- 1School of Economics and Management, Wuchang Shouyi University, Wuhan, China

- 2Research Center for Hubei Agricultural Modernization and Rural Development, Wuhan, China

- 3China Waterborne Transport Research Institute, Beijing, China

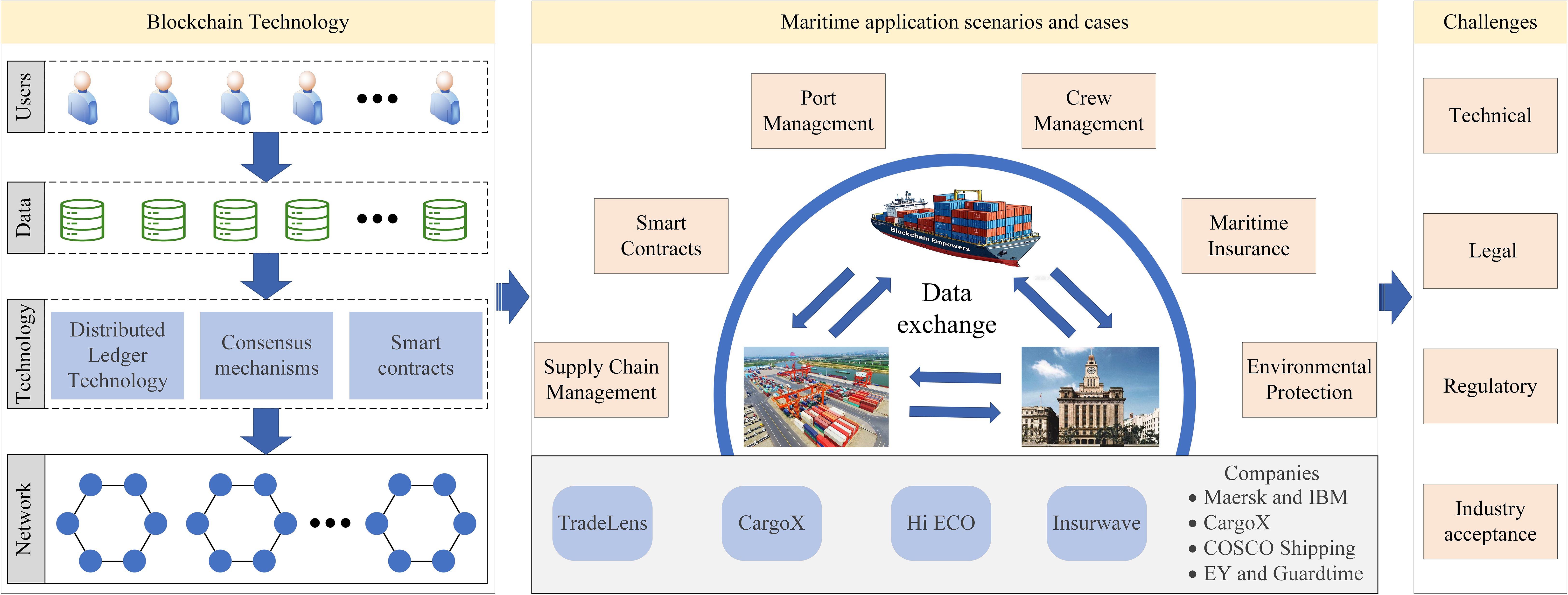

The shipping market involves multiple stakeholders, including cargo owners, shipping companies, and maritime authorities. To prevent issues such as information concealment and privacy breaches, these stakeholders often establish complex and multi-layered data exchange processes, which significantly reduce the operational efficiency of the shipping market. Decentralized blockchain technology can prevent data tampering, thereby establishing an effective consensus mechanism among multiple parties. This paper first summarizes the application scenarios of blockchain technology in the shipping market, including supply chain management, smart contracts, port management, crew management, marine insurance, and environmental protection. Subsequently, using real-world cases such as TradeLens, CargoX, COSCO SHIPPING Hi ECO, and Insurwave, the advantages of blockchain technology in enhancing shipping efficiency and reducing costs are elaborated. Finally, the challenges of applying blockchain technology in the shipping market, from both technical and regulatory perspectives, are outlined.

1 Introduction

The 2008 global financial crisis exposed the vulnerabilities of the traditional financial system and the drawbacks of centralized management. In response to the crisis, governments worldwide implemented a series of loose monetary policies. While these measures alleviated short-term economic pressures, they also eroded public confidence in the traditional financial system. Against this backdrop, Satoshi Nakamoto published the whitepaper Bitcoin: A Peer-to-Peer Electronic Cash System on October 31, 2008 (Nakamoto, 2008), introducing Bitcoin, a digital currency based on blockchain technology. Bitcoin’s core innovation lies in its use of blockchain to create a secure payment network that eliminates the need for third-party intermediaries. By leveraging distributed ledger technology and cryptographic algorithms, Bitcoin solves the double-spending problem (Zaghloul et al., 2020) and introduces a “mining” mechanism to incentivize participants to validate transactions. The emergence of Bitcoin was not only a direct response to the shortcomings of the traditional financial system but also provided the world with a decentralized, transparent, and open network for value exchange.

As blockchain technology evolved, its applications expanded beyond the financial sector, offering new solutions to challenges in other industries, particularly in international trade and shipping. International trade is a cornerstone of the global economy, and maritime shipping, as the primary mode of international trade, handles approximately 90% of global trade volume (Farah B et al., 2024). However, the shipping industry has long been plagued by complex processes, data opacity, inefficiencies, and high operational costs. Traditional shipping processes involve multiple parties and extensive paperwork, leading to slow information transfer, coordination difficulties, and even fraud. For instance, a shipping trade from Kenya to the Netherlands typically requires over 30 parties, more than 200 interactions, and up to 10 days to process shipping documents (Kim et al., 2024). Jensen et al. (2018) noted that a single international shipment can involve more than 40 organizations, generating a large volume of documents in various formats. This inefficient operational model not only increases time and costs but also undermines the competitiveness of global supply chains.

Blockchain technology has brought new opportunities for transformation in the shipping industry amid the global digital transformation of the economy. Its decentralized and tamper-proof characteristics effectively address long-standing issues of information asymmetry and trust deficits in the shipping industry (Liu et al., 2023). By recording critical data such as cargo transportation information, vessel locations, and port handling records on the blockchain, all parties can access and verify information in real time, thereby enhancing supply chain transparency and collaboration efficiency. Additionally, blockchain’s smart contract functionality enables the automation of complex business processes (Viriyasitavat and Hoonsopon, 2019). The application of blockchain technology in the shipping sector not only holds economic value but also carries profound social significance. By reducing the use of paper documents and optimizing processes, blockchain can significantly lower operational costs in the shipping industry. Its transparency and security help reduce fraudulent activities and enhance trust within the industry. According to the United Nations Conference on Trade and Development (UNCTAD), global maritime trade is expected to grow by 2% in 2024 and continue to expand at an average annual rate of 2.4% until 2029 (https://unctad.org/system/files/official-document/rmt2024overview_ch.pdf). In this context, the application of blockchain technology will provide critical technical support to the shipping industry, enabling it to play a more significant role in the global trade system.

