- 1School of Economics and Management, Qingdao University of Science and Technology, Qingdao, China

- 2School of Management Engineering, Qingdao University of Technology, Qingdao, China

- 3School of Economics, Ocean University of China, Qingdao, China

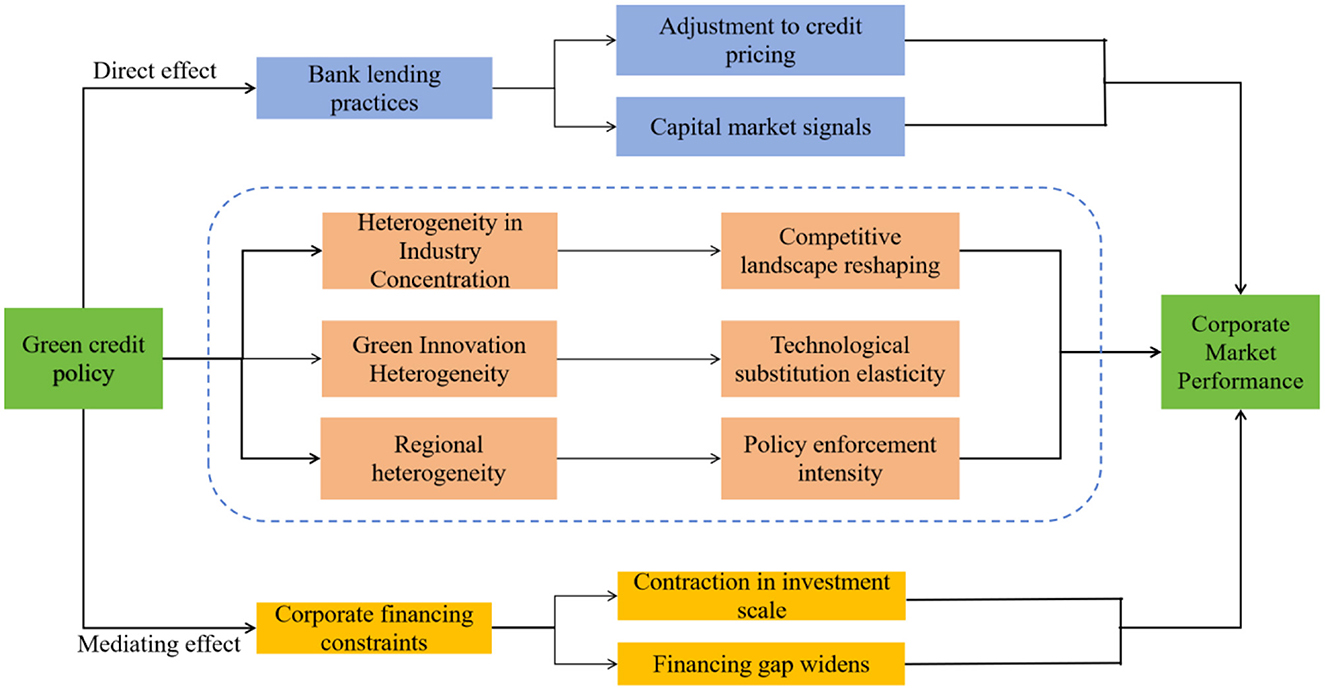

As the contradiction between China's economic growth and energy consumption becomes increasingly prominent, how to guide resource allocation towards green sectors through financial policies has emerged as a critical issue for achieving sustainable development. As a key instrument integrating environmental regulation with financial control, green credit policies require in-depth examination to determine their effectiveness in directing credit resources, improving corporate environmental behavior, and promoting economic transformation. This study employs data from A-share listed companies between 2008 and 2023, utilizing the 2012 issuance of the Green Credit Guidelines as a natural experiment. It applies a Difference-in-Differences (DID) approach to examine the impact of green credit policies on the market performance of polluting enterprises and their underlying mechanisms. Findings reveal that green credit policies significantly suppress the market performance of heavily polluting enterprises, with this effect primarily channeled through heightened financing constraints, particularly pronounced among privately owned firms. Heterogeneity analysis indicates marked variations in policy impact across firms differing in industry concentration, possession of green innovations, and regional development levels. Polluting enterprises in highly concentrated industries, those possessing green innovations, and those located in eastern regions experience relatively lesser impacts. These findings not only validate the effectiveness of green credit policies in optimizing credit resource allocation but also provide novel empirical evidence for understanding the synergistic mechanisms between financial policies and environmental governance. The study further refines the differentiated implementation mechanisms for green credit policies, avoiding the excessive impact of a ‘one-size-fits-all' approach on certain enterprises, and demonstrates the benefits of considering different perspectives and levels of analysis.

1 Introduction

According to the 2024 Global Greenhouse Gas Emissions Report, six organizations and nations—including China, the United States, India, and the European Union—constitute the world's largest greenhouse gas emitting economies, accounting for 62.7% of global emissions. Currently, China's carbon dioxide emissions constitute approximately 33% of the global total, with coal consumption reaching 4.589 billion tons in 2024, accounting for roughly 51% of worldwide consumption.

To address pressing global ecological challenges and uphold its responsibilities as a major nation, President Xi announced at the seventy fifth UN General Assembly: “China aims to peak CO2 emissions before 2030 and achieve carbon neutrality before 2060,” demonstrating its commitment to global climate action. As a pivotal regulatory instrument for directing credit resources toward low-carbon and sustainable development, green credit policy plays a transformative role in restructuring China's economy (Zhou et al., 2025). By mandating financial institutions to incorporate environmental risks into credit decisions, it imposes financing constraints on polluting firms while offering preferential funding for green projects. Its efficacy stems from regulatory-driven adjustments in bank lending behavior rather than voluntary market choices, reflecting a government-led integration of financial resource allocation with environmental regulation.

In 2012, the former China Banking Regulatory Commission promulgated the Green Credit Guidelines (hereinafter referred to as the Guidelines), granting banks the authority to allocate credit resources rather than merely coordinating environmental protection and credit management efforts. This policy innovation embodies China's distinctive environmental finance governance model, combining market-based adjustments through financial instruments with rigid constraints of administrative oversight (Zhu and Lin, 2022). It advances ecological civilization construction while maintaining stable economic growth (Lee and Lee, 2022).

Its essence lies in altering price signals and credit accessibility to reshape corporate cost-benefit functions, thereby influencing polluting firms' market performance and behavioral choices. Corporate market performance, measured by abnormal stock returns relative to market benchmarks, captures dynamic investor expectations and sensitively reflects policy shocks or firm-specific changes in market pricing (Fang and Na, 2020). Thus, green credit policy not only quantifies the economic costs of environmental regulation but also mirrors market expectations for green transition. Firms successfully implementing green strategies gain valuation premiums (Zhang et al., 2022), while high-pollution, energy-intensive enterprises face capital market penalties. This stock price divergence provides regulators with market-based metrics to evaluate policy effectiveness and helps investors identify green investment opportunities. Furthermore, green credit policy profoundly impacts polluting firms' market performance by altering their financing constraints. By raising credit thresholds and financing costs, it directly curtails their investment capacity, leading to reduced market share and profitability. Concurrently, it forces firms to either pursue green innovation or shift to high-value-added, low-pollution sectors (Liu T. et al., 2024). Such financing constraints affect not only short-term financial indicators but also investor expectations and valuation logic, ultimately reshaping industry competition and performance distribution through stock price fluctuations.

Green credit policies hold unique value within environmental policy frameworks. By employing market-based mechanisms for credit resource allocation, they internalize environmental risks into corporate financing costs. This approach overcomes the inflexibility of command-and-control policies while addressing the limitations of environmental taxes and subsidies, which can only regulate production costs (Gao et al., 2022; Li and Ramanathan, 2024). This mechanism, leveraging financial instruments to influence corporate environmental behavior, achieves dual objectives: controlling pollution emissions at source and promoting green transformation. Its efficacy extends beyond immediate environmental governance outcomes, persistently shaping enterprises' long-term investment decisions and thereby influencing green development trajectories—a core characteristic difficult for other environmental policy tools to replicate.

Consequently, examining the impact of green credit policies on polluting enterprises' market performance holds significant theoretical and practical value. By altering firms' financing constraints, this policy not only directly influences investment decisions and operational performance but also reshapes investor expectations and valuation logic through capital market transmission mechanisms, offering a fresh perspective for assessing the economic effects of environmental regulation. Can green credit policies influence corporate market performance in capital markets? What are the underlying mechanisms? Do these effects differ across heterogeneous firms? Clarifying these questions forms the core focus of this paper.

The remainder of this paper is structured as follows: The second section reviews related literature. The third section presents theoretical analysis and hypotheses. The fourth section outlines the research design. The fifth section provides empirical analysis. The sixth section offers conclusions and recommendations.

2 Literature review

2.1 Macroeconomic effects of green credit policy

Research on green credit policy has established a robust theoretical framework and empirical evidence regarding its macroeconomic impacts. By directing financial resources from polluting industries to environmentally sustainable sectors through differentiated pricing and credit controls, the policy optimizes industrial structures and fosters green economic growth (Liu et al., 2017; Wang Y. et al., 2019; Dogah et al., 2025). During policy implementation, commercial banks establish environmental entry thresholds, internalizing the social costs of pollution emissions into corporate financing costs. This mechanism corrects environmental externalities through market forces (Zhou et al., 2021).

Green credit policies demonstrate significant efficacy in enhancing regional green total factor productivity, primarily through mechanisms that improve resource allocation efficiency, stimulate green technological innovation, and facilitate industrial upgrading (Lin and Zhong, 2024). Notably, the implementation outcomes of green credit policies exhibit pronounced regional heterogeneity, with areas characterized by higher financial marketization and stricter environmental regulations tending to realize greater policy dividends (Wu and Fu, 2025). From a financial stability perspective, green credit policies mitigate potential environmental risk exposures within the banking system by restricting lending to environmentally high-risk enterprises, thereby helping to guard against stranded asset risks arising from tightening environmental regulations (Zhou et al., 2022; Jia et al., 2025). However, some studies also highlight potential short-term disruptions from policy transitions, particularly in regions with high concentrations of traditional industries, where credit contraction may exacerbate employment pressures and economic volatility (Jiang and Jiang, 2023; Liu and Wang, 2023). The realization of policy outcomes further depends on the refinement of supporting institutional frameworks, including robust environmental disclosure systems, effective market oversight mechanisms, and comprehensive innovation incentive policies (Guo et al., 2022). Cross-national comparative studies reveal that green credit policies exert a more pronounced effect on industrial restructuring within bank-dominated financial systems, offering significant insights for developing nations implementing green finance policies (Rapih et al., 2025). As policy implementation deepens, academia is increasingly examining the synergistic effects between green credit and other environmental policies, exploring how policy combinations can achieve a win-win outcome for environmental protection and economic development.

