Abstract

Introduction:

Upgrading China’s marine industrial structure toward sustainability and higher value is central to the nation’s strategy of becoming a maritime power. Environmental regulation plays a pivotal role in this transition, yet its influence in the marine sector remains insufficiently examined.

Methods:

Using panel data from 11 coastal provinces, this study distinguishes between command-and-control and market-based regulation, and applies a threshold regression model to evaluate their respective impacts and interactions.

Results:

The analysis reveals that command-and-control regulation follows an inverted U-shaped pattern: moderate enforcement encourages industrial optimization, while overly stringent measures suppress innovation and slow transformation. Market-based regulation currently has a net negative effect, reflecting limited effectiveness under existing policy conditions. Nonetheless, evidence points to a potential U-shaped relationship, suggesting that better policy design and implementation could reverse this trend. Threshold results further show that while command-and-control regulation is unaffected by market-based intensity, strong command-and-control enforcement markedly weakens the impact of market-based tools.

Discussion:

These findings underscore the need to calibrate regulatory intensity and improve coordination between regulatory instruments. A balanced mix of policies, tailored to the specific dynamics of the marine economy, can help unlock the full potential of environmental regulation and support high-quality, sustainable growth in China’s marine industries.

1 Introduction

The ocean has long served as a vital foundation for human life. According to the State of the Ocean Report 2024 released by UNESCO, the intensification of human economic activities has placed global marine ecosystems under unprecedented threat from environmental pollution, thereby endangering the sustainability of the marine economy. In response, the Sustainable Development Goals (SDGs) and the UN Decade of Ocean Science for Sustainable Development explicitly call for a transformation of the marine economy—promoting more environmentally friendly marine activities while sustaining economic growth. The objective is to reverse the declining trend in ocean health and ensure that the marine environment continues to support human economic development, thus achieving long-term sustainability. China has in recent years clearly positioned the construction of a ‘maritime power’ as a central national strategy. As reported in the 2024 China Marine Economy Statistical Bulletin, the gross ocean product (GOP) totaled RMB 10.5438 trillion that year., surpassing the ten-trillion mark for the first time and accounting for over 7.8% of national GDP, signaling strong momentum in marine economic growth. China’s efforts to build a maritime power are clearly accelerating.

Despite this rapid growth, China’s marine economy remains constrained by significant environmental and resource pressures. Over the past three decades, economic development in coastal regions has largely relied on a growth paradigm driven primarily by quantitative expansion leading to industrial structures heavily dependent on natural resources and concentrated in low-end sectors (Chen et al., 2025). On the basis of the 2024 China Marine Economy Statistical Bulletin, traditional resource-intensive and high-emission industries such as marine fisheries, offshore oil and gas, and marine chemical industries still occupy a dominant share, whereas emerging high-value sectors like marine biopharmaceuticals and marine renewable energy account for less than 3%. Additionally, service sectors such as marine tourism and maritime transport together comprise more than 55% of the industry, yet their technological content and innovation capacity remain relatively low (Papageorgiou, 2016). Overall, the Chinese marine industry faces a structural imbalance characterized by “low-end, large-scale” sectors and “high-end, small-scale” sectors. This structural mismatch limits the potential for sustainable marine economic growth while placing greater strain on the marine ecosystem (Liu et al., 2017). Both the 19th and 20th National Congress of the Communist Party of China emphasized the need to “Facilitate the structural transformation of the marine industry and realize the high-quality advancement of the marine economy.” Achieving this goal requires not only safeguarding the health of the marine ecosystem but also steering industrial development toward greener and more advanced pathways (Li et al., 2021). In this process, marine environmental resources—characterized by non-excludability and non-rivalry as public goods—render market mechanisms inherently ineffective in regulating their use. Thus, institutional or policy interventions are essential to reconcile the tension between environmental protection and marine industrial upgrading (Yusheng et al., 2024). By designing and implementing appropriate environmental policies, governments can influence the behavior of economic agents in the marine sector, reducing the negative externalities of pollution. These policy-induced changes in enterprise behavior, in turn, affect the broader trajectory of marine industrial development (Ye et al., 2022). Therefore, understanding how environmental regulation affects the advancement of marine industrial structures is a pressing and practical question for achieving sustainable marine development.

Currently, no established theoretical consensus exists regarding how environmental regulation influences industrial upgrading. The mechanisms linking the two remain a focal point of academic inquiry, particularly within the marine context. To explore this relationship, it is essential to examine the nature and functional pathways of environmental regulation. Environmental regulations are conventionally grouped into two paradigms—command-and-control policies and market-based tools—based on their underlying regulatory architectures (Wang and Shen, 2016). Command-and-control policies directly modifies corporate decision-making through legal or administrative means, compelling compliance with environmental standards. Common instruments include environmental laws, regulations, and emission limits (Blackman et al., 2018). Conversely, market-driven regulatory instruments aim to internalize pollution externalities through price mechanisms, employing tools such as emission charges, environmental protection taxes, and tradable permits (Qi et al., 2023). Both types of regulation inevitably elevate regulatory expenditure burdens for material-intensive oceanic sectors and introduce technological thresholds, thereby curbing inefficient and polluting production capacities and pressuring firms to transition toward greener and more technologically advanced models (Sun et al., 2021a). Command-and-control policies exert direct pressure on enterprises, requiring them to allocate resources toward energy efficiency improvements and emission abatement, promoting structural upgrading. Meanwhile, although market-based policies may increase short-term operational costs, they incentivize firms to invest in innovation to reduce long-term liabilities. Through the “innovation compensation effect,” firms can internalize the compliance costs imposed by environmental regulation, which in turn contributes to technological advancement and structural optimization of industries (Zhu et al., 2021).

Synthesizing the empirical evidence, environmental regulation demonstrably accelerates the structural advancement of marine industries, however, owing to the differing mechanisms of various regulatory types, their impacts on marine industries vary significantly in terms of intensity, effectiveness, and timing. For example, command-and-control regulation eliminates outdated capacity by increasing firms’ compliance costs, yet according to the “pollution haven” hypothesis, its effectiveness depends on the intensity of enforcement (Liu and Guo, 2023). In the early stages, when regulatory intensity is low and enforcement is lenient, firms can achieve compliance at relatively low costs, resulting in minimal impact on industrial structure. As regulatory intensity strengthens, high-pollution enterprises are either phased out or compelled to undergo green transformation, thereby promoting industrial upgrading. However, once regulatory pressure exceeds a certain threshold, it may lead to over-regulation. In such cases, the viability of enterprises becomes compromised, forcing relocation or exit from the market, causing declines in overall marine industrial output and investment. This, in turn, compresses firms’ capacity to invest in innovation and technology, ultimately hindering sustainable development and structural upgrading (Li et al., 2024), thus, command-and-control regulatory intensity exerts a nonlinear influence on marine industrial upgrading, characterized by an inverted U-shaped trajectory. In contrast, market-based environmental regulation also demonstrates stage-dependent effects on marine industrial transformation. In its early stages, weak incentive intensity may only trigger limited green investments among a small number of enterprises, exerting negligible influence on overall industrial structure. As the strength of market-based incentives increases—through tax breaks, emission trading, and other mechanisms—the cost of technological innovation is substantially reduced. This facilitates corporate investment in sustainable technologies, activating an eco-innovation dynamic that establishes competitive technological advantages and propels sectoral transition from resource-dependent to innovation-centric marine value chains. (Liu et al., 2021). Nevertheless, when incentives exceed an optimal threshold, unintended consequences may arise, such as excessive reliance on subsidies or resource misallocation, including phenomena like policy arbitrage (Li and Gao, 2022). Therefore, the policy implications of market-based environmental governance on industrial upgrading also exhibits threshold effects and diminishing marginal returns. In practice, marine policy frameworks typically integrate prescriptive standards with price-based instruments, which often interact in complementary ways. Within a well-coordinated framework, command-and-control policies impose clear institutional constraints on firms’ environmental responsibilities, while market-based tools lower transformation costs and reduce resistance to technological upgrading, thereby jointly fostering green industrial transition (Cui et al., 2022). However, overly stringent and inflexible command-and-control regulation can suppress market vitality and stifle industrial innovation, whereas insufficient market incentives may fail to induce meaningful behavioral change. Institutional differences among China’s coastal provinces represent a critical contextual factor influencing the effectiveness of environmental regulation. Provinces with stronger governance quality and enforcement capacity can implement environmental policies more consistently, enhancing both credibility and signaling effects for enterprises. In such settings, command-and-control and market-based instruments are more likely to encourage sustained technological upgrading rather than short-term cost-avoidance strategies. Conversely, in provinces with weaker institutional capacity, environmental regulation may suffer from fragmented enforcement, policy discontinuity, or even regulatory capture, all of which dilute policy impacts and generate heterogeneous outcomes. Comparable trends have been observed in other emerging economies, where regional governance capacity plays a decisive role in determining the success of environmental interventions. Beyond institutional capacity, several objective constraints may also hinder industrial upgrading under market-based incentive schemes. Under imperfect market conditions, firms often face limited access to green financing or advanced technologies, constraining their ability to respond effectively to market signals such as emission charges (Liu et al., 2021). In regions with underdeveloped governance and environmental management systems, uneven implementation of Market-Based Environmental Regulation (MER) frequently leads firms to adopt compliance strategies centered on short-term cost minimization rather than innovation. Moreover, when market-based instruments are applied alongside highly stringent command-and-control measures, the combined regulatory burden can significantly raise operating costs, thereby discouraging firms from investing in technological upgrading (Destek et al., 2025). These dynamics underscore the importance of achieving an optimal synergy between the two policy types to maximize regulatory efficiency and support structural transformation.

