Abstract

The adoption of green fuels in the shipping industry serves as a primary means to reduce carbon emissions. However, its widespread implementation faces coordination challenges among government, port, and marine fuel supplier. This paper develops a marine fuel supply chain model comprising government, port, marine green and conventional fuel suppliers, comparatively analyzing the decision-making effects of various entities in the marine fuel supply chain under non-cooperative fuel suppliers without government participation, cooperative fuel suppliers without government participation, non-cooperative fuel suppliers with government participation, and cooperative fuel suppliers with government participation four different models. The paper primarily examines key performance indicators including government expenditure, port profit, and the aggregate profits of the two marine fuel suppliers. The findings demonstrate that: carbon tax can effectively boost the sales of green marine fuel, marine fuel suppliers collaboration significantly reduces government expenditure; and increased substitutability between green and conventional marine fuels leads to rising trends in government expenditure, port profit, and total marine fuel supplier profit.

1 Introduction

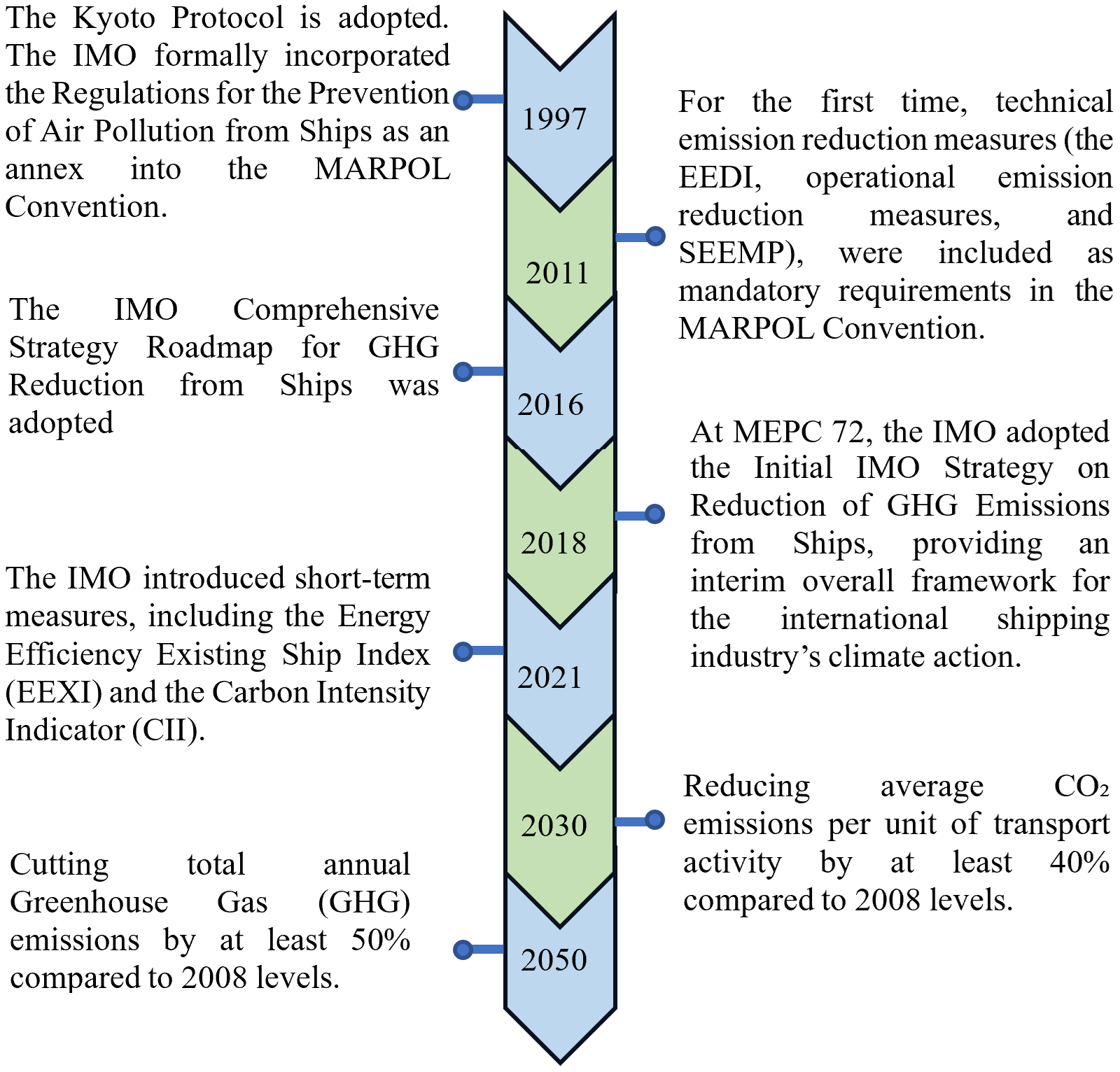

Global shipping serves as a critical pillar of international trade, facilitating approximately 80% of global merchandise transport (Xu et al., 2025a; Zhu et al., 2025). However, its environmental externalities have become increasingly pronounced. According to International Maritime Organization data, the sector emits 1 billion tuns of carbon annually, accounting for 3% of global greenhouse gas emissions (Zou et al., 2025). The World Bank warns that without effective mitigation measures, maritime emissions could increase by 50-250% by 2050, severely jeopardizing the Paris Agreement’s 1.5°C warming limit (Li et al., 2023a; Gan et al., 2025a). In response, the international community is accelerating maritime decarbonization. International Energy Agency projections indicate that zero-carbon fuels must constitute 15% of marine energy use by 2030 to achieve net-zero emissions by 2050 (Parris et al., 2024). The timeline of IMO’s carbon emission reduction strategy is shown in Figure 1.

Figure 1

IMO carbon reduction strategy development timeline.

The maritime industry is witnessing a paradigm shift in fuel diversification, driven by decarbonization imperatives (Wang et al., 2025; Xie and Zhou, 2025). Among transitional alternatives, liquefied natural gas (LNG) has achieved the most extensive commercialization to date, owing to its established bunkering infrastructure. However, as a hydrocarbon fuel, LNG demonstrates limited environmental efficacy, providing merely 20-30% lifecycle carbon emission reductions relative to conventional marine fuels (McKinlay et al., 2021; Duan et al., 2025). In the pursuit of genuine carbon neutrality, hydrogen, ammonia, and battery-electric systems have emerged as technologically viable pathways. Hydrogen fuel cell technology has reached operational maturity in short-sea applications. Nevertheless, scalability constraints persist, particularly concerning volumetric energy density and the nascent state of hydrogen distribution networks. Ammonia presents compelling advantages for deep-sea decarbonization, combining favorable energy density with manageable storage parameters (Evrin and Dincer, 2019). However, its adoption is complicated by toxicity concerns and suboptimal combustion characteristics, exhibiting 10–15% lower thermal efficiency than marine diesel (Xu et al., 2025b). Green methanol has gained prominence due to its exceptional environmental performance, delivering 75-85% lower lifecycle carbon intensity versus conventional fuels while virtually eliminating sulfur emissions (99% reduction) and substantially mitigating nitrogen oxides (80% reduction) (Zamboni et al., 2024; Gan et al., 2025b). This synthetic fuel further benefits from practical handling advantages as a room-temperature liquid, presenting a compelling balance between sustainability and operational feasibility.

The energy transition in maritime shipping will exhibit protracted transitional characteristics, with emerging green fuels and conventional marine fuels likely to coexist and compete for an extended period. According to International Energy Agency projections, this competitive landscape may persist until 2040 or beyond, fundamentally attributable to the gradual maturation of technologies, cost competitiveness, infrastructure development, and policy implementation (Park and Choi, 2025). The international regulatory framework is accelerating this transition process. Policy instruments such as the International Maritime Organization’s Carbon Intensity Indicator and the European Union’s Emissions Trading System are progressively driving the adoption of cleaner energy solutions through increasingly stringent environmental standards (Xiao et al., 2025). However, it is noteworthy that these policies generally adopt phased implementation strategies (e.g., IMO’s 40% emission reduction target by 2030), which inherently provide a transitional buffer for conventional fuels. Within this context, conventional fuels continue to maintain regulatory compliance during the transition period through various mitigation approaches, including biofuel blending, carbon capture, utilization, and storage retrofits, and switching to lower-carbon alternatives such as LNG. Moreover, regional disparities in policy enforcement further decelerate the phase-out of conventional fuels (Shi et al., 2018). The stringent zero-emission vessel mandates implemented in Nordic countries stand in stark contrast to the relatively lenient regulatory standards in some developing economies. This regional policy divergence, coupled with the incremental improvement in techno-economic viability, has fostered a dynamic competitive equilibrium between green and conventional fuels—a seesaw battle shaped by evolving regulatory frameworks (Xu and Chen, 2025). The transition pathway is consequently characterized by gradual displacement rather than abrupt substitution, with the pace of change contingent upon localized regulatory pressures and technological advancements.

