- Institute of Logistics Science and Engineering, Shanghai Maritime University, Shanghai, China

Two-sided marine freight platforms attract massive participation from shippers and carriers through efficient matching of shipping demand and capacity resources. While intensifying market competition has driven these platforms to prioritize greenness level alongside pricing strategies, adopting hybrid revenue models (e.g., commission rate and membership fees), their operational dynamics under network externality and multihoming effects remain underexplored. This paper establishes three platform scenarios (monopoly, competitive single-homing, and competitive multihoming) and investigates the optimization of green-pricing strategies. The results demonstrate that: A monopoly platform maximizes profit under low commission rates, whereas in competitive multihoming scenarios, one platform dominates by strategically sacrificing its rival’s profit; High freight rate consistently favors monopolistic platforms regardless of transaction frequency, while low freight rate enables Pareto optimality through single-homing on both sides; When shippers exhibit low sensitivity to greenness level and weak network externalities, competitive multihoming emerges as optimal. These findings provide actionable insights for platform differentiation, green-pricing governance, and sustainable competition in evolving digital freight markets. This study provides a decision-making framework for optimizing the operations of marine freight platforms in sustainable market environments.

1 Introduction

1.1 Background

As a pivotal link in logistics networks, marine platforms play a critical role in facilitating seamless transportation and optimizing supply chain operations (Tufano et al., 2023). Two-sided marine platforms connect shippers and carriers, acting as intermediaries that facilitate demand-supply matching through services like dynamic pricing, real-time tracking, and capacity management. Unlike traditional companies that focus on a single service, two-sided marine platforms offer a flexible marketplace where shippers can select from multiple carriers. Recent studies, such as those by Li et al. (2024) and Wang et al. (2023), highlight the increasing importance of these platforms in improving logistics efficiency and reducing market frictions, especially in the context of green-pricing strategies. Two-sided marine freight platforms such as Shipa Freight and Flexport have rapidly risen in their respective segments, forming a relatively mature market landscape. These two-sided marine freight platforms, by consolidating freight and capacity information across the country, are capable of efficiently matching shippers’ demands with carriers’ supplies in a short period (Guo et al., 2022). Despite the rapid development of two-sided marine freight platforms, they are also facing challenges such as intensifying homogenized competition and insufficient user stickiness (Deng et al., 2023; Wang et al., 2024). To address these challenges, shipping platform companies are actively exploring differentiated competitive strategies, with pricing strategies emerging as a core element of platform competition. Currently, marine freight platforms commonly adopt a commission-based fee model. To enhance user stickiness and platform revenue, some platforms have begun experimenting with differentiated pricing strategies such as membership systems. For instance, Flexport has introduced a membership system for freight forwarders, offering priority booking and customized logistics solutions to attract users; Freightos, on the other hand, has launched a subscription-based model for shippers, providing real-time freight rate comparisons and market analytics to improve user retention.

However, relying solely on pricing strategies and differentiated pricing mechanisms, such as membership fees and commission rates, cannot fully alleviate the competitive pressures faced by two-sided marine freight platforms. In this context, the level of greenness plays a vital role. Specifically, it measures the extent to which the platform itself promotes sustainability through actions such as incentivizing carriers to adopt eco-friendly technologies, offering low-carbon transportation options, and integrating green practices into platform operations. For instance, Flexport, as a two-sided marine platform, promotes the use of sustainable energy through its green logistics solutions, while Freightos offers low-carbon transportation options by providing real-time freight rate comparisons and market analytics. These examples emphasize the growing importance of both greenness and pricing strategies in shaping platform competitiveness. Therefore, the optimization of green-pricing strategies for two-sided marine freight platforms with network externality and multihoming effects has become a focal topic for both theoretical and practical attention.

1.2 Research questions

The pricing issue of two-sided marine freight platforms has become a focal point of research both domestically and internationally. Existing studies have provided significant theoretical support for understanding their pricing mechanisms, yet limitations remain: First, while previous studies have provided valuable theoretical insights, they often abstract away from certain practical characteristics of two-sided marine freight platforms, such as price elasticity, network externalities, and green service incentives. This study attempts to address these aspects through a stylized yet more application-oriented modeling approach. Second, the current literature predominantly focuses on technical issues such as route optimization, vehicle-cargo matching, and scheduling, with insufficient in-depth research on pricing strategies. Our work fills this void by systematically analyzing pricing strategies under different market scenarios. Lastly, while previous studies have identified important factors such as fee structure design, differentiated service strategies, platform subsidy mechanisms, and logistics service efforts, there is a lack of a systematic and integrated analysis that connects these elements with the greenness level and pricing strategies on two-sided marine freight platforms. This paper bridges that gap by integrating these factors into a unified framework to optimize pricing and greenness level decisions in complex market environments.

This paper constructs a two-sided marine platform that connects shippers and carriers, focusing on the optimization of green-pricing strategies for two-sided marine freight platforms with network externalities and multihoming effects. The main research questions addressed in this paper are as follows: (1) How does the platform’s commission rate affect the profits of the two-sided marine freight platform? (2) What is the impact of freight rate and the number of transactions on platform profits? (3) How do shippers’ sensitivity to greenness level and network externalities influence the greenness level and platform profits?

1.3 Main findings and contribution

This study examines the impact of different market competition and user attribution on the profitability of two-sided marine freight platforms. The main findings indicate that when the commission rate is low, the freight platform achieves maximum profit under monopoly conditions. Conversely, under multi-homing scenarios, one platform maximizes its profit at the expense of the other. Regardless of the number of transactions, when the single freight rate is high, the profit of the freight platform under monopoly conditions remains the highest. When the single freight rate is low, single-homing on both sides can achieve Pareto optimality. Additionally, when both the shipper’s sensitivity to greenness level and network externalities are low, the two-sided marine freight platform opts for a multihoming on one side only model.

The contributions of this paper are summarized as follows: First, this paper makes a significant theoretical contribution by applying the concept of green-pricing strategy optimization to the emerging field of two-sided marine freight platforms. While the existing literature has predominantly focused on platform construction and regulation, there has been limited research on how two-sided market dynamics and green-pricing strategies specifically intersect within the marine freight sector. By integrating two-sided market theory into our analysis, this study provides novel insights into the optimization of green-pricing strategies and addresses a gap in the literature. Second, the study goes beyond the typical focus on single revenue models (such as membership fees or commission rates) by exploring hybrid revenue models, where both membership fees and commission rates are utilized. This more realistic approach mirrors the operational strategies of real-world platforms and adds a layer of practical relevance to the research. It allows for a deeper understanding of how platforms can optimize pricing strategies, especially in the context of greenness. Lastly, we examine the impact of different market structures, such as monopoly and competitive environments, on platform pricing and greenness strategies. Additionally, we introduce the scenario where shippers can multi-homing, but carriers are restricted to single-homing, which better reflects real-world market dynamics and regulatory constraints. This aspect of the study provides valuable insights into platform differentiation, competition, and sustainability in digital freight markets.

The remainder of this paper is organized as follows. Section 2 reviews the relevant literature. Section 3 presents the problem description and model formulation. Section 4 analyzes the green-pricing strategies of two-sided maritime freight platforms under both monopoly and competitive market scenarios. Section 5 provides a comparative analysis of the monopoly and competitive market models. Section 6 discusses the findings, compares them with existing literature, and outlines implications, limitations, and future research directions. Section 7 concludes the paper, with proofs provided in the appendix.

2 Literature review

In recent years, with the rapid development of two-sided marine freight platforms, there has been a growing body of literature examining the pricing strategies of these platforms. The literature relevant to this paper primarily encompasses three areas: pricing mechanisms in two-sided platforms, sustainability and green initiatives in marine logistics, and network externalities and multihoming behaviors.

2.1 Pricing mechanisms in two-sided platforms

The pricing strategies of two-sided platforms typically involve complex interactions between multiple stakeholder groups, aiming to enhance competitiveness. Xu et al. (2021) investigated the equilibriums of platform encroachment and price matching in a sea-cargo supply chain with a liner company and two asymmetric forwarders. Xu et al. (2020) segmented users into new and existing customers, as well as low-cost and high-cost categories, and implemented discriminatory pricing. In the study of pricing decisions for network freight platforms, Zhang and Gao (2021) examined a two-period pricing game model supported by blockchain technology, analyzing the network effects between competing platforms. Guo et al. (2022) proposed an improved mechanism considering heterogeneous transaction costs, where platforms determine transaction prices and match supply and demand based on bids from shippers and carriers. Yang et al. (2023) utilized generalized linear models to analyze the impact of factors such as transportation distance and cargo weight on freight insurance pricing. Sui et al. (2024) studied the two-sided dynamic pricing strategies of competing platforms when offering value-added services. While the above studies emphasize user segmentation pricing as well as platform competition and dynamic pricing, this paper focuses on the composite membership and transaction fees charged by platforms to shippers and carriers.

2.2 Sustainability and green initiatives in marine logistics

With the growing global concern over climate change, the sustainable development of the marine logistics industry has come into focus. Research has shown that successful operation of a green marine freight platform requires the collaborative participation of shippers and carriers, and relies on the platform’s own initiatives to promote sustainable development (Wang et al., 2023). Blockchain technology plays a crucial role in enhancing transparency and trust, as its implementation in marine platforms enables reliable carbon emission tracking (Lu et al., 2024). Besides, Li et al. (2024) employed the Hotelling model to analyze two-sided marine platform pricing strategies to incentivize carriers to adopt more environmentally friendly practices. In addition, advances in digital and smart lifecycle management of green ports, such as optimization of waste discharge and shipping management systems, contribute to the overall sustainability of marine logistics (Zhang et al., 2024). Liu et al. (2025) conducted a comparative analysis of profits and carbon emissions, further demonstrating that carbon emissions can be reduced while improving the profitability of the marine supply chain. The above study points out that the green transformation of the marine industry needs to integrate technological innovation, policy guidance and multi-party collaboration in order to realize the synergistic development of economic benefits and ecological protection. On this basis, this study innovatively constructs an economic analysis model that includes the level of greenness, focusing on the mechanism of the greenness level of two-sided marine freight platforms on their profits.