In summary, compared to command-and-control policies, market-based regulation exhibits greater flexibility and long-term sustainability. However, adjusting firms’ economic behavior through market mechanisms generally requires a longer time frame, and may not yield immediate results as command-style enforcement does. The two types of environmental regulation differ not only in their mechanisms of influence but also in how they interact with one another. Thus, accurately identifying the functional pathways through which different types of regulation affect marine industrial restructuring toward knowledge-intensive activities is essential for designing more targeted and effective green development policies. Based on this understanding, this study systematically investigates how compliance-based and price-based environmental instruments differentially drive industrial metamorphosis in China’s marine sector across regulatory implementation phases. It also contextualizes the findings within the realities of progress in China’s ocean economy, with the goal of offering theoretical insight and policy recommendations for the country’s efforts to become a maritime power and promote high-quality marine economic growth.

The marginal contributions of this study are threefold: (1) Through empirical modeling of coastal province data (2009-2020), this work decodes how environmental policy instruments catalyze structural transformation in China’s marine industries. (2) This study dichotomizes environmental regulations into prescriptive and market-incentive instruments, employing threshold regression to quantify asymmetric regulatory responses across intensity gradients. (3) The analysis captures the heterogeneity in the effects of environmental regulation: command-and-control policies follow an inverted U-shaped pattern, while market-based regulation currently exhibits a negative impact with a potential U-shaped trend. Drawing on these findings, the study provides actionable suggestions for marine environmental policymaking.

The remainder of this paper is structured as follows: Section 2 synthesizes extant literature; Section 3 details model specification and empirical methodology; Section 4 analyzes empirical findings with contextual interpretation; Section 5 concludes with theoretical contributions and policy recommendations.

2 Literature review

2.1 Typologies of environmental regulation in theory and practice

Environmental regulation serves as a pivotal governance mechanism for mediating growth-ecology tensions. Within China’s high-quality development paradigm, such regulation plays an increasingly central role in guiding industrial upgrading. Generally, environmental governance mechanisms fundamentally comprise three modalities: command-and-control, market-based, and public participation. These instruments exhibit significant heterogeneity in their modes of influence on economic agents. (1) Command-and-control instruments mandate codified ecological standards and juridical limitations for enterprises, prioritizing material-intensive industries with elevated emissions profiles (Liu et al., 2016). Such policies are effective in promoting technological spillovers in cleaner industries and accelerating industrial upgrading. However, their capacity to stimulate green innovation is relatively limited, and overly stringent enforcement may lead to resource misallocation or suppressed innovation (Yi et al., 2019). Nevertheless, when combined with market-based instruments, command regulations can generate synergistic effects that significantly enhance overall policy effectiveness (Shi and Li, 2022). (2) Market-driven environmental policy—such as emissions trading schemes and environmental protection taxes—leverages price signals to motivate firms to pursue self-driven technological advancement and upgrading. Numerous studies have confirmed facilitating role of market-based policies in advancing industrial restructuring, particularly among green and high-tech enterprises (Sun et al., 2021b). Notably, the effect of such policies on green innovation often exhibits nonlinear characteristics, implying that policy intensity must be carefully calibrated to avoid under-incentivization or policy arbitrage (Shen et al., 2022). (3) Public participation-based regulation relies on mechanisms such as public oversight, corporate social responsibility, and media pressure to raise environmental awareness and accountability among firms. While such approaches can stimulate voluntary compliance, empirical studies on their effectiveness remain inconclusive (Hu et al., 2020).

2.2 Research on the impact of environmental regulation

Understanding the effects of environmental regulation on industrial transformation, green technological innovation, and ecological efficiency has become a key focus in recent literature, particularly in the context of recent environmental and economic challenges. Cui et al. (2022) conducted an evaluation of the influence of various forms of environmental regulation on energy ecological efficiency from the perspective of ecological energy performance. Their analysis demonstrates that both command-and-control and market-based regulatory instruments exert statistically significant inhibitory effects in certain regions, with evidence of threshold effects. Moreover, environmental regulation not only influences ecological efficiency directly, but also serves as a key driver shaping enterprises’ green innovation activities. Li and Gao (2022), through a game-theoretic model, found that under market-driven environmental policy, the behaviors of enterprises and banks are significantly affected by the strength of policy subsidies and penalties. As the cost disparity between varying technological levels widens, firms tend to increase investment in autonomous green innovation, thereby reducing dependence on external technology acquisition. Liu et al. (2021) argued that mandatory environmental regulation significantly suppress industrial growth, while no strong Granger causality was found between market-oriented environmental regulation and industrial expansion. Furthermore, Li et al. (2024), through an empirical investigation of pollution control policies concluded that although command-based environmental regulation effectively reduces corporate emissions, it simultaneously inhibits total factor productivity. This result supports the notion that “compliance costs” outweigh the “innovation compensation effect,” meaning that under strict regulatory constraints, firms often rely on end-of-pipe solutions instead of allocating resources to technological innovation, thereby hindering sustainable industrial transformation. While environmental regulation affects various economic and environmental outcomes, its effect on the industrial restructuring constitutes the primary focus of this study.

