- 1College of Economics and Management, Jiangsu University of Science and Technology, Zhenjiang, China

- 2Energy Soft Science Research Center, Nanjing University of Aeronautics and Astronautics, Nanjing, China

The issue of emissions reduction in the shipping industry has garnered widespread attention from the international community. The International Maritime Organization and many countries have been exploring market-based emission reduction measures such as the carbon tax. Given China’s pivotal role in international maritime trade, developing effective carbon reduction policies is essential for the nation and the broader decarbonization of global shipping. To establish a shipping carbon tax system tailored to China’s context, it is imperative to draw upon international practices while grounding the framework in the realities of China’s market economy and the specifics of its shipping industry. Following the overarching requirement of coordinated international and domestic advancement, this study clarifies the design principles and basis for a carbon tax on shipping. Building on this analysis, policy recommendations are proposed for China’s adoption of such a tax. The findings aim to provide theoretical support for subsequent research on energy conservation and emissions reduction in the shipping industry, leveraging the role of the shipping carbon tax in achieving the “dual carbon” targets.

1 Introduction

Climate change is triggering unprecedented chain reactions on a global scale, with greenhouse gas concentrations in the atmosphere reaching historic highs. This phenomenon poses severe and urgent challenges to human living environments and worldwide economic development (Grant et al., 2025). As the world’s largest carbon emitter, China, on the one hand, has generated a large amount of carbon emissions due to the fast economic growth, and on the other hand, is burdened with an increasingly heavy responsibility of reducing emissions because of the huge total amount of emissions (Liu et al., 2015; Huang et al., 2021). In this context, China has officially released the “Action Plan for Carbon Dioxide Peaking Before 2030”, which aims to thoroughly implement the major strategic arrangements of the State Council regarding carbon peaking and carbon neutrality (dual carbon targets), and steadily and orderly advance all actions for carbon dioxide peaking (Lu et al., 2019; Wang et al., 2023c). “Dual carbon” targets represent a broad and profound systemic transformation of the economy and society, necessitating the integrated application of diversified strategies and measures to ensure the timely achievement of this ambitious objective (Wang et al., 2021; Wei et al., 2022).

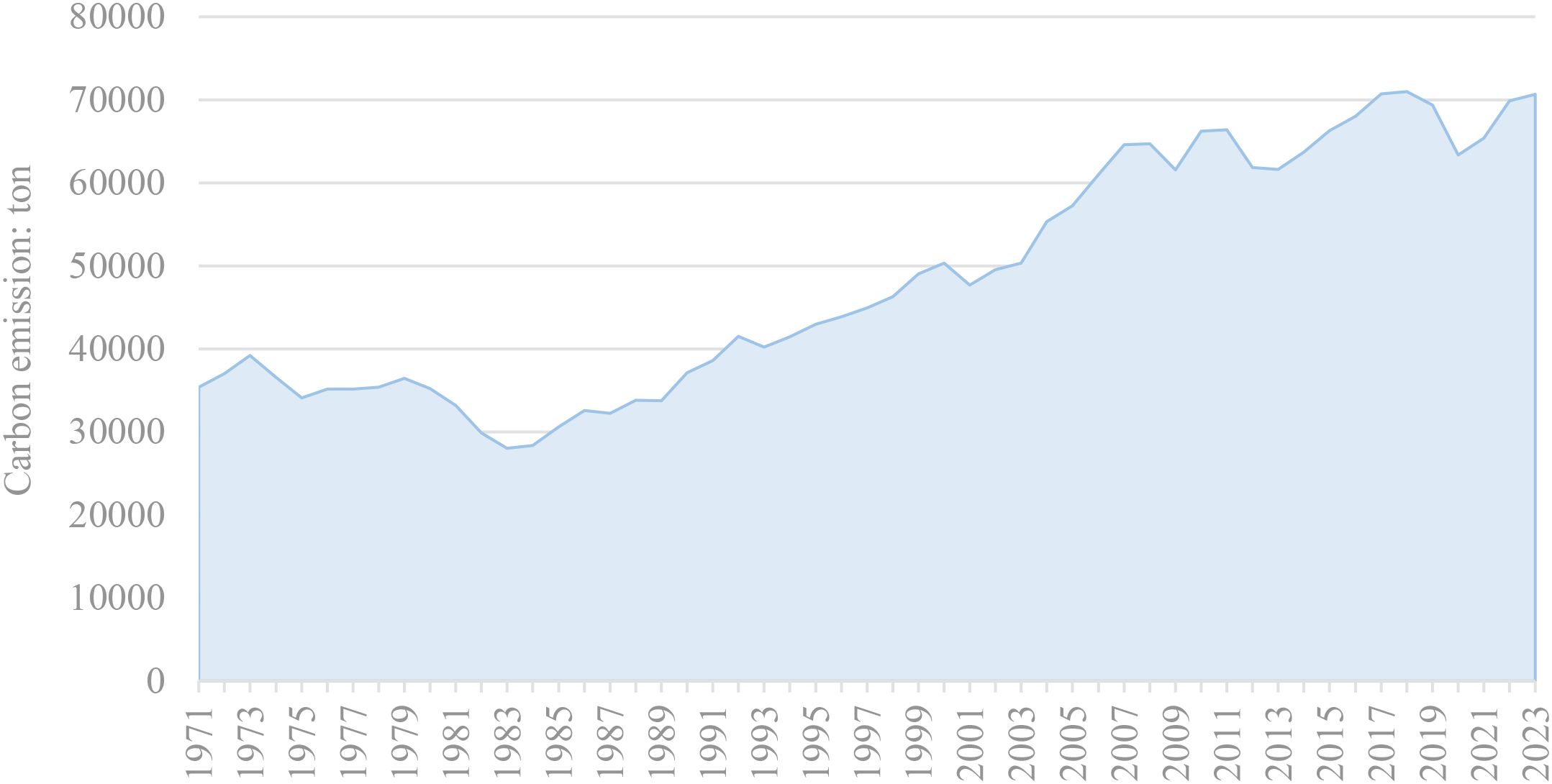

As the artery of global economic trade, the shipping industry plays a crucial role in worldwide commerce. Meanwhile, the annual carbon emissions of the shipping industry are still on the rise, as shown in Figure 1 (Statista, 2025). The shipping industry, with its high energy consumption and substantial carbon emissions, has long been criticized by the outside world due to its lagging carbon emission standards and delayed decarbonization efforts (Wan et al., 2018; Wang et al., 2023b). The International Maritime Organization (IMO) aims to achieve net-zero emissions from shipping by 2050. In that case, a decarbonization wave is sweeping through the shipping industry, which aims to reduce total emissions by 30% by 2030 compared with 2008, and strives to achieve a 10% share of alternative fuel usage to 10% (IMO, 2023).

China’s shipping industry development model has been relatively extensive for a long time. The trend toward ship upsizing has continuously boosted engine power requirements, driving a sharp increase in fossil fuel consumption. China holds a pivotal position in the international shipping trade. Therefore, promoting the development of green and low-carbon shipping is not only a crucial component in achieving the country’s “dual carbon” targets but also an important measure for the in-depth implementation of pollution prevention and control (Chen et al., 2024). China’s shipping industry has achieved initial progress in green development. However, the industry still faces many bottlenecks in pollution prevention and control and carbon reduction, and the green shipping policy framework requires further refinement (Yang et al., 2023; Sun et al., 2025). To fully implement the new development concepts and effectively respond to climate change, stronger policy measures must be adopted to enhance the green transformation of the shipping industry, reduce carbon emission intensity, and ultimately establish a sustainable, low-carbon shipping model.

The carbon tax is a crucial policy tool for the shipping industry to combat climate change and will significantly advance the green and low-carbon transformation of international trade and the shipping industry (Han et al., 2023). Pollution allows ship operators to profit without bearing the associated costs, leading to a divergence between marginal private net product and marginal social net product. The carbon tax internalizes external environmental costs to narrow this gap (Pan et al., 2024). This market-based mechanism incentivizes ship operators to optimize voyage decisions, adopt alternative fuels, and improve energy efficiency through price signals.

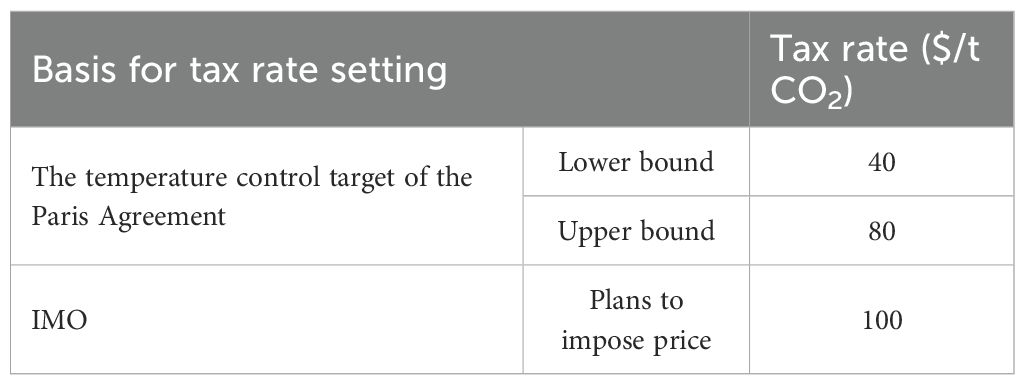

The Marine Environment Protection Committee at its 75th session proposed establishing a maritime research fund, suggesting carbon tax revenues could finance research on accelerating low- and zero-carbon technologies and fuel applications (IMO, 2020). During the 76th session, Singapore and other nations endorsed this proposal. The Marshall Islands, Solomon Islands, and co-sponsoring countries further advocated for a comprehensive mandatory carbon tax to reduce carbon emissions, emphasizing IMO’s leadership role in developing a universal carbon pricing mechanism (IMO, 2021). The carbon pricing mechanism that will affect the global shipping industry in 2025 is specifically shown in Table 1.

