- 1Department of Thematic Studies, Linkoping University, Linköping, Sweden

- 2Department of Banking and Finance, University of Nigeria, Enugu Campus, Enugu, Nigeria

This paper investigates the transformative potential of financial institutions in driving the shift toward a regenerative economy, with a particular emphasis on embedding circularity within financial and economic systems. In the face of escalating ecological degradation, resource exhaustion, and systemic inequality, there is an urgent imperative to reimagine traditional economic models through restorative and sustainable frameworks. This study critically examines the role of banks, investment firms, and allied financial entities in operationalizing circular economy (CE) principles across lending practices, asset allocation, and investment portfolios. It explores key mechanisms such as green bonds, circular economy-linked loans, sustainable finance instruments, and the financing of closed-loop supply chains, assessing their capacity to enable regenerative business transitions. The paper also interrogates the influence of evolving policy regimes and regulatory frameworks in either enabling or constraining financial sector alignment with circular imperatives. Drawing from interdisciplinary literature spanning sustainable finance, ecological economics, and institutional theory, the research identifies both structural barriers and emergent opportunities shaping the financial sector's response to circularity. Findings reveal that while promising innovations exist, institutional inertia, risk perception biases, and valuation misalignments remain critical obstacles. Nevertheless, the study contends that financial institutions hold a catalytic role in accelerating systemic circular transitions if supported by coherent policy instruments, reconfigured risk models, and metrics that reflect long-term ecological value. The paper concludes that advancing a regenerative economy requires integrated approaches that converge finance, governance, and sustainability science to embed circularity at the core of capital flows and economic design.

1 Introduction

The transition from a linear to a circular economy (CE) is widely regarded as one of the most pressing and transformational shifts required for achieving long-term sustainability and global environmental resilience (Kirchherr et al., 2017; Ghisellini et al., 2016). Circularity challenges the conventional “take-make-waste” paradigm, instead promoting regenerative systems that emphasize resource efficiency, waste minimization, closed-loop production, and long-term socio-ecological value creation. While industries such as manufacturing and agriculture have attracted considerable attention in CE debates, the financial sector arguably the backbone of economic systems remains underexplored in this context. This article critically interrogates the extent to which financial institutions can catalyze a regenerative economy by embedding CE principles within their structural and operational frameworks.

Despite a growing body of literature on sustainable finance and environmental, social, and governance (ESG) criteria, critical gaps persist in understanding how banking systems can meaningfully contribute to CE transitions (Aracil et al., 2021; Alkaraan et al., 2022). Specifically, while sustainability has increasingly permeated financial discourse, the operationalization of circularity within financial institutions remains conceptually ambiguous and practically underdeveloped. Existing financial models often remain entrenched in linear economic logics, driven by short-term profitability, risk minimization, and conventional valuation metrics that inadequately capture the multidimensional benefits of circular investments (Haas et al., 2015; Morseletto, 2020a,b).

The motivation for this study is rooted in this critical disconnect: how can finance, as the primary allocator of capital, evolve from a risk-averse, profit-driven institution into a transformative agent of regenerative change? This research is guided by the urgent necessity to realign financial mechanisms with circular objectives, particularly given the mounting pressures of climate change, ecological degradation, and resource scarcity (Dewick et al., 2020; Hafner et al., 2020). Accordingly, this article aims to examine the systemic impediments to circular finance adoption and to identify transformative pathways that enable financial institutions to serve as engines of CE innovation.

Therefore, this study is anchored by a core interrogation into the structural and cognitive barriers that inhibit financial institutions from effectively supporting circular economy (CE) business models, with four interlinked lines of inquiry providing a multidimensional analytical lens: first, by exploring how traditional risk assessment frameworks may be reconfigured to embed circularity metrics and long-term sustainability performance, thereby challenging prevailing logics of short-term return and linear asset depreciation; second, by examining the role of financial innovations such as green bonds, CE-linked loans, and emerging FinTech mechanisms in translating the abstract ideals of circular finance into concrete, scalable financial instruments capable of aligning investment flows with regenerative economic principles; third, by interrogating the extent to which regulatory frameworks, both hard and soft law, can be designed or adapted to create robust incentives that redirect capital from resource-intensive, linear models toward more circular, systems-oriented investment pathways; and finally, by addressing the imperative to evolve prevailing asset valuation methodologies in order to capture the distributed, long-term, and often non-linear value propositions that CE business practices offer, thereby redefining what constitutes financial performance, risk, and return in an ecologically bounded economy. Together, these questions not only dissect the institutional inertia and epistemic blind spots of conventional finance but also map out a strategic agenda for enabling transformative alignment between financial systems and circular economy imperatives.

Nevertheless, these questions are situated within an emerging academic and policy conversation that seeks to bridge financialization with ecological regeneration, yet which remains fragmented by disciplinary silos and inconsistent definitions (Macchiavello and Siri, 2022; Flaherty et al., 2017). To address these challenges, the article advances a multidisciplinary analytical framework, drawing from sustainable finance, ecological economics, and innovation systems theory to critically assess the role of financial institutions in enabling circular transformations.

The issue at hand is not merely a technical or operational dilemma but a deeply institutional and cognitive one. Financial institutions are historically embedded within growth-oriented, short-termist paradigms that prioritize immediate returns and risk hedging over long-term ecological sustainability (Bennett and Kottasz, 2012; Liang and Renneboog, 2020). These paradigms manifest in narrowly defined credit risk models, underdeveloped ESG scoring systems, and a lack of standardized circularity metrics. Circular business models, by contrast, often entail uncertain revenue streams, complex material flows, and intangible value propositions that traditional finance mechanisms are ill-equipped to assess (Ghisellini et al., 2016; Cui et al., 2014).

Compounding this misalignment is the absence of coherent regulatory incentives and policy frameworks that mandate or encourage circular investment. While green finance initiatives have gained traction such as green bonds and sustainability-linked loans their scope often remains confined to carbon mitigation and energy efficiency, falling short of fully embracing circular principles such as industrial symbiosis, resource regeneration, and product-service systems (Bhutta et al., 2022; Gilchrist et al., 2021). Without a broader and more nuanced understanding of circularity, financial products risk becoming tokenistic or marginally impactful, thereby failing to drive systemic change.

Another critical gap lies in the underutilization of technological tools and data-driven models that could enhance circular finance adoption. Financial technologies (FinTech) and artificial intelligence (AI), when properly harnessed, offer powerful tools for real-time data analytics, predictive modeling, and sustainability tracking (Bollaert et al., 2021; Kavuri and Milne, 2019). Blockchain, for instance, can ensure traceability and transparency in circular supply chains, thereby reducing financial risk associated with resource recovery and reuse (Chueca Vergara and Ferruz Agudo, 2021). Yet, the integration of such technologies remains sporadic and lacks a guiding strategic vision aligned with CE goals.

From a theoretical standpoint, this study builds on the argument that finance is not merely a passive vehicle for capital allocation but a socially embedded institution capable of shaping economic futures (Atun et al., 2012; Lovins and Fullerton, 2014). Accordingly, reimagining finance for the circular economy entails a reconceptualization of value, risk, and investment that transcends linear metrics and encompasses regenerative outcomes. This theoretical reframing requires financial actors to internalize planetary boundaries, lifecycle thinking, and intergenerational equity into their decision-making matrices.

To do so, financial institutions must undertake several key transformations:

• Redesign Risk Assessment Frameworks: Conventional models assess risk based on historical financial data and market volatility, often ignoring systemic environmental risks or long-term resource constraints. Incorporating circularity into these frameworks necessitates the integration of new indicators such as lifecycle impact, material circularity indicators, and ecosystem service dependencies (Kumar et al., 2025; Hafner et al., 2020).

• Develop CE-Linked Financial Instruments: Existing green finance mechanisms must be expanded and refined to address circular economy objectives. This includes instruments that directly fund product take-back schemes, remanufacturing initiatives, and industrial symbiosis projects. These instruments should be underpinned by robust monitoring, reporting, and verification (MRV) protocols to ensure accountability (Banga, 2019; Bhutta et al., 2022).

• Rethink Asset Valuation Methodologies: Current accounting and valuation practices undervalue intangible and systemic benefits of circular models. By adapting valuation models to incorporate resource savings, extended product lifecycles, and environmental risk mitigation, circular investments can become more financially viable (Ilic et al., 2020; Fusco Girard and Gravagnuolo, 2017).

• Leverage Technological Innovations: Financial institutions should invest in digital infrastructures that support CE goals. AI can enhance sustainability scoring, while blockchain can provide immutable records of material flows and ownership, enabling more accurate risk assessments and compliance tracking (Liu et al., 2023; Fallahi et al., 2023).

