Abstract

Introduction:

With the introduction of the strategy of a strong marine power and the “dual-carbon” goal, green, low-carbon and sustainable development has become an important requirement for the growth of the Ocean Economy. Green finance is a financial activity that promotes environmental improvement, climate change response and efficient resource utilization. The “dual-carbon” goal is a major national strategy proposed by the Chinese Government in 2020 to achieve carbon peaking and carbon neutrality, which is a two-stage carbon emission reduction strategic goal proposed by the Chinese Government. China is committed to achieving carbon peaking by 2030, i.e., no further growth in carbon dioxide emissions after peaking, and carbon neutrality by 2060, i.e., offsetting its own carbon dioxide emissions through afforestation, energy conservation and emission reduction. This goal is not only an important initiative for China to address climate change, but also has a profound impact on global climate governance. Through the support of green finance, China is promoting the green transformation and sustainable development of its ocean economy while realizing the “dual carbon” goal. As one of the world’s largest ocean economies, with more than 18,000 kilometers of coastline and an ocean GDP that accounts for 7.8% of the country’s GDP, the development of the ocean economy has a significant impact on the sustainable use of global ocean resources. Therefore, it is of great practical significance for this paper to explore the impact of green finance on China’s ocean economy growth under the “dual-carbon” goal based on the data of China’s coastal provinces and cities from 2008 to 2022.

Methods:

This paper constructs green finance index comprehensive evaluation system, calculates green finance index of Chinese coastal provinces and cities, This paper uses a fixed-effects model to analyze the role of green finance in achieving the ‘dual-carbon’ goal and fostering the growth of China’s ocean economy, and combines with the threshold effect model to further study the nonlinear role of green finance on China’s ocean economy. The paper takes green finance as the core explanatory variable. In this paper, green finance is taken as the core explanatory variable, per capita gross domestic product (GDP) as the explanatory variable, income from marine scientific research and the scale of marine industry as the threshold variables, and the number of authorized patents, GDP index, stock market activity, energy consumption structure, the scale of the tertiary industry and the scale of the secondary industry as the other control variables.

Results:

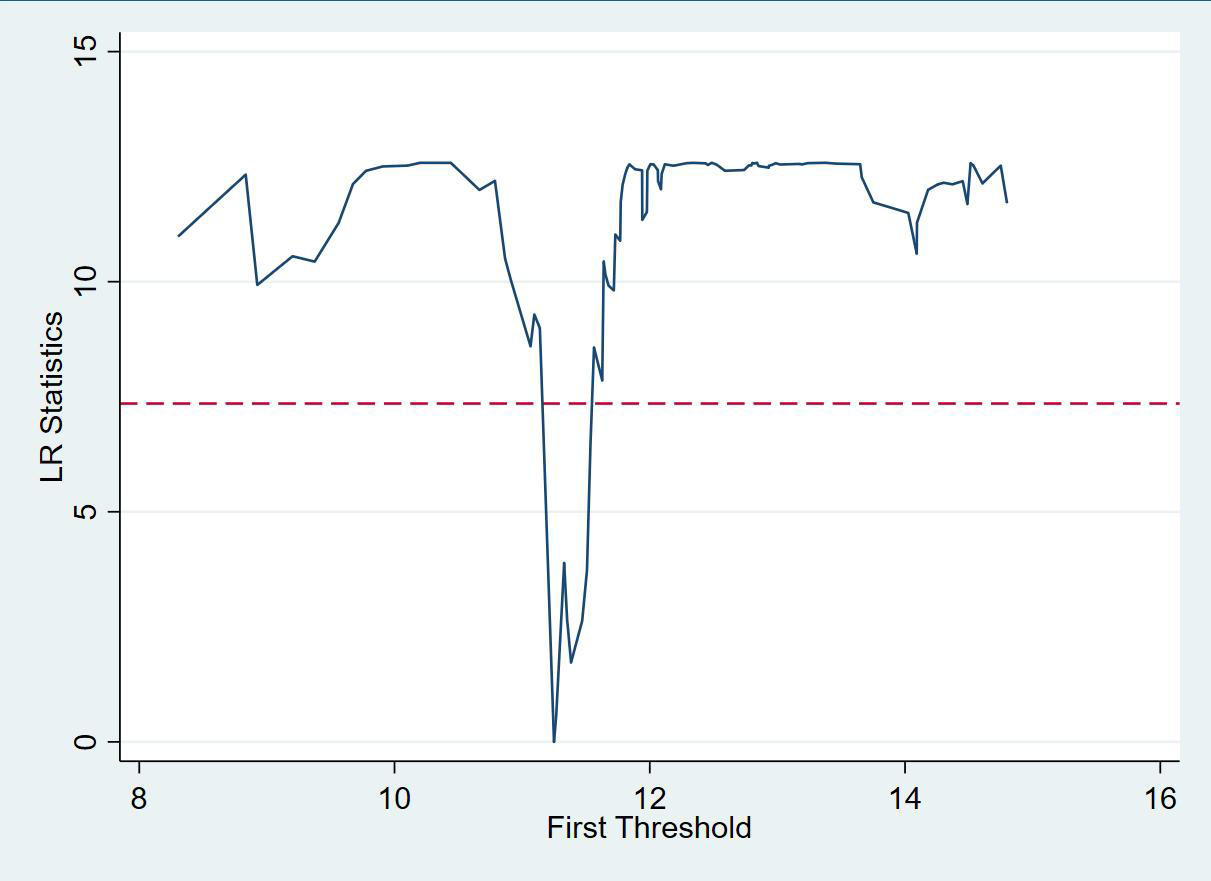

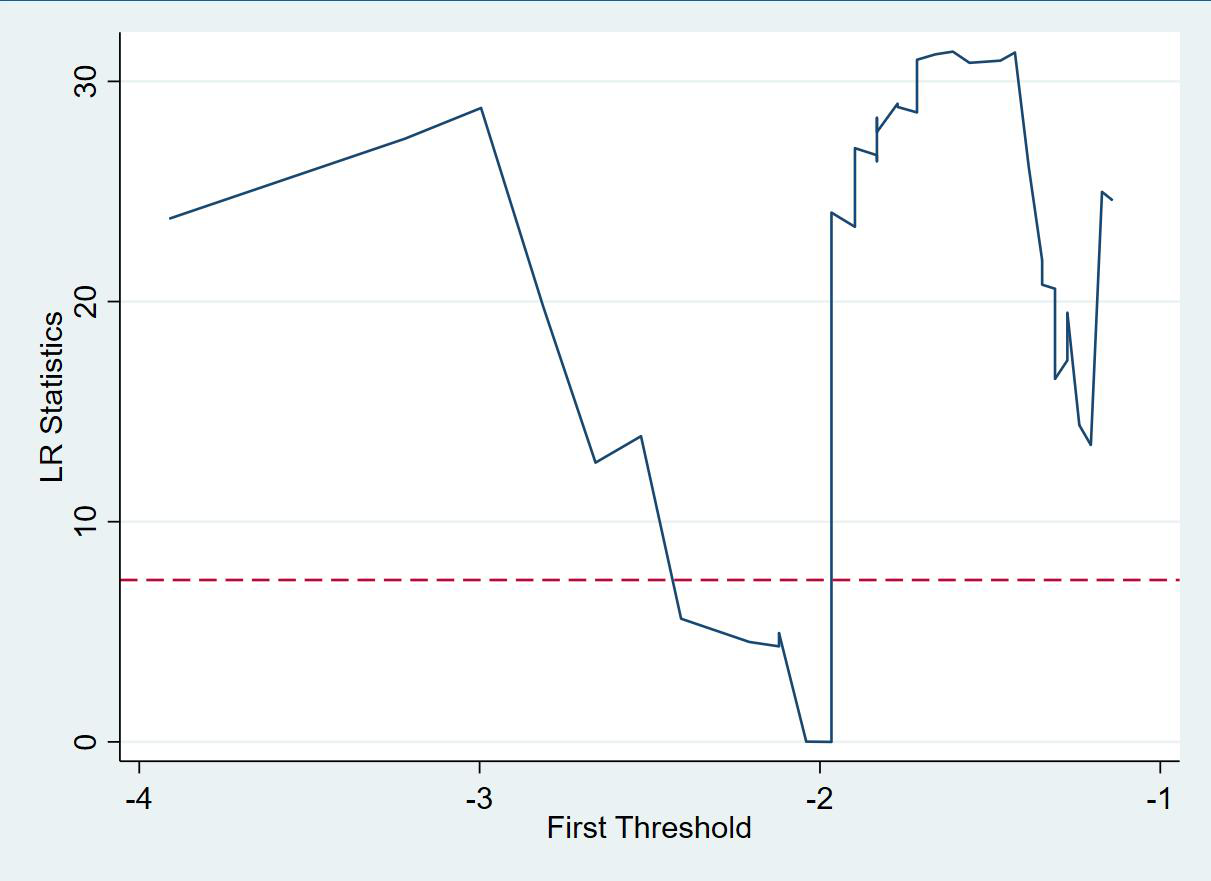

It is found that 1) Green finance has a positive effect on China’s ocean economic growth, with the strongest positive effect on the Southern Ocean Economic Zone. 2) The scale of the marine industry, the scale of the tertiary industry, and the scale of the secondary industry have a significant positive effect on the ocean economic growth in the Nouthern, Eastern, and Southern Ocean Economic Zones, as well as in China as a whole. In addition, the stock market activity has a positive contribution from a national perspective, but a negative hindering effect in the Northern Ocean Economic Zone. 3) The gross regional product index, stock market activity, and energy consumption structure in the Northern Ocean Economic Zone have a negative hindering effect, and the gross regional product index has the most negative hindering effect. The negative hindering effect of the number of authorized patents, GDP index and stock market activity is not significant in the Eastern Ocean Economic Zone, and the negative hindering effect of the income of marine scientific research institutions, GDP index and stock market activity is not significant in the Southern Ocean Economic Zone. From a national perspective, the number of authorized patents has a negative hindering effect, but it has a significant positive promoting effect in the Southern Ocean Economic Zone. 4) The intensity of the positive promoting effect of green finance on China’s ocean economic growth is non-linear, and when the index of the income from the funding of marine-based scientific research institutes reaches 11.249, the promoting effect of green finance on the growth of the ocean economy is slightly weakened. When the marine industry scale index reaches -1.9661, the promotion effect of green finance on ocean economic growth will be significantly weakened.

Discussion:

This paper comprehensively evaluates the development of green finance in China’s coastal provinces and municipalities by constructing a comprehensive evaluation system of green finance indexes suitable for the ocean economic field, dividing the study area into the Northern Ocean Economic Zone, the Eastern Ocean Economic Zone and the Southern Ocean Economic Zone, and investigating the role of green finance on China’s ocean economic growth under the goal of “dual-carbon” and its spatial variability. The study will examine the role of green finance on China’s ocean economic growth under the “dual-carbon” goal and the spatial variability, and combine with the threshold effect model to further clarify the nonlinear relationship of green finance on China’s Ocean Economy, so as to provide valuable countermeasure suggestions for policy makers.