Therefore, an in-depth investigation into the competitive dynamics between marine green and conventional fuels carries significant practical implications. This research not only provides scientific foundations for policymakers to formulate emission reduction strategies and optimize decarbonization pathways, but also enables shipping companies and fuel suppliers to develop more forward-looking business strategies, thereby mitigating investment risks during the transition period. The research framework of this paper is structured as follows: Section 1 elaborates on the research background and conducts a systematic literature review. Section 2 develops a tripartite decision-making model for marine fuel supply chains involving port, marine green and conventional fuel suppliers, and government, with particular focus on analyzing the game-theoretic interactions under horizontal integration scenarios among fuel suppliers. Section 3 performs numerical simulations and empirical analyses based on the established model. Finally, Section 4 synthesizes the key findings and proposes potential directions for future research.

2 Literature review

We focus on the decision-making optimization for government, port, and marine fuel supplier regarding the substitutability of green and conventional marine fuels in the marine fuel supply chain. Accordingly, this section reviews the following three categories of literature.

2.1 Comparison between green and conventional marine fuels

Adachi et al. (2014) conducted an economic comparison between LNG-fueled low-speed diesel engines and conventional fuels for container ships on the Asia-Europe route, demonstrating that LNG-powered vessels exhibit superior net present value and a shorter investment payback period over a 20-year timeframe. Hua et al. (2017) performed a life cycle assessment revealing that substituting heavy fuel oil with LNG in maritime transport leads to substantial reductions in SO2 (99.8%), PM10 (97.5%), and NOx (38–39%) emissions. However, the greenhouse gas mitigation effect remains limited due to methane slip. Percic et al. (2022) employed life cycle assessment and cost analysis to evaluate green ammonia fuel cells, finding an 84% reduction in carbon emissions compared to conventional diesel systems, albeit at higher costs. Blue ammonia fuel cells showed better cost-effectiveness but remained 27-43% more expensive than diesel alternatives. Lagemann et al. (2022) developed a dual-objective optimization model, identifying LNG as a viable transitional solution for near-term emission reductions, while ammonia emerges as a more suitable option for long-term decarbonization. Their study highlights the critical influence of carbon pricing and biofuel availability on optimal emission reduction pathways. Law et al. (2022) established a green fuel assessment framework for ships, ranking biodiesel highest in overall performance. Their analysis indicated hydrogen/ammonia fuel costs at 3–4 times conventional fuel prices, with electric vessels facing frequent energy replenishment challenges. Li et al. (2023b) systematically assessed the feasibility of LNG-fueled ships in the Yangtze River Basin through integrated economic and emission models, addressing the transformation needs of inland waterway transport. Zhang et al. (2023) proposed a two-stage optimization model incorporating navigation load characteristics and spatial constraints, comprehensively evaluating alternative fuels (hydrogen, ammonia, methanol, and natural gas) for large cruise ship applications. McKinlay et al. (2024) developed ship-type-specific energy technology models, including fuel cells, and successfully applied them to dynamic simulations of marine energy systems. Tu et al. (2024) employed marginal abatement cost methodology to construct an emission reduction assessment model for shipping. Their quantitative analysis revealed significant cost-benefit variations between energy efficiency technologies and alternative fuel adoption, emphasizing the substantial impact of fuel price volatility and carbon pricing mechanisms on emission reduction economics. Sagin et al. (2025) demonstrated that blending 10-30% biodiesel with marine diesel effectively reduces pollutant emissions, achieving NOx reductions of 11.2–27.1% and CO2 reductions of 5.3-19.5%, thereby validating biofuel blends as a feasible approach for improving shipping’s environmental performance.

2.2 The government’s role in green marine fuel

Wan et al. (2018) pioneered the development of the Strategic Regulatory Economic Technological Infrastructure evaluation model, employing an analytic hierarchy process (AHP) method to quantitatively assess the LNG-fueled vessel development levels across nations. Their empirical findings revealed Norway’s significant lead over the United States and China in LNG maritime applications. Mäkitie et al. (2022) conducted a comprehensive survey of 281 Norwegian shipowners, identifying a distinct adoption pattern: larger, more established operators tended to embrace alternative fuels to fulfill contractual obligations, while small and medium-sized enterprises demonstrated relatively slower transition rates. Through principal-agent theory analysis, Monios and Fedi (2023) attributed the EU’s LNG transition policy shortcomings to incentive misalignment within multi-level governance structures, resulting in policy instability. Their study advocates for more collaborative regulatory frameworks to facilitate future alternative fuel adoption, particularly hydrogen. Jeong and Yun (2023) employed stochastic model evaluation to demonstrate LNG’s superior economic viability compared to conventional low-sulfur oil under carbon pricing mechanisms, while highlighting ammonia’s dependence on supplementary policies due to cost barriers and technological uncertainties. Carlisle et al. (2024) adopted a mixed-methods approach to investigate UK public perceptions of marine alternative fuels, revealing strongest support for biofuels and hydrogen, neutral acceptance of LNG, and marked opposition to ammonia-based solutions. Inal (2024) critically examined current international standards, noting their predominant LNG focus and inadequate coverage of hydrogen’s unique safety considerations, particularly concerning cryogenic storage and flammability risks. Latapí et al. (2024) utilized the TIMES-NEU model to demonstrate that phased carbon and fossil fuel taxation could enable complete methanol transition by 2040, while emphasizing the necessity of mandatory bans to achieve full ammonia adoption by 2050. Wang et al. (2024) evaluated China’s maritime safety management system for alternative fuel vessels, acknowledging the effectiveness of the existing “legislation-policy-industry standards” tripartite framework while identifying needs for enhanced regulatory mechanisms and international cooperation. Cao et al. (2025) demonstrated that optimized vessel design parameters combined with green hydrogen utilization could achieve cost parity with conventional shipping solutions. Barone et al. (2025) employed dynamic energy simulation tools to advocate for government-led initiatives promoting fossil-to-bio methanol/LNG conversion through tax incentives and multi-generation system design. Kumar et al. (2025) conducted Baltic Sea emission simulations, confirming LNG’s 99% particulate matter reduction capability while highlighting persistent methane slip issues requiring targeted policy interventions. Li et al. (2025) underscored governments’ pivotal role in establishing alternative marine fuel supply chains during shipping’s early decarbonization phase.

2.3 Collaboration on green marine fuel supply chain

Jiao and Wang (2021) employed game theory to compare two emission reduction strategies - shore power and low-sulfur oil. Their analysis revealed that carbon pricing thresholds critically determine shipping companies’ strategic preferences, with empirical validation conducted using Shenzhen Port as a case study. Shang et al. (2024) examined the optimization effects of government subsidies on green shipping supply chains from the perspective of shippers’ environmental preferences. Their findings demonstrated that shipper-targeted subsidy policies can substantially enhance shipping companies’ propensity to invest in alternative fuels. Through an investigation of digital transformation in shipping, Xue and Lai (2024) identified collaborative models between shipping firms and technology providers as key drivers for green innovation within the industry. Their research highlighted the synergistic potential of such partnerships in advancing sustainable maritime technologies. Fullonton et al. (2025) emphasized the necessity of multi-stakeholder collaboration among governments, enterprises, and supply chain actors to facilitate green ammonia adoption in shipping. Their study outlined three critical intervention areas: infrastructure investment, technical standardization, and incentive policy design, proposing these as essential components for mitigating market risks and achieving industry-wide coordination. Zhang et al. (2025) demonstrated that shipper-targeted subsidy models yield the most pronounced corporate social responsibility (CSR) investment effects in shipping companies. Their analysis revealed that moderate CSR investments can simultaneously enhance both economic performance and environmental outcomes within shipping supply chains.

