PRISMA guidelines.

During content analysis, the articles were collected to gain insights into their potential, challenges, applications, and methodologies utilized in BTB. The study was guided by the three phases of preparing, organizing, and reporting described by Elo and Kyngäs (2008). The preparation phase aims to form a categorization based on related and common characteristics from a collection of grouped headings. This includes an interpretation process that helps identify categories that describe the phenomenon that has been analyzed (Elo and Kyngäs, 2008). The first concern is determining what to analyze: in this case, the study gathered 214 articles from databases using research-relevant terms. Each article was manually reviewed in the organizing phase to identify the challenges, opportunities, key methodologies, and how the design was conducted. The selected articles are decent in number and sufficient to represent the objective of this study. These existing BT artifact methodologies are loosely mapped to the explicit DSR artifact types of Hevner et al. (2004). Finally, for reporting purposes, the study has summarized the outcome of the content analysis and represented the findings.

3.5 DSR methodologies

DSR involves developing, implementing, evaluating, and adapting artifacts for problem-solving. Its emphasis on designing and developing these artifacts makes it helpful in creating BTB solution models. DSR provides improvements over traditional methods in designing IS artifacts in domains like business operation (Almtiri and Miah, 2020), higher education (Miah and Solomonides, 2021), smart city initiatives (Miah and Vu, 2020), healthcare management solutions (Miah et al., 2019; Khanom and Miah, 2020; Miranda and Miah, 2023), making understanding it crucial for BTB artifact design. It offers established methodologies for artifact creation and aims to advance ideas, practices, technical skills, and items that support the effective development and management of IS frameworks (Gregor and Hevner, 2013). Hevner et al. (2004) proposed seven guidelines and five artifact types for the design of IS artifacts. DSR is a scientific, critical thinking approach that involves creating new knowledge by designing innovative artifacts and analysing their use and adoption to enhance decision support systems (Hevner, 2007; Hevner and Chatterjee, 2010; Vaishnavi, 2007). Hevner et al. (2004) outlined five DSR artifact types for artifact design: (1) construct, (2) model, (3) method, (4) instantiation and (5) design theory. Additionally, Hevner et al. (2004) proposed the following seven guidelines for DSR methodology: (1) designing artefacts, (2) identifying problems, (3) evaluating designs, (4) making research contributions, (5) maintaining research rigor, (6) designing a search process, and (7) communicating findings.

The study selected DSR for several reasons. Firstly, the proposed IntelliSLR utilizes the DSR methodology to develop the LDA topic analysis model. Secondly, previous BTB studies that used DSR for artifact design were identified and analyzed. Finally, existing BTB applications were mapped to DSR artifact types. Mapping BTB artifacts to DSR artifact types provides a clear picture of the current landscape of BTB artifact types and their maturity. This classification synthesizes heterogeneous contributions and offers design guidance for future BTB research. The mapping shows overall representations of the BTB artifact types and directs researchers towards substantial next steps. Unlike broader empirical or conceptual approaches, DSR provides a coherent, actionable scaffold that makes it uniquely appropriate for mapping, comparing and advancing BTB artifacts adopted in banking applications. From a practical standpoint, future BTB artifacts can be developed following a structured, action-oriented methodology such as DSR, designing artifacts systematically from problem identification, artifact design to evaluation and refinement.

3.6 Topic modelling

The study combines traditional review methods with intelliSLR topic modeling (Kushwaha et al., 2021). The study utilises topic modelling, a probabilistic text-mining technique popular in computer science for extracting information from large text datasets. This approach has been employed in numerous studies (Sabharwal and Miah, 2022; Sabharwal et al., 2022; Abuhay et al., 2018; Grimmer, 2009; Ouhbi et al., 2013) and uses various machine learning (ML) algorithms (Quinn et al., 2009) such as Latent Semantic Indexing (LSI), Latent Semantic Analysis (LSA), Latent Dirichlet Allocation (LDA), Non-Negative Matrix Factorization (NMF), Parallel LDA (PLDA), and Pachinko Allocation Model (PAM). The study designed an LDA-based framework for broad and effective adoption (DiMaggio et al., 2013; Behera et al., 2019; Koltsova and Koltcov, 2013) for the intelliSLR. LDA is an unsupervised, probabilistic ML algorithm that identifies topics by analyzing word co-occurrence patterns across a corpus (Greene and Cross, 2017). Each topic derived from LDA is represented as a probability distribution across documents.

This study highlights the use of LDA in academic contexts and examines four key parameters: text pre-processing, model parameter selection, reliability, and validity. Initially, documents need to be converted into a machine-readable format, focusing only on their most informative features for effective topic modeling. This process involves three stages: pre-processing, topic modeling, and post-processing, as illustrated in Figure 3. To assist future researchers, the authors have shared the artifact’s code on GitHub with default parameters (https://github.com/rafsunsheikh/blockchain_in_banking_slr.git).

Figure 3. Proposed LDA framework adopted from Sabharwal and Miah (2022).

3.6.1 Pre-processing

Székely and Brocke (2017) explained that pre-processing is a seven-step process, which is explored below and referred to in Figure 3 as part B:

1. Load data: The text data file is imported using the Python command.

2. Optical character recognition (OCR): characters are recognised using OCR from the PDF files and converted to text.

3. Filtering non-English words: Non-English words are removed.

4. Document tokenization: Split the text into sentences and the sentences into words. Convert words to lowercase and remove punctuation.

5. Text cleaning: The text has been cleaned using portstemmer.

6. Word lemmatization: Words in the third person are changed to the first person, and past and future verb tenses are changed into the present.

7. Stop word removal: All stop words are removed.

The selected research papers were stacked into a Python environment and converted into a single text file at this stage. The seven DSR steps have been carried out, as described earlier in the methodology.

3.6.2 Topic modelling using LDA

As shown in Figure 3, part B, all 214 selected research articles were chosen for LDA topic modelling. The LDA model results include the coherence score for each selected topic and a list of the most common words associated with each.

3.6.3 Post-processing

The post-processing stage aims to identify and label relevant topics for the literature review. The output of the LDA model is a list of topics accompanied by probability scores for each publication. The algorithm assigns each publication to a topic and ranks the list based on the highest probability for each publication-topic pair. To minimize topic identification errors, the most frequent words in each topic are inspected, and the publications are reviewed. After reviewing the topics, they will be presented as a ranked list.

As shown in Equations 1, 2, LDA defines each word in each document as coming from a topic, and the topic is selected from a set of keywords with two matrices:

And, it can be said that the probability of a word in a given document, i.e.,

where T is the total number of topics. Let’s assume there are W keywords for all the documents.

After assuming conditional independence, it can be stated that,

And hence

That is the dot product of

4 Findings

In the findings, the study presents top topics and their associated keywords, along with the distribution of the topics and their graph visualization, constructing tables for existing studies based on phases, methodological classification, BT features explored, and the application areas in each phase.

4.1 Topic modelling results

The study discusses the intelliSLR findings of the 214 selected articles. The implication of LDA has gathered some interesting topic areas from the collection of publications. The following stages present the LDA topic modelling findings.

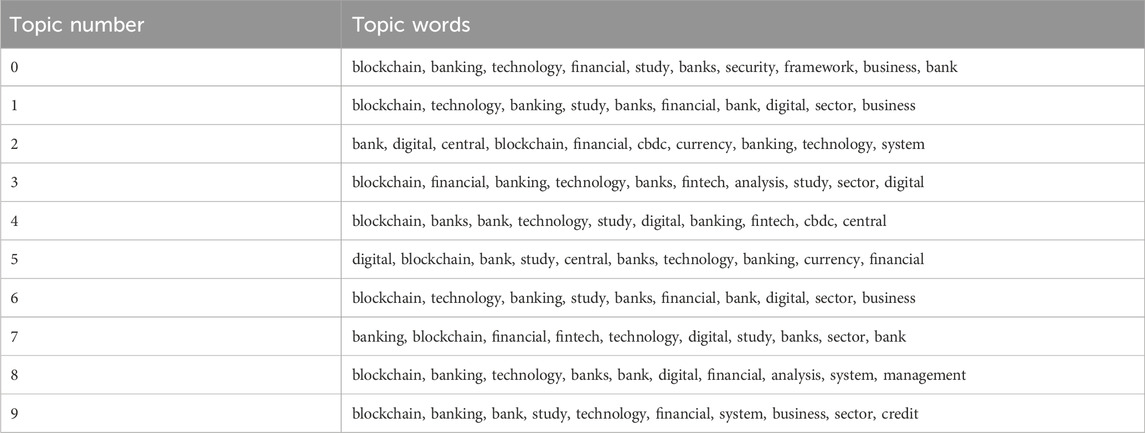

The LDA topic model primarily depends on two key parameters: the ‘id2word′ dictionary and the “corpus—doc_term_matrix.” The model is configured to identify 20 topics, each characterized by a set of 20 keywords, with each keyword holding a specific weight within its topic. These topics, such as Topic 0, are examined and interpreted within the LDA framework, as shown below:

(0,’0.024*“blockchain” + 0.014*“banking” + 0.013*“digital” + 0.013*“technology” + 0.011*“financial” + 0.010*“bank” + 0.009*“central” + 0.007*“banks” + 0.007*“cbdc” + 0.007*“study” + 0.006*“payment” + 0.006*“system” + 0.005*“currency” + 0.005*“transactions” + 0.005*“security” + 0.004*“analysis” + 0.004*“sector” + 0.004*“nan” + 0.004*“transaction” + 0.004*“business”’)

Determining the optimal number of topics involves building LDA models with varying K values and choosing the highest coherence score. Typically, selecting the “K” where topic coherence growth slows down results in meaningful and interpretable topics. However, choosing a much higher “K” can lead to finer sub-topics but may cause keywords to repeat across multiple topics, reducing clarity.