1 Introduction

Globally, many countries have committed to reducing carbon emissions from production systems (Huisingh et al., 2015; Huang et al., 2024; Abbas et al., 2021, 2022).On October 31, 2021, the World Meteorological Organization (WMO) released an interim report on “The State of the Global Climate in 2021” at the 26th United Nations Climate Change Conference According to the report’s statistical data, the global average temperature in 2021 has increased by about 1.09°C compared to 1850-1900, while the 2020 global greenhouse gas (GHG) concentration has reached a new peak. Global greenhouse gas concentrations have reached a new peak in 2020. Rapid depletion of natural resources and environmental pollution generated by economic development have brought great pressure on the ecological environment (Razzaq et al., 2021), and extreme events such as high-temperature heat waves, high temperature and high humidity, floods, and severe droughts and composite extreme events have increased significantly (Zhao et al., 2024), against this background, realizing the “win-win situation” between energy conservation and emission reduction and economic growth In this context, realizing a “win-win situation” between energy conservation and emission reduction and economic growth is the key to promoting high-quality economic development (Zhang YC et al., 2023). In 2019, at the United Nations Climate Action Summit, United Nations Secretary General Guterres proposed the concept of “carbon neutrality” for the first time. Carbon neutrality refers to the reduction of greenhouse gas emissions by adopting a series of environmental protection measures, so that carbon dioxide emissions are equal to or lower than the amount absorbed, thus realizing zero emissions. This is considered a turning point in the global response to climate change, and countries have subsequently made emission reduction commitments in response to the carbon neutrality goal (Wang and Gao, 2024).In September 2020, China’s President Xi Jinping declared at the 75th United Nations General Assembly that China would increase its nationally-owned contribution, adopt more vigorous policies and measures, and that carbon dioxide emissions would strive to peak by 2030, with an Efforts will be made to achieve carbon neutrality by 2060. Since then, the Chinese government has incorporated the “dual-carbon” goals of carbon peaking and carbon neutrality into its overall national development strategy and formulated a series of policies and measures to promote the realization of the “dual-carbon” goals (Sun and Huang, 2020).

In 2020, the Outline of the Fourteenth Five-Year Plan for the National Economic and Social Development of the People’s Republic of China and the Visionary Goals for 2035 proposes to “actively expand the space for the development of the Ocean Economy” (Shi, 2022). The ocean economy has become the blue engine of China’s economic development. In 2023, China’s gross marine product was 9909.7 billion yuan, an increase of 6.0% over the previous year, a growth rate of 0.8% higher than that of GDP, and accounted for 7.9% of GDP, an increase of 0.1% over the previous year (Liu, 2024). The development of the ocean economy is an important support for the implementation of China’s sustainable development strategy. The sustainable utilization of marine resources and the protection of the marine environment are the keys to achieving sustainable development of the ocean economy (Li et al., 2024). However, with the rapid development of the ocean economy and the increasing frequency and expansion of human activities, the marine environment has suffered a certain degree of pollution and damage, and environmental problems have become more and more prominent, and the concept of green development of the ocean economy has been put forward (Gai et al., 2021). Scholars believe that green finance is of great significance to the green development of ocean economy (Xu and Gao, 2022; Zheng et al., 2022). The “dual-carbon” goal creates new opportunities for marine environmental protection and sustainable resource use. Green finance serves as a key tool in achieving these objectives (Baştürk, 2024).

Green finance, also known as environmental financing, is a financial concept that optimizes financial business and achieves sustainable development from the perspective of environmental protection (Southwestern University of Finance and Economics et al., 2015). Green finance seeks economic development in environmental protection and realizes the balance between the economy and the environment (Salazar, 1998), and mainly studies the problem of green economic capital financing, which is an organic combination of sustainable economic development and financial issues (Cowan, 1998). By the end of June 2023, the balance of local and foreign currency green loans in China was RMB 27.05 trillion, an increase of 38.4% over the previous year, higher than the growth rate of all loans by 27.8%, and an increase of RMB 5.45 trillion over the beginning of 2023. China has formed a green financial product system with green credit as the main body and comprehensive green bonds, green insurance, green funds, green trusts, green leasing, carbon finance and other co-development (Zhou SJ. et al., 2024). While green finance significantly reduces the credit line of high-pollution industries, it diverts more funds to green industries, realizes the optimal allocation of resources, and thus effectively reduces carbon emissions (Zhang and Wu, 2024). Under the guidance of green financial policies, enterprises will independently carry out green technological innovation to improve the degree of enterprise specialization, socialization and energy-saving and emission reduction efficiency, thus promoting the process of enterprise decarbonization (Zhang and Jia, 2024).

Green finance can not only effectively promote the development of the ocean economy and boost the optimization and upgrading of the marine industrial structure, but also provide financial support and risk management services to help the ocean economy achieve low-carbon development (Liu and Yang, 2019). Through financing and investment support, the marine industry is able to expand the scale of development, issue blue bonds, provide financial support for the layout of the whole industry chain of clean energy, and respond to the national goals of carbon peaking and carbon neutrality (Hou et al., 2020; Ji et al., 2020). In addition, the financial support brought by green finance has provided assistance to the marine industry to carry out technological development and assume environmental social responsibility (Bian and Yang, 2023). However, some scholars question whether green finance can reduce carbon emissions and promote the sustainable development of the Ocean Economy. Some scholars argue that financial agglomeration has not served to promote the efficiency of marine technology to reduce carbon emissions (Sun et al., 2017), and that there is an inhibitory effect on the growth of the ocean economy (Zhao and Peng, 2017; Yu, 2013). This is due to the high risk nature of the ocean economy that makes it more difficult for commercial banks to lend money, making it difficult to produce a positive promotion effect (Zhuang, 2020).

In 2020, Chinese President Xi Jinping clearly put forward the “dual carbon” targets. Prior to that, the concept of “dual carbon,” along with the sustainable development and green finance ideas behind it, had already been deeply practiced in China. In 2008, China Industrial Bank announced its adoption of the “Equator Principles,” becoming the first “Equator Bank” in China, marking a milestone in the development of green finance in the country. In 2016, the People’s Bank of China, the Ministry of Finance, and seven other ministries and commissions jointly issued the “Guiding Opinions on Building a Green Financial System,” proposing to promote green finance to support environmental protection and sustainable development. In 2021, the Central People’s Government of the People’s Republic of China released the “14th Five-Year Plan for Marine Economic Development,” advocating for the green and low-carbon transformation of the ocean economy and facilitating the integration of green finance with the ocean economy. In recent years, China’s practices in green finance and the pursuit of the “dual carbon” targets have provided valuable experience for the global community. This paper selects China as the scope of study and sets the research time frame from 2008 to 2022. This period covers the entire journey of green finance, from its nascent stages to rapid development, and also witnesses the historical process of the “dual carbon” targets, from their proposal to their comprehensive implementation. It not only facilitates a deeper understanding of the impact of green finance on China’s marine economic growth but also offers useful insights for other countries and regions.

This paper constructs a comprehensive evaluation system of green finance index, adopts a fixed-effects model, to study the role of green finance on China’s ocean economic growth and spatial heterogeneity under the “dual-carbon” goal, and combines with the threshold effect model to further clarify the nonlinear role of green finance on China’s Ocean Economy. The purpose of this paper is to explore the role of green finance in promoting the transition of China’s ocean economy to a green and sustainable direction and realizing the “dual-carbon” goal in the marine sector, as well as the specific impacts of this transition on economic growth, so as to provide feasible countermeasures for the marine industry, financial institutions and other stakeholders, as well as for policy makers, which is of strong practical significance. It is of great practical significance.

2 Literature review

2.1 Green finance and the ocean economy

In the 1990s, the concept of green finance was formally proposed (White, 1996), and the early theoretical research focusing on the role of financial institutions in environmental protection and sustainable economic development (Jeucken and Bouma, 1999), since then, it has gradually shifted to quantitative research. At present, research mainly focuses on the economic and environmental effects of green financial development, and scholars generally believe that green finance can optimize resource allocation, promote ecological and resource protection (Eremia and Stancu, 2006), and promote economic structural change (Chen et al., 2019). However, scholars have not yet agreed on the nature of the impact of green financial development on economic growth. Some scholars believe that green financial development can significantly promote economic growth (Markandya et al., 2015; Ruiz et al., 2016; Zhou et al., 2020), and generate new kinetic energy by suppressing outdated production capacity and promoting industrial transformation to help economic development (Chu and Zong, 2018; Fang and Lin, 2019a); however, there are scholars who believe that green financial development will inhibit economic growth (Ning and She, 2014), the correlation between green finance and economic growth in five provinces in northwest China was tested, and it was found that the overall impact coefficient was positive, but the performance of each province was different (Liu and Liu, 2020), which indicates that green finance and economic development cannot be simply understood as a linear relationship.

Technological innovation, informationization level, green finance and environmental regulation are considered to have important impacts on the green development of the ocean economy (Xu and Gao, 2022; Li et al., 2020; Zheng et al., 2022), and scholars have also explored the impacts of the marine environment on the marine economies of different countries (Kildow and McIlgorm, 2010; Wang et al., 2021), using variable fuzzy identification model, set-pair analysis method and other methods to measure the level of green development of the Ocean Economy, as well as spatio-temporal evolution analysis, regional differences and dynamic change trend analysis (Liang, 2019). The expansion of the total scale of green financial funds has a significant role in promoting the green transformation of the ocean economy (Xu et al., 2019), and further research has found that environmental regulation plays a positive regulating role between the development of green finance and the upgrading of industrial structure, strengthens the role of upgrading of industrial structure in promoting the high-quality development of the Ocean Economy, and also shows a positive regulating effect in the direct effect of green finance on the high-quality development of the ocean economy effect (Xu and Dong, 2024), a view that has received more support (Liu et al., 2015; Wang and Yao, 2016; Hu and Zhao, 2018). In addition, some studies have shown that the coupling and coordination between green finance and high-quality development of the ocean economy is generally on a steady upward trend, but there are significant differences between provinces and cities, such as the coupling and coordination degree of Tianjin, China, which is significantly higher than that of other provinces (Wang et al., 2023). However, green finance faces challenges such as mismatch between the supply and demand of funds, difficulties in meeting the needs of financial service institutions, and the lack of financial instruments and products in supporting the development of the Ocean Economy, and its role in promoting the growth of the ocean economy is limited by the differences in the level of construction of relevant supporting facilities in different regions (Zhao et al., 2020).

