Abstract

Artificial intelligence (AI) serves as a pivotal force restructuring enterprise organization, significantly advancing green transition and promoting sustainable macroeconomic and societal development. This paper empirically examines the effects and transmission channels of AI on firm-level environmental performance, drawing on panel data from Chinese A-share listed firms spanning 2009–2022 and leveraging the establishment of the “National New Generation Artificial Intelligence Innovation Development Pilot Zone” as a quasi-natural experiment within a difference-in-differences (DID) framework. Results demonstrate that AI adoption significantly improves firms' environmental performance. Mechanism analysis indicates that AI facilitates this improvement primarily through enhanced market integration and the stimulation of green innovation activities. Heterogeneity analysis further reveals that the positive impact of AI on environmental performance is more substantial among firms in non-heavy-polluting and capital-intensive sectors.

1 Introduction

In the paradigm of global sustainable development, corporate environmental performance has emerged as a pivotal metric for assessing organizational competitive advantage and corporate social responsibility (Sang et al., 2024). The Global Sustainable Investment Alliance documents that sustainable investment portfolios reached $35.3 trillion globally in 2022, constituting 36% of aggregate global investments—representing a 15% increase from 2018. This empirical evidence substantiates the significant integration of environmental performance criteria into investor decision frameworks. Corporate environmental performance functions not merely as the fundamental catalyst for ecological transformation but also determines whether firms can execute successful transitions toward sustainable business models. Nevertheless, during environmental policy implementation, tensions between regulatory compliance requirements, market incentives, and technological constraints create significant barriers to substantive corporate ecological innovation (Ambec et al., 2013; Meckling and Jenner, 2016). Concurrently, amid the fourth industrial revolution, emerging technologies—particularly artificial intelligence—are fundamentally reconfiguring global sustainability paradigms, functioning as the primary mechanism for production system transformation and sustainable development (Acemoglu and Restrepo, 2018; Babina et al., 2024), thereby creating novel pathways for corporate ecological transition.

Within the context of the fourth industrial revolution, China has systematically promoted artificial intelligence integration across production systems and societal applications. The government introduced the “New Generation Artificial Intelligence Development Plan” in 2017, subsequently implementing the National New Generation Artificial Intelligence Innovation Development Experimental Zone policy in 2019, designed to explore innovative frameworks for integrating artificial intelligence with socioeconomic development (Teplova et al., 2023). Throughout artificial intelligence sector development, China has established international sustainability networks through technological diffusion and knowledge transfer mechanisms (Xue et al., 2024). As “National Pilot Zone for the Innovation and Development of New Generation Artificial Intelligence” (the AI Application Pilot Zone) evolve from research-oriented initiatives toward comprehensive industrial ecosystems, they constitute practical platforms for multinational corporations to enhance environmental performance metrics. Consequently, rigorously examining the causal relationship between government-initiated artificial intelligence programs and corporate environmental performance carries significant implications for facilitating ecological transformation among Chinese enterprises while simultaneously providing theoretical frameworks and empirical insights for global organizations pursuing sustainable development objectives and climate change mitigation strategies.

2 Literature review

Artificial intelligence (AI) functions as a pivotal driver in the advancement of modern technological frameworks (Tariq et al., 2021), synthesizing methodologies from computer science, statistics, and neuroscience (Mohseni et al., 2021) to facilitate autonomous machine learning, reasoning, and decision-making. AI aims to transcend human cognitive constraints in addressing complex, high-dimensional problems (Silver et al., 2016; Duan et al., 2022). The trajectory of AI research has shifted from foundational theoretical constructs and rule-based systems—anchored in mathematical logic and heuristic algorithms (Newel and Simon, 1976)—to data-driven modeling approaches (Mitchell, 1997), and subsequently, to a proliferation of application domains (Murphy, 2000; Martin and Jurafsky, 2009). As AI becomes increasingly embedded across sectors and research frontiers diversify, rigorous assessment of its developmental trajectory and the identification of key determinants have become paramount. Prevailing measurement approaches in the literature include patent counts (Uhm et al., 2020), algorithmic efficiency metrics (LeCun et al., 2015), and industry growth indicators (Brynjolfsson and McAfee, 2017). Additionally, some studies operationalize smart city pilot policies as proxy variables to gauge urban intelligence, thereby evaluating AI from a policy implementation perspective (Liu et al., 2022). The ongoing advancement of AI technologies, optimization of core algorithms, and expansion of application scenarios (Agrawal et al., 2022; Li et al., 2024) have broadened the spectrum of influencing factors from initial data quality and scale (Janssen et al., 2020) to encompass human capital, R&D investment (Agrawal et al., 2022), and policy frameworks (Hinton et al., 2012).

Corporate ESG encapsulates both the fulfillment of corporate social responsibility and the enhancement of governance structures, with corporate environmental performance constituting the environmental pillar of ESG and focusing on firm-level environmental actions and outcomes (Arvidsson and Dumay, 2022). In response to the global diffusion of sustainable development norms and increasingly stringent regulatory environments, research on corporate environmental performance has evolved from a narrow focus on pollutant abatement and resource efficiency (Hart, 1995) to a holistic consideration of all operational dimensions (Finkbeiner, 2009). The conceptualization of corporate environmental performance has been refined to include dimensions such as natural environment stewardship and eco-innovation (Delmas and Burbano, 2011; Schiederig et al., 2012), yielding a more granular understanding of its scope. Therefore, environmental performance is widely recognized as a proxy for a firm's contribution to environmental sustainability (Ambec et al., 2013), prompting extensive inquiry into its measurement and determinants. Measurement methodologies predominantly rely on ESG ratings (Friede et al., 2015), green governance indicators (Ioannou and Serafeim, 2015), and environmental investment metrics (Zhang et al., 2022), though issues of data comparability and temporal lag persist. Determinants are analyzed from both internal and external perspectives: internally, a firm's environmental responsibility orientation directly influences performance metrics such as energy efficiency, emissions reduction, and resource utilization (Sun et al., 2024; Liu et al., 2024); externally, heightened public environmental consciousness and regulatory emphasis on environmental protection link corporate environmental strategies to market reputation and competitive positioning (Chen and Li, 2024; Bai et al., 2024), incentivizing firms to enhance environmental outcomes.

Existing literature relevant to this study predominantly investigates the relationship between enterprise intelligence levels and environmental outcomes through quantitative methodologies, including statistical analyses and case studies (Skiter et al., 2022; Wang A. et al., 2024). Mechanistically, AI's advanced data analytics, pattern recognition, and automation capabilities facilitate corporate green transformation by driving technological innovation, enhancing product efficiency, and optimizing resource allocation (Qin et al., 2024; Lee and Yan, 2024). The impact of AI development on corporate environmental outcomes is multifaceted: Ying et al. (2023) demonstrate that AI adoption can augment green total factor productivity via improvements in technical efficiency and innovation. The incorporation of digital technologies, including AI, big data analytics, cloud computing, and blockchain, into production and operational processes enhances management structures, increases production efficiency, and improves environmental outcomes, thereby reshaping corporate operations and fostering low-carbon economic growth (Helfat et al., 2023; Bosse et al., 2023; Bahoo et al., 2023).

Despite substantial progress, several research gaps remain. First, there is a paucity of empirical studies examining the impact of AI Application Pilot Zone policies on corporate environmental performance. This study addresses this gap by utilizing panel data from China's A-share listed companies (2009–2022) to empirically assess the effects of the “National Pilot Zone for the Innovation and Development of New Generation Artificial Intelligence” on corporate environmental performance. Second, the roles of market integration and corporate green innovation are underexplored in the literature on AI's impact mechanisms; this study incorporates these dimensions to enrich the analysis of intelligence and environmental performance. Third, the study investigates the heterogeneous effects of policy-driven AI application development on corporate ecological performance across industry types and characteristics, offering targeted policy recommendations to enhance environmental outcomes. Given China's comprehensive industrial landscape—spanning traditional, high-energy sectors to emerging, green industries—the context provides a robust empirical setting for examining the nexus between AI development and corporate environmental performance. Moreover, insights from China's government-led AI development model offer valuable reference points for other countries, particularly developing economies, seeking to establish effective government-enterprise linkages to advance sustainable development.

3 Theoretical analysis

3.1 Direct impact of the AI Application Pilot Zone on enterprise environmental performance

As an advanced general-purpose technology characterized by robust data processing, intelligent analytics, and precise decision-making capabilities, artificial intelligence (AI) fundamentally enhances firms' environmental performance through the intelligent optimization of resource allocation, increased transparency and credibility in environmental information disclosure, and strengthened environmental monitoring and management.