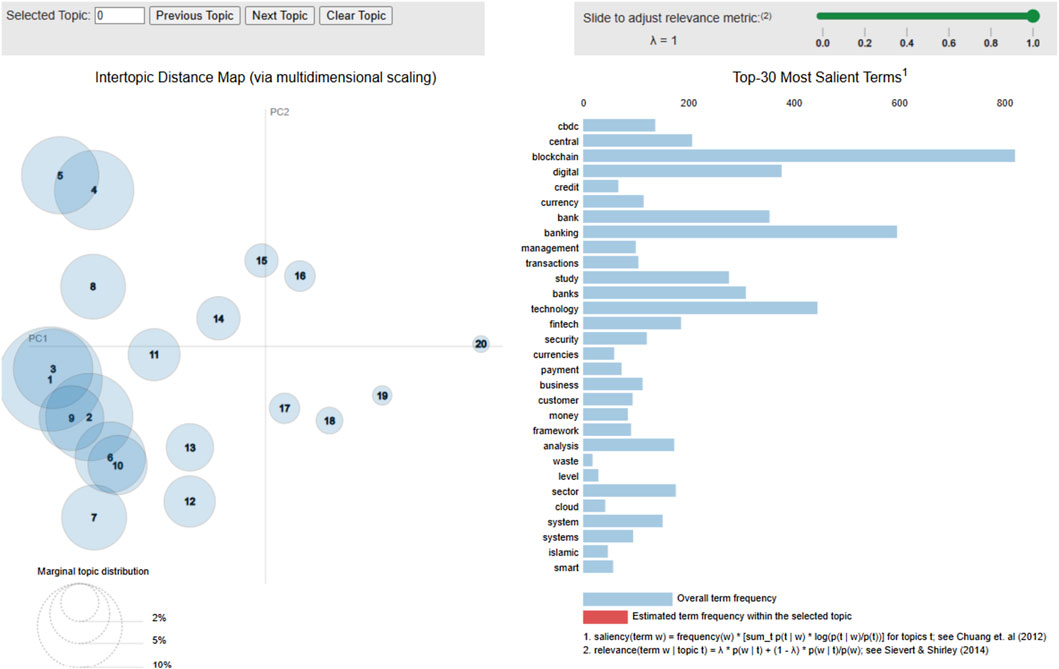

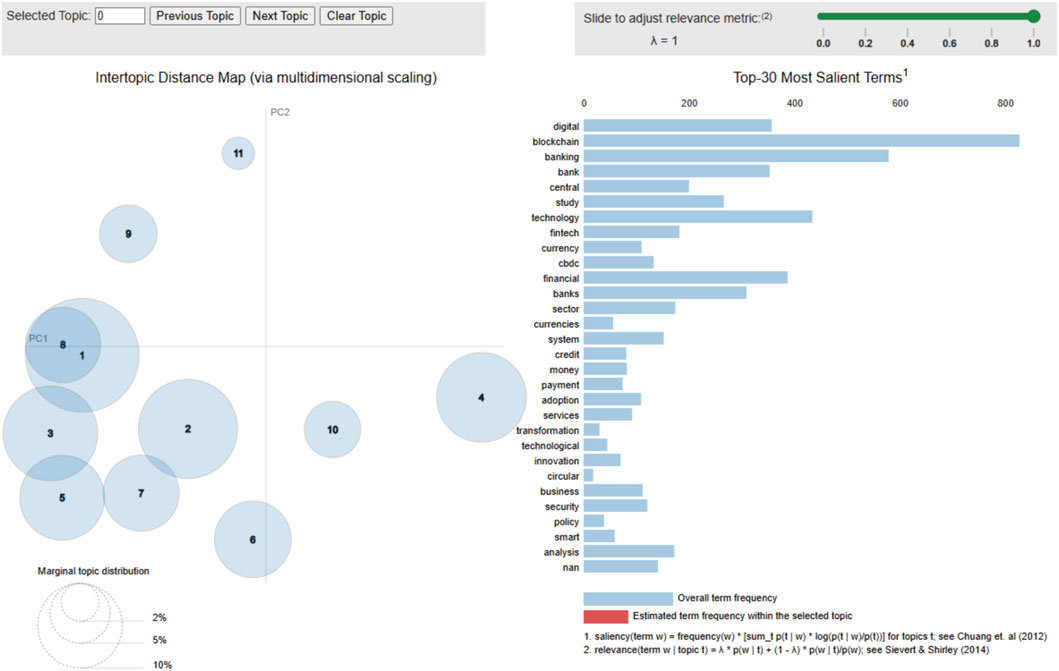

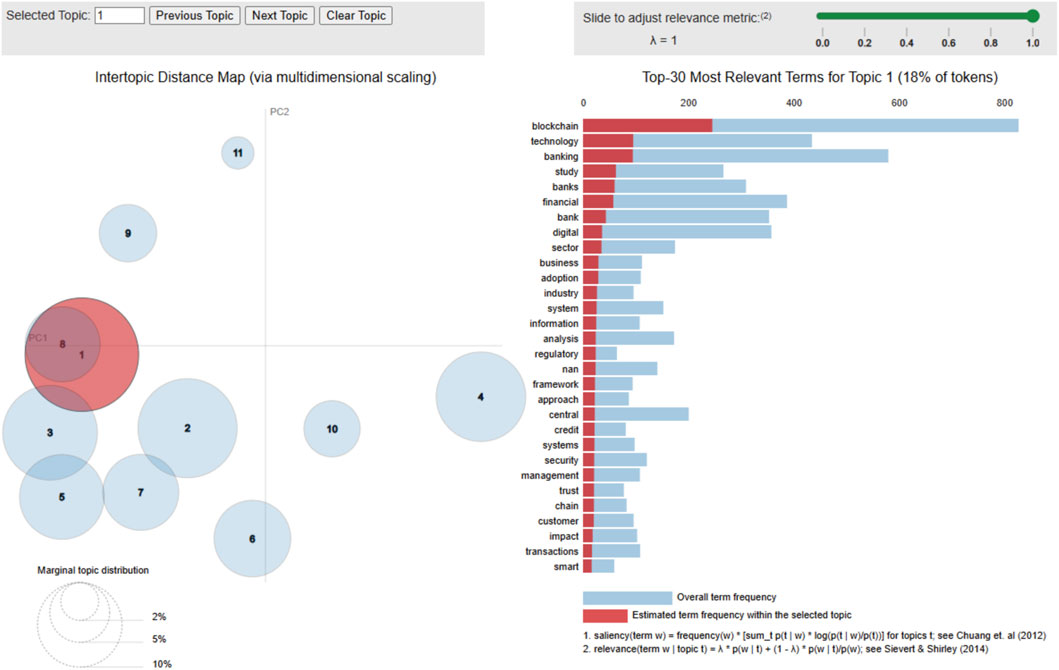

Model perplexity and topic coherence values for 20 topics are −7.28864544189294 and 0.33667478698675, respectively. A lower perplexity indicates a better model for measuring the efficiency of the LDA model. Topics and associated keywords were analyzed using an interactive chart with the pyLDAvis package. This visualization displays 20 topics and the most salient terms within each, but these topics overlap, as shown in Figure 4, meaning keywords are repeated across them. Due to this overlap, the decision was made to set num_topics = 11, which is presented in the PyLDAvis Figure 5. Each bubble on the left plot represents a topic; larger bubbles indicate more prominent topics. A good topic appears as a large, distinct bubble spread across the graph, rather than clustered in one area. Conversely, a model with many overlapping, small bubbles grouped together suggests too many topics, as seen in Figure 4.

Bubbles that are farther apart indicate greater variation. For example, topic 1 covers blockchain technology adoption in banking and financial sectors, including digital banking, fintech research, analysis, and management.