A thorough review of existing studies indicates that the pathways connecting environmental regulation and industrial structural upgrading involve intricate and interdependent processes. Broadly, two major pathways are identified: First, command-and-control policies can exert a “forcing mechanism” that eliminates outdated production capacity, thereby expediting the shift toward greener and higher-end industries. Second, market-based instruments encourage green technological innovation and facilitate structural transformation from resource-intensive to value-intensive sectors (Du et al., 2021; He and Zheng, 2023). Compared to rigid mandates, market-based policy instruments including tax incentives and environmental levies are generally more sustainable and adaptable across regions (Zhang et al., 2019b; Zhu et al., 2024). Second, from the perspective of policy spatial effects, environmental regulation often demonstrates significant spatial spillover. For instance, policy effects in China’s eastern provinces tend to radiate outward, while central and western regions confront two major challenges related to “regulatory suppression” and “development constraints” (Song et al., 2021; Zeng and Liu, 2023). As a result, the positive impacts of regulation are more evident in economically developed coastal areas, whereas negative effects—or risks of “growth inhibition”—are more prevalent in less developed inland and resource-dependent regions (Shao et al., 2021; Yu and Wang, 2021). This highlights the moderating role of regional development level and resource endowment. Third, the stringency of regulatory policies has a decisive influence on outcomes. For example, moderate levels of command-based regulation can effectively foster structural upgrading, but excessive enforcement may deter innovation and investment. Similarly, market-based instruments exhibit threshold characteristics—only beyond a certain intensity do they significantly guide industries toward high-end transformation (Yin et al., 2024). In addition, technological innovation and economic development levels function as key mediating factors influencing the relationship between regulatory policies and evolution of industrial structure (Wang et al., 2022). Institutional quality, policy transparency, and intergovernmental strategic interactions also deeply shape the effectiveness of regulatory implementation (Zhang, et al., 2019a). In sum, environmental regulation exerts a significant impact on industrial restructuring, but its effectiveness is contingent upon policy type, regional context, developmental stage, and institutional dynamics.

2.3 Research gap

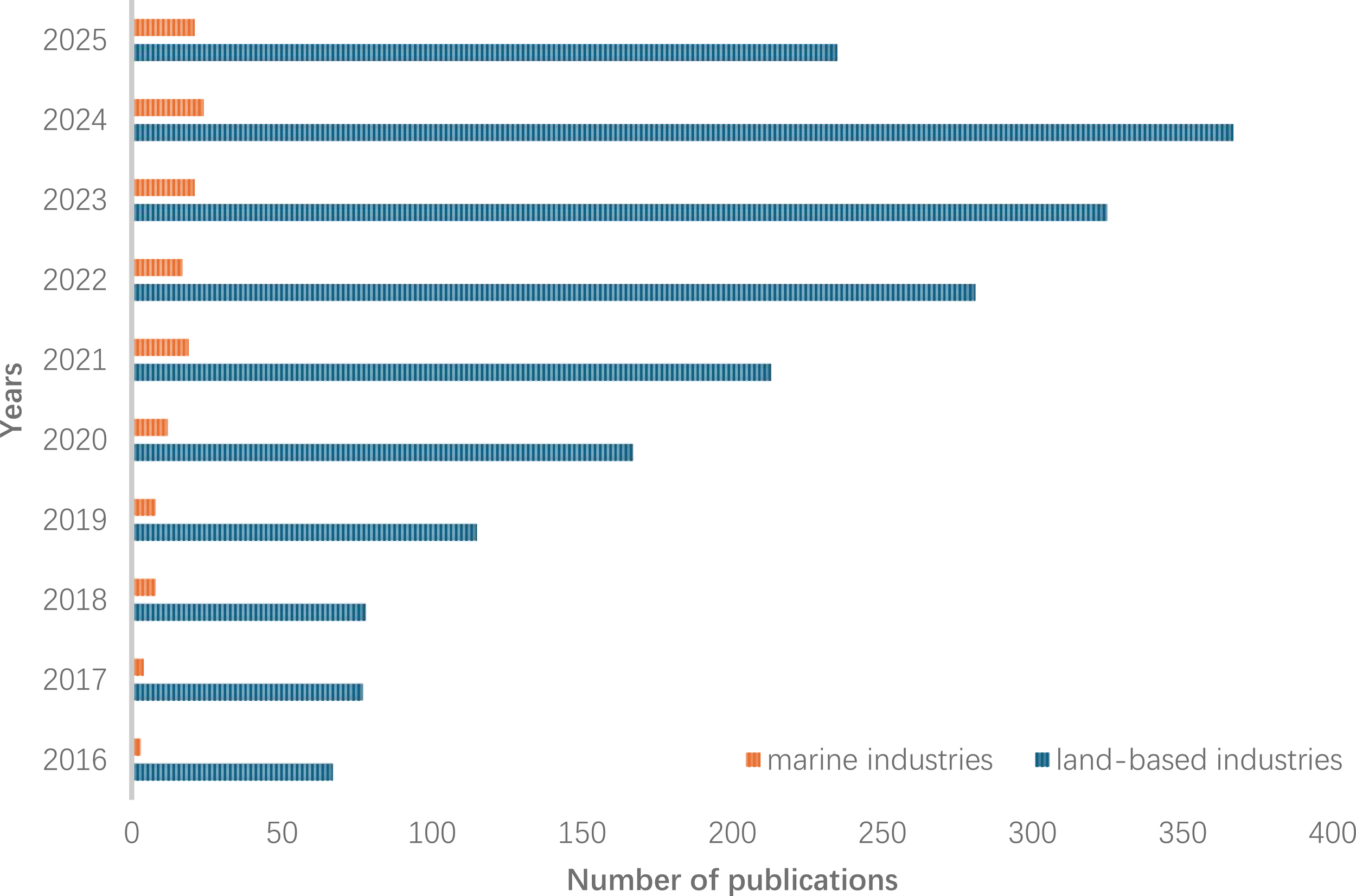

While a large body of research has examined the effects of environmental regulation on industrial upgrading in land-based sectors such as manufacturing, energy, and construction (Wang et al., 2022; Du et al., 2021), studies focusing specifically on the marine economy remain scarce. According to a search conducted in the Web of Science database (Time span: 2016–2025; Database: All), using the keywords “environmental regulation” and “industrial structure” (excluding “marine”), a total of 1,925 relevant publications were identified. In contrast, using the keywords “environmental regulation” and “industrial structure” and “marine”, only 137 related studies were found, the results are shown in Figure 1. The nearly fifteenfold difference highlights the significant research gap in the marine sector regarding the relationship between environmental regulation and industrial structure. Given the unique characteristics of the marine economy —including its development model, resource endowment, and ecological sensitivity—the transferability of results obtained from land-based research to marine environments remains uncertain. Most existing studies primarily focus on the role of environmental regulation on marine green technological innovation or on total factor productivity (Liu and Chen, 2022; Ren and Ji, 2021). Although green innovation may serve as an intermediate variable for structural transformation (Sun et al., 2023), it does not fully explain the mechanism by which environmental regulation influences the marine industry structure. There is a clear lack of in-depth investigation into how various forms of environmental regulatory policies affect the pathways of marine industrial transformation. Additionally, the development and regulation of marine industries vary significantly across countries. For example, the United States emphasizes ecosystem-based marine spatial planning (Colgan, 2013), while Japan focuses on technological innovation in high-value-added marine sectors (Ding and Tabeta, 2024). In contrast, China’s marine economy still relies heavily on resource-intensive industries and exhibits fragmented regulatory oversight. These research gap hampers the effective deployment of policy tools in efforts to achieve sustainable and high-quality development of the marine economy. Our research provides an empirical perspective on how environmental policy affects structural transformation in China’s marine industries, offering insights for other developing coastal economies seeking sustainable marine development.

Figure 1

Comparison of research in the fields of land and marine.

3 Research design

Building upon theoretical foundations, subsequent segments establish methodological architecture through econometric parameterization, measurement standardization, empirical pattern documentation, and data provenance verification.

3.1 Econometric model

Drawing on the prior analysis, this study develops an empirical framework to assess how varying levels of environmental regulatory policies affect the structural evolution of the marine industry. The marine industrial upgrading index serves as the explained variable, while the core explanatory factors are the intensities of command-and-control (CER) and market-based (MER) environmental regulations. To capture potential nonlinear effects, the model also incorporates the squared terms of both CER and MER. Notably, the process of marine industrial upgrading is inherently dynamic and may unfold over an extended period. To account for this persistence, the first-order lag of the marine industrial upgrading variable is incorporated into the model. Moreover, given the potential bidirectional causal relationship between marine industrial upgrading and marine environmental regulation, endogeneity concerns may arise, potentially biasing the estimation results. To address this issue and obtain consistent parameter estimates, this study employs the System Generalized Method of Moments (System GMM) to estimate the dynamic panel model. The specification of the dynamic panel framework is as follows:

Where the subscript i denotes provinces, and t refers years. ISU is the Industrial structure upgrading index, ER is used to index the intensity of marine environmental regulation in regional jurisdiction, it includes Command-and-Control Marine Environmental Regulation (CER) and Market Incentive Marine Environmental regulation (MER), and X indexes other control variables excluding environmental regulation intensity. , are the intercept term, random disturbance term, respectively. represents the error term of the entire model.

