Abstract

Introduction:

This study investigates the relationship between financial literacy and investment decisions among Palestinian individuals participating in the stock market. It also examines the moderating role of overconfidence in this relationship.

Methods:

A quantitative approach was employed using a modified version of the OECD financial literacy questionnaire, adapted for the Palestinian context. The instrument included six sections: demographic information, factors influencing investment decisions, financial literacy, knowledge, and behavior. A total of 146 investors were surveyed.

Results:

The findings reveal that Palestinian investors possess a basic level of financial literacy, which positively influences their investment decisions. Demographic variables showed no significant effect on financial literacy. However, overconfidence was found to strengthen the relationship between financial literacy and investment decision-making.

Discussion:

The study provides new insights into how financial knowledge and behavioral biases, such as overconfidence, jointly shape investment behavior. These findings highlight the importance of financial education initiatives and behavioral training in enhancing investor decision-making in emerging markets like Palestine.

Introduction

Financial literacy, a critical skill set for managing personal finances and making informed economic decisions, has seen an evolution in research, gradually expanding its scope to encompass a wide range of demographic and socioeconomic backgrounds. After the global financial crisis in 2008, which was evident in the behavioral theory that lack of financial knowledge may lead to irrational financial behavior, financial literacy was the focus of attention for policymakers and national regulators. The complexity of financial assets through financial engineering, such as credit card swaps, forex funds, and future contracts, and their accessibility to world financial markets proved that investors who lack financial knowledge and skills could not cope with such challenges and needed financial education and protection (Campbell et al., 2011).

Furthermore, Atkinson and Messy (2012) argued that financial literacy is a crucial component of economic growth. They argued that informed and financially literate populations are better able to contribute to and benefit from economic activities, particularly in complex financial markets. Agarwal et al. (2009) demonstrated that financially literate individuals were more likely to make prudent savings and borrowing decisions, which is crucial in a fast-changing financial environment. Consequently, people must acquire the necessary knowledge and skills to protect their personal finances and adjust to the ever-changing financial landscape. By doing so, they can greatly enhance their contribution to fostering economic growth. Personal loans constituted 36% of total credit facilities in 2014, an uptick fueled in part by government tax initiatives that made it easier for individuals to borrow and invest—often without adequately accounting for risk (Samarah and Riyahi, 2014). In parallel, financial literacy has been identified as a driving force behind both financial inclusion and saving behaviors, with Mehak and Dharni (2022) demonstrating that individuals equipped with a stronger knowledge base tend to save more and have improved access to financial services.

Recent studies have expanded the discussion by integrating behavioral factors into financial education. For example Maheshwari et al. (2025) overconfidence acts as a significant mediator between financial literacy and investment behavior because people with high confidence but limited knowledge base tend to make poor investment decisions. Yanti and Endri (2024) discovered that Jakarta millennials' overconfidence together with their financial behavior directly affects their financial literacy levels and investment choices. The research supports the need to include behavioral elements in financial education programs especially in developing economies such as Palestine because formal financial knowledge remains restricted. This link between literacy and economic outcomes is particularly evident in developing contexts, where higher levels of financial literacy correlate with entrepreneurial success (Bongomin et al., 2017). Moreover, Grohmann et al. (2018) highlight that the benefits of financial literacy vary across different income levels and demographic segments, underscoring the importance of tailored interventions that address diverse financial needs.

In Palestine, financial literacy is the first objective of the 5-year national financial inclusion plan. The dual challenge of low financial literacy and behavioral bias becomes more relevant. Therefore, understanding how financial literacy interacts with overconfidence is essential for improving investment decisions and achieving economic empowerment in such contexts. In this respect, some studies carried out in the Palestinian environment have focused on financial literacy for Palestinian investors and the extent of their knowledge and perception regarding the importance of accounting information in rationalizing their investment decisions.

For example, Al-Buhaisi and Najm (2009) establish that the Palestinian investors' awareness and understanding of the role of accounting information in investment decisions and such state of their financial literacy is below the required standards; they need to enhance those through training courses and periodic financial reports, which would enable them to make the best possible investment decisions. Also, the study of Al-Afifi (2014) found that the financial literacy level of Palestinian investors was low, where there are misunderstanding in investing concepts and the risks resulted, so that, it is important to offer qualified staffs to providing financial suggestions to Palestinian investors, and providing financial and investment literacy courses for investors. Despite these efforts, research on financial literacy in Palestine remains scarce, and the current situation points to a need for more detailed analysis. There is little data available on how various demographic factors, such as age, gender, income, and education, influence financial literacy levels and investment behaviors in the region. Moreover, while several studies globally have linked financial literacy to better financial decision-making, fewer have explored how psychological biases, such as overconfidence, impact the application of financial knowledge in investment choices.

In light of the instability of the results regarding the level of financial literacy among Palestinian investors and its role in the effectiveness of investment decisions, this research came to investigates the degree of Palestinian investors' financial literacy who invest locally or internationally, as well as the effect of demographic factors on financial literacy, such as gender, age, education specialization, investment experience, job title, and monthly income. In addition, we will test the relationship between financial literacy and the factors affecting investment decisions. The research aims to answer questions related to the level of financial literacy among Palestinian investors and whether it is within the threshold set by the OCED at 60.5%. A key focus is on overconfidence, a psychological factor that influences the relationship between financial literacy and investment decisions. By exploring overconfidence, the study reveals how psychological biases may affect the application of financial knowledge in investment decisions.

This paper probes into the Palestinian stock market as an emerging and maturing financial market, aiming to provide valuable insights into the investment choices of investors in developing countries. It highlights the critical importance of assessing the level of financial literacy and the psychological biases, such as overconfidence, that shape investment behavior. A key premise of this study is that differing levels of financial literacy in the developing world give rise to varied patterns of investment behaviors, which can have a significant impact on economic stability and growth, both positively and negatively.

The rest of this paper is organized as follows: Section 2 reviews the literature on financial literacy, overconfidence, and investment decision-making. Section 3 describes the research methodology, including data collection tools and model specification. Section 4 presents the empirical findings and analysis. Section 5 concludes the paper by summarizing the main results, outlining policy implications, and identifying the study's limitations and areas for future research.