Red bars indicate how many times a specific topic produced a particular term. For example, in Figure 6, the word “blockchain” appears approximately 800 times overall, with 250 occurrences within topic 1. The word with the longest red bar is the most frequently used among the keywords associated with that topic. A good topic model features large, distinct bubbles spread across the chart. As shown in Figure 6, the bubbles tend to cluster in one area. One practical use of topic modeling is identifying the main topic in a sample document. The study determines the topic with the highest percentage contribution in that document, as demonstrated in Figure 7.

The post-processing step was to analyze the findings and create a clear depiction of the topics. This involves evaluating the most frequently used words that distinguish each topic. LDA yields soft clusters where documents and keywords can be spread across multiple topics. Because our corpus shares domain-generic terms (e.g., blockchain, banking, technology), several topics exhibit surface overlap. To interpret the keywords and their overlaps, the study treated blockchain, banking, bank, technology, financial, and study as background words for labelling purposes. And it focused on the differentiators keywords like security, framework, fintech, system, management, credit, central, CBDC, currency, and others. Table 4 displays the top ten topics numbered from 0 to 9, which list the topic numbers and related words. Topic 0 overlaps with generic adoption topics, but uniquely brings security or governance. Topic 1 has no unique differentiator, promotes generic adoption, and is a near duplicate of topic 6. Topic 2 is CBDC-focused and co-loaded with system integration. Topic 3 is about general adoption with the FinTech and innovation lens. Topic 4 sits between CBDC (Topics 2 and 5) and Fintech (Topic 3). Topic 5 concerns CBDC issuance, and topic 6 has no unique differentiator. Topic 7 overlaps with topic 3, keeping a sector-level market or industry view. Topic 8 shows a distinct IT or operational management angle. Moreover, topic 9 is the only topic about credit, lending, or credit risk use cases.

To identify more detailed insights, the study conducted a detailed content analysis of the reviewed literature.

4.2 Content analysis findings

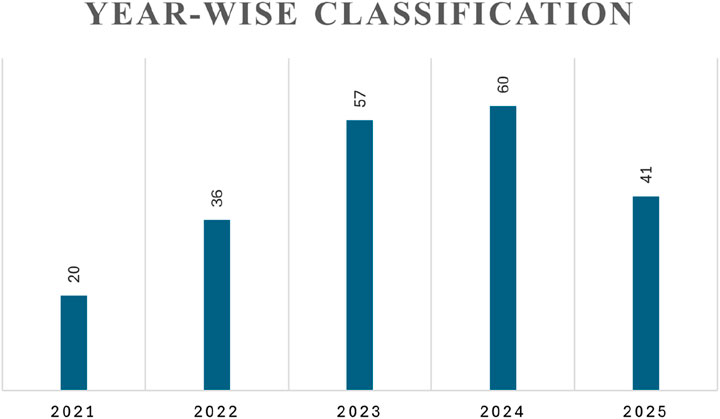

In this study, the content analysis provides overall descriptions of the selected articles as well as classified the articles based on the technological adoption phases. The overall descriptions include year-wise classification, country-wise classification (country of origin), methods utilised, most publishing journals, and applications area in focus, and BTB application mapping with DSR artifact types of the reviewed articles.

The study observed an increase in BT in banking research from 2021. There is a substantial increase in publications year over year. This indicates that both academia and industry have started to take BT seriously. Figure 8 shows the trend of publications.

In Supplementary Table A1, the study lists the top 29 publishing journals year-wise, observing that IEEE Access (6) has published the most articles, followed by SN Computer Science (4), RIBAF (3), TFSC (3), JCBTP (3), and so on. This indicates that this research area has caught the attention of most of the high-ranking journals in this domain.

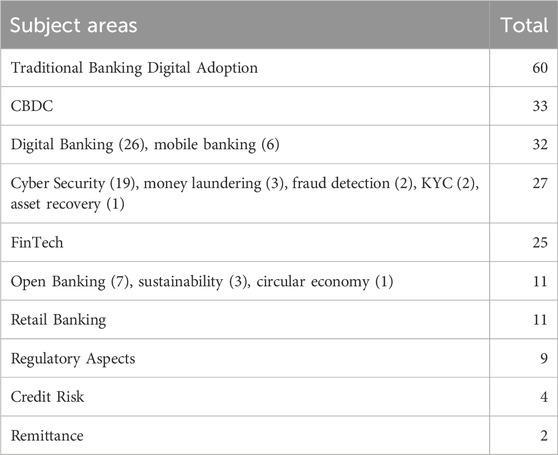

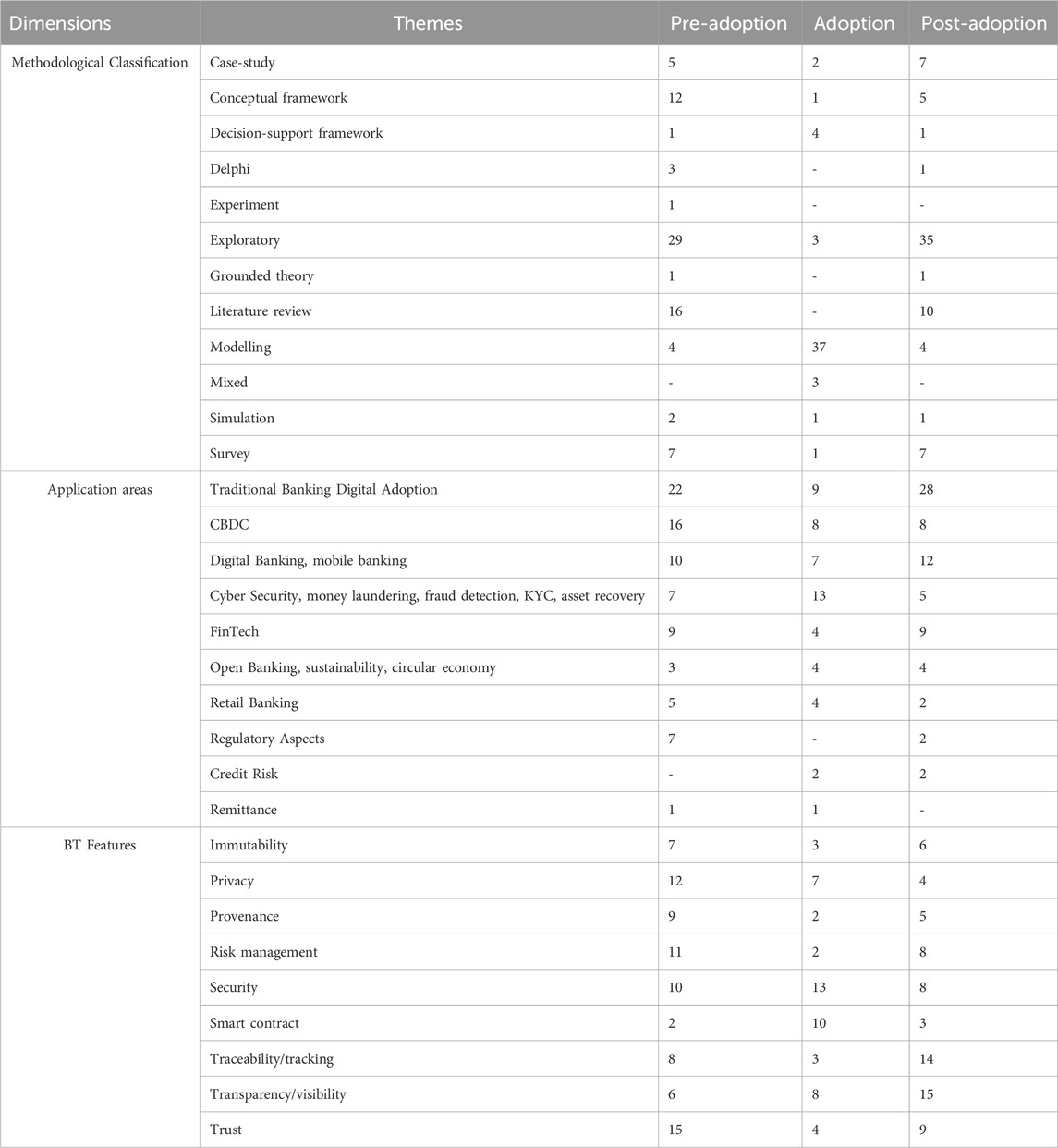

Based on the literature, the study observed that digital adoption of traditional banking systems had the most publications, followed by other application areas like CBDC, digital and mobile banking, security-related topics like cybersecurity, AML, fraud detection, KYC and asset recovery, FinTech, and sustainable banking topics like open banking and circular economy. Other subject areas like retail banking, regulatory and legal aspects, credit risks, and remittance are also explored for BT research. Counting the number of BT studies in banking application areas gives a landscape map regarding the amount of previous work in each area. This establishes the denominator for later, deeper analysis. This helps future researchers to compare counts across areas, revealing under-researched niches and over-represented topics, guiding where rigorous studies are most required. Table 5 presents the classification of the reviewed literature according to the application areas.