As discussed, both command-type and incentive-based environmental interventions commonly intersect and support one another in advancing marine economic development. Different types of regulatory tools may influence each other’s effectiveness, suggesting the existence of threshold effects. Following Hansen’s (2000) methodology, a panel threshold regression model is employed (Equation 2) to examine the interaction-driven non-linear effects between environmental policy types. The model is specified to detect whether one type of regulation exhibits differential impacts depending on the intensity of the other type, providing insight into their dynamic interplay.

Among them, I is the indicative function, refers the threshold variable, is the threshold value, and the meanings of the other letters are the same as those in Equation 1.

3.2 Explained variable: upgrading of marine industrial structure

The degree of refinement in the marine industrial structure serves as the central analytical variable in this study, which reflects the shift in the marine economy toward more advanced and sustainable industrial configurations. This concept encompasses two dimensions: (i) the transition of industrial focus from primary industries toward secondary and tertiary sectors (i.e., from agriculture to manufacturing and services); and (ii) The shift from labor-driven sectors to those reliant on capital and advanced technology, indicating increasing reliance on innovation and capital input. For the purpose of constructing a quantitative indicator of marine industrial upgrading, this study adopts the industrial upgrading index proposed by Yuan and Zhu (2018), which captures changes in the relative shares of different industries and reflects the overall degree of structural advancement (Equation 3). The index is calculated as follows:

In the above formula, denotes the share of the i-th marine industry in the total marine gross output value, and represents the relative weights assigned to various industries according to its level of technological advancement. In line with conventional classifications of industrial sophistication, this study values of 1, 2, and 3 to the primary, secondary, and tertiary marine sectors, respectively, as their weights. This weighting scheme allows the index to effectively reflect the degree of industrial upgrading and the directional shift toward a more innovation-driven and service-oriented marine economy.

3.3 Explanatory variable: environmental regulation

3.3.1 Command-and-control marine environmental regulation

Since command-and-control environmental regulations primarily manifest as governmental legislation and intervention, they are generally difficult to quantify. Currently, academic circles primarily measure environmental regulations from two perspectives: inputs and outputs. From the input perspective, the primary method involves using pollution control investment amounts to reflect a region’s expenditures on pollution control and management. This approach provides a relatively straightforward approach to evaluate the level of environmental policy implementation. In terms of output, the primary method involves using pollution emission intensity, which measures environmental regulation by emissions intensity per unit of production. However, this perspective primarily reflects the level of pollution in a region. Due to limitations in China’s statistical methodology, there is deficiency in publicly available data on investment in marine pollution control and pollutant emissions for marine industries. However, investment in environmental pollution control for each province originate from the ‘China Environmental Yearbook.’ After comprehensive consideration, the following method is utilized to evaluate the level of implementation of command-driven marine environmental regulation, first, calculate the industrial pollution control costs for marine industries in each coastal province (Equation 4),

PC represents regional environmental pollution control investment costs, GOP represents provincial-level marine GDP, and GDP represents regional gross domestic product. Given the interprovincial differences in marine industrial structures, environmental regulation intensity is proxied by pollution control investment per unit of marine economic output, as shown in the following formula (Equation 5):

It is important to note that, due to the absence of comprehensive and consistent statistical data on marine-specific pollution control investment across all coastal provinces for the study period, this research adopts CER as an approximate measure of command-and-control regulation intensity in the marine sector. This scaling method has been employed in prior studies to allocate sectoral investments when direct data are unavailable (Yu et al., 2024). Nevertheless, it does not fully reflect the particularities of marine environmental governance, especially considering that a large share of marine pollution originates from land-based sources. Consequently, the estimated CER intensity should be interpreted as a proxy rather than a precise measure, and the potential bias introduced by this approximation is acknowledged.

3.3.2 Market-based environmental regulation

Market-based environmental regulation utilizes economic mechanisms to guide enterprises toward pollution reduction and sustainable development. Considering the spatial and resource-oriented characteristics of the marine economy, this study selects marine area usage fees per unit area as a proxy for the intensity of market-based environmental regulation (MER). This fee system reflects how the state allocates sea area use rights through pricing, embodying market-based incentives in marine resource governance. While we acknowledge that this proxy does not cover the full range of MER instruments such as emissions trading or green taxes, we note that due to China’s current statistical reporting limitations, provincial-level data on carbon trading revenues and marine-related green taxation are either unavailable, incomplete, or inconsistent across years. Therefore, marine area usage fees serve as the most reliable and consistently available indicator for capturing the economic dimension of environmental regulation in the marine context during the study period (2009–2020).

3.4 Control variables

The industrial upgrading and realignment of the marine sector constitute a multifaceted and dynamic process of economic evolution. In addition to environmental regulation, various other factors may exert significant influence. To more accurately isolate the effects of environmental regulation, this study includes a set of control variables to account for potential confounding factors, selected from three core dimensions that most critically impact economic activity: human capital, financial capital, and material resources.

3.4.1 Marine labor scale

This variable reflects the scale of labor input within marine industries, quantified by the number of employees engaged in marine-related activities in each coastal reign. A larger marine labor force typically suggests a reliance on labor-intensive industries, which are generally associated with lower levels of industrial sophistication. Therefore, the expected sign of this variable is negative.

3.4.2 Marine talent pool

Talent is a core driver of structural transformation. A well-structured and highly qualified workforce provides the foundation for technological advancement and the growth of high value-added sectors, thereby promoting structural upgrading. In contrast, an imbalanced talent structure may hinder industrial renewal and sustainable growth. This study uses the number of marine research and development personnel as a proxy for the talent pool, with an expected positive sign.

3.4.3 Marine innovation investment

Investment in innovation is a key force behind industrial upgrading. Increased expenditure on R&D, technological transformation, and emerging sectors can enhance firms’ competitiveness and accelerate the shift toward high-tech, high-value-added industries. Moreover, such investment helps transform traditional industries, thereby promoting sustainable and efficient economic development. This study uses marine R&D expenditure to measure innovation investment. A higher investment level is expected to correlate with a higher degree of structural upgrading.

3.4.4 Marine foreign direct investment

FDI often brings with it advanced technologies, managerial expertise, and capital, which can enhance local firms’ productivity and technological capacity, thus promoting structural upgrading. Given the lack of direct statistical data on FDI in the marine sector, this study uses the proportion of marine-related FDI in total FDI as a proxy. The calculation is as follows (Equation 6):

Where is the total foreign direct investment in the region, GOP is the Gross Ocean Product, GDP is the region’s Gross Domestic Product.

3.4.5 Energy consumption level

Energy expenditure reflects the resource utilization efficiency of economic activity. High energy consumption is often associated with low value-added and resource-intensive industries, which constrain industrial upgrading. Reducing energy use encourages the restructuring of traditional industries and fosters the development of energy-efficient and high-tech sectors. This study uses total regional energy consumption to measure this variable. A higher energy consumption level is expected to negatively affect structural upgrading, so the expected sign is negative.

We utilize panel data from 11 coastal regions in China spanning the years 2009 to 2020 for empirical analysis. All raw data are sourced from official statistical publications, including the China Statistical Yearbook, China Marine Statistical Yearbook, and China Environmental Statistical Yearbook. For variables involving price or monetary values, inflation adjustments were made to express all figures in constant 2009 prices. To address potential issues of non-stationarity and heteroskedasticity, all relevant variables were log-transformed prior to analysis. Descriptive statistics for the key variables are presented in Table 1.