Literature review

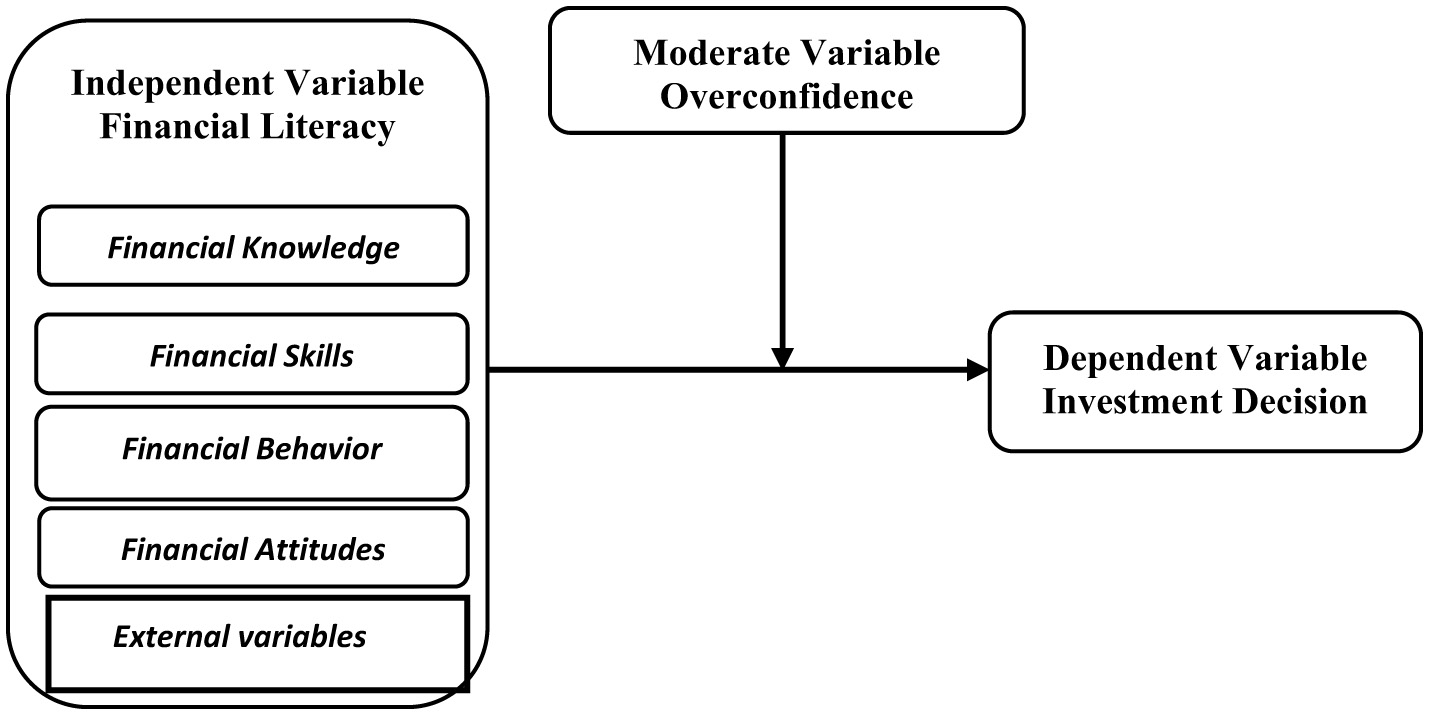

Financial literacy, as defined by the Organisation for Economic Co-operation and Development (2005), encompasses a combination of financial awareness, knowledge, skills, attitudes, and behaviors necessary for achieving personal financial wellbeing. This definition underscores the importance of not only understanding financial concepts but also applying them effectively in real-world situations. Huston (2010) further emphasizes that financial literacy is crucial for interpreting and utilizing financial information, enabling individuals to make informed decisions about saving, investing, and borrowing. Additionally, Remund (2010) argues that confidence in applying financial knowledge should be included as a key component of financial literacy measurement, as it significantly influences decision-making effectiveness. As shown in Figure 1, the conceptual framework illustrates the relationship between financial literacy and investment decision-making, with overconfidence acting as a moderating variable.

Figure 1

Conceptual framework.

A substantial body of research has established a strong link between financial literacy and improved decision-making. Miller et al. (2015), in their meta-analysis of 188 studies, found that higher levels of financial literacy are consistently associated with better financial decisions. Similarly, Lusardi and Mitchell (2014) demonstrated that financial knowledge and numeracy skills are essential for navigating complex financial situations, such as retirement planning and managing unexpected financial shocks. These findings highlight the practical benefits of financial literacy in enhancing individuals' ability to make sound financial choices. However, disparities in financial literacy levels across demographic groups remain a significant challenge. Singh (2014) noted that financial literacy varies widely based on factors such as age, gender, education, and income, suggesting that targeted financial education programs are necessary to address these gaps. This is particularly relevant in developing economies, where access to financial education is often limited, and financial markets are less transparent.

The impact of financial literacy on specific financial behaviors, such as retirement planning and stock market participation, has been widely studied. For instance, Safari et al. (2021) found that financial knowledge significantly improves retirement planning outcomes in the Congo Republic. Their study emphasized the role of financial education and positive attitudes toward financial products in fostering long-term financial security. Similarly, Lusardi and Mitchell (2015) highlighted the challenges in establishing a direct causal relationship between financial knowledge and behavior, advocating for experimental approaches to better understand this dynamic. In the context of investment decisions, Kumari (2020) explored the impact of financial literacy on undergraduate students, revealing that despite low levels of financial knowledge, increased literacy positively influenced their investment choices. This finding is supported by Hastings and Tejeda-Ashton (2012), who argued that enhancing financial literacy could improve the efficiency of financial markets and regulatory frameworks. These studies collectively underscore the importance of financial literacy in empowering individuals to make informed investment decisions.

Overconfidence, a well-documented cognitive bias, plays a significant role in shaping financial behavior. Daniel and Titman (2000) and Ricciardi and Simon (2001) demonstrated that overconfidence distorts risk perception, leading to excessive risk-taking and suboptimal investment decisions. Kahneman's (2012) Nobel-winning work on behavioral finance further elucidated how overconfidence can lead to systematic errors in judgment, even among financially literate individuals.

Recent studies, such as those by Weixiang et al. (2022), Alshebami and Aldhyani (2022), and Chu et al. (2012), have explored the interplay between financial literacy and overconfidence. They found that while financial literacy can mitigate some of the negative effects of overconfidence, it does not eliminate them entirely. For example, overconfident investors often exhibit the disposition effect, holding onto losing investments for too long and selling winning investments too early (Chu et al., 2012). These behaviors, driven by overconfidence, can undermine the benefits of financial literacy and lead to poor investment outcomes. The research by Wahyu and Firmialy (2024) showed that financial literacy and overconfidence both affect investment choices of Generation Z investors in Bandung while risk tolerance served as a mediating factor and gender functioned as a moderator. Zhou and Wei (2025) showed that when investors demonstrate excessive confidence about their financial understanding they tend to sell their assets excessively and react too strongly to market volatility.

Interestingly, Pikulina et al. (2017) argued that overconfidence can, in some cases, have a positive impact on investment outcomes. Confident investors may be more likely to seize high-return opportunities by leveraging their financial knowledge. However, this effect is contingent on their ability to accurately assess risks, which is often compromised by overconfidence. Thus, while overconfidence can occasionally enhance decision-making, it generally exacerbates risk-taking behaviors and reduces the effectiveness of financial literacy.

In Palestine, financial literacy remains a significant challenge, with studies indicating low levels of financial knowledge among investors. Al-Buhaisi and Najm (2009) found that Palestinian investors often lack awareness of the importance of accounting information in making informed investment decisions. Similarly, Al-Afifi (2014) highlighted widespread misunderstandings of investment concepts and risks among Palestinian investors, underscoring the need for targeted financial education programs.

These findings align with broader research on financial literacy in developing economies, where limited access to financial education and resources often hinders individuals' ability to make informed financial decisions. The Palestinian context is further complicated by economic instability and political uncertainty, which exacerbate the challenges faced by investors. As such, tailored financial literacy initiatives are essential for improving investment behaviors and fostering economic growth in Palestine.

Despite a growing body of research explores the role of financial literacy in shaping individual financial behavior, much of this literature is concentrated in developed economies, with limited focus on conflict-affected and emerging markets such as Palestine. Most studies examine financial knowledge in isolation, without accounting for behavioral biases like overconfidence that often distort rational investment decisions. While recent research has acknowledged the psychological dimensions of financial behavior (e.g., Alshebami and Aldhyani, 2022; Wahyu and Firmialy, 2024), empirical studies integrating both financial literacy and overconfidence bias in the context of Palestinian investors remain scarce. Furthermore, there is a lack of research that examines how demographic variables interact with behavioral and knowledge-based factors to shape investment outcomes.

To address these gaps, the research aims to fill these knowledge gaps by studying financial literacy effects on investment choices of Palestinian individual investors while analyzing how overconfidence bias influences these decisions. The research objectives include: This study evaluates the financial literacy levels which investors demonstrate when trading on the Palestine Stock Exchange. The research investigates how financial literacy directly affects investment choices. The study investigates how overconfidence acts as a moderator between financial literacy and investment choices. The research investigates how demographic factors including age, gender, education level and experience affect both financial literacy and investment choices.

Finally, this study highlights the importance of financial literacy in enhancing investment decision-making, particularly in developing economies such as Palestine. It also marks the complex interplay between knowledge and behavioral biases like overconfidence, which can either support or undermine financial decisions. Given the current limitations of cross-sectional designs, future research should adopt experimental or longitudinal approaches to better understand causality and inform targeted financial education policies in emerging markets.