The current literature exhibits several significant limitations in examining the interplay between green and conventional marine fuels and their respective roles within supply chains. First, while numerous studies (e.g., Adachi et al., 2014; Hua et al., 2017) have evaluated the economic or environmental merits of individual fuel types, they fail to provide a systematic analysis of fuel substitution dynamics. This oversight neglects the competitive and complementary relationships between alternative energy sources in maritime applications. Second, although some scholars (e.g., Jeong and Yun, 2023) have investigated policy instruments’ influence, their analyses inadequately address how demand-side factors—such as shipper preferences or charterer requirements—moderate fuel substitution patterns. This represents a critical blind spot, as end-user behavior fundamentally shapes adoption pathways. Third, discussions of supply chain collaboration (e.g., Fullonton et al., 2025) remain largely theoretical, lacking operational models to capture the strategic interactions among key stakeholders—particularly the tripartite game-theoretic relationships between marine fuel suppliers, ports, and government. To address these gaps, this paper constructs a marine fuel supply chain game-theoretic model incorporating the elasticity of marine fuel substitution. By optimizing the marine fuel supply chain based on demand substitution characteristics, it enables government to design differentiated carbon tax-subsidy schemes and guides port and marine fuel suppliers in formulating more forward-looking fuel investment strategies.

3 Model construction

3.1 Problem description

We constructed a three-level marine fuel supply chain optimization model consisting of government, port, and marine fuel suppliers. In this model, the roles and decision-making order of each subject are as follows: the government, as the top-level decision-maker, is responsible for formulating carbon tax and green fuel subsidy; As an intermediate link, marine fuel suppliers focus on the production and supply of green and conventional fuels, while ports act as bottom tier executors responsible for the sales of green and conventional fuels for ships. The Stackelberg game framework is used for decision-making interaction among various entities, and the decision-making order follows the hierarchical structure of government →marine fuel suppliers → port. Based on this model framework, we propose the following basic assumptions:

-

Single-type green fuel consideration.

-

Perfect rationality of all decision-making entities.

-

Complete information symmetry among stakeholders.

The parameters, variables, and corresponding descriptions are shown below.

Parameter.

: Demand for conventional marine fuel.

: Demand for green marine fuel.

: The profit of the port.

: The profit of the marine fuel supplier.

: The expenditure of government.

: Production cost of conventional marine fuel.

: Production cost of green marine fuel.

: Carbon emissions per unit of conventional fuel.

: Port carbon emission cap.

T: Non-cooperative marine fuel suppliers without government participation.

H: Cooperative marine fuel suppliers without government participation.

GT: Non-cooperative marine fuel suppliers with government participation.

GH: Cooperative marine fuel suppliers with government participation.

Variable.

: Retail price of conventional marine fuel.

: Retail price of green marine fuel.

: Wholesale price of conventional marine fuel.

: Wholesale price of green marine fuel.

: Per-unit subsidy for green marine fuel.

: Carbon tax rate per unit of emissions.

3.2 Non-cooperative model

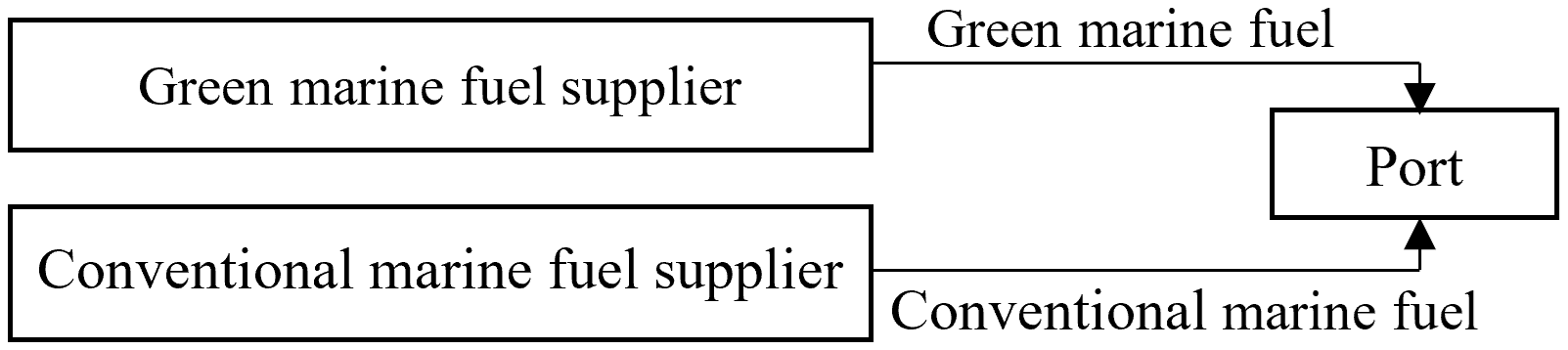

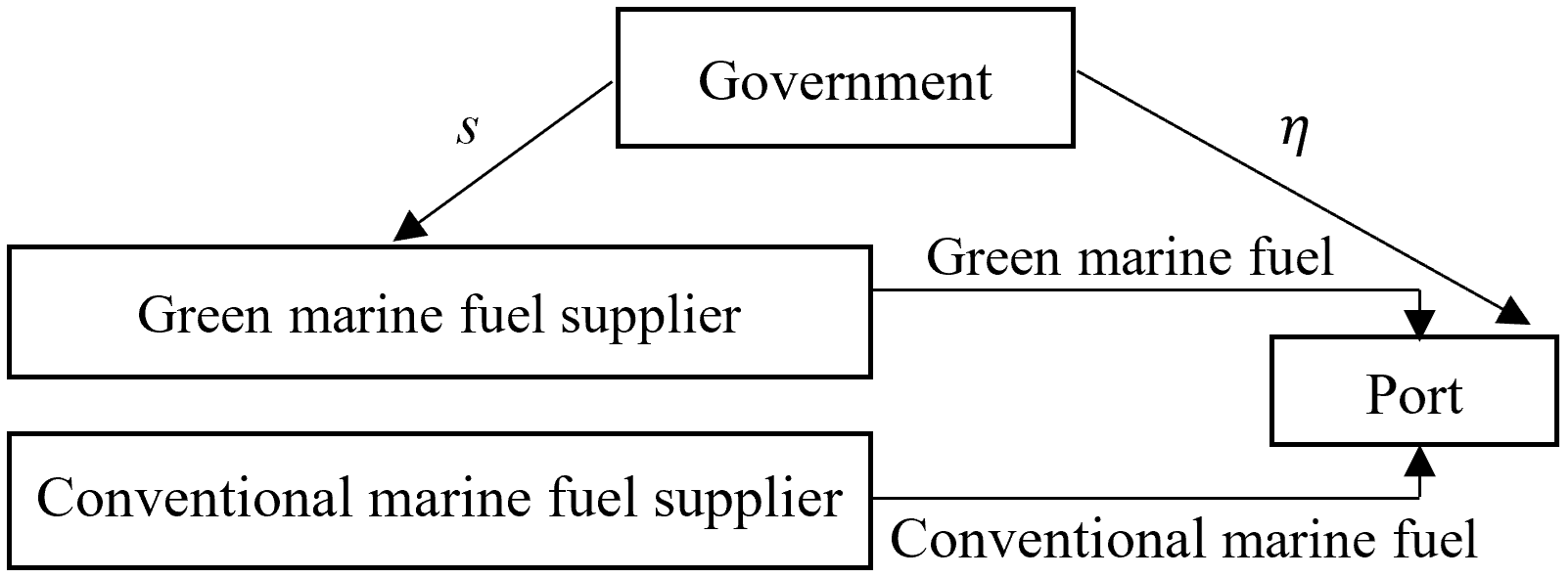

The three-level marine fuel supply chain consisting of the government, port, and marine fuel suppliers is illustrated in Figure 2.

Figure 2

Marine fuel supply chain without government participation.

There exists a competitive relationship between marine conventional and green fuels. The demand for conventional fuel is inversely proportional to its own retail price but positively correlated with the price of green fuel. Similarly, the demand for green fuel follows the same pattern, exhibiting an inverse relationship with its own price and a positive relationship with conventional fuel prices. The specific calculation formulas of demands for marine conventional and green fuels are shown in Equations 1 and 2.

and denote the market scales of conventional marine fuel and green marine fuel respectively; and represent the price sensitivity coefficients of each fuel’s own demand; while indicates the cross-price elasticity coefficient between the two fuels’ demands. The port profit is calculated as shown in Equation 3.

represents the sales revenue from conventional marine fuel, while denotes the sales revenue from green marine fuel. indicates the unused carbon emission allowance after port operations, which can be sold externally with representing the corresponding sales income. By solving the first-order conditions and , the optimal solutions for and can be derived, as specified in Equations 4 and 5.

