- 1School of Marine Sciences, University of Maine, Orono, ME, United States

- 2Maine Center for Coastal Fisheries, Stonington, ME, United States

- 3Global Economic Dynamics and the Biosphere, The Royal Swedish Academy of Sciences, Stockholm, Sweden

- 4Stockholm Resilience Center, Stockholm University, Stockholm, Sweden

- 5Faculty of Arts and Social Sciences, University of Technology Sydney, Ultimo, NSW, Australia

Reliance on international seafood markets leaves small-scale fishers and fishing economies vulnerable to distant disturbances that can negatively affect market prices and trigger social, economic, and environmental crises at local levels. This paper examines the role of seafood trade routes and re-exports in masking such market linkages. We employ a network approach to map the global trade routes of lobster (Homarus spp.) from small-scale producers in North America to terminal markets and evaluate the extent to which intermediary nations act to obscure producer-market relationships. In taking this approach, we provide a method for systematically measuring “teleconnectivity” created through seafood trade routes, and thus making explicit vulnerabilities to small-scale fisheries from this teleconnectivity. Our empirical analysis shows that the perceived trade diversification of lobster producers is masking increased dependencies on a reduced number of end-markets, particularly in Asia. These results suggest, paradoxically, that the apparent diversification of trade partnerships may actually amplify, rather than reduce, the vulnerabilities of small-scale fishers associated with international trade by making risk harder to identify and anticipate. We discuss our results in the context of local fisheries and global seafood trade and describe key impediments to being able to monitor market dependencies and exposure to potential vulnerabilities.

Introduction

The world is witnessing unprecedented levels of global trade of natural resources as a result of increasingly liberal trade policies (OECD, 2003; Melchior, 2006; Campling, 2016) and advancements in technology and logistical capacity (Anderson et al., 2010). Tveterås et al. (2012) report that an estimated 78% of worldwide seafood supply is now influenced by global trade competition and 36% is directly traded across international borders at a value of US$148 billion. This represents a 515% increase in the trade of fisheries products for human consumption by value from 1976 to 2014 (FAO, 2016).

Increased seafood trade has been argued to produce a suite of benefits to nations, including wealth production, employment opportunities, and food security (Thorpe, 2005; Toufique and Belton, 2014; Asche et al., 2015). However, these gains are often unevenly distributed across regions and sectors and tend to disadvantage developing nations in the global south (Béné et al., 2010a,b; FAO, 2012; Prell et al., 2017). Trade also plays a paradoxical role by simultaneously making systems both more and less connected. In fisheries, for example, decreased connectivity is exemplified by the way trade decouples marine ecosystems and the often small-scale harvesters that depend on them, from consumers through geographic, socioeconomic, and cultural separation (Cheung and Chang, 2011; Fabinyi and Liu, 2016). Crona et al. (2015a) argue that this decoupling weakens the feedback loop between harvesters and consumers, making it difficult for consumers to track the ecological impacts of their purchasing decisions and respond accordingly. This dynamic is further compounded by widespread seafood mislabeling (Jacquet and Pauly, 2008) and gray and illegal trade activities, which have been estimated at 11 to 26 million tons per year (Agnew et al., 2009).

Increased connectivity on the other hand is simultaneously witnessed through new interdependencies between previously disassociated places and processes created by international trade. These emergent linkages expose small-scale fishers in geographically distinct regions to seemingly unrelated threats and disturbances, making them susceptible to what Liu et al. (2013) and Adger et al. (2009) have described as “teleconnected” surprises and vulnerabilities. “Teleconnected” refers to the idea that phenomena occurring far away are correlated through a global process, such as trade. Examples of teleconnected surprises caused by trade in small-scale fisheries are widespread. Severe flooding in southern China in 1998, for instance, caused a sudden drop in the price of bêche-de-mer (sea cucumber) in the Philippines because Chinese consumers were preoccupied with clean-up efforts and temporarily reduced consumption of luxury food products (Akamine, 2005). Another case is the ban imposed by the European Union on tilapia from Lake Victoria in the late 1990s, which resulted in severe socioeconomic hardship for lakeside communities and displaced trade from the European Union to Israel (Abila, 2003; Geheb et al., 2008). Similarly, elevated levels of heavy metals were detected in shipments of spiny dogfish from the United States that were bound for the European Union, where standards for heavy metals and PCBs are more stringent. The discovery caused the market to come to a sudden halt, adding additional strain on an already depressed fishing sector (Stoll et al., 2015).

These experiences have catalyzed interest in alternative and local seafood distribution systems (Bolton et al., 2016), but the pace of trade has not waned. More than 200 nations currently participate in international seafood trade (FAO, 2016) and the average number of trade partners per country has risen by 65% since 1994, increasing from 25.3 in 1994 to 41.7 in 2012 (Gephart and Pace, 2015).

