Abstract

Subjective financial scarcity poses a significant concern that negatively impacts individuals' wellbeing. With attention tunneling to present financial worries, individuals might neglect their future financial situation, even if they objectively have enough funds to save. Such behavior can contribute to a deficient financial situation in retirement. To assess the impact of subjective financial scarcity on the intention to save for retirement, we conduct an online vignette survey experiment (n = 134). Using the two-limit tobit model, we find that subjective financial scarcity leads to lower retirement savings rate. We contribute to the literature by testing theoretical predictions of scarcity theory, providing experimental evidence for the myopic financial behavior orientation of retirement saving rates. We offer practical implications for policymakers, suggesting that interventions that promote saving for retirement should be designed with subjective financial scarcity and stress reduction messages in mind.

1 Introduction

Financial scarcity can be a situation where an individual objectively lacks, or subjectively feels a deficit in financial resources to make ends meet (Kalil et al., 2022; Mullainathan and Shafir, 2013; Sarial-Abi et al., 2021). Objective indicators of financial scarcity include having low income (Shah et al., 2015), high debt (Sussman and Shafir, 2012), being in poverty (Haushofer and Fehr, 2014) or having low current or childhood socio-economic status (Griskevicius et al., 2013; Yoon and Kim, 2018). Subjective financial scarcity relates to feelings and experiences, such as feeling disappointed or financially inferior by not achieving a desired financial state (Cannon et al., 2019; Sharma and Alter, 2012) or perceiving a subjective lack of liquidity together with the imagined future consequences (Cook and Sadeghein, 2018).

We focus on subjective scarcity, which is more related to a state of mind, rather than the absolute quantity of funds an individual possesses. Someone making a decent regular income could very well experience the mindset of financial scarcity when overspending or when suffering a perceivable financial shock, such as a sudden drop in their stock portfolio. The subjective approach to financial scarcity aligns with related research fields, e.g., approaching financial wellbeing as subjective (Riitsalu and Van Raaij, 2022; Sharma and Alter, 2012). In addition, subjective measures, such as feeling happy, have been found to be more impactful for general wellbeing than objective measures, such as income (Diener et al., 1999). Likewise, subjective measures of financial (or economic) scarcity have shown to have better predictive power compared to income (Auger et al., 2024), and connected to behavioral concepts such as financial avoidance (Hilbert et al., 2022) and pro-environment behavior (Berthold et al., 2023). And, regarding policy implications, the subjective feeling of financial scarcity is considerably more approachable through cost effective behavioral interventions and nudges than alleviating poverty through, for examples, fundamental changes in the social security system and redistribution (Benartzi et al., 2017).

The relationship between financial scarcity and prudent financial behavior is not entirely clear. One perspective suggests that individuals experiencing financial scarcity may become more price-conscious and more efficient in managing their limited resources (Mullainathan and Shafir, 2013; Shah et al., 2012, 2018). In some cases, individuals may also make better trade-off evaluations between financial choices (Frederick et al., 2009, see an alternative view by Plantinga et al., 2018). As when resources are already scarce, one must be more careful in their spending to make ends meet. However, financial scarcity is linked to increases in irresponsible behavior such as overborrowing (Cook and Sadeghein, 2018), overspending on vices (Banerjee and Duflo, 2007), and gambling (Economou et al., 2019; Haisley et al., 2008). It could be that a scarcity mindset leads to more impulsive financial decisions or seeking out a temporary alleviation to the negative emotion.

Our study addresses a specific type of prudent financial decisions – saving for retirement. As financial scarcity is a subjective feeling, individuals who objectively have enough disposable income and could save a part of it, might still feel unable to do so. Consequently, individuals focusing on their present subjective financial scarcity might neglect saving which then can exacerbate both subjective and objective financial scarcity in retirement.

Previous research has documented the connection between financial scarcity and present biased financial decisions (Carvalho et al., 2016; Shah et al., 2012) and neglect of long-term financial goals (Hertwig and Engel, 2016; Hilbert et al., 2022). There is a significant research gap in providing experimental evidence on financial scarcity and retirement saving decisions (de Bruijn and Antonides, 2022; Hamilton et al., 2019).

The aim of the study is to assess the role of subjective financial scarcity for the intention to save for retirement. We conducted an online between-subject experiment in a student sample (n = 134) in Estonia, where a second pension pillar policy change1 is taking place. Examining students is in our case very relevant, as they will soon enter the labor market and need to make exactly the decisions about saving for retirement that we model in our experiment (see institutional background in Section 3.1). The experiment featured a vignette based on the Psychological Inventory of Financial Scarcity scale (PIFS, van Dijk et al., 2022). Participants were randomly assigned to receive one of two descriptions of a person – one who experiences subjective financial scarcity or one who does not. Subsequently, we measured recommendations for that person about how much to save for retirement, and a set of control variables. We make use of a vignette since inducing stress and financial scarcity in a participant is ethically questionable.

Since the decision variable exhibits both lower and upper censoring as a consequence of the design of the vignette, the two-limit tobit model (Maddala, 1983) is used as the estimation framework. Our results show that participants recommended a person experiencing subjective financial scarcity to save less money for retirement. Subjective financial scarcity is significantly related to retirement savings, even when taking into account common attitude measures like risk aversion and time preference.

We contribute to the literature on scarcity theory by providing experimental evidence for the connection between financial scarcity and lower retirement savings. We also add to research that addresses the myopic financial behavior orientation of financial scarcity, showing that the feeling of present financial scarcity can lead to financial problems in the future as scarcity inhibits retirement saving rates. Our results also have practical implications for policy, indicating the necessity to consider financial scarcity mindset concerns in addition to, for example, financial education campaigns. Interventions that promote saving for retirement could be designed to highlight how a small contribution today will alleviate financial scarcity in the future, which in turn would help reduce subjective financial scarcity in the present.

We structure the remainder as follows. In the next section, we summarize previous research on financial decision-making in the context of financial scarcity. We then briefly describe the pension system background of Estonia and proceed with the experimental design and results. Finally, we discuss our results and policy implications.

2 Literature review

2.1 Financial scarcity

Financial scarcity could be both an objective assessment and a subjective state (Cook and Sadeghein, 2018; Mullainathan and Shafir, 2013). Experiencing financial scarcity can have severe negative consequences for wellbeing (Martin and Hill, 2015; Netemeyer et al., 2018). Studies have linked financial scarcity to adverse effects in general and mental health, such as anxiety and depression (Dijkstra-Kersten et al., 2015; Sommet et al., 2018; Sommet and Spini, 2022). Financial scarcity also often leads to taking on more debt (Cook and Sadeghein, 2018; Shah et al., 2019), which has been causally linked to depression (Gathergood, 2012; Richardson et al., 2013).

Furthermore, executive functions (behavior and emotion regulation, metacognition) are also impacted by experiencing financial scarcity (O'Neill et al., 2021), as is prudent healthy behavior such as regular exercise and eating healthily (Venn and Strazdins, 2017). While detrimental effects can certainly be moderated by objective factors of lacking enough money for necessities, a significant part is subjective, how much stress and worry somebody feels about their financial situation (de Bruijn and Antonides, 2020; Haushofer and Fehr, 2014; Simonse et al., 2022; van Dijk et al., 2022).