2.3 Network externalities and multihoming behaviors

Research on two-sided markets primarily revolve around core characteristics such as network externalities and user affiliation. In terms of network externalities, scholars have examined both within-group and cross-group network externalities. Chu and Manchanda (2016) found that in C2C platforms, the impact of the seller’s user base on buyers initially increases and then decreases, while the cross-group network externality effect of buyers on sellers remains relatively stable. Kung and Zhong (2017) utilized game theory models to study the two-sided pricing strategies of delivery platforms, integrating the sharing economy and network externalities.

Regarding user affiliation, Jeitschko and Tremblay (2020) investigated the choices passengers make between single-homing and multi-homing. Bernstein et al. (2021) analyzed scenarios where drivers provide services on either a single platform or dual platforms. Similarly, Guo et al. (2023) constructed a model for ride-sharing platforms to explore the impact of drivers’ multi-homing behavior on platform market share and driver welfare. Building on these studies, this paper integrates user affiliation with two-sided platforms to explore issues of single-homing and partial multi-homing of two-sided users in two-sided markets.

2.4 Summary of the related literature

In terms of pricing mechanisms, scholars’ studies on user segmentation pricing, blockchain dynamic pricing, and bidding and trading mechanisms have generally ignored the impact of composite fee structures on platform profits while promoting the development of platform competition theory. In the field of sustainable development research, scholars’ analyses of green port digitization emphasize the importance of technological innovation and policy coordination for marine emissions reduction while using Stackelberg game results to study carbon reduction trade-offs, but less often combine environmental factors with platform pricing. In terms of network effects and user attribution, analyses of green port digitization and the results of using the Stackelberg game to study carbon emission reduction trade-offs both emphasize the importance of technological innovation and policy coordination for marine emission reduction, but less often combine environmental factors with platform pricing dynamics.

However, there are obvious limitations in existing studies: most prior work tends to analyze pricing strategies or greenness levels in isolation without considering their interactions under bilateral market dynamics. In contrast, our study combines pricing strategies with greenness decisions while considering the unique characteristics of marine freight platforms, such as high freight cost elasticity, user multi-attribution, and network effects. In addition, prior studies have typically neglected systematic research that interacts greenness incentives with different market structures, such as monopoly, single-homing, and multihoming competition. By constructing an analytical framework that integrates pricing mechanisms, greenness level, and network externalities while taking into account the unique characteristics of two-sided marine freight platforms, this study provides new theoretical and practical insights into the rapidly evolving marine freight platform economy.

To clearly demonstrate the distinctions between this paper’s research and previous studies, Table 1 highlights the main contributions of this paper, covering categories such as two-sided marine platform, freight platform, pricing mechanisms, sustainability and green initiatives, and affiliation behavior.

3 Problem description and model formulation

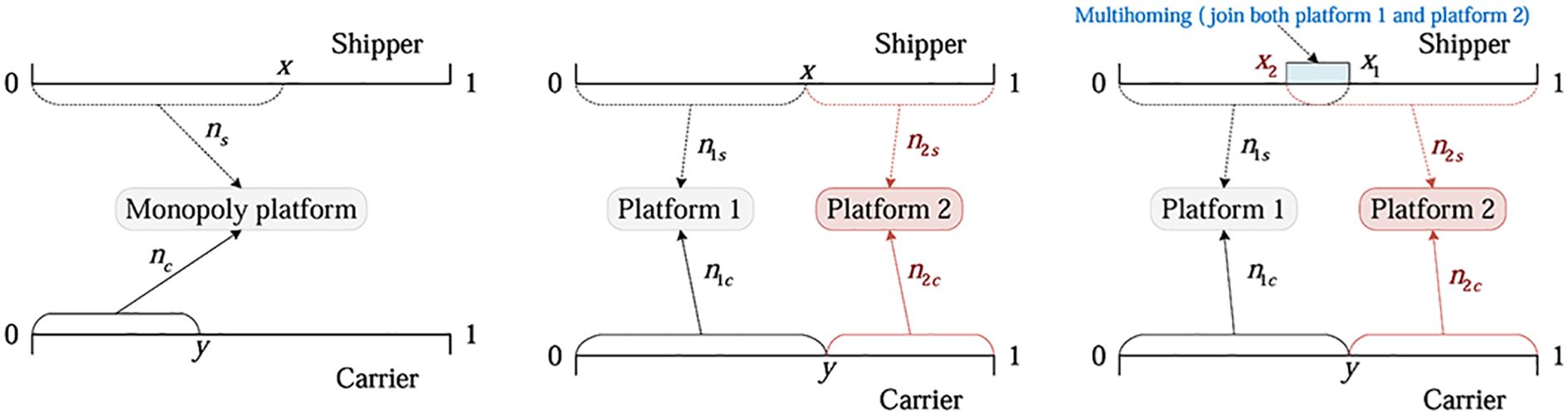

This paper develops a two-sided marine platform that connects shippers (s) and carriers (c), focusing on the optimization of green-pricing strategies for these platforms with network externalities and multihoming effects. The model examines two distinct market structures: monopoly and competitive duopoly for two-sided marine freight platforms. Specifically, under the monopoly scenario, a single platform dominates the market with full pricing power, serving as the exclusive intermediary between shippers and carriers who have no alternative options. The monopoly platform strategically optimizes its pricing and greenness level to maximize profits without competitive pressure. In contrast, the competitive duopoly scenario features two platforms vying for users through strategic interactions in pricing and sustainability investments. Here, user affiliation follows two patterns: single-homing on both sides, where both shippers and carriers exclusively join one platform due to contractual obligations or platform differentiation; and multi-homing on one side only, where shippers participate on both platforms simultaneously while carriers typically remain single-homing due to operational constraints like exclusivity agreements. This asymmetric multi-homing reflects real-world dynamics, where freight forwarders (shippers) leverage multiple platforms for flexibility, while transport providers (carriers) commit to single platforms for operational efficiency. This paper explores situations involving single-homing on both sides and multihoming on one side only, while also analyzing the impact of the platform’s greenness level on the participants’ choices. By comparing these three models, the paper provides valuable insights into the interactions between the various participants and how environmental sustainability factors influence these dynamics. This comprehensive analysis offers a deeper understanding of the complex relationships within two-sided marine freight platforms, as illustrated in Figure 1.

Figure 1. Market structure of the two-sided marine freight platforms (Monopoly, Single-homing on both sides and Multihoming on one side only).

3.1 Model parameter symbols

This study examines competition in two-sided marine freight platforms by adapting the classical Hotelling linear city model to account for platform-specific dynamics. While drawing on Hotelling’s fundamental framework of service providers located at endpoints with uniformly distributed users along a unit interval, we reconceptualize this spatial competition model to capture the unique network effects in marine platform markets.

The two-sided marine platform exhibits distinctive cross-group externalities, where value creation differs from Hotelling’s original conception. Unlike the conventional model where value derives from physical proximity, marine platform value emerges through interdependent participation. Specifically, shippers gain utility from increased carrier presence through enhanced service options and competitive pricing, while carriers benefit from greater shipper participation via higher order volumes and improved capacity utilization. We quantify these reciprocal effects through a symmetric coefficient β, the cross-network externality coefficient between platform users, which maintains the Hotelling tradition of parsimonious parameterization while capturing the platform’s essential characteristic of balanced, mutual influence between sides.

We define t as a mismatching cost coefficient to measure the platform’s efficiency in reducing search and coordination frictions (Zhang et al., 2023), thereby enabling the quantification of efficiency gains from the platform’s matching and coordination services. The mismatch cost coefficient for shippers and carriers is assumed to be sufficiently large, satisfying , indicating that user preferences are not dominated by network effects (Jung et al., 2019; Xie et al., 2021). For model simplicity, the fixed costs of carriers providing services are not considered.

This paper introduces the greenness level to measure the platform’s efforts in implementing green policies and providing sustainable services (Cai et al., 2023). We assume the platform’s cost function for providing greenness level follows a quadratic form to satisfy the cost convexity principle, i.e., . This convex and monotonically increasing cost structure aligns with fundamental microeconomic assumptions and has been widely adopted in related literature (Sarkar and Bhala, 2021; Huang et al., 2021). The parameter θ represents shippers’ sensitivity coefficient to the platform’s greenness level, capturing how their utility responds to environmental improvements.

For each completed order, the platform deducts a certain proportion k as commission, where (Li and Wu, 2024; Yuan et al., 2024). We use λ to denote the number of transactions and use , to denote the number of users. We assume that the number of shippers and the number of transactions is not equivalent or proportional. This distinction arises because not all shippers participate in the platform with the same frequency or the same volume of transactions. The membership fees paid by shippers and carriers are denoted by and , respectively. The freight rate refers to the payment per unit of goods that shippers pay carriers for transportation services. All notations are summarized in Table 2.

3.2 Utility of shippers

In a monopoly market, shippers seek carriers on the platform to transport goods and have certain requirements for the greenness level provided by the platform. Therefore, the shipper utility function consists of positive and negative utilities. The positive utility consists of the cross network externality that the carrier brings to the shipper , and the greenness level of the platform ; the negative utility consists of unit transaction membership fee charged by the platform to the shipper , the freight rate p, and the transaction costs tx. Besides, unit transaction membership fee is based on the idea that shippers perceive the membership fee as a cost spread across the number of transactions they make. Consequently, the utility function of shippers is given by (Wang et al., 2024; Guo et al., 2022). is characterized by , representing the shippers’ transaction distance.

In the single-homing scenario, where each shipper and each carrier exclusively chooses one platform (either platform 1 or platform 2), with full market participation on both sides, the utility of shippers are , . is characterized by , where x is the ‘‘intersection’’ of the two utility functions, representing the decision maker’s satisfaction with the outcome for that choice.