Diversification among trade partners theoretically offsets the risk of exposure to distant threats and reduces vulnerabilities by decreasing the dependency that any one producer-nation and its small-scale producers has on a particular market (importer). However, in today's hyper-connected world, many new trade partnerships are not necessarily correlated with an increased number of markets, but rather an increase in the number of intermediaries acting as waypoints between producer-nations and terminal markets. Product is exported to these intermediaries and then re-exported again. A number of interwoven socioeconomic and political factors related to the location and cost of processing, tariffs, and illegal and gray trade practices drives this phenomenon (Jacquet and Pauly, 2008; Agnew et al., 2009; Collins and Sun, 2010; Prell et al., 2017). This makes it increasingly difficult to discern the true reliance that producers have on particular markets, and therefore obscures looming vulnerabilities of local fisheries to distant market dynamics.

Given the rising potential for teleconnected surprises created by increasing trade, efforts to assess teleconnectivity and measure the masking of market dependencies created by indirect seafood trade routes is important. Elucidating these relationships will not reduce exposure to trade related vulnerabilities per se but can reduce the potential for surprise otherwise imminent if unnoticed or misrepresented trade teleconnections are not acknowledged. This logic is consistent with standard risk management approaches employed in numerous sectors including those associated with public health, engineering, and project management. Such approaches provide estimates of hazards and the probability and magnitude of threat, yet in the fisheries sector trade related risks are poorly understood.

This paper provides a method for systematically assessing the teleconnectivity created through seafood trade routes using network analysis. We show how the methodology can be employed by using the case of lobster (Homarus spp.) and analyzing trade routes for it through time, as well as evaluating the effect of re-exports on the appearance of market dependence between producer-nations and terminal-markets. We focus on lobster as a case example because it is a high-value commodity that is traded worldwide and it is of particular sociocultural and economic importance in North America, where it supports thousands of small-scale fishers (Steneck et al., 2011; Stoll et al., 2016). We also use this case because it speaks to, and illustrates, the growing role of China in the global seafood economy. Our analysis highlights the dynamic nature of seafood trade routes and shows how market dependencies change with time. The approach also quantifies the masking of market dependencies created by indirect seafood trade routes. Evidence of such masking suggests that teleconnected vulnerabilities are being obscured, creating an environment where risk of surprise to producer-nations is likely exacerbated.

Materials and Methods

Trade Data

Data behind the seafood trade route analysis are derived from the United Nations Comtrade database, an online portal of international trade statistics (United Nations, 2017). We use the 6-digit Harmonized System (HS) codes for fresh (030622) and frozen (030612) lobster. These codes include American (H. americanus) and European lobster (H. gammarus), but not any of the species of rock and spiny lobster or Norway lobster (Nephrops norvegicus). Data for prepared and preserved lobster products are not included, since it is not possible to distinguish between the different species of lobster in this data.

Producer-nations and their annual landings were identified using the FAO Global Capture Production database (FAO, 2017). Trade statistics were then extracted from the UN Comtrade database for all nations trading lobster from 2006 to 2015. Any country trading lobster which was not identified by FAO as a producer is treated as a re-exporter. Focusing on re-exported product allows us to distinguish between nations that are terminal markets and those that effectively serve as intermediaries. In using this approach, we make several assumptions that warrant explicit acknowledgment. First, our analyses are based on the assumption that trade data provided in the UN Comtrade database are accurate. We recognize that this may not always be the case, yet UN figures are the most widely accepted data currently available. This most likely means that our results provide an under-estimate of the issue, since any inaccuracies in the data would further obscure dependencies between producer-nations and terminal markets. Another assumption relates to the delineation of trade routes. Throughout our analysis we are liberal in our designation of direct trade, which we define as trade occurring between producer-nations and non-producer nations. This assumption overlooks instances in which producer-nations themselves engage in re-export activities by importing and then re-exporting product that they did not harvest1. This assumption is necessary because the UN Comtrade database does not provide information about country of origin, making it impossible to trace the flow of product within a nation. This assumption also likely underestimates the masking of trade routes.

Network Analysis

Seafood trade often involves nations that act as “middlemen” in the supply chain, importing and then subsequently re-exporting product. This results in indirect linkages between nations, creating dependencies that are sometimes difficult to identify if focus remains primarily on direct trade (i.e., trade between a producer and a non-producer). As a result, they are rarely accounted for in assessments of fisheries resilience or sustainability.

We begin to address this issue by mapping seafood trade routes from producer-nations to terminal markets and evaluating the extent to which re-exporting intermediaries obscure the magnitude of true producer-market relationships, referred to here as market dependency. This approach, which is based on network analysis, thus measures the true dependence of producer nations on terminal markets over time, and provides a method for systematically assessing the extent of teleconnectivity created through seafood trade routes.