2.2 Microeconomic effects of green credit policy

Green credit policy significantly influences corporate behavior, particularly through financing constraints. By imposing stricter environmental compliance checks, banks reduce credit availability and increase interest rates for non-compliant firms, creating a “financing penalty” that compels firms to internalize environmental risk costs (Wang E. et al., 2019; Tian et al., 2024). This leads to divergent financing adjustments: long-term debt ratios decline as banks grow cautious toward polluting projects, while firms increasingly rely on trade credit as an alternative funding source (Liu X. et al., 2024; Zhang et al., 2021).

The policy also reshapes corporate investment decisions. Polluting firms face trade-offs between capital expenditures and environmental investments, with some reducing production capacity to close financing gaps, which lowers emissions but hampers productivity (Guo et al., 2025). Others invest proactively in pollution control to secure credit, incurring short-term costs but fostering sustainable growth (Chai et al., 2022). However, elevated financing costs can trap firms in a “compliance-capacity dilemma,” where environmental compliance exacerbates financial strain (Li and Liu, 2024). Regarding innovation, the Porter Hypothesis suggests environmental regulations drive green innovation to offset costs (Porter and Linde, 1995; Wang and Qi, 2016; Hu et al., 2021). Yet, some evidence indicates that policies may increase green patent quantity without improving quality (Tao et al., 2021). In concentrated industries, dominant firms may pass compliance costs downstream, weakening policy incentives (Wu et al., 2022). These findings highlight the need for balanced policy design that pairs financing constraints with incentives to encourage proactive innovation.

2.3 Determinants of corporate market performance

Corporate market performance is shaped by internal governance and external institutional environments. Internally, effective governance structures—such as board independence, executive incentives, and shareholder oversight—enhance strategic decision-making and resource efficiency, reducing agency costs and boosting long-term value creation (Ozbek, 2025; Wanyan and Zhao, 2024). Strong environmental performance, as measured by ESG frameworks, lowers capital costs and enhances valuations through positive reputation effects (Sheikh, 2018).

Externally, financial regulations and industrial policies, including green credit policy, significantly influence market performance. As a hybrid of environmental and financial regulation, green credit policy operates uniquely by internalizing environmental risks into financing costs, reshaping bank lending behaviors and corporate capital structures (Wu et al., 2023). Traditional studies argue that stringent standards erode competitiveness, but the Porter Hypothesis suggests well-designed policies spur innovation, enhancing productivity and market value (Rahman et al., 2020). Empirical evidence reveals dual effects: financing constraints increase financial distress risks for polluters, while innovation incentives promote green transitions and long-term competitiveness (Gangi et al., 2020; Tian et al., 2025). These insights provide a multidimensional framework for understanding the interplay between green finance and corporate performance.

In summary, the existing literature provides a theoretical foundation and empirical evidence for the transmission mechanisms of China's green credit policy, though certain limitations persist. First, scant attention has been devoted to how green credit policies affect corporate performance in capital markets. Second, while the effects of green credit policy have been widely discussed, in-depth exploration of factors related to enterprise heterogeneity remains limited. Third, environmental policy research has predominantly relied on the Porter effect framework, with insufficient examination of technological innovation from a financing perspective. In contrast to prior studies, this paper offers the following contributions and innovations: (I) The influence of green credit policy on corporate market performance is quantitatively analyzed from a financing perspective, expanding the literature on its micro-effects. (II) The study enriches environmental regulation research, where focus has traditionally been placed on emission reduction impacts of market-based or policy instruments, by addressing the underexplored micro-impact of green credit policy. (III) The policy effects of green credit policy on enterprise market performance are demonstrated across three dimensions—industrial concentration, green technological innovation, and regional economic development levels—elucidating its micro-impact through heterogeneity analyses, thereby offering robust policy implications.

3 Theoretical analysis and research hypothesis

3.1 Green credit policy and enterprise market performance

Based on the core logic of credit rationing theory, the mechanism by which green credit policies suppress the market performance of polluting enterprises can be systematically elucidated from both the supply and demand sides of the credit market. On the credit supply side, commercial banks, as risk-averse financial institutions, inherently tend to implement credit rationing under conditions of information asymmetry (Stiglitz and Weiss, 1981). Green credit policies effectively raise the credit access threshold for polluting enterprises by making environmental risks explicit as hard constraints in credit approval processes (Yin et al., 2021). This institutional constraint compels banks to adopt stricter environmental compliance screening in lending decisions, leading to credit line reductions or outright loan rejections for non-compliant firms. Consequently, polluting enterprises face an exogenous financing “quantitative rationing” dilemma.

On the demand side, green credit policy increases financing costs, significantly altering polluting firms' capital structure decisions. Specialized loans for environmental compliance often carry higher interest rate premiums, increasing financial burdens, while banks' shortening of loan maturities forces more frequent debt rollovers, heightening liquidity risks (Fang and Guo, 2018). This “price rationing” effect raises the net present value threshold for investments, compelling firms to forgo marginally profitable expansion opportunities. The dynamic evolution of credit rationing further amplifies policy effectiveness, as progressively stricter environmental risk assessments exclude marginally eligible firms from credit markets (Xing and Lai, 2011). Additionally, persistent credit constraints trigger investor skepticism about firms' long-term viability, leading to valuation discounts in capital markets (Tang and Li, 2000). The interplay between credit and capital markets sustains downward pressure on the market performance of polluting enterprises.

3.2 Green credit policy, financing and enterprise market performance

The primary role of the capital market is recognized as the allocation of resources among various entities. Corporate market performance is generally tied to company fundamentals, with stronger fundamentals corresponding to improved market outcomes (Gu and Guo, 2004). When strict credit access thresholds are imposed, loan interest rates are raised, or credit resources are redistributed by banks based on corporate environmental pollution risks, the financing costs of heavily polluting companies increase. Following the promulgation of the Green Credit Guidelines (Credit), greater emphasis is placed by banks on environmental and social responsibility performance, in addition to operational conditions and risks, during credit evaluations, thereby elevating the cost and difficulty of obtaining funds for heavily polluting enterprises. Currently, bank loans remain the predominant financing source for listed companies in China (Ni and Kong, 2016; Wang et al., 2025). External environmental costs are internalized by green credit policy, necessitating that heavily polluting enterprises either invest in production factors, redirect resources toward pollution control, or incur higher interest expenses to secure equivalent loan amounts as before (Liu et al., 2021). Failure to undertake pollution control or reduction activities prevents enterprises from passing bank risk assessments or obtaining loans, reducing available capital. This reduction in capital is likely to constrain resources essential to core business operations, directly lowering productivity and profitability while indirectly heightening operational risks, thus suppressing market performance. Although the policy effect of Credit contributes to pollution reduction, environmental protection, and energy conservation, it conflicts with the core objective of maximizing corporate profits. Moreover, pollution control activities are characterized by high risk and prolonged investment return cycles, offering little short-term economic gain compared to traditional innovation (Rezende et al., 2019). Given limited enterprise capital, diminished resources may further impair core business operations, reducing productivity and profitability, and consequently inhibiting market performance.

Due to principal-agent issues and information asymmetry, the perfect market hypothesis is invalidated, and financing constraints are commonly faced by enterprises. The cost of obtaining external funds is increased by financing constraints, primarily through credit demand and restricted credit channels (Fan et al., 2015). Existing financing constraints within enterprises may amplify the inhibitory impact of Credit on the market performance of heavily polluting firms (Wang et al., 2024c, 2023). Loanable funds for such enterprises are reduced by Credit, suppressing performance and, consequently, market outcomes. The effect of Credit varies across heavily polluting enterprises depending on the severity of their financing constraints. When confronted with high external financing costs, heavily polluting enterprises under stringent financing constraints may scale back production investment to bolster cash reserves, mitigating future risks (Yu, 2012). However, this reduction in production capacity and profitability is likely to deteriorate market performance. Resource redistribution by banks further complicates loan access for heavily polluting enterprises under strong financing constraints, hindering maintenance of original production scales and exacerbating market performance declines. Additionally, most heavy-pollution industries, such as manufacturing, are characterized by high investment, significant depreciation, and extended return periods (Qin and Wang, 2020). Investment levels in firms with strong financing constraints are adversely affected, as insufficient funds to sustain prior investment environments may precipitate capital chain disruptions, potentially impacting related enterprises. Based on this analysis, the following hypotheses are proposed:

Hypothesis 1: The implementation of green credit policy exerts a negative effect on the market performance of heavily polluting enterprises.

Hypothesis 2: Market performance of heavily polluting enterprises is inhibited by green credit policy through increased financing constraints.

3.3 The heterogeneity of green credit policy effect

Under the neoclassical economics assumption of enterprise homogeneity, endogeneity within firms is deemed absent, and resource allocation is considered irrelevant to corporate profits. In practice, however, a dynamic perspective reveals long-term accumulation of knowledge and capabilities in enterprise development (Yang and Liu, 2002). Enterprises exhibit heterogeneity in reality, with variations in knowledge and capabilities yielding differing efficiency levels and competitive advantages in economic activities (Nelson and Winter, 1982).

Additional costs are imposed on companies by the implementation of green credit policy, penalizing those with high energy consumption and poor environmental performance. These costs disproportionately burden enterprises, particularly smaller firms in industries with low concentration, where heightened competition elevates non-systematic risks in stock returns (Wu et al., 2012), thereby affecting market performance. Financing costs are increased and bank credit constraints tightened by environmental regulation, limiting alternative financing options. In low-concentration industries, highly competitive enterprises may capitalize on a “predatory effect” to usurp funds from less competitive peers, potentially forcing their exit (Wu et al., 2012). Consequently, the influence of Credit on corporate market performance is posited to vary with industry concentration.

Well-designed environmental policies are generally acknowledged to foster green technology development, such as energy and emission reduction innovations, offsetting implementation costs via an innovation compensation effect, as posited by the Porter Hypothesis (Porter and Linde, 1995). Green technology innovation is often adopted by enterprises to mitigate pollution control costs. As an environmental policy, Credit compels heavily polluting firms to pursue such innovation. However, differing resource endowments and innovation capacities lead enterprises to adopt varied competitive strategies tailored to their circumstances (Wen et al., 2022). Enterprises with robust innovation capabilities may sustain green technology R&D, whereas those with weaker capabilities exhibit unsustainable R&D efforts, susceptible to external influences like subsidies or taxes (Noailly and Smeets, 2015; Hussain et al., 2022). Consequently, enterprises with strong innovation capabilities are likely to experience distinct developmental and competitive trajectories compared to those with weaker capabilities, with higher green innovation efficiency correlating with improved profitability, operational performance, and growth, thus enhancing market performance (Zhang et al., 2019). The influence of Credit on market performance is therefore suggested to differ based on enterprises' green technology innovation capabilities.