Financial scarcity also affects cognitive functions by focusing or tunneling attention to finances (Mullainathan and Shafir, 2013; Shah et al., 2012; Tomm et al., 2023). This means that individuals experiencing financial scarcity are likely to (over)focus on financial matters at hand, which can impose cognitive strain, leading to a decline in mental performance (Mani et al., 2013). This effect has seen more recent corroboration, as a scarcity mindset could lower available attention to allocate to other tasks (Kalil et al., 2022; Lichand and Mani, 2020). Cognitive effects have also been documented as an increased cognitive load closer to the paydays, even if the changes to their cashflow were trivial (Mani et al., 2020). Perhaps financially constrained individuals even perceive the world quite differently to non-constrained individuals, placing an economics dimension to everyday life tasks (Shah et al., 2018).

However, the financial scarcity and its effect on cognition stream of research has seen mixed results (Carvalho et al., 2016; de Bruijn and Antonides, 2022). In particular, the effects of financial scarcity and cognitive fatigue originally posed by Shah et al. (2012) do not replicate very well (Camerer et al., 2018; Shah et al., 2019). Furthermore, the results by Mani et al. (2013) on diminished mental performance do not replicate either, when income levels are not analyzed as a dichotomous variable (Wicherts and Scholten, 2013). Therefore, it is unclear if subsequent cognitive tasks suffer in performance when an individual is in a financial scarcity mindset, but the evidence for attention tunneling remains strong.

The literature shows the connection between a financial scarcity mindset and several issues ranging from wellbeing to lifestyle choices but remains unclear on cognitive performance. However, the question of whether experiencing financial scarcity increases prudent financial behavior or leads into an objective “poverty trap” remains unanswered.

2.2 Financial scarcity and financial decision-making

The effect of financial scarcity of prudent financial decision-making has seen mixed results in the literature (Hamilton et al., 2019). It could be argued that having limited means focuses individuals experiencing financial scarcity toward being more efficient with money, as they stretch every bit of money to their maximum efficiency (Shah et al., 2012). At the same time, there is evidence of financial scarcity being connected to a more present biased financial decision-making (Carvalho et al., 2016) leading to a poverty trap (Hilbert et al., 2022).

Financial constraints could influence individuals to make more prudent financial decisions (Shah et al., 2012), mainly through focusing attention to the financial task at hand (Shah et al., 2019), better understanding of correct item price valuation (Shah et al., 2015), and theoretical observations of better trade-off analysis of opportunity costs (Bertrand et al., 2006; Frederick et al., 2009). As such, opportunity costs are more likely to be considered when individuals perceive (financial) constraints (Spiller, 2011). However, recent research has produced results contrary to this idea, with financially constrained and non-constrained participants considering trade-off costs in a similar fashion, as both groups neglect opportunity costs (Plantinga et al., 2018).

Financial scarcity could also have a detrimental effect on financial decision-making. Financial scarcity is linked to financial avoidance, such that an individual experiencing financial scarcity is likely to avoid assessing their current financial situation, learning financial information and making a financial decision that suits their long-term goals (Hertwig and Engel, 2016; Hilbert et al., 2022). Not wanting to know about ones' current financial situation could be a result of an utility calculation – if the financial situation of the bank account (once checked) would turn out worse than expected, it might trigger sadness. Financial scarcity can also disrupt important financial skills such as calculating loan costs and reborrowing to cover previous loans (Cook and Sadeghein, 2018). Likewise, there is evidence for financial constraints and financial scarcity related to overborrowing (de Bruijn and Antonides, 2022; Shah et al., 2019). Therefore, individuals in a financial scarcity mindset could be present biased to the extent that they seek relief to their financial worries in loans, disregarding the high costs associated.

Finally, financial scarcity, is found to be connected to higher risk aversion and increased temporal discounting (Dohmen et al., 2011; Green et al., 1996; Haushofer and Fehr, 2014). This means that the individuals experiencing financial scarcity are more likely to focus on present financial issues (or be present biased, e.g., O'Donoghue and Rabin, 1999), disregarding future financial gains, which in turn lowers lifetime wealth (Finke and Huston, 2013). Sequences of overly discounting future yields could create a feedback loop which reinforces financial scarcity. In other words, the financial scarcity mindset is associated with lower retirement savings due to temporal discounting (e.g., and attention tunneling to present financial worries. This leads us to our hypothesis:

-

H1: Individuals in a financial scarcity mindset save less for retirement.

2.3 Institutional background for the study

As the experiment took place in Estonia, we need to address key institutional details about the Estonian pension system. The Estonian pension system relies on three pillars: the first pillar is a tax financed pay-as-you-go pension, with the individual accumulating rights to receive a state pension after 15 years of working in Estonia. The second pillar is a mandatory funded tax-favored pension scheme with the option to opt out, while the third is a tax-favored and funded voluntary pillar (Estonian Social Insurance Board, 2025; Piirits and Võrk, 2019). The second pillar was established in 2002 and is mandatory for individuals born from 1983 and onwards, others can apply to join. Individuals can choose a mutual fund to invest in both the second and the third pension pillar (Piirits and Võrk, 2019). Individuals are recommended to supplement their retirement income by having savings independent of the pension system, an unofficial fourth pension pillar.

Inadequate retirement preparation is a critical issue in Estonia. According to Eurostat (2021), Estonia has the largest share of employed elderly (age 65-69) in Europe (32.5%). That is more than double the proportion of 65- to 69-year-olds in the European Union average (13.2%). Compared to the two other Baltic countries, the Estonian elderly employment figures are similar (Latvia at 29%, Lithuania 26.8%). Estonia is also one of the countries with the lowest pension income replacement ratios in the OECD, where an average pension replaces 34% of pre-retirement income, according to 2022 data (the OECD average is 61%) (OECD Net Pension Replacement Rates, 2021). With such a low replacement ratio, the relative poverty rate of pensioners in Estonia is one of the highest among OECD countries. In 2022, 37.6% of individuals aged 65+ in Estonia are in relative poverty, while the average for OECD countries is 13.1% (OECD Relative Poverty Rates, 2021). There are again parallels with the two other Baltic countries, even though Latvia has a higher pension replacement rate of 53%, Latvian elderly relative poverty rate is 33%, while Lithuanian' figures are 29 and 25%, respectively.

Based on the year-end data from the Estonian Ministry of Finance Database (2022), 43% of the population (or 574,137) were enrolled in the 2nd pension pillar with a fund size of 4 billion €, while 147,800 were enrolled in the 3rd pension pillar with a fund size of 0.67 billion € (and a further 38,700 people in an insurance fund). Therefore, the current average accumulated pension assets per capita in these two pillars is small, 6,745€ for the average 2nd pension pillar and 3,602€ in the 3rd pillar. The median accumulated savings are 2,566 in the 2nd pillar and 1,015 in the 3rd pillar, indicating high variance between accounts. Furthermore, in 2022, about 447,000 people made contributions to their 2nd pillar and 108,000 made contributions to their 3rd pillar, indicating that many do not regularly contribute to their 3rd pillar funds. The average age of a 3rd pillar contributor is 44.3, their average income is 2,645€, which is considerably higher than the average salary of 1,685€ (based on 2022 data).