To examine the role of seafood re-exports and evaluate their masking effect we use a network approach. Specifically, we use weighted eigenvector centrality in the R package igraph. This is a common network metric that describes the relative importance of individual nodes based on their position in a network and the centrality of adjacent nodes (Bonacich, 1987). In other words, eigenvector centrality allows us to characterize the “global” prominence of a node (nation) in the network depicting the global trade of lobster (as opposed to “local” prominence, which measures such as degree centrality will do). The methodology relies crucially on two steps.

First, we measure the eigenvector centrality of nations engaged in lobster trade worldwide from 2006 to 2015 by calculating their centrality using only direct trade relationships (i.e., producer nation exports) for each year. We refer to this as Direct Trade Network (DTN). While this provides an assessment of the relative importance of producer nations and importers, the focus on direct trade does not allow us to evaluate the role of non-producing nations, which often import product for re-export rather than domestic consumption (or a combination of both).

To capture re-export—which is instrumental for uncovering any potential masking effects of terminal markets by falsely assuming trade diversification—we calculate the eigenvector centrality of nations engaged in global lobster trade (yearly, for the same time period), including both direct trade and re-exported trade. We refer to this as All Trade Network (ATN).

We arrive at the masking effect of re-exporting seafood by deducting eigenvector centrality values calculated in the first step by those calculated in All Trade Network (ATN).

To assess changes in the importance of trading nations over time, and thus evaluate if the evolution of trade patterns has reduced or increased the masking effect, we then order these centrality scores arrived at for each year (2006–2015) to get a rank for each country in both DTN and ATN. We do this to evaluate how the relative importance of nations changes over time, both in terms of direct trade and re-exporting patterns. We calculate this change by first standardizing the ranks (accounting for the different numbers of trade partners in DTN and ATN) and then subtracting the output of DTN from ATN using the equation:

where Rt1 equals the rank of country R in ATN at time (t) and Rt2 is the rank of country R in DTN at the same time (t). Standardization of ranks was done by letting all nations with non-existent values for any DTN or ATN (a result of them not being involved in trade during this time period) assume the lowest rank + 1 for that time period. In simple terms, all nations not trading in any particular year therefore tie for last place.

Finally, to determine the functional role of each trading nation—either as an intermediary or terminal market—we calculate the difference between in- and out-degree centrality in the ATN network. This allows us to differentiate between the countries who import for domestic consumption (in-degree would be high, while out-degree virtually null), and those functioning as re-exporting hubs (the difference between in- and out-degree would be minimal).

Results

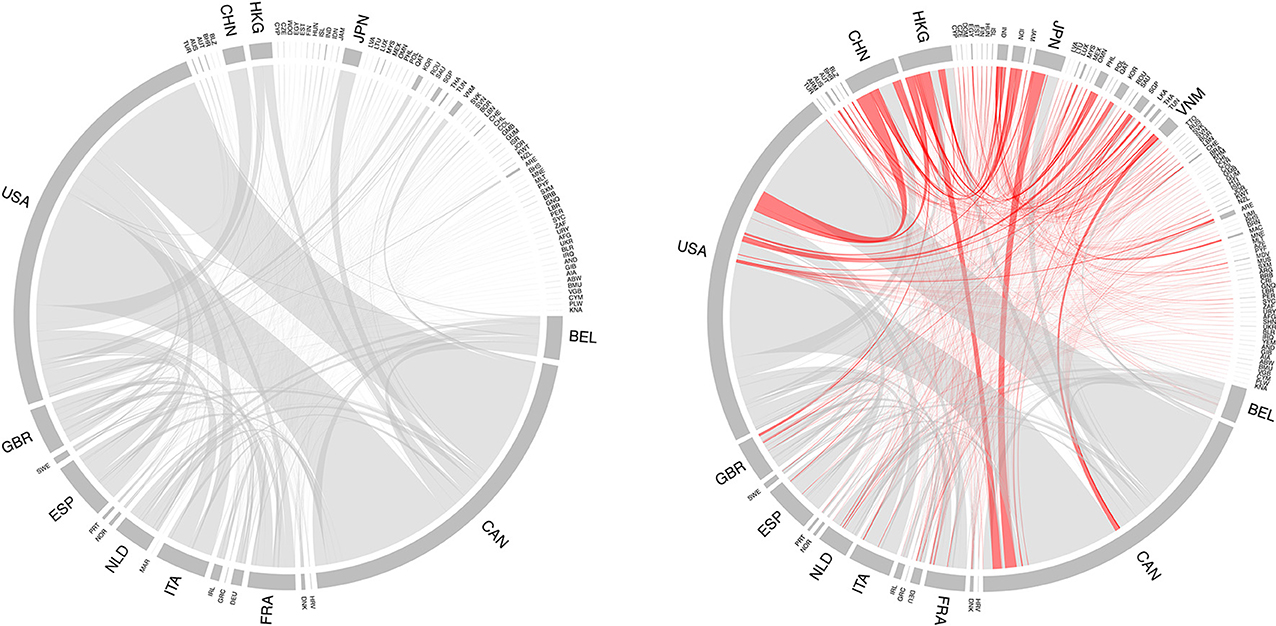

We find that market dependencies between producer-nations and terminal-markets for lobster are consistently masked, but the degree of distortion of true market dependencies varies between nations and across regions (Figure 1). Between 2006 and 2015 the underestimation of this market dependency (based on re-export) ranges from 7 to 14% of total traded value per year. As we discuss in the subsequent section, this finding is conservative.

