- 1School of Law, Dalian Maritime University, Dalian, China

- 2Faculty of Management and Economics, Dalian University of Technology, Dalian, China

China’s current compensation mechanism for ship-source oil pollution integrates the 1992 Civil Liability Convention with a domestic compensation fund. However, it faces significant challenges in effectively addressing major oil spill incidents. The domestic fund’s collection mechanism is inflexible, and the liability cap for individual incidents is too low. Furthermore, the scope of compensation is limited, covering only emergency response expenses, cleanup costs, and direct economic losses in sectors like fishing and tourism, while neglecting long-term ecological damages. As the utilization of supertankers increases, the existing compensation system becomes inadequate to manage the risks associated with large-scale oil spills. Through a multi-dimensional analysis, this study illustrates that joining the 1992 Fund Convention would greatly enhance China’s compensation capacity. As the world’s largest oil importer, China’s anticipated annual contribution of approximately £8 million accounts for less than 0.01% of the oil industry’s profits, making it a manageable financial obligation for the industry. By adopting Canada’s dual-fund model, which unites international and domestic funds, China could create a more comprehensive compensation system that effectively addresses cross-border incidents and supports long-term ecological restoration. Acceding to the Fund Convention would provide a practical solution to marine environmental risks and reaffirm China’s strategic commitment to international responsibility, advancing the vision of a “Community of Shared Future for Mankind” in maritime governance. This transition would position China as pivotal in shaping equitable and sustainable naval policies.

1 Introduction

On April 27, 2021, the Liberian-flagged oil tanker A Symphony collided with the Panama-flagged cargo vessel Sea Justice in the southeastern waters near Chaolian Island, Qingdao City, Shandong Province, China. The accident significantly damaged the second cargo hold on the port side of A Symphony, leading to the leakage of approximately 9,419 tons of oil into the sea. This incident triggered one of the most severe oil spill pollution events in China’s nearshore waters in recent years, ranking second only to the Sanchi disaster (Zhuo, 2020). The total affected area was 4,360 square kilometers, with the oil spill impacting a shoreline length of 786.5 kilometers, including island shorelines. Although China has acceded to the 1992 International Convention on Civil Liability for Oil Pollution Damage (CLC), the 1992 International Convention on the Establishment of an International Fund for Compensation for Oil Pollution Damage (FC) applies solely to the Hong Kong Special Administrative Region of China (Zhuo, 2020).

Several key factors influence China’s decision regarding its oil pollution compensation mechanism:

First, China has established an independent domestic compensation mechanism for oil pollution damage. In 2012, the country created the China Oil Pollution Compensation Fund (COPCF), which is funded through levies on maritime oil cargo fees. This fund compensates for damages caused by significant ship-source oil pollution incidents, covering the spillage of persistent oils. The compensation limits are adjusted according to domestic regulations to reflect the specific needs of the Chinese shipping industry (Faure and Wang, 2008). In this context, the COPCF substitutes for the International Fund Convention, reducing China’s necessity to accede to the 1992 FC.

Second, the economic cost and burden-sharing implications play a significant role in China’s decision-making. Membership in the Fund Convention would require Chinese companies to contribute based on the volume of oil imported (Hao, 2019). As the world’s largest oil importer, China’s contributions would likely be substantial, potentially facing opposition from major oil companies. In contrast, the domestic oil pollution compensation system, financed locally through a levy (0.3 RMB per ton) on domestic oil cargo owners, avoids additional contributions to the International Fund and aligns more effectively with domestic cost-control measures.

Third, international conventions face challenges in promptly revising compensation limits. The existing compensation limits may not adequately address large-scale oil pollution incidents in Chinese waters (Faure and Wang, 2008). In contrast, the domestic fund can adjust these limits quickly through policy modifications, providing greater flexibility. Furthermore, as China’s primary shipping activities are concentrated in coastal and domestic routes, the domestic compensation system is better suited to address the specific needs of these areas.

Following the A Symphony oil spill, the shipowner established a fund to limit liability for oil pollution damage at the Qingdao Maritime Court. Under the 1992 CLC, the liability cap for this case was approximately CN¥ 470 million (about 65.3 million USD), while the total claims for fisheries losses and ecological damage filed at the Qingdao Maritime Court amounted to approximately CN¥ 3.74 billion (about 519 million USD). The losses significantly exceeded the compensation limit. In July 2024, the court ratified all claims related to the maritime accident. After the creditors reached an agreement on the distribution plan, the court legally confirmed the agreement and issued a ruling on December 26, 2024, to distribute the funds accordingly. Ultimately, only about one-eighth of the losses from the oil spill incident were compensated.

The A Symphony disaster highlights the limitations of China’s current ship-source oil pollution compensation system, which relies on a combination of the CLC and COPCF. If the 1992 FC had been applicable, compensation for this case could have increased by 203 million SDRs from the IOPC Fund, providing more comprehensive protection for the A Symphony oil spill victims. Consequently, experts from China’s shipping and legal sectors have recommended that China accede to the 1992 FC to ensure that future major maritime oil pollution incidents are adequately compensated.

2 Methods

This study employs a mixed-methods approach to analyze the limitations of China’s current oil pollution compensation system and evaluate the feasibility of adopting the 1992 FC. The methodology integrates case simulations, economic cost-benefit analysis, and comparative legal assessments, all supported by historical data and international case studies.

2.1 Data collection and sources

The study focuses on oil spills of 50 tons or more within China’s jurisdictional waters from 1974 to 2023. Data is drawn from three primary sources:

2.1.1 Historical incident data

Oil spill statistics from Chinese maritime authorities, including the National Major Marine Oil Spill Emergency Capacity Development Plans (2015–2035), provide key insights into past oil spill events and their impacts.

2.1.2 Economic and trade data

Information on crude oil import volumes, tanker spill trends (1970–2024) from the International Tanker Owners Pollution Federation (ITOPF), corporate profits, and fund contributions (1974–2024) is sourced from reputable institutions, including the United Nations Conference on Trade and Development (UNCTAD), the International Maritime Organization (IMO), Clarksons, Refinitiv, China Customs, the Chinese National Bureau of Statistics, and the annual reports of major oil companies. This data provides a comprehensive overview of the economic landscape of China’s oil industry.

2.1.3 Legal case data

Data derived from international compensation cases, particularly from legal databases such as I-Law, Westlaw, HeinOnline, and LexisNexis, along with cases from the International Oil Pollution Compensation (IOPC) Fund (e.g., the Prestige and Hebei Spirit incidents) (Hao, 2019), serves as invaluable benchmarks for evaluating China’s compensation framework and identifying potential areas for enhancement.

All data was cleaned and normalized for consistency. For example, currency values (SDR, RMB, GBP) were converted to a common currency using each year’s average annual exchange rates.

2.2 Analytical framework

2.2.1 Case simulation and loss gap analysis

A case simulation was adopted to quantify compensation shortfalls in large-scale oil spill incidents. The 2021 A Symphony spill, which incurred losses of 3.7 billion RMB, is a case study illustrating potential compensation gaps. The authors undertook the following steps:

2.2.1.1 Input parameters

The simulation incorporated various factors, including tanker size (VLCC: 300,000 tons), liability limits under the 1992 CLC (89.77 million SDR), and China’s domestic fund cap (30 million RMB) (Jakovina, 1993).

2.2.1.2 Comparative scenario

A comparative scenario was modeled to estimate compensation coverage should China adopt the 1992 FC, which has a compensation cap of 203 million SDR. The analysis aimed to assess how the fiscal burden on local governments could be reduced by comparing the current system with the Fund Convention framework and evaluating how the latter provides additional support, thereby minimizing financial strain on local authorities.

2.2.2 Economic burden and contribution capacity assessment

A cost-benefit model was used to evaluate the financial feasibility of China’s participation in the 1992 FC. Annual contribution levies were estimated using the following formula:

Contribution=Oil Imports (tons) × IOPC Rate (£0.0159455/ton) (Jakovina, 1993)

This formula estimates contributions based on China’s oil import volumes. A profit impact analysis was then conducted, comparing the contributions to the net profits of China’s top three oil companies—China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec), and China National Offshore Oil Corporation (CNOOC)—from 2020 to 2023. This analysis determined the affordability of the contributions as a percentage of these companies’ profits.

2.2.3 Legal and policy comparative analysis

A structured comparative legal framework was used to assess the effectiveness of China’s domestic oil pollution compensation fund (COPCF) against international models, such as Canada’s dual-fund system:

2.2.3.1 Compensation scope

Legal texts, including the CLC, the FC, and COPCF regulations, were analyzed to identify coverage gaps, particularly regarding ecological restoration (Gasu, 2022), which is often excluded from compensation under China’s current system.

2.2.3.2 Case law review

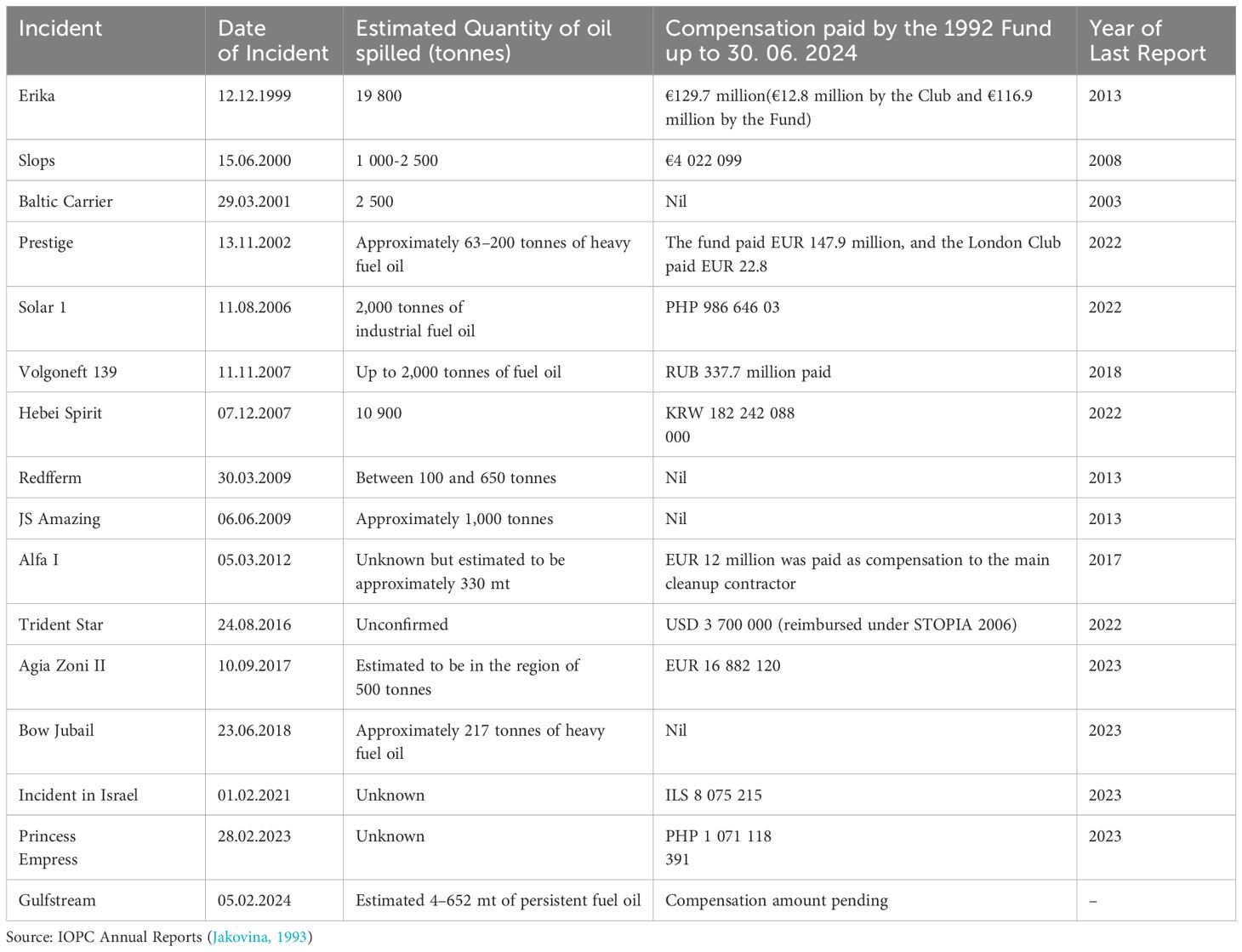

The study reviewed major IOPC cases (1999–2024) to analyze compensation trends per ton of spilled oil and evaluate claims processing efficiency.

2.2.3.3 Policy synergy

The analysis examined the interactions between the CLC and the FC, depicting the allocation of liability and risk-sharing mechanisms among the parties involved in oil pollution compensation.

This multi-dimensional methodology comprehensively integrates case, economic, and legal analyses to assess China’s oil pollution compensation system. The findings provide actionable recommendations for reform, particularly by adopting the 1992 FC.

3 Results

This paper systematically illustrates the necessity and feasibility of China’s participation in the 1992 FC by comparing various compensation mechanisms, simulating risk trends, and assessing the economic burdens involved. The key findings are as follows:

3.1 Domestic fund limitations necessitate the need for international mechanisms

Sovereign state jurisdictional boundaries constrain domestic funds and cannot cover oil pollution damage caused by Chinese-flagged vessels operating in foreign waters (e.g., incidents in Southeast Asia), complicating claims processing. The International Fund, operating through a dual mechanism of “shipowner liability (CLC) + cargo owner contributions (IOPC Fund),” facilitates global risk-sharing. This mechanism addresses the complex risks of expanding China’s “Belt and Road” maritime network.