As an IMO member, China consistently attaches great importance to and actively supports IMO’s climate change initiatives (Ma and Wang, 2022). China possesses the world’s largest fleet, the most numerous ports, and a leading shipbuilding industry, giving it a unique position and competitive advantage in global shipping, which plays a crucial role in both international trade and emission reduction responsibilities. When developing its shipping carbon tax system, China should draw on international carbon taxation experience while considering its national conditions. The system should adhere to the principle of common but differentiated responsibilities for emission reduction targets, promote fair and practical international shipping carbon reduction measures, and ensure alignment with China’s future shipping trade development.

It’s a formidable challenge to achieve the “dual carbon” targets in the shipping industry. The shipping carbon tax is an effective market-based emission reduction measure, its implementation involves complex issues requiring in-depth examination (IMO, 2018). This paper first examines the theoretical foundations of carbon tax, compares carbon tax with other emission reduction measures, and analyzes the potential impacts of carbon tax on the shipping industry. It then elucidates the significance of implementing the carbon tax in China’s shipping industry. Building upon China’s existing taxation framework, the study systematically outlines the design principles and basis for a shipping carbon tax, ultimately proposing carbon tax schemes tailored to China’s national conditions. The paper specifically addresses four key questions: What are the strategic implications of implementing a shipping carbon tax in China? Is it feasible to impose a carbon tax? What principles and foundations should guide the design of such a carbon tax? How can China establish an effective shipping carbon tax scheme?

2 Literature review

2.1 Theory and practice of carbon tax

From the economic perspective, carbon emissions resemble other environmental pollution issues; economic entities maximize their self-interest by overexploiting public goods like the environment, causing environmental damage and generating negative externalities (Hardin, 1968; Zhang et al., 2019). The economic entity cannot fully internalize the costs of pollution emissions, preventing markets from accurately reflecting true environmental costs. The Organization for Economic Cooperation and Development (OECD) proposed the “polluter pays principle”, providing the theoretical foundation for carbon taxation (OECD, 2008; Tan et al., 2022).

The concept of carbon tax originates from the book “Economics of Welfare” published by the British economist Pigou in 1920, also known as the Pigou tax (Pigou, 1920). Carbon tax refers to the tax imposed on carbon dioxide emissions, which is often collected at the production or consumption side of fossil fuels (Aldy and Stavins, 2012). It has the dual attributes of environmental law and tax law, as well as the mechanism functions of both the government and the market, generating potential “dual dividends” that can improve the environment and enhance economic efficiency simultaneously. Pearce (1991) formally defined the dual dividend concept when discussing tax system reform, demonstrating that the carbon tax could enable the government to achieve dual targets. The first dividend is the “green dividend”, which increases the cost of using traditional fossil energy to prompt enterprises to adopt new types of energy or improve energy utilization efficiency, thereby achieving emission reductions. The second dividend represents the “social dividend”, tax revenues can further support emission reduction initiatives, enhance economic efficiency, promote social equity, and increase social welfare (Avi-Yonah and Uhlmann, 2009; Chen and Nie, 2016). Liu (2024) even believes that by internalizing carbon intensity, a carbon tax can achieve a “quadruple dividend”, encompassing emission reduction, energy transition, economic growth, and welfare enhancement.

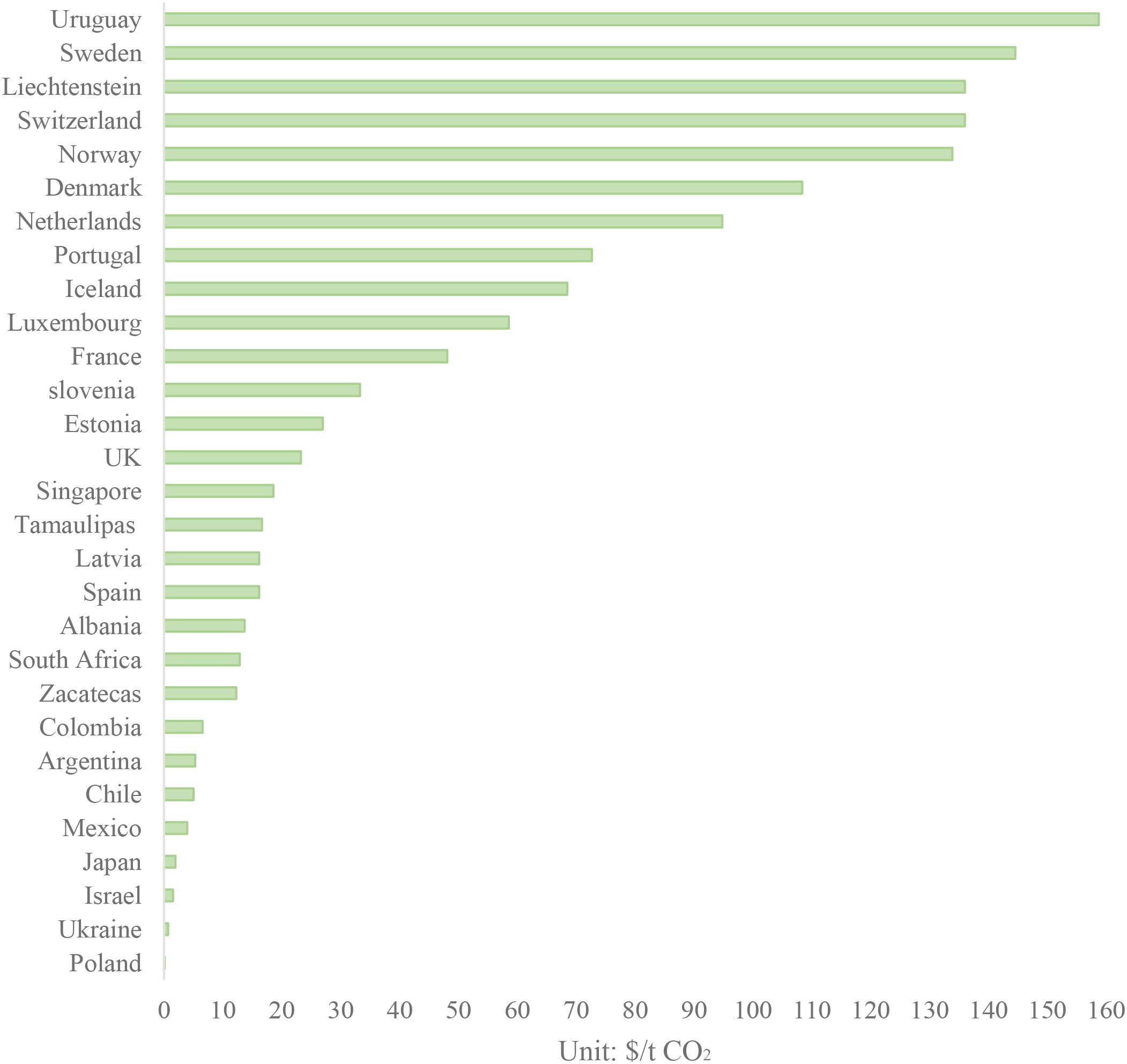

The carbon tax has established mature theoretical frameworks and practical experience in developed countries and regions such as the European Union. According to The World Bank’s report “State and Trends of Carbon Pricing 2025”, as of April 2025, more than twenty countries and regions have implemented the carbon tax (World Bank, 2025a). These jurisdictions exhibit significant variations in carbon tax rates, as shown in Figure 2 (World Bank, 2025b). Overall, the carbon tax rates in European countries are relatively high, but currently, the carbon prices of most countries are still far below the level of 40-80$/t CO2 required to achieve the 1.5°C temperature control target of the Paris Agreement. The High-Level Commission’s report has determined that to keep the global temperature control target below 2°C by 2030, the carbon price needs to be set at 50-100$/t CO2. It can be seen from this that the current carbon tax rate is relatively low and still needs to be further raised.

To reduce carbon emissions in the shipping industry, international organizations and governments worldwide have implemented various policy measures to promote carbon emission reduction (Zhang et al., 2022; Jin et al., 2024). Since January 1, 2024, the shipping industry has been officially incorporated into the EU emissions trading system. Under this system, ship operators must pay carbon quotas for each ton of carbon dioxide they emit.

