- 1Department of Finance, Monash University, Subang Jaya, Malaysia

- 2Faculty of Finance, City University of Macau, Macao, Macao SAR, China

- 3Department of Econometrics and Business Statistics, Monash University, Subang Jaya, Malaysia

This study examines the impact of oil price shocks on the stock performance of 73 listed banks—41 conventional and 32 Islamic—across dual banking systems in net oil-exporting and importing countries. Employing panel fixed-effects and two-stage least squares (2SLS) IV regressions, we address both endogeneity and unobserved heterogeneity. The results indicate that oil price fluctuations have a significant impact on bank stock returns, with a stronger negative effect during oil price declines, particularly those driven by demand-side shocks. Islamic banks are more sensitive to these fluctuations than their conventional counterparts, reflecting greater exposure to oil-dependent macroeconomic environments. Robustness checks confirm the presence of non-linear and asymmetric effects: bank stock returns respond more adversely to falling oil prices than to increases in oil prices. These responses differ systematically across bank types and levels of national oil dependency. Our findings underscore the importance of accounting for oil price risk in bank valuation and performance forecasting. For financial managers and investors, the results underscore the importance of incorporating oil-related risk factors into portfolio management, stress testing, and pricing models. For regulators and policymakers, the evidence supports the adoption of macroprudential tools such as countercyclical capital buffers and sector-specific supervisory frameworks to strengthen banking system resilience, particularly for Islamic banks operating in oil-dependent economies. Additionally, disclosure standards should be enhanced to improve transparency around oil price exposure, enabling better-informed decision-making across all stakeholder-dependent economies.

1 Introduction

The economies of the Gulf Cooperation Council (GCC) countries, such as Saudi Arabia, Bahrain, and Kuwait, are heavily reliant on hydrocarbon exports. This dependence renders them particularly vulnerable to oil price shocks, which can trigger cascading effects across fiscal policy, investment, and the banking sector (Nasir et al., 2019; Rocha et al., 2011). During periods of high oil prices, these governments often engage in increased fiscal spending, which stimulates credit expansion and enhances banking performance. Conversely, oil price declines can suppress public investment and reduce bank profitability, particularly in systems with lending portfolios concentrated in oil-related sectors (Chakraborty et al., 2018; Apergis et al., 2014).

The volatility of oil prices and its spillover to financial markets has become even more evident during crisis periods such as the COVID-19 pandemic, where time-frequency connectedness between oil and stock markets intensified significantly (Chen et al., 2024; Chen et al., 2025). This has been particularly relevant for both oil-exporting and importing nations, with African and emerging markets showing heightened sensitivity to oil demand and supply shocks under bearish market conditions (Tiwari et al., 2025).

In response to the economic and systemic risks associated with heavy reliance on oil revenues and the volatility of global oil prices, several policy initiatives have been introduced, particularly in major oil-exporting countries. Notably, Saudi Arabia’s Vision 2030 represents a comprehensive national strategy aimed at reducing the country’s economic dependence on oil by promoting diversification and strengthening its financial sector. A key pillar of this strategy is the advancement of Islamic finance, which now represents a substantial proportion of financial assets across the region (Hassan and Aliyu, 2018). Islamic banking, grounded in Shariah principles, emphasizes risk-sharing, asset-backed financing, and the prohibition of interest (riba). These principles shape distinctive financial practices that are increasingly embedded in the institutional frameworks of banking systems throughout the Gulf Cooperation Council (GCC) and broader MENA region.

Despite the growing prominence of Islamic finance, limited empirical research has investigated how oil price returns influence the performance of banks, particularly in oil-dependent economies and dual banking systems. Studies have shown that oil price changes can impact bank profitability, lending behavior, and equity performance; however, comparative analysis across different bank types and varying levels of oil dependency remains sparse (Alqahtani and Samargandi, 2020; Maghyereh and Abdoh, 2021).

This study offers several key contributions to the literature on financial market responses to commodity price shocks. First, it provides a comparative analysis of how oil price returns affect the stock performance of Islamic and conventional banks, offering insights into the differential sensitivities rooted in distinct banking models. Second, it examines whether national oil dependence influences the oil–bank return relationship, thereby integrating the macroeconomic context into financial performance analysis. Third, the study assesses the relative explanatory power of major oil price benchmarks—WTI, Brent, and Dubai—on bank stock movements, providing new evidence on the relevance of these benchmarks. Additionally, it examines the asymmetric and non-linear effects of oil price changes, the impact of sharp oil price drops, and the moderating role of bank-specific characteristics, including profitability, solvency risk, and systemic exposure. By bridging the literature on energy economics, Islamic finance, and stock market performance, the paper enriches the understanding of bank resilience and informs policy strategies in oil-dependent economies.

This article is structured as follows: Section 2 provides a comprehensive review of the relevant and recent literature on bank performance and oil price fluctuations, emphasizing key findings and identifying existing research gaps. Section 3 outlines the data sources and details the methodological approach employed to investigate the impact of oil price dynamics on banking sector performance. Section 4 presents the empirical results, followed by an in-depth discussion of the findings in relation to the existing literature, along with robustness checks to validate the results. Finally, Section 5 concludes the paper by summarizing the main insights and offering practical policy implications derived from the analysis.

2 Literature review

2.1 Oil prices, macroeconomic conditions, and banking sector performance

Oil price volatility has a profound impact on macroeconomic variables and financial institutions, particularly in oil-exporting economies (Hamilton, 1983; Gisser and Goodwin, 1986). Recent studies emphasize that not all oil price shocks are homogeneous in effect. Maghyereh and Abdoh (2021) demonstrate that in the GCC context, oil supply shocks have a more substantial impact on systemic bank risk than demand shocks, particularly during periods of crisis, such as the global financial crisis and the COVID-19 pandemic. Additional contributions by Alqahtani and Klein (2021) highlight that GCC stock markets are highly sensitive to both local and global geopolitical risks and oil price volatility, though responses differ by country. The role of market sentiment is further amplified under extreme market conditions, with asymmetric spillovers detected during COVID-19 and crisis periods (Chen et al., 2024; Tiwari et al., 2025).

The dynamic interactions between oil prices and emerging markets have also been documented. Using novel quantile-based methods, Tiwari et al. (2022) identified that oil shocks influence emerging market stock indices differently, with demand shocks generally acting as net spillover transmitters and supply shocks as receivers. This heterogeneity reinforces the importance of distinguishing between oil-importing and oil-exporting nations in empirical models (Cashin et al., 2014).

2.2 Oil Price returns and bank performance mechanism

Banking systems in oil-exporting countries are particularly susceptible to sectoral concentration risk, as credit exposure is often tilted toward oil and energy-related industries. Lending to these sectors, while profitable during oil booms, can significantly increase systemic vulnerabilities during downturns (Huang et al., 1996; Nandha and Faff, 2008). In the context of the GCC, Alqahtani and Samargandi (2020) identified an inverse U-shaped relationship between oil prices and banking indices, suggesting that beyond a certain threshold, rising oil prices may induce negative financial consequences, including overheating, inflationary pressures, and asset mispricing. Empirical evidence also indicates that the transmission of oil price returns to bank performance varies across economic cycles. Maghyereh and Abdoh (2024) demonstrate that oil price uncertainty has a significant impact on sovereign credit risk, particularly during crises such as the 2014–2015 oil price crash and the COVID-19 outbreak, both of which severely affected fiscal balances and liquidity in oil-dependent MENA countries.

Beyond sectoral exposures, oil prices influence bank performance through macroeconomic and fiscal channels. In oil-exporting countries, high oil prices increase government revenues, enabling expansionary fiscal policies that support economic activity and stimulate bank lending. Conversely, declining oil prices lead to fiscal tightening, reduced public spending, and lower credit demand. Banks in these environments face not only asset quality deterioration but also heightened capital constraints, particularly for publicly listed banks that are unable to raise equity under depressed stock valuations.

In oil-importing MENA economies, the effect manifests differently. Rising oil prices increase import costs and inflation, prompting tighter monetary policy, which raises interest rates and funding costs for banks. These pressures can lead to credit rationing and reduced profitability. Moreover, as macroeconomic volatility rises, investor sentiment toward bank stocks may deteriorate, particularly when oil price shocks are viewed as harbingers of broader economic instability.

Thus, the oil-bank transmission mechanism in the MENA region is shaped by the oil dependency structure, the fiscal capacity to absorb shocks, and the degree of exposure to oil-linked borrowers. Our empirical findings, presented later in the article, reflect these differentiated dynamics across oil-exporting and importing countries, underscoring the importance of accounting for oil-market conditions in assessing bank stock performance.

2.3 Islamic and conventional banks under oil price fluctuations

Islamic banks are governed by unique principles that prohibit the charging of interest and emphasize equity-based contracts. Although these structures theoretically offer different exposures to macroeconomic shocks, the effect of oil price returns on the performance of Islamic banks remains poorly established. Bilgin et al. (2021) report that while economic uncertainty raises default risk in conventional banks, Islamic banks remain comparatively unaffected due to structural and institutional buffers.

In the GCC context, Alsharif (2021) shows that while Islamic banks are more capitalized and liquid, they are also less efficient and exhibit distinctive responses to systemic shocks. Boukhatem and Djelassi (2022) find that Islamic banks’ deposits are more reactive to oil price changes, although their financing activities exhibit greater rigidity.

Raheem et al. (2024) emphasize the importance of decomposing oil shocks into demand, supply, and risk components, as their effects on sectoral bank performance vary across bank types and market states. This is particularly relevant for assessing oil return exposure in dual banking systems, such as those in the GCC.

2.4 Oil market uncertainty and financial market linkages

Oil market uncertainty, measured by the Oil Volatility Index (OVX), has become a key determinant of financial market performance. Lin and Su (2020) find asymmetric and heterogeneous relationships between oil market uncertainty and Islamic stock returns, particularly in oil-importing versus oil-exporting nations. This asymmetry is magnified at higher quantiles of uncertainty, suggesting non-linear risk transmission.

These findings resonate with those of Tiwari et al. (2025), who document that risk shocks act as spillover receivers and reflect safe-haven dynamics in certain emerging markets. Collectively, this literature reveals that oil price returns and volatility have differentiated effects across financial systems, bank types, and regional markets. This study contributes by bridging these strands—exploring how oil price returns, economic context, and banking models interact to shape stock market performance in Islamic and conventional banks.

Building on the gaps and insights identified in the literature, this study focuses on three key research questions that guide the empirical analysis:

• How does the level of national oil dependence influence the sensitivity of bank stock performance to oil price movements?

• Do Islamic and conventional banks respond differently to changes in oil prices, reflecting their distinct financial structures and risk exposures?

• Among the major oil price benchmarks—WTI, Brent, and Dubai—which most effectively explain variations in bank stock returns?

3 Data and methodology

3.1 Data

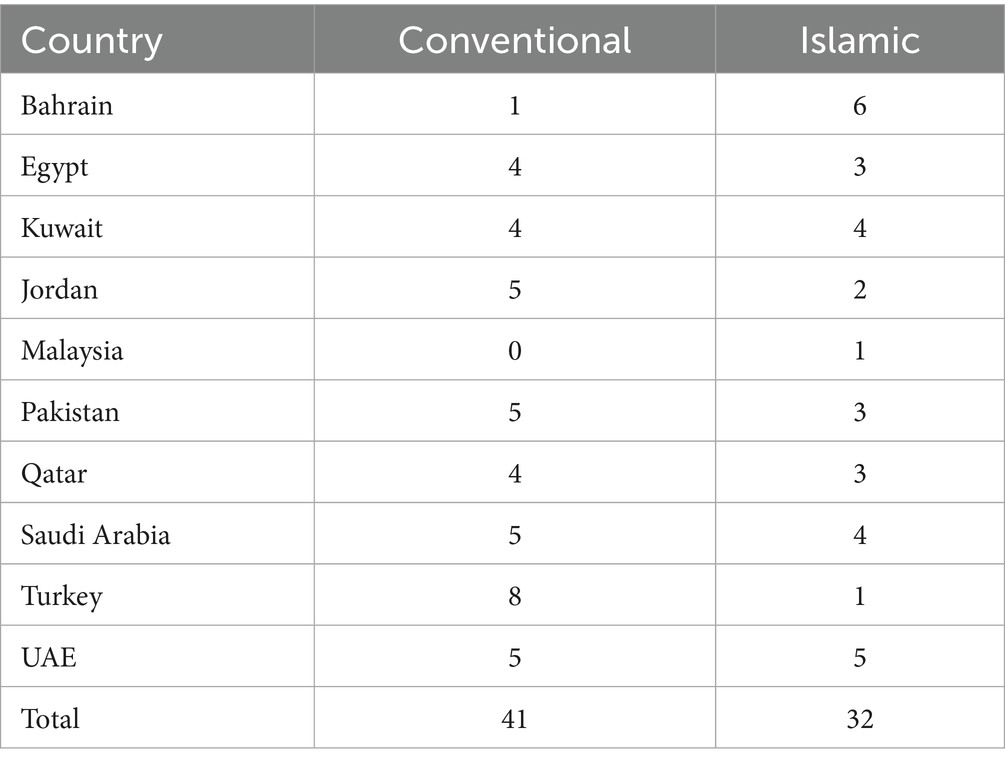

This study aims to investigate the impact of oil prices on the performance of bank stocks.1 Therefore, we collect only publicly traded banks, both conventional and Islamic banks, that have available market data to extract the returns, which restrains the number of selected banks. For instance, Beck et al. (2013) selected a total of 88 Islamic banks, of which 41 are listed. Similarly, Narayan et al. (2018) employed 26 listed Islamic banks to investigate price discovery. Boubakri et al. (2019) utilized 28 listed Islamic banks to examine their stock liquidity. As illustrated in Table 1, we selected 41 listed conventional banks and 32 listed Islamic banks in the countries under investigation, namely Bahrain, Egypt, Jordan, Malaysia, Pakistan, Qatar, Saudi Arabia, Turkey, and the UAE. Bangladesh is removed from our data sample due to its absence from 2008 to 2011, which covers a significant period of the oil price drop. In Malaysia, to the best of our knowledge, there is only one listed Islamic bank, called BIMB, whereas the rest, including major banks such as Maybank and Public Bank, incorporate Islamic banking operations through their Islamic banking subsidiaries. Therefore, this corporate setup makes it difficult to break down the stock performance of the group into conventional and Islamic subparts. The list of selected conventional and Islamic banks is extracted from Bankscope. Eventually, we constructed the data sample over the period 2006–2017.2

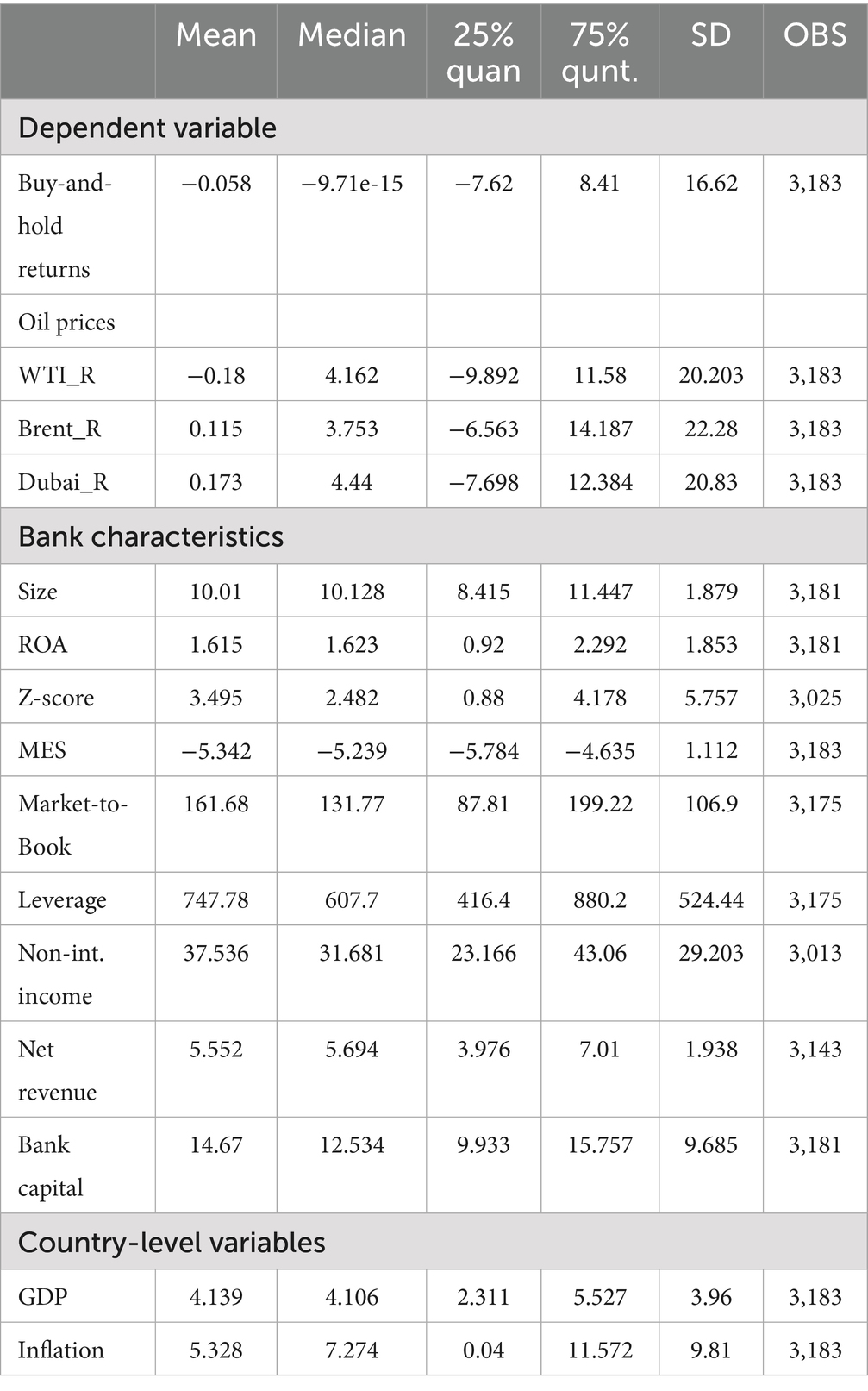

Following Irresberger et al. (2015) and Garel and Petit-Romec (2017), we collect quarterly accounting data related to idiosyncratic bank characteristics from Bloomberg. The stock price data for the selected banks are also collected from Bloomberg. We aggregate daily returns to compute quarterly buy-and-hold returns. The oil price data for WTI, Brent, and Dubai benchmarks are collected from DataStream. Similar to the calculation of quarterly buy-and-hold returns for banks, we aggregate the quarterly returns of three oil benchmark prices to match the frequency of the accounting and buy-and-hold returns for banks. The macro variables for the robustness tests, namely GDP growth and inflation, which are collected at an annual frequency, are sourced from the World Bank.3 Finally, following Beltratti and Stulz (2012) and Irresberger et al. (2015), we winsorize the quarterly bank buy-and-hold returns and bank-level accounting-based characteristics at the 1st and 99th percentiles to reduce potential outlier influence. The statistics for all variables are presented in percentage form in Table 2.

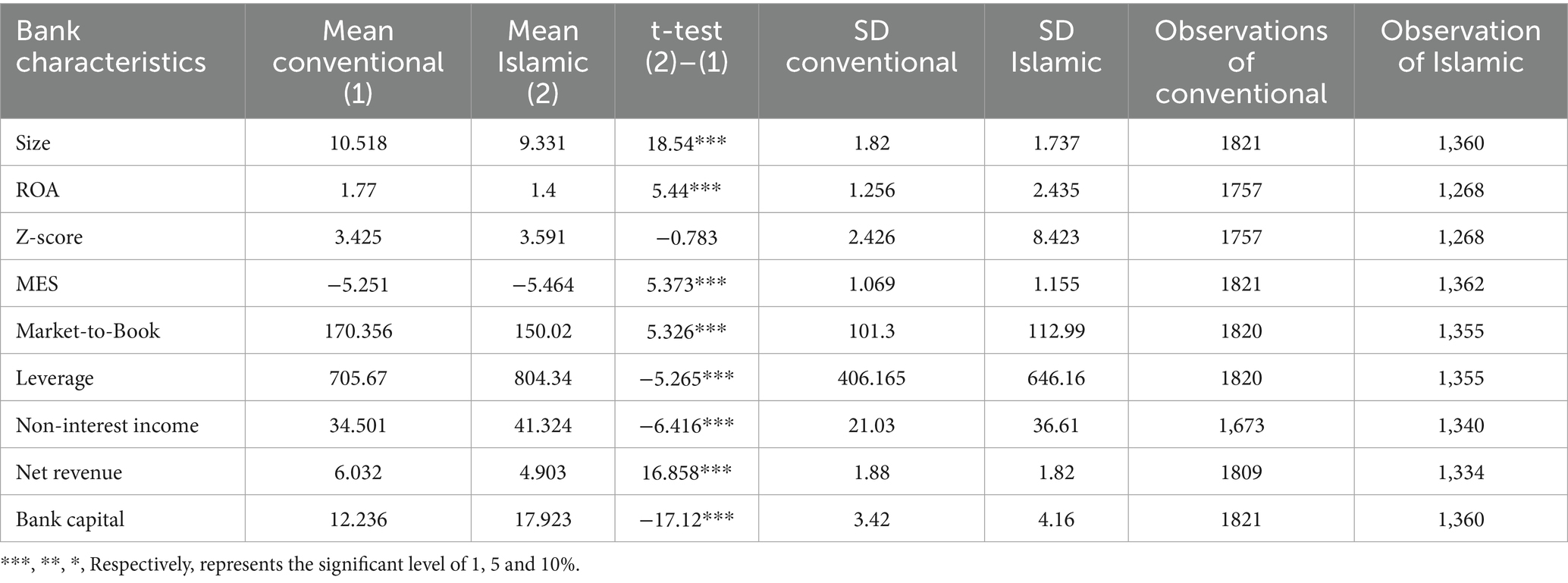

Before testing whether conventional and Islamic banking react differently to oil price shocks, we compare the idiosyncratic bank characteristics based on accounting measures in Table 3. We capture that the average size of Islamic banks in the sample is significantly smaller than that of their conventional counterparts. For the ROA, as the primary earnings indicator, we find a statistically significant difference between the two banking models, which is inconsistent with the inferences of Alqahtani et al. (2016). This inconsistency may be attributed to the different selection of sample countries and the period covered in this study.4 Nevertheless, we concur with Alqahtanti et al. that ROA is a superior tool to compare the earnings of conventional and Islamic banks due to two reasons. First, ROA shows how efficiently the banks transform their assets into earnings (Dietrich and Wanzenried, 2011). Second, ROE can be biased since it is impacted by the bank’s degree of financial leverage. Financial leverage is significantly lower for Islamic banks (Bashir, 2003).

Consistent with Abedifar et al. (2013), we fail to document a significant difference in the Z-score between the two banking models. Prior studies, such as those by Beck et al. (2013), Abedifar et al. (2013), and Alqahtani et al. (2016), suggest that Islamic banking is better capitalized. Nevertheless, Abedifar et al. (2013) explain that the higher returns and capital of Islamic banks are undermined by their higher asset return volatility. For other idiosyncratic bank characteristics, conventional banking outperforms its Islamic counterparts in marginal expected shortfall (MES) and net revenues, whereas Islamic banking achieves superior non-interest income.

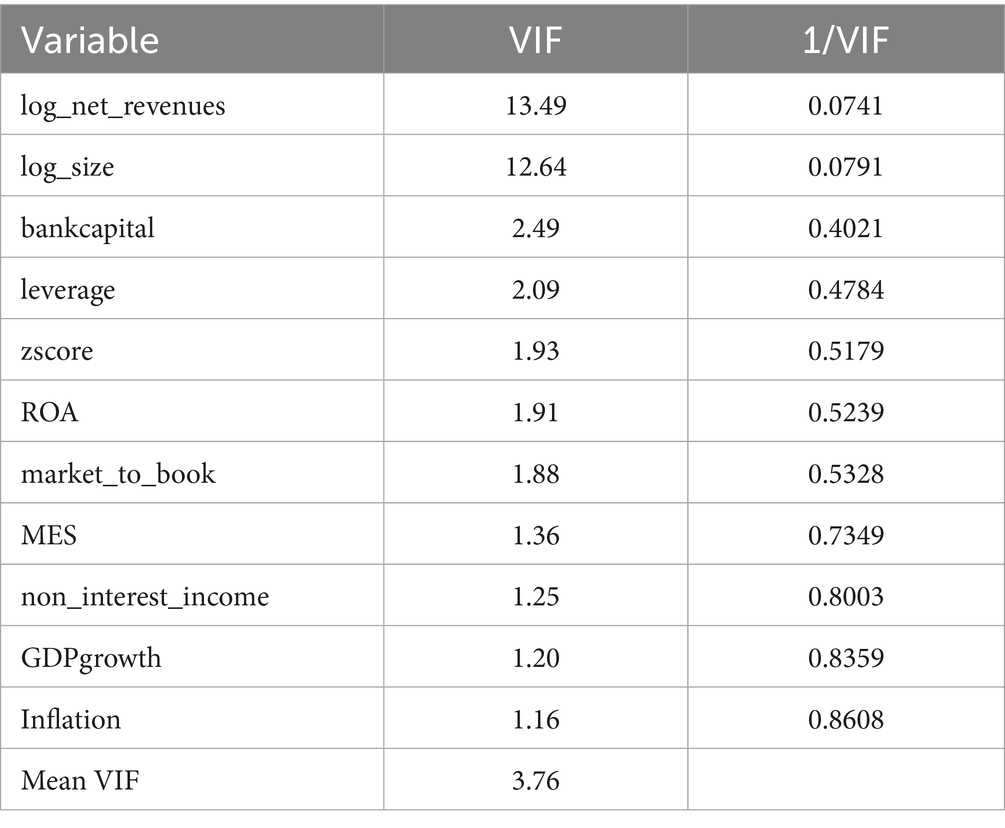

To ensure the reliability of our regression estimates, we assessed multicollinearity among the explanatory variables using the Variance Inflation Factor (VIF). Table 4 report the VIF values for the main independent variables included in the model. The results show that most variables have VIF values well below the conventional threshold of 10, suggesting that multicollinearity is not a major concern. While log_net_revenues and log_size have relatively higher VIF values (13.49 and 12.64, respectively), these reflect the natural correlation between firm size and revenue rather than problematic redundancy. The mean VIF is 3.76, which falls within the acceptable range. These findings support the robustness of our regression results and confirm that multicollinearity is unlikely to significantly bias the estimated coefficients.

3.2 Methodology

We employ a statistical technique for panel analysis to investigate the influence of oil prices on bank stock performance. The fundamental analytical model is discussed.

The selection of buy-and-hold returns in Equation 1 as the proxy of the dependent variable, which is bank stock performance, is based on Irresberger et al. (2015). EV𝑐,𝑡 refers to the major explanatory variables in our study that contains the interactive terms composed by the oil returns and country category (i.e., oil net exporting and importing countries) and the interactions of oil returns and sharp oil price drops (i.e., 2008–2009 and 2014–2015). It is worth noting that we aim to investigate whether Islamic banks are more sensitive to variations in oil prices. To fulfill this research purpose, we add the interaction term, namely 𝐼𝑠𝑙𝑎𝑚𝑖𝑐 × 𝑂𝑖𝑙 𝑟𝑒𝑡𝑢𝑟. 𝑂𝑖𝑙 𝑟𝑒𝑡𝑢𝑟𝑛, which consists of a set of explanatory variables, namely WTI, Brent, and Dubai crude returns. 𝐼𝑠𝑙𝑎𝑚𝑖𝑐 is an indicator variable that equals one if the bank is an Islamic bank and zero otherwise.

Control variables are primarily constructed based on the idiosyncratic characteristics of individual banks. We choose the logarithm of the banks’ total assets to control for the size of the banks in the sample, which follows Aebi et al. (2012) and Gandhi and Lustig (2015).5 In addition to banks’ size, we employ return on assets (ROA) to control for the profitability of banks. Noticeably, Irresberger et al. (2015) address that investors are likely to make rational decisions to sell the stocks of banks that are significantly affected by systemic risk. Thus, they utilize MES to mitigate the exposure of banks to systemic risk. Hence, we follow Acharya et al. (2017) in computing MES as the negative return on a bank’s stock, calculated on the days when the market experienced its 5% worst outcomes over the period covered in our study.

Moreover, we include the market-to-book ratio, Z-score, banks’ non-interest income ratio, and bank capital as control variables. The market-to-book ratio is defined as the market value of common equity divided by the book value of common equity. The Z-score, also known as distance-to-default, is a common measure of bank stability, computed as a bank’s equity-to-asset ratio plus ROA, and is eventually divided by the standard deviation of the return on assets. A higher Z-score indicates a lower probability of bank insolvency. A bank’s non-interest income ratio is calculated as the sum of non-interest income scaled by the sum of the bank’s non-interest income and net interest income. Eventually, we also include bank capital, defined as the bank’s equity divided by total assets, in the set of control variables.6 Besides, we add country-fixed effects, time-fixed effects, and bank-fixed effects. In general, our list of controls follows Irresberger et al. (2015), who also studied the banks’ stock performance. Descriptions of the variables and their sources are given in Appendix 1.

4 Empirical results and discussion

As suggested in the previous sections. We conduct several tests in three dimensions. First, we examine whether the nexus between oil returns and bank stock performance is stronger in oil-exporting countries than in oil-importing countries. Following the study by Cashin et al. (2014), we categorize Bahrain, Kuwait, Malaysia, Qatar, Saudi Arabia, and the UAE as oil net-exporting countries. The rest of the countries, such as Pakistan, Jordan, and Turkey, are categorized as oil net-importing countries. Second, we specifically investigate whether there is any incremental effect of oil prices on bank market returns during periods of oil price drops. Third, we examine whether the stock performance of Islamic banks is more or less sensitive to variations in oil returns. Finally, we attempt to determine which banking model (Islamic versus conventional) is more vulnerable to fluctuations in oil returns.

4.1 Does oil return impact bank stock performance in oil net exporting countries more than the impact in oil-importing countries?

As proposed by the previous argument, the over-expanded oil industry has the potential to impose a “crowd-out” effect on other industries in the economy, resulting in less diversified industries. This substantially decreases the banks’ ability to diversify their loan portfolios, concentrating most of the loans in oil-related businesses. Therefore, we suggest that the nexus between oil returns and bank stock performance is stronger in oil net-exporting countries. To test this hypothesis, we introduce an interactive term composed of the oil benchmark returns and the indicator of oil’s next exporting countries (ONEC, hereafter). In our sample, we define Bahrain, Kuwait, Malaysia, Qatar, Saudi Arabia, and the UAE as the oil net exporters (Rafiq et al., 2016). As shown in Table 5, the significant coefficients on the interactive terms suggest an incremental effect of oil price returns on the bank stock returns. It is worth noting that the main effect of the indicator variable is excluded because oil prices are time-variant series, and ONEC is the country indicator. The addition of the main effect variables results in a collinearity problem when time and country fixed effects are added to the analyses.7 Therefore, these terms cannot be included at the same time.

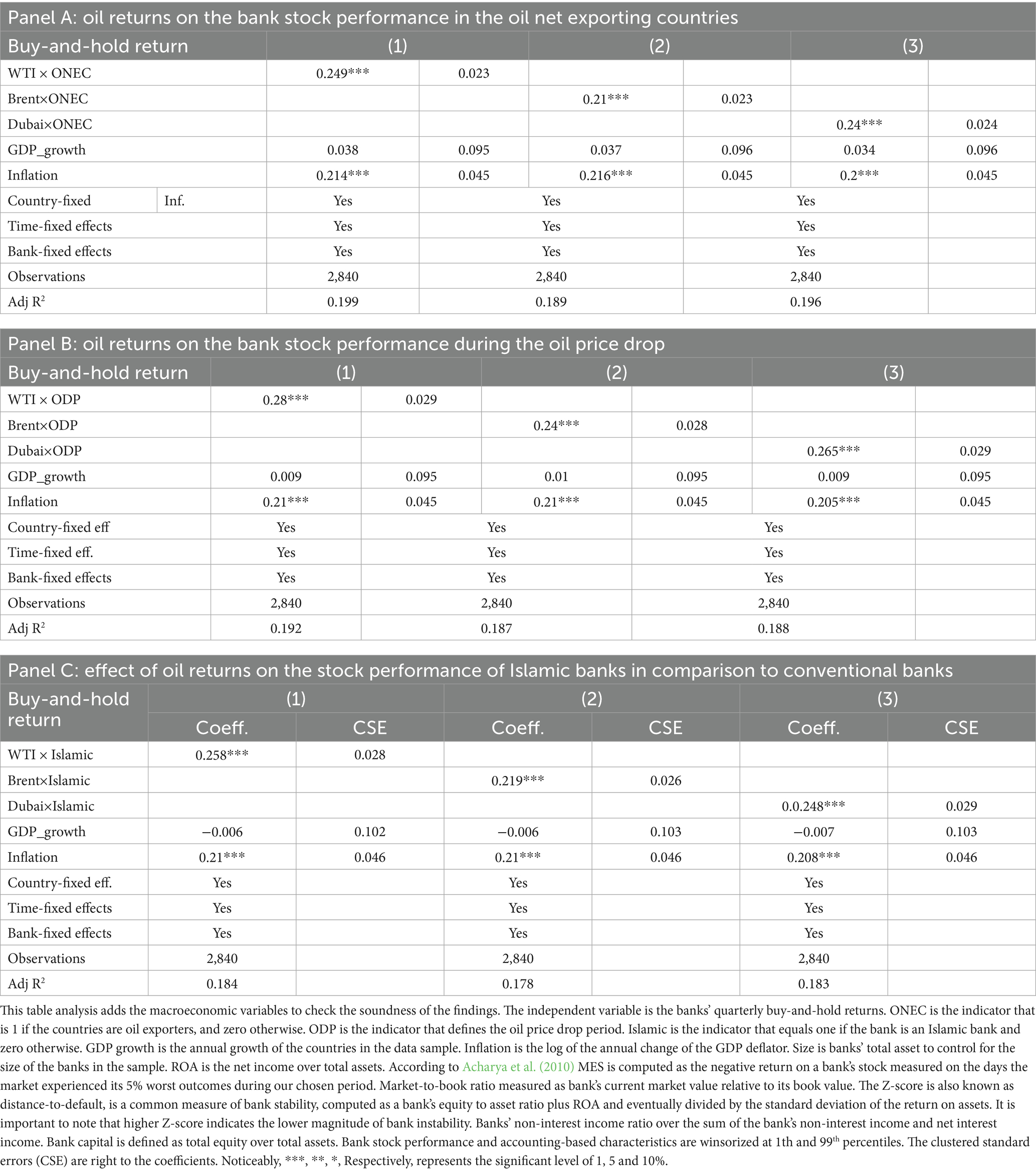

Table 5. Analyses based on whether the effects of oil returns on the bank stock performance are larger in the oil net export countries.

Regarding the control variables, we find a significant negative impact of bank size on buy-and-hold returns, which aligns with the results of Gandhi and Lustig (2015) and Irresberger et al. (2015). Our results also show significant coefficients for the market-to-book ratio, suggesting that a higher market-to-book ratio is associated with higher stock returns, which supports the findings of Aebi et al. (2012). In contrast to the relationship between the market-to-book ratio and banks’ buy-and-hold returns, our results indicate that a higher leverage ratio is associated with worse stock buy-and-hold returns for banks. The latter result aligns with those reported by Fahlenbrach and Stulz (2011).

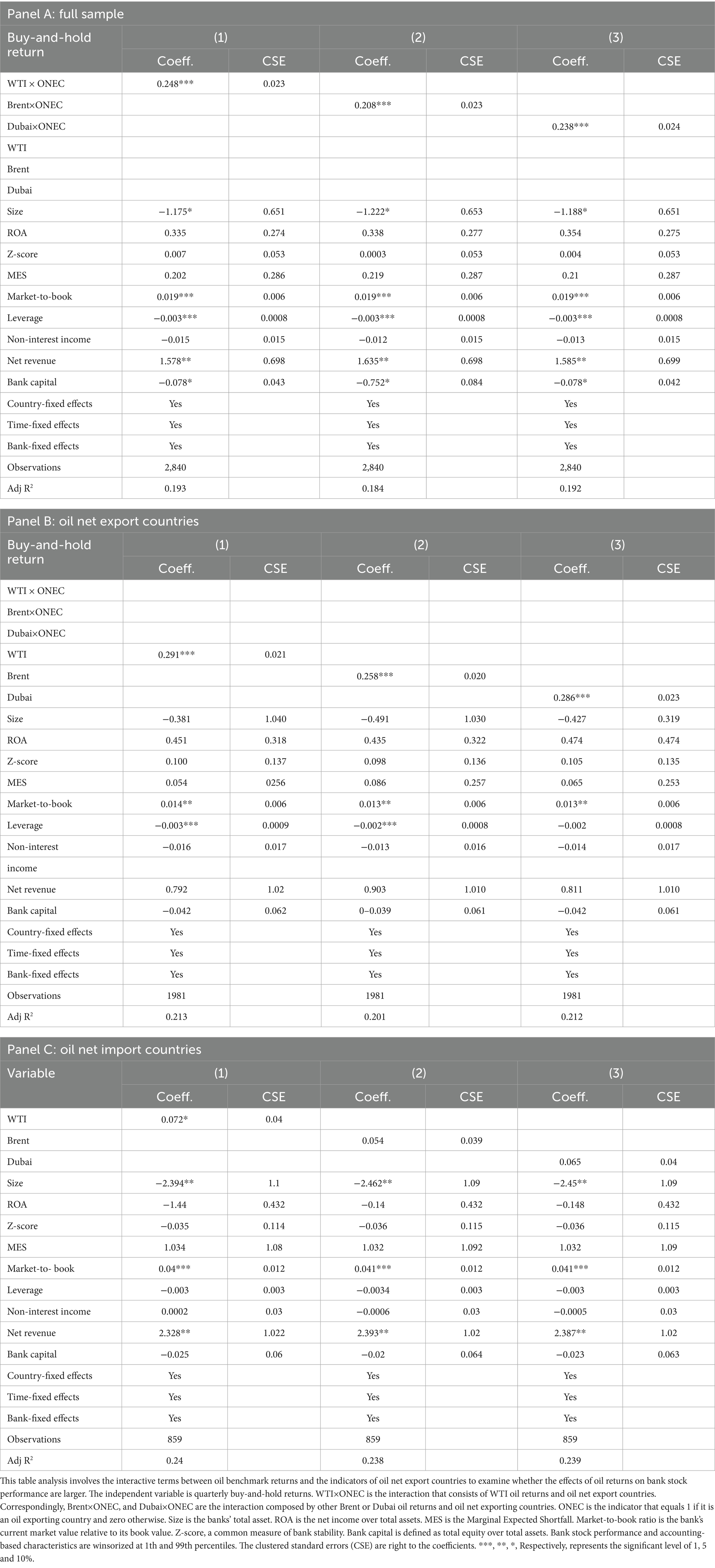

We use interaction terms to test the existence of the incremental effect of oil price changes on bank returns in both oil-exporting and oil-importing countries. Panel A of Table 5 represents the full sample. The interaction term of oil price in net exporting countries (ONEC) in panel A, Table 5, shows significant coefficients for the three oil price benchmarks that represent the returns. We further split the sample into net oil-exporting countries and net oil-importing countries, as shown in Panels B and C in Table 5. Panel B of Table 5 suggests a positive relationship for the ONCE group. However, Panel C Table 5 fails to report concrete evidence of the oil price impact on banks’ returns in net oil-importing countries. Overall, the findings are consistent with our anticipations.

Table 5 analysis involves the interactive terms between oil benchmark returns and the indicators of oil-exporting countries to examine whether the effects of oil returns on bank stock performance are larger. The independent variable is quarterly buy-and-hold returns. WTI × ONEC refers to the interaction between WTI oil returns and oil-exporting countries. Correspondingly, Brent×ONEC and Dubai×ONEC are the interactions composed of other Brent or Dubai oil returns, as well as oil-exporting countries. ONEC is the indicator that equals 1 if the country is an oil exporter and 0 otherwise. Size refers to the bank’s total assets. ROA is the net income over total assets. MES is the Marginal Expected Shortfall. The market-to-book ratio represents the bank’s current market value in relation to its book value. The Z-score is a common measure of bank stability. Bank capital is defined as total equity over total assets. Bank stock performance and accounting-based characteristics are winsorized at the 1st and 99th percentiles. The clustered standard errors (CSE) are right to the coefficients. ***, **, *, respectively, represents significance levels of 1, 5, and 10%.

4.2 Is bank stock performance more sensitive to oil returns variation when oil prices drop?

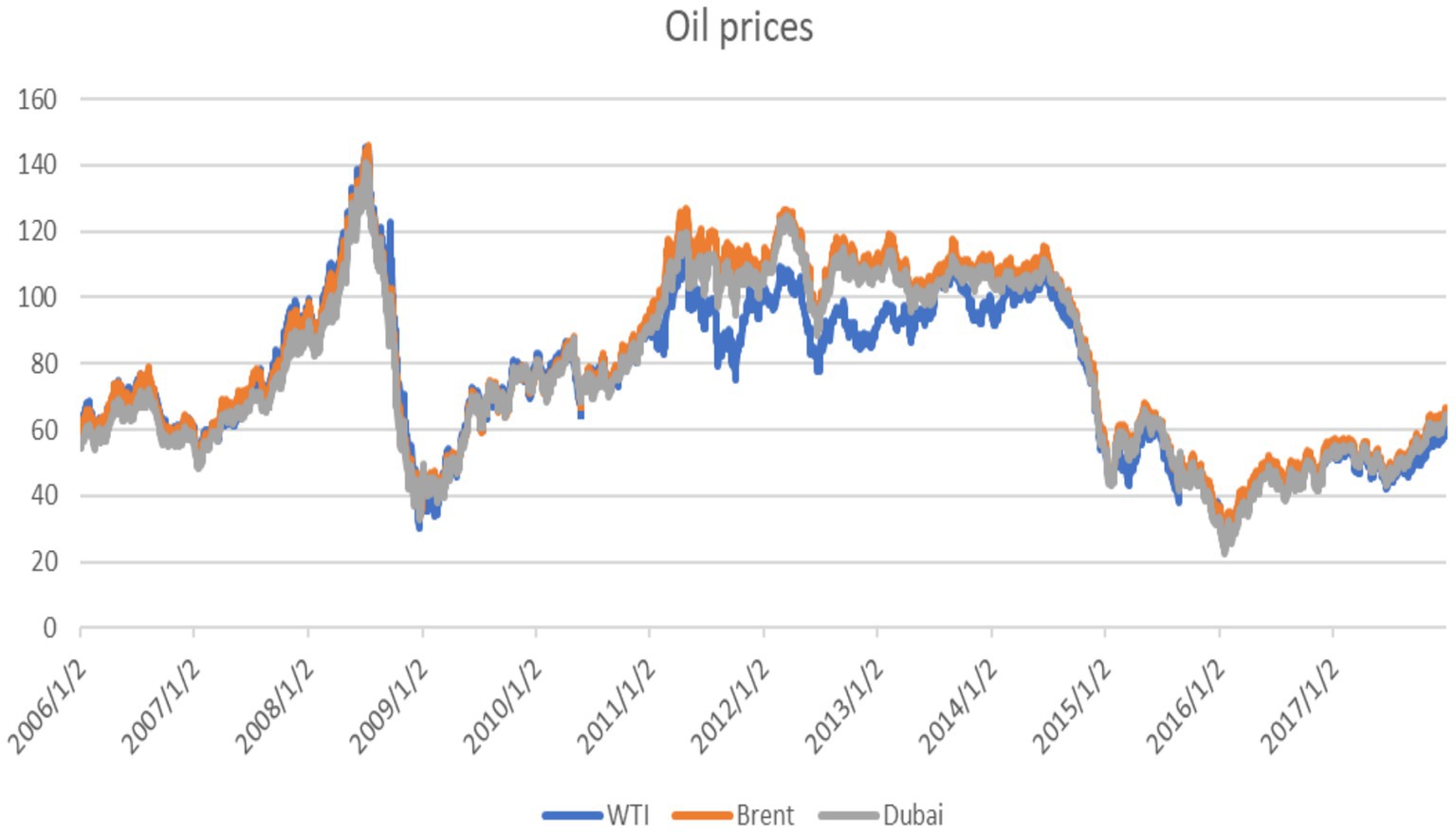

As discussed earlier, we suggest that the sharp drops in oil prices may cause a significant shock to the domestic economy, which motivates us to further investigate the strength of the relationship between oil returns and buy-and-hold returns of banks during periods of sharp oil price drops. Figure 1 illustrates that there are two periods during which oil prices experienced a significant decline. The first period starts in July 2008 and ends in February 2009. The second period, which commences in July 2014 and ends in 2015, is specified by Jarrett et al. (2019). Therefore, we define the two periods (2008Q3-2009Q1 and 2014Q3-2015Q4) as oil price drop periods (ODP, hereafter). The first period overlaps with the recent Global Financial Crisis, suggesting a heterogeneous nexus between oil returns and bank stock performance if the two periods are jointly analyzed. Therefore, we separate the two periods in our analysis and introduce ODP1 (2008Q3-2009Q1) and ODP2 (2014Q3-2015Q4). Similar to the previous analyses, we exclude the main effect variables due to the collinearity problem, as ODP varies with the time-fixed effects.

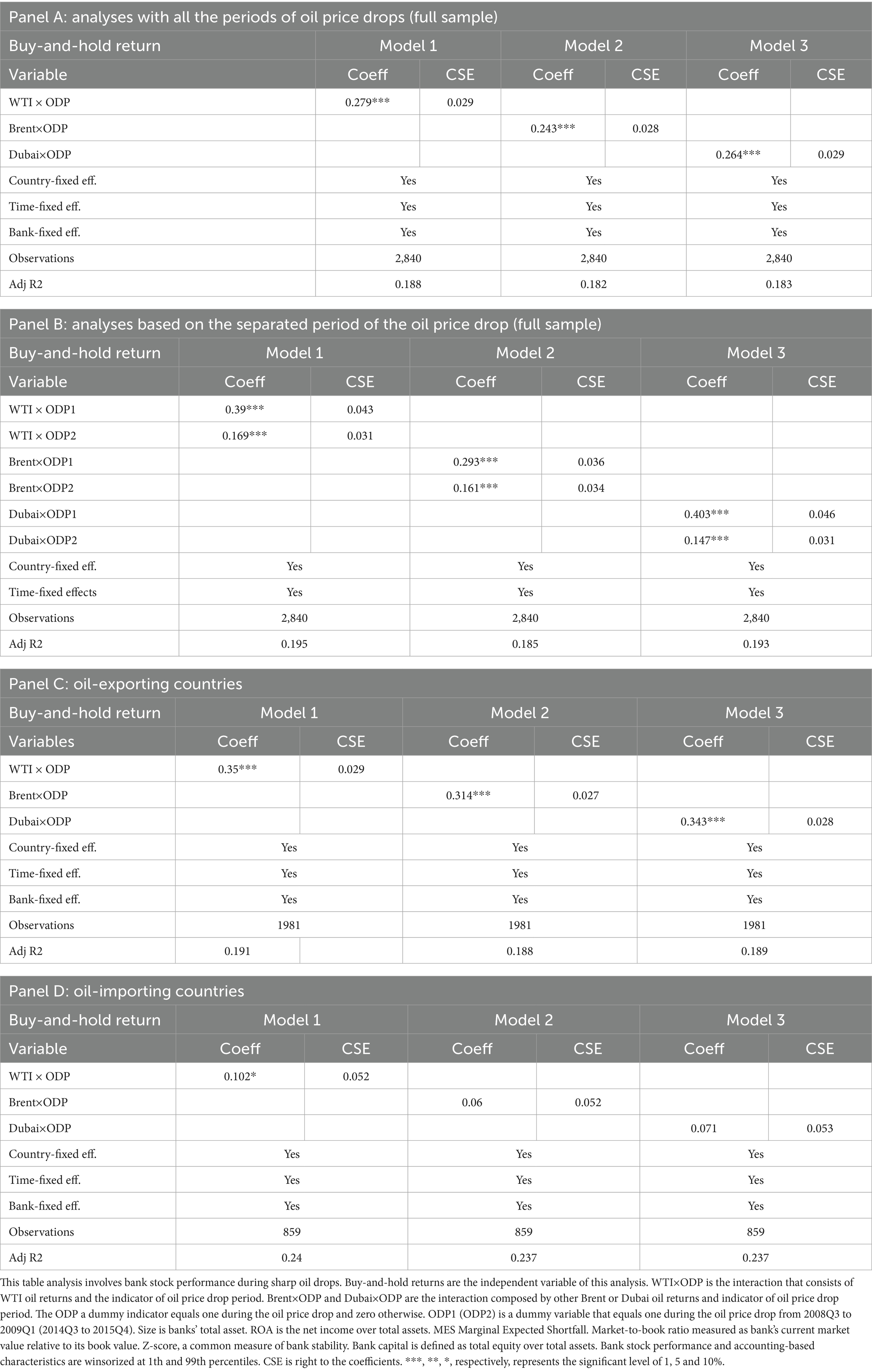

To learn about the effect of oil price sharp drops and bank stock performance, we incorporate the interactive terms, namely WTI × ODP, Brent×ODP, and Dubai×ODP, into the analysis for the two-period (full sample). As shown in panel A of Table 6, all the coefficients of the interactive terms are significant at a 1% level, suggesting a consistent positive relationship between oil price returns and buy-and-hold returns of the banks. In other words, the nexus between oil returns and bank stock performance varies across the entire sample period and increases during the significant oil price drop, specifically for net oil-exporting countries.

As discussed above, the first period of oil price decline, from 2008Q3 to 2009Q1, was also a period of crisis. This overlapping effect may suggest that banks in our sample from GCC countries might simultaneously suffer from the crisis and oil price shocks, plausibly indicating that bank stock performance might be more prone to oil price shocks due to the crisis’s impact. Therefore, we examine the two periods of oil price drops separately and employ the following models: WTI × ODP1, WTI × ODP2, Brent×ODP1, Brent×ODP2, Dubai×ODP1, and Dubai×ODP2. Results in Panel B Table 6 show significant coefficients of the interactive terms, which support our propositions and show that the impact during the oil price sharp drops during the financial crisis (ODP1) was stronger than the drop during the second period 2014–2015 (ODP2).

To further check the heterogeneous reaction of the bank stock performance to the oil price shocks, we also split the sample into two subsamples, namely oil net exporting countries and net oil-importing countries. Results presented in Panel C Table 6 show that all the coefficients on WTI × ODP, Brent×ODP, and Dubai×ODP are significant. These results suggest that bank stock performance is more susceptible to oil price drops in oil-exporting countries, which supports the findings presented in Table 5. However, the results in Panel D, Table 6, indicate a weak or no impact for oil-importing countries. This result is similar to the results shown in Panel C Table 5 for the full period for oil-importing countries. Overall, the findings presented in Section 3.2 support the non-linear oil-equity nexus argued by Salisu and Isah (2017).

4.3 Are Islamic banks more resilient to the oil price variation?

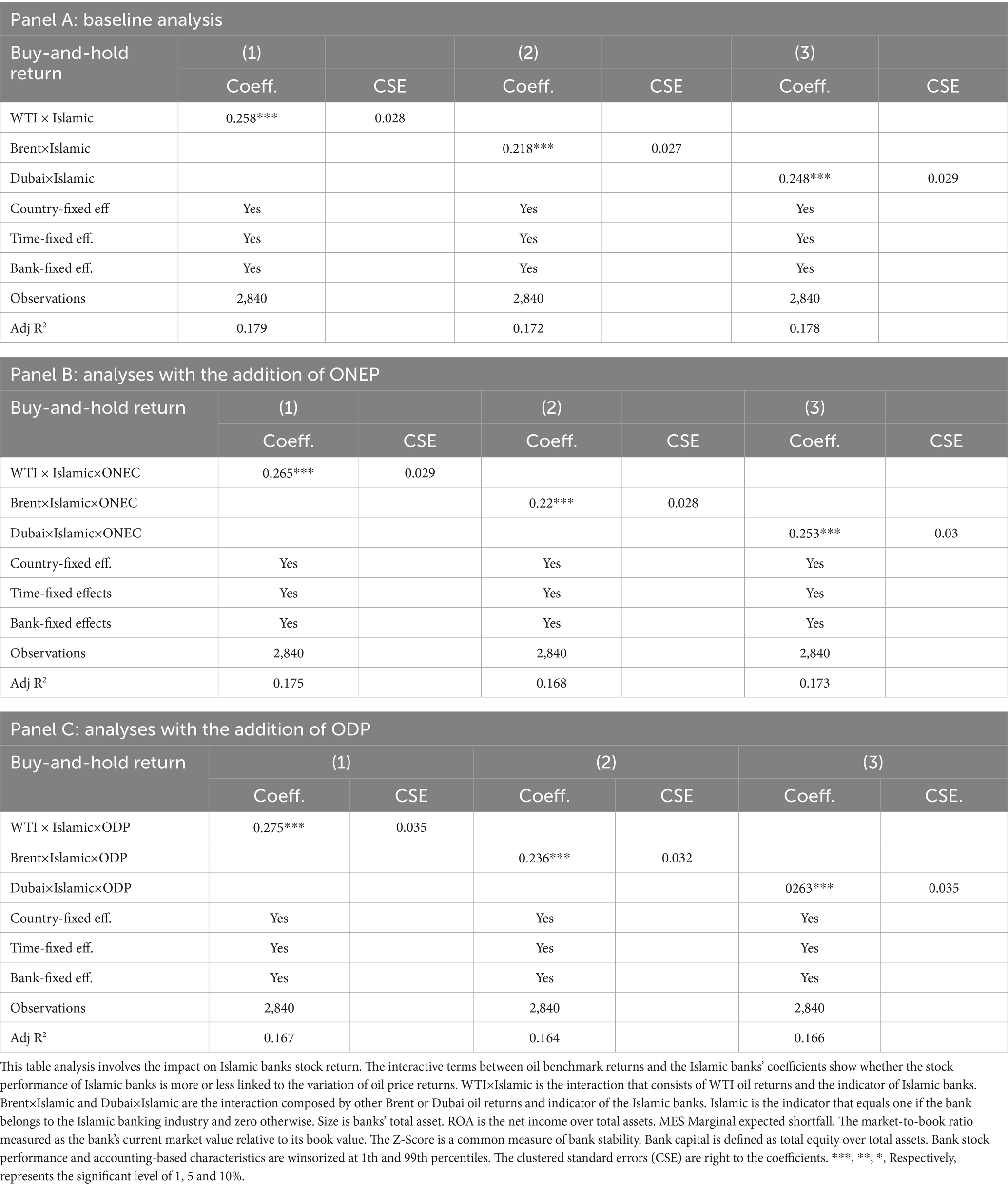

In this section, we employ the interactive terms of WTI × Islamic, Brent×Islamic, and Dubai×Islamic to examine whether the stock performance of Islamic banks is more or less prone to the oil price variation. In Panel A of Table 7, the coefficients on all the aforementioned interactive terms are positive and statistically significant at the 1% level, indicating that the stock performance of Islamic banks is more sensitive to variations in oil prices. As previously argued, there are no main effect variables involved in the analyses, because the indicator of Islamic is collinear with the bank fixed effects, and the variables of oil returns are collinear with time fixed effects.

As inferred from previous literature, the effects of oil price shocks on bank stock performance differ between oil-importing countries and oil-exporting countries. Therefore, we extend the previous analyses by creating a three-term interaction, adding oil net exporting countries (ONEC) to the model specifications. Results in Panel B of Table 7 show that coefficients on all three interaction terms are positive and significant, suggesting that the market returns of Islamic banks in the net oil-exporting countries are more sensitive to the oil price variation than the Islamic banks in the net oil-importing countries, which supports the findings in Panel A of Table 7. Moreover, we incorporate ODP into the analysis to further examine how the stock performance of Islamic banks responds to changes in oil prices during oil price drops. The findings in Panel C of Table 7 show that the market performance of Islamic banks is more prone to the fluctuation of oil prices when the oil prices experience price drops.

Table 7 analysis examines the impact on the stock returns of Islamic banks. The interactive terms between oil benchmark returns and the Islamic banks’ coefficients indicate whether the stock performance of Islamic banks is more or less closely linked to the variation in oil price returns. WTI × Islamic refers to the interaction that involves WTI oil returns and the indicator of Islamic banks. Brent×Islamic and Dubai×Islamic are the interactions composed of other Brent or Dubai oil returns and indicators of Islamic banks. Islamic is the indicator that equals one if the bank belongs to the Islamic banking industry and zero otherwise. Size is the bank’s total assets. ROA is the net income over total assets. MES: Marginal expected shortfall. The market-to-book ratio is calculated as the bank’s current market value divided by its book value. The Z-score is a common measure of bank stability. Bank capital is defined as total equity over total assets. Bank stock performance and accounting-based characteristics are winsorized at the 1st and 99th percentiles. The clustered standard errors (CSE) are right to the coefficients. ***, **, *, respectively, represents significance levels of 1, 5, and 10%.

4.4 Analyses for the GCC countries with strong oil dependence

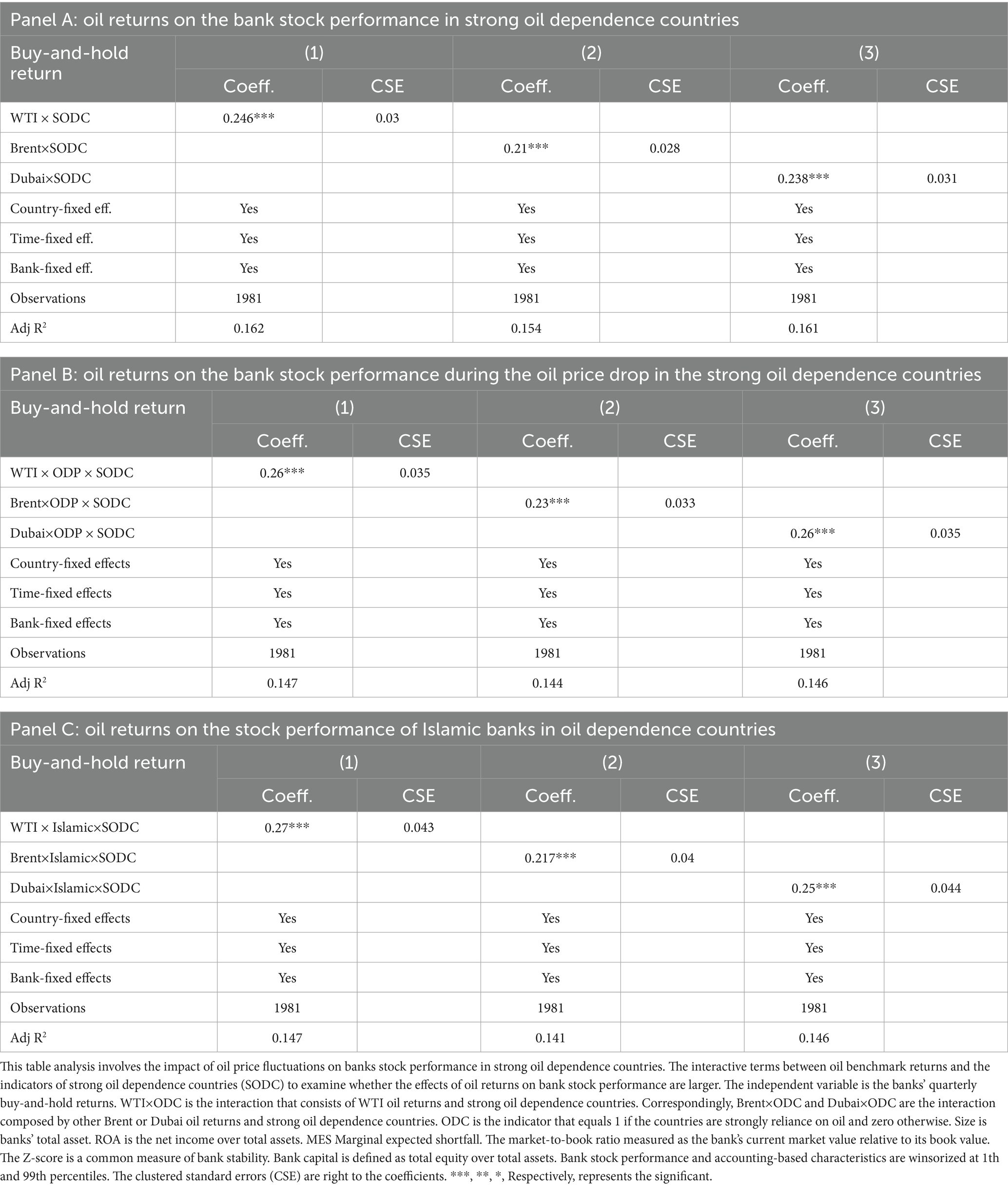

The above analyses show the findings of the oil net exporters. Nevertheless, the motives behind Vision 2030 in Saudi Arabia pique our curiosity to further examine the oil-bank relationship in countries with strong oil dependence. Although numerous studies do not differentiate between oil net exporters and importers, very few studies define countries with high oil dependence. According to the argument of Nasir et al. (2019), among all the GCC countries, only the economies of Bahrain, Saudi Arabia, and Kuwait have the largest exposure to the oil industry. Hence, we define the above three countries as those with a strong dependence on oil rents or strong oil dependence countries (SODC, hereafter). Moreover, to compare the findings related to oil net exporters presented in the previous analyses, we restrict our sample to include only oil net export countries, namely the three GCC countries mentioned above.

Results in Table 8, Panel A, show a stronger oil-bank linkage when the interaction term of oil returns and SODC is introduced. Notably, the foregoing analyses reveal a stronger oil-bank linkage in the group of oil net exporters. Hence, the findings in Panel A of Table 8 further support the argument that the oil-bank linkage is enhanced by the stronger oil-economy linkage. Moreover, the findings in Table 8, Panel B, suggest a stronger reaction of bank stock performance to oil price drops (ODP) in SODC, which further supports the results of Panel A, Table 8. Similarly, the stock performance of Islamic banks in SODC is more sensitive to oil returns in the oil net exporter group, as compared to the findings in Panel B of Table 7.

Table 8 analysis examines the impact of oil price fluctuations on the stock performance of banks in oil-dependent countries. The interactive terms between oil benchmark returns and the indicators of strong oil dependence countries (SODC) are examined to determine whether the effects of oil returns on bank stock performance are larger. The independent variable is the banks’ quarterly buy-and-hold returns. WTI × ODC refers to the interaction between WTI oil returns and oil-dependent countries. Correspondingly, Brent×ODC and Dubai×ODC are the interactions composed of other Brent or Dubai oil returns and strong oil-dependent countries. ODC is the indicator that equals 1 if the country is strongly reliant on oil and 0 otherwise. Size is the bank’s total assets. ROA is the net income over total assets. MES: Marginal expected shortfall. The market-to-book ratio is calculated as the bank’s current market value divided by its book value. The Z-score is a common measure of bank stability. Bank capital is defined as total equity over total assets. Bank stock performance and accounting-based characteristics are winsorized at the 1st and 99th percentiles. The clustered standard errors (CSE) are right to the coefficients. ***, **, and* represent the significance levels, respectively.

4.5 Which banks are more resilient to oil price shocks?

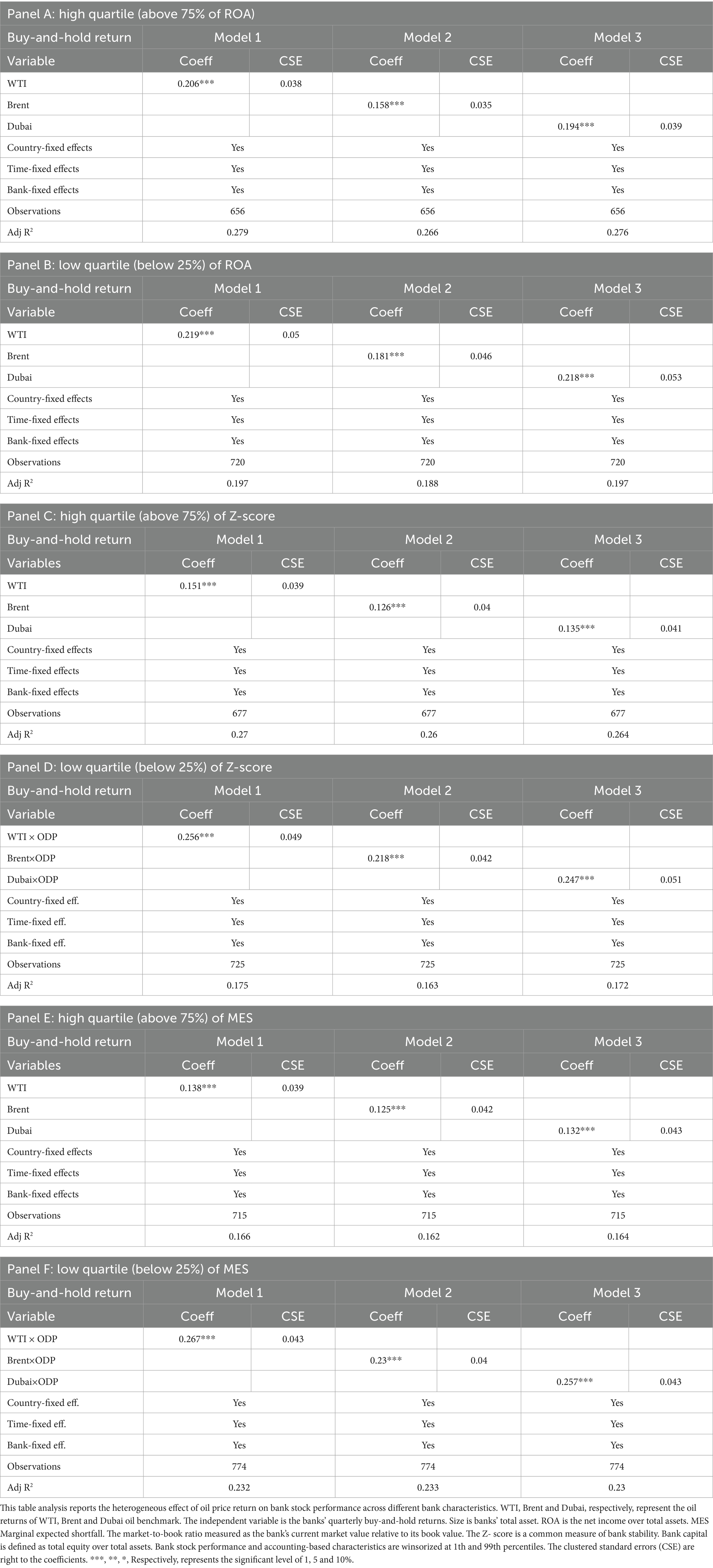

The above analyses indicate that bank market performance in oil-exporting countries is vulnerable to oil price shocks. We also find a stronger impact of oil returns on bank stock performance during periods of declining oil prices. Moreover, the returns of Islamic banks are more susceptible to fluctuations in oil prices. Nevertheless, these findings further pique our curiosity to investigate whether bank characteristics may decrease or increase bank resilience to oil price shocks. Following the spirit of Irresberger et al. (2015), we add a set of bank characteristics to the list of our control variables, namely ROA, Z score, and MES, and run three major sets of analyses.8 Besides, we split up the sample into the first 25% quartile and the last 75% quartile for each set of analyses.

Results in Panel B of Table 9 show the results for the low ROA (0–25% quartile). The coefficients of the three variables of oil returns are larger than those presented in Table 9, panel A (75% quartile), suggesting that the higher the bank’s profitability, the lower the impact of an oil price shock on bank market returns in the selected countries. Panels C and D of Table 9 show the Z-score results as an indicator of solvency risk. A higher Z-score suggests lower bank insolvency risk, and vice versa. Similar to the findings on ROA, banks with a higher Z-score (indicating lower insolvency risk) exhibit less sensitivity to oil price shocks. Regarding MES, we observe that market performance with lower returns (below the 25% quartile) is more vulnerable to oil price shocks, which is consistent with the ROA and Z-score. Overall, our results suggest that ROA, Z-score, and MES are the primary bank characteristics that influence its sensitivity to oil price fluctuations.

Table 9 presents the heterogeneous effect of oil price returns on bank stock performance across different bank characteristics. WTI, Brent, and Dubai, respectively, represent the oil returns of the WTI, Brent, and Dubai oil benchmarks. The independent variable is the banks’ quarterly buy-and-hold returns. Size is the bank’s total assets. ROA is the net income over total assets. MES: Marginal expected shortfall. The market-to-book ratio is calculated as the bank’s current market value divided by its book value. The Z-score is a common measure of bank stability. Bank capital is defined as total equity over total assets. Bank stock performance and accounting-based characteristics are winsorized at the 1st and 99th percentiles. The clustered standard errors (CSE) are right to the coefficients. ***, **, and *, respectively, represent significance levels of 1, 5, and 10%.

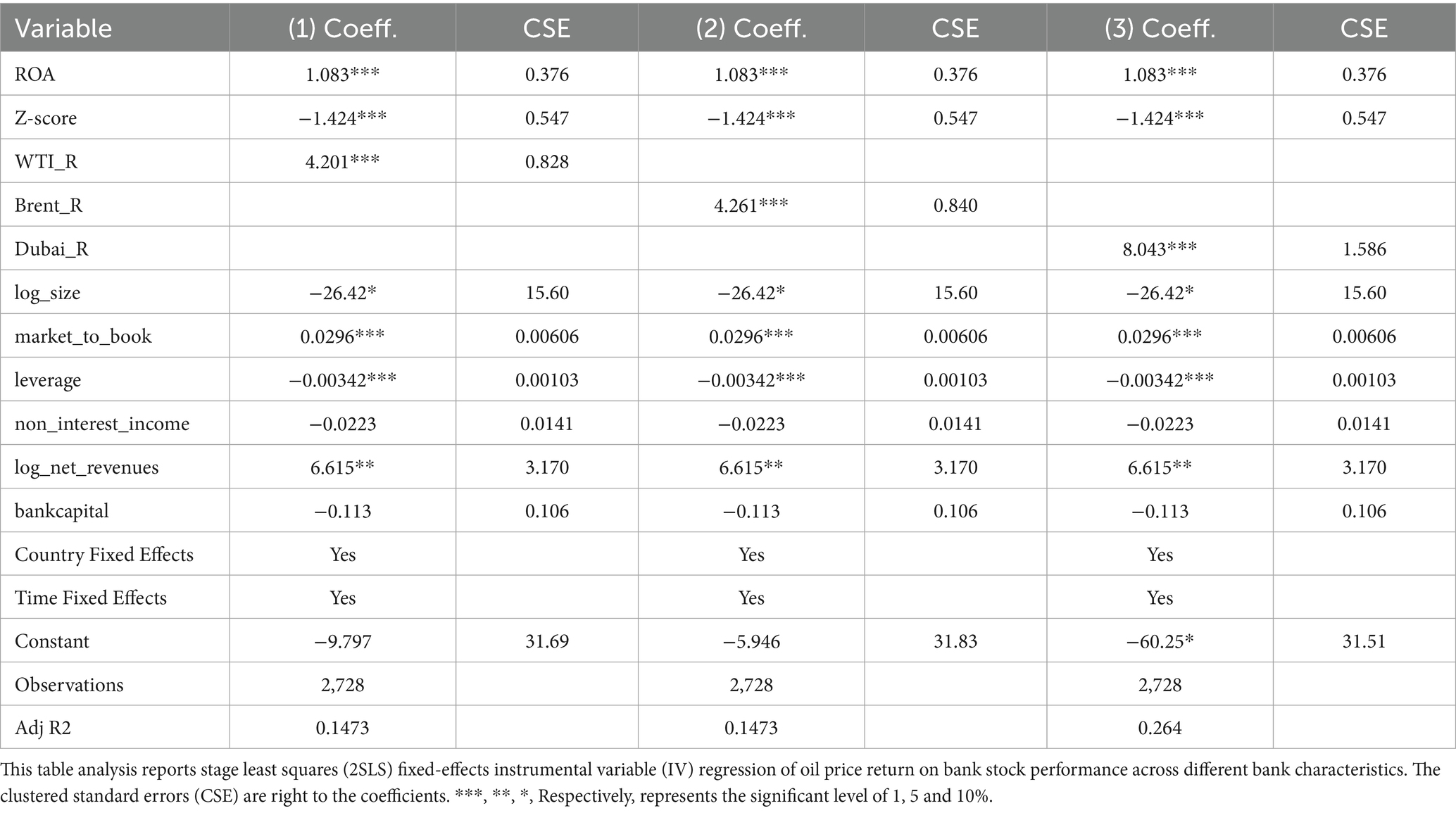

4.6 Robustness check: instrumental variable estimation

To address potential endogeneity and further validate our empirical strategy, we implement a two-stage least squares (2SLS) fixed-effects instrumental variable (IV) regression. This method is designed to correct reverse causality and omitted variable bias that may arise from the simultaneous determination between bank performance measures and stock returns.

We consider ROA and Z-score as endogenous variables, given their potential feedback effects from market valuations. To instrument these variables, we employ their lagged values (l_roa and l_zscore), leveraging the panel structure to introduce temporal separation. This approach enhances causal identification while maintaining internal consistency. Control variables such as size, leverage, non-interest income, and net revenues are treated as exogenous due to their relative stability and limited exposure to short-term shocks.

The IV model is estimated with country-fixed effects and time-fixed effects to absorb unobservable heterogeneity and macroeconomic fluctuations. The results, presented in Table 10, are consistent with our baseline findings: ROA remains positively associated with stock returns, while the Z-score exhibits a significant negative relationship. Crucially, oil return variables (WTI, Brent, and Dubai) continue to display robust and statistically significant positive coefficients, reinforcing the central conclusion that oil price movements are a key driver of bank stock performance. The model is estimated using a 2SLS fixed-effects specification with country and time (quarterly) fixed effects, ensuring control for unobserved heterogeneity and macroeconomic influences. The following Stata command summarizes the specification:

4.7 Non-linear and asymmetric effects of oil prices on bank stock returns

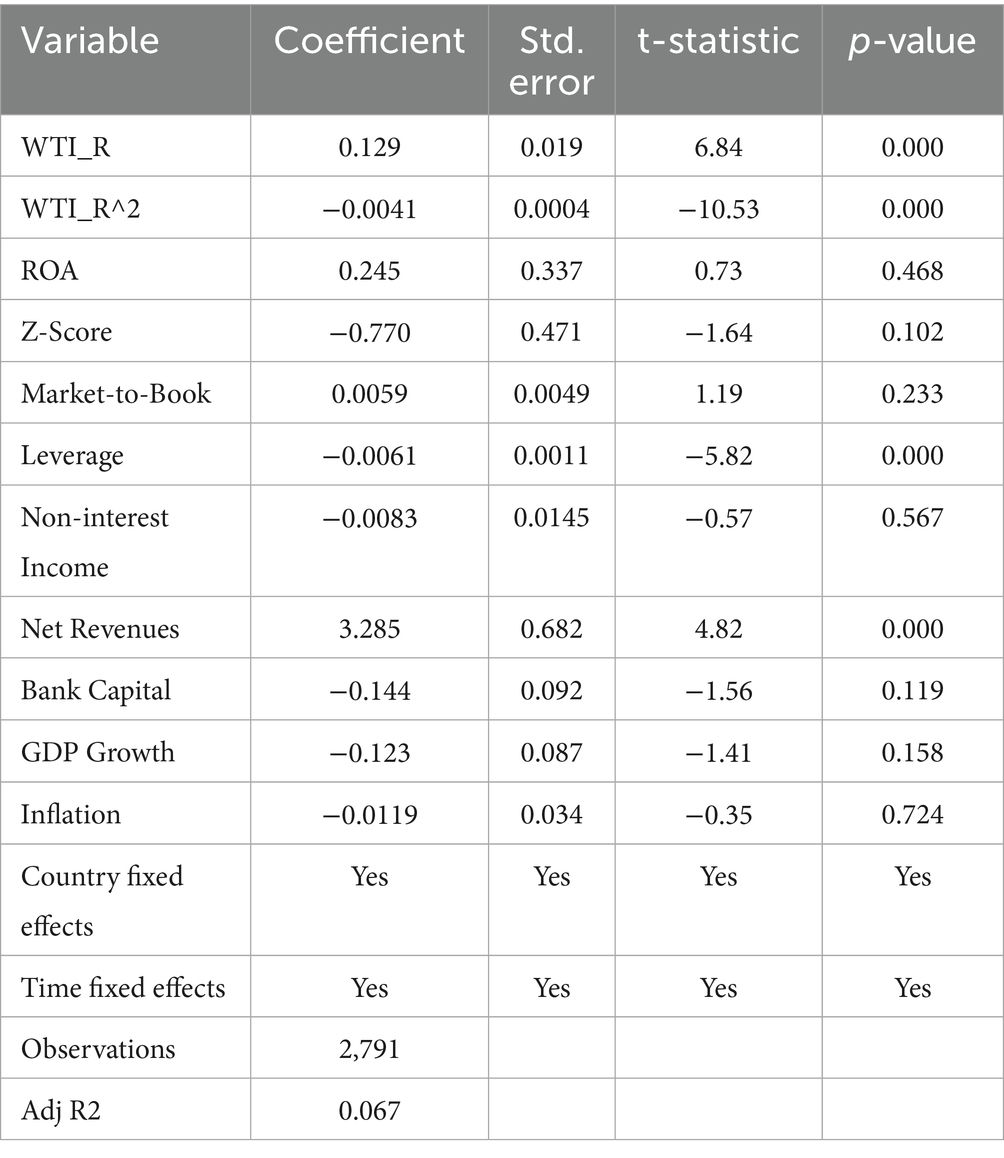

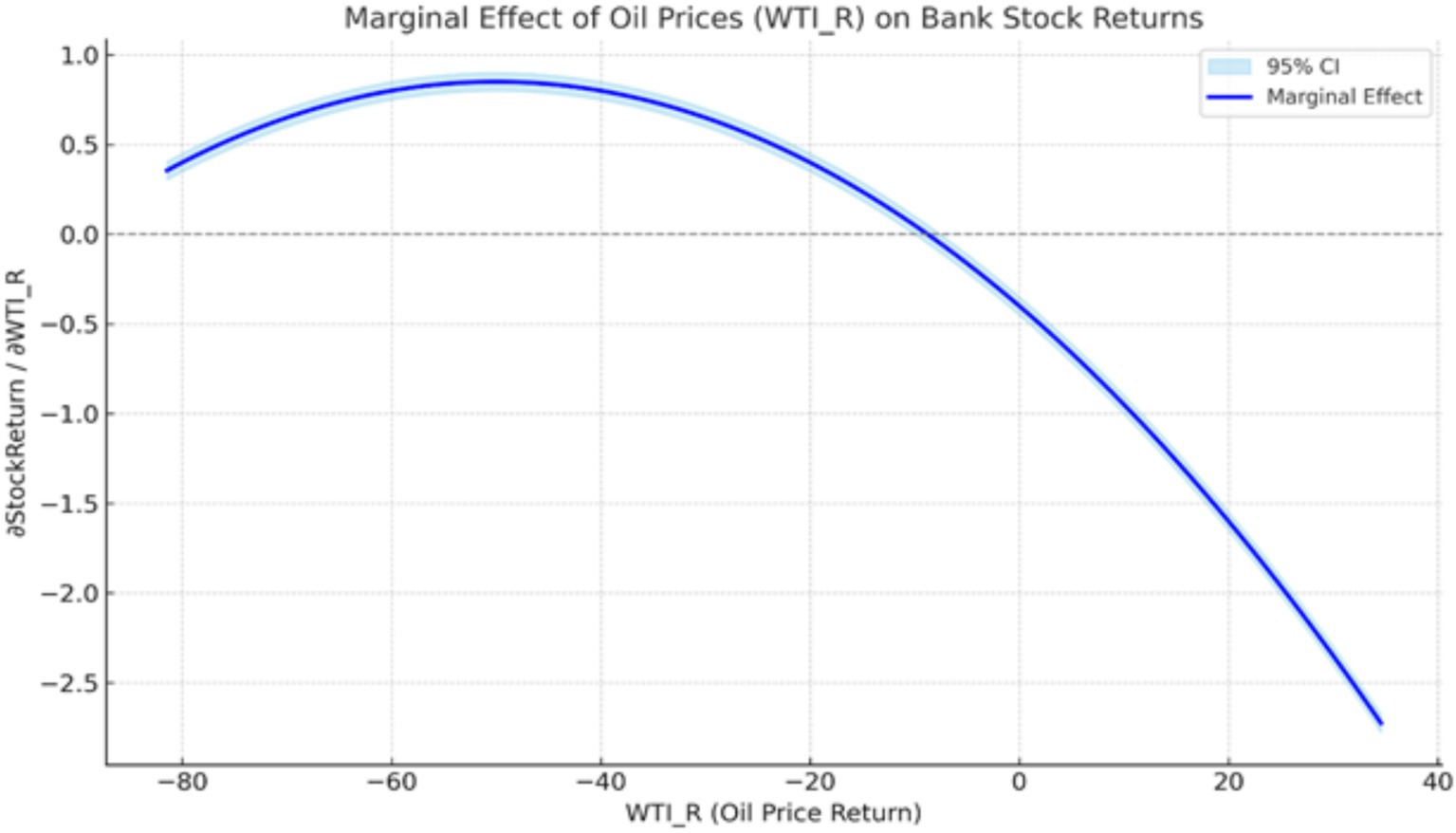

To assess whether the relationship between oil prices and bank stock returns is non-linear, we augment our baseline fixed-effects regression model by including a squared term for oil price returns (WTI_R^2). The estimation results, presented in Table 11, show that both the linear and squared terms are statistically significant. The positive coefficient on the linear term and the negative coefficient on the squared term indicate a concave relationship, consistent with the concept of diminishing marginal returns as oil prices rise. This result implies that while moderate oil price increases may initially boost bank stock returns—likely reflecting improved economic outlook and lending conditions—the marginal benefit weakens at higher price levels. Beyond a certain threshold, further increases may introduce inflationary pressure or market instability, thus negatively affecting bank performance.

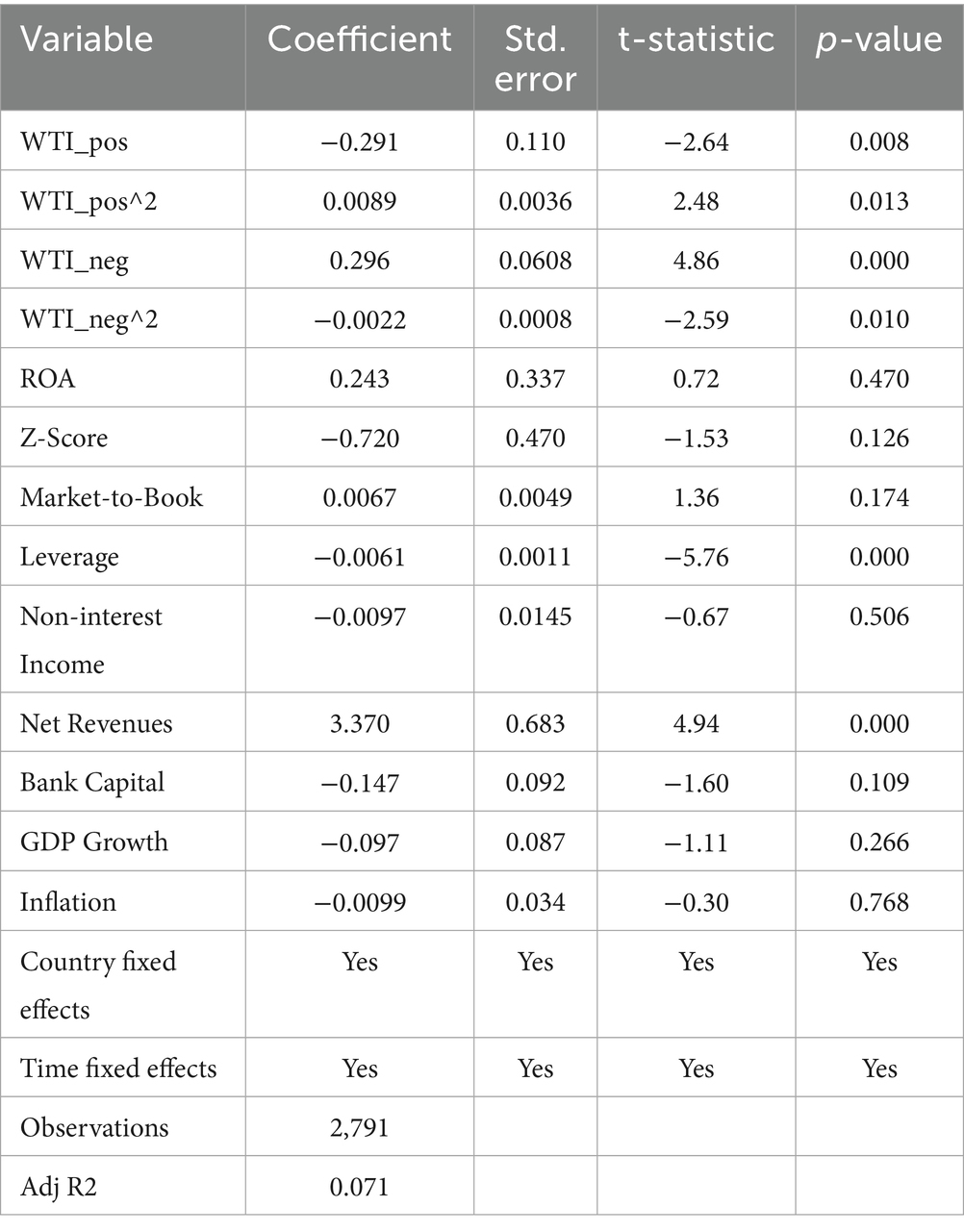

To further investigate potential asymmetries, we decompose oil price changes into positive (WTI_pos) and negative (WTI_neg) components, including both linear and squared terms in the model. As shown in Table 12, the results reveal a U-shaped pattern for positive oil shocks and an inverted U-shaped pattern for negative ones. That is, small positive shocks initially reduce bank stock returns, but the effect becomes less negative or even positive at larger magnitudes. In contrast, negative shocks initially increase stock returns, but the positive effect declines with larger shocks. These asymmetric and non-linear patterns highlight the complex dynamics of oil price transmission to financial markets. They also underscore the importance of modeling both the magnitude and direction of oil price movements when assessing their impact on bank stock performance.

To visualize this effect, we plot the marginal effect of oil price changes on bank stock returns across the observed range (Figure 2). The downward-sloping curve confirms that the impact of oil price movements decreases and eventually becomes negative, with the shaded confidence bands indicating statistical significance at conventional levels.

Figure 2. Displays the marginal effect of oil price changes (WTI_R) on bank stock returns across the observed range, based on a quadratic regression model. The shaded region represents the 95% confidence interval. The downward trend supports a concave (nonlinear) relationship.

4.8 Further robustness tests

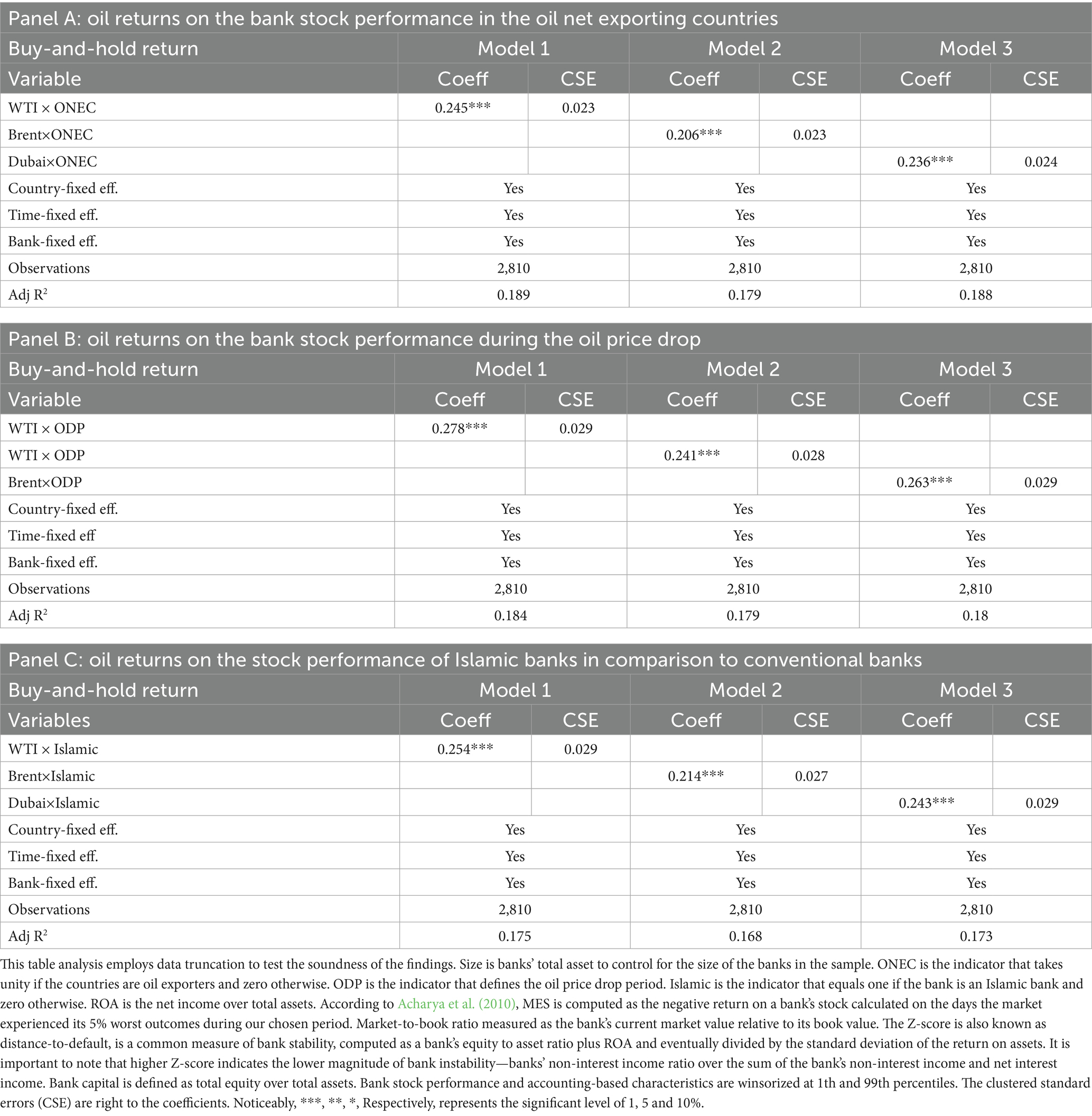

To test the soundness of the major findings presented in the previous sections, we follow Irresberger et al. (2015) and Beck et al. (2013) by adding macroeconomic variables and applying data truncation at the 1 and 99% levels. In Table 10, all the results remain robust with the addition of GDP and inflation as macroeconomic factors. In Table 11, the data truncation removes outliers rather than winsorizing them, as in the previous analyses. The findings remain robust even after the removal of outliers.

Table 13 analysis incorporates macroeconomic variables to validate the soundness of the findings. The independent variable is the banks’ quarterly buy-and-hold returns. ONEC is the indicator that equals 1 if the country is an oil exporter and 0 otherwise. ODP is the indicator that defines the period of the oil price drop. Islamic is the indicator that equals one if the bank is an Islamic bank and zero otherwise. GDP growth refers to the annual growth rate of the countries in the data sample. Inflation is the log of the annual change of the GDP deflator. Size is the bank’s total assets, used to control for the size of the banks in the sample. ROA is the net income over total assets. According to Acharya et al. (2010), MES is computed as the negative return on a bank’s stock measured on the days the market experienced its 5% worst outcomes during our chosen period. The market-to-book ratio is calculated as a bank’s current market value divided by its book value. The Z-score, also known as distance-to-default, is a common measure of bank stability, computed as a bank’s equity-to-asset ratio plus ROA and eventually divided by the standard deviation of the return on assets. It is important to note that a higher Z-score indicates a lower magnitude of bank instability. A bank’s non-interest income ratio is the sum of the bank’s non-interest income and net interest income divided by the bank’s non-interest income. Bank capital is defined as total equity over total assets. Bank stock performance and accounting-based characteristics are winsorized at the 1st and 99th percentiles. The clustered standard errors (CSE) are right to the coefficients. Notably, ***, **, and *, respectively, represent significance levels of 1, 5, and 10%.

Table 14 analysis employs data truncation to test the soundness of the findings. Size refers to the bank’s total assets, used to control for the size of banks in the sample. ONEC is the indicator that takes the value of unity if the country is an oil exporter and zero otherwise. ODP is the indicator that defines the period of the oil price drop. Islamic is the indicator that equals one if the bank is an Islamic bank and zero otherwise. ROA is the net income over total assets. According to Acharya et al. (2010), MES is computed as the negative return on a bank’s stock calculated on the days the market experienced its 5% worst outcomes during our chosen period. The market-to-book ratio is calculated as the bank’s current market value divided by its book value. The Z-score is also known as distance-to-default, is a common measure of bank stability, computed as a bank’s equity to asset ratio plus ROA and eventually divided by the standard deviation of the return on assets. It is important to note that a higher Z-score indicates a lower magnitude of bank instability—the banks’ non-interest income ratio over the sum of the bank’s non-interest income and net interest income. Bank capital is defined as total equity over total assets. Bank stock performance and accounting-based characteristics are winsorized at the 1st and 99th percentiles. The clustered standard errors (CSE) are right to the coefficients. Notably, ***, **, and *, respectively, represent significance levels of 1, 5, and 10%.

5 Conclusion and policy implications

This study demonstrates that oil price fluctuations significantly influence the stock performance of both Islamic and conventional banks, particularly in oil-exporting Gulf Cooperation Council (GCC) countries such as Saudi Arabia, Kuwait, and Bahrain. Our empirical findings suggest that Islamic banks are more vulnerable to oil-related volatility than their conventional counterparts, a pattern that is particularly pronounced during periods of oil price declines and in countries with a strong economic reliance on oil. These outcomes carry critical implications for financial sector resilience, regulatory oversight, and broader economic policymaking in both oil-exporting and oil-importing countries within the MENA region.

From a regulatory perspective, macroprudential policy frameworks should be recalibrated to explicitly account for oil price exposure. While current regulations—such as Basel III—primarily emphasize credit cycle dynamics, our findings highlight the need to address commodity-linked vulnerabilities, particularly those arising from oil price shocks. In this context, regulators in oil-exporting economies, such as Saudi Arabia and Kuwait, should consider enhancing capital buffer requirements beyond the standard 2.5% of risk-weighted assets (RWA) prescribed under Basel III, to better reflect the systemic risks associated with oil dependency. Concurrently, financial authorities in oil-importing countries such as Jordan, Pakistan, and Turkey should strengthen their stress-testing mechanisms to more comprehensively model the fiscal and financial spillovers from oil price volatility.

Sector-specific credit policies are also necessary to support economic diversification and long-term stability. In line with national strategies such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050 roadmap, regulators should promote lending to renewable energy, clean manufacturing, and sustainable transport sectors. Similar efforts should also be supported in oil-importing economies. For example, Jordan’s Renewable Energy and Energy Efficiency Fund (JREEEF) can be scaled to attract bank lending for solar and water-energy projects. Pakistan and Turkey can also build on existing commitments to accelerate investment in wind, solar, and LNG infrastructure by establishing binding clean energy targets and implementing regulatory reforms, such as Turkey’s “Super Permit” system for renewable projects.

Government support is crucial for overcoming the structural barriers to financing clean energy. Public-private coordination can mobilize capital toward bankable projects by enhancing credit information systems, strengthening legal enforcement, and refining pricing mechanisms. Countries such as Pakistan should leverage regional partnerships such as CPEC to finance large-scale projects like the Quaid-e-Azam Solar Park. Jordan can deepen cooperation with Gulf States through CEPA agreements to expand wind and solar capacity. Transparent power purchase agreements (PPAs) and targeted fiscal incentives will be crucial in mitigating risk and ensuring the scalability of these investments.

At the bank level, financial institutions—both Islamic and conventional—must strengthen their internal risk management systems to reflect commodity-linked exposure. Banks should regularly incorporate oil-price volatility into their stress-testing procedures, adjusting the frequency and magnitude of shocks to match their geographic and portfolio exposures. Islamic banks, in particular, should scale up profit-and-loss sharing (PLS) Sukuk and equity-based instruments to support renewable energy initiatives, industrial decarbonization efforts, and infrastructure upgrades. This approach not only aligns with ESG principles but also reduces excessive concentration in oil-dependent sectors.

Furthermore, banks should develop and deploy financial instruments to hedge oil-price risk. In oil-importing countries such as Jordan, Pakistan, and Turkey, forward contracts, swaps, or capped pricing agreements can help utilities and energy-intensive industries mitigate the impact of rising input costs. In oil-exporting economies, put options or hedging floors may be suitable for stabilizing income during price downturns. For Islamic banks, Shariah-compliant alternatives—such as Wa’ad-based commodity contracts and Islamic profit rate swaps—offer viable hedging mechanisms while adhering to ethical financing norms.

Finally, cross-border collaboration and capacity-building are crucial for implementing these reforms effectively. Financial institutions should collaborate with multilateral bodies such as the Islamic Financial Services Board (IFSB), the Bank for International Settlements (BIS), and the Islamic Development Bank to develop technical training, ESG integration strategies, and tools for modeling energy market risks. These initiatives will not only build resilience in the banking sector but also make a meaningful contribution to national development goals and long-term financial sustainability across the MENA and GCC regions.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

MSS: Conceptualization, Methodology, Project administration, Validation, Writing – original draft, Writing – review & editing. DL: Conceptualization, Data curation, Formal analysis, Software, Writing – original draft. AH: Investigation, Methodology, Software, Writing – review & editing. MS: Conceptualization, Investigation, Methodology, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Acknowledgments

We are grateful to the faculties who participated in the Bag Brown Lunch at Monash University Malaysia. The first author acknowledges the partial financial support of the Ministry of higher education (MOHE) of Malaysia under the scheme (FRGS/2/2013/SS07/MUSM/03/2).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Any alternative text (alt text) provided alongside figures in this article has been generated by Frontiers with the support of artificial intelligence and reasonable efforts have been made to ensure accuracy, including review by the authors wherever possible. If you identify any issues, please contact us.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fclim.2025.1504207/full#supplementary-material

Footnotes

1. ^Adenso-Diaz & Gascon (1997), and Liadaki & Gaganis (2010) both document strong link between bank efficiency and stock performance.

2. ^The data of macroeconomic variables ends in 2017, which defines the ending point of our data sample.

3. ^Irresberger et al. (2015) also use annual macroeconomic variables for the robustness test.

4. ^Alqahtani et al. (2016) covers only GCC countries from 1998 to 2012 whereas we have added Egypt, Pakistan in addition to five GCC countries from 2006 to 2017.

5. ^Aebi et al. (2012) confirm a negative relationship between the size of banks and their stock performance during the financial crisis. Gandhi & Lustig (2015) conclude that the distorting influence of the size of large banks on their stock returns is due to the bailout guarantees during the financial crisis.

6. ^We also tried to involve Tier 1 capital ratio or total capital ratio to control for bank capital. Unfortunately, the data we collected from BankScope and Bloomberg contains many missing values so that we are had to use the ratio of equity over total assets as the indicator of bank capital. It is worth noting that Garel & Petit-Romec (2017) also use this ratio to measure the bank capital.

7. ^As argued by Beck et al. (2013), the main effect variables that construct the interaction terms cannot co-exists with their corresponding fixed effect in the regression analysis due to the potential effect of collinearity. For example, ONEC dummy cannot coexist with country-fixed effects. The indicator of oil returns varies with time, and it cannot be introduced when time fixed effects are added to the regression. We have confirmed this issue by writing to Thorsten Beck.

8. ^We failed to employ bank capital as one of the dimensions of bank characteristics because the bank capital used in this study is the ratio of equity over total assets. The data of tier 1 captial or Basel capital ratio is scarce, resulting in the deletion of many observations while analyzing the data.

References

Abedifar, P. , Molyneux, P. , and Tarazi, A. (2013). Risk in Islamic banking. Rev. Finance 17, 2035–2096. doi: 10.1093/rof/rfs041

Acharya, V. V. , Cooley, T. , Richardson, M. , and Walter, I. (2010). Manufacturing tail risk: A perspective on the financial crisis of 2007–2009. Found. Trends Finance. 4, 247–325. doi: 10.1561/0500000025

Acharya, V. V. , Pedersen, L. H. , Philippon, T. , and Richardson, M. (2017). Measuring systemic risk. Rev. Financ. Stud. 30, 2–47. doi: 10.1093/rfs/hhw088

Adenso-Diaz, B. , and Gascon, F. (1997). Linking and weighting efficiency estimates with stock performance in banking firms. USA: The Wharton Financial Institutions Center.

Aebi, V. , Sabato, G. , and Schmid, M. (2012). Risk management, corporate governance, and bank performance in the financial crisis. J. Bank. Financ. 36, 3213–3226. doi: 10.1016/j.jbankfin.2011.10.020

Alqahtani, A. , and Klein, T. (2021). Oil price changes, uncertainty, and geopolitical risks: on the resilience of GCC countries to global tensions. Energy 236:121541. doi: 10.1016/j.energy.2021.121541

Alqahtani, F. , Mayes, D. G. , and Brown, K. (2016). Economic turmoil and Islamic banking: evidence from the Gulf cooperation council. Pac. Basin Financ. J. 39, 44–56. doi: 10.1016/j.pacfin.2016.05.017

Alqahtani, F. , and Samargandi, N. (2020). The influence of oil prices on the banking sector in oil-exporting economies: is there a psychological barrier? Int. Rev. Financ. Anal. 69:101470. doi: 10.1016/j.irfa.2020.101470

Alsharif, M. (2021). Risk, efficiency and capital in a dual banking industry: Evidence from GCC banks. Manag. Financ. 47, 1213–1232. doi: 10.1108/MF-10-2020-0529

Anginer, D. , Demirguc-Kunt, A. , and Zhu, M. (2014). How does competition affect bank systemic risk? J. Financ. Intermed. 23, 1–26. doi: 10.1016/j.jfi.2013.11.001

Apergis, N. , El-Montasser, G. , Sekyere, E. , Ajmi, A. N. , and Gupta, R. (2014). Dutch disease effect of oil rents on agriculture value added in Middle East and north African (MENA) countries. Energy Econ. 45, 485–490. doi: 10.1016/j.eneco.2014.07.025

Bashir, A. H. M. (2003). Determinants of profitability in Islamic banks: some evidence from the Middle East. Islam. Econ. Stud. 11, 31–57.

Beck, T. , Demirgüç-Kunt, A. , and Merrouche, O. (2013). Islamic vs. conventional banking: business model, efficiency and stability. J. Bank. Financ. 37, 433–447. doi: 10.1016/j.jbankfin.2012.09.016

Beltratti, A. , and Stulz, R. M. (2012). The credit crisis around the globe: why did some banks perform better? J. Financ. Econ. 105, 1–17. doi: 10.1016/j.jfineco.2011.12.005

Bilgin, M. H. , Danisman, G. O. , Demir, E. , and Tarazi, A. (2021). Economic uncertainty and bank stability: conventional vs. Islamic banking. J. Financ. Stab. 56:100911. doi: 10.1016/j.jfs.2021.100911

Boubakri, N. , Chen, R. , Guedhami, O. , and Li, X. (2019). The stock liquidity of banks: a comparison between Islamic and conventional banks in emerging economies. Emerg. Mark. Rev. 39, 210–224. doi: 10.1016/j.ememar.2019.03.006

Boukhatem, J. , and Djelassi, M. (2022). The bank-lending channel of monetary policy transmission in a dual banking system: empirical evidence from panel VAR modeling. Cogent Econ. Finance 10:2107765. doi: 10.1080/23322039.2022.2107765

Cashin, P. , Mohaddes, K. , Raissi, M. , and Raissi, M. (2014). The differential effects of oil demand and supply shocks on the global economy. Energy Econ. 44, 113–134. doi: 10.1016/j.eneco.2014.03.014

Chakraborty, I. , Goldstein, I. , and Mackinlay, A. (2018). Housing price booms and crowding-out effects in bank lending rev. Financ. Stud 31, 2806–2853. doi: 10.1093/rfs/hhy033

Chen, Y. , Msofe, Z. A. , and Wang, C. (2024). Asymmetric dynamic spillover and time-frequency connectedness in the oil-stock nexus under COVID-19 shock: evidence from African oil importers and exporters. Res. Policy 90:104849. doi: 10.1016/j.resourpol.2024.104849

Chen, Y. , Msofe, Z. A. , Wang, C. , and Chen, M. (2025). Time–frequency connectedness between oil price shocks and stock returns under bullish and bearish market states: evidence from African oil importers and exporters. Comput. Econ. 66, 1035–1069. doi: 10.1007/s10614-024-10712-3

Dietrich, A. , and Wanzenried, G. (2011). Determinants of bank profitability before and during the crisis: evidence from Switzerland. J. Int. Financ. Mark. Inst. Money 21, 307–327. doi: 10.1016/j.intfin.2010.11.002

Fahlenbrach, R. , and Stulz, R. M. (2011). Bank CEO incentives and the credit crisis. J. Financ. Econ. 99, 11–26. doi: 10.1016/j.jfineco.2010.08.010

Gandhi, P. , and Lustig, H. (2015). Size anomalies in US bank stock returns. J. Financ. 70, 733–768. doi: 10.1111/jofi.12235

Garel, A. , and Petit-Romec, A. (2017). Bank capital in the crisis: it's not just how much you have but who provides it. J. Bank. Financ. 75, 152–166. doi: 10.1016/j.jbankfin.2016.11.009

Gisser, M. , and Goodwin, T. H. (1986). Crude oil and the macroeconomy: tests of some popular notions. J. Money Credit Bank. 18, 95–103.

Hassan, M. K. , and Aliyu, S. (2018). A contemporary survey of Islamic banking literature. J. Financ. Stab. 34, 12–43. doi: 10.1016/j.jfs.2017.11.006

Huang, R. D. , Masulis, R. W. , and Stoll, H. R. (1996). Energy shocks and financial markets. J. Futur. Mark. 16, 1–27.

Irresberger, F. , Mühlnickel, J. , and Weiß, G. N. (2015). Explaining bank stock performance with crisis sentiment. J. Bank. Financ. 59, 311–329. doi: 10.1016/j.jbankfin.2015.06.001

Jarrett, U. , Mohaddes, K. , and Mohtadi, H. (2019). Oil price volatility, financial institutions and economic growth. Energy Policy 126, 131–144. doi: 10.1016/j.enpol.2018.10.068

Liadaki, A. , and Gaganis, C. (2010). Efficiency and stock performance of EU banks: is there a relationship? Omega 38, 254–259. doi: 10.1016/j.omega.2008.09.003

Lin, B. , and Su, T. (2020). The linkages between oil market uncertainty and Islamic stock markets: evidence from quantile-on-quantile approach. Energy Econ. 88:104759. doi: 10.1016/j.eneco.2020.104759

Maghyereh, A. , and Abdoh, H. (2021). The effect of structural oil shocks on bank systemic risk in the GCC countries. Energy Econ. 103:105576. doi: 10.1016/j.eneco.2021.105568

Maghyereh, A. , and Abdoh, H. (2024). Oil price uncertainty and sovereign credit risk in GCC countries: fresh evidence. Int. Econ. Econ. Policy 21, 457–482. doi: 10.1007/s10368-024-00607-x

Nandha, M. , and Faff, R. (2008). Does oil move equity prices? A global view. Energy Econ. 30, 986–997. doi: 10.1016/j.eneco.2007.09.003

Narayan, P. K. , Sharma, S. S. , Thuraisamy, K. S. , and Westerlund, J. (2018). Some preliminary evidence of price discovery in Islamic banks. Pac.-Basin Financ. J. 52, 107–122. doi: 10.1016/j.pacfin.2017.12.007

Nasir, M. A. , Al-Emadi, A. A. , Shahbaz, M. , and Hammoudeh, S. (2019). Importance of oil shocks and the GCC macroeconomy: a structural VAR analysis. Res. Policy 61, 166–179. doi: 10.1016/j.resourpol.2019.01.019

Rafiq, S. , Sgro, P. , and Apergis, N. (2016). Asymmetric oil shocks and external balances of major oil exporting and importing countries. Energy Econ. 56, 42–50. doi: 10.1016/j.eneco.2016.02.019

Raheem, I. D. , le Roux, S. , and Rehman, M. U. (2024). Oil shocks and the Islamic financial market: evidence from a causality-in-quantile approach. Int. Econ. 180:100559. doi: 10.1016/j.inteco.2024.100559

Rocha, R. D. R. , Farazi, S. , Khouri, R. , and Pearce, D. (2011). The status of Bank lending to SMEs in the Middle East and North Africa region: the results of a joint survey of the Union of Arab Bank and the World Bank. World Bank Policy Res. 5607, 1–56.

Salisu, A. A. , and Isah, K. O. (2017). Revisiting the oil price and stock market nexus: a nonlinear panel ARDL approach. Econ. Model. 66, 258–271. doi: 10.1016/j.econmod.2017.07.010

Tiwari, A. K. , Abakah, E. J. A. , Dwumfour, R. A. , and Mefteh-Wali, S. (2022). Connectedness and directional spillovers in energy sectors: international evidence. Appl. Econ. 54, 2554–2569. doi: 10.1080/00036846.2021.1998326

Tiwari, A. K. , Dam, M. M. , Altıntaş, H. , and Bekun, F. V. (2025). The dynamic connectedness between oil price shocks and emerging market economies stock markets: evidence from new approaches. Energy Econ. 141:108101. doi: 10.1016/j.eneco.2024.108101

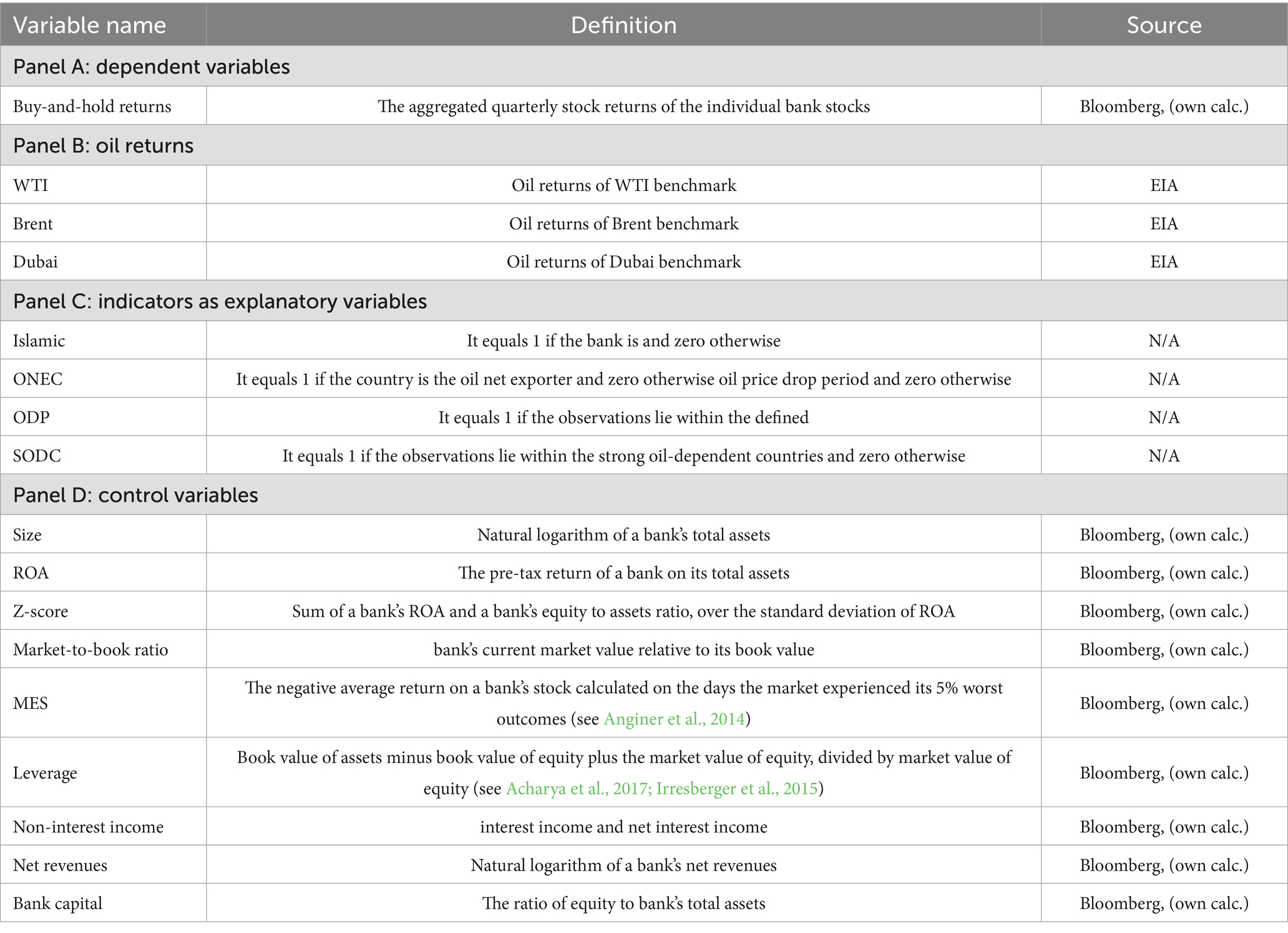

Appendix 1

TABLE A1 Description of variables.

Keywords: G21, F30, Q40 conventional and Islamic banks, bank stock performance, oil price shocks, net oil exporters, oil-dependent countries

Citation: Shaiban MS, Li D, Hasanov AS and Seho M (2025) Does fossil oil price matter? Market performance of banks in the dual banking system and policy implications. Front. Clim. 7:1504207. doi: 10.3389/fclim.2025.1504207

Edited by:

Osvaldo Rodríguez-Hernández, National Autonomous University of Mexico, MexicoReviewed by:

Samuel Sunday Idowu, Caleb University, NigeriaMohamed R. Abonazel, Cairo University, Egypt

Yufeng Chen, Zhejiang Normal University, China

Copyright © 2025 Shaiban, Li, Hasanov and Seho. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mohammed Sharaf Shaiban, bW9oYW1tZWQuc2hhaWJhbkBtb25hc2guZWR1

Mohammed Sharaf Shaiban

Mohammed Sharaf Shaiban Di Li2

Di Li2 Akram Shavkatovich Hasanov

Akram Shavkatovich Hasanov Mirzet Seho

Mirzet Seho