AI is a critical factor for firms aiming to achieve and maintain a competitive edge through the optimization of production processes and enhanced resource recycling rates (Lozano et al., 2015). Within the AI Application Pilot Zone, advanced algorithms support multidimensional data acquisition and fine-grained analysis of production processes, enabling the accurate detection of high energy consumption and pollution-intensive nodes (Yang et al., 2025). This supports the intelligent management of production systems, leading to decreased resource utilization and pollutant emissions (Asha et al., 2022), thus promoting green production and enhancing environmental performance. Additionally, AI empowers firms to accurately identify and classify heterogeneous waste streams, enhancing recycling efficiency and resource recovery, and catalyzing the transition toward a circular economy (Platon et al., 2024). Drawing on externality theory, improvements in environmental performance generate positive externalities by reducing dependence on primary resources and lowering societal environmental governance costs. The adoption of AI-driven green production thus enables firms to meet societal expectations for environmental stewardship, access environmentally conscious markets, internalize positive externalities, and establish a reinforcing cycle between environmental and economic gains, thereby incentivizing continuous environmental performance improvement.

AI also plays a critical role in enhancing corporate environmental performance by improving the transparency and credibility of environmental information disclosure. Through advanced environmental monitoring systems, AI enables real-time tracking and analysis of pollutant emissions, significantly increasing regulatory efficiency and accuracy relative to conventional approaches (Mishra et al., 2019). This compels firms to proactively invest in process optimization and emissions abatement, thereby driving environmental performance gains. Furthermore, AI's advanced data analytics and predictive capabilities provide a scientific basis for environmental oversight and management. According to principal-agent theory, while owners prioritize long-term environmental sustainability, managers may focus on short-term outcomes; AI implementation delivers comprehensive and accurate environmental data, strengthening managerial oversight and aligning managerial actions with owners' environmental objectives, thus promoting more rigorous and effective environmental management.

Moreover, AI enhances firms' responsiveness to external pressures, including regulatory scrutiny and the demand for green finance. Enterprises in the AI Application Pilot Zone benefit from an intelligent information infrastructure that enables more accurate and timely environmental information disclosure, meeting regulatory requirements and public expectations. In line with signaling theory, heightened consumer environmental awareness shifts market preferences toward firms with superior environmental performance (Zhang et al., 2020), incentivizing technological innovation and improved environmental governance. This, in turn, increases firms' attractiveness to green investors, facilitating access to capital for environmental projects and technological R&D, and establishing a positive feedback mechanism. The immutable and traceable nature of AI further ensures the authenticity and reliability of environmental disclosures, mitigating greenwashing risks (Palomares et al., 2021) and supporting sustained improvements in environmental performance.

In summary, we propose Hypothesis H1: The establishment of the AI Application Pilot Zone significantly enhances firms' environmental performance.

3.2 Indirect impact of the AI Application Pilot Zone on corporate environmental performance

By advancing intelligent and green infrastructure, fostering resource and talent agglomeration, implementing digitalized and precise resource allocation, and driving policy and institutional innovation, the AI Application Pilot Zone has significantly facilitated market integration, thereby creating a conducive market environment for enterprises to improve environmental performance. Initially, the establishment of intelligent and green infrastructure within the Pilot Zone serves as a catalyst for market integration aligned with green development objectives, enhancing firms' environmental performance at its origin. Intelligent infrastructure elevates the precision and responsiveness of environmental monitoring systems (Viqueira et al., 2020), while green infrastructure fosters a supportive context for sustainable development, leading to reduced pollutant emissions. These developments also facilitate inter-firm green collaboration, lowering transaction costs in both internal environmental management and external market interactions, thus advancing market integration and corporate environmental outcomes. Secondly, the AI Application Pilot Zone drives market integration and corporate environmental performance through the aggregation of resources and digitalized allocation mechanisms. According to new economic geography theory, the spatial concentration of economic activities generates positive externalities—such as economies of scale and knowledge spillovers—that reinforce market integration. The AI Application Pilot Zone utilizes policy incentives and industrial agglomeration to attract resources and human capital, thereby fostering green collaboration and market integration through the diffusion of knowledge. Simultaneously, AI-enabled data integration and advanced analytics provide a robust scientific foundation for the efficient allocation of market resources (Haleem et al., 2022). This synergy between resource agglomeration and technological empowerment accelerates firms' green transformation, strengthens industrial chain connectivity, enhances the efficiency of market resource allocation, and drives the green evolution of the industrial ecosystem, collectively improving corporate environmental performance. Finally, policy and institutional innovation within the AI Application Pilot Zone robustly supports cross-regional capital cooperation, enabling enterprises to access and share environmental resources across regions and industries, thereby enhancing environmental performance. Market failure theory posits that environmental resource externalities persist under market mechanisms, with individual firm decisions often neglecting environmental impacts. Additionally, information asymmetry in cross-regional and cross-industry transactions impedes corporate cooperation and resource sharing (Reddy and Fabian, 2020). The AI Application Pilot Zone capitalize on policy advantages to establish unified market rules and regulatory frameworks, reducing regional and sectoral regulatory discrepancies, mitigating market transaction uncertainties, and facilitating the free flow of market factors. This not only supports cross-regional corporate expansion but also broadens access to environmental protection resources, thereby providing strong institutional support for enterprises to further improve their environmental performance.

Green innovation, a critical metric of enterprise innovation and R&D capabilities, is the primary driver of green transformation, enterprise upgrading, and enhanced environmental performance (Shi and Yang, 2022), with artificial intelligence playing a catalytic role. The establishment of the AI Application Pilot Zone cultivates a favorable innovation ecosystem for green technology collaboration, thereby enhancing environmental performance through inter-organizational synergies. Drawing on the technological innovation diffusion theory, a robust AI-enabled innovation ecosystem aggregates diverse innovation actors, facilitating the diffusion and adoption of green technologies. AI empowers firms to transcend sectoral boundaries, fostering resource sharing and cross-industry green technology transfer (Aldoseri et al., 2024), which further augments environmental performance. Simultaneously, policy instruments such as tax incentives and subsidies within the AI Application Pilot Zone expedite knowledge spillovers and technology transfer, accelerating the commercialization of green innovation (Wang H. et al., 2024), internalizing positive externalities and attenuating adverse environmental impacts. Secondly, AI facilitates departmental collaboration, unlocking enterprises' green innovation potential, and improving environmental performance through internal resource integration. The resource-based theory posits that resource heterogeneity and non-replicability are sources of competitive advantage. AI facilitates the resolution of interdepartmental technical bottlenecks, enabling efficient cross-functional collaboration and supporting green innovation (Wang et al., 2025). This intra-organizational integration fosters a distinctive green resource configuration and innovation ecosystem, strengthening sustainable green competitiveness and mitigating internal environmental externalities. Thirdly, AI-driven technological empowerment enables enterprises to scale up green innovation, leveraging economies of scale in green development. The theory of economies of scale posits that production and operational costs initially decline with scale expansion, while technological innovation and process optimization extend the cost-reduction frontier. AI algorithms allow firms to accurately identify energy- and resource-intensive nodes within production processes (Chen et al., 2025). Through targeted technological upgrading and process reengineering, firms can effectively curtail incremental costs associated with pollution abatement and resource consumption during scale expansion. Simultaneously, with AI's information mining capabilities, enterprises can assess the feasibility of large-scale application (Liu et al., 2025). This anticipatory R&D strategy reduces fixed costs, achieves marginal cost savings, and enhances environmental performance at the technological source, thereby generating synergistic economic and environmental returns.

Furthermore, market integration and corporate green innovation exhibit a pronounced synergistic effect in advancing the environmental performance of enterprises. Market integration broadens the spatial and sectoral reach of green innovation activities, enabling firms to overcome regional constraints and access a more extensive and heterogeneous customer base. As integration intensifies, firms are incentivized to increase investment in green R&D and enhance their competitive positioning by responding to diversified demand for environmentally friendly products. Concurrently, market integration facilitates access to higher-quality collaborative partners. Cross-regional and cross-industry cooperation enables firms to leverage complementary advantages and share critical innovation resources—including technology, capital, and human capital—thereby providing substantial impetus for green innovation. In turn, the diffusion of green innovation outcomes by enterprises catalyzes further market integration within the green sector. Upstream suppliers upgrade their technological capabilities to meet the demand for green inputs, while downstream distributors adapt marketing strategies to promote green products, fostering coordinated development along the value chain. This dynamic accelerates the integration of markets for green products and technologies. As a result, market integration enriches the resource base for green innovation, while the proliferation of green innovation outcomes deepens market integration in the environmental domain, establishing a self-reinforcing virtuous cycle. Within this cycle, firms continuously optimize production processes, adopt advanced eco-friendly technologies and materials, reduce pollutant emissions, and enhance resource use efficiency, thereby markedly improving environmental outcomes and achieving the dual objectives of economic growth and environmental sustainability.

To summarize, the development of the AI Application Pilot Zone enhances the environmental performance of enterprises by promoting market integration and increasing the level of green innovation within them. Based on this, we propose Hypothesis H2:

H2a: The construction of the AI Application Pilot Zone promotes the environmental performance of enterprises by improving the level of market integration;

H2b: The construction of the AI Application Pilot Zone promotes corporate environmental performance by enhancing the level of corporate green innovation.