It is unlikely that individuals are preparing for retirement with independent investing, as the share financial assets in household net worth in 2021 is 15%, which is lower than the European average of 1/5 of net assets (Estonian Central Bank, 2021). Finally, as a recent study on Estonian pension literacy showed that only 10% of the population is sufficiently on track with retirement preparation, while many future retirees appear to depend on the state pension instead (Pulk et al., 2024), which was recently indexed to an average of 700€ per month for 2024 (85% of the national minimum wage).

Joining the 2nd pension pillar scheme is mandatory for all Estonian tax residents when they turn 18 (Estonian Social Insurance Board, 2025). Even though contributing is not possible without being employed, each individual can still set up a pension fund for when they eventually start to work. If a fund is not chosen, a passively managed index fund is randomly assigned when receiving the first paycheck. However, it is possible to opt out of the 2nd pension pillar contributions entirely, in which case there is a 10-year ban from joining the scheme again. The 3rd pension pillar is voluntary, and savers can freely deposit and withdraw from the fund at any time.

For the 2nd and the 3rd pension pillars, different tax incentives are in place to encourage saving. Contributing to the second and third pension pillars is income tax deductible (20%, increases to 22% in 2025), although there is a maximum contribution cap of 15% of yearly income (up to a maximum of 6,000 €) for the 3rd pension pillar. In addition, there is an important policy change that is implemented during this experiment regarding pension pillar contributions. Namely, starting in 2024, Estonians can select to increase their contribution into the 2nd pension pillar from 2% of their monthly gross salary to either 4 or 6%. This gives a suitable avenue to examine the intention to change the current contribution rate into the second pillar which we use in our experimental materials.

3 Data and methods

3.1 Participants

The sample consists of 134 bachelor and master level economics students in Estonia (see Table 1 in the design section for details). The experiment was conducted in October 2024. Participants did not receive an incentive to complete the study, apart from a learning experience. We deliberately decided not to include an incentive as it might distract participants from the research question, as there is no normatively objective correct benchmark available to incentivize for a pension savings rate.

Table 1

| Variable | No stress (n = 69) | Stress (n = 65) |

|---|---|---|

| Female (p = 0.14) | 65.2% | 49.2% |

| Working full-time (p = 0.98) | 29.0% | 29.2% |

| Working part-time (p = 0.48) | 21.7% | 16.9% |

| Gig work (p = 0.09) | 4.3% | 12.3% |

| Not working (p = 0.77) | 36.2% | 33.8% |

| Own company (p = 0.66) | 5.8% | 7.7% |

| No employment answer (p = 0.13) | 3.0% | 0.0% |

| Personal 2nd pillar rate (p = 0.84) | 1.62 (2.07) | 1.55 (1.87) |

| Personal 3rd pillar rate (p = 0.87) | 2.07 (4.67) | 1.95 (3.86) |

| Age (p = 0.42) | 23.23 (5.65) | 24.15 (7.49) |

| Personal financial scarcity (p = 0.17) | 4.38 (2.14) | 4.92 (2.42) |

| Risk attitude (p = 0.73) | 5.55 (1.70) | 5.66 (1.96) |

| Time preference (p = 0.12) | 6.45 (1.95) | 6.97 (1.87) |

| Confidence (p = 0.59) | 5.58 (2.43) | 5.82 (2.60) |

| Trust in pension provider (p = 0.69) | 6.67 (2.05) | 7.02 (2.15) |

Sample characteristics and randomization checks.

P-values are chi-squared tests (first 6 characteristics) and ANOVA. Missing values are included in the total proportions. Proportions within group and means depicted here, parenthesis within cells is the standard deviation. Age is collected as a continuous variable. Personal financial scarcity, risk attitude, time preference, confidence, and trust in pension providers are all measured on 10-point scales with high values indicating higher agreement. Personal contribution rates are 0 to 6% for the 2nd pillar and 0 to 15% for the 3rd pension pillar.

3.2 Design

Our experiment2 features two treatment groups, in which participants receive a similar but slightly modified vignette that describes their friend Keit (Keit is a common unisex name in Estonia). We construct our vignette based on The Psychological Inventory of Financial Scarcity, or PIFS (van Dijk et al., 2022) scale (see Appendix A for the PIFS survey questions). The PIFS is a self-assessed subjective appraisal of one's affective response toward their financial situation, combining the psychological stress framework (Cohen et al., 1997; Cundiff et al., 2020) and scarcity theory (Mullainathan and Shafir, 2013). Therefore, the PIFS highlights situations where financial concerns exceed available resources, which in turn narrows attention and focus to these concerns. The PIFS consists of twelve items in four main components – scarcity of money, lack of control over personal finances, financial worries and rumination, and short-term focus. It has shown to be a robust measure (Hilbert et al., 2022; Simonse et al., 2022; van Dijk et al., 2022).

We combine the four main components of PIFS into a vignette of a person. We opt for a vignette design as their precision is usually as good (or sometimes even better) as personal recommendations (Stantcheva, 2023) and avoids the ethical concerns of inducing financial scarcity in the participants. For the vignette, one treatment group receives a description of a person that highlights subjective financial scarcity components (see Appendix A for more details), while the other group receives a description that refers to the opposite. We call these treatment groups “stress” and “no stress” respectively. The text the participants receive is the following (no-stress group modifications in parenthesis):

“Suppose you have a friend named Keit, who works a full-time job earning the national average wage. Keit rents an apartment in Annelinn [a common population-dense neighborhood in Tartu] and does not have any debt. They like dining out with friends and going to the cinema.

Keit does not feel in control (feels in control) over finances and is quite often short of money (has enough money to spend). Keit often worries (does not worry too much) about money and lives more from day to day (plans ahead for future expenses).”

We include details about Keits' living situation, which is common for both experiment groups, informing participants that Keit has full-time employment, earns the national average wage, lives in a (to the sample audience) known and common neighborhood, is not in debt, and a few lifestyle elements. We chose these lifestyle elements (dining out and going to the cinema) as examples of common social activities among younger Estonians living in urban areas. While affordability varies, we wanted to avoid having too costly elements, while still showing that Keit has discretionary income to spend. The function of this text is to reduce ambiguity in assessing living conditions and show that it is purely a subjective perception of financial scarcity.

After the participants read through the randomly assigned description, they proceeded to answer three questions regarding saving for retirement and a few control questions, as detailed in the following measures section (see Appendix B for the full survey).

3.3 Measures and approach to analysis

The study includes three dependent variables, (1) second pension pillar contribution rate, (2) third pension pillar contribution rate, (3) personal portfolio contribution rate. The second pension pillar contribution rate is measured as a categorical variable with 0, 2, 4, and 6% as possible options. Both the third pension pillar contribution rate and the personal portfolio rate are continuous variables ranging from 0 to 15%. The cutoff point was set at 15% as this is the maximum tax-incentivized contribution rate into the 3rd pension pillar and to limit unrealistic total savings rates, which we compute as a sum over these three dependent measures.

The control variables we included were gender, work situation (working full-time, part-time, doing gig work, not working, or being an entrepreneur/CEO of own company), and how much the participant personally contributes to their second and third pension pillar funds3.