3.2 Dual drivers of risk trends and the need for global governance

China’s maritime oil transport continues to expand at an annual growth rate of 5.7%. The number of Very Large Crude Carriers (VLCCs) is increasing, and the density of high-risk shipping routes, such as the South China Sea and the Strait of Malacca, is also rising, heightening the likelihood of significant oil pollution incidents. Relying solely on domestic and CLC funds creates an inadequate compensation cap to cover the potential scale of losses. Accessing the 1992 FC would enhance China’s influence in developing international maritime regulations and contribute to establishing a more equitable global environmental responsibility framework (Derrig et al., 2024), aligning with the strategic goal of fostering a “Community of Shared Future for Mankind.”

3.3 Economic costs are manageable, and compensation benefits are significant

As the world’s largest importer of crude oil, with an annual import volume exceeding 500 million tons, China’s estimated yearly contribution to the IOPC Fund would amount to approximately £ 8 million, based on an average contribution rate of 0.0159455 pounds per ton. This figure represents less than 0.01% of the profits of Chinese oil companies, thus constituting a manageable cost for enterprises. The IOPC Fund can provide compensation of up to approximately 203 million SDR for a single incident, which substantially exceeds the domestic oil pollution fund’s cap of 30 million RMB. In the event of an incident involving a Symphony-class vessel, the compensation shortfall can be addressed by the 1992 Convention Fund, significantly alleviating financial pressure on both the government and enterprises during emergencies.

4 Discussion

4.1 Overall reduction in ship-related oil spill risks but increased losses per incident

4.1.1 Increased crude oil imports in china and rising losses per spill incident

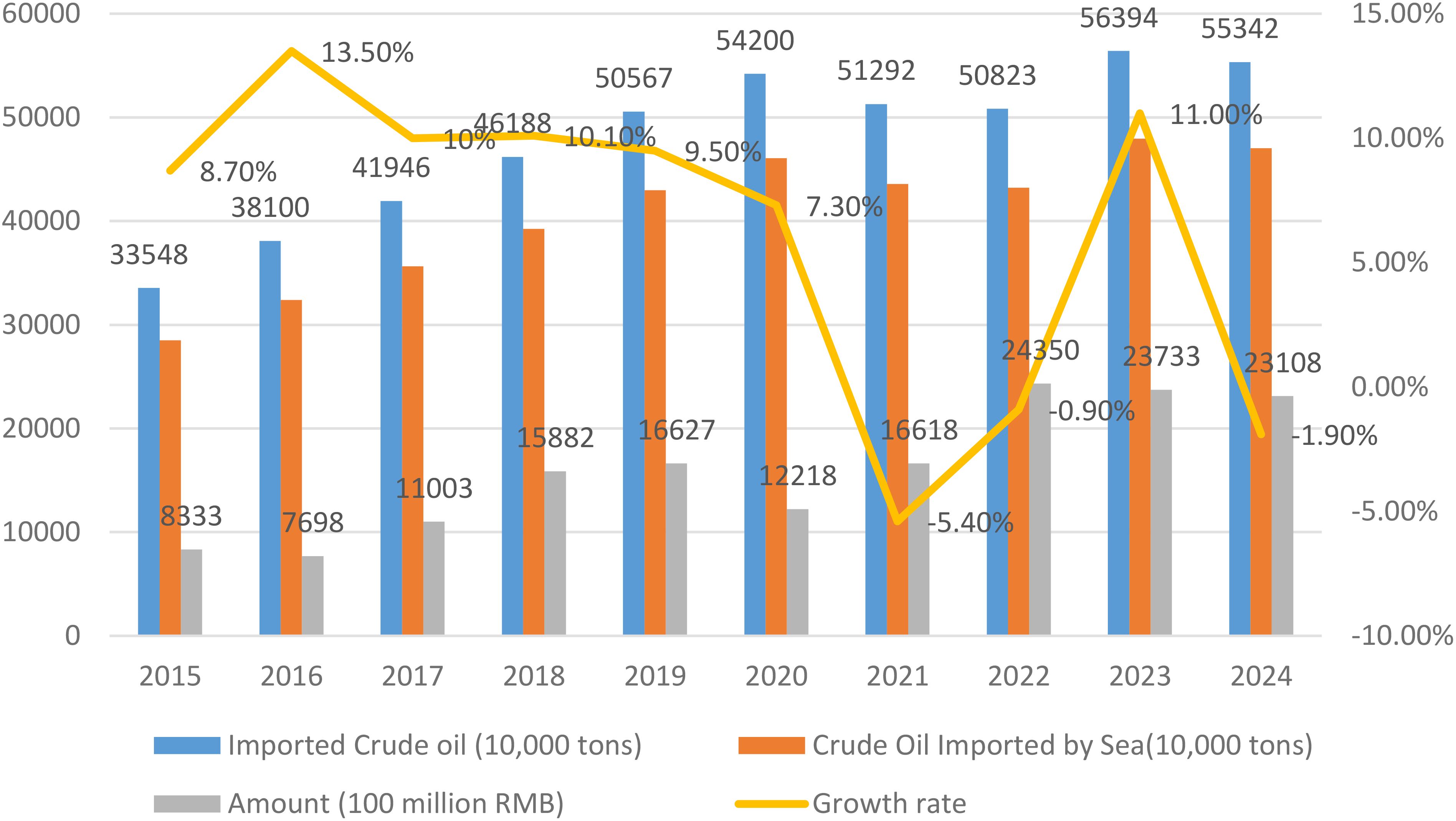

Since 1993, China has become a net oil importer, steadily increasing its imports. In the past five years, oil imports have stabilized at over 500 million tons annually, with maritime transport accounting for more than 85% of this total volume (see Figure 1). The majority of this oil is sourced from the Middle East and Africa, transported via the Strait of Malacca, while pipeline transportation contributes approximately 15%, primarily through the China-Russia, China-Kazakhstan, and China-Myanmar pipelines. The large volume of oil transported by sea poses significant environmental risks to China’s coastal regions. According to the International Tanker Owners Pollution Federation (ITOPF) ‘s 2008 annual report, “Recent observations indicate that the risk of oil spills is directly proportional to the total volume of maritime traffic in a given region.” (Gasu, 2022) Consequently, China has been classified by ITOPF as a “high-risk area” for oil spills (Xiong et al., 2013). It highlights the correlation between rising oil imports and increased spill risks, particularly in high-traffic zones like the South China Sea.