2.2 “Dual carbon” and the ocean economy

China’s ocean economy has undergone a rapid transition from a “crude” model that relies on high inputs of labor, capital, energy and excessive CO2 emissions to a more “frugal and intensive” development model (Ding and Dong, 2024).In this transition process towards a “dual-carbon” goal, China’s shipping industry has taken measures such as accelerating the green transformation of the shipbuilding industry, which has significantly reduced carbon emissions and maintained a dominant position in the field of reducing carbon emissions in global shipping Hu and Dong, 2024). In the future, the decarbonization of the shipping industry will rely more on intelligent technologies (Xiao et al., 2025). In addition, there are significant differences in the carbon emission efficiency of ocean fisheries among regions in China. Except for Hebei and Guangxi, the carbon emission efficiency of marine fisheries in most regions is maintained at a high level, and these high-efficiency regions show a certain spatial dependence, especially the “high-high” clustering characteristics (Zhang, 2021). Scholars have deeply analyzed the factors affecting the efficiency of marine carbon emissions, and the level of science and technology is considered to be the most important factor, while the scale of marine fisheries, the scale of the Ocean Economy, the degree of opening up to the outside world, and the structure of the marine industry also play an important role (Di et al., 2024). Innovation is the core driving force to promote the high quality of the ocean economy and achieve the “dual carbon” goal (Pan et al., 2024). In addition, carbon trading policies, ownership structure, industrial structure, environmental regulations, and technological level all contribute significantly to the synergistic development of China’s marine industry agglomeration and carbon emission reduction. However, the facilitating effects of these factors are significantly heterogeneous across regions (Cheng et al., 2022; Xu et al., 2023). ocean economic activities to satisfy domestic demand are the main source of carbon emissions, while in terms of carbon transfer, the ocean economy is characterized by a two-way co-existence, which is generally manifested in the fact that carbon outflow is greater than carbon inflow. In the carbon transfer network, Tianjin, Shandong and Guangdong become the central nodes in the network by virtue of their strong centrality (Zhang Y. et al., 2023). The level of marine science and technology and innovation are the key factors driving the realization of the “dual-carbon” goal, and there is spatial heterogeneity in the contribution of these factors to carbon emission reduction in different regions (Lin and Teng, 2024).

2.3 “Dual carbon” and green finance

A high level of green finance plays a key role in promoting the realization of the “dual-carbon” goal, and this contribution is largely dependent on the effective guidance of the government (Wang JY et al., 2024). A number of studies have revealed that there are regional differences in the impact of green finance on carbon emissions. Green bonds can significantly reduce the intensity of urban carbon emissions, and this effect is more pronounced in regions with a higher degree of financial marketization and weaker environmental regulations (Zhang K. et al., 2023). Green finance is most effective in promoting carbon emission reduction in central China, followed by western and Eastern regions (Yan et al., 2024). The carbon emission reduction effect of green finance is more prominent in cities of large scale and above, as well as in cities with stronger innovation capacity. Green technology progress and industrial structure optimization is an important way for green finance to promote the realization of the “dual-carbon” goal, and there are obvious differences in the role of green finance development in carbon emission reduction in different regions (Tan, 2020; Chen et al., 2024). Green technology innovation plays an intermediary role in the carbon emission reduction effect of green finance, while environmental regulation and financial marketization further enhance the carbon emission reduction effect of green finance (Zhou WH. et al., 2024). Technological innovation is an important mechanism for green finance to exert emission reduction effects (Wen et al., 2022). Expanding the scale of the green finance market, providing enterprises with the financial support needed for low-carbon transformation, and guiding substantive technological innovation to optimize the domestic industrial structure are key ways to achieve the “dual-carbon” goal (Wang YL. et al., 2024). However, some studies have also pointed out that environmental investment and the increase in the level of economic development may have a negative moderating effect on the carbon emission reduction effect of green finance (Xu et al., 2024). In addition, the coupling and coordination degree of green finance and low carbon economy in China shows a fluctuating upward trend, but it has not yet reached the state of high-quality coupling and coordination, and the green financial system is relatively lagging behind (Liu and Xu, 2024). The impact of green finance on carbon emission efficiency also shows some lag and backward effects, indicating that green finance needs to be continuously focused and optimized in the process of achieving the goal of “double carbon” (Wu and Xu, 2023).

In summary, it is widely recognized in the current academic community that green finance has a driving effect on the growth of the Ocean Economy, but this relationship is not a simple linear link, but shows significant regional heterogeneity. China’s ocean economy is undergoing a transition from a “crude” mode to a “conservation and intensification” mode, during which the carbon emission efficiency of the marine industry is characterized by spatial aggregation (Tian et al., 2023). In terms of the impact of green finance on China’s carbon emissions, different regions show obvious differences, with the central region showing the most prominent role of green finance in carbon emission reduction, followed by the western and Eastern regions (Li and Lin, 2023).

However, although existing literature has extensively explored the relationship between green finance and China’s ocean economy and its regional variability, there are still many shortcomings. Most studies use qualitative analysis or simple statistical analysis methods, and lack in-depth and systematic quantitative research and modeling, which limits the in-depth understanding and accurate prediction of the relationship between green finance and China’s Ocean Economy. In addition, although the literature has noted the differences between green finance and ocean economy in different regions, there is still a lack of in-depth exploration of the deep-seated reasons and mechanisms behind these differences. Therefore, the purpose of this paper is to further explore the deep relationship between green finance and China’s ocean economy under the “dual-carbon” goal, and to explain the reasons for the differences between green finance and China’s ocean economy in different regions, with a view to providing a more accurate and scientific basis for the formulation and implementation of relevant policies.

3 Study area and evaluation system

3.1 Study area

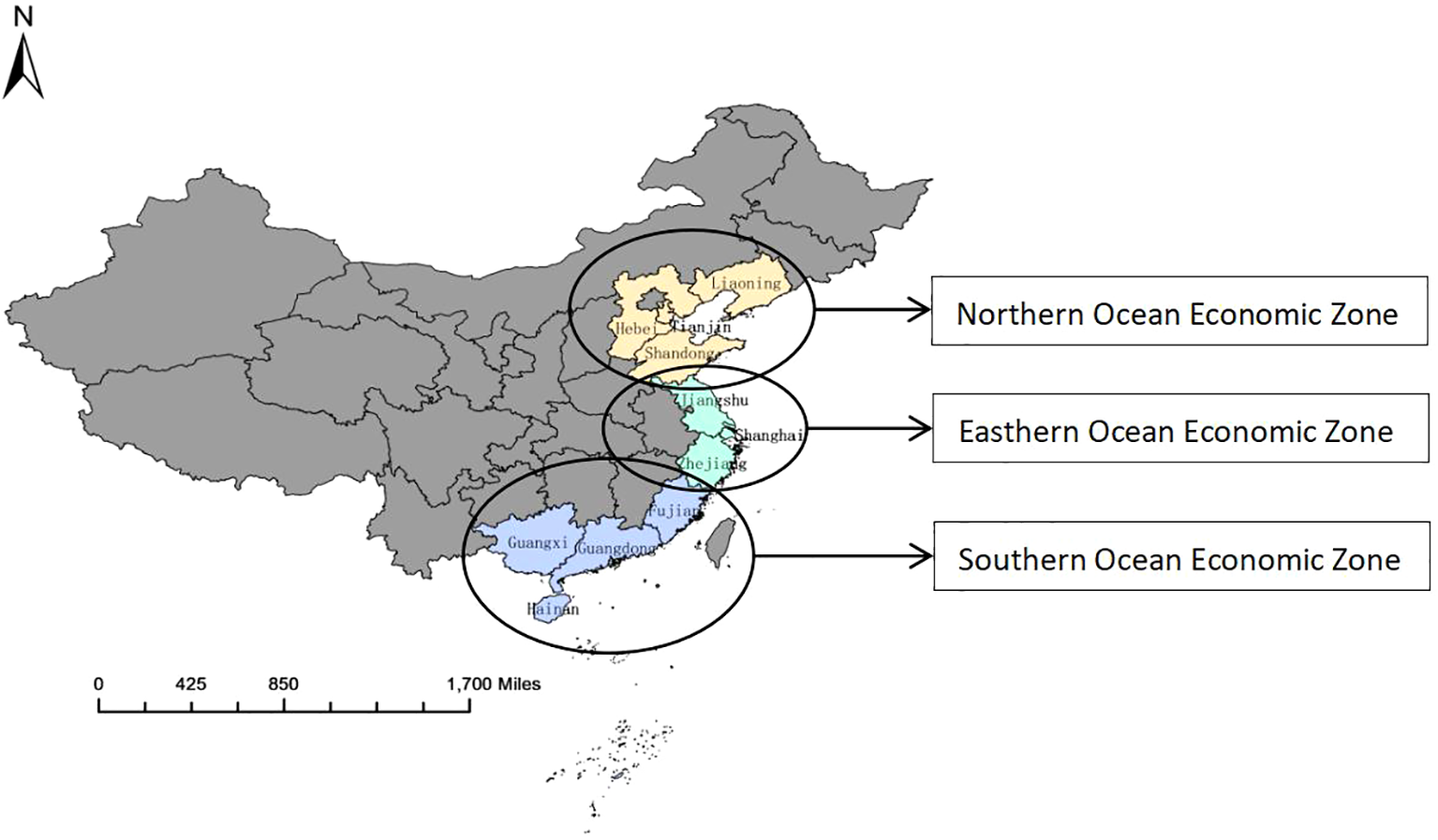

The ocean economy has become an important engine of global economic growth. As the world’s second largest economy, China’s rapid growth in the ocean economy not only promotes domestic economic development, but also enhances China’s influence in the global economy. Coastal areas are an important part of the development of the Ocean Economy, and play an important role in China’s national strategy. There are 14 coastal provinces and cities in China, and considering the availability and completeness of the data, this paper excludes Hong Kong, Macao, and Taiwan, and the study area covers a total of 11 provinces and cities, including Liaoning, Hebei, Tianjin, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, Guangxi, and Hainan. According to China’s “13th Five-Year Plan for the Development of the National Ocean Economy” (The 13th Five-Year Plan for the Development of the National Ocean Economy: the Northern Ocean Economic Zone consists of the Liaodong Peninsula, Bohai Bay and Shandong Peninsula coasts and sea areas; the Eastern Ocean Economic Zone consists of the Jiangsu, Shanghai and Zhejiang coasts and sea areas; and the Southern Ocean Economic Zone consists of the Fujian Province, the mouth of the Pearl River and its two flanks, the Beibu Gulf, and the coasts and sea areas of Hainan Island), the 11 provinces and cities in the study area are categorized into the Northern Ocean Economic Zone, the Eastern Ocean Economic Zone and the Southern Ocean Economic Zone, of which the Northern Ocean Economic Zone includes Liaoning, Hebei, Tianjin, Shandong and Hainan; the Eastern Ocean Economic Zone includes Jiangsu, Shanghai and Zhejiang; and the Southern Ocean Economic Zone includes Fujian, Guangdong, Guangxi and Hainan (Table 1).

Table 1

| Study area | Name of region, province and city | Number of provinces and cities |

|---|---|---|

| Northern Ocean Economic Zone | Liaoning, Hebei, Tianjin, Shandong | 4 |

| Eastern Ocean Economic Zone | Jiangsu, Shanghai, Zhejiang | 3 |

| Southern Ocean Economic Zone | Fujian, Guangdong, Guangxi, Hainan | 4 |

Scope of the study area.

Different regions have different natural resource endowment and ecological environment capacity due to their geographic location, climatic conditions, geological structure and other factors. The Northern Ocean Economic Zone is located in the north of China, covering Liaodong Peninsula, Bohai Bay and Shandong Peninsula, with rich marine fishery resources and port resources; the Eastern Ocean Economic Zone is located in the Yangtze River Delta region, with unique marine transportation conditions and rich marine mineral resources; the Southern Ocean Economic Zone involves Fujian, the Pearl River Estuary and its two flanks, the Beibu Gulf, and Hainan Island, whose tropical and subtropical climate conditions are suitable for the development and utilization of marine biological resources. China’s coastal provinces and cities have their own characteristics and advantages in the development of the Ocean Economy, and a categorized discussion is more conducive to clarifying the actual role of green finance on ocean economic growth in each region.