Our data are primarily sourced from the official websites of major shipping companies, such as COSCO Shipping, Maersk, and Mediterranean Shipping Company (MSC), among others. Through these websites and relevant databases, we have collected industry-related information. Clarkesontrack, an online shipping tracking service, has also assisted us in obtaining the latest shipping data. Additionally, we have retrieved relevant studies from the past five years via databases including Scopus, ScienceDirect, and Web of Science. The key search terms employed mainly include “blockchain + ship navigation,” “blockchain + maritime management,” “blockchain and shipping,” and “blockchain + ports,” among others. Through the aforementioned databases, we have compiled relevant studies published in the past five years. Finally, these materials were systematically organized and integrated into the paper entitled “Blockchain in Maritime: Applications, Effects and Challenges.”

The research framework of this paper is illustrated in Figure 1.

The remainder of this paper is organized as follows: Section 2 introduces the fundamental principles, development trends, and advantages of blockchain technology. Section 3 outlines the challenges facing the maritime industry. Section 4 discusses the application scenarios of blockchain in the maritime sector. Section 5 presents specific case studies of blockchain applications in shipping. Section 6 examines the challenges and limitations of blockchain in maritime applications. Section 7 concludes the paper.

2 Blockchain

2.1 Fundamental principles of blockchain

Distributed Ledger Technology (DLT) forms the foundation of blockchain (Leema et al., 2021). By storing data across multiple nodes in a network, each node maintains a complete copy of the ledger, enabling decentralized data storage and sharing. As a large-scale decentralized system, blockchain utilizes hash algorithms and consensus mechanisms to ensure the permanent storage and tamper-proof nature of on-chain data. Hash algorithms generate unique “fingerprints” for data, where even minor changes to the data will alter the fingerprint, making tampering easily detectable. Consensus mechanisms enable nodes in the network to agree on the authenticity of data, ensuring that only valid data is added to the chain. Blockchain also serves as a “data audit” tool, organizing untrusted data and processing nodes to facilitate data exchange. Since blockchain is a decentralized technology, it can reduce the costs associated with centralized servers. Additionally, blockchain uses digital signatures and consensus algorithms to block malicious node requests, ensuring data security. Smart contracts are a critical component of blockchain technology. Pre-written code deployed on the blockchain can automatically execute when specific conditions are met. Because smart contracts are maintained and executed by multiple nodes, they eliminate single points of failure and risks associated with centralized control. Furthermore, blockchain’s encryption and consensus mechanisms ensure the security and reliability of smart contracts.

2.2 Development trends of blockchain

With the rapid development of information technology, blockchain technology (Peck and Moore, 2017; Yaga et al., 2019) has evolved from its initial application in Bitcoin (Efanov and Roschin, 2018; Simanta, 2018) to the second-generation Ethereum platform Hyperledger’s blockchain 3.0 with smart contracts (Benhamouda et al., 2019). Now it has developed into blockchain 5.0 integrated with cutting-edge technologies such as artificial intelligence and Industry 4.0. Each iteration brings unprecedented opportunities and challenges to various industries.

Blockchain 1.0: Ensured distributed storage, allowed data sharing between nodes, and achieved transaction transparency (Mukherjee and Pradhan, 2021). It was primarily applied in the field of digital currencies and used the Proof of Work (PoW) consensus algorithm (Ferdous et al., 2020), mainly in public chains.

Blockchain 2.0: Introduced new cryptographic methods (Diffie and Hellman, 2022), such as incorporating Merkle trees (Mao et al., 2017) into the data layer for more efficient transaction management. It also proposed new consensus algorithms for private or consortium chains, reducing the computational requirements of PoW, lowering the costs of data block verification and transaction execution, and helping prevent fraud. The most notable system in this phase was Ethereum, proposed in 2013 (Shiu, 2008; Viriyasitavat and Hoonsopon, 2019). However, Blockchain 1.0 and 2.0 were limited by low transaction throughput and high costs.

Blockchain 3.0: Designed to support diverse data structures and authentication protocols (Swan, 2015; Zou et al., 2019), enabling blockchain applications beyond the financial sector.

Blockchain 4.0: With the rise of Industry 4.0, Blockchain 4.0 aims to provide an ideal solution to meet industrial demands. Compared to Blockchain 3.0, it focuses on improving consensus algorithm efficiency, network scalability, and reducing computational requirements (Peck, 2017; Yang et al., 2019). Consensus algorithms evolved from simple logic to advanced programming languages, enabling the execution of complex contracts that align more closely with real-world transaction logic.