China's vast geographical expanse leads to diverse regional resource endowments and technological capacities, shaping internal economic growth and contributing to regional disparities (Lee et al., 2022). Eastern China, characterized by relative capital abundance but constrained environmental capacity, has advanced toward upgrading its factor endowment structure. This shift theoretically supports industrial transformation toward greener practices through environmental regulation. However, the application of green credit policy, a market-based regulatory tool, reveals a misalignment between its implementation intensity and regional development stages (Yuan and Xie, 2014).

In eastern regions, financial institutions often enforce green credit standards with rigid “one-size-fits-all” constraints, overlooking the incremental transition needs of enterprises. Most polluting firms in these areas remain entrenched in low-value-added segments of global value chains, heavily reliant on traditional energy inputs, which hinders rapid adoption of green technologies in the short term. The lack of transitional arrangements tailored to local factor endowment structures has led to unintended consequences: instead of fostering industrial upgrading, the policy increases corporate transition costs. These effects manifest as declining market valuation benchmarks and reduced investment returns. The theoretical mechanism flowchart is shown in Figure 1. Based on this analysis, the following hypotheses are proposed:

Hypothesis 3a: Market performance of enterprises in low-concentration industries is more significantly affected by green credit policy than that in high-concentration industries.

Hypothesis 3b: Market performance of enterprises with strong green technology innovation capabilities is less affected by green credit policy compared to those with weak capabilities.

Hypothesis 3c: Market performance of enterprises in developed regions is less affected by green credit policy than that in underdeveloped regions.

4 Research design

4.1 Sample and data

The effect of the Green Credit Guidelines, issued on January 29, 2012, on enterprise market performance is examined through a quasi-natural experiment, with the impact of green credit policy analyzed using the difference-in-differences method. To account for the influence of the 2008 international financial crisis and ensure data availability, A-share listed industrial companies from 2008 to 2023 are selected as the research sample.

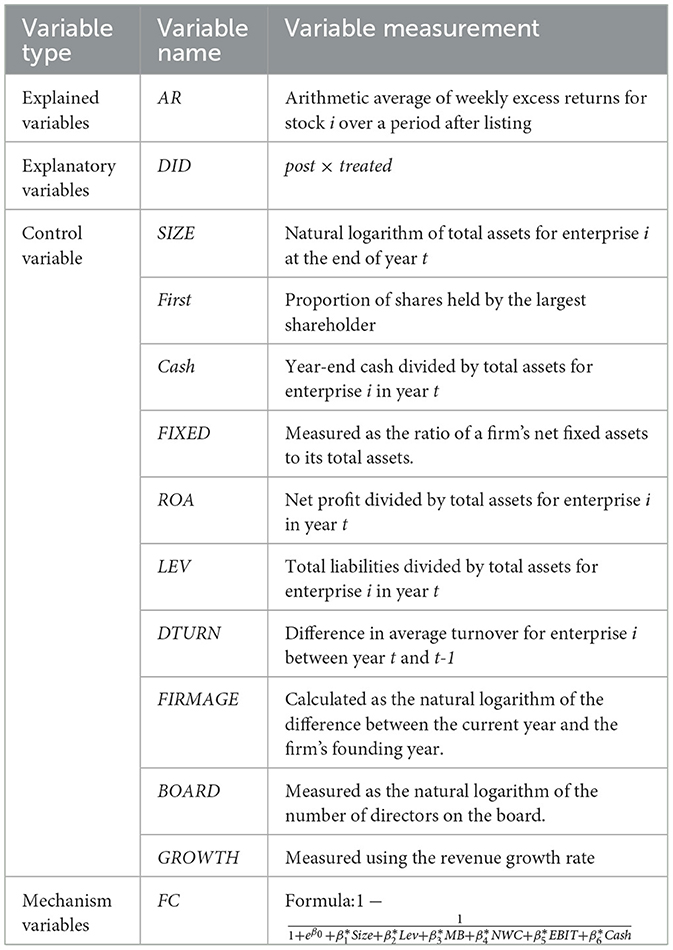

4.2 Definition of variables

4.2.1 Explained variables

Following the enactment of the green credit policy, the loanable amount available to heavily polluting enterprises is diminished, while that for green and low-polluting enterprises is increased. Reduced loanable funds may lead to unfavorable prospects and diminished investment returns for heavily polluting enterprises in the capital market. In contrast, non-heavy polluting enterprises may achieve investment returns exceeding the market average. Drawing on the methodologies of previous studies (Fang and Na, 2020; Zhang and Zhang, 2016) the average weekly excess return1 (AR) is selected as a proxy for corporate market performance. The variable is defined as follows:

Here, N represents the number of trading weeks in a year, rit denotes the yield of stock i in week t of the trading year, and rat signifies the weighted average yield of the A-share market in week t.

4.2.2 Explanatory variables

The interaction term of the group dummy variable treated and the time dummy variable post (denoted as treated × post or DID) is utilized as the explanatory variable to capture the policy effect of green credit policy on enterprise market performance. The variable post is defined as a time dummy, with the years prior to policy implementation (2008–2011) assigned a value of 0 and the years following implementation (2012–2019) assigned a value of 1. Following the methodology of Hu et al. (2021), this study defines polluting enterprises based on three regulatory documents: The classified management catalog for environmental verification of listed companies, the guidelines for environmental information disclosure of listed companies, and the industry classification guidance for listed companies. Specifically, enterprises in the following sectors are classified as polluters: Mining (Industry codes: B06, B07, B08, B09), Manufacturing (Industry codes: C17, C19, C22, C25, C26, C28, C29, C30, C31), Production and Supply of Electricity and Heat (Industry code: D44). A dummy variable is assigned a value of 1 if an enterprise belongs to these polluting sectors and 0 otherwise.

4.2.3 Control variable

To account for the influence of factors other than green credit policy on enterprise market performance, control variables are incorporated by referring to previous studies (Fang and Na, 2020; Zhang and Zhang, 2016; Wang et al., 2024b). Enterprise size (Size) is defined as the natural logarithm of total assets to reflect production scale; ownership concentration (First) is measured as the proportion of shares held by the largest shareholder to indicate the extent of corporate management rights; cash holdings (Cash) are calculated as the ratio of year-end cash to total assets to assess risk response capacity; fixed asset ratio (Fixed) is measured as the ratio of a firm's net fixed assets to its total assets; return on assets (Roa) is included as net profit divided by total assets; asset-liability ratio (Lev) is determined as total liabilities divided by total assets to evaluate solvency; and stock turnover rate (Dturn) is computed as the difference in average turnover between year t and t-1 to measure liquidity in the capital market; board size (Board) is calculated as the natural logarithm of the number of directors on a firm's board; firm age (Firmage) is computed as the natural logarithm of the difference between the current year and the firm's founding year; ownership concentration (Top) is measured by the percentage of shares held by the largest shareholder; corporate growth (Growth) is measured using the revenue growth rate.

Enterprise yield data are sourced from the China Stock Market & Accounting Research (CSMAR) database, while industry pollution intensity data are obtained from the China Statistical Yearbook and China Environmental Statistical Yearbook. Following established practices (Wang et al., 2024a,b), samples from the following categories are excluded: (I) listed companies in the financial and real estate industries; (II) all Special Treatment (ST) and Particular Transfer (PT) companies; and (III) insolvent companies. To mitigate the impact of extreme values, all continuous variables are winsorized at the 1% and 99% levels. Detailed variable definitions are provided in Table 1.

4.3 Model setting

4.3.1 DID model

The issuance of the Green Credit Guidelines is regarded as an exogenous event for enterprises. The effectiveness of the Difference-In-Differences (DID) method hinges on ensuring comparable characteristics between the experimental and control groups. Although the influence of varying environmental conditions on enterprises is acknowledged, enterprise development is recognized as heterogeneous over time, with characteristics evolving accordingly. Additionally, potential disruptions from other events during the sample period (2008–2023) are noted. To address these issues, Propensity Score Matching (PSM), as proposed by Heckman (1979), is employed to preprocess the samples, reducing bias from confounding factors. As a non-parametric estimation method, PSM does not require assumptions about the conditional mean function of observable factors or the probability distribution of unobservable factors. Following Heckman et al. (1998), the propensity score matching difference-in-differences (PSM-DID) approach is utilized to assess changes in corporate market performance post-policy implementation. The following model is constructed:

In Equation 2, ARi, t represents the enterprise yield index, DIDi, t denotes the double-difference variable (treated × post), Xi, t encompasses the control variables, λt accounts for time fixed effects, δi represents individual fixed effects, and εit is the random error term, where i indicates the enterprise and t denotes time.

4.3.2 Dynamic effect test model

To evaluate the net effect of the Green Credit Guidelines and the temporal trend of its impact on corporate market performance, a dynamic effect model is formulated by incorporating time dummy variables for the years following policy issuance (2012–2023). Equation 3 is specified as follows:

In this model, year2012i, t through year2023i, t are dummy variables corresponding to each year post-policy, while λt, δi, and εit remain consistent with Equation (2), representing time fixed effects, individual fixed effects, and the random error term, respectively.

5 Empirical results and analysis

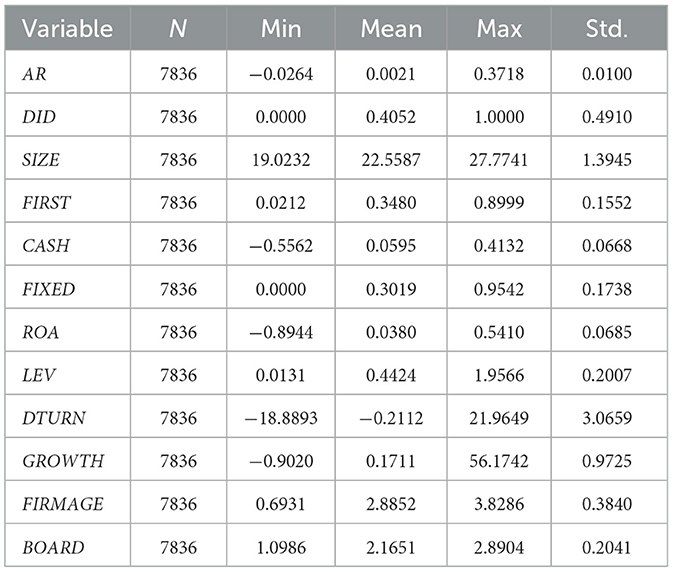

5.1 Descriptive statistics

Indicators of A-share industrial listed companies from 2008 to 2023 are selected for this study. Descriptive statistical results of the main variables in the sample data are presented in Table 2. The mean values of each variable are found to align closely with those reported in relevant references. Numerically, the mean and standard deviation of AR are 0.0021 and 0.0.0100, respectively, suggesting variability in the market performance of A-share companies. The experimental group is composed of heavily polluting companies, while the control group comprises non-heavy polluting companies.