This paper uses Arcgis software to draw the distribution map of China’s Ocean Economic Zone, as shown in Figure 1 below, the Ocean Economic Zone presents the characteristics of the development of marine industry clusters, and the marine industries with similar industrial characteristics, technological level and market demand will form industrial clusters, so as to reduce the cost, improve the efficiency, and enhance the competitiveness.

Figure 1

Distribution of China’s Ocean Economic Zones.

3.2 Comprehensive evaluation system of green finance index

During the G20 Hangzhou Summit, China and the United Kingdom jointly released the G20 Green Finance Synthesis Report, which provides an authoritative definition of green finance, which refers to investment and financing activities that generate environmental benefits in support of sustainable development (Hou and Guo, 2024). Most of the existing studies use green credit to characterize the level of green finance development, which is difficult to fully reflect the connotation of green finance. Green credit, green securities, green funds, green financial bonds, green insurance, eco-banking, etc. have become the “new normal” of the financial industry, and the main products of green finance include green credit, green securities, green insurance and carbon finance. Green credit is the largest component of green finance, directly reflecting the support of financial institutions for green projects; green investment, including equity investment, project investment and other forms of investment, can reflect the market’s long-term support for the green industry; green insurance for green projects to provide risk protection to reduce the impact of environmental risks on the project; green bonds are one of the most mature tools in the development of the global green finance market; green support includes government subsidies, tax incentives, special funds and other policy tools, which is an important force to promote the development of green finance; green rights and interests include carbon emission rights, sewage rights and other market-based environmental rights and interests trading tools; green fund focuses on green industry investment, which can effectively guide the flow of funds to green projects Li and Xia, 2014; Ma, 2016; He and Cheng, 2022).Most of the existing studies use green credit to characterize the level of green financial development, which is difficult to comprehensively reflect the connotation of green finance. On the basis of existing studies, this paper constructs a comprehensive evaluation system of green financial index applicable to the ocean economic field (Fang and Lin, 2019b; Yu and Fan, 2022), which consists of seven level 1 indicators, namely, green credit, green investment, green insurance, green bond, green support, green fund and green rights and interests, and the contribution of each indicator is positive. Among them, green credit is represented by the proportion of total credit for environmental protection projects to total credit; green investment is represented by the proportion of investment in environmental pollution control to GDP; green insurance is represented by the proportion of revenue from environmental pollution liability insurance to total premium income; green bonds are represented by the proportion of total green bond issuance to total issuance of all bonds; green support is represented by the proportion of fiscal environmental protection expenditure to fiscal general budgetary expenditure; green fund is represented by the proportion of total market value of green funds to total market value of all funds; and the contribution of each indicator is positive. Green funds are represented by the total market value of green funds as a percentage of the total market value of all funds; green equity is represented by the total amount of equity market transactions in carbon trading, energy use rights trading, and sewage rights trading (Table 2).

Table 2

| First-level index | Secondary indicators | Methodology for measuring secondary indicators | Attributes | Weights |

|---|---|---|---|---|

| Green Credit | Percentage of credits for environmental projects | Total credit/total credit for environmental projects | + | 13.903% |

| Green Investment | Investment in environmental pollution control as a share of GDP | Investment in environmental pollution control/GDP | + | 12.36% |

| Green Insurance | Extent of promotion of environmental pollution liability insurance | Environmental pollution liability insurance income/total premium income | + | 18.474% |

| Green Bond | Extent of green bond development | Total green bond issuance/total all bond issuance | + | 13.202% |

| Green Support | Percentage of fiscal expenditure on environmental protection | Financial environmental protection expenditures/financial general budget expenditures | + | 16.72% |

| Green Fund | Percentage of green funds | Total market capitalization of green funds/total market capitalization of all funds | + | 14.317% |

| Green Benefits | Green equity development depth | Carbon trading, energy rights trading, emissions trading/total equity market transactions | + | 11.025% |

Green finance index comprehensive evaluation system.

3.3 Green finance index for China’s coastal provinces and municipalities

The green finance index is an important indicator for measuring the performance of financial institutions in environmental, social and governance aspects. According to the comprehensive evaluation system of the green finance index constructed above, the green finance index can reflect the proportion of credits for environmental protection projects, investment in environmental pollution control, the degree of promotion of environmental pollution liability insurance, the issuance of green bonds and other aspects. Calculating the green finance index of China’s coastal provinces and cities will help to understand the development status of coastal provinces and cities in the field of green finance, as well as the spatial characteristics of the level of green finance development, so as to formulate a more scientific and reasonable strategy of sustainable development and promote the realization of the “dual-carbon” goal for the marines.

The entropy method, which is used as the main method for determining the weights of criteria/structures, can assess data completeness more objectively, enhance the interpretability of the results, and mitigate the influence of subjective factors (Wang et al., 2013). In this paper, the entropy method is used to measure the green finance index of China’s coastal provinces and cities. There are six measurement steps, including data standardization, calculation of sample value weight, calculation of information entropy, calculation of redundancy, calculation of information weight and calculation of comprehensive score, as follows:

The first step is to standardize the data (Equation 1):

In the second step, the weight of each sample value in the total sample, P(ij), is calculated from the normalization matrix (Equation 2):

In the third step, the information entropy for each indicator is calculated based on the weight (Equation 3):

In the fourth step, the redundancy dj of each metric is calculated based on the information entropy (Equation 4):

In the fifth step, the weight wj of each indicator is calculated based on the redundancy (Equation 5):

In the sixth step, the green finance index GFIi is calculated based on the weights and normalized indicator values (Equation 6):

This paper calculates the green finance index of China’s coastal provinces and cities based on the above methodology, and the related data are from the Statistical Yearbook and Environmental Status Bulletin of China and provinces and cities, as well as the China Science and Technology Statistical Yearbook, the China Energy Statistical Yearbook, the China Financial Yearbook, the China Agricultural Statistical Yearbook, the China Industrial Statistical Yearbook, and the China Tertiary Industry Statistical Yearbook.