Table 1

| Variable | Symbol | Mean | Std.Dev | Min | Max | Predictive coefficient |

|---|---|---|---|---|---|---|

| Industrial structure upgrade | LnISU | 0.29 | 0.45 | -0.78 | 1.52 | / |

| Command-and-control environmental regulation | LnCER | 10.27 | 1.22 | 4.92 | 15.50 | ? |

| Market Incentive Environment Regulation | LnMER | 2.02 | 1.56 | -1.01 | 6.72 | ? |

| Labor force size | LnLB | 5.52 | 0.67 | 4.41 | 6.82 | – |

| Talent pool | LnTP | 7.24 | 0.87 | 4.96 | 8.87 | + |

| Innovative investment | LnRD | 10.57 | 1.69 | 5.63 | 13.09 | + |

| Foreign Direct Investment in the marine sector | LnFDI | 5.83 | 1.35 | 2.74 | 8.97 | + |

| Energy consumption level | LnEC | 7.76 | 0.80 | 5.87 | 10.13 | – |

Descriptive statistics.

4 Empirical analysis

Prior to conducting the empirical analysis, we performed panel unit root tests to examine the stationarity of the selected variables. Specifically, both the Levin–Lin–Chu (LLC) and Fisher-ADF tests were employed. The stationarity tests reveal that all variables are stable at the 1% significance level, ensuring that the panel data do not suffer from unit root problems and thus preventing spurious regression.

4.1 The impact of environmental regulation on the upgrading of the marine industrial structure

Owing to potential interdependence between command-and-control and market-based regulatory mechanisms, their concurrent inclusion in a single regression model may pose multicollinearity risks. To circumvent this, the two principal explanatory variables—Command-and-Control Environmental Regulation (CER) and Market-Based Environmental Regulation (MER)—are incorporated individually into the regression models. We address the endogeneity issue in the model by employing the System GMM, using lagged values of the variables as instrumental variables for estimation. The results of the Sargan test indicate that the model cannot reject the null hypothesis of instrument validity, confirming the appropriateness of the selected instruments. Furthermore, the AR(2) show evidence of first-order serial correlation in the residuals but no second-order serial correlation, meeting the standard assumptions for dynamic panel GMM estimation. These results collectively suggest that the model specification is appropriate. The results are presented in Table 2.

Table 2

| Explanatory variable | Upgrading of the marine industrial structure (LnISU) | |

|---|---|---|

| Model 1 | Model 2 | |

| L.LnISU | 0.787***(0.225) | 1.441***(0.295) |

| LnCER | 1.741***(0.601) | / |

| LnCER2 | -0.083*(0.048) | / |

| LnMER | / | -0.321***(0.104) |

| LnMER2 | / | 0.041(0.039) |

| LnLB | 0.468*(0.257) | 1.435***(0.420) |

| LnTP | -0.205(0.167) | 0.548(0.403) |

| LnRD | 0.192(0.175) | 0.853*(0.511) |

| LnFDI | 0.028***(0.009) | 0.320***(0.045) |

| LnEC | -0.159*(0.086) | -0.101(0.129) |

| C | -0.965***(0.323) | 0.237***(0.123) |

| AR(2) | 0.48 | 0.35 |

| Sargan test | 25.22 | 31.89 |

The impact of environmental regulation on the upgrading of the marine industrial structure.

Values in parentheses represent standard errors. The symbols * and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

As shown in Table 2, it is evident that both CER and MER exhibit significant nonlinear effects on the upgrading of the marine industrial structure. However, the two types of regulation differ considerably in terms of direction and magnitude, and the roles of control variables also display consistent patterns.

In Model 1, the linear coefficient of CER is 1.741 and statistically significant at the 1% level, whereas the quadratic term is −0.083, significant at the 10% level. These results reveal an inverted U-shaped relationship between CER and the upgrading of the marine industrial structure. This suggests that moderate levels of regulatory intensity can effectively drive structural upgrading by forcing the exit of outdated and polluting capacities, thereby facilitating a transition toward greener and more advanced industries. Yet, once the degree of regulation becomes overly stringent, the associated compliance costs begin to crowd out firms’ investment in innovation and production, ultimately hindering industrial upgrading. According to Model 2, the estimated coefficient for MER is −0.321, significant at the 1% level, whereas the quadratic term is positive (0.041) but statistically insignificant at conventional confidence levels. This indicates that no significant U-shaped relationship is detected between MER and marine industrial upgrading within the current data range. The negative coefficient of MER suggests that, in its present form, market-based environmental regulation may hinder structural upgrading. This divergence from the expected mechanism could be attributed to the limited scope, insufficient strength, or imperfect design of MER tools at this stage of China’s policy and economic development. Under such conditions, firms may face transition costs related to resource reallocation, compliance adjustments, and short-term production disruptions, thereby weakening the immediate effectiveness of market-based regulation in driving structural optimization. Moreover, the current negative impact may also reflect a policy lag: market-based incentives often require a sustained period for firms to adapt, invest in new technologies, and shift business models. As China’s marine economy continues to mature and instruments such as green subsidies, carbon trading, and tax incentives are more effectively implemented, the long-term effect of MER could gradually turn positive, even though such a turning point is not yet statistically observable in the present study.

The results for the control variables indicate that labor force size exerts a significant positive effect on marine industrial upgrading in both models, suggesting that an expanded labor pool provides essential production factor support and facilitates technology introduction and diffusion. Foreign direct investment (FDI) also shows a significantly positive relationship in both models, implying that the technological spillovers and managerial advantages brought by FDI contribute to industrial structure optimization. In contrast, R&D investment is significantly positive in Model 2 but insignificant in Model 1, possibly because market-based incentive mechanisms are more effective in stimulating firms’ innovation activities, thereby translating into tangible industrial upgrading outcomes. Energy consumption exhibits a significant negative effect in Model 1, reflecting the constraints faced by energy-intensive industries under stringent command-and-control regulation, whereas it is insignificant in Model 2, potentially due to the limited short-term impact of incentive-based policies on energy use patterns. Human capital reserves are insignificant in both models, indicating that talent advantages have not been fully transformed into technological breakthroughs or drivers of industrial upgrading, highlighting the need to optimize talent structure and the institutional environment to unlock their potential.

4.2 Interactions between different forms of environmental regulation

As indicated by the preceding theoretical analysis, Distinct forms of environmental regulation may interact in complex and interdependent ways. Before implementing the threshold regression model, this study first tests for the presence of threshold effects. Using the bootstrap method with 300 replications, we set alternative threshold variables and values, divide the sample into sub-intervals, and test whether parameter estimates differ significantly across these intervals. The results of the threshold existence test are presented in Table 3.

Table 3

| Threshold variable | Number of thresholds | F stat | p-value | crti10 | crti5 | crti1 |

|---|---|---|---|---|---|---|

| LnCER | 1 | 93.04 | 0.000 | 12.41 | 14.71 | 19.16 |

| 2 | 4.84 | 0.3733 | 7.93 | 9.77 | 148.61 | |

| LnMER | 1 | 11.39 | 0.143 | 12.417 | 14.454 | 17.876 |

| 2 | 6.41 | 0.440 | 10.538 | 14.121 | 17.272 |

The threshold effect of environmental regulations.

As shown in Table 3, when the CER is used as the threshold variable, the F-statistic for the single-threshold test is 93.04 with a p-value of 0.00, while the test for a double threshold is not statistically significant. These results reveal that the effect of Market-Based Environmental Regulation (MER) on the advancement of the marine industrial structure is subject to a statistically significant single-threshold effect, determined by the strength of command-and-control regulation, with the estimated threshold value being 12.3. This finding implies that the effectiveness of market-oriented regulatory measures is not uniform but is contingent upon the extent of command-and-control regulation in place. Conversely, when MER is used as the threshold variable, no significant threshold effect is found, suggesting that the influence of command-and-control regulation on marine industrial upgrading does not depend significantly on the level of market-based regulation. Based on these findings, we proceed with a single-threshold regression model, and the corresponding results are presented in Table 4.