As financial scarcity is associated with risk aversion and increased temporal discounting (Dohmen et al., 2011; Green et al., 1996; Haushofer and Fehr, 2014), we included measures for personal financial scarcity (Sergeyev et al., 2023), risk attitude and time preference (Dohmen et al., 2011), confidence in making pension decisions (Tokar Asaad, 2015), and trust in pension providers (Hansen, 2012). These measures are all elicited on 10-point scales with 10 indicating highest agreement (see Appendix B for details).

We first analyze the sample and randomization between groups with chi-squared tests and one-sided ANOVA where appropriate. The main effects of the experiment are assessed with one-sided ANOVA. Finally, we examine the influence of the various attitude measures and background variables by estimating a two-limit tobit model. As explained in Section 1, two-limit tobit is used instead of OLS because the decision variable exhibits both lower and upper censoring as a consequence of the limits set in the experimental design.

4 Results

4.1 Descriptive analysis

We start with descriptive statistics (Table 1) and randomization checks through chi-square tests. Female representation is slightly higher in the no stress group (65.2%) compared to the stress group (49.2%), but this difference is not statistically significant (p = 0.14). Employment patterns are similar between groups, with full-time work being almost identical (29.0 vs. 29.2%), while part-time work and gig work have modest differences (21.7 vs. 16.9% and 4.3 vs. 12.3%, respectively) that are not statistically significant. Personal contribution rates to the second and third pillars are comparable, participants on average contribute 2% to the 2nd pillar and 2% of their salary to the 3rd pillar. The average age of the participants is 23 in the no stress group and 24 in the stress group. Psychological variables, including personally perceived financial scarcity, risk attitude, time preference, confidence in pension decisions, and trust in pension providers, suggest similar trends in attitudes and perceptions across the two groups. Therefore, randomization between groups was successful.

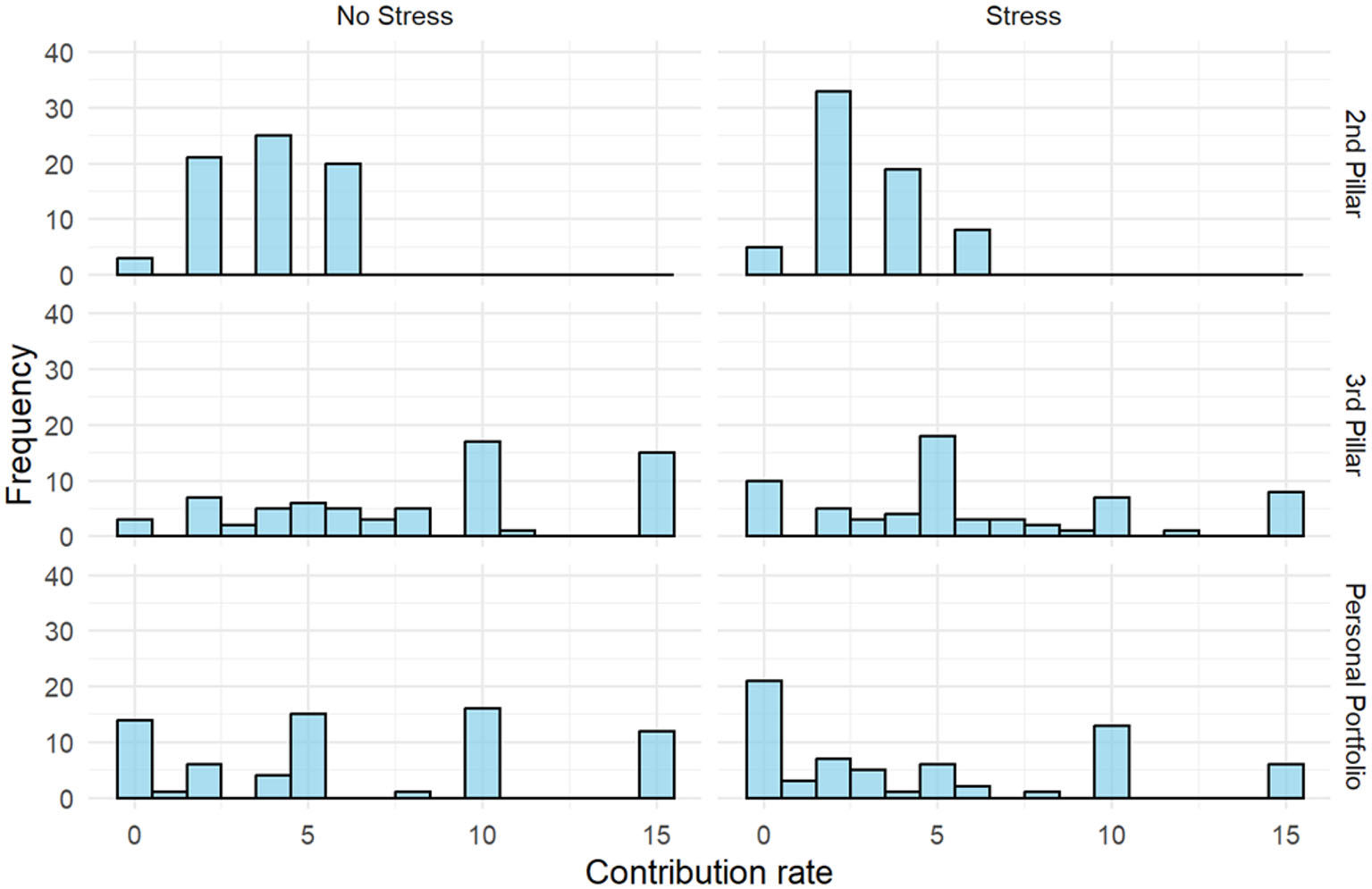

As the experiment design includes dependent variables that have lower and upper limits by design, we should assess possible accumulation of observations at the limits. For this reason, we examine histograms (see Figure 1). The histograms show rather marked patterns between the two groups, with the contribution rates in the stress group being clustered more to the left.

Figure 1

Histograms of the dependent variables. 2nd pillar contribution is limited to 0 to 6, 3rd and personal portfolio contributions to 0 to 15.

4.2 Univariate analysis

For all dependent variables, the effect direction was consistent – participants recommended the person experiencing financial scarcity to save less money for retirement (see Table 2). The participants who were shown the financially stressed depiction of Keit, suggested an average of 4.92 percentage points lower total contribution rate compared to their counterparts who saw a description of a financially non-stressed Keit. We saw a similar effect across all measured variables – contribution into the 2nd and 3rd pension pillars, and contribution rate to personal portfolio.

Table 2

| Dependent variable | No stress (n = 69) | Stress (n = 65) | Diff |

|---|---|---|---|

| 2nd pension pillar contribution | 3.80 (1.75) | 2.92 (1.62) | 0.88** |

| 3rd pension pillar contribution | 8.22 (4.63) | 6.01 (4.54) | 2.21** |

| Personal portfolio | 6.55 (5.24) | 4.71 (4.98) | 1.84* |

| Total contribution | 18.57 (8.76) | 13.65 (8.87) | 4.92** |

Main results.

