- 1School of Business, Shandong Jianzhu University, Jinan, China

- 2Shandong Provincial Academy of Innovation and Development, Jinan, China

- 3College of Economics and Management, Beijing University of Technology, Beijing, China

This paper analyzes the structural challenges faced by South Africa, such as high dependence on coal power, low penetration rate of clean energy and lagging power grid infrastructure. Combined with the basis and bottlenecks of energy cooperation between China and South Africa, it proposes a multi-dimensional cooperation path centered on technological synergy, financial innovation and institutional adaptation. This path requires both sides to focus on joint research and development of clean energy technologies, cultivation of localized industrial chains and upgrading of smart grids. By innovating hybrid financing tools and risk hedging mechanisms, they can break through capital constraints and promote the reform of South Africa’s energy policy to activate market vitality. At the same time, it is emphasized to deeply integrate China’s advantages in the clean energy industry with South Africa’s resource endowments, establish a mutual recognition system for technical standards and a long-term mechanism for talent cultivation, and ultimately achieve the dual goals of optimizing South Africa’s energy structure and regionalizing the application of China’s technical standards. Clean energy cooperation between China and South Africa is not only about capacity matching, but also requires the establishment of a sustainable collaborative innovation ecosystem to provide a replicable regional cooperation model for the energy transition of emerging economies.

1 Introduction

Since the establishment of diplomatic relations in 1998, the strategic cooperation between China and South Africa has continued to deepen. Currently, a comprehensive strategic partnership of coordination covering multiple dimensions such as politics, economy and science and technology has been formed, entering a historical peak of bilateral exchanges. In September 2018, the summit of the heads of state of the two countries established a strategic alignment mechanism between the “Belt and Road Initiative” and South Africa’s “Economic Reconstruction and Recovery Plan” (MFA, 2021; IEA, 2019; Huo et al., 2018) focusing on innovative tracks such as digital infrastructure, the clean energy revolution, and artificial intelligence applications, and simultaneously exploring new energy cooperation spaces such as energy storage system integration and smart microgrid construction (Matthews and Wynes, 2022; People’s Daily, 2018).

As typical samples of the transformation of traditional energy, the two countries jointly shoulder the dual mission of relying on fossil energy and low-carbon transformation. South Africa’s coal reserves account for 91% of Africa’s total, reaching as high as 55.3 billion tons. Both have the same energy consumption structure as China and have a huge demand for coal. Although both countries are vigorously promoting energy transformation and increasing the proportion of renewable and clean energy usage, the basic energy status of coal is still difficult to be shaken in the short term (Wu et al., 2020). Under the constraints of the Paris Agreement, both sides have formulated a clear roadmap: The South African government has committed to reducing carbon dioxide emissions by 350–420 million tons by 2030; Achieve carbon neutrality by 2050 (Li and Dong, 2024; IEA, 2021; CCERA, 2020). China plans to increase the proportion of non-fossil energy consumption to around 25%, reduce carbon dioxide emissions per unit of GDP by more than 65% compared with 2005, smoothly achieve the carbon peaking target before 2030, and jointly participate in the reform of the global climate mechanism (Khan, A., et al., 2023; Yang, Y., et al., 2023; The State Council of the People’s Republic of China, 2021).

The strategic complementarity in the field of clean energy is reshaping the pattern of cooperation. In 2024, China’s newly added and cumulative installed Solar PV capacity will remain the world’s largest, with its manufacturing capacity accounting for 90% of the global total (China Lianhe Credit Rating Co, 2025), which is deeply tied to South Africa’s annual new Solar PV demand. In the new green hydrogen race, according to statistics from the China Hydrogen Energy Alliance Research Institute, China’s hydrogen production in 2022 was approximately 35.33 million tons, accounting for more than one-third of the global total (Kuang, 2024). This has formed a technological coupling with South Africa’s average annual sunshine resources of 2,500 h. The two sides have initiated key cooperation in key technical fields such as joint research and development of electrolyzers and liquid hydrogen storage and transportation. This full industrial chain collaboration model not only strengthens South Africa’s strategic position as an energy hub in Africa, but also provides a regional implementation fulcrum for China’s clean energy standard system.

2 The current development status of energy transition in South Africa

2.1 Analysis of the energy industry in South Africa

South Africa, as a typical contradiction in the global mining and energy transition, presents significant dual characteristics in its economic and energy structure: On the one hand, the mining industry, as a pillar of the national economy, contributed 7.5% of the GDP in 2024. Its platinum, gold and coal production ranked first, third and sixth in the world respectively. Its resource exports accounted for approximately 30% of the country’s total exports, supporting the world’s fifth-largest mining scale. On the other hand, data from 2024 shows that coal-fired power generation in South Africa accounts for as high as 70% (Ministry of Commerce of the People’s Republic of China, 2025a; Gao et al., 2023), making it one of the countries with the highest carbon emission intensity in the world and facing urgent pressure for energy transition. To fulfill its commitments under the Paris Agreement, South Africa has set a goal of reducing greenhouse gas emissions by 34% by 2020, by 42% by 2025, and achieving carbon neutrality by 2050 (Lou, 2023).

To achieve this transformation, South Africa has established a multi-level policy framework: the “Integrated Resources Plan” launched in 2011. After revision in 2019, it was clearly stated that 11.5 GW of coal-fired power capacity would be phased out and new installations of renewable energy such as wind power and Solar PV power would be added as substitutes. South Africa has successively released the “Low-emission Development Strategy” and the draft of “National Determined Contributions” Through the Renewable Energy Independent Power Generation and Procurement Program (REIPPPP), the monopoly of the state power company Eskom has been broken, and private capital has been attracted to participate in energy projects. Currently, landmark projects such as the 100 MW solar thermal power station in Hongshi have been completed. To accelerate the mechanism reform, South Africa has merged the former Ministry of Mineral Resources and the Ministry of Energy to form the DMRE, and is promoting the spin-off and reorganization of Eskom. It plans to set up an independent transmission operator to activate market vitality. In terms of financial incentives, the government offers 20 billion rand in tax breaks, focusing on supporting clean technology research and development, energy efficiency improvement and environmental protection projects. At the same time, it implements policy tools such as the “Clean Energy Protection Price” and “voucher Trading” to lower the threshold for green investment (CIN, 2024; CEN, 2021). However, the transformation process is confronted with multiple constraints. First of all, South Africa is one of the countries with the highest unemployment rate in the world, with the unemployment rate remaining at around 25% for a long time. With the implementation of low-carbon emission reduction measures, the coal industry is bound to be impacted. Secondly, the majority of South Africa’s energy production relies on coal-fired power generation, and its carbon dioxide emissions account for approximately half of the African continent’s total. According to the current path to achieving carbon neutrality, to reach the goal of carbon neutrality by 2050, the time for reducing emissions is extremely tight and the difficulty is very high. Furthermore, the latest research report from Price water house coopers shows that South Africa needs a cumulative investment of approximately 700 billion US dollars to achieve carbon neutrality by 2050 (Oyewo et al., 2019). However, South Africa’s overall economic performance has been poor in recent years, and the prospects for raising and obtaining funds are not optimistic (Zhou et al., 2022; Asongu et al., 2020). At the international level, South Africa has received a commitment of 8.5 billion US dollars from Europe and the United States through the “Just Energy Transition Partnership” for power grid upgrades and compensation for the retirement of coal-fired power plants. However, geopolitical competition has intensified - Europe and the United States are competing for the green hydrogen market through the “Global Gateway Initiative”, while China is leading the construction of a 500 thousand tons green hydrogen base in the Northern Cape Province with its technological cost advantage, forming a multi-party competitive and cooperative pattern (Wang, 2022). At present, South Africa’s energy transition is at a critical window period: it needs to integrate regional resources such as Solar PV power in North Africa and hydropower in Congo through ultra-high voltage transmission technology, while also balancing social equity, economic stability and climate responsibility (Amari et al., 2022). The practice of this country provides a unique model for the low-carbon transformation of resource-dependent economies, and its success or failure will profoundly affect the energy governance process in Africa and even globally.