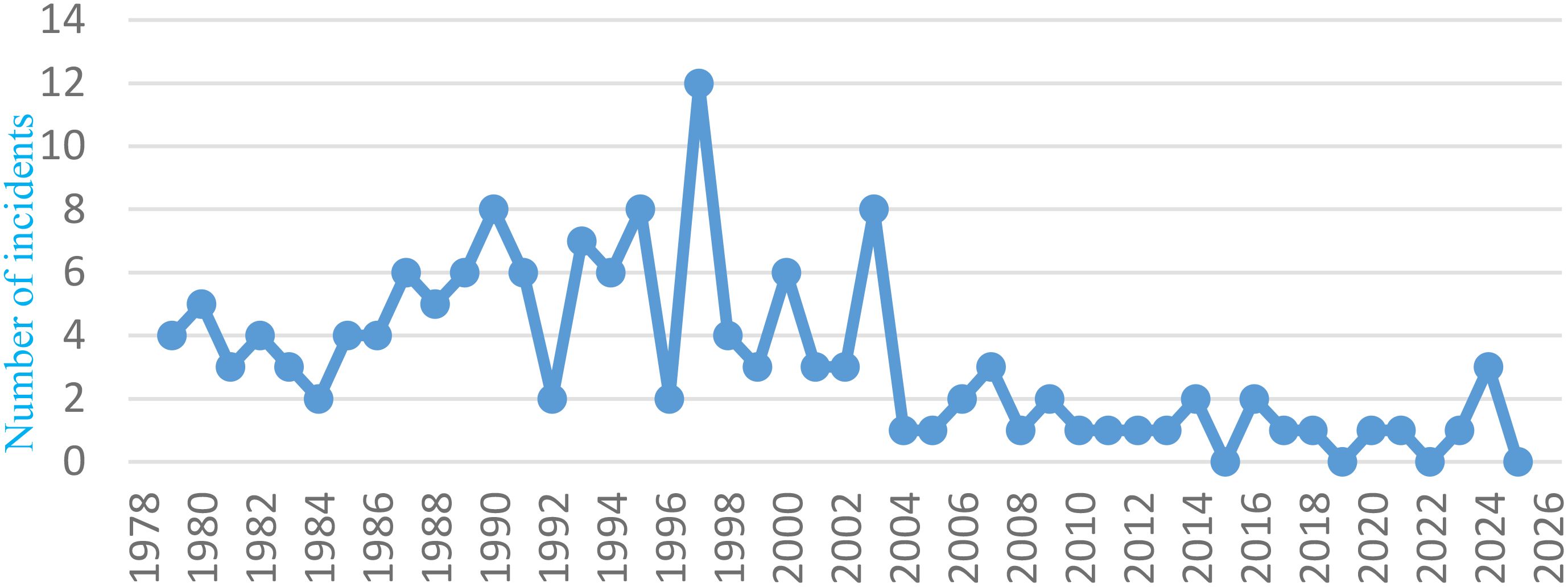

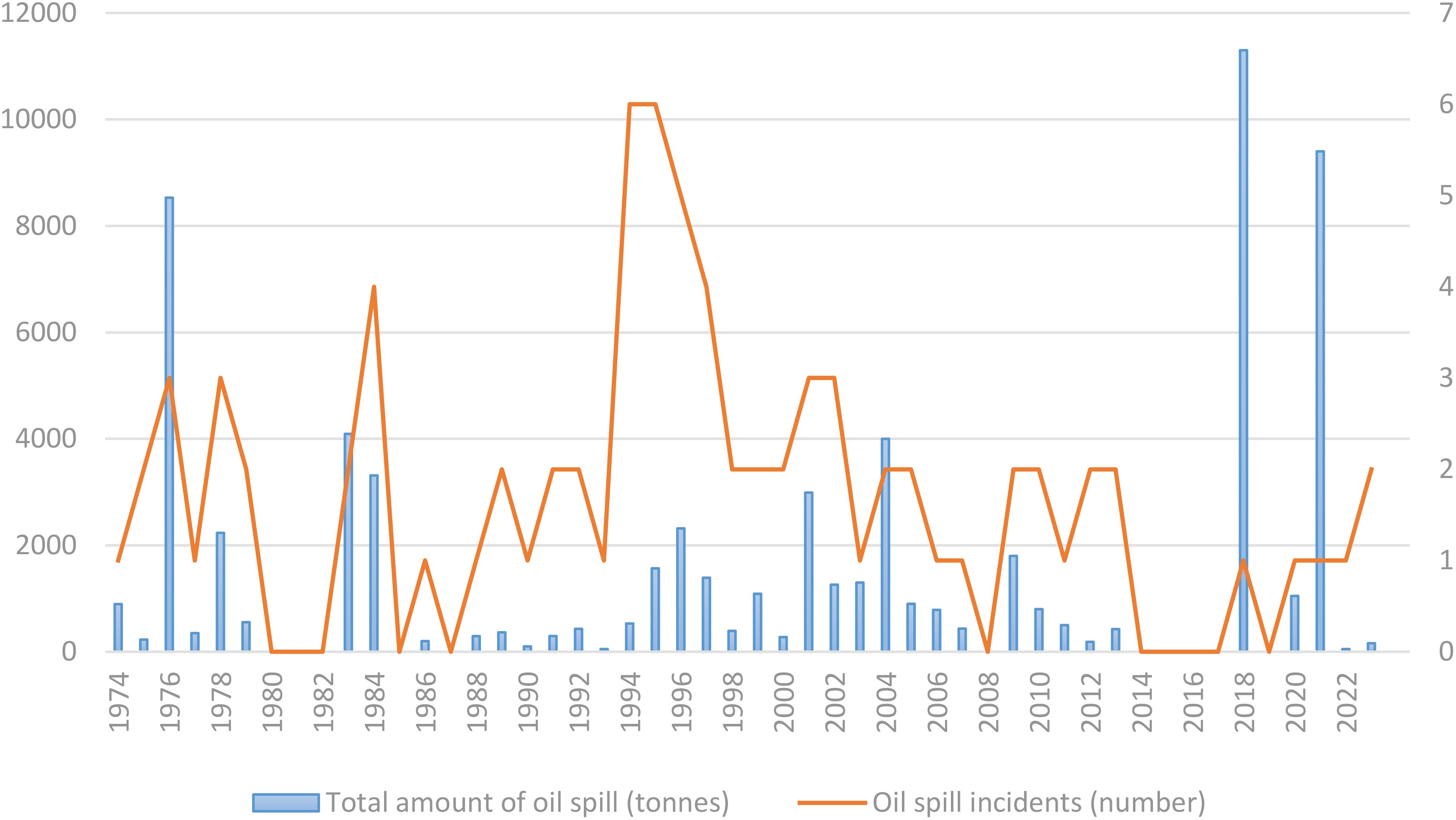

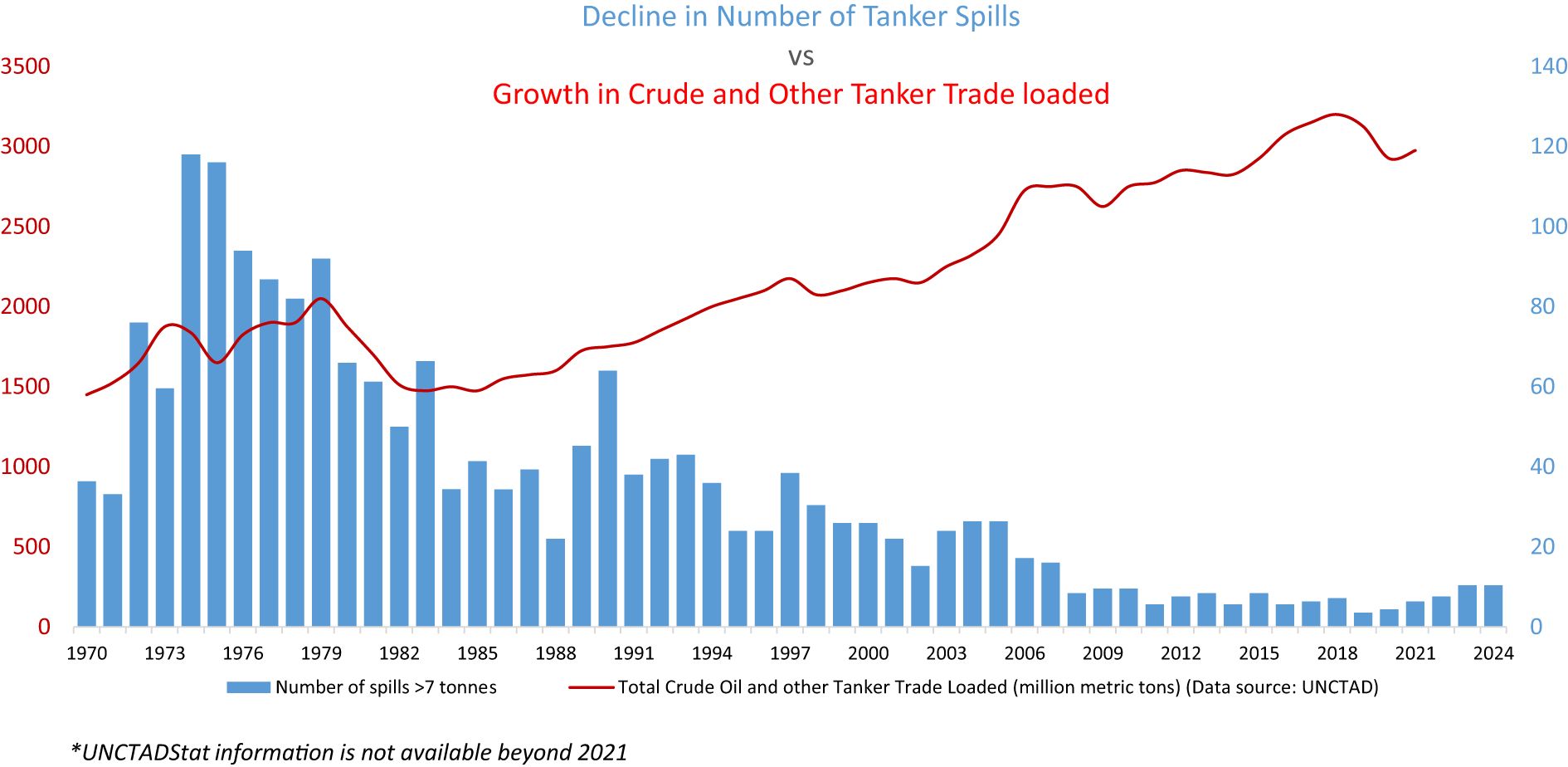

Statistics indicate that between 1974 and 2023, China experienced 83 offshore oil spills involving 50 tons or more, with 27 incidents (approximately 32.5%) exceeding 500 tons and 12 incidents (approximately 14.5%) surpassing 1,000 tons. The most catastrophic spill occurred in 2018, when the Sanchi tanker released 113,000 tons of oil, making it the only spill to exceed 10,000 tons. Cumulatively, these incidents resulted in a total oil loss of 168,528 tons, with the 2018 Sanchi incident accounting for approximately 67% of this total (see Figure 2) (Chen and Hu, 2020). As illustrated in Figure 2, most major oil spills in China’s coastal waters occurred during the 1970s and, more recently, in conjunction with China’s expanding crude oil imports. While the former pattern aligns with global trends in oil spills, the latter reflects the notable increase in oil transport. Despite the growth in maritime oil transport capacity, the frequency of oil spills in China’s territorial waters has decreased. This decline can be attributed to larger tankers, which, although improving risk resistance, also increase the potential scale of individual oil spill disasters. Notwithstanding technological advancements and safer navigation practices, VLCCs’ spills dominate the total volume due to their immense cargo capacity. Data from ITOPF’s Oil Tanker Spill Statistics (2024) (see Figure 3) further support this observation, stating: “While increased tanker movements might imply a heightened risk, it is encouraging to observe that the downward trend in oil spills persists despite an overall increase in oil trading over this period.” (Derrig et al., 2024) In the 2020s, 37 oil spills of 7 tons or more occurred, resulting in a total loss of 38,000 tons. Notably, 91% of this oil loss resulted from just 10 major incidents, with the remaining 9% stemming from 27 more minor spills. The data highlights the critical role of VLCCs in the severity of spills, as their size and cargo capacity can lead to catastrophic environmental damage. Accidents involving VLCCs—whether due to collisions, groundings, or other causes—have the potential to trigger large-scale oil spills, requiring extensive response and recovery efforts.

Figure 2. Annual variation in the number of oil spill incidents and total oil spill volume in China (1974–2023). The total oil spill amount in 2018 is presented after being scaled down by a factor of 1:10.

Figure 3. Decline in tanker oil spill incidents vs. growth in crude and other tanker trade loaded (1970-2024). (Source: ITOPF, Oil Tanker Spill Statistics 2024).

4.1.2 Oil spills and their growing ecological impact on China’s coast

Oil spill risks along China’s coast are particularly high in areas such as the Bohai Sea-North Yellow Sea, the Yangtze River Estuary, the Taiwan Strait, and the Pearl River Estuary. These areas coincide with major ports, including Ningbo-Zhoushan, Shanghai, Qingdao, Guangzhou, Tianjin, and Dalian, which handle significant cargo volumes and play key roles in the country’s crude oil imports. Furthermore, these regions face “extremely high risk” due to the dense traffic of oil-carrying vessels and their proximity to ecologically sensitive areas (Derrington, 2017). The high levels of maritime traffic in these zones increase the likelihood of oil spill accidents. Historical data from 1973 to 2020 reveals multiple oil spill incidents in these regions, indicating deficiencies in emergency response capabilities.

These high-risk areas also host essential ecosystems, including mangroves, coral reefs, and fishing zones, making them especially vulnerable to the long-term damage caused by oil spills (Fry and Amesheva, 2016). Enhancing marine environmental protection laws is crucial for reducing these risks and ensuring that victims of oil spills receive appropriate compensation for their losses. Local governments should also be encouraged to create specialized funds for ecological compensation, aiding in post-accident environmental recovery (Wu, 2002). Safeguarding marine ecosystems is vital for China’s national interests and raises concerns among neighboring countries. For example, South Korean scholars have emphasized the need for China to increase compensation for oil-related pollution (Kyung, 2009).

4.2 Insufficient legal mechanism for oil pollution compensation in China

4.2.1 Structural defects in china’s oil pollution compensation legal framework

Oil pollution incidents typically lead to claims for five types of pollution damage: property damage, costs associated with cleanup operations both at sea and onshore, economic losses incurred by the fishing and mariculture industries, financial losses in the tourism sector, and expenses related to environmental restoration (Xiong et al., 2013). China has implemented a compensation framework called “CLC + Domestic Fund.” Under the 1992 CLC, shipowners are liable up to a predetermined limit in case of an oil pollution incident involving their vessels. However, this compensation mechanism does not fully address the range of damages caused by oil pollution. An improved international oil pollution compensation system would include provisions for shipowners and oil cargo owners, thereby establishing a dual-track compensation system. Such a system would enhance the comprehensiveness and effectiveness of compensation, ensuring adequate relief for victims of an oil pollution incident (Yoon, 2009).

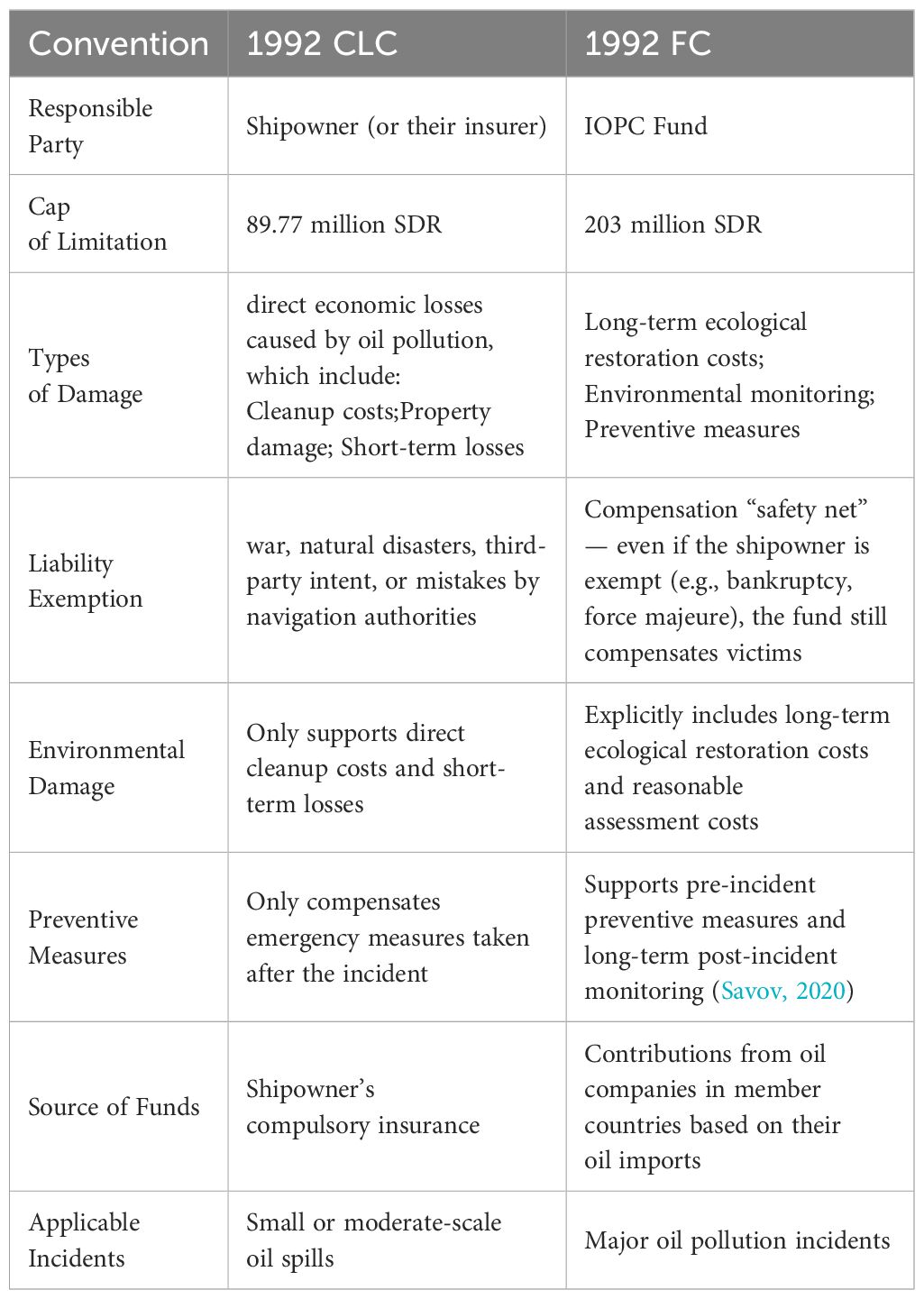

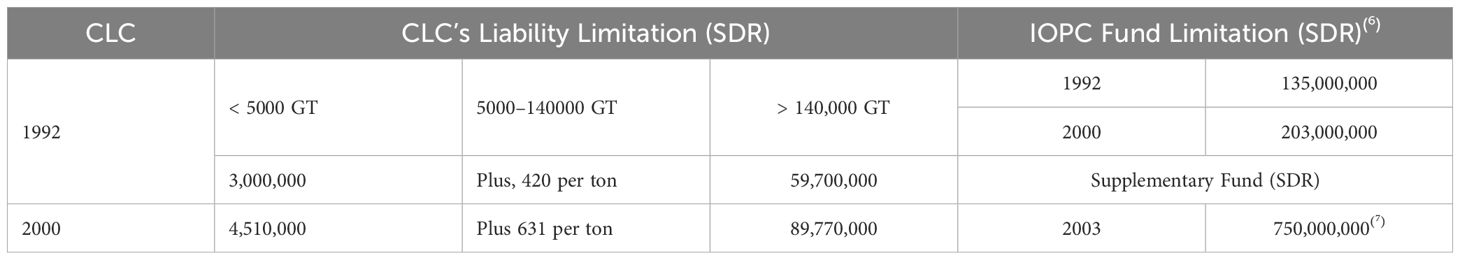

In particular, the 1992 CLC primarily covers direct economic losses, such as those incurred by the fishing and tourism industries (Cheong, 2012). The 1992 FC expands this coverage by addressing a wider range of affected parties. When comparing the compensation limits, liability coverage, and funding sources between the two conventions, the FC offers coverage for long-term ecological restoration, which is excluded under the CLC, and increases the compensation cap by 126% (203 million SDR versus 89.77 million SDR) (see Table 1) (Maes, 2005). However, China’s decision not to ratify the 1992 FC limits the extent of compensation available for large-scale oil pollution incidents, such as the “Symphony” accident. The existing single compensation mechanism is insufficient to address all types of damage, and the available funds fall short of effectively supporting environmental restoration and recovery efforts (Liao and Li, 2022).