Hypothesis

In fact, financial literacy research over the years has expanded in various ways to embrace a wide array of demographic and socio-economic groups. However, significant knowledge and research gaps still exist in wide areas, particularly in developing economies like Palestine, where financial literacy has been recognized as one of the important elements of economic empowerment. According to the Palestinian Monetary Authority and the Palestinian Central Bureau of Statistics, the level of financial literacy remains low, and a large percentage of the population does not have even basic knowledge of finance. This is the gap in financial education that now calls for regulatory developments such as creating NFIS 2018−2025—a 5-year National Financial Inclusion Strategy that emphasizes financial literacy as its main aim. NFIS showed that there was a clear weakness in the capabilities, skills, knowledge, and financial literacy of a large number of Palestinians. Also, the study of Al-Afifi (2014) has found that the level of financial literacy of Palestinian investors was low. Thus, the first hypothesis could be as follows:

-

H 1 : Palestinian investors exhibit a moderate level of financial literacy, as measured by their understanding of financial concepts, ability to manage personal finances, and make informed investment decisions.

Research on financial literacy has consistently demonstrated its critical role in shaping individual and community financial decision-making. Higher levels of financial literacy are associated with improved decision-making abilities, as evidenced by Miller et al. (2015) in their meta-analysis of 188 studies. Similarly, Lusardi and Mitchell (2014) emphasized that financial knowledge and numeracy skills are essential for navigating complex financial situations, particularly in unexpected or challenging circumstances. However, disparities in financial literacy across demographic groups, such as age, gender, and education, underscore the need for targeted financial education initiatives to enhance market transparency and price monitoring (Singh, 2014). In the Palestinian context, studies by Al-Buhaisi and Najm (2009) and Al-Afifi (2014) have explored the relationship between financial literacy and investment decision-making, revealing mixed results and highlighting the need for further research. These findings collectively support the hypothesis that increased financial literacy significantly enhances the quality of investment decisions among Palestinian investors.

-

H 2 : Higher levels of financial literacy significantly improve the quality of investment decisions among Palestinian investors, as evidenced by greater diversification, risk awareness, and alignment with long-term financial goals.

Demographic variables of the study sample usually play an important role in determining the relationship between the study variables, and this role varies according to the study population. This applies to the relationship between financial literacy and investment decisions, although previous studies on this topic in the Palestinian environment did not address the impact of demographic variables of the study sample individuals. Accordingly, the third hypothesis can be as follows:

-

H3: Demographic factors, including gender, age, academic qualification, field of specialization, and investment experience, significantly influence the financial literacy levels among Palestinian investors.

Overconfidence further enhances the complexity of this relationship between financial literacy and quality in investment decisions. Overconfidence, according to the studies of Daniel and Titman (2000) and Ricciardi and Simon (2001) is also one of those factors that distort risk perception and result in riskier investment behavior. Recent work by Weixiang et al. (2022) and Chu et al. (2012) further supports Kahneman's Nobel-winning work on this issue, showing that financial literacy indeed dampens the negative effect of overconfidence, enabling individuals to make more balanced and informed financial decisions.

-

H4: Overconfidence positively moderates the relationship between financial literacy and investment decision-making quality among Palestinian investors, amplifying the application of financial knowledge in investment scenarios while potentially increasing risk-taking behavior.

Research methodology

This study relied on the appropriate descriptive analytical approach by conducting the necessary statistical analysis of the study variables (financial literacy, overconfidence, and investment decisions) derived from the data collected from the study sample by means of a questionnaire, in order to know the effect of the independent variables on the dependent variable and the role of the mediating variable in this relationship, and thus to come up with the most important results and recommendations.

The approach allows us to describe the current state of financial literacy among Palestinian investors while also analyzing its impact on their investment behaviors. By using this method, we can better understand the nuances of how demographic factors and cognitive biases affect financial decision-making.

Justification: A descriptive analytical approach was chosen because it allows for a clear examination of how financial literacy intersects with investment decisions, making it well-suited to analyzing the nuances of this relationship in an emerging market like Palestine. This method not only provides rich, contextual insights into the financial behaviors of local investors but also ensures that the results are directly applicable to the unique socio-economic conditions within the region. Moreover, by illuminating specific patterns and challenges faced by Palestinian investors, this approach contributes new evidence to the relatively limited literature on behavioral finance in developing economies and underscores the practical implications for policymakers and educational initiatives aimed at enhancing financial decision-making.

-

Tailoring to Local Context: We adjusted the OECD financial literacy questionnaire to ensure that it reflects the special financial and economic circumstances of Palestinian investors. Such as:

Islamic Finance: Some questions were adapted to address common Sharia-compliant products (e.g., murabaha) relevant to the Palestinian market.

Socio-Economic Conditions: Items assessing risk perception were tailored to reflect heightened sensitivity to geopolitical uncertainties and limited access to traditional banking services in some regions (Grohmann et al., 2018).

Sample selection

We consider that the actual population of interest comprises all the Palestinian investors trading with brokerage companies operating in Palestine. The population spread is very high; hence, we referred to Sekaran and Bougie (2016) sampling table to arrive at the sample size.

-

Sample size: Based on the guidelines from Sekaran and Bougie, we aimed for a sample size of 250 investors. The questionnaire was distributed via an electronic link to five brokerage firms, who sent the survey to a random selection of investors.

-

Responses: Of the 250 questionnaires distributed, we received 164 responses, of which 146 were deemed eligible after reviewing for completeness and relevance to the study.

-

Justification: This sampling method ensures that the data collected reflects the investment behaviors of a diverse group of Palestinian investors. By involving multiple brokerage firms, we ensured that our sample captures a wide range of investment experiences and demographic backgrounds, which strengthens the generalizability of our findings.

Data collection sources

We relied on two primary sources to gather the necessary information and data for the study.

Secondary Data: The researcher used the secondary sources to collect the necessary data and information, represented by books and related literature, scientific journals, published research, and university theses. He also used electronic resources available on the Internet and various databases to obtain the latest scientific research on the subject of study.

Primary Data: A questionnaire related to the subject of the study was developed based on the theoretical framework of this study and the previous studies that were presented previously.

Study variables

We examined several key variables to understand the relationship between financial literacy, overconfidence, and investment decisions:

-

- Independent Variable (Financial Literacy): Measured using a modified version of the OECD questionnaire, covering financial knowledge, understanding of financial products, and the ability to apply financial concepts to real-world scenarios.

-

- Dependent Variable (Investment Decisions): Captured through questions assessing the level of diversification, risk tolerance, and the type of assets in which investors choose to allocate their funds (e.g., stocks, bonds, real estate).

-

- Moderating Variable (Overconfidence): Measured through a comparison of participants' self-assessed financial knowledge and confidence with their actual performance in financial literacy questions.

-

- Demographic Factors: Age, gender, education, job title, income level, and years of investment experience were collected to understand their influence on both financial literacy and investment decisions.

Results

Table 1 shows the distribution of the study sample members according to the personal variables.

Table 1

| Personal variables | Categories | Frequency | Percent |

|---|---|---|---|

| Gender | Male | 79 | 54.1 |

| Female | 67 | 45.9 | |

| Total | 146 | 100.0 | |

| Age | < 30 | 87 | 59.6 |

| 30–40 years | 27 | 18.5 | |

| 41–50 years | 20 | 13.7 | |

| more than 50 years | 12 | 8.2 | |

| Total | 146 | 100.0 | |

| Academic degree | High school | 10 | 6.8 |

| Diploma | 6 | 4.2 | |

| Bachelor degree | 112 | 76.7 | |

| Master or Ph.D. | 18 | 12.3 | |

| Total | 146 | 100.0 | |

| Specialization | Finance and banking | 95 | 65.1 |

| Business and economics | 50 | 34.2 | |

| Other field | 1 | 0.7 | |

| Total | 146 | 100.0 | |

| Experience in stock market | < 5 years | 106 | 72.6 |

| between 6 and 9 years | 13 | 8.9 | |

| 10 years and above | 27 | 18.5 | |

| Total | 146 | 100.0 | |

| Job Title | Employee | 33 | 22.6 |

| Manager | 36 | 24.7 | |

| Owner | 37 | 25.3 | |

| Other | 40 | 27.4 | |

| Total | 146 | 100.0 | |

| Income | $500–$999 | 77 | 52.7 |

| $1,000–$1,999 | 26 | 17.8 | |

| $2,000–$2,999 | 26 | 17.8 | |

| Above $3,000 | 17 | 11.6 | |

| Total | 146 | 100.0 |

Distribution of study sample members according to personal variables.