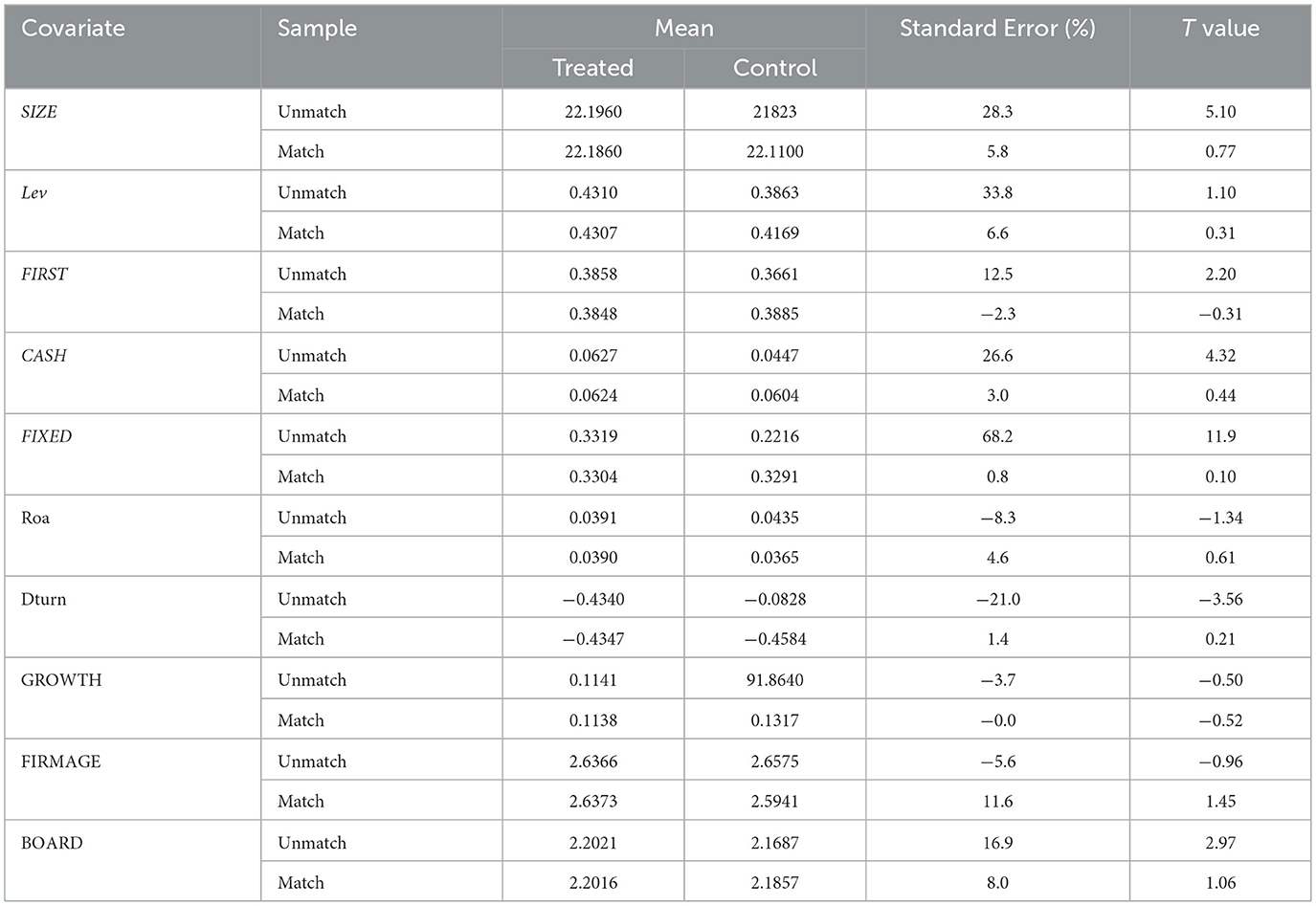

5.2 Propensity Score Matching method(PSM)

The reliability of PSM results is confirmed when no significant differences in observable variables between the control and experimental groups are observed post-matching. Balance test results for the samples after 1:1 matching are shown in Table 3. Ten covariates potentially influencing firm grouping are selected: SIZE, FIRST, CASH, FIXED, LEV, ROA, DTURN, GROWTH, FIRMAGE and BOARD. The rationale for their inclusion is outlined as follows: (1) SIZE reflects resource control and production factors, with large-scale enterprises typically exhibiting higher productivity and potentially greater pollution than smaller counterparts, influencing industrial pollutant emission intensity (Sun and Wang, 2014); (2) FIRST indicates ownership concentration; higher concentration enhances executive decision-making power, potentially leading to short-term profit-focused decisions that increase pollution under performance pressure; (3) CASH measures cash flow scale; larger cash reserves reduce financing constraint pressures and enhance solvency, allowing enterprises to either improve pollution control or increase production without environmental responsibility, affecting emission intensity; (4) FIXED reflects a firm's capital intensity and mortgage capacity; (5) ROA measures the efficiency with which a company utilizes its total assets to generate profits; (6) LEV reflects the asset-liability ratio; higher ratios signal greater development ambition, potentially expanding production and pollution; (7) DTURN captures stock turnover; low-carbon transitions or pollution emissions may alter investor expectations, increasing turnover; (8) GROWTH measures corporate growth potential and market competitiveness; (9) FIRMAGE indicates organizational maturity and market adaptability; (10) BOARD is a critical governance structure metric influencing strategic decision-making efficiency and environmental governance effectiveness.

Results in Table 3 indicate that post-matching, the deviation of each variable is significantly reduced, with absolute values below 12%, meeting the matching standard of less than 20% proposed by Rosenbaum and Rubin (1983). This outcome suggests a robust matching effect.

5.3 Baseline results

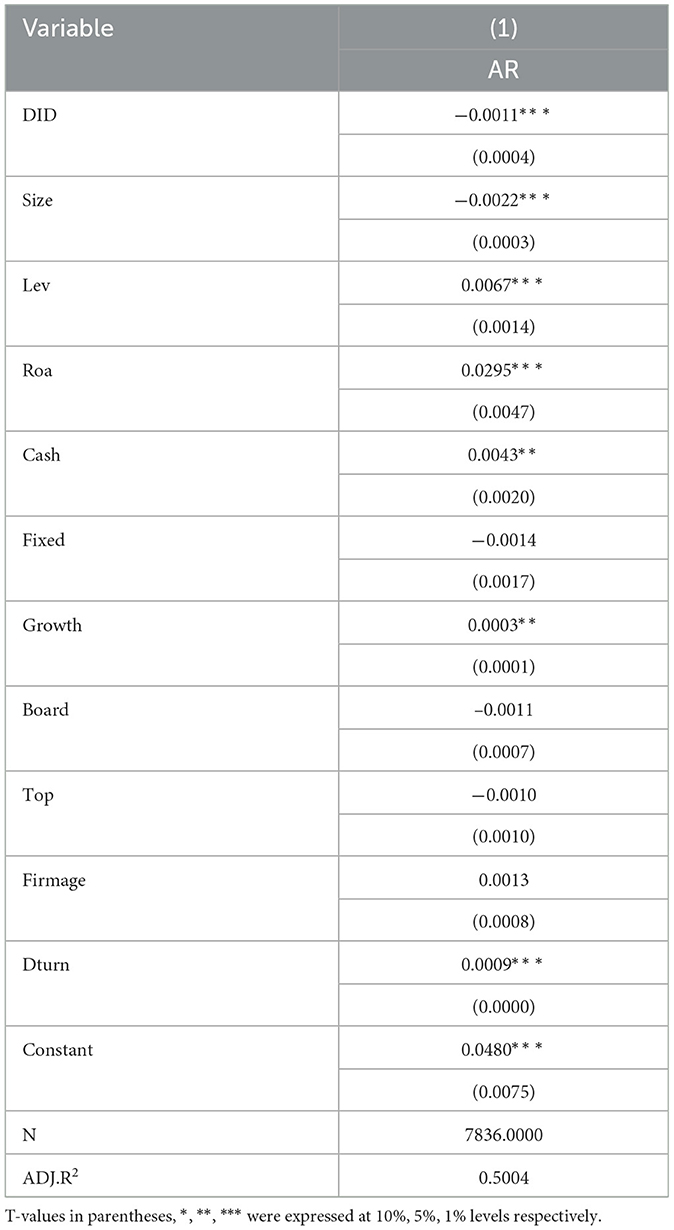

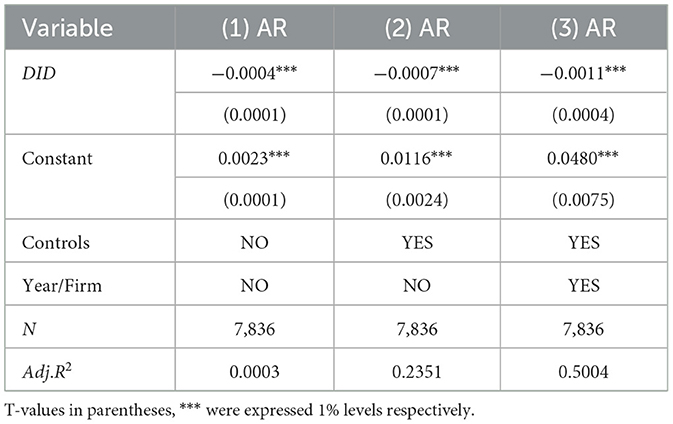

A two-way fixed effects model is adopted for regression testing, following Yang and Li (2020) and Sun et al. (2019). The effect of green credit policy on enterprise market performance is detailed in Tables 4, 5. Control variables, individual effects, and time effects are incrementally included in columns (1) through (3), with the model's R2 improving progressively, indicating continuous optimization. Coefficients of the interaction term DID are −0.0004, −0.0007, and −0.0011 in columns (1) to (3), respectively, significant at least at the 5% level. These results demonstrate that post-credit implementation, the market performance of heavily polluting enterprises is significantly reduced, performing notably worse than prior to the policy. Access to credit resources is restricted for heavily polluting companies by the green credit policy, lowering their financing capacity and influencing production and investment decisions. Loan costs are increased following Credit implementation, constraining the development of heavily polluting firms. Internal managers may question the production and cash flow capacities of these enterprises, impacting future planning and investment, and reducing investor expectations in the capital market. Consequently, Credit is shown to suppress the market performance of heavily polluting enterprises, validating Hypothesis 1.