Key distinctions between the CLC and the FC lie in several crucial areas. Firstly, the FC substantially increases the compensation limit regarding compensation capacity, addressing the funding inadequacies observed in major accidents under the CLC. Concerning liability coverage, the FC acts as a “safety net,” providing compensation even when shipowners are exempt (e.g., due to bankruptcy or force majeure), ensuring that victims still receive compensation. In addition, while the CLC focuses on addressing direct losses, the FC extends its support to long-term environmental restoration, thus aligning with the principles of sustainable development (Handl, 2019). In addition, the FC encourages international cooperation by integrating contributions from shipowners and oil companies in member countries, promoting shared risk. Integrating these contributions is particularly beneficial for high-risk coastal regions or ports within contracting countries. By acceding to the 1992 FC, nations can establish a more robust and comprehensive oil pollution compensation system that effectively balances the advancement of the shipping industry with the imperative of safeguarding ecological protection (Zhang et al., 2014).

4.2.2 Limitations of the domestic oil pollution fund in China

The “Management Measures for the Collection and Use of the Ship Oil Pollution Damage Compensation Fund” reveals that China’s domestic oil pollution compensation system faces three significant challenges that hinder its operational efficiency.

One primary challenge is the inflexible fund collection mechanism and inadequate compensation for individual incidents. The system currently applies a fixed rate of 0.3 RMB per ton of imported oil, disconnecting the fund’s accumulation from the growing risks associated with oil transportation. Annual fund collection is based on receiving 500 million tons of persistent oil products transported through China’s jurisdictional waters, generating approximately 150 million yuan. Historical data shows that, as of June 2020, the fund has processed 16 claims totaling around 64 million yuan in compensation (Chen and Hu, 2020). The fund’s compensation cap of 30 million yuan per incident is insufficient to address typical oil pollution events, rendering its capacity inadequate for effectively managing such incidents.

Another challenge is the domestic fund mechanism’s narrow compensation scope. Currently, the fund only covers compensation for emergency response costs, pollution control and cleanup measures, reasonable marine ecological restoration, natural fishery resource recovery, and direct economic losses in the fishing and tourism sectors (Maritime Safety Administration of the People’s Republic of China, 2024). However, it does not account for emerging forms of damage, such as the loss of ecosystem services, biodiversity degradation, or the disruption of climate regulation functions. Specifically, long-term impacts, such as the depletion of fishery resources and subsequent societal and environmental consequences, are insufficiently compensated. These emerging damages have significant long-term effects on marine ecosystems and the socio-economic system, yet these losses remain inadequately addressed due to the limited scope of compensation. As a result, ecosystem restoration and socio-economic recovery are more challenging. The Conventions governing these matters have been revised several times over the last two decades, with the latest version (1992 CLC and 1992 FC) providing more straightforward guidelines regarding environmental damage compensation (Dicks, 2008).

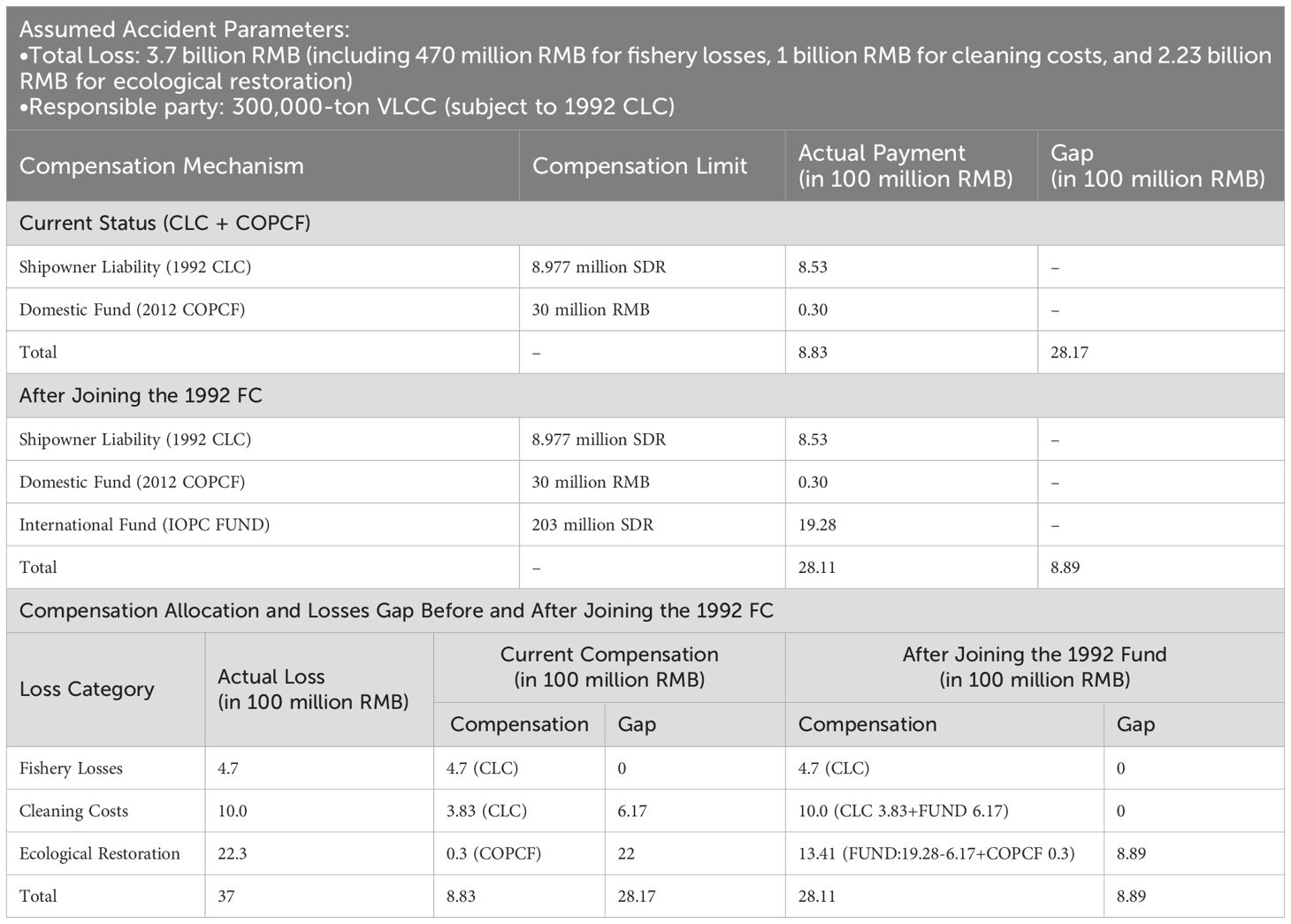

The final challenge pertains to the mismatch of risk in the era of super oil tankers. The widespread use of VLCCs and other large oil tankers has consistently increased China’s oil imports. By 2023, China accounted for approximately 20%-25% of global crude oil imports, with most of this oil transported via VLCCs. However, the 1992 CLC’s liability cap, set at 89.77 million SDR, is significantly lower than the cargo’s value and the potential environmental damage caused by such incidents (Jacobsson, 2024). This discrepancy means that, in the event of large-scale oil pollution, the current compensation framework cannot fully cover the resulting economic losses or environmental restoration costs, rendering the risk transfer mechanism ineffective (Li et al., 2013). Consequently, the efficiency and scope of compensation in response to oil pollution events are severely undermined. The fund’s cap of 30 million RMB covers less than 20% of the costs associated with VLCC-related spills, thereby highlighting the necessity for international risk-sharing mechanisms (see Table 2).

4.3 Simulation of the loss gap in major oil spill incidents

Under China’s current legal framework for oil pollution, a simulation is conducted for an oil spill incident analogous to the “A Symphony” oil spill, where the actual damages exceed 3.7 billion RMB. The simulation uses a 300,000-ton VLCC as a case study, comparing the total compensation available through China’s domestic fund (capped at 30 million RMB) with the compensation under the 1992 CLC shipowner liability insurance (with a maximum of 8.977 million SDR). The compensation gap is further evaluated by comparing it to the 1992 FC (with a maximum limit of 203 million SDR) and 1992 CLC shipowner liability. The following analysis simulates the compensation gap for a major oil spill incident. All monetary values in the table are converted based on the 2023 exchange rate: 1 SDR ≈ 9.5 RMB.

To quantify the financial implications of adopting the 1992 FC, we analyzed compensation coverage and uncompensated losses under China’s current “CLC + COPCF” framework versus a hypothetical “CLC + COPCF + FC” system. Key parameters included: (1) an exchange rate of 1SDR≈9.5RMB (2023 average); (2) liability caps under the 1992 CLC (89.77million SDR≈853million RMB), the 1992 FC (203million SDR≈1,928.5million RMB), and the COPCF (30 million RMB); and (3) total losses from the A Symphony oil spill (3,700million RMB). Under the current system (CLC + COPCF), compensation totaled 883 million RMB (853 M RMB [CLC]+30 M RMB [COPCF]), covering 23.9% of losses and leaving 2,817million RMB uncompensated. With FC accession, total compensation rose to 2,811 million RMB (1,928 M RMB [FC] + 30 M RMB [COPCF] - 617 M RMB [CLC]), reducing uncompensated losses to 889 million RMB and achieving a 68.44% reduction.

Equation 1 demonstrates the FC’s capacity to alleviate fiscal burdens and enhance ecological restoration funding, aligning with case simulations in Table 3.

By comparing the compensation capacity across the different mechanisms, the following conclusions can be drawn:

Firstly, while the institutional gap has been significantly reduced, there is still room for further optimization. Under the current framework (CLC + COPCF), only 23.9% of the total loss is covered (8.83 million RMB out of 37 million RMB). However, after joining the 1992 FC, compensation coverage increases to 76% (28.11 million RMB), representing a 52.1% increase in the coverage rate. Notably, the funding gap for ecological restoration is reduced by 59.6%, from 22 million RMB to 8.89 million RMB. As a result, joining the FC would reduce uncompensated losses from 2.8 billion RMB to 889 million RMB, a decrease of 68.44%.

Secondly, local governments must bear approximately 1.97 billion RMB in costs under the current system. In contrast, joining the 1992 FC would reduce this burden to 889 million RMB, representing a 54.9% decrease. If local governments cannot absorb this responsibility, restoring the marine ecological environment is unlikely. In practice, most major oil spill incidents in China lead to irreversible environmental damage due to insufficient compensation funds.

Finally, several feasible measures could be adopted to address the existing compensation gap: One approach is for China to join the 1992 FC, which would reduce the fiscal burden of a single VLCC oil spill by 1.081 billion RMB (from the original gap of 2.817 billion RMB to the new gap of 889 million RMB). Alternatively, increasing the COPCF compensation limit could enhance the fund’s capacity, raising the single-incident cap from 30 million RMB to 300 million RMB. This increase would ensure sufficient reserves, such as maintaining a COPCF balance of 1 billion RMB. Additionally, in a catastrophic pollution accident, the COPCF Management Committee could be authorized to levy special assessments and increase the fund’s compensation capacity, further alleviating government pressure.