2.2 Related research on carbon tax and other emission reduction measures

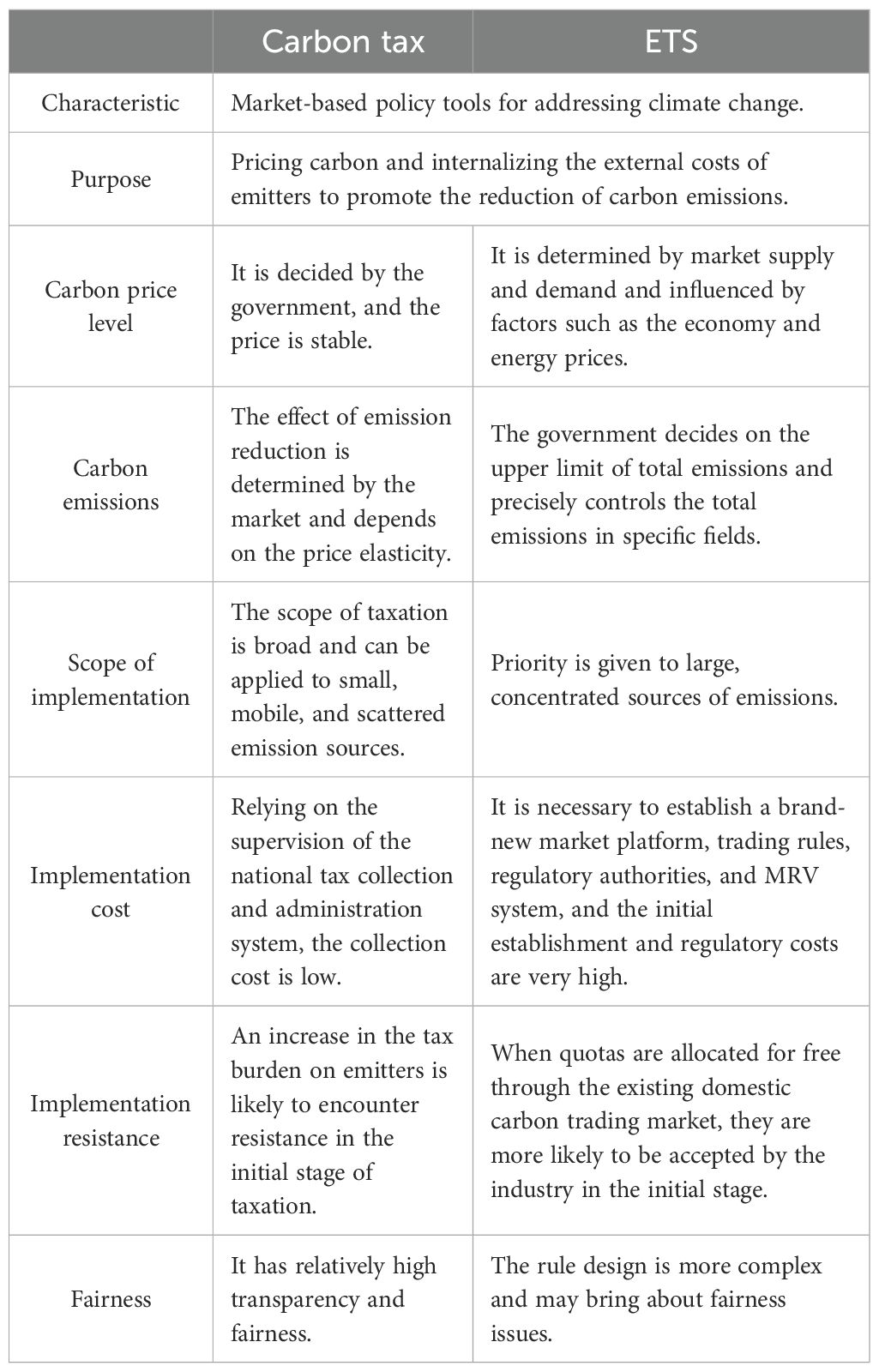

Carbon tax and emissions trading system (ETS) have consistently attracted significant academic attention as the two most important market-based emission reduction strategies (Li and Su, 2017; Gao et al., 2020; Wang et al., 2022; Xu et al., 2023). ETS implementation conditions are relatively strict, and the implementation cost is relatively high, often only applicable to large-scale enterprises in a specific industry (Liu et al., 2015). In contrast, the carbon tax mechanism follows a price control approach, where the government sets the price, it provides stronger price signals, imposes lower administrative costs, offers greater policy flexibility, and facilitates better coordination with other climate policies (Morgan and Patomäki, 2021). Carbon tax typically achieves greater emission reductions than ETS (Green, 2021; Ahmad et al., 2024), carbon tax is more significant in the long run, and the emission reduction cost is also lower than ETS (Yu, 2020). A detailed comparison between the carbon tax and ETS is shown in Table 2.

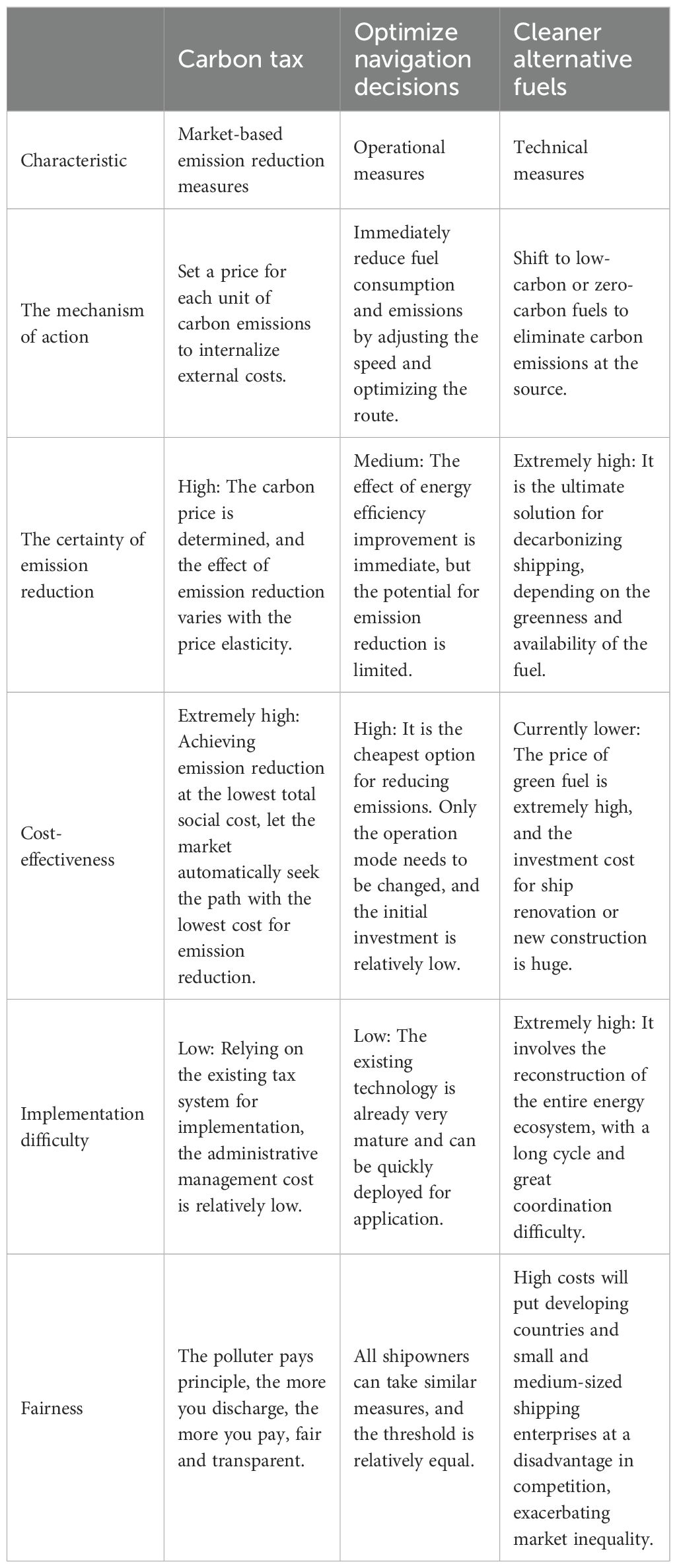

Emission reduction strategies in the shipping industry usually include optimizing navigation decisions, such as route optimization, speed optimization, etc (Moore et al., 2018). Or use cleaner alternative fuels, such as low-carbon fuels like LNG and methanol (Arefin et al., 2020; Tvedten and Bauer, 2022; Elkafas et al., 2022), and zero-carbon fuels like hydrogen and ammonia. Optimizing operational measures and using alternative fuels are highly dependent on the autonomy of enterprises, which may lead some enterprises to refrain from taking action to save costs. The carbon tax is enforced through legislation, covering all eligible ships to prevent operators from evading their emission reduction responsibilities. The comparison among Carbon tax, optimized navigation decisions, and cleaner alternative fuels is shown in Table 3. The carbon tax is not in competition with the other two measures, it’s a key policy that coordinates and leads them. Aims to create a fair, competitive environment, allowing the market to independently discover the most cost-effective emission reduction combinations (such as prioritizing adopting optimized navigation decisions and gradually transitioning to cleaner alternative fuels). Consequently, this approach achieves emission reduction goals at the lowest overall cost to society.

Table 3. Comparison among carbon tax, optimized navigation decisions, and cleaner alternative fuels.

2.3 Research on the impact of carbon tax on the shipping industry

The International Maritime Organization (IMO) and national governments typically formulate energy conservation and emission reduction policies for the shipping industry, but policy effectiveness always depends on the industry’s implementation efforts. To date, the IMO has established a series of work plans and guidelines, including the carbon tax (Wan et al., 2018; Garcia et al., 2020).

Many scholars have also explored the feasibility of imposing the carbon tax on the shipping industry (Lagouvardou et al., 2020; Tiwari et al., 2021). The exerted limited impact of imposing a lower carbon tax price (10-50$/t CO2) on transportation costs, the national economy, and import prices, etc (Halim et al., 2019). When imposing a relatively high carbon tax (90$/t CO2), China’s GDP loss is the greatest among all countries (Lee et al., 2013). Cariou et al. (2023) conducted the standard gravity model and found that imposing the carbon tax of 50$/t CO2 was insufficient to change shipowners’ decisions. Therefore, they suggested imposing a carbon tax of 100$/t CO2, which could effectively reduce carbon emissions. Yuan et al. (2023) evaluated multiple speed optimization models with different objective functions, concluding that a carbon tax of 1,300 ¥/t CO2 would be most appropriate for the shipping industry. Harahap et al. (2023) conducted a comparative analysis of alternative marine fuels, found that methanol is economically viable when the carbon tax exceeds 100€/t CO2, while ammonia gains economic advantage at tax rates above 200€/t CO2. Several scholars have begun investigating progressive carbon taxation schemes. Ding et al. (2020) examined various carbon tax designs across different shipping routes and alternative fuels, demonstrating that progressive carbon taxes outperform fixed carbon taxes on specific routes. Similarly, Mundaca et al. (2021) argue that gradually increasing carbon tax rates represent a more rational approach to tax policy design.

Existing studies demonstrate that scholars worldwide have extensively explored the feasibility of implementing the carbon tax in the shipping industry, providing scientific foundations for policy formulation (Li and Yang, 2024; Pereda et al., 2025; Wang and Countryman, 2025). However, significant variations in economic systems, taxation regimes, and maritime trade patterns among nations make it challenging to establish a unified global carbon tax standard for shipping. Given this context, individual countries must develop tailored shipping carbon tax policies based on their specific national conditions and shipping trade development, and jointly assist the shipping industry in reducing emissions.

The novelty of this article lies in the fact that we determined the upper limit of the progressive carbon tax. Compared to previous studies, this approach designs both the tax rate and the progressive brackets for the progressive carbon tax mechanism more systematically. The theoretical equity of the progressive tax system aligns with the development needs of China’s current dual carbon targets. There are significant differences in the size of ships, large-sized ships typically generate higher carbon emissions and greater economic benefits. By imposing higher tax rates on these high-emission and high-income ship operators, the progressive tax mechanism can narrow the economic disparity to some extent. This policy is consistent with China’s pursuit of common prosperity, while also facilitating the realization of its dual-carbon targets.