5.4 Dynamic effect test

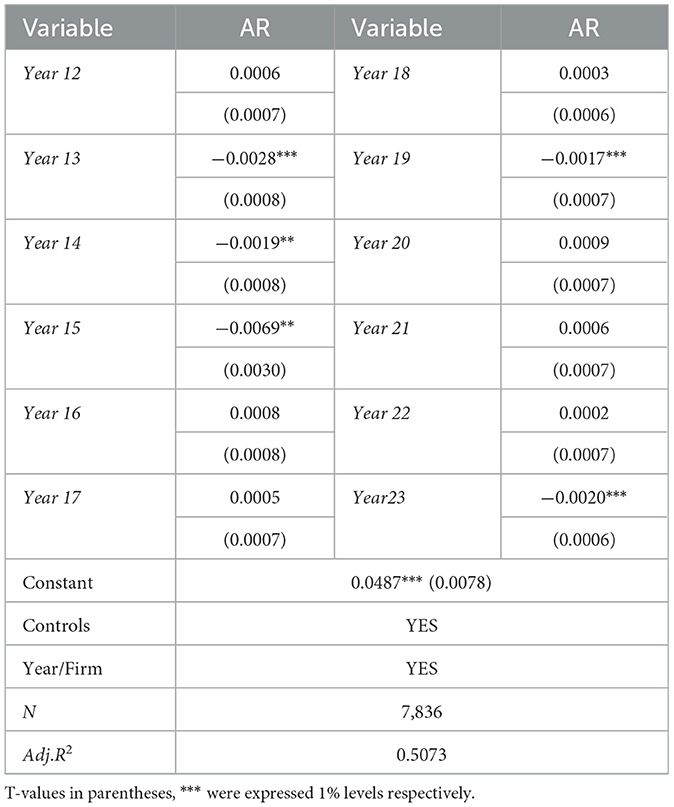

The dynamic effect of the Credit policy on corporate market performance is assessed through Model (3), with estimation results presented in Table 6. Net policy effects from 2012 to 2019 are predominantly negative, with significant negative effects at the 5% level in 2013 (−0.0028) and 2015 (−0.0069). An inhibitory effect on the market performance of heavily polluting enterprises is evident in 2013, intensifying in 2015. However, coefficients post-2015 alternate between positive and negative without consistent significance, suggesting a short-term inhibitory impact of Credit, possibly due to limited enterprise funds. Post-implementation, bank loans are required by relevant enterprises to bridge funding gaps for long-term strategic planning. Investments in environmental protection activities, such as pollution control and reduction, are necessitated to meet bank regulatory standards and secure loans for production needs. Given that heavily polluting enterprises are typically asset-heavy with substantial fixed assets, higher opportunity and sunk costs are incurred to comply with loan requirements, necessitating extended adaptation periods to policy changes. Thus, the negative impact on heavily polluting enterprises diminishes gradually 4 years after policy implementation.

5.5 Robustness test

The reliability of empirical results is verified through robustness tests conducted from four perspectives: changing research samples, altering policy nodes, adjusting PSM matching ratios, and performing a parallel trend test. Results are summarized in Table 7.

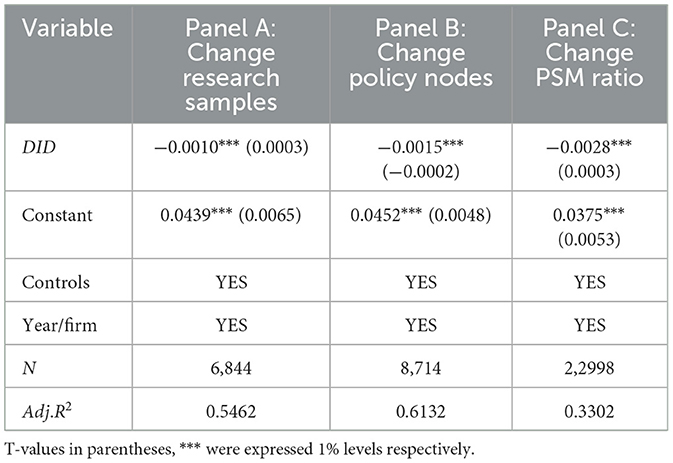

Panel A: Change Research Samples. To mitigate potential confounding effects from the 2008-2009 financial crisis and 2020-2023 pandemic shocks, we exclude these periods and re-estimate the model. The coefficient direction and statistical significance of the core explanatory variable remain substantively unchanged, demonstrating that the inhibitory effect of green credit policy on polluting firms' market performance is robust across time dimensions. This confirms that the policy's impact is not driven by extreme economic events during specific periods.

Panel B: Change Policy Nodes. To test whether the policy effect is biased due to implementation lags, we conduct a counterfactual analysis by artificially setting the green credit policy's inception year to 2013. The regression results show that the coefficient of the core variable remains significantly negative with a comparable magnitude, indicating that the baseline findings are not driven by short-term shocks or market anticipation effects during the initial policy phase but rather reflect the policy's sustained impact. This further validates the robustness of our conclusions.

Panel C: Change PSM Ratio. To mitigate potential estimation biases from sample selection, we reconstruct the treatment and control groups using a 1:2 nearest-neighbor Propensity Score Matching (PSM) method. Post-matching balance tests confirm that covariate standardized biases are significantly reduced (all below 10%) with no systematic differences observed. Regression results demonstrate that the coefficient direction and statistical significance of the core explanatory variable remain stable, verifying that the negative impact of green credit policy on polluting firms' market performance is robust to self-selection issues. This affirms the sample-dimensional robustness of our findings.

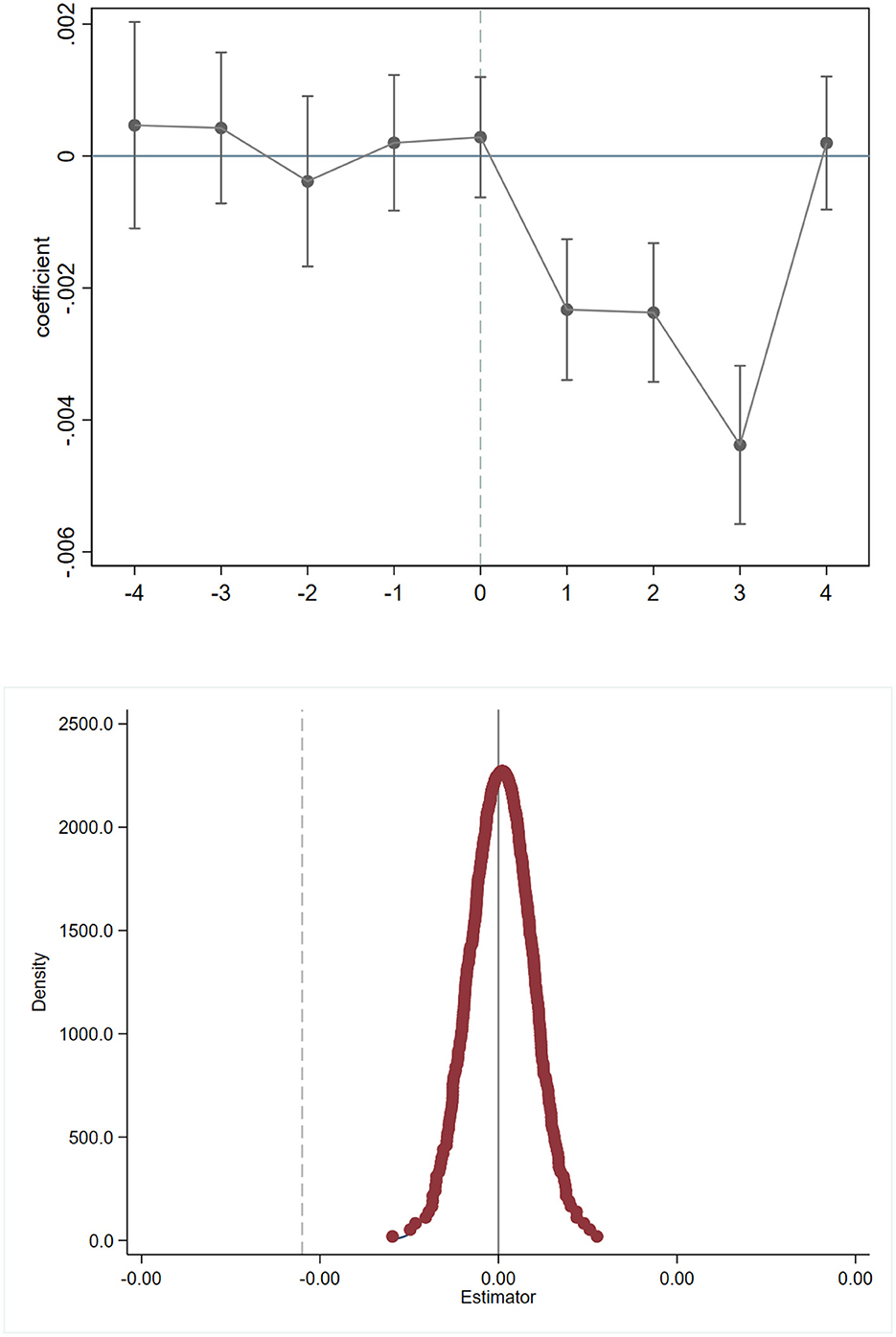

Panel D: Parallel Trend Test. The DID model's applicability requires no systematic pre-policy trend differences between groups. An event study method (Deschenes et al., 2017) is employed, with results in Figure 2 showing no significant pre-Credit differences in policy impact on corporate risk-taking, satisfying the parallel trend assumption.

Panel E: Placebo Test. To mitigate potential biases from unobserved factors, we conduct a placebo test by randomly assigning treatment group status and policy implementation timing. The coefficients of the falsified policy variables are statistically insignificant across all iterations, with their distribution tightly clustered around zero. In contrast, the baseline regression estimate lies in the extreme tail of this distribution. This divergence confirms that the suppressive effect of green credit policy on polluting firms' market performance is not driven by unobserved confounding factors, thereby enhancing the credibility of our findings.