2.2 The situation of clean energy development in South Africa

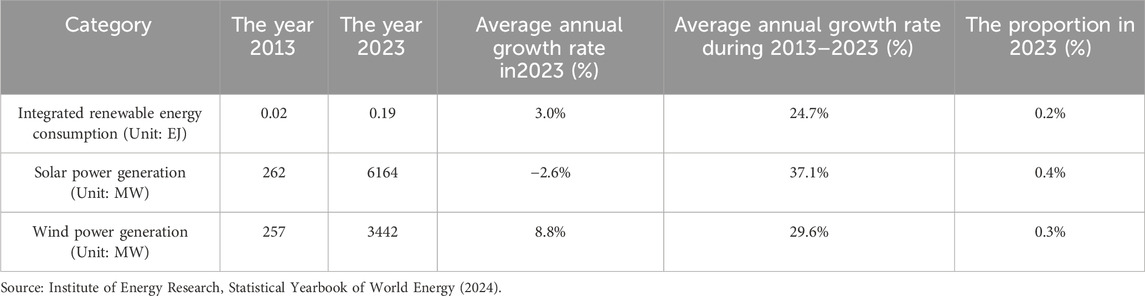

Since the South African president proposed the “Energy Action Plan” in 2022 to end the load shedding and achieve energy security, the clean energy market in South Africa has been heating up. Solar energy projects in South Africa are advancing steadily, with both scale and situation reaching new highs repeatedly. From the perspective of key indicators, the development of clean energy in South Africa has shown the notable characteristics of “high growth rate and low base” over the past decade (as shown in Table 1).

According to Table 1, in the data of clean energy development from 2013 to 2023, the scale of clean energy development in South Africa has shown a significant increase from 2013 to 2023, but the overall scale is still relatively small, and its proportion in the energy structure urgently needs to be improved. The installed capacity has expanded rapidly, but the growth rates have been differentiated in recent years. The installed capacity of solar energy has soared from 262 MW in 2013 to 6,164 MW in 2023, increasing by 23.5 times over a decade, with an average annual growth rate of 37.1%, making it the fastest-growing sector. However, a negative growth of −2.6% occurred in 2023, which might be affected by policy adjustments or bottlenecks in power grid access. The installed capacity of wind power increased from 257MW to 3,442MW, with an average annual growth rate of 29.6%. It still maintained a positive growth of 8.8% in 2023, reflecting its advantages in technological maturity and grid adaptability. Despite the average annual growth rate of clean energy consumption being 24.7% over the past decade, it accounted for only 0.2% of South Africa’s total energy consumption in 2023, which is far lower than the global average of about 15%. South Africa’s energy structure adjustment lags behind, and its reliance on coal power has not been broken.

Structural contradictions remain prominent. First of all, the rapid growth has not changed the energy landscape. As of the end of 2023, South Africa’s electricity consumption will still be dominated by fossil fuels, accounting for 83% of the total electricity consumption. In contrast, the proportion of low-carbon electricity only accounts for 17%, among which solar energy makes up approximately 8%, wind power nearly 5%, and nuclear energy contributes about 4%, with a significant disparity in dominance. The actual contribution of clean energy is weak, reflecting structural contradictions such as the weak peak shaving capacity of the power grid and the rigidity of the electricity price mechanism (LCP, 2024).

Secondly, in March 2025, the South African energy regulatory authority officially approved the electricity price adjustment plan of the South African national power company Eskom. According to the approved rate, it is expected that the electricity price for direct supply users of Eskom will increase by 12.7%, 5.4% and 6.2% respectively in 2025, 2026 and 2027 (Ministry of Commerce of the People’s Republic of China, 2025b; KPMG, 2024; Nkosi and Dikgang, 2018). The short-term increase in electricity prices in South Africa may raise the operational risks of Chinese-funded projects and further deteriorate their cash flow, threatening the implementation of long-term power purchase agreements signed by Chinese enterprises. Furthermore, on the surface, the severe aging of infrastructure, shortage of energy resources and insufficient power facilities are the main causes of the large-scale power outages in South Africa in recent years. However, from a deeper perspective, the structural flaws in South Africa’s power supply system are the fundamental reason for the frequent occurrence of large-scale power outages in recent years.