Figure 1. Direct trade and re-export of Homarus spp. Global (2015) (Left) trade of Homarus spp. from producer-nations accounting for direct trade only. (Right) All trade of Homarus spp. including re-export (red). Width of edges between nations indicates relative value (US$) of trade.

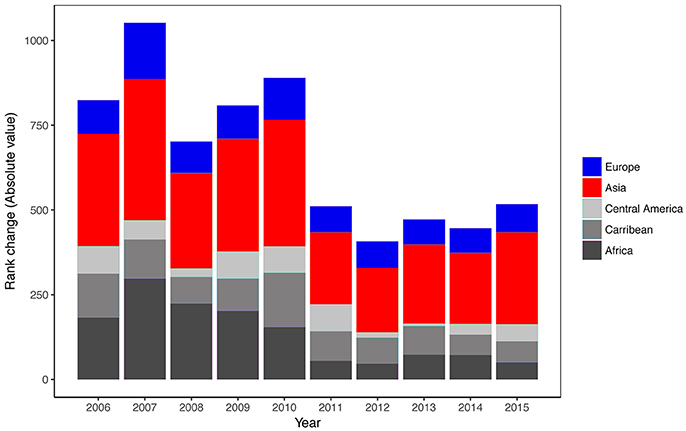

Calculation of the change in rank order between DTN and ATN allows us to assess changes in the importance of trading nations over time, and thus evaluate if the evolution of trade patterns has reduced or increased the regional masking effect of interest. Figure 2 shows the cumulative change in rank of nations over time between the two trade networks, presented per geographic region. This change reflects the aggregate relative masking of true market dependency when only accounting for direct trade. While this masking is notable in the trade network in all regions except North America, it is most pronounced in Asia2. Asia is consistently the region with the largest change in rank when contrasting only direct trade with directly traded and re-exported volumes over time, indicating a strong masking effect in this region, which results from the existence of prominent trade hubs and also large terminal-markets that are receiving re-exported product. Specifically, we find that 11 nations in Asia change ranks between DTN and ATN by at least 5 positions. By contrast, only 1 nation in Europe changes by more than 5 positions in rank (Iceland +25).

Figure 2. Relative degree of masking of true market dependence by region. Values are based on total change in rank order (aggregated by region) when comparing eigenvector centrality scores based on direct, and combined direct and re-exported lobster trade statistics. Note that North America is not visible in the graph as it consistently ranks as the most important node in the network and rank does not change.

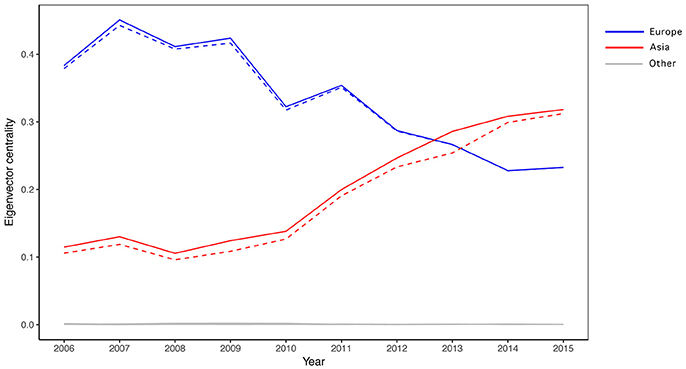

To calculate the magnitude of masking created by re-exports (Figure 3) we assess the annual discrepancy between eigenvector centrality for DTN and ATN per region. Accounting for re-exports (ATN), we find that the cumulative eigenvector centrality of European nations decreases annually from a high of 0.45 in 2007 to <0.25 in 2015 (−44%), indicating their declining importance in the global trade of lobster. This downward trend is contrasted by the cumulative change in eigenvector centrality of Asian nations. Between 2006 and 2015, centrality increases by 278%, from 0.11 to 0.32, explained by a rise in trade by several Asian nations. In particular, South Korea (+170%), Vietnam (+3,397%), Hong Kong (+256%), and China (+3,047%) all become more central nodes in the lobster trade network during the 10-year study period. The difference between DTN and ATN among European nations is relatively small, and between 2012 and 2015 is virtually non-existent. However, we find evidence that there is consistent masking in Asia from 2006 to 2015 (−7% per year) (Figure 3).