** P<0.01, *P < 0.05. P-values from ANOVA. Depicted means (standard deviation in parentheses). We also analyzed group differences with a Mann-Whitney test as a robustness check. The Mann-Whitney test did not show any statistically significant differences to ANOVA.

4.3 Multivariate analysis

Next, we assess the effects of other variables on the contribution rates within the experiment. We do this by conducting a two-limit tobit regression for each of the four dependent variables (see Table 3).

Table 3

| 2 nd Pillar | 3 rd Pillar | Portfolio | Total | |||||

|---|---|---|---|---|---|---|---|---|

| Coef. | SE | Coef. | SE | Coef. | SE | Coef. | SE | |

| (Intercept) | 3.87 | 2.41 | 3.03 | 6.30 | −3.04 | 8.71 | 6.17 | 9.90 |

| Scarcity treatment | −0.97** | 0.37 | −2.83** | 0.97 | −3.79** | 1.37 | −5.71** | 1.50 |

| Gender (0=female) | −0.92* | 0.42 | −1.75 | 1.09 | 0.91 | 1.53 | −1.86 | 1.70 |

| Employed full-time | 0.30 | 2.06 | 5.13 | 5.40 | 4.38 | 7.41 | 8.66 | 8.55 |

| Employed part-time | −0.41 | 2.04 | 1.30 | 5.35 | −0.76 | 7.36 | 1.40 | 8.49 |

| Gig work | −1.05 | 2.10 | 3.18 | 5.52 | −0.08 | 7.59 | 1.95 | 8.76 |

| Not working | −0.08 | 2.02 | 3.02 | 5.31 | 1.62 | 7.29 | 5.10 | 8.42 |

| Own company | −1.01 | 2.12 | 3.40 | 5.56 | 1.91 | 7.64 | 4.71 | 8.80 |

| Personal 2nd pillar rate | 0.43** | 0.12 | 0.47 | 0.31 | 0.13 | 0.43 | 0.76 | 0.47 |

| Personal 3rd pillar rate | 0.02 | 0.05 | 0.28 * | 0.14 | 0.32 | 0.20 | 0.42* | 0.21 |

| Age | −0.05 | 0.04 | −0.03 | 0.09 | −0.06 | 0.13 | −0.09 | 0.14 |

| Personal scarcity | 0.14 | 0.09 | −0.09 | 0.23 | 0.34 | 0.32 | 0.17 | 0.35 |

| Risk attitude | 0.13 | 0.12 | 0.21 | 0.31 | 0.31 | 0.43 | 0.45 | 0.47 |

| Time preference | 0.08 | 0.10 | 0.00 | 0.27 | 0.91* | 0.38 | 0.68 | 0.42 |

| Confidence | −0.08 | 0.10 | 0.07 | 0.25 | −0.20 | 0.35 | −0.12 | 0.39 |

| Trust | −0.03 | 0.11 | 0.20 | 0.29 | −0.02 | 0.41 | 0.23 | 0.45 |

| logSigma | 0.67** | 0.08 | 1.64** | 0.08 | 1.95** | 0.09 | 2.10** | 0.07 |

| N total | 132 | 132 | 132 | 132 | ||||

| Left-censored | 8 | 13 | 33 | 4 | ||||

| Uncensored | 96 | 96 | 81 | 120 | ||||

| Right-censored | 28 | 23 | 18 | 8 | ||||

| Log-likelihood | −235.79 | −330.10 | −321.97 | −437.31 | ||||

| McFadden Pseudo R2 | 0.10 | 0.08 | 0.05 | 0.09 | ||||

Two-limit tobit regression models of the dependent variables included in the study.

** p<0.01, *p < 0.05. SE is asymptotic standard errors. The dependent variables have the following limits: 0 to 6 for 2nd pillar, 0 to 15 for 3rd pillar, 0 to 15 for personal portfolio, 0 to 36 for total contribution, which is calculated as a sum of the previous three. Scarcity treatment is 1 for stress group; 0 for no stress group. Personal financial scarcity, risk attitude, time preference, confidence, and trust in pension providers are all measured on 10-point scales with high values indicating higher agreement. Personal contribution rates are 0 to 6% for the 2nd pillar and 0 to 15% for the 3rd pension pillar.

The results of the two-limit tobit regression model indicate that the treatment group variable (i.e., whether the person was randomized into the scarcity or no-scarcity condition) remains strongly statistically significant for predicting contribution rates, even when taking control variables into account. We observe only minimal other statistically significant indicators, such as personal 2nd pension pillar's contribution rate predicting contribution recommendation to the 2nd pension pillar and likewise for the 3rd pension pillar, gender for the 2nd pillar and time preference for the personal portfolio contribution rate. The only control variable that remains weakly relevant for the total contribution rate is personal 3rd pillar contribution rate, which can signify a more financially savvy investor4. We conclude that the treatment effect was the main relevant contributor to retirement savings recommendations.

5 Discussion

We experimentally test whether subjective financial scarcity reduces the contribution rate for retirement savings by having participants read a vignette of a person deliberating their retirement savings rate. Importantly, the salary and living conditions of the person in the vignette was the same in both cases – only their own subjective assessment of financial scarcity was different.

The results of the experiment support our hypothesis – participants consistently recommended a person in a financial scarcity mindset to save less for retirement compared to a non-scarcity frame. Interestingly, financial scarcity remained the dominant explanatory factor in predicting contribution rates even when compared to well-documented controls such as higher risk aversion and temporal discounting (Dohmen et al., 2011; Green et al., 1996; Haushofer and Fehr, 2014).

As financial scarcity can be linked with both prudent and irresponsible financial decisions (Cook and Sadeghein, 2018; Mullainathan and Shafir, 2013; Shah et al., 2012, 2018), we experimentally show how retirement saving decisions are negatively affected by financial scarcity. Our results are consistent with previous research that has argued that scarcity affects cognitive functions by tunneling attention to the scarce aspect, such as finances (Mullainathan and Shafir, 2013; Shah et al., 2012; Tomm et al., 2023), which is associated with a short-term focused mind (van Dijk et al., 2022). Being overly short-term focused can create problems in the retirement saving decisions context – living only in the moment can impose even harsher financial constraints in the future, solidifying another avenue of stress. Thus, our results support the findings that connect financial scarcity and present biased financial decision-making that neglect future benefits (Carvalho et al., 2016; Hertwig and Engel, 2016; Hilbert et al., 2022).

We also need to account for potential limitations. The study featured a vignette of a person, but it could be that financial scarcity interacts differently when assessing a situation about another person when compared to a real-world decision. Therefore, further research could preferably include field experiments and establish stronger robustness by examining financial scarcity across other countries. However, eliciting financial stress in participants for the sake of an experiment should be addressed with caution, as it poses ethical concerns.

It could also be argued that the effect size may differ because the vignette asks participants to suggest behavior for someone else, rather than deciding how they would act themselves (Eriksen et al., 2020). However, our primary focus is on the differences in proposed saving rates between the two financial scarcity frames, rather than the effect size itself. Since both groups in the experiment suggest behavior for another person, the effect of financial scarcity is isolated, supporting our main argument about the direction of the effect.