2.3 Trends in generating electricity using clean energy in South Africa

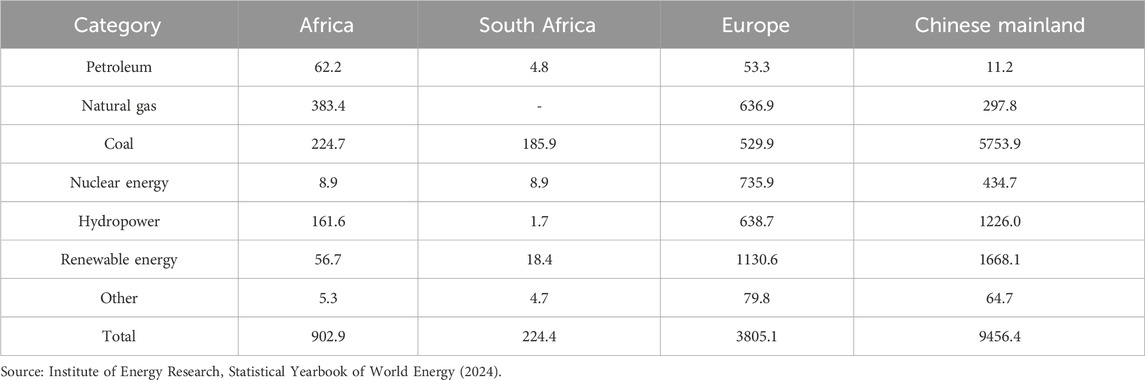

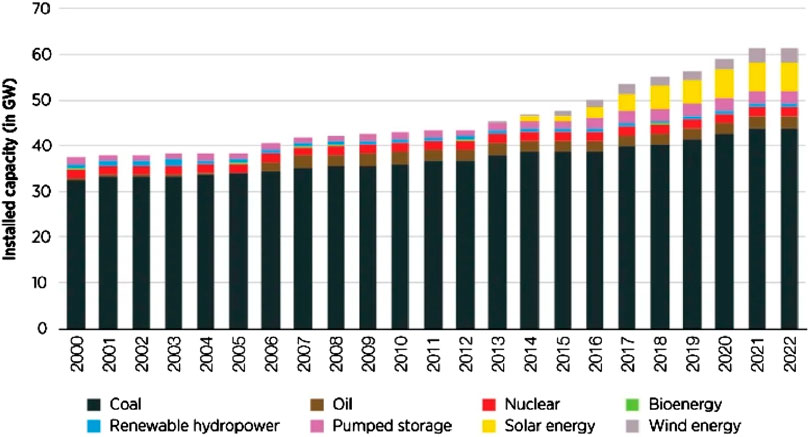

South Africa mainly relies on natural gas and coal for power generation. The clean energy power generation in Europe and China is 20 times and 27 times that of Africa, respectively. In the structure of power generation by fuel, clean energy has become the main fuel for power generation in Europe, while natural gas and coal are still the main fuels in South Africa and China (see Figure 1).

Figure 1. Electricity generation in South Africa, 2000–2022 Source: (IRENA, 2023d).

From the data of fuel power generation in 2023, it can be seen that the global energy structure shows significant regional differences. As the focus of Africa’s energy transition, South Africa has exposed the dual challenges of being highly dependent on traditional energy and lagging behind in the clean energy process. As shown in Table 2, South Africa’s total electricity consumption accounts for only 24.8% of Africa’s total, but the proportion of coal-fired power generation is as high as 82.8%, far exceeding the African average of 24.9% and China’s 60.8%. This single structure results in carbon intensity of up to 0.89 kg of carbon dioxide per kilowatt-hour of electricity compared to 0.46 globally. Moreover, the flexibility of the power grid is seriously insufficient - the pumped storage capacity is only 3.2 GWh, which cannot match the fluctuating characteristics of clean energy, and the curtailment rate of Solar PV power reached 12% in 2023. There is a structural imbalance in energy in South Africa. Its technical route is overly focused on Solar PV power, neglecting the coordinated development of wind power and energy storage. South Africa accounts for all of Africa’s nuclear power capacity, but it has not added any new units in the past decade. The plan to extend the lifespan of the existing Koeberg nuclear power plant until 2044 has been hindered by a funding gap of 5.8 billion US dollars, making it difficult to replicate China’s average annual growth rate of 11.3% in nuclear power (BP, 2024).

The “multi-energy complementarity” model of China is of reference value to South Africa. The clean energy penetration rate of the “wind-solar-thermal storage integration” base implemented in Ordos is 42%, and the power abandonment rate has been reduced to below 5% through a mandatory 25% energy storage ratio. If South Africa introduces a similar mechanism in the sixth round of the REIPPPP tender, it can promote Solar PV energy storage projects and accelerate the process of coal power substitution.

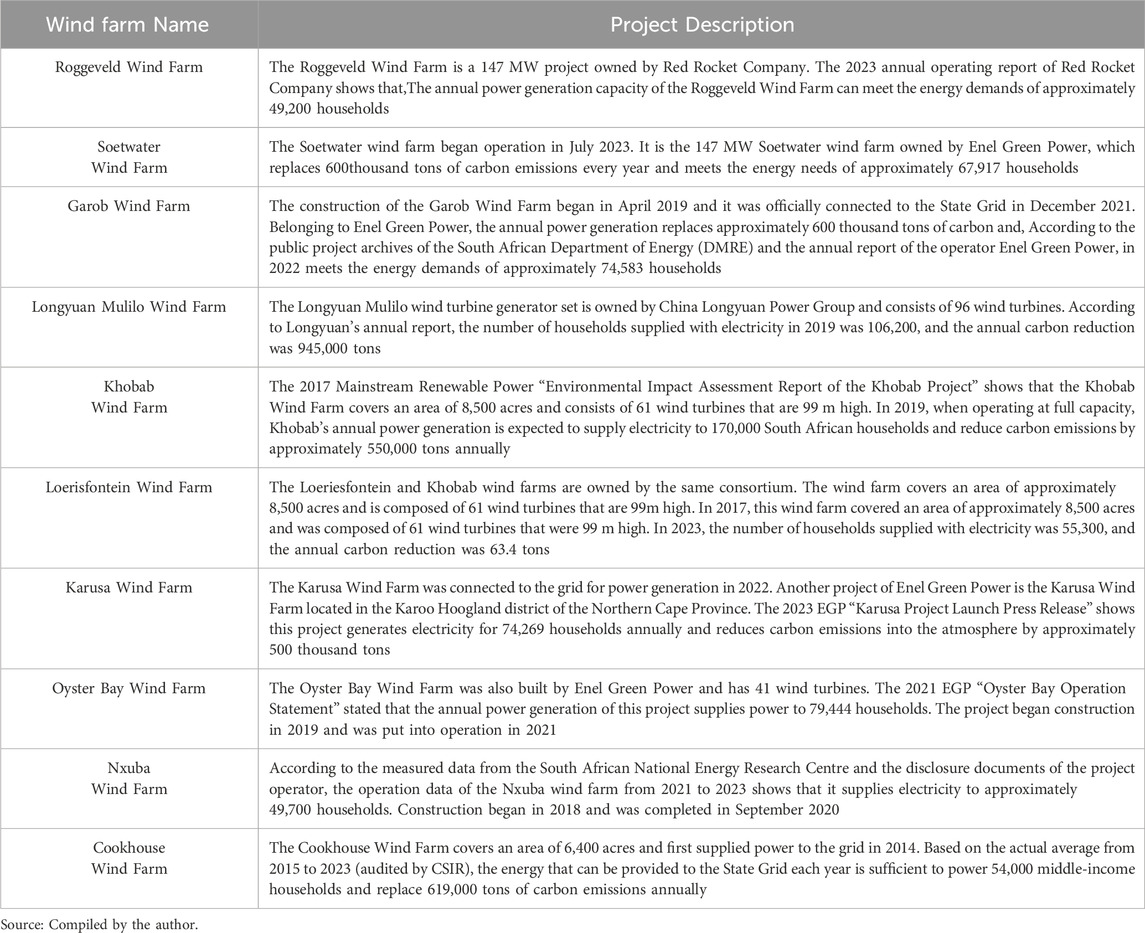

There are currently over 30 utility-scale wind energy projects in operation in South Africa. Wind energy, as an important component of the country’s energy structure, is accelerating its development. With more and more projects coming online as part of the government’s independent clean energy power procurement plan, the wind energy industry is gaining momentum. According to the data from the South African Wind Energy Association, South Africa leads in Africa, accounting for 30% of the continent’s installed wind power capacity, with representative wind farms (as shown in Table 3).