4.4 Quantitative analysis of oil companies’ economic burden and contribution capacity

4.4.1 Basic situation of fund compensation and contributions

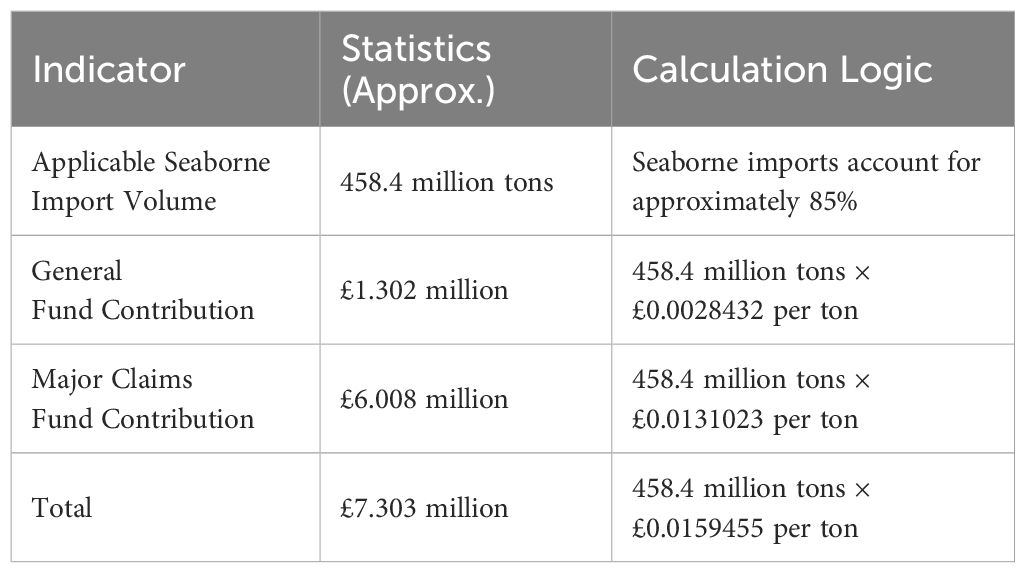

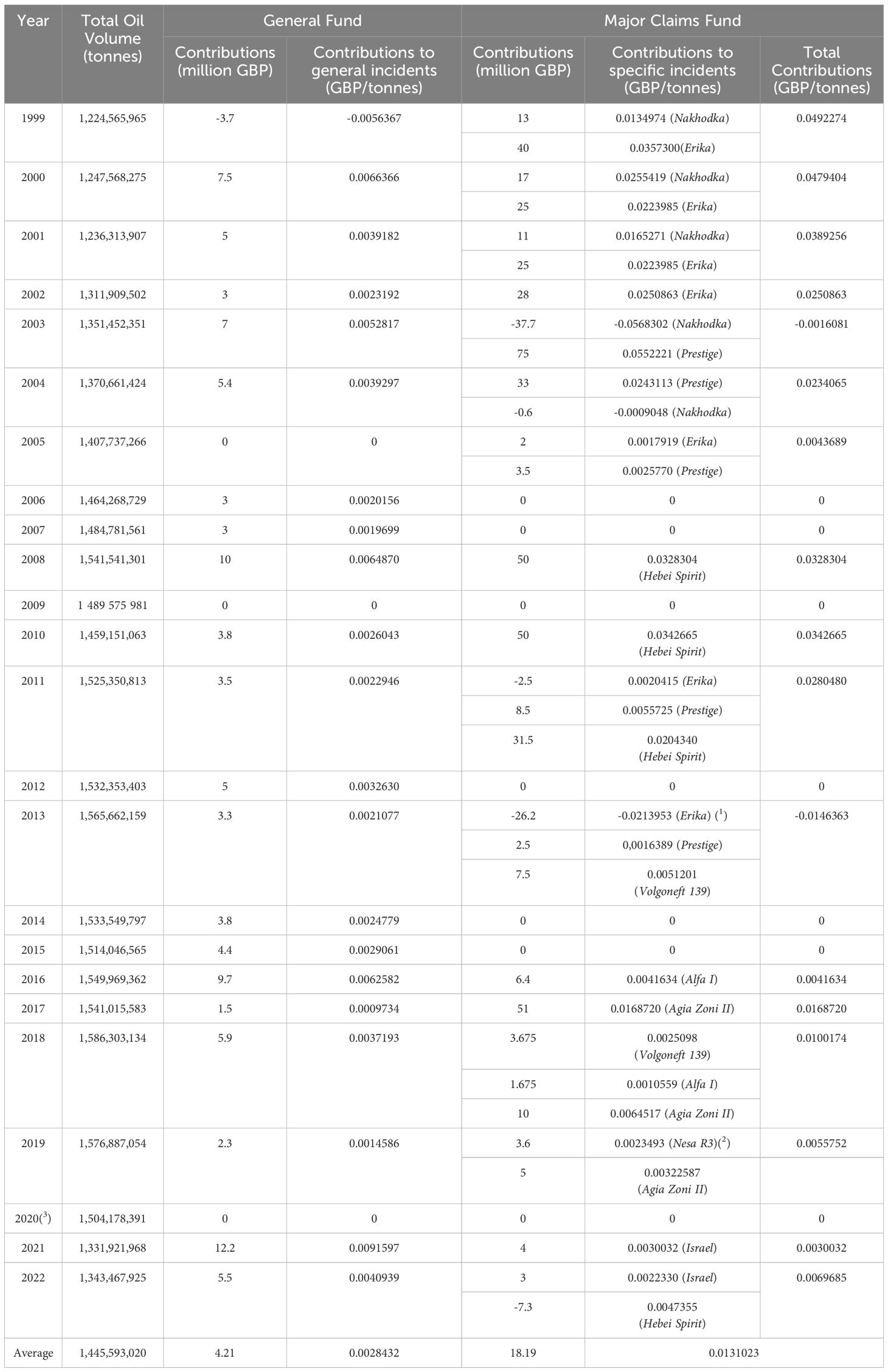

Since its establishment in 1978, the IOPC Fund has processed 155 incidents, distributing approximately £788 million in compensation as of December 31, 2024, with £331 million related to the 1971 Fund (Derrington, 2017). The authors have compiled data on maritime oil imports eligible for contributions, as well as the total contributions and the amounts allocated to the General Fund and the Major Claims Fund from 2008 to 2021 (Fry and Amesheva, 2016). This dataset facilitates the calculation of the historical average annual contribution for both funds. Based on recent maritime oil import data from China, the potential contribution burden that China would incur upon joining the convention is estimated, providing a framework for assessing its economic burden. According to IOPC statistics from 1999 to 2021, the average annual total contribution volume was 1,443,680,761 tons, with a contribution rate of £0.0028432 per ton for the General Fund and £0.0131023 per ton for the Major Claims Fund. The combined contribution for both funds amounts to £0.0159455 per ton. Based on this contribution rate, China’s estimated annual contribution is relatively negligible in comparison to the profits of the oil industry (see Table 4).

Table 4. Breakdown of oil quantities and contribution amounts for the IOPC fund (1999-2022) (Wu, 2002).

Notably, contributions to the Major Claims Fund were predominantly concentrated before 2006, a trend attributed to the frequent occurrences of major oil spill incidents during this period. Data from 1999 to 2005 reveals a General Fund contribution rate of £0.0023501 per ton, while the Major Claims Fund received 13 contributions, with an average annual contribution of £0.0268207 per ton. The combined average yearly contribution amounted to £0.0291708 per ton. In contrast, from 2006 to 2021, the average annual contribution to the General Fund was £0.0036180 per ton, while the Major Claims Fund contribution averaged £0.0078806 per ton. The total combined yearly contribution for these 16 years was £0.0114986 per ton, reflecting a 60.58% decrease compared to the £0.0291708 per ton observed in 1999-2005 (Adshead, 2018). This decline is also lower than the 23-year average of £0.0159455 per ton, indicating that the frequency of major oil spill incidents was notably higher in the 1990s, contributing to the surge in contributions during that time. However, advancements in shipbuilding, vessel management, and navigation technology have resulted in a downward trend in the frequency of major marine oil spills since the 2010s (see Figure 3).

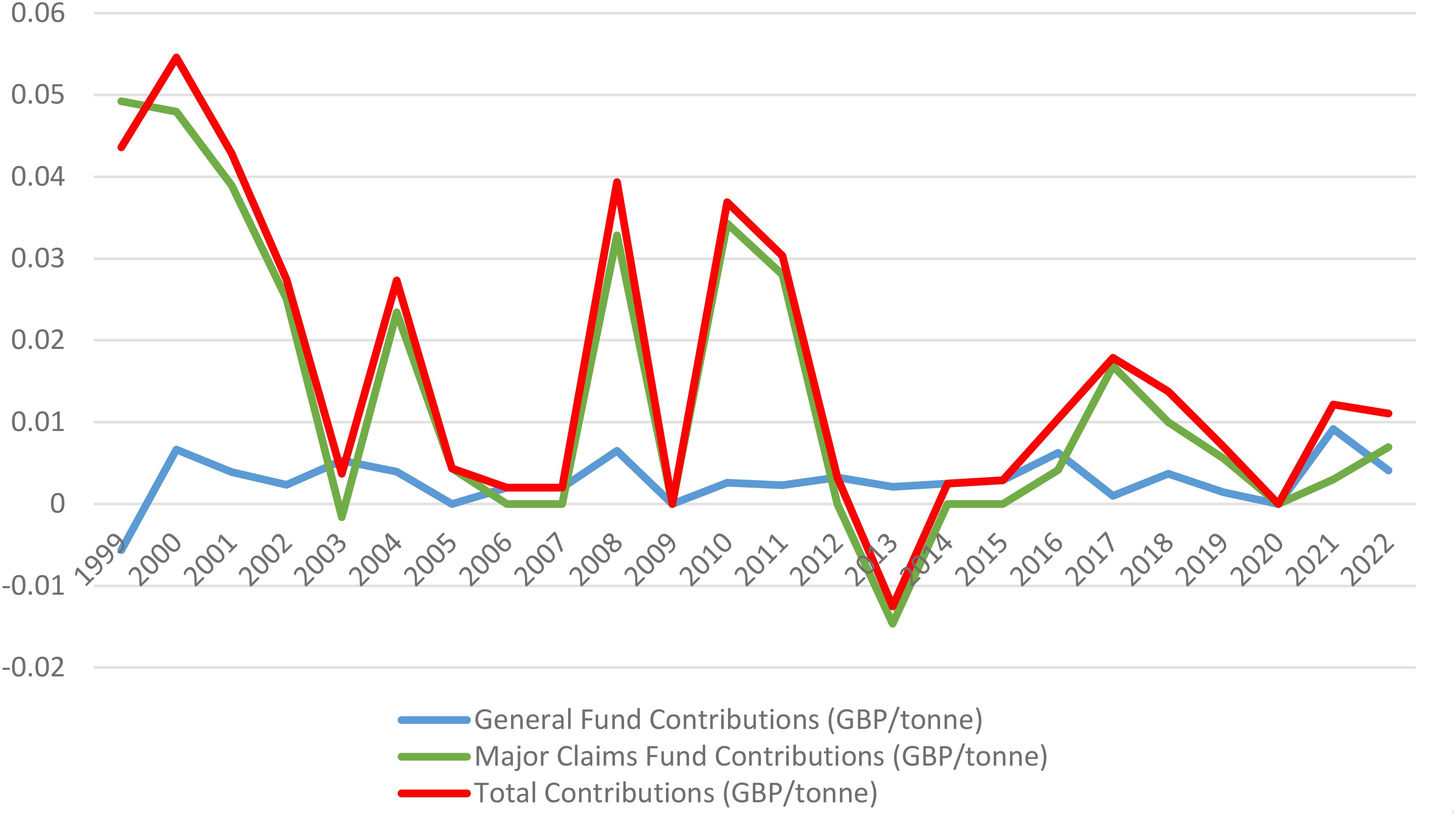

As illustrated in Figure 4, the per-ton contribution cost for the General Fund remains relatively stable, generally ranging from £0.001 to £0.006 per ton, with minimal fluctuation. Contributions to the Major Claims Fund, however, exhibit significant spikes, particularly in response to the Erika (1999), Prestige (2002), and Hebei Spirit (2007) incidents, which together account for over 60% of the total contributions for major accidents. These major incidents dominate contribution patterns, with their per-ton rates being approximately 4.6 times higher than those for routine incidents (£0.0131023 vs. £0.0028432/ton).

Figure 4. IOPC contributions to the general fund and major claims fund (1999-2022). (Source: IOPC fund annual reports).

With advancements in navigation and shipbuilding technologies, the period following 2006 saw a decline in the frequency of maritime accidents and the number of claims filed with the IOPC Fund. This reduction is evident in the overall decreasing trend of IOPC claims since 2010, which can be attributed to enhanced ship safety standards. Furthermore, this trend highlights the fund’s capability to manage infrequent yet catastrophic spills (see Figure 5). Figure 4 further illustrates that total contributions are influenced mainly by occasional major accidents, creating short-term financial pressures for major oil-importing countries during high-incident years (e.g., 2003, 2008, 2017). In the case of particularly severe incidents, per-accident costs remain substantial, as exemplified by the Hebei Spirit incident in 2010, which resulted in significant contributions over two consecutive years—£0.0328304 per ton in 2008 and £0.0342665 per ton in 2010—reflecting the long-term costs associated with incident response and remediation.

Over 85% of China’s crude oil imports are transported by sea, with only a small proportion arriving via pipelines from Central Asia and Russia (Wang et al., 2020). In 2021-2022, China imported 485.9 million, 450.2 million, and 439.2 million tons of crude oil by sea, respectively (Maes, 2005). If China joins the FC, and based on the average sea-imported oil quantity of 458.4 million tons over these three years, the total global allocated oil volume would be 1.44468 billion tons (historical average) + 458.4 million tons (China) = 1.90308 billion tons. Assuming the per-ton contribution rate remains unchanged, China’s contributions would be as follows: General Fund contribution = £0.0028432/ton × 458.4 million tons ≈ £1,303,033; Major Claims Fund contribution = £0.0131023/ton × 458.4 million tons ≈ £6,006,094, resulting in a total contribution of £7,309,127 (Liao and Li, 2022). Additionally, if the annual average allocated oil volume is 1.44468 billion tons, China’s inclusion would add 458.4 million tons of allocated oil, resulting in a 31.73% increase in the IOPC’s annual contribution total. Therefore, China’s participation will directly expand the fund’s capacity and enhance its ability to compensate for accident-related claims.

4.4.2 Major incident impact analysis

The 1992 Fund operates through two distinct funds: the General Fund and the Major Claims Fund. The General Fund is allocated for the day-to-day operations of the 1992 Fund and for addressing smaller claims arising from oil pollution incidents, effectively functioning as the organization’s “operating budget.” In contrast, the Major Claims Fund is specifically designated to cover compensation costs that exceed the General Fund’s threshold of 4 million SDR, typically in response to large-scale oil pollution incidents. To manage its associated compensation costs, a separate Major Claims Fund is established for each significant oil pollution incident. Since the establishment of the IOPC Fund in 1978, a total of 155 claims cases have been recorded; of these, 48 cases belong to the 1992 Fund, while 107 are under the 1971 Fund. Approximately 19 of these cases required the establishment of a Major Claims Fund, including four instances established under the STOPIA 2006 framework. As a result, incidents that exceed the General Fund’s threshold are relatively infrequent (Savov, 2020). The article compiles data on 16 major incidents that occurred after the entry into force of the 1992 FC, in which the volume of oil spilled exceeded 200 tons. The three most significant incidents in terms of spill magnitude are the Prestige spill (2002, 63,200 tons), followed by the Erika (1999, 19,800 tons), and the Hebei Spirit (2007, 10,900 tons). The median spill volume for these incidents is approximately 1,000 to 2,500 tons. In the 12 incidents that have been compensated, the 1992 Fund has disbursed at least 320 million euros. The highest compensation for a single incident was awarded to the Prestige spill, amounting to 147.9 million euros, followed by Erika at 116.9 million euros. Three cases remain unresolved (Baltic Carrier, Redfferm, and Bow Jubail), where compensation was not granted due to the loss failing to meet the compensation threshold, the liable party has already made full payments, or the claims not passing the review process.