• Policy and Regulatory Engagement: Regulatory institutions must create enabling environments for circular finance. This includes the establishment of circular finance taxonomies, disclosure mandates for circularity metrics, and fiscal incentives for banks that fund CE-aligned enterprises (Mitschke-Collande and Narberhaus, 2019; Kalmykova et al., 2018).

This article contributes to academic discourse by filling a crucial gap in CE literature the financial dimension of circular transition. While CE scholarship has traditionally focused on material flows, production-consumption systems, and technological innovations, the role of financial actors remains marginal. This study argues that without the proactive engagement of financial institutions, the CE transition will remain partial, fragmented, and ultimately inadequate to confront planetary crises.

Furthermore, by embedding CE principles into the core logic of financial operations, banks and financial institutions can unlock new pathways for innovation, risk mitigation, and long-term value creation. The article thus positions finance not only as a potential enabler but as a necessary condition for regenerative economies. Bridging the conceptual and operational divide between finance and circularity is both a scientific challenge and a moral imperative, particularly in light of escalating climate and social risks.

In sum, this study offers a critical and integrative perspective on the transformative role of finance in CE transitions. Through synthesizing insights from financial innovation, ecological economics, and regulatory studies, it presents a comprehensive agenda for aligning financial systems with circular objectives. Through a rigorous analysis of structural barriers, institutional incentives, and technological potentials, the article aims to contribute actionable knowledge for scholars, practitioners, and policymakers committed to fostering regenerative economic futures.

2 Research design

This study adopts a conceptual analysis approach to critically examine the structural and cognitive barriers that impede financial institutions from becoming catalysts of a regenerative, circular economy. Rather than employing empirical methods to collect quantitative or qualitative data, the research is grounded in a theory-driven, multi-perspective interrogation of the evolving interface between finance and circularity. The objective is not merely to deconstruct existing financial paradigms but to explore the conceptual realignments, institutional adaptations, and systemic innovations necessary for finance to support regenerative economic transitions.

The research is guided by four interlinked analytical lines of inquiry, each representing a critical dimension of the finance-circular economy nexus. To explore these, the study draws on an interdisciplinary corpus spanning circular economy scholarship, financial systems theory, environmental economics, regulatory governance, and innovation studies. Literature selection follows a purposive strategy, prioritizing high-impact theoretical works, policy reports, financial sector white papers, and emerging frameworks from supranational institutions such as the EU, UNEP FI, and the Ellen MacArthur Foundation. These sources are treated as “texts” for conceptual analysis vehicles through which discourses, assumptions, and institutional logics are articulated and circulated.

The analytical framework combines typological deconstruction with normative and critical institutional analysis. First, concepts such as “risk,” “value,” “performance,” and “return” are unpacked to reveal their historically embedded, linear-industrial underpinnings. Second, each of the four inquiry dimensions is examined in depth: (1) the potential reconfiguration of risk assessment frameworks through the integration of circularity metrics and long-term performance horizons, (2) the operational and symbolic roles of financial innovations like green bonds, CE-linked loans, and FinTech in mainstreaming circular finance, (3) the design of regulatory regimes that foster or hinder circular investment practices, and (4) the reconceptualization of asset valuation methodologies to capture multi-capital, distributed, and long-duration value creation.

Each dimension is analyzed through a thematic synthesis of literature, followed by a critical comparison of competing conceptual framings. This process allows for the identification of internal tensions, normative blind spots, and ideological resistances embedded within conventional financial logics. The criteria for evaluation include conceptual clarity, systemic coherence, alignment with sustainability imperatives, and institutional feasibility.

Crucially, the research advances beyond critique by proposing an integrative conceptual model for “circular finance,” one that reimagines financial institutions not as passive allocators of capital but as proactive enablers of regenerative economic transformation. This reconceptualization is informed by principles from systems thinking, ecological economics, and financial justice. Through foregrounding the epistemic and structural shifts needed within financial institutions, the study seeks to illuminate both the constraints and the latent possibilities for transformative change in aligning finance with circular economy imperatives.

3 Circular economy risk modeling

One of the fundamental barriers to circular economy (CE) financing lies in the epistemological inadequacies of traditional risk assessment frameworks, which are ill-equipped to capture the distributed value, resilience, and systemic benefits inherent in circular business models (Haas et al., 2015; Dewick et al., 2020). Rooted in neoclassical financial orthodoxy, conventional credit risk analysis relies predominantly on backward-looking indicators such as historical financial performance, linear asset depreciation, and vertically integrated supply chains that systematically undervalue firms structured around regenerative and multi-lifecycle models (Goovaerts and Verbeek, 2018; Kirchherr et al., 2017). In contrast, CE enterprises are embedded within complex socio-technical ecosystems characterized by resource efficiency, prolonged product utility, and material recirculation (Bhatnagar and Sharma, 2022; Fusco Girard and Gravagnuolo, 2017). This ontological divergence necessitates a reconstitution of the theoretical architecture underpinning financial risk, inviting a shift toward models that reflect the dynamic value potential of circular strategies (United Nations Environment Programme Finance Initiative, 2024).

Theoretical efforts to recast risk evaluation thus demand integration of novel indicators capturing circular supply chain dependencies, material recovery potential, and the strategic mitigation of resource scarcity. This aligns with the broader transition toward stakeholder capitalism and ESG-integrated finance, where value creation extends beyond short-term shareholder returns (Zubair Mumtaz and Alexander Smith, 2019; Zheng et al., 2019). The introduction of CE risk modeling entails embedding multi-tier supply chain resilience, resource dependency, and lifecycle asset valuation into credit assessment matrices (Fallahi et al., 2023; Liang and Renneboog, 2020). Here, conventional finance's depreciation-centric logic confronts the regenerative principles of CE, with circular firms often exhibiting extended asset lifespans and value-enhancing reuse potential attributes that traditional assessments fail to account for (Kalmykova et al., 2018; Morseletto, 2020a,b).

From a systems theory perspective, the failure to recognize this multi-cyclicality not only leads to mispriced risk but also perpetuates capital misallocation and inhibits transition finance (Gilchrist et al., 2021). Incorporating CE-specific metrics such as product durability, embedded environmental benefits, and recirculation rates can help financial institutions reconceptualize creditworthiness through a more holistic, future-oriented lens (Banga, 2019). Additionally, as technological advancements continue to enhance material recovery and traceability, CE enterprises stand to gain competitive advantages in an increasingly regulated sustainability landscape (Gilchrist et al., 2021). Therefore, risk models must evolve to reflect these structural transformations and accommodate variables like reverse logistics efficiency, secondary market volatility, and compliance with circular policy frameworks.

A foundational pillar of CE risk modeling is the incorporation of supply chain resilience as a central evaluative criterion. Unlike linear systems, circular enterprises depend heavily on reverse logistics, secondary raw materials, and local loops of value creation, rendering them both more adaptive to resource shocks yet vulnerable to operational discontinuities (Esposito et al., 2017; Hartley et al., 2020). The integration of dynamic, scenario-based risk evaluations rooted in resilience theory and complexity economics offers a promising paradigm for capturing this adaptive capacity (Hafner et al., 2020; Ghisellini et al., 2016). Through embedding resilience analytics and probabilistic modeling into their credit risk toolkits, banks can reduce uncertainty and support a more accurate valuation of CE firms (Flaherty et al., 2017; Desalegn and Tangl, 2022). Further, the development of bespoke insurance products and risk-sharing mechanisms would institutionalize this resilience, fostering risk symbiosis between financiers and CE actors.

Equally important is the valuation of circular assets, which challenges the foundational premises of traditional accounting and financial valuation theory. CE business models reject the logic of planned obsolescence, prioritizing longevity, repairability, and modularity. In this context, valuation methodologies such as real-options analysis and multi-cycle asset valuation become vital tools (Fullerton and Lovins, 2013; Bollaert et al., 2021). Such approaches align with post-growth and regenerative economic theories, advocating for financial systems that reward enduring value creation rather than extractive short-termism (Macchiavello and Siri, 2022; Cunha et al., 2021). The development of standardized valuation guidelines, reflecting circular asset performance, is thus an institutional imperative. Policy-led transparency frameworks could further facilitate the mainstreaming of CE asset classes within investment portfolios (Lo and Yu, 2015).