3 China's assistance measures for South Africa's energy transition and development

South Africa has always been a close bilateral partner of China. China’s approach to non-energy diplomacy has formed four distinctive energy cooperation methods: energy cooperation under the framework of state aid, energy exchange for investment, energy community, and market investment (Jing and Zhang, 2018). In recent years, China has accelerated its low-carbon process through technological export, project investment and financing innovation (He, Z., et al., 2020). In the field of wind power, the De ‘a Wind Farm built by Longyuan Power contributed 6.4% of South Africa’s installed wind power capacity. In terms of Solar PV power, the Hongshi Solar Thermal Power Station is equipped with a molten salt energy storage system to enhance the stability of the power grid. Chinese components account for 75% of the Solar PV market share in South Africa. In the field of green hydrogen, the project in the Northern Cape Province led by CGN plans to produce 500 thousand tons of green hydrogen annually by 2030, relying on China’s low-cost electrolyzer technology. At the policy level, Chinese capital has facilitated the implementation of South Africa’s REIPPPP mechanism, leveraging over two billion US dollars in investment through tools such as “carbon emission reduction-linked loans”. Meanwhile, Chinese enterprises have set up localized Solar PV module factories in South Africa, committing that the proportion of local employees will exceed 60% by 2030. However, they are facing challenges such as adaptability to sand and dust environments and geopolitical competition from Europe and the United States, and thus need to strengthen joint research and development and multilateral cooperation.

3.1 China’s policy support for South Africa’s energy transition

The bottleneck of clean energy development in South Africa urgently needs to be broken through through international collaboration, and China provides systematic support through a multi-level policy framework. Since the establishment of diplomatic relations between China and South Africa in 1998, 25 years have passed. Facing the continuous emergence of global challenges, the two sides have jointly developed a comprehensive strategic partnership, actively built a high-level China-South Africa community with a shared future, and jointly played an active role in China-Africa relations and South-South cooperation. Both sides have continuously strengthened cooperation in key areas such as energy resources, green development, and science and technology. Zhongnan has also always regarded energy transformation as a key focus of their cooperation and has constantly introduced policy guidance. In past 10 years (2015–2024), South Africa’s “IRP 2019” introduced Chinese wind power technical standards for the first time, promoting the Longyuan De ‘a project to become the first grid-connected project of REIPPPP that adopted 100% Chinese units; The “South-Central New Energy Cooperation Plan” further requires achieving a localization rate of 60% for photovoltaic modules by 2030, facilitating Zhonghuan Co., Ltd. to establish a technical training center in Cape Town. China-South Africa energy cooperation policies are gradually constructed, several important events are taken for instance, in 2015, China proposed the “Ten Major China-Africa Cooperation Plans” at the FOCAC Johannesburg Summit; in 2017, established the Energy Committee of the South-South Economic and Trade Association, led by the Southern Africa Company of Power China; in 2021, Established the China-African Union Energy Partnership; in 2024, established an All-round Strategic Cooperative Partnership for a New Era.

China and Africa have gradually advanced the energy cooperation mechanism at the government level and encouraged and supported Chinese enterprises to participate in the investment, construction and operation of power projects in South Africa through various means. As a comprehensive strategic partner of China, a member of the BRICS countries and a co-construction country of the “Belt and Road Initiative”, South Africa has further expanded and deepened economic and trade cooperation in the energy field, bringing tangible benefits to China and Africa.

3.2 China’s energy investments and financing in South Africa

(1) China’s Direct Investment in South Africa

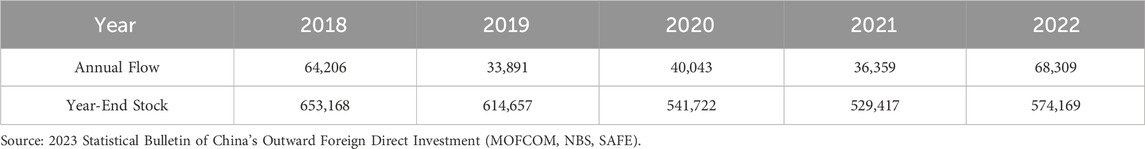

As of 2022, China’s direct investment flow in South Africa was 683 million US dollars, the direct investment stock was 5.742 billion US dollars, and the cumulative investment in South Africa exceeded 25 billion US dollars, creating more than 400,000 jobs for the local area, Among them, the energy and power sector directly contributed 92,000 jobs, and the local production of Solar PV and electric vehicles in the manufacturing industry absorbed 121,000 people. The total employment proportion of the clean energy industry chain reached 48.8%, becoming the core growth pole of employment cooperation between China and South Africa (DTIC, 2022; China Embassy in SA, 2023). It is mainly concentrated in fields such as power energy, infrastructure, mining, communication, manufacturing, finance, transportation and logistics, etc. (as shown in Table 4).

(2) Clean Energy Project Investments

In the field of wind power. China Longyuan Power has invested in the construction of the De’a Wind Farm, with a total installed capacity of 244,500kW, accounting for 8.2% of South Africa’s wind power installed capacity. It generates 750 GWh of electricity annually and supplies power to 300,000 households. The project adopts the “construction - operation - transfer” model, driving more than 800 local jobs. Industrial and Commercial Bank of China provided a project loan of 250 million US dollars, with an interest rate 1.2% lower than that of international syndicates (Du, 2022).

In the fields of Solar PVs and solar thermal energy. China Energy Engineering Corporation is undertaking the EPC general contracting of the Hongshi 100 MW solar thermal power Station project. After its completion, the project will be equipped with a 12-h molten salt energy storage system, reducing carbon dioxide emissions by 480 thousand tons annually. It will provide 480 GWh of clean electricity to the South African power grid each year, meeting the electricity demands of approximately 200,000 South African households. This will significantly reduce the country’s reliance on traditional fossil fuels and greatly lower carbon emissions in South Africa. It is of great strategic significance for the energy transition in South Africa. The project provided more than 600 direct jobs for the local area. During the peak period of the project, approximately 1,800 workers were employed, making significant contributions to the local economic and social development (Chang and Liang, 2024).