5.6 Additional analysis and tests

5.6.1 Mechanism test

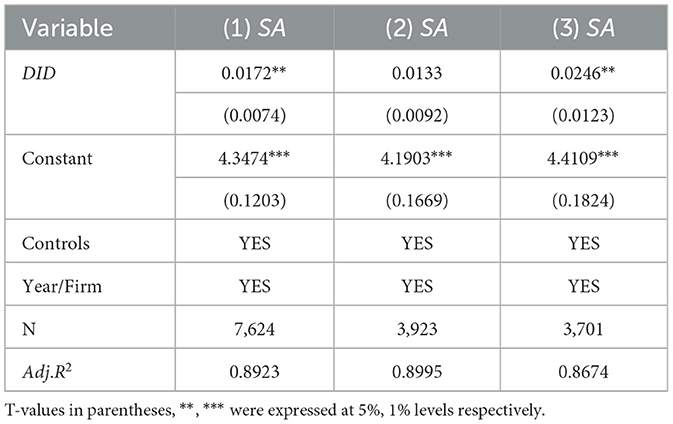

This study adopts the financing constraints (FC) index proposed by Hadlock and Pierce (2010) to quantify corporate financing constraints. Regression results in Table 8 show that in Column (1), the DID coefficient is significantly positive (0.0077) at the 5% level, indicating that green credit policy exacerbates financing constraints for heavily polluting companies, adversely affecting their market performance and verifying Hypothesis 2. Post-Credit, financing constraints are intensified, altering internal capital markets, impairing financing ability, and deteriorating market performance. Credit mandates banks to allocate resources based on pollution emissions, compelling heavily polluting firms to invest in pollution reduction to secure loans, increasing financing costs and difficulties. Loan amounts are restricted, and interest rates are elevated, raising interest expenditures, reducing cash flow and current assets, and ultimately diminishing production scale, profitability, and market performance.

Analysis of samples segmented by ownership reveals distinct impacts of green credit policies. For State-Owned Enterprises (SOEs) in Column (2), the DIFFERENCE-IN-DIFFERENCES (DID) coefficient is statistically insignificant, indicating limited policy influence. In contrast, for private enterprises in Column (3), the DID coefficient is significantly positive (0.0246) at the 5% level, demonstrating a notable effect on privately-owned polluting firms through the financing constraint channel. This disparity arises from China's unique institutional environment and differing enterprise characteristics.

Financing constraints, as an intermediary variable, exhibit heterogeneous transmission mechanisms across ownership types. SOEs, benefiting from close government ties, access alternative financing options such as fiscal subsidies and policy-based loans, reducing reliance on bank credit (Yin et al., 2021). Consequently, green credit policy shocks have a weaker transmission through the financing constraint channel for SOEs. In contrast, private enterprises face persistent credit discrimination and depend heavily on bank financing. Green credit policies intensify their financing constraints by tightening credit availability. SOEs' scale advantages and ample collateral meet banks' risk control standards, while implicit government guarantees lower environmental risk premiums, further diminishing the policy's intermediary effect. Conversely, private firms, limited by smaller asset scales and inadequate environmental disclosure, are more likely to face exclusion from credit markets post-policy implementation, amplifying the financing constraint effect.

5.6.2 Research based on industry concentration

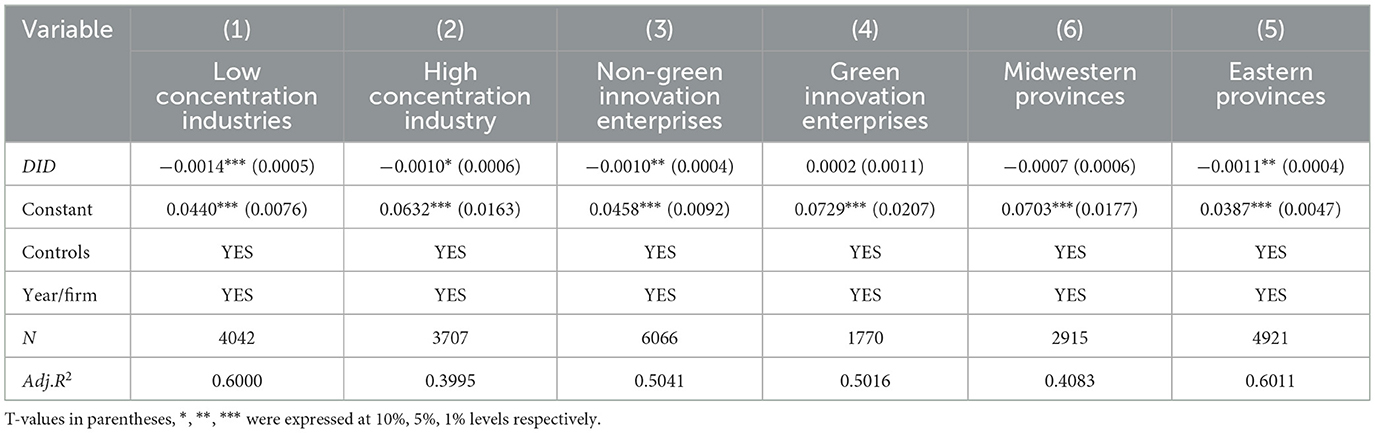

This study employs the Herfindahl-Hirschman Index (HHI) to categorize enterprises into high-HHI and low-HHI groups, thereby examining the differential impact of green credit policies on the market performance of polluting enterprises under varying HHI levels. Regression results in Table 9, Columns (1) and (2), reveal a DID coefficient of −0.0014 (significant at 1%) for low-concentration industries, and −0.0010 (significant at 10%) for high-concentration industries. Within competitive market structures, enterprises face intense peer competition and weak pricing power. Financing constraints arising from green credit policies exacerbate operational pressures, rendering firms unable to pass on environmental compliance costs through higher product prices or spread fixed costs via economies of scale. This results in a marked decline in market performance. By contrast, enterprises in highly concentrated industries typically possess market dominance and strong bargaining power. They can shift environmental compliance costs to downstream consumers by adjusting product pricing, while simultaneously leveraging economies of scale to reduce environmental governance costs per unit of output. This enables them to effectively buffer against the negative impacts of policy shocks. Thus, low-concentration industries are more significantly affected, validating Hypothesis 3a.

5.6.3 Research on enterprise green technology innovation

Green patent licensing is employed to gauge enterprise green technology innovation, with samples divided into non-green innovation (no patents) and green innovation (patents present) groups. One-period lagged patent data are used to account for timeliness. Regression results in Table 9, Columns (3) and (4), show a DID coefficient of −0.0010 (significant at 1%) for non-green innovation firms, and −0.0002 (insignificant) for green innovation firms. Enterprises lacking green innovation typically cling to traditional production models, relying primarily on passive measures such as end-of-pipe treatment equipment for environmental governance. Such investments divert operational cash flow without significantly enhancing production efficiency, leaving these firms more vulnerable to financial distress during credit tightening. Conversely, enterprises pursuing green innovation achieve source-end emission reductions through process innovation and clean technology adoption. Their environmental investments synergize with productivity gains, effectively offsetting cost pressures arising from policy shocks. The technological barriers established through green innovation grant enterprises differentiated competitive advantages, enabling them to capitalize on market share expansion even as policy requirements intensify. Conversely, firms reliant on conventional technologies face dual pressures from shrinking market share and rising financing costs due to their inability to meet increasingly stringent environmental standards, resulting in significantly more pronounced deterioration in their market performance. Thus, non-green innovation firms are more impacted, validating Hypothesis 3b.

5.6.4 Research based on regional economic development

Samples are divided into eastern (11 provinces) and central-western (20 provinces) regions per the China Statistical Bureau classification. Regression results in Table 9, Columns (5) and (6), indicate a DID coefficient of −0.0007 (insignificant) for central-western regions, and −0.0011 (significant at 5%) for eastern regions. The eastern regions, as China's economically advanced areas, exhibit higher marketization levels and well-established environmental regulatory frameworks. Financial institutions operating there possess stronger compliance incentives and greater operational flexibility when implementing green credit policies. They can rigorously link corporate environmental performance to credit resource allocation, thereby imposing hard constraints on polluting enterprises. In contrast, local governments in the western regions often prioritize economic growth over environmental protection when balancing the two, adopting a more flexible approach to policy implementation. This hinders the effective transmission of green credit constraints. Furthermore, the eastern regions possess more robust environmental disclosure systems, enabling higher verifiability of corporate environmental performance. This facilitates the precise implementation of green credit policy incentives and penalties. Conversely, the western regions suffer from relatively weak environmental monitoring capabilities, making it difficult for banks to ascertain the true environmental performance of enterprises. Consequently, considerable flexibility exists in policy enforcement. Thus, central-western firms are more affected, validating Hypothesis 3c.

6 Conclusions and policy implications

This study systematically investigates the mechanisms by which green credit policies affect the market performance of polluting enterprises, highlighting the critical mediating role of financing constraints. It provides a novel theoretical framework for understanding the interplay between environmental regulation and corporate financial behavior. Our findings partially align with prior research on the suppressive effects of green credit policies through credit rationing (Su and Lian, 2018), while offering a more detailed explanation of the underlying mechanisms. Specifically, we find that financing constraints significantly mediate policy impacts, with notable heterogeneity based on ownership structure. State-owned enterprises (SOEs), leveraging stronger financing capabilities and access to policy-based resources, experience milder impacts on market performance compared to private firms, corroborating Liu et al. (2019) on the role of ownership in credit access while adding new insights within the green finance context.

Further, the study identifies pronounced heterogeneity in policy effects across industry concentration, innovation, and regional factors. Enterprises in highly concentrated industries, with greater market bargaining power and resource integration capabilities, face less severe impacts from policy shocks, complementing Li et al. (2023) emphasis on market power influencing credit access. Similarly, firms with green innovations mitigate financing constraints by securing policy support through technological transformation, consistent with Zhou et al. (2022) argument on innovation's role in alleviating financial pressures. Additionally, enterprises in eastern China, benefiting from more developed financial markets and robust policy implementation, exhibit greater resilience to green credit policy shocks compared to those in central and western regions. These findings enrich the literature by demonstrating how market structure and regional financial disparities modulate policy outcomes, providing a more nuanced understanding of green credit policy's differential impacts.

First, a feedback mechanism between local governments and enterprises is recommended to enhance coordination between green policies and industrial upgrading. Support for pollution control, environmental protection, and energy conservation is already provided by the state, yet balancing these efforts across China's expansive central governance structure proves challenging. Initiative is encouraged from local governments to promote green industrial layouts and foster circular economy industry chains. Industrial layouts should be optimized, reasonable industrial policies formulated to guide the upgrading of polluting enterprises, and fiscal policies designed to support this transition. Consideration should also be given to transforming production waste into regional resources, accelerating energy integration, and comprehensively enhancing green development capabilities.