Table 4

| Explained variable(LnISU) | Coefficient | Std. err. | t | P>t |

|---|---|---|---|---|

| LnEC | 0.390 | 0.171 | 2.28 | 0.025 |

| LnLB | -0.226 | 0.336 | -0.67 | 0.503 |

| LnRD | 0.215 | 0.067 | 3.19 | 0.002 |

| LnFDI | 0.091 | 0.035 | 2.64 | 0.009 |

| LnTP | -0.039 | 0.083 | -0.46 | 0.643 |

| LnMER(LnCER<12.3) | -0.073 | 0.027 | -2.65 | 0.009 |

| LnMER(LnCER>=12.3) | -5.405 | 0.563 | -9.61 | 0.000 |

| C | 0.246 | 0.059 | 4.17 | 0.000 |

Threshold regression in panel data.

The empirical results presented in Table 4 reveal a clear threshold effect in the interaction between command-and-control environmental regulation (CER) and market-based environmental regulation (MER) on marine industrial upgrading. Specifically, the coefficient of MER is –0.073 when CER intensity is below the threshold value of 12.3, and it sharply drops to –5.405 when CER exceeds this threshold. First, even at lower levels of CER, MER appears to exert a negative effect on industrial upgrading. This may be due to the limited incentive strength of current market-based policies—such as sea area usage fees—which may raise production costs without providing sufficient innovation stimuli or policy clarity. Additionally, these instruments may lack consistency or transparency across provinces, reducing firms’ responsiveness to price signals and dampening their motivation to invest in technological upgrading. Second, and more critically, the adverse effect of MER intensifies significantly when CER becomes overly stringent. Under high-intensity CER, enterprises already face considerable regulatory compliance costs. The introduction of additional market-based fees can lead to excessive financial burden, especially in capital-constrained marine industries. In this dual-pressure scenario, firms may shift from proactive upgrading strategies toward defensive survival tactics, focusing only on meeting the minimum legal standards—a phenomenon referred to as “regulatory crowding-out.” This reflects a breakdown in the coordination between policy tools and weakens MER’s expected incentive effect.

These findings highlight the importance of regulatory synergy. MER and CER should not be viewed as additive instruments but as interdependent tools that must be carefully balanced. Without such coordination, MER may not only lose its effectiveness but may also become counterproductive under strong CER conditions. The results thus suggest that policymakers should enhance the coherence of environmental regulation by optimizing the timing, strength, and structure of policy instruments, ensuring they are both complementary and context-appropriate. Moreover, complementary measures—such as innovation subsidies, financial access programs, and regulatory capacity-building—may be necessary to mitigate unintended burdens and reinforce the role of MER in promoting green upgrading.

4.3 Robustness test

To conduct additional validation of the robustness of the empirical evidence presented earlier, robustness checks have been undertaken by replacing key variables. Specifically, the dependent variable representing marine industrial upgrading is substituted with an alternative indicator that captures the “high-end” trend of the marine economy. Following Cheng et al. (2018), this study employs the ratio of the tertiary marine industry’s value added to that of the secondary marine industry to represent the level of marine industrial upgrading. We still use the GMM method for testing. Data for the analysis were sourced from the China Statistical Yearbook and China Marine Statistical Yearbook. An increase in this ratio indicates a growing share of the tertiary industry, which can reasonably reflect the trend toward structural upgrading in the marine economy. The regression results are reported in According to Table 5, The estimated coefficient for the linear component of command-and-control environmental regulation remains positively significant, while the quadratic term is significantly negative, confirming the presence of an inverted U-shaped relationship between CER and the upgrading of the marine industry. In contrast, the linear coefficient for market-based environmental regulation is significantly negative, and its quadratic term is positive but not significant, which is consistent with the findings from the baseline model.

Table 5

| Explanatory variable | Upgrading of the marine industrial structure (LnISU) | |

|---|---|---|

| Model 1 | Model 2 | |

| L.LnISU | 0.949***(0.157) | 0.601***(0.133) |

| LnCER | 1.297***(0.426) | / |

| LnCER2 | -0.063***(0.016) | / |

| LnMER | / | -0.050**(0.027) |

| LnMER2 | / | 0.010(0.007) |

| LnLB | 0.325***(0.110) | 0.094**(0.044) |

| LnTP | -0.008(0.012) | -0.058(0.040) |

| LnRD | 0.191(0.172) | 0.015(0.017) |

| LnFDI | 0.021***(0.009) | 0.030***(0.009) |

| LnEC | -0.478**(0.262) | -0.225*(0.133) |

| C | -1.473***(0.372) | 0.376***(0.130) |

| AR(2) | 0.51 | 0.47 |

| Sargan test | 28.75 | 22.56 |

Robustness tests: the impact of environmental regulation on marine industrial upgrading.

Values in parentheses represent standard errors. The symbols *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Furthermore, to examine the statistical significance of the interaction between various types of marine environmental policies, the core explanatory variable representing command-and-control regulation is substituted. Specifically, we use the regional exhaust gas treatment rate as index for the stringency of command-and-control environmental regulation. This choice is based on the fact that air pollution remains the primary form of emissions in China’s marine industries, and a high treatment rate of exhaust gas generally reflects stringent environmental supervision by local governments. Therefore, this indicator can reasonably capture the level of administrative enforcement in command-and-control regulation. We then perform a threshold regression analysis to examine the interaction effects between MER and CER, using the updated variable. The results are presented in Table 6.

Table 6

| Explained variable (LnISU) | Coefficient | Std. err. | t | P>t |

|---|---|---|---|---|

| LnEC | -0.552 | 0.079 | -7.01 | 0.000 |

| LnLB | 0.101 | 0.304 | 0.330 | 0.740 |

| LnRD | 0.047 | 0.031 | 1.530 | 0.129 |

| LnFDI | 0.478 | 0.045 | 10.52 | 0.000 |

| LnTP | -0.070 | 0.075 | -0.93 | 0.353 |

| LnMER(LnCER<6.98) | -0.039 | 0.016 | -2.44 | 0.016 |

| LnMER(LnCER>=6.98) | -0.368 | 0.044 | -8.38 | 0.000 |

| C | 1.342 | 1.625 | 0.830 | 0.410 |

Robustness tests: panel threshold regression results.

The results shown in Table 6 indicate that when MER is used as the threshold variable, the impact of CER on marine industrial upgrading does not exhibit a significant threshold effect. In contrast, when CER is used as the threshold variable, a significant threshold effect is observed in the impact of MER on marine industrial upgrading, with the identified threshold value equal to 6.98. Specifically, when the intensity of CER is below 6.98, the coefficient of MER is –0.039, while when CER exceeds 6.98, the coefficient sharply decreases to –0.368. This suggests that when command-and-control regulatory stringency surpasses a defined threshold, the detrimental influence of market-based regulation on the upgrading of industries becomes markedly stronger. This trend corroborates earlier empirical studies. In summary, these results confirm the robustness of the model, and suggest that the influence of environmental regulation on the evolution and advancement of the marine industry is both statistically reliable and theoretically consistent.