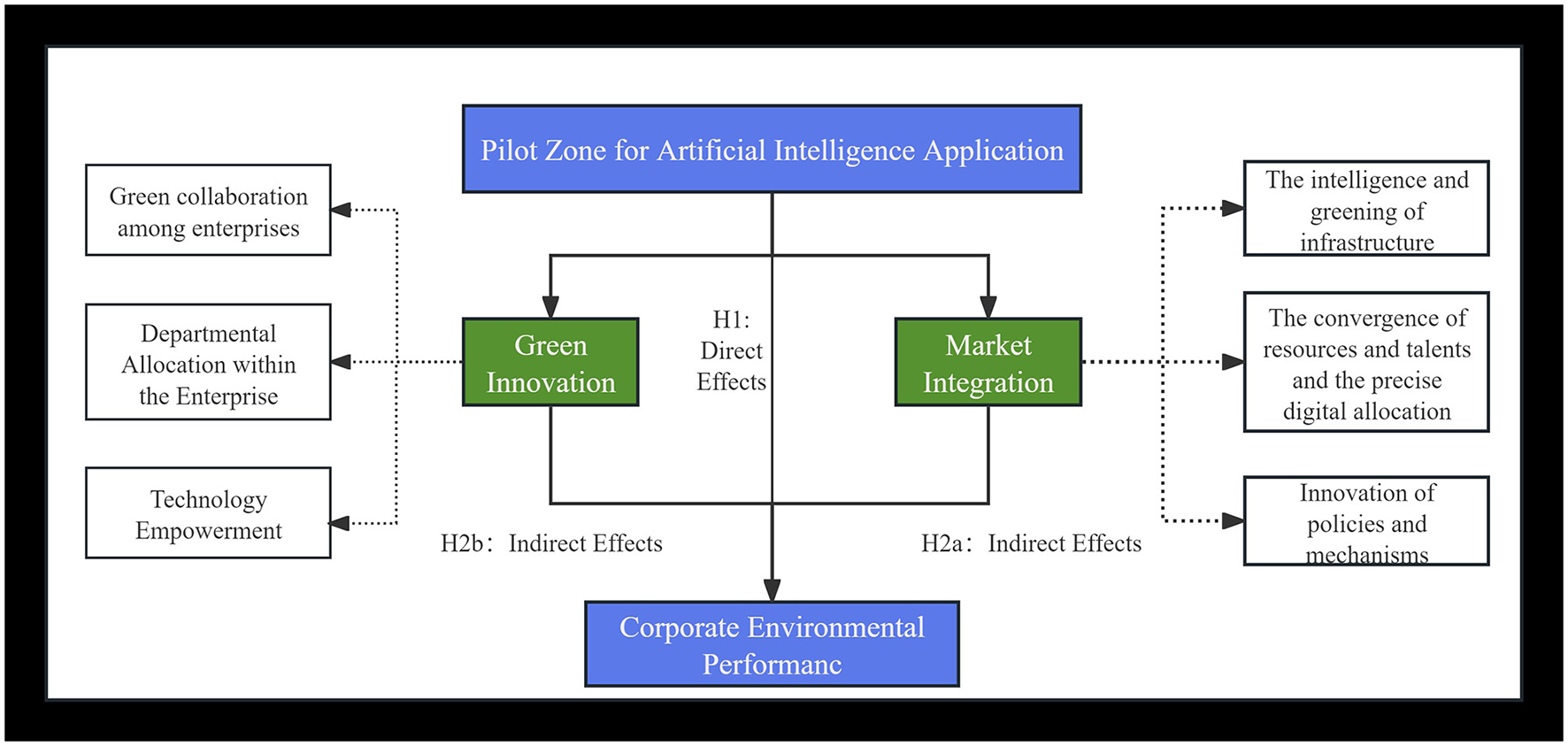

The framework of the theoretical analysis is shown in Figure 1.

Figure 1

Mechanism diagram of the impact of the AI Application Pilot Zone for Artificial Intelligence Application on the corporate environmental performance.

4 Research and design

4.1 Empirical model setting

4.1.1 Benchmark model

Theoretical analysis suggests that enterprises located in pilot and non-pilot cities may exhibit divergent environmental performance due to unobservable heterogeneity in certain systematic urban characteristics. Furthermore, the implementation of the policy—specifically, the establishment of a leading zone for artificial intelligence applications—introduces temporal variation in environmental outcomes between these two groups. The intersection of cross-sectional and temporal differences provides a robust quasi-natural experimental setting, mitigating endogeneity concerns arising from selection bias and facilitating credible identification of the policy effect. Based on this, this study constructs the following multi-period DID model:

In formula (1),i, trepresents enterprises and time. Ei, t is the environmental performance of the enterprise.AIi, t is the pilot policy of the leading area for artificial intelligence application. Controlsj, i, tis the group of control variables; j is the number of control variables; vi is used to control the micro characteristics of the enterprise that do not change over time, ut is used to control the macroeconomic factors that change over time, εi, t is the random error term, and [[Inline Image]] is the constant term. The core regression coefficient of formula (1) is β1. If β1 is significantly positive, it indicates that the construction of the leading area for artificial intelligence application can significantly improve the environmental performance of enterprises.

The AI Application Pilot Zone (AI) represents treat × post in a multi-phase DID model. The question is whether the enterprise's location falls within the Pilot Zone. If it belongs to the Pilot Zone, take 1; otherwise, take 0. The post is the time when the Pilot Zone is set up. For years of establishment and later years, take 1; otherwise, take 0. The AI Application Pilot Zone in Shanghai (Pudong New Area), Shenzhen, and Jinan-Qingdao are scheduled to be established in 2019, while those in Beijing, Tianjin (Binhai New Area), Hangzhou, Guangzhou, and Chengdu are planned for 2021. Due to the bidirectional fixed effect of the model on individuals and years, only AI was included in the model in this study, while treat and post would have introduced multicollinearity, so they were excluded from the model.

4.1.2 Mechanism model

Refer to Shang et al. (2024) to adopt the stepwise regression method for the mechanism test and build the following model based on Equation (1):

In formula (2), i, trepresents enterprises and time. Mi, t is the mechanism variable, the core explanatory variable is still the pilot policy of the pilot area of artificial intelligence application(AIi, t); other control variables are the same as those in Formula (1). The centrally observed regression coefficient of formula (2) is β2. If β1and β2 both are significantly positive, it indicates that the construction of an AI application pilot area can improve the environmental performance of enterprises Mi, t.

4.2 Index selection and measurement method

4.2.1 Explained variable: corporate environmental performance (E)

Existing studies usually measure enterprises' environmental aspects mainly by the level of ESG ratings (Sun et al., 2024; Lan and Zhou, 2024; Zhang et al., 2024). Although the ESG indicator system reflects the sustainable development level of enterprises to a certain extent, this measurement method ignores the possible differences in the environmental sub-indicators within ESG of enterprises with the same rating, resulting in biases in the estimation results. Considering that currently, China has not established a unified enterprise-level environmental indicator system covering the whole country, in order to achieve a more accurate assessment of enterprises' environmental performance and avoid the above-mentioned potential biases, this study only includes the environmental sub-indicators in ESG within the scope of the research. Based on the availability of the data, this study uses Hua Zheng ESG rating data to measure the environmental performance of enterprises according to their environmental scores of listed companies (out of 100), with higher scores indicating better environmental performance of listed companies.

4.2.2 Explanatory variables: pilot policy of the AI Application Pilot Zone (AI)

The core explanatory variable of this study is the pilot policy of the leading area for the AI Application Pilot Zone (AI). Since the environmental performance of an enterprise is an inherent attribute in the production and operation process of the enterprise, if relevant indicators at the enterprise level are used to measure the degree of intelligent application of the enterprise, there is a high probability of endogeneity problems. This makes it difficult for us to clearly define the causal relationship between the development of artificial intelligence and the environmental performance of enterprises. The pilot policy of the leading area for artificial intelligence application is an externally imposed influence and has no direct connection with the enterprise's operation. Therefore, including the pilot policy of the leading area in the scope of the study can effectively weaken the possible endogeneity problems in the model and provide a more solid and reliable basis for an in-depth exploration of the relationship between the development of artificial intelligence and the environmental performance of enterprises.