In the multi-homing scenario, where shippers may join both platforms while carriers remain exclusive to a single platform, with all market participants served, the utility function for multi-homing shippers is . It is preferable for shipper to join both platforms when both and . Therefore, all shippers choose to join platform 1, where is characterized by . All shippers choose to join platform 2, where is characterized by . Shippers multihoming (Bakos and Halaburda, 2020).

3.3 Utility of carriers

From the perspective of carriers, the service provider is the platform. Therefore, carriers also need to pay the unit transaction membership fee . It is assumed that only shippers perceive platform quality, while carriers rely on the platform to obtain transaction opportunities. Taking Didi Freight as an example, shippers are sensitive to greenness level and may switch to other platforms if their experience is poor; carriers, on the other hand, are more concerned about order volume and income, and may stay on the platform even if the experience is mediocre due to the volume of orders. Therefore, this paper does not consider the fixed costs of carriers or their positive utility perception of the platform’s greenness level. The utility function of carriers in a monopoly market is . is characterized by , indicating the carriers’ transaction distance.

In a competitive market, considering real-world scenarios where platforms require carriers to affix exclusive labels on their vehicles, the affiliation on the carrier side is unidirectional. The utility functions of carriers on platform 1 and platform 2 are and , respectively. is characterized by .

3.4 Profit of two-sided marine freight platforms

Only when the user utility (i.e., u) is greater than 0 will shippers and carriers join the two-sided marine freight platform. The platform’s profit consists of four components: the membership fees collected from shippers , the membership fees collected from carriers , the commission earned from each transaction , and the investment cost in greenness level . Therefore, the profit function for platform can be expressed as , where represents the cost of providing greenness level.

3.5 Sequence of the events

This paper employs the backward induction method. In the first stage, the platform aims to maximize profit and determines the platform greenness level q. In the second stage, the platform decides on the membership fees and for shippers and carriers. In the third stage, shippers and carriers simultaneously decide whether to join the platform based on the platform’s decisions. In the fourth stage, the platform determines the scale of the two-sided user base. The specific process is illustrated in Figure 2.

4 Pricing strategy for two-sided marine freight platforms

4.1 Under monopoly market (M)

This section explores the pricing strategy of two-sided marine freight platforms under monopoly market. As the sole service provider, the platform holds significant market power, with its core objective being to maximize profit through pricing strategies. However, unlike traditional monopoly markets, the two-sided market characteristics of freight platforms make pricing strategies more complex. The platform must simultaneously consider the demands of both shippers and carriers and attract and maintain the participation of both user groups through reasonable pricing.

In this scenario, the utility function of shippers is . When , shippers join the platform, and thus . The utility function of carriers is . When , carriers join the platform, and thus . Therefore, the profit of the two-sided marine freight platform can be expressed by Equation 1:

The profit of the two-sided marine freight platform consists of four components: the membership fees collected from shippers and carriers , the commission income from transactions , and the investment cost in greenness level .

Lemma 1. The platform’s optimal greenness level is , the optimal pricing for shippers is and the optimal pricing for carriers is . The optimal scale of shippers on the two-sided marine freight platform is , the optimal scale of carriers is and the platform′s optimal profit is .

Note: The superscript ∗ denotes the equilibrium solution. For the proof of Lemma 1, please refer to the appendix.

Corollary 1. Under this model, the impacts of the platform’s commission rate k, the shipper′s sensitivity coefficient to platform greenness level θ, and the number of transactions λ on the equilibrium outcomes are as follows:

1. If , , , ; if , .

2. , .

3. , .

Corollary 1 reveals that as the platform commission rate increases, the greenness level and platform profits increase. This is because the platform’s increased commission rate directly boosts its revenue, providing more resources for green initiatives. The enhanced greenness level, in turn, strengthens the platform’s appeal, making environmentally conscious shippers willing to pay higher membership fees. Meanwhile, the platform can maintain carrier engagement by appropriately reducing their fees, thereby balancing the ecosystem’s stability. This mechanism exemplifies a typical “reinvesting profits” model, where the platform leverages profitability from its core business to support sustainable development strategies, achieving synergistic growth of commercial and environmental value.

When shippers’ sensitivity to the platform’s greenness level increases, the number of both shippers and carriers may decline. If the platform fails to rapidly improve its green performance to meet shippers’ higher environmental expectations, some users may churn, leading to carrier attrition and ultimately reducing overall user scale. This phenomenon reveals that the marine industry is facing a competitive trend in terms of environmental standards, and that platforms that fail to continuously optimize their green strategies may fall into the “innovator’s dilemma”: it is difficult to meet the needs of shippers with high environmental requirements, and the scale of their operations will shrink, making them less attractive to carriers. From the perspective of management practice, platform operators need to establish a dynamic monitoring mechanism to capture changes in users’ green preferences in a timely manner, and improve environmental performance through technological innovation and operational optimization. At the same time, platforms should also rationally allocate resources and seek a balance between short-term cost investment and long-term competitiveness cultivation, such as maintaining market competitiveness through phased implementation of green technology renovation and establishment of environmental premium mechanisms.

As the number of transactions grows, users’ membership fees also increase, and the platform may implement a “price discrimination” strategy for high-frequency users, charging a premium to those with higher dependency. High-frequency users tend to be less price-sensitive, allowing the platform to employ anchoring effects and tiered membership systems to implement value-based pricing and justify premium charges. Additionally, for shippers with strong green preferences, differentiated payment plans (such as green membership surcharges) can be designed to maximize their willingness to pay. This structured pricing approach not only boosts platform revenue but also funds green investments, ultimately fostering a virtuous cycle between business sustainability and environmental governance.

4.2 Under competitive markets (C)

As market competition intensifies, platforms transition from monopoly to competitive two-sided marine freight platforms. In competitive platforms, shippers can freely choose among platforms, while platforms restrict carriers from accepting orders on multiple platforms through non-compete agreements, branding measures, and other strategies to lock in capacity. Although these strategies help consolidate capacity resources in the short term, they also increase user mobility across platforms, highlighting the issue of user affiliation. The problem of user affiliation not only affects the platform’s user base and market share but also directly impacts pricing strategies and profitability. Therefore, this section will explore the pricing strategies of two-sided marine freight platforms in competitive markets, divided into two scenarios: single-homing on both sides and multihoming on one side only.

4.2.1 Single-homing on both sides (CS)

In the case of single-homing on both sides, both shippers and carriers can only join one of the platforms. The utility functions of shippers on platform 1 and platform 2 are and , respectively. The utility functions of carriers on platform 1 and platform 2 are and , respectively. Therefore, the profit of the two-sided marine freight platform can be expressed by Equations 2 and 3:

The profit of the two-sided marine freight platform consists of the membership fees charged to shippers and carriers and , the proportional fees extracted from each transaction and , and the platform’s investment costs in greenness level and . At this point, , (Xie et al., 2021; Zhang et al., 2023).

Lemma 2. Under this model, the optimal greenness level levels for the platform are , . The optimal membership fee for shippers are , . The optimal membership fee for carriers is , . Therefore, the optimal scale for shippers are , . The optimal scale for carriers are , .

Corollary 2. Under this model, the comparison of profits for two-sided marine freight platforms, as well as shipper’s sensitivity coefficient to platform greenness level and the number of transactions on the equilibrium results are as follows:

1. If , ;

2. If , , ; , ;

3. If , , , , , .

Corollary 2 reveals that in a competitive market with single-homing on both sides, when platform 1’s freight rate exceeds a certain threshold, its profit will surpass that of platform 2. This occurs because higher freight rate is often associated with superior green services and premium customer segments, enabling platform 1 to secure commission premiums through service differentiation. This cost structure effectively serves as a mechanism for screening high-value shippers and signaling service quality, successfully transforming an apparent cost disadvantage into a substantive service advantage.

When platform 1’s transaction volume meets specific conditions, an increase in shippers’ sensitivity to the platform’s greenness level will expand its user base. This is because an active transaction environment not only directly enhances the platform’s attractiveness but also strengthens its competitive edge through two pathways: First, larger transaction volumes provide financial support for green investments, creating a self-reinforcing cycle of scale expansion, environmental upgrades, and user growth. Second, this improvement generates competitive spillover effects, driving the entire industry to raise environmental standards. This dynamic process explains why leading platforms can continuously expand their competitive advantages in markets with growing environmental awareness, while also offering new insights into the environmental governance mechanisms within platform economies.

4.2.2 Multihoming on one side only (CM)

In the market structure with multihoming on one side only, shippers, leveraging their advantageous position, can flexibly choose to join multiple two-sided marine freight platforms to expand their business channels. In contrast, carriers face more restrictions, as many platforms limit their ability to join competing platforms through non-compete agreements, resulting in carriers typically being able to choose only a single platform. This constraint reinforces the dominant position of shippers while also intensifying competition among platforms for carrier resources. As shown in Figure 1, the scale of shippers joining only platform 1 and platform 2 is and , respectively, where represents the scale of shippers joining both platform 1 and platform 2. The utility of single-homing shippers is , . When shippers multihoming on both platforms, using the services of both platforms, they also need to pay fees to both platforms. Therefore, the utility of multihoming shippers is . Therefore, the profit of the two-sided marine freight platform can be expressed by Equations 4 and 5:

The profit of the two-sided marine freight platform consists of the membership fees charged to shippers and carriers and , the proportional fees extracted from each transaction and , and the platform’s investment costs in greenness level and .

Lemma 3. The optimal greenness level levels for the platform are , . The optimal membership fee for shippers is , . The optimal membership fee for carriers are , .

Corollary 3. The comparison of profits for two-sided marine freight platforms, as well as the impact of the number of transactions on the equilibrium results are as follows:

1. If , ;

2. If , ; if , ; if , , .

Corollary 3 indicates that in a competitive market with multihoming on one side only, when the freight rate on platform 1 exceeds a certain threshold, the profit of platform 1 is higher than that of platform 2. Although platform 1 may process fewer transactions than platform 2, the revenue premium generated by its elevated unit costs more than compensates for this volume disadvantage. This phenomenon stems from the revenue premium effect of higher unit costs. Beyond the threshold level, the additional income not only offsets the transaction volume gap but creates supernormal profits. This necessitates platforms to develop sophisticated cost-benefit models to precisely identify the optimal cost threshold range for maximizing returns.