Figure 3. Total eigenvector centrality of regions between 2006 and 2015. Solid lines denote values based on all trade and hashed lines represent trade without re-exports results.

China provides an illustrative example of how seafood trade routes with intermediary trading nations contribute to masking true market dependencies and exposure to risk linked to these. While China's expanding appetite for lobster has been well-documented, particularly in association with the Chinese New Year and Guanggun Jie (Singles' Day), estimates in both the media and the scholarly literature consistently under-represent the magnitude of the Chinese market by underplaying the role that trade intermediaries play in routing product to China (e.g., Fabinyi, 2017). In 2015, producer-nations exported US$154.8 million worth of lobster directly to China, but an additional US$29.1 million3 worth of product was routed to China through re-export by other nations, indicating that China's actual import of lobster was 19% larger than conventional estimates based on direct trade. This lobster is distributed to China by way of seven primary intermediaries: Thailand (THA), Hong Kong SAR (HNK), Indonesia (IDN), India (IND), Philippines (PHL), Malaysia (MYS), and Sri Lanka (LKA). This stands in contrast to Europe, where re-export appears to be <2%.

Discussion

Teleconnectivity or the coupling of seemingly disparate processes and places is thought to expose fishers to risks that prior to intensive global trade were not of major importance (Crona et al., 2015b). This article examines the role that seafood trade intermediaries play in obscuring market dependencies for lobster and provides a method for assessing teleconnectivity via trade–arguably a first step in identifying and understanding the surprises and potential vulnerabilities associated with such telecoupling (c.f. Adger et al., 2009; Liu et al., 2013).

We find that despite the participation of an increasing number of nations in the global trade of lobster, many of these countries function primarily as intermediaries, thereby masking true terminal-market dependency. More research is needed to understand the extent to which trade routes are masking market dependencies in other fisheries, as lobster market dynamics are not necessarily representative of other species. However, consistent with other recent research on global seafood trade, we find that Asia is becoming an increasingly important market for fisheries products and has recently overtaken Europe as the largest market outside North America (e.g., Villasante et al., 2013). Our findings also show that the apparent diversification that is occurring as a result of increased seafood trade obscures the growing dependency that lobster-producing nations have on key markets, of which one of the largest is China.

Further research is needed to more fully understand the risks associated with the masking created by seafood trade routes. However, one hypothesis is that this pattern could further accentuate teleconnected vulnerabilities by setting producer-nations up for surprise in the marketplace. In the case of lobster, the seasonality of both landings and the market as well as quality of lobsters being landed (soft-shell vs. hard-shell) accounts for some of the change in ex-vessel lobster price, but there have also been several points in the 25 years when prices dropped suddenly, causing socioeconomic hardship in coastal communities where they are harvested. In the United States, for example, the ex-vessel price for lobster has had three punctuated drops observed in 2001, 2008, and 2011. In each case, these episodes were described as “crises” on account of the socioeconomic impacts (and general anxiety) that they caused fishers. Indeed, the stress associated with these price drops was so severe that it reportedly led to several outbreaks of violence among industry members (Acheson and Acheson, 2010). What ties these episodes together is that unforeseen trade dynamics—as opposed to a change in the status of the lobster fisheries alone—played a key role driving the change in price. In 2001, traders were unable to physically distribute as much product due to the downsizing of aircrafts in the wake of the terrorist attacks on the World Trade Center in New York City; in 2008, global economic instability led to less demand for luxury products worldwide; and in 2012, processors in Canada were unable to keep pace with supply. This coupling between price and trade dynamics highlights the vulnerability that producer-nations can be exposed to through trade and underscores the need for understanding and anticipating these vulnerabilities and their origins.

The risk associated with trade is particularly relevant for producer-nations that rely heavily on export markets like China, which have political structures that facilitate abrupt and broad-scale policy changes. These changes can, and have, taken many forms. For example, scholars have documented that the Chinese government placed an economic sanction on Norwegian salmon after a Nobel prize was awarded to dissident Liu Xiaobo (Chen and Garcia, 2016). In another instance, the Chinese government banned geoducks and other shellfish from the Northwest Pacific region due to concerns about paralytic shellfish poisoning and inorganic arsenic (NOAA, 2014). The point here is not to make China the culprit as it represents an increasingly valuable market in the global seafood economy, but to highlight the vulnerability created by market dependencies in general, particularly in situations that can lead to abrupt market changes. Not being able to clearly see these dependencies and anticipate change has the potential to amplify such vulnerabilities. This finding, though here specifically explored for lobster, is likely to be relevant for other seafood commodities and sectors, given that re-exporting seafood is a relatively common practice.