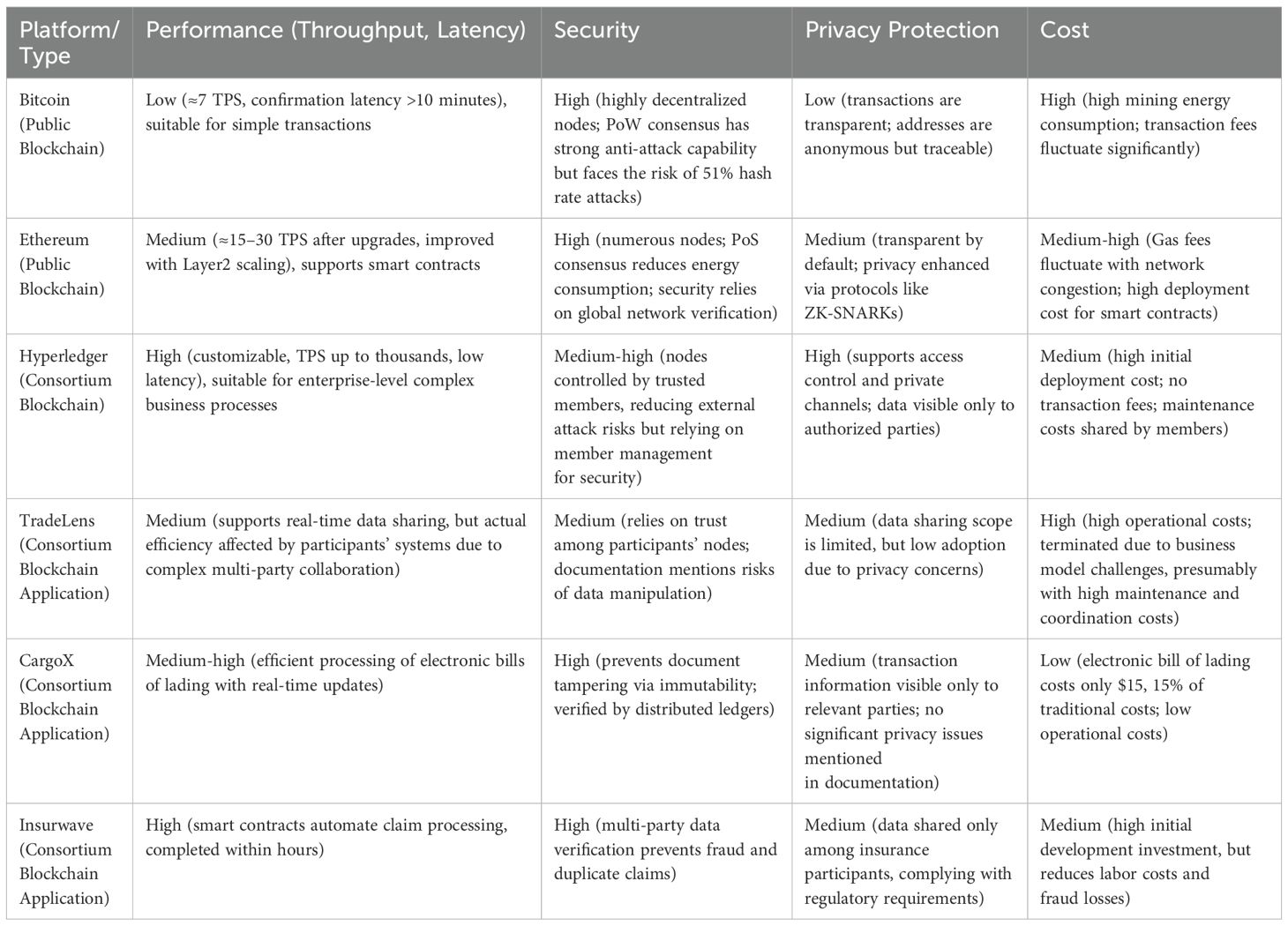

Blockchain 5.0: In this framework, blockchain technology becomes more intelligent and integrates with artificial intelligence (AI), data analytics, and other Industry 4.0-related technologies. This integration enables intelligent and automated operations supported by blockchain (Choi and Siqin, 2022). In order to illustrate the differences between different blockchain technologies, we have listed the characteristics of different blockchain platforms in Table 1.

2.3 Advantages of blockchain

The unique design of blockchain technology demonstrates significant advantages in various fields, particularly in data management and business process optimization. Blockchain achieves data transparency and traceability through distributed ledger technology (Feng et al., 2020; Zhu et al., 2021; Piera et al., 2022). By making all transaction data accessible to network participants, it reduces information asymmetry and enhances data reliability. In the shipping industry, for example, key data such as cargo transportation status, vessel locations, and port handling processes can be shared in real time, improving supply chain transparency.

Additionally, blockchain’s immutability (Dahal, 2023) prevents data from being altered or deleted after being recorded. Each block is cryptographically linked to the previous one, forming an irreversible chain structure that effectively prevents data forgery and fraud. Blockchain ensures data security through cryptographic algorithms and consensus mechanisms. All transactions are encrypted and verified by multiple nodes in the network, making it difficult to attack or manipulate the blockchain.

The decentralized nature of blockchain (Guo and Liang, 2016; Cai et al., 2018; Lee, 2019; Zwitter and Hazenberg, 2020) eliminates reliance on a single entity. Data and transactions are maintained and verified by multiple nodes in the network, reducing the need for intermediaries, lowering transaction costs, and enhancing system sustainability and stability. These advantages highlight the immense potential of blockchain technology in various fields, including shipping, providing critical support for the digital transformation of industries.

3 Challenges in the maritime industry

The maritime industry plays a crucial role in global trade. But its operational process is complex and involves numerous stakeholders and frequent data exchange, which often leads to low efficiency, information asymmetry, and occasional violations of privacy and data integrity.Historically, the industry has relied heavily on paper-based documentation or fragmented electronic systems for information transmission, leading to insufficient data transparency (Liu et al., 2023). This has fostered widespread data silos, where critical information such as cargo transit status, real-time vessel locations, and port handling progress cannot be shared in real-time. Such information asymmetry not only diminishes supply chain transparency but also exacerbates coordination challenges among various parties. Without comprehensive access to real-time operational data, corporate decision-making is frequently hampered by a lack of accuracy and timeliness.

Cumbersome and Inefficient Processes are significant and pervasive issues in traditional maritime operations (Venkatesh et al., 2017). Traditional shipping processes depend on extensive paperwork and manual operations, which are not only inefficient but also prone to human errors, further reducing operational efficiency. For example, the issuance, transfer, and verification of bills of lading (B/L) often consume considerable time and resources. The transfer of paper B/L typically involves multiple intermediaries, making the process complex and error-prone. Customs authorities have varying document requirements; for instance, some require stamps to be made with black ink, and if blue ink is used, the documents are rejected, causing cargo to be stranded at ports (Jovanovic et al., 2022). Shippers must then resubmit the B/L, often via traditional means of mailing, which can take several days. Establishing a trusted digital platform could enable timely document transfer, improving the efficiency of the entire supply chain and optimizing trade processes.

Fraudulent Activities (Shirani, 2018; Morra, 2019; Wang et al., 2022; Olakunle et al., 2023) are frequent in the maritime industry, closely linked to low transparency and complex processes. Incidents such as forged bills of lading, false cargo declarations, and duplicate financing are common. In 2020, Singapore-based oil trading company Hin Leong Trading was exposed for long-term fraudulent activities, including forging bills of lading and other key documents to conceal massive losses. The company illegally extracted goods by reusing B/L and defrauded multiple banks, involving a total of $3.5 billion. Such incidents not only directly harm the economic interests of businesses but also damage the industry’s overall reputation, making it more difficult for legitimate companies to operate in a complex trade environment. Blockchain technology has the potential to fundamentally address these issues, bringing more efficient and secure operational models to the industry. Next, we will explore specific application scenarios of blockchain technology in the maritime sector.