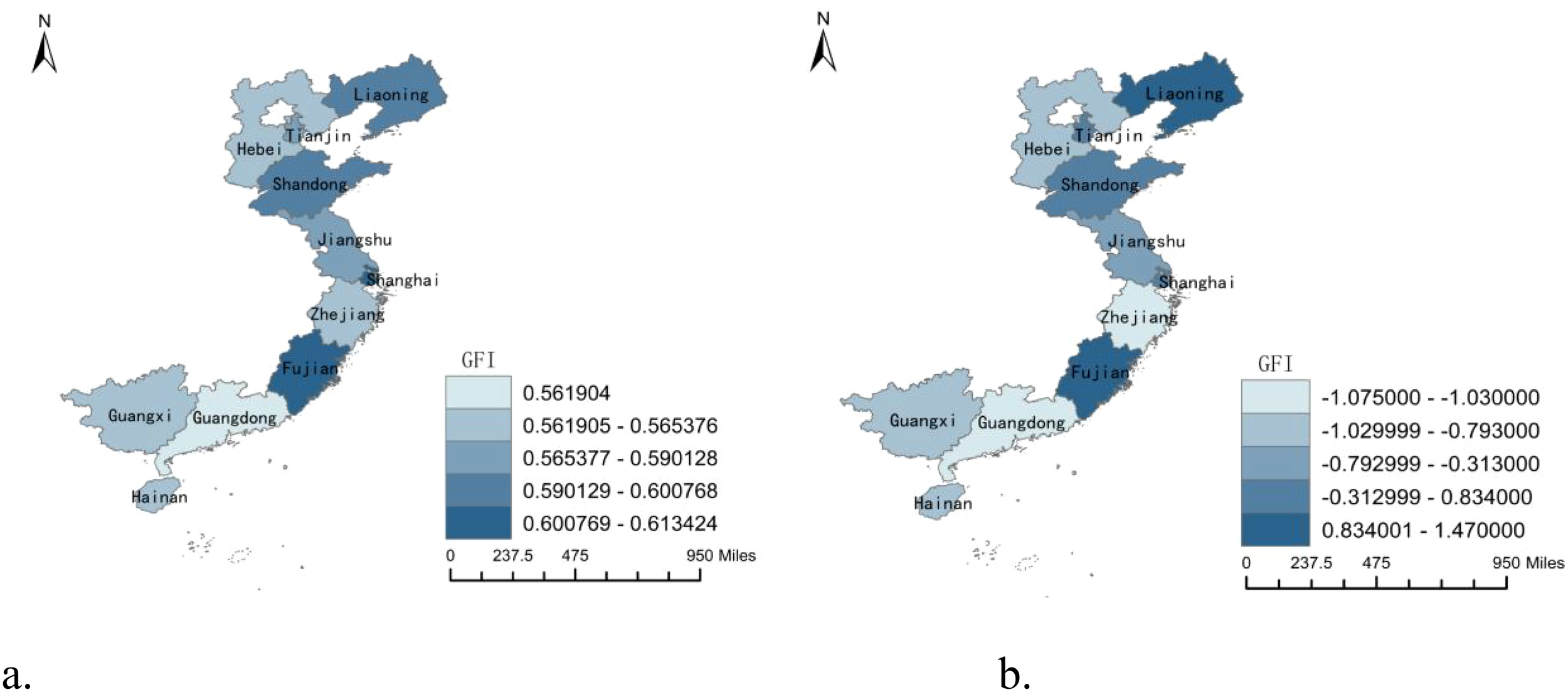

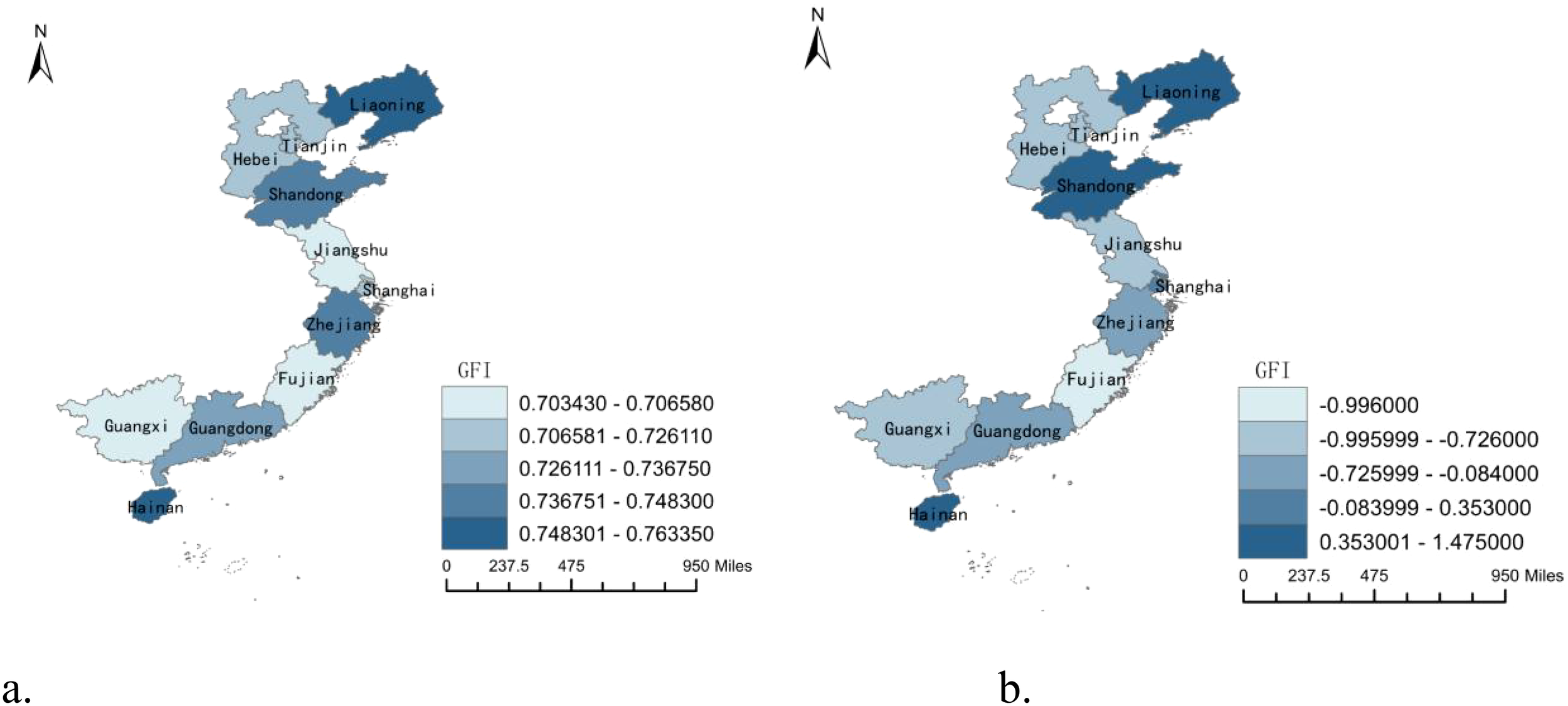

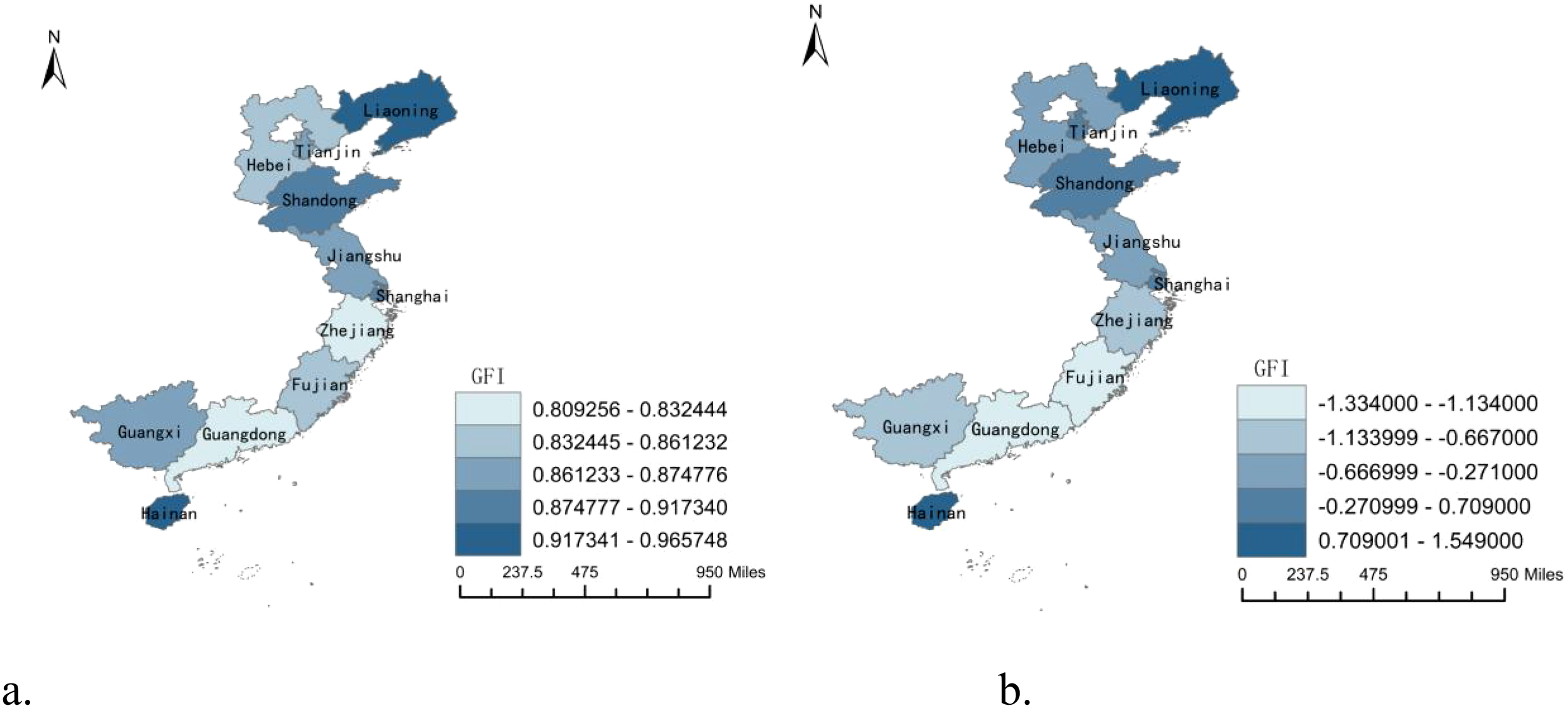

Figures 2a , 3a, 4a show the green financial development status of China’s coastal provinces and cities in 2008, 2015 and 2022, respectively. To enhance the credibility of the study, this paper uses factor analysis to cross-validate the green financial development status of China’s coastal provinces and cities. Factor Analysis (FA) is a multivariate statistical method used to study the underlying structure between observed variables. It explains the correlation between variables by attributing multiple observed variables to a few potential factors. Its formula is expressed as Equation 7:

Figure 2

(a) Green finance developments in 2008 (b) Green finance developments in 2008.

Figure 3

(a) Green finance developments in 2015 (b) Green finance developments in 2015.

Figure 4

(a) Green finance developments in 2022 (b) Green finance developments in 2022.

X denotes the matrix of observed variables. f denotes the matrix of factor scores, which are unobservable latent variables. a denotes the matrix of factor loadings, which reflect the correlation between the variables and the factors. ϵ denotes the error terms, which are a part of the information unique to each variable and are usually ignored in the actual analyses.

The factors were first extracted using principal component analysis and the number of factors was determined. Then the factor loading matrix was rotated to make the factor interpretation clearer. Finally, the performance of each sample on the public factors was obtained by calculating the scores of each public factor, and the factor scores were weighted and averaged according to the variance contribution ratio of each factor to finally obtain the composite score. It is found that the obtained comprehensive scores of green finance in China’s coastal provinces and cities in 2008, 2015 and 2022 (Figures 2b, 3b, 4b) are highly similar to the results of the previous study (Figures 2a, 3a, 4a), and the distribution of the level of green finance development in each coastal province and city is basically the same. The entropy value method and factor analysis method are objective assignment methods, and the two methods yield similar results, proving the reliability of the study.

From the viewpoint of the spatial characteristics of development, the green finance index of the Northern Ocean Economic Zone is always higher than that of the Eastern and Southern Ocean Economic Zones, but the gap is gradually narrowing, and there is an obvious difference in the development speed of green finance in different Ocean Economic Zones. The development speed of green finance in the Eastern Ocean Economic Zone is relatively fast, while Hainan in the Southern Ocean Economic Zone has a rapid development momentum, and the development of green finance in the Northern Ocean Economic Zone is relatively smooth.

From the perspective of development potential characteristics, the development of green finance in China’s Ocean Economic Zones still has a large potential, especially Hainan in the Southern Ocean Economic Zone and Liaoning in the Northern Ocean Economic Zone. Although Hainan started late, it is growing faster and is expected to become a new engine of green finance development in the future. Hainan’s green financial index was low in 2008, in order to accelerate the development of Hainan eight relevant departments jointly issued the “Hainan Provincial Green Financial Reform and Development Implementation Program”, the issuance of green bonds and green credit balance of the annual incremental rankings of the top five of the province’s enterprises and banks to give incentives to guide the financial resources tilted to the field of green, emission reduction, innovation of green financial products, support for the issuance of green and blue bonds, the establishment of green low-carbon investment funds, and enriching green insurance products, Hainan’s green financial index has improved significantly, and the speed of green financial development is the fastest among coastal provinces and cities. Liaoning’s green financial index in 2008, 2015 and 2022 has been at the leading level. Liaoning has established an advanced green financial service platform “Liao Green Pass”, continuously improved the green financial support project database, set up a carbon emission right pledge service center, and incorporated the green financial evaluation results into the rating system of financial institutions of the central bank. In addition, Liaoning has formulated evaluation standards for the identification of green enterprises and green finance, and standardized the development of green finance business.

As can be seen from the development of green finance in China’s coastal provinces and municipalities in 2008, 2015 and 2022, despite the overall increase in the index, there are still differences in the green finance index between different regions, reflecting the unevenness of green finance development. Second, the growth rate of the green finance index is not consistent across regions. The indexes of some regions grow faster, while the growth of other regions is relatively slow. Therefore, this paper investigates the heterogeneity of the development of green finance indexes in various regions, with a view to finding corresponding programs to promote the development of green finance in various regions and to promote the overall high-quality growth of China’s Ocean Economy.

4 Methodology and data

This paper firstly adopts a fixed-effect model to explore the relationship between green finance and China’s ocean economy under the “dual-carbon” goal. Fixed Effects Model (FEM) is able to control for individual characteristics (e.g., geographic location, ocean resource endowment, etc.) that do not vary over time, thus estimating more accurately the impact of green finance on ocean economy growth. In addition, the Fixed Effects Model is suitable for dealing with panel data and can alleviate the endogeneity problem. In order to verify the applicability of the fixed-effects model, this paper conducts a Hausman test, which shows that the fixed-effects model is superior to the random-effects model (see Table 3). Considering the differences in the level of economic development, resource endowment and policy environment of China’s coastal regions, this paper further conducts a heterogeneity test by dividing the sample into the Nouthern, Eastern and Southern Ocean Economic Zone and conducting fixed effects regressions separately. This sub-regional analysis can reveal the spatial heterogeneity of green finance on ocean economy growth and provide a scientific basis for the formulation of differentiated policies. Finally, through the threshold effect model, the non-linear relationship between green finance and ocean economic growth is further studied, the threshold value is identified, and countermeasures are proposed to promote the development of China’s ocean economy through green finance under the “dual-carbon” goal.

Table 3

| Hausman test | Value |

|---|---|

| chi2(9) | 34.67 |

| Prob>chi2 | 0.0001 |

Results of Hausman test.

4.1 Fixed effects model

The development of the ocean economy is influenced by various factors, including geographic location, resource endowment, and the policy environment, and there are significant differences in ocean economic growth between different regions.

The fixed-effects model can capture this individual variability and more accurately analyze the impact of green finance on ocean economy growth. At the same time, the fixed-effects model can alleviate the endogeneity problem to a certain extent. Certain individual characteristics that do not change over time may affect green finance development and ocean economy growth at the same time. Through the Fixed Effects Model, the interference of these time-varying factors can be eliminated and the reliability of the conclusions can be improved. In this paper, we use the panel data of China’s coastal provinces and cities from 2008-2022, and the fixed-effects model is very suitable for analyzing this kind of data structure with both time and individual dimensions. It can take full advantage of the panel data to analyze the dynamic impact of green finance on ocean economy growth. Its formula can be expressed as Equation 8:

Where denotes provinces and municipalities and denotes time; denotes the per capita gross marine product of province and municipality at time ; denotes an individual fixed effect, which represents an individual-specific characteristic that does not change over time; denotes the coefficient of the independent variable; denotes the value taken by province and municipality at time ; and is the error term.