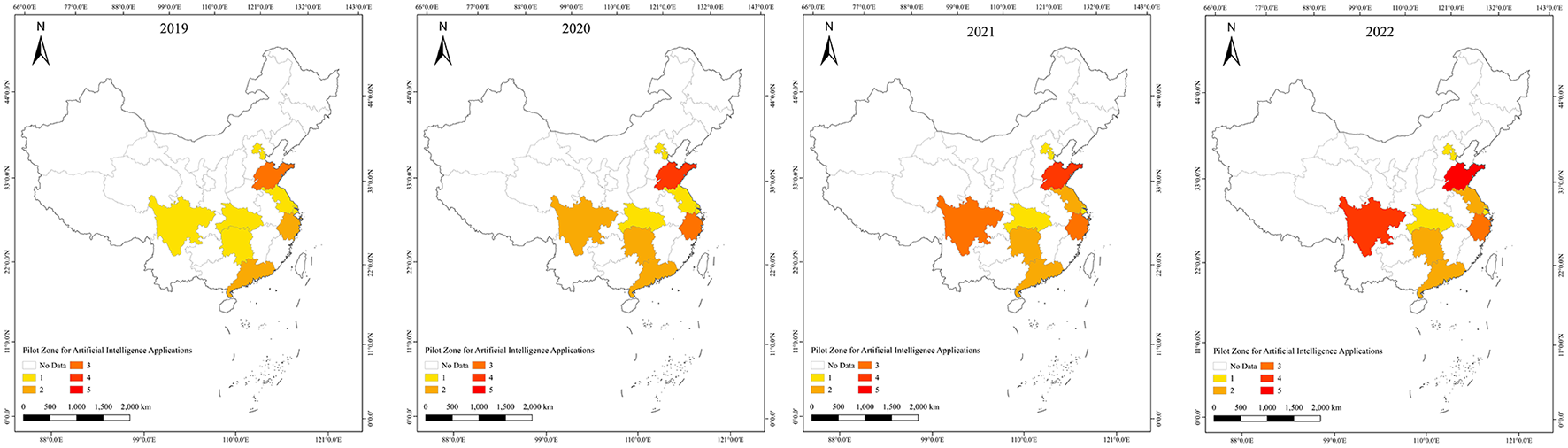

The distribution of the AI Application Pilot Zone for Artificial Intelligence Application is shown in Figure 2.

Figure 2

Distribution Map of the AI Application Pilot Zone for Artificial Intelligence Application. The administrative region data in this map is made based on the map review number GS(2024) 0650, and the base map data has not been modified.

4.2.3 Control variables

Corporate environmental performance is affected by A variety of factors. Regarding existing studies, This study introduces control variables covering both the enterprise and city aspects to avoid the potential impacts that these influencing factors may have on the research. At the enterprise level, the following variables are controlled: enterprise Size, Ownership concentration (TOP1), Growth, Return on equity (ROE), Total assets turnover (ATO), and company age (List Age).

The city-level control variables employed in the analysis include: (1) Economic development level (Pgdp), which serves as a proxy for municipal economic capacity and is intrinsically linked to environmental protection expenditure, policy resource allocation, and technological absorptive capacity (Ganda, 2020). Incorporating this variable mitigates potential endogeneity by disentangling the effects of economic growth from those attributable to artificial intelligence. (2) Industrial structure (Is), operationalized as the proportion of secondary industry in GDP, captures the sectoral composition of economic activity. Given that secondary industry constitutes the principal source of industrial emissions and represents a critical domain for AI deployment, its share directly influences both environmental load and the potential for technological synergy (Popescu et al., 2024). Controlling for industrial structure addresses confounding from baseline pollution intensity, thereby facilitating a more precise estimation of AI's causal impact on corporate environmental performance and enhancing the robustness of empirical results.

The detailed descriptions of specific variables are provided in Supplementary material.

4.3 Sample selection and descriptive statistics of variables

Considering the availability and timeliness of the data, this study selects relevant data from Chinese A-share listed companies from 2009 to 2022. To ensure the reliability of the research results, listed companies, including those with PT, ST, and *ST designations, as well as those in the financial and real estate sectors and listed companies with severely missing relevant data, are excluded from the data. After preprocessing, a total of 38,677 firm-year observations are finally obtained. The environmental performance data, which is the score of the environmental sub-indicators in the Huazheng ESG rating data, is sourced from the Shangdao Ronglv database. The enterprise-level data are from CSMAR, while the city-level data are from the China Statistical Yearbook. Other data are obtained from the Wind database.

Table 1 shows the descriptive statistics of the main variables. Among them, the mean and standard deviation of corporate environmental performance (E) are 60.516 and 7.295, respectively, indicating that there are specific differences in environmental performance among listed companies. The mean and standard deviation of AI pilot policies (AI) are 0.181 and 0.385, indicating that 18.1% of companies are located in the pilot cities of AI Pilot Zones during the sample period.

Table 1

| Variable | N | Mean | SD | Min | Median | Max |

|---|---|---|---|---|---|---|

| E | 38,677 | 60.516 | 7.295 | 29.46 | 60.33 | 95.16 |

| AI | 38,677 | 0.181 | 0.385 | 0 | 0 | 1 |

| Size | 38,677 | 22.16 | 1.333 | 14.942 | 21.954 | 28.636 |

| Roe | 38,677 | 0.065 | 0.218 | −14.819 | 0.077 | 2.379 |

| Ato | 38,677 | 0.666 | 0.542 | −0.048 | 0.558 | 12.373 |

| Growth | 38,677 | 4.214 | 688.899 | −1.309 | 0.109 | 134607.09 |

| Top 1 | 38,677 | 0.345 | 0.151 | 0.003 | 0.323 | 0.9 |

| Listage | 38,677 | 1.999 | 0.966 | 0 | 2.197 | 3.497 |

| Is | 38,677 | 6.947 | 1.317 | 0 | 6.868 | 9.426 |

| Pgdp | 38,677 | 6.566 | 3.833 | 0 | 6 | 26 |

Describes statistical variables.

5 Empirical results analysis

5.1 Benchmark regression results

The benchmark regression results of the impact of the construction of the AI Application Pilot Zone on the environmental performance of enterprises are shown in Table 2. Among them, the regression results without control variables and with control variables are shown in Column (1) and Column (2), respectively. The regression coefficients of AI are 1.194 and 1.271, respectively, both of which have passed the significance test at the 1% level, confirming that the construction of the leading area has a positive effect on improving the environmental performance of enterprises. The reason for this is that the construction of the AI Application Pilot Zone is conducive to enterprises' continuous improvement of the sharing mechanism, promoting the aggregation of high-level talents, projects and other resources, enabling enterprises to continuously enhance their environmental performance and facilitating the green transformation of enterprises. In conclusion, Hypothesis H1 of this study is verified.

Table 2

| Variable | (1) | (2) |

|---|---|---|

| E | E | |

| AI | 1.194*** (0.177) | 1.271*** (0.180) |

| Size | 1.046*** (0.106) | |

| Roe | −0.378*** (0.144) | |

| Ato | −0.022 (0.155) | |

| Growth | −0.001*** (0.000) | |

| Top1 | −1.234* (0.712) | |

| Listing | −1.611*** (0.134) | |

| Is | 0.110*** (0.041) | |

| Pgdp | −0.014 (0.034) | |

| Constant | 57.903*** (0.144) | 37.674*** (2.241) |

| Time fixed effect | YES | YES |

| Industry fixed effect | YES | YES |

| N | 3,8677 | 38,677 |

| R 2 | 0.076 | 0.087 |

Baseline regression results.

With *, ** and *** denoting significance at the 10%, 5%, and 1% levels, respectively.

5.2 Robustness tests

To verify the robustness of the core conclusion that “the construction of the AI Application Pilot Zone has a positive effect on improving enterprise environmental performance,” this study conducted robustness tests from multiple dimensions, including parallel trend tests, placebo tests, and Heckman's two-stage estimation.

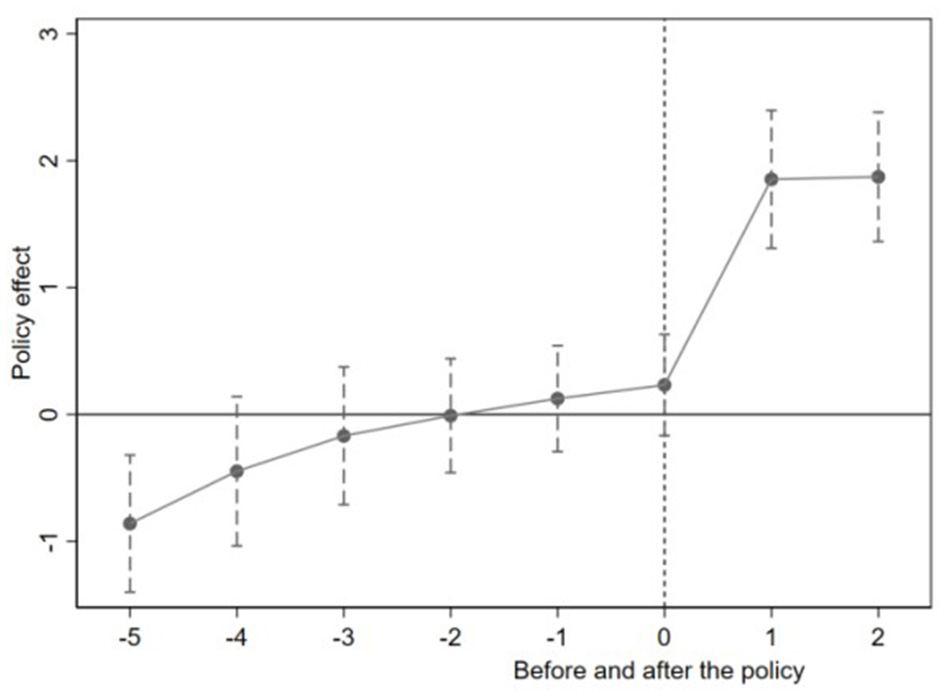

5.2.1 Parallel trend test

In this study, the listed enterprises located in the AI Application Pilot Zone and those not located in the Pilot Zone are tested for parallel trends, and the test results are shown in Figure 3. Before the implementation of the policy, the policy effect fluctuated around 0, with a small amplitude of fluctuation, indicating that there was no significant systemic difference in the environmental performance between the treatment group and the control group without policy intervention. This suggests that the premise of the parallel trend hypothesis was satisfied. Following the implementation of the policy, its effect increased significantly. It remained at a high level, and the confidence interval did not contain 0, indicating that the construction of the AI Application Pilot Zone had a significant positive impact on the environmental performance of listed enterprises, that is, after the implementation of the policy, the environmental performance of enterprises in the treatment group was significantly improved compared with that of the control group. Overall, the application of the differential model to assess the impact of the AI Application Pilot Zone construction on the environmental performance of listed companies supports the parallel trend hypothesis.