Furthermore, CE risk modeling must be embedded within a broader regulatory and policy context. With the rise of Extended Producer Responsibility (EPR), landfill taxation, and green procurement, policy landscapes are increasingly skewing investment risks and returns in favor of circular firms (He et al., 2019; Ilic et al., 2020). Hence, financial models must integrate regulatory foresight and policy trajectory mapping to effectively anticipate future compliance costs and revenue structures (Kalmykova et al., 2018; Kumar et al., 2025). Institutionalizing such foresight mechanisms supports the development of adaptive investment strategies that remain robust under evolving sustainability mandates (Mitschke-Collande and Narberhaus, 2019). Calls for a harmonized global taxonomy for circular finance echo this need, aiming to reduce ambiguity and increase investor confidence in CE ventures (Aracil et al., 2021).

Moreover, financial innovation through instruments such as green bonds, sustainability-linked loans, and ESG-aligned credit facilities has the potential to de-risk circular investments while channeling capital into regenerative enterprises (Bhutta et al., 2022; Jelemensky, 2022). However, mainstream risk assessment frameworks have yet to adequately incorporate the unique structuring of such instruments (Cui et al., 2014; Kavuri and Milne, 2019). Theoretical integration of ESG and sustainability finance drawing from institutional theory and legitimacy theory could aid in reforming financial norms and heuristics (Alkaraan et al., 2022; Chueca Vergara and Ferruz Agudo, 2021). Leveraging AI, big data analytics, and blockchain technology further enhances transparency and risk prediction capabilities, while supporting traceability and performance monitoring across CE value chains (Liu et al., 2021, 2023).

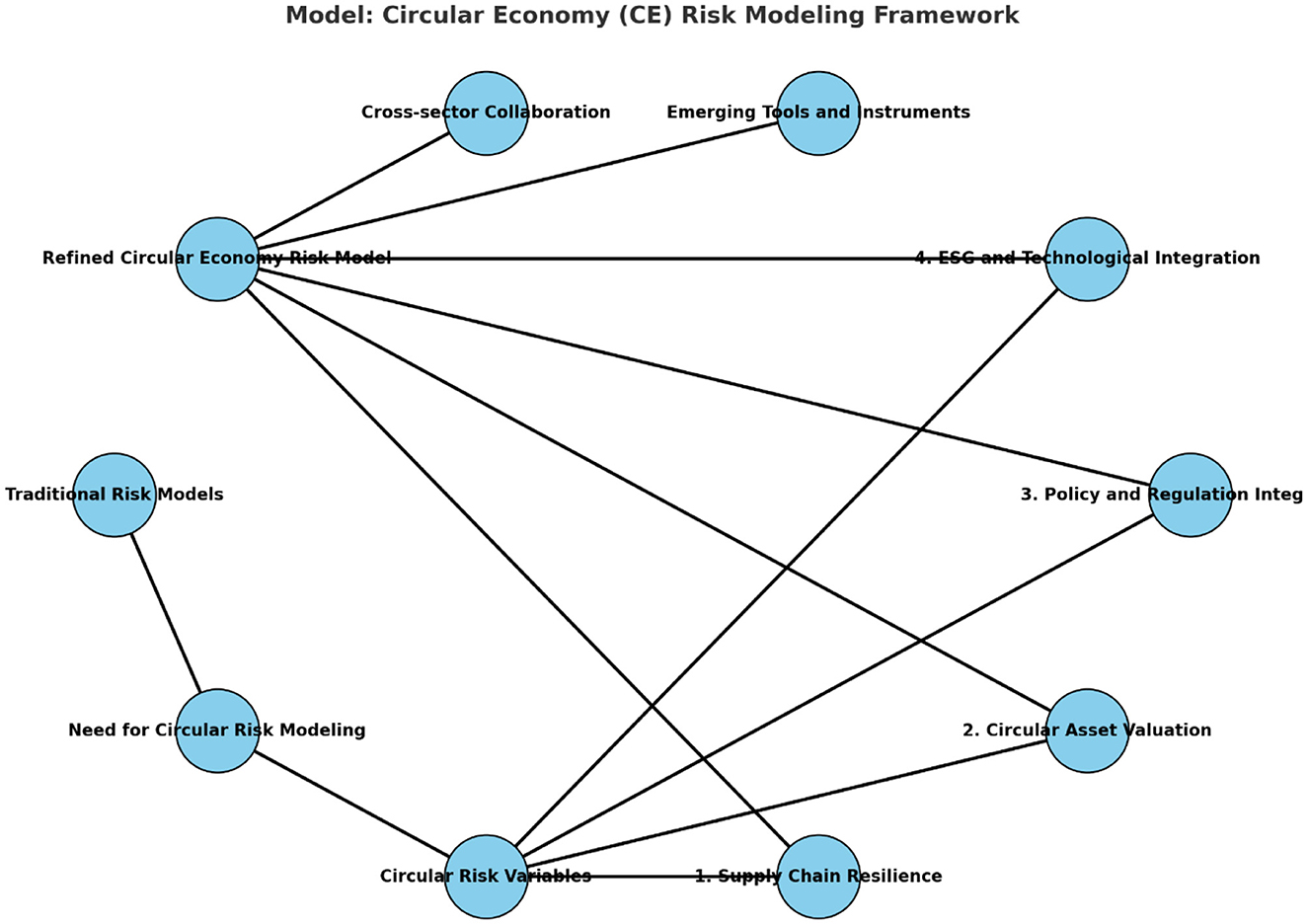

Lastly, the theoretical scaffolding of CE risk modeling must rest on the collaborative construction of knowledge between financial institutions, policy actors, and circular innovators. This epistemic co-production, supported by cross-sectoral partnerships, can drive the standardization of circularity metrics, institutional learning, and the diffusion of best practices (Morseletto, 2020a,b; Kirchherr et al., 2017). The transition toward regenerative finance thus requires a paradigmatic shift away from static, siloed assessments and toward integrative, lifecycle-based financial modeling that embeds resilience, environmental stewardship, and regulatory co-evolution (Gunarathne and Lee, 2021). A globally coordinated approach to CE risk modeling and policy alignment will be essential to mainstream CE financing and reorient financial markets as enablers of circular prosperity (ECOFACT, 2024; Maltais and Nykvist, 2020; Figure 1).

Figure 1. The Circular Economy (CE) Risk Modeling Framework reconceptualizes traditional financial risk assessment by integrating five interdependent components that reflect the unique dynamics of circular business models. At its foundation is Supply Chain Resilience, which evaluates multi-tier dependencies, reverse logistics performance, and the volatility of secondary material markets. This lens shifts focus from just-in-time linear chains to adaptive networks that are more resistant to shocks and resource scarcity. Circular Asset Valuation challenges the depreciation-driven logic of traditional accounting by emphasizing multi-cycle utility, product durability, and regeneration potential. Through tools like real-options analysis, CE assets are revalued based on their capacity to retain economic value over multiple use-phases. Policy and Regulatory Integration addresses the need to embed foresight into financial modeling by factoring in EPR schemes, landfill taxes, and green procurement policies. These forward-looking variables help investors anticipate changes in compliance costs and subsidy landscapes. ESG and Technological Integration utilizes AI, blockchain, and big data to provide transparent, real-time tracking of CE flows, thereby reducing information asymmetry. Finally, Cross-sector Collaboration acts as the institutional backbone, fostering standardization of metrics and co-creation of financial instruments that collectively de-risk circular investments. Together, this model anchors financial institutions in a regenerative economic paradigm. Source: Developed by the Authors.

4 Circular business lending: reconfiguring financial logics for a regenerative economy

The transition from a linear to a circular economy (CE) is not merely a technical shift; it is a paradigmatic transformation that demands the restructuring of core institutional logics, particularly within financial systems. Traditional banking models in-depthly embedded in neoclassical economic assumptions of infinite growth, linear value chains, and short-term returns are structurally ill-suited to accommodate the temporalities, risk profiles, and systemic feedback characteristic of circular business models (Esposito et al., 2017; Kirchherr et al., 2017). In contrast, CE enterprises often emphasize value retention over extraction, product longevity over throughput, and closed-loop cycles over linear consumption, fundamentally challenging the heuristics by which financial institutions assess risk and value (Ghisellini et al., 2016; Kumar and Turnbull, 2006).

This misalignment reflects deeper theoretical tensions between mainstream finance's emphasis on transactional efficiency and the CE's focus on regenerative systems thinking. Mainstream financial valuation often privileges immediate returns and tangible collateral, while CE models especially those structured around Product-as-a-Service (PaaS), remanufacturing, or reverse logistics generate value in more distributed, intangible, and long-term ways. Such structural mismatches call for a critical rethinking of financial intermediation models through the lens of sustainability transitions theory (Markard et al., 2012), which recognizes that innovation in socio-technical systems (such as banking) must be coupled with institutional, cultural, and regulatory transformation.

A central proposition emerging in the literature is the development of CE-linked lending mechanisms financial instruments that align loan conditions with key performance indicators (KPIs) grounded in sustainability, resource circularity, and systems efficiency (He et al., 2019; Chueca Vergara and Ferruz Agudo, 2021). These KPIs must not only quantify inputs and outputs but reflect dynamic material flow systems, life cycle implications, and socio-ecological value creation. The integration of Life Cycle Assessment (LCA) and Material Flow Analysis (MFA) into financial decision-making is thus imperative, as it enables a systemic assessment of environmental impacts and potential returns over extended temporal horizons (Kalmykova et al., 2018).

Preferential loan conditions such as reduced interest rates or grace periods tied to CE-specific environmental targets (e.g., waste minimization, use of secondary raw materials, PaaS implementation) represent one practical entry point into this reorientation (Desalegn and Tangl, 2022; Ilic et al., 2020). These instruments can be embedded within Sustainability-Linked Loans (SLLs) that hinge on achieving pre-agreed sustainability performance targets. Critically, this form of lending goes beyond green finance's traditional focus on renewable energy and carbon mitigation to embrace broader regenerative outcomes and systemic efficiency hallmarks of the CE (Maltais and Nykvist, 2020; Banga, 2019).

However, these financial innovations demand more than procedural change; they necessitate a re-theorization of risk and value within financial economics. Circular business models are often perceived as risk-laden due to uncertainties in secondary material markets, longer payback periods, and the nascency of performance metrics. Yet, these “risks” largely reflect the biases of conventional risk assessment models, which fail to capture non-linear benefits, positive externalities, and long-term resilience-building generated by CE practices (Hartley et al., 2020; Haas et al., 2015). Scholars such as Fullerton and Lovins (2013) argue for a shift toward regenerative finance, where value is co-defined by ecological restoration, social utility, and circular efficiency challenging the extractivist epistemologies that underpin traditional financial logic.

A theoretical framework that supports this transition is ecological modernization theory, which posits that capitalism and environmentalism can be reconciled through institutional innovation, technological advancement, and market-driven reform (Mol and Sonnenfeld, 2000). Financial institutions, under this paradigm, are not mere passive conduits of capital but active agents in reshaping economic structures. As such, their role in CE financing is not ancillary it is foundational. However, critical scholars caution that unless embedded in robust regulatory and normative frameworks, green finance may be co-opted by “weak sustainability” paradigms that merely extend business-as-usual practices under a new label (Cui et al., 2014; Gilchrist et al., 2021).

To mitigate this, third-party verification and CE certification become instrumental in ensuring the integrity of CE-linked finance. Financial institutions can collaborate with life-cycle certifiers and CE rating agencies to validate environmental outcomes and reduce information asymmetry (Ghisellini et al., 2016). This approach can bolster investor confidence and guard against greenwashing, a growing concern in rapidly expanding green bond and sustainability-linked debt markets (Bollaert et al., 2021; Bhatnagar and Sharma, 2022).

In parallel, the rise of green and transition bonds, particularly in emerging markets, illustrates the growing convergence between capital markets and CE objectives (Bhutta et al., 2022; Banga, 2019). These instruments offer firms access to diversified capital while tethering investment to environmental performance benchmarks. In developing countries, where access to credit is often constrained, green bonds offer a vehicle for scaling CE innovations, yet their uptake is hampered by weak institutional frameworks, inconsistent policy signals, and limited capacity for environmental reporting (Flaherty et al., 2017). Here, state-backed guarantees, tax incentives, and CE-specific financial frameworks can act as enablers of inclusive finance (Lo and Yu, 2015; Morseletto, 2020a,b).

Crucially, digital financial innovations including fintech platforms, blockchain verification systems, and AI-driven credit scoring present new avenues for operationalizing CE finance (Macchiavello and Siri, 2022; Kavuri and Milne, 2019). These tools can enhance transparency, reduce transaction costs, and enable real-time monitoring of CE performance indicators. For instance, smart contracts embedded in blockchain platforms can dynamically adjust loan terms based on verified environmental performance, thereby aligning financial flows with material circularity (Goovaerts and Verbeek, 2018). Moreover, big data analytics can facilitate granular tracking of resource efficiency and waste generation across supply chains, enabling better calibration of credit risk and sustainability value (Aracil et al., 2021).

Impact investing where capital is allocated with the intention of generating measurable environmental and social outcomes adds another critical layer to the CE financing ecosystem (Cunha et al., 2021). Therefore, integrating environmental, social, and governance (ESG) metrics into portfolio selection and performance monitoring, asset managers can embed CE principles into mainstream investment strategies. This not only diversifies funding sources for circular enterprises but also helps reorient market norms around systemic value and regenerative outcomes (Liang and Renneboog, 2020).

Nevertheless, the current hesitancy of the banking sector to fully embrace CE finance stems from structural inertia, lack of standardization, and regulatory ambiguity. The integration of CE principles requires a cognitive shift in financial decision-making, supported by institutional legitimacy, regulatory clarity, and macroeconomic incentives. Governments and central banks can act as systemic enablers by establishing CE taxonomies, providing concessional finance, and fostering public-private partnerships (PPPs) that reduce the perceived risks of investing in circular transitions (Mitschke-Collande and Narberhaus, 2019; Fusco Girard and Gravagnuolo, 2017).

From a theoretical standpoint, the debate over CE finance is fundamentally a debate about the purpose of finance in society. Should finance serve to maximize shareholder value through arbitrage and short-term speculation, or should it be reconceptualized as a tool for long-term value creation and ecological resilience? This debate is not merely normative; it has deep institutional and epistemological implications. The regenerative economy envisioned by CE frameworks demands that finance operate not as a parasitic appendage to the real economy, but as a proactive enabler of structural transformation (Lovins and Fullerton, 2014; Ozili and Opene, 2021).

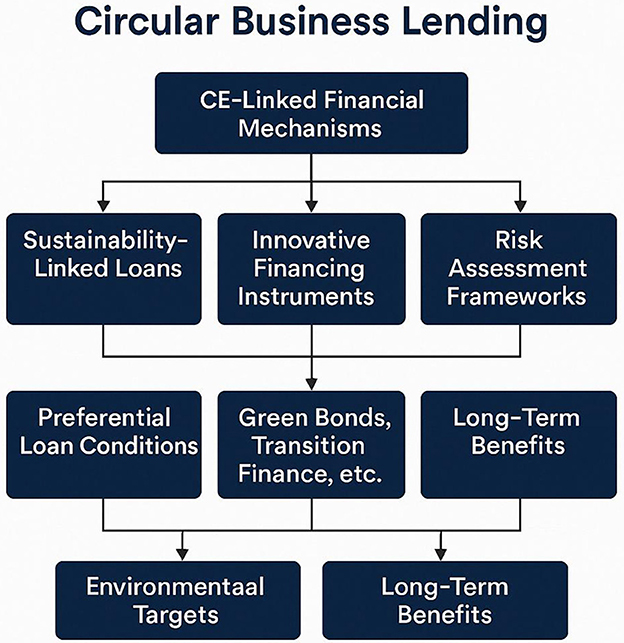

In parallel, the success of CE-linked finance will depend on the ability of financial institutions to transcend the limits of linear economic logic and embrace systems-based, interdisciplinary, and long-horizon thinking. This requires rethinking value, recalibrating risk, and reconstructing financial instruments that are not only fit for purpose in a CE context but actively catalytic of regenerative outcomes. Through deliberate alignment with policy frameworks, technological innovation, and social enterprise, banking institutions can evolve from passive lenders to active architects of sustainability transitions. The challenge ahead lies not in the availability of capital, but in the institutional imagination to deploy it in service of a future that is economically viable, ecologically resilient, and socially just (Figure 2).

Figure 2. The flowchart intricately captures the dynamic architecture of financial institutions' engagement in circular economy (CE) financing. At the core lies CE-Linked Lending, anchoring a system that integrates sustainability principles across the entire financial ecosystem. The process begins with Circular Business Models, characterized by product-as-a-service innovations, recycled inputs, and waste minimization. These models feed into Sustainability-Linked Loans (SLLs) and Green Bonds, which serve as targeted instruments offering preferential terms based on environmental performance. Simultaneously, Risk Assessment Frameworks rooted in Life Cycle Assessment (LCA) and Material Flow Analysis (MFA) recalibrate creditworthiness by emphasizing long-term ecological and economic returns. The system is further enhanced by Digital Finance & Fintech, deploying AI and blockchain to ensure real-time KPI tracking and transparency. This supports Impact Investments and ESG Portfolios, directing capital to CE frontrunners. Surrounding this architecture are enabling pillars: Policy Interventions, Third-Party Verification, and Public-Private Partnerships, which collectively reduce risk, prevent greenwashing, and build investor trust catalyzing a regenerative financial paradigm. Moreover, the model validates a critical feedback loop: as circular enterprises meet or exceed sustainability KPIs, their access to finance improves, reinforcing a performance-based incentive structure. This creates a virtuous cycle of environmental accountability and financial inclusion. Through linking capital flows to measurable ecological outcomes, financial institutions not only de-risk circular investments but actively shape market behaviors, embedding circularity into mainstream economic governance. Source: Developed by the Authors.

5 Stranded assets and circular finance

The transition toward a circular economy (CE) presents a fundamental challenge to traditional asset valuation, particularly for industries with high resource dependency, such as real estate, manufacturing, and fossil-fuel-dependent sectors (Cunha et al., 2021; Gilchrist et al., 2021). As regulatory policies, consumer preferences, and technological advancements increasingly favor CE-aligned business models, linear economy-based investments are at significant risk of becoming stranded assets those that suffer from unanticipated or premature devaluation (Mezher et al., 2002; Hartley et al., 2020). Financial institutions, which have historically relied on valuation models designed for linear production-consumption systems, must adapt their methodologies to incorporate lifecycle resource efficiency, secondary market potential, and regenerative asset utilization (Kalmykova et al., 2018; Lovins and Fullerton, 2014).

Stranded assets in the context of the CE arise from the misalignment between traditional investment strategies and emerging sustainability requirements. Fossil-fuel infrastructure, single-use plastics, and non-recyclable materials face increasing obsolescence as stringent environmental policies and extended producer responsibility (EPR) frameworks reshape industries (Hartley et al., 2020; Ghisellini et al., 2016). Moreover, the financial sector has been slow to internalize the full spectrum of risks associated with resource-intensive industries, leading to suboptimal capital allocation and potential financial instability (Gilchrist et al., 2021; Hafner et al., 2020).

Regulatory frameworks such as the European Green Deal and the Basel III Accord emphasize the necessity of integrating climate-related financial disclosures into risk assessment models (Banga, 2019; Hafner et al., 2020). The Task Force on Climate-related Financial Disclosures (TCFD) highlights the growing importance of stranded asset risk in institutional investment portfolios, particularly for banks, insurers, and pension funds with high exposure to carbon-intensive industries (Maltais and Nykvist, 2020; Lo and Yu, 2015). Financial institutions that fail to account for these risks may face significant balance sheet vulnerabilities, especially as investors demand greater accountability regarding environmental, social, and governance (ESG) factors (Alkaraan et al., 2022; Liu et al., 2021).

To address these risks, financial institutions must develop innovative circular finance mechanisms that integrate CE principles into investment decisions. Circular finance refers to financial instruments, investment models, and risk assessment methodologies designed to support circular business models, such as product-as-a-service, industrial symbiosis, and closed-loop supply chains (Fallahi et al., 2023; Kirchherr et al., 2017).

One prominent example is green bonds, which have emerged as a critical funding tool for CE initiatives (Bhutta et al., 2022; Banga, 2019). Unlike traditional bonds, green bonds explicitly allocate capital toward environmentally sustainable projects, including infrastructure retrofitting, renewable energy, and circular production systems (Flaherty et al., 2017; Jelemensky, 2022). However, despite their potential, green bonds currently represent a small fraction of global financial markets, highlighting the need for expanded regulatory incentives and financial innovation (Desalegn and Tangl, 2022; Hafner et al., 2020).

Additionally, fintech solutions and digital financial services are playing an increasingly important role in supporting circular business models. Emerging technologies such as blockchain and artificial intelligence (AI) enable more accurate tracking of resource flows, verification of sustainable supply chains, and real-time assessment of asset depreciation in circular systems (Bollaert et al., 2021; Chueca Vergara and Ferruz Agudo, 2021). Sustainable banking initiatives, driven by fintech advancements, provide alternative financing models such as peer-to-peer lending, sustainability-linked loans, and impact investing (Aracil et al., 2021; Macchiavello and Siri, 2022).

However, for financial institutions to become enablers of a regenerative economy, they must shift from static valuation models toward dynamic methodologies that account for the longevity and adaptability of circular assets. Traditional valuation metrics, such as net present value (NPV) and discounted cash flow (DCF) analysis, often fail to capture the full potential of circular enterprises (Kalmykova et al., 2018; Lovins and Fullerton, 2014). In contrast, CE-aligned valuation frameworks should integrate factors such as:

• Lifecycle Resource Efficiency: Evaluating assets based on their ability to minimize waste, maximize resource recovery, and enhance energy efficiency (Cunha et al., 2021; Morseletto, 2020a,b).

• Secondary Market Potential: Assessing the economic viability of reused, remanufactured, or refurbished materials and products in secondary markets (Esposito et al., 2017; Fusco Girard and Gravagnuolo, 2017).

• Regenerative Asset Utilization: Measuring the capacity of investments to regenerate natural ecosystems and create net positive environmental impacts (Ghisellini et al., 2016; Morseletto, 2020a,b).

These valuation criteria necessitate a paradigm shift in financial modeling, requiring banks and investment firms to move beyond traditional risk-return assessments and incorporate sustainability-driven key performance indicators (KPIs; Goovaerts and Verbeek, 2018; Kumar et al., 2025).

Banks, asset managers, and insurers have a critical role to play in mainstreaming circular finance by adopting proactive investment policies and advocating for supportive regulatory frameworks. Sustainable banking models, such as those pioneered by Triodos Bank and ASN Bank, demonstrate that profitability and sustainability can coexist when financial institutions align their portfolios with CE principles (Aracil et al., 2021; Goovaerts and Verbeek, 2018).

Moreover, public-private partnerships (PPPs) can bridge financing gaps by leveraging government-backed incentives to de-risk circular investments (Atun et al., 2012; Cui et al., 2014). Blended finance instruments, combining concessional funding with private capital, have proven effective in scaling CE projects, particularly in developing economies where financial barriers remain significant (Desalegn and Tangl, 2022; Liang and Renneboog, 2020).

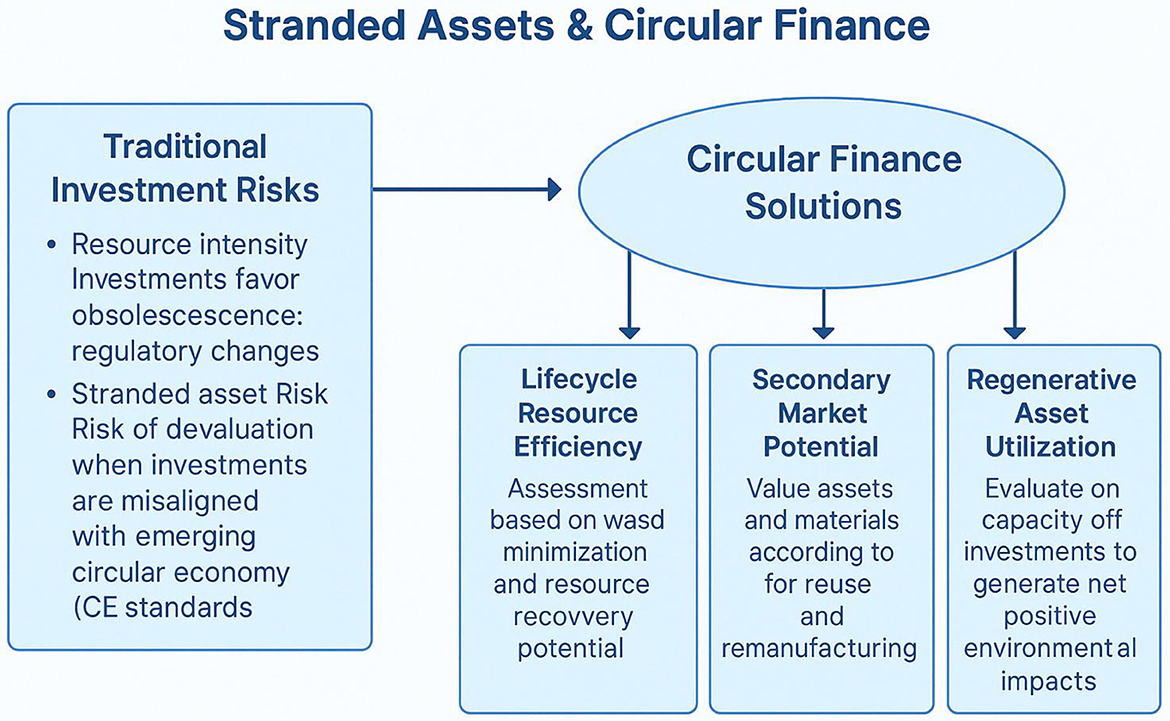

Ultimately, the financial sector's transition toward circular finance is not merely an economic imperative but a necessity for achieving long-term sustainability goals. As the risks of stranded assets intensify and regulatory landscapes evolve, financial institutions must take the lead in redefining investment paradigms that support regenerative economic models (Haas et al., 2015; Mitschke-Collande and Narberhaus, 2019). In doing so, they can not only mitigate financial risks but also catalyze systemic change toward a resilient and circular economy (Figure 3).

Figure 3. The diagram presents a systems-based model that critically explains how financial institutions can transition from linear investment paradigms to circular finance to mitigate stranded asset risks and support a regenerative economy. It begins with traditional linear valuation models such as Net Present Value (NPV) and Discounted Cash Flow (DCF) that ignore resource depletion, environmental externalities, and lifecycle inefficiencies, leaving industries like fossil fuels, plastics, and resource-intensive real estate exposed to premature asset devaluation. These stranded assets emerge under increasing regulatory pressures (e.g., the EU Green Deal), shifting consumer preferences, and technological disruption, signaling a structural misalignment with circular economy principles. The central transformation pathway in the model is “Circular Finance,” which reorients capital allocation using three interconnected pillars: lifecycle resource efficiency (minimizing waste and maximizing resource recovery), secondary market potential (assessing reuse and remanufacturing value), and regenerative asset utilization (investing in assets that restore ecosystems). Enabling mechanisms such as green bonds, digital fintech tools (e.g., AI, blockchain), and blended finance amplify this shift by de-risking sustainable investments. Ultimately, the model envisions financial institutions adopting dynamic valuation metrics and ESG-aligned KPIs, catalyzing systemic economic transformation toward circularity, resilience, and long-term value creation. Source: Developed by the Authors.

6 Integrating digital innovation with financial products to drive a regenerative economy

The transition to a regenerative economy requires an innovative alignment of financial systems with circular economy (CE) principles. Combining financial products that promote circularity with digital innovations like blockchain, AI, and big data can create a powerful ecosystem that fosters sustainability and economic growth. Financial products such as pay-per-use models, product-as-a-service lending, and leasing structures are essential in channeling capital into CE-aligned businesses (Banga, 2019; Kavuri and Milne, 2019). These models incentivize the longevity of assets, reduce resource extraction, and support material reuse, directly contributing to the regenerative economy's core objectives (Fullerton and Lovins, 2013; Esposito et al., 2017).

To scale these circular financial models in today's fast-paced global economy, digital innovations are crucial. Technologies like blockchain enable transparent and verifiable transactions, reducing uncertainty and fostering trust between stakeholders (Upadhyay et al., 2021; Dabbous and Tarhini, 2021). AI and big data analytics can streamline credit assessments by leveraging real-time sustainability data, allowing for more precise risk evaluations and better decision-making in lending practices (Bracci et al., 2022; Galaz et al., 2018). Together, these innovations can create efficient, scalable systems that facilitate the transition toward a regenerative economy by promoting circular business models and opening up new revenue streams (Kumar et al., 2025; Kumar and Turnbull, 2006).

Innovative financial products are pivotal in channeling capital toward circular economy (CE)-aligned businesses, creating a sustainable financial ecosystem. Models like pay-per-use financing, product-as-a-service lending, and leasing-based finance provide alternatives to traditional ownership-based models, supporting CE goals (Banga, 2019; Kavuri and Milne, 2019). These financial structures enhance asset longevity, encourage material reuse, and reduce resource extraction, aligning with a regenerative economy's core objectives (Fullerton and Lovins, 2013; Esposito et al., 2017). Moreover, integrating CE principles into product design, these models help trigger systemic shifts in business operations, unlocking new revenue streams and driving sustainable practices (Macchiavello and Siri, 2022; Lo and Yu, 2015).

The monetization of circularity extends beyond financial products. Therefore, integrating CE principles into financial services, financial institutions can catalyze broader economic transformations. Circular financial models allow businesses to access capital more effectively while reducing the environmental impacts associated with traditional production methods (Zhou et al., 2021). Moreover, these models offer financial institutions a competitive edge, creating new market opportunities for sustainability-conscious investors and businesses. This alignment between finance and sustainability enables a more resilient and circular economy, promoting long-term economic growth while simultaneously addressing environmental challenges (Kumar et al., 2025; Liu et al., 2021).

Digital technologies can significantly enhance the role of financial services in driving the circular economy by increasing transparency, accessibility, and efficiency (Zhou et al., 2021; Treleaven, 2015). Blockchain technology, for example, can enable secure, transparent, and verifiable transactions, ensuring that financial products and services align with sustainability objectives (Upadhyay et al., 2021; Dabbous and Tarhini, 2021). Smart contracts, powered by blockchain, can automate the execution of CE-related transactions, reducing administrative costs and improving operational efficiency. This level of transparency also ensures that both financial institutions and businesses are held accountable to their sustainability commitments (Aracil et al., 2021).

AI and big data analytics further bolster circular banking by facilitating more accurate credit assessments and real-time risk modeling, based on sustainability metrics (Bracci et al., 2022; Galaz et al., 2018). These technologies allow financial institutions to assess risks more precisely, promoting more sustainable lending practices and improving the flow of capital to circular businesses. Through adopting these technologies into their operations, financial institutions can better serve the needs of circular economy businesses, while simultaneously enhancing their own operational efficiency and financial performance (Kouhizadeh et al., 2021; Beck et al., 2016).

Consequently, Digital technologies also open new pathways for expanding circular economy financing to a broader spectrum of businesses, including small and medium-sized enterprises (SMEs) and start-ups (Bollaert et al., 2021). Moreso, through leveraging AI, blockchain, and other digital tools, financial institutions can offer scalable and customizable financial solutions to businesses transitioning toward more sustainable models. This democratization of finance ensures that circular economy principles can be embedded across various sectors, from manufacturing to services, and across both developed and emerging markets. Such inclusivity is critical to ensuring that circularity becomes a global movement, transcending geographical and financial barriers (Beck et al., 2016).

Moreover, the rise of digital finance solutions strengthens the ability of financial institutions to promote environmental, social, and governance (ESG) practices. Circular economy models aligned with digital technologies enable financial institutions to meet regulatory requirements while improving financial performance (Alkaraan et al., 2022). As demand for sustainable investments grows, financial institutions that adopt circular economy principles and digital innovations are poised to attract sustainability-conscious investors and businesses seeking to future-proof their operations (Kavuri and Milne, 2019). This alignment of business, finance, and technology helps drive the broader shift toward sustainability, creating a more resilient, regenerative global economy.

Most importantly, the development of sustainable financial instruments, such as green bonds, is further enhanced by digital technologies. Green bonds are increasingly used to fund renewable energy and circular economy projects (Bhatnagar and Sharma, 2022; Sartzetakis, 2021). Digital platforms and blockchain technologies enable real-time tracking and verification of how these funds are used, ensuring that investments are directed toward projects with clear sustainability outcomes (Maltais and Nykvist, 2020; Ning et al., 2022). This level of transparency not only attracts a growing pool of investors but also builds accountability within financial markets, reinforcing the demand for regenerative economic practices.

These technologies allow investors to track their impact more effectively, creating a feedback loop that reinforces the drive toward sustainability. Nevertheless, increasing transparency, blockchain can also ensure that funds directed toward CE initiatives lead to measurable positive environmental impacts, further incentivizing circular business models. This integration of digital finance and sustainability creates a robust infrastructure for green investments, offering investors a clearer understanding of their financial and environmental returns (Macchiavello and Siri, 2022). As such, digital solutions and circular finance strategies work in tandem to create an ecosystem that nurtures a regenerative, sustainable economy.

While challenges remain, particularly in terms of ensuring the long-term financial viability of circular economy investments, digital technologies can help reduce uncertainties by improving data accuracy and providing real-time monitoring (Goovaerts and Verbeek, 2018; Gunarathne and Lee, 2021). AI can analyze sustainability performance across supply chains, providing valuable insights that inform lending decisions. Big data analytics allows financial institutions to predict market trends and adapt to changing consumer preferences, helping banks align their strategies with the growing demand for sustainability (Kumar et al., 2025; Kalmykova et al., 2018). These technological advancements help create a more secure and adaptable financial ecosystem that supports circular economy initiatives.

Therefore, the integration of circular economy principles with digital innovations is essential for driving the transition to a regenerative economy. Financial institutions that leverage these technologies to create circular financial products will be at the forefront of this transformative shift, opening new revenue streams and growth opportunities while promoting sustainability (Ozili, 2021; Macchiavello and Siri, 2022). This integrated approach ensures that financial products not only support sustainable practices but also foster a resilient and regenerative economic system that benefits people, businesses, and the planet. Through these efforts, financial institutions can become the catalysts of a regenerative economy, accelerating the transition toward a sustainable future.

7 Regulatory frameworks for circular finance

In the transition to a regenerative economy, the role of financial institutions is pivotal. However, the successful integration of Circular Economy (CE)-aligned financing requires supportive and coherent regulatory frameworks (Mazzucato and Penna, 2016; Saravade and Weber, 2020). Governments and financial regulators must create and enforce policies that facilitate the involvement of financial institutions in driving circularity, while aligning the financial system with long-term sustainability goals (Volz, 2018; Schoenmaker, 2021). The urgency of this shift is underscored by the growing recognition that the financial sector has the potential to become a key enabler of the regenerative economy through effective policy and regulation (D'Orazio and Popoyan, 2019; Chenet et al., 2019).

One of the primary regulatory strategies is the introduction of tailored guidelines that incentivize financial institutions to integrate circularity into their operations. Governments can provide capital requirement adjustments for investments in CE-oriented projects, which would lower the perceived financial risk and incentivize banks to finance circular businesses (Benedikter, 2011; Aracil et al., 2021). These measures can be complemented by tax incentives aimed at reducing the cost of financing circular initiatives, encouraging the flow of capital into regenerative projects (Bhatnagar and Sharma, 2022; Goovaerts and Verbeek, 2018). For example, in 2021, the European Union unveiled its Green Deal, coupled with financial mechanisms such as the EU Green Taxonomy, to guide and incentivize private investments in green and circular initiatives (Desalegn and Tangl, 2022; Peeters, 2005).

Moreover, regulatory bodies can mandate the adoption of standardized reporting frameworks, which would require financial institutions to integrate CE-specific metrics into their risk assessments and disclosures. This would promote transparency and enable financial institutions to assess the circularity of their portfolios effectively, mitigating the risks of financing non-sustainable activities (Benedikter, 2011; Berrou et al., 2019). Regulatory measures that mandate standardized disclosures on circularity and environmental impacts also help manage the inherent uncertainties and risks of CE investments (Toxopeus et al., 2018; Kumar et al., 2025). Such regulatory frameworks would not only increase the credibility of financial products linked to circularity but also bolster investor confidence in the long-term returns of sustainable investments (Hafner et al., 2020; Cui et al., 2014).

An essential component of regulatory frameworks is the development of innovative financial products that align with the principles of the circular economy. Financial instruments such as green bonds, sustainable loans, and impact investing have emerged as critical vehicles for channeling capital into circular projects (Gilchrist et al., 2021; Banga, 2019). Governments can support the issuance of green bonds by guaranteeing favorable tax treatment for such bonds or creating government-backed financial instruments that provide first-loss protection to reduce risk for private investors (Flaherty et al., 2017; Sartzetakis, 2021). For example, the issuance of Green Bonds in the European Union has proven successful in mobilizing substantial funds for circular initiatives, such as the financing of renewable energy projects and sustainable infrastructure development (Maltais and Nykvist, 2020; Bhutta et al., 2022).

Furthermore, regulators can introduce laws that encourage financial institutions to develop products tailored to circular business models. These include loans that reward businesses for adopting closed-loop production systems or for demonstrating substantial reductions in resource consumption (Gunarathne and Lee, 2021; Kumar et al., 2025). The success of the Green Bond market exemplifies the potential for financial products to support the circular economy, with nations such as Sweden, France, and the Netherlands leading the way in developing successful frameworks for green bonds (Ning et al., 2022; Goovaerts and Verbeek, 2018).

It is important to establish that Regulatory frameworks are not limited to national efforts; international collaboration is essential for harmonizing financial regulations and scaling circular finance initiatives globally. The role of international organizations such as the United Nations Environment Programme (UNEP) and the World Bank is critical in shaping global policy frameworks that foster circular finance (United Nations Environment Programme Finance Initiative, 2024; Ghisellini et al., 2016). For instance, UNEP's initiative on responsible banking calls for financial institutions to align their business models with sustainable and circular economy principles, advocating for policies that support the circularity of financial products (United Nations Environment Programme Finance Initiative, 2024). The development of the Green Climate Fund (GCF), which channels global finance to support developing countries' transitions to low-carbon economies, also exemplifies the positive impact of international financing mechanisms that prioritize sustainability (Cui et al., 2014; Atun et al., 2012).

National efforts, too, have seen progressive strides. In China, the government has integrated circular economy principles into its 13th Five-Year Plan, supporting the creation of a favorable regulatory environment for circular finance (Lo and Yu, 2015; Velenturf et al., 2018). The inclusion of circular economy principles in China's broader environmental policy frameworks encourages the financial sector to play a more active role in funding resource-efficient and sustainable projects (Zheng et al., 2019). Similarly, countries such as the UK and Germany have introduced regulatory measures that integrate circularity into financial reporting, with the European Union's Sustainable Finance Disclosure Regulation (SFDR) setting a precedent for mandating disclosures on sustainability metrics (Morseletto, 2020a,b; Kirchherr et al., 2023).

While the potential for regulatory frameworks to accelerate the transition to circular finance is immense, challenges persist. One major hurdle is the risk of regulatory fragmentation, which could hinder cross-border investments and create uncertainty for investors (Mitschke-Collande and Narberhaus, 2019; Toxopeus et al., 2018). Moreover, the evolving nature of the circular economy poses challenges in terms of defining what constitutes a truly circular investment, with many businesses engaging in superficial “green-washing” to benefit from sustainability incentives (Kalmykova et al., 2018; Kumar et al., 2025). The lack of universally accepted definitions and metrics for circularity remains a significant challenge for regulatory frameworks striving for consistency and clarity (Haas et al., 2015; Chueca Vergara and Ferruz Agudo, 2021).

Likewise, while there are notable examples of success in regulatory support for circular finance, further work is needed to create comprehensive and coherent frameworks that incentivize financial institutions to become the engines of a regenerative economy. Strengthening these frameworks through the integration of tailored financial products, standardized reporting, and international cooperation will be crucial for aligning financial markets with the objectives of sustainability and circularity (Morseletto, 2020a,b; Desalegn and Tangl, 2022). Only through such comprehensive efforts can the financial sector effectively contribute to building a regenerative, circular economy.

8 Implications: understanding the contribution of financial institutions in advancing a regenerative economy

The exploration of financial institutions' role in fostering a regenerative economy, as outlined in Banking on Circularity: Can Financial Institutions Become the Engines of a Regenerative Economy? presents critical insights for both theory and practice. The findings not only contribute to the emerging field of sustainable finance but also push the boundaries of conventional banking paradigms. This section critically engages with the contributions to theory, practice, and policy, while also discussing the study's limitations and future research avenues.

8.1 Contributions to theory

This research contributes significantly to the evolving theoretical discourse on sustainable finance and the circular economy by providing an integrated framework that links financial systems with circular principles. A central theme of this study is the shift from traditional economic paradigms, which largely focus on linear growth models, to systems that prioritize regeneration, sustainability, and resource efficiency. In doing so, the study extends current literature by addressing how financial institutions can not only mitigate environmental risks but actively drive systemic change in the economy through the integration of circularity into financial products, policies, and practices.

One of the most profound theoretical contributions of this study is its critique of traditional financial systems, which have long been structured around short-term profitability and growth, often at the expense of environmental sustainability. Traditional financial models, such as those rooted in shareholder primacy, have typically marginalized environmental concerns, viewing them as externalities rather than inherent components of business and investment strategies (Friedman, 2007). This research challenges that perspective by suggesting that financial institutions can be pivotal agents in promoting long-term sustainable development through the adoption of circular economy principles. Through framing financial institutions as active agents in the circular economy, this study contributes to a growing body of work that reconceptualizes finance not merely as a tool for investment and profit but as a force for societal transformation (Fallahi et al., 2023; Dewick et al., 2020).

Through the integration of circular economy principles into financial models, this study redefines the role of financial institutions within broader environmental governance frameworks. Financial systems are traditionally seen as intermediaries for capital allocation. However, this study theorizes that they can be reframed as key drivers of systemic transitions toward sustainability. Drawing from the work of authors like Geissdoerfer et al. (2017) and Lacy and Rutqvist (2015), the study reinforces the idea that finance is not neutral in the transition toward sustainable systems but can actively shape the course of that transition. The financial sector's alignment with circular economy principles, such as reducing waste, optimizing resource use, and promoting renewable energy investments, introduces new pathways for integrating sustainability into economic models.

This study also contributes to the theoretical development of the circular economy framework by highlighting the intersection of circular principles with financial practices. The circular economy has been predominantly explored in the context of waste management, product design, and resource optimization. While these contributions are foundational, the financial dimension has remained less explored. By embedding finance within the circular economy framework, this research adds depth to the understanding of how financial mechanisms like green bonds, circular investment funds, and impact investing can drive circularity in industries traditionally resistant to change, such as heavy manufacturing, transport, and energy (Chenet et al., 2019; Blomsma and Brennan, 2017).

The study also builds on earlier work by exploring how circular business models can be supported by financial instruments that align incentives for both businesses and investors with sustainability goals. As Gunarathne and Lee (2021) and Goyal and Kumar (2021) have suggested, circular economy financing involves more than just capital allocation; it requires aligning investment returns with environmental and social value creation. The research introduces novel financial tools that foster circularity, including waste-to-resource financing and restorative investments, which enhance the circular economy narrative by bringing the role of finance into sharper focus.

Furthermore, this study pushes the boundaries of current theoretical frameworks by addressing the ways in which financial institutions can directly intervene in shifting industries toward circularity through investment in innovation, sustainable technologies, and infrastructure development. The research proposes that financial actors, such as banks and asset managers, play a critical role in scaling up circular innovations in supply chains, renewable energy systems, and infrastructure development. This theoretical shift underscores the importance of collaboration between public and private sector stakeholders, something that has been less emphasized in mainstream circular economy literature (Kirchherr et al., 2018).

Another key contribution to theory is the integration of Environmental, Social, and Governance (ESG) metrics within the circular economy framework. The current theoretical understanding of ESG metrics often focuses on their role in risk mitigation and reputation management for financial institutions (Aracil et al., 2021; Ozili, 2020). However, this research extends the conversation by positioning ESG metrics as essential tools for promoting circular economy practices. The study demonstrates that ESG performance is not only an indicator of environmental stewardship but a mechanism through which financial institutions can drive sustainable practices, such as reducing carbon footprints, supporting green technologies, and incentivizing regenerative processes (Agbakwuru et al., 2024). This reimagining of ESG metrics as vehicles for circular economy transitions offers a new theoretical perspective that bridges the gap between financial performance and environmental regeneration.

Through offering a detailed examination of how ESG metrics can be aligned with circular economy strategies, this study advances a more holistic view of how businesses can balance financial returns with long-term sustainability objectives. Additionally, this research provides insights into the relationship between circular finance and other emerging financial models, such as impact investing and regenerative finance (Schroeder et al., 2019). These models, which seek to quantify the positive social and environmental outcomes of investments, represent a theoretical shift from traditional finance to a more inclusive and impact-driven approach.

This study also contributes to the theoretical understanding of financial innovation as a catalyst for systemic transformation. As sustainability challenges grow increasingly complex, the study draws upon the work of scholars like Schaltegger and Burritt (2018) and Markard et al. (2012) to argue that financial innovation is crucial for overcoming barriers to circular economy implementation. The integration of digital technologies, such as blockchain for transparent supply chains or AI for optimizing resource use, is theorized as a key enabler of circular finance. The research posits that these innovations can provide real-time data, improve decision-making, and enhance accountability, thereby facilitating the scaling of circular economy solutions. This extension of financial innovation into the realm of circularity adds a new dimension to existing theories of innovation and sustainability by highlighting how finance can support technological and business model innovations that are central to circular economies.

8.2 Contributions to practice and policy

This research provides crucial contributions to practice and policy by offering actionable insights that guide financial institutions, policymakers, and industry leaders in embedding circular economy principles into their operational and regulatory frameworks. The study bridges the gap between theory and practice by illustrating how financial institutions can be mobilized to foster circularity, both through their investment strategies and by developing financial products that incentivize sustainable and regenerative practices. In addition, it provides policymakers with clear recommendations on creating regulatory environments that encourage the adoption of circular finance and the integration of circular economy principles into national and international economic systems.

A significant contribution of this research to practice is its demonstration of how financial institutions can proactively integrate circular economy principles into their business models and investment portfolios. Traditional financial institutions have often been resistant to such changes due to perceived risks and limited understanding of how circularity aligns with long-term profitability (Ellen MacArthur Foundation, 2013). However, this study shows that circular finance can actually offer competitive advantages in terms of risk reduction, portfolio diversification, and long-term profitability (Bocken et al., 2016). Financial institutions that embrace circular economy principles can support the development of sustainable technologies, such as renewable energy projects, waste-to-resource innovations, and sustainable infrastructure, thereby contributing to both environmental sustainability and economic growth (Geissdoerfer et al., 2017).

Practically, this research encourages financial actors, including banks, investment firms, and insurers, to shift from short-term, linear thinking to a long-term, circular approach. For instance, by adopting green bonds, sustainable asset-backed securities, and circular investment funds, financial institutions can direct capital to projects that promote circular practices and support the transition to a more regenerative economy. This is consistent with the findings of Sepetis (2022), who argued that the finance sector must reorient itself to prioritize investments that contribute to broader societal goals, such as sustainability, inclusivity, and resilience.

Furthermore, this research calls for the development of innovative financial instruments tailored to circularity. This can be achieved through creating funding mechanisms that specifically support resource efficiency, material recovery, and waste minimization, financial institutions can incentivize firms to adopt circular business models (Lacy and Rutqvist, 2015). These instruments could include impact investing, sustainability-linked loans, and performance-based financing models that reward circularity in business practices. The application of such financial tools could dramatically shift how companies measure and manage their environmental impact, creating a more tangible connection between financial performance and sustainability outcomes (Kumar et al., 2025).

On the policy front, the research highlights the crucial role of government and international policy in supporting the transition to a circular economy through financial incentives, regulatory frameworks, and public-private partnerships. Policymakers can enable circular finance by creating incentives that lower the cost of capital for companies adopting circular business models. This could include tax breaks for investments in renewable energy infrastructure, subsidies for companies implementing waste reduction strategies, and the introduction of preferential lending rates for circular projects (Bocken et al., 2016).

Governments can also introduce mandatory disclosure requirements related to circular economy practices and sustainability metrics, similar to the ESG reporting frameworks already in place in some jurisdictions (Ozili, 2021). As circular economy metrics are still in development, governments can play a pivotal role by promoting standardized reporting on circularity, which would help investors and businesses make informed decisions. According to Kirchherr et al. (2018), this type of regulatory clarity will provide financial institutions with the confidence to channel investments into circular economy projects and foster greater market transparency.

Additionally, this study suggests that policymakers should incorporate circular economy principles into their broader sustainability agendas. National and regional policies, such as those supporting the EU Green Deal (European Commission, 2020), can be aligned with circular finance mechanisms to create comprehensive economic strategies that promote environmental regeneration. This can be reflected by ensuring that policies are coherent across different sectors, from waste management and renewable energy to infrastructure and transport, governments can stimulate the market demand for circular financial products and services, thus ensuring greater systemic adoption (Gunarathne and Lee, 2021).

Furthermore, policymakers can foster international cooperation to develop harmonized standards for circular finance across borders. Circular finance, by its nature, requires global coordination to address transboundary challenges such as supply chain resource use and waste management. As highlighted by Lacy and Rutqvist (2015), the creation of global financial regulatory frameworks and standardization of circular economy metrics will be essential for scaling circular finance across international markets.

The research also stresses the need for financial institutions to collaborate with policymakers in the co-development of policy frameworks that enable circular economy practices. Financial institutions are often viewed as key stakeholders in policy debates, yet their active participation in policymaking related to circularity remains limited (Peeters, 2005). This study suggests that greater collaboration between financial institutions and policymakers is essential to ensuring that financial products and policies are effectively aligned with sustainability goals. For example, collaboration could include co-creating financial tools that address policy gaps, such as in areas like carbon pricing and material recovery, while also ensuring that such tools are adaptable across different national contexts (Geissdoerfer et al., 2017).

Moreover, financial institutions can help to advocate for circular economy policies that incentivize sustainable innovation. Thus, providing evidence of the economic benefits of circularity, such as increased resource efficiency and improved risk mitigation, financial institutions can play an instrumental role in persuading policymakers to prioritize circular economy frameworks in their policy agendas (Jelemensky, 2022). This proactive role is particularly important in regions where circular economy policies are still emerging, such as in developing economies, where financial institutions can help to shape national policy through strategic investments and public advocacy.

8.3 Limitations of the study and future research directions

Despite the contributions made by this study, several limitations must be acknowledged to provide a rigorous and transparent understanding of its scope. These limitations do not undermine the value of the research but rather offer opportunities for future investigation to deepen and broaden the current findings.