5 Conclusion and implication

Against the backdrop of China’s strategy to establish itself as a maritime power and foster high-quality marine economic development, steering the marine industrial structure toward greener and more advanced directions has become an inevitable task. As a key policy instrument to coordinate ecological conservation and economic expansion, the role of environmental regulation is fundamental in guiding the progression of the marine industrial structure. This study uses panel data from 11 coastal provinces in China to conduct an empirical analysis of how environmental regulation influences the advancement of the marine industrial structure. Given the current regulatory context in China, where command-and-control and market-based instruments are the two dominant types of environmental regulation, we explore their respective impacts and potential interactions using a threshold regression model. The results indicate that both types of regulation have significant effects on marine industrial transformation and advancement, but differ in strength, direction, and policy implications. Specifically, command-and-control regulation exhibits an inverted U-shaped effect. At moderate levels, such regulation facilitates the phasing out of outdated and polluting capacities, promoting green and high-end industrial transformation. However, when regulatory intensity exceeds a critical threshold, rising compliance costs begin to suppress firms’ innovation and investment, hindering the upgrading process. In contrast, market-based environmental regulation currently shows a negative impact on marine industrial upgrading—likely due to incomplete policy design, insufficient incentive strength, and weak enterprise responsiveness. Nevertheless, the quadratic trend suggests a potential U-shaped relationship, implying that as these policies mature and become more effective, they may eventually support industrial upgrading. Threshold regression results further reveal an important interaction: when the level of enforcement of command-and-control regulation exceeds a threshold value (CER > 12.3), it significantly dampens the effectiveness of market-based instruments, potentially rendering them ineffective. Under strong administrative constraints, additional market-oriented tools may increase overall compliance costs, shifting firm priorities toward survival rather than innovation, thereby reducing the intended incentives for structural transformation.

In light of the empirical evidence, the following policy measures are recommended to promote the upgrading of the marine industry and strengthen the impact of environmental regulatory frameworks:

1.Optimize the intensity of command-and-control regulation. Establish a tiered regulatory framework that sets differentiated emission and compliance standards according to the development stage, technological capacity, and pollution profile of each marine industry sub-sector. Regulatory intensity should be dynamically adjusted based on regular performance assessments, environmental monitoring data, and industry feedback to avoid both under-enforcement (which risks ineffectiveness) and over-enforcement (which may stifle innovation). In parallel, integrate these standards with market-based measures to ensure mutual reinforcement rather than policy conflict.

2.Strengthen and diversify the market-based regulatory toolkit. Expand current instruments beyond cost-based approaches such as sea-use charges and emissions trading, to include a broader set of incentive-driven measures—e.g., targeted green subsidies, preferential tax rates for eco-innovative firms, and low-interest green financing. Design reward schemes that prioritize high-value-added, low-carbon marine industries, thereby creating a clear “reward the innovators, penalize the polluters” signal. Pilot projects can be used to test new incentive mechanisms before large-scale rollout, reducing policy uncertainty for enterprises.

3.Enhance coordination between regulatory approaches. Develop an integrated policy framework that clearly delineates the roles of command-and-control and market-based instruments, preventing excessive overlap that leads to a “double burden” on enterprises. This could involve cross-departmental policy alignment committees, joint policy impact assessments, and coordinated timelines for introducing new measures. The objective should be to identify optimal intensity combinations that lower compliance costs while sustaining strong environmental incentives, thus maximizing the complementary effects of both regulatory types.

Despite offering a systematic theoretical and empirical examination, this study has several limitations that warrant further research. First, the measurement of market-based environmental regulation (MER) remains non-standardized in existing literature. The proxy variable adopted here, while widely used in prior studies, may not fully capture the breadth, depth, and qualitative aspects of policy implementation—such as the diversity of instruments, enforcement efficiency, and regional adaptation. Future studies should seek to develop more comprehensive, multidimensional indices that better reflect the actual functioning of MER in practice. Second, although the models in this paper incorporate nonlinearities and threshold effects, other important mechanisms—such as dynamic policy coordination, institutional adaptation over time, and spatial spillover effects—remain underexplored. These aspects are particularly relevant in the marine economy, where ecological systems and industrial supply chains often span multiple administrative boundaries. Future research could employ spatial econometric models or dynamic panel approaches to capture these cross-regional and temporal interactions more effectively. Finally, due to data constraints, this study relies on province-level panel data, which may mask intra-provincial variations and sector-specific responses. Access to higher-resolution, firm-level or sectoral data would enable a more granular analysis of how different types of environmental regulation influence technological upgrading and industrial restructuring within the marine economy. Such refinements would provide more precise and region-specific policy guidance for achieving sustainable and high-quality marine economic development.

Statements

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

LL: Methodology, Supervision, Data curation, Conceptualization, Writing – review & editing, Writing – original draft. HW: Data curation, Software, Writing – original draft, Methodology, Formal Analysis, Writing – review & editing. DC: Writing – review & editing, Writing – original draft, Software, Data curation, Methodology, Formal Analysis.

Funding

The author(s) declare that no financial support was received for the research, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that Generative AI was used in the creation of this manuscript. Basic language polishing was conducted using the generative AI tool ChatGPT-4.0.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1

Blackman A. Li Z. Liu A. A. (2018). Efficacy of command-and-control and market-based environmental regulation in developing countries. Annu. Rev. Res. Econ.10, 381–404. doi: 10.1146/annurev-resource-100517-023144

2

Chen Y. Zhang H. Pei L. (2025). The development trend of China’s marine economy: A predictive analysis based on industry level. Front. Mar. Sci.12. doi: 10.3389/fmars.2025.1544612

3

Cheng Z. Li L. Liu J. (2018). Industrial structure, technical progress and carbon intensity in China’s provinces. Renewable Sustain. Energy Rev.81, 2935–2946. doi: 10.1016/j.rser.2017.06.103

4

Colgan C. S. (2013). The ocean economy of the United States: Measurement, distribution, & trends. Ocean Coast. Manage.71, 334–343. doi: 10.1016/j.ocecoaman.2012.08.018

5

Cui S. Wang Y. Zhu Z. Zhu Z. Yu C. (2022). The impact of heterogeneous environmental regulation on the energy eco-efficiency of China’s energy-mineral cities. J. Cleaner Prod.350, 131553. doi: 10.1016/j.jclepro.2022.131553

6

Destek M. A. Özkan O. Tiwari S. (2025). Market-based and non-market-based policies: A quantile approach to environmental technology innovation in G-7 countries. Techn. Forecasting Soc. Change217, 124173. doi: 10.1016/j.techfore.2025.124173

7

Ding Y. Tabeta S. (2024). A comprehensive index for assessing the sustainable blue economy: A Japanese application. Ocean Coast. Manage.258, 107401. doi: 10.1016/j.ocecoaman.2024.107401

8

Du K. Cheng Y. Yao X. (2021). Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ.98, 105247. doi: 10.1016/j.eneco.2021.105247

9

Hansen B. E. (2000). Sample splitting and threshold estimation. Econometrica68, 575–603. doi: 10.1111/1468-0262.00124

10

He Y. Zheng H. (2023). How does environmental regulation affect industrial structure upgrading? Evidence from prefecture-level cities in China. J. Environ. Manage.331, 117267. doi: 10.1016/j.jenvman.2023.117267

11

Hu H. Cao H. Zhang L. Ma Y. Wu S. (2020). Effects of heterogeneous environmental regulation on the control of water pollution discharge. Desalination Water Treat205, 208–213. doi: 10.5004/dwt.2020.26349

12

Li M. Gao X. (2022). Implementation of enterprises’ green technology innovation under market-based environmental regulation: An evolutionary game approach. J. Environ. Manage.308, 114570. doi: 10.1016/j.jenvman.2022.114570

13

Li J. Huang J. Li B. (2024). Do command-and-control environmental regulations realize the win-win of “pollution reduction” and “efficiency improvement” for enterprises? Evidence from China. Sustain. Dev.32, 3271–3292. doi: 10.1002/sd.2842

14

Li F. Xing W. Su M. Xu J. (2021). The evolution of China’s marine economic policy and the labor productivity growth momentum of marine economy and its three economic industries. Mar. Policy134, 104777. doi: 10.1016/j.marpol.2021.104777

15

Liu X. Chen S. (2022). Has environmental regulation facilitated the green transformation of the marine industry? Mar. Policy144, 105238. doi: 10.1016/j.marpol.2022.105238