As indicated in Table 5, a clear correlation exists between the volume of oil spilled and the compensation provided by the fund—larger spills generally result in higher compensation amounts, as demonstrated by the Prestige and Erika incidents (Zhang, 2022). However, exceptions include the Solar 1 incident (2,000 tons), where compensation was limited to 986,000 Philippine pesos (approximately 160,000 euros) due to its relatively minor environmental impact, and the Agia Zoni II incident (500 tons), which resulted in compensation of 16.88 million euros owing to its significant adverse effects on a sensitive ecological area. The average salary per ton of oil spilled is derived from the Prestige incident at approximately 2,340 euros per ton, Erika at approximately 6,550 euros per ton, and the overall median compensation between 1,000 and 3,000 euros per ton. The compensation amount is still pending for the Gulfstream incident 2024, which spilled 4,652 tons of oil, although it is anticipated to be the highest payout in recent years.

The data presented above highlight several key observations. The IOPC Fund is crucial for compensating for major incidents like the Prestige and Erika disasters (Cho, 2010), This compensation, exceeding 100 million euros, significantly alleviates the financial burden on affected governments. The compensation per ton of oil spilled varies considerably, ranging from 500 to 7,000 euros, influenced by factors such as the nature of the spill and the ecological sensitivity involved (refer to Table 5). Since 2010, the efficiency of compensation has improved notably. For example, the Agia Zoni II case in 2017 resulted in a payment of 16.88 million euros, completed within five years, while the Princess Empress case in 2023 saw a fee of 107 million Philippine pesos (approximately 1.7 million euros) processed within just one year. These major claims emphasize the necessity of China’s accession to the FC. Should a disaster similar to the Erika disaster occur in China, the current compensation mechanism would be insufficient. Furthermore, historical cases, particularly those arising in ecologically sensitive areas, demonstrate the need for higher compensation, as evidenced by the Agia Zoni II case, underscoring the importance of China in enhancing the protection of its high-risk environmental zones.

4.4.3 Financial impact on China’s three major oil companies from joining the 1992 FC

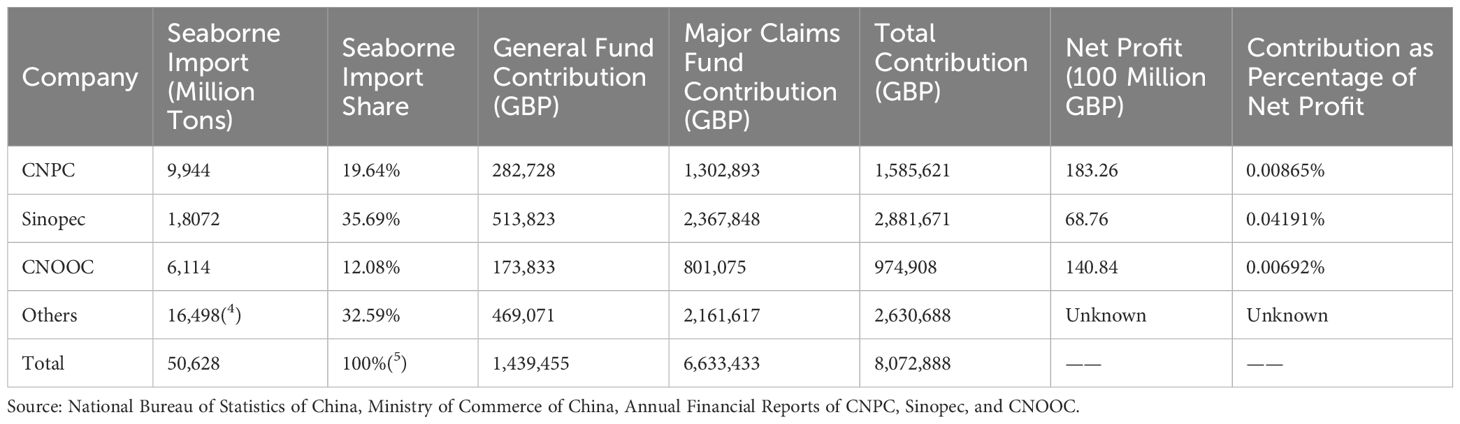

If China were to join the 1992 FC, its three major oil companies, CNPC, Sinopec, and CNOOC, would assume the primary financial responsibility for compensating for oil spills. These companies are critical to China’s crude oil import operations. Based on the average volume of seaborne oil imports from 2020 to 2022, which amounted to 4.859 million tons, 4.502 million tons, and 4.392 million tons, respectively, the total annual volume of crude oil imported by sea is approximately 45.8 million tons. Should these oil imports incur contributions, the average contribution per ton to the General Fund over the past 14 years (as indicated in Table 4) would be £0.0028432 per ton, while the contribution to the Major Claims Fund amounts to £0.0131023 per ton. These contributions lead to a total contribution of £0.0159455 per ton. Consequently, the average annual contribution for China’s oil imports during 2020-2022, as outlined in Table 6, would total approximately £7.303 million, or 64.22 million RMB. The calculation formula for the contribution is given by: Contribution = Oil Imports (tons) × IOPC Rate (£0.0159455/ton). The data sources include the average annual volume of China’s seaborne crude oil imports between 2020 and 2022, which was 458.4 million tons, and the historical average contribution rate of £0.0159455 per ton, as reported in the IOPC Fund Annual Reports (1999–2021). Between 2020 and 2022, the total profits of China’s petrochemical industry reached 515.55 billion RMB (Zhang et al., 2014), 1.16 trillion RMB (Maritime Safety Administration of the People’s Republic of China, 2024), Moreover, 1.13 trillion RMB, respectively, yielding an average annual profit of 935.18 billion RMB. The total contributions from oil import enterprises, representing 0.00687% of the industry’s total profit, suggest that the financial burden would be relatively modest.

In addition to the broader industry impact, further internal analysis may be conducted based on the classification of oil import enterprises in China. Oil importers in the country are categorized into those with state-owned and non-state-owned trade import rights (Dicks, 2008). Five companies that hold state-owned trade import rights manage their imports through automatic import licensing with no quantity restrictions. These companies include Sinochem International Corporation, China National Petroleum Corporation, China United Petroleum Limited, Zhuhai Zhenrong Limited, and CNOOC. The remaining 60 companies possess non-state-owned trade import rights and are subject to annual import quotas issued by the government (Jacobsson, 2024). Among these 60 companies, four do not exceed yearly imports of 150,000 tons (collectively importing 200,000 tons). All other 56 companies, which import more than 150,000 tons annually, would therefore be subject to contributions (Li et al., 2013). Table 7 summarizes the import volumes and proportions of these two categories of companies. It highlights that state-owned enterprises control the majority of imports, thereby simplifying the levy collection process.

In China, the decision to participate in the FC is often influenced by the perspectives of major oil companies, with the views of the three state-owned oil companies typically guiding high-level policy decisions. For this analysis, 2023 has been selected as the sample year due to its record-high crude oil imports. The contributions and their relative proportions for China’s three major oil companies are estimated based on this data. While China’s total crude oil imports are expected to continue rising, the overall annual import volume is likely to fluctuate around the 2023 level in the coming years, owing to the rapid advancement of new energy technologies and the deceleration of economic growth. Although public data regarding the crude oil imports of the five state-owned trading companies is not readily accessible, CNPC’s 2023 financial report reveals that the company processed 1,398.8 million barrels of crude oil, with 697.7 million barrels sourced from its oil and gas operations (Adshead, 2018). The remaining 701.1 million barrels (50.1%) were procured externally, and an additional 1.634 million barrels of crude oil were self-produced overseas (Wang et al., 2020). These volumes totaled 864.5 million barrels (approximately 11.7 million tons), representing about 20.7% of the national crude oil imports, totaling 56.394 million tons in 2023. Assuming that 85% of these crude oil volumes were imported by sea, the total amount subject to contributions would be 9.944 million tons, accounting for 19.64% of seaborne imports.

According to Sinopec’s 2023 financial report, the company processed 21.261 million tons of externally sourced crude oil, representing 70% of its total annual processing volume of 25.8 million tons and 37.7% of national crude oil imports (Zhang, 2022). Assuming that 85% of these crude oil volumes were imported by sea, the total volume subject to contributions would be 18.072 million tons, accounting for 35.69% of seaborne imports. CNOOC’s 2023 financial report indicates that the company’s overseas net oil production was 1,420,934 barrels per day, yielding approximately 518.64 million barrels (about 7.193 million tons), constituting 12.75% of national crude oil imports (Cho, 2010). Assuming that 85% of these crude oils were imported by sea, the total amount subject to contributions would be 6.114 million tons or 12.08% of seaborne imports.

By applying the contribution rates of £0.0028432 per ton for the General Fund and £0.0131023 per ton for the Major Claims Fund, the total contribution for these companies can be calculated at £8,066,699. Using the average exchange rate of £1 to RMB 8.7933 in 2023, the profits attributable to shareholders for CNPC, Sinopec, and CNOOC in 2023 were 161.146 billion RMB (approximately £17.90 billion), 60.463 billion RMB (approximately £6.72 billion), and 123.843 billion RMB (approximately £13.76 billion), respectively. From these figures, the contribution amounts and their ratios to net profits for these companies can be estimated, as shown in Table 8, illustrating that oil companies face a relatively small financial burden.

In 2023, sea freight crude oil imports for CNPC, Sinopec, and CNOOC accounted for 19.64%, 35.69%, and 12.08%, collectively representing 67.41% of the total imports. Sinopec led with the largest share, importing 18,072 million tons, significantly higher than the other companies. This large share reflects Sinopec’s considerable reliance on imports, consistent with its status as a refining giant. CNPC imported 9,944 million tons, representing 19.64% of total imports, aligning with its integrated business model encompassing exploration, refining, and sales. CNOOC’s import volume, at 6,114 million tons (12.08%), was the lowest, reflecting its strategic focus on self-produced crude oil, including domestic and overseas equity oil, thereby minimizing the need for external imports. The remaining 32.59% was accounted for by other companies, including private refining entities such as Hengli Group and Zhejiang Rongsheng Holding Group, with a total import volume of 16,498 million tons.

Regarding contribution amounts, the top three oil companies collectively allocated £5,442,200, with Sinopec contributing £2,881,671, CNPC £1,585,621, and CNOOC £974,908. When considering the contribution as a percentage of net profit, Sinopec exhibited the highest proportion at 0.04191%, which can be attributed to its comparatively lower profit in 2023 than in previous years. However, the absolute impact of this contribution on Sinopec’s overall profitability was minimal. CNPC and CNOOC had contribution percentages significantly below 0.01% (0.00865% and 0.00692%, respectively), highlighting the relatively lighter financial burden on these companies. The substantial profitability of their upstream exploration businesses, with CNPC’s net profit at £18.326 billion and CNOOC’s at £14.084 billion, supports this. Therefore, despite the higher absolute contribution amounts, the financial impact of these costs on their profitability remains negligible, given the companies’ large net profits.

The contribution burden remains minimal for the industry as a whole. For example, the 60 companies with non-state-owned trade import rights collectively imported 16,498 million tons of crude oil via sea freight, with a total contribution of £2,630,688. Although the profits of these companies are not fully disclosed, data from the State-owned Assets Supervision and Administration Commission (SASAC) indicate that the total profit of China’s petrochemical industry in 2023 was ¥873.36 billion (approximately £99.32 billion) (Faure, 2016). The total contribution of £8,072,888 (approximately ¥70.99 million) represents only 0.00865% of the industry’s total profit for the year, well within these companies’ financial capacity to absorb.

If China were to join the 1992 FC, the institutional leverage effect would be substantial. The total contribution of £8,072,888 could trigger potential international fund compensation exceeding £200 million under the CLC+FC, significantly enhancing China’s marine environmental risk management capabilities. By joining the FC and utilizing the international fund compensation mechanism, China would secure high levels of protection and potential compensation with minimal financial investment. This strategy would effectively enhance the country’s ability to respond to marine environmental risks while simultaneously fulfilling its international obligations and contributing to broader strategic objectives. This model appeals to governments, corporations, and the international community, as it aligns with the best cost-effectiveness and risk-management practices (Jacobsson, 1996).

4.5 Reform path of China’s oil pollution liability and compensation model

4.5.1 Interaction between the CLC and the FC

The CLC and the FC ensure the equitable allocation of responsibility between shipowners and cargo owners in the context of ship-source oil pollution incidents (Zhao and Chang, 2022). These conventions achieve this through distinct yet complementary mechanisms, facilitating effective liability allocation and promoting collaborative risk-sharing.

Firstly, the liability mechanism under the CLC mandates that shipowners secure compulsory insurance to cover their liability in the event of an oil pollution incident. According to the CLC, a shipowner’s liability is limited based on the ship’s tonnage, with compensation provided within the shipowner’s insurance coverage scope. This mechanism mitigates the risk of harm to affected parties, ensuring that compensation is available even if the shipowner is financially unable to meet their obligations.