An examination of the demographic and background profiles of the survey participants, which is presented in Table 1, serves as a basis to comprehend the dissimilarity within the sample that may determine investment decision-making. The majority of participants in this study are male (54.1%) compared to female (45.9%), suggesting an almost balanced gender distribution. This diversity makes possible a more extensive exploration of views on investments considering gender differences.

It is evident from the data that the majority of participants, approximately 59.6%, are aged below 30, which indicates that investment is dominated by the young generation, who could be inclined to more aggressive trading strategies or hold higher risk tolerance. The higher education level among the sample is high, with 76.7% stating that the respondents have a good educational background where the possibility of having knowledge of financial markets should not be ignored. However, as part of a generalized financial education, and specifically in finance and banking (65.1%), it may affect investment decisions too.

The distribution of experience shows that traders with < 5 years on the market make up a large part of the sample (72.6%), potentially indicating a lack of practical knowledge to make investment decisions. This is a significant factor as it could potentially impact the reliance on various factors during decision-making, given that these levels can range from low to high in terms of confidence and comprehension.

One way to better understand the participants and their investment behavior is through their job titles and income levels, which are indicators of professional and economic background and could potentially affect their investment choices and risk appetite. Individuals with higher incomes are more likely to choose riskier investments, as they may have a greater tolerance for loss.

Going further than descriptive statistics, this work uses a five-point Likert scale to determine the factors that influence investment decisions. The division into low, medium, and high agreement scores enables a more detailed understanding of respondents' attitudes toward the investment decision factors. The use of period length calculations to interpret these scores contributes to the methodological reliability of the analysis because it ensures that a significant difference is defined between various levels of agreement.

In a similar vein, an alternative examination in this context highlights the role of addressing investment decision sub-dimensions, which may consist of personal and financial needs, company image, advocate opinions, neutral information, and accounting information. A deep insight into these factors is required to cover a full-spectrum analysis of how investor demographic and background characteristics, along with individual attributes and perceptions, can contribute to shaping the investment decision-making process.

It is very important to consider what these results mean. This kind of interpretation goes beyond the scope of this paper, but as an example, it could be mentioned that high dependability on accounting information implies that investors pay more attention to financial health and performance indicators while making investment decisions. The pronounced role of company image and advocate recommendations in driving investment behavior reflects the significance of reputational cues and social influences.

It is noteworthy that knowledge of investment decision-making differs with demographic characteristics that allow the design of particular financial educational programs. Meanwhile, in order to obtain information on how low the level of financial literacy is among participants of the training seminar, we analyzed which indicators and methods should be used for assessing financial literacy, and this analysis showed that almost all basic knowledge regarding market indicators and estimating financial risks is lacking or weak.

Reliability of the study tool

The principle of reliability refers to the degree of stability and consistency of answers in relation to a given scale. Researchers typically measure scale reliability by determining the extent of internal consistency using Cronbach's alpha coefficient. The scale is considered valid if Cronbach's alpha is >0.70; however, this study adopts Cronbach's alpha value for all variables. Table 2 showed that all of Cronbach's alpha values were >0.70 (Hair Jr et al., 2011). Therefore, we conclude that the scales adopted in this study have a suitable level of reliability.

Table 2

| Dimensions | Sub-dimensions | Number of items | Cronbach's alpha | Skewness | Kurtosis |

|---|---|---|---|---|---|

| Factors Affect Investment Decision | Financial and personal needs | 6 | 0.78 | – | – |

| Company image | 7 | 0.81 | – | – | |

| Neutral information | 7 | 0.71 | – | – | |

| Advocate recommendation | 5 | 0.88 | – | – | |

| Accounting information | 9 | 0.78 | – | – | |

| Factors affect investment decision | 34 | 0.91 | −0.302 | 1.344 | |

| Financial knowledge | 20 | 0.706 | −1.082 | 1.849 | |

| Financial skills | 7 | 0.705 | −1.006 | 0.343 | |

| Financial behavior | 9 | 0.752 | 0.302 | 0.396 | |

| Overconfidence decisions | 7 | 0.785 | |||

Diagnostic statistics and scale items for study variables.

Table 2 provides some insight into the reliability and distribution of the study variables, which explain factors influencing investment decisions through diagnostic statistics. It is evident from Cronbach's alpha values for each sub-dimension that all have a satisfactory to excellent level of internal consistency, meaning that items within each sub-dimension measure reliably the same construct. The Advocate Recommendation sub-dimension shows the highest reliability (α = 0.88), which implies a very strong internal consistency among the items, indicating how much investors rely on advocate recommendations when making their investment decisions. This exceptionally high reliability testifies to the coherence of the items assessing investors' reliance on advocate recommendations.

On the other hand, neutral information and financial knowledge have the lowest-values for Cronbach's α scores (α = 0.71 and α = 0.706), but still are above the acceptable threshold of 0.7 for reliability values, indicating a relatively less reliable yet still unbroken collection of items measuring those sub-dimensions. The meaning is that though the items may be, in general, coherent in terms of content validation and theoretical underpinnings, there might be an option to further purify scales on them toward better concordance within their different components.

The general reliability of Cronbach's alpha for the Factors Affecting Investment Decision scale (α = 0.91) is way above the desired level, which is a reflection of exceptional consistency within the scale. Given this high consistency, we can confidently assert that the scale accurately captures the intricate nature of investment decision factors, thereby serving as a dependable foundation for future research.

Analyzing skewness and kurtosis values, the authors reinforced the study with a methodological approach. The reported figures were all well within the normal distribution range, confirming that we are dealing with parametric data that allows for flawless performance of statistical tests. According to this particular characteristic of normality, a well-balanced dataset with no significant deviations from the mean is mandatory to ensure the accuracy and precision of any statistical analysis in the study being conducted.

These findings have implications beyond just statistics. The scales' trustworthiness demonstrates that the research reveals all aspects of factors affecting investment decisions, such as financial and personal needs, company reputation, and advocate recommendations. The shape of the data with a normal distribution implies that it is likely to be representative, making the study's conclusions applicable beyond this sample.

An effective methodological frame further supports the numbers generated by the diagnostic statistics, providing a strong foundation for investigating the connections between factors and investment decisions. By ensuring both reliability and normal distribution in the variables used in this study, it sets a standard that subsequent researchers can carry out more extensive analyses on those components that have not yet unveiled their complicated logics of investment behavior.

Structural honesty

Structural validity refers to the relationship of the degrees of the items on the scale to the total degree if it measures one thing, and exploratory factor analysis indicates that the components or items measure something in common, which means their structural validity. Exploratory factor analysis also uses the observed factors as categories to classify variables into the factors they represent.

The results of the factor analysis of the domain of factors affect investment decisions.

Researcher used exploratory factor analysis to verify the psychometric properties of the questionnaire. The rotation matrix for the items of the factors that affect investment decisions, including five sub-dimensions measured using 34 items, is presented in Table 3.

Table 3

| Item | Component | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 | 0.695 | ||||

| 2 | 0.667 | ||||

| 3 | 0.632 | ||||

| 4 | 0.678 | ||||

| 5 | 0.697 | ||||

| 6 | 0.612 | ||||

| 7 | 0.818 | ||||

| 8 | 0.617 | ||||

| 9 | 0.713 | ||||

| 10 | 0.701 | ||||

| 11 | 0.642 | ||||

| 12 | 0.599 | ||||

| 13 | 0.732 | ||||

| 14 | 0.679 | ||||

| 15 | 0.613 | ||||

| 16 | 0.652 | ||||

| 17 | 0.580 | ||||

| 18 | 0.552 | ||||

| 19 | 0.712 | ||||

| 20 | 0.771 | ||||

| 21 | 0.653 | ||||

| 22 | 0.573 | ||||

| 23 | 0.752 | ||||

| 24 | 0.788 | ||||

| 25 | 0.598 | ||||

| 26 | 0.617 | ||||

| 27 | 0.630 | ||||

| 28 | 0.704 | ||||

| 29 | 0.756 | ||||

| 30 | 0.735 | ||||

| 31 | 0.637 | ||||

| 32 | 0.922 | ||||

| 33 | 0.590 | ||||

| 34 | 0.922 | ||||

Rotation matrix for the items of factors affect investment decision.

Determinant = 0.013, KMO = 0.84, Bartlett's test = 5,145.632, (Sig.) = 0.000.