4 Application scenarios of blockchain in the maritime sector

4.1 Supply chain management

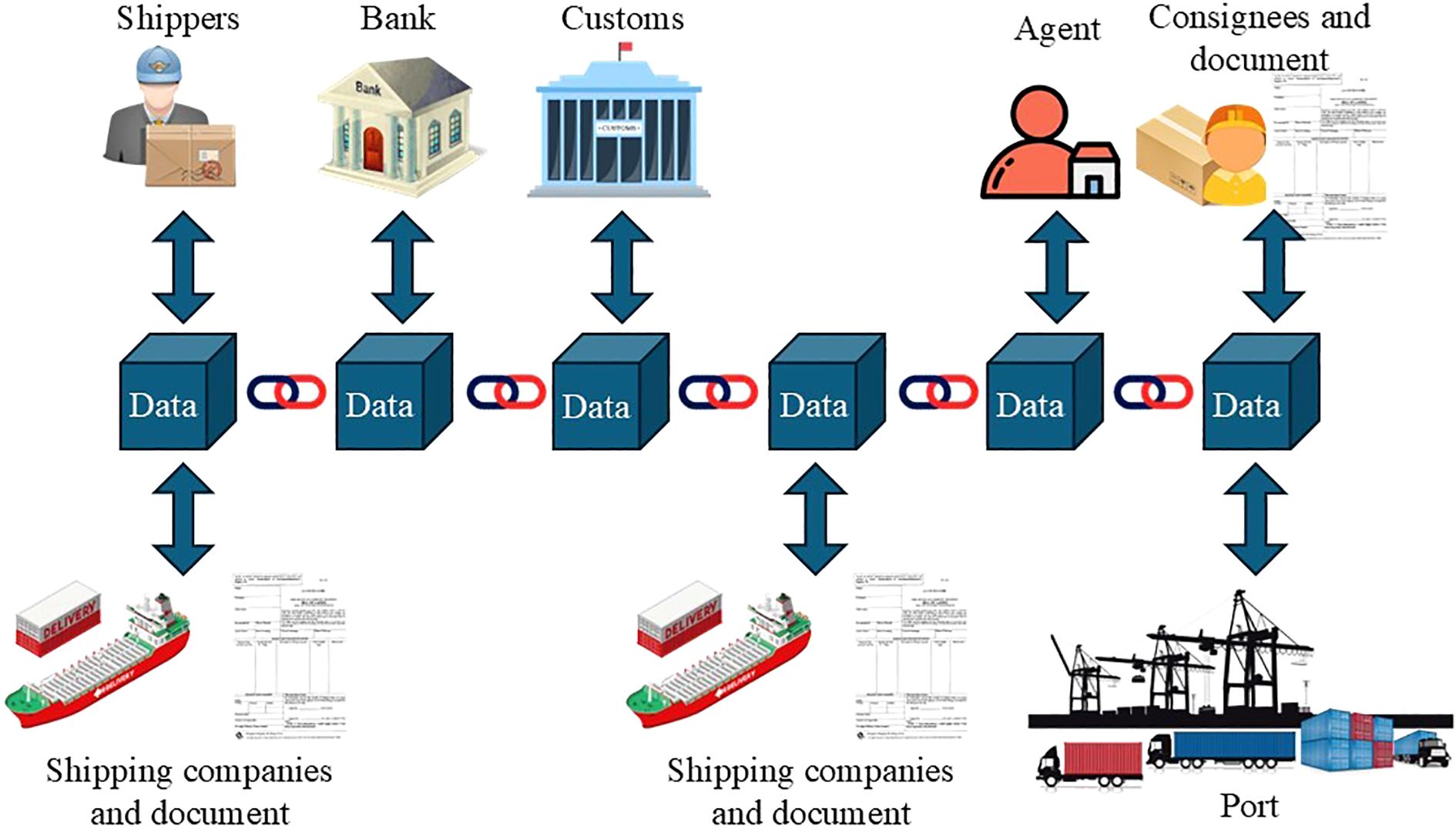

Maritime supply chains involve multiple stakeholders, including shippers, carriers, ports, customs, and consignees. Information exchange is complex and prone to errors. Traditional supply chain management relies on paper documents or fragmented electronic systems, leading to severe data silos (Jovanovic et al., 2022) and information asymmetry. Blockchain technology offers an innovative solution through distributed ledger technology (Abeyratne A and Monfared, 2016; Deshpande et al., 2017; Sunyaev and Sunyaev, 2020). By recording key data such as cargo transportation status, vessel locations, and port handling progress, blockchain ensures that all stakeholders can access and verify information in real time, enhancing supply chain transparency and collaboration efficiency. Blockchain’s cargo tracking and traceability features (Justin and Naveen U, 2020) document every step of the cargo journey from shipment to delivery, making the origin and flow of data transparent. Additionally, blockchain’s immutability effectively prevents fraudulent activities such as false cargo declarations and forged bills of lading. B/L information recorded on the blockchain can be verified in real time, making forgery nearly impossible. This enhances trust among stakeholders, making maritime supply chain management more efficient, transparent, and secure. We have added a flow chart to intuitively show how data moves within the shipping supply chain, where the data undergoes on-chain operations to ensure its authenticity. Figure 2 shows the application process of blockchain in supply chain management.

4.2 Smart contracts

Smart contracts, a key application of blockchain technology, demonstrate significant advantages in traditional maritime contract execution. Traditional maritime operations rely on manual fulfillment of contract terms, which is not only inefficient but also prone to disputes due to information asymmetry, human errors, or intentional fraud. To address these challenges, blockchain-based smart contracts provide a novel solution. Smart contracts significantly improve contract execution efficiency. Traditional maritime operations depend on manual fulfillment of contract terms, which is time-consuming and prone to disputes caused by information asymmetry, human errors, or fraud. Smart contracts are automated protocols that encode contract terms into code, enabling automatic execution when predefined conditions are met, without relying on third-party intermediaries. For example, when cargo reaches its destination, smart contracts can immediately verify the cargo status and logistics information against predefined conditions and trigger the payment process, enabling automated settlement and simplifying complex procedures. This effectively avoids potential commercial risks such as delayed payments or premature shipments. Since all transaction records are securely stored on the blockchain, the authenticity and integrity of data are ensured, facilitating subsequent audits (Rozario and Vasarhelyi, 2018; Dai et al., 2019) and compliance checks.

4.3 Port management

Traditional port management relies on paper documents, making real-time information sharing and collaboration difficult and affecting overall port efficiency. Blockchain technology offers an innovative solution for port management. By using blockchain to record and share the usage status of port equipment (e.g., cranes, trucks, and warehouses) in real time, managers can allocate resources more efficiently, reduce equipment idle time and port congestion, and optimize vessel turnaround times, thereby improving overall throughput. Blockchain’s immutability enables the recording of all historical operational data at ports, helping to identify and prevent risks such as fraud, cargo damage, or regulatory violations. It also simplifies compliance checks, ensuring that all activities comply with legal and regulatory requirements and reducing the risk of legal disputes and fines. By building a decentralized data-sharing platform, blockchain promotes real-time data sharing among port managers, shipping companies, and suppliers, enhancing collaboration efficiency, reducing communication costs, and accelerating decision-making processes. This drives port management toward greater efficiency, transparency, and security.

4.4 Crew management

Crew management is a critical component of the maritime industry (Praetorius et al., 2020), encompassing areas such as certification management, work records, and career development. Traditional crew management relies heavily on paper documents, which are not only prone to loss and damage but also vulnerable to forgery and fraudulent claims. Blockchain technology provides a solution by securely recording seafarers’ certification details, training records, and work history in a transparent and immutable manner. Shipping companies and relevant authorities can verify seafarers’ credentials in real time, preventing forgery and ensuring the authenticity and compliance of their qualifications. Additionally, blockchain enables comprehensive tracking of seafarers’ work history, including voyage records, job performance, and performance evaluations, providing reliable data support for human resource management and recruitment processes in shipping companies. This simplifies cumbersome procedures, reduces errors caused by manual operations, and enhances the efficiency and accuracy of crew data management across the industry.

4.5 Marine insurance

The traditional marine insurance process (Shuyi and Lee, 2021) is complex, involving multiple stages from initial risk assessment and policy issuance to risk monitoring and recommendations during the insurance period. In the event of an incident, the insured must promptly report the claim, negotiate with the insurer, and await settlement. These steps are not only cumbersome but also heavily reliant on manual operations and paper-based documentation, leading to prolonged claims processing times. Moreover, issues such as lack of transparency or operational errors often result in disputes. Fraudulent claims and duplicate reimbursements are common in marine insurance, further increasing operational costs and risks for insurers. Blockchain technology can record insurance policy terms, claims history, and settlement data in real time, ensuring that all parties have access to and can verify information, effectively preventing fraud and duplicate claims. This enhances transparency and efficiency in the insurance process, fostering a fairer market environment. Smart contracts can automatically trigger the claims process when predefined conditions are met. For instance, in cases of cargo loss or vessel damage, smart contracts can verify claim conditions and execute payouts automatically, reducing human intervention and operational errors. This significantly shortens claims processing times and improves the overall efficiency of the marine insurance market.