When the freight rate satisfies certain conditions, the platform’s greenness level is positively correlated with the number of transactions. This is because, when the freight rate meets specific conditions, the platform can allocate revenue to improve greenness level. The resulting improved environmental performance attracts eco-conscious users, driving transaction growth. This virtuous cycle requires platforms to implement systematic resource allocation frameworks. By continuously monitoring the input-output efficiency of green investments and dynamically optimizing strategies, platforms can effectively transform environmental expenditures into sustainable competitive advantages. The findings provide valuable insights for platform operators to balance cost structures, environmental performance, and transaction volumes in asymmetric market competition. The study further suggests that in the context of low-carbon transformation of the shipping industry, platform operators can turn environmental spending into a differentiated competitive advantage by implementing ship energy efficiency retrofits in phases, optimizing routing algorithms to reduce carbon emissions, and establishing a carbon credit reward mechanism.

5 Analysis

Building on this foundation, this section will conduct an in-depth study of the platform commission rate, freight rate, and the shipper’s sensitivity coefficient to platform greenness level in two-sided marine freight platforms. It should be particularly noted that the two-sided platform model constructed in this study is characterized by exclusivity, and its analytical framework is not applicable to the operational scenarios of single-sided infrastructure service providers such as ports. Due to the complexity of the model, some properties and comparative results are intricate. Therefore, based on theoretical analysis, this paper combines numerical simulations for intuitive demonstration. According to the literature (Bakos and Halaburda, 2020; Xie et al., 2021), the model parameters are set as follows: , , , , , , , .

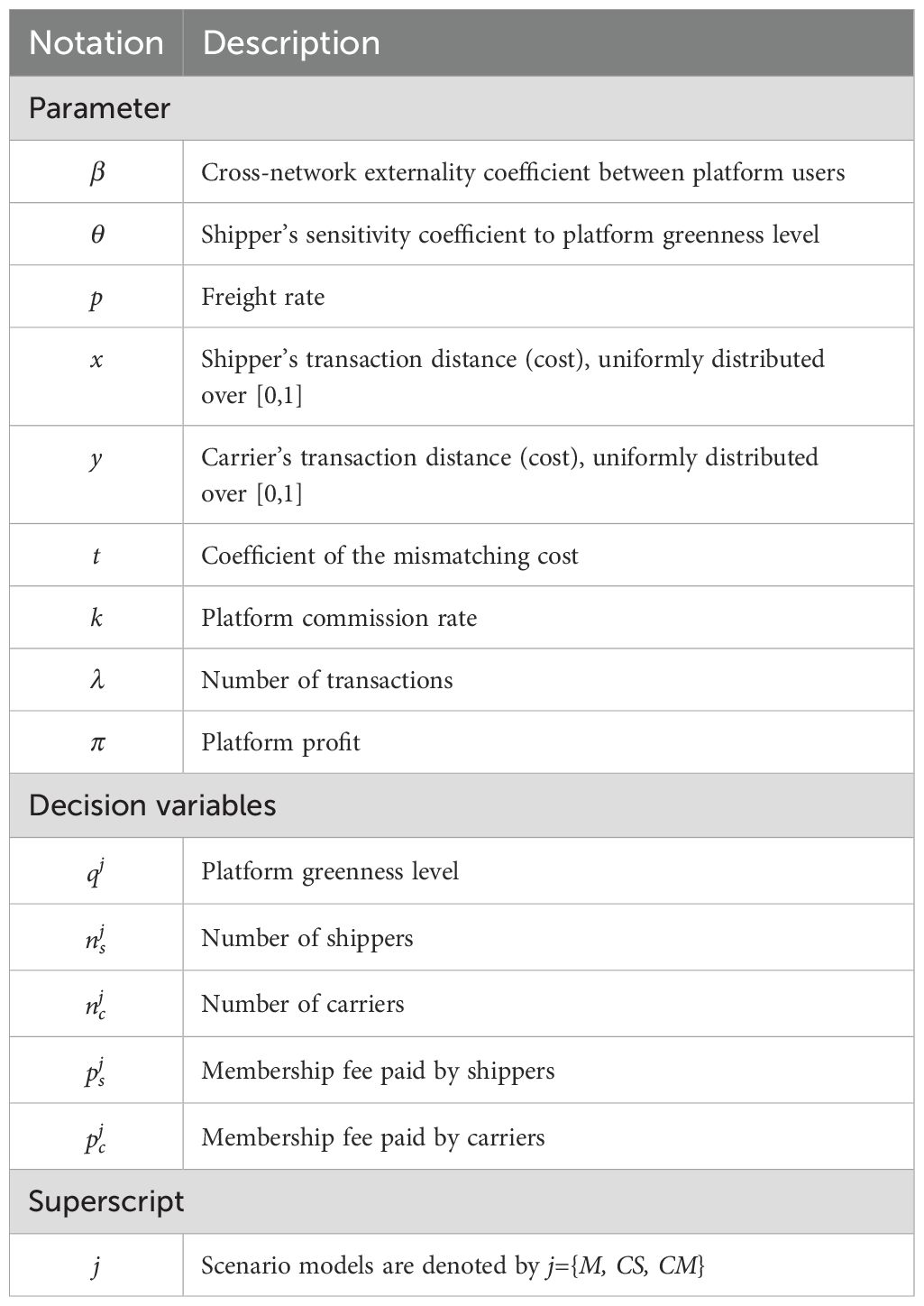

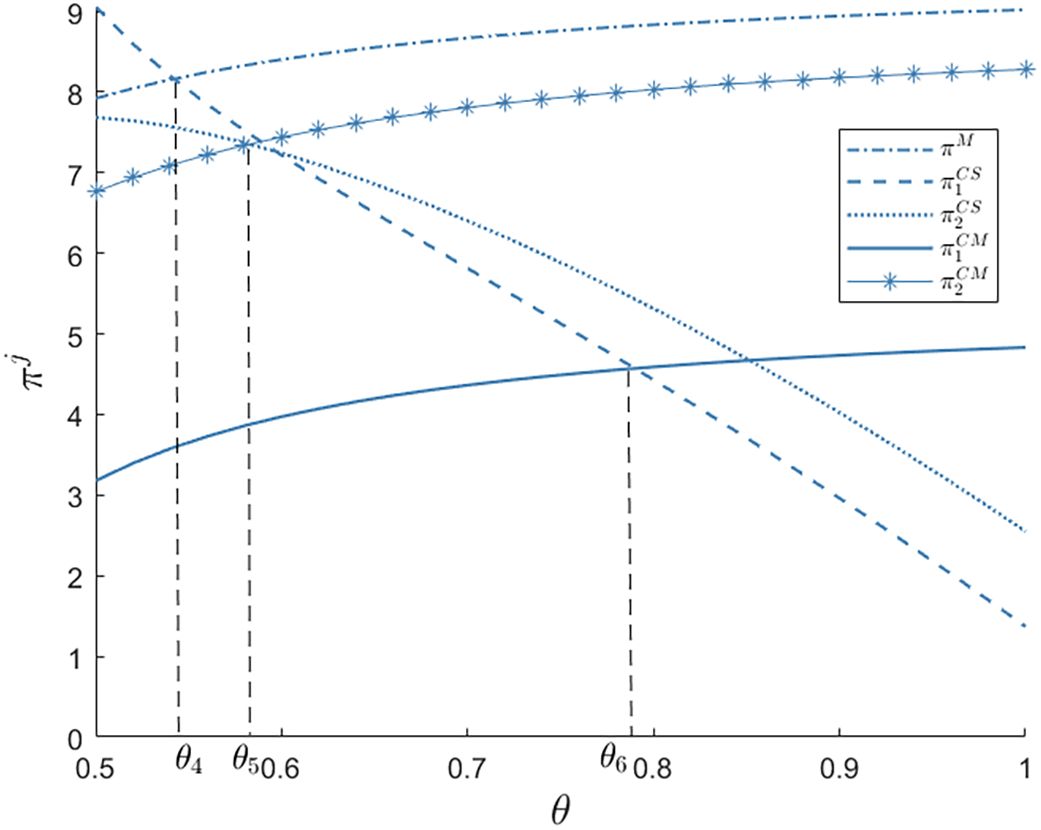

5.1 The impact of the platform commission rate

In this subsection, we compare the differential impact of the platform commission rate on the profits of two-sided marine freight platforms in monopoly and competitive markets, as illustrated in Figure 3, thereby providing guidance for two-sided marine freight platforms to formulate optimal commission strategies.

Proposition 1. The impact of the platform commission rate on platforms profits: If , ; otherwise, .

As the platform commission rate increases, the profits of two-sided marine freight platforms also increase. Specifically, when the commission rate is relatively low, monopoly market platforms gain significant profit advantages due to their market dominance. This phenomenon can be explained by price elasticity theory: since users in monopoly markets exhibit lower sensitivity to price changes, transaction volumes do not decline significantly when platforms raise commission rates. Transaction cost economics further indicates that higher switching costs in monopolistic scenarios enhance user stickiness, enabling platforms to maintain user scale while achieving profit growth. When the commission rate is relatively high, platform 2 achieves the highest profit in the competitive market under the multihoming on one side only scenario, followed by the single-homing on both sides scenario. This is because, in the multihoming on one side only scenario, platform 2 attracts multihoming users through differentiated strategies, offsetting potential user loss due to the high commission rate, thereby achieving higher revenue. In the single-homing on both sides scenario, although user loyalty is higher, the high commission rate may drive some price-sensitive users to switch to other platforms, resulting in lower revenue for platform 2 compared to the multihoming on one side only scenario. This observation aligns with consumer surplus theory, demonstrating that a single pricing mechanism struggles to achieve effective market segmentation.