The profits of marine fuel suppliers originate from their wholesale operations. Specifically, the profit function for conventional fuel supplier is formulated in Equation 6a, while that for green fuel supplier is presented in Equation 6b.

The optimal solutions for and can be derived by solving the first-order conditions and , as specified in Equations 7 and 8 respectively.

By substituting Equations 7 and 8 into Equations 4 and 5, the optimal solutions for and can be obtained, as presented in Equations 9 and 10.

Based on , , , and , the values of , , and can be determined.

3.3 Cooperative model

Under the cooperative model between conventional and green marine fuel suppliers, the port profit function remains consistent with Equation 3 while the fuel pricing satisfies and . The profit calculation for the joint fuel supplier consortium is given by Equation 11.

The optimal solutions for and can be derived by solving the first-order conditions and , as specified in Equations 12 and 13 respectively.

The retail prices of conventional and green marine fuels under full cooperation model, and , can be obtained by substituting Equations 12 and 13 into Equations 4 and 5, with the detailed solutions shown in Equations 14 and 15 respectively.

Theorem 1. For any cooperative structure of marine fuel suppliers (either cooperative or non-cooperative), the carbon tax promotes the demand for green marine fuel while simultaneously suppressing the demand for conventional marine fuel.

Proof. Based on the demand functions (1) and (2), for conventional marine fuel, , and can be calculated. Therefore, the carbon tax has a negative inhibitory effect on the demand for conventional marine fuel. Similarly, for green marine fuel, it is evident that , and . Therefore, the government’s carbon tax policy has a positive incentive effect on the demand for green marine fuel.

Inspiration: The government’s imposition of carbon tax on conventional marine fuel can effectively promote the application of green marine fuel. Therefore, the government should increase the intensity of carbon tax collection and promote the development of carbon trading markets.

To systematically analyze the impact of cooperative modes between conventional and green marine fuel suppliers on supply chain profits, we establish the following benchmark parameters for numerical simulation: 40, 35, 6, 6, 5, 10, 20, 0.2, 50, 40. Based on this parameter configuration, we solve each entity’s profit maximization problem to derive equilibrium prices, demand quantities, and profit levels under different scenarios. The comprehensive computational results are summarized in Table 1.

Table 1

| Parameter | Non-cooperative | Cooperative |

|---|---|---|

| 45.69 | 89.70 | |

| 2126.76 | 2044.85 | |

| 10.31 | 8.00 | |

| 5.54 | 1.25 | |

| 13.44 | 19.86 | |

| 21.85 | 28.64 | |

| 29.58 | 32.80 | |

| 29.56 | 32.85 |

Calculation results under two models.

The calculation results in Table 1 show that while cooperation between marine fuel suppliers significantly increases their own profits, it has multiple impacts on the entire market: First, the cooperation leads to substantial increases in wholesale prices for both green and conventional marine fuels, which in turn push up retail prices and suppress market demand, particularly causing a 77.4% () plunge in green marine fuel demand; Second, port profit consequently decrease by 3.9% (); Finally, although total fuel consumption and carbon emissions are reduced, this mainly stems from demand contraction rather than optimization of the energy structure. These results indicate that while cooperation between marine fuel suppliers improves their own benefits, it may hinder the promotion of green marine fuel and weaken the effectiveness of carbon tax.