3 Theoretical and practical significance of China’s shipping carbon tax

In the context of facilitating the low-carbon transformation of green shipping and advancing the progress of the “dual carbon” targets, establishing the shipping carbon tax is a pivotal policy measure to bring about fundamental changes in the technological level and energy structure of the shipping industry. As an important climate policy tool for China’s shipping industry, the shipping carbon tax represents a significant innovation in the country’s climate governance mechanism and tax system, and profoundly influences the development of global shipping emission reduction mechanisms (Hu et al., 2021).

3.1 Shipping carbon tax pushes the shipping industry’s dual carbon targets

The 83rd session of the Marine Environment Protection Committee (MEPC 83) approved a net-zero framework that explicitly explores Market-Based Measures (MBMs) and demonstrates a clear inclination toward the ETS (IMO, 2025). This latest development has sparked a critical policy question: If ETS becomes mainstream, will it still be necessary for China to impose a national carbon tax? Could this lead to policy overlap and weaken the international competitiveness of China’s shipping industry due to increasing costs?

This study holds that carbon tax and ETS are not a simple substitution relationship, but should rather be regarded as complementary policy instruments that perform distinct functions at different levels (Goulder and Schein, 2013). Even after the international carbon market mechanism has matured, the carbon tax at the sovereign level will continue to offer unique strategic value. The international shipping ETS is a mechanism designed to address global carbon emissions caps and ensure fair competition among nations. Its primary objective is to prevent carbon leakage and raise funds for the global green shipping transition. Carbon tax is a fiscal and environmental policy tool within national sovereignty. Firstly, it’s the core advantage of providing domestic enterprises with a stable and predictable long-term carbon price signal (Metcalf and Stock, 2020). This price certainty is crucial for guiding domestic shipping companies to make high-risk, long-cycle, low-carbon capital investments, such as investing in new energy ships or developing alternative fuels. It effectively compensates for the potential uncertainty in ETS carbon prices caused by market fluctuations. Secondly, implementing a national carbon tax is a strategic measure to safeguard the country’s economic sovereignty and enhance long-term competitiveness. Relying solely on the eventual formation of an international mechanism could place China’s shipping industry in a strategically passive position. Establishing a domestic carbon pricing first can proactively internalize environmental costs, thereby driving technological upgrades and structural optimization. Carbon tax strengthens resilience to international compliance requirements (Aldy and Stavins, 2012). More importantly, directing carbon tax revenue to reduce other taxes and fees for domestic shipping companies, subsidize green technology innovation, or invest in low-carbon port infrastructure can effectively offset their compliance costs and avoid weakening the overall industry competitiveness (Murray and Rivers, 2015). In the long term, exploring a carbon tax system provides a theoretical basis and policy options for China to develop a multi-layered and integrated policy framework for reducing shipping industry emissions, which is of crucial strategic significance for China to achieve its dual carbon targets smoothly.

3.2 Shipping carbon tax is an important innovation in the green tax system

Fiscal subsidy is an important means to facilitate the transition between conventional and new energy sources (Rentschler and Bazilian, 2017; Zhang and Zahoor, 2025). In this context, ship operators would naturally prefer purchasing clean-energy-powered ships. However, large-scale subsidy programs would impose substantial fiscal burdens on both central and local governments and are not sustainable in the long term (Du et al., 2023). Meanwhile, for ship operators, if the replacement cost is too high, they may find even subsidies insufficiently attractive. Therefore, the shipping industry requires more effective policy mechanisms to incentivize emission reductions.

China plans to establish a green tax governance system featuring “multi-tax co-governance” and “multi-strategy combination” of tax preferential policies. The current tax system only imposes resource taxes or consumption taxes on fossil fuels. Although it can objectively play a certain role in reducing emissions, the effect is minimal (Hu et al., 2021; Gao et al., 2024; Arcila et al., 2024). Overall, China’s current tax policies have not yet developed clear responses to the critical directive outlined in the “Carbon Peak Action Plan Before 2030”, which calls for establishing a tax policy system conducive to green and low-carbon development to enhance taxation’s role in promoting market entities’ sustainable transition. The proposal of the shipping carbon tax could provide valuable supplementation to improve China’s green tax system.

3.3 Shipping carbon tax promotes emission reduction in the global shipping industry

Climate change is a global challenge, and the environment is a global public good (Uitto, 2016; Dupoux and Martinet, 2022). All nations and industrial sectors must undertake the responsibility for energy conservation and emission reduction. Although the IMO has formulated relevant emission reduction policies, current enforcement efforts still require strengthening. Additional policy measures are needed to achieve the shipping industry’s decarbonization targets (Bertoldi, 2022). The shipping industry is characterized by cross-border operations, with over 90% of international trade conducted by sea. A carbon tax can effectively address the “tragedy of the Commons” issue and prevent the transfer of emission reduction responsibilities among countries. The European Union has taken the lead in incorporating shipping into the carbon market (EU ETS). If China does not establish an independent carbon tax system, it will passively bear the carbon cost of the European Union.

The decarbonization of the shipping industry is a long and complex process, yet remains an essential pathway (Romano and Yang, 2021; Urban et al., 2024). To enable China’s shipping industry to effectively lead the global shipping industry to accelerate the realization of decarbonization goals, it is necessary to rely on the government’s coerciveness to formulate new policy measures. As a developing country, China started its research and implementation of shipping emission reductions later than developed nations (Wu et al., 2024). However, as a responsible major country, China still actively participates in shipping emission reduction. If China participates in formulating the rules for the carbon tax on shipping, it is expected to make a significant contribution to reducing emissions in the global shipping industry, expand its influence in international shipping affairs (Liu et al., 2023).

Establishing the shipping carbon tax in China not only provides a valuable reference for energy conservation and emission reduction in the shipping industry of a large number for developing countries, but also plays a key role in future cooperation on emission reduction in the shipping industry among countries and regions, enabling China to contribute “Chinese wisdom” and “Chinese solutions” under the framework of energy conservation and emission reduction of the IMO. Play a leading role in the construction of climate governance mechanisms for the global shipping industry, jointly promote the sustainable development of international shipping, and have a profound impact on the development of emission reduction mechanisms in the global shipping industry.

4 Feasibility of implementing carbon tax on the shipping industry in China

4.1 Theoretical feasibility

Theoretically, environmental tax frameworks have been progressively refined, evolving from environmental negative externalities to “Pigouvian tax” and the “Polluter pays principle” (Pigou, 1920). Environmental negative externalities refer to the negative impacts on the environment caused by certain behaviors in economic activities, which are not borne or compensated by the parties involved in the relevant behaviors (Tian et al., 2020). Pigou tax is levied on polluters based on the degree of harm caused by pollution, using tax revenue to bridge the gap between the private and social costs of polluters’ production (Mardones, 2022). The polluter pays principle means that all individuals and organizations that discharge pollutants into the environment should pay a certain fee following certain standards to compensate for the losses caused by their polluting behaviors (Tilton, 2016). The imposition of a carbon tax on shipping should also be grounded in these principles: First, the carbon tax internalizes the environmental costs associated with fossil fuel consumption by ships (Angela and Margit, 2022). Second, the administrative costs of implementing a carbon tax are lower than those associated with regulatory or permit approaches. Third, in the long term, the carbon tax can incentivize improvements in energy efficiency or compel ship operators to adopt cleaner alternative energy sources by increasing the cost of traditional high-carbon energy use (Chai et al., 2025). Carbon taxes have transitioned from purely theoretical and policy research to practical implementation, demonstrating the theoretical feasibility of imposing a carbon tax on shipping.

4.2 Policy feasibility

At the 26th Conference of the Parties, the United Nations Climate Change Conference proposed the Glasgow Climate Convention. About 50 developing countries called on IMO member states to impose mandatory emission taxes on Marine fuels. The potential carbon tax revenue is huge, with the total collection expected to be between 1 - 3.7 trillion US dollars by 2050, that is, 40–60 billion US dollars per year (Dominioni et al., 2022). IMO recommends implementing a carbon tax of 100$/t CO2 on marine fuels starting in 2025 (MEPC, 2021).

In 2007, “China’s National Climate Change Program” explicitly proposed measures to mitigate greenhouse gas emissions and enhance the country’s adaptability to climate change (National Development and Reform Commission, 2007). Concurrently, emphasized the need to accelerate the introduction and implementation of fiscal, pricing, and financial incentive policies conducive to energy conservation and emission reduction. It called for improving the fiscal policy framework for energy conservation and emission reduction, formulating relevant expenditure policies, tax policies, and pricing mechanisms, to phase out outdated production capacity, promoting industrial restructuring, and accelerating the development and industrial application of emission-reduction technologies (Bi et al., 2024). Imposing a carbon tax on shipping aligns with China’s current development objectives of implementing the scientific outlook on development and achieving green shipping, and with this “Program” requirement to establish effective policy mechanisms.

4.3 Technical feasibility

The carbon tax has the advantage of simpler calculation. The tax basis of the carbon tax relies on carbon emissions. As the carbon content of different energy sources remains constant, the CO2 emissions from ship fuel consumption can be accurately determined. By monitoring fuel consumption and applying fixed carbon coefficients, the real carbon emission data can be easily calculated, making tax base measurement relatively straightforward and technically feasible (C2ES, 2024). Moreover, existing carbon tax policies implemented worldwide provide valuable references for China (Parry, 2019). These international experiences enable them to design appropriate tax levels based on shipping emission characteristics, effectively regulating carbon emissions in the shipping industry while minimizing excessive negative impacts on low-income and low-emission ship operators, thus reducing implementation barriers.

5 Design principles and basis for shipping carbon tax

In designing the shipping carbon tax, it is necessary to clarify its design basis. This paper examines the construction principles and design basis by drawing upon China’s fundamental tax system principles and incorporating international carbon tax theories and practices. The design principles for this new tax include the principle of tax legality, the principle of tax fairness, the principle of tax efficiency, and the principle of substantive taxation. The design basis covers multiple aspects: functional role, design mechanisms, core advantages, tax objective, tax stages, implementation pathways, carbon tax rate, management and distribution authority of carbon tax revenue, and the utilization of carbon tax revenue.