Figure 3

Parallel trend test.

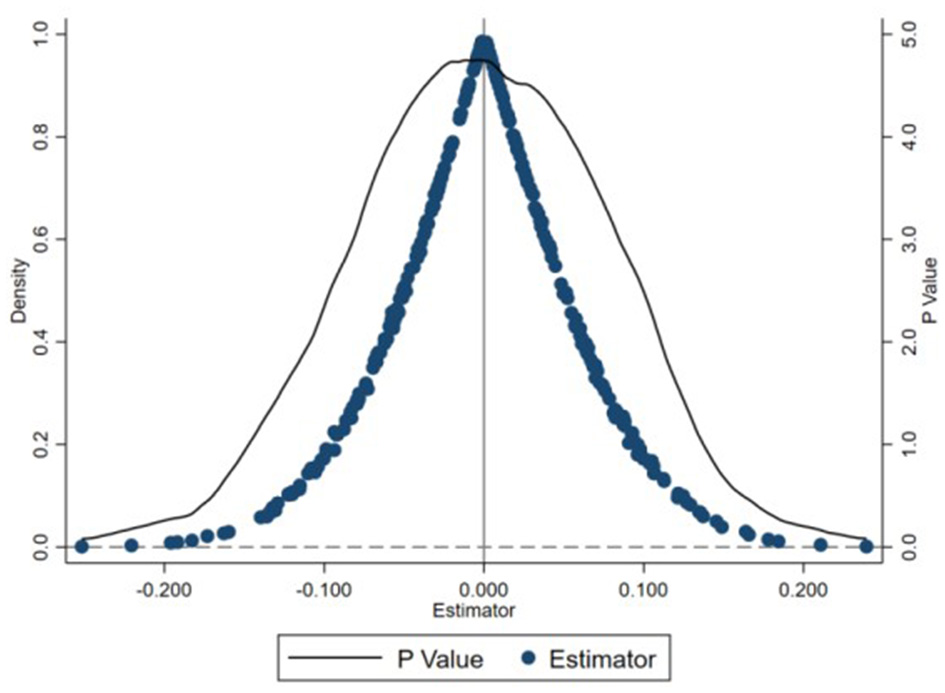

5.2.2 Placebo test

Referring to the research method of Chetty et al. (2009), we conduct individual placebo tests by randomly assigning pilot regions of the AI Application Pilot Zone. This approach enables us to rigorously assess whether the observed treatment effects are genuine or attributable to random variation. In other words, the objective is to ascertain whether the association between artificial intelligence development and corporate environmental performance identified in the baseline regression is attributable to the AI Application Pilot Zone intervention, rather than confounded by latent, unobservable factors beyond our control. Suppose in the individual placebo test, the estimated coefficient of the generated false interaction term has no significant difference from 0. In that case, it indicates that the effect observed in the benchmark regression is relatively reliable and is not a spurious relationship caused by unobservable factors. The test results are shown in Figure 4. During the random process, the mean values of the regression coefficients all approach 0, proving that the improvement effect of the development of artificial intelligence on the environmental performance of enterprises observed in the benchmark regression is relatively reliable and is not caused by unobservable factors. This means that the conclusion of this study has a certain degree of robustness.

Figure 4

Placebo test.

5.2.3 Replace explained variables

According to extant studies (Sang et al., 2024; Ding et al., 2022), ESG, as a crucial metric of a firm's overall performance in environmental, social, and governance dimensions, its score can effectively reflect a company's efforts and achievements in sustainable development, while the corporate environmental information disclosure index focuses on presenting a company's environmental situation from the perspective of information disclosure. To some extent, it also reflects the degree to which an enterprise values and fulfills its environmental responsibilities. Based on this, the study employs the environmental information disclosure quality index (EIDQ) to replace the explained variables in order to test the robustness of the baseline regression results, selecting corporate ESG score data (ESG) and corporate environmental disclosure. The enterprise environmental disclosure index refers to the methodology of Li et al. (2021), and utilizes the environmental research database in the CSMAR database to classify enterprises' disclosures of environmental information based on whether they are monetized or not. Subsequently, the scores of specific items for monetizable environmental information were summed and logarithmically processed to obtain EIDQ, and the regression analysis results are presented in Table 3. The results in columns (1) to (2) demonstrate that after replacing the explained variable, the regression coefficient of AI remains positive and has passed the significance test at a minimum of the 5% level, indicating a positive promoting effect on the enterprise's environmental performance. Therefore, the findings of this study are upheld following the test of replacing the explained variable.

Table 3

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| ESG | EIDQ | E | E | E | E | |

| AI | 0.800*** (0.127) | 0.038** (0.017) | 0.875*** (0.196) | 1.766*** (0.095) | ||

| RIL | 0.003*** (0.000) | |||||

| IIL | 1.187** (0.535) | |||||

| Control variables | YES | YES | YES | YES | YES | YES |

| Year fixed effects | YES | YES | YES | YES | YES | YES |

| Industry fixed effects | YES | YES | YES | YES | YES | YES |

| N | 38,677 | 38,677 | 38,677 | 38,677 | 24,030 | 38,677 |

| R 2 | 0.035 | 0.029 | 0.086 | 0.057 | 0.059 | 0.037 |

Robustness test 1.

With *, ** and *** denoting significance at the 10%, 5%, and 1% levels, respectively.

5.2.4 Replacing the core explanatory variable

Consider the contingent effect of the policy being too short. Because the pilot policy in the AI Application Pilot Zone has been implemented for a short period, there may be a problem of contingency in the research results. To this end, this study uses the number of regional AI enterprises as an indicator to replace the regional level of artificial intelligence (RLI), and the level of intelligent investment by enterprises to replace the artificial intelligence level at the enterprise level (IIL), Among them, the IIL refers to the method of Yu et al. (2020). According to the account names of fixed assets and intangible assets and the amount of each asset in the notes to the financial reports of the listed companies, the amount of intangible asset investment and fixed asset investment related to artificial intelligence of enterprises was sorted out, and then the level of intelligent investment was measured by the proportion of the combined amount of the two to the total annual assets of enterprises. The results are shown in Table 3 results. The results in columns (3) to (4) show that, after replacing the core explanatory variable, the regression coefficient is positive at the significance level of 1%. Therefore, the results of this study still hold after the test of replacing the core explanatory variable.

5.2.5 Change the sample observation period

Since the first batch of the AI Application Pilot Zone was established in 2019, to enhance the credibility of the research results, the sample period was narrowed, with the scope limited to 2017–2021, ensuring a relatively balanced period before and after the policy implementation. The results of regression analysis are shown in Table 3. The results in column (3) show that the regression coefficient remains significantly positive even after the sample period is shortened. Therefore, the research results of this study remain valid even after the sample observation period is altered.

5.2.6 Propensity score matching (PSM-DID)

Factors at the regional level may influence the establishment of the AI Application Pilot Zone. For example, the more intelligent the manufacturing sector, the greater the probability of being approved as the AI Application Pilot Zone, which may lead to a selection bias in the sample. To solve this problem, this study uses the propensity score matching method, selects all control variables in the model (1) as matching variables, and selects listed enterprises with the most suitable characteristics for enterprises in the Pilot Zone and matches them in the non-Pilot Zone with the help of the nearest neighbor matching method of “one with three and no return.” The successfully matched samples were set as the control group, and then model (1) was used to conduct regression analysis. The results of the regression analysis are presented in Column (4) of Table 3. The regression coefficient of the results is still positive at the 1% significance level, which also supports the research conclusion of this study.

5.2.7 Heckman two-stage method

Heckman's two-stage method can better solve the endogeneity problem caused by sample selection bias. In this study, the level of human capital in the region, measured numerically by the number of ordinary college students, is selected as the explained variable in the first stage. The level of human capital in the locality is also a key variable. As a crucial support for regional innovation capacity and economic development, human capital has a profound impact on the growth and development of enterprises. The level of regional human capital will affect the acquisition of high-quality talent by enterprises and subsequently impact the technological innovation ability and environmental management strategy of enterprises. In sample selection, the difference in human capital levels between regions may lead to some enterprises being over- or under-selected, resulting in endogenous problems. By including it in the analysis, various factors in the sample selection process can be considered more comprehensively, thereby correcting sample selection bias and improving the study's accuracy.