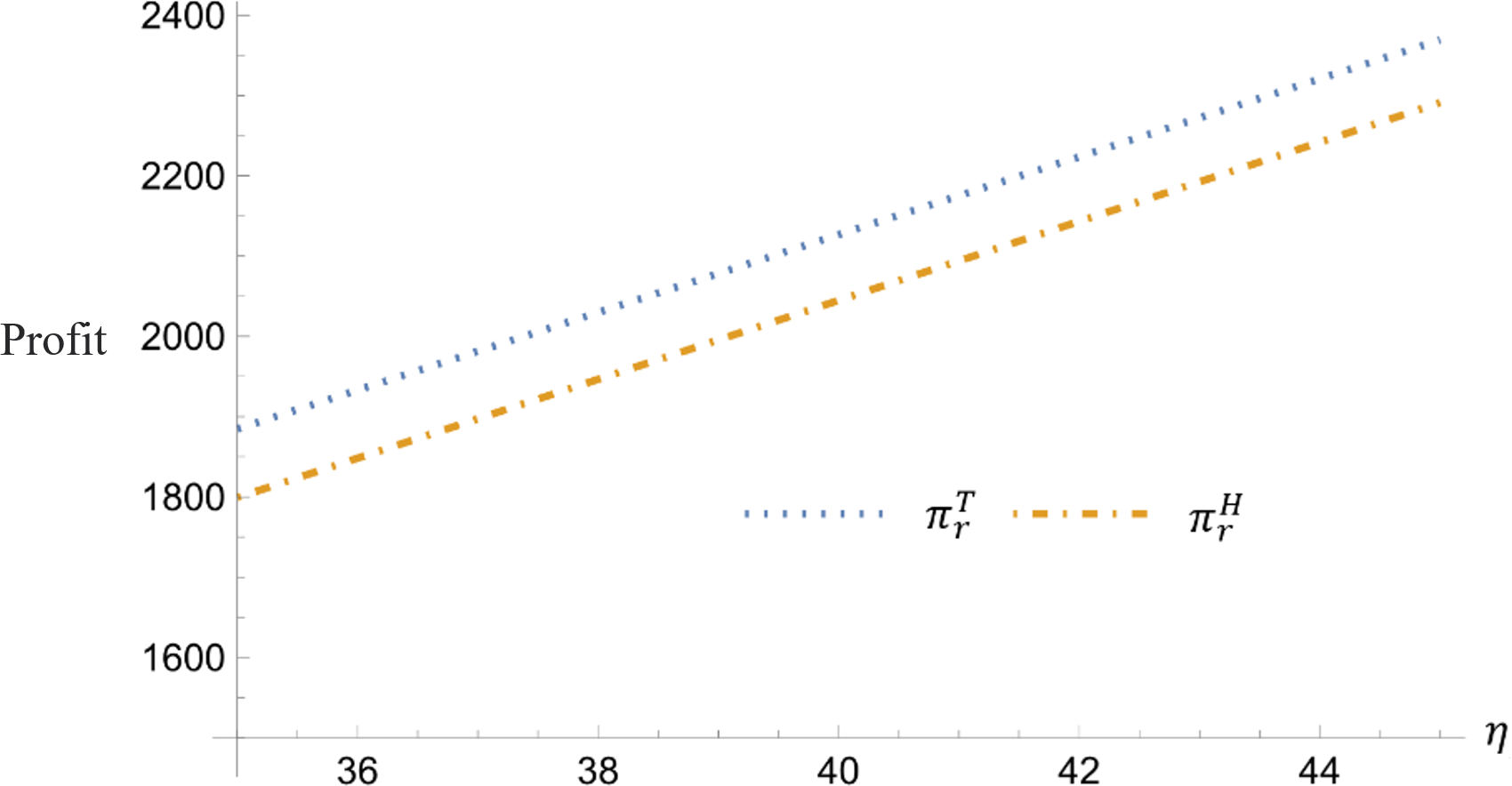

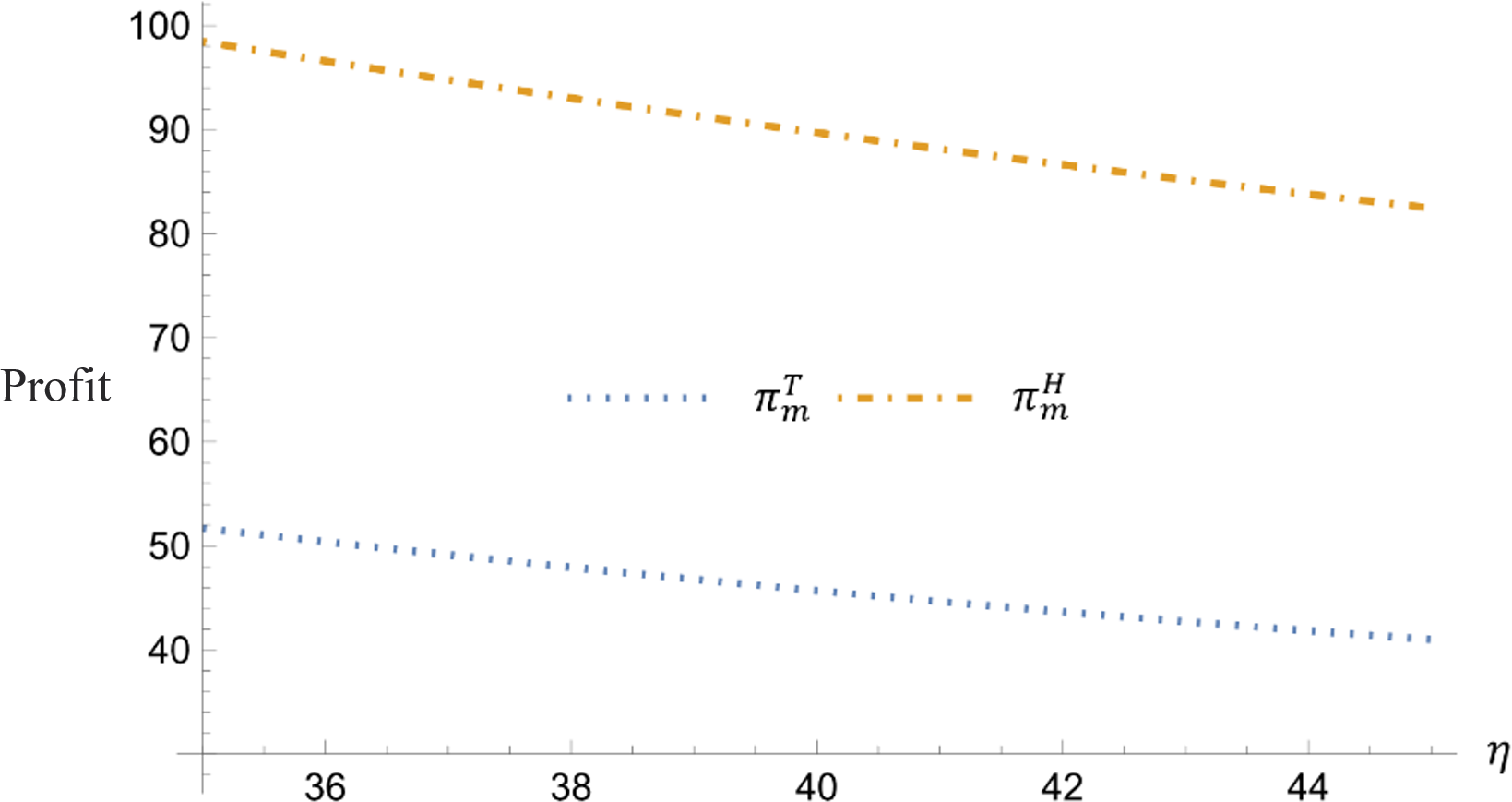

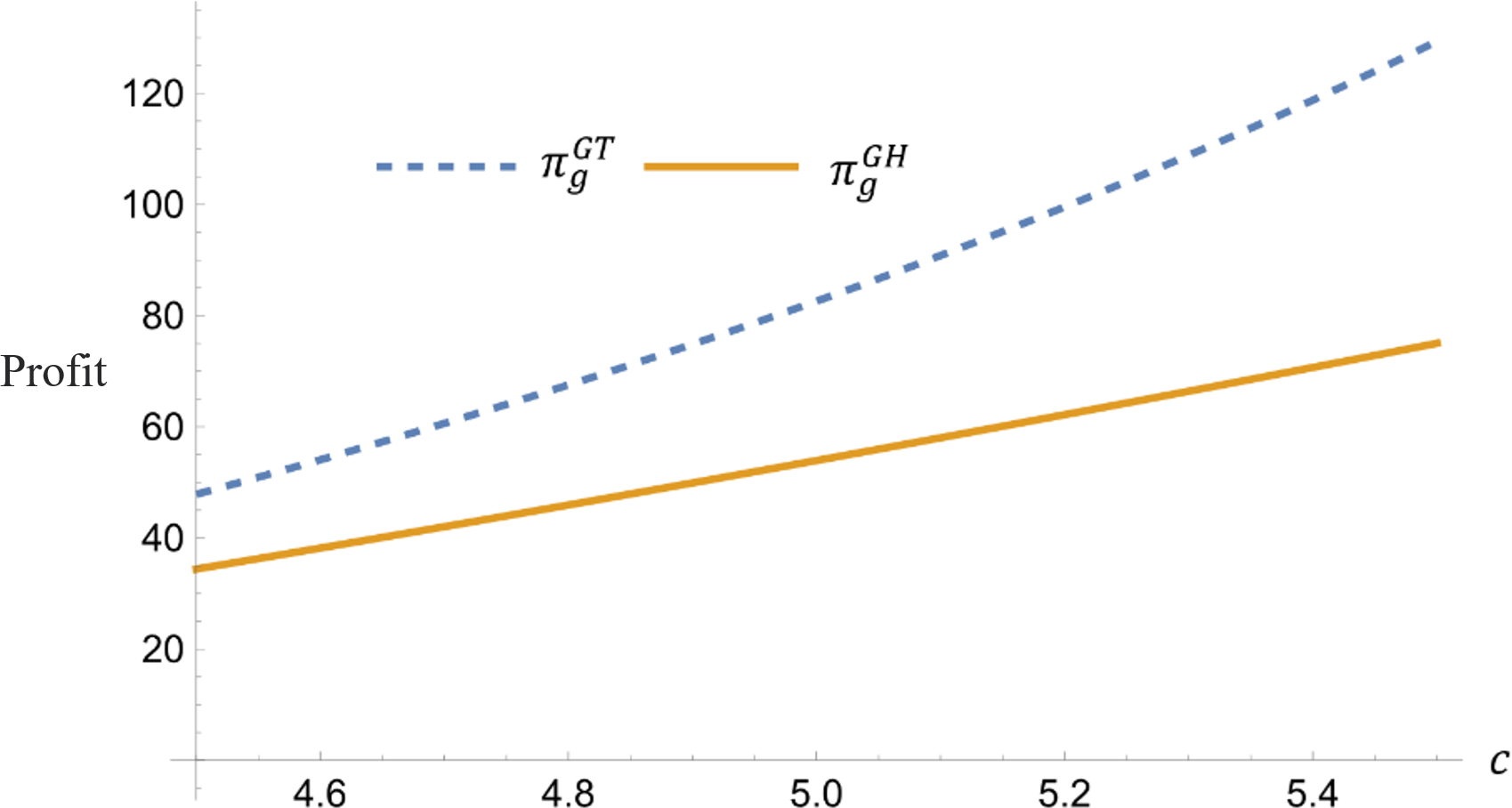

The carbon tax significantly impacts the profits of port and marine fuel suppliers. To thoroughly analyze the degree of influence of carbon tax rate changes on each entity’s profit, this section employs numerical simulation methods to examine the dynamic trends of port profits and marine fuel supplier profits under different carbon tax levels. The specific analytical results are presented in Figures 3 and 4.

Figure 3

Impact of variation on port profit.

Figure 4

Impact of variation on marine fuel supplier profit.

Figure 3 demonstrates a significant positive correlation between the carbon tax rate η and port profit. Under the marine fuel suppliers cooperation model, the sensitivity coefficient of port profit to the carbon tax is , while in the non-cooperation model, the coefficient is . These empirical results indicate that the implementation of carbon tax can effectively enhance port profit, and this conclusion remains robust across different market structures. The underlying mechanism primarily stems from the increased revenue effect of carbon emission rights trading. Model derivation shows that the first-order partial derivative of the sales revenue from port’s surplus carbon emission allowances , with respect to the carbon tax rate is . This mathematically confirms that higher carbon tax directly strengthen the port’s ability to generate income through carbon markets.

The numerical analysis reveals the carbon tax’s suppressive effect on marine fuel suppliers’ profits. As shown in Figure 4, the sensitivity analysis indicates that marine fuel suppliers’ total profits decrease significantly with rising carbon tax rates η, with a more pronounced negative impact under the cooperation model ()compared to the non-cooperation model (). This suppression effect mainly stems from two aspects: first, ports reduce conventional fuel purchases () to maximize carbon allowance trading revenue, directly harming conventional marine fuel suppliers’ interests; second, although carbon tax should theoretically boost green marine fuel demand, the substitution effect fails to fully offset the profit loss from declining conventional marine fuel sales due to green marine fuels’ higher costs.