5.1 Design principles of the shipping carbon tax

The basic principles of tax law reflect the fundamental attributes of tax activities, serve as the foundation for the establishment of the tax legal system. They are universal legal guidelines that permeate the entire process of tax law legislation, law enforcement, judicial practice, and compliance. To establish a shipping carbon tax policy that suits China’s national conditions, it should be based on the basic principles of China’s existing tax laws, including the principle of tax legality, the principle of tax fairness, the principle of tax efficiency, and the principle of substantive taxation

5.1.1 Principle of tax legality

The establishment of any new tax should follow the principle of tax legality. Having a legal basis is fundamental, and the specific rules of the carbon tax system must be clearly defined through a strict legislative process (Blaufus et al., 2016; Van der Vlugt, 2023). First of all, the establishment of a new tax must be stipulated by law. Without explicit legal provisions, the tax authority has no power to impose taxes, and the taxpayer does not bear the obligation to pay taxes. The legality of tax is the primary condition of the principle of tax legality. Second, the essential elements of taxation must also be clearly defined by law, serving as objective standards for the concretization of tax relationships. This requires that key elements such as the taxing authority, taxpayer, taxable object, and tax rate must and can only be determined by the legislature in the law. Finally, the procedures governing the realization of rights and obligations for all parties in tax relationships must be explicitly prescribed by law and followed following legal procedures.

5.1.2 Principle of tax fairness

The principle of tax fairness means that when the state imposes taxes, it should ensure that the tax burden of taxpayers is commensurate with their affordability and that the burden levels among different taxpayers remain balanced (Musgrave, 1959). In terms of horizontal fairness, all shipping enterprises that consume fossil energy should be taxpayers of the carbon tax, which achieves formal fairness. Regarding vertical fairness, multiple factors such as the ship type, size, emissions, and revenue should be fully considered, and a variety of measures should be comprehensively adopted to ensure that different shipping enterprises bear the same substantive persuasion, achieving substantive tax fairness (Kaplow, 1989).

5.1.3 Principle of tax efficiency

The principle of tax efficiency requires maximizing tax revenue at minimal cost. Tax administrative efficiency consists of two components: collection costs and compliance costs. Collection costs refer to the expenses incurred by tax authorities during the taxation process. The proportion of these costs to the tax revenue collected represents collection efficiency. Adopting advanced collection methods can reduce costs and improve efficiency. Compliance costs refer to the expenses borne by taxpayers in fulfilling their tax obligations. The tax system should be simplified as much as possible, with transparent and convenient procedures, as well as clear and accurate legal language, to minimize compliance costs (United Nations, 2021). Tax economic efficiency focuses on optimizing the tax system, utilizing the fiscal, economic, regulatory, and social policy functions of taxation to promote social stability and economic development. Government taxation involves the transfer of resources from the private sector to the public sector for redistribution. If tax distribution is inappropriate, it will distort the market economy, affect the decisions of producers and consumers, lead to welfare losses, and result in an excessive tax burden (Auerbach and Hines, 2002).

5.1.4 Principle of substantive taxation

The principle of substantive taxation means that, for a certain situation, it is not advisable to determine whether it should be taxed merely based on its appearance and form. Instead, it should be judged based on the actual situation, especially the economic purpose and the substance of economic activity, to assess whether it meets the elements of taxation, to conduct taxation fairly, reasonably, and effectively (Freedman, 2004). The tax collection authorities need to consider not only the transaction arrangements in civil law, but also the transaction arrangements with reasonable commercial purposes and economic substance as the basis, and determine the tax burden of taxpayers according to their true affordability. “ability-to-pay” is an important manifestation of the principle of substantive taxation, advocating that the tax burden that different taxpayers should bear be determined based on their actual tax burden capacity. It focuses on combining the strength of tax payment capacity with whether the tax burden is fair, and reflects tax fairness through the tax payment capacity of different taxpayers (Saez and Stantcheva, 2016).

5.2 Design basis of shipping carbon tax

5.2.1 Functional role

In China, taxes are classified into general taxes and purpose taxes based on whether they serve specific purposes. Purpose tax typically refers to the tax levied to achieve particular political, economic, or social objectives of the country, or for the revenues are specifically allocated for certain special expenditures (Maria et al., 2025). Carbon tax plays a role in promoting energy conservation and emission reduction and facilitating the achievement of the “dual carbon” targets (Li and Peng, 2020). As a major country in maritime trade and demand, the carbon emissions of China’s shipping industry cannot be ignored. However, up to now, China’s shipping sector has not yet implemented any effective market-based emission reduction mechanisms. The shipping carbon tax is levied on the carbon dioxide produced by ships during navigation. It explicitly fulfills the function of encouraging emission reductions among ship operators through price mechanisms, which is in line with the general characteristics of a purpose tax.

5.2.2 Design mechanism

The carbon tax design mechanism is based on price control. The government sets the tax rate, and carbon emitters pay the corresponding carbon tax. This mechanism avoids establishing absolute emission ceilings, instead utilizing price signals to guide emission entities’ operational decisions and optimize production processes, thereby achieving emission reduction objectives with comparatively greater mitigation potential (Wang et al., 2023a).

5.2.3 Core advantages

The carbon tax demonstrates distinct advantages in terms of price certainty and administrative efficiency. Firstly, the carbon tax provides higher price certainty. By setting a fixed and transparent price signal on carbon emissions, it offers a stable and predictable cost environment for emitters. This allows shipping companies to make long-term investment decisions in low-carbon technologies with greater confidence, reducing the risks associated with carbon price volatility commonly observed in ETS (Metcalf and Stock, 2020). Such price stability is especially critical for capital-intensive industries like shipping, where ship retrofitting and alternative fuel adoption require substantial upfront investment. Secondly, the carbon tax exhibits superior administrative efficiency. It can leverage existing national tax collection systems, significantly lowering the costs of implementation, monitoring, and enforcement compared to a newly established ETS, which requires complex mechanisms for allowance allocation, market oversight, and compliance verification (Metcalf and Weisbach, 2009; Zhao et al., 2016). The streamlined administration reduces cost burdens and enhances policy feasibility, particularly in a globally operating sector such as shipping. Furthermore, the simplicity and transparency of a carbon tax help mitigate opportunities for rent-seeking behavior and market manipulation (Nordhaus, 2019). These advantages make the carbon tax an efficient and effective instrument for mitigating greenhouse gas emissions in international shipping.

5.2.4 Tax objective

At present, carbon tax systems primarily adopt two taxation objectives. One is to directly levy taxes on emission quantities, but it requires sophisticated monitoring equipment, so the implementation cost is relatively high. The second approach calculates emissions based on fuel consumption volumes and carbon content, representing a simpler approach currently adopted by multiple nations (Sen and Vollebergh, 2018; Küfeoğlu, 2024; Lin and Li, 2011). Given the current inadequacy of ship carbon emission monitoring equipment in China, it poses challenges for accurately measuring actual ship carbon emissions during navigation. In the initial stage, it could focus on taxing fossil fuel consumption and its carbon content. Subsequent improvements in monitoring equipment would enable direct taxation based on actual carbon emissions during sailing.

5.2.5 Tax stage

Current carbon tax collection mechanisms primarily fall into three categories: The first is to impose taxes only at the production side of fossil fuels; the second is to impose taxes only at the consumption side of fossil fuels (Eichner and Pethig, 2015); the third is to impose taxes on both the production stage and the consumption stage simultaneously (Chang, 2013). Taxation at the production side is convenient for administration and can reduce the compliance cost. However, the price signal is difficult to be effectively transmitted to consumers, thereby partially diminishing the regulatory effectiveness of the carbon tax. Simultaneous taxation at both production and consumption sides would lead to the problem of double taxation, resulting in excessive fiscal burdens that hinder widespread implementation (Shome, 2021).

Taxing at the consumption side better aligns with the “polluter pays principle”. Price changes are directly transmitted to ship operators who use marine fuel, strengthening their awareness of energy conservation and emission reduction (Xue et al., 2019). Taxing at the consumption side not only applies to ships with large emissions, but also effectively covers small, dispersed, or mobile ships, thereby better fulfilling the carbon tax’s role in achieving carbon neutrality for the shipping industry. Under future stricter emission targets, multi-sided taxation may merit consideration to maximize emission reductions across the maritime sector.

5.2.6 Implementation pathways

Carbon tax designs typically adopt two approaches: integrated taxation and independent taxation (Yeldan, 2019). The integrated taxation modifies existing tax instruments by incorporating fossil fuel carbon content or direct emissions into existing tax types. The independent taxation establishes new tax instruments specifically targeting carbon emissions. At present, most countries adopt integrated taxation, incorporating it as part of the green tax system for energy conservation, emission reduction, and environmental protection. Some countries regard it as a component of consumption tax or resource tax, while others regard it as a component of environmental protection tax.

China’s current tax reform context presents distinct advantages and disadvantages for both implementation pathways. Adopting an integrated tax within existing environmental protection tax frameworks reduces legislative complexity and administrative burdens while maintaining continuity and stability. This approach enhances social acceptability and proves particularly suitable for initial implementation phases (Cai, 2024). Independent taxation operates autonomously from other tax categories, applying exclusively to its designated taxation criteria. This model demonstrates clear emission reduction objectives and maintains a self-contained taxation system. In the context of more stringent requirements for energy conservation and emission reduction in the future shipping industry, establishing the carbon tax as an independent category would more effectively demonstrate China’s ambitious decarbonization commitments.

5.2.7 Carbon tax rate

The core element of the carbon tax is the tax rate. The shipping carbon tax rate in this paper refers to the ratio between the tax payable by the ship operator and the carbon emissions. Inadequate tax rates yield limited emission reduction effects, while excessive rates impose undue cost burdens on operators. Rate determination should adhere to equity principles, aligning tax liabilities with payment capacities to maintain relative balance among different shipping operators.