One other potential limitation is that the sequential order of questions could introduce ordering effects, potentially influencing responses on individual saving plans. While we do not expect this to significantly alter the direction of the main findings, as previous research on Estonian pension preferences has shown (Pulk et al., 2025), it could somewhat influence the effect size. Due to sample constraints, it was not possible in this case to devote more treatments groups to examining order effects, as one manipulation (e.g., having personal portfolio contribution rate first, while another group sees it last among our three dependent variable questions) would result in a doubling of required treatment groups.

Statements

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical approval was not required for the studies involving humans because the study did not involve personal & consequential decisions for participants - instead they made a decision for a hypothetical person described in a vignette. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

KP: Writing – original draft, Writing – review & editing. TP: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1.^ As of January 2024, Estonians could opt to increase their contribution rate into the 2 pension pillar from the fixed 2% contribution to either 4% or 6% of their gross salary, effectively doubling or tripling their current contribution rate. The change in rates went into effect at the start of 2025.

2.^ Preregistration can be found at https://aspredicted.org/gxck-hxq3.pdf.

3.^ We do not include a control variable for the participants own investment portfolio. 3 pillar investments already capture individuals who are more active investors, and personal portfolio is likely more associated with wealth rather than pension-specific savings behavior, which is the main interest of this study.

4.^ Since investments in the 3 pension pillar are significantly tax incentivized (22% income tax deduction on a maximum of 15% of yearly income or 6000€ per year) while offering a selection of index funds for investors with different preferences, it follows that an investor seeking to maximize returns should first maximize their 3 pillar contribution. There is no penalty for withdrawing funds from the 3 pillar, apart from paying the income tax deduction previously obtained via contributing to the pillar.

References

1

Auger V. Sommet N. Normand A. (2024). The perceived economic scarcity scale: a valid tool with greater predictive utility than income. Br. J. Soc. Psychol.63, 1112–1136. 10.1111/bjso.12719

2

Banerjee A. V. Duflo E. (2007). The economic lives of the poor. J. Econ. Perspect.21, 141–168. 10.1257/jep.21.1.141

3

Benartzi S. Beshears J. Milkman K. L. Sunstein C. R. Thaler R. H. Shankar M. et al . (2017). Should governments invest more in nudging?Psychol. Sci.28, 1041–1055. 10.1177/0956797617702501

4

Berthold A. Cologna V. Hardmeier M. Siegrist M. (2023). Drop some money! The influence of income and subjective financial scarcity on pro-environmental behaviour. J. Environ. Psychol.91:102149. 10.1016/j.jenvp.2023.102149

5

Bertrand M. Mullainathan S. Shafir E. (2006). Behavioral economics and marketing in aid of decision making among the poor. J. Pub. Policy Mark.25, 8–23. 10.1509/jppm.25.1.8

6

Camerer C. F. Dreber A. Holzmeister F. Ho T.-H. Huber J. Johannesson M. et al . (2018). Evaluating the replicability of social science experiments in nature and science between 2010 and 2015. Nat. Hum. Behav.2:9. 10.1038/s41562-018-0399-z

7

Cannon C. Goldsmith K. Roux C. (2019). A self-regulatory model of resource scarcity. J. Consum. Psychol.29, 104–127. 10.1002/jcpy.1035

8

Carvalho L. S. Meier S. Wang S. W. (2016). Poverty and economic decision-making: evidence from changes in financial resources at payday. Am. Econ. Rev.106, 260–284. 10.1257/aer.20140481

9

Cohen S. Kessler R. C. Gordon L. U. (1997). Measuring Stress: A Guide for Health and Social Scientists. Oxford: Oxford University Press.

10

Cook L. A. Sadeghein R. (2018). Effects of perceived scarcity on financial decision making. J. Pub. Policy Mark.37, 68–87. 10.1509/jppm.16.157

11

Cundiff J. M. Boylan J. M. Muscatell K. A. (2020). The pathway from social status to physical health: taking a closer look at stress as a mediator. Curr. Direct. Psychol. Sci.29, 147–153. 10.1177/0963721420901596

12

de Bruijn E.-J. Antonides G. (2020). Determinants of financial worry and rumination. J. Econ. Psychol.76:102233. 10.1016/j.joep.2019.102233

13

de Bruijn E.-J. Antonides G. (2022). Poverty and economic decision making: a review of scarcity theory. Theory Decis.92, 5–37. 10.1007/s11238-021-09802-7

14

Diener E. Suh E. M. Lucas R. E. Smith H. L. (1999). Subjective wellbeing: three decades of progress. Psychol. Bull.125, 276–302. 10.1037/0033-2909.125.2.276

15

Dijkstra-Kersten S. M. A. Biesheuvel-Leliefeld K. E. M. Wouden J. C. van der Penninx B. W. J. H. Marwijk H. W. J. van. (2015). Associations of financial strain and income with depressive and anxiety disorders. J. Epidemiol. Community Health, 69, 660–665. 10.1136/jech-2014-205088

16

Dohmen T. Falk A. Huffman D. Sunde U. Schupp J. Wagner G. G. (2011). Individual risk attitudes: measurement, determinants, and behavioral consequences. J. Eur. Econ. Assoc.9, 522–550. 10.1111/j.1542-4774.2011.01015.x

17

Economou M. Souliotis K. Malliori M. Peppou L. E. Kontoangelos K. Lazaratou H. et al . (2019). Problem gambling in greece: prevalence and risk factors during the financial crisis. J. Gamb. Stud.35, 1193–1210. 10.1007/s10899-019-09843-2

18

Eriksen K. W. Kvaløy O. Luzuriaga M. (2020). Risk-taking on behalf of others. J. Behav. Exp. Finance26:100283. 10.1016/j.jbef.2020.100283

19

Estonian Central Bank (2021). Estonian Central Bank1/2023 Eesti leibkondade varad ja kohustused: 2021. aasta uuringu tulemused. (2023). Tallinn: Eesti Pank.

20

Estonian Ministry of Finance Database (2022). Available online at: https://app.powerbi.com/view?r=eyJrIjoiZTEwZjNlOWUtMWU0Yy00NjBlLTk3ODctODZhNjcyMzE3_NjM0IiwidCI6IjRmYjQ2MmUyLWE2MzktNGJlNC1iM2U1LTM2ZWM1MTg0M_2M5MSIsImMiOjl9 (accesed January 23, 2025).

21

Estonian Social Insurance Board (2025). Available online at: https://sotsiaalkindlustusamet.ee/en (accessed January 23, 2025)

22

Eurostat (2021). Employment rates by sex, age and citizenship (%). Available online at: https://ec.europa.eu/eurostat/databrowser/view/LFSA_ERGAN__custom_4932313/default/table?lang=en (accesed January 23, 2025).