4 Government participation

The three-level marine fuel supply chain comprising government, port, and marine fuel suppliers under government participation is illustrated in Figure 5.

Figure 5

Marine fuel supply chain with government participation.

To foster the development of the green marine fuel industry, governments typically implement industrial subsidy policies (Xu et al., 2025c). Within this policy context, the profit function for green marine fuel suppliers is calculated as shown in Equation 16.

The government aims to minimize total expenditures, which primarily consist of two components: environmental pollution costs and green marine fuel subsidies . Here, represents the environmental remediation costs associated with conventional marine fuel consumption, while denotes the government’s subsidy expenditures for the green marine fuel industry. Consequently, the government’s optimal decision-making problem can be formulated as the total expenditure minimization model shown in Equation 17. This model reflects the government’s balanced consideration between environmental management and fiscal expenditures, coordinating carbon tax and subsidy policies to control pollution costs while promoting green fuel development.

The analytical solutions for optimal subsidy and carbon tax are obtained by solving and , given in Equations 18 and 19.

The equilibrium conditions in Equations 18 and 19 yield the analytical solutions for optimal pricing: (Equation 20), (Equation 21), (Equation 22), and (Equation 23).

Under the cooperative mode of marine fuel suppliers, the joint profit function of conventional and green marine fuel suppliers can be represented by Equation 24.

The port profit function remains consistent with Equation 3, and the government expenditure function aligns with Equation 16. The computational results are as follows: , ,, , , .

Theorem 2. Under government participation, the optimal total government expenditure when marine fuel suppliers cooperate is strictly less than that under non-cooperative model.

Proof. Following the model derivation, the government expenditures under marine fuel suppliers non-cooperative () and cooperative () models can be obtained as shown in Equations 25 and 26, respectively.

The calculation yields the ratio between and as . This proves that the government expenditure under marine fuel suppliers’ cooperation is strictly lower than that under non-cooperation.

Inspiration: Collaboration between green and conventional marine fuel suppliers can reduce upstream competition in the marine fuel supply chain and decrease the sales volume of green and conventional marine fuels (). As a result, government spending can be reduced. Therefore, the government should encourage green and conventional marine fuel suppliers to strengthen cooperation.

Based on the parameter settings in Section 3.3, this section conducts numerical simulations to analyze the impact of the substitute coefficient c between marine fuels on the profits of each supply chain entity. The comprehensive computational results are summarized in Table 2.

Table 2

| Parameter | Non-cooperative | Cooperative |

|---|---|---|

| 82.58 | 53.91 | |

| 43.84 | 106.87 | |

| 2213.16 | 1720.1 | |

| 9.73 | 6.35 | |

| 6.06 | 3.96 | |

| 13.24 | 20.53 | |

| 21.81 | 27.18 | |

| 29.66 | 32.46 | |

| 29.54 | 32.22 | |

| 0.21 | 2.92 | |

| 41.76 | 33.33 |

Calculation results under two models under government participation.

From Table 2, it can be seen that cooperation between marine fuel suppliers can reduce government expenditure and lead to an increase in subsidy for green marine fuel and a decrease in carbon tax. At the same time, the impact on the profits of marine fuel suppliers and port, as well as the demand, wholesale prices, and retail prices of green and conventional marine fuels, is the same as the government non participation model.

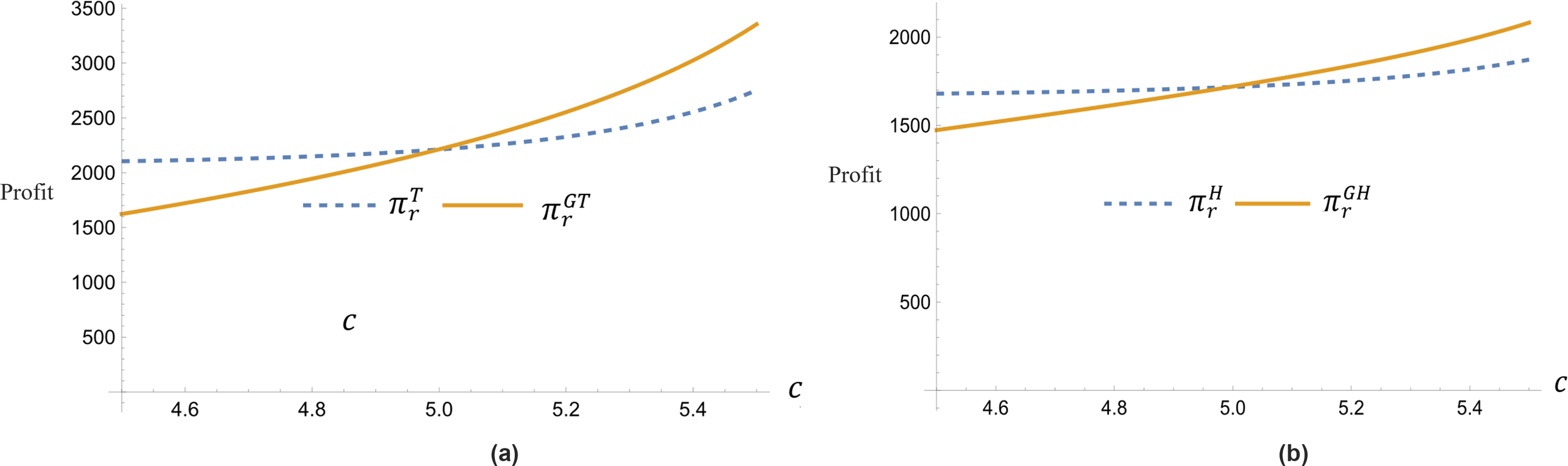

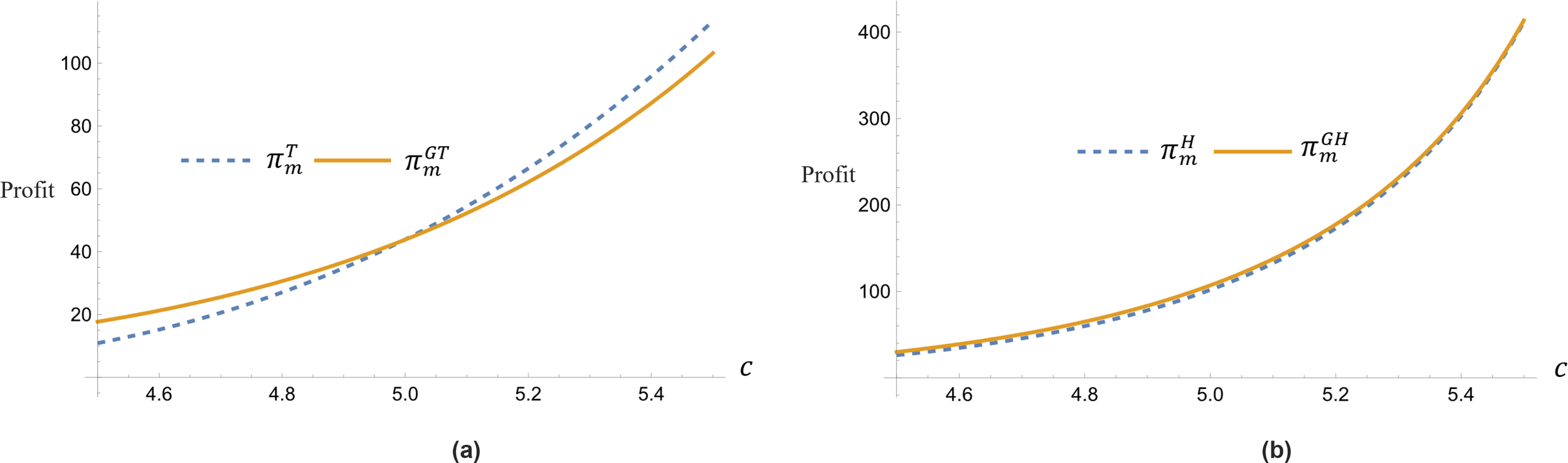

As shown in Figures 6, 7, 8, the government expenditure, marine fuel suppliers’ profits, and port profit all exhibit significant variation trends with changes in the substitute coefficient (c) between green and conventional marine fuels.