Finland, as a pioneer in the field of carbon tax, implemented the strategy of increasing tax rates, effectively mitigating political resistance to carbon tax reform. In contrast, the Netherlands’ adoption of higher initial tax rates encountered significant political opposition during the same period. The case of the Netherlands shows that even if the policy design is well-intentioned, it may be stranded due to political resistance if there is a lack of adequate communication with stakeholders and transitional buffer arrangements. The critical importance of formulating appropriate tax rates at different stages. Initial implementation warrants relatively modest rates, while long-term rates should at least meet the temperature control targets (World Bank, 2023; Cariou et al., 2023) or match IMO’s proposed pricing scheme to facilitate international coordination of shipping carbon taxation (MEPC, 2021).

At present, the current tax rates in China are divided into three types: fixed tax rate, proportional tax rate, and progressive tax rate. The fixed tax rate refers to the direct stipulation of a fixed tax amount based on the number or unit of the object of taxation. Tax liabilities vary with the emission volume. However, significant economic disparities typically exist between high- and low-emission ships, resulting in divergent tax-bearing capacities. Imposing taxes at the same amount disconnects between payment abilities and tax burden, resulting in the drawback of superficial equality while concealing actual inequality, which has a more significant negative impact on low-income groups (Wesseh et al., 2017; Moz-Christofoletti and Pereda, 2021). However, due to its simple calculation, it is often used in policy-making and academic research. Previous studies on shipping carbon taxes have mostly been fixed tax rates. The proportional tax rates maintain a constant ratio between the tax base and tax amount, remaining unaffected by the base’s magnitude. Typically applied as a certain percentage of revenue, these rates predominantly feature in turnover taxes and property taxes. However, such mechanisms create inequitable tax burdens that violate the ability-to-pay principle, thus remaining suitable only for specific tax categories. This study will not elaborate further on proportional taxation. Recent studies indicate progressive carbon tax demonstrates greater feasibility (Ding et al., 2020; Fu et al., 2021; Dietsch, 2024), with excess progressive rates representing the most prevalent approach. This mechanism classifies taxable amounts into multiple brackets, applying gradually increasing rates to each successive bracket. The graduated structure ensures moderate progression, preventing abrupt tax burden increases at bracket thresholds.

Given the resistance to the implementation of the carbon tax, it is advisable to adopt a lower tax rate in the initial stage to avoid a significant impact on the shipping industry and reduce the resistance to collection. It is suggested to be consistent with the average carbon price of the ETS. In the future, the tax rate will be gradually raised in phases based on the implementation effect of the carbon tax. The fixed tax rate offers computational simplicity and standardization advantages, particularly suitable for early implementation phases. However, to better satisfy equity-efficiency requirements and embody the ability-to-pay principle, in the later stages of promoting the realization of the “dual carbon” targets, tax rate reforms should accommodate substantial emission variations across ship types, potentially adopting excess progressive taxation mechanisms.

5.2.8 Management and distribution authority of carbon tax revenue

China’s taxation system classifies taxes into three categories based on revenue management and distribution authority: central taxes, local taxes, and central-local shared taxes (Zhang, 2017a). The implementation of the shipping carbon tax will significantly impact macroeconomic conditions and the shipping indust. In this regard, it seems more reasonable to regard it as a central tax and have it uniformly collected, managed, and used by the central government. Given the extensive coverage and implementation challenges of the shipping carbon tax, central enforcement ensures more efficient policy execution. However, considering China’s current fiscal structure with limited local tax revenues, adopting a central-local sharing mechanism could enhance local implementation incentives. The current distribution rules of some central-local shared taxes in China can be referred to, with 50% collected by the central government and 50% by local governments.

5.2.9 Utilization of carbon tax revenue

National carbon tax systems demonstrate varied positioning, leading to divergent perspectives on revenue utilization. Scholars advocating independent carbon taxation typically endorse earmarked funding approaches. As a prospective purpose tax, the shipping carbon tax should fulfill its regulatory function through price mechanisms while directing revenues toward maritime sector initiatives. Allocating these funds to support critical emission-reduction infrastructure projects for ships and ports represents a more rational approach. Such revenue recycling mechanisms enhance carbon mitigation effectiveness and facilitate energy transition (Huang and Xu, 2023). However, some scholars raise objections based on the Environmental Protection Tax’s practice of not earmarking revenues from atmospheric pollutant taxation. These arguments advocate integrating carbon tax revenues into general public budgets for unified allocation.

The imposition of carbon taxes on ship operators inevitably increases operational costs, potentially disrupting stable industry development. Revenue redistribution mechanisms can effectively mitigate implementation resistance (Klenert et al., 2018; Rotaris and Danielis, 2019). British Columbia’s approach offers valuable insights, establishing comprehensive tax-economic compensation mechanisms and implementing the carbon tax (Murray and Rivers, 2015; Kumbhakar et al., 2022). Carbon tax revenue is recycled to support the clean energy subsidy can improve both cost-effectiveness and emission performance, and thus perform better than carbon tax alone (Zhang et al., 2017b). By applying the principle of “tax neutrality” to return carbon taxes to enterprises and residents, it can not only alleviate the public’s resistance to tax increases, but also effectively enhance the social acceptance of policies, while maintaining the incentive effect of emission reduction. Chinese authorities could consider channeling shipping carbon tax revenues back to operators through fiscal incentives, thereby reducing marginal private net product disparities across operators (Sun et al., 2021). Potential measures include enhancing subsidies for energy-efficient marine equipment and supporting renewable energy adoption. Operators demonstrating verifiable environmental protection achievements and improved resource efficiency may qualify for tax rebates.

6 Design of the shipping carbon tax scheme

Establishing a comprehensive carbon tax system represents a significant policy innovation for China’s climate change mitigation strategy (Liu, 2024; Feng et al., 2022). This market-based mechanism aims to achieve greater emission reduction targets at lower economic costs, fulfilling China’s international climate commitments while facilitating the transition toward green and low-carbon economic development. At present, China remains in a phase of rapid development in shipping trade demand, with persistently high industrial energy consumption that creates significant challenges in balancing economic growth and emission control (Chang, 2022). This context necessitates a gradual, phased approach to establishing a robust shipping carbon tax system, requiring continuous adjustments aligned with evolving trade patterns and environmental requirements, representing a long-term institutional development process. Adopting differentiated taxation principles according to distinct developmental phases of shipping trade enhances both environmental governance effectiveness and administrative efficiency in shipping carbon taxation, achieving optimal integration of equity and efficiency. Based on this, this paper proposes two collection schemes for carbon taxes.

6.1 Fixed carbon tax

The design of the fixed carbon tax scheme is relatively simple. The carbon tax liabilities can be calculated based on the carbon tax rate and carbon emissions. The calculation of the fixed carbon tax amount is shown in (Equation 1):

represents the tax liabilities of the fixed carbon tax; represents the fixed carbon tax rates, which are shown in Table 4; represents carbon emissions.

The fixed carbon tax demonstrates significant effectiveness in promoting emission reductions during initial implementation phases, yet proves less conducive to long-term decarbonization objectives. Carbon taxation has disproportionate impacts on lower-income ship owners. Generally, ships with lower carbon emissions also have lower income, and their tax burden capacity naturally cannot be compared with that of shipbuilding enterprises with higher carbon emissions, higher income, and relatively higher tax burden capacity. Consequently, fixed carbon tax exacerbates economic disparities between low- and high-emission ships. Nevertheless, its computational simplicity facilitates implementation during initial policy phases, which can reduce the difficulty of management.

6.2 Progressive carbon tax

The progressive carbon tax and the fixed carbon tax are set differently. Generally, the higher the carbon emissions of a ship, the higher the income will be. From the perspective of welfare economics, as income increases, its marginal utility decreases accordingly, and the tax liabilities should also be heavier (Layard et al., 2008). Adopting a progressive tax rate is more in line with substantive equality. Progressive taxation reflects the principle of ability-to-pay by imposing differential treatment based on taxpayers’ varying capacities. Typically, high- and low-emission ships exhibit significant economic disparities, differing not only in carbon consumption but also in tax-bearing capacity. Imposing a uniform tax rate disconnects tax capacity from tax capabilities, creating a disparity between nominal equality and substantive inequality. Therefore, it is more appropriate to impose a progressive carbon tax on high- and high-income ship owners, which can be adapted to the carbon consumption and tax burden capacity of taxpayers. The progressive tax can reflect taxpayers’ tax-paying ability dynamically, over the long term, and continuously. With the continuous increase of the taxable objects, it is more reasonable that the growth rate of the tax amount is faster than that of the taxable objects. However, due to the computational complexity of progressive tax, previous studies have rarely applied it, with even fewer examining it in the shipping industry. This gap provides feasible opportunities for further exploration in this study.

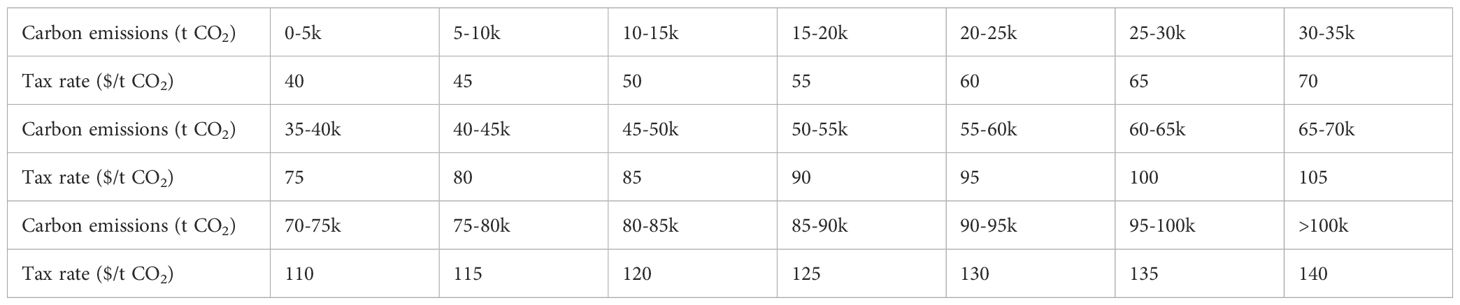

The progressive carbon tax design in this paper adopts the excess progressive carbon tax. Firstly, referring to the design of Ding et al (2022), every 5,000 tons is divided into one bracket, and each bracket is increased by $5. In contrast, according to the “polluter pays principle” (Yan et al., 2022), the threshold is set to zero in this paper. Meanwhile, considering the feasibility of collection, the price of the top bracket is set by referring to the relatively high carbon tax prices that have been implemented worldwide at present. The specific settings are as shown in Table 5:

Under the progressive carbon tax scheme, the higher the emissions, the higher the applicable tax rate at the corresponding stage. Then the tax payable in the case of the progressive carbon tax is shown in Equation 2.

represents the tax liabilities of the progressive carbon tax; represents the tax rate applicable to the current progressive brackets; represents the quick deduction number for the current progressive bracket.