Overall, the monopoly market maximizes profits through its exclusive advantage at low commission rates, while in the competitive market, the multihoming on one side only model achieves higher revenue by attracting multihoming users at high commission rates, with the single-homing on both sides model following closely behind. The research findings reveal the dynamic relationship between pricing strategies and market structures. Monopoly markets leverage their market power to dominate in low commission rate environments, whereas competitive markets must employ differentiation strategies and flexible pricing to adapt to the challenges of high commission rate scenarios.

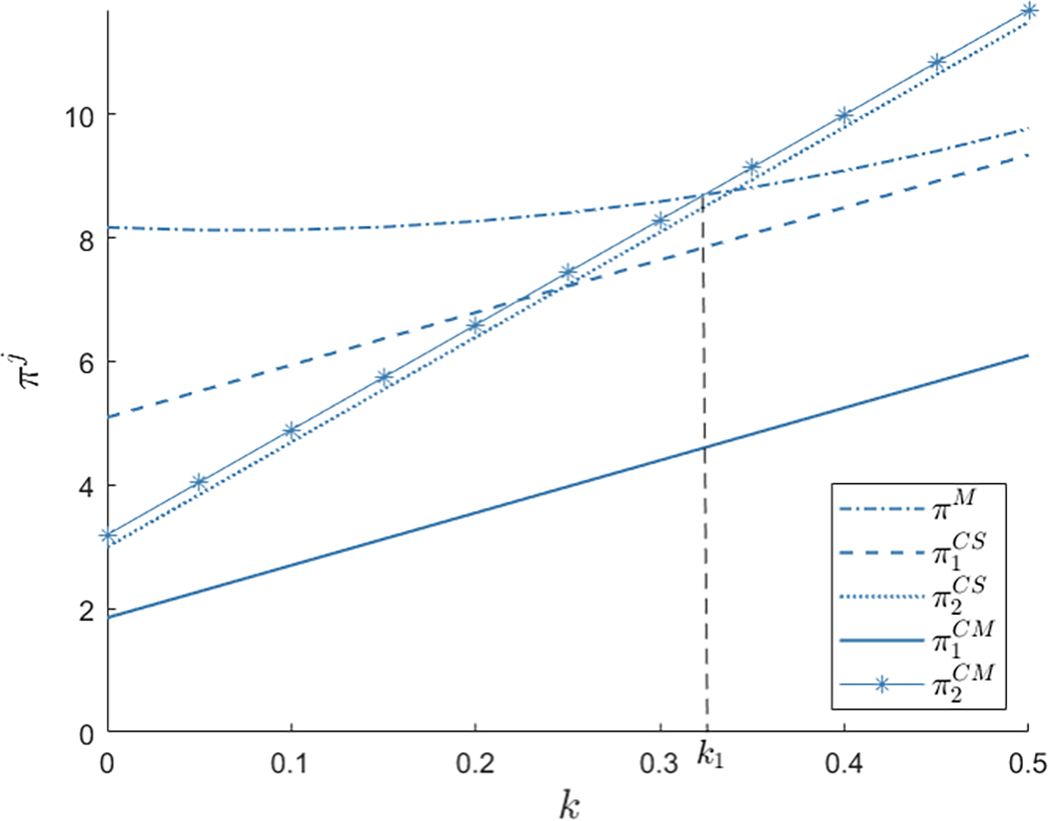

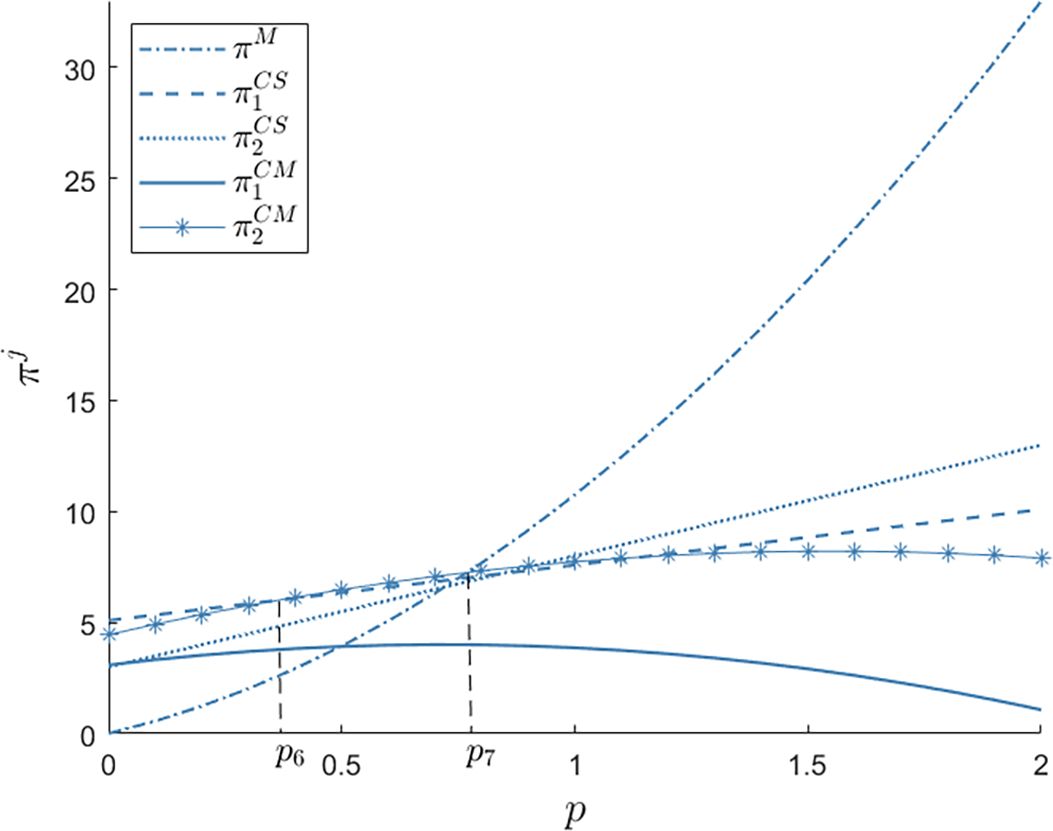

5.2 The influence of freight rate and transaction quantity

The freight rate and the number of transactions are critical factors in the operation of two-sided marine freight platforms, directly influencing the choices of shippers and carriers. An appropriate freight pricing strategy can attract more users, increase order volume, and ensure carrier earnings, thereby maintaining stable platform capacity. Therefore, this section investigates the impact mechanisms of the freight rate p and the number of transactions on the profits of two-sided marine freight platforms, as illustrated in Figures 4, 5, to help platforms better balance revenue.

Proposition 2. The impact of freight rate on two-sided marine freight platforms profits: If , ; if , ; if , .

As the freight rate increases, the profits of platforms in monopoly markets and under the single-homing on both sides scenario increase, while profits under the multihoming on one side only scenario decrease. Specifically, when the freight rate is relatively small, platform 1 achieves the highest profit under the single-homing on both sides scenario because users are less sensitive to price changes, and the loyalty of single-homing users ensures stable transaction volume, allowing platform 1 to achieve higher profits without intense competition. This aligns with consumer lock-in theory—single-homing users exhibit strong loyalty, ensuring stable transaction volumes despite price increases. When the freight rate satisfies , platform 2 achieves the highest profit under the multihoming on one side only scenario, as platform 2 attracts multihoming users through differentiated strategies, offsetting the impact of increased freight rates. When the freight rate is relatively high, the monopoly platform regains profit dominance. Here, absolute pricing power and absence of substitutes allow full cost pass-through to users, maximizing revenue without competitive leakage. This reinforces Bain’s entry barrier theory, where monopoly platform exploits scale and exclusivity to sustain margins.

Under the multihoming on one side only scenario, users become more sensitive to price changes and may choose platforms with lower fees, forcing platforms to reduce freight rates, which leads to decreased profits. In contrast, under monopoly and single-homing on both sides scenarios, platforms can directly benefit from increased freight rates through exclusive user access or user loyalty, thereby achieving profit growth. This finding offers important implications for two-sided marine freight platform operations: First, in a multi-homing competitive environment, platforms should avoid engaging in pure price wars, but rather maintain pricing power by improving service quality, optimizing shipping networks, or enhancing green competitiveness. Second, platforms with monopolistic positions or stable user bases may implement premium pricing strategies by leveraging their market dominance, while ensuring regulatory compliance. Third, platform operators should adopt differentiated strategies based on actual market structures, such as strengthening user lock-in mechanisms on dominant routes. Furthermore, as the digital transformation of the shipping industry accelerates, platforms need to dynamically assess evolving user affiliation patterns and promptly adjust their business models to sustain profitability.

Proposition 3. The impact of the freight rate and the number of transactions on the profits of two-sided marine freight platforms :

1. Platform 1: If and , ; if , ; if , .

2. Platform 2: If and , ; if , ; if , ; if , .

3. Comparative analysis of market models: If and , ; if , ; if , .

As shown in Figure 5, when the freight rate is relatively small and the number of transactions is relatively large, only a monopoly market exists. This is because the platform leverages economies of scale to reduce unit costs and consolidate its market position, making it difficult for competitors to enter or compete. The emergence of monopoly markets under specific cost and transaction volume conditions demonstrates how economies of scale create natural barriers to entry. When freight rate is low coupled with high transaction volumes, the incumbent platform achieves cost advantages that effectively deter competition, consistent with classical industrial organization theories of natural monopoly. When the freight rate is relatively large, the monopoly platform achieves the highest profit, which is consistent with Proposition 2. The monopoly platform can maximize profits by adjusting the freight rate and the number of transactions: lower freight rate attracts more users and increase transaction volume, while higher freight rate, though potentially reducing transaction volume, increases per-transaction profits enough to offset the loss. This suggests that platforms can strategically leverage pricing power to optimize the trade-off between transaction volume and unit profitability.