To further assess the instrumental variable's applicability, this study conducts additional tests on the selected instrumental variable (IV) for correlation and exogeneity. Initially, the instrumental variable IV (F = 80.02, p < 0.001) exhibited a significant correlation with the endogenous variable, thus satisfying the correlation requirement. Subsequently, the exogeneity constraint of instrumental variable IV was validated (F = 0.29, p > 0.1), suggesting that its direct impact on the dependent variable was statistically insignificant. Lastly, instrumental variable IV passed the identification underestimation test (Kleibergen-Paap LM p < 0.001) and the weak instrument test (Cragg-Donald F = 707.42), which substantially exceeded the F-value at the 10% significance level (16.38), indicating a significant correlation between the instrumental variable and the endogenous variable. Weak instrument robust inference further supports the significant effect of endogenous variables on the dependent variable (Anderson-Rubin p < 0.05). Detailed test results are available in Supplementary material.

The specific process is as follows: In the first stage, the above variables are treated as explanatory variables, and all control variables from the benchmark regression model are added to construct the Probit model. Then, the inverse Mills ratio (IMR) is calculated. In the second stage, IMR was used as the control variable and added to the benchmark model for regression analysis. The regression results are presented in column (1) of Table 4. The results show that the regression coefficient after adjusting for sample selection bias is still positive and has passed the significance test at the 1% level, further confirming the reliability of the conclusions of this study.

Table 4

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| E | E | E | E | E | |

| Chat | 5.018*** (0.206) | ||||

| L1.AI | 1.482*** (0.219) | ||||

| L2.AI | 1.782*** (0.299) | ||||

| AI | 1.153*** (0.430) | 1.257*** (0.188) | |||

| Control variables | YES | YES | YES | YES | YES |

| Year fixed effects | YES | YES | YES | YES | YES |

| Industry fixed effects | YES | YES | YES | YES | YES |

| N | 38,677 | 32,322 | 28,079 | 14,371 | 37,196 |

| R 2 | 0.696 | 0.104 | 0.085 | 0.067 | 0.087 |

Robustness test 2.

With *, ** and *** denoting significance at the 10%, 5%, and 1% levels, respectively.

5.2.8 Counterfact test

In the parallel trend test, it is found that there is a lag effect of policies. Based on this, to thoroughly explore the robustness of regression results and accurately assess the specific characteristics of policy lag, this study employs a counterfactual test with policy variables lagged by 1 period and 2 periods, respectively. Specifically, in constructing the regression model, the policy variables representing the AI Application Pilot Zone were treated with corresponding lags of 1 and 2 periods in the time dimension. The results are presented in columns (2) and (3) of Table 4. The regression coefficients after one and two periods of lag are 1.482 and 1.782, respectively, which is still positive at the significance level of 1%, indicating that the influence of the policy factor of the construction of the AI Application Pilot Zone on the environmental performance of enterprises is not immediate, but has a noticeable lag effect. At the same time, with the increase in the number of lagging periods, the regression coefficient becomes more extensive, meaning that the policy's promoting effect on the environmental performance of enterprises will be gradually released over time in a certain period after its implementation.

5.2.9 Exclude the effects of other policies

In order to verify the robustness of the model, sub-samples of concurrent policies such as carbon emissions trading pilots, new energy demonstration cities, and smart city pilots were excluded for model estimation, and the results are shown in column (4) of Table 4. Controlling other variables unchanged, the regression coefficient is 1.153, which is still positive at the significance level of 1%, indicating that after excluding the interference of other policies, the policy of the artificial intelligence application Pilot Zone still has a significant positive impact on the environmental performance of enterprises, further confirming the reliability of the conclusions of this study.

5.2.10 Control the impact of the surrounding city

Considering that corporate environmental performance may be influenced by policy diffusion, factor flows and competitive effects in the surrounding cities, in order to further enhance the robustness of the research conclusions, the surrounding cities of the pilot cities were included as control variables in this study. Specifically, if the surrounding city i of j where the enterprise is located belongs to the AI Application Pilot Zone, treat takes 1; otherwise, it takes 0. post is the time when the Pilot Zone was established, taking 1 for the year of establishment and 0 for subsequent years, then generating a dummy variable of the interaction term between whether the surrounding city is a pilot area and the time when the Pilot Zone was established, and incorporating it into the model for regression, which can simultaneously capture the dynamic comprehensive impact of the surrounding city on the enterprise's environmental performance. Avoid the policy spatio-temporal effects that may be missed by single-variable control. The results are shown in column (5) of Table 4. The estimated coefficient is 1.257 and remains statistically significant at the 1% level, demonstrating that the AI Application Pilot Zone exerts a robust and significant positive impact on firm-level environmental performance, even after accounting for potential spatial spillover effects from adjacent cities. This finding further substantiates the robustness of our results.

5.3 Mechanism test

According to the above theoretical analysis, under the current pattern of economic development driven by science and technology and the pursuit of sustainable development, the level of market integration, as an effective tool to break the information barrier, has become one of the channels for the construction of the AI Application Pilot Zone to affect the environmental performance of enterprises. At the same time, the level of corporate green innovation, as a core element of sustainable enterprise development, also continues to enhance environmental performance. Therefore, referencing the methodology of Ahammad et al. (2017), uses the number of off-site subsidiaries of listed enterprises in the first year (the natural logarithm of the number of participating holding companies established in non-registered cities with a shareholding ratio of more than 50% plus 1) to measure the level of enterprises' off-site investment and the degree of market integration of enterprises (TIi, j). At the same time, market integration is assessed using the price method, which employs the price differential between cities, in accordance with the methodology of Hu and Ma (2023). By calculating the reciprocal of the market segmentation index to obtain the market integration degree of the city (PBMi, t), that is:

R i, j represents the relative price between cities, λ represents the mean of relative prices.

Leveraging the complementarity between innovation tiers, green invention patents serve as proxies for a firm's core green innovation capability, whereas green utility model patents indicate the effectiveness of technological commercialization. The combined use of these metrics facilitates a holistic assessment of the entire “R&D–application” continuum in evaluating corporate green innovation performance (Du et al., 2023). Therefore, we select the number of green practical invention patents(GINi, j) and the total number of green invention patents of listed enterprises(AINi, j) represents the level of green innovation among enterprises.

Substitute TIi, j ?PBMi, tinto Equation (2), and the results are shown in Table 5. The regression results in columns (1) to (2) show that compared with the results of baseline regression, the coefficients of AI are all significantly positive, 1.574 and 1.315, respectively, and are all significant, at least based on 10%, which supports the theoretical mechanism analysis of this study and indicates that the construction of the AI Application Pilot Zone further accelerates the process of market integration—enabling enterprises to improve their environmental performance. Therefore. Research hypothesis H2a verified.

Table 5

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| TI | PBM | GIN | AIN | |

| AI | 1.574* (0.825) | 1.315*** (0.062) | 0.164*** (0.021) | 0.147*** (0.021) |

| Control variables | YES | YES | YES | YES |

| Year fixed effects | YES | YES | YES | YES |

| Industry fixed effects | YES | YES | YES | YES |

| N | 38,677 | 38,677 | 38,677 | 38,677 |

| R 2 | 0.138 | 0.430 | 0.629 | 0.647 |

Mechanism tests.

With *, ** and *** denoting significance at the 10%, 5%, and 1% levels, respectively.

Substitute GINi, j?AINi, jinto Equation (2), and the results are shown in Equations (3) and (4) of Table 5. Compared with the results of baseline regression, the regression coefficients of AI in column (3) and column (4) are significantly positive and pass the 1% significance level test, which validates the theoretical mechanism analysis of this study and indicates that under the promotion of pilot policies in the AI Application Pilot Zone, enterprises can improve their environmental performance by improving the level of corporate green innovation. Therefore, the research hypothesis H2b has been verified.

6 Analysis: heterogeneity analysis

Prior empirical analyses have consistently indicated that the implementation of the AI Application Pilot Zone substantially improves firms' environmental performance metrics. However, it has not been proven whether there are differences in the effects of this construction among different types of enterprises. Therefore, this study will categorize enterprises based on two dimensions —industry type and industrial nature —and conduct heterogeneity tests.