4.6 Environmental protection

Maritime transport is a pillar of economic globalization and one of the oldest modes of transportation, accounting for approximately 90% of global trade volume. However, it generates significant greenhouse gas emissions, particularly carbon dioxide (Alamoush et al., 2024), contributing to about 3% of global greenhouse gas emissions (Rony et al., 2023). Exhaust emissions from ship fuel combustion have also become a major source of air pollution (Weihao et al., 2020). To reduce ship emissions, the International Maritime Organization (IMO) has established Emission Control Areas (ECAs) and issued sulfur limit orders (SLO). Traditional data recording and monitoring methods are susceptible to tampering and forgery, making it difficult to effectively enforce environmental regulations. Blockchain technology, with its decentralized and immutable characteristics, provides a reliable technical platform for accurately recording ship emission data and waste treatment processes. By using blockchain for emission monitoring, real-time monitoring and verification of ship emission data can be achieved. In traditional models, emission data may be inaccurate due to human factors or system errors, resulting in low regulatory efficiency and an inability to promptly correct non-compliant emissions. On a blockchain platform, each emission data entry is encrypted and forms an immutable data block containing detailed information such as emission time, location, pollutant type, and concentration. This data can be shared in real time with relevant regulatory agencies, ensuring that all emission activities comply with environmental regulations and promoting the industry’s green development.

5 Blockchain applications in shipping: key use cases

5.1 TradeLens: pioneering a new era of transparency and efficiency in global shipping

In 2018, Maersk, a global leader in shipping, collaborated with IBM, a technology giant, to develop the TradeLens platform. This platform leverages blockchain technology to create a shared, real-time database for tracking cargo status. Participants in the TradeLens ecosystem—including carriers, shippers, port operators, and customs authorities—gain access to accurate, reliable, and near real-time information. By utilizing advanced data analytics, these stakeholders can enhance their internal planning systems, reduce uncertainties related to cargo availability, and improve customer service (Vujičić et al., 2020). Additionally, the platform helps shipping companies reduce costs associated with empty container repositioning, a common and inefficient practice in the industry. By providing real-time visibility into the global location of available containers, TradeLens enables optimized container allocation and routing, minimizing unnecessary transportation expenses. Early tests by Maersk and IBM demonstrated that blockchain-based tracking and the elimination of paper documents could reduce administrative costs by up to 15% of the cargo’s value (Jovanovic et al., 2022).

For governments and customs agencies, TradeLens offers timely and accurate documentation, streamlining inspection and audit processes. Ports and terminals can increase vessel throughput, handling more cargo within the same timeframe and achieving higher returns. Despite these significant advantages and technological breakthroughs, TradeLens fell short of its ambitious goals. In Q1 2023, Maersk and IBM announced the discontinuation of the platform, citing low adoption rates and challenges in establishing a viable business model. Although many companies expressed interest in TradeLens’ technology (Anne et al., 2018), the number of active users failed to reach a commercially sustainable scale. Concerns over data sharing and privacy among stakeholders further hindered its growth. Nevertheless, TradeLens provided valuable insights for the industry, demonstrating how emerging technologies can address long-standing challenges in traditional sectors and inspiring further exploration of similar solutions.

5.2 CargoX leads the electronic bill of lading revolution

The Bill of Lading (BoL) is a critical document in international trade, detailing information such as shipper, consignee, carrier, cargo description, freight charges, and BoL number. It also serves as a title document, where the holder is recognized as the legal owner of the goods. Traditional paper-based BoL processes are complex, time-consuming, and prone to inefficiencies, including information asymmetry, document loss, or tampering risks. In 2018, CargoX introduced blockchain technology to issue electronic Bills of Lading (eBL), which is the first blockchain based Bills of Lading (Li et al., 2020), significantly enhancing transaction security and efficiency. By leveraging the immutable nature of blockchain, CargoX ensures traceability for every operation, increasing transparency and trust throughout the shipping process.

Blockchain empowers CargoX to transform the logistics industry in several ways. Its core advantage lies in enhanced security, as distributed ledger technology records transactions across multiple nodes, making data nearly impossible to alter or falsify. Blockchain eBL also improves transparency by enabling real-time updates and sharing of cargo status changes among all relevant parties, addressing issues of information lag. By reducing reliance on paper documents and accelerating transaction speeds, CargoX significantly lowers operational costs. For instance, the cost of a CargoX eBL is only $15, approximately 15% of the price of a traditional paper BoL (Kim et al., 2024). This reduction in paperwork costs improves cash flow and promotes more efficient maritime transport management.

5.3 COSCO SHIPPING Hi ECO: driving green and low-carbon transformation with blockchain

As a critical component of international trade, the shipping industry accounts for approximately 3% of global greenhouse gas emissions. Transitioning to greener and low-carbon practices is essential for achieving high-quality development and aligning with global sustainability goals. COSCO SHIPPING has actively responded to the Chinese government’s strategic decisions on carbon peaking and neutrality, as well as the International Maritime Organization’s target of achieving net-zero greenhouse gas emissions around 2050. To accelerate its green transformation, COSCO SHIPPING launched the Hi ECO carbon reduction traceability and certification application.

Hi ECO offers green shipping services by fueling vessels with biofuel, achieving a 17%-19% reduction in carbon emissions compared to traditional fuels. Leveraging the traceability and immutability of blockchain, Hi ECO ensures that all carbon emission-related data is authentic, transparent, and trustworthy, enhancing customer confidence in eco-friendly shipping. COSCO SHIPPING has established a strategic partnership with the Global Shipping Business Network (GSBN) to develop a blockchain-based green certification system. This system issues Hi ECO green certificates, accurately recording carbon reduction data from biofuel usage during each voyage. This innovative certification approach not only improves data accuracy but also provides customers with verifiable proof of their environmental efforts. Hi ECO aligns with COSCO SHIPPING’s broader emission reduction strategy, particularly its “Well to WAKE” commitment, which aims to reduce carbon footprints across the entire lifecycle of fuel production and vessel operations.

5.4 Marine insurance

To address the low transparency, slow processing, and high costs associated with traditional marine insurance, Insurwave was developed as the world’s first blockchain-based marine insurance platform. A collaboration between EY, Guardtime, and other industry leaders, Insurwave is a fully decentralized platform that utilizes distributed ledger technology and smart contracts. It seamlessly integrates multi-source data, including vessel location, cargo status, and weather conditions, enabling real-time access for all participants. When a vessel enters a high-risk area (e.g., a conflict zone or severe weather region), the system automatically identifies the risk, adjusts premium pricing, or triggers claims processing (Averin et al., 2021). This automation reduces manual intervention, lowers operational costs, and enhances data accuracy. Traditional marine insurance markets are plagued by redundant information, cumbersome manual processes, and incomplete or unreliable asset data (Singhal et al., 2024). Insurwave addresses these issues by creating an immutable audit trail, fostering trust among stakeholders, simplifying premium pricing, and accelerating claims processing. Claims payments can be completed within hours, and premiums are settled in seconds, while insurers gain real-time risk tracking capabilities. Since its commercial launch in 2018, Insurwave has gained global traction, supporting 500,000 transactions in its first year and managing risks for over 1,000 commercial vessels (Singhal et al., 2024). Currently, Insurwave is expanding into emerging markets such as China and Singapore, furthering its global reach.