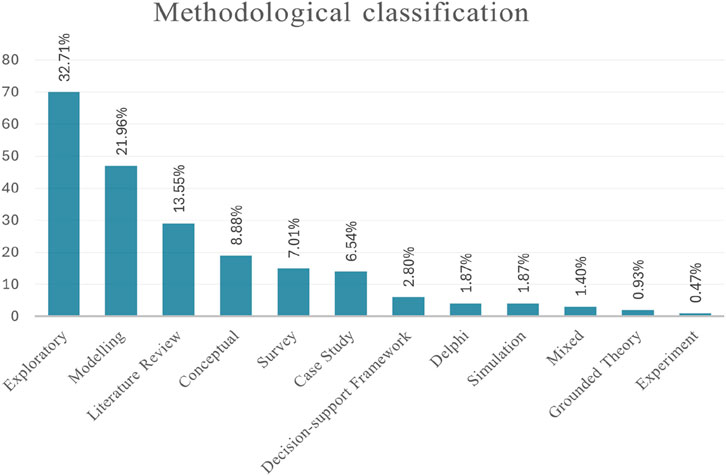

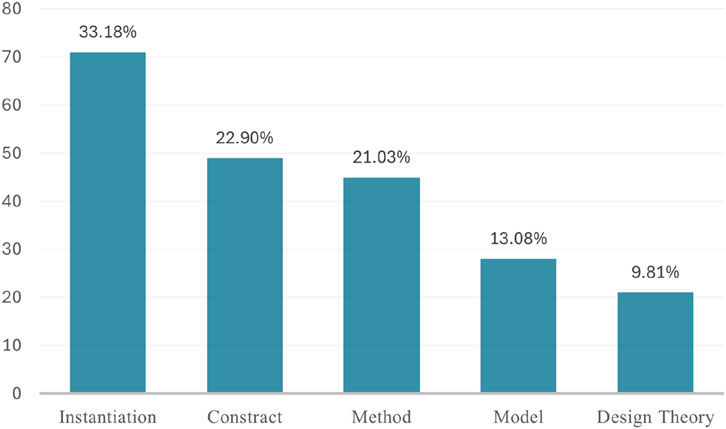

Figure 9 presents the methodology-based classification of the selected research publications. It can be observed that among the reviewed literature, 33% are exploratory studies, 22% are modelling-based studies, 14% are literature reviews, 9% are research focused on conceptual or theoretical frameworks, 7% are surveys, and 6.5% are case studies. Figure 10 illustrates the mapping of BTB applications with DSR artifact types. 33% of BTB applications match the characteristics of the instantiation artifact type, followed by 23% as construct, 21% as method, 13% as model, and 10% as design theory, respectively.

4.3 Classification of articles based on technological adoption phases

This section classifies the articles based on the perspectives regarding conceptualization, design, adoption, and implications. Hence, the study determined three major phases: pre-adoption, adoption, and post-adoption of BT in banking. Table 6 summarizes the classification findings based on three technological adoption phases. The details of the classified articles are presented in Supplementary Appendix B.

4.3.1 Pre-adoption phase

This phase involves the prerequisites for adopting BTB, including designing and executing pilot projects and understanding bank managers' intentions, either central, national, or commercial banks, regarding BTB adoption. Under this theme, 84 articles have been classified. Supplementary Tables B2–B4 detail the methodologies used by authors under the pre-adoption phase, the subject areas of the articles, and the BT features examined in this context, respectively.

A broad spectrum of studies has examined the potential benefits and implications of CBDC design. CBDC can influence financial stability and institutional structures (Kosanović, 2025). Many countries are planning to transform their traditional database-based transactional system with CBDC. It can also modernize payment systems and tax policy frameworks (Stöckel, 2025; Nascimento et al., 2024). When implemented using permissionless distributed ledger technologies (DLTs), their utility in banking operations will significantly increase (Guo R et al., 2024). Some researchers have proposed technical enhancements such as Layer 2 rollups for better privacy and scalability (Nyffenegger, 2024), and have also highlighted sociopolitical blind spots in institutional narratives around CBDCs (Swartz and Westermeier, 2023). Also, permissioned blockchains have been recommended for CBDCs due to their controlled access, but scalability remains a concern (Zhang and Huang, 2021). A good number of studies have identified motivations, policy frameworks, and design models (Dionysopoulos et al., 2023; Ozili, 2022a; Ozili, 2022b; Cioroianu et al., 2023) can be challenges for CBDC adoption.

Blockchain can potentially mitigate governance issues and credit risks in conventional banking systems, as surveyed in Bangladesh (Islam et al., 2025). In China, strategic frameworks combining artificial intelligence (AI), big data, internet of things (IoT), and blockchain are expected to improve FinTech competitiveness among banks (Wang S. et al., 2025). Swiss banks emphasize regulation and trust over present banking methods and consider operational transformation through blockchain (Schueffel and Stuessi, 2025). Cybersecurity and privacy are major concerns across regions, which brings the discussion of BT adoption (Wang et al., 2024). In the UAE, Islamic banks have demonstrated investment willingness to embrace BT to enhance their service efficiency (Mbaidin et al., 2023b). Regional case studies add a different perspective to BT adoption. In Jordan, Islamic banks are influenced by economic efficiency, training, and technological turbulence in their BT adoption decisions (Alnsour, 2024). After the latest pandemic, Sub-Saharan Africa has built toward digital infrastructure, growing their interest in blockchain and AI (Salimi, 2025).

New architectural and trust frameworks are also gaining attention. ZKP-trust security architectures powered by blockchain are proposed for better data integrity (Chaudhry and Hydros, 2023). Creative implementations such as time-banking for elderly care and decentralized identity solutions can also offer new directions (Chen et al., 2022; Zainal et al., 2022). Blockchain can improve business intelligence and audit mechanisms, combining with IoT (Ji and Tia, 2021; Al-Khasawneh and Al-Khasawneh, 2023). Despite considerable benefits, blockchain’s widespread deployment is still limited, constrained by cost, regulation, and infrastructure (Osmani et al., 2020; Khanna and Haldar, 2022).

4.3.2 Adoption phase

This phase relates to early adoption projects, adoption opportunities and challenges, and decisions related to BT adoption. A total of 54 papers have been classified under this category. Supplementary Table B4 represents methodologies followed by the authors utilised under the adoption phase. Supplementary Table B5 presents the application subject areas of the articles. Supplementary Table B6 presents BT Features explored under the adoption theme.

Blockchain technology is transforming the banking sector by enhancing trust, transparency, security, traceability, and privacy. Financial institutions are increasingly adopting blockchain-based Know Your Customer (KYC) systems to securely stream the onboarding process for new customers (Karadag et al., 2024; Kumar C. V. et al., 2024). These solutions reduce onboarding costs and improve data security. Similarly, advanced identity verification systems using blockchain have been developed to enhance financial privacy and regulatory compliance (Lazcano, 2024; Liao et al., 2022; Riad and Elhoseny, 2022). In India, blockchain adoption in banks has significantly improved banking performance by enabling competitive advantage (Garg et al., 2023). Integration with AI for fraud detection and real-time response is also gaining attention (Roy and Prabhakaran, 2025; Hajiabbasi et al., 2023; Liu and Li, 2022). In Pakistan, blockchain-based credit availability systems have improved SMEs’ access to digital and mobile banking (Rehman et al., 2023).

Developing secure and scalable transaction models has been a key area of research. Blockchain-based frameworks such as HACECA and IoTBlockFin enhance transaction security, speed, and fraud prevention (Chorey and Sahu, 2024; Syed and Ahmad, 2024). Others have proposed systems like checkpoint models and microsegmentation for cyberattack prevention in e-banking (Chorey and Sahu, 2024; Al-Zubaidie and Jebbar, 2024). Secure cross-border remittance and offline CBDC systems also highlight the adaptability of blockchain in improving cash flow and reducing infrastructure dependence (Mor et al., 2024; Attarde et al., 2024). In central banking, blockchain is explored for complex applications such as foreign exchange reserve management and secure CBDC transaction models. Full Homomorphic Encryption (FHE), smart contracts, and hybrid consensus mechanisms3 are used to enhance security and efficiency (Shafin and Reno, 2024; Islam and In, 2024). Banking institutions often face trilemma among scalability, decentralization and security (Reno and Roy, 2025). It is difficult to enhance all three factors altogether. In ideal use cases, any two of the factors can be made efficient, while compromising the other one. This trilemma factors are a ongoing research problem. Several research have emphasized on scalability issue, where BT network can perform more transactions in a single second. Meanwhile, research on permissioned and modular hybrid blockchain systems helps overcome regulatory and specifically scalability challenges in BT solution deployments (Zhang et al., 2021; 2023; Benedetti et al., 2025). Emerging solutions like CBP2P payment systems, ZKP-trust models, and quantum-resistant CBDC settlement frameworks guide to the future of decentralized finance (Peng et al., 2022; Chaudhry and Hydros, 2023; Lee et al., 2021). While blockchain has proven beneficial for cost savings, credit risk control, and disintermediation in post-trading and letters of credit (Cucculelli and Recanatini, 2021; Fridgen et al., 2021), researchers and industry experts are continuously putting more focus on the regulatory frameworks and policies remain more technical factors while developing blockchain adoption strategies (Chen et al., 2021; Ramchandra et al., 2021; Komatiguntala et al., 2025).