Monitoring market dependencies will require greater attention to the movement of product around the world, including that which is re-exported by non-producer nations. Our current capacity to do this, however, is significantly limited by two compounding factors. First, the Harmonized System (HS), which was established in 1988 as a way to standardize the global trade of commodities, is not conducive for traceability because the 6-digit trade codes that are used largely lack species-level resolution (Chan et al., 2015)4. The HS codes for Homarus spp. represent somewhat of an exception in that they only include two species (American and European lobster) that are relatively constrained (geographically), but even this analysis is limited. Much more commonly, though, HS codes aggregate species in ways that make it impossible to make even rough estimates of trade patterns. For example, all of the approximately 60 species of rock lobster that are harvested worldwide are lumped into a single set of HS codes. Being able to accurately delineate seafood trade routes for most species therefore will not be possible until trade data is collected at the species-level along with information about the origin of harvest.

Second, our ability to discern trade routes and understand market dependencies is hampered by incomplete data and gray and illegal seafood trade. We see signs of this in the lobster trade data, which likely has the effect of underestimating the masking of dependencies that we report in this paper. For example, in 2015 Vietnam did not report any re-export of lobster to China. We do not know why this data is not in the UN Comtrade Database, but given that US$67.2 million worth of lobster was exported to Vietnam and Vietnam is a well-known gray trading hub for seafood into China (Barclay et al., 2016), it is likely that some portion of this product ended up in China. Such gray trade would therefore mean that our results underrepresent the real-world importance of the Chinese market. There are also several other sources of potential error that add uncertainty to our estimate. Hong Kong SAR, for example, imported US$81.2 million worth of lobster in 2015, making it among the largest importers of lobster worldwide. Yet it only reported US$5.5 million worth of lobster trade to China. Though lobster is certainly consumed in Hong Kong SAR, it is quite likely that a portion of the remaining product also ends up in China by way of gray or illegal trade since Hong Kong SAR has a well-documented history of being a strategic waypoint for seafood trade into China (Akamine, 2005; To and Shea, 2012; Eriksson and Clarke, 2015).

We have focused on the role that seafood trade routes play in obscuring teleconnectivity and therefore potentially masking vulnerabilities for small-scale producers around the world. We emphasize this point because it is unrepresented in the literature on small-scale fisheries and seafood trade. However, ultimately, complex trade routes that mask connectivity also have implications for ongoing discussions about food safety, labeling (including widespread mislabeling that occurs in many locations), certification (which requires traceability), taxes and tariff collection, implementation and enforcement of CITES laws, and marine resource sustainability in general (see e.g., Bailey et al., 2016; Cawthorn and Mariani, 2017).

Data Availability

The datasets analyzed for this study can be found in the United Nations COMTRADE Database [https://comtrade.un.org] and FAO Global Capture Production Database [http://www.fao.org/fishery/statistics/collections/en].

Author Contributions

JS and BC conceived of the research. JS and EF prepared and organized the data. JS conducted the analyses and wrote the draft. BC, MF, and EF provided edits and feedback.

Funding

Funding to support this research was provided by the Maine Research Reinvestment Fund, by the Erling-Persson Family Foundation through the Global Economic Dynamics and the Biosphere Program at the Royal Swedish Academy of Sciences and by a Society in Science-Branco Weiss Fellowship.

Conflict of Interest Statement

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

We extend our appreciation to Fei Chai, Yong Chen, and Ziwen Ye for help facilitating a scoping trip to Hong Kong and southern mainland China in early 2016 that greatly informed the ideas presented in this paper and to Curt Brown and Bob Bayer for their insights about global lobster trade dynamics. We also thank the insightful input provided by the reviewers.

Footnotes

1. ^Trade between the United States and Canada provides an example of this dynamic. Both countries land lobster, but also trade with each other.

2. ^The consistent top rank of North America means that no change in rank is observed over time and signals that the masking effect is null for this region.

3. ^Re-exported trade represented 35% of the total value in 2014.

4. ^Chan et al. (2015) report that only 9.9% of fisheries products with HS codes are reported at the species level

References

Abila, R. (2003). Fish Trade and Food Security: Are they Reconcilable in Lake Victoria? Available online at: https://www.researchgate.net/profile/Richard_Abila/publication/263681186_Fish_trade_and_food_security_Are_they_reconcilable_in_Lake_Victoria/links/0c96053ba9f7ac07be000000/Fish-trade-and-food-security-Are-they-reconcilable-in-Lake-Victoria.pdf

Acheson, J. M., and Acheson, A. W. (2010). Factions, models and resource regulation: prospects for lowering the maine lobster trap limit. Hum. Ecol. 38, 587–598. doi: 10.1007/s10745-010-9348-9

Adger, W. N., Eakin, H., and Winkels, A. (2009). Nested and teleconnected vulnerabilities to environmental change. Front. Ecol. Environ. 7, 150–157. doi: 10.1890/070148

Agnew, D. J., Pearce, J., Pramod, G., Peatman, T., Watson, R., Beddington, J. R., et al. (2009). Estimating the worldwide extent of illegal fishing. PLoS ONE 4:e4570. doi: 10.1371/journal.pone.0004570

Akamine, J. (2005). Role of the trepang traders in the depleting resource management: a philippine case. Senri Ethnol. Stud. 67, 259–278. doi: 10.15021/00002671

Anderson, J. J., Asche, F., and Tveteras, S. (2010). “World Fish Markets,” in Handbook of Marine Fisheries Conservation and Management, eds R. Q. Grafton, R. Hillborn, D. Squires, M. Tait, and M. Williams (Oxford: Oxford University Press), 113–123.