In the field of green hydrogen,Q CGN is leading the planning of a project in the Northern Cape Province, with a green hydrogen production capacity of 500 thousand tons by 2030. It will use alkaline electrolyzers independently developed in China, with costs 30% lower than those in Europe and the United States. The project aims to export to the European Union and the East Asian market.

(3) Innovative Financing Mechanisms

Led by policy banks. In 2023, the Export-Import Bank of China provided a special US dollar loan to Eskom, the South African national power company, for grid upgrades. The additional clause stipulates that one-third of the funds should be used for the grid connection of clean energy. The China Development Bank has provided financing for the decommissioned coal-fired power projects in Mpumalanga Province through the “Coal-fired Power Transition Bond”, with the interest rate linked to the reduction volume.

Launch the special fund. The China-Africa Development Fund has cumulatively injected capital into South Africa’s energy projects, including the Redstone Solar Thermal Power Station and the North Cape Green Hydrogen Base. The Silk Road Fund has taken a stake in the ±800 kV high-voltage direct current transmission project between South Africa and Mozambique, enhancing the regional power trading capacity.

Multilateral platform collaboration. In 2023, the BRICS New Development Bank approved loans to support distributed Solar PV projects in South Africa, allowing one-third of the funds to be settled locally in the rand to avoid exchange rate risks. The Forum on China-Africa Cooperation has committed to providing green credit lines to South Africa from 2024 to 2026, with a focus on supporting energy storage and smart grids.

3.3 China’s contributions to South Africa’s energy infrastructure

China has been deeply involved in South Africa’s energy transition through technology export, equipment manufacturing and project investment, focusing on green infrastructure and the construction of local capabilities, to help solve the dual predicaments of power shortage and reliance on coal power. As a landmark achievement of the Belt and Road cooperation between China and South Africa, the De ‘A Wind Power Project supports the local economic and social development with green electricity and maintains the local ecological balance through green actions in the field of clean power. From the perspective of social benefits, the De A Wind Farm helps train local operation and maintenance personnel and uses a portion of the electricity revenue from the pilot Solar PV project in Limpopo Province to improve medical care and education.

Leading enterprises in the construction machinery industry have empowered the upgrading of the industrial chain through localized operations. For instance, Zoomlion and XCMG have supplied more than three-fifths of the hoisting equipment for clean energy projects in South Africa. The digital construction system has significantly shortened the construction period of Solar PV power stations. Meanwhile, relying on the export advantages of the “new three items” of Solar PV products, the export of Solar PV components to South Africa has increased significantly. The power purchaser, investor, EPC construction party, financing entity and major equipment suppliers of the project are all from China. While providing clean, economical and reliable energy for South Africa, it has also driven the entire clean energy industry chain to go global, achieving integrated operation of investment, construction and operation.

Meanwhile, the Export-Import Bank of China provides special loan financial support and forms a complementary mechanism of policy and marketization. The Silk Road Fund has taken a stake in the UHV transmission project between South Africa and Mozambique to enhance the regional green power transmission capacity. In 2023, China and South Africa signed the “Green Energy Partnership Agreement”, planning to jointly build a localized Solar PV industrial chain, with the goal of creating over 20,000 clean energy jobs by 2030.

4 The challenges China faces in promoting the energy transition in South Africa

4.1 The monopolistic position of traditional energy enterprises is not easy to break

China faces systemic resistance from traditional energy interest groups in promoting South Africa’s energy transition. Its monopoly pattern is manifested as a triple lock-in effect of technology, capital and political influence (Marti and Puertas, 2022).

At the level of technological monopoly. Eskom, the South African national power company, controls approximately 90% of the country’s transmission and distribution network. Its design standards are centered around coal-fired power, which has led to structural obstacles for the integration of clean energy into the grid. The current Eskom power grid has an average service life of 35 years, with a high transmission loss rate and a negligible capacity for clean energy access, far less than 40% of the planned target. This forces Chinese investment in projects such as the De ‘a Wind Farm to build dedicated substations, resulting in a significant increase in costs. More crucially, Eskom restricts third-party access through the right to set technical standards: it requires clean energy power stations to be equipped with coal-fired units as peak shaving backup power sources, essentially maintaining the rigid demand for coal-fired power.

At the economic monopoly level. The coal industry has formed a closed-loop interest chain of “resources - employment - finance”. According to the “Coal Industry Employment and Just Transition Review 2023” released by the Minerals Council South Africa, the number of directly employed people in the South African coal industry in 2023 was 68,000. Therefore, trade union organizations have joined forces with Eskom to resist the retirement of coal-fired power plants and demand that the lifespan of new coal-fired power stations be extended to 2040. The four major banks in South Africa have raised the financing interest rate for clean energy projects by 2%–3% higher than that for coal-fired power through credit bundling. When the Export-Import Bank of China attempted to support Solar PV projects with low-interest loans, it encountered a joint resistance from local financial institutions, forcing the Chinese side to bear high financing risks.

Political lobbying mechanism. Traditional energy giants are deeply embedded in the policy-making system. Coal enterprises, through the “Mining Chamber of Commerce”, successfully delayed the implementation of the “Carbon Tax Act” by lobbying lawmakers and pushed the government to inject capital into Eskom to maintain the operation of coal power. This directly weakened the effectiveness of the REIPPPP mechanism supported by China: In the 2023 clean energy tender in South Africa, Eskom postponed the grid connection of the winning projects by 2–3 years on the grounds of “insufficient grid capacity”, causing Solar PV projects invested by Chinese enterprises to come to a standstill.

4.2 The risk of debt default affects the investment confidence of foreign enterprises

In the process of promoting South Africa’s energy transition, China’s debt default risk has posed a significant challenge to the sustainability of investment, specifically manifested in predicaments such as unbalanced debt structure, weakened sovereign solvency and uncertainty of project returns. In 2023, South Africa’s public debt-to-GDP ratio has reached 77%, and Fitch’s rating remains at BB-, which has led to a rise in the loan risk premium of China’s policy-based financial institutions and an extension of the approval cycle for new loans in China. From 2021 to 2023, the rand depreciated by 34% against the US dollar over the past 3 years, which has increased the actual burden of dollar-denominated debts. As a result, Chinese enterprises have been forced to adopt currency swap tools, raising annual costs and significantly weakening the economic viability of their projects. Meanwhile, the pricing mechanism of South Africa’s electricity market is distorted by Eskom’s monopoly, and the execution risks of clean energy power purchase agreements are prominent. Although CGN’s Solar PV project in the Northern Cape Province signed a 20-year PPA, Eskom has been in arrears with clean energy electricity charges due to financial crises, resulting in a continuous expansion of the project’s cash flow gap. Some Chinese-funded projects were forced to introduce risk guarantees from the World Bank, but the premium rates were extremely high, further diluting the rate of return. In 2024, the South African government proposed to convert part of its sovereign debt into “Climate Transition Bonds”, requiring creditors to accept an extension of 10–15 years and binding carbon emission intensity indicators. This has led to impairment risks for South African bonds held by China. Furthermore, the draft of South Africa’s Public Interest Debt Management Act grants the government the power to unilaterally adjust the priority of debt repayment, threatening the order of collateral repayment for China in energy projects. This has a direct impact on China’s promotion of South Africa’s energy transition process.