As shown in Table 3, the exploratory factor analysis identified five components, or factors, that represent the different aspects of investment decisions. In this study, the orthogonal rotation method yielded loadings ranging from 0.552 to 0.922, all exceeding the standard threshold of 0.4. It implies an ideal, unequivocal pattern of association between the questionnaire questions and the corresponding factors that they attempt to reflect. The readability and understanding provided by the proposed factor structure confirm not only that it is appropriate to the theory underlying this work, but also that each factor has distinct impacts on investors' investment decisions.

The allocation of items across the five components illustrates the interrelated factors influencing investment decisions. Items with the highest loadings on each component, for example, can be considered indicators reflecting those factors. This subtle categorization delivers priceless information on what exact details of widespread financial and personal needs and company image matter most to investors. The distinction contributes to an in-depth analysis of investment behaviors and how various aspects come together to shape decision-making processes.

In addition, even though the determinant of the correlation matrix is low (0.013), it is nevertheless significant and not zero, indicating that the problem of multicollinearity does not exist within the analyzed group. This requirement is essential for a factor analysis because it ensures that each item uniquely contributes to exploring the factors; there should be no repetition or redundancy when selecting items for a given scale.

An important indicator of sample adequacy, the Kaiser–Meyer–Olkin (KMO) statistic is an impressive 0.84, well above the critical threshold value of 0.5. The large KMO value suggests that the size of the sample analyzed for our study has been sufficient; this, in turn, strengthens our belief that the factor analysis results are also dependable and accurate. A large KMO value is indicative of the degree to which variables are predicted by other variables with no error and hence can be used for structure identification by factor analysis.

Based on Bartlett's Test of Sphericity, the data can be factored, as evidenced by a test statistic of 5,145.632, which is statistically significant at the 0.000 level against an alpha level set at 0.05. This suggests a strong rejection of the null hypothesis that the variables are orthogonal (uncorrelated). Instead, it proves relationships among the variables. Also, it gives a green light to use factor analysis with the dataset, as this means that the variables are highly enough correlated to justify dimension reduction.

The results of the factor analysis of the domain of behavior

We used exploratory factor analysis to verify the psychometric properties of the questionnaire. The rotation matrix for the nine items measuring behavior is presented in Table 4 below.

Table 4

| Item | Component |

|---|---|

| 1 | 0.656 |

| 2 | 0.484 |

| 3 | 0.584 |

| 4 | 0.621 |

| 5 | 0.650 |

| 6 | 0.561 |

| 7 | 0.652 |

| 8 | 0.699 |

| 9 | 0.595 |

Rotation matrix for the items of behavior.

Determinant = 0.02, KMO = 0.655, Bartlett's test = 213.156, (Sig.) = 0.000.

The exploratory factor analysis provides valuable insights into the psychometric qualities of a measuring tool for the behavioral domain. All nine items loaded above the minimum standard level of 0.4, indicating an acceptable level of item-factor correlation. This distribution emphasizes behavior as a multi-faceted trait, and separate dimensions create this more general construct. The determinant of the correlation matrix is 0.02, indicating no multicollinearity between components and unique identities for each item.

The KMO test score of 0.655 surpasses the minimal criterion value of 0.50, suggesting that the variables exhibit sufficient pattern and correlation to warrant an exploratory approach for latent variable identification and data reduction. Bartlett's sphericity test strengthens the data set's factorability by producing a highly significant result (213.156, Sig. = 0.000), indicating that there are enough correlations among the variables.

It is crucial to consider the identified behavioral components within a broader context, as every component demonstrates one behavioral aspect expressed through the questionnaires. The distribution pattern of item loadings suggests a complex interplay among contributing variables, necessitating an investigation into the interconnection and reciprocal reinforcement of these components.

Identified components can reflect underlying behavior theories that might be elaborated on or contested by future research. In practical terms, discerning the separate components of behavior as shown through factor analysis can help design interventions, policies, and strategies to ensure desired behavior changes.

In conclusion, this outcome highlights the need to develop and validate measurement tools constantly and consistently when conducting behavioral research. Emerging studies may improve on these results by assessing the predictive validity of behavioral components discovered or studying their application across contexts and populations.

The results of the factor analysis of the domain of decisions

We used exploratory factor analysis to verify the psychometric properties of the questionnaire. The rotation matrix for the items of the decisions, measured using seven items, is presented in Table 5 below.

Table 5

| Item | Component |

|---|---|

| 1 | 0.700 |

| 2 | 0.806 |

| 3 | 0.830 |

| 4 | 0.572 |

| 5 | 0.413 |

| 6 | 0.734 |

| 7 | 0.558 |

Rotation matrix for the items of decisions.

Determinant = 0.01, KMO = 0.819, Bartlett's test = 282.381, (Sig.) = 0.000.

The exploratory factor analysis results in Table 5 provide valuable insights into the structure of decision-making when measured with a questionnaire. The factor loadings span from 0.413 to 0.830, signifying a strong connection between each item and at least one identified component, with none falling below the commonly accepted threshold. This indicates that decision-making is a multifaceted concept, with different dimensions or aspects collectively contributing to this complex construct.

The determinant of the correlation matrix is meaningful because it exceeds zero, eliminating concerns about multicollinearity between survey questions. The Kaiser–Meyer–Olkin (KMO) measure of sampling adequacy reaches 0.819, significantly greater than the cut-off level of 0.50, confirming the sufficiency of the sample size and implying a large number of interrelations between items. This high value of KMO implies that the dataset is appropriate for finding underlying dimensions in decision-making and forms a solid basis for factor analysis.

A Bartlett test of sphericity was carried out to strengthen the case that the dataset is factorable, providing highly convincing results that affirmatively reject the null hypothesis that the variables are not related or imply they are indeed related at all. These findings have implications for intervention development, policy-making, and educational programs focused on decision-making skills.

These findings add to the decision-making literature by providing evidence in favor of the many-dimensional nature of decision-making processes and their multi-stage model. Future studies can scrutinize these dimensions further, considering how they interact with each other and external forces. The analysis is reliable, and the results can be used as they are. However, it is possible to enhance this work by using other approaches, such as confirmatory factor analysis, to test the validity of the structure identified or examine how these decision-making components vary in different population groups or contexts.

This part, including the results of the study, depends on the descriptive statistics for the research variables

Table 6 below displays some descriptive results for the research variables used in this study. The table shows the mean and standard deviation for the factors that affect investment decisions: financial knowledge, financial skills, behavior, and financial decisions.

Table 6

| Rank | No. | Sub-dimensions | Mean | Std. deviation | Degree of approval |

|---|---|---|---|---|---|

| 1 | 5 | Accounting information | 4.06 | 0.49 | High |

| 2 | 2 | Company image | 4.01 | 0.50 | High |

| 3 | 4 | Advocate recommendation | 3.92 | 0.55 | High |

| 4 | 1 | Financial and personal needs | 3.87 | 0.50 | High |

| 5 | 3 | Neutral information | 3.78 | 0.53 | High |

| Factors affect investment decision | 3.94 | 0.43 | High | ||

| 1 | Decrease of risk | 3.99 | 0.82 | High | |

| 2 | Investment diversification | 4.14 | 0.75 | High | |

| 3 | Actual Dividends | 3.53 | 1.00 | Medium | |

| 4 | Easiness of getting a loan | 4.09 | 0.81 | High | |

| 5 | Expected Dividends | 4.00 | 0.80 | High | |

| 6 | Expected losses in local market | 3.47 | 1.10 | Medium | |

| Factors related to financial and personal needs | 3.87 | 0.50 | High | ||

| 1 | Religion believes | 4.13 | 0.89 | 3 | |

| 2 | Board of directors' reputation | 4.30 | 0.85 | 1 | |

| 3 | Company reputation | 4.15 | 0.75 | 2 | |

| 4 | The company's position in the industry | 3.95 | 0.84 | 5 | |

| 5 | Company code of ethics | 3.96 | 0.85 | 4 | |

| 6 | Company's corporate governance | 3.85 | 0.85 | 6 | |

| 7 | Company's social responsibility | 3.72 | 0.90 | 7 | |

| Factors related to the company image | 4.01 | 0.50 | High | ||

| 1 | Market index volatility | 3.43 | 1.05 | 6 | |

| 2 | Media coverage | 3.97 | 0.69 | 3 | |

| 3 | Government as an investor | 3.71 | 0.85 | 5 | |

| 4 | General economic indicator | 4.17 | 0.81 | 1 | |

| 5 | Local political stability | 4.00 | 0.80 | 2 | |

| 6 | Global political stability | 3.87 | 0.82 | 4 | |

| 7 | Recommendation from broker | 3.32 | 1.04 | 7 | |

| Neutral information | 3.78 | 0.53 | High | ||

| 1 | Recommended from one of the family member | 3.34 | 0.97 | 5 | |

| 2 | Recommendation from a friend | 4.07 | 0.85 | 3 | |

| 3 | Recommendation from financial analyst and financial advisor | 4.08 | 0.87 | 2 | |