The role of blockchain in open banking is also emerging. Secure authentication and access management systems improve user trust and privacy (Tsai et al., 2024; Liao et al., 2022). Permissioned blockchain frameworks help manage consent and compliance in real time (Ghosh et al., 2024), while cloud-hosted financial data is safeguarded using blockchain-based access control (Riad and Elhoseny, 2022). Supply chain finance and construction sectors see improved transparency and automation through blockchain-based bank transactions (Scott et al., 2024; Scott and Broyd, 2024; Kao et al., 2022).

Globally, the adoption strategy of BT in banking varies by region and cultural expectations. In Cambodia, factors such as trust and social influence are significant influencers for BT adoption (Chov and Ou, 2022), while in Latin America, information security models are getting priority in their central bank operations (Romero et al., 2023). Italy’s Spunta project has achieved interbank transparency and efficiency (Cucari et al., 2021). As Indonesia’s finTech growth in Islamic banking faces challenges due to outdated IT infrastructure, they are shifting to better system integration, specifically adopting BT in the banking sector (Iskandar et al., 2022).

4.3.3 Post-adoption phase

This phase is related to the outcomes of implementing BT either through a virtual platform, a simulation, or in a real-world scenario. This sub-section also discusses whether the outcomes are positive and meet or go beyond the expectations at the pre-adoption and adoption phases. A total of 76 studies fall under this phase. Supplementary Table B7 represents methodologies followed by the authors utilised under this theme. Supplementary Table B8 represents the application subject areas of the articles. Moreover, Supplementary Table B9 represents BT features explored under the phase.

Integrating blockchain and FinTech rapidly transforms global banking systems, improving operational efficiency, trust, and security across regions. In Taiwan, organizational and technological factors were identified as key enablers for blockchain adoption in banks (Lu et al., 2024), while in Spain and Australia, blockchain enhanced banks’ dynamic capabilities and financial performance (Ogunrinde et al., 2025; Almadadha, 2025). Similar benefits were observed in Jordan and the UAE, where blockchain reduced costs, improved accounting information systems, and strengthened business outcomes (Zaqeeba et al., 2024; Al-Dmour et al., 2024; Ahmed, 2025). In Nigeria and Bahrain, blockchain adoption led to better financial reporting and bank performance (Ajape and Adelowotan, 2025; Naser et al., 2024; Odunayo et al., 2023). Meanwhile, countries like the USA and China are leveraging blockchain for real-time audits, cybersecurity, and improved market efficiency (Wang et al., 2022; Ullah et al., 2024; Guo S et al., 2024; Thommandru and Chakka, 2023; Thambirajan and Devaraj, 2025; Liao et al., 2022; Kanu et al., 2022).

CBDCs continue to attract global attention. Researchers have mapped key trends, identified security and legal challenges, and confirmed that BT-based models enhance security and preserve privacy in CBDC systems (Banerjee and Sinha, 2024; Lee et al., 2021; Miernicki, 2023; Wang et al., 2022). Additionally, the benefits of CBDC issuance include GDP growth and improved monetary policy (Barrdear and Kumhof, 2021). However, risks vary across regions, with DeFi’s Total Value Locked (TVL) growth modestly disrupting traditional bank deposits and requiring tailored regulations (Harir and Mkaddem, 2024; Frolov et al., 2024). BT-driven CBDC frameworks have also supported financial inclusion and real-time audits (Tunzina et al., 2024; Sethaput and Innet, 2023). In addition, hybrid models using AI and blockchain help improve credit access and monitor government debt spillovers (Roy and Prabhakaran, 2025; Wang et al., 2023). Blockchain integration into accounts receivable and lending has shown promise in improving SME financing and profitability (Zhang et al., 2023; Iacoviello and Bruno, 2023).

Blockchain continues to reshape banking models, especially regarding strategic innovation and efficiency. Blockchain adoption is also linked to UN sustainability goals, though energy use and data quality remain concerns (Griffiths and Baudier, 2023). In regions like Vietnam and Jordan, Industry 4.0 technologies, including blockchain, AI, and cloud computing, are bringing digital transformation, requiring robust ICT infrastructure and cybersecurity (Ngoc Thach et al., 2021; Haridan et al., 2023). Case studies in Italy, Egypt, and India have demonstrated successful BT adoptions in interbank systems, fund transfers, and banking reconciliation (Cucari et al., 2021; Murad and Musbah, 2021; Ravi, 2021). Meanwhile, legal and geopolitical factors shape blockchain adoption, as seen in Turkey’s speculative crypto narratives and EU CBDC regulation debates (Hoyng, 2023; Miernicki, 2023).

The future of banking lies in balancing blockchain innovation with policy and infrastructure readiness. Smart contract-enabled blockchain models benefit cross-border trade, large-value payments, and mobile services, improving efficiency and reducing costs (Wandhöfer, 2022; Alsalim and Ucan, 2022). Studies also suggest that blockchain reduces market volatility, strengthens monetary sovereignty, and drives circular economy goals through inclusion and traceable finance (Ozili, 2022a; Othman et al., 2022; Afolabi and Olanrewaju, 2023). As blockchain evolves from pilot projects to full-scale adoption, its impact on operational models, competitive advantage, and sustainability will depend on institutional agility and smart regulation (Rajnak and Puschmann, 2020; Damiani and Tumelero, 2023).

This paper examines existing studies of BT adoption in banking sector, with a special focus to reveal on how BT architectures are evolving. The study’s analysis has scrutinised 214 relevant articles from peer-reviewed journals across four databases, covering 2021 to 2025, through an intelligent literature review by a combined approach of content analysis and Latent Dirichlet Allocation (LDA) topic modelling. From an information systems viewpoint, the study divided the findings into three phases: pre-adoption, adoption, and post-adoption, highlighting blockchain’s dimensions, applications in banking, competitive advantages, the current banking landscape, and the challenges that inhibit widespread adoption of BT based banking systems.

5 Discussion

This study examined existing BT studies from a new perspective of IS to represent insights of the BTB adoption, developing a new intelligent SLR approach through a combined iterative procedure involving LDA topic modelling and traditional content analysis. This framework is called as intelliSLR, which was helpful to researchers harnessing sample articles from a huge literature. However, the analysis has scrutinised 214 relevant articles from peer-reviewed journals across four databases, covering 2021 to 15 July 2025. From an IS viewpoint, the study divided the findings into three phases: pre-adoption, adoption, and post-adoption, highlighting blockchain’s dimensions, applications in banking, competitive advantages, the current banking landscape, and the challenges that inhibit widespread adoption of BTB.

This study has identified a novel opportunity for using DSR of IS in developing BTB solutions. Only a few studies explicitly employ DSR as their methodological approach in the banking sector. As a modern IS method, DSR offers explicit approaches that emphasize not only IS design innovation, such as product and process perspectives with special focus on methodological innovation. DSR demands both rigorous knowledge contribution and practical relevance for stakeholders. While many studies describe the design process, few produce artifacts with a strong theoretical focus. Although numerous BT-based banking applications have been created without employing a DSR framework, their theoretical contribution and the clarity of their design are limited, reducing their potential as formal design artifacts for future adaptation or broader application, as found. However, understanding the development methodologies and design issues related to BTB is crucial for new knowledge generation for BT designers, IS researchers, and industry practitioners, supporting further innovation in BT applications.

The study’s review has confirmed several well-known trends in BTB. Studies consistently identify BT, especially permissioned ledgers and smart contracts, as key frameworks. The increase in publications from 2021 to July 2025 indicates growing academic and industry interest in BT-driven research. As detailed in Supplementary Appendix B, these works cover a wide range of applications, including FinTech, CBDCs, KYC systems, and fraud prevention. Looking ahead, the future of BT involves better integration with traditional systems, regulatory compliance, scalable infrastructure improvements and corporate social responsibility (Ding et al., 2024). Challenges include the complexity of legacy banking workflows and confidentiality issues in financial data sharing, which make cross-chain protocols and privacy tools like ZKPs and ring signatures more relevant. Nonetheless, in-depth research using these advanced models remains limited due to technical hurdles and a lack of extensive empirical benchmarking.