4.3 There is a shortage of professional and technical talents in energy

South Africa has abundant labor resources and is in the process of energy transition, but it lacks talents in high-tech fields. The energy professional and technical talents in South Africa mainly consist of two parts: those independently cultivated by South Africa itself and those who come to work in South Africa from foreign energy enterprises. There are mainly four reasons for the current shortage of high-tech talents.The environment for foreign technicians staying in South Africa is not open. Foreign enterprises have great difficulties in obtaining visas for skilled workers in South Africa. The instability of South African society and the current energy crisis are major obstacles for international talents to come to South Africa. Secondly, South Africa is short of its own technical personnel. The clean energy equipment in South Africa is mainly imported products. Due to the low educational level of domestic skilled workers and the continuous shortage of skilled labor for installing energy equipment, the local retail of clean energy equipment cannot provide timely services in installation and maintenance, thereby limiting consumers’ confidence in the use of clean energy equipment. Thirdly, there is a shortage of educational resources. South Africa’s National Development Plan aims to train 30,000 skilled workers each year by 2030. However, data shows that currently, less than 20,000 skilled workers are trained annually. The shortage of technical talents in the fields of energy resources and power planning, as well as the insufficiency of educational resources, make it impossible to carry out systematic planning for clean energy in the country. As a result, the market for technical talents is in short supply. Fourth, there is a serious brain drain. According to statistics from the African Education Development Association, a large number of high-quality talents from African countries are currently residing overseas, with South Africa ranking among the top. Compared with developed countries, African countries have no advantages in either software or hardware. The wage level in some African countries is only one-tenth of that in developed countries, which is bound to lead to the flow of high-quality talents to developed countries.

5 Conclusion, implications and policy recommendations

South Africa’s energy transition requires its own impetus as well as cooperation from the international community. As one of the external partners in the development and utilization of clean energy in South Africa, China has always been an active participant, builder and contributor to Africa’s energy transition. For South Africa, in the process of energy transition, it should seize the development opportunity of global carbon neutrality, accelerate the construction and reform of the clean energy system, accelerate the cooperative construction of low-carbon power facilities, encourage technological innovation and talent cultivation, and formulate an energy revolution roadmap dominated by clean energy. Propose practical and quantifiable goals for each stage, as well as promotion measures in aspects such as technological research and development, market cultivation, and institutional construction to ensure the realization of these goals.

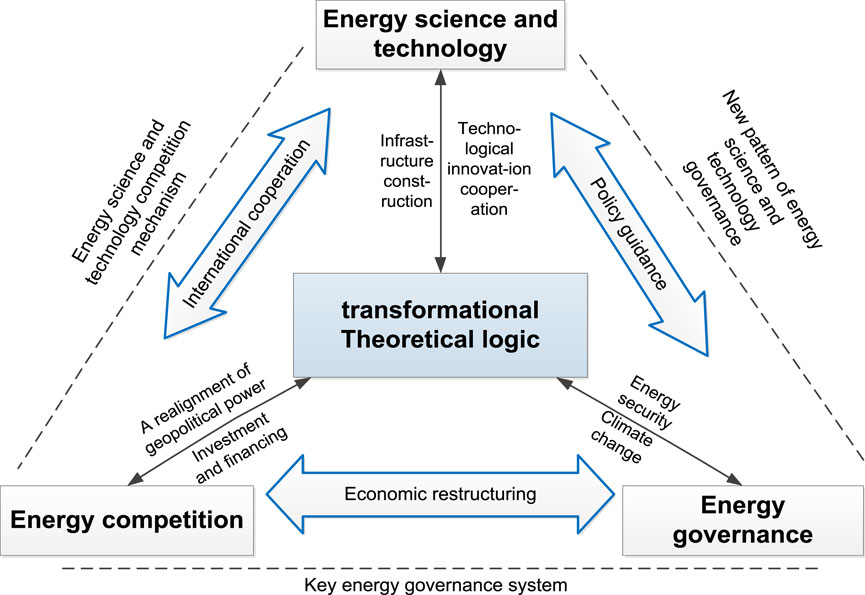

5.1 From the logic of global transformation to the framework of localized actions

Regarding the issue of traditional energy monopoly, it is necessary to shift from the logic of global transformation to a localized action framework. The global energy transition is supported by three major pillars: breakthroughs in energy technology, strategic energy competition, and the reconstruction of energy governance. Technological innovation drives the reduction of clean energy costs, and digitalization empowers the flexibility of the energy system. The focus of geopolitical competition has shifted to the right to set standards for critical minerals and clean technologies. The EU’s carbon tariff and the US Inflation Reduction Act have intensified the industrial game. The governance system urgently needs to reshape multilateral rules and balance supply chain security and climate equity. South Africa needs to base itself on global trends and construct a collaborative reform framework of “policy - market - technology” (as shown in Figure 2).

Government dimension. Accelerate institutional restructuring and the elimination of monopolies. Strengthen cross-departmental collaboration between minerals and energy. Establish independent transmission operators and open up grid access rights, allowing private power stations to increase the proportion of direct electricity sales. Revise the “Renewable Energy Procurement Plan”, remove the capacity limit for individual projects, introduce the weight of energy storage construction, and shift the assessment of localization rate from equipment procurement to technology transfer.

Market dimension. Activate the synergy and risk hedging mechanism between private capital and technology. Establish an insurance pool for clean energy power purchase agreements, covering risks such as exchange rate fluctuations and Eskom repayment defaults, with premiums accrued from electricity revenue. Relying on China’s Solar PV production capacity advantages and South Africa’s resource endowment of vanadium REDOX flow batteries, a joint laboratory for energy storage technology will be jointly established to develop long-duration energy storage systems suitable for Africa’s high-temperature and high-humidity environment (Gaur et al., 2022), and simultaneously promote local production by Chinese enterprises.

Technical dimension. Make a leapfrog layout in the cutting-edge track. Introduce China’s ultra-high voltage technology to build a “hydropower corridor”, reduce transmission losses, and simultaneously deploy Huawei’s energy cloud system to construct a green hydrogen hub. Taking advantage of the potential of Solar PV power generation in South Africa, the first GW-level Solar PV - electrolytic cell - ammonia synthesis integrated base in Central Africa will be built to break through the carbon tariff barrier of the European Union. South Africa’s energy reform needs to break through the institutional deadlock to release market vitality, leverage the value of resources with technological levers, and achieve a strategic leap from “lignite dependence” to “green energy hub” in the process of reconstructing global energy governance.