For platform 1, when the freight rate falls within a certain range, the single-homing on both sides strategy is optimal for profit maximization, as it monopolizes user resources to avoid diversion. For platform 2, when the freight rate is relatively small, the single-homing on both sides strategy yields the highest profit. However, within a specific range, the multihoming on one side only strategy can achieve higher profits, as its strong service appeal attracts both single-homing and multihoming users, with the additional transaction volume compensating for the loss from diversion. The results underscore that there is no universal optimal strategy, but rather context-dependent approaches that must account for both operational costs and network effects.

In summary, when the freight rate is relatively small and the number of transactions is relatively large, or when the freight rate is relatively large, the monopoly market achieves the highest profit. When the freight rate is relatively small, the single-homing on both sides strategy yields the highest profit. This finding has three practical implications for the strategic decision-making of marine freight platforms: First, in market segments with significant scale effects such as trunk routes or bulk cargo transportation, platforms should be committed to building monopoly advantages and enhancing profitability through economies of scale. Second, in competitive markets such as regional routes or LTL freight transportation, platforms can adopt bilateral user-locking strategies and establish stable user relationships to maintain profitability. Finally, the study suggests that platforms establish a dynamic evaluation mechanism to intelligently choose the optimal market entry and competition strategy based on key parameters such as route characteristics, cargo volume scale and freight rate level.

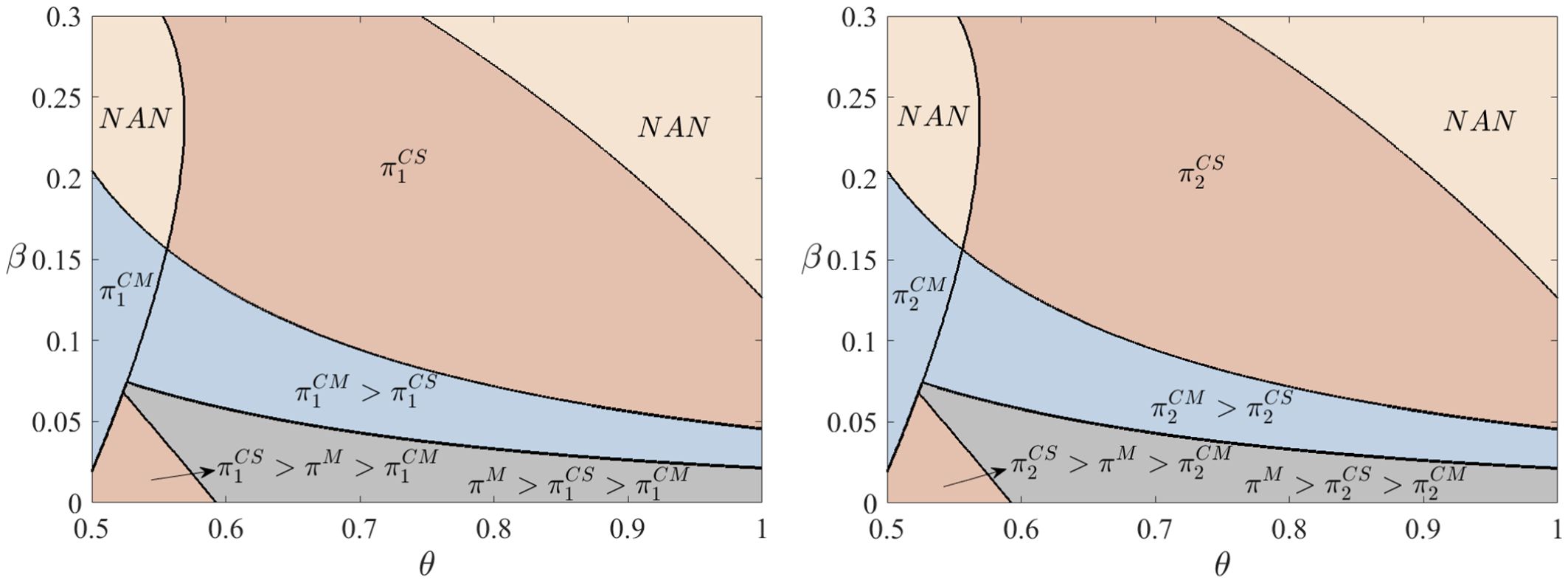

5.3 Effect analysis of greenness level sensitivity coefficient and network externality

The shipper’s sensitivity coefficient to platform greenness level and network externality are critical factors influencing the greenness level and profits of two-sided marine freight platforms. The shipper’s sensitivity coefficient to platform greenness level directly affects shippers’ choices and loyalty, as high greenness level attracts more users and enhances the platform’s competitiveness. Simultaneously, platforms exhibit significant network externality, where an expanding user base increases the platform’s overall value. The shipper’s sensitivity coefficient to platform greenness level and network externality interacts, jointly shaping the platform’s greenness level and profit levels, as illustrated in Figures 6–8.

Figure 6. Impact of greenness level sensitivity coefficient and network externality on platform greenness level.

Proposition 4. The impact of shipper’s sensitivity coefficient and network externality on greenness level:

1. For platform 1: If and , ; if , .

2. For platform 2: If and , ; if , ; if , .

3. Comparative analysis of market models: If and , ; if , .

As demonstrated in Figure 6, Proposition 4 shows that when the shipper’s sensitivity coefficient to platform greenness level is relatively small and the network externality satisfies , the greenness level is highest under the multihoming on one side only scenario. When the shipper’s sensitivity coefficient to platform greenness level satisfies , the greenness level is highest under the single-homing on both sides scenario. This is because a lower shipper’s sensitivity coefficient to platform greenness level implies that shippers prioritize factors such as price over absolute greenness level. When network externality is at a moderate level, the multihoming on one side only scenario incentivizes platforms to improve greenness level through competition. Under this scenario, platforms actively enhance greenness level to attract and retain users, thereby standing out in the competition. As a result, greenness level reaches its highest level under the multihoming on one side only scenario. Therefore, when the shipper’s greenness preference is not strong, moderate network externalities will stimulate differentiated competition among platforms, prompting them to compete for market share by improving the greenness level. When the user’s environmental awareness is at a moderate level, the platform adopts a focused strategy rather than aggressive competition. Since users do not choose from multiple platforms, the platform can focus its limited resources on green service enhancement without falling into a consumptive price war or excessive competition.

Additionally, when the shipper’s sensitivity coefficient to platform greenness level is within a certain range (not extremely high), the single-homing on both sides scenario allows platforms to focus their resources and service capabilities on meeting user needs, thereby delivering higher greenness level. Since users do not multihoming, platforms do not need to engage in intense competition to attract users but instead maintain user loyalty through consistent greenness level. Therefore, marine freight platforms can realize sustainable development through the following strategies: First, establish a scientific system for assessing users’ environmental preferences and accurately identify high-quality customer groups with moderate demand for greenness. Second, based on the analysis of customers’ needs, invest resources in the technological upgrading of ship emission reduction. Lastly, construct a mechanism for dynamically correlating greenness levels with the freight rate system.

Proposition 5. The impact of the shipper’s sensitivity coefficient to platform greenness level on platform profits:

1. Comparison of platform profits in monopoly and competitive markets: If , ; otherwise, .

2. Comparison of platform profits in a competitive market: If , ; otherwise, ; if , ; otherwise, .

Figure 7 shows that as the shipper’s sensitivity coefficient to platform greenness level increases, the impact on platform profits varies significantly across different market structures and user affiliation models: In a monopoly market, platforms attract users by improving greenness level and adjusting pricing, leading to profit growth as sensitivity increases. Monopoly platforms capitalize on their market dominance to extract premium pricing from eco-conscious shippers while achieving cost efficiencies through large-scale green technology deployment. In the multihoming on one side only model, competitive pressure drives platforms to optimize services, and profits similarly grow with increased sensitivity. In contrast, under the single-homing on both sides model, improving greenness level raises costs, but the limited user base results in insufficient revenue growth, causing profits to decline as sensitivity increases. Specifically, the single-homing on both sides model yields the highest profits under low sensitivity, while monopoly market or multihoming on one side only models are more advantageous under high sensitivity. Therefore, the conditions for profit maximization depend on the shipper’s sensitivity coefficient to platform greenness level, market structure, and user affiliation model.

This phenomenon illustrates the strategic importance of aligning market positioning with environmental investment strategies, where platforms must carefully consider how user mobility, market concentration, and environmental preferences interact to determine the profitability of sustainability initiatives. The findings suggest that environmental strategy cannot be divorced from competitive strategy, as the same green investment can produce dramatically different financial outcomes depending on these structural market characteristics.