Secondly, the supplementary liability mechanism established under the FC provides an additional layer of protection. The FC creates an international fund to supplement the shipowner’s liability, extending coverage to cargo owners, the marine environment, and other affected parties. Specifically, it provides additional compensation to victims without full compensation under the CLC. Consequently, the FC does not replace the shipowner’s liability; instead, it ensures that victims receive adequate financial redress when the shipowner’s liability proves insufficient to cover the full extent of the damage.

Thirdly, the interaction between the CLC and the FC creates a dual-layer mechanism for liability distribution that optimizes protection. This interconnected framework ensures that shipowners bear the initial responsibility for compensation through compulsory insurance, while the FC provides supplementary support to cover any shortfalls. This dual-layer mechanism minimizes legal gaps and risks associated with relying on a single source of liability, thereby enhancing the global implementation of maritime accident liability. Moreover, it mitigates potential risks in international trade and shipping arising from legal inconsistencies between countries or regions. The IOPC Fund affirms that this compensation framework, including the Supplementary Fund, is well-equipped to address substantial oil spill incidents, as demonstrated in Table 9. This framework highlights that the 1992 FC serves as a “safety net” by providing additional compensation when shipowner liability proves insufficient (Faure, 2016).

4.5.2 Operation mechanism of the COPCF

The COPCF was officially established on July 1, 2012, in accordance with the “Regulations on the Collection and Management of Ship Oil Pollution Damage Compensation Fund,” which were jointly issued by the Ministry of Finance and the Ministry of Transport. The COPCF established a management committee, a secretariat, and a claims service center. The management committee consists of representatives from various member units, including the Ministry of Transport, Ministry of Finance, Ministry of Natural Resources, Ministry of Ecology and Environment, Ministry of Agriculture and Rural Affairs, and corporations such as CNPC, Sinopec, and CNOOC. The committee is responsible for decision-making and overseeing the compensation process. The secretariat handles daily coordination, while the claims service center, under the Ministry of Transport, consists of five departments: the Comprehensive Department, Finance Department, Claims Review Department, Investigation and Evaluation Department, and Legal Affairs Department. These departments manage case intake, technical evaluations, legal consultations, and the execution of compensation.

From 2012 to 2021, the COPCF accumulated a total of 1.278 billion yuan in funds and processed 203 ship oil pollution damage claims across China’s maritime regions, compensating 372 applicants. By June 2022, the total compensation paid out by the fund amounted to approximately 103 million yuan. The fund primarily covers ship oil pollution damage compensation and monitoring expenses for the management committee. Compensation includes emergency response costs, pollution control or removal measures, direct economic losses from the fishing and tourism industries, and costs related to restoring marine ecology and supporting natural fisheries, which together account for 81.18% of total expenditures. Monitoring projects include, among others, the “Sanchi” collision and explosion incident.

According to the “Ship Oil Pollution Damage Compensation Fund Claims Guidelines (2024 Edition),” the claims process is as follows: After a ship oil pollution damage event, the affected party must first seek compensation from the primary liable party—the owner of the vessel and their oil pollution liability insurer or financial guarantor. Typically, the victim will first file a lawsuit with the domestic maritime court or apply for arbitration with an arbitration institution, requesting that the ship owner and insurer bear responsibility for the pollution damage. If a court or arbitration ruling determines that full compensation cannot be obtained from the ship owner and insurer, the victim may apply to the Ship Oil Pollution Damage Compensation Fund for secondary compensation. If the first-level liable party cannot be located, the victim may directly apply to the Fund for compensation. Claims for compensation or reimbursement from the Fund must be submitted to the Claims Service Center within three years from the date of the oil pollution event, with a maximum claim period of six years. Any time spent on litigation or arbitration concerning the dispute between the claimant and the ship owner or insurer is not counted towards the time limit for applying to the Fund.

The claims process begins with the submission of a written application and supporting materials (such as court judgments and pollution accident certificates) to the Claims Service Center. Within 15 working days, the Claims Service Center will assess the completeness, timeliness, and eligibility of the application. If accepted, the applicant will receive an “Acceptance Notice” or a “Non-Acceptance Notice.” Once a claim is accepted, the Claims Service Center will issue a “Claim Registration Notice” within 15 working days, notifying other victims to submit their claims, and processing claims in the order of submission. During the investigation and evaluation phase, the Claims Service Center will verify the cause and extent of the damage through written reviews, field investigations (conducted with two personnel and documented), collection of third-party data, or technical appraisals. The investigation report must be completed within six months of the claim registration deadline, extendable to nine months. Based on this report, a compensation plan will be proposed, and a “Claims Report” will be drafted, with a deadline of two months, extendable to five months. The case will then undergo review by the management committee, with claims involving compensation amounts of ≤3 million yuan reviewed in writing, and those exceeding 3 million yuan reviewed on-site, both requiring expert evaluations. After approval, the Claims Service Center will issue a “Compensation Decision Notice” within 15 working days. If the claim is not approved, further investigation will be conducted. Compensation payments are made through the financial treasury system, with claimants required to submit a payment receipt. Payments will be suspended during the objection review period. The Claims Service Center may recoup any advance payments made on behalf of the claimant once the responsible party or entity has restored payment capacity, deducting amounts if recovery is not possible due to the claimant’s fault. Once the case is closed, it will be archived for long-term storage. Case details, including the amount and rationale, will be publicly disclosed on the website within 20 working days of case closure.

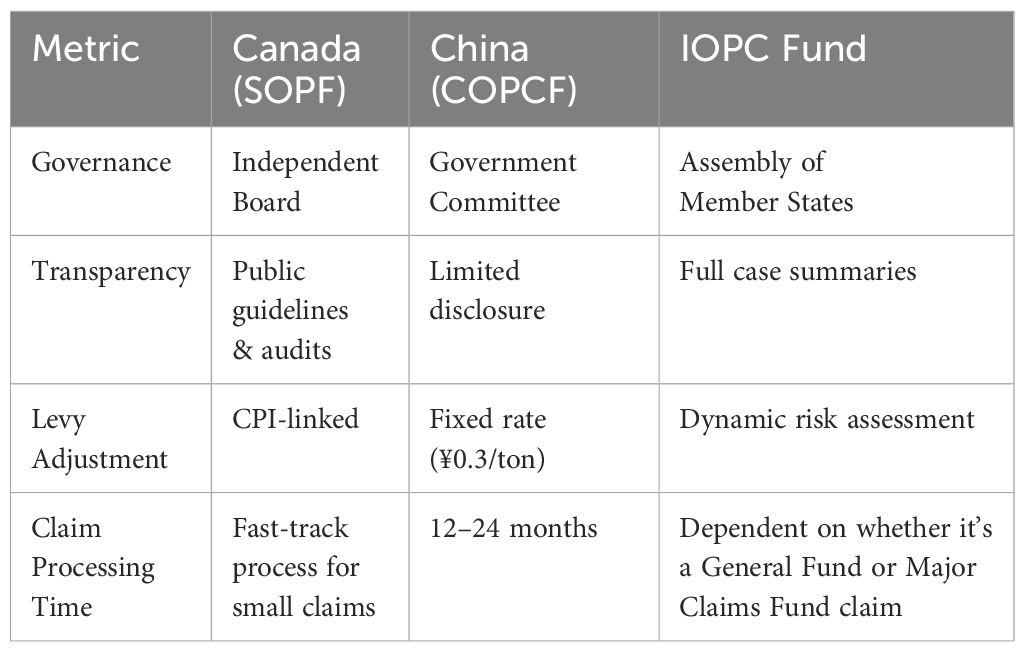

Special circumstances include the possibility of advance payments before all victims have been identified and the recalculation of claim deadlines after a lawsuit or arbitration has been suspended. The key principles of the claims process include the requirement that losses must be directly related to the incident, with a maximum compensation of 30 million yuan per incident, distributed proportionally, and reduced by any insurance or subsidies already obtained. The overall claims process follows these steps: “Application Acceptance → Registration Notice → Investigation and Evaluation → Report Drafting → Graded Review → Decision Notice → Payment/Recovery → Case Closure and Public Disclosure,” ensuring a standardized, transparent, and efficient process that safeguards the rights of victims and protects marine environmental safety, in line with the “Claims Guidelines (2024 Revised Edition).” For details regarding the governance, transparency, and processing efficiency of COPCF, SOPF, and IOPC Funds, please refer to Table 10.

4.5.3 Comparative analysis of different compensation models

International models for compensating for oil pollution damage vary, with three principal approaches widely recognized. The global convention model, established in the 1970s, is exemplified by the CLC and the IOPC. Since then, over 120 countries have adopted this model. Under this model, ship-source oil pollution damage compensation is provided through the shipowner’s liability fund and the international oil pollution fund. The second model is the US model (Paulsen, 1984). Although the United States is not a signatory to the CLC and FCs, it has enacted the Oil Pollution Act of 1990 (OPA 90), establishing the National Pollution Funds Center (NPFC) and the Oil Spill Liability Trust Fund (OSLTF), which creates a domestic oil pollution fund with a compensation cap of up to 1 billion USD (Yoon, 2009). The third model is the Canadian model. Canada has ratified both the CLC and FCs while also establishing a domestic oil pollution fund, the Ship-source Oil Pollution Fund (SOPF), to supplement compensation from the international oil pollution fund. Following an oil spill, the SOPF provides initial funding for cleanup and compensation and subsequently seeks reimbursement from the shipowner and the global oil pollution fund under the relevant conventions. China’s model diverges from these three approaches by combining a domestic fund (COPCF) with the CLC framework (Cui and Zhang, 2023). This model aims to balance the responsibilities of shipowners and cargo owners. However, the relatively low compensation limit for a single incident under the domestic fund and the insufficient liability caps under the CLC framework present significant challenges in addressing larger-scale accidents. From the perspective of securing sufficient compensation for environmental pollution, the current model is less effective than the purely international conventions or the US model, which offers higher liability limitsa (Rodriguez et al., 2017).

(1)Experience from the EU Model for China. The EU has developed a comprehensive, multi-dimensional approach to oil spill compensation that serves as a model for preventing and addressing oil pollution incidents. This system is based on international conventions such as the 1992 CLC and the 1992 IOPC Fund. Additionally, it incorporates key regional directives, national laws, and EU-specific legal frameworks, including EU Directive 2005/35/EC of the European Parliament and of the Council on Ship-Source Pollution and the Introduction of Penalties for Infringements. This directive embodies the “polluter pays” principle and mandates member states to adopt legislation to ensure shipowners’ liability for oil pollution damage (Varvastian, 2015).

The directive further requires member states to develop national contingency plans incorporating comprehensive systems for monitoring, responding to, and mitigating oil spills while ensuring prompt compensation for any resulting damage. Additionally, member states must implement preventive measures against oil pollution, including making spill response equipment and trained personnel available. The directive also establishes enforcement mechanisms, penalties, and fines for non-compliance with regulations related to ship-source pollution.

Beyond international conventions, the EU allows the creation of national compensation schemes to address oil pollution damages not fully covered by the CLC and IOPC Fund. These schemes are especially relevant for damages such as environmental restoration or indirect losses, which may be outside the scope of international frameworks. For instance, France has developed its compensation system to complement international mechanisms, covering damages to wildlife or tourism losses that may not always be included under the 1992 CLC (Rodriguez et al., 2017).

China could enhance its oil pollution compensation system by adopting a dual-layered approach similar to the EU model, where the polluter is held strictly liable, and a supplementary fund, akin to the IOPC Fund, is available to cover damages exceeding the shipowner’s liability limit. Additionally, integrating the “polluter pays” principle more thoroughly into China’s legal framework and improving compliance with national contingency plans could significantly boost the system’s overall efficacy. The EU has also established effective frameworks for cross-border compensation, particularly in regions like the North Sea. China could benefit from strengthening regional cooperation in the South China Sea and other maritime areas by developing joint compensation mechanisms for transboundary oil pollution Incidents.

(2)Experience from the US Model for China. The United States employs a unique approach to oil spill compensation through OPA 90. This legislation established the OSLTF, a national fund to cover oil spill cleanup and damage costs. The fund is primarily financed by a federal oil tax, ensuring its sustainability. The US relies exclusively on domestic legislation to address oil pollution compensation. Under OPA 90, liability for oil spills is initially assigned to the responsible party (typically the shipowner); however, the federal government can intervene to cover additional costs through the OSLTF, which has a compensation cap for each incident (Broussard, 2010).

The US model strongly emphasizes immediate access to funds for cleanup and recovery, minimizing delays in response efforts. This emphasis on quick access contrasts with the international model, where obtaining supplementary compensation may take longer. The OSLTF’s $1 billion liability cap provides significant coverage, although it has faced criticism for inadequately addressing the full scope of damage in large-scale spills.

Given China’s accession to the 1992 CLC, it is unlikely that the US domestic legal model will directly apply to China. However, there are significant lessons that China could learn from the US oil pollution law. First, China could broaden the scope of oil pollution compensation to include long-term ecological restoration and indirect economic losses, thereby providing more comprehensive environmental protection. Second, China might consider significantly increasing the liability cap to better align with the risks associated with ultra-large oil tankers.