The findings suggest that while blockchain is often praised for its ability to “let consensus determine trust” instead of relying on intermediaries, these systems need design frameworks for design and adoption. This is especially true in areas like digital identity verification and automated compliance, where complex policy rules must be embedded in smart contracts.

5.1 Theoretical implications

The study developed a new intelligent SLR methodology and demonstrated its application, presenting a combined intelligent review that leverages content analysis and LDA topic modeling to review huge literature. The framework has informed through Hevner et al. (2004) seven DSR guidelines. The methodological framework could further guide new researchers on conducting an integrated intelligent literature review for achieving more accurate insights. Consequently, the study expands existing knowledge by introducing an intelligent literature review approach to save time and effort for future scholars. The study highlights the initial stage of DSR in BT deployment, noting that researchers and banking professionals typically lack familiarity with DSR guidelines. Moreover, the findings ensure DSR could be a guide for BT research, emphasizing seven key guidelines: (1) design as an artifact, (2) problem identification, (3) design evaluation, (4) research contributions, (5) research rigor, (6) designing a search process, and (7) communicating research findings. However, limited research on how DSR guidelines can be effectively used is yet to be revealed. The study endeavors to expand the DSR methodology by integrating blockchain technology to analyze past literature.

5.2 Practical implications for banking professionals

Beyond its theoretical contributions, this study offers substantial practical value for banking professionals. It synthesises the state of BT adoption in the banking domain into an actionable knowledge base that can inform artifact planning and delivery. Specifically, the review provides practitioners with a structured pathway for designing new BT artifacts, from requirements analysis, problem scoping, architecture selection, design controls, to development, evaluation, and deployment in production settings. By aligning these activities with DSR guidelines, practitioners can articulate the artifact and its novelty and demonstrate both rigor and relevance to stakeholders. The study further supports decision-making by sharing the potential of problem solving in different application areas, as well as mapped BT artifacts into DSR artifact types will help the practitioners choose requires category of artifacts in the specific problem case. The study also helps highlighting governance mechanisms for consortium operation and identifying transformation patterns with legacy systems and regulatory reporting flows. In practice, banking professionals can use the findings to prioritise high-friction, multi-party processes; select appropriate category, data management, and confidentiality mechanisms and design reliable BT artifacts. In this way, the study functions as a reliable, end-to-end reference for banks seeking to de-risk adoption, accelerate time-to-value, and scale blockchain solutions under real operational and regulatory constraints.

6 Concluding remarks and future research

The study has produced some interesting insights of BTB adoption from an IS point of views, through a comprehensive analysis. The literature analysis can be viewed as an innovative approach that combines content analysis and topic modelling, which has not been sufficiently addressed or applied in existing BTB studies, especially for identifying BT transformation and stages of BT adoption. This study demonstrated that BTB has progressed beyond exploratory proofs toward targeted application, most notably on permission blockchain and smart-contract workflows, although the knowledge creation in this domain remain fragmented. Using an intelligent SLR mechanism (intelliSLR), this study combines topic modelling with qualitative synthesis, and mapped 214 studies (2021 to July, 2025) across three adoption stages and classified contributions into DSR artifact types.

The findings reveal a rapid rise in publications related to BT in banking, which can be categorized into three technological adoption stages. Over the years, many studies have concentrated on BT adoption opportunities and challenges as part of pre-BTB adoption exploration. Others have implemented BT in various banking areas to achieve operational transformation and benefit from decentralization features of BT. Several studies have also assessed the outcomes of BTB as a post-adoption evaluation. The review also highlights application areas and methodological classifications used in banking research across these 214 articles. Few BTB studies explicitly adopt DSR as their methodology. Most rely on traditional systems development, but they often lack a thorough design and evaluation framework, and informed participation throughout the development is infrequent. Notably, the study found that, although many BTB applications have been developed, their design specifications are often imprecise, restricting their usefulness for future adoption or broader application. In the study, existing BTB applications are mapped into five DSR artifact types, serving as existing design knowledge for future DSR researchers interested in BTB research. Future researchers can develop intelligent SLR model, similar to the study following DSR guidelines, similar to the LDA topic modeling approach, using LSTM or Google BERT so that researchers can reveal more untold insights from the literature and reduce the time required in manual literature review procedures like context analysis, allowing them to review large volumes of literature quickly. Moreover, the evidence from the study points to clear opportunities including process transparency, auditability, and programmable compliance. The study identified some clear research gaps including limited evaluation under realistic banking operations, inconsistent reporting of privacy or confidentiality controls, and weak articulation of reusable, theory-informed artifacts.

BTB is becoming a key research area where IS is well positioned to contribute. However, existing works in this area has been fragmented and lacks coordination. While some system development examples are emerging, they are mainly isolated projects or developer-led applications, often not following best practices. Without a research-driven development approach, their broader contribution to knowledge remains limited. To accelerate impact, collective research grounding in relevant literature is now essential in BTB domain. The study can help developing in a modern research paradigm to design BTB artifacts following DSR and report transparent, reproducible evaluation, benchmark scalability, privacy and interoperability using structured workloads and metrics relevant to regulated finance. The study can also support in standardising integration patterns for legacy systems and architectural design documentation and synthesis to track rapid developments without sacrificing research rigor. Consolidating around these priorities will convert evolutionary prototypes into effective banking systems advancing both academic contribution and operational practices, which could be interesting study avenue for future research.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

RS: Conceptualization, Formal Analysis, Investigation, Methodology, Writing – original draft. SM: Methodology, Project administration, Supervision, Validation, Writing – review and editing. JS: Methodology, Supervision, Writing – review and editing. PC: Methodology, Supervision, Writing – review and editing.

Funding

The authors declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

Author PC was employed by AUDC Pty Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The authors declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbloc.2025.1667848/full#supplementary-material

Footnotes

1As Nakamoto (2008) defined earlier from a technical standpoint, the blockchain technology is an encrypted, linked, and timestamped distributed database (ledger) where nodes in the network reach consensus on its status through a consensus mechanism.

2A ZKP model provides proof of the identity of individuals without providing the individuals personal information (Goldwasser et al., 1989).

3Hybrid consensus mechanisms are blockchain consensus protocols that combine two or more consensus schemes like Proof-of-Work (PoW), Proof-of-Stake (PoS) or Practical Byzantine Fault Tolerance (PBFT) to leverage each scheme’s strengths and mitigate their weaknesses (Chen et al., 2025).

References

Abuhay, T. M., Kovalchuk, S. V., Bochenina, K., Mbogo, G., Visheratin, A. A., Kampis, G., et al. (2018). Analysis of publication activity of computational science society in 2001–2017 using topic modelling and graph theory. J. Comput. Sci. 26, 193–204. doi:10.1016/j.jocs.2018.04.004

Afolabi, J. A., and Olanrewaju, B. U. (2023). Cryptocurrencies and central banks’ monetary policy roles. Int. J. Electron. Finance 12 (2), 97. doi:10.1504/ijef.2023.129912

Ahmed, I. E. (2025). Analyzing the impact of blockchain technology on banking transaction costs using the random forest method. Front. Blockchain 8, 1551970. doi:10.3389/fbloc.2025.1551970

Ajape, M. K., and Adelowotan, M. O. (2025). Digital accounting practices and financial performance: quantitative research in seven international deposit money banks in Nigeria. IBIMA Bus. Rev., 1–13. doi:10.5171/2025.202801

Akter, S., Sultana, S., Gunasekaran, A., Bandara, R. J., and Miah, S. J. (2024). Tackling the global challenges using data-driven innovations. Ann. Operations Res. 333 (2–3), 517–532. doi:10.1007/s10479-024-05875-z

Al-Aboodi, H., and Fard, K. R. (2024). Novel approach for hyperledger fabric using iot for bank transactions. J. Mech. Continua Math. Sci. 19 (12). doi:10.26782/jmcms.2024.12.00013

Al-Debei, M. M., and Avison, D. (2010). Developing a unified framework of the business model concept. Eur. J. Inf. Syst. 19 (3), 359–376. doi:10.1057/ejis.2010.21

Al-Dmour, A., Al-Dmour, R., Al-Dmour, H., and Al-Adwan, A. (2024). Blockchain applications and commercial bank performance: the mediating role of AIS quality. J. Open Innovation Technol. Mark. Complex. 10 (2), 100302. doi:10.1016/j.joitmc.2024.100302

Al-Khasawneh, R., and Al-Khasawneh, T. (2023). An empirical study on the impacts of the fourth industrial revolution technologies on internal audit in Jordanian banks. J. Syst. Manag. Sci. 13 (6). doi:10.33168/jsms.2023.0632

Al-Zubaidie, M., and Jebbar, W. (2024). Transaction security and management of blockchain-based smart contracts in E-Banking-Employing microsegmentation and yellow saddle goatfish. Deleted J. 4 (2), 71–19. doi:10.58496/mjcs/2024/005