6 Challenges of blockchain in maritime applications

As an innovative technology, blockchain presents significant opportunities for the development of the maritime industry. However, with this emerging technology, it is crucial not only to explore its potential value but also to comprehensively assess the technical challenges and risks it may face. This dual consideration is of paramount importance.

6.1 Technical challenges

Scalability: The maritime industry involves a vast volume of transactions and data, including cargo transportation information, vessel location data, and port handling records, all of which require efficient processing and storage. However, existing blockchain networks, such as Bitcoin and Ethereum, often struggle with scalability issues, including low throughput and high latency, when handling high-concurrency transactions (Alamoush et al., 2024). These limitations make it difficult to meet the maritime industry’s demand for high-frequency transactions and real-time data processing.

Interoperability: Maritime transportation involves multiple stakeholders, including cargo owners, shipping companies, and maritime authorities, who frequently exchange data. These stakeholders often develop and maintain independent legacy systems that use different technical standards and data formats. This creates challenges for cross-system data exchange and exacerbates the issue of data silos. Initially, some companies attempted to develop proprietary blockchain systems, hoping to establish industry standards and attract competitors to join. However, this approach proved ineffective, leading instead to the parallel development of multiple blockchain solutions and further complicating interoperability.

Data Security: Even blockchain is not immune to various cybersecurity threats (Amine et al., 2022). In a blockchain network, if a single entity or a group of entities controls more than 50% of the network’s computing power, they could potentially manipulate the blockchain and its transactions (Farah B et al., 2024). For the maritime sector, such attacks could result in the tampering of critical data, such as vessel navigation records or cargo transaction information, undermining the credibility of the entire supply chain. While the immutability of blockchain data is a significant advantage if the data recorded is accurate, the authenticity and accuracy of data before it is added to the blockchain cannot be guaranteed. For example, in a blockchain-based application, if its sensors are compromised by a malicious attack, the erroneous data transmitted by the sensors would be permanently recorded on the immutable blockchain ledger.

6.2 Compliance and regulatory challenges

Maritime transportation is inherently cross-border, requiring operations across multiple jurisdictions with varying regulatory requirements. Therefore, the implementation of blockchain technology must account for differences in laws and regulations across regions, including data protection, privacy, cybersecurity, and specific maritime legislation. The varying attitudes and levels of acceptance toward blockchain technology in different countries further compound the compliance risks associated with its adoption. For instance, countries like Singapore and Switzerland have established clear blockchain regulations to encourage technological innovation. In contrast, India maintains a cautious stance, implementing stringent regulatory measures. Meanwhile, some Middle Eastern countries impose strict limitations on the application of blockchain technology.

The decentralized and highly transparent nature of blockchain also conflicts with the European Union’s General Data Protection Regulation (GDPR). GDPR explicitly grants users the “right to be forgotten” (Munim et al., 2021), allowing individuals to request the deletion of their personal data. However, blockchain data is distributed across numerous nodes and is inherently difficult to modify or delete once recorded. Additionally, GDPR permits data collection only for specific purposes and strictly limits the scope of data usage. The high transparency of blockchain means that all participants can access data on the chain, potentially exposing datasets to unauthorized users or enabling their use for unintended purposes. This clearly contravenes the provisions of GDPR.

6.3 Industry acceptance challenges

The traditional and conservative nature of the maritime industry poses significant barriers to the adoption of new technologies (Marija et al., 2020). With a long history rooted in stable business processes and established profit distribution mechanisms, many companies and institutions remain cautious about emerging technologies like blockchain, fearing potential disruptive impacts. Intermediaries such as freight forwarders, for instance, may perceive blockchain as a threat to their role and interests due to its potential to reduce the need for middlemen, leading to resistance. To address these challenges, it is essential to enhance the industry’s understanding and awareness of blockchain technology through education and training (Liu et al., 2023; Sergey et al., 2023). Additionally, solutions must be designed to balance the interests of all stakeholders, ensuring that every participant can benefit from technological innovation.

Concerns about data sharing and privacy among different stakeholders also hinder the adoption of blockchain. Because many people are unwilling to share their data on blockchain platforms, fearing that competitors may exploit it. This reluctance further hinders the development of blockchain in the maritime sector.

Moreover, the implementation of blockchain networks and applications requires substantial financial investment, including costs for hardware infrastructure, software development and maintenance, data processing and storage, and technical personnel training. For small and medium-sized enterprises, these costs can be particularly prohibitive. Furthermore, the processing of massive amounts of data, such as transaction verification and consensus mechanisms, demands significant computational resources, leading to increased energy consumption and potential environmental pollution. These factors further escalate the overall implementation costs of blockchain technology.

7 Conclusions

The decentralized, immutable, and highly transparent nature of blockchain technology offers a new approach to addressing long-standing issues in the maritime shipping industry. Through various applications—including supply chain management, smart contracts, port management, crew management, marine insurance, and environmental protection—blockchain can significantly enhance industry transparency, streamline business processes, and reduce operational costs. This paper aims to address the complexities and inefficiencies in data exchange processes caused by multi-stakeholder participation in the shipping market, as well as long-standing industry pain points such as information asymmetry, cumbersome procedures, and high fraud risks. It provides application pathways, practical examples, and strategies for addressing challenges related to blockchain technology, thereby offering valuable insights to shipping companies, maritime personnel, and maritime regulatory authorities, while also providing guidance for the implementation of blockchain in the maritime sector. The three core contributions of this paper are as follows: (1) A systematic review of typical application scenarios of blockchain technology in the shipping market, providing a clear scenario framework for industry applications; (2) Verification of the practical value of blockchain in improving shipping efficiency and reducing costs through real-world cases such as TradeLens, CargoX, and COSCO Shipping’s Hi ECO; (3) A comprehensive analysis of the challenges in applying blockchain in the shipping market from both technical and regulatory perspectives, offering risk warnings and response directions for industry practice.

7.1 Limitations of this study

In exploring the application of blockchain technology in the maritime sector, this study has the following limitations: First, the scope of case analysis is limited, focusing primarily on practices of leading platforms such as TradeLens and CargoX, as well as large shipping enterprises. It insufficiently explores blockchain application scenarios in small and medium-sized shipping enterprises and regional ports, lacking comparative analysis of differences in technology adoption among entities of varying scales. Second, the discussion at the technical level is biased toward theoretical frameworks, with insufficient in-depth analysis of specific technical bottlenecks in the implementation of blockchain in maritime contexts, and no inclusion of performance test data for different consensus algorithms in maritime scenarios. Finally, the analysis of industry acceptance relies on case descriptions, lacking stakeholder behavior research based on questionnaires or empirical data, making it difficult to quantitatively assess the actual obstacles to technology promotion.