5.2 Build a China-South Africa new energy power infrastructure cooperation mechanism

The establishment of a cooperation mechanism for clean energy power facilities between Central and South China can optimize the investment structure and deepen local integration from three dimensions: “technology adaptation - financial innovation - institutional synergy”. In terms of technical adaptation, China’s ±800 kV DC transmission technology has been introduced to increase transmission capacity and reduce loss rates. The reliance on the Eskom main grid has been reduced through blockchain peer-to-peer transactions. In terms of financial innovation, we have combined the Export-Import Bank of China for concessional loans, the “Silk Road Fund” for equity investment, and the BRICS New Development Bank Rand green bonds to form a diversified financing tool to hedge against exchange rate risks. We have also established the China-South Clean Energy Risk Sharing Fund to provide a compensation mechanism for risks such as policy changes. In terms of localized cultivation, an African operation and maintenance training center has been established based on the China-South African Energy project, and joint research institutes with local research institutions and universities have been carried out to address specific African issues such as high-temperature attenuation of Solar PV power. Promote the revision of South Africa’s Electricity Regulation Act, allowing Chinese-funded power stations to sell electricity directly through the ITSMO system. At the same time, establish a mutual recognition system for green certificates between China and South Africa, embedding mechanisms and technologies to break monopolies, using financial tools to diversify risks, and enhancing the resilience of the local ecosystem.

5.3 Enhance South Africa’s technological innovation and talent development

In response to the common problems of technological backwardness and talent shortage faced by South African cooperative enterprises, Chinese research institutes and universities can enhance their technical support for the clean energy sector in South Africa in a targeted manner. At the level of technological research and development, targeted innovations are carried out relying on the China-South Africa New Energy Joint Laboratory. Focusing on the high-temperature and high-humidity climate characteristics of South Africa, technologies are jointly developed with Chinese photovoltaic enterprises. Long-duration energy storage systems suitable for the African power grid are developed. A clean energy technology incubator is also built in South Africa to produce core patents and deploy and apply the patented technologies to key infrastructure. In terms of talent cultivation, a hierarchical education system can be established. At the vocational education end, the “dual-mentor system” is implemented. Chinese engineers in South Africa can serve as enterprise mentors and jointly teach with professors from South African universities. The government will take the lead in jointly building a master’s and doctoral program in clean energy, and send South African students to Chinese enterprises for practical training in a targeted manner. This program aims to cultivate compound talents with both technical vision and engineering experience, and build an innovation ecosystem suitable for South Africa through localized technology adaptation and talent gradient cultivation.

5.4 Innovate the forms of China’s aid to South Africa

The form of China’s assistance to South Africa’s energy transition should shift from traditional financial support to a composite model. In terms of technological empowerment, we will break through the one-way equipment export model, jointly build a photovoltaic industrial park, and accelerate the improvement of clean energy power popularization level and energy allocation capacity in South Africa. At the market co-construction level, innovate the “resource for investment” mechanism. China assists South Africa in laying out the preparatory work such as the launch, research, planning and financing of major projects. Fully integrate small-scale clean energy projects and technologies to enhance energy output and management efficiency. Establish a cross-border green certificate trading platform between China and Africa simultaneously, convert the carbon reduction volume of South Africa’s solar thermal power plants into CBAM recognized certificates of the European Union, and help South African export enterprises avoid carbon tariffs. In terms of ecological cultivation. For start-up enterprises, a China-Africa Green Innovation Fund will be established to provide “flexible repayment” loan support for local clean energy science and technology innovation projects. Interest rate discounts will be implemented for projects with a high rate of technology localization, so that the assistance of clean energy can truly help the people of South Africa. We will encourage and support more enterprises of the two countries to connect with demands, explore potential, expand investment cooperation in clean energy, and contribute to the green and sustainable development of the two countries.

Author contributions

HG: Investigation, Writing – review and editing, Writing – original draft, Conceptualization. WF: Validation, Supervision, Writing – review and editing. RY: Writing – review and editing, Data curation.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Amari, M., Mouahkar, K., and Jarboui, A. (2022). ICT development, governance quality and the environmental performance: avoidable thresholds from the lower and lower-middleincome countries. Manag. Environ. Qual. An Int. J. 33 (2), 125–140. doi:10.1108/MEQ-12-2020-0299

Asongu, S. A., Agboola, M. O., Alola, A. A., and Bekun, F. V. (2020). The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci. Total Environ. 712, 136376. doi:10.1016/j.scitotenv.2019.136376

BP (2024). World energy outlook. London, UK: BP. Available online at: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html.pdf (Accessed August 8, 2024).

CCERA (China Coal Economic Research Association) (2020). in 2020, South Africa's coal output was 252.2 million tons and its export was 73.396 million tons. Available online at: http://m.100ppi.com/focus/detail-news-1777506.html (Accessed February 20, 2020).

CEN (China Energy News) (2021). National energy information platform South Africa's energy storage policy: has the change really arrived?. Available online at: https://baijiahao.baidu.com/s?id=1688114520015759664&wfr=spider&for=pc (Accessed January 6, 2021).

Chang, T. T., and Liang, Z. Q. (2024). China-Africa cooperation has injected vigorous green impetus into Africa's development”. Available online at: https://baijiahao.baidu.com/s?id=1809102212135392445&wfr=spider&for=pc (Accessed September 3, 2024).

China Lianhe Credit Rating Co (2025). Analysis of the photovoltaic industry in 2025. Available online at: https://pdf.dfcfw.com/pdf/H3_AP202504061652226616_1.pdf?1743950453000.pdf (Accessed April 3, 2025).

CIN (China Infrastructure News) (2024). Full! The largest tower-type solar thermal power station in South Africa was successfully connected to the grid for the first time. Available online at: https://baijiahao.baidu.com/s?id=1810550014005425004&wfr=spider&for=pc (Accessed September 18, 2024).

Du, Y. F. (2022). Shared energy cooperation opportunities - longyuan's De 'a Wind Farm in South Africa has cumulatively generated over 3.8 billion kilowatt-hours of electricity. Available online at: https://m.gmw.cn/baijia/2022-12/03/1303213182.html (Accessed September 3, 2022).