Figure 6

Impact of variation on government expenditure.

Figure 7

Impact of variation on port profit. (a)η = ηGT. (b)η = ηGH.

Figure 8

Impact of variation on marine fuel supplier profit. (a)η = ηGT. (b)η = ηGH.

Figure 6 demonstrates that government expenditure increases with enhanced substitutability between green and conventional marine fuels. This relationship stems from the positive correlation between the substitute coefficient c and both demand for conventional marine fuel and green marine fuel , as established in Equations 1 and 2.

The simulation results in Figure 5 reveal that government total expenditure shows a significant upward trend as the substitute coefficient between green and conventional marine fuels increases. This phenomenon can be theoretically explained through the demand functions (Equations 1, 2): since both conventional marine fuel demand and green fuel demand are positively correlated with the substitute coefficient , the government faces dual expenditure pressures - (1) rising environmental governance cost as increased directly elevates pollution cost , and (2) expanding subsidy scales as maintaining green marine fuel competitiveness requires increased expenditure.

The numerical simulations in Figures 7 and 8 demonstrate that an increase in the substitute coefficient c between marine fuels significantly enhances supply chain profits. As substitute coefficient c between green and conventional marine fuels improves, both port profit and marine fuel supplier profits growth across all four models. This phenomenon stems from dual mechanisms: (1) enhanced fuel substitutability expands market scales for both marine fuels through demand complementarity effects; (2) increased substitution elasticity provides port and marine fuel suppliers with greater decision-making flexibility to dynamically optimize fuel portfolios based on marginal revenue principles. Specifically, port can adjust sales structures to improve unit profit, while marine fuel suppliers optimize production allocation efficiency.

5 Conclusion

The adoption of green marine fuels demonstrates significant environmental and social benefits in reducing shipping emissions while profoundly impacting conventional marine fuel supply chain. This trend has garnered substantial attention from governments, shipping companies, ports, and marine fuel suppliers in major maritime nations. Currently, numerous governments have implemented policy measures including financial subsidies and tax incentives to support green marine fuel development. Major global ports are accelerating bunkering infrastructure construction - for instance, Shanghai Port has established a clear target to achieve 300,000 tons of green fuel supply capacity by 2030. However, the green marine fuel supply chain still faces multiple challenges, particularly insufficient cross-sector coordination, with notable mismatches between port bunkering infrastructure development timelines and fuel suppliers’ actual production capacities.

We develop a marine fuel supply chain model involving government, port, and marine fuel suppliers, with particular focus on analyzing the substitution effects between green and conventional marine fuels and the impacts of marine fuel supplier cooperation strategies on stakeholder decisions. The study yields three key findings: First, carbon tax effectively promotes green marine fuel adoption while suppressing conventional marine fuel demand, regardless of whether marine fuel suppliers adopt cooperative or competitive strategies. Second, cooperative behavior between conventional and green fuel suppliers significantly reduces total government expenditure. Third, enhanced substitutability between the green and conventional marine fuel leads to increased government expenditure, port profit, and marine fuel supplier profit. These findings provide theoretical foundations for formulating green marine fuel promotion policies.

This paper has several limitations that warrant improvement. First, the current model only considers three stakeholders (government, port, and marine fuel supplier), while shipping company as key demand-side player significantly influence marine fuel supply chain efficiency through their fuel consumption capacity. Future research should prioritize developing a four-party optimization model incorporating government, port, shipping company, and marine fuel supplier coordination. Second, the analysis does not differentiate between various green fuel types (e.g., green methanol vs. green hydrogen) and their techno-economic characteristics. Subsequent studies should investigate the differential impacts of multi type green marine fuel competition on marine fuel supply chain development.

Statements

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Author contributions

YJ: Formal Analysis, Writing – review & editing, Supervision. C-YX: Writing – original draft, Funding acquisition. JX: Methodology, Writing – original draft, Investigation.

Funding

The author(s) declare financial support was received for the research and/or publication of this article. We gratefully acknowledge the financial support from National Social Science Fund of China (no. 24BGL018). The host of this fund is C-YX (corresponding author).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1

Adachi M. Kosaka H. Fukuda T. Ohashi S. Harumi K. (2014). Economic analysis of trans-ocean LNG-fueled container ship. J. Of Mar. Sci. And Technol.19, 470–478. doi: 10.1007/s00773-014-0262-5

2

Barone G. Buonomano A. Del Papa G. Giuzio G. F. Maka R. Palombo A. et al . (2025). Steering shipping towards energy sustainability: alternative fuels in decarbonization policies. Energy.331, 136827. doi: 10.1016/j.energy.2025.136827

3

Cao N. N. D. Andrianov D. Vecchi A. Davis D. Brear M. J. (2025). Achieving affordable, clean shipping by integrating ship design and clean fuels. Transportation Res. Part D: Transport Environment.139, 104579. doi: 10.1016/j.trd.2024.104579

4

Carlisle D. P. Feetham P. M. Wright M. J. Teagle D. A. H. (2024). Public response to decarbonisation through alternative shipping fuels. Environ. Dev. Sustainability.26, 20737–20756. doi: 10.1007/s10668-023-03499-0

5

Duan K. P. Dong S. L. Fan Z. Zhang S. L. Shu Y. Q. Liu M. Q. (2025). Multimode trajectory tracking control of Unmanned Surface Vehicles based on LSTM assisted Model Predictive Control. Ocean Engineering.328, 121015. doi: 10.1016/j.oceaneng.2025.121015

6

Evrin R. A. Dincer I. (2019). Thermodynamic analysis and assessment of an integrated hydrogen fuel cell system for ships. Int. J. Hydrogen Energy.44, 6919–6928. doi: 10.1016/j.ijhydene.2019.01.097

7

Fullonton A. Lea-Langton A. R. Madugu F. Larkin A. (2025). Green ammonia adoption in shipping: Opportunities and challenges across the fuel supply chain. Mar. Policy171, 106444. doi: 10.1016/j.marpol.2024.106444

8

Gan L. X. Gao Z. Y. Zhang X. Y. Xu Y. Liu R. W. Xie C. et al . (2025a). Graph neural networks enabled accident causation prediction for maritime vessel traffic. Reliability Eng. System Safety.257, 110804. doi: 10.1016/j.ress.2025.110804

9

Gan L. X. Li X. Yan T. Song L. Xiao J. L. Shu Y. Q. (2025b). Intelligent ship path planning based on improved artificial potential field in narrow inland waterways. Ocean Engineering.317, 119928. doi: 10.1016/j.oceaneng.2024.119928

10

Hua J. Wu Y. Chen H. L. (2017). Alternative fuel for sustainable shipping across the Taiwan Strait. Transportation Res. Part D: Transport Environment.52, 254–276. doi: 10.1016/j.trd.2017.03.015

11

Inal O. B. (2024). Decarbonization of shipping: Hydrogen and fuel cells legislation in the maritime industry. Brodogradnja.75, 75205. doi: 10.21278/brod75205

12

Jeong H. Yun H. (2023). A stochastic approach for economic valuation of alternative fuels: The case of container ship investments. J. Cleaner Production.418, 138182. doi: 10.1016/j.jclepro.2023.138182

13

Jiao Y. Wang C. X. (2021). Shore power vs low sulfur fuel oil: pricing strategies of carriers and port in a transport chain. Int. J. Low-Carbon Technologies.16, 715–724. doi: 10.1093/ijlct/ctaa105

14

Kumar R. Salo K. Yao F. B. Maxime S. Laura R. V. Booge D. et al . (2025). Charting the course to cleaner shipping routes: emission inventory for Baltic Sea shipping and green fuel potential. Carbon Manage.16, 2523919. doi: 10.1080/17583004.2025.2523919

15

Lagemann B. Lindstad E. Fagerholt K. Rialland A. Erikstad S. O. (2022). Optimal ship lifetime fuel and power system selection. Transportation Res. Part D: Transport Environment.102, 103145. doi: 10.1016/j.trd.2021.103145

16

Latapí M. Davíosdóttir B. Cook D. Jóhannsdóttir L. Radoszynski A. M. Karlsson K. (2024). Hydrogen fuel cells in shipping: A policy case study of Denmark, Norway, and Sweden. Mar. Policy.163, 106109. doi: 10.1016/j.marpol.2024.106109