7.2 Future research directions

Future research can be expanded in the following dimensions: (1) Technology Integration and Performance Optimization**: Explore the in-depth integration of blockchain with 5G, edge computing, and the Internet of Things (IoT) to build a real-time data on-chain system covering the entire “vessel-port-cargo” link. Focus on solving issues such as sharding technology optimization and cross-chain protocol standardization under high-frequency transactions. (2) Green Shipping and Sustainable Development: Focus on the application mechanisms of blockchain in maritime carbon footprint tracking and green fuel certification. Design smart contract-based carbon trading platforms to realize automated verification and write-off of ship emission data and carbon quotas. Building on the COSCO Shipping Hi ECO case, expand blockchain traceability systems for biofuel supply chains to promote the standardization of global shipping carbon markets. (3) Cross-Industry Standards and Regulatory Collaboration: Collaborate with multiple entities such as maritime organizations, customs, and financial institutions to formulate data interface standards for blockchain in maritime trade and establish cross-jurisdictional regulatory sandbox mechanisms. Study solutions for compatibility between the EU’s GDPR and the immutability of blockchain, and explore the application of “selective forgetting” technology in protecting maritime data privacy.

Looking ahead, as blockchain technology continues to develop and mature, its application scenarios are diversifying, and new research directions are emerging. To fully unlock the potential of this technology, collaboration among industry stakeholders is crucial, including advancements in technological innovation, policy support, standardization, and the establishment of industry consensus. It is foreseeable that with the gradual improvement of these key elements, the application prospects of blockchain technology in the maritime sector will further expand, bringing profound and positive impacts to the industry.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

ZL: Writing – original draft, Conceptualization. YS: Investigation, Supervision, Visualization, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by the National Key Research and Development Program of China 2023YFB4302302 and Leading Contingency Project of China Waterborne Transport Research Institute (Major Project) No.WTI-132404.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abeyratne A S. and Monfared P. R. (2016). Blockchain ready manufacturing supply chain using distributed ledger. Int. J. Res. Eng. Technol. 5, 1–10. doi: 10.15623/ijret.2016.0509001

Alamoush S. A., Ballini F., and Ölçer I. A. (2024). Investigating determinants of port decarbonisation implementation using the lens of Implementation Theory. Transport Economics Manage., 290–111. doi: 10.1016/j.team.2024.04.002

Amine M. F. B., Elochukwu U., Hanan H., David B., Miroslav B., and Ivan A. (2022). Xavier B.Cyber security in the maritime industry: A systematic survey of recent advances and future trends. Information 13, 22–22. doi: 10.3390/info13010022

Anne G., Karen C., and Marina S. (2018). pplying blockchain technology: evidence from norwegian companies. Sustainability 10, 1985–1985. doi: 10.3390/su10061985

Averin A., Musaev E., and Rukhlov P. (2021). “Review of existing blockchain-based insurance solutions,” in 2021 International Conference on Quality Management, Transport and Information Security, Information Technologies (IT&QM&IS). IEEE. 140–143.

Benhamouda F., Halevi S., and Halevi T. (2019). Supporting private data on Hyperledger Fabric with secure multiparty computation. IBM J. Res. Dev. doi: 10.1147/JRD.2019.2913621

Cai W., Wang Z., Ernst J. B., Hong Z., Feng C., and Leung M. (2018). Decentralized applications: The blockchain-empowered software system. IEEE Access 6, 53019–53033. doi: 10.1109/ACCESS.2018.2870644

Choi T. M. and Siqin T. (2022). Blockchain in logistics and production from Blockchain 1.0 to Blockchain 5.0: An intra-inter-organizational framework. Transportation Res. Part E 160, 102653.

Dahal S. B. (2023). Enhancing E-commerce security: the effectiveness of blockchain technology in protecting against fraudulent transactions. Int. J. Inf. Cybersecurity 7, 1–12.

Dai J., He N., and Yu H. (2019). Utilizing blockchain and smart contracts to enable audit 4.0: from the perspective of accountability audit of air pollution control in China. J. Emerging Technol. Accounting 16, 23–41. doi: 10.2308/jeta-52482

Deshpande A., Stewart K., Lepetit L., and Gunashekar S. (2017). Distributed Ledger Technologies/Blockchain: challenges, opportunities and the prospects for standards. Overview Rep. Br. Standards Institution (BSI) 40, 1–34.

Diffie W. and Hellman M. E. (2022). New directions in cryptography[M]//Democratizing Cryptography: the work of Whitfield Diffie and Martin Hellman. 365–390.

Efanov D. and Roschin P. (2018). The all-pervasiveness of the blockchain technology. Proc. Comput. Sci. 123, 116–121. doi: 10.1016/j.procs.2018.01.019

Farah B M., Ahmed Y., Mahmoud H., Shah A. S., Kadir M., Taramonli S., et al. (2024). A survey on blockchain technology in the maritime industry: Challenges and future perspectives. Future Generation Comput. Syst. 157, 618–637. doi: 10.1016/j.future.2024.03.046

Feng H., Wang X., Duan Y., Zhang J., and Zhang X. (2020). Applying blockchain technology to improve agri-food traceability: A review of development methods, benefits and challenges. J. cleaner production 260, 121031–121031. doi: 10.1016/j.jclepro.2020.121031

Ferdous M. S., Chowdhury M. J. M., Hoque M. A., and Colman A. (2020). Blockchain consensus algorithms: A survey. arXiv preprint arXiv:2001.07091.

Guo Y. and Liang C. (2016). Blockchain application and outlook in the banking industry. Financial Innovation 2, 1–12. doi: 10.1186/s40854-016-0034-9

https://unctad.org/system/files/official-document/rmt2024overview_ch.pdf. Available online at: https://unctad.org/system/files/official-document/rmt2024overview_ch.pdf (Accessed June, 2025).

Jensen T., Vatrapu R., and Bjørn-Andersen N. (2018). Avocados crossing borders: The problem of runaway objects and the solution of a shipping information pipeline for improving international trade. Inf. Syst. J. 28, 408–438. doi: 10.1111/isj.12146

Jovanovic M., Kostić N., Sebastian I. M., and Sedej T. (2022). Managing a blockchain-based platform ecosystem for industry-wide adoption: the case of TradeLens. Technological Forecasting Soc. Change 184, 121981. doi: 10.1016/j.techfore.2022.121981

Justin S. and Naveen U V. P. M. (2020). Supply chain transparency through blockchain-based traceability: an overview with demonstration. Comput. Ind. Eng. 150, 106895. doi: 10.1016/j.cie.2020.106895

Kim H., Xiao Z., Zhang X., Fu X., and Qin Z. (2024). Rethinking blockchain technologies for the maritime industry: an overview of the current landscape. Future Internet 16, 454–454. doi: 10.3390/fi16120454

Lee J. Y. (2019). A decentralized token economy: How blockchain and cryptocurrency can revolutionize business. Business Horizons 62, 773–784. doi: 10.1016/j.bushor.2019.08.003

Leema R. G., Rajmohan R., Usharani S., Kiruba K., and Manjubala P. (2021). Fundamentals of Blockchain and Distributed Ledger Technology (DLT)[M]//Recent Trends in Blockchain for information systems security and privacy. (CRC Press), 3–38.

Li K., Gharehgozli A., Ahuja M. V., and Lee J. Y. (2020). Blockchain in maritime supply chain: A synthesis analysis of benefits, challenges and limitations. J. Supply Chain Operations Manage. 18, 257.

Liu J., Zhang H., and Zhen L. (2023). Blockchain technology in maritime supply chains: applications, architecture and challenges. Int. J. Production Res. 61, 3547–3563. doi: 10.1080/00207543.2021.1930239

Mao J., Zhang Y., Li P., Li T., Wu Q., and Liu J. (2017). A position-aware Merkle tree for dynamic cloud data integrity verification. Soft Computing 21, 2151–2164. doi: 10.1007/s00500-015-1918-8

Marija J., Edvard T., Dražen Ž, and Saša A. (2020). Improving maritime transport sustainability using blockchain-based information exchange. Sustainability 12, 8866.

Morra L. (2019). Application of blockchain technologies to logistics and to container’s transportation industry (Luiss Guido Carli).

Mukherjee P. and Pradhan C. (2021). “Blockchain 1.0 to blockchain 4.0—The evolutionary transformation of blockchain technology,” in Blockchain technology: applications and challenges (Springer International Publishing, Cham), 29–49.

Munim Z. H., Duru O., and Hirata E. (2021). Rise, fall, and recovery of blockchains in the maritime technology space. J. Mar. Sci. Eng. 9, 266. doi: 10.3390/jmse9030266

Olakunle O., Kasypi M., Adel G., Saira A., and Fatt L. C. (2023). Sustainable transition towards greener and cleaner seaborne shipping industry: Challenges and opportunities. Cleaner Eng. Technol. 13, 100628. doi: 10.1016/j.clet.2023.100628

Peck M. E. (2017). Blockchain world-Do you need a blockchain? This chart will tell you if the technology can solve your problem. IEEE Spectr. 54, 38–60. doi: 10.1109/MSPEC.2017.8048838

Peck M. E. and Moore S. K. (2017). The blossoming of the blockchain. IEEE Spectr. 54, 24–25. doi: 10.1109/MSPEC.2017.8048835

Piera C., Roberto C., Del P. V., Eugenio O., and Giustina S. (2022). Blockchain technology for bridging trust, traceability and transparency in circular supply chain. Inf. Manage. 59, 103508. doi: 10.1016/j.im.2021.103508

Praetorius G., Hult C., and Österman C. (2020). Maritime resource management: current training approaches and potential improvements. TransNav Int. J. Mar. Navigation Saf. Sea Transportation 14, 573–584. doi: 10.12716/1001.14.03.08

Rony Z. I., Mofijur I., Hasan M. M., Rasul M. G., Jahirul M. I., Ahmed S. F., et al. (2023). Alternative fuels to reduce greenhouse gas emissions from marine transport and promote UN sustainable development goals. Fuel 338, 127220.

Rozario A. and Vasarhelyi M. A. (2018). Auditing with smart contracts. Int. J. Digital Accounting Res., 1–27. doi: 10.4192/1577-8517-v18_1

Sergey T., Hegner K. R., and Olli-Pekka H. (2023). The key challenges of blockchain implementation in maritime sector: summary from literature and previous research findings. Proc. Comput. Sci. 217, 348–357. doi: 10.1016/j.procs.2022.12.230

Shiu C. J. (2008). Of mice and men: why an anticommons has not emerged in the biotechnology realm. Tex. Intell. Prop. LJ 17, 413.

Shuyi P. and Lee S. J. L. (2021). Blockchain adoptions in the maritime industry: a conceptual framework. Maritime Policy Manage. 48, 777–794. doi: 10.1080/03088839.2020.1825855

Singhal N., Goyal S., and Singhal T. (2024). “Decentralized insurance: reshaping the future of coverage,” in Potential, Risks, and Ethical Implications of Decentralized Insurance (Springer Nature Singapore, Singapore), 1–48.

Sunyaev A. and Sunyaev A. (2020). Distributed ledger technology[J]. Internet computing: principles of distributed systems and emerging internet-based technologies, 265–299.

Venkatesh V., Zhang A., Luthra S., Dubey R., Subramanian N., and Mangla S. (2017). Barriers to coastal shipping development: An Indian perspective. Transportation Res. Part D 52, 362–378. doi: 10.1016/j.trd.2017.03.016

Viriyasitavat W. and Hoonsopon D. (2019). Blockchain characteristics and consensus in modern business processes. J. Ind. Inf. Integration 13, 32–39. doi: 10.1016/j.jii.2018.07.004

Vujičić S., Hasanspahić N., Car M., and Čampara L. (2020). Distributed ledger technology as a tool for environmental sustainability in the shipping industry. J. Mar. Sci. Eng. 8, 366. doi: 10.3390/jmse8050366

Wang Y., Chen P., Wu B., Wan C P., and Yang Z. (2022). A trustable architecture over blockchain to facilitate maritime administration for MASS systems. Reliability Eng. System Saf. 219, 108246. doi: 10.1016/j.ress.2021.108246

Weihao M., Shunfeng H., Dongfang M., Dianhai W., Sheng J., and Fengzhong Q. (2020). Scheduling decision model of liner shipping considering emission control areas regulations. Appl. Ocean Res., 102416.

Yaga D., Mell P., and Roby N. (2019). Scarfone K.Blockchain technology overview. arXiv preprint arXiv,1906.11078.

Yang W., Aghasian E., Garg S., Herbert D., Disiuta L., and Kang B. (2019). A survey on blockchain-based internet service architecture: requirements, challenges, trends, and future. IEEE Access 7, 75845–75872. doi: 10.1109/Access.6287639

Zaghloul E., Li T., Mutka M. W., and Ren J. (2020). Bitcoin and blockchain: Security and privacy[J. IEEE Internet Things J. 7, 10288–10313. doi: 10.1109/JIoT.6488907

Zhu P., Hu J., Li X., and Zhu Q. (2021). Using blockchain technology to enhance the traceability of original achievements. IEEE Trans. Eng. Manage. 70, 1693–1707. doi: 10.1109/TEM.2021.3066090

Zou S., Xi J., Wang H., and Xu G. (2019). CrowdBLPS: A blockchain-based location-privacy-preserving mobile crowdsensing system. IEEE Trans. Ind. Inf. 16, 4206–4218. doi: 10.1109/TII.9424

Keywords: maritime, blockchain, traffic management, shipping company, sustainability

Citation: Li Z and Sun Y (2025) Blockchain in maritime: applications, effects and challenges. Front. Mar. Sci. 12:1627544. doi: 10.3389/fmars.2025.1627544

Received: 13 May 2025; Accepted: 14 July 2025;

Published: 31 July 2025.

Edited by:

Weihao Ma, Wuhan University of Technology, ChinaCopyright © 2025 Li and Sun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yongqiang Sun, c3VueXFAd3RpLmFjLmNu

Zhao Li

Zhao Li Yongqiang Sun3*

Yongqiang Sun3*