16

Liu Y. Guo M. (2023). The impact of FDI on haze pollution: “Pollution paradise” or “pollution halo?”–Spatial analysis of PM2.5 concentration raster data in 283 cities. Front. Environ. Sci.11. doi: 10.3389/fenvs.2023.1133178

17

Liu L. Jiang J. Bian J. Liu Y. Lin G. Yin Y. (2021). Are environmental regulations holding back industrial growth? Evidence from China. J. Cleaner Prod.306, 127007. doi: 10.1016/j.jclepro.2021.127007

18

Liu W. Tong J. Yue X. (2016). ). How does environmental regulation affect industrial transformation? A study based on the methodology of policy simulation. Math. Problems Eng.2016, 2405624. doi: 10.1155/2016/2405624

19

Liu B. Xu M. Wang J. Xie S. (2017). Regional disparities in China’s marine economy. Mar. Policy82, 1–7. doi: 10.1016/j.marpol.2017.04.015

20

Papageorgiou M. (2016). Coastal and marine tourism: A challenging factor in Marine Spatial Planning. Ocean Coast. Manage.129, 44–48. doi: 10.1016/j.ocecoaman.2016.05.006

21

Qi Y. Zhang J. Chen J. (2023). Tax incentives, environmental regulation and firms’ emission reduction strategies: Evidence from China. J. Environ. Econ. Manage.117, 102750. doi: 10.1016/j.jeem.2022.102750

22

Ren W. Ji J. (2021). How do environmental regulation and technological innovation affect the sustainable development of marine economy: New evidence from China’s coastal provinces and cities. Mar. Policy128, 104468. doi: 10.1016/j.marpol.2021.104468

23

Shao W. Yin Y. Bai X. Taghizadeh-Hesary F. (2021). Analysis of the upgrading effect of the industrial structure of environmental regulation: evidence from 113 cities in China. Front. Environ. Sci.9. doi: 10.3389/fenvs.2021.692478

24

Shen T. Li D. Jin Y. Li J. (2022). Impact of environmental regulation on efficiency of green innovation in China. Atmosphere13(5), 767. doi: 10.3390/atmos13050767

25

Shi Y. Li Y. (2022). An evolutionary game analysis on green technological innovation of new energy enterprises under the heterogeneous environmental regulation perspective. Sustainability14(10), 6340. doi: 10.3390/su14106340

26

Song Y. Zhang X. Zhang M. (2021). The influence of environmental regulation on industrial structure upgrading: Based on the strategic interaction behavior of environmental regulation among local governments. Techn. Forecasting Soc. Change170, 120930. doi: 10.1016/j.techfore.2021.120930

27

Sun Z. Wang X. Liang C. Cao F. Wang L. (2021a). The impact of heterogeneous environmental regulation on innovation of high-tech enterprises in China: Mediating and interaction effect. Environ. Sci. Pollut. Res.28, 8323–8336. doi: 10.1007/s11356-020-11225-w

28

Sun Z. Wang X. Liang C. Cao F. Wang L. (2021b). The impact of heterogeneous environmental regulation on innovation of high-tech enterprises in China: Mediating and interaction effect. Environ. Sci. Pollut. Res.28, 8323–8336. doi: 10.1007/s11356-020-11225-w

29

Sun J. Zhai N. Miao J. Mu H. Li W. (2023). How do heterogeneous environmental regulations affect the sustainable development of marine green economy? Empirical evidence from China’s coastal areas. Ocean Coast. Manage.232, 106448. doi: 10.1016/j.ocecoaman.2022.106448

30

Wang Y. Shen N. (2016). Environmental regulation and environmental productivity: The case of China. Renew. Sustain. Energy Rev.62, 758–766. doi: 10.1016/j.rser.2016.05.048

31

Wang L. Wang Z. Ma Y. (2022). Heterogeneous environmental regulation and industrial structure upgrading: Evidence from China. Environ. Sci. Pollut. Res.29, 13369–13385. doi: 10.1007/s11356-021-16591-7

32

Ye F. He Y. Yi Y. Quan Y. Deng Y. (2022). Promotion of environmental regulation on the decoupling of marine economic growth from marine environmental pollution—Based on interprovincial data in China. J. Environ. Plann. Manage.65, 1456–1482. doi: 10.1080/09640568.2021.1932771

33

Yi M. Fang X. Wen L. Guang F. Zhang Y. (2019). The heterogeneous effects of different environmental policy instruments on green technology innovation. Int. J. Environ. Res. Public Health16(23), 4660. doi: 10.3390/ijerph16234660

34

Yin K. Miao Y. Huang C. (2024). Environmental regulation, technological innovation, and industrial structure upgrading. Energy Environ.35, 207–227. doi: 10.1177/0958305X221125645

35

Yu L. Guo Z. Ji J. (2024). Environmental regulation and marine economic resilience: An institutional synergy perspective. Mar. pollut. Bull.205, 116643. doi: 10.1016/j.marpolbul.2024.116643

36

Yu X. Wang P. (2021). Economic effects analysis of environmental regulation policy in the process of industrial structure upgrading: Evidence from Chinese provincial panel data. Sci. Total Environ.753, 142004. doi: 10.1016/j.scitotenv.2020.142004

37

Yuan H. Zhu C. (2018). Have national high-tech zones promoted the transformation and upgrading of China’s industrial structure? China Ind. Economics08), 60–77. doi: 10.19581/j.cnki.ciejournal.2018.08.004

38

Yusheng C. Sun Z. Zhou Y. Yang W. Ma Y. (2024). Can the regulation of the coastal environment facilitate the green and sustainable development of the marine economy? Ocean Coast. Manage.254, 107203. doi: 10.1016/j.ocecoaman.2024.107203

39

Zeng G. Liu T. (2023). Analysis on spatial effect of environmental regulation on upgrading of industrial structure in China. Environ. Sci. pollut. Res.30, 55485–55497. doi: 10.1007/s11356-023-26186-z

40

Zhang G. Zhang P. Deng N. Bao H. Li J. (2019a). Spatial effect of environmental regulation measures on industrial structure upgrading from the empirical analysis of Beijing-Tianjin-Hebei region and its surrounding areas. Chin. J. Pop. Resour. Environ.17, 267–277. doi: 10.1080/10042857.2019.1656046

41

Zhang G. Zhang P. Zhang Z. G. Li J. (2019b). Impact of environmental regulations on industrial structure upgrading: An empirical study on Beijing-Tianjin-Hebei region in China. J. Cleaner Prod.238, 117848. doi: 10.1016/j.jclepro.2019.117848

42

Zhu H. Fang H. Hua F. Shao W. Cai P. (2024). The impact of environmental regulations on the upgrading of the industrial structure: Evidence from China. Heliyon10(5), e27091. doi: 10.1016/j.heliyon.2024.e27091

43

Zhu X. Zuo X. Li H. (2021). The dual effects of heterogeneous environmental regulation on the technological innovation of Chinese steel enterprises—Based on a high-dimensional fixed effects model. Ecol. Econ.188, 107113. doi: 10.1016/j.ecolecon.2021.107113

Summary

Keywords

marine economy, environmental regulation, industrial upgrading, threshold effect, policy, interaction

Citation

Liu L, Wang H and Cai D (2025) Environmental regulation and the upgrading of marine industries: evidence from China’s coastal provinces. Front. Mar. Sci. 12:1656530. doi: 10.3389/fmars.2025.1656530

Received

30 June 2025

Accepted

29 August 2025

Published

17 September 2025

Volume

12 - 2025

Edited by

Xuemei Li, Ocean University of China, China

Reviewed by

Yi-Che Shih, National Cheng Kung University, Taiwan

Mengqi Ding, China Agricultural University, China

Updates

Copyright

© 2025 Liu, Wang and Cai.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lu Liu, liulu11161@163.com

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.