| 4 | Auditor opinion | 3.90 | 0.99 | 4 | |

| 5 | Stock dividends | 4.22 | 0.79 | 1 | |

| Advocate recommendation | 3.92 | 0.55 | High | ||

| 1 | Stock market liquidity | 3.20 | 1.04 | 9 | |

| 2 | Rumors | 4.23 | 0.74 | 3 | |

| 3 | Expected profit | 4.10 | 0.80 | 5 | |

| 4 | Insider information | 4.03 | 0.85 | 7 | |

| 5 | Past stock performance | 4.00 | 0.82 | 8 | |

| 6 | Information from internet and Credible information from economic and financial cites | 4.06 | 0.84 | 6 | |

| 7 | Stock price | 4.41 | 0.69 | 1 | |

| 8 | Reliability of company financial statement | 4.14 | 0.79 | 4 | |

| 9 | Expected stock split and raise of capital | 4.40 | 0.69 | 2 | |

| “Accounting information” | 4.06 | 0.49 | High | ||

| 1 | Stock market liquidity | 3.20 | 1.04 | 9 | |

Factors affecting investments decisions.

The study evaluates various factors affecting investment decisions, with an average score of 3.94. Financial data is considered the most important factor, with an average value of 4.06, indicating that it plays a significant role in decision-making. Perhaps due to corporate reputation and social responsibility, company image ranks second.

The analysis of sub-dimensions reveals differences in evaluations, with the first dimension, ‘Advocate Recommendations,' receiving an average score of 3.92, indicating that professional advice has less impact but still has high worth. Financial and personal needs, such as investment diversification and market risk perceptions, have a mean value of 3.87, whereas neutral information has a mean value of 3.78, indicating less influence in decision-making.

Investment diversification is considered the most important factor, with a mean value of 3.47–4.14. Expected losses in the local market have a low mean score, indicating that they are not a concern. Company image, an attribute of governance quality, has a good mean value, while social responsibility has a lower mean score, emphasizing less emphasis.

Investors make complex and diverse investment decisions, ranking and ordering the most significant factors according to their place in an investor hierarchy. The module “Accounting Information” received the highest average score, indicating that financial data plays a vital role in investment decision-making. Investors consider personal advice, financial objectives, and economic factors when making investment decisions. The classification of levels, such as “Advocate Recommendations,” “Financial and Personal Needs,” and “Neutral Information,” reveals different preferences about the significance of “Investment Diversification” or how an investor might evaluate a “Company Image.” We should apply these multiple angles in practice to shape more informed investment strategies, enhance corporate governance practices, and drive social responsibility initiatives, as they enhance our understanding of financial behavior as shown in Table 7 below.

Table 7

| Item | Full mark | Mean | Std. deviation | Degree of approval |

|---|---|---|---|---|

| Financial knowledge | 20 | 12.23 | 3.40 | Medium |

| Financial skills | 7 | 4.69 | 1.92 | High |

Mean, standard deviation, importance and ranking of financial knowledge & financial skills.

The study reveals a significant disparity between financial knowledge and skills among respondents. The average score for financial knowledge is 12.23 out of 20, suggesting a good understanding of money matters but potentially lacking in critical decision-making. This suggests that most people have some knowledge but may not be equipped to handle the advanced complexity of today's financial environment.

On the other hand, the average score for financial skills is 4.69 out of 7, indicating a general ability to apply financial knowledge to everyday life. This indicates expertise in managing financial affairs and making informed decisions. However, the higher assessment for skills suggests that individuals might be more competent at applying than theoretical appreciation.

The overlap of these two areas raises questions about how knowledge and skills relate to each other in the financial domain. We can nurture practical skills in finance independently from theoretical understanding, depending on factors like experiential learning, interest levels, and the relevance of managing personal finances with deep theoretical knowledge.

An inadequate level of financial knowledge and skills sparks debates on the efficacy of financial education programs. It is essential to ensure that financial education programs include practical skills to enable easy application in real-life situations. Continuous financial literacy throughout a person's life is also critical for financial wellness.

In the increasingly involved financial industry and challenging personal decision-making, developing an individual's financial knowledge and skills is essential for financial wellness. To fully understand and implement financial abilities, we need new teaching methods that combine theoretical learning with hands-on work, such as simulations or business examples as shown in Table 8 below.

Table 8

| No | Statement | Mean | Std. deviation | Rank | Degree |

|---|---|---|---|---|---|

| 3 | I read contracts before I sign them | 4.63 | 0.63 | 1 | High |

| 7 | I feel it is important to save part of my salary each month | 4.42 | 0.80 | 2 | High |

| 1 | I pay all my expenses before I buy new things | 4.32 | 0.85 | 3 | High |

| 2 | I shop around and compare prices before I buy anything | 4.21 | 0.84 | 4 | High |

| 9 | I am afraid of taking loans | 3.79 | 1.13 | 5 | High |

| 6 | I use automatic payment to pay my bills and buy my necessities | 3.77 | 1.02 | 6 | High |

| 8 | I am afraid of using credit cards | 3.03 | 1.17 | 7 | Medium |

| 4 | When I buy anything, I do not care if it is a want or a need | 3.01 | 1.20 | 8 | Medium |

| 5 | When I take a loan, the only thing I think of is how to spend it | 2.78 | 1.22 | 9 | Medium |

| “Behavior” | 3.77 | 0.47 | High | ||

| 1 | I am confidence that my investment decisions are more accurate than my friends | 3.89 | 0.92 | 2 | |

| 2 | I cab predict the trend of the market | 3.31 | 0.99 | 6 | |

| 3 | Usually, my expectations align with what happens in the market | 3.49 | 0.82 | 4 | |

| 4 | The investment plan I make is the reason for my investment returns | 3.75 | 0.77 | 3 | |

| 5 | I am confident that I can finish any homework in less time | 3.91 | 0.78 | 1 | |

| 6 | Always my returns beats the market | 3.44 | 0.89 | 5 | |

| 7 | I over trade in the market | 2.82 | 1.10 | 7 | |

| “Overconfidence decisions” | 3.51 | 0.59 | Medium | ||

Mean and standard deviation for Items domain “financial behavior and overconfidence decision”.

Table 8 provides a comprehensive analysis of people's financial behavior and attitudes toward self-perception in financial decision-making. Research aiming at understanding the psychological determinants of financial behavior thrives on the duality between responsible financial management and excessive confidence in financial decision-making.

Higher scores indicate that participants possess considerable amounts of financial prudence, reflecting a greater degree of such quality. These behaviors, with their historical basis in financial wisdom, indicate that people appreciate the need to be responsible in spending and recognize the risks associated with capricious transactions or wasteful investments. However, the apprehension about using credit cards and taking loans indicates a complicated perspective on indebtedness.

Overconfident determinations shed light on the psychological depth of financial decision-making. High scores indicate a belief in completing tasks more efficiently than others and a confidence in investment decisions surpassing those of peers. This feature may facilitate an attempt at action but can also play a negative role by underestimating risks and overestimating one's ability to influence financial results.

The division between prudent money practices and an erroneous belief that one's decisions are always accurate reveals the complexity of interconnections among knowledge, skills, and psychological biases in financial domains. In general, people show a reasonable level of prudence in routine financial acts, but there is a separate phenomenon of overconfidence in decision-making abilities that is particularly significant in investment contexts.