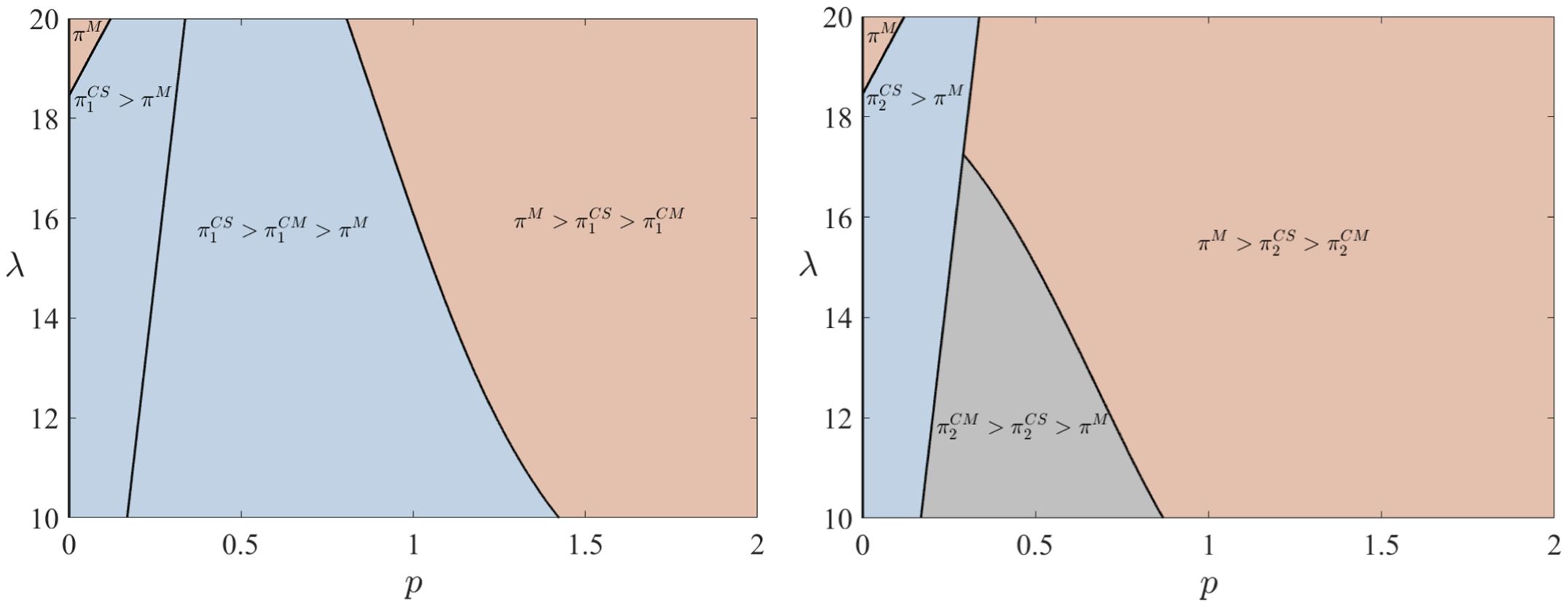

Proposition 6. The impact of shipper’s sensitivity coefficient and network externality on platform profits:

1. For platform 1: If and , ; if and , ; if and , ; if and , ; if and , .

2. For platform 2: If and , ; if and , ; if and , ; if and , ; if and , .

3. Comparative analysis of market models: If and , ; if and or and , ; if , .

As demonstrated in Figure 8, Proposition 6 indicates that when the shipper’s sensitivity coefficient to the platform’s greenness level is relatively high and the cross-network externality coefficient between platform users is relatively low, the platform achieves maximum profit in a monopolistic market. This is because the platform’s core competitiveness stems from green differentiation rather than network effects. Given users’ low reliance on cross-side interactions, the platform can directly capture premium returns by enhancing its environmental attributes without relying on subsidy strategies or user scale effects, thereby maximizing profits under a monopoly model. Therefore, if users in the target market are highly sensitive to the platform’s environmental standards but network effects are weak (e.g., low-frequency transactions), the platform should prioritize investments in green technology, such as offering low-carbon shipping routes or carbon footprint certification services, to achieve premium returns—exemplified by Maersk’s “ECO Delivery” green methanol shipping service.

When network externalities are moderate, the platform achieves maximum profit under a multihoming on one side only scenario. This is because moderate network effects require a certain scale of user interactions to create value but are not strong enough to fully lock in users. By allowing price-sensitive users (e.g., shippers or carriers) to access multiple platforms, the platform expands their participation, thereby enhancing its appeal to single-homing users on the other side and maximizing profits through exclusivity in a single-sided market.

When network externalities are either weak or strong, the platform achieves maximum profit under a single-homing on both sides scenario. This is because, when network externalities are weak, users have low dependence on the platform, necessitating exclusive user agreements (e.g., exclusivity clauses) to ensure stable transaction volumes and prevent user attrition. Conversely, when network externalities are strong, the platform’s natural monopoly effect becomes pronounced, and users tend to concentrate on a single platform to maximize network value, making the single-homing model more effective in locking in users and increasing profits.

Notably, regardless of the strength of network externalities, the platform should consistently deepen its core competencies, such as green shipping technologies (e.g., carbon footprint monitoring systems) and value-added service systems. It should establish a dynamic market diagnostic mechanism to regularly assess user scale and network effect intensity, implement a gradual strategy adjustment from single-side openness to dual-side lock-in, and maintain a competitive edge through differentiated services.

6 Discussion

In this section, we present and interpret the core results of the study, compare them with relevant literature, and provide implications for academic, policy makers, and managers. Additionally, we discuss the limitations of the study and offer directions for future research.

6.1 Core results and comparison with key studies

This study uncovers several important insights into the dynamics of pricing strategies on two-sided marine freight platforms. One of the key findings is that a monopoly platform maximizes profit under low commission rates. This finding aligns with existing literature such as Bernstein et al. (2021) on platform competition but expands upon it by incorporating the role of environmental sustainability in shaping platform strategies. We also find that in competitive multihoming scenarios, one platform can dominate by sacrificing its rival’s profits, a result that builds on previous studies in competitive market structures (e.g., Zhang et al., 2023), while adding a new dimension by considering environmental preferences as a strategic tool.

The study further reveals that high freight rate tends to favor monopolistic platforms, which is consistent with earlier work by Belleflamme and Peitz (2019), who found that higher transaction costs tend to strengthen monopoly power. However, our study also shows that when freight rate is low, Pareto optimality is achievable through single-homing on both sides of the platform. This provides a new angle on how freight rate interacts with market structure and green-pricing strategies to enhance platform efficiency and market outcomes.

An important contribution of this study is the exploration of the role of shippers’ sensitivity to greenness and network externalities. We find that when shippers exhibit low sensitivity to greenness and weak network externalities, competitive multihoming emerges as the optimal scenario. This contrasts with the more traditional view that strong network externalities always lead to monopolistic outcomes (Rochet and Tirole, 2006), suggesting that weaker externalities can lead to more competitive outcomes in certain market contexts.

Finally, the integration of green-pricing strategies with traditional pricing models, such as commission rates and membership fees, offers a novel contribution to the literature. While much of the existing research, such as Yang et al. (2023), has focused on platform pricing in the absence of environmental factors, recent studies have increasingly addressed sustainability challenges specific to the shipping industry (e.g., Xu et al., 2025). This study highlights how greenness can serve as a differentiator in competitive markets, providing new insights into the role of sustainability in marine platform competition.

6.2 Implications for academic and policy makers

This study has several implications for both academic and policy makers. From a theoretical perspective, the study contributes to the field of two-sided market theory by integrating green-pricing strategies with network externalities and platform competition. The model developed here provides a more holistic understanding of how environmental factors influence platform behavior, filling a gap in the literature that has not adequately addressed the intersection of sustainability and pricing strategies. This opens up new research opportunities, such as investigating the impact of specific green technologies or policies on platform economics.

For policy makers, the findings highlight the need for regulatory frameworks that support the green transformation of the marine freight sector. Given the increasing importance of sustainability, it is crucial for regulators to create incentives for platforms to adopt greener practices, such as green certification systems or subsidies for environmentally friendly shipping technologies. Additionally, the introduction of tariff caps on monopolized routes, as suggested by our findings, could help prevent market concentration and ensure fairer competition, particularly in markets dominated by large players. Encouraging multi-platform strategies could also promote more sustainable practices, as platforms would be incentivized to compete on both service quality and sustainability.

From a managerial standpoint, the study provides practical insights into how platform managers can optimize their pricing strategies in the context of competitive markets and sustainability concerns. Managers should consider implementing hybrid pricing models that combine membership fees with commission rates to create a more stable and predictable revenue stream. Additionally, understanding users’ environmental preferences and integrating green-pricing strategies into platform offerings could serve as a key differentiator in attracting eco-conscious users. Platforms that successfully incorporate sustainability into their value proposition may gain a competitive edge and build stronger customer loyalty.

6.3 Limitations and future research directions

While this study provides important insights, it has several limitations that future research could address. First, the model makes simplifying assumptions about two key aspects of platform dynamics. It treats network externalities as homogeneous between shippers and carriers, when in reality their mutual influences may differ significantly. The model also assumes uniform transportation costs across user groups, despite practical variations that may arise from differing operational scales or market positions. Future research could investigate how these concurrent forms of heterogeneity, in both network effects and cost structures, collectively impact platform competition and profitability patterns.

Second, the study examines greenness at a macro level, focusing on general sustainability goals rather than specific green practices or technologies. Future research could refine this by analyzing the impact of specific green initiatives, such as the adoption of biofuels or the implementation of energy-efficient shipping technologies, on platform operations. This would provide more detailed insights into how different green strategies affect platform pricing and user behavior.

Third, the study is based on theoretical models, and while this provides a useful framework, it lacks empirical validation. Future research could incorporate real-world data from marine freight platforms to test the robustness of the proposed pricing models and better understand how these strategies perform in practice. Empirical studies could also explore how factors such as market size, regional differences, and regulatory environments impact platform pricing and green-pricing strategies.

Finally, this study does not account for regional or behavioral differences that may affect platform dynamics. Future research could investigate how cultural and geographic differences influence user behavior, particularly in relation to green-pricing strategies and multihoming. By considering these factors, researchers could gain a better understanding of the broader applicability of the findings and how these dynamics play out in different market contexts.

7 Conclusion and policy recommendations

7.1 Conclusion

In light of the current development status of two-sided marine freight platforms and the application trends of intelligent technologies, we conduct an in-depth analysis of the pricing decisions and related influencing factors of platforms under both monopolistic and competitive market structures. By introducing greenness level as a key variable, a pricing model for two-sided marine freight platforms is constructed. Based on the current state of two-sided marine freight platforms and incorporating greenness level, this paper establishes pricing models for two-sided marine freight platforms under both monopolistic and competitive market conditions. It provides a theoretical foundation and practical guidance for platforms to formulate reasonable pricing strategies in different market environments, thereby contributing to the sustainable development of two-sided marine freight platforms.

Through a detailed analysis of the model, the study reveals the following key findings: A monopoly platform maximizes profit under low commission rates, whereas in competitive multihoming scenarios, one platform dominates by strategically sacrificing its rival’s profit; High freight rate consistently favors monopolistic platforms regardless of transaction frequency, while low freight rate enables Pareto optimality through single-homing on both sides; When shippers exhibit low sensitivity to greenness level and weak network externalities, competitive multihoming emerges as optimal. These findings provide actionable insights for platform differentiation, green-pricing governance, and sustainable competition in evolving digital freight markets.