6.1 Differences in industry types

When exploring the impact of the AI Application Pilot Zone on the environmental performance of enterprises, the heterogeneity of industry types cannot be ignored. Due to the particularity of their industry types, heavily polluting enterprises may face environmental policies of different intensities compared with other enterprises. This makes the impact of the pilot policy of the AI Application Pilot Zone on the environmental performance of enterprises in heavily polluting industries likely to be different from that of non-heavily polluting enterprises. In order to deeply verify whether there is heterogeneity in the impact of the AI Application Pilot Zone on the environmental performance of enterprises among industries, This study is mainly based on the classification and Management List of Listed Companies' Environmental Protection Verification Industry formulated by the Ministry of Environmental Protection of China in 2008, the Guidelines for Environmental Information Disclosure of Listed Companies and the Guidelines for Listed Companies' Classification of Industry revised by the China Securities Regulatory Commission in 2012 to divide heavily polluting industries and non-heavily polluting industries. The results are shown in Columns (1) and (2) of Table 6. The specific classification is placed in Supplementary material.

Table 6

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Polluting | Cleaning | Capital-intensive | Technology-intensive | Labor-intensive | |

| E | E | E | E | E | |

| AI | 0.815** (0.345) | 1.321*** (0.186) | 1.084*** (0.400) | 1.145*** (0.272) | 1.141*** (0.306) |

| Control variables | YES | YES | YES | YES | YES |

| Year fixed effects | YES | YES | YES | YES | YES |

| Industry fixed effects | YES | YES | YES | YES | YES |

| N | 12,164 | 34,156 | 6,682 | 17,317 | 12,819 |

| R 2 | 0.072 | 0.085 | 0.083 | 0.064 | 0.117 |

Heterogeneity test.

With *, ** and *** denoting significance at the 10%, 5%, and 1% levels, respectively.

As can be seen from Columns (1) and (2) of Table 6, the regression coefficients of the construction of the AI Application Pilot Zone on the environmental performance of enterprises of different industry types are all significantly positive, indicating that the construction of the AI Application Pilot Zone has a promoting effect on the environmental performance of enterprises of both industry types. However, both the regression coefficient and the significance level of heavily polluting industries are lower than those of non-heavily polluting industries. On the one hand, heavily polluting industries have been under pressure from stringent environmental regulations for a long time. On the road to green transformation and upgrading, it is crucial to enhance competitiveness through significant technological advancements, thereby reducing production costs and emission reduction costs. The technical resources and policy support provided by the AI Application Pilot Zone is crucial for polluting industries and has vigorously promoted the improvement of their environmental performance.

On the other hand, compared with heavily polluting industries, non-heavily polluting industries face lighter environmental regulations, and the environmental governance costs they need to bear are also relatively lower. Seemingly, the pilot policy of the AI Application Pilot Zone has a weaker inducing factor for improving their environmental performance. However, the non-heavy pollution industry itself has a good foundation, strong acceptance and adaptability to new technologies and policies, and the policy support and technical resources in the Pilot Zone provide it with a broader space for development, enabling it to more quickly translate these advantages into improved environmental performance, thus showing a higher coefficient and significance.

6.2 Differences in industrial nature

Industry heterogeneity constitutes a critical dimension in evaluating the effects of the AI Application Pilot Zone on firms' environmental performance. Distinct industrial characteristics—such as capital intensity, labor intensity, and technology intensity—entail divergent production processes, resource dependencies, and capacities for technological adoption, which may result in differential policy impacts across sectors. Accordingly, this study implements subgroup analyses based on industrial classification to rigorously assess the heterogeneous effects of the AI Application Pilot Zone on corporate environmental performance across various industry types. Therefore, in this study, enterprises were categorized and analyzed according to the 2012 industry classification standards of the China Securities Regulatory Commission to investigate the impact of artificial intelligence application Pilot Zone construction on the environmental performance of enterprises across various industries. The specific classification types are detailed in Supplementary material.

From columns (3) to (5) of Table 6, it can be seen that the regression coefficients of the construction of the pilot area for the application of artificial intelligence in capital-intensive, labor intensive and technology-intensive industries are all significantly positive, indicating that the construction of the AI Application Pilot Zone has significantly improved the environmental performance of enterprises in the capital intensive, labor intensive and technology-intensive industries. However, the regression coefficients of the three industries reveal the characteristics of capital-intensive, labor-intensive, and technology-intensive industries. The reasons may be as follows: Firstly, in capital-intensive industries, their production processes are highly dependent on large-scale capital investment for the purchase of advanced equipment and facilities, and the replacement cost of these assets is high. Although the construction of the AI Application Pilot Zone can provide specific technical resources and policy support, due to the characteristics of the industry, it is difficult for enterprises to adjust and optimize the existing capital-intensive production system on a large scale in a short period to absorb and apply new technologies to improve environmental performance fully. Therefore, although policies have a positive impact on their environmental performance, the extent of improvement is relatively limited. Second, for labor-intensive industries, labor costs account for a relatively large proportion of total costs, and production processes are relatively flexible. When the industry is faced with the technical and policy support provided by the AI Application Pilot Zone, it can quickly make local adjustments to the production process, improve production efficiency, reduce resource waste, and enhance its environmental performance by introducing relatively simple intelligent technologies or management methods. Compared to capital-intensive industries, labor-intensive industries have lower adjustment costs, a faster response to policy changes and technological advancements, and more rapid improvements in corporate environmental performance. Finally, technology-intensive industries themselves view technological innovation and application as their core competitiveness, possess intense research and development capabilities in technology, and are highly sensitive to and receptive to new technologies. The technical infrastructure and policy incentives offered by the AI Application Pilot Zone align closely with the developmental requirements of technology-intensive sectors, effectively catalyzing firms' innovation capacity and facilitating advancements in the research, development, and deployment of green technologies. This, in turn, leads to substantial enhancements in firms' environmental performance. Consequently, enterprises within technology-intensive industries exhibit relatively greater improvements in environmental outcomes attributable to the implementation of pilot policies in the AI Application Pilot Zone.

7 Conclusions and discussions

This study uses the exogenous shock of the pilot policy ofthe AI Application Pilot Zone and, based on the multi-period difference-in-differences method (DID), explores the impact effect and the action mechanism of the development of artificial intelligence on the environmental performance of enterprises. The study finds that the development of artificial intelligence has a significant promoting effect on the environmental performance of enterprises, and this conclusion has been verified through a series of robustness tests. At the same time, The mechanism test demonstrates that constructing the AI Application Pilot Zone enables enterprises to enhance their green innovation level while promoting the efficient circulation of resources and the precise matching of supply and demand. This, in turn, facilitates market integration, thereby improving the environmental performance of enterprises. This synergistic mechanism of government guidance, market promotion and enterprise efforts provides a new way to understand and improve corporate environmental performance. The further heterogeneity test reveals that the impact of constructing the AI Application Pilot Zone on the environmental performance of enterprises is more pronounced in non-heavy-polluting industries. From the industry perspective, the degree of impact shows a distinct gradient difference among different industry types, as follows: capital-intensive industries are the most affected, followed by labor-intensive industries, and technology-intensive industries are the least affected.

Based on the above conclusions, the following suggestions are put forward: First, at the enterprise level, formulate industry-specific strategies. Develop differentiated AI application development strategies for various industry types. For capital-intensive industries, the government should establish dedicated artificial intelligence research and development funds, specifying fund details, requiring enterprises to submit application proposals, and establishing demonstration projects. For labor-intensive industries, jointly develop training courses with professional institutions, subsidizing expenses, and establishing service teams to provide supply chain optimization solutions. For technology-intensive industries, establish incentive mechanisms for industry-university-research collaborations and host innovation forums. Considering industry-specific pollution characteristics, implement differentiated subsidies for heavily polluting industries. For enterprises meeting environmental protection standards, establish green channels for land use, project approval, etc., to encourage the adoption of clean production technologies. Organize enterprises in heavily polluting industries to collaborate with research institutions to develop new pollution control technologies. Simultaneously, encourage enterprises in non-polluting industries to form environmental alliances to share environmental resources and expertise. Encourage leading enterprises in heavily polluting industries to drive their upstream and downstream counterparts to jointly control pollution and enhance the overall environmental protection standards of the industry. Second, at the market level, to promote market integration and resource circulation, the government can collaborate with big data enterprises and research institutions to establish regional data-sharing platforms, develop unified standards and security protocols, and ensure data circulation security. Establish a dedicated artificial intelligence market supervision group to conduct regular inspections and evaluations, promptly correct irregularities, and maintain market order. Furthermore, formulate a long-term development plan for AI technology in the market circulation field, clarifying goals and tasks at different stages, guiding enterprises and social capital to invest rationally, promoting continuous innovation and application of AI technology, and assisting enterprises in improving environmental performance and achieving sustainable development.

While actively exploring the role of AI in enhancing the environmental performance of enterprises, it is imperative to acknowledge the inherent risks within the sustainability context. Regarding data privacy, AI's reliance on extensive datasets, if inadequately managed by enterprises, can result in user privacy breaches. Algorithmic bias presents an equally significant concern. AI algorithms trained on biased historical data may yield inequitable outcomes in decisions such as resource allocation and environmental assessments, thereby exacerbating uneven distribution. Consequently, when enterprises implement AI to improve environmental performance, they must establish robust risk management systems, conduct regular algorithm evaluations and revisions, and fortify measures to mitigate potential AI-related hazards. Furthermore, governmental bodies should institute policies, regulations, and industry standards to guide enterprises in the safe and sustainable utilization of AI technology, thereby achieving a balance between environmental performance enhancement and risk mitigation.