Gao, Y., Murshed, M., Ozturk, I., Saqib, N., Siddik, A. B., and Alam, M. M. (2023). Can financing technological development programs mitigate mineral resource consumption-related environmental problems faced by Sub-Saharan African nations? Resour. Policy 87 (Part A), 104343. doi:10.1016/j.resourpol.2023.104343

Gaur, A., Balyka, O., Glynnc, J., Curtis, J., and Daly, H. (2022). Low energy demand scenario for feasible deep decarbonization: whole energy systems modeling for IrelandRenewable and Sustain. Energy Transit. 2, 1–19. doi:10.1016/j.rset.2022.100024

He, Z., Zhou, Y., and Liu, Y. (2020). System dynamics simulation on China's energy consumption in 2050: based on the policy scenarios of key industries. J. Nat. Resour. 35 (11), 2696–2707. doi:10.31497/zrzyxb.20201111

Huo, X., Shang, Y., and Li, J. (2018). Xi jinping held talks with the president of South Africa: strengthening cooperation within the framework of the Belt and Road initiative and the forum on China-Africa cooperation. Available online at: https://www.yidaiyilu.gov.cn/xwzx/xgcdt/60977.htm (Accessed July 24, 2018).

IEA (2019). Africa energy outlook. Paris: IEA. Available online at: https://www.iea.org/reports/africa-energy-outlook-2019.pdf (Accessed September 4, 2021).

IEA (2021). Net zero by 2050: a roadmap for the global energy sector. Available online at: https://www.iea.org/events/net-zero-by-2050-a-roadmapfor-the-global-energy-system (Accessed May 18, 2021).

IRENA (2023). Renewable energy statistics 2023, International Renewable Energy Agency, Abu Dhabi. Available online at: www.irena.org/Publications/2023/Jul/Renewable-energy-statistics-2023.

Jing, Z. K., and Zhang, Y. Y. (2018). Analysis of China's cooperation methods with non-energy sources. Guangxi Soc. Sci. 7, 149–154. doi:10.3969/j.issn.1004-6917.2018.07.029

Khan, A., Sampene, A. K., and Ali, S. (2023). Towards environmental degradation mitigation: the role of regulatory quality, technological innovation and government effectiveness in the CEMAC countries. Heliyon 9 (6), e17029. doi:10.1016/j.heliyon.2023.e17029

KPMG (2024). The energy institute. Statistical review of world energy 2024. Available online at: https://kpmg.com/cn/zh/home/insights/2024/08/statistical-review-of-world-energy-2024.html (Accessed August 26, 2024).

Kuang, J. (2024). China's hydrogen production accounts for more than 30%, firmly holding the position of the world's top hydrogen producer. Available online at: https://www.stcn.com/article/detail/1158634.html (Accessed March 27, 2024).

LCP (Low Carbon Power) (2024). Electricity in South Africa in 2024. Available online at: https://lowcarbonpower.org/region/South_Africa (Accessed December 3, 2024).

Li, L., and Dong, X. (2024). The green and low-carbon transformation of energy in South Africa is accelerating. Available online at: https://baijiahao.baidu.com/s?id=1775443657757081221&wfr=spider&for=pc (Accessed December 27, 2024).

Lou, C. (2023). Legislative progress and implications of “South Africa’s climate change Act”. Law11 11 (4), 3089–3100. doi:10.12677/OJLS.2023.114441

Marti, L., and Puertas, R. (2022). Sustainable energy development analysis: energy trilemma. Sustain. Technol. Entrepreneursh. 1, 100007–100010. doi:10.1016/j.stae.2022.100007

Matthews, H. D., and Wynes, S. (2022). Current global efforts are insufficient to limit warming to 1.5°C. Science 376, 1404–1409. doi:10.1126/science.abo3378

MFA (Ministry of Foreign Affairs of China) (2021). Forum on China-Africa cooperation - Beijing action plan (2019-2021). Available online at: https://www.fmprc.gov.cn/web/gjhdq_676201/gjhdqzz_681964/zfhzlt_682902/zywj_682914/t1592067.shtml (Accessed April, 2025).

MOFCOM(Ministry of Commerce of the People's Republic of China) (2025a). The annual total production capacity of the new coal project in South Africa exceeds 40 million tons. Available online at: http://za.mofcom.gov.cn/jmxw/art/2025/art_94b27136fa0f43c3892fa923c6e90595.html (Accessed January 21, 2025).

MOFCOM(Ministry of Commerce of the People's Republic of China) (2025b). The South African National Power Company will raise electricity prices. Available online at: https://za.mofcom.gov.cn/jmxw/art/2025/art_4f51729ed6f94ef2907e486828cf8a9d.html (Accessed March 20, 2025).

Nkosi, N., and Dikgang, J. (2018). Pricing electricity blackouts among South African households. Johannesburg, South Africa: University of.

Oyewo, A., Aghahosseini, A., Ram, M., Lohrmann, A., and Breyer, C. (2019). Pathway towards achieving 100% renewable electricity by 2050 for South Africa. Sol. Energy 191, 549–565. doi:10.1016/j.solener.2019.09.039

People's Daily (2018). Xi jinping: join hands for a shared destiny and work together for development - keynote speech at the opening ceremony of the 2018 forum on China-Africa cooperation Beijing summit. Available online at: http://politics.people.com.cn/n1/2018/0903/c1001-30269464.html (Accessed September 4, 2018).

The State Council of the People's Republic of China (SCPRC) (2021). Notice of the state Council on printing and distributing the action plan for carbon dioxide peaking before 2030. Available online at: https://www.gov.cn/gongbao/content/2021/content_5649731.htm (Accessed October 24, 2021).

Wang, S. (2022). Research on investment in the national electricity market of South Africa. Int. Eng. Serv. 11, 55–58.

Wu, Q., Zhou, N., and Cheng, J. (2020). A review and prospects of the supply security of strategic key minerals. Resour. Sci. 42 (8), 1439–1451. doi:10.18402/resci.2020.08.01

Yang, Y., Xia, S. Y., and Jin, Z. Y. (2023). The logic and research outlook of reshaping geopolitics through energy transition. Acta Geogr. Sin. 78 (9), 2299–2315. doi:10.11821/dlxb202309012

Keywords: renewable energy, energy transition, energy cooperation, mutual benefit, China-South Africa cooperation

Citation: Guo H, Feng W and Yan R (2025) China’s strategic thoughts and suggestions on promoting South Africa’s clean energy transition. Front. Chem. Eng. 7:1643007. doi: 10.3389/fceng.2025.1643007

Received: 07 June 2025; Accepted: 30 June 2025;

Published: 22 July 2025.

Edited by:

Leilei Dai, University of Minnesota Twin Cities, United StatesReviewed by:

Yongqiang Zhang, Zhejiang University of Finance and Economics, ChinaYang Bai, China University of Petroleum (East China), China

Xiaoling Ma, University of Surrey, United Kingdom

Copyright © 2025 Guo, Feng and Yan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wen Feng, MTE3MTg2MzA4MkBxcS5jb20=

Hongli Guo

Hongli Guo Wen Feng2*

Wen Feng2*