7.2 Policy recommendations

Based on the findings of this study, the following policy recommendations are proposed to optimize the green-pricing strategies for two-sided marine freight platforms:

First, regulators should strengthen anti-monopoly measures within the shipping industry to prevent dominant platforms from manipulating freight rates and stifling competition. To support the growth of small and medium-sized platforms, tax incentives and subsidies should be offered, fostering a more competitive and innovative market environment. Additionally, industry associations should lead efforts to establish stable membership fee standards and require platforms to disclose transparent cost structures, reducing the impact of short-term freight rate fluctuations. Second, a green certification system should be implemented for the marine industry, with key sustainability indicators such as ship energy efficiency and the use of alternative fuels incorporated into the assessment. This would incentivize platforms to prioritize greener practices and enhance the environmental competitiveness of marine freight. Finally, tariff caps should be introduced on monopolized routes to protect the interests of cargo owners, alongside encouraging the adoption of multi-platform strategies. Supporting cargo owners in accessing multiple platforms will enhance market competition and incentivize greener practices by increasing platform accountability and sustainability efforts.

The successful implementation of these policies will drive the green transformation of marine freight platforms, improve operational efficiency, and create a more resilient and sustainable global marine transportation system.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material. Further inquiries can be directed to the corresponding author.

Author contributions

WZ: Writing – review & editing, Supervision, Conceptualization, Methodology, Validation, Funding acquisition. LJ: Visualization, Writing – original draft, Software, Writing – review & editing, Investigation, Formal analysis. WC: Formal analysis, Writing – review & editing, Methodology, Supervision.

Funding

The author(s) declare that financial support was received for the research and/or publication of this article. This research was supported by Humanities and Social Sciences Youth Foundation of Ministry of Education of China (No. 20YJC630215).

Acknowledgments

The authors thank the editor and reviewers for their numerous constructive comments and encouragement that significantly improved our paper.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fmars.2025.1601322/full#supplementary-material.

References

Bakos Y. and Halaburda H. (2020). Platform competition with multihoming on both sides: subsidize or not? Manage. Science. 66, 5599–5607. doi: 10.1287/mnsc.2020.3636

Belleflamme P. and Peitz M. (2019). Platform competition: Who benefits from multihoming? Int. J. Industrial Organization. 64, 1–26. doi: 10.1016/j.ijindorg.2018.03.014

Bernstein F., DeCroix G. A., and Keskin N. B. (2021). Competition between two-sided platforms under demand and supply congestion effects. Manufacturing Service Operations Management. 23, 1043–1061. doi: 10.1287/msom.2020.0866

Cai J., Sun H., Shang J., and Hegde G. G. (2023). Information structure selection in a green supply chain: Impacts of wholesale price and greenness level. Eur. J. Operational Res. 306, 34–46. doi: 10.1016/j.ejor.2022.11.002

Chu J. and Manchanda P. (2016). Quantifying cross and direct network effects in online consumer-to-consumer platforms. Marketing Science. 35, 870–893. doi: 10.1287/mksc.2016.0976

Deng J., Chen X., Wei W., and Liang J. (2023). Resource coordination scheduling optimisation of logistics information sharing platform considering decision response and competition. Comput. Industrial Engineering. 176, 108892. doi: 10.1016/j.cie.2022.108892

Guo X., Haupt A., Wang H., Qadri R., and Zhao J. (2023). Understanding multi-homing and switching by platform drivers. Transportation Res. Part C: Emerging Technologies. 154, 104233. doi: 10.1016/j.trc.2023.104233

Guo J., Zhang J., Cheng T. C. E., and Zhao S. (2022). Truthful double auction mechanisms for online freight platforms with transaction costs. Transportation Res. Part B: Methodological. 158, 164–186. doi: 10.1016/j.trb.2022.02.009

Huang S., Zhang X., and Chen S. (2021). Information acquisition with advertising threshold effect under manufacturer encroachment in a supply chain. Transportation Res. Part E: Logistics Transportation Review. 153, 102439. doi: 10.1016/j.tre.2021.102439

Jeitschko T. D. and Tremblay M. J. (2020). PLATFORM COMPETITION WITH ENDOGENOUS HOMING. Int. Economic Review. 61, 1281–1305. doi: 10.1111/iere.12457

Jung D., Kim B. C., Park M., and Straub D. W. (2019). Innovation and policy support for two-sided market platforms: can government policy makers and executives optimize both societal value and profits? Inf. Syst. Res. 30, 1037–1050. doi: 10.1287/isre.2019.0851

Kung L. and Zhong G. (2017). The optimal pricing strategy for two-sided platform delivery in the sharing economy. Transportation Res. Part E: Logistics Transportation Review. 101, 1–12. doi: 10.1016/j.tre.2017.02.003

Li H., Gao J., and Li X. (2024). Blockchain adoption strategy of two-sided shipping platforms connecting forwarder and liner company. Ocean Coastal Management. 247, 106932. doi: 10.1016/j.ocecoaman.2023.106932

Li P. and Wu B. (2024). Information-sharing strategy in a two-stage hybrid platform under co-opetition background. Expert Syst. Applications. 255, 124642. doi: 10.1016/j.eswa.2024.124642

Liu J., Lyu Y., Wu J., and Wang J. (2025). Adoption strategies of carbon abatement technologies in the maritime supply chain: impact of demand information sharing. Int. J. Logistics Res. Applications. 28, 70–97. doi: 10.1080/13675567.2022.2115025

Lu B., Fan L., Tang Y., Perera S. C., and Wang J. (2024). The value of blockchain for shipping platforms: a perspective from multi-homing and network effects. Int. J. Production Res. 62, 1–23. doi: 10.1080/00207543.2024.2429787

Rochet J. and Tirole J. (2006). Two-sided markets: a progress report. RAND J. Economics. 37, 645–667. doi: 10.1111/j.1756-2171.2006.tb00036.x

Sarkar S. and Bhala S. (2021). Coordinating a closed loop supply chain with fairness concern by a constant wholesale price contract. Eur. J. Operational Res. 295, 140–156. doi: 10.1016/j.ejor.2021.02.052

Sui R., Liu M., Liu Y., and Zha X. (2024). Two-sided dynamic pricing and value-added service investment strategies of competitive platforms considering indirect network effects. Int. J. Production Economics. 272, 109262. doi: 10.1016/j.ijpe.2024.109262

Tufano A., Zuidwijk R., and Van Dalen J. (2023). The development of data-driven logistic platforms for barge transportation network under incomplete data. Omega. 114, 102746. doi: 10.1016/j.omega.2022.102746

Wang T., Cheng P., and Zhen L. (2023). Green development of the maritime industry: Overview, perspectives, and future research opportunities. Transportation Res. Part E: Logistics Transportation Review. 179, 103322. doi: 10.1016/j.tre.2023.103322

Wang G., Hu X., Wang T., Liu J., Feng S., and Wang C. (2024). Tripartite evolutionary game analysis of a logistics service supply chain cooperation mechanism for network freight platforms. Int. J. Intelligent Systems. 2024, 1–17. doi: 10.1155/2024/4820877

Xie J., Zhu W., Wei L., and Liang L. (2021). Platform competition with partial multi-homing: When both same-side and cross-side network effects exist. Int. J. Production Economics. 233, 108016. doi: 10.1016/j.ijpe.2020.108016

Xu L., Shi J., and Chen J. (2021). Platform encroachment with price matching: Introducing a self-constructing online platform into the sea-cargo market. Comput. Industrial Engineering. 156, 107266. doi: 10.1016/j.cie.2021.107266

Xu M., Tang W., and Zhou C. (2020). Price discrimination based on purchase behavior and service cost in competitive channels. Soft Computing. 24, 2567–2588. doi: 10.1007/s00500-019-03760-7

Xu C., Wang Y., Yao D., Qiu S., and Li H. (2025). Research on the coordination of a marine green fuel supply chain considering a cost-sharing contract and a revenue-sharing contract. Front. Marine Science. 12. doi: 10.3389/fmars.2025.1552136

Yang C., Chen L., and Xia Q. (2023). Freight insurance pricing strategy based on an online freight platform. Industrial Manage. Data Systems. 123, 2929–2945. doi: 10.1108/IMDS-05-2023-0307

Yuan X., Zhang X., Tang F., Wei Q., and Zhang D. (2024). Implementing operational strategy of closed-loop supply chain considering data intelligence level with an online platform. Sustain. Futures. 8, 100237. doi: 10.1016/j.sftr.2024.100237

Zhang D. and Gao X. (2021). Soft sensor of flotation froth grade classification based on hybrid deep neural network. Int. J. Production Res. 59, 4794–4810. doi: 10.1080/00207543.2021.1894366

Zhang Z., Song C., Zhang J., Chen Z., Liu M., Aziz F., et al. (2024). Digitalization and innovation in green ports: A review of current issues, contributions and the way forward in promoting sustainable ports and maritime logistics. Sci. Total Environment. 912, 169075. doi: 10.1016/j.scitotenv.2023.169075

PubMed Abstract | PubMed Abstract | Crossref Full Text | Google Scholar

Keywords: two-sided market, marine freight platform, greenness level, pricing strategy, Stackelberg game

Citation: Zhang W, Ji L and Chen W (2025) Optimization of green-pricing strategies for two-sided marine freight platforms with network externality and multihoming effects. Front. Mar. Sci. 12:1601322. doi: 10.3389/fmars.2025.1601322

Received: 27 March 2025; Accepted: 12 May 2025;

Published: 10 June 2025.

Edited by:

Kang Chen, Dalian Maritime University, ChinaReviewed by:

Yi-Che Shih, National Cheng Kung University, TaiwanZongtuan Liu, Ningbo University of Finance and Economics, China

Huida Zhao, Shenzhen University, China

Miaohui Liu, Hong Kong Polytechnic University, Hong Kong SAR, China

Shanhua Wu, Ningbo University, China

Yunqiang Wu, Shenyang University of Technology, China

Copyright © 2025 Zhang, Ji and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.