For successful financial education, it is necessary to pay attention not only to the formation of knowledge and skills but also to psychological biases, such as excessive self-confidence. This information can help individuals recognize these biases and improve decision-making by taking into account both the risks and opportunities associated with financial decisions.

Quantitative analysis of investment decisions

The regression equation (econometric model) tries to find the numbers for the connections and interactions between not knowing enough about money, being too sure of yourself, and making bad investment decisions. It does this by providing statistical support for the hypotheses that were put forward at the start of this research, as shown in Table 9 below.

Table 9

| Variable | Coefficient (β) | Standard error | t-Statistic | P-value | Comment |

|---|---|---|---|---|---|

| Constant (β0) | 2.969 | 0.179 | 16.573 | < 0.001 | Highly significant |

| Financial literacy (β1) | 0.045 | 0.014 | 3.163 | 0.002 | Significant positive effect |

| Overconfidence (β2) | 0.467 | – | 6.580 | < 0.001 | Significant positive moderator |

| Interaction term (β3) | – | – | – | – | Enhances the model significantly |

Regression equation (econometric model).

The study presents an econometric model that examines the impact of financial literacy and overconfidence on investment decisions in Palestine. The model uses numerical methods to provide a detailed understanding of investor behavior. It assesses the direct consequences of these variables and how overconfidence influences the connection between financial literacy and the quality of investment decisions.

The results show that even without financial literacy and overconfidence, there is a baseline level of investment decision-making quality that is positive. This suggests that other factors not accounted for also play a positive role in investment decision-making quality among the target population. Financial literacy has a positive effect on investment decisions by increasing market investment levels, potentially increasing returns, and lowering risk. Overconfidence also shows a significant moderating effect, as it enhances the application of financial knowledge in making investment decisions. This implies that investors who are more confident in their financial acumen tend to make more assertive investment decisions.

The interaction term between financial literacy and overconfidence improves the model considerably, suggesting that when combined, both independent variables have an added effect on investment decision quality. The results are statistically reliable, with low p-values (below 0.05) showing robust evidence that the null hypothesis is incorrect.

The study contributes to the knowledge base in behavioral finance and helps provide strategies for effective financial education programs and policy reforms to help investors make better investment choices.

This part, testing the study hypotheses

-

H1: Palestinian investors exhibit a moderate level of financial literacy, as measured by their knowledge and skills in managing personal finances and making informed investment decisions.

The first hypothesis was tested by applying the one-sample T-test to the study sample members' estimates of financial knowledge, in addition to the test as shown in Table 10 below.

Table 10

| Hypothesis | Mean | S.D | Degree | T | Sig. | Result |

|---|---|---|---|---|---|---|

| The Palestinian investors' financial knowledge is weak | 12.23 | 3.40 | Medium | 19.829 | 0.00 | Reject |

Result of (one sample T-test) to the study sample members' estimates of the financial knowledge.

The study uses a one-sample T-test to examine the financial literacy of Palestinian investors, revealing that their understanding of financial concepts is moderate. This contradicts the initial hypothesis that Palestinian investors lack financial knowledge, as the statistical analysis shows that they possess a solid grasp of financial concepts beyond mere familiarity. This contradicts preconceived notions about financial literacy levels in emerging markets or regions facing economic and political challenges.

The findings suggest that even in such contexts, investors can attain a commendable degree of financial literacy, which is crucial for well-informed investment choices. This discovery underscores the value of tailored initiatives aimed at promoting financial education and raising awareness. Interventions in education could focus on closing specific gaps in knowledge, leading to an overall elevation of financial literacy.

However, understanding the surrounding circumstances and the fundamental elements contributing to this moderate level of financial understanding becomes essential. Factors such as financial education availability, cultural financial conduct standards, and persistent economic difficulties in the area could all influence the financial literacy landscape among investors in Palestine.

The intermediate degree of financial expertise, which exceeds the minimum requirement for competence, highlights the diversity among investors and the impact of different levels of comprehension in finance on investment behaviors. Acknowledging this diversity is crucial for creating financial education initiatives and formulating policies that facilitate well-informed financial decision-making.

We need to conduct additional research to explore the various aspects of financial literacy among Palestinian investors, examining areas where they excel and struggle in terms of financial knowledge and skills. This will provide valuable insight into how to assist investors in making decisions that align with their financial objectives and the overall economic landscape of the region.

-

H2: Increased financial literacy significantly enhances the quality of investment decisions among Palestinian investors.

To test this hypothesis, the regression was applied. Table 11 shows that.

Table 11

| Independent variable | Unstandardized coefficients | Standardized coefficients | R | R 2 | F | Sig. | Result | ||

|---|---|---|---|---|---|---|---|---|---|

| B | Std. error | Beta | T | ||||||

| Constant | 2.969 | 0.179 | 16.573 | 0.255 | 0.065 | 10.006 | 0.002 | Accept | |

| Financial literacy (financial knowledge) | 0.045 | 0.014 | 0.255 | 3.163 | |||||

Results of Regression for the impact of financial literacy on investment decision quality.

The study reveals a significant correlation between financial literacy and the quality of investment decisions made by Palestinian investors. The positive beta coefficient (β = 0.255) and t-test (T = 3.163) indicate a statistically significant relationship between financial literacy and the quality of investment decisions. Financial literacy can explain a modest amount of variance in decision quality, as indicated by the R2 value of 0.065, but it remains a critical step toward understanding this process.

The research findings confirm the importance of financial education literature, suggesting that well-informed investors make sound and consistent decisions with long-term goals. An increase in Palestinian investors' financial literacy can significantly enhance investment decision quality, providing empirical proof for claims supported in financial behavior research.

We could apply these relationships in practice, highlighting the importance of promoting financial literacy through specialized financial education programs for investors. Financial literacy has a positive effect on decision-making quality, leading to better and more informed investment decisions and contributing to stability and prosperity within the Palestinian context.

The results support the inclusion of financial education in a larger context of economic development policies, allowing for the development of a more dynamic, adaptive, and knowledgeable investor base. However, the R2 value shows that financial literacy only accounts for about 6.5% of the variance in investment decision quality, raising questions about the complexity of investment decisions.

Future research should explore additional variables, such as psychological factors, market belief, and individual investor attributes, to clarify the complexity of determinants in investment decision-making. A microanalysis would facilitate more bespoke educational interventions focusing on the most crucial components of financial literacy.

The regression analysis not only establishes the positive association of financial literacy with investment decision quality among Palestinian investors but also considers the interaction of influencing factors. This underscores the importance of financial education and the need for multifaceted intervention programs to improve investment behaviors, contributing to society's prosperity.

-

H3: Demographic factors, including gender, age, academic qualification, field of specialization, and investment experience, significantly influence the financial literacy levels among Palestinian investors.

We applied the analysis of variance (Independent Samples T-Test) on the financial literacy of the study sample members about gender and (ANOVA) on the financial literacy of the study sample members due to the variables (Academic Degree, Specialization, Experience in Stock Market, Job Title, Income), and the results are presented in Table 12 below.

Table 12

| Gender | Mean | S.D | T | DF | Sig. |

|---|---|---|---|---|---|

| Male | 12.65 | 3.48 | 1.603 | 144 | 0.11 |

| Female | 11.75 | 3.25 |

Results for (independent samples T-test) on financial literacy of the study sample members about to gender.

The study investigates demographic factors affecting the financial literacy of Palestinian investors, focusing on gender disparities. There was no significant difference in financial literacy levels between males and females, with a p-value of 0.11 and a T-value of 1.603. This suggests that gender is not solely responsible for determining a person's level of financial literacy.

The findings suggest that there are no notable gender-based gaps in financial literacy, which could be due to the success of achieving gender equality in education and participation in economic activities within Palestinian society. However, any inequalities regarding financial literacy may go unnoticed due to more influential determinants of financial education and exposure, such as accessibility to resources, quality of education, or socio-cultural norms.

The results provide a wider field for analyzing demographic variables, but there is an absence of gender-based inequalities in this area, calling for research into other demographic features such as age, academic level, investment background, occupational status, and income. This finding has a significant influence on financial education programs and policymaking, suggesting that gender-neutral financial education methodologies can be useful. However, it is crucial to ensure equal access to financial education among all individuals, regardless of their sex, to maintain or achieve equality.