Based on the previous discussion, this study argues that imposing a fixed carbon tax in the initial stage is simple to calculate and aligns with existing international carbon tax policies. Due to the imperfection of the existing monitoring equipment, it is more convenient to impose taxes on the carbon content of fossil fuels. The taxation could be implemented at the consumption end, effectively leveraging the price mechanism of carbon tax to directly pass cost changes to fossil fuel users (i.e., ship operators). Meanwhile, the carbon tax could be integrated into existing tax categories, building upon China’s current environmental protection tax framework to minimize implementation resistance. Regarding tax administration and revenue usage, it is recommended to designate it as a local tax to enhance collection incentives. The revenue could be returned to taxpayers through measures such as subsidies for ship equipment upgrades or clean energy adoption in the regional shipping sector, thereby improving taxpayer compliance.

In the middle and later stages, the collection method of the carbon tax should be continuously improved. With the continuous upgrading of monitoring equipment, it is more reasonable to change the taxable object to direct carbon emissions. The adoption of a progressive carbon tax collection method can effectively alleviate inequality among different emission groups. At this point, to demonstrate China’s determination to save energy and reduce emissions, it is more appropriate to establish a carbon tax as an independent tax type.

7 Conclusions and suggestions

“Common but differentiated responsibility” is a fundamental principle of international environmental law. Its essence is that all countries have common obligations and responsibilities in global environmental protection, but the magnitudes of these responsibilities vary. That is, developed countries bear the main responsibility, and developing countries bear the secondary responsibility. The reason is that the largest part of global greenhouse gas emissions in history and at present originated from developed countries. Per capita emissions in developing countries remain relatively low. Although China is a member of the developing countries, it still actively participates in the formulation of international shipping emission reduction policies, which can set an example for the majority of developing countries.

As the largest developing country, China plans to achieve the maximum reduction in carbon emission intensity within 30 years, fully demonstrating China’s responsibility as a major country in addressing climate change. China’s shipping trade is still in a stage of rapid growth at present. When formulating a shipping carbon tax that suits China’s national conditions, the following aspects can be considered in detail:

For the tax collection authorities, to ensure the efficiency and professionalism of tax collection and administration, it is suggested to adopt a mixed model of division of labor and collaboration, which is led by the State Taxation Administration, verified by the Ministry of Ecology and Environment in coordination, collected by local customs on behalf of the authorities, and supervised by local governments. The State Taxation Administration, as the competent collection authority, is responsible for the collection, deposit, inspection, and daily management of taxes. Relying on the existing system, a sub-module for the collection and management of ship carbon tax will be developed to achieve interconnection and interoperability with the ship registration, navigation trajectory, and other data of the Ministry of Transport, so as to realize automated and low-cost tax source monitoring and tax calculation. The Ministry of Ecology and Environment is the authority for technical verification and standard formulation. Be responsible for establishing and maintaining the database of ship emission factors, and provide technical support to verify the actual emissions or energy consumption data of ships. Share data with the State Taxation Administration to provide a scientific basis for tax calculation. All local customs authorities act as the actual institutions responsible for collection. By referring to the collection method of tariffs, the customs can collect the tariffs on behalf of others in a timely and effective manner, and reduce the difficulty of tax collection. Local governments act as auxiliary supervisory and data-providing institutions. Provide accurate key data such as ship registration information, port entry and exit reports, and fuel refueling records. Conduct on-site spot checks at the port to verify the authenticity of the information declared by ships and prevent tax evasion.

In terms of the designated use of taxes, to ensure that the funds are used for their intended purposes and to enhance policy acceptance, it is suggested that the tax revenue be included in the National Green Shipping Transformation Fund and allocated based on actual needs, with a focus on supporting the following areas: Supply-side incentives. Subsidies for green shipbuilding and retrofit start with domestic green ship order subsidies. For shipowners who place orders to build low-carbon or zero-carbon fuel ships at domestic shipyards, subsidies will be provided at a certain proportion of the cost. Secondly, subsidies for the renovation of existing ships are provided to support energy-saving technological renovations on existing ships. Infrastructure incentives. To accelerate the construction of green infrastructure, the first step is to provide subsidies for the construction and operation of shore power systems at ports, covering the cost of building shore power facilities at ports. Additionally, electricity price subsidies should be offered to vessels using shore power to reduce their usage costs. Secondly, there is a subsidy for the green fuel bunkering system, supporting major ports in building a network of bunkering stations for green fuels such as LNG, ammonia, and hydrogen. Innovation incentives. Support research and development and demonstration, and fund research institutes and enterprises to carry out research and development and demonstration projects of cutting-edge technologies such as zero-carbon fuel engines, new battery technologies, and carbon capture, utilization and storage.

International coordination is a key issue that demands thorough examination in the discussion of carbon tax implementation. Unilateral measures (EU ETS) and domestic carbon pricing policies (a potential future Chinese carbon tax on shipping) may interact in ways that create overlapping charges. This could lead to double taxation and impair the competitiveness of affected enterprises. The core solution lies in achieving mutual recognition and linkage of carbon pricing mechanisms through international coordination. One viable approach is to promote the development of a global market-based measure under the framework of the IMO. Such a mechanism would fundamentally prevent regulatory fragmentation and jurisdictional overlaps. Before this global system is fully established, China should proactively engage in bilateral or multilateral consultations with the European Union. The objective would be to explore a mutual recognition mechanism that allows Chinese shipping companies to offset their compliance costs under the EU ETS against their domestic carbon tax liabilities, thereby alleviating the burden on businesses. Simultaneously, when designing its national carbon tax system for shipping, China should incorporate provisions for international compatibility. Specifically, the system should explicitly grant tax reductions to enterprises that have already fulfilled equivalent carbon emission reduction obligations abroad. This approach would uphold national regulatory sovereignty while demonstrating policy flexibility and a commitment to international coordination.

The shipping carbon tax is an important measure for China’s shipping industry to address climate change and achieve the “dual carbon” targets. It also constitutes an essential part of improving China’s green tax system. At present, China’s green tax system has been initially established, but there is significant work remaining to develop a green tax system that conforms to the “dual carbon” targets. It is suggested that the reform path of the shipping carbon tax be implemented in phases.

Firstly, in the initial phase of policy implementation, a fixed carbon tax is recommended to facilitate a swift rollout, minimize administrative resistance and costs, and deliver a clear price signal. This approach avoids overly complex calculation methods. The tax would apply to all international ships entering Chinese jurisdictional waters as well as all domestic ships. The fixed rate would be determined based on the ship’s main engine power and its Energy Efficiency Design Index (EEDI) rating. Secondly, after the tax collection and management system matures, a more precise tax system should be adopted, and incentives for emission reduction should be strengthened. The tax base can be changed from the calculation of the main engine power of ships to the actual amount of fuel consumed as the benchmark, and carbon emissions can be calculated based on the emission coefficients of different fuels for collection. This approach requires ships to submit a Fuel Oil Tank Report certified by a third party when entering Chinese ports. Big data analytics should be employed to compare the rationality of the shipping route trajectory and fuel consumption to prevent tax evasion. During this period, carbon taxes were directly linked to fuel consumption, encouraging shipowners to choose low-energy-consuming ships and pay more attention to optimizing operational energy efficiency management, such as speed. Finally, during the mature stage of policy implementation, the shipping carbon tax will become a mature tax type, precisely aligning with the dual carbon targets of the shipping industry and becoming a powerful policy tool for reducing emissions in the shipping industry. At this point, a progressive carbon tax can be introduced to set an industry baseline for the carbon emissions of ships. For ships below the baseline, a lower tax rate can be applied. For ships above the baseline, a higher-level tax rate shall be applied. At the same time, the baseline can be dynamically adjusted. In accordance with the actual needs of energy conservation and emission reduction, the baseline can be continuously lowered to continuously drive the industry towards zero. It is most effective to eliminate high-carbon and backward transportation capacity, reward the green pioneers in the industry, and drive a green revolution in the entire shipping industry.

The theoretical contributions of this paper: (1) It enriches and expands the boundaries of multiple disciplines, and is a deepening of environmental economics and public finance. The traditional fixed carbon tax corrects market failure by internalizing external costs, while the progressive carbon tax introduces the principles of “fairness” and “ability to pay”. It not only theoretically explores “efficiency”, but also delves deeper into the realization path of “fairness”. This enriches the theoretical model of the carbon tax system, transforming it from a single tool into a complex one that also has the function of regulating income distribution. (2) It is an innovation in the design of global environmental governance and emission reduction systems. The global shipping industry is facing a typical “collective action dilemma” (such as the flagship country and convenience flag issues) in reducing emissions. Progressive carbon tax schemes (taxing ships based on emissions rather than nationality) may offer new ideas to break through this predicament. Theoretically, it can create a “differentiated mechanism for sharing the responsibility of emission reduction”, which provides a new theoretical paradigm for global commons governance.