Asche, F., Bellemare, M. F., Roheim, C., Smith, M. D., and Tveteras, S. (2015). Fair enough? Food security and the international trade of seafood. World Dev. 67, 151–160. doi: 10.1016/j.worlddev.2014.10.013

Bailey, M., Bush, S. R., Miller, A., and Kochen, M. (2016). The role of traceability in transforming seafood governance in the global South. Curr. Opin. Environ. Sustain. 18, 25–32. doi: 10.1016/j.cosust.2015.06.004

Barclay, K., Kinch, J., Fabinyi, M., Waddell, S., Smith, G., Sharma, S., Kichawen, P., et al. (2016). Interactive Governance Analysis of the Bêche-de-Mer “Fish Chain” from Papua New Guinea to Asian Markets. Sydney, NSW: University of Technology Sydney.

Béné, C., Hersoug, B., and Allison, E. H. (2010a). Not by rent alone: analysing the pro-poor functions of small-scale fisheries in developing countries. Dev. Policy Rev. 28, 325–358. doi: 10.1111/j.1467-7679.2010.00486.x

Béné, C., Lawton, R., and Allison, E. H. (2010b). “Trade matters in the fight against poverty”: narratives, perceptions, and (lack of) evidence in the case of fish trade in Africa. World Dev. 38, 933–954. doi: 10.1016/j.worlddev.2009.12.010

Bolton, A. E., Dubik, B. A., Stoll, J. S., and Basurto, X. (2016). Describing the diversity of community supported fishery programs in North America. Mar. Policy 66, 21–29. doi: 10.1016/j.marpol.2016.01.007

Bonacich, P. (1987). Power and centrality: a family of measures'. J. Sociol. 92, 1170–1182. doi: 10.1086/228631

Campling, L. (2016). Trade politics and the global production of canned tuna. Mar. Policy 69, 220–228. doi: 10.1016/j.marpol.2016.02.006

Cawthorn, D.-M., and Mariani, S. (2017). Global trade statistics lack granularity to inform traceability and management of diverse and high-value fishes. Sci. Rep. 7:12852. doi: 10.1038/s41598-017-12301-x

Chan, H. K., Zhang, H., Yang, F., and Fischer, G. (2015). Improve customs systems to monitor global wildlife trade. Science 348, 291–292. doi: 10.1126/science.aaa3141

Chen, X., and Garcia, R. J. (2016). Economic sanctions and trade diplomacy: sanction-busting strategies, market distortion and efficacy of China's restrictions on norwegian salmon imports. China Inform. 30, 29–57. doi: 10.1177/0920203X15625061

Cheung, G. C. K., and Chang, C. Y. (2011). Cultural identities of Chinese business: networks of the shark-fin business in Hong Kong. Asia Pac. Bus. Rev. 17, 343–359. doi: 10.1080/13602380903461623

Collins, R., and Sun, X. (2010). China's grey channels as access points for foreign food products to the Chinese domestic market. China Inform. 24, 61–74. doi: 10.1177/0920203X09354962

Crona, B. I., Daw, T. M., Swartz, W., Norström, A. V., Nystrom, M., Thyresson, M., et al. (2015a). Masked, diluted and drowned out: how global seafood trade weakens signals from marine ecosystems. Fish Fish. 17, 1175–1182. doi: 10.1111/faf.12109

Crona, B. I., Van Holt, T., Petersson, M., Daw, T. M., and Buchary, E. (2015b). Using social–ecological syndromes to understand impacts of international seafood trade on small-scale fisheries. Glob. Environ. Change 35, 162–175. doi: 10.1016/j.gloenvcha.2015.07.006

Eriksson, H., and Clarke, S. (2015). Chinese market responses to overexploitation of sharks and sea cucumbers. Biol. Conserv. 184, 163–173. doi: 10.1016/j.biocon.2015.01.018

Fabinyi, M. (2017). Producing for Chinese luxury seafood value chains: different outcomes for producers in the Philippines and North America. Mar. Policy 63, 184–190. doi: 10.1016/j.marpol.2015.03.024

Fabinyi, M., and Liu, N. (2016). The Social context of the Chinese food system: an ethnographic study of the Beijing seafood market. Sustainability 8, 244–217. doi: 10.3390/su8030244

FAO (2016). The State of World Fisheries and Aquaculture 2016. Rome: Food and Agricultural Organization of the United Nations.