This finding is of interest to investigators who want to deepen their understanding of the difference between financial literacy in various demographic divisions. Future research should investigate qualitative elements of financial education, including personal experiences, cultural influences, and access to financial resources, to shed light on factors that hinder or help improve financial awareness among people from varied backgrounds as shown in Table 13.

Table 13

| Group variables | Category | Mean | S.D | Source of variation | Sum of squares | DF | Mean square | F | Sig. |

|---|---|---|---|---|---|---|---|---|---|

| Age | < 30 | 12.11 | 3.31 | Between groups | 14.402 | 3 | 4.801 | 0.411 | 0.745 |

| 30–40 years | 12.30 | 2.45 | Within groups | 1,657.680 | 142 | 11.674 | |||

| 41–50 years | 12.95 | 4.44 | Total | 1,672.082 | 145 | ||||

| more than 50 years | 11.75 | 4.07 | |||||||

| Academic degree | High school | 10.70 | 5.27 | Between groups | 30.785 | 3 | 10.262 | 0.888 | 0.449 |

| Diploma | 11.50 | 3.15 | Within groups | 1,641.297 | 142 | 11.558 | |||

| Bachelor degree | 12.35 | 3.11 | Total | 1,672.082 | 145 | ||||

| Master or Ph.D. | 12.61 | 3.96 | |||||||

| Specialization | Finance and banking | 12.47 | 3.44 | Between groups | 17.278 | 2 | 8.639 | 0.747 | 0.476 |

| Business and economics | 11.76 | 3.34 | Within groups | 1,654.804 | 143 | 11.572 | |||

| Other field | 13.00 | - | Total | 1,672.082 | 145 | ||||

| Experience in stock market | < 5 years | 12.11 | 3.21 | Between groups | 7.503 | 2 | 3.752 | 0.322 | 0.725 |

| between 6 and 9 years | 12.23 | 3.00 | Within groups | 1,664.579 | 143 | 11.640 | |||

| 10 years and above | 12.70 | 4.29 | Total | 1,672.082 | 145 | ||||

| Job title | Employee | 11.67 | 4.20 | Between groups | 27.689 | 3 | 9.230 | 0.797 | 0.497 |

| Manager | 12.61 | 2.39 | Within groups | 1,644.394 | 142 | 11.580 | |||

| Owner | 12.70 | 3.77 | Total | 1,672.082 | 145 | ||||

| Other | 11.93 | 3.07 | |||||||

| Income | $500–$999 | 12.00 | 3.16 | Between groups | 9.039 | 3 | 3.013 | 0.257 | 0.856 |

| $1,000–$1,999 | 12.54 | 2.93 | Within groups | 1,663.043 | 142 | 11.712 | |||

| $2,000–$2,999 | 12.42 | 3.70 | Total | 1,672.082 | 145 | ||||

| Above $3,000 | 12.53 | 4.67 |

Results for (ANOVA) on financial literacy of the study sample members about to (academic degree, specialization, experience in stock market, job title, income).

Using ANOVA, the study investigated the impact of demographic factors on financial literacy among Palestinian investors. The results showed that none of these factors had a statistically significant effect on financial literacy levels, challenging the common assumption that demographic components are determinants of low financial literacy. This suggests that financial literacy programs may be more accessible and effective for different demographic groups, possibly due to cultural or social norms or resources that overcome traditional demographic barriers.

The fact that financial literacy is pretty much the same across all demographic groups could mean that outside factors, like the economy, political unrest, and social norms, have a bigger impact on financial literacy than certain demographic factors. In areas with substantial external influences, the demand for financial expertise is likely to be highly generalized, leading to an unvarying practice and attainment of financial knowledge and skills.

The findings are significant for financial education policy and program structure, as there are no significant differences between groups' means on any financial literacy scales, indicating that specific programs can be helpful. Initiatives that address common needs and reach a wider population may also be effective. These results emphasize the need for ensuring access to financial education and information across different populations, such as ages and socio-economic status.

The results do not support the third hypothesis, but they provide new avenues for future study, such as understanding the development and maintenance of financial literacy across various demographics, including attitudes toward finance, psychological traits, or specific educational experiences.

-

H4: Overconfidence acts as a positive moderator in the relationship between financial literacy and investment decision-making quality among Palestinian investors, enhancing the application of financial knowledge in investment scenarios.

To test this hypothesis, hierarchical regression analysis was used to test the role of overconfidence as a moderating variable in the relationship between financial literacy and investment decisions. Table 14 shows this.

Table 14

| Model | Predictor | Beta | T | R | R 2 | R^2 | F | F | Sig. |

|---|---|---|---|---|---|---|---|---|---|

| First step | Financial literacy | 0.255 | 3.163 | 0.255 | 0.065 | – | 10.006 | – | 0.004 |

| Second step | Financial literacy | 0.221 | 3.105 | 0.531 | 0.282 | 0.217 | 28.124 | 43.302 | 0.000 |

| Overconfidence | 0.467 | 6.580 |

Overconfidence as a moderating variable in relationship between financial literacy and investment decisions.

The hierarchical regression analysis reveals that financial literacy positively influences the quality of investment decisions, with at least 6.5% of fluctuations in quality among Palestinian investors due to financial literacy. However, including overconfidence in the regression analysis significantly changes how people perceive this relationship. Upon considering overconfidence, the R2 value increases to 0.282, indicating that this variable significantly contributes to the model's explanation. This sudden increase of 21.7% in R2 after including overconfidence signals its strong effect on how financial literacy relates to investment decisions. These results align with Zhou and Wei (2025), who found that overconfidence increases behavioral risk during volatile markets, and Wahyu and Firmialy (2024), who demonstrated its moderating effect among Generation Z investors. Together, these findings confirm that addressing overconfidence is critical for translating financial knowledge into sound investment actions, especially in emerging markets like Palestine.

One can view overconfidence as a cognitive bias that amplifies the application of knowledge in decision-making. High levels of confidence in financial analysis and investment choice might act as a booster for more successful application of financial knowledge while making investment decisions. However, this behavior also allows potential risks of investors underestimating or overstating their comprehension of complex financial instruments.

The positive interaction between overconfidence and financial literacy has serious implications for finance and financial advice. Financial literacy programs should focus on imparting knowledge and influencing investors' overconfidence to prevent them from overestimating their financial abilities. These results highlight the importance of a tailored strategy in financial advice, where investment decisions are guided by advisors' analysis of investors' confidence levels along with their knowledge and skills in finance.

This research paves the way for further investigations to understand which psychological characteristics have been intervening in reducing the impact of financial literacy on investment decision-making. Additional research could determine the level of overconfidence that is beneficial enough to exploit gains resulting from financial literacy in investment decisions without exposing individuals to dangerous forms of risk-taking behaviors.

The findings from this research provide a comprehensive examination of the factors influencing investment decisions among Palestinian investors, with a particular focus on the role of financial literacy and overconfidence. By analyzing the demographic and background profiles of participants, the study has met its primary objectives, which were to assess the level of financial literacy and to determine the factors that significantly affect investment decisions within this unique market context.

Achievement of objective 1: assessing financial literacy

The research effectively evaluated the knowledge of investors, in Palestine using a questionnaire from the OECD organization. Findings indicate that although there is some level of literacy among participants it differs based on demographic factors. For example investors (representing 59.6% of the sample) generally possess an educational background but often lack expertise, in finance and banking. It seems that although individuals may have a foundation, in knowledge to some extent; there appears to be a lack of proficiency in financial abilities that are essential, for making well informed investment choices. This discovery corresponds with research emphasizing the significance of tailored learning (referencing Safari et al., 2021).

The Analysis of the questionnaire feedback reveals that financial understanding (measured by Cronbach's α at 0.706) and financial abilities (measured by Cronbach's α at 0.705) show levels of reliability when compared to other aspects such, as advocate recommendations (measured by Cronbach's α at 0.88). This indicates that even though investors heavily depend on sources like advocates or company reputation for information their own financial knowledge is still in the stage of development. This underscores the necessity, for initiatives tailored specifically for this group.

Achievement of objective 2: identifying key factors affecting investment decisions