Almadadha, R. (2025). Blockchain and financial performance: empirical evidence from major Australian banks. Front. Blockchain 8, 1463633. doi:10.3389/fbloc.2025.1463633

Almtiri, Z. H. A., and Miah, S. J. (2020). “Impact of business technologies on the success of e-commerce strategies: smes perspective,” in 2020 IEEE Asia-Pacific conference on computer science and data engineering (CSDE), 1–7. doi:10.1109/CSDE50874.2020.9411376

Alnsour, I. R. (2024). Technological turbulence as hindrance between factors influencing readiness of senior management and implementing blockchain technology in Jordanian Islamic banks: a structural equation modeling approach. J. Innovation Entrepreneursh. 13 (1), 18. doi:10.1186/s13731-024-00377-5

Alsalim, M. S. H., and Ucan, O. N. (2022). Secure banking and international trade digitization using blockchain. Optik 272, 170269. doi:10.1016/j.ijleo.2022.170269

Arnott, D., and Pervan, G. (2012). Design science in decision support systems research: an assessment using the hevner, march, park, and ram guidelines. J. Assoc. Inf. Syst. 13 (11), 923–949. doi:10.17705/1jais.00315

Asifa, M., Sarwar, F., Nawaz, L., and Akbar, R. (2024). Banking fintech adoption: systematic review with bibliometric and content analysis. Serbian J. Manag. 19, 293–317. doi:10.5937/sjm19-46743

Attarde, K., Jaiswal, C., Khatwani, R., Pinto, G., and Kumar, V. (2024). A novel central bank digital currency framework design for offline and foreign transactions based on blockchain. Digital Policy Regul. Gov. 27, 201–220. doi:10.1108/dprg-10-2023-0146

Banerjee, S., and Sinha, M. (2024). The policy endorsement of central bank digital currency - trend analysis and research scope using bibliometric review. Int. J. Manag. Pract. 18 (1), 64–91. doi:10.1504/ijmp.2025.143077

Barrdear, J., and Kumhof, M. (2021). The macroeconomics of central bank digital currencies. J. Econ. Dyn. Control 142, 104148. doi:10.1016/j.jedc.2021.104148

Benedetti, M., De Sclavis, F., Favorito, M., Galano, G., Giammusso, S., Muci, A., et al. (2025). An analysis of pervasive payment channel networks for central bank digital currencies. Comput. Commun. 240, 108199. doi:10.1016/j.comcom.2025.108199

Centobelli, P., Abbate, S., Nadeem, S. P., and Garza-Reyes, J. A. (2022). Slowing the fast fashion industry: an all-round perspective. Curr. Opin. Green Sustain. Chem. 38, 100684. doi:10.1016/j.cogsc.2022.100684

Chaudhry, U. B., and Hydros, A. K. M. (2023). Zero-trust-based security model against data breaches in the banking sector: a blockchain consensus algorithm. IET Blockchain 3 (2), 98–115. doi:10.1049/blc2.12028

Chen, N., Shen, K., and Liang, C. (2021). Hybrid decision model for evaluating blockchain business strategy: a bank’s perspective. Sustainability 13 (11), 5809. doi:10.3390/su13115809

Chen, H., Chu, Y., and Lai, F. (2022). Mobile time banking on blockchain system development for community elderly care. J. Ambient Intell. Humaniz. Comput. 14 (10), 13223–13235. doi:10.1007/s12652-022-03780-6

Chen, W., Li, X., Wang, G., Li, L., Shen, J., and Li, E. (2025). HML-BFT: hybrid multi-layer BFT consensus with reputation model for large-scale blockchain. Peer-to-Peer Netw. Appl. 18 (1), 62. doi:10.1007/s12083-024-01888-4

Cheong, B. C. (2025). Leveraging blockchain for enhanced transparency and traceability in sustainable supply chains. Discov. Anal. 3 (1), 6. doi:10.1007/s44257-025-00032-7

Chorey, P. A., and Sahu, N. (2024). Enhancing banking transaction security with a hybrid access control consensus algorithm through blockchain-enabled checkpoint model. SN Comput. Sci. 5 (6), 776. doi:10.1007/s42979-024-03128-1

Choudhary, A., Chawla, M., and Tiwari, N. (2024). A blockchain-based framework for academic bank of credit with transparent credit mobility. Clust. Comput. 27 (5), 6667–6688. doi:10.1007/s10586-024-04312-x

Chov, B., and Ou, P. (2022). Determinants of the consumer’s adoption of the next-generation Mobile payments and banking: a case study of the bakong system. SN Bus. and Econ. 2 (10), 160. doi:10.1007/s43546-022-00345-9

Cioroianu, I., Corbet, S., Larkin, C., and Oxley, L. (2023). Developing central bank digital currencies: a reality check during cryptocurrency euphoria. Econ. Bus. Lett. 12 (2), 105–114. doi:10.17811/ebl.12.2.2023.105-114

Creswell, J. W., and Guetterman, T. C. (2018). Educational research: planning, conducting, and evaluating quantitative and qualitative research.

Cucari, N., Lagasio, V., Lia, G., and Torriero, C. (2021). The impact of blockchain in banking processes: the interbank spunta case study. Technol. Analysis Strategic Manag. 34 (2), 138–150. doi:10.1080/09537325.2021.1891217

Cucculelli, M., and Recanatini, M. (2021). Distributed ledger technology systems in securities post-trading services. Evidence from European global systemic banks. Eur. J. Finance 28 (2), 195–218. doi:10.1080/1351847x.2021.1921002

Damiani, R. M., and Tumelero, C. (2023). The influence of intrapreneurship on accelerating digital transformation in a bank’s credit operations center. REGEPE Entrepreneursh. Small Bus. J., e2171. doi:10.14211/regepe.esbj.e2171

DiMaggio, P., Nag, M., and Blei, D. (2013). Exploiting affinities between topic modeling and the sociological perspective on culture: application to newspaper coverage of U.S. government arts funding. Poetics 41 (6), 570–606. doi:10.1016/j.poetic.2013.08.004

Ding, C. J., Zhao, M., Wang, J., Shao, D. X., Miah, S. J., and Yue, L. (2024). Social robots in the context of corporate participation in rural revitalization: a binary legitimacy perspective. Technol. Forecast. Soc. Change 205, 123033. doi:10.1016/j.techfore.2023.123033

Dionysopoulos, L., Marra, M., and Urquhart, A. (2023). Central bank digital currencies: a critical review. Int. Rev. Financial Analysis 91, 103031. doi:10.1016/j.irfa.2023.103031

Domazet, E., Merdzan, G., Cvetkoska, V., Mechkaroska, D., Serdaroglu, S., and Sucubasi, B. (2024). Revolutionising the document workflow using blockchain in banking sector. Facta Univ. - Ser. Electron. Energetics 37 (1), 107–123. doi:10.2298/fuee2401107d

Drummer, D., and Neumann, D. (2020). Is code law? Current legal and technical adoption issues and remedies for blockchain-enabled smart contracts. J. Inf. Technol. 35 (4), 337–360. doi:10.1177/0268396220924669

Elo, S., and Kyngäs, H. (2008). The qualitative content analysis process. J. Adv. Nurs. 62 (1), 107–115. doi:10.1111/j.1365-2648.2007.04569.x

Evans, B. C., Coon, D. W., and Ume, E. (2011). Use of theoretical frameworks as a pragmatic guide for mixed methods studies: a methodological necessity? J. Mix. Methods Res. 5 (4), 276–292. doi:10.1177/1558689811412972

Fridgen, G., Radszuwill, S., Schweizer, A., and Urbach, N. (2021). Blockchain won’t kill the banks: why disintermediation doesn’t work in international trade finance. Commun. Assoc. Inf. Syst. 49 (1), 603–623. doi:10.17705/1cais.04932

Frolov, S., Ivasenko, M., Dykha, M., Shalyhina, I., Hrabar, V., and Fenyves, V. (2024). Interaction between decentralized financial services and the traditional banking system: a comparative analysis. Banks Bank Syst. 19 (2), 53–74. doi:10.21511/bbs.19(2).2024.05

Gan, Q., Lau, R. Y. K., and Hong, J. (2021). A critical review of blockchain applications to banking and finance: a qualitative thematic analysis approach. Technol. Analysis Strategic Manag. 37, 387–403. doi:10.1080/09537325.2021.1979509

Garg, P., Gupta, B., Kapil, K. N., Sivarajah, U., and Gupta, S. (2023). Examining the relationship between blockchain capabilities and organizational performance in the Indian banking sector. Ann. Operations Res. 348, 1513–1546. doi:10.1007/s10479-023-05254-0