Second, effective implementation of green credit policy hinges on banks' adherence to policy requirements. To ensure continuity, an enterprise information disclosure system is proposed to be established by the government and relevant departments, facilitating accessible and fluid information flow while reducing banks' information acquisition costs. The ability of banks to accurately rate heavily polluting enterprises is identified as critical to Credit implementation. An imperfect disclosure system may lead to judgment errors, increasing unnecessary costs and undermining policy credibility. Active promotion of environmental, social, and corporate governance (ESG) policies by third-party institutions is advocated. Currently, voluntary disclosure by enterprises predominates, complicating ESG calculations. Unified ESG disclosure standards and evaluation criteria for assessing corporate environmental and social responsibility performance are suggested to be formulated and promulgated by the state, reinforcing enterprise awareness of these responsibilities and boosting proactive green development.

Third, environmental governance and green development are recognized as long-term endeavors. Rational planning of green credit policies and related supporting measures is emphasized for future efforts, alongside enhanced coordination of responsibility awareness among all stakeholders. A two-way feedback mechanism is proposed, structured as follows: central government (including central banks) → local governments → banks → enterprises. Within this framework, the overarching guidance role of local governments is to be maximized, with banks and enterprises positioned as primary implementers, leveraging the market's resource allocation capabilities. When policies aligned with China's national conditions are issued by the central government, assistance from local governments is recommended to support banks and oversee enterprise compliance. A comprehensive set of evaluation indicators and systems for green credit and supporting policies is suggested to be established by the central bank, such as integrating green credit coverage or quality into the macro-prudential assessment (MPA) framework. Such unified indicators and systems are expected to broaden the scope and precision of green credit measurement, strengthen the accounting and supervision framework, ensure orderly market operations, and assist banks in overcoming challenges during policy trials.

Fourth, the development and refinement of green credit-related policies are addressed. As a financial instrument, green credit carries inherent risks of losses to banks or enterprises. The rationality and standardization of green credit policy implementation are proposed to be bolstered through policy formulation, minimizing bad debt losses and mitigating banking risks. Systemic financial risks and crisis prevention are urged to be considered by policymakers. The ultimate goal of green credit policy—promoting energy conservation, emission reduction, and cleaner production—is underscored, emphasizing that emission reductions should not be pursued solely for their own sake. Policy clarity is recommended regarding the types of new energy, the scope of green patents, and the boundaries of cleaner production, preventing enterprises from engaging in ineffective green production merely to secure credit eligibility.

This study has several limitations that future research should address. First, the measurement of market performance is constrained by the completeness of corporate data disclosure, which may not fully capture actual environmental performance. To enhance robustness, future studies could incorporate more granular market data for validation. Second, this analysis focuses primarily on bank credit as a financing channel, overlooking the moderating effects of alternative financing methods, such as trade credit and equity financing, on policy outcomes. Subsequent research could explore the role of diverse financing structures in shaping corporate responses to green credit policies.

Additionally, the observation period of this study may not fully capture the long-term dynamic impacts of green credit policies due to their time-lagged effects, particularly regarding enterprises' strategic adjustments to comply with these policies. To address this, future research could pursue the following directions: first, integrate micro-level credit data from financial institutions to examine banks' decision-making processes during policy implementation; second, investigate the interactions between green credit policies and other corporate environmental governance practices; and third, explore the potential of digital technologies to improve the precision and effectiveness of green credit policies. These expanded inquiries will provide a more comprehensive understanding of green finance policy outcomes, offering a stronger scientific foundation for refining China's green finance system (Su and Lian, 2018; Liu et al., 2019; Zhou et al., 2022).

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Author contributions

ZW: Conceptualization, Data curation, Formal analysis, Methodology, Validation, Visualization, Writing – original draft. BB: Data curation, Formal analysis, Investigation, Methodology, Validation, Writing – original draft. CZ: Formal analysis, Investigation, Methodology, Software, Validation, Writing – review & editing. YL: Investigation, Methodology, Validation, Visualization, Writing – review & editing. JW: Project administration, Resources, Supervision, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that Gen AI was used in the creation of this manuscript. Generative AI statement During the preparation of this work, the author(s) used ChatGPT in order to improve language and readability. After using this tool, the author(s) reviewed and edited the content as needed and take full responsibility for the content of the published article.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Adjustment of ARi multiplier 100 during certification process.

References

Chai, S., Zhang, K., Wei, W., Ma, W., and Abedin, M. (2022). The impact of green credit policy on enterprises' financing behavior: evidence from Chinese heavily-polluting listed companies. J. Clean. Product. 363:132458. doi: 10.1016/j.jclepro.2022.132458

Deschenes, C., Greenstone, M., and Shapiro, J. S. (2017). Defensive investments and the demand for air quality: evidence from the NOx budget program. Am. Econ. Rev. 107, 2958–2989. doi: 10.1257/aer.20131002

Dogah, K., Wesseh, P., and Adomako, S. (2025). Green credit policy, technological innovation, and corporate financial performance: evidence from the energy industry. Bus. Strategy Environ. 34, 1171–1188. doi: 10.1002/bse.4041

Fan, H. C., Li, Y., and Guo, G. Y. (2015). the impact of credit constraints on the relationship between productivity and export price. J. World Econ. 38, 79-107.

Fang, X. M., and Na, J. L. (2020). Stock market reaction to green innovation: evidence from GEM firms. Econ. Res. J. 10, 106-123.

Fang, Y., and Guo, J. J. (2018). Is the environmental violation disclosure policy effective in China? —evidence from capital market reactions. Econ. Res. J. 10, 158-174.

Gangi, F., Daniele, L., and Varrone, N. (2020). How do corporate environmental policy and corporate reputation affect risk-adjusted financial performance? Bus. Strateg. Environ. 29, 1975–1991. doi: 10.1002/bse.2482

Gao, X., Liu, N., and Hua, Y. (2022). Environmental protection tax law on the synergy of pollution reduction and carbon reduction in China: evidence from a panel data of 107 cities. Sustain. Product. Consum. 33, 425–437. doi: 10.1016/j.spc.2022.07.006

Gu, J., and Guo, J. J. (2004). Asymmetrical information and stock pricing. Econ. Res. J. 2, 106-114.

Guo, L., Tan, W., and Xu, Y. (2022). Impact of green credit on green economy efficiency in China. Environ. Sci. Pollut. Res. 29, 35124–35137. doi: 10.1007/s11356-021-18444-9

Guo, R., Zhang, Y., Chen, K., Wang, Y., and Ning, L. (2025). Heterogeneous impact of green finance instruments on firms' green innovation novelty: Policy mix or mess? Energy Econ. 144:108315.

Hadlock, C., and Pierce, J. (2010). New evidence on measuring financial constraints: moving beyond the KZ index. Rev. Fin. Stud. 23, 1909–1940. doi: 10.1093/rfs/hhq009

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometric 47, 153–161. doi: 10.2307/1912352

Heckman, J. J., Ichimura, H., and Todd, P. (1998). Matching as an econometric evaluation. Rev. Econ. Stud. 65, 261-294.

Hu, G. Q., Wang, X. Q., and Wang, Y. (2021). Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 98:105134. doi: 10.1016/j.eneco.2021.105134

Hussain, J., Lee, C. C., and Chen, Y. X. (2022). Optimal green technology investment and emission reduction in emissions generating companies under the support of green bond and subsidy. Technol. Forecast. Soc. Change 183:121952. doi: 10.1016/j.techfore.2022.121952

Jia, J., Zhang, R., Zhao, G., Chen, F., and Wang, P. (2025). Digital inclusive finance and urban carbon intensity reduction: unraveling green credit mechanisms and spatial heterogeneity across Chinese Cities. Sustainability 17:4813. doi: 10.3390/su17114813

Jiang, P., and Jiang, H. (2023). Green finance policy and labor demand. Econ. Lett. 225:111065. doi: 10.1016/j.econlet.2023.111065

Lee, L. L., Feng, Y., and Peng, D. Y. (2022). A green path towards sustainable development: the impact of low-carbon city pilot on energy transition. Energy Econ. 115:106343. doi: 10.1016/j.eneco.2022.106343

Lee, L. L., and Lee, L. L. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 107:105863. doi: 10.1016/j.eneco.2022.105863

Li, R., and Ramanathan, R. (2024). The interactive effect of environmental penalties and environmental subsidies on corporate environmental innovation: is more better or worse? Technol. Forecast. Soc. Change 200:23193. doi: 10.1016/j.techfore.2023.123193

Li, X., Wu, M., Shi, C., and Chen, Y. (2023). Impacts of green credit policies and information asymmetry: from market perspective. Res. Policy 81:103395. doi: 10.1016/j.resourpol.2023.103395

Li, Y., and Liu, Y. (2024). Green credit policy and firm's financing: evidence from China. Appl. Econ. Lett. 1–6. doi: 10.1080/13504851.2025.2541806

Lin, Y., and Zhong, Q. (2024). Does green finance policy promote green total factor productivity? Evidence from a quasi-natural experiment in the green finance pilot zone. Clean. Tech. Environ. Policy 26, 2661–2685. doi: 10.1007/s10098-023-02729-3

Liu, J. Y., Xia, Y., Fan, Y., Lin, S. M., and Wu, J. (2017). Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Product. 163, 293–302. doi: 10.1016/j.jclepro.2015.10.111

Liu, S., Xu, R. X., and Chen, X. Y. (2021). Does green credit affect the green innovation performance of high-polluting and energy-intensive enterprises? Evidence from a quasi-natural experiment. Environ. Sci. Pollut. Res. 28, 65265–65277. doi: 10.1007/s11356-021-15217-2

Liu, T., Yin, Z., Fan, M., Korkmaz, A., and Yue, P. (2024). Green credit policy and asset-debt maturity mismatch in highly polluting enterprises: evidence from China. Econ. Anal. Policy 83, 946–965. doi: 10.1016/j.eap.2024.08.002

Liu, X., Liu, X., Chen, J., and Gao, J. (2024). Where there is policy, there is strategy: the impact of a green credit policy on the debt allocation strategy of business groups. Pacific Basin Fin. J. 83:102232. doi: 10.1016/j.pacfin.2023.102232

Liu, X., Wang, E., and Cai, D. (2019). Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Fin. Res. Lett. 29, 129–135. doi: 10.1016/j.frl.2019.03.014

Liu, X., and Wang, X. (2023). How green finance reshapes employment structure: evidence from green credit. Pol. J. Environ. Stud. 33:171681. doi: 10.15244/pjoes/171686

Nelson, R. R., and Winter, S. G. (1982). An Evolutionary Theory of Economic Change. Boston: Harvard University Press.