Substituting the explanatory variables, core explanatory variables and other control variables selected in this paper to get Equation 9:

Where GMP denotes the per capita gross marine product of each province and city; GFI denotes the green finance index of each province and city; FMR denotes the funding income of marine scientific research institutions; NPG denotes the number of authorized patents of each province and city; GRI denotes the index of the gross regional product of each province and city; SMA denotes the stock market activeness of each province and city; SMI denotes the scale of the marine industry of each province and city; ECS denotes the energy consumption structure; STI denotes the scale of tertiary industry in each province and city; SSI indicates the scale of secondary industry in each province and city.

4.2 Fixed effects model test

In order to verify the reasonableness of the selected model, this paper used the Hausmann test for model testing. The results show that the statistic of the chi-square test reaches 34.67, and the significance level of this statistic is much lower than 0.01, which strongly rejects the original hypothesis, thus proving that the selection of the Fixed Effects Model to analyze in this paper is reasonable (Table 3).

4.3 Threshold model

Under the “dual-carbon goal”, the impact of the development of green finance on the growth of the ocean economy shows a complex non-linear relationship. With the continuous development of green finance, its role in promoting the ocean economy gradually increases, while it may also be limited by certain thresholds. Threshold Model is a kind of nonlinear regression model, which assumes that the relationship between the dependent variable and the independent variable has different manifestations in different intervals, and is able to capture the nonlinear relationship of the dependent variable when the independent variable reaches a certain threshold, which is suitable for studying the potential threshold effect of green finance on ocean economy growth. Traditional segmented regression models and high order term models, etc. can also simulate the nonlinear relationship, but segmented regression models often need to determine the segmentation point in advance, and there may be the case of multiple cut-off points, which is complicated to deal with and easy to interfere with the objectivity of the empirical results. Higher term models can also simulate nonlinear relationships by introducing higher terms for the independent variables, but they may be overfitted, especially when the true relationship is segmented and linear, the higher terms may not be accurate enough, and the coefficients are difficult to interpret. In contrast to traditional segmented regression models, high order terms, and other models that explore nonlinear relationships, Threshold Effect Models are able to automatically determine cut-off points based on the characteristics of the data itself, and deal with single or multiple thresholds while maintaining linearity within the segments, which makes it more straightforward to interpret the effects in each interval. In addition, the Threshold Model fits the data more accurately, especially when there is an obvious structural change in the relationship between the variables, rather than a smooth nonlinear change, and the use of the Threshold Model is more effective in exploring the nonlinear relationship between green finance and ocean economy growth. Therefore, this paper adopts the Threshold Model for analysis. The formula is as follows:

When the threshold variable qit is less than or equal to the threshold value γ, the model is Equation 10:

When the threshold variable qit is greater than the threshold value γ, the model is Equation 11:

Equations 10, 11 are combined to obtain Equation 12:

Where denotes provinces and cities, and denotes time; denotes gross marine product per capita; denotes green finance index; denotes threshold variable; denotes a specific threshold value; is an indicator function that takes the value of 1 when the condition is established, and 0 otherwise; denotes the individual effect; and denotes a random disturbance term.

4.4 Variable selection and data sources

4.4.1 Selection of variables

4.4.1.1 Explained variables

Gross Maritime Product per capita (GMP). In this paper, the Gross Maritime Product per capita (GMP) of China’s coastal provinces and cities is selected as an explanatory variable, representing the development of the ocean economy of coastal provinces and cities in the current year, which is obtained by dividing the sum of the value added of the marine industry and marine-related industries by the resident population of each province and city (Xia et al., 2019).

4.4.1.2 Core explanatory variables

Green Finance Index (GFI). The GFI represents the level of green finance development in China’s coastal provinces and cities, and consists of seven level 1 indicators: green credit, green investment, green insurance, green bond, green support, green fund and green equity, and is calculated by the entropy method. Green finance supports low-carbon, environmentally friendly and sustainable economic activities through financial instruments, promotes environmental protection and actively responds to climate change, and the development of green finance is an important tool for realizing the goal of “double carbon” (An, 2021).

4.4.1.3 Threshold variables

Marine research funding revenue (FMR). FMR is obtained from the current year’s revenue of marine scientific research institutions plus the government’s input in capital construction funds. By providing financial support and preferential policies, green finance guides the flow of social capital to marine scientific research institutions, thus increasing the revenue from marine scientific research funding. This injection of funds helps to promote research and development and innovation in marine science and technology, improve the utilization efficiency of marine resources and reduce environmental pollution, in line with the “dual-carbon” goal of reducing carbon emissions and promoting green development (Lu and Yao, 2024).

Scale of Marine Industry (SMI). It is expressed by the proportion of regional gross marine product to GDP. Green finance support for the marine industry can promote the rapid development of the industry and thus expand the scale of the marine industry. As the scale of the marine industry expands, its contribution to the ocean economy will also increase, which will help optimize the industrial structure and reduce the dependence on traditional high-pollution industries, in line with the orientation of the “dual-carbon” goal (Cao et al., 2015).

4.4.1.4 Other control variables

Number of Granted Patents (NPG). It is expressed by the number of patents authorized in the current year. The number of authorized patents reflects the results of technological innovation and R&D activities. For the ocean economy, technological innovation is an important driving force to promote the development of ocean resources, the upgrading of ocean equipment, and the protection of the ocean environment, among other key aspects. Technological innovation is a key factor in enhancing the competitiveness of the ocean economy, and green finance, by supporting ocean science and technology R&D, can promote the authorization of more ocean-related patents, thus promoting the development of the ocean economy (Wu et al., 2020).

Gross Regional Index (GRI). Taking 2000 Gross Regional Product as the base period (Gross Regional Product Index 100), it is calculated based on the growth ratio of Gross Regional Product in that year. The Gross Regional Index is an important indicator for measuring the development of the regional economy, and for the ocean economy, the overall development of the regional economy will lead to the prosperity of the ocean industry. By supporting green industries and projects, green finance helps to improve the overall quality and efficiency of the regional economy, thus indirectly promoting the development of the ocean economy (Li et al., 2014).

Stock Market Activity (SMA). The total value of outstanding shares derived from the number of tradable shares outstanding in the year multiplied by the share price at that time indicates the stock market activity reflects the financing ability of the capital market and investor confidence, for the ocean economy, an active stock market can provide more financial support for the ocean industry. Green finance financing through the capital market can guide the flow of funds to the field of ocean environmental protection, ocean science and technology, and promote the sustainable development of the ocean industry (Ju et al., 2015).

Energy Consumption Structure (ECS). Derived from the share of coal in energy consumption in the current year. Energy consumption structure reflects the preference and efficiency of regional energy use. For the ocean economy, optimizing the energy consumption structure helps reduce energy consumption and environmental pollution in the ocean industry. By supporting the development of clean energy and renewable energy, green finance helps to optimize the energy consumption structure and reduce the dependence on traditional energy, thus reducing carbon emissions and environmental pollution in the ocean industry (Rui, 2025).

Scale of tertiary industry (STI). It is expressed by the proportion of the output value of the tertiary industry to the GDP in the current year. The scale of tertiary industry reflects the change of regional economic structure and the trend of industrial upgrading. For ocean economy, the rapid development of tertiary industry helps to improve the overall quality and efficiency of ocean economy. Green finance can promote the optimization and upgrading of the structure of ocean economy by supporting the development of tertiary industries such as ocean tourism and ocean information service (Ding et al., 2022).

Size of secondary industry (SSI). It is expressed by the proportion of the output value of the secondary industry to the GDP in the current year. The scale of the secondary industry reflects the level of regional industrialization and the strength of the manufacturing industry. For the ocean economy, the development of the secondary industry is an important force to promote the growth of the ocean economy. Although the secondary industry is often accompanied by higher energy consumption and environmental pollution, green finance can realize a win-win situation in terms of economic and environmental benefits by supporting its green transformation and upgrading (Li and Huang, 2022).

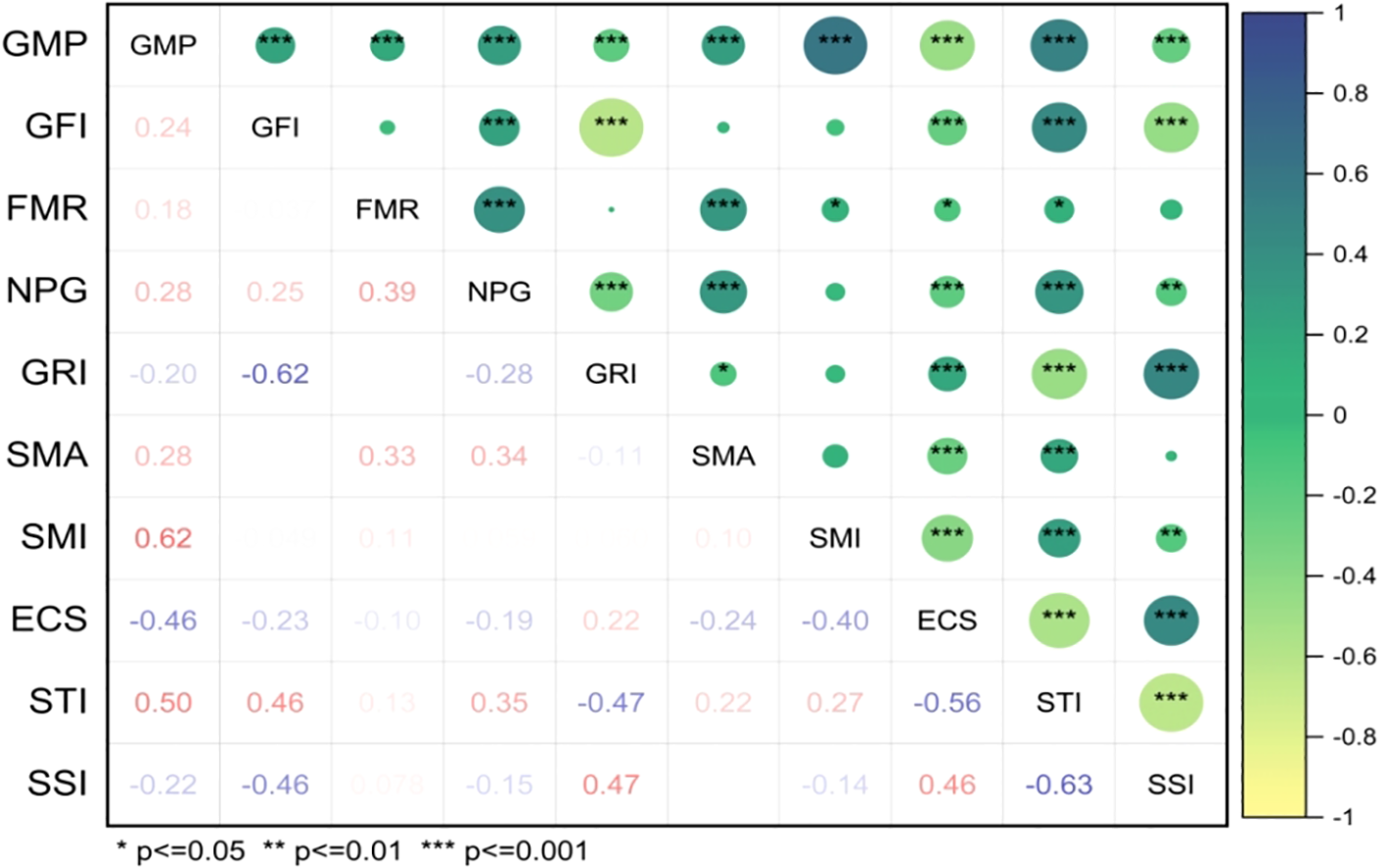

To avoid the problem of heteroskedasticity and multicollinearity, the variables are logarithmized in this paper, so there are cases where the variables are negative. Below are the descriptive statistics (Table 4) and the correlation test (Figure 5) for the variables selected in this paper.