Ghosh, A., Mukhopadhyay, I., and Chakraborty, S. (2024). Design and architectural implementation of consortium blockchain based framework for open banking customer consent and data handling. SN Comput. Sci. 5 (2), 271. doi:10.1007/s42979-023-02593-4

Goldwasser, S., Micali, S., and Rackoff, C. (1989). The knowledge complexity of interactive proof systems. SIAM J. Comput. 18 (1), 186–208. doi:10.1137/0218012

Gomathi, C., and Jayasri, K. (2022). Rain drop service and biometric verification based blockchain technology for securing the bank transactions from cyber crimes using weighted fair blockchain (WFB) algorithm. Cybern. and Syst. 54 (4), 550–576. doi:10.1080/01969722.2022.2103229

Greene, D., and Cross, J. P. (2017). Exploring the political agenda of the european parliament using a dynamic topic modeling approach. Polit. Anal. 25 (1), 77–94. doi:10.1017/pan.2016.7

Gregor, S., and Hevner, A. R. (2013). Positioning and presenting design science research for maximum impact. MIS Q. 37 (2), 337–355. doi:10.25300/misq/2013/37.2.01

Griffiths, P. D. R., and Baudier, P. (2023). Enabling responsible banking through the application of blockchain. J. Innovation Econ. and Manag. N° 41 (2), 17–49. doi:10.3917/jie.pr1.0126

Grimmer, J. (2009). A Bayesian hierarchical topic model for political texts: measuring expressed agendas in senate press releases. Polit. Anal. 18 (1), 1–35. doi:10.1093/pan/mpp034

Guo, R., Jia, Y., and Shentu, L. (2024). The effect of audit digital transformation on audit quality: evidence from digital bank confirmations. China J. Account. Stud., 1–35. doi:10.1080/21697213.2024.2442769

Guo, S., Kreitem, J., and Moser, T. (2024). DLT options for CBDC1. J. Central Bank. Theory Pract. 13 (1), 57–88. doi:10.2478/jcbtp-2024-0004

Hajiabbasi, M., Akhtarkavan, E., and Majidi, B. (2023). Cyber-physical customer management for internet of robotic things-enabled banking. IEEE Access 11, 34062–34079. doi:10.1109/access.2023.3263859

Haridan, N. M., Hassan, A. F. S., Shah, S. M., and Mustafa, H. (2023). Financial innovation in Islamic banks: evidence on the interaction between shariah board and FinTech. J. Islamic Account. Bus. Res. 14 (6), 911–930. doi:10.1108/jiabr-11-2022-0305

Harir, N., and Mkaddem, Z. B. (2024). The impact of decentralized finance development on banks deposits variability: PVAR approach. J. Financial Regul. Compliance 33, 244–264. doi:10.1108/jfrc-11-2024-0224

Hendershott, T., Zhang, X., Zhao, J. L., and Zheng, Z. (2021). FinTech as a game changer: overview of research frontiers. Inf. Syst. Res. 32 (1), 1–17. doi:10.1287/isre.2021.0997

Hevner, A., and Chatterjee, S. (2010). “Design research in information systems,” in Integrated series on information systems/integrated series in information systems. doi:10.1007/978-1-4419-5653-8

Hevner, N., March, N., Park, N., and Ram, N. (2004). Design science in information systems research. MIS Q. 28 (1), 75. doi:10.2307/25148625

Hoang, Y. H., Ngo, V. M., and Vu, N. B. (2023). Central bank digital currency: a systematic literature review using text mining approach. Res. Int. Bus. Finance 64, 101889. doi:10.1016/j.ribaf.2023.101889

Hoffman, M. R., Ibáñez, L.-D., and Simperl, E. (2020). Toward a formal scholarly understanding of blockchain-mediated decentralization: a systematic review and a framework. Front. Blockchain 3, 35. doi:10.3389/fbloc.2020.00035

Hoffmann, C. H. (2021). Blockchain use cases revisited: micro-lending solutions for retail banking and financial inclusion. 系统科学与信息学报(英文) 9 (1), 1–15. doi:10.21078/jssi-2021-001-15

Hoyng, R. (2023). From bitcoin to farm bank: an idiotic inquiry into blockchain speculation. Convergence Int. J. Res. Into New Media Technol. 29 (4), 1015–1032. doi:10.1177/13548565231154104

Iacoviello, G., and Bruno, E. (2023). Exploring a new business model for lending processes in the banking sector using blockchain technology: an Italian case study. Int. J. Digital Account. Res., 47–68. doi:10.4192/1577-8517-v23_3

Indriasari, E., Prabowo, H., Gaol, F. L., and Purwandari, B. (2022). Intelligent digital banking technology and architecture. Int. J. Interact. Mob. Technol. (iJIM) 16 (19), 98–117. doi:10.3991/ijim.v16i19.30993

Iskandar, N. R. D. M., Maryanti, T., Jayaprawira, N. a. R., and Sari, S. N. (2022). Indonesian Islamic banking fintech model strategy: ANP method. Aptisi Trans. Technopreneursh. (ATT) 4 (2), 142–152. doi:10.34306/att.v4i2.257

Islam, M. M., and In, H. P. (2024). An auditable, privacy-preserving, transparent unspent transaction output model for blockchain-based central bank digital currency. IEEE Open J. Comput. Soc. 5, 671–683. doi:10.1109/ojcs.2024.3486193

Islam, M. M., Islam, M. M., Islam, M. A., Alharthi, M., and Hassan, M. S. (2025). Shaping the future: board communication, credit risk and blockchain technology evolution in banking industries – evidence from Bangladesh. Int. J. Islamic Middle East. Finance Manag. doi:10.1108/imefm-04-2024-0206

Ji, F., and Tia, A. (2021). The effect of blockchain on business intelligence efficiency of banks. Kybernetes 51 (8), 2652–2668. doi:10.1108/k-10-2020-0668

Kanu, C., Nnam, M. U., Ugwu, J. N., Achilike, N., Adama, L., Uwajumogu, N., et al. (2022). Frauds and forgeries in banking industry in Africa: a content analyses of Nigeria deposit insurance corporation annual crime report. Secur. J. 36 (4), 671–692. doi:10.1057/s41284-022-00358-x

Kao, Y., Shen, K., Lee, S., and Shieh, J. C. P. (2022). Selecting the fintech strategy for supply chain finance: a hybrid decision approach for banks. Mathematics 10 (14), 2393. doi:10.3390/math10142393

Karadag, B., Zaim, A. H., and Akbulut, A. (2024). Blockchain-based KYC model for credit allocation in banking. IEEE Access 12, 80176–80182. doi:10.1109/access.2024.3410874

Khanna, P., and Haldar, A. (2022). Will adoption of blockchain technology be challenging: evidence from Indian banking industry. Qual. Res. Financial Mark. 15 (2), 361–384. doi:10.1108/qrfm-01-2022-0003

Khanom, N., and Miah, S. J. (2020). On-cloud motherhood clinic: a healthcare management solution for rural communities in developing countries. Pac. Asia J. Assoc. Inf. Syst., 60–85. doi:10.17705/1pais.12103

Kis, M., and Singh, B. (2018). “A cybersecurity case for the adoption of blockchain in the financial industry,” in IEEE international conference on internet of things (iThings) and IEEE green computing and communications (GreenCom) and IEEE cyber, physical and social computing (CPSCom) and IEEE smart data. Halifax, NS, Canada: SmartData, 1491–1498. doi:10.1109/Cybermatics_2018.2018.00252

Koltsova, O., and Koltcov, S. (2013). Mapping the public agenda with topic modeling: the case of the Russian livejournal. Policy and Internet 5 (2), 207–227. doi:10.1002/1944-2866.poi331

Komatiguntala, D., Kota, P., Krishnan, D., Kongari, A., Dadhabai, S., and Bommisetti, R. K. (2025). Data privacy in blockchain management scheme with nudge theory for banking sector. Edelweiss Appl. Sci. Technol. 9 (5), 1204–1220. doi:10.55214/25768484.v9i5.7124

Kosanović, N. (2025). Central bank digital currencies: financial stability perspective. J. Central Bank. Theory Pract. 14 (1), 145–162. doi:10.2478/jcbtp-2025-0008

Kumar, A. S., Setty, V. K. L. N., and Ravi, G. (2022). How blockchain enables financial transactions in the banking sector. Int. J. Bus. Glob. 31 (1), 1. doi:10.1504/ijbg.2022.124545

Kumar, A., Srivastava, A., and Gupta, P. K. (2022). Banking 4.0: the era of artificial intelligence-based fintech. Strateg. Change 31 (6), 591–601. doi:10.1002/jsc.2526

Kumar, A., Srivastava, A., and Gupta, P. K. (2024). Comprehensive survey on modern technology for improved bank credit risk. Int. J. Bus. Inf. Syst. 47 (2), 173–189. doi:10.1504/ijbis.2024.142287