Ni, J., and Kong, L. W. (2016). Environmental information disclosure, bank credit decisions and debt financing cost: evidence from the listed company in heavy polluting industries of a-shares in shanghai stock market and shenzhen stock market. Econ. Rev. 1, 147–156.

Noailly, J., and Smeets, R. (2015). Directing technical change from fossil-fuel to renewable energy innovation: an application using firm-level patent data. J. Environ. Econ. Manag. 72, 15–37. doi: 10.1016/j.jeem.2015.03.004

Ozbek, O. (2025). Assessing the market performance of US corporate spin-offs: effects of directors' age and external board appointments along with their interaction. Corp. Gov. 25, 843–859. doi: 10.1108/CG-06-2023-0282

Porter, M. E., and Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9, 97–118. doi: 10.1257/jep.9.4.97

Qin, Y., and Wang, Y. H. (2020). “Environment regulation, financing constraints and heavy-polluting enterprises' investment path selection in greening innovation,” in Collected Essays on Finance and Economics, Hangzhou in Zhejiang province: Zhejiang University of Finance and Economics, Vol. 10, 75–84. doi: 10.13762/j.cnki.cjlc.2020.10.007

Rahman, M., Aziz, S., and Hughes, M. (2020). The product-market performance benefits of environmental policy: Why customer awareness and firm innovativeness matter. Bus. Strategy Environ. 29, 2001–2018.

Rapih, S., Borges, J., and Susantiningrum, S. (2025). Environmental policies stringency, and cross-border banking: the mediating role of green industries. Fin. Res. Lett. 74:106734. doi: 10.1016/j.frl.2024.106734

Rezende, L. A., Bansi, A. C., Alves, M. R., and Galina, S. R. (2019). Take your time: examining when green innovation affects financial performance in multinationals. J. Clean. Product. 233, 993–1003. doi: 10.1016/j.jclepro.2019.06.135

Rosenbaum, P. R., and Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika 70, 41–55. doi: 10.1093/biomet/70.1.41

Sheikh, S. (2018). Corporate social responsibility, product market competition, and firm value. J. Econ. Bus. 98, 40–55. doi: 10.1016/j.jeconbus.2018.07.001

Stiglitz, J. E., and Weiss, A. (1981). Credit rationing in markets with imperfect information. Am. Econ. Rev. 71, 393–410.

Su, D. W., and Lian, L. L. (2018). Does green credit affect the investment and financing behavior of heavily polluting enterprises. J. Financ. Res. 12, 123–137.

Sun, X. J., Zhai, S. P., and Yu, S. (2019). Can flexible tax enforcement ease corporate financing constraints evidence from a natural experiment on tax-paying credit rating disclosure. Chin. Indus. Econ. 3, 81–99.

Sun, X. M., and Wang, J. (2014). Effects of environmental regulation on chinese enterprises size distribution. Chin. Indus. Econ. 12, 44–56.

Tang, Q. M., and Li, C. T. (2000). Research on the relationship between stock return and monetary policy. Stat. Res. 12, 36–40.

Tao, F., Zhao, J. Y., and Zhou, H. (2021). Does environmental regulation improve the quantity and quality of green innovation evidence from the target responsibility system of environmental protection. Chin. Indus. Econ. 2, 136–154.

Tian, J., Sun, S., Cao, W., Bu, D., and Xue, R. (2024). Make every dollar count: the impact of green credit regulation on corporate green investment efficiency. Energy Econ. 130:107307. doi: 10.1016/j.eneco.2024.107307

Tian, Y., Hou, A., Hu, C.-C., and Chai, L. (2025). Policy-driven ESG mandates for immediate financial performance and long-term Innovation: Synergistic insights from Chinese enterprises. J. Clean. Product. 520:146142. doi: 10.1016/j.jclepro.2025.146142

Wang, B. B., and Qi, S. Z. (2016). The Effect of market-oriented and command-and-control policy tools on emissions reduction innovation an empirical analysis based on china's industrial patents data. China Indus. Econ. 6, 91–108.

Wang, E., Liu, X., Wu, J., and Cai, D. (2019). Green credit debt maturity and corporate investment evidence from China. Sustainability 11:583. doi: 10.3390/su11030583

Wang, J., Li, M., Moorhead, M., and Skitmore, M. (2024a). Forecasting financial distress in listed Chinese construction firms: leveraging ensemble learning and non-financial variables. Construct. Manag. Econ. 43, 175–195. doi: 10.1080/01446193.2024.2403553

Wang, J., Li, M., Skitmore, M., and Chen, J. (2024b). Predicting construction company insolvent failure: a scientometric analysis and qualitative review of research trends. Sustainability 16:2290. doi: 10.3390/su16062290

Wang, J., Li, X., Memari, A., Skitmore, M., Zhong, Y., and Ashuri, B. (2023). Data-driven assessment on the corporate credit scoring mechanism for Chinese construction supervision companies. Construct. Manag. Econ. 41, 961–975. doi: 10.1080/01446193.2023.2220832

Wang, J., Li, X., Memari, A., Skitmore, M., Zhong, Y., Ashuri, B., et al. (2024c). Assessing the implementation and effectiveness of China's social credit system of the construction industry: a case study of Nanjing. Int. J. Construct. Manag. 25, 850–859. doi: 10.1080/15623599.2024.2369391

Wang, Y., Pan, D. Y., Peng, Y. C., and Liao, X. (2019). China's incentive policies for green loans: a DSGE approach. J. Fin. Res. 11, 1–18.

Wang, Z., Bian, B., and Wang, J. (2025). Influence of green credit policy on corporate risk-taking: the mediating effect of debt maturity mismatch and the moderating effect of executive compensation. Sustainability 17:2862. doi: 10.3390/su17072862

Wanyan, R., and Zhao, T. (2024). The contradictory impact of ESG performance on corporate competitiveness: empirical evidence from China's Capital Market. J. Environ. Manag.371:123088. doi: 10.1016/j.jenvman.2024.123088

Wen, H. W., Zhong, Q. M., and Lee, C. C. (2022). Digitalization, competition strategy and corporate innovation: evidence from Chinese manufacturing listed companies. Int. Rev. Fin. Anal. 82:102166. doi: 10.1016/j.irfa.2022.102166

Wu, H. M., Yang, X. Q., and Wei, H. (2012). Product market competition and firm's stock idiosyncratic risk based on the empirical evidence of chinese listed companies. Econ. Res. J. 47, 101–115

Wu, Q., Chen, G., Han, J., and Wu, L. (2022). Does corporate ESG performance improve export intensity? Evidence from Chinese listed firms. Sustainability 14:12981.

Wu, S., Qu, Y., Huang, H., et al. (2023). Carbon emission trading policy and corporate green innovation: internal incentives or external influences. Environ. Sci. Pollut. Res. 30, 31501–31523. doi: 10.1007/s11356-022-24351-4

Wu, Z., and Fu, L. (2025). Can the construction of ecological civilization pilot demonstration areas improve urban green total factor productivity? Evidence from China. Environ. Econ. Manag. 13:1429406. doi: 10.3389/fenvs.2025.1429406

Xing, T. C., and Lai, Z. Q. (2011). Review on the influence of monetary policy on stock market. Commerc. Res. 8,126–130.

Yang, R. F., and Li, S. S. (2020). Can the innovation pilot policy lead enterprise innovation? Micro-evidence from the national innovative city pilot. Stat. Res. 37, 32–45.

Yang, R. L., and Liu, G. (2002). On heterogeneity and competitive advantage of firm inside. China Indus. Econ. 1, 88–95.

Yin, W., Zhu, Z. Y., Kirkulak-Uludag, B., and Zhu, Y. P. (2021). The determinants of green credit and its impact on the performance of Chinese banks. J. Clean. Product. 286:124991. doi: 10.1016/j.jclepro.2020.124991

Yu, J. W. (2012). Credit constraints, dividend dividends and corporate preventive saving motivation evidence from chinese listed companies. J. Fin. Res. 10, 97–110.

Yuan, Y. J., and Xie, R. H. (2014). Research on the effect of environment regulation to industrial restructuring—empirical test based on provincial panel data of China. China Indus. Econ. 8, 57–69.

Zhang, D. Y., Rong, Z., and Ji, Q. (2019). Green innovation and firm performance: evidence from listed companies in China. Res.Conserv. Recyc. 144, 48–55. doi: 10.1016/j.resconrec.2019.01.023

Zhang, S. L., Wu, Z. H., Wang, Y., and Hao, Y. (2021). Fostering green development with green finance: an empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 296:113159. doi: 10.1016/j.jenvman.2021.113159

Zhang, X. Y., and Zhang, Y. Q. (2016). Venture capital, innovation capability and post-ipo performance. Econ. Res. J. 51, 112–125.

Zhang, Y. J., Cao, S. K., Lin, X. H., Su, Z., and Wang, K. (2022). Corporate financial decision under green credit guidelines: evidence from China. J. Asia Pacific Econ. 5, 1–26. doi: 10.1080/13547860.2022.2072095

Zhou, K., Qu, Z., Wang, J., Chen, J., and Zhang, J. (2025). Policies for achieving carbon reduction in China from 1995 to 2022: a review and content analysis. Sustainability 17, 2071–1050. doi: 10.3390/su17031326

Zhou, X., Caldecott, B., Hoepner, A., and Wang, Y. (2022). Bank green lending and credit risk: an empirical analysis of China's green credit policy.. Buss Strateg. Environ. 31, 1623–1640. doi: 10.1002/bse.2973

Zhou, Y., Shi, Z. Y., and Wu, L. B. (2021). Green policy under the competitive electricity market: an agent-based model simulation in Shanghai. J. Clean. Product. 299:113501. doi: 10.1016/j.jenvman.2021.113501

Keywords: green credit policy, market performance, financial cost, financial constraints, China

Citation: Wang Z, Bian B, Zhu C, Lu Y and Wang J (2025) Green credit policy's impact on polluting firms' market performance: the role of financing constraints. Front. Environ. Econ. 4:1611379. doi: 10.3389/frevc.2025.1611379

Received: 19 May 2025; Accepted: 05 September 2025;

Published: 03 October 2025.

Edited by:

Michael Getzner, Vienna University of Technology, AustriaCopyright © 2025 Wang, Bian, Zhu, Lu and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Baocheng Bian, YmJjQHN0dS5vdWMuZWR1LmNu

Zhongshuai Wang

Zhongshuai Wang Baocheng Bian

Baocheng Bian Chunqian Zhu2

Chunqian Zhu2 Jun Wang

Jun Wang