23

Finke M. S. Huston S. J. (2013). Time preference and the importance of saving for retirement. J. Econ. Behav. Organ.89, 23–34. 10.1016/j.jebo.2013.03.004

24

Frederick S. Novemsky N. Wang J. Dhar R. Nowlis S. (2009). Opportunity cost neglect. J. Consum. Res.36, 553–561. 10.1086/599764

25

Gathergood J. (2012). Debt and depression: causal links and social norm effects*. Econ. J.122, 1094–1114. 10.1111/j.1468-0297.2012.02519.x

26

Green L. Myerson J. Lichtman D. Rosen S. Fry A. (1996). Temporal discounting in choice between delayed rewards: the role of age and income. Psychol. Aging11, 79–84. 10.1037/0882-7974.11.1.79

27

Griskevicius V. Ackerman J. M. Cantú S. M. Delton A. W. Robertson T. E. Simpson J. A. et al . (2013). When the economy falters, do people spend or save? responses to resource scarcity depend on childhood environments. Psychol. Sci.24, 197–205. 10.1177/0956797612451471

28

Haisley E. Mostafa R. Loewenstein G. (2008). Myopic risk-seeking: the impact of narrow decision bracketing on lottery play. J. Risk Uncertain.37, 57–75. 10.1007/s11166-008-9041-1

29

Hamilton R. W. Mittal C. Shah A. Thompson D. V. Griskevicius V. (2019). How financial constraints influence consumer behavior: an integrative framework. J. Consum. Psychol.29, 285–305. 10.1002/jcpy.1074

30

Hansen T. (2012). Understanding trust in financial services: the influence of financial healthiness, knowledge, and satisfaction. J. Serv. Res.15, 280–295. 10.1177/1094670512439105

31

Haushofer J. Fehr E. (2014). On the psychology of poverty. Science344, 862–867. 10.1126/science.1232491

32

Hertwig R. Engel C. (2016). Homo Ignorans: deliberately choosing not to know. Perspect. Psychol. Sci.11, 359–372. 10.1177/1745691616635594

33

Hilbert L. P. Noordewier M. K. van Dijk W. W. (2022). The prospective associations between financial scarcity and financial avoidance. J. Econ. Psychol.88:102459. 10.1016/j.joep.2021.102459

34

Kalil A. Mayer S. Shah R. (2022). Scarcity and Inattention. SSRN Electron. J. 10.2139/ssrn.4138637

35

Lichand G. Mani A. (2020). Cognitive Droughts. Zurich: Department of Economics, University of Zurich, Working Paper No. 341. 10.2139/ssrn.3540149

36

Maddala G. (1983). Limited Dependent and Qualitative Variables in Econometrics. New York: Cambridge University Press. 10.1017/CBO9780511810176

37

Mani A. Mullainathan S. Shafir E. Zhao J. (2013). Poverty impedes cognitive function. Science341, 976–980. 10.1126/science.1238041

38

Mani A. Mullainathan S. Shafir E. Zhao J. (2020). Scarcity and cognitive function around payday: a conceptual and empirical analysis. J. Assoc. Consum. Res.5, 365–376. 10.1086/709885

39

Martin K. D. Hill R. P. (2015). Saving and wellbeing at the base of the pyramid: implications for transformative financial services delivery. J. Serv. Res.18, 405–421. 10.1177/1094670514563496

40

Mullainathan S. Shafir E. (2013). Scarcity: Why Having Too Little Means So Much. New York, NY: Times Books/Henry Holt and Co, 289.

41

Netemeyer R. G. Warmath D. Fernandes D. Lynch J. G. Jr . (2018). How am i doing? perceived financial wellbeing, its potential antecedents, and its relation to overall well-being. J. Consum. Res.45, 68–89. 10.1093/jcr/ucx109

42

O'Donoghue T. Rabin M. (1999). Doing it now or later. Am. Econ. Rev.89, 103–124. 10.1257/aer.89.1.103

43

OECD Net Pension Replacement Rates (2021). Available online at: https://www.oecd.org/en/data/indicators/net-pension-replacement-rates.html (accessed January 23, 2025).

44

OECD Relative Poverty Rates (2021). Available online at: https://www.oecd.org/en/data/indicators/poverty-rate.html?oecdcontrol-9f300511bc-var6=Y_GT65&oecdcontrol-8027380c62-var3=2021(accessed January 23, 2025).

45

O'Neill J. Cameron C. E. Leone L. A. Orom H. (2021). Financial scarcity is indirectly related to multiple aspects of executive function through stress and the strength of association depends on childhood poverty. J. Theor. Soc. Psychol.5, 464–477. 10.1002/jts5.111

46

Piirits M. Võrk A. (2019). The effects on intra-generational inequality of introducing a funded pension scheme: a microsimulation analysis for Estonia. Int. Soc. Secur. Rev.72, 33–57. 10.1111/issr.12194

47

Plantinga A. Krijnen J. M. T. Zeelenberg M. Breugelmans S. M. (2018). Evidence for opportunity cost neglect in the poor. J. Behav. Decis. Making31, 65–73. 10.1002/bdm.2041

48

Pulk K. Riitsalu L. Comerford D. A. (2025). Prompts cause people to update their preference of when to take retirement and increase confidence in choice. Int. Soc. Secur. Rev.78, 3–27. 10.1111/issr.12380

49

Pulk K. Võrk A. Riitsalu L. Vain K. Trankmann S. Atkinson A. et al . (2024). Pensionitarkuse uuring. Available online at: https://sm.ee/sites/default/files/documents/2024-06/Pensionitarkuse%20uuring.%20L%C3%B5pparuanne.pdf (accesed January 23, 2025).

50

Richardson T. Elliott P. Roberts R. (2013). The relationship between personal unsecured debt and mental and physical health: a systematic review and meta-analysis. Clin. Psychol. Rev.33, 1148–1162. 10.1016/j.cpr.2013.08.009

51

Riitsalu L. Van Raaij W. F. (2022). Current and future financial well-being in 16 countries. J. Int. Mark.30, 35–56. 10.1177/1069031X221095076

52

Sarial-Abi G. Ulqinaku A. Viglia G. Das G. (2021). The effect of financial scarcity on discretionary spending, borrowing, and investing. J. Acad. Mark. Sci. 51, 1214–1243. 10.1007/s11747-021-00811-0

53

Sergeyev D. Lian C. Gorodnichenko Y. (2023). The economics of financial stress. SSRN Electron. J. 10.2139/ssrn.4461635

54

Shah A. K. Mullainathan S. Shafir E. (2012). Some consequences of having too little. Science338, 682–685. 10.1126/science.1222426

55

Shah A. K. Mullainathan S. Shafir E. (2019). An exercise in self-replication: replicating Shah, Mullainathan, and Shafir (2012). J. Econ. Psychol.75:102127. 10.1016/j.joep.2018.12.001

56

Shah A. K. Shafir E. Mullainathan S. (2015). Scarcity frames value. Psychol. Sci.26, 402–412. 10.1177/0956797614563958

57

Shah A. K. Zhao J. Mullainathan S. Shafir E. (2018). Money in the mental lives of the poor. Soc. Cogn.36, 4–19. 10.1521/soco.2018.36.1.4

58

Sharma E. Alter A. L. (2012). Financial deprivation prompts consumers to seek scarce goods. J. Consum. Res.39, 545–560. 10.1086/664038

59

Simonse O. Van Dijk W. W. Van Dillen L. F. Van Dijk E. (2022). The role of financial stress in mental health changes during COVID-19. Npj Mental Health Res.1:1. 10.1038/s44184-022-00016-5