17

Law L. C. Mastorakos E. Evans S. (2022). Estimates of the decarbonization potential of alternative fuels for shipping as a function of vessel type, cargo, and voyage. Energies.15, 7468. doi: 10.3390/en15207468

18

Li W. W. Hu Z. L. Chen X. Q. (2025). Governmental functions in establishing alternative marine fuel supply chains in shipping decarbonization governance. Sustainability.17, 2808. doi: 10.3390/su17072808

19

Li Z. ,. W. Wang K. Liang H. Z. Wang Y. P. Ma R. Q. Cao J. L. et al . (2023a). Marine alternative fuels for shipping decarbonization: Technologies, applications and challenges. Energy Conversion Management.30, 39–60. doi: 10.2478/pomr-2023-0020

20

Li D. C. Yang H. L. Xing Y. W. (2023b). Economic and emission assessment of LNG-fuelled ships for inland waterway transportation. Ocean Coast. Management.246, 106906. doi: 10.1016/j.ocecoaman.2023.106906

21

Mäkitie T. Steen M. Saether E. A. Bjorgum O. Poulsen R. T. (2022). Norwegian ship-owners' adoption of alternative fuels. Energy Policy.163, 112869. doi: 10.1016/j.enpol.2022.112869

22

McKinlay C. J. Turnock S. R. Hudson D. A. (2021). Route to zero emission shipping: Hydrogen, ammonia or methanol? Int. J. Hydrogen Energy.46, 28282–28297. doi: 10.1016/j.ijhydene.2021.06.066

23

McKinlay C. J. Turnock S. R. Hudson D. A. Manias P. (2024). Hydrogen as a deep sea shipping fuel: Modelling the volume requirements. Int. J. Hydrogen Energy69, 863–873. doi: 10.1016/j.ijhydene.2024.05.054

24

Monios J. Fedi L. (2023). The principal-agent problem in hierarchical policy making: A failure of policy to support the transition to LNG as an alternative shipping fuel. Mar. Policy.157, 105846. doi: 10.1016/j.marpol.2023.105846

25

Park M. Choi W. (2025). Solid oxide fuel cell-internal combustion engine hybrid system for ships fueled by ammonia. Fuel.387, 134201. doi: 10.1016/j.fuel.2024.134201

26

Parris D. Spinthiropoulos K. Ragazou K. Giovou A. Tsanaktsidis C. (2024). Methanol, a plugin marine fuel for green house gas reduction-A review. Energies.17, 605. doi: 10.3390/en17030605

27

Percic M. Vladimir N. Jovanovic I. Korican M. (2022). Application of fuel cells with zero-carbon fuels in short-sea shipping. Appl. Energy.309, 118463. doi: 10.1016/j.apenergy.2021.118463

28

Sagin S. Haichenia O. Karianskyi S. Kuropyatnyk O. Razinkin R. Sagin A. et al . (2025). Improving green shipping by using alternative fuels in ship diesel engines. J. Mar. Sci. Engineering.13, 589. doi: 10.3390/jmse13030589

29

Shang T. Y. Wu H. Wang K. Yang D. Jiang C. M. Yang H. J. (2024). Would the shipping alliance promote or discourage green shipping investment? Transportation Res. Part D: Transport Environ.128, 104102. doi: 10.1016/j.trd.2024.104102

30

Shi W. M. Xiao Y. Chen Z. McLaughlin H. Li K. X. (2018). Evolution of green shipping research: themes and methods. Maritime Policy Management.45, 863–876. doi: 10.1080/03088839.2018.1489150

31

Tu H. Liu Z. Y. Zhang Y. F. (2024). Study on cost-effective performance of alternative fuels and energy efficiency measures for shipping decarbonization. J. Mar. Sci. Engineering.12, 743. doi: 10.3390/jmse12050743

32

Wan C. P. Yan X. P. Zhang D. Yang Z. L. (2018). A novel policy making aid model for the development of LNG fuelled ships. Transportation Res. Part A:Policy Practice.119, 29–44. doi: 10.1016/j.tra.2018.10.038

33

Wang T. Xiao G. Biancardo S. A. (2025). The impact of the 21st-Century Maritime Silk Road on sulfur dioxide emissions in Chinese ports: based on the difference-in-difference model. Front. Mar. Science.12. doi: 10.3389/fmars.2025.1608803

34

Wang Q. W. Zhang H. Xi S. T. (2024). China's law and policy framework for maritime safety regulation of alternative fuel ships in the decarbonization transition. Mar. Policy.163, 106142. doi: 10.1016/j.marpol.2024.106142

35

Xiao G. Caleb A. Wang T. Biancardo S. A. (2025). Evaluating the impact of ECA policy on sulfur emissions from the five busiest ports in America based on difference in difference model. Front. Mar. Science.12. doi: 10.3389/fmars.2025.1609261

36

Xie F. Zhou Z. (2025). Port green investment strategy under government subsidization and regulation policy. Front. Mar. Science.12. doi: 10.3389/fmars.2025.1661382

37

Xu L. Chen Y. (2025). Overview of sustainable maritime transport optimization and operations. Sustainability.17, 6460. doi: 10.3390/su17146460

38

Xu L. Li X. Yan R. Chen I. (2025a). How to support shore-to-ship electricity constructions: Tradeoff between government subsidy and port competition. Transportation Res. Part E: Logistics Transportation Review.201, 104258. doi: 10.1016/j.tre.2025.104258

39

Xu C. Y. Wang Y. Q. Yao D. L. Qiu S. Y. Li H. (2025c). Research on the coordination of a marine green fuel supply chain considering a cost-sharing contract and a revenue-sharing contract. Front. Mar. Science.12. doi: 10.3389/fmars.2025.1552136

40

Xu L. Wu J. Yan. R. Chen J. (2025b). Is international shipping in right direction towards carbon emissions control? Transport Policy.166, 189–201. doi: 10.1016/j.tranpol.2025.03.009

41

Xue Y. M. Lai K. H. (2024). Digital green shipping innovation: conception, adoption, and challenges. J. Global Inf. Management.32, 349929. doi: 10.4018/JGIM.349929

42

Zamboni G. Scamardella F. Gualeni P. Canepa E. (2024). Comparative analysis among different alternative fuels for ship propulsion in a well-to-wake perspective. Heliyon.10, e26016. doi: 10.1016/j.heliyon.2024.e26016

43

Zhang W. X. He Y. Wu N. Y. Zhang F. Z. Lu D. N. Liu Z. K. et al . (2023). Assessment of cruise ship decarbonization potential with alternative fuels based on MILP model and cabin space limitation. J. Cleaner Production.425, 138667. doi: 10.1016/j.jclepro.2023.138667

44

Zhang Y. G. Kuang H. B. Wan M. Zhang M. Li J. Z. (2025). Research on government subsidy strategy of green shipping supply chain considering corporate social responsibility. Res. Transportation Business Management.60, 101368. doi: 10.1016/j.rtbm.2025.101368

45

Zhu L. Q. Zhou R. Li X. J. Lu S. P. Liu J. P. (2025). Research on the optimization of collaborative decision making in shipping green fuel supply chains based on evolutionary game theory. Sustainability17, 5186. doi: 10.3390/su17115186

46

Zou Y. Xiao G. Li Q. Biancardo S. A. (2025). Intelligent maritime shipping: A bibliometric analysis of internet technologies and automated port infrastructure applications. J. Mar. Sci. Engineering.13, 979. doi: 10.3390/jmse13050979

Summary

Keywords

carbon tax, green marine fuel, substitution effects, government, marine fuel supply chain

Citation

Jiang Y, Xu C-y and Xu J (2025) Research on optimization of green marine fuel supply chain considering fuel substitution effects. Front. Mar. Sci. 12:1668875. doi: 10.3389/fmars.2025.1668875

Received

18 July 2025

Accepted

08 August 2025

Published

28 August 2025

Volume

12 - 2025

Edited by

Yaqing Shu, Liverpool John Moores University, United Kingdom

Reviewed by

Zhiyong Ji, Zhejiang Wanli University, China

Yunting Zhang, Shanghai University of International Business and Economics, China

Updates

Copyright

© 2025 Jiang, Xu and Xu.

This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chang-yan Xu, cyxu@shmtu.edu.cn

Disclaimer

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.