FAO (2017). Global Capture Production Database. FAO Available online at: http://www.fao.org/fishery/statistics/global-capture-production/en

Geheb, K., Kalloch, S., Medard, M., Nyapendi, A.-T., Lwenya, C., and Kyangwa, M. (2008). Nile perch and the hungry of Lake Victoria: Gender, status and food in an East African fishery. Food Policy 33, 85–98. doi: 10.1016/j.foodpol.2007.06.001

Gephart, J. A., and Pace, M. L. (2015). Structure and evolution of the global seafood trade network. Environ. Res. Lett. 10, 1–11. doi: 10.1088/1748-9326/10/12/125014

Jacquet, J. L., and Pauly, D. (2008). Trade secrets: renaming and mislabeling of seafood. Mar. Policy 32, 309–318. doi: 10.1016/j.marpol.2007.06.007

Liu, J., Hull, V., Batistella, M., DeFries, R., Dietz, T., Fu, F., et al. (2013). Framing sustainability in a telecoupled world. Ecol. Soc. 18, 26. doi: 10.5751/ES-05873-180226

Melchior, A. (2006). Tariffs in Wolrd Seafood Trade. Rome: Food and Agriculture Organization of the United Nations.

NOAA (2014). Statement by NOAA Fisheries on the Most Recent Letter from Chinese Authorities (Silver Spring: NOAA), 1–1.

Prell, C., Sun, L., Feng, K., He, J., and Hubacek, K. (2017). Uncovering the spatially distant feedback loops of global trade: a network and input-output approach. Sci. Total Environ. 586, 401–408. doi: 10.1016/j.scitotenv.2016.11.202

Steneck, R. S., Hughes, T. P., Cinner, J. E., Adger, W. N., Arnold, S. N., Berkes, F., et al. (2011). Creation of a gilded trap by the high economic value of the maine lobster fishery. Conserv. Biol. 25, 904–912. doi: 10.1111/j.1523-1739.2011.01717.x

Stoll, J. S., Beitl, C. M., and Wilson, J. A. (2016). How access to Maine's fisheries has changed over a quarter century: the cumulative effects of licensing on resilience. Glob. Environ. Change 37, 79–91. doi: 10.1016/j.gloenvcha.2016.01.005

Stoll, J. S., Pinto da Silva, P., Olson, J., and Benjamin, S. (2015). Expanding the “geography” of resilience in fisheries by bringing focus to seafood distribution systems. Ocean Coastal Manag. 116, 185–192. doi: 10.1016/j.ocecoaman.2015.07.019

Thorpe, A. (2005). “Growth and equity: grounds for inserting the sector in PRSPS and NDPS,” in Mainstreaming Fisheries into National Development and Poverty Reduction Strategies: Current Situation and Opportunities (Rome: FAO Fisheries Circular). Available online at: http://www.fao.org/docrep/008/y5930e/y5930e00.HTM

To, A. W., and Shea, S. K. (2012). Patterns and dynamics of bêche-de-mer trade in Hong Kong and mainland China: implications for monitoring and management. Traffic Bull. 24, 65–76.

Toufique, K., and Belton, S. (2014). Is aquaculture pro-poor? Empirical evidence of impacts on fish consumption in Bangladesh. World Dev. 64, 609–620. doi: 10.1016/j.worlddev.2014.06.035

Tveterås, S., Asche, F., Bellemare, M., Smith, M., Guttormsen, A., Lem, A., et al. (2012). Fish is food-the FAO's fish price index. PLoS ONE 7:e36731. doi: 10.1371/journal.pone.0036731

United Nations (2017). UN Comtrade Database. Available online at: https://comtrade.un.org/

Keywords: seafood trade, teleconnectivity, globalization, lobster, China, vulnerability

Citation: Stoll JS, Crona BI, Fabinyi M and Farr ER (2018) Seafood Trade Routes for Lobster Obscure Teleconnected Vulnerabilities. Front. Mar. Sci. 5:239. doi: 10.3389/fmars.2018.00239

Received: 20 April 2018; Accepted: 21 June 2018;

Published: 10 July 2018.

Edited by:

Simone Libralato, National Institute of Oceanography and Experimental Geophysics, ItalyReviewed by:

Athanassios C. Tsikliras, Aristotle University of Thessaloniki, GreeceDyhia Belhabib, University of British Columbia, Canada

Copyright © 2018 Stoll, Crona, Fabinyi and Farr. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Joshua S. Stoll, am9zaHVhLnN0b2xsQG1haW5lLmVkdQ==

Joshua S. Stoll

Joshua S. Stoll Beatrice I. Crona

Beatrice I. Crona Michael Fabinyi

Michael Fabinyi Emily R. Farr2

Emily R. Farr2