The practical contribution of this paper: (1) It provides a “Chinese solution” for global shipping emission reduction. At present, the global shipping emission reduction regulations are mainly led by the IMO, but the process is slow and highly controversial. If China can take the lead in proposing a scientific, fair and feasible carbon tax collection plan, it will be a major contribution to the global shipping industry’s energy conservation and emission reduction. (2) Provide top-level design for China to establish a domestic shipping emission reduction policy system. Research on shipping carbon taxes can provide a blueprint for designing a unified emission reduction policy framework, helping China to proactively address the possible extended impact of the EU’s carbon Border adjustment mechanism (CBAM) on the shipping industry and smoothly advance the dual carbon targets domestically. (3) Provide clear, fair and powerful transformation signals for the shipping industry. The tax rate table under the progressive tax system provides all market participants with a clear expectation of future carbon costs, facilitating long-term investment decisions by enterprises (such as which fuel to order for ships). The principle of fairness that the polluter pays principle is reflected through differentiated tax rates. The punitive high tax rates on high-emission and low-efficiency ships have effectively driven the innovation and diffusion of green technologies.

The author fully acknowledges that this paper still has many deficiencies. It merely conducts a qualitative analysis on how to construct a shipping carbon tax policy that suits China’s national conditions, but lacks relevant quantitative research content. Therefore, we expect that in future research, more detailed quantitative studies will be conducted on how shipbuilding enterprises and ship operators respond to the carbon tax policy. Despite some shortcomings, the qualitative analysis in this paper can still provide effective suggestions for constructing a shipping carbon tax that suits China’s national conditions.

Author contributions

HL: Funding acquisition, Writing – original draft, Writing – review & editing. KJ: Funding acquisition, Writing – review & editing. MG: Methodology, Supervision, Writing – original draft. TM: Formal Analysis, Validation, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was funded by the he National Philosophy and Social Science Foundation Project of China [23BGL003]; National Natural Science Foundation of China [71874073]; Postgraduate Research & Practice Innovation Program of Jiangsu Province [KYCX23_3813]; Key Topic of Teaching Reform of Degree and Postgraduate Education in Jiangsu Province [JGKT23_B060]; Key Project of Scientific Research Planning Project of Chinese Association of Higher Education [23PG0205].

Acknowledgments

The authors are thankful to the referee for the useful suggestions and comments.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmad M., Li X. H., and Wu Q. (2024). Carbon taxes and emission trading systems: Which one is more effective in reducing carbon emissions? - A meta-analysis. J. Clean. Prod. 476, 143761. doi: 10.1016/j.jclepro.2024.143761

Aldy J. E. and Stavins R. N. (2012). The promise and problems of pricing carbon: theory and experience. J. Environ. Dev. 21, 152–180. doi: 10.1177/1070496512442508

Angela K. and Margit S. (2022). Carbon taxation: A review of the empirical literature. J. Econom. Surv. 37, 1353–1388. doi: 10.1111/joes.12531

Arcila A., Chen T., and Lu X. L. (2024). The effectiveness of consumption tax on the reduction of car pollution in China. Transport. Res. Part D: Transport. Environ. 134, 104302. doi: 10.1016/j.trd.2024.104302

Arefin M. A., Nabi M. N., Akram M. W., Islam M. T., and Chowdhury M. W. (2020). A review on Liquefied Natural Gas as fuels for dual fuel engines: opportunities, challenges and response. Energies 13, 6127. doi: 10.3390/en13226127

Auerbach A. J. and Hines J. J. R. (2002). “Taxation and economic efficiency,” in Handbook of public economics, vol. 3. Elsevier Science, 1347–1421. doi: 10.1016/S1573-4420(02)80025-8

Avi-Yonah S. R. and Uhlmann D. M. (2009). Combating global climate change: why a carbon tax is better a response to global warming than cap and trade. Stanford Environ. Law J. 28, 3–50. Available online at: https://www.e-education.psu.edu/geog432/sites/www.e-education.psu.edu.geog432/files/images/Avi-Yonah,%20R.S.%20and%20D.M.%20Uhlman%20Stanford%20Environmental%20Law%20Journal%202009.pdf (Accessed October 10, 2024).

Bertoldi P. (2022). Policies for energy conservation and sufficiency: Review of existing policies and recommendations for new and effective policies in OECD countries. Energy Build. 264, 112075. doi: 10.1016/j.enbuild.2022.112075

Bi S. H., Kang C. Y., Bai T. T., and Yi X. T. (2024). The effect of green fiscal policy on green technological innovation: evidence from energy saving and emission reduction fiscal policy. Environ. Sci. pollut. Res. 31, 10483–10500. doi: 10.1007/s11356-023-31798-6

Blaufus K., Hundsdoerfer J., Jacob M., and Sünwoldt M. (2016). Does legality matter? The case of tax avoidance and evasion. J. Econom. Behav. Organ. 127, 182–206. doi: 10.1016/j.jebo.2016.04.002

Cai W. (2024). Refining environmental protection taxes for a sustainable future. Cell Rep. Sustain. 1, 100264. doi: 10.1016/j.crsus.2024.100264

Cariou P., Halim R. A., and Rickard B. J. (2023). Ship-owner response to carbon taxes: Industry and environmental implications. Ecol. Econ 212, 107917. doi: 10.1016/j.ecolecon.2023.107917

Center for Climate and Energy Solutions(C2ES) (2024). Carbon tax basics. Available online at: https://www.c2es.org/content/carbon-tax-basics/ (Accessed August 12, 2025).

Chai S. L., Huo W. J., Li Q., and Ji Shi Q. X. P. (2025). Effects of carbon tax on energy transition, emissions and economy amid technological progress. Appl. Energy 337, 124578. doi: 10.1016/j.apenergy.2024.124578

Chang N. (2013). Sharing responsibility for carbon dioxide emissions: A perspective on border tax adjustments. Climate Policy 59, 850–856. doi: 10.1016/j.enpol.2013.04.046

Chang Y. C. (2022). Accelerating domestic and international dual circulation in the Chinese shipping industry-An assessment from the aspect of participating RCEP. Mar. Policy 135, 104862. doi: 10.1016/j.marpol.2021.104862

Chen S., Miao C. Y., and Zhang Q. (2024). Understanding the evolution of China’s green shipping policies: Evidence by social network analysis. J. Clean. Prod. 482, 144204. doi: 10.1016/j.jclepro.2024.144204

Chen Z. Y. and Nie P. Y. (2016). Effects of carbon tax on social welfare: A case study of China. Appl. Energy 183, 1607–1615. doi: 10.1016/j.apenergy.2016.09.111

Dietsch P. (2024). A fairer and more effective carbon tax. Nat. Sustain. 7, 1584–1591. doi: 10.1038/s41893-024-01429-0

Ding W. Y., Wang Y. B., Dai L., and Hu H. (2020). Does a carbon tax affect the feasibility of Arctic shipping? Transport. Res. Part D: Transport. Environ. 80, 102257. doi: 10.1016/j.trd.2020.102257

Dominioni G., Englert D., and Salgmann R. (2022). Carbon revenues from international shipping: Enabling an effective and equitable energy transition-summary for policymakers. Available online at: https://www.worldbank.org/en/topic/transport/publication/carbon-revenues-from-international-shipping (Accessed August 12, 2025).

Du Y. S., Zhao Y. T., and Li H. (2023). Subsidy policy and carbon quota mechanism of the Chinese vehicle industry. Transport. Res. Part D: Transport. Environ. 121, 103806. doi: 10.1016/j.trd.2023.103806

Dupoux M. and Martinet V. (2022). Could the environment be a normal good for you and an inferior good for me? A theory of context-dependent substitutability and needs. Res. Energy Econ 69, 101316. doi: 10.1016/j.reseneeco.2022.101316

Eichner T. and Pethig R. (2015). Unilateral consumption-based carbon taxes and negative leakage. Res. Energy Econ 40, 127–142. doi: 10.1016/j.reseneeco.2015.03.002

Elkafas A. G., Rivarolo M., and Massardo A. F. (2022). Assessment of alternative marine fuels from environment, technical, and economic perspectives onboard ultra large container ship. Int. J. Maritime Eng. 164, A125–A134. Available online at: https://orcid.org/0000-0001-5438-9814 (Accessed October 10, 2024).

European Commission, Maritime transport in EU emissions trading system (ETS) (2025). Available online at: https://climate.ec.europa.eu/eu-action/transport-decarbonisation/reducing-emissions-shipping-sector/faq-maritime-transport-eu-emissions-trading-system-ets_en (Accessed August 12, 2025).

Feng P., Lu H. Y., Li W., and Wang X. Y. (2022). Tax policies of low carbon in China: effectiveness evaluation, system design and prospects. Front. Environ. Sci. 10. doi: 10.3389/fenvs.2022.953512

Freedman J. (2004). Defining taxpayer responsibility: In support of a general anti-avoidance principle. Br. Tax Rev. 4, 332–357.

Fu Y. P., Huang G. H., Liu L. R., and Zhai M. Y. (2021). A factorial CGE model for analyzing the impacts of stepped carbon tax on Chinese economy and carbon emission. Sci. Tot. Environ. 759, 143512. doi: 10.1016/j.scitotenv.2020.143512

Gao Y. N., Li M., Xue J. J., and Liu Y. (2020). Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ 90, 104872. doi: 10.1016/j.eneco.2020.104872

Gao Z. Y., Zhang Y. H., Li L. Q., and Hao Y. (2024). Will resource tax reform raise green total factor productivity levels in cities? Evidence from 114 resource-based cities in China. Resour. Policy 88, 104483. doi: 10.1016/j.resourpol.2023.104483

Garcia B., Foerster A., and Lin J. (2020). Net zero for the international shipping sector? An analysis of the implementation and regulatory challenges of the IMO strategy on reduction of GHG emissions. J. Environ. Law 33, 85–112. doi: 10.1093/jel/eqaa014

Goulder L. H. and Schein A. R. (2013). Carbon taxes vs. cap and trade: a critical review. Climate Change Econ 4, 1350010. doi: 10.1142/S2010007813500103

Grant L., Vanderkelen I., and Gudmundsson L. (2025). Global emergence of unprecedented lifetime exposure to climate extremes. Nature 641, 374–379. doi: 10.1038/s41586-025-08907-1

Green J. F. (2021). Does carbon pricing reduce emissions? A review of ex-post analyses. Environ. Res. Lett. 16, 043004. doi: 10.1088/1748-9326/abdae9