Table 4

| Variable | Obs | Mean | Std. Dev. | Min | Max. |

|---|---|---|---|---|---|

| GMP | 165 | -.0978179 | .8762697 | -2.752002 | 1.806894 |

| GFI | 165 | -.3143129 | .131507 | -.5764243 | -.0348523 |

| FMR | 165 | 12.2171 | 1.455464 | 8.304 | 14.99342 |

| NPG | 165 | 4.39989 | 1.773788 | 0 | 7.159292 |

| GRI | 165 | 4.683119 | .032786 | 4.579852 | 4.765587 |

| SMA | 165 | 8.997614 | 1.162214 | 6.915723 | 11.47077 |

| SMI | 165 | -1.884524 | .5899212 | -3.912723 | -.5621189 |

| ECS | 165 | -1.28128 | .5822702 | -3.491037 | -.3227622 |

| STI | 165 | -.7416248 | -1833772 | -1.10262 | -.2997547 |

| SSI | 165 | -.8656963 | .2441876 | -1.655482 | -.5091603 |

Descriptive statistical analysis of variables.

Figure 5

Correlation test.

As can be seen in Figure 5, the absolute value of the correlation test coefficients among the variables are all below 0.7, indicating that there is no multicollinearity problem. In addition, the results show that the correlation between Gross Maritime Product per capita (GMP) and other variables is significant.

4.4.2 Data sources

The data used in this paper come from the China Marine Statistical Yearbook, the China Ocean Economy Statistical Bulletin, the Statistical Yearbooks of China’s provinces and cities, the Bulletin on the State of the Environment, as well as the China Science and Technology Statistical Yearbook, the China Energy Statistical Yearbook, the China Financial Yearbook, the China Agricultural Statistical Yearbook, the China Industrial Statistical Yearbook, and the China Tertiary Industry Statistical Yearbook.

4.5 Unit root test

The data series adopted in this paper are time series, and smoothness is an important characteristic of time series data, which means that the statistical characteristics of the time series do not change over time, while the non-smooth series may show the characteristics of trend, seasonality or random fluctuations, which will make the empirical results produce “pseudo-regression” results. In addition, homogeneous panel data have similar statistical characteristics, while heterogeneous panel data have different characteristics, which may lead to biased estimation and erroneous statistical inference if heterogeneous panel data are mistakenly treated as homogeneous panel data. In order to avoid “pseudo-regression” and ensure the validity of the estimation results, it is necessary to analyze the smoothness of the time series data and panel data, i.e., to test whether the data process is smooth through the unit root test. In this paper, we use both the LLC test for the homogeneous panel hypothesis and the Fisher-ADF test for the heterogeneous panel hypothesis, and the results of both tests reject the original hypothesis of the existence of a unit root, indicating that the series is smooth (Table 5).

Table 5

| Variables | Fisher-ADF | LLC | Result | |||

|---|---|---|---|---|---|---|

| Inverse chi-squared | Inverse normal | Inverse logit | Modified inv. chi-squared | |||

| GMP | 53.9448*** | -2.5157*** | -3.1289*** | 4.8159*** | -3.8087*** | Reject |

| GFI | 89.2720*** | -5.5049*** | -6.8288*** | 10.1416*** | -7.1908*** | Reject |

| FMR | 47.0065*** | -2.9042*** | -3.0034*** | 3.7699*** | -1.6864** | Reject |

| NPG | 54.0054*** | -3.0673*** | -3.5418*** | 4.8250*** | -2.0516** | Reject |

| GRI | 64.5952*** | -3.8772*** | -4.6803*** | 6.4215*** | -4.7078*** | Reject |

| SMA | 47.9987*** | -1.5964* | -1.6753** | 3.9194*** | -8.0928*** | Reject |

| SMI | 43.8804*** | -1.8625** | -2.2715** | 3.2986*** | -3.2208*** | Reject |

| ECS | 87.7141*** | -5.5109*** | -6.9204*** | 9.9068*** | -4.9923*** | Reject |

| STI | 35.2320** | -1.6795** | -1.7443** | 1.9948** | -4.3581*** | Reject |

| SSI | 47.3317*** | -3.0767*** | -3.1517*** | 3.8189*** | -3.0084*** | Reject |

LLC test and Fisher-ADF test.

*** indicates 1% significant, ** indicates 5% significant, and * indicates 10% significant.

5 Empirical analysis

5.1 Analysis of fixed effects regression results

In this paper, based on the fixed-effect model, the Gross Maritime Product per capita (GMP), Green Finance Index (GFI), Marine research funding revenue (FMR), Scale of Marine Industry (SMI), Number of Granted Patents (NPG), Gross Regional Index (GRI), Stock Market Activity (SMA), Energy Consumption Structure (ECS), Scale of tertiary industry (STI), Size of secondary industry (SSI), and Size of secondary industry (SSI) 10 indicators to construct two models (1) and model (2). Among them, model (1) is the regression of Gross Maritime Product per capita (GMP) and all variables, and model (2) is the regression of Gross Maritime Product per capita (GMP) and green financial index (GFI), and the fixed effect regression results of models 1 and 2 are shown in Table 6.

Table 6

| Model (1) | Model (2) | |

|---|---|---|

| GFI | 2.394*** | 2.155*** |

| (0.244) | (0.154) | |

| FMR | -0.002 | |

| (0.013) | ||

| NPG | -0.052** | |

| (0.020) | ||

| GRI | -0.553 | |

| (0.614) | ||

| SMA | 0.049** | |

| (0.023) | ||

| SMI | 0.853*** | |

| (0.059) | ||

| ECS | 0.064 | |

| (0.074) | ||

| STI | 0.734** | |

| (0.369) | ||

| SSI | 1.172*** | |

| (0.294) | ||

| _cons | 5.856** | 0.580*** |

| (2.886) | (0.052) |

Fixed effects regression results.

***indicates 1% significant, ** indicates 5% significant.

From the regression results of model (1) and model (2), it can be seen that the coefficients of Green Finance Index (GFI) are both significant and positive, which proves the stability of the positive promotion effect of green finance (GFI) on Gross Maritime Product per capita (GMP), and with the increase of Green Finance Index (GFI), the Gross Maritime Product per capita (GMP) grows as well. This positive relationship reflects the fact that green finance guides the flow of funds to environmentally friendly and low-carbon projects, which not only accelerates the green growth of the Ocean Economy, but also effectively promotes carbon emission reduction. Green finance-supported projects tend to use cleaner and more efficient technologies, reducing dependence on fossil fuels and directly lowering carbon emissions. In addition, the positive contribution of green finance (GFI) to Gross Maritime Product per capita (GMP) in model (2) emphasizes the robustness of the regression using fixed effects in this paper.

In the model (1), the variables with significant coefficients of are six variables: Green Finance Index (GFI),Number of Granted Patents (NPG),Stock Market Activity (SMA), Scale of Marine Industry (SMI), Scale of tertiary industry (STI) and Size of secondary industry (SSI); the variables with insignificant coefficients are three variables, namely, Marine research funding revenue (FMR), Gross Regional Index (GRI) and Energy Consumption Structure (ECS). The coefficients are not significant for three variables: Marine research funding revenue (FMR), Gross Regional Index (GRI) and Energy Consumption Structure (ECS).

The significant and negative coefficient on the Number of Granted Patents (NPG) suggests that, although there is a high number of patents granted, it is likely that the conversion of patents into actual productivity is inefficient in the marine industry sector. A large number of patents remain only on paper and are not effectively transformed into products or services to promote the growth of the Ocean Economy. Instead, the large amount of R&D resources invested in acquiring these patents takes away other resources that could have been used to promote the growth of the Ocean Economy, resulting in a negative correlation between the Gross Maritime Product per capita (GMP) and the Number of Granted Patents (NPG).

The coefficient of Stock Market Activity (SMA) is significant and positive, indicating the importance of the capital market in supporting the green transition and low-carbon development of the marine industry. An active capital market provides marine enterprises committed to green transformation and low-carbon development with the necessary financial support for research and development of new technologies, improvement of production processes, enhancement of energy efficiency, and facilitation of scale expansion and competitiveness enhancement, thus playing a key role in realizing the “dual-carbon” goal.

The coefficient of the Scale of Marine Industry (SMI) is significant and positive, reflecting that the growth of the gross marine product can further attract capital to the marine industry. As the Scale of Marine Industry (SMI) expands, more capital and resources are invested in environmentally friendly and low-carbon projects, promoting the green transformation of the whole industrial chain. At the same time, the growth of the marine industry also drives the economic prosperity of coastal areas, providing a broader space and more possibilities for carbon emission reduction.

The coefficient of the Scale of tertiary industry (STI) is significant and positive, indicating that the prosperity of the marine service industry can drive the development of related industries and provide more services and support for the Ocean Economy. Driven by the “dual-carbon” goal, the marine service industry needs to continuously innovate its service mode and improve its service quality to meet the growing green and low-carbon demand. For example, the marine tourism industry can develop more green tourism projects to attract tourists while reducing carbon emissions. The marine transportation industry can optimize shipping routes and improve the energy efficiency of ships to reduce carbon emissions during transportation.

The coefficient on the size of the Size of secondary industry (SSI) is significant and positive, indicating that the development of industry remains an important driver of ocean economic growth. Although the rise of the service sector has contributed more and more to the growth of the ocean economy in recent years, industry is still an indispensable part of the Ocean Economy. In the context of the “dual-carbon” goal, industry needs to pay more attention to energy conservation, emission reduction and green transformation, and contribute to carbon emission reduction while realizing economic growth.