60

Sommet N. Morselli D. Spini D. (2018). Income inequality affects the psychological health of only the people facing scarcity. Psychol. Sci.29, 1911–1921. 10.1177/0956797618798620

61

Sommet N. Spini D. (2022). Financial scarcity undermines health across the globe and the life course. Soc. Sci. Med.292:114607. 10.1016/j.socscimed.2021.114607

62

Spiller S. A. (2011). Opportunity cost consideration. J. Consum. Res.38, 595–610. 10.1086/660045

63

Stantcheva S. (2023). How to run surveys: a guide to creating your own identifying variation and revealing the invisible. Annu. Rev. Econ. 15 205–234. 10.1146/annurev-economics-091622-010157

64

Sussman A. B. Shafir E. (2012). On assets and debt in the psychology of perceived wealth. Psychol. Sci.23, 101–108. 10.1177/0956797611421484

65

Tokar Asaad C. (2015). Financial literacy and financial behavior: assessing knowledge and confidence. Financ. Serv. Rev.24, 101–117. 10.61190/fsr.v24i2.3236

66

Tomm B. Shafir E. Zhao J. (2023). Scarcity captures attention and induces neglect: eyetracking and behavoral evidence. OSF. 10.31234/osf.io/c9jq6

67

van Dijk W. W. van der Werf M. M. B. van Dillen L. F. (2022). The psychological inventory of financial scarcity (PIFS): a psychometric evaluation. J. Behav. Exp. Econ.101:101939. 10.1016/j.socec.2022.101939

68

Venn D. Strazdins L. (2017). Your money or your time? How both types of scarcity matter to physical activity and healthy eating. Soc. Sci. Med. 172, 98–106. 10.1016/j.socscimed.2016.10.023

69

Wicherts J. M. Scholten A. Z. (2013). Comment on “poverty impedes cognitive function.”Science342, 1169–1169. 10.1126/science.1246680

70

Yoon S. Kim H. C. (2018). Feeling economically stuck: the effect of perceived economic mobility and socioeconomic status on variety seeking. J. Consum. Res.44, 1141–1156. 10.1093/jcr/ucx091

6 Appendix A. Psychological Inventory of Finance Stress (PIFS) survey questions

Source: (van Dijk et al., 2022). Abbreviations used: SoM = Shortage of Money, FWR = Financial Worries and Rumination, STF = Short Term Focus, LoC = Lack of Control.

-

SoM1: I often don't have enough money.

-

SoM2: I am often not able to pay my bills on time.

-

SoM3: I often don't have money to pay for the things that I really need.

-

LoC1: I experience little control over my financial situation.

-

LoC2: I think I am not able to manage my finances properly.

-

LoC3: When I think about my financial situation, I feel powerless.

-

FWR1: I am constantly wondering whether I have enough money.

-

FWR2: I have a hard time thinking about things other than my financial situation.

-

FWR3: I often worry about money.

-

STF1: I am only focusing on what I have to pay at this moment rather than my future expenses.

-

STF2: I don't take future expenses into account.

-

STF3: Because of my financial situation, I live from day to day.

7 Appendix B. Survey text, translated from Estonian to English

Dear participants, With this survey we are examining the pension choices of people in Estonia. For this, we ask you to focus on one hypothetical situation. The survey takes about five minutes. Your contributions are anonymous and cannot be linked to your personal information. The following is important information about the second and third pension pillars in Estonia. Please read it carefully: An employed person can soon apply to contribute 2%, 4% or 6% of their gross salary into the second pension pillar. At the moment, it is possible to contribute 2% of your gross salary. To the contributed amount (2–6%), the state adds 4% extra, which is deducted from the employees' social tax. The third pension pillar allows you to save into a pension fund, thereby receiving a 20% income tax discount on the paid-in amount. The discount can be obtained on an amount that does not exceed 15% of gross income, or 6000€ per year.

If you are willing to participate in the survey, please continue. We are very grateful for your answers!

——————– Participants see one of the following ——————–

Vignette text for group 1 (group 2 text in italics):

Suppose you have a friend named Keit, who works a full-time job earning the national average wage. Keit rents an apartment in Annelinn and does not have any debt. They like dining out with friends and going to the cinema. Keit does not feel in control (feels in control) over finances and is quite often short of money (has enough money to spend). Keit often worries (does not worry too much) about money and lives more from day to day (plans ahead for future expenses).

———– The next questions are common for both groups ———–

Keit is considering whether or not to save money in the II or III pension pillar.

Q1. Considering Keit's situation, which amount would you recommend contributing into the second pillar:

-

0% of monthly salary

-

2% of monthly salary

-

4% of monthly salary

-

6% of monthly salary

Q2. Which amount would you recommend Keit to contribute into the third pillar: (numerical value between 0-15% of the monthly salary)

Q3. In addition to regular contributions to pension pillars, would you recommend Keit to have a personal portfolio as well? If yes, which sum would you recommend contributing each month? (numerical value 0-15% of the monthly salary)

—————————————————————————————

Q4.1 How concerned are you about your current financial situation? (10-point scale, 1 = not at all concerned, 10 = very concerned)

Q4.2 How do you assess yourself, do you generally avoid risks or are you more willing to take risks? (10-point scale, 1= not at all willing to take risks, 10 = completely willing to take risks)

Q4.3 If you compare yourself to other people, are you generally willing to give up some of your benefits today in order to reap greater benefits in the future? (10-point scale, 1= not at all willing to give up benefits today, 10 = completely willing to give up benefits today)

Q4.4 How confident in making decisions regarding your pension? (10-point scale, 1= not at all confident, 10 = completely confident)

Q4.5 To what extent do you believe that your pension provider is trustworthy? (10-point scale, 1= not at all trustworthy, 10 = completely trustworthy)

—————————————————————————————

Q 5.1 Your gender

-

Female

-

Male

-

Other

-

Don't want to answer

Q 5.2 Your age (open answer) Q 5.3 Which of the following best describes your work situation?

-

I work full-time

-

I work part-time

-

I do gig work

-

I am self-employed/have my own company

-

I don't work

-

Don't want to answer

Q 5.4 What percentage of your gross salary do you currently contribute (or have applied to contribute) to your second pension pillar? Please provide a numerical answer between 0–6%. If you do not contribute to the second pillar, please enter 0.

Q 5.5 What percentage of your gross salary do you currently contribute (or have applied to contribute) to your third pension pillar? Please provide a numerical answer between 0–15%. If you do not contribute to the third pillar, please enter 0.

Summary

Keywords

financial scarcity, retirement, saving behavior, experiment, pension

Citation

Pulk K and Post T (2025) Subjective financial scarcity today = objective financial scarcity in the future? The impact of subjective financial scarcity on saving for retirement. Front. Behav. Econ. 4:1379577. doi: 10.3389/frbhe.2025.1379577

Received

31 January 2024

Accepted

31 March 2025

Published

22 April 2025

Volume

4 - 2025

Edited by

Peter McGee, University of Arkansas, United States

Reviewed by

Peter Moffatt, University of East Anglia, United Kingdom

Kushal Lamichhane, University of Arkansas, United States

Updates

Copyright

© 2025 Pulk and Post.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kristjan Pulk kristjan.pulk@ut.ee

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.