4.5.4 China can learn from Canada’s Triple compensation model

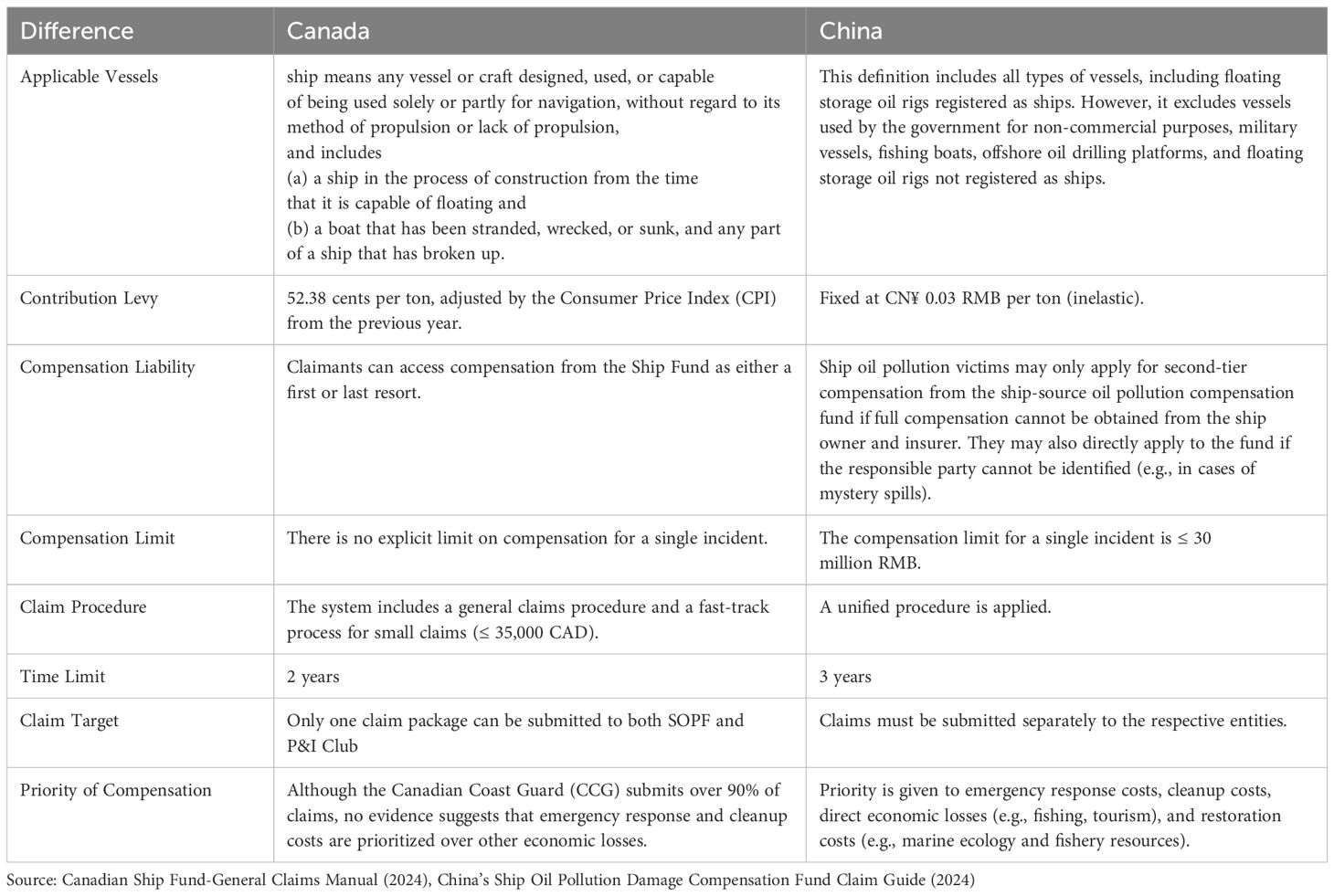

In this context, the Canadian model offers a valuable reference for China. Canada’s “CLC + FC + SOPF” triple-layer model effectively enhances compensation efficiency and coverage through system coordination. The core value of this model lies in its ability to expand the coverage scope of compensation, maintain a dynamic balance in fund collection, and streamline the claims process. A comparison between Canada’s Ship-source Oil Pollution Fund and China’s domestic oil pollution fund is provided in Table 11. The table highlights Canada’s CPI-adjusted levies and unlimited per-incident coverage by comparing the compensation models. In contrast, China’s fixed-rate, capped fund is inadequately equipped to address the risks associated with the VLCC era.

The Canadian model offers China an optimized framework integrating “gradual reform” and “institutional leapfrogging.” China is positioned to establish a “three-tier oil pollution compensation system” with global demonstration potential through a phased strategy involving institutional transplantation, efficiency enhancement, and rule output. This system, which includes mandatory shipowner insurance, the IOPC Fund, and a domestic fund, effectively manages marine environmental risks and contributes to developing an advanced paradigm for maritime governance in the 21st century. Establishing this system represents a critical response to current environmental challenges and a strategic institutional arrangement to advance China’s ambitions to become a maritime power.

Concerning domestic legal mechanisms, China has systematically revised its maritime laws and regulations to better align with international legal frameworks (Sundaram, 2016). Notably, amendments to the Maritime Law and the Marine Environmental Protection Law have significantly enhanced the compatibility between China’s domestic legal system and key international conventions, such as the CLC and the FC. These legal reforms provide more comprehensive protection for domestic shipping companies and establish a synergistic mechanism for coordinating international and domestic legal frameworks. Through this dynamic interaction, China can safeguard its interests within the global maritime legal framework while actively contributing to the evolution of international maritime rules, thereby fostering a more equitable and reasonable legal environment. This process of legal coordination lays a robust institutional foundation for China to augment its influence on global maritime governance.

In terms of reform strategy, this paper advocates for a phased approach: (a) Short-term measures: Conduct a comprehensive study on revising domestic laws to better align the Maritime Law and the Marine Environmental Protection Law with international conventions, placing particular emphasis on enhancing the contribution levy mechanism and streamlining fund claim procedures. Additionally, considering the large-scale release of non-persistent oils in the Sanchi spill, extending the COPCF to cover oil pollution damage not addressed by the CLC and the FC would be beneficial.8 This provision would provide better protection for victims of such oil spills and further strengthen safeguards for the marine environment. (b) Medium-term plans: Retain the regional emergency response functions of the domestic fund while establishing a cross-border, large-scale incident assurance mechanism based on international conventions, thereby creating a “domestic-international” dual protection system. (c) Long-term strategy: Actively participate in developing global shipping environmental protection standards as a member state of relevant conventions, promoting the establishment of a contribution ratio adjustment mechanism based on developmental disparities, thus achieving a dynamic balance of responsibilities and rights.

It is important to note that joining the 1992 FC does not undermine the value of the domestic mechanism (Yang, 2017). Instead, establishing a multi-tiered risk-sharing system aims to achieve an optimal configuration of “safety-cost” benefits. In the context of global shipping integration and the climate crisis, China’s proactive engagement in the international environmental governance system reflects the responsibilities of a significant global power. It represents a rational approach to risk mitigation. This strategy will provide sustained institutional support for China’s aspiration to become a maritime power.

5 Conclusion

The 2021 A Symphony oil spill exposed critical vulnerabilities in China’s marine oil pollution compensation framework. While the current “CLC + COPCF” model represents an initial effort to balance domestic needs with international standards, its limitations—low compensation caps, fragmented liability mechanisms, and inadequate funding for ecological restoration—render it insufficient to address large-scale disasters. This incident underscores an urgent imperative: China’s accession to the 1992 FC is advantageous and essential to align its compensation system with global best practices and safeguard its maritime interests (Manieri, 1991).

5.1 Economic feasibility and strategic benefits

Joining the 1992 FC imposes a negligible financial burden on China’s oil industry. Annual contributions, estimated at £8 million (approximately 0.01% of industry profits), would unlock access to the IOPC Fund’s compensation cap of 203 million SDR per incident—a 126% increase over the current CLC limits. This shift would transfer the fiscal burden of ecological restoration from local governments to a global risk-sharing mechanism, alleviating pressures on public funds while ensuring long-term environmental recovery. This transition promises enhanced financial security for industries and coastal communities, reducing uncompensated losses by 68.4% in major spills like A Symphony.

5.2 Institutional synergy and legal reform

A phased reform strategy is recommended to optimize China’s compensation framework. Short-term: Revise domestic laws, including the Maritime Code and Marine Environmental Protection Law, to incorporate dynamic levy mechanisms and expand the COPCF’s scope to cover non-persistent oils. Medium-term: Establish a dual-layer governance system where the COPCF addresses regional incidents while the IOPC Fund manages cross-border disasters, ensuring seamless coordination between domestic and international mechanisms. Long-term: Actively shape global maritime governance by advocating for equitable contribution models that reflect developmental disparities, positioning China as a rule-maker rather than a rule-taker (Brennan, 1989).

5.3 Global leadership and ecological civilization

China’s accession to the FC transcends technical compliance; it embodies a strategic commitment to multilateralism and ecological sustainability. By adopting the FC, China transitions from a passive participant to a proactive leader in maritime governance, aligning its economic ambitions with environmental stewardship. This move safeguards China’s coastal ecosystems, which are critical to achieving its “ecological civilization” goals, and fosters a “community of shared future for the oceans.” In an era of climate crises and escalating maritime risks, joining the FC underscores China’s resolve to balance growth with responsibility, setting a precedent for sustainable global naval governance in the 21st century.

The 1992 FC offers a pragmatic, cost-effective solution to China’s compensation gaps while advancing its geopolitical aspirations. By embracing this framework, China secures its maritime rights, mitigates environmental risks, and solidifies its role as a responsible global power committed to equitable and sustainable ocean governance.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

XW: Conceptualization, Formal analysis, Funding acquisition, Writing – original draft. XL: Investigation, Supervision, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. The fieldwork is supported by the following project: The National Social Science Fundamental Project, China (Grant No. 23FFXB048).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The reviewer KZ declared a shared affiliation with the author XW to the handling editor at the time of review.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ The per-ton contribution amounts for Erika, Prestige, and Volgoneft 139 are calculated based on the total volume of contributing oil for 1999, 2011, and 2006, respectively.

- ^ The per-ton contribution amounts for Nesa R3 and Agia Zoni II are calculated based on the total volume of contributing oil for 2012 and 2016, respectively.

- ^ Regarding the General Fund, given the difficulties arising from the COVID-19 pandemic, it was decided not to levy 2020 contributions for payment by March 1, 2021. It was instead decided that the General Fund would take out a loan of £3.9 million from the Hebei Spirit Major Claims Fund until March 2022. The loan will be repaid with contributions levied in 2021 and due for payment by March 1, 2022.

- ^ The volume of crude oil imported by 60 companies with non-state-owned trade import rights is included here, assuming these companies also import 85% of their oil by sea.

- ^ In addition to the three major Chinese oil companies and those with non-state-owned trade rights, companies such as Zhuhai Zhenrong Co., Ltd. also import oil, albeit holding a small market share. Due to the unavailability of data, these companies are not specifically detailed in this table.

- ^ The maximum amount payable by the 1992 Fund regarding an incident occurring before November 1, 2003, was SDR 135 million (USD 183.1 million), including the sum paid by the shipowner (or its insurer) under the 1992 Civil Liability Convention. The limit was increased by 50.37% to SDR 203 million (USD 275.3 million) on November 1, 2003. The increased limit applies only to incidents occurring on or after this date.

- ^ The maximum amount of compensation payable for any one incident of pollution damage in States that become Parties to the Supplementary Fund Protocol is SDR 750 million, which, as of December 31, 2023, corresponded to some £790 million. This includes the amounts payable under the 1992 Civil Liability and Fund Conventions. The Protocol is optional, and participation is open to all States Parties to the 1992 Fund Convention.

- ^ Article 5 of the 2024 Guidelines for Claims under the Ship Oil Pollution Damage Compensation Fund states that if a court ruling determines that the total oil pollution damage caused by the discharge of non-persistent cargo oil from a tanker exceeds the compensation limit for oil pollution damage set under the Maritime Code of the People's Republic of China, the claimants may seek compensation and reimbursement from the COPCF.

References

Adshead J. (2018). The application and development of the polluter-pays principle across jurisdictions in liability for marine oil pollution: the tales of the Erika and the prestige. J. Environ. Law 30, 425–452. doi: 10.1093/jel/eqy020

Brennan B. V. (1989). Liability and compensation for oil pollution from tankers under private international law: tovalop, cristal, and the exxon valdez. Georgetown Int. Environ. Law Rev. 2, 1–18.

Broussard S. J. (2010). The oil pollution act of 1990: an oil slick over robins dry dock. Loyola Maritime Law J. 8, 153–196.

Chen Q. S. and Hu S. (2020). Research on marine oil spill accidents along China’s coastal waters. Ocean Dev. Manage. 12, 50–51.

Cheong S.-M. (2012). Fishing and tourism impacts in the aftermath of the hebei-spirit oil spill. J. Of Coast. Res. 28, 1648–1653. doi: 10.2112/JCOASTRES-D-11-00079.1

Cho D.-O. (2010). Limitations of the 1992 CLC/FC and enactment of the special law on the M/V Hebei Spirit incident in Korea. Mar. Policy 34, 447–452. doi: 10.1016/j.marpol.2009.09.011

Cui L.-Z. and Zhang L. (2023). Research on the establishment procedure of China maritime claims liability limitation fund. Dong-A Law Rev. 98, 337–359. doi: 10.31839/DALR.2023.02.98.337

Derrig R., Grainger C., Hassanali K., and Bateh F. (2024). Protecting the ocean in the contemporary international order: Capacity-building and technology transfer from the Stockholm Declaration to the BBNJ Agreement. Int. J. Mar. Coast. Law 39, 571–582. doi: 10.1163/15718085-BJA10176

Derrington S. C. (2017). of reefs and men”: When the best-laid plans go awry, have we an accepta ble way forward? Aust. New Z. Maritime Law J. 31, 1–13.