5.2 Heterogeneity analysis

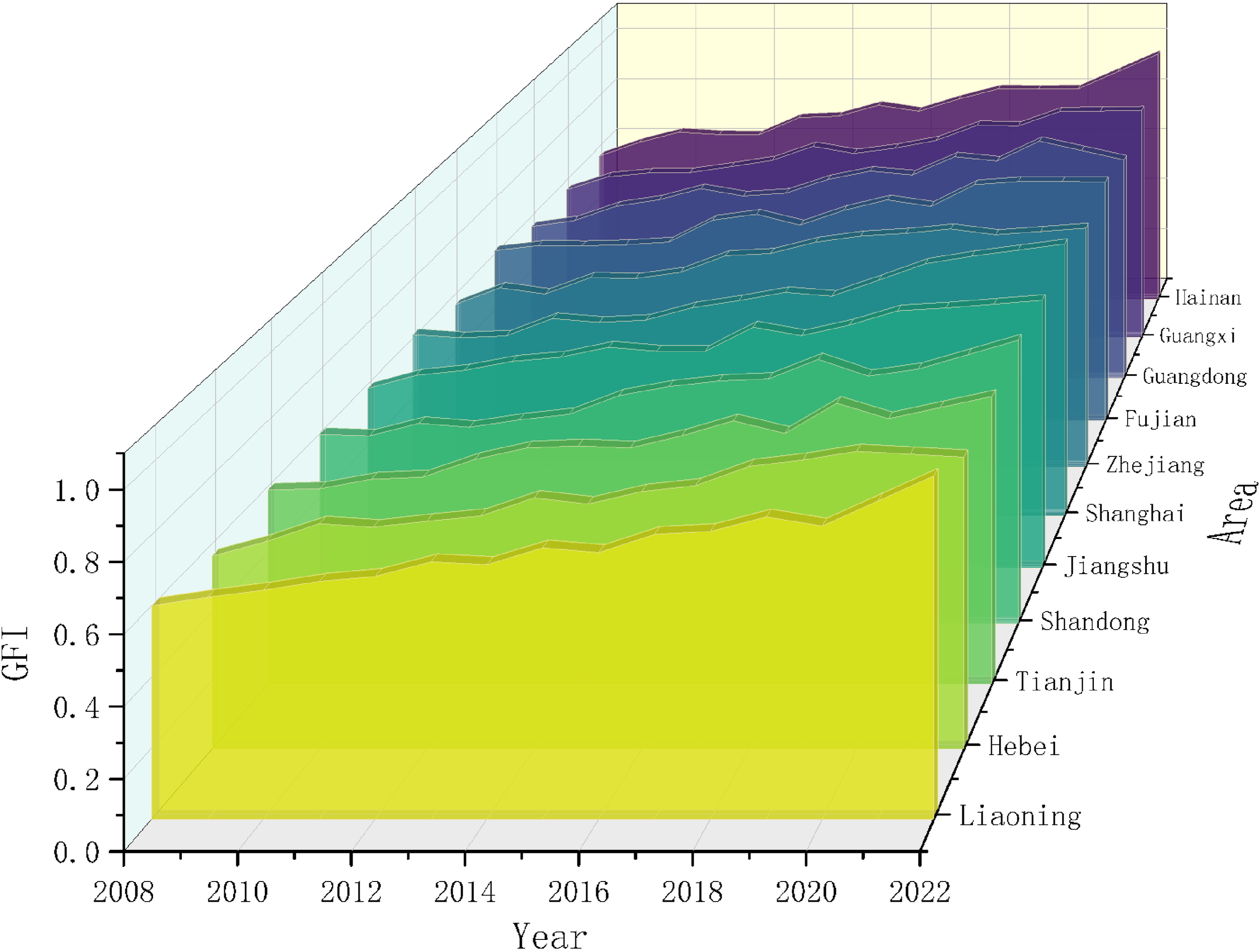

In order to explore the potential heterogeneity of green finance on China’s ocean economic growth, this paper firstly analyzes the level of green finance development in China’s coastal provinces and cities in a comparative manner (Figure 6).

Figure 6

Level of green finance development in China’s coastal provinces and municipalities.

As can be seen in Figure 6, the Green Finance Index (GFI) of most cities shows an upward trend from 2008 to 2022, indicating that the development of these cities in the field of green finance has achieved positive results, in particular, the level of green finance development in Hainan and Liaoning has improved most rapidly. The growth of Shanghai, Shandong and Jiangsu is also more significant, indicating that the development of green finance in these regions is also more effective.

Next, this paper analyzes the spatial heterogeneity of China’s ocean economy from three regions: the Northern Ocean Economic Zone, the Eastern Ocean Economic Zone, and the Southern Ocean Economic Zone (Table 7).

Table 7

| Northern Ocean Economic Zone |

Eastern Ocean Economic Zone |

Southern Ocean Economic Zone |

|

|---|---|---|---|

| GFI | 0.461 | 1.809*** | 2.121*** |

| (0.357) | (0.333) | (0.429) | |

| FMR | 0.016 | 0.040*** | -0.003 |

| (0.019) | (0.011) | (0.019) | |

| NPG | 0.026 | -0.039 | 0.078*** |

| (0.032) | (0.026) | (0.028) | |

| GRI | -4.054*** | -0.086 | -0.601 |

| (0.855) | (0.729) | (1.041) | |

| SMA | -0.098** | -0.021 | -0.002 |

| (0.040) | (0.024) | (0.043) | |

| SMI | 0.814*** | 1.119*** | 0.884*** |

| (0.051) | (0.132) | (0.199) | |

| ECS | -0.398** | 0.109** | 0.054 |

| (0.174) | (0.056) | (0.107) | |

| STI | 4.516*** | 3.949*** | 2.689*** |

| (0.659) | (0.678) | (0.791) | |

| SSI | 5.381*** | 0.984*** | 2.676*** |

| (0.707) | (0.331) | (0.548) | |

| _cons | 28.427*** | 6.538** | 9.298* |

| (4.809) | (3.233) | (4.885) |

Fixed effects regression results for each region of China’s Ocean Economy.

***indicates 1% significant, ** indicates 5% significant, and * indicates 10% significant.

The empirical results in Table 7 show that:

In terms of green finance, both the Eastern Ocean Economic Zone and the Southern Ocean Economic Zone show a significant positive contribution. Every 1% increase in the Green Finance Index (GFI) of the Eastern Ocean Economic Zone will lead to a 1.809% increase in Gross Maritime Product per capita (GMP), demonstrating the high level of green finance development in the region and its significant role in promoting the Ocean Economy. Although the Southern Ocean Economic Zone started later, every 1% increase in its Green Finance Index (GFI) will also lead to a 2.121% increase in Gross Maritime Product per capita (GMP), demonstrating the region’s rapid development and positive dynamics in green finance. However, the coefficient of the Green Finance Index (GFI) in the Northern Ocean Economic Zone is not significant, indicating that the development of green finance in the region has not yet fully revealed its role in promoting the Ocean Economy.

Despite the high green financial index (GFI) of the Northern Ocean Economic Zone, the role of green finance in promoting the ocean economy is not significant, which is essentially the result of the superposition of multiple factors such as lagging development of green financial infrastructure, lack of implementation of green financial policies, mismatch between the rigidity of the industrial structure and the demand for green finance, and differences in the market conditions for green finance: first of all, the development of green financial infrastructure is lagging behind. The financial system of the Northern Ocean Economic Zone is relatively closed, with a single green financial product, mainly traditional green credit, and a lack of specialized green financial institutions and talents. Unclear certification standards for green projects have led to banks being cautious about green credit, making it difficult for funds to be effectively injected into the ocean economy. The Eastern Ocean Economic Zone and the Southern Ocean Economic Zone have mature financial markets and internationalized financial centers, with abundant green financial products, such as green credits, blue bonds, carbon financial derivatives, etc., and financial institutions have stronger risk assessment and pricing capabilities for green projects. Secondly, the implementation of green financial policies and the implementation effect is poor. The Northern Ocean Economic Zone is relatively lagging behind in the synergistic planning of “dual-carbon” target and industrial transformation, and the development of ocean economy in some provinces still relies on petrochemical and other high-energy-consuming industries, so the green financial policies and industrial transformation policies have failed to form a synergy, resulting in the flow of funds to the traditional industries’ “pseudo-green” projects instead of the real green projects. Local governments in the Eastern Ocean Economic Zone and the Southern Ocean Economic Zone are more active in the implementation of green financial policies, and the supporting measures are perfect. Zhejiang, Guangdong and other places through the construction of the “green financial reform pilot zone”, the policy objectives are closely integrated with the development of the local community, and promote the rapid implementation of green financial tools. Third, the rigidity of the industrial structure of the Northern Ocean Economic Zone does not match the demand for green finance. Green finance is more effective in supporting technology-intensive industries, while the Northern Ocean Economic Zone is dominated by heavy chemical industries and resource-based industries, with strong rigidity of industrial structure, high cost and long cycle of green transformation. Green finance funds may be used more for the environmental transformation of traditional industries than for emerging areas of the ocean economy such as marine renewable energy and marine eco-tourism, resulting in a limited pulling effect on the growth of the ocean economy. The Eastern Ocean Economic Zone and the Southern Ocean Economic Zone have formed modern ocean industry clusters, such as Zhejiang’s marine biopharmaceutical industry cluster and Fujian’s ocean engineering equipment industry cluster, with a lighter and more diversified industrial structure, and a high proportion of service and high-tech industries, which are more compatible with green finance, such as green bonds supporting offshore wind power projects and blue carbon sink trading, directly promoting ocean economy’s High value-added growth. In addition, the Eastern Ocean Economic Zone and the Southern Ocean Economic Zone have more mature financial market conditions, with a large number of financial institutions, a perfect financial service system, and a wider range of innovation and application of green financial products and tools. This enables green finance to more effectively guide the flow of funds to ocean economy-related industries and promote ocean economy growth. In contrast, the development of the financial market in the Northern Ocean Economic Zone is relatively lagging behind, financial institutions and products are relatively single, and the penetration and influence of green finance is insufficient, resulting in the promotion of its role in the ocean economy not yet fully manifested.

In terms of research investment, the coefficient of Marine research funding revenue (FMR) in the Eastern Ocean Economic Zone is significant and positive, and every 1% increase will lead to a 0.04% increase in Gross Maritime Product per capita (GMP), which indicates that the increase in research investment effectively promotes technological innovation and industrial upgrading. In contrast, the coefficients of the Nouthern and Southern Ocean Economic Zones are not significant in this aspect. The Northern Ocean Economic Zone, such as Shandong and Liaoning, is dominated by traditional marine heavy industries like shipbuilding and marine chemicals. Research funding may flow more towards technological improvements in these traditional industries rather than emerging marine technology fields such as marine biomedicine and deep-sea exploration. The disconnection between scientific research projects and market demand has led to a low conversion rate of achievements. State-owned enterprises and large scientific research institutions dominate the Northern Ocean Economic Zone, with low participation from small and medium-sized enterprises, making it difficult for scientific research results to be realized through market-oriented mechanisms. The provinces within the Northern Ocean Economic Zone face homogenized competition in marine scientific research, resulting in dispersed funding and a challenge in forming a scale effect. In the Southern Ocean Economic Zone, provinces like Guangdong and Fujian are dominated by the private economy and export-oriented industries. Local governments tend to support manufacturing or service industries with short-term results and have limited budgets for long-term marine scientific research. The ocean economy in the Southern Ocean Economic Zone is centered around service industries such as port logistics and coastal tourism, with enterprises focusing their research and development needs on technology introduction or equipment upgrading rather than original technology innovation. As a result, the marginal contribution of local research funding to marine economic growth is relatively low. Additionally, the Southern Ocean Economic Zone is weak in research areas such as marine environment monitoring and deep-sea resource exploration, with scientific research institutions mostly focusing on short-term application projects, making it difficult to break through key technological bottlenecks. Furthermore, the migration of high-end marine research talents to core cities in the east, such as Shanghai and Hangzhou, further weakens local innovation capabilities.