Finally, despite the attainment of certain findings through theoretical and empirical analyses, offering a novel perspective on understanding and improving the environmental performance of enterprises, this study is subject to limitations stemming from subjective and objective factors, including the authors' expertise and data acquisition constraints. Future research can be expanded from the following perspectives. First, the present analysis focuses exclusively on the exogenous shock introduced by the establishment of the AI Application Pilot Zone, without systematically accounting for the potential confounding or interactive effects of other relevant policy instruments—such as environmental subsidy schemes and carbon emissions trading mechanisms—when implemented alongside AI-related policies. Second, although this study rigorously investigates the micro-level impacts and transmission channels of the AI Application Pilot Zone on firm-level environmental outcomes, it does not extend to a comprehensive assessment of macro-level effects on urban environmental quality, which warrants further exploration.

Furthermore, concerning the research sample, diverse national and regional policies govern the intersection of AI development and sustainable development. The EU's 2019 Green Deal exemplifies this, aiming for a sustainable economic transition through environmental policies. The United States' 2022 Chips and Science Act prioritizes domestic chip industry competitiveness, while the UK's March 2023 white paper, “Regulatory Approach to Promoting Innovation in AI,” demonstrates a flexible AI regulatory framework. These approaches diverge from China's government-enterprise interaction model for AI promotion. Due to data limitations from other developed and developing nations, the empirical analysis did not include a cross-national comparative analysis or fully assess the heterogeneous impacts of AI on corporate environmental performance across different policy environments, thereby limiting the generalizability of the findings. Future research will focus on improving research capabilities, refining policy effect assessments, expanding the sample, acquiring data from a broader range of countries and regions, and conducting cross-national comparative analyses to comprehensively understand the impact of AI policies on corporate environmental performance, thus addressing the current research's generalizability limitations.

Statements

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JZ: Writing – review & editing, Writing – original draft. JH: Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

We are deeply grateful to the teachers and classmates who offered their opinions during the course of this research work, as well as to the organizations that provided convenient conditions.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frevc.2025.1607149/full#supplementary-material

References

1

Acemoglu D. Restrepo P. (2018). The race between man and machine: implications of technology for growth, factor shares, and employment. Am. Econ. Rev.108, 1488–1542. 10.1257/aer.20160696

2

Agrawal A. Gans J. Goldfarb A. (2022). Prediction Machines, Updated and Expanded: The Simple Economics of Artificial Intelligence. Boston, MA: Harvard Business Press.

3

Ahammad M. F. Tarba S. Y. Frynas J. G. Scola A. (2017). Integration of non-market and market activities in cross-border mergers and acquisitions. Br. J. Manag.28, 629–648. 10.1111/1467-8551.12228

4

Aldoseri A. Al-Khalifa K. N. Hamouda A. M. (2024). AI-powered innovation in digital transformation: key pillars and industry impact. Sustainability16:1790. 10.3390/su16051790

5

Ambec S. Cohen M. A. Elgie S. Lanoie P. (2013). The porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness?Rev. Environ. Econ. Policy7, 2–22. 10.1093/reep/res016

6

Arvidsson S. Dumay J. (2022). Corporate ESG reporting quantity, quality and performance: where to now for environmental policy and practice?. Business Strat. Environ.31, 1091–1110. 10.1002/bse.2937

7

Asha P. Natrayan L. Geetha B. T. Rene Beulah J. Sumathy R. Varalakshmi G. et al . (2022). IoT-enabled environmental toxicology for air pollution monitoring using AI techniques. Environ. Res.205:112574. 10.1016/j.envres.2021.112574

8

Babina T. Fedyk A. He A. Hodson J. (2024). Artificial intelligence, firm growth, and product innovation. J. Fin. Econ.151:103745. 10.1016/j.jfineco.2023.103745

9

Bahoo S. Cucculelli M. Qamar D. (2023). Artificial intelligence and corporate innovation: a review and research agenda. Technol. Forecast. Soc. Change188:122264. 10.1016/j.techfore.2022.122264

10

Bai F. Shang M. Huang Y. (2024). Corporate culture and ESG performance: empirical evidence from China. J. Clean. Prod.437:140732. 10.1016/j.jclepro.2024.140732

11

Bosse D. Thompson S. Ekman P. (2023). In consilium apparatus: artificial intelligence, stakeholder reciprocity, and firm performance. J. Business Res.155:113402. 10.1016/j.jbusres.2022.113402

12

Brynjolfsson E. McAfee A. (2017). The business of artificial intelligence. Harvard Business Rev. 95, 100–110. 10.1145/3078836

13

Chen D. Lin X. Qiao Y. (2025). Perspectives for artificial intelligence in sustainable energy systems. Energy318:134711. 10.1016/j.energy.2025.134711

14

Chen Q. Li M. (2024). Environmental regulatory system reform and corporate ESG ratings: evidence from China. Econ. Modell.135:106710. 10.1016/j.econmod.2024.106710

15

Chetty R. Looney A. Kroft K. (2009). Salience and taxation: theory and evidence. Am. Econ. Rev.99, 1145–1177. 10.1257/aer.99.4.1145

16

Delmas M. A. Burbano V. C. (2011). The drivers of greenwashing. California Manag. Rev.54, 64–87. 10.1525/cmr.2011.54.1.64

17

Ding J. Lu Z. Yu C. H. (2022). Environmental information disclosure and firms' green innovation: evidence from China. Int. Rev. Econ. Fin.81, 147–159. 10.1016/j.iref.2022.05.007

18

Du L. Wei M. Wu K. (2023). Information technology and firm's green innovation: evidence from China. Environ. Sci. Poll. Res.30, 97601–97615. 10.1007/s11356-023-29320-z

19

Duan X. Wang X. Zhao P. Shen G. Zhu W. (2022). DeepLogic: joint learning of neural perception and logical reasoning. IEEE Trans. Pattern Anal. Mach. Intell.45, 4321–4334. 10.1109/TPAMI.2022.3191093

20

Finkbeiner M. (2009). Carbon footprinting—opportunities and threats. Int. J. Life Cycle Assess.14, 91–94. 10.1007/s11367-009-0064-x

21

Friede G. Busch T. Bassen A. (2015). ESG and financial performance: aggregated evidence from more than 2,000 empirical studies. J. Sust. Fin. Invest.5, 210–233. 10.1080/20430795.2015.1118917

22

Ganda F. (2020). Effect of foreign direct investment, financial development, and economic growth on environmental quality in OECD economies using panel quantile regressions. Environ. Qual. Manag.30, 89–118. 10.1002/tqem.21715

23

Haleem A. Javaid M. Qadri M. A. Singh R. P. Suman R. (2022). Artificial intelligence (AI) applications for marketing: a literature-based study. Int. J. Intell. Netw.3, 119–132. 10.1016/j.ijin.2022.08.005

24

Hart S. L. (1995). A natural-resource-based view of the firm. Acad. Manag. Rev.20, 986–1014. 10.2307/258963

25

Helfat C. E. Kaul A. Ketchen D. J J.r. Barney J. B. Chatain O. et al . (2023). Renewing the resource-based view: new contexts, new concepts, and new methods. Strat. Manag. J.44, 1357–1390. 10.1002/smj.3500

26

Hinton G. Deng L. Yu D. Dahl G. E. Mohamed A. R. Jaitly N. et al . (2012). deep neural networks for acoustic modeling in speech recognition: the shared views of four research groups. IEEE Sig. Process. Magaz.29, 82–97. 10.1109/MSP.2012.2205597

27

Hu Z. Ma S. (2023). The impact of market integration on enterprises' digital innovation: also on the measurement method of digital innovation. Econ. Res. J.58, 155–172.

28

Ioannou I. Serafeim G. (2015). The impact of corporate social responsibility on investment recommendations: analysts' perceptions and shifting institutional logics. Strat. Manag. J.36, 1053–1081. 10.1002/smj.2268

29

Janssen M. Brous P. Estevez E. Barbosa L. S. Janowski T. (2020). Data governance: organizing data for trustworthy artificial intelligence. Govern. Inform. Quart.37:101493. 10.1016/j.giq.2020.101493

30

Lan L. Zhou Z. (2024). Complementary or substitutive effects? The duality of digitalization and ESG on firm's innovation. Technol. Soc. 77:102567. 10.1016/j.techsoc.2024.102567

31

LeCun Y. Bengio Y. Hinton G. (2015). Deep learning. Nature521, 436–444. 10.1038/nature14539

32

Lee C. C. Yan J. (2024). Will artificial intelligence make energy cleaner?Evid. Nonlin. Appl. Energy363:123081. 10.1016/j.apenergy.2024.123081

33

Li K. Tang L. Yang X. (2024). Alleviating limit cycling in training GANs with an optimization technique. Sci. China Math.67, 1287–1316. 10.